#i always do so well in january theres so many options to choose from but then it dwindles

Explore tagged Tumblr posts

Text

monthly favourites 2024

I did this last year it was fun

jan - 📚 Fight Club - Chuck Palahniuk

🎬 Good Will Hunting 1997

feb - 📚 The Adventures of Amina Al-Sirafi - S.A. Chkraborty

🎬 Bring It On 2000

mar - 📚 The Song of Achilles - Madeline Miller

🎬 Bottoms 2023

apr - 📚 American Psycho - Bret Easton Ellis

🎬 no movies watched

may - 📚 Homage to Catalonia - George Orwell

🎬 Challengers 2024

jun - 📚 We Have Always Lived in the Castle - Shirley Jackson

🎬 Anatomy of a Fall 2023

jul - 📚 Alligator and Other Stories - Dima Alzayat

🎬 An American Werewolf in London 1981

aug - 📚 Hard Times - Charles Dickens

🎬 no movies watched

sep - 📚 Butter - Asako Yuzuki

🎬 The Great Gatsby 2013

oct - 📚 The Beekeeper of Aleppo - Christy Lefteri

🎬 Don't Worry Darling 2022

nov - 📚 Why I'm No Longer Talking To White People About Race - Reni Eddo-Lodge

🎬 I Care A Lot 2020

dec - 📚 Let Sleeping Pharmacists Lie - Janelle Soong

🎬 Daredevil 2003

I tag @welcome-to-latveria @screaminggay @brw @thesupergirls @catinfroghat @curlyhairedbooklover @saturnaftertaste @shamemp3 and anyone else who wants to do it too, up to you if you want to do books, movies or both!

#my post#tag game#mariam reads books#mariam watches movies#2024#books#movies#i always do so well in january theres so many options to choose from but then it dwindles

14 notes

·

View notes

Note

Hey, so I graduated this past May and since then I've just been working 40 hours a week. I feel like I need to go to college to do something with my life but I feel like theres so much in my way and I havent done anything to even start and I dont have a clue what I'd want to do. I'm so unsure on how to do anything regarding financial aid or even applying to colleges. I'm also worried that it wouldn't work with my schedule for my job. I work 5 days with 2 off days and I'm on evenings so I feel like I wouldn't be able to balance work and school, but I would have to bc I'm my only financial support. Sorry for the dumping my problems, but any advice?

How To Do College 101

Congratulations on your graduation! Working a full-time job after graduation (during a freaking pandemic, no less) is no small feat either, and I applaud you for that, too. Once upon a time, I was like you: I didn’t know anything about college except that I wanted to go, and now I run a blog telling people how to go to college. College might be strange and unfamiliar now, but in time, you will learn how to do it!

This might be my longest post, so strap in for a fun ride!! My answer comes to you in three parts:

How To Do Community College

How To Do University

How To Do Financial Aid

P.S. I’m going to say this only once, but feel free to ask why: Do not attend a for-profit college. Okay, now onto the basics!

How To Do Community College

I encourage you to read my Ode to Community College. Community colleges are real colleges designed for people who are low on funds, are working or have other responsibilities, don’t know what they want to study yet, and/or don’t know how college works yet.

Step 1: Applying

Community colleges accept anyone who applies, and the application is usually just like filling out a job application, but you will also need to send in your high school transcript, and I recommend sending any test scores. Your college may have you take a placement test to see if you’re ready for college. If you’re not quite ready, they may have you take some pre-college courses in English or math before you officially start a degree program.

Step 2: Choosing a Degree Program

Among other things, community colleges award associate’s degrees, which are essentially the first two years of a bachelor’s degree at a four-year college or university. You’ll take introductory classes like English, math, science, and social sciences, as well as electives (i.e. fun classes). Here’s a list of programs that might be offered at your community college.

Step 3: Taking the Right Classes

Make sure you stick to your college’s degree plan so that you take classes that 1) count toward your associate’s degree and 2) will transfer to a university. Most classes you take for an associate’s degree (AA, AS, or AFA) should transfer to a bachelor’s degree (BA, BS, or BFA) easily enough, but sometimes universities aren’t very transfer-friendly. The best option is to transfer to a university that has a partnership with your community college, which is information you should be able to find on your community college’s website. If your community college doesn’t have any partners, you’ll want to research the transfer policies at the universities you’re interested in and follow their guidelines on what classes to take.

Step 4: Transferring

In your last year of community college, you will apply to a four-year college or university for your bachelor’s degree. You’ll need to pick a major when you apply because for the next two years, that’s what you will be studying. Make sure you tour the university before you attend and get acclimated before your first day!

How To Do University

Whether or not you attend community college for the first two years or enroll directly into a four-year college or university, you’ll want to understand how to navigate the basics as early as possible.

Step 1: Exploring Your Options

Use my Self-Reflection Toolkit and this quiz from Marquette University to explore potential majors. These are just meant to get you thinking and guide you as you learn more about yourself and your interests. This process will take time to research and figure out, and if you enroll directly into a four-year college you can change your major after you apply. As I mentioned, the first two years are mostly basics and figuring stuff out, so either way you have time.

I was very bad at choosing colleges to apply to and applied almost at random. I learned a lot from those mistakes, and on my FAQ page you’ll see me trying to impart that wisdom on others. I recommend doing your research, going on virtual tours, and getting used to just looking at college websites, even if you don’t know what you want yet. Start by window shopping for colleges in your state and see what they have to offer you. College Board also has tools for finding a college that fits your needs. It’s worth starting as early as possible, and I know that you can do it. Like I said, I was really bad at it and I still made it through.

Step 2: Applying

Applying to a four-year college will take more steps than a community college application. Many colleges require letters of recommendation, essays, and application fees (look on their websites for fee waivers). More information is on my FAQ page, of course, but be prepared to complete these steps before application deadlines. Each college sets its own deadline, but if you want to go next year, you’ll likely need to apply by January or February. Applying can be daunting, but you will need to do it at some point, even if you go to community college first.

Step 3: Finding Resources

Access any and all resources your university offers, which will include advising, counseling, career services, and more. The same is true at a community college, but I would argue it’s even more true at a university. You might find out about internships, research opportunities, fun events, and all that stuff that excited you when you saw it on your university’s website! Even if you don’t feel like you need resources, you’re paying for them, so you might as well use them! Often people won’t know how to help you unless you tell them you’re struggling, like how you told me what you’re going through and I wrote a post that’s turning into a short novel! (I’ll be done soon, I promise.)

Step 4: Taking The Right Classes

Just like at a community college, you want to make sure you’re taking classes that count toward your degree and interest you. Make sure you’re following the prescribed degree plan on your university’s website and communicated by your advisor. If you find that you’ve chosen a major that doesn’t fit your interests, make sure you speak with your professors, your advisor, and anyone else whose opinion you trust.

How To Do Financial Aid

Step 1: Understanding The Basics

There are three major types of financial aid: loans (money you have to pay back after you graduate), grants (government money you’re awarded based on your financial need that you don’t have to pay back), and scholarships (money from a college or other source that is awarded for any reason that you don’t have to pay back). Loans might come from the government, your college, or a bank. I recommend borrowing from the federal government because the interest is so low (basically, it’s cheaper to pay off than a bank loan).

Step 2: Filling Out FAFSA

If you want to go to college next fall, or if you just want to do a practice round, fill out FAFSA now. I’m assuming you’re under 24, so you will need your parents’ tax information even if they’re not going to help you pay for college. Filling out FAFSA will never, not ever ever ever require you or your parents to take out any loans. Rather, FAFSA gives you access to any need-based financial aid you might be eligible for, whether that aid comes from the government or not. Loans agreements are a totally separate form, and you can take some loans without your parents’ help. If you’re not eligible for FAFSA, check whether your state or college has its own FAFSA alternative.

Step 3: Reading Your Award Letter

After a college sends an acceptance letter, they will also send a financial aid award letter. The letter will show you how much you’ve been awarded in scholarships and grants and how much you can take out in loans from the federal government or the college itself. You should compare your financial aid amount to the total cost of attendance, will you can find on the college’s financial aid webpage. The total cost of attendance is how much it costs to pay for tuition, fees, housing, and a rough estimate of your other living expenses. Basically, it’s how much it costs to be a student for one year.

As you said, I wouldn’t expect you to be able to work 40 hours while maintaining good grades, so may need to be frugal and creative to fill in any gaps financial aid didn’t cover. Private colleges tend to have a really big “sticker price,” but may offer generous scholarships as discounts, whereas public colleges tend to be cheaper and may have (large and small) scholarships to help you pay.

Step 4: Applying

In addition to the scholarships that you may be automatically awarded if you meet certain criteria, your colleges may also have scholarships that you have to apply for by yourself. This information will be located on a college’s financial aid webpage. There are also scholarships from nonprofit organizations and businesses. Visit my resources page for info, ask people you know if they’re aware of any scholarships, ask your boss and coworkers, and ask Google for “scholarships in [your town].”

Okay, I threw a lot at you, but those are the basics as I see them! You can totally do this. It’s going to be a big learning curve, but the payoffs will be big. And you can always come back here for more advice and reassurance. I’m proud of you already for thinking of your future and doing what you can to support yourself and your learning.

123 notes

·

View notes

Text

When There’s Blood in the Street (Why It’s Not Quite Time to Be Long Crypto)

Timothy Enneking is the founder and the primary principal of Digital Capital Management, LLC (DCM).

——————-

Two members of the Rothschild family are credited, perhaps incorrectly, with the (in)famous quote regarding investing: “When there is blood in the street” (James in the mid-19th century and Nathan, after the battle of Waterloo).

The family has been one of the richest in the world for over 200 years, so there’s something to be said for following the advice of its members… In the crypto space, therefore, the question becomes, Is there enough blood in the streets now that it’s the time to buy? I would argue no. Or, more precisely, not quite yet.

The basis for this conclusion is the past behavior of bitcoin (which, for the purposes of this article, I will use as a proxy for the entire crypto market – fully aware of the fact that it’s not perfect in that role, but only reasonably good).

The data set used is all related to bitcoin drops of 80 percent or more.

That’s because there is a very interesting aspect to historical BTC performance: There are no peak-to-valley drops between 57 percent and 82 percent over its trading history. Thus, it becomes quite easy to narrow the data down (since a drop of 50 percent is fundamentally and qualitatively different from a drop of more than 80 percent).

This leaves us with four instances: a bit too few in an ideal world, but enough, in some cases, to reach some rather definite conclusions.

The four drops are:

Of course, the last one is not yet over. Note that the current bear market has, to date, barely exceeded the third largest. To reach second place, BTC would have to drop to $2,553. To take first place, BTC would have to fall back to $1,239.

If we analyze the drops more closely, some interesting facts emerge. For instance, the average number of days between peak and valley is 233, or about 8 months. (The average would be 10 months without the unusual 2013 drop, which saw a peak-to-valley duration of two days.) This reinforces the conclusion that another bottom is probably close in terms of timing.

Then, once crypto markets hit bottom, how long does a recovery generally take?

We see those data below:

So, with quite a range, the average time for the price to double from the bottom is four months. The average time to reach the prior peak is one year and four months, or one year from the bottom doubling. Once that peak is reached, however, the time for the peak to double is a remarkable two months – and the range of the data is quite small: from one to three months. Conclusion: once enough momentum to reach the prior peak has been achieved, it consistently keeps going very strongly.

As we can see, the range of dates to reach and double the peak is far less than the range to double the bottom. Again, the sample is small, but the trend is clear. However, it’s also clear that the time required for all three metrics is increasing over time; thus, it may well take longer to hit each level this time around.

Are we at the bottom?

Further analysis is required to determine this. Let’s call it “spike analysis.”

BTC virtually always reaches a peak and puts in a bottom with a spike. In other words, there is not a nice round hill at the top and a gently sloping down-and-up valley at the bottom. Bitcoin’s tops and bottoms are more violent. And that “violence” can be measured.

For the first peak from the first table above, we have some statistical data, but no good graph as 2011 graphs are not generally available. However, regardless of the data source, the wick is enormous, up to 40 percent from the immediately surrounding prices.

For the November 2011 valley, the graph is quite interesting. The drop, while it does not look dramatic because of the tremendous jump (about 500 percent) shortly thereafter, was actually nearly 10 percent with an almost immediate recovery. The total drop was also the largest drop in bitcoin history in percentage terms at 93.6 percent.

The next peak, in April 2013 was even more dramatic, with a jump of 25-40 perecent depending on what one chooses as the starting point.

Stunningly, the next valley was put in two days later. (For those of you who, as I, lived through this, you will remember that this sudden spike and drop were directly related to the Cyprus debt crisis.)

(Please note that I am not addressing in any detail the various exogenous events which may have driven the crypto peaks and/or valleys. In addition to Cyprus in 2013, you had PBOC/MtGox in late 2013 and early 2014, the futures market-fueled rise in late 2017, ICO and general crypto regulation in 2018, etc. Good fuel for another article, but too much to address here.)

Again, depending on what one chooses as a baseline, the drop here was about 20 perecent. (It should also be noted that this drop may be viewed as a double or even triple bottom, but as it was put in over a very short period of time, the analysis still holds.) This is now the fourth largest drop in BTC history, having just been displaced by the current one.

The next peak was later that same year, in November. This peak is a bit of an anomaly for two reasons: first, the spike was only about an 8 percent increase and, second, there was a clear double top – although, again, over a very short period of time.

The next valley was just over one year later, in January 2015. This time the drop was about 15 percent and was very clear. The total peak-to-valley drop, at 86.9 percent, remains the second-largest in bitcoin history.

The final peak, and almost certainly the best known, was in December of last year. This was roughly a 12 percent peak and was extremely clear.

Finally, we look at the current price chart. We can see that there was a large drop from 6,000, but there has been nothing like a “violent” bottom put in – in fact, the opposite is true.

When capitulation?

Of course, a “violent bottom” is simply another way of saying “capitulation.” That concept has become so well known that many people, including authors of articles similar to this, are asking “have we seen capitulation yet?” (My favorite recent quote in this regard is “point of apparent capitulation” – which appeared about $1,000 ago.)

Here is my thought on capitulation: it will be obvious to nearly everyone when it happens. If lots of people are asking whether “that move down” was capitulation or not, it wasn’t.

So ,where will the bottom be? In my opinion, there is a relatively small chance of putting in a bottom around $2,800. However, I suspect that the odds are higher that the BTC price will test $2,000 within a month or two. Even if I’m correct, however, that would only move this drop to second place of all time.

One further point I would like to make is to address the question which “crypto folk” never ask, but which “fiat folk” do: Can the Bitcoin price drop to zero?

I remember almost six years ago when I first heard of bitcoin and cryptocurrencies. I wasn’t convinced they would survive. After a year or so, survival wasn’t an issue, but scale and importance were. Now, it seems clear to me that crypto trading tokens (so I’m deliberately excluding blockchain applications which do not rely on “cryptocurrencies” that trade) and bitcoin are here to stay and that they will eventually play a non-trivial role in the financial system.

Without going into a long explanation, there is simply too much infrastructure that has been and is being developed, too many people with too much “skin in the game,” and too many advantages for the trading token ecosystem to utterly collapse.

The conclusion: a new bottom is nigh upon us, but not quite here yet. Or said another way, there is not yet enough blood running in the crypto streets to simply start buy bitcoin and other tokens which trade.

From an investment standpoint, however, while it’s not the time to buy, it is the time to invest. It’s obviously impossible to time the bottom exactly, so one must be positioned to invest now to maximize the benefit of the reversal. How to do that? Select a long-short investment vehicle (which the Rothschilds did not have) and invest now. I’m quite certain you won’t have to wait long for the next bull run to begin and, in the meantime, such a vehicle can make money on the balance of the drop.

Bitcoin in red via Shutterstock

!function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n; n.push=n;n.loaded=!0;n.version='2.0';n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)}(window, document,'script','//connect.facebook.net/en_US/fbevents.js'); fbq('init', '239547076708948'); fbq('track', "PageView"); This news post is collected from CoinDesk

Recommended Read

Editor choice

BinBot Pro – Safest & Highly Recommended Binary Options Auto Trading Robot

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

9.5

Demo & Pro Version Try It Now

Read full review

The post When There’s Blood in the Street (Why It’s Not Quite Time to Be Long Crypto) appeared first on Click 2 Watch.

More Details Here → https://click2.watch/when-theres-blood-in-the-street-why-its-not-quite-time-to-be-long-crypto-9

0 notes

Text

The 6 Lastest Trends In Florida Vacation Rentals

News And Information About Florida Vacation Rentals

Three Generations of Casa Del Mar And Counting! Beachfront Vacation Rentals Three Generations of Casa Del Mar And Counting! 2018-04-15T11:02:49+00:00By Casa Del Mar |Categories: Guest Stories | Before Google, before cell phones, and whenthe office was writing their room schedules and hanging them on the walls! ,Ron Eydenberg discovered Casa Del Mar, while in Longboat Key.In 1983, he reserved one of our units and therest is three generations ofhistory. I had the pleasure of sitting down with Ron, with what I thought was a planned set of standard guest interview questions I was in for a surprise. Ron, a retired school administrator continues to teach at Boston College and has been enjoying Casa Del Mar with Jane, his wife of almost 50 years. He has been bringingtheir daughters, Lesley and Nicole, and their families, for over 32 years. Pull out the shovels and pails! Eydenbergs grandchildren, Connor and Rylee, now teenagers, and Finn at age 9, still spend their school vacations carryingout a familytradition of building sandcastles on Casa Del Mars favoritebeach! Collecting shells and revisiting their favorite restaurants are also ALWAYS on the agenda! So are walks, jet skiing, kayaking and visits to the Mote. Noe, Rons son-in-law, also likes to go boating. In January, Connor will participate in a five-dayinvitational program, at the nearby sports academy, IMG!

https://casadelmar.net/three-generations-of-casa-del-mar-and-counting/

Well, flying into the Sarasota/Bradenton airport (SRQ) just got easier as well as less expensive. Frontier Airline recently announced they will be offering direct, non-stop flights from Atlanta beginning December 10, 2018. Flights between Sarasota Bradenton International Airport andHartsfield-Jackson Atlanta International Airport will be offered three times a week on Mondays, Wednesdays and Fridays. As an added bonus to this already great news, Frontier is offering special introductory fares as low as $39 each way! This is the latest in a series of new destinations offered via budget airlines. Earlier this year, SRQ and Frontier announced new non-stop flights to Cleveland and to Philadelphia. Sarasota-Bradenton International Airport and Frontier Airlines will provide the service to Cleveland and Philadelphia beginning in December. The flights to Philadelphia International Airport begin on December 10, 2018 with flights offered Mondays and Fridays. In April of this year, Allegiant launched its first Sarasota routes, flying to Pittsburgh, Indianapolis and Cincinnati. Since the addition of Allegiant and Frontier to the airport this year, traffic numbers are increasing. According to airport authorities July saw a 30 percent increase in passenger traffic, with a 23 percent increase in June, and a 16 percent increase in May.

https://annamariaislandcondorentals.com/new-flights-to-sarasota-bradenton-airport-srq/

If youre looking for privacy and amenities, this is probably not going to be your best option. You may also end up paying additional fees to book your stay. According to VRMintel.com , Airbnb charges an additional 6 to 12 percent of the cost of the rental. The site also says that same fee can be even higher on VRBO.com. According to VRMintel, The service fee is between 5 to 12 percent for most bookings, but can be above or below, based on the reservation. Vacation Rentals with Royal Shell vs. Staying at a Hotel When most people think about traveling, they consider staying at a hotel. Theres normally free breakfast or some sort of special if you book early or during a certain time of the year. But is a hotel room really the best choice if you vacation travel accommodations want to feel more integrated into the city youre visiting? Tausha from The Globe Getter points out that you dont get the same feeling when you have to walk down a hallway, use an elevator and take a bunch of extra steps to get to the citys center. If you stay in a vacation rental property, itll already feel homier and less sterile right off the bat. And besides, you wont feel so much like an outsider in your new temporary city when you can walk out the front door and be steps away from beaches, shops, restaurants and things to do.

https://www.royalshell.com/best-vacations/planning/how-to-choose-the-best-vacation-rentals-websites/

5 Places To Grab Dessert While In Seaside, FL On vacation, its okay to let yourself splurge on tasty treats, especially if youre vacationing somewhere along 30A. There are so many yummy local dessert places near Seaside, Florida, so if youre staying somewhere nearby , you wont want to miss out. 30A Pop Stop is one of the unique local dessert places near Seaside. There are so many delicious flavors to choose from with local ingredients. You can get these fun specialty popsicles in fruity flavors like strawberry mojitos and avocado lime, or in creamy flavors like salted caramel and chai tea. Image Credit: @outoftheofficetraveling Instagram Dawsons Yogurt & Fudge Works is a classic Seaside establishment. Ever since 1988 this sweet shop has been serving up delicious goodies like frozen yogurt, smoothies, and fudge, for locals and tourists alike. Although not exclusive to 30A, Five Daughters Bakery is a favorite around here. This family-owned bakery got its start in Franklin, TN. Since then, theyve added locations in Atlanta and Seaside. However, the Seaside bakery is actually a food truck set up downtown with tons of different donut creations. From bacon and maple syrup to paleo-friendly, Five Daughters Bakery has it all. 4.

https://www.fivestargulfrentals.com/blog/dessert-places-in-seaside-florida/

0 notes

Text

The perfect is the enemy of the good

Im home! Over the past two weeks, I drove 1625 miles across across seven southeastern states. I had a blast hanging out with readers, friends, and colleagues. Plus, it was fun to explore some parts of the country that Kim and I skipped during our RV trip a few years ago. Most fun of all, though, was talking to dozens of different people about money. After two weeks of money talk, I have a lot to think about. I was struck, for instance, by how many people are paralyzed by the need to make perfect decisions. Theyre afraid of making mistakes with their money, so instead of moving forward, they freeze like a deer in headlights. It might seem strange to claim that the pursuit of perfection prevents people from achieving their financial aims, but its true. Long-time readers know that this is a key part of my financial philosophy: The perfect is the enemy of the good. Here, for instance, is a typical reader email: Thirty-plus years ago I was making much less money than when I retired so my tax rate was lower. I sometimes wonder now if it would have been better to pay the taxes at the time I earned the money and invest and pay taxes all along rather than deferring the taxes. You can make yourself crazy thinking about stuff like that! Yes, you can make yourself crazy thinking about stuff like that. This reader retired early and has zero debt. Theyre in great financial shape. Yet theyre fretting over the fact that tax-deferred investments might not have been the optimal choice back in 1986. Regret is one of the perils of perfectionism. There are others. Lets look at why so many smart people find themselves fighting the urge to be perfect. Maximizers and Satisficers For a long time, I was a perfectionist. When I had to make a decision, I only wanted to choose the best. At the same time, I was a deeply unhappy man who never got anything done. Although I didnt realize it at the time, the pursuit of perfection was the root of my problems. In 2005, I read The Paradox of Choice by Barry Schwartz. This fascinating book explores how a culture of abundance actually robs us of satisfaction. We believe more options will make us happier, but the increased choice actually has the opposite effect. Especially for perfectionists. [embedded content] Schwartz divides the world into two types of people: maximizers and satisficers. Heres how he describes the difference: Choosing wisely begins with developing a clear understanding of your goals. And the first choice you must make is between the goal of choosing the absolute best and choosing something that is good enough. If you seek and accept only the best, you are a maximizerMaximizers need to be assured that every purchase or decision was the best that could be made. In other words, maximizers are perfectionists. The alternative to maximizing is to be a satisficer, writes Schwartz. To satisfice is to settle for something that is good enough and not worry about the possibility that there might be something better. To maximizers, this sounds like heresy. Settle for good enough? Good enough seldom is! proclaims the perfectionist. To her, the satisficer seems to lack standards. But thats not true. A satisficer does have standards, and theyre often clearly defined. The difference is that a satisficer is content with excellent while a maximizer is on a quest for perfect. And heres the interesting thing: All of this maximizing in pursuit of perfection actually leads to less satisfaction and happiness, not more. Heres what Schwartz says about his research: People with high maximization [tendencies] experienced less satisfaction with life, were less optimistic, and were more depressed than people with low maximization [tendencies]Maximizers are much more susceptible than satisficers to all forms of regret. Schwartz is careful to note that being a maximizer is correlated with unhappiness; theres no evidence of a causal relationship. Still, it seems safe to assume that there is a connection. Ive seen it in my own life. Maximizing in Real Life

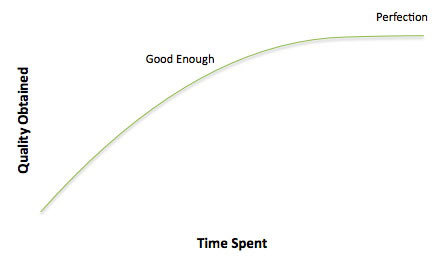

For a long, long time, I was a maximizer. When I had to make any sort of decision, I researched the hell out of it. I wanted to buy and do and have only the best. But you know what? No matter how much time I put into picking the perfect product, it always fell short of my expectations. Thats because theres no such thing as a perfect product. In the olden days, for instance, if I needed to buy a dishwasher, I would make an elaborate spreadsheet to collate all of my options. Id then consult the latest Consumer Reports buying guide, check Amazon reviews, and search for other resources to help guide my decision. Id enter all of the data into my spreadsheet, then try to find the best option. The trouble? There was rarely one best option for any choice I was trying to make. One dishwasher might use less energy while another produced cleaner dishes. This dishwasher might have special wine holders while that had the highest reliability scores. How was I supposed to find the perfect machine? Why couldnt one manufacturer combine everything into one Super Dishwasher? It was an impossible quest, and I know that now. Nowadays, Im mostly able to ignore my maximizing tendencies. Ive taught myself to be a satisficer. When I had to replace my dead dishwasher three years ago, I didnt aim for perfection. Instead, I made a plan and stuck to it. First, I set a budget. Because it would cost about $700 to repair our old dishwasher, I allowed myself that much for a new appliance.Next, I picked one store and shopped from its universe of available dishwashers.After that, I limited myself to only a handful of brands, the ones whose quality I trusted most.Finally, I gave myself a time limit. Instead of spending days trying to find the Best Dishwasher Ever, I allocated a couple of hours on a weekend afternoon to find an acceptable model. Armed with my Consumer Reports buying guide (and my phone so that I could look stuff up online), I marched into the local Sears outlet center. In less than an hour, I had narrowed my options from thirty dishwashers to three. With Kims help, I picked a winner. The process was quick and easy. The dishwasher has served us well for the past three years, and Ive had zero buyers remorse. A Trivial Example At Camp FI in January, one of the attendees explained that hes found freedom through letting go of trivial decisions. For things that wont have a lasting impact on his life, he doesnt belabor his options. Instead, he makes a quick decision and moves on. In restaurants, for instance, he doesnt look at every item on the menu. He doesnt try to optimize his order. Instead, he makes a quick pass through the list, then picks the first thing that catches his eye. It sounds silly, he told me, but doing this makes a huge difference to my happiness. For the past four months, Ive been trying this technique. You know what? It works! I now make menu choices in seconds rather than minutes, and my dining experience is better because of it. This is a trivial example, I know, but its also illustrative of the point Im trying to make. Perfect Procrastinators Studies have shown that perfectionists are more likely to have physical and mental problems than those who are open-minded and flexible. Theres another drawback to the pursuit of perfect: It costs time and lots of it. To find the best option, whether its the top dishwasher or the ideal index fund, can take days or weeks or months. (And sometimes its an impossible mission.) The pursuit of perfection is an exercise in diminishing returns: A bit of initial research is usually enough to glean the basics needed to make a smart decision.A little additional research is enough to help you separate the wheat from the chaff.A moderate amount of time brings you to the point where you can make an informed decision and obtain quality results.Theoretically, if you had unlimited time, you might find the perfect option. The more time you spend on research, the better your results are likely to be. But each unit of time you spend in search of higher quality offers less reward than the unit of time before.

Quality is important. You should absolutely take time to research your investment and buying decisions. But remember that perfect is a moving target, one thats almost impossible to hit. Its usually better to shoot for good enough today than to aim for a perfect decision next week. Procrastination is one common consequence of pursuing perfection: You can come up with all sorts of reasons to put off establishing an emergency fund, to put off cutting up your credit cards, to put off starting a retirement account. But most of the time, your best choice is to start now. Who cares if you dont find the best interest rate? Who cares if you dont find the best mutual fund? Youve found some good ones, right? Pick one. Get in the game. Just start. Starting plays a greater role in your success than any other factor. There will always be time to optimize in the future. When you spend so much time looking for the best choice that you never actually do anything, youre sabotaging yourself. The perfect is the enemy of the good. Final Thoughts If your quest for the best is making you unhappy, then its hurting rather than helping. If your desire to get things exactly right is preventing you from taking any sort of positive action, then youre better off settling for good enough. If you experience regret because you didnt make an optimal choice in the past, force yourself to look at the sunny side of your decision. Train yourself to be a satisficer. Ask yourself what good enough would mean each time youre faced with a decision. What would it mean to accept that instead of perfection?If you must pursue perfection, focus on the big stuff first. I get a lot of email from readers who fall into the optimization trap. They spend too much time and energy perfecting small, unimportant things newspaper subscriptions, online savings accounts, etc. instead of the things that matter most, such as housing and transportation costs. Fix the broken things first, then optimize the big stuff. After all of that is done, then it makes sense to get the small things perfect.Practice refinement. Start with good enough, then make incremental improvements over time. Say youre looking for a new credit card. Instead of spending hours searching for the best option, find a good option and go with it. Then, in the months and years ahead, keep an eye out for better cards. When you find one you like, make the switch. Make perfection a long-term project.Dont dwell on the past. If youve made mistakes, learn from them and move on. If youve made good but imperfect decisions such as the Money Boss reader who wishes they hadnt saved so much in tax-deferred accounts celebrate what you did right instead of dwelling on the minor flaws in the results.Embrace the imperfection. Everyone makes mistakes even billionaires like Warren Buffett. Dont let one slip-up drag you down. One key difference between those who succeed and those who dont is the ability to recover from a setback and keep marching toward a goal. Use failures to learn what not to do next time. I dont think perfection is a bad thing. Its a noble goal. Its not wrong to want the best for yourself and your family. But I think its important to recognize when the pursuit of perfection stands in your way rather than helps you build a better life. https://www.getrichslowly.org/perfect-is-the-enemy-of-the-good/

0 notes

Text

reminiscions, so to speak

I’ve been thinkin about this for a while, but havent really sat down to try to formulate this. But a lot of people whom I knew as teenagers or early 20s, when I was a teenager. There are sooo many people who are now (publically) trans, or at least not-cis, that I remember from back in jr high or high school, before anybody had really figured out The Genders. It makes me really glad, to see how many people are self-actualizing. I love to see the updates in their lives that they post on fb, at least the ones who haven’t defriended me. (This enjoyment is only a little vicarious, truth be told. It is mostly genuine happiness for them).

I know its very likely that I’ll never reconnect with any of the people with whom i’ve grown distant (not through any fault of their own. it really is 90% circumstances (everybody moving across the country, to either like boston or ... seattle? portland? Big Oregon City, or for those who are still local just issues of me not having a lot of free time with which to hang out with them) and 10% my hell brain self-sabotaging relationships/avoiding everything), but I often think about them and how they’re doing.

One of the people I’ve mentioned hasn’t defriended me on FB, and I still interact with their posts every now and then - I think a lot about the time when I was 16 and said some really horrific things to them without realizing just what I was saying. I’ve been feeling terrible about it, but I know I’ll never actually send them the apology I want to send - they deserve better than to be reminded of it out of the blue.

At one point last October, I was on this other person’s FB wall, i dont even remember why. sometime in like january or Dec, I saw a comment on somebody else’s status by somebody with the same last name as this person, with similar viewpoints. I click around, and figure out that this person has defriended me, and also publically came out on fb as trans. Last week I saw a photo posted of them with their sign at the chicago trans liberation march (which obvs I didnt go to, i’m not Out and I dont intend to be, until the time of my choosing, so i dont interact publically with Trans (tm) things. i’m fb friends with both my parents), and they looked really happy. Not about the occasion, but as a person, it looked like they had let an awful amount of weight off their shoulders. I remember them being as deeply unhappy as many of us were, back in high school (a lot of us were deeply depressed. It just turns out for a few of us that the depression was tied to the Genders so getting stuff done for the one helped the other). So, I’m glad that theyve realized their gender and are happier for it. I also wonder (a lot) if thats why they defriended me - I’m not really out on fb, and since I haven’t spoken to this person in years they probs wouldn’t even know that I’m also non cis, so maybe they defriended me when they did their official fb transition stuff. I get it, it would make sense to, but... it still wounds me, a bit.

those two were a couple years older than me and I was never that close to ‘em in high school. this third person was in my grade and a couple classes with me, and.... I was a horrible person to them. Not intentionally, I’ve always had the best of intentions, but that doesn’t mean the actions i had done weren’t horribly misogynistic or racist. A few things I didn’t even realize until years later, what I actually had been doing. They defriended me a couple years back. They’re non-cis as well, but I dont know anything more specific than that.

That was the Complicated Feelings w/r/t the non-cis folk i knew in high school. I had some online friends whove also come to realize their own genders as well, who I’ve also grown apart form. This one was largely due to MSN messenger no longer being a thing, and then me getting busy with irl stuff and basically never being online anymore. I don’t really got any Complicated Feelings for most of this group, its mostly that I miss them but realize there’s p much no feasible way to get back into regular comms with them, and I’ve accepted that.

There was one person, who knew they were trans all the way back when I first met them. But they never talked about it with me. At least 85% of our conversations were political. At the time, I was in early high school, where I was a libertarian at the time. They were staunchly communist, I figure marxist is probs the best term for their beliefs but I’ll be honest, I know jack diddly squat about the academic details of the different schools of communist thought. Anyways, we chatted a lot on MSN back when that was around. At one point I started FB friending the other online friends I’ve got, but this person never actually accepted the friend request. its still in their inbox. I last talked to them about 3 or 4 years ago, I believe in my 2nd year of college. I asked why they hadnt accepted the friend request and they said somethin to the tune of ‘im an asshole lol’. this persons typing style is completely different from that but thats the effect my memory has of that message. Our conversation at the time also turned political. Now, after getting to college and having my eyes opened at, well, a lot of stuff, i’ve since become fairly leftist. probably communist? socialist? idk. Anyways, at the time, I was pretty caught up in the politics of one tumblr user Moneycat. If you weren’t around for that, the gist of it (as i recall) was that... actually, i honestly can’t recall the minutae or which parts werent very good. there are other posts going around from some years back that go over her politics and the flaws thereof. one of their ideas was that gender is a social class, inasmuch as bourgeoisie or proletariat are, and that trans women are a distinct social class from cis women and men. I had recently read one of her posts about how gender theorizing had led her to become a communist, and how the two were inextricably linked, and tbh she was this huge popular rly smart trans lady blogger so i p much hero worshiped her and adopted as many of her politics as i could understand. So I tried explaining this gender theory of communism to my old communist pal, and they were very displeased by it. I did a poor job, to be sure, but they disagreed staunchly. I dont remember the other details of what I was arguing but I do remember it was more out there than just what i’ve typed so far. Cuz I opened the conversation with “hey did you know that i’ve also become a communist now?” or somethin like that, and they were like ‘oh nice, how did you come to this conclusion?” and I went into moneycat’s gender communism and they did not agree. And that was our last conversation. and idk how to start conversations. Even tho we’re not fb friends, i can still IM them via fb, so the option is always open, but I never do it. I miss this person a lot, and its been hurting me for years that they never accepted the friend request. we actually had been decently close online (as far as I recall. i have poor memory at best in general, and there’s a good chance I actually have brain trauma that’s making my memory even worse but that appointment is in may). and they’re fb friends with all our mutual online friends. so its just me. i’m not good enoguh.

And I know if I actually ever made a snapchat I could probably easily get back in contact with literally everybody ever, I know for a fact that all but the last person have snapchats, and I’m p sure that they’d all be receptive to at least messages over it, but.... I tried making a snapchat once, and was immedietely conflicted. Do I go with my IRL name and snap with my family and classmates and colleagues? If I do that, I dont want to have my snapchat available online here cuz I want to maintain at least a veneer of separation between my online identity and my “family” “professional” identity. Or do I go with my online name, but then refuse to snap w/ like my mom and sis? I ended up deleting the app and never doing anything with it. so I basically refuse to have a snapchat, and p much only have fb these days, which... is not the best method of communication.

Compounding this is my awkwardness with people i’ve known for a while - my memory really does get atrocious about some things, to the point where i’ve hung out with people for years before actually knowing 100% their name. this is deeply embarassing for me, and I dont wanna hurt em, so I dont let on that I dont remember their names. especially if i’ve known them for forever, but havent had a ton of meaningful interactions with them, theres a v good chance i’ll know them, i’ll recognize them, but i wont be able to drum up their name from the depths of my mind. this is awkward. so i sometimes avoid going to places where there are people who might fit this bill. some people from high school who I kinda knew and hung out in the same friend group as me, and a lot of my not immediate (step)relatives. so at the photos for the trans march, where I saw the photo of the one person from 2nd bullet point, I also saw a lot of other people from high school who I’d be awkward around. altho this reminds me, there was a 4th person actually, from high school as well. i think... they blocked me? i dot remember. i know they werent on fb a lot, but they were fb friends with me. i just went through my own friend list as well as that of 2 people who i thought would be mutuals with them but... i dont see them. I’m p sure i recall seeing like,,,, last year or 1.5 years ago that they had changed their fb name from their birth name to a feminine name, as well as changed their gender and all that other stuff that comes with coming Out? but I dont recall and I cant find em anymore. if they have blocked me.... oh well. nothin i can do about it. about any of it really. nothing that i’m going to do anyways.

0 notes

Text

When There’s Blood in the Street (Why It’s Not Quite Time to Be Long Crypto)

Timothy Enneking is the founder and the primary principal of Digital Capital Management, LLC (DCM).

——————-

Two members of the Rothschild family are credited, perhaps incorrectly, with the (in)famous quote regarding investing: “When there is blood in the street” (James in the mid-19th century and Nathan, after the battle of Waterloo).

The family has been one of the richest in the world for over 200 years, so there’s something to be said for following the advice of its members… In the crypto space, therefore, the question becomes, Is there enough blood in the streets now that it’s the time to buy? I would argue no. Or, more precisely, not quite yet.

The basis for this conclusion is the past behavior of bitcoin (which, for the purposes of this article, I will use as a proxy for the entire crypto market – fully aware of the fact that it’s not perfect in that role, but only reasonably good).

The data set used is all related to bitcoin drops of 80 percent or more.

That’s because there is a very interesting aspect to historical BTC performance: There are no peak-to-valley drops between 57 percent and 82 percent over its trading history. Thus, it becomes quite easy to narrow the data down (since a drop of 50 percent is fundamentally and qualitatively different from a drop of more than 80 percent).

This leaves us with four instances: a bit too few in an ideal world, but enough, in some cases, to reach some rather definite conclusions.

The four drops are:

Of course, the last one is not yet over. Note that the current bear market has, to date, barely exceeded the third largest. To reach second place, BTC would have to drop to $2,553. To take first place, BTC would have to fall back to $1,239.

If we analyze the drops more closely, some interesting facts emerge. For instance, the average number of days between peak and valley is 233, or about 8 months. (The average would be 10 months without the unusual 2013 drop, which saw a peak-to-valley duration of two days.) This reinforces the conclusion that another bottom is probably close in terms of timing.

Then, once crypto markets hit bottom, how long does a recovery generally take?

We see those data below:

So, with quite a range, the average time for the price to double from the bottom is four months. The average time to reach the prior peak is one year and four months, or one year from the bottom doubling. Once that peak is reached, however, the time for the peak to double is a remarkable two months – and the range of the data is quite small: from one to three months. Conclusion: once enough momentum to reach the prior peak has been achieved, it consistently keeps going very strongly.

As we can see, the range of dates to reach and double the peak is far less than the range to double the bottom. Again, the sample is small, but the trend is clear. However, it’s also clear that the time required for all three metrics is increasing over time; thus, it may well take longer to hit each level this time around.

Are we at the bottom?

Further analysis is required to determine this. Let’s call it “spike analysis.”

BTC virtually always reaches a peak and puts in a bottom with a spike. In other words, there is not a nice round hill at the top and a gently sloping down-and-up valley at the bottom. Bitcoin’s tops and bottoms are more violent. And that “violence” can be measured.

For the first peak from the first table above, we have some statistical data, but no good graph as 2011 graphs are not generally available. However, regardless of the data source, the wick is enormous, up to 40 percent from the immediately surrounding prices.

For the November 2011 valley, the graph is quite interesting. The drop, while it does not look dramatic because of the tremendous jump (about 500 percent) shortly thereafter, was actually nearly 10 percent with an almost immediate recovery. The total drop was also the largest drop in bitcoin history in percentage terms at 93.6 percent.

The next peak, in April 2013 was even more dramatic, with a jump of 25-40 perecent depending on what one chooses as the starting point.

Stunningly, the next valley was put in two days later. (For those of you who, as I, lived through this, you will remember that this sudden spike and drop were directly related to the Cyprus debt crisis.)

(Please note that I am not addressing in any detail the various exogenous events which may have driven the crypto peaks and/or valleys. In addition to Cyprus in 2013, you had PBOC/MtGox in late 2013 and early 2014, the futures market-fueled rise in late 2017, ICO and general crypto regulation in 2018, etc. Good fuel for another article, but too much to address here.)

Again, depending on what one chooses as a baseline, the drop here was about 20 perecent. (It should also be noted that this drop may be viewed as a double or even triple bottom, but as it was put in over a very short period of time, the analysis still holds.) This is now the fourth largest drop in BTC history, having just been displaced by the current one.

The next peak was later that same year, in November. This peak is a bit of an anomaly for two reasons: first, the spike was only about an 8 percent increase and, second, there was a clear double top – although, again, over a very short period of time.

The next valley was just over one year later, in January 2015. This time the drop was about 15 percent and was very clear. The total peak-to-valley drop, at 86.9 percent, remains the second-largest in bitcoin history.

The final peak, and almost certainly the best known, was in December of last year. This was roughly a 12 percent peak and was extremely clear.

Finally, we look at the current price chart. We can see that there was a large drop from 6,000, but there has been nothing like a “violent” bottom put in – in fact, the opposite is true.

When capitulation?

Of course, a “violent bottom” is simply another way of saying “capitulation.” That concept has become so well known that many people, including authors of articles similar to this, are asking “have we seen capitulation yet?” (My favorite recent quote in this regard is “point of apparent capitulation” – which appeared about $1,000 ago.)

Here is my thought on capitulation: it will be obvious to nearly everyone when it happens. If lots of people are asking whether “that move down” was capitulation or not, it wasn’t.

So ,where will the bottom be? In my opinion, there is a relatively small chance of putting in a bottom around $2,800. However, I suspect that the odds are higher that the BTC price will test $2,000 within a month or two. Even if I’m correct, however, that would only move this drop to second place of all time.

One further point I would like to make is to address the question which “crypto folk” never ask, but which “fiat folk” do: Can the Bitcoin price drop to zero?

I remember almost six years ago when I first heard of bitcoin and cryptocurrencies. I wasn’t convinced they would survive. After a year or so, survival wasn’t an issue, but scale and importance were. Now, it seems clear to me that crypto trading tokens (so I’m deliberately excluding blockchain applications which do not rely on “cryptocurrencies” that trade) and bitcoin are here to stay and that they will eventually play a non-trivial role in the financial system.

Without going into a long explanation, there is simply too much infrastructure that has been and is being developed, too many people with too much “skin in the game,” and too many advantages for the trading token ecosystem to utterly collapse.

The conclusion: a new bottom is nigh upon us, but not quite here yet. Or said another way, there is not yet enough blood running in the crypto streets to simply start buy bitcoin and other tokens which trade.

From an investment standpoint, however, while it’s not the time to buy, it is the time to invest. It’s obviously impossible to time the bottom exactly, so one must be positioned to invest now to maximize the benefit of the reversal. How to do that? Select a long-short investment vehicle (which the Rothschilds did not have) and invest now. I’m quite certain you won’t have to wait long for the next bull run to begin and, in the meantime, such a vehicle can make money on the balance of the drop.

Bitcoin in red via Shutterstock

!function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n; n.push=n;n.loaded=!0;n.version='2.0';n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)}(window, document,'script','//connect.facebook.net/en_US/fbevents.js'); fbq('init', '239547076708948'); fbq('track', "PageView"); This news post is collected from CoinDesk

Recommended Read

Editor choice

BinBot Pro – Safest & Highly Recommended Binary Options Auto Trading Robot

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

9.5

Demo & Pro Version Try It Now

Read full review

The post When There’s Blood in the Street (Why It’s Not Quite Time to Be Long Crypto) appeared first on Click 2 Watch.

More Details Here → https://click2.watch/when-theres-blood-in-the-street-why-its-not-quite-time-to-be-long-crypto-7

0 notes

Text

When There’s Blood in the Street (Why It’s Not Quite Time to Be Long Crypto)

Timothy Enneking is the founder and the primary principal of Digital Capital Management, LLC (DCM).

——————-

Two members of the Rothschild family are credited, perhaps incorrectly, with the (in)famous quote regarding investing: “When there is blood in the street” (James in the mid-19th century and Nathan, after the battle of Waterloo).

The family has been one of the richest in the world for over 200 years, so there’s something to be said for following the advice of its members… In the crypto space, therefore, the question becomes, Is there enough blood in the streets now that it’s the time to buy? I would argue no. Or, more precisely, not quite yet.

The basis for this conclusion is the past behavior of bitcoin (which, for the purposes of this article, I will use as a proxy for the entire crypto market – fully aware of the fact that it’s not perfect in that role, but only reasonably good).

The data set used is all related to bitcoin drops of 80 percent or more.

That’s because there is a very interesting aspect to historical BTC performance: There are no peak-to-valley drops between 57 percent and 82 percent over its trading history. Thus, it becomes quite easy to narrow the data down (since a drop of 50 percent is fundamentally and qualitatively different from a drop of more than 80 percent).

This leaves us with four instances: a bit too few in an ideal world, but enough, in some cases, to reach some rather definite conclusions.

The four drops are:

Of course, the last one is not yet over. Note that the current bear market has, to date, barely exceeded the third largest. To reach second place, BTC would have to drop to $2,553. To take first place, BTC would have to fall back to $1,239.

If we analyze the drops more closely, some interesting facts emerge. For instance, the average number of days between peak and valley is 233, or about 8 months. (The average would be 10 months without the unusual 2013 drop, which saw a peak-to-valley duration of two days.) This reinforces the conclusion that another bottom is probably close in terms of timing.

Then, once crypto markets hit bottom, how long does a recovery generally take?

We see those data below:

So, with quite a range, the average time for the price to double from the bottom is four months. The average time to reach the prior peak is one year and four months, or one year from the bottom doubling. Once that peak is reached, however, the time for the peak to double is a remarkable two months – and the range of the data is quite small: from one to three months. Conclusion: once enough momentum to reach the prior peak has been achieved, it consistently keeps going very strongly.

As we can see, the range of dates to reach and double the peak is far less than the range to double the bottom. Again, the sample is small, but the trend is clear. However, it’s also clear that the time required for all three metrics is increasing over time; thus, it may well take longer to hit each level this time around.

Are we at the bottom?

Further analysis is required to determine this. Let’s call it “spike analysis.”

BTC virtually always reaches a peak and puts in a bottom with a spike. In other words, there is not a nice round hill at the top and a gently sloping down-and-up valley at the bottom. Bitcoin’s tops and bottoms are more violent. And that “violence” can be measured.

For the first peak from the first table above, we have some statistical data, but no good graph as 2011 graphs are not generally available. However, regardless of the data source, the wick is enormous, up to 40 percent from the immediately surrounding prices.

For the November 2011 valley, the graph is quite interesting. The drop, while it does not look dramatic because of the tremendous jump (about 500 percent) shortly thereafter, was actually nearly 10 percent with an almost immediate recovery. The total drop was also the largest drop in bitcoin history in percentage terms at 93.6 percent.

The next peak, in April 2013 was even more dramatic, with a jump of 25-40 perecent depending on what one chooses as the starting point.

Stunningly, the next valley was put in two days later. (For those of you who, as I, lived through this, you will remember that this sudden spike and drop were directly related to the Cyprus debt crisis.)

(Please note that I am not addressing in any detail the various exogenous events which may have driven the crypto peaks and/or valleys. In addition to Cyprus in 2013, you had PBOC/MtGox in late 2013 and early 2014, the futures market-fueled rise in late 2017, ICO and general crypto regulation in 2018, etc. Good fuel for another article, but too much to address here.)

Again, depending on what one chooses as a baseline, the drop here was about 20 perecent. (It should also be noted that this drop may be viewed as a double or even triple bottom, but as it was put in over a very short period of time, the analysis still holds.) This is now the fourth largest drop in BTC history, having just been displaced by the current one.

The next peak was later that same year, in November. This peak is a bit of an anomaly for two reasons: first, the spike was only about an 8 percent increase and, second, there was a clear double top – although, again, over a very short period of time.

The next valley was just over one year later, in January 2015. This time the drop was about 15 percent and was very clear. The total peak-to-valley drop, at 86.9 percent, remains the second-largest in bitcoin history.

The final peak, and almost certainly the best known, was in December of last year. This was roughly a 12 percent peak and was extremely clear.

Finally, we look at the current price chart. We can see that there was a large drop from 6,000, but there has been nothing like a “violent” bottom put in – in fact, the opposite is true.

When capitulation?

Of course, a “violent bottom” is simply another way of saying “capitulation.” That concept has become so well known that many people, including authors of articles similar to this, are asking “have we seen capitulation yet?” (My favorite recent quote in this regard is “point of apparent capitulation” – which appeared about $1,000 ago.)

Here is my thought on capitulation: it will be obvious to nearly everyone when it happens. If lots of people are asking whether “that move down” was capitulation or not, it wasn’t.

So ,where will the bottom be? In my opinion, there is a relatively small chance of putting in a bottom around $2,800. However, I suspect that the odds are higher that the BTC price will test $2,000 within a month or two. Even if I’m correct, however, that would only move this drop to second place of all time.

One further point I would like to make is to address the question which “crypto folk” never ask, but which “fiat folk” do: Can the Bitcoin price drop to zero?

I remember almost six years ago when I first heard of bitcoin and cryptocurrencies. I wasn’t convinced they would survive. After a year or so, survival wasn’t an issue, but scale and importance were. Now, it seems clear to me that crypto trading tokens (so I’m deliberately excluding blockchain applications which do not rely on “cryptocurrencies” that trade) and bitcoin are here to stay and that they will eventually play a non-trivial role in the financial system.

Without going into a long explanation, there is simply too much infrastructure that has been and is being developed, too many people with too much “skin in the game,” and too many advantages for the trading token ecosystem to utterly collapse.

The conclusion: a new bottom is nigh upon us, but not quite here yet. Or said another way, there is not yet enough blood running in the crypto streets to simply start buy bitcoin and other tokens which trade.

From an investment standpoint, however, while it’s not the time to buy, it is the time to invest. It’s obviously impossible to time the bottom exactly, so one must be positioned to invest now to maximize the benefit of the reversal. How to do that? Select a long-short investment vehicle (which the Rothschilds did not have) and invest now. I’m quite certain you won’t have to wait long for the next bull run to begin and, in the meantime, such a vehicle can make money on the balance of the drop.

Bitcoin in red via Shutterstock

!function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n; n.push=n;n.loaded=!0;n.version='2.0';n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)}(window, document,'script','//connect.facebook.net/en_US/fbevents.js'); fbq('init', '239547076708948'); fbq('track', "PageView"); This news post is collected from CoinDesk

Recommended Read

Editor choice

BinBot Pro – Safest & Highly Recommended Binary Options Auto Trading Robot

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

9.5

Demo & Pro Version Try It Now

Read full review

The post When There’s Blood in the Street (Why It’s Not Quite Time to Be Long Crypto) appeared first on Click 2 Watch.

More Details Here → https://click2.watch/when-theres-blood-in-the-street-why-its-not-quite-time-to-be-long-crypto-6

0 notes

Text

When There’s Blood in the Street (Why It’s Not Quite Time to Be Long Crypto)

Timothy Enneking is the founder and the primary principal of Digital Capital Management, LLC (DCM).

——————-

Two members of the Rothschild family are credited, perhaps incorrectly, with the (in)famous quote regarding investing: “When there is blood in the street” (James in the mid-19th century and Nathan, after the battle of Waterloo).

The family has been one of the richest in the world for over 200 years, so there’s something to be said for following the advice of its members… In the crypto space, therefore, the question becomes, Is there enough blood in the streets now that it’s the time to buy? I would argue no. Or, more precisely, not quite yet.

The basis for this conclusion is the past behavior of bitcoin (which, for the purposes of this article, I will use as a proxy for the entire crypto market – fully aware of the fact that it’s not perfect in that role, but only reasonably good).

The data set used is all related to bitcoin drops of 80 percent or more.

That’s because there is a very interesting aspect to historical BTC performance: There are no peak-to-valley drops between 57 percent and 82 percent over its trading history. Thus, it becomes quite easy to narrow the data down (since a drop of 50 percent is fundamentally and qualitatively different from a drop of more than 80 percent).

This leaves us with four instances: a bit too few in an ideal world, but enough, in some cases, to reach some rather definite conclusions.

The four drops are:

Of course, the last one is not yet over. Note that the current bear market has, to date, barely exceeded the third largest. To reach second place, BTC would have to drop to $2,553. To take first place, BTC would have to fall back to $1,239.

If we analyze the drops more closely, some interesting facts emerge. For instance, the average number of days between peak and valley is 233, or about 8 months. (The average would be 10 months without the unusual 2013 drop, which saw a peak-to-valley duration of two days.) This reinforces the conclusion that another bottom is probably close in terms of timing.

Then, once crypto markets hit bottom, how long does a recovery generally take?

We see those data below:

So, with quite a range, the average time for the price to double from the bottom is four months. The average time to reach the prior peak is one year and four months, or one year from the bottom doubling. Once that peak is reached, however, the time for the peak to double is a remarkable two months – and the range of the data is quite small: from one to three months. Conclusion: once enough momentum to reach the prior peak has been achieved, it consistently keeps going very strongly.

As we can see, the range of dates to reach and double the peak is far less than the range to double the bottom. Again, the sample is small, but the trend is clear. However, it’s also clear that the time required for all three metrics is increasing over time; thus, it may well take longer to hit each level this time around.

Are we at the bottom?

Further analysis is required to determine this. Let’s call it “spike analysis.”

BTC virtually always reaches a peak and puts in a bottom with a spike. In other words, there is not a nice round hill at the top and a gently sloping down-and-up valley at the bottom. Bitcoin’s tops and bottoms are more violent. And that “violence” can be measured.

For the first peak from the first table above, we have some statistical data, but no good graph as 2011 graphs are not generally available. However, regardless of the data source, the wick is enormous, up to 40 percent from the immediately surrounding prices.

For the November 2011 valley, the graph is quite interesting. The drop, while it does not look dramatic because of the tremendous jump (about 500 percent) shortly thereafter, was actually nearly 10 percent with an almost immediate recovery. The total drop was also the largest drop in bitcoin history in percentage terms at 93.6 percent.

The next peak, in April 2013 was even more dramatic, with a jump of 25-40 perecent depending on what one chooses as the starting point.

Stunningly, the next valley was put in two days later. (For those of you who, as I, lived through this, you will remember that this sudden spike and drop were directly related to the Cyprus debt crisis.)

(Please note that I am not addressing in any detail the various exogenous events which may have driven the crypto peaks and/or valleys. In addition to Cyprus in 2013, you had PBOC/MtGox in late 2013 and early 2014, the futures market-fueled rise in late 2017, ICO and general crypto regulation in 2018, etc. Good fuel for another article, but too much to address here.)

Again, depending on what one chooses as a baseline, the drop here was about 20 perecent. (It should also be noted that this drop may be viewed as a double or even triple bottom, but as it was put in over a very short period of time, the analysis still holds.) This is now the fourth largest drop in BTC history, having just been displaced by the current one.

The next peak was later that same year, in November. This peak is a bit of an anomaly for two reasons: first, the spike was only about an 8 percent increase and, second, there was a clear double top – although, again, over a very short period of time.

The next valley was just over one year later, in January 2015. This time the drop was about 15 percent and was very clear. The total peak-to-valley drop, at 86.9 percent, remains the second-largest in bitcoin history.

The final peak, and almost certainly the best known, was in December of last year. This was roughly a 12 percent peak and was extremely clear.

Finally, we look at the current price chart. We can see that there was a large drop from 6,000, but there has been nothing like a “violent” bottom put in – in fact, the opposite is true.

When capitulation?

Of course, a “violent bottom” is simply another way of saying “capitulation.” That concept has become so well known that many people, including authors of articles similar to this, are asking “have we seen capitulation yet?” (My favorite recent quote in this regard is “point of apparent capitulation” – which appeared about $1,000 ago.)

Here is my thought on capitulation: it will be obvious to nearly everyone when it happens. If lots of people are asking whether “that move down” was capitulation or not, it wasn’t.

So ,where will the bottom be? In my opinion, there is a relatively small chance of putting in a bottom around $2,800. However, I suspect that the odds are higher that the BTC price will test $2,000 within a month or two. Even if I’m correct, however, that would only move this drop to second place of all time.

One further point I would like to make is to address the question which “crypto folk” never ask, but which “fiat folk” do: Can the Bitcoin price drop to zero?

I remember almost six years ago when I first heard of bitcoin and cryptocurrencies. I wasn’t convinced they would survive. After a year or so, survival wasn’t an issue, but scale and importance were. Now, it seems clear to me that crypto trading tokens (so I’m deliberately excluding blockchain applications which do not rely on “cryptocurrencies” that trade) and bitcoin are here to stay and that they will eventually play a non-trivial role in the financial system.

Without going into a long explanation, there is simply too much infrastructure that has been and is being developed, too many people with too much “skin in the game,” and too many advantages for the trading token ecosystem to utterly collapse.

The conclusion: a new bottom is nigh upon us, but not quite here yet. Or said another way, there is not yet enough blood running in the crypto streets to simply start buy bitcoin and other tokens which trade.

From an investment standpoint, however, while it’s not the time to buy, it is the time to invest. It’s obviously impossible to time the bottom exactly, so one must be positioned to invest now to maximize the benefit of the reversal. How to do that? Select a long-short investment vehicle (which the Rothschilds did not have) and invest now. I’m quite certain you won’t have to wait long for the next bull run to begin and, in the meantime, such a vehicle can make money on the balance of the drop.

Bitcoin in red via Shutterstock

!function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n; n.push=n;n.loaded=!0;n.version='2.0';n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)}(window, document,'script','//connect.facebook.net/en_US/fbevents.js'); fbq('init', '239547076708948'); fbq('track', "PageView"); This news post is collected from CoinDesk

Recommended Read

Editor choice

BinBot Pro – Safest & Highly Recommended Binary Options Auto Trading Robot

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

9.5

Demo & Pro Version Try It Now

Read full review

The post When There’s Blood in the Street (Why It’s Not Quite Time to Be Long Crypto) appeared first on Click 2 Watch.

More Details Here → https://click2.watch/when-theres-blood-in-the-street-why-its-not-quite-time-to-be-long-crypto-4

0 notes

Text

When There’s Blood in the Street (Why It’s Not Quite Time to Be Long Crypto)

Timothy Enneking is the founder and the primary principal of Digital Capital Management, LLC (DCM).

——————-

Two members of the Rothschild family are credited, perhaps incorrectly, with the (in)famous quote regarding investing: “When there is blood in the street” (James in the mid-19th century and Nathan, after the battle of Waterloo).

The family has been one of the richest in the world for over 200 years, so there’s something to be said for following the advice of its members… In the crypto space, therefore, the question becomes, Is there enough blood in the streets now that it’s the time to buy? I would argue no. Or, more precisely, not quite yet.

The basis for this conclusion is the past behavior of bitcoin (which, for the purposes of this article, I will use as a proxy for the entire crypto market – fully aware of the fact that it’s not perfect in that role, but only reasonably good).

The data set used is all related to bitcoin drops of 80 percent or more.

That’s because there is a very interesting aspect to historical BTC performance: There are no peak-to-valley drops between 57 percent and 82 percent over its trading history. Thus, it becomes quite easy to narrow the data down (since a drop of 50 percent is fundamentally and qualitatively different from a drop of more than 80 percent).

This leaves us with four instances: a bit too few in an ideal world, but enough, in some cases, to reach some rather definite conclusions.

The four drops are:

Of course, the last one is not yet over. Note that the current bear market has, to date, barely exceeded the third largest. To reach second place, BTC would have to drop to $2,553. To take first place, BTC would have to fall back to $1,239.