#i have been very busy causing problems for a site with no public api

Explore tagged Tumblr posts

Text

I've been doing different and unrelated code for a while: has anyone at Tumblr open-sourced a version of the NPF-block-to-dashboard-HTML code?

#tumblr api#coding#i have been very busy causing problems for a site with no public api#and wheezing

10 notes

·

View notes

Text

COVID: The Squeeze Play on the Population

It’s a con as old as the hills. The ancient chieftain of a little territory looks out across his domain and says to his top aide, “You know, we have these clusters of people worshiping different gods. That’s not good for business. Our business is CONTROL, so we need UNITY. Make up the name of some god, and go out there and sell it. Take down those little shrines and tell all the people they have to believe in the new deity. Use force and censorship when necessary. Later on, I may decide I’M really the name you chose for the new god. We’ll see. If you have any trouble right away, call me on my cell. I’ll be out sunning by the pool.”

Unity of thought. That’s what controllers are after.

In the case of this fake epidemic, the population must view WHAT IT IS in the way public officials and the press are describing it. Dissenting analysis must be pushed into the background.

Here is a 4/9 Bloomberg News headline: “5G Conspiracy Theory Fueled by Coordinated Effort.” [1] A sub-headline states, “Researchers identify disinformation campaign but not source.” The article begins: “A conspiracy theory linking 5G technology to the outbreak of the coronavirus is quickly gaining momentum…” Nature Made Calcium, M... Buy New $9.00 ($0.03 / Count) (as of 03:55 EDT - Details)

Obviously, such wayward thinking has to be stopped. And down further in the Bloomberg article, we have chilling news: “Some social media companies have taken action to limit the spread of coronavirus conspiracy theories on their platforms. On Tuesday, Google’s YouTube said that it would ban all videos linking 5G technology to coronavirus, saying that ‘any content that disputes the existence or transmission of Covid-19’ would now be in violation of YouTube policies.”

“In the U.K., a parliamentary committee on Monday called on the British government to do more to ‘stamp out’ coronavirus conspiracy theories, and said it was planning to hold a hearing later this year at which representatives from U.S. technology giants will be asked about how they have handled the spread of disinformation on their platforms.”

Independent analysis of the “epidemic” hangs in the balance. The masters of control want to maintain an information monopoly.

It goes without saying that, in order to achieve this monopoly, detailed surveillance of Internet content is necessary.

Another type of surveillance is also part of the squeeze play. Apple.com has the story (press release, 4/10) [2]:

“Across the world, governments and health authorities are working together to find solutions to the COVID-19 pandemic, to protect people… Since COVID-19 can be transmitted through close proximity to affected individuals, public health officials have identified contact tracing as a valuable tool to help contain its spread. A number of leading public health authorities, universities, and NGOs around the world have been doing important work to develop opt-in contact tracing technology.”

“To further this cause, Apple and Google will be launching a comprehensive solution that includes application programming interfaces (APIs) and operating system-level technology to assist in enabling contact tracing. Given the urgent need, the plan is to implement this solution in two steps while maintaining strong protections around user privacy.” All-Natural Large Heat... Buy New $27.95 ($27.95 / Count) (as of 03:18 EDT - Details)

“First, in May, both companies will release APIs that enable interoperability between Android and iOS devices using apps from public health authorities. These official apps will be available for users to download via their respective app stores.”

“Second, in the coming months, Apple and Google will work to enable a broader Bluetooth-based contact tracing platform by building this functionality into the underlying platforms. This is a more robust solution than an API and would allow more individuals to participate, if they choose to opt in, as well as enable interaction with a broader ecosystem of apps and government health authorities. Privacy, transparency, and consent are of utmost importance in this effort, and we look forward to building this functionality in consultation with interested stakeholders. We will openly publish information about our work for others to analyze.”

“All of us at Apple and Google believe there has never been a more important moment to work together to solve one of the world’s most pressing problems. Through close cooperation and collaboration with developers, governments and public health providers, we hope to harness the power of technology to help countries around the world slow the spread of COVID-19 and accelerate the return of everyday life.”

If you believe citizen privacy is an utmost concern in the minds of Google and Apple, I have condos for sale on the far side of the moon.

The tracing tools appear to involve a very rapid expansion of Snitch Culture. What else are “opt-in users” going to communicate about? The weather? Lunch?

“Dear Relevant Users and Public Health Officials: Yes, I know Marty. Sad to hear he’s been diagnosed with COVID-19. I did have a brief meeting with him just prior to the lockdown. I suppose I might be infected. I should get tested right away. Let’s see, who else was at the meeting? Marty’s brother, Felix, and Carrie, who is Felix’ on and off girlfriend. Six months ago she was tested for an STD, I don’t know the results—Sandy, the broker at Wilson and Wise was also at the meeting—OMG, that could mean the whole company is infected—and Sandy’s dog Tootsie—can animals spread the virus?—then there was a janitor who came into the room, I think his name is Al. He lives down near the docks. He has a brother who I hear is a drug dealer and a compulsive gambler. He owes money to some nasty people, I think…Anything I can do to stop the spread of the virus, let me know…”

Enlist the citizenry to act as spies on each other. A useful tactic. Qunol Ultra CoQ10 100m... Buy New $25.35 ($0.21 / Count) (as of 02:39 EDT - Details)

It rips the fabric of social trust.

It blows apart privacy.

It exposes people to government intervention.

It cements the UNITY DICTUM: the epidemic has only one portrait, and the population must bow before it.

An answer? A counter? More citizens must become independent reporters and publish their findings. More citizens must set up blogs and sites that act as old-fashioned street newsstands, posting the work of independent journalists and investigators.

For every ten they censor, a hundred must spring up.

Nothing is riding on this except the immediate future—freedom, slavery, medical dictatorship, a borderless planet operated as one super-corporation, the individual vs. the collective, the energy of the individual soul.

Or people can say doom is upon us and nothing can be done about it.

Or people can sit at home and suck on the lockdown lollipop.

In Ohio, there is a protest see here and here.

SOURCES: [1]: 5G Virus Conspiracy Theory Fueled by Coordinated Effort [2]: Apple and Google partner on COVID-19 contact tracing technology

-Jon Rappaport

0 notes

Text

Monthly Web Development Update 9/2019: Embracing Basic And Why Simple Is Hard

Monthly Web Development Update 9/2019: Embracing Basic And Why Simple Is Hard

Anselm Hannemann

2019-09-13T13:17:00+02:002019-09-13T11:44:31+00:00

Editor’s note: Please note that this is the last Monthly Web Development Update in the series. You can still follow the Web Development Reading List on Anselm’s site at https://wdrl.info. Watch out for a new roundup post format next month here on Smashing Magazine. A big thank-you to Anselm for sharing his findings and his thoughts with us during the past four years.

Do we make our lives too complex, too busy, and too rich? More and more people working with digital technology realize over time that a simple craft and nature are very valuable. The constant hunt to do more and get more productive, with even leisure activities that are meant to help us refuel our energy turning into a competition, doesn’t seem to be a good idea, yet currently, this is a trend in our modern world. After work, we feel we need to do two hours of yoga and be able to master the most complex of poses, we need a hobby, binge-watch series on Netflix, and a lot more. That’s why this week I want to encourage you to embrace a basic lifestyle.

“To live a life in which one purely subsists on the airy cream puffs of ideas seems enviably privileged: the ability to make a living merely off of one’s thoughts, rather than manual or skilled labor.” — Nadia Eghbal in “Basic”

What does basic stand for? Keep it real, don’t constantly do extra hours, don’t try to pack your workday with even more tasks or find more techniques to make it more efficient. Don’t try to hack your productivity, your sleep, let alone your meditation, yoga, or other wellness and sports activities. Do what you need to do and enjoy the silence and doing nothing when you’re finished. Living a basic life is a virtue, and it becomes more relevant again as we have more money to spend on unnecessary goods and more technology that intercept our human, basic thoughts on things.

News

Firefox 69 is out, bringing us JavaScript public instance fields, Resize Observers, Microtask APIs, CSS overflow-block, and @supports for selectors.

General

Chris Coyier asks the question if a website should work without JavaScript in 2019. It breaks down to a couple of thoughts that mainly conclude with progressive enhancement being more important than making a website work for users who actively turned off JavaScript.

Privacy

Brave’s research reveals how Google works around the legal requirements of the GDPR directive on its DoubleClick service, exposing private user data to millions of websites without any control.

UI/UX

In our modern world, it’s easy to junk things up. We’re quick to add more questions to research surveys, more buttons to a digital interface, more burdens to people. Simple is hard.

Web Performance

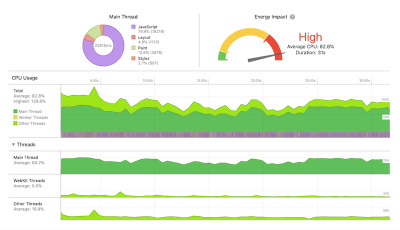

So many users these days use the Internet with a battery-driven device. The WebKit team shares how web content can affect power usage and how to improve the performance of your web application and save battery.

Scrolling a page with complex rendering and video playback has a significant impact on battery life. But how can you make your pages more power efficient? (Image credit)

JavaScript

Philip Walton shows how we can use native JavaScript modules in production today.

Tooling

There’s a new tool in town if you want to have a status page for your web service: The great people from Oh Dear now also provide status pages.

Bastian Allgeier shares his thoughts on simplicity on the web, where we started, and where we are now. Call it nostalgic or not, the times when we simply uploaded a file via FTP and it was live on servers were easy days. Now with all the CI/CD tooling around, we have gotten many advantages in terms of security, version management, and testability. However, a simple solution looks different.

Accessibility

Adrian Roselli shares why we shouldn’t under-engineer text form fields and why the default CSS that comes with the browser usually isn’t enough. A pretty good summary of what’s possible, what’s necessary, and how to make forms better for everyone visiting our websites. It even includes high-contrast mode, dark mode, print styles, and internationalization.

Work & Life

Adam Blanchard summarized his notes and thoughts from TechFestival in Copenhagen and shares behaviors that transform organizations.

Claire Lew explains why the question of how to motivate employees is misguided and how great managers support their employees’ thoughts and ideas to foster self-motivation.

A lot of developers hate to be interrupted as it can harm productivity for hours. Samuel Taylor wrote a thought-provoking article to help us understand why a “developers vs. others” mentality decreases trust in a team and how you can take matters into your own hands, asking yourself why people interrupt you and take this as a chance to improve.

Nadia Eghbal shares why externalizing all our thoughts is not only a good thing. Embracing the basic in our lives is a virtue we should focus on more and this article is great food to make us think.

A method to solve the problem of that one thing on our task list that is “so meaningful and important that it brings up a ton of uncertainty for us, and causes us to avoid, run, distract, comfort, procrastinate.”

Going Beyond…

Snøhetta’s Powerhouse Brattørkaia produces twice the energy it uses with clever architecture and technology like solar panels all over the place. Isn’t that an office building we’d love to go to for work?

It might be that scientists have been underestimating the pace of climate change as the sea temperature measurements which were made in the past decade lacked accuracy.

This isn’t business as usual. Business as usual has time but we can use a short break to finally start shaping our future. From September 20th to 27th, millions will join young climate strikers on the streets and demand an end of the age of fossil fuels. I’m ready and will support this movement. Let’s do our best to cut down emissions — by driving less or flying less, especially if it’s “for fun”. Together we can change everything.

—Anselm

(cm)

0 notes

Text

Version 443

youtube

windows

zip

exe

macOS

app

linux

tar.gz

I had a great week doing nice cleanup and quality of life work.

Hey, we had a problem getting the macOS release to build this week. The macOS link above goes to a build using a simpler and faster method. It should work fine, but please let me know if you have any trouble. As always, back up before you update!

highlights

Popup messages can now launch complex jobs from a button. The first I've added is when a subscription hits its 'periodic' file limit. The situation itself is now better explained, and a button on the popup will create a new downloader page with the specific query set up with an appropriate file limit to fill in the gap. The second is if you try to upload some content to a repository that your account does not have permission for (this is affecting sibling- and parent-uploading PTR users as the shared public account is changing), the popup message that talks about the issue now has a button that takes you straight to the manage services panel for the service and starts automatic account creation.

Subs should now be more careful about determining when they have 'caught up' to a previous sync. Small initial file limits are respected more, and the 'caught up' check is now more precise with sites that can give multiple files per URL or very large gallery pages.

I gave options->speed and memory a full pass. The layout is less crushed and has more explanation, the options all apply without needing a client restart, and the new, previously hardcoded cache/prefetch thresholds are now exposed and explained. There's a neat thing that gives an example resolution of what will be cached or prefetched, like 'about a 7,245x4,075 image', that changes as you fiddle with the controls.

The client has recently had worse UI lag. After working with some users, the biggest problems seemed to come in a session with lots of downloaders. I traced the cause of the lag and believe I have eliminated it. If you have had lag recently, a second or two every now and then, please let me know how things are now.

If you use the Client API a lot while the client is minimised, you can now have it explicitly prohibit 'idle mode' while it is working under options->maintenance and processing.

full list

quality of life:

when subscriptions hit their 'periodic file limit', which has always been an overly technical term, the popup message now explains the situation in better language. it also now provides a button to automatically fill in the gap via a new gallery downloader page called 'subscription gap downloaders' that gets the query with a file limit five times the size of the sub's periodic download limit

I rewrote the logic behind the 'small initial sync, larger periodic sync' detection in subscription sync, improving url counting and reliability through the third, fourth, fifth etc... sync, and then generalised the test to also work without fixed file limits and for large-gallery sites like pixiv, and any site that has URLs that often produce multiple files per URL. essentially, subs now have a nice test for appropriate times to stop url-adding part way through a page (typically, a sub will otherwise always add everything up to the end of a page, in order to catch late-tagged files that have appeared out of order, but if this is done too eagerly, some types of subs perform inefficiently)

this matters for PTR accounts: if your repository account does not have permissions to upload something you have pending, the popup message talking about this now hangs around for longer (120 seconds), explains the issue better, and has a button that will take you directly to the _manage services_ panel for the service and will hit up 'check for auto-account creation'

in _manage services_, whenever you change the credentials (host, port, or access key) on a restricted service, that service now resets its account to unknown and flags for a swift account re-fetch. this should solve some annoying 'sorry, please hit refresh account in _review services_ to fix that manually' problems

a new option in maintenance and processing allows you to disable idle mode if the client api has had a request in the past x minutes. it defaults disabled

an important improvement to the main JobScheduler object, which farms out a variety of small fast jobs, now massively reduces Add-Job latency when the queue is very busy. when you have a bunch of downloaders working in the background, the UI should have much less lag now

the _options->speed and memory_ page has a full pass. the thumbnail, image, and image tile caches now have their own sections, there is some more help text, and the new but previously hardcoded 10%/25% cache and prefetch limits are now settable and have dynamic guidance text that says 'about a 7,245x4,075 image' as image cache options change

all the cache options on this page now apply instantly on dialog ok. no more client restart required!

.

other stuff, mostly specific niche work:

last week's v441->442 update now has a pre-run check for free disk space. users with large sessions may need 10GB or more of free space to do the conversion, and this was not being checked. I will now try to integrate similar checks into all future large updates

fixed last week's yandere post parser link update--the post url class should move from legacy moebooru to the new yandere parser correctly

the big maintenance tasks of duplicate file potentials search and repository processing will now take longer breaks if the database is busy or their work is otherwise taking a long time. if the client is cluttered with work, they shouldn't accidentally lag out other areas of the program so much

label update on ipfs service management panel: the server now reports 'nocopy is available' rather than 'nocopy is enabled'

label update on shortcut: 'open a new page: search page' is now '...: choose a page'

fixed the little info message dialog when clicking on the page weight label menu item on the 'pages' menu

'database is complicated' menu label is updated to 'database is stored in multiple locations'

_options->gui pages->controls_ now has a little explanatory text about autocomplete dropdowns and some tooltips

migrate database dialog has some red warning text up top and a small layout and label text pass. the 'portable?' is now 'beneath db?'

the repositery hash_id and tag_id normalisation routines have two improvements: the error now shows specific service_ids that failed to lookup, and the mass-service_hash_id lookup now handles the situation where a hash_id is mapped by more than one service_id

repository definition reprocessing now corrects bad service_id rows, which will better heal clients that previously processed bad data

the client api and server in general should be better about giving 404s on certain sorts of missing files (it could dump out with 500 in some cases before)

it isn't perfect by any means, but the autocomplete dropdown should be a _little_ better about hiding itself in float mode if the parent text input box is scrolled off screen

reduced some lag in image neighbour precache when the client is very busy

.

boring code cleanup:

removed old job status 'begin' handling, as it was never really used. jobs now start at creation

job titles, tracebacks, and network jobs are now get/set in a nicer way

jobs can now store arbitrary labelled callable commands, which in a popup message becomes a labelled button

added some user callable button tests to the 'make some popups' debug job

file import queues now have the ability to discern 'master' Post URLs from those that were created in multi-file parsing

wrote the behind the scenes guts to create a new downloader page programmatically and start a subscription 'gap' query download

cleaned up how different timestamps are tracked in the main controller

next week

I am now on vacation for a week. I'm going to play vidya, shitpost the limited E3, listen to some long music, and sort out some IRL stuff.

v444 should therefore be on the 23rd. I'll do some more cleanup work and push on multiple local file services.

Thank you for your support!

0 notes

Text

Just how to Choose an Online Payment Solution

Just how to Choose an Online Payment Solution

Exactly how to choose an Online Payment Service and also our choice

The payment supplier is selected based upon many different criteria. Several of these are the solution accessibility in the nation where your checking account is, prices of a purchase, monthly charges, the prices of integration, and whether it settles sales tax concerns or allows for integration with a few other popular payment solutions. A lot of these concerns should be responded to by You the customer. Stripe is our favored selection as it had exceptional API abilities. This article will certainly use Stripe as its payment cpu of selection. Alipay

Ideal Practices for payment suppliers

Retry if purchase did not been successful The transaction could fall short not just as a result of technological reasons yet in some cases inadequate funds might be the reason. You must retry processing the transaction between an hour to number of days later on.

Know when your CC will end Some of the card details will run out or their data will no longer stand for different reasons. When you do not have valid CC data charging the customer will not be feasible. The major card systems supply a service that allows you check if there are any kind of updates pending for the consumer information that you keep. Some of the on-line payment remedies will certainly also update card information for you. Red stripe will certainly do this for most of MasterCard, Discover, as well as Visa cards. Not just CC.

Be aware that in some parts of the world individuals are not willing to pay with their Charge card The most effective example of this is China when Alipay is the major payment resource. It is worth keeping in mind that not all customers more than happy handing out their card information so making use of a widely known payment approach assists to boost the completion price of potential deals. Red stripe also sustains Alipay for China as well as for Europe Giropay, iDEAL

We wish to have Alipay Often customers just want to use Alipay UK as they know with the brand name. Do not be stubborn - Stripe will certainly aid to optimize your revenue. Stripe and also Paypal are straight rivals there is no combination between them.

Best practices while utilizing the Red stripe payment procedure

PCI compliance with Stripe

Many users end up being PCI certified by filling out the Self-Assessment Questionnaire (SAQ) offered by the PCI Safety And Security Standards Council. The kind of SAQ depends upon how you collect card information. The easiest technique of PCI validation is SAQ A. The fastest means to end up being PCI compliant with Stripe is to see to it you get a prefilled SEQ A. If so Stripe will certainly load the SEQ A for you as well as will make it readily available for you to download to your account's conformity setups after the initial 20 or so purchases. The means to attain this is as adheres to:

- Utilize the Embedded form called Check out, Stripe.js as well as Aspects (it provides far better format modification then Check out). You can utilize react-stripe-elements which makes use of Stripe.js API or Stripe mobile SDK libraries. When you're using react-native select tipsi-stripe. ipsi-stripe bindings are not formally sustained by Stripe so assistance will not formally inform you that they get approved for prefilled SEQ-A compliance - but they do.

- If you are making use of web serve your settlements pages need to utilize HTTPS.

In all those instances information is firmly transmitted directly to Red stripe without it passing through your servers. When you choose the fastest means you will certainly not need to do anything more. It is as straightforward as this up until you reach 6 million transactions annually then you will have to fill up a Record on Compliance to verify your PCI conformity each year.

Plan for technological failing - Idempotency essential If you are utilizing API to take payments you should plan for a technical failing as all networks are unstable. If failing occurs wit is not constantly feasible to understand if a charge was made or otherwise. When it comes to a network failure you must retry the deal. The Idempotency secret is a prevention device against charging a customer two times. If somehow you sent the payment twice - which might take place due to retrying procedures after a failing. In Stripes node lib you just add it to alternatives specification while billing. Each Idempotency key will time out after 24 hours so afterwards time if you make a payment with the same Idempotency secret you will charge the client.

Stripe charges in cents not dollars On the internet payment options like PayPal charge in bucks as opposed to cents. However that in Stripes all charges are made in smallest currency system. This is not only the instance concerning bucks, Stripes does it for all currencies.

Test

Red stripe offers lots of card numbers for you to examine various circumstances on the frontend and also symbols so you can straight check your backend. For instance you can not only test Visa, Mastercard, American Express, Discover, Diners Club and also JCB Cards yet additionally worldwide cards and also 3D Secure Cards. Stripe additionally supplies you with tokens so you can evaluate failing circumstances like a cost being decreased, or a cost being obstructed due to the fact that its deceitful, an ended card, or a handling mistake. So you will be prepared for every little thing that can take place when you go live.

Do not place JSON in description - Use metal

Be descriptive as you can. Metadata is your good friend. You can improve your Red stripe purchase with custom-made information so you can after that see it in the dashboard. For example you can add points like consumer ID or the delivery ID in metadata so there is no reason to pollute your deal summary.

Should I accumulate extra information?

The bare minimum to gather from a CC is its number, CVV and also expiration day yet you can accumulate extra. You can additionally collect the postal code/ CC holder name/ address for Address Verification System (AVS). If you accumulate them it will raise Wechat Payment UK safety since the scams avoidance algorithms will certainly have much more information and will have the ability to react a lot more accurately. Nonetheless, from the individual point of view it's even more information to kind - which is not constantly excellent. Clients are just human and also occasionally make mistakes when going into data which can additionally cause some deals to be rejected. So you must select just how much data you need and also what will certainly function best for you and also your revenue. Similarly financial institutions will sometimes deny repayments with a 'do not recognize' standing and also you will certainly have to call your client so they can ask their financial institution regarding the reason (high level of current activity on a card, an absence of matching AVS info, a card being over its limit, or a variety of various other reasons which only the financial institution will certainly recognize).

If you are any kind of on-line supplier of service or products, a method for consumers to pay quickly and easily online is becoming increasingly more essential. Online payment options are abundantly offered, and offer consumers a far more streamlined as well as hassle-free internet purchasing experience. The complying with are several of the advantages to carrying out online payment remedies. These apply to small businesses and large ventures alike (though the substantial bulk of bigger companies do have on the internet payment services).

Reduce of Purchase

It only stands to factor: if a purchase is simpler as well as quicker to make, there is a greater possibility that a person will make it. When you contrast the amount of time and also problem it requires to write out a check, placed it in a stamped envelope, and send it with filling in a name as well as a couple of credit card digits and after that clicking submit, it is clear at to which the client will perceive as much easier. As well as, in fact they will certainly be right even in a measurable sense worrying the quantity of time invested. Hence from a standard sales standpoint, it makes sense to supply online payment alternatives UK.

Up-to-Date Appearance

Beyond the above, a site that uses on-line payment solutions shows up much more up-to-date and contemporary. Online payment is the standard now, the rule as opposed to the exemption. So it makes a site appear even more market mindful as well as technically updated. This can aid to strengthen the sight for the customer that the website is legit, present, and also customer-oriented.

Simpler to Track and Organize

It is less complicated to track as well as arrange sales that are made online. The software program that processes these payments may additionally include analysis and also organizational components that are very handy in both evaluation of the sales performance of the website and also publication maintaining. And also excellent analysis and organization of supplier information is constantly handy for optimizing as well as streamlining a business.

Conserves Time and also Resources

These online payment services UK conserve the moment and sources of a company. Some examples are their capability to immediately handle repeating payments, produce billings automatically, as well as act as user interfaces for customer questions and complaints. The sheer workforce conserved right here alone is factor to institute these services.

Movement

These repayments can be received anywhere internet gain access to is available. This significantly frees up time and also permits higher flexibility both of business employees and also customers. When a customer can buy anywhere they can utilize their laptop computer, and also a firm can similarly receive those repayments basically anywhere and also anytime, the window for making purchases is a lot higher. This is all thanks to the raised availability/mobility.

A relatively current growth in this area is what is known as mobile payment. This is a growing network that enables people to Wechat Pay for goods or solutions making use of just mobile phones. Once again, what is occurring here is that payment is ending up being also easier to make in a variety of different circumstances and areas.

As you can see, applying an on-line payment option E14 5NR for your organisation makes sense on various levels. If you anticipate to have any type of significant online sales presence, allowing customers to make on line settlements is basically a requirement. Discover a great solution that matches your company needs and also you'll be ready to go.

Today's culture is slowly proceeding in the direction of a cashless economy! People favor to utilize their plastic as opposed to hard cash. Indeed, making use of charge card is a whole lot simpler than lugging money around. One card is all that you require to suit your purse whereas in case of cash money you need to carry a mass amount because you don't recognize how much you may need at one go. While talking with a company boss who lives next door, I realized the relevance of on the internet payment and also its growing importance for business globe. They have actually begun using different on-line payment remedies as well as terminating the acceptance of cash money from the customers. You need to work with people in order to man the cash counters while in case of online cash transfer the process is quick, basic as well as hassle-free.

On the internet payment transfer is much safer option also. Credit cards are issued by a financial institution after a prolonged verification process. While paying with your charge card, you need to mandatorily check all payment related details before final confirmation. Likewise, you MUST inspect credit card and also bank declarations meticulously after every payment to make certain the appropriate quantity has actually been debited, and also that no scams has happened throughout the particular transaction phase. Bulk of individuals likewise make use of conventional payment portals (PayPal, Authorize.net, and so on) to transfer funds to the vendor. Occasion coordinators as well are relying greatly on such on the internet payment processing and also administration options to effectively deal with event registration charges and/or ticket sales.

On-line payment services feature some major advantages such as:

PCI Compliance

It suggests you can securely make use of such an option for monetary purchases of any kind of kind. PCI which means Payment Card Industry has actually gotten a few objectives that all credit card providing and also dealing financial institutions require to adhere to. Some of the objectives include keeping a protected network, securing the card owner's information, as well as consistently keeping an eye on every single deal that takes place using credit cards.

SSL 128-bit Information Security

Bulk of on-line payment administration software adhere to the SSL 128-bit data file encryption plan to protect info that passes through the system. Therefore, the online payment remedy allows you refine all types of credit/debit card settlements and payments made using preferred gateways firmly, stopping any kind of chances of fraudulence.

Tension-free Cash Handling

Companies of all kinds, event monitoring firms plus course organizers discover an online payment service extremely easy to use. It is since they don't have to trouble around separately collecting money from the consumers, attendees or trainees. The on the internet system successfully transfers money from the purchaser's to the seller's savings account in minutes with least human disturbance.

On-line payment options could be the secret to saving personal time. It's simple to establish automatic electronic payment choices. You can log on each month to pay your expenses. Or you can license for repayments to be made as regularly as you want without going to your computer. Electronic settlements save you time due to the fact that you are not in the automobile or standing at the bank in line to make a withdrawal or transfer. Doing settlements online is very easy for people with standard computer system skills. If you want straight deposits from your business instead of waiting on a paper check, just offer your firm your account info to set up deposits with the financial institution, and also the transfers begin usually in a few pay cycles.

As an organisation on-line payment services will certainly conserve you a great deal of time and paperwork. You will have exact, organized records of the paychecks you spread at your fingertips. It will not take long to initiate worker pay-roll direct down payments when fundamental account information is authorized and become part of the system. Currently instead of preparing each specific check, printing it, and afterwards signing it, your pay-roll heads out at the touch of a few computer system keys.

Increasingly more company is being carried out online so online payment solutions is a progressively approved as well as preferred purchase. Cash can be transferred in real time where in the past, somebody could have to wait days for a check to show up, hoping it would certainly get to all and not obtain lost in the mail, and afterwards take it to the bank to deposit and wait for funds to clear. Currently, due to the strict regulatory steps that safeguard on the internet settlements, transfers are often offered to the recipient instantly or within a couple of hours of transfer. In today's stressed economy, having prompt accessibility to money that is your own or being able to pay your expenses in the nick of time when you can manage it, is a welcome benefit.

Online payment remedies is a terrific idea for people that require to move large or regular quantities of cash and also are worried for their safety and security. Before digital transfers, individuals had to take pay-roll to a bank, approve repayments personally, as well as handle money handy. Currently as opposed to stressing over being robbed at any step of the method, digital transfers offer a high degree of security. Staff members don't need to bother with washing a paper check when they do washing and after that needing to change it. Digital transfer guarantees the money goes straight to the designated account.

0 notes

Text

Guest Post: Ten Questions the SEC Will Probably Be Asking Google

John Reed Stark

Earlier this week, media reports circulated that this past spring Google had exposed the private data of thousands of the Google+ social network users and then opted not to disclose the issue, in part because of concerns that doing so would draw regulatory scrutiny and cause reputational damage. In the wake of these revelations, one question is whether the SEC will look into these circumstances. In the following guest post, John Reed Stark, President of John Reed Stark Consulting and former Chief of the SEC’s Office of Internet Enforcement, takes a look at what he regards as a likely SEC investigation and the questions that the SEC likely will be asking. A version of this article originally appeared on Securities Docket. I would like to thank John for allowing me to publish his article on this site. I welcome guest post submissions from responsible authors on topics of interest to this blog’s readers. Please contact me directly if you would like to submit an article. Here is John’s post.

***********************

Google has a problem and, having served for over 11 years as Chief of the SEC’s Office of Internet Enforcement, my guess is that the SEC is probably investigating.

On October 8, 2018, Google announced that it will close most of its failing social media platform Google+ and implement several new privacy measures because of a previously undisclosed software bug relating to its Google+ application programming interphase (API). Google created the API to help app developers access an array of profile and contact information about the people who sign up to use their apps, as well as the people they are connected to on Google+.

Google also mentioned that up to 500,000 Google+ users potentially had their personal data exposed. In addition, Google reported that up to 438 applications may have used the defective Google+ API, which makes estimations of impacted individuals difficult to ascertain.

Meanwhile the Wall Street Journal and the Washington Post are reporting that Google hid the Google+ API defect from shareholders and others for fear of regulatory examination, Congressional inquiry and other negative ramifications.

What a mess. Let the onslaught of scrutiny begin, which in my opinion will undoubtedly include an investigation by the U.S. Securities and Exchange Commission (SEC), the federal regulator tasked with policing the disclosures to shareholders by public companies like Google.

But what precisely will the SEC want to know? Assuming I am right about an ongoing SEC investigation, this article presents ten questions SEC enforcement staff will be posing to Google executives and others, in connection with an investigation of Google’s public disclosures of the Google+ API defect.

Some Background: Post 2018 SEC Cybersecurity Disclosure Guidance

On February 20th, 2018, the SEC issued further interpretive guidance to assist public companies in preparing disclosures about cybersecurity risks and incidents (the “2018 SEC Guidance”).

The 2018 SEC Guidance offers the SEC’s views about public companies’ disclosure obligations under existing law with respect to matters involving cybersecurity risk and incidents. It also addresses the importance of cybersecurity policies and procedures and the application of disclosure controls and processes, insider trading prohibitions, and Regulation FD and selective disclosure prohibitions in the cybersecurity context.

The 2018 SEC Guidance serves as a follow-up to the October 13, 2011 SEC Division of Corporation Finance staff guidance, which also pertained exclusively to the cybersecurity- related disclosure obligations of public companies (the “2011 SEC CF Guidance”).

The fact that the 2011 SEC CF Guidance was published by the staff while the 2018 SEC Guidance was adopted by the Commission itself, though indicative of the gravity of the issue of the SEC and cyber incident disclosure, makes little actual difference for practitioners. Whether guidance emanates from the SEC staff or from the SEC itself, it should be taken with the same high level of significance and attentiveness.

Along those lines, much of the 2018 SEC Guidance tracks the 2011 SEC CF Guidance, retaining a focus on “material” cyber risks and incidents and expanding upon its predecessor while also reinforcing the SEC’s expectations about cyber-disclosure. But if the 2011 SEC CF Guidance was a wake-up call for public companies, the 2018 SEC Guidance was a resounding fire alarm — and is a must-read for any C-suite executive at a public company.

In short, the 2018 SEC Guidance:

Stresses the need for public companies to put into practice disclosure controls and procedures designed to escalate cybersecurity risks and incidents to the right c-suite executives;

Emphasizes the urgency for public companies to make appropriate disclosure to investors; and

Articulates the SEC’s growing concerns about unlawful trading involving data security incidents.

The 2018 SEC Guidance also serves as a stark reminder for public companies that disclosures relating to data security events present an array of regulatory and litigation issues and has quickly evolved into an increasingly specialized area of securities regulation.

Pre-2018 SEC Cyber-Disclosure Guidance

On October 13, 2011, the SEC released the 2011 SEC CF Guidance, its first ever staff guidance pertaining exclusively to the cybersecurity-related disclosure obligations of public companies.

With the 2011 SEC CF Guidance, the SEC officially (and quite noticeably) added cybersecurity into the mix of disclosure by putting every public company on notice that cyber-attacks and cybersecurity vulnerabilities fell squarely within a public company’s reporting responsibilities.

The 2011 SEC CF Guidance covered a public company’s reporting responsibilities both just after a cyberattack as a “material” event, and before as a “risk factor.” In their essence, these notions clarified the SEC’s long- standing requirement that public companies report “material” events to their shareholders. What precisely renders an event material has plagued securities lawyers for years and has been the subject of countless judicial decisions, SEC enforcement actions, law review articles, law firm guidance and the like – but can be effectively summed up as any important development or event that “a reasonable investor would consider important to an investment decision.”

Prior to the 2011 SEC CF Guidance, publicly traded companies were not necessarily required to report in their SEC filings if a data security incident had occurred or if they had fixed the problem. After the 2011 SEC CF Guidance, however, publicly traded companies were more compelled to acknowledge cyber-attacks other data security incidents to regulators, and explain the measures they planned to take to close their cyber-security gaps.

With respect to the aftermath of a cyberattack, the 2011 SEC CF Guidance discussed the myriad of ways a cyber-attack can impact the operations of a public company. Next the 2011 SEC CF Guidance set forth the various reporting sections of typical SEC filings that could warrant mention of the cyber-attack, including Risk Factors; Management’s Discussion and Analysis of Financial Condition and Results of Operations; Description of Business, Legal Proceedings, Financial Statement Disclosures; and Disclosure Controls and Procedures.

With respect to the mere possibility of a cyber-attack, the 2011 SEC CF Guidance noted that companies should also “consider the probability of cyber incidents occurring and the quantitative and qualitative magnitude of those risks, including the potential costs and other consequences resulting from misappropriation of assets or sensitive information, corruption of data or operational disruption.”

Even though the SEC staff might have viewed the 2011 SEC CF Guidance as simply a reiteration of previously existing requirements, there remained little doubt at the time of its publication that the 2011 SEC CF Guidance imposed an arguably unprecedented and certainly significant obligation upon public companies.

Against the backdrop of the 2011 CF Guidance and the 2018 SEC Guidance, below are ten questions Google should expect from SEC enforcement staff.

Question #1: Was Google’s Internal Investigation of the Google+ API Vulnerability a Fulsome and Robust Process of Neutrality, Objectivity, Transparency and Candor?

When it comes to data security incidents, one option for Google is to investigate the problem itself – get to the bottom of it, improve security practices, policies and procedures and move forward with better, stronger and more robust security. This seems to have been Google’s approach – and it may have very well succeeded.

However, there is a far more effective, more rewarding and more cost-effective option, which SEC enforcement staff has come to respect and appreciate. Whether it is British Petroleum struggling to handle the aftermath of an oil refinery explosion killing 15 Alaskan workers; Wells Fargo adjusting its operations after a massive company fraud committed by 5,300 employees against over two million customer accounts; or any company experiencing a threat to its customers, the same lesson always rings true. Confront the issue head-on with independence, transparency and integrity.

For starters, strong leaders seek answers from independent and neutral sources of information and when responding to data security incidents. Google’s leaders should:

Engage a former law enforcement agent or prosecutor from an independent and neutral law firm or consulting firm (preferably never engaged before) to conduct an investigation and report its findings to the board;

Direct the law firm to engage an independent digital forensics firm to examine the Google+ API issue;

Report the investigation’s progress to shareholders, regulators and other constituencies and fiduciaries every step of the way; and

Disclose the details of the findings to those users impacted.

Instead of trying to characterize an incident, effective leaders begin with these three steps, which evidence strong corporate ethics; fierce customer dedication; and steadfast corporate governance.

Next is to anoint someone from the engaged outside investigative team to serve as the face of the response. This person should be a former law enforcement official with impeccable credentials and the kind of gravitas that customers, shareholders and other important members of the public will trust and respect.

By navigating problems with integrity and transparency, Google can shift the tides in their favor, seizing the opportunity to reinforce strong business ethics; renewed customer dedication; and steadfast corporate governance.

But Google’s announcement makes no mention of any independent investigation. Rather Google’s announcement focuses on findings and conclusions rendered by its own “Privacy & Data Protection Office,” a council of top Google product executives who oversee key decisions relating to privacy.

C-Suite executives and boards of directors are not politicians and do not have the luxury of conducting potentially self-serving investigations and offering sanitized reports and findings; they have fiduciary obligations to shareholders and others to seek the truth and they should do so with independency, neutrality, transparency and candor. Otherwise, any formal findings can lack credibility and integrity, and no one, including the SEC enforcement staff, will take the investigative and remedial effort seriously.

Question #2: What Did the Google Board Know, and When Did They Know It?

The 2018 SEC Guidance for public companies on cybersecurity-related disclosures garnered a great deal of attention for what it says about the threat and risk that cybersecurity presents for public companies — large and small. With cyber-incidents capturing headlines around the world with increasing frequency, businesses and regulators have come to recognize that cyber-incidents are not a passing trend, but rather in our digitally connected economy, an embedded risk that is here to stay. Indeed, these cybersecurity risks represent a mounting threat to businesses — risks that can never be completely eliminated.

Much of the published commentary concerning the 2018 SEC Guidance focused on the technical aspects of the SEC’s instructions regarding the need for additional disclosure in a company’s periodic filings and the SEC’s updated views on the timing of cyber-related disclosures and what that means for insider trading windows. However, the 2018 SEC Guidance also says a lot about the SEC’s expectations of boards with respect to data security incidents, including disclosure-related responsibilities.

The SEC’s views on the role of the board have evolved over the past few years, culminating with the release of the 2018 SEC Guidance, which likely prompted many corporate boards to take tangible steps to translate their general awareness and high-level concerns around cybersecurity risks into specific behaviors and precise actions that are identifiable, capable of being readily implemented and heavily documented.

The comments contained in the 2018 SEC Guidance evidence the SEC’s strong views regarding the board’s essential role in this emerging area of enterprise risk and remove any doubt that for those who serve as corporate directors, “cybersecurity” can no longer be just a buzz word or a simple talking point. While many board members characterize cybersecurity risks as “an existential threat,” few, if any, have taken the time to go beyond attaining a superficial understanding of what that really means for their companies. Corporate directors now must consider themselves on notice. When it comes to cybersecurity, they are expected to dig in and, therefore, must demand greater visibility into what is oft presented as a murky and highly complex area best left to technologists.

Specifically, the 2018 SEC Guidance advises that public companies should disclose the role of boards of directors in cyber risk management, at least where cyber risks are material to a company’s business. With respect to the Google+ vulnerability, the SEC enforcement staff will probe about communication lines up to the board from the ground level at Google, searching for any broken links; any lack of transparency or candor; any concealment or “cleansing” of inculpatory information and any other related corporate governance failure.

Historically, when it comes to their CFOs and the financial reporting function, the successful board paradigm has been one of vigorous and independent supervision, requiring the participation of independent third parties. The same should go for CTOs, CIOs and CISOs, and the maxim of trust but verify should be equally operative in both contexts.

The SEC enforcement staff will want to know what steps, if any, Google took to enhance its board’s cybersecurity oversight in response to the 2018 SEC Guidance, and will want to understand the Google board’s approach to cybersecurity and the Google board’s involvement in the handling and management of the Google+ API defect.

Question #3: Where was Google’s CEO?

If Google’s CEO does not embrace and understand the importance of cybersecurity, the company has little chance of effectively carrying out its responsibility to ensure proper risk-based measures are in place and functioning. It is the CEO who is charged with day-to-day management responsibility and, as history tells us, those in the organization will, in fact, “follow the leader.” This may seem like an obvious point, but its criticality cannot be overstated.

Why would a CEO not take the issue of cybersecurity seriously? CEOs have a lot on their plate. And, like it or not, it is a reality of human behavior that there is a tendency to downplay the potential for certain risks — “this is not going to happen to us” — until those risks manifest themselves and then it is just too late. By then, the damage is already done, and the consequences can be immediate and, at times, catastrophic.

Recognizing this reality, the 2018 SEC Guidance actually offers shareholders an assist in the effort to focus the attention of the CEO. The SEC explicitly recognizes the importance of “tone at the top,” as demonstrated by one of its more specific and impactful directives, requiring that so-called executive certifications regarding the design and effectiveness of disclosure controls now encompass cybersecurity matters (such as certifications made pursuant to the Exchange Act Rules 13a-14 and 15d-14 as well as Item 307 of Regulation S-K and Item 15(a) of Exchange Act Form 20-F).

Disclosure controls and procedures should ensure that relevant cybersecurity risk and incident information is reported to management so that they may make required certifications and disclosure decisions. Here, the SEC actually stole a page from the playbook of former SEC Chairman Harvey Pitt, who originated the idea of executive certifications way back in 2002.

Shocked after officials of such scandal-plagued companies such as Enron and Worldcom testified on Capitol Hill that they did not know their companies were reporting false or misleading information, Chairman Pitt conjured up the idea of executive certifications which was remarkably successful, effective — and quite ingenuous.

Then Chairman Pitt dictated that top corporate officials, chief executive officers and chief financial officers, must declare personally — literally, to take an oath — that their most recent financial statements are accurate. The new rule applied to companies’ future reports as well.

By making a “certification,” these officers are swearing that they know, for certain, that financial reports are true. If the reports are not, the executives must explain why these results are not accurate. This eventually led some companies to restate their results to comply with certification.

Just like former SEC Chairman Pitt’s certification requirement sought to ensure accurate financial reporting and responsible executive conduct regarding financial results, current SEC Chairman Jay Clayton’s 2018 SEC Guidance seeks to ensure accurate cybersecurity reporting and responsible executive conduct regarding data security incidents.

These required certifications by a company’s principal executive officer and principal financial officer as to the design and effectiveness of cyber-related disclosure controls and procedures can be somewhat challenging. Company executives making these certifications have to consider whether a company’s disclosure controls and procedures for cybersecurity are, in particular, capable of fully assessing and escalating such cyber risks and incidents. Along these lines, the SEC will look to see if Google executives have developed and implemented some methodology to “drill down” into Google’s technical conclusions, perhaps even independently validating IT conclusions and representations when necessary.

The expanded certification rule seeks to drive executive-level ownership and accountability with respect to the reporting of cybersecurity incidents and the broader area of data security. Indeed, the 2018 SEC Guidance states:

“These certifications and disclosures should take into account the adequacy of controls and procedures for identifying cybersecurity risks and incidents and for assessing and analyzing their impact.”

The SEC certainly understands the centrality of the CEO’s role and now the CEO must affirmatively certify to the adequacy of the organization’s cybersecurity controls. SEC enforcement staff will attempt to determine if Google’s CEO and senior executives have accepted – and embraced – both the spirit and the language of this new SEC certification requirement.

Question #4: What Were Google’s Formal Policies, Practices and Procedures Relating to Disclosure of Data Security Incidents?

SEC enforcement staff will want to review all of Google’s formal policies, practices and procedures relating to the disclosure of cybersecurity incidents.

The 2018 SEC Guidance encourages companies to implement policies, practices and procedures mandating that important cyber risk and incident information escalate “up the chain,” from IT teams to senior management, allowing for informed, intelligent and knowledgeable decisions.

This particular communications edict must have hit close to home for SEC Chairman Clayton, who when testifying before Congress about a data breach at the SEC, was clearly miffed that the SEC staff had not shared certain critical information with the various SEC Commissioners, including the Chairman. At that time, then-SEC Commissioner Michael S. Piwowar even went so far as to issue a formal statement about the lack of communication to him about the SEC data breach, stating:

“I commend Chairman Clayton for initiating an assessment of the SEC’s internal cybersecurity risk profile and approach to cybersecurity from a regulatory perspective. In connection with that review, I was recently informed for the first time that an intrusion occurred in 2016 in the SEC’s Electronic Data Gathering, Analysis, and Retrieval (“EDGAR”) system. I fully support Chairman Clayton and Commission staff in their efforts to conduct a comprehensive investigation to understand the full scope of the intrusion and how to better manage cybersecurity risks related to the SEC’s operations.”

Question #5: What was the Nature of any Google Disclosure Related to the Data Security Incident or the Risks of Data Security Incidents?

Much like the 2011 SEC CF Guidance, the 2018 SEC Guidance can be somewhat maddening with respects to the actual content of a company’s disclosure regarding a data security incident.

For example, as to the particularity of any data security incident’s disclosure, the SEC seems to want to have its cake and eat it too. On the one hand, the 2018 SEC Guidance appears to allow for a lack of specifics so as not to compromise a company’s security, stating:

“This guidance is not intended to suggest that a company should make detailed disclosures that could compromise its cybersecurity efforts – for example, by providing a “roadmap” for those who seek to penetrate a company’s security protections. We do not expect companies to publicly disclose specific, technical information about their cybersecurity systems, the related networks and devices, or potential system vulnerabilities in such detail as would make such systems, networks, and devices more susceptible to a cybersecurity incident.”

On the other hand, the 2018 SEC Guidance cautions companies not to use any sort of generic “boilerplate” type of language in its disclosures, stating somewhat opaquely:

“We expect companies to provide disclosure that is tailored to their particular cybersecurity risks and incidents. As the Commission has previously stated, we ‘emphasize a company-by-company approach [to disclosure] that allows relevant and material information to be disseminated to investors without boilerplate language or static requirements while preserving completeness and comparability of information across companies.’ Companies should avoid generic cybersecurity-related disclosure and provide specific information that is useful to investors.”

Along these lines, any conclusions about the adequacy (or inadequacy) of the actual substance of any Google disclosure concerning the Google+ API defect will be the subject of debate. SEC staff will review texts, emails, reports and other relevant documents pertaining to the Google+ vulnerability discovery and remediation, and then follow-up seeking testimonial evidence from Google employees and outside experts to better understand the particulars of the “bug.”

With respect to Google’s risk disclosures, the SEC enforcement staff will likely consider Google’s vague reference to risk in its October 8th announcement, which stated:

“The review did highlight the significant challenges in creating and maintaining a successful Google+ that meets consumers’ expectations. Given these challenges and the very low usage of the consumer version of Google+, we decided to sunset the consumer version of Google+”

The SEC staff will want to know if Google incorporated into its SEC filings the risk associated with the “challenges,” and will want to read the details of the Google “review,” cited above in Google’s October 8th announcement.

Question #6: How Long Did It Take for Google to Remediate After Discovery of the Data Security Vulnerability?

Good news on this front for Google. Google should take some comfort that the 2018 SEC Guidance recognizes that data security incident investigations are complicated and cannot be completed overnight.

The SEC recognizes that the investigation of data security incidents can take time, and that some companies may not want to make any disclosures about an incident when they do not have some comfortable handle on the facts of the situation. The 2018 SEC Guidance states:

“Understanding that some material facts may be not available at the time of the initial disclosure, we recognize that a company may require time to discern the implications of a cybersecurity incident. We also recognize that it may be necessary to cooperate with law enforcement and that ongoing investigation of a cybersecurity incident may affect the scope of disclosure regarding the incident.”

But the SEC also qualifies its recognition of the complexity of data security incidents and warns companies that the need for a lengthy investigation into a data security incident is not necessarily an automatic excuse for delaying the disclosure of a data security incident, stating:

“However, an ongoing internal or external investigation – which often can be lengthy – would not on its own provide a basis for avoiding disclosures of a material cybersecurity incident.”

Of course, when a data security incident happens, the public’s demand for immediate answers is understandable. Lifesavings are at risk while the perpetrators of hacking schemes are rarely identified, let alone captured and prosecuted. However, in the aftermath of most data security incidents, there exists no CSI-like evidence which would allow for speedy evidentiary findings and rapid remediation.

While some data security incidents may provide key evidence early-on, most never do, or even worse, provide a series of false positives and other stumbling blocks. The evidence among the artifacts, remnants and fragments of a data security incident is rarely in plain view; it can rest among disparate logs (if they even exist), volatile memory captures, server images, system registry entries, spoofed IP addresses, snarled network traffic, haphazard and uncorrelated timestamps, Internet addresses, computer tags, malicious file names, system registry data, user account names, network protocols and a range of other suspicious activity.

Moreover, evidence can become difficult to nail down — logs are destroyed or overwritten in the course of business; archives become corrupted; hardware is repurposed; and the list goes one.

For instance, in Google’s case, according to the Wall Street Journal, certain key logs were simply never retained, which created obstacles for its internal investigators:

“Because the company kept a limited set of activity logs, it was unable to determine which users were affected and what types of data may potentially have been improperly collected, the two people briefed on the matter said. The bug existed since 2015, and it is unclear whether a larger number of users may have been affected over that time.”

In short, the evidence analyzed during a data security incident can be a massive, jumbled and chaotic morass of terabytes of data. That is why the investigation of a data security incidents can take weeks, perhaps months, before any concrete conclusions begin to take shape. Rushing to judgment (and disclosure) might not only create further confusion and expense, but it can also undermine the objectivity, truth and confidence that the public (especially shareholders) deserves.

Question #7: Did Google Undertake a Timely and Comprehensive Disclosure of its Data Security Incident?

The Wall Street Journal reported one blockbuster fact that will be a lightning rod for SEC enforcement attention:

“[Google] opted not to disclose the issue this past spring, in part because of fears that doing so would draw regulatory scrutiny and cause reputational damage.”

The SEC will likely begin its investigation by reviewing Google’s disclosures since March of 2018, when a privacy task force formed inside Google, code-named Project Strobe, apparently discovered the API problem during a company-wide audit of the company’s APIs. Google’s announcement states that:

“We discovered and immediately patched this bug in March 2018. We believe it occurred after launch as a result of the API’s interaction with a subsequent Google+ code change.”

The 2018 SEC Guidance clearly emphasizes the need for timely disclosure, probably taking a lesson from the Equifax data breach and, ironically from the SEC’s own data breach experience, which SEC Chairman Jay Clayton admitted should have been disclosed earlier.

Equifax, one of three elite repositories of personal credit information, and a trusted source for personal security and identity theft defense products, disclosed a cyber-attack that could potentially affect 148 million consumers — nearly half of the U.S. population. The accessed Equifax data reportedly included sensitive information such as social security numbers, birthdays, addresses, and in some instances, driver’s license numbers — a virtual treasure trove for identity thieves.

Not long after the Equifax data breach, SEC Chairman Jay Clayton also announced a data breach into the SEC’s EDGAR system, a vast database that contains information about company earnings, share dealings by top executives and corporate activity such as mergers and acquisitions. Accessing that information before it’s disclosed publicly could allow hackers to profit by trading ahead of the information’s release.

With respect to the Equifax data breach, now “retired” Equifax CEO Richard Smith told a breakfast meeting in mid-August 2017 that data fraud is a “huge opportunity,” allowing Equifax to sell consumers more offerings. Smith touted the company’s credit-monitoring offerings, according to a video recording of the meeting at the University of Georgia’s Terry College of Business, and declared that protecting consumer data was “a huge priority” for the company.

But what the Equifax CEO failed to mention was that less than three weeks earlier, Equifax had apparently discovered a potentially massive data security incident and that Equifax had called in expert incident response firm Mandiant, to investigate. Yet, it was not until a few weeks later on Sept. 7, that Equifax disclosed the massive data breach to the public.

With respect to the SEC data breach, the SEC itself may have opted for a similar path of delayed notification. Reports and SEC Chairman Clayton’s testimony before the Senate Banking Committee indicate that the SEC data breach was discovered in 2016, and the possible illegal trades were detected in August of 2017, but the SEC did not disclose any information about the incident until September 20th, 2017.

Senior executives at both the SEC and Equifax have angered their constituents with their arguably sluggish disclosure. Both entities probably focused too much upon what they were legally and contractually obligated to disclose, rather than taking a more holistic approach to the question.

Per the 2018 SEC Guidance, if Google learned of a cybersecurity incident or cyber-risk that was material to its investors, then Google was expected to make appropriate disclosures. The 2018 SEC Guidance even goes so far as to remind public companies to consider obligations under the stock listing requirements, such as Section 202.05 of the NYSE Listed Company Manual and NASDAQ Listing Rule 5250(b)(1). Additionally, when Google experienced a data security incident of any type, the 2018 SEC Guidance emphasizes the possible need to “refresh” previous disclosures during the process of investigating a cybersecurity incident or past events.

When organizing the disclosure of data security incidents and overall cybersecurity risks, just like the 2011 SEC CF Guidance, the 2018 SEC Guidance explains that disclosure of data security incidents may be required in sections of public filings addressing Risk Factors, MD&A, Description of Business, Legal Proceedings and Financial Statement Disclosures.

No doubt, SEC enforcement staff will be pouring over these various sections of disclosure, looking for any possibly misleading information or material omission.

Question #8: Was There any Trading by Any Google Personnel Who Knew of the Data Security Incident?

While empirical data may suggest otherwise, some data security incidents can impact a company’s stock price – such as the actual stock price drops immediately following disclosure of the Equifax and Target breaches. In such situations, executives who learn of a data security incident, if it is material and nonpublic, could be violating insider trading laws if they engage in any trading of the company’s stock.

Along these lines, the 2018 SEC Guidance warned corporate insiders not to sell shares of a company when holding confidential knowledge about cyberattacks and breaches that could affect stock price. This is an area not covered by the 2011 SEC CF Guidance but made sense to include in the 2018 SEC Guidance.

Equifax once again probably triggered the SEC’s concerns and prompted inclusion of this principle in the 2018 SEC Guidance. The Equifax data breach also involved a stock sell-off by some of its executives before the disclosure of its experience of a cyber-attack and spurred an SEC insider trading investigation that resulted in at least one SEC enforcement action against an Equifax manager for unlawful insider trading. Intel CEO Brian Krzanich got hit with a similar backlash, too, for selling a large block of shares after learning of the Meltdown and Specter computer chip vulnerabilities, but before disclosing them to the public.

The SEC is obviously expecting that Google have thoughtful and well-documented consideration of data security incidents in the context of possible trading on material, nonpublic information – and carefully drafted, robust and precise policies, practices and procedures in place to demonstrate a rigorous culture of compliance.

SEC enforcement staff will likely explore whether the 2018 SEC Guidance prompted Google to review, with data security incidents in mind, their trade restriction policies, permissible trading windows, insider trading training curricula, codes of ethics, trade authorization procedures, trading training manuals and the like.

Question 9: Was Google Mindful of Regulation FD When Briefing Outsiders About its Data Security Incident?

Regulation FD (for “Fair Disclosure”), promulgated by the SEC under the Securities Exchange Act of 1934, as amended prohibits companies from selectively disclosing material nonpublic information to analysts, institutional investors, and others without concurrently making widespread public disclosure.

Regulation FD reflects the view that all investors should have equal access to a company’s material disclosures at the same time. Since its enactment in 2000, Regulation FD has fundamentally reshaped the ways in which public companies conduct their conference calls, group investor meetings, and so‐called “one‐on‐one” meetings with analysts and investors.

The SEC adopted Regulation FD to address the selective disclosure by issuers of material nonpublic information. In its adopting release, the SEC expressed concerns about reported instances of public companies disclosing important nonpublic information, such as advance warnings of earnings results, to securities analysts or selected institutional investors or both, before making full disclosure of the same information to the general public. Those privy to the information beforehand were able to profit or avoid a loss at the expense of everyone else.

The 2018 SEC Guidance emphasizes that companies subject to Regulation FD (like Google) should have policies and procedures to promote compliance with Regulation FD regarding cybersecurity risks and incidents.

In particular, these policies and procedures should work to ensure that Google did not make any selective disclosures about cybersecurity risks and incidents to Regulation FD-enumerated persons without the required broadly disseminated public disclosure. This can create unanticipated problems for any public company experiencing any form of data security incident, because Regulation FD can throw a wrench into an already challenging disclosure process.

For example, in the aftermath of a data security incident of any kind, in addition to any consumer notifications, a broad range of other important notifications may immediately arise, such as briefings to customers, partners, employees, vendors, affiliates, insurance carriers, and a range of other interested/impacted parties.

Given the broad swath of interested parties, SEC enforcement staff will be looking to make sure Google maintained careful and methodical communications practices to ensure that their disclosures were consistent, and not selective.

Question #10: Do Google’s Disclosures, or Lack Thereof, Amount to Criminal Behavior?

Perhaps the most important takeaway from the 2018 SEC Guidance is a notion not specifically stated in the four corners of the document, but rather found in an SEC enforcement action (and parallel DOJ criminal prosecution) filed on the very same day of the 2018 SEC Guidance’s release.

In the SEC enforcement action, captioned SEC v. Jon E. Montroll and Bitfunder, the SEC charged a former bitcoin-denominated platform and its operator with operating an unregistered securities exchange and defrauding users of that exchange. The SEC also charged the operator with making false and misleading statements in connection with an unregistered offering of securities.

Among other accusations, the SEC alleges that BitFunder and its founder Jon E. Montroll operated BitFunder as an unregistered online securities exchange and defrauded exchange users by misappropriating their bitcoins and failing to disclose a cyberattack on BitFunder’s system that resulted in the theft of more than 6,000 bitcoins.

The SEC actually alleges fraud because of the lack of disclosure of the data security incident to customers/account holders, effectively bypassing the issue of whether there is actually any statutory or regulatory disclosure obligation. In other words, by keeping the data security incident a secret, the exchange (which was unlawfully unregistered), committed a fraud upon its customers. The SEC Complaint states:

“Montroll failed to disclose the theft [which occurred by means of a cyber-attack] and the deficit to Ukyo Notes investors and potential investors. By failing to disclose these facts, Montroll misled investors and potential investors – who were led to believe they would profit, at least in part, from BitFunder’s operations – to reasonably believe that BitFunder was a secure and profitable business.”