#ig markets joint account

Explore tagged Tumblr posts

Text

The Instagram reality

Few weeks ago we had our yearly advertising shooting at my company. It‘s the same procedure as every year, a lot shootings with good looking femal and male models. This year we had for the first time a new (relatively unknown) model agency, because our CEO wants a new look with new faces for our products. After we we’re done, it‘s a tradition that the whole teams goes out together for dinner.

I don't know if everyone is aware that in addition to normal characteristics such as height, weight, hair color, etc., the number of Instagram followers is now also an important feature on the model's set card.

I got talking to one of the new models who had recently switched from one of the big agencies to this new one. She was relatively unknown, one face among many, with just under 8,000 IG followers. Until she made the "mistake" of falling in love with a celebrity actor. Her agency was delighted at how this relationship could be used to increase her market value. Her partner had been relatively reserved about his private life until then, but after his agent was also taken with the idea, he agreed to post more "private" photos with his girlfriend.

In the beginning, the posts were limited to pictures of joint appearances at events. The number of her followers slowly rose from 8,000 to 20,000 within a few months. Then she was advised to post more private things. Gradually, she posted more photos from vacations, home, family celebrations, etc., always on her account, while the actor still only showed pictures from public appearances together.

As a result, the number of her followers rose significantly to over 100,000 within a very short time. Unfortunately, the majority of them were his fans. Then it happened what always happens.

The posts about her work as model faded more and more into the background and everyone was only interested in her relationship. Her family, friends and even work partners were almost overrun by his fans and not alway in a friendly way. Her requests for photo shoots became fewer and fewer. Her agency was told that they didn't want to work with a model who had no independence and was only defined by her partner, especially as his fans didn't correspond to the target group of most companies.

The pressure from her agency became more and more, which also affected her relationship, which finally failed. After the relationship ended, the number of her followers dropped significantly. When her bookings stopped and her agency told her to look for another job, she decided for a new start at another agency.

This is just one of many examples of why even "private" posts on IG always have a business background, whether it's vacation pictures from Caribbean islands, trips to celebrity ski races, snapshots of private excursions in which the car is also pictured, etc.

PRIVATE does not exist on social media, even if many would like to believe it does. Fans are only being sold a fantasy that they want to see!

197 notes

·

View notes

Text

Top 10 Forex Brokers: A Comprehensive Guide for Traders

In the ever-evolving world of forex trading, selecting the right broker can significantly impact your trading success. With numerous options available, it’s crucial to identify brokers that offer the best services, reliability, and features tailored to your trading needs. In this article, we present the top 10 forex brokers that stand out in the industry, ensuring that traders have a reliable partner in their trading journey.

1. IG Group: A Leader in Forex Trading

IG Group is a well-established name in the forex trading space. With over 45 years of experience, IG provides a robust platform for both beginners and experienced traders. The broker offers a vast range of currency pairs, competitive spreads, and advanced trading tools. IG's regulatory compliance across multiple jurisdictions ensures that your funds are secure.

Key Features:

Regulatory Authority: FCA, ASIC, and NFA

Trading Platforms: Proprietary platform, MetaTrader 4 (MT4)

Account Types: Standard and premium accounts

Educational Resources: Webinars, tutorials, and market analysis

2. OANDA: An Innovative Trading Experience

OANDA has carved a niche for itself through its innovative technology and comprehensive trading services. Known for its excellent customer service and robust trading platform, OANDA caters to traders of all experience levels. It offers a wide selection of forex pairs and features like advanced charting tools and APIs for automated trading.

Key Features:

Regulatory Authority: FCA, CFTC, ASIC

Trading Platforms: OANDA’s proprietary platform and MT4

Account Types: Standard and premium accounts

Commission Structure: Transparent pricing with no hidden fees

3. Forex.com: A Trusted Forex Trading Platform

Forex.com, part of the GAIN Capital Holdings, Inc., is a well-respected broker providing an extensive range of trading options. With its user-friendly platform, Forex.com is ideal for both beginners and seasoned traders. The broker’s comprehensive research and analysis tools enable traders to make informed decisions.

Key Features:

Regulatory Authority: FCA, CFTC

Trading Platforms: Proprietary platform and MT4

Account Types: Standard and commission accounts

Research Tools: Daily market analysis and in-depth research reports

4. TD Ameritrade: A Comprehensive Trading Ecosystem

TD Ameritrade offers an extensive range of trading options, making it a popular choice for forex traders. The broker provides a powerful trading platform that integrates forex trading with other asset classes, allowing for a diversified investment strategy. The robust educational resources available make TD Ameritrade a great choice for novice traders.

Key Features:

Regulatory Authority: SEC, FINRA

Trading Platforms: thinkorswim, web-based platform

Account Types: Individual and joint accounts

Educational Resources: Extensive library of videos, articles, and tutorials

5. Pepperstone: Best for Low Costs

Pepperstone is renowned for its low-cost trading options and exceptional customer service. The broker is particularly appealing to active traders due to its tight spreads and high execution speed. Pepperstone offers various trading platforms, including MT4 and cTrader, catering to diverse trading preferences.

Key Features:

Regulatory Authority: ASIC, FCA

Trading Platforms: MT4, MT5, cTrader

Account Types: Standard and Razor accounts

Customer Support: 24/5 live chat and support

6. eToro: A Social Trading Pioneer

eToro has transformed the forex trading landscape with its unique social trading features. The platform allows traders to follow and copy the trades of successful investors, making it ideal for beginners. eToro also provides an array of educational resources and an easy-to-navigate platform.

Key Features:

Regulatory Authority: FCA, CySEC

Trading Platforms: eToro proprietary platform

Account Types: Retail and professional accounts

Unique Features: Social trading and copy trading functionalities

7. AvaTrade: A Global Trading Leader

AvaTrade is known for its wide range of trading instruments and comprehensive trading services. With a focus on providing a user-friendly experience, AvaTrade offers multiple trading platforms, including MT4 and its own web-based platform. The broker also features extensive educational materials to support traders.

Key Features:

Regulatory Authority: Central Bank of Ireland, ASIC, FSA

Trading Platforms: MT4, MT5, AvaTradeGo

Account Types: Standard and Islamic accounts

Market Analysis: Regular webinars and trading signals

8. XM: Excellent for Forex and CFDs

XM is recognized for its exceptional customer service and competitive trading conditions. The broker offers a vast selection of forex pairs and CFDs, catering to a wide range of trading strategies. XM provides educational resources to assist traders in navigating the forex market effectively.

Key Features:

Regulatory Authority: ASIC, CySEC

Trading Platforms: MT4, MT5

Account Types: Micro, Standard, and Zero accounts

Promotions: Various bonuses and trading incentives

9. FXCM: The Expert Trader's Choice

FXCM is a reputable broker that offers a robust trading platform with advanced features suitable for expert traders. With a wide variety of currency pairs and low spreads, FXCM provides traders with competitive trading conditions. The broker’s comprehensive market research and analysis tools are beneficial for strategic trading.

Key Features:

Regulatory Authority: FCA, ASIC

Trading Platforms: Trading Station, MT4

Account Types: Standard and Active Trader accounts

Research Tools: Extensive market analysis and news updates

10. Interactive Brokers: The Professional Trader's Platform

Interactive Brokers is a well-known broker that caters to professional traders and institutions. With low commissions and a wide array of trading instruments, Interactive Brokers is an excellent choice for serious traders. The platform offers advanced trading tools and resources for in-depth market analysis.

Key Features:

Regulatory Authority: SEC, FINRA

Trading Platforms: Trader Workstation (TWS), web-based platform

Account Types: Individual, joint, and institutional accounts

Educational Resources: Comprehensive trading courses and webinars

Conclusion

Choosing the right forex broker is essential for trading success. Each of the brokers listed above offers unique features, competitive pricing, and robust support to help traders navigate the forex market effectively. When selecting a broker, consider factors such as regulation, trading platform, and customer service to find the one that best suits your trading needs.

#forextrading#forex education#forex market#forex trading#forexsignals#investment#forex robot#forex#xauusd#forex expert advisor

0 notes

Text

tokyo revengers idol au hcs part 3 that no one asked for AGAIN here’s part 1 and part 2 to get a better understanding. this is what the members would be doing alongside their idol promotions+ what they would post on social media toman tbh these guys are all just so damn funny on their own that they would constantly be invited to comedy variety shows. maybe perhaps doing something similar to seventeen or wanna one where they even have their own variety show on youtube (ie. seventeen’s-going seventeen series or wanna one’s show on mnet) mikey-he would post basic food pics like of his parfaits or taiyaki but also it’s rare because he’d constantly forget his password. however on important days he’ll post long emotional and sentimental posts that hit you in your feels thanking his members and fans always. he also has a youtube channel posting random funny vlogs. draken- he has his own personal soundcloud to upload solo mixtapes/songs feat diff members. posts photos of his bikes and different tattoos he would be getting. responds with 1-2 words to fans during fansigns or ig comments but like mikey, once in a while, will also write heartfelt posts thanking everyone. baji- his ig feed is filled with animals + dance practice vids. also has his own soundcloud too. trolls his members by commenting on their stuff. “delete this u ugly mf no one wants to see this”. takemichi- very chatty, (sometimes too chatty where he’ll end up accidentally spoiling their next album info) and interactive on social media to his fans. tries his best to respond to most comments or ama ig stories questions. posts a lot of selfies and photos of his members. king of fan service. chifuyu- beautiful photos of the sky a lot on his ig (in canon he wanted to be a pilot :,) ) along with cute soft selfies. (which baji and kazutora troll and comment being like “damn....u ugly AF!” “lmao stop pretending to act cute u loser” kazutora- his ig is filled with pure chaos. just pics of him catching his members slipping (sleeping photos where they’re drooling or have their eyes slightly open or making ugly faces behind the scenes). also has photos of cursed memes and memes made by fans. he’s a literal enigma. mitsuya- very wholesome ig photos- lots of photos of his family, group photos, sometimes cool artsy edited selfies. occasional photoshoot photos. hakkai- ig is filled lots of #ootd photos and occasional photos from his modeling or acting gigs (he’s the visual, duh!) gets a lot of sponsorships from big brands. pah-chin: has a joint youtube channel with peyan. they do silly challenges but will sometimes post dance videos (feat. baji) since they’re the main/lead dancers. fans love him because of his “matter-of-fact” responses that are funny without even trying. (example- fan comment: omg i love u guys soooo much u guys are the best in the whole world!!!<333 toman OUTSOLD!. pah-chin: idk about best in the world but we’ll just take “the best in our neighborhood” for now i guess. thanks.”) peyan: joint youtube channel with pah-chin. at fan signs mikey has to warn him to chill out cuz peyan will accidentally yell and scare fans without meaning to, but he’s just really excited to meet his fans is all ^_^ angry: posts a lot of wholesome photos like mitsuya (selfies with smiley) and writes a lot of motivational sweet captions cheering fans up and reminding them to always be happy :,) smiley: joint youtube account with angry. smiley does a lot of prank videos and angrys just usually in the back like 🧍♂️... he also does tiktok- he would be doing all the dances, memes, and trends. inui: ok hear me out, i mentioned before inui has similar vibes as cha eunwoo so i’d figure his ig would give the same vibe as his (iykyk). since he’s the other visual he would be getting a TON of acting and modeling gigs. idk why but i feel like inui would be a great actor (his facial expressions during tenjiku arc, the range!). actor of the year. gets a lot of skincare commercial deals too.

black dragons shinichiro- photos of bikes, cars, and photos where hes pretending to do a cool pose but his members (+mikey) would troll and comment “LAME!!!!!” “why tf do u look like that?” “hey leader, it’s not too late to delete this now bestie :)” does fun ig lives. on variety shows as a joke his members tease him there as well. really great at fan-service and pulls the whole “pretend boyfriend” scenario with fans (the delusional fans are gonna act up if he keeps this up...). taiju- (if shinichiro did not exist in this au OR if you wanted both in the group) photos of him at the gym, photoshoot photos. inui- similar to if he was in toman, his ig would just be a lot of cool and cute photos of him from behind the scenes of dramas or photoshoots. a soft visual king. occasional selfies with koko and bike photos. kokonoi- has a personal youtube channel but he would be Drowning in sponsorship videos all from high-end designer brands. he’s just casually flexing that PPL in his vlogs. ig feed is a lot of #ootd photos or pics taken with inui. him and inui would be makeup brand ambassadors or faces of brands (ex: like jennie from blackpink represents chanel). in this case kokonoi would be the face of fendi (he wears fendi slides in the manga cover) and inui would be the face of jimmy choo (his heels in the manga cover looked like jimmy choo but i could be wrong.. but u know what i mean)

tenjiku izana- pretty leader has a very artsy ig feed. extremely photogenic like inui. has photoshoot photos and candid pose photos. acts in dramas time to time (gg second male lead syndrome). kakucho- posts gym or dance practice videos on his feed but he posts rarely because he’s just too busy or forgets he actually has an ig. loves commenting on takemichi’s posts “haha no wonder ur called baka-michi!” as a joke. kanji- posts gym photos but it’s rare because he always forgets his password. ran- the other visual. he would be modeling for high-fashion brands and go on runway shows. also definitely gives off actor vibes (he would be constantly casted in dark action movies hahaha). loves giving fan service. rindou- in contrast to his brother, rindou when it comes to fan service, he loves trolling fans. also he’s really good at drawing a line between fans (y’know, keeping the delusional ones in check...which means he ‘friend-zones’ them but it’s for their own good tbh idols need to remind people their boundaries). has a youtube channel where he just posts random dance practice vids and occasional vlogs. also comments under his brothers ig posts “you look stupid af in this wtf”. on variety shows people find their brotherly banter hilarious. mutou- posts gym photos, also really awkward selfies (he doesn’t know what his angle is lmao). another member who also reminds fans of their boundaries and keeps it real. (sanzu always likes his photos though and hypes him up in the comments). sanzu- shy baby. constantly following mutou around. posts a lot of cute selfies and random pics of shogi stuff (he tags mutou in it of course). during fan signing/autograph sessions they love putting cute headband props on him like this or this.

bonten because this group’s concept and aesthetic is mysterious, mature, artsy, gloomy, and dark they will take this concept to the grave. (minus a few exceptions) they are invited to variety/talk-shows but never make an appearance because they want to keep the air of mystery around them. (it’s a good marketing technique). mikey- does not have any social media. he does have a private account to lurk around but no one knows what it is. kokonoi- has a youtube channel but it’s locked and you have to pay to get into it. posts super short vlogs and teasers. thats it. (the ultimate scam! but their fans love them too much to notice). lots of sponsored #ootd posts on ig. kakucho- he would be modeling ONLY high fashion brands and high end editorial places. his instagram is just his exquisite and expensive modeling photos whether it be candid backstage photos from shows, candid runway walk pics/vids, pics of diff photoshoots you name it. doesn’t really comment much. ran- visual. similar to kakucho- modeling ONLY high fashion brands and editorial places. instagram is filled with modeling photos but also some artsy scenery pics he took. rindou- posts short artsy dancing clips (like modern dances in black&white filter) on ig. sanzu- since he’s the other visual, he also posts a lot of his modeling/acting photos on instagram. also pretty chatty (he’s the exception) on social media and loves teasing and trolling fans. posts with a lot of random cute emojis on everything. “just ate lunch and now im off to practice hehe 🍜🍇🤟💃🤠🧚♂️💞🦋” no one really knows why he uses random emojis but it’s just endearing lmao. kanji- no social media at all. akashi- manager....or if you made him the rapper in this au then he too would also not have any social media.

#tokyo revengers#takemichi hanagaki#mikey#manjiro sano#draken#ken ryuguji#nahoya kawata#souya kawata#peyan#chifuyu matsuno#baji keisuke#kazutora hanemiya#hajime kokonoi#inui seishu#ran haitani#pah-chin#rindou haitani#sanzu haruchiyo#takashi mitsuya#izana kurokawa#kakucho hitto#idol au

154 notes

·

View notes

Text

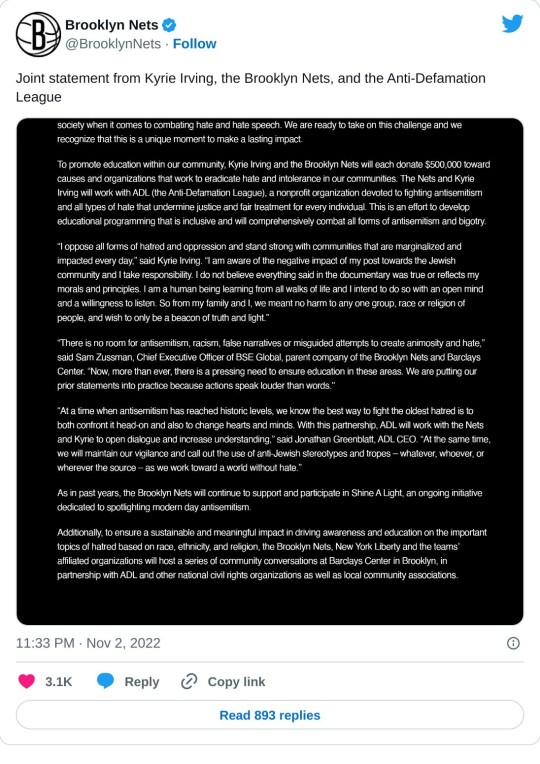

Kanye West Tweets Pic of Kyrie Irving Amid NBA Player’s Antisemitism Controversy

West reposted the image on Twitter after featuring it earlier this week on his suspended Instagram account.

Gil Kaufman11/3/2022

Kanye West attends the 2015 CFDA Awards at Alice Tully Hall at Lincoln Center on June 1, 2015 in New York City. Taylor Hill/FilmMagicnone

After getting locked out of Instagram again earlier this week for violating the site’s policies, Kanye West re-posted an image from his suspended IG on Twitter early Thursday morning (Nov. 3) of controversial Brooklyn Nets star Kyrie Irving in what appears to be the embattled rapper’s latest provocation.

The timing of the tweet by West (who now goes by Ye) came after Irving released a joint statement with the Anti-Defamation League and his team in which the point guard and the Nets each pledged to donate $500,000 to “causes and organizations that work to eradicate hate and intolerance” after Irving was widely criticized last week for sharing a link to an antisemitic movie on his social feeds.

The since-deleted tweet linked to a video posted by conspiracy theorist Alex Jones which promoted the antisemitic 2018 movie Hebrews to Negroes: Wake Up Black America. The post by Irving drew widespread condemnation at a time when Ye has been deplatformed and seen his once-formidable fashion and music empire greatly diminished after repeatedly spreading antisemitic hate speech.

Like Ye, Irving steadfastly defending his right to spread such rhetoric in a post-game press conference on Saturday at which he said, “In terms of the backlash, we’re in 2022, history is not supposed to be hidden from anybody and I’m not a divisive person when it comes to religion, I embrace all walks of life. So the claims of antisemitism and who are the original chosen people of God and we go into these religious conversations and it’s a big no, no, I don’t live my life that way.”

The NBA, Nets owner Joe Tsai and the ADL strongly condemned Irving for spreading antisemitic speech, with ADL CEO Jonathan Greenblatt tweeting, “The book and film he promotes trade in deeply #antisemitic themes, including those promoted by dangerous sects of the Black Hebrew Israelites movement. Irving should clarify now.”

After initially defending his right to post on his personal accounts and vowing now to “stand down on anything I believe,” Irving reversed course and said in the statement, “I oppose all forms of hatred and oppression and stand strong with communities that are marginalized and impacted every day. I am aware of the negative impact of my post towards the Jewish community, and I take responsibility.”

Before his latest Instagram suspension, West posted a smiling pic of Irving on Sunday with the caption, “There’s some real ones still here.” Ye posted a different snap of Irving on Twitter Thursday with no comment just hours after the athlete’s mea culpa. In the wake of the Irving controversy, the Ye post was the latest provocation in a month-long spree in which the rapper has repeatedly made antisemitic remarks that Forbes reported has resulted in him losing his billionaire status as most of his high-profile fashion, music and sports marketing clients have fled his now-radioactive brand.

West had his Twitter account temporarily restricted after posting in early October that he was going to go “Death Con 3 On JEWISH PEOPLE.” The Irving post marked Ye’s return to the platform a week after self-proclaimed “free speech absolutist” Tesla/SpaceX CEO Elon Musk bought the site; a new studyreported that homophobic, racist and antisemitic hate speech on Twitter dramatically spiked in the hours and days following Musk’s takeover.

The amplification of anti-Jewish tropes by such high-profile figures also comes just months after the Anti-Defamation League — which tracks anti-Semitic behavior nationwide — reported a 34% rise in anti-Semitic incidents in 2021 (to 2,717), which averaged out to more than seven such incidents per day.

Check out Ye’s tweet and the Nets and Irving’s statements below.

3 notes

·

View notes

Text

An Ask

Social Media Anon here!

Well, I'm a little confused (and surprised) by what's going on in the padalecki's social media but I have a (I think) rational theory.

Firstly, engagement is EVERYTHING, but it's a very current indicator, it only tracks the median of the last 20 posts, which for some posters can be week on week.

Even taking that into account, Jared and Gen are going through the floor!

Take Gen first, it used to be that each type of post she had received a specific "value". Her alone, not many likes for her following (20-35K), then her with the kids got more, her with Jared got WAY MORE, the kids alone got way more and Jared.. was her prize.

I said that, as her engagement was in danger of slipping below 3, her props would come out more, kids and in particular JARED would feature more on her block. That's what happened (it wasn't rocket science) BUT the value of Jared in likes has diminished substantially, which I wasn't expecting. Her romantic Tuscan adventure posts are getting only 40K after a week. A photo of her and Jared would normally be in the 100k. Then, of course, he had a rarity value but now he's plastering himself everywhere (I'll come back to that). Even the kids are getting less likes. To get high likes it has to be a professional photograph with Jared looking super hot. Snap with him looking... well ordinary... isn't enough.

However, she's pushed her engagement back up to 6, mainly because her content is 60% Jared now.

What's really interesting is what is happening to Jared's social media. His engagement is going DOWN. He was at 6.49 when I looked last night, which is a MEGA FALL. that's good in media terms but nothing like the previous excellent.. and it's a BIG drop in a short time.

So, what's happening? Well I think two things.

Firstly, there is, yet another, Jared rebranding. He seems to be becoming a professional Texan. He can't do an interview without saying Y'all and mentioning Texas. He IS Texan, but he spent 15 years promoting a soft, mid America Jared and now he just seems like SOUTHERN GUY. Given Walker advertises on Fox, it's not surprising he's going for this image, but he definitely seems to be hitting a new market. He has to be really careful that doesn't alienate his old ones. You tell a man by the company he keeps and Jared seems to hang out with dicks... and he does it on social media.

Secondly, he's getting overexposed. He's EVERYWHERE to fans with nonsense stories. Given that that is Gen's thing with the blog he should have realised how irritating it is. There is no actual content in his exposure. He's either flogging orange pee or at hooters or on a gondola, it's boring.

Jared needs to get a CONTENT CREATOR. Over exposure is a killer.

I can see the network have an issue. They need Walker to break the CW bubble. They are missing the point though. It DID. Week one was brilliant for them. The show is crap and viewers turned off. There problem wasn't attracting viewers , it's show content. They turned off.

Jared is going down hill on Social Media. Jensen will get a BIG PUSH when soldier boy arrives on screen and before by Kripke to draw SPN fans in. So it'll be interesting to see whether Soldier Boy, rather than Walker, causes the schizm in J2 social media joint tracking, with them finally reliant on their own current conduct rather than the legacy of SPN.

If it does that will be something to discuss with those who claimed Jensen was becoming a bit part actor to Jared's super success.

My own view, this is an exercise in quality mattering, which is something Jared and Gen both need to learn. Their social media is SPN social media, when that dies at the moment so do they.

Oh, and Gen and TOWWN are both raiding the piggie bank to buy followers again...

Stay Safe everyone!

Social Media anon requested this be corrected to be anonymous but I couldn’t for the life of me figure out how to get it as an ask, so here we are!

I think that it says a lot about Jared and Gen’s content (mostly Gen on this point) that even the props aren’t bringing in the interest anymore. I’ve always said that they come off as too fake and manufactured to come off as genuine.

Just for kicks I went to Jensen’s IG, Jared’s IG, Gen’s IG and Danneel’s IG. I compared the numbers of similar types of posts (I even picked ones that were posted roughly around the same time) and the difference is incredible. Jensen’s birthday post for JJ has over 1 million likes, Jared’s post of him and O (posted around the same time, if not further back) has half of that. I think people really are picking up on Jared and Gen coming off as fake.

I’ve seen people who are getting tired of the constant content so I wouldn’t be surprised at all if that oversaturation of the Pads is getting to people. You know there’s something amiss when Danneel, who only posts once in a while now, gets twice the amount of likes and comments as Gen does and she posts every day. I’m sure that does wonders for her ego too.

I’m interested to see how the social media numbers change when Soldier Boy is introduced on screen and during the break from Walker, that’s for sure.

28 notes

·

View notes

Note

Hi,

I am the person with bug ask. Thank you for clarification.

If you don't mind me asking, this actually raises a different question then. A lot of fans have posted about it that means it's public. What do you think his studio going to explain? They can imply his account was hacked but wouldn't it be too suspicious to provide this excuse as they have done it at the time of his ig last year.

Moreover, many of his fans are really toxic (very bad experience with them) and not stupid. This might give them an ammunition to attack people if studio is silent.

Last few days, I've noticed both the celebrities are testing the market for their joint appearance in probable near future but the response is overwhelmingly toxic. They can only be quited down with their conspiracy theories (at least the misguided ones) if ggdd acknowledge each other silently and steadily as friends. I just feel their silence on the matter would be better than any excuse.

I think you're overthinking it, Anon. No statement will be made about this. My understanding is the video was only up for a few moments, and it's easy for fans to dismiss as a glitch. Even BXG are doing that, so solos won't have any difficulty doing it either.

As for solos and that whole nightmare for GGDD, I gave my thoughts about it in this post.

13 notes

·

View notes

Text

How Do I Know Whether My Strategy Is Running Correctly With risehills?

How Do I Know Whether My Strategy Is Running Correctly With risehills? Read More http://fxasker.com/question/496f671e85c272e8/ FXAsker

#admiral markets romania youtube#aetos rank structure#alpari nz#avatrade israel#axitrader opening hours#BLACKWELL GLOBAL#cftc citifx#city index guaranteed stop loss#deltastock logo#dukascopy kaskus#forex account in axis bank#fp markets spreads#fresh and easy markets locator#fxdd fixed spreads#gkfx metatrader 4#ig markets joint account#instaforex in nigeria#instaforex vs exness#ironfx social trader#pepperstone historical tick data#RISEHILLS#roboforex ecn pro#shimano biomaster xtb 8000 cena#velocity trade vancouver#windsor 6f draw bias#About Forex

0 notes

Photo

IG Markets Broker Review

IG Markets is one of the most accomplished brokers in the industry. This broker has 200,000 active members worldwide and continues to grow its customer base ever since its foundation in 1974. Rookies will be happy to hear that registering for an account takes only several minutes, and requires only basic information. With the option of opening a direct forex account with a minimum deposit of 250 GBP, it’s no wonder so many traders are opting to use this broker. There are also other account options available, including demo, individual, joint, or corporate accounts. For more information on this highly recommended broker, simply continue reading our in-depth IG Markets Broker review.

3 notes

·

View notes

Text

Kanye West Tweets Pic of Kyrie Irving Amid NBA Player’s Antisemitism Controversy

West reposted the image on Twitter after featuring it earlier this week on his suspended Instagram account.

Gil Kaufman11/3/2022

Kanye West attends the 2015 CFDA Awards at Alice Tully Hall at Lincoln Center on June 1, 2015 in New York City. Taylor Hill/FilmMagicnone

After getting locked out of Instagram again earlier this week for violating the site’s policies, Kanye West re-posted an image from his suspended IG on Twitter early Thursday morning (Nov. 3) of controversial Brooklyn Nets star Kyrie Irving in what appears to be the embattled rapper’s latest provocation.

The timing of the tweet by West (who now goes by Ye) came after Irving released a joint statement with the Anti-Defamation League and his team in which the point guard and the Nets each pledged to donate $500,000 to “causes and organizations that work to eradicate hate and intolerance” after Irving was widely criticized last week for sharing a link to an antisemitic movie on his social feeds.

The since-deleted tweet linked to a video posted by conspiracy theorist Alex Jones which promoted the antisemitic 2018 movie Hebrews to Negroes: Wake Up Black America. The post by Irving drew widespread condemnation at a time when Ye has been deplatformed and seen his once-formidable fashion and music empire greatly diminished after repeatedly spreading antisemitic hate speech.

Like Ye, Irving steadfastly defending his right to spread such rhetoric in a post-game press conference on Saturday at which he said, “In terms of the backlash, we’re in 2022, history is not supposed to be hidden from anybody and I’m not a divisive person when it comes to religion, I embrace all walks of life. So the claims of antisemitism and who are the original chosen people of God and we go into these religious conversations and it’s a big no, no, I don’t live my life that way.”

The NBA, Nets owner Joe Tsai and the ADL strongly condemned Irving for spreading antisemitic speech, with ADL CEO Jonathan Greenblatt tweeting, “The book and film he promotes trade in deeply #antisemitic themes, including those promoted by dangerous sects of the Black Hebrew Israelites movement. Irving should clarify now.”

After initially defending his right to post on his personal accounts and vowing now to “stand down on anything I believe,” Irving reversed course and said in the statement, “I oppose all forms of hatred and oppression and stand strong with communities that are marginalized and impacted every day. I am aware of the negative impact of my post towards the Jewish community, and I take responsibility.”

Before his latest Instagram suspension, West posted a smiling pic of Irving on Sunday with the caption, “There’s some real ones still here.” Ye posted a different snap of Irving on Twitter Thursday with no comment just hours after the athlete’s mea culpa. In the wake of the Irving controversy, the Ye post was the latest provocation in a month-long spree in which the rapper has repeatedly made antisemitic remarks that Forbes reported has resulted in him losing his billionaire status as most of his high-profile fashion, music and sports marketing clients have fled his now-radioactive brand.

West had his Twitter account temporarily restricted after posting in early October that he was going to go “Death Con 3 On JEWISH PEOPLE.” The Irving post marked Ye’s return to the platform a week after self-proclaimed “free speech absolutist” Tesla/SpaceX CEO Elon Musk bought the site; a new studyreported that homophobic, racist and antisemitic hate speech on Twitter dramatically spiked in the hours and days following Musk’s takeover.

The amplification of anti-Jewish tropes by such high-profile figures also comes just months after the Anti-Defamation League — which tracks anti-Semitic behavior nationwide — reported a 34% rise in anti-Semitic incidents in 2021 (to 2,717), which averaged out to more than seven such incidents per day.

Check out Ye’s tweet and the Nets and Irving’s statements below.

1 note

·

View note

Text

Cloud Robotics Market Industry Growth, Share, Size, Trends and Analysis by 2025 | Rapyuta Robotics, Ortelio, Tend.ai, Ericsson, Fanuc Corporation

Cloud Robotics Market includes the analysis and discussion of important industry trends, market size, market share estimates, profiles of the leading industry players, and forecasts. Amazon Robotics, Google, Huawei, IBM, Microsoft, C2RO, CloudMinds, Hit Robot Group, V3 Smart Technologies, Rapyuta Robotics, Ortelio, Tend.ai, Ericsson, Rockwell Automation Inc., Fanuc Corporation, Yaskawa Electric Corporation, Mitsubishi, Kuka AG, ABB Group, Calvary Robotics, HotBlack Robotics Srl, Motion Controls Robotics, Wolf Robotics LLC, Tech Con Automation Inc., Matrix Industrial Automation, SIASUN and Automation IG.

The global cloud robotics market accounted for USD 2.01 billion in 2017 and is projected to grow at a CAGR of 29% in the forecast period of 2018 to 2025.

Get Download Exclusive Sample Report + All Related Graphs & Charts @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-cloud-robotics-market

Cloud robotics is a field of robotics that endeavors to raise cloud advancements, for example, cloud computing, cloud storage, and other web innovations focused on the advantages of united framework and shared administrations for robotics.

Market Drivers and Restraints:

Rising internet and cloud infrastructure.

Rapid progress of wireless technology.

Rapid development of software frameworks and services.

Data Privacy and Security Concerns

High Initial Costs and R&D Expenses

Cloud robotics is a forthcoming pattern in the smart arrangement of an industry. It comprise of attributes of both robotics and also cloud base innovation. From robotics, it has inferred three functionalities, for example, sensation, incitation, and control, though, from cloud innovation it has empowered pervasive, helpful, on request organize access to a common pool of configurable assets.

MAJOR TOC OF THE REPORT

Chapter One: Cloud Robotics Market Overview

Chapter Two: Manufacturers Profiles

Chapter Three: Global Cloud Robotics Market Competition, by Players

Chapter Four: Global Cloud Robotics Market Size by Regions

Chapter Five: North America Cloud Robotics Revenue by Countries

Chapter Six: Europe Cloud Robotics Revenue by Countries

Chapter Seven: Asia-Pacific Cloud Robotics Revenue by Countries

Chapter Eight: South America Cloud Robotics Revenue by Countries

Chapter Nine: Middle East and Africa Revenue Cloud Robotics by Countries

Chapter Ten: Global Cloud Robotics Market Segment by Type

Chapter Eleven: Global Cloud Robotics Market Segment by Application

Get Detailed Toc @ https://www.databridgemarketresearch.com/toc/?dbmr=global-cloud-robotics-market

Regionally, this report categorizes the production, apparent consumption, export and import of global Cloud Robotics Market covering:

- North America (United States, Canada and Mexico)

- Europe (Germany, France, UK, Russia and Italy)

- Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

- South America (Brazil, Argentina, Colombia)

- Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Cloud Robotics Market is highly fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. The report includes market shares of Cloud Robotics Market for global, Europe, North America, Asia Pacific and South America.

Reasons for Buying this Cloud Robotics Report

1. Cloud Robotics Market report aids in understanding the crucial product segments and their perspective.

2. Initial graphics and exemplified that a SWOT evaluation of large sections supplied from the Cloud Robotics industry.

3. Even the Cloud Robotics economy provides pin line evaluation of changing competition dynamics and retains you facing opponents.

4. This report provides a more rapid standpoint on various driving facets or controlling Cloud Robotics promote advantage.

5. This worldwide Cloud Robotics report provides a pinpoint test for shifting dynamics that are competitive.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-cloud-robotics-market

About Us:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: [email protected]

Browse Related Reports @

Data Wrangling Market

DNS SErvice Market

0 notes

Text

DFC’s Third Board Meeting: LICs, Liquidity, and LNG

New Post has been published on http://khalilhumam.com/dfcs-third-board-meeting-lics-liquidity-and-lng/

DFC’s Third Board Meeting: LICs, Liquidity, and LNG

At last week’s Board of Directors meeting, DFC brought forward nine projects totaling US$2.5 billion. As part of DFC’s COVID-19 economic response program, several transactions focus on providing emergency liquidity to banks, with a notable emphasis on the Western Hemisphere. DFC also provided $1.7 billion to energy sector projects in Mozambique—marking the agency’s first big-ticket investment in a low-income country (LIC)—and deployed $6 million in equity across projects in Kenya and Rwanda. A list of recent projects can be found here. The board also approved two key policies: an independent accountability mechanism and a foreign currency lending policy. Ahead of the meeting, DFC also announced the appointment of its first independent Inspector General (IG), a welcome move—and a particularly important one, in light of the agency’s expanded authorities under the Defense Production Act and recent events linked to an ill-fated Kodak transaction which is now on pause (see our previous commentary on the DPA and the need for an appointed DFC IG here and here). In this monitor, we look at how the latest batch of projects help shift DFC’s overall portfolio balance towards lower-income markets and examine the agency’s COVID-19 response so far which remain largely focused on the provision of liquidity to financial intermediaries.

Portfolio balance

DFC approved a total of $3.6 billion transactions this quarter—its largest to date—bringing total approved transactions in 2020 to over $5.8 billion. And with the latest slate of approved projects, the new agency is starting to shift its portfolio balance towards lower-income markets. Though DFC’s significant expansion (by investment volume) into LICs this quarter is driven almost entirely by a single project: $1.5 billion in political risk insurance for an onshore liquified natural gas plant in Mozambique. (See Todd Moss and Katie Auth’s take on the project here.)

So far this year, over 75 percent of DFC’s 2020 dollars invested in lower-middle income countries (LMICs) are in India and Kenya. By contrast, DFC investments in UMICs are almost entirely concentrated in Latin America and the Caribbean. In total the region makes up around 35 percent of DFC dollars committed in 2020 (the OPIC portfolio was closer to 25 percent). The European and Central Asian portfolio remains the agency’s smallest regional subset. But DFC recently announced the opening of a regional office in Belgrade, so we anticipate this portfolio will grow. DFC also plans to establish a regional team based in Africa, and, while visiting India, President Trump announced a permanent DFC office based in the country.

Crisis response

In May, as part of its COVID-19 response, DFC launched a $4 billion Rapid Response Liquidity Facility to provide additional financing for existing DFC projects. To complement its economic response, DFC also announced a $2 billion Global Health and Prosperity Initiative to strengthen health systems in developing countries. It is unclear exactly how many projects have been funded under these initiatives or what is in the pipeline—only one project (a $400 million loan to a Brazilian bank) approved this quarter was explicitly named as being under the Rapid Response Liquidity Facility. However, the latest board meeting did include the approval of a few key investments seemingly aimed at economic stabilization, including $250 million in financing for a systemically important bank in Colombia that will focus on making loans to underserved clients (women, SMEs and mortgage loans for loan income borrowers), $100 million for a consumer financing services company in Mexico that lends to SMEs (with a special focus on women run SMEs), and $150 million to a bank in Costa Rica. So far this year, 47 percent of DFC’s dollars in have been channeled through financial intermediaries, with the bulk in the Western Hemisphere. The vast majority of these projects focus on meeting crisis liquidity needs.

Scaling up lending to existing clients appears to be a key component of DFC’s economic response. By our count, 13 of 39 recently announced deals are with clients that already have active DFC projects. But as our colleague Nancy Lee points out in her piece on Eight Principles for the DFI Crisis Response, “even in the immediate term, focusing only on existing clients is not enough. DFIs will rightly be judged by whether they reach firms, financial institutions, and countries hit hardest.” Blended finance projects—like the USAID co-financed $14.75 portfolio guarantee to support SME lending and microfinance institutions in West—provide an innovative approach to achieving this reach. Collaboration with DFIs could be another strategy to reach hardest hit markets and populations. As Lee also points out, during a time of crisis DFIs “need to work out equitable plans to share risk and returns in ways that maximize their collective impact, share balance sheet costs, and share pipelines.” We remain perplexed by how little DFC appears to be doing with other DFIs during this time. DFC could be uniquely positioned to help de-risk and crowd in other DFIs into higher risk projects. As a member of the DFI Alliance, DFC participated in a joint statement in April on DFI collaboration during the crisis, so perhaps there are some programs in the pipeline. Overall, we see positive trends in the portfolio, with some smaller innovative projects, especially across the African continent and in India. With a likely deepening economic crisis globally in the months ahead, DFC will need to take stock of how its crisis response measures have performed to date, scale up the successes, and deepen its partnerships with the broader DFI community.

0 notes

Text

where can i see my Instagram funds transaction history?

where can i see my Instagram funds transaction history? Read More http://fxasker.com/question/d72d07ab40c75d32/ FXAsker

#activtrades handelszeiten forex#activtrades mt4#ads securities platform#axitrader uk#BLACKWELLTRADER#bmfn logo#cmsfx japan tool demo#dukascopy 911 instagram#exness instagram#forex time frame 5 minuti#forex trading education in mumba#forex trading examples#fxgm varning#fxpro eurusd#fxpro instagram#gkfx metatrader#HKT#iamfx login#ic markets oil#ig markets joint account#ig markets wti#INSTAGRAM#kevin aprilio hotforex#tomoko kawase instagram#windsor 75 diner#Forex Trading Online

0 notes

Text

Covid19 update: Cloud Robotics Market to set Phenomenal Growth |Motion Controls Robotics, Wolf Robotics LLC

Cloud Robotics Market report includes the analysis and discussion of important industry trends, market size, market share estimates, profiles of the leading industry players, and forecasts. Amazon Robotics, Google, Huawei, IBM, Microsoft, C2RO, CloudMinds, Hit Robot Group, V3 Smart Technologies, Rapyuta Robotics, Ortelio, Tend.ai, Ericsson, Rockwell Automation Inc., Fanuc Corporation, Yaskawa Electric Corporation, Mitsubishi, Kuka AG, ABB Group, Calvary Robotics, HotBlack Robotics Srl, Motion Controls Robotics, Wolf Robotics LLC, Tech Con Automation Inc., Matrix Industrial Automation, SIASUN and Automation IG.

The global cloud robotics market accounted for USD 2.01 billion in 2017 and is projected to grow at a CAGR of 29% in the forecast period of 2018 to 2025.

Download Free Sample Report @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-cloud-robotics-market

Market Drivers and Restraints:

Rising internet and cloud infrastructure.

Rapid progress of wireless technology.

Rapid development of software frameworks and services.

Data Privacy and Security Concerns

High Initial Costs and R&D Expenses

Cloud robotics is a field of robotics that endeavors to raise cloud advancements, for example, cloud computing, cloud storage, and other web innovations focused on the advantages of united framework and shared administrations for robotics. Cloud robotics is a forthcoming pattern in the smart arrangement of an industry. It comprise of attributes of both robotics and also cloud base innovation. From robotics, it has inferred three functionalities, for example, sensation, incitation, and control, though, from cloud innovation it has empowered pervasive, helpful, on request organize access to a common pool of configurable assets.

MAJOR TOC OF THE REPORT

Chapter One: Cloud Robotics Market Overview

Chapter Two: Manufacturers Profiles

Chapter Three: Global Cloud Robotics Market Competition, by Players

Chapter Four: Global Cloud Robotics Market Size by Regions

Chapter Five: North America Cloud Robotics Revenue by Countries

Chapter Six: Europe Cloud Robotics Revenue by Countries

Chapter Seven: Asia-Pacific Cloud Robotics Revenue by Countries

Chapter Eight: South America Cloud Robotics Revenue by Countries

Chapter Nine: Middle East and Africa Revenue Cloud Robotics by Countries

Chapter Ten: Global Cloud Robotics Market Segment by Type

Chapter Eleven: Global Cloud Robotics Market Segment by Application

Get Detailed Toc @ https://www.databridgemarketresearch.com/toc/?dbmr=global-cloud-robotics-market

Cloud Robotics Market is highly fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. The report includes market shares of Cloud Robotics Market for global, Europe, North America, Asia Pacific and South America.

Regionally, this report categorizes the production, apparent consumption, export and import of global Cloud Robotics Market covering:

- North America (United States, Canada and Mexico)

- Europe (Germany, France, UK, Russia and Italy)

- Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

- South America (Brazil, Argentina, Colombia)

- Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Reasons for Buying this Cloud Robotics Report

1. Cloud Robotics Market report aids in understanding the crucial product segments and their perspective.

2. Initial graphics and exemplified that a SWOT evaluation of large sections supplied from the Cloud Robotics industry.

3. Even the Cloud Robotics economy provides pin line evaluation of changing competition dynamics and retains you facing opponents.

4. This report provides a more rapid standpoint on various driving facets or controlling Cloud Robotics promote advantage.

5. This worldwide Cloud Robotics report provides a pinpoint test for shifting dynamics that are competitive.

Buy now@ https://www.databridgemarketresearch.com/checkout/buy/enterprise/global-dairy-enzymes-market

About Us:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: [email protected]

0 notes

Text

Energy bonds: Unloved, out of favor, and potentially attractive

Energy equities and credit underperformed the broader markets in 2019, and within energy credit, high yield bonds underperformed investment grade bonds. At Invesco Fixed Income, we believe these performance discrepancies may create interesting investment opportunities in 2020. In investment grade, we favor midstream companies focused on corporate actions to improve credit fundamentals. In high yield, we favor exploration and development companies with positive free cash flow and midstream energy companies with diversified assets.

2019 marked by energy volatility

Looking back to a little over a year ago, the fourth quarter of 2018 was challenging for many asset classes as global recession fears mounted. Crude oil was particularly under pressure with benchmark prices down nearly 40% due to global demand concerns and a relentless rise in US shale oil production.1 But OPEC and key non-OPEC producers came to the rescue in December 2018 with the announcement of a coordinated production cut.2 Helped by easing global recession fears, oil rallied in the first few months of 2019 and has had the continued implicit support of OPEC and non-OPEC producers.

Fast forward to the end of last year, December 2019, and OPEC surprised the market again with an even deeper production cut to stay ahead of a potentially over-supplied oil market in 2020.3 While oil has remained partially supported by this ongoing supply-side management, natural gas prices have been under pressure from surging US shale gas production, which has oversupplied the US market with little relief in sight.

Decoupling of major energy markets

Against this backdrop of commodity volatility, energy equities lacked investor support in 2019 and largely underperformed the rest of the market.4 In credit markets, investment grade (IG) energy outperformed high yield (HY) energy.5 We believe such performance discrepancies may create unique opportunities for bond investors in 2020.

Figure 1: 2019 indexed asset class performance review

Source: Bloomberg L.P., Barclays Live, data from Dec. 31, 2018, to Dec. 31, 2019. WTI stands for West Texas Intermediate oil prices. OAS stands for option-adjusted spread. Note: US IG and US HY energy OAS index performance reflect inverse indexed changes for ease of comparison to other prices since bond yields and prices move in opposite directions. Indices are Russell 1000 Energy Index, Bloomberg Barclays U.S. Investment Grade Energy Index, Bloomberg Barclays U.S. High Yield Energy Index. Oil (WTI) and natural gas are prices.

In IG credit, midstream sector stands out

IG energy posted positive returns in 2019 but underperformed the overall IG market.6 However, all “energy companies” are not created equal, and we believe there is more credit support embedded in the volume-driven midstream sector (companies that transport hydrocarbons via pipelines) versus the commodity price-sensitive exploration and production (E&P) sector.

While we wait to see evidence of the E&P sector’s ability to consistently generate free cash, we are more encouraged by the corporate actions taken and positive fundamental changes in the IG midstream sector. Midstream companies have generally committed to solid investment grade ratings, slower growth, greater cash retention and reduced leverage, resulting in select ratings upgrades. Midstream’s search for a lower cost of capital has also included asset sales, dividend cuts, de-levering mergers and acquisitions, corporate simplifications and joint ventures, among other bondholder-friendly actions.

We expect more credit-supportive corporate actions in 2020. Further, attractive relative valuations, in our view, compared to the IG index (after 2019’s relative underperformance) and the sector’s focus on slower growth, greater cash retention and lower leverage could bode positively for bondholders in 2020.6 We expect the midstream sector to remain focused on cost of capital optimization in a way that is accretive, not only to the equity community, but also to bondholders.

Brighter macro outlook could boost HY energy in 2020

Within HY, the energy sector was by far the worst performing sector in 2019.7 However, most of HY energy’s underperformance was due to CCC energy names and, to a lesser extent, single Bs.8 BB energy names performed more in-line with the overall market.9

There are several reasons that HY energy underperformed last year:

A greater number of energy bankruptcies with low creditor recoveries.

Investor fatigue due to volatility in recent years.

Uncertainty over oil and gas prices due to macro and supply concerns.

Poor energy equity performance as investors pushed back on the industry’s historical focus on quick growth over profits and cash flow.

The perception that HY’s access to capital was largely closed (except to high-quality BB-rated energy companies), impairing the extension of looming bond maturities in 2021 and 2022.

The outsized natural gas exposure of some HY issuers.

Poor technicals, as HY was out of favor with money managers and some credit hedge funds.

If the macro picture improves, or even stabilizes, 2020 could see a reversal of 2019’s poor technicals, and HY energy could gain positive momentum as the perceived access to capital improves, allowing some stressed issuers to potentially refinance and push out near-term maturities.

Given this possibility, and our view that spreads and yields have reached attractive levels in an otherwise tight market, there may be compelling opportunities in US high yield energy in 2020. In this space, we favor E&P companies that are rated single B or BB, have low production costs, are expected to generate positive free cash flow, and have manageable bond maturities. We also favor midstream companies with diversified assets and minimal exposure to basins that are expected to experience lower volumes, especially in natural gas.

Conclusion

After uneven performance in 2019 across commodities, energy credit and energy equities, and given broader economic uncertainty, investing in US energy credit requires caution, in our view. The potential for continued commodity and bond price volatility warrants a vigilant and deliberate investment approach.

At Invesco Fixed Income, we believe this backdrop may create investment opportunities for meticulous and value-oriented active investment managers. As such, we continue to scour the universe of IG and HY energy credit for opportunities exhibiting creditor-specific catalysts and attractive risk-adjusted return potential.

1 Source: Bloomberg L.P., Reflects the 38.0% price change for oil (WTI) from Sept. 28, 2018 ($73.25 per barrel) to Dec. 31, 2018 ($45.41 per barrel).

2 Source: OPEC, Dec. 7, 2018.

3 Source: OPEC, Dec. 6, 2019.

4 Based on index price changes for the period Dec. 31, 2018, to Dec. 31, 2019, for the Russell 1000 Energy Index (+6.7%) vs. the Russell 1000 Index (+31.4%).

5 Based on changes in the index OAS from Dec. 31, 2018 to Dec. 31, 2019 for the US Investment Grade Energy Credit Index (31.8% OAS decline) vs. the US High Yield Energy Credit Index (9.0% OAS decline). Spread declines imply price improvements.

6 Based on changes in the index OAS from Dec. 31, 2018, to Dec. 31, 2019, for the US Investment Grade Credit Index (37.2% OAS decline) vs. the US Investment Grade Energy Credit Index (31.8% OAS decline). Spread declines imply price improvements.

7 Based on 4.71% total returns for the J.P. Morgan Domestic High Yield Energy Index versus 14.08% total returns for the J.P. Morgan High Yield Index, data from Jan. 1, 2019, to Dec. 12, 2019.

8 Source: JP Morgan, “Credit Market Dysfunction: A Story in (Mostly) Pictures,” Tarek Hamid, Jon H Dorfman, CFA, Aaron Rosenthal, CFA, Nov. 1, 2019.

Source: JP Morgan estimates, data from Jan. 2, 2019, to Dec. 31, 2019.

9 Ratings source: Standard & Poor’s. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. Not Rated indicates the debtor was not rated and should not be interpreted as indicating low quality. A negative in Cash indicates fund activity that has accrued or is pending settlement. For more information on Standard and Poor’s rating methodology, please visit www.standardandpoors.com and select ‘Understanding Ratings’ under Rating Resources on the homepage.

Important Information

Blog header image: Jose Luis Stephens / EyeEm / Getty

The OAS or “option-adjusted spread” is the difference between the yield of a fixed income security and the risk-free yield, which is adjusted to take into account an embedded option. Typically, a US Treasury yield is considered the risk-free rate.

The Russell 1000® Energy Index, a trademark/service mark of the Frank Russell Co.®, is composed of energy-related securities.

The Bloomberg Barclays US Corporate High Yield Energy Index includes high yield rated debt issues from North American companies involved in the energy sector.

The Bloomberg Barclays US IG Energy Index is a sub-index of the Bloomberg Barclays US Credit Index, which measures the investment grade, US dollar-denominated, fixed rate, taxable corporate and government related bond markets.

Past performance cannot guarantee future results. Diversification does not guarantee a profit or eliminate the risk of loss.

A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets.

Businesses in the energy sector may be adversely affected by foreign, federal or state regulations governing energy production, distribution and sale as well as supply-and-demand for energy resources. Short-term volatility in energy prices may cause share price fluctuations.

Fixed income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Junk bonds involve a greater risk of default or price changes due to changes in the issuer’s credit quality. The values of junk bonds fluctuate more than those of high-quality bonds and can decline significantly over short time periods.

The opinions referenced above are those of the author as of Feb. 5, 2020. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/energy-bonds-unloved-out-of-favor-and-potentially-attractive/

0 notes

Text

interview | cole sprouse x reader

request

written by: yours truly

edited by: @jugheadxreaderinyourhead

anonymous said: I loved guest star!! 😍 I was wondering if you could make a fic about cole how youve been keeping your relationship for months now and fans are suspecting that youre dating because of all the bts and photos of you and his ig and in one interview that youre having together someone questions you guys about it. sorry if this was long 😂 i love your fics 😘❤

a/n: basically this is another guest star part but an interview!

✿

“god i’m so nervous”. you mutter pulling on your fingers as you wait in the green room with your boyfriend cole and co-star kj. we were about to endure a joint interview and it was your first lot of press you’ve done for riverdale.

but it wasn’t that factor that made you nervous, it was that people were becoming more and more aware of your romantic relationship with cole.

you’d been able to keep it under wraps for the whole two years you’ve been dating but now that you were both sharing the small screen people had caught on.

so you had to control yourselves whenever you were out. refraining yourselves from snap chatting each other or posting photos all over your instagrams.

you had to be strictly platonic. you didn’t need any sort of bad press if you two were to break up. so for now you weren’t a couple, you were just a couple of besties.

or atleast that’s what you thought. you thought were pulling it off. but more and more accounts for your ‘ship name’ with cole had popped up on both twitter and instagram and not to mention the constant questions when meeting fans in the flesh.

especially when they caught you out mid-date. when you two had to coyly pretend that you were waiting on other friends to excuse the fact that you were out together without the rest of the cast.

and to be quite frank you were getting sick of all the pretending and running around. sometimes you just wanted kiss your boyfriend or hold his hand whilst you walked down the streets.

not that you really had the opportunity to take a leisurely stroll down the road, being famous disney stars and all.

“you’ll be fine”, cole whispers walking toward you making sure no one was staring at the two of you. he placed a soft hand on your shoulder, instantly filling you with comfort.

“just breathe okay? if they ask don’t say yes but don’t say no, yeah? that way we aren’t lying or avoiding the question” you nod smiling to the boy as a young women calls you over to the interview room.

the three of you file in, sitting down on a huge plush couch, each boy on either side of you as the interviewer sits in her own seperate lounge chair.

the interviewer starts her intro off strong turning toward the three of you. “kj apa as archie andrews, y/n l/n as c/n c/l/n and cole sprouse as jughead jones on the cw’s riverdale!”

the three of you all smile greeting the interviewer, and the camera crew, as you settle into the interview, talking about the upcoming season and possible plot.

you were too busy worrying to even pay attention to half the stuff that was spewing from the ladies mouth, that you barely noticed her turn to you and begin to engage in conversation until kj smoothly nudged you.

patting down your dress you push your hair off your shoulder as she addressed you directly.

“so how is it for you to go from disney to the darker side of the cw?”

“i mean it’s a lot different to disney i’ll tell you that”. you pause the group laughing to themselves “i didn’t even really think i’d be coming back to acting but i couldn’t resist the role”.

she nods playing with the cards in her palms. “so anything in particular that’s vastly different?”

“well - it’s still directed for the younger generation but i feel like in disney it was more so for the children than the preteens for example…and the content we’re filming is a lot heavier than the stuff we dealt with on y/d/s but it’s also just as fun and exciting as i remember”.

“so you and cole -” you freeze at the mention of him, “both disney kids coming back to acting. kj what was it like to know that you were working with some of the greatest names in disney?”

you breathe a sigh of relief taking a sip from the glass of water on the table as you listen to kj rattle on about how much he adored cole and dylan.

“both of their shows i watched religiously. me and my mates used to love it aye. especially y/d/s with uh y/n we loved her a lot - im pretty sure one of my mates had a poster of her”.

you blush giggling to yourself. “so you had a crush on y/n?” the interviewer laughs, kj turning red at the words. you continue laughing placing a hand around his arm.

“aw kj!!!” you swoon embarrassing him further. cole joined in on the fun, “yeah he was a big fan we kinda had to push him a bit and be like ’hey buddy“.

kj shakes his head furiously to the camera his words rushing out in defence “nah nah nah”. sending you and cole into a laughing fit as the kiwi struggled to cover up his words.

“i mean i was a fan. like who wasn’t aye, but nah it’s a lot of fun filming with them and we all are good friends with the others too. but ugh yeah- it’s hard to go out anywhere because fans notice them from a mile away”

the interviewer laughs “wait people still notice you as your disney characters?” we both nod cole taking the lead.

“i mean it’s very flattering but as you can see im not the same kid with the blonde shaggy bowl cut so sometimes i question how they’d recognise me- especially from friends”.

you smile the interviewer looking to you for input “what about you?”

you nod leaning back slightly into the couch feeling coles arm against the top of the couch.

“they do yes, i go anywhere and they all yell ”c/n“ and sometimes i just forget and then they’re running and i’m running and then they’re screaming and i’m screaming”.

the room started to laugh.

“it’s a very weird situation” you giggle the interviewer cutting in.

“and you looking nothin like that girl anymore- you look amazing!”

you place a hand over your heart in awe “thank god for that” you joke poking fun at yourself. “i grew up and hit puberty and sometimes when i hear someone say ’hey you look like that girl off y/d/s? i’m like damn i must be having a rough day”.

the interviewer giggles “oh don’t be so hard on yourself- doesn’t she look hot now boys?” she slaps kj’s leg and they both nod.

“god yeah she’s come along way from disney-even though i still had a crush on c/n”, cole comments a smile growing on your face at the compliment.

“so are you all single?”

your heart plummets at the question. the dreaded question for anyone in the industry is asked whenever they are in one or aren’t. no one wants to be asked this question ever.

cole answers first surprising you “i’m not no”.

“i am” kj chirps taking a long drink from his water.

“i’m not either” you clear your throat smiling, refusing to make eye contact with cole.

the interviewer smirks knowing she got the answer you wanted “oh so you two are off the market”. she pretends to act surprised “well who are they”.

cole replies cutely “for us to know and you to never find out- all you need to know is she’s beautiful and one of a kind”.

you fight off the blush tinting on your cheeks as the interviewer wraps up the interview.

“one last question before you guys leave- serpent jughead? yes or no?”

“yes yes yes” you stammer feeling confident. “have you seen jughead in a leather jacket? serpent jughead is the best thing to come out of riverdale”.

cole blushes and the interview is officially over. cole’s manager walking over to escort us back to our green room.

“i think you might have just outed us” he teases walking dangerously close to you, his hot breathe on your neck.

“what can i say- serpent juggie just does some indescribable things to me”.

tag list: @hauntedcherryblossombanana-blog @sadbreakfastclb @jugandbettsdetectiveagency @kindfloweroflove @fragilefrances @mydelightfulcollectiontyphoon @onceuponagladerhead @natalieroseg @sardonic-jug

#cole sprouse#cole sprouse imagines#imagines#riverdale imagines#riverdale#riverdale cast#kj apa#headcanon#one shots#request

555 notes

·

View notes