#i got a newer second hand one but the delivery kept getting delayed so i decided to start and finish this on my old ipad to commemorate it

Explore tagged Tumblr posts

Text

doing it scared!! (birthday self portrait)

#okay to rb<3 (someone asked)#lil story i use a pretty old ipad i got second hand when i was 20 that was already 3 years in use by the time i got it#and it has been slowing down recently but thanks to commisions and birthday money i could afford a new one#i got a newer second hand one but the delivery kept getting delayed so i decided to start and finish this on my old ipad to commemorate it#it took over a week because my ipad kept crashing or just wouldnt work ect but i was determined we were gonna see this piece through#and we did it! and u know what then happened? within the hour of me finishing this i got the tracking notification for my new one#the universe was waiting this out w me. goodbye old friend#u can sleep now#digital art#art#digital drawing#artists on tumblr#illustration#digital aritst#artist#omatoxin#portrait#self portrait#my birthday

151 notes

·

View notes

Link

Airbus’ announcement on Monday evening to take a majority stake in Bombardier’s C Series program was a total mic drop for the global airline and aviation community.

And Boeing wound up with egg on its face.

For those unfamiliar with the backstory details, a few weeks back, the U.S. Department of Commerce had proposed a tariff of 219.63% for each Bombardier C Series aircraft imported into the U.S. For those unfamiliar with the Bombardier C Series Program, much less what the implications would be for any U.S.-based airline customer that would be affected by such a preposterous measure, the story dates back to July 2004 when Bombardier, Inc. of Canada decided to create a new aircraft prototype that would challenge Airbus and Boeing in the narrowbody space.

The C Series program, as it soon would be known, was aimed at growing Bombardier’s fleet plan beyond the sub-100 seat market category. Bombardier had successfully penetrated the regional and turboprop segment with the de Havilland Canada Dash 8, Canadair Regional Jet (CRJ) and Q400 turboprop.

Image Credit: Bombardier

The reason for up-scaling? Bombardier had plenty of existing competition within its own space, namely with Brazil’s Embraer and eventually Russia’s Sukhoi civilian jets. But more saliently, Boeing and Airbus were investing heavily in the, “Middle of the Market” (MOM) space with the former having massive success with the 737-Next Generation project and -MAX prototype, and Airbus investing in the New Engine Option (NEO). These aircrafts would enable Boeing and Airbus to supply their customers with long-range aircraft capable on narrowbody planes, which would then allow them to fly transoceanic routes at significantly lower costs than widebody jets.

But these projects, essentially, neglected the sub-150 seat passenger sector. And Bombardier felt that there would still be plenty of demand for this space, especially as Boeing’s 737 Classic and Airbus A320-Classic jets grew older and without replacements.

So Bombardier created the C Series, and with several generations in mind. It would launch starting with the -100 and future generations, including the -300 and -500, would be positioned to fly short-to-medium haul routes that were best flown on smaller gauge aircraft, but at higher schedule frequencies, such as heavily-trafficked business markets like Atlanta to Dallas or Chicago to New York. In addition, the C Series could also fly long-haul missions with a full Premium cabin configuration, such as London to New York, Toronto or Boston. The plane was certified for STOL (Short Take-off and Landing) runways like London City Airport (LCY) or Toronto Billy Bishop Airport (YTZ) which are located within walking distance to Central Business Districts.

In short, the C Series could be a viable “niche” aircraft for airlines like British Airways or Qatar Airways, which fly all-Premium cabin flights to high-yielding destinations, or airlines like Delta that operate high-frequency shuttle flights between important business markets. It would also enable airlines like Porter, based at Billy Bishop Airport, to operate longer-range missions to the Western U.S. and Canada, which it is currently unable to do with its Q400 planes.

And it was so that the C Series marketed itself, except that it was plagued with issues during the late 2000s and early 2010s following the Global Financial Crisis of 2008, soaring fuel prices and later, a series of unfortunate events at Bombardier. Production for the CRJ product was very backlogged in the early 2010s, right around the time that the Bombardier C Series program was destined to begin testing. Then, the Pratt and Whitney 1500G engines that the C Series was to use were grounded in May 2014, so that was a problem. Bombardier was forced to layoff thousands of employees and undergo a restructuring program.

2015 was a bit brighter as it was able to end the year with 100% certification testing for SWISS International Airlines, its launch customer, but the sales were null and future prospects were grim. It lost out on a major opportunity with United, who opted to go with Boeing instead (it was later discovered that Boeing offered a very attractive deal to United for 737-700s instead). Furthermore, Porter and Billy Bishop Airport were blocked from expanding the runway at YTZ, which meant that the current length of the runway was incapable of allowing the C Series to land there.

What saved the program, however, was Delta’s order of 75 CS100s in April 2016, with options for an additional 50. The order was valued at $5.6 billion and was also somewhat of a first for Delta. Though Delta has been progressively ordering newer aircraft lately, with the Airbus A350 for instance, Delta has also been known to buy second-hand aircraft at cheap prices and exhaust them through useful life. Classic examples include buying the 717-200 from Southwest, acquired through its merger with AirTran, and retaining McDonnell-Douglas MD-88s and MD-90s that it has used for decades. It also retained Northwest Airlines’ 747-400s, DC-9s, and Airbus A330s, though the NWA DC-9s have been retired, the 747-400s will go by the end of the year and Delta canceled Northwest’s 787 order. Point blank, Delta was taking on a huge risk here.

So when the U.S. Department of Commerce levied the tariff, naturally, the carrier that would take an immediate hit happened to be Delta.

Ironically, the plot twist has political implications: U.S. airline CEO’s have had an – let’s just say interesting – series of interactions with Donald Trump since he took office in January. Leadership personnel at aircraft manufacturers are no different. Trump, remember, Tweeted on December 6, 2016, that Boeing’s costs were, “out of control” for building a brand new 747 Air Force One and then shrieked, “cancel order!” Delta, meanwhile, attributed a revenue bump by the end of the fiscal year 2016 to Trump’s election, calling it a “Trump Bump.” Then, Boeing got on Trump’s side after his mercurial Tweet and invited him to tour the Boeing factory in South Carolina in February, where Trump “promoted jobs” for Americans, even though Boeing would eventually lay-off 200 people the following summer.

As such, the Boeing Company was trying to become pretty buddy-buddy with the Administration before the tariff proposal was announced. In Boeing’s eyes, the struggles of the C Series program had curated Bombardier $570 million worth of launch-aid loans from Canada, the U.K., and Quebec, along with a $1 billion bailout from Quebec in 2015 when the program was on the verge of collapse. Bombardier also received $1.5 billion in equity investment from a Quebec Pension Fund. When the order was made in September 2017, it was then learned that the final judgment would take place in early 2018. Boeing seemingly had no issue with making such allegations to support the tariffs imposed by the U.S. Dept of Commerce.

And so, the trade war began.

Never mind the fact that Boeing likely felt threatened by the success of the C Series sales after the Delta order. Or that Boeing may have discounted the 737s by up to 70% (purportedly) for United when they mulled getting the C Series.

And Delta was obviously not going to pay the absurd tariffs for the C Series.

The whole move on the Boeing’s part was mired in hypocrisy. After all, it is one strike to accuse a smaller competitor of receiving unfair subsidies when in reality, the market is dominated by a duopoly (Boeing and Airbus, whom Boeing has also had a history of engaging in spats with).

It is another thing when Boeing tried to align itself with an Administration that has a penchant for throwing allies under the bus very whimsically, then indulging them to come promote jobs on your campus before letting hundreds of jobs go a few months later.

Let’s also remember how some of Boeing’s business practices, such as outsourcing (787 anyone?) came at the expense of many of its customers with years of delivery delays. Boeing ain’t no Boy Scout.

It is also myopic for Boeing to view the Bombardier deal with as much concern given how small BBD is compared to Boeing. And, not to mention, how close the entire C Series program was on the brink of death: hardly a “threat” to a manufacturer that has 38% of the global market share (compared to 6% for Bombardier). In fact, per the 2016 Commercial Aviation leet and MRO Forecast, Bombardier’s market share is projected to drop within the next ten years by 1% while Boeing’s is expected to grow by 2%. Meanwhile, Airbus’ is expected to rise from 28% to 36%.

Global Fleet Market share – 2016

If I were Boeing, I would be way more concerned with a different competitor, one that is far more dominant than Bombardier, for potential losses.

And now, Boeing has even more reasons to be fearful, since Airbus is taking a 50.01% stake in the C Series limited partnership for no cash or debt considerations. Literally overnight, the biggest rival to Boeing will be able to adopt a 100-150 seat plane in its armada.

The best part? While Boeing used Donald Trump as a pawn to spew rubbish about protecting American jobs, which was not the case, the real heroes who are saving both American and British jobs happen to be two non-American companies: Airbus and Bombardier. All of the Bombardier C Series assembly lines in Quebec will remain, and then additional factory space for the imported parts will be sent to an existing Airbus facility in Mobile, AL.

Subsequently, this presumably means no more tariff threats for Delta. They can continue to receive the C Series as they initially anticipated without the slap in the face. Plus, if there were any person who deserved to cry victim in this whole saga, it was Delta, who shrewdly kept quiet and merely expressed disdain for the Administrations’ decree, rather than burn a bridge with Boeing. After all, Delta is a very strong Boeing customer, utilizing its 737s, 757s, 767s and 777 aircraft.

Just another data point that when bad policies are blindly mixed with airline and aviation politics, the potion is toxic. Thank goodness the leadership at Airbus and Bombardier, thankfully backed by the wisdom of their more progressive political climates, were able to show much better resilience and foresight in this story.

Healthy competition fosters innovation. Squashing it produces nothing of value.

The only loser in this silly spat was a bruised ego in Chicago.

This article was originally published on Travel Codex. Read it at Airbus’ Majority Stake in Bombardier C Series is Boeing’s Loss.

http://ift.tt/2gQh9vm

Think-Dash.com

0 notes

Text

Day 743: PVT

Hello from Oakland!

TL;DR: PVT assembly is done; Mass Production should start next month.

We have quite a bit of news to report this month. Probably the biggest and most exciting news is that we're (finally) no longer three weeks away from starting the pilot run (also known as PVT). Roughly 85 PVT units were produced last week and are finishing up 72 hours of 'burn-in' testing now. On Wednesday, our third-party QC agency will double-check them as they go into their boxes. On Thursday or Friday, an express shipper should pick them up and put them on a plane destined for our fulfillment partner in California.

From there, they'll be dispatched to some early Kickstarter backers.

(We know we haven't sent your surveys yet. We're working on the survey design with BackerKit now. Look for email about the survey in your inbox in the next week or so.)

Long time, no backer update

It's been about six weeks since we last wrote. The first three weeks were pretty quiet, but the last three weeks have been mind-bendingly busy. The past week was really, really busy. We live-tweeted the PVT run.

The first few Model 01s start their 72 hour burn-in tests

Algernon collected our tweets from last week into a series of moments:

Day one: https://twitter.com/i/moments/876743212114825216

Day two: https://twitter.com/i/moments/877030769008533504

Day three: https://twitter.com/i/moments/877393482255564800

Day four: https://twitter.com/i/moments/877758532044685312

Jesse just returned from two weeks in Shenzhen. The plan was for him to spend a little over a week there finalizing the keycap laser engraving, checking out last minute details and supervising PVT on Monday, June 19. Things didn't go exactly to plan, but as you'll read, things went!

Keycap factory

Jesse's first day in Shenzhen, he visited our keycap factory to check in on updates to our injection molds and to talk through some issues with the trays they made for the laser engraving factory to use during the painting and engraving process.

Visiting with our keycaps' injection molds

They promised to get things fixed up right away and to produce sample keycaps within a day or two. When the caps still hadn't shown up by Friday morning, we got a little antsy and asked what the problem was. Our factory's team said they weren't quite sure, since the keycap factory claimed to have already completed the modifications.

At this point, we were prepared for any number of possible explanations or excuses. We've had a lot go wrong during the manufacturing process and thought that we were beyond being surprised.

The factory called up the keycap supplier, who told them that the modifications weren't done… and that getting them done that day might be difficult.

Because the factory had caught fire.

They reassured us that nobody had been hurt (and that our tooling was fine) and seemed to be up and running by the next day.

They did manage to get 120 sets of keycaps and painting jigs done in time for PVT, though the painting jigs appeared to still be of the older design that was prone to warping. Our factory doesn't know why the keycap factory hasn't delivered the newer painting jigs, but has promised to get to the bottom of it.

Keycap laser engraving factory

On his second day in Shenzhen, Jesse and the team from the factory braved typhoon Merbok to pay a visit to the keycap laser engraving factory in Dongguan. The primary issue on the agenda was figuring out why the keycap labels kept ending up significantly offset from where we'd put them.

We'd been sending files to the factory that showed the key labels with a variety of annotations to help the laser operator place them correctly. We'd gone so far as to build a layout that matched the painting jig to the millimeter.

Once we got to the keycap factory, the laser company took the sample keycap sets we'd brought with us and painted them black. They put them in the drying oven and suggested we go for lunch.

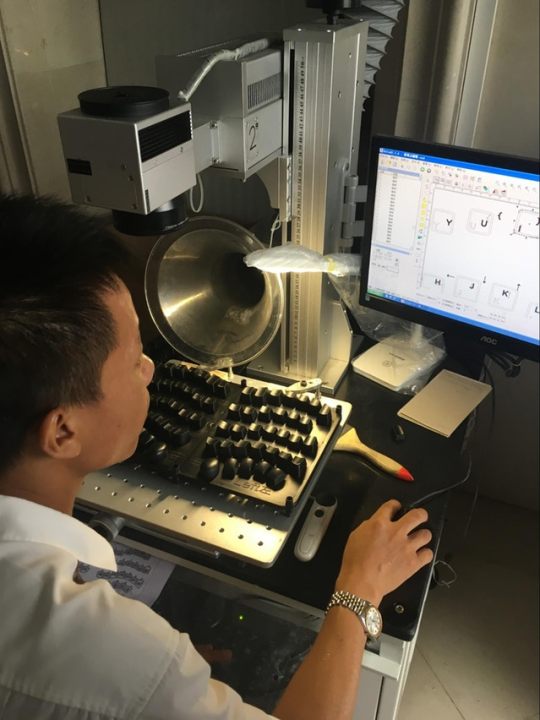

An engineer at the laser-engraving supplier aligns key legend

When we got back, we watched as the laser engraving technician printed out a copy of our alignment template, deleted all of the guide lines from the file, imported the legends into the laser engraving software, and proceeded to try to eyeball the correct label placement.

Going in, we were annoyed at how far off the legends were. In retrospect, it's astonishing how good his manual placement was.

After a bit of back and forth, we found a workflow that seemed to work better. We convinced him to keep the keycap top edge outlines in the drawing and to use those to make sure he was placing the labels correctly. That seemed to work better.

PCB Fabrication

The factory's regular PCB fabrication company wasn't able to make the boards in time for PVT, so they ended up using another supplier we recommended. These are folks that friends of ours have used on numerous occasions. Instead of the 20 days the factory's regular supplier quoted, these folks quote 6-7 day lead time. Well, they usually quote 6-7 day lead time. This time around, they quoted a 10-12 day lead time. Twelve days would have had the boards done on the Thursday before PVT began. But on Thursday, they told our factory that the earliest they could promise delivery was Monday. When the factory pushed back, they said that if we didn't like the lead time, we could try another supplier.

The factory escalated to a customer service manager who said that they could do Sunday, but that was the best we'd get. Sunday delivery meant that PCBA wouldn't start until Monday, which would delay PVT. This was not ideal, but we seemed stuck. Asking around a bit, some friends mentioned that the supplier had been "closed by the government for some reason."

We reached out to Ken Li, our amazing project management consultant. Ken said "What's our order number? Hang on a minute."

Ken came back about 10 minutes later saying that he'd reached out to the CEO of the PCB factory, whom he happens to know, and that the CEO had promised our PCBs would be delivered on Saturday. In the end, he was as good as his word and the boards arrived late on Saturday.

PCBA

The factory's regular PCBA (PCB Assembly) shop is located in the same building as the factory. Unfortunately, they don't work on Sundays and the factory couldn't get them to budge, so, in an effort to catch up to the promised PVT schedule, they reached out to another supplier who do work on Sundays. This was the first time they'd worked with this supplier. And, as of last Wednesday, it is the last time they will work with this supplier.

This diode should never have made it through the PCBA shop's QC process. Consequently, the factory won't be using this PCBA shop again

Every single PCB had problems. Most of the issues were mis-soldered diodes. The boards looked like they'd been assembled by hand, rather than by machine. They also looked like nobody had done a simple visual inspection after assembly.

Visual inspection is a standard part of commercial PCB assembly. Any halfway decent vendor has automated equipment to do visual checks of boards after assembly.

The factory ended up having to "rework" every board to fix surface mount assembly issues. This ended up being a two day setback. In hindsight, we would have been better off if they'd used their regular SMT shop, like they'll be doing for mass production.

Type C Cables

We thought we had a workable Type C cable for PVT, but when the factory placed the order with the supplier, they admitted that they didn't actually have the cables or the required raw materials to make more in stock and that we'd be looking at a lead time of 3 weeks or more.

Plan B was to wake up early on Saturday morning and go to Huaqiang Bei, the world's largest electronics market and buy some cables retail for PVT. Ken offered to come along and to bring a friend who was a professional cable maker who wanted a chance to pitch for our business.

Over coffee, he convinced us that we really, really didn't want to buy retail cables in the market and said he could build cables to our spec, on our deadline.

He ran off to find some samples of a few options. When he got back, we talked through our requirements and he promised to send samples.

Four days later, we had three sample cables that looked like we expected. Shortly after Jesse headed home from Shenzhen, the vendor delivered all the cables for PVT.

PVT production

Jesse didn't tell the factory it was his birthday, but they still delivered quite the birthday present. The factory fired up the assembly line and produced all of the PVT units on Wednesday, June 21.

We'll talk more about the assembly line in a future update.

QC

The next day, Jesse sat with the factory's QC team and our third-party QC agency to review the assembled units and to start to identify what quality issues they need to look out for and what we generally consider acceptable. For the sorts of parts they're used to dealing with, this is pretty easy. For some things, like the wooden enclosures, we needed to be a bit more detailed.

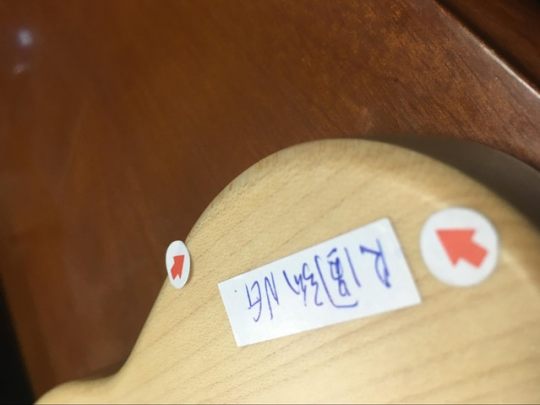

This wooden enclosure failed QC because the edge had been sanded too much, rendering it flat, rather than rounded.

Wood is, of course, a natural material without a uniform color. We showed the factory examples of unacceptable problems, which included tooling marks on visible surfaces, wood filler on visible surfaces, and ugly discolorations. At the same time, they pointed out issues they thought we'd reject. For the most part, we agreed with them.

Model 01 keyboards that have passed our QC checks

It was a pretty long day, but we managed to go through about 70 keyboards. The way it worked was that we’d choose a category of defect to review (like “keycaps” or “wood”) and then queue up each keyboard. The factory’s QC team would check the keyboard and either pass it or reject it. If they rejected it, they’d add a little arrow sticker pointing at the problem. If they passed it, they’d hand it to our QC guy. He’d review it, either adding a sticker and rejecting it or pass it and hand it to Jesse. He’d review the keyboard. If Jesse didn’t pass it, we’d stop the line, discuss the defect and the QC team would modify their acceptance criteria.

At the end of a given pass through the keyboards, we’d all review the rejected keyboards together to make sure they weren’t being overly critical.

This "birdseye" Model 01 is the one Jesse gave Kaia for our 10 year wedding anniversary. (If you look closely, you can see a keycap that failed QC and had to be swapped out.)

The one surprise for everybody was "birdseye figure" Maple. Our jaws dropped when we found a few examples of birdseye maple in with the PVT keyboard enclosures. They were gorgeous. The factory's QC team thought they looked funny and didn't look like they were supposed to. It took a bit, but they now understand that if any birdseye Maple makes it into the supply chain, they shouldn't reject it. (Right now, we’re not able to promise anyone a birdseye figure enclosure. It’s very much luck of the draw.)

At the end of the night, the factory packed us up a carton of six keyboards, which Jesse hand-carried back to California, where we’ll be doing a little bit of additional QC.

In-house QC

Issues we found during PVT

By far, the biggest issues we ran into during PVT were with the quality of laser-engraving on the keycaps. At some point, we'll do a writeup of the root cause of the keycap issues, but that'll be a few thousand words on its own.

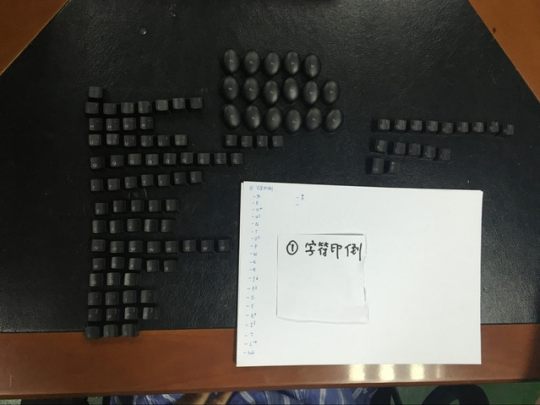

Checking every keycap by hand

We ended up with an eye-watering defect rate of around 25% on the laser engraving for the keycap sets. The two biggest failures were poorly aligned legends and keycaps that had been laser-engraved backwards. The proximate cause of these problems was that the keycaps need to be moved (manually!) from one painting jig to another in order to make sure the bottom edges of the keycaps get good paint coverage. Because this process requires a human to touch every single keycap, it's a point where errors get introduced.

These are a subset of the keycaps that failed QC. The factory lined them up and counted them to help drive-home the magnitude of the problem to their suppliers

Needless to say, this isn't going to work for mass production.

We've spent a bunch of time with the factory going over process improvements for mass production. They want to do a bit of research and testing before deciding on a final solution, but we've got a few promising options.

What's next?

Now that PVT production is "done", there's still a lot to do before you get your keyboards. Thankfully, almost all of it is straightforward for the factory.

Once we get the PVT units to the states, we'll ship them out to willing early backers. (There will be a question on the backer survey about it.) After that, we'll be eagerly awaiting feedback from folks who get PVT keyboards to make sure that we’re not missing something obvious.

The factory will be subjecting a few Model 01s to torture tests. They'll be exposing them to a few days of ultra-bright UV, spraying them down with a saline fog, and dropping them on a concrete floor. While we sort of wish we could be there to watch these tests, we're probably better off not having to watch the torture taking place. That should take about two weeks.

The factory will also be sending one keyboard to the FCC test lab to send onward to their partner lab in Taiwan for final testing and issuance of the "Declaration of Conformity". That should also take about two weeks.

At the same time, the factory is working to refine their internal test and assembly process based on the PVT run. That'll let them build Model 01s faster and more reliably when they have to make a few thousand of them at a go.

Right now, we're expecting the first couple thousand units to roll off the line in July.

<3 j+k

0 notes