#hybrid vehicle market growth

Explore tagged Tumblr posts

Text

The global hybrid vehicle market is expected to reach 8696 thousand units by 2030, growing at a CAGR of 8.12% from 2022 to 2030.

The global hybrid vehicle market is expected to reach 8696 thousand units by 2030, growing at a CAGR of 8.12% from 2022 to 2030.

The growth of the hybrid vehicle market is being driven by a number of factors, including:

Stricter emission regulations: Governments around the world are increasingly tightening emission regulations, which is driving demand for more fuel-efficient vehicles. Hybrid vehicles offer a significant improvement in fuel efficiency over traditional gasoline-powered vehicles, making them a compliance option for many automakers.

Rising demand for green vehicles: Consumers are increasingly concerned about the environment and are looking for ways to reduce their carbon footprint. Hybrid vehicles offer a way to do this without sacrificing performance or convenience.

Government incentives: Many governments offer tax breaks and other incentives for the purchase of hybrid vehicles, which makes them more affordable for consumers.

Advances in technology: The development of more advanced hybrid technologies is making hybrid vehicles more efficient and affordable. This is making them a more attractive option for consumers and businesses.

Get a free sample copy of the research report: https://www.vynzresearch.com/automotive-transportation/hybrid-vehicle-market/request-sample

The global hybrid vehicle market is segmented by component, electric powertrain type, propulsion, degree of hybridization, vehicle type, and region.

By component, the market is segmented into electric motor, battery, and transmission. The electric motor is the most critical component in a hybrid vehicle, as it is responsible for providing the power that drives the car. The battery stores the energy that is generated by the electric motor and provides power when the engine is not running. The transmission is responsible for transferring the power from the electric motor and the engine to the wheels.

By electric powertrain type, the market is segmented into parallel hybrid and series hybrid. Parallel hybrids have both an electric motor and an internal combustion engine (ICE). The electric motor and the ICE can work together to power the vehicle, or the electric motor can power the vehicle on its own. Series hybrids have an electric motor and an ICE, but the electric motor is only used to power the vehicle when the ICE is not running.

By propulsion, the market is segmented into hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and natural gas vehicles (NGVs). HEVs are the most common type of hybrid vehicle. They use a small electric motor to supplement the ICE, which helps to improve fuel efficiency. PHEVs have a larger electric motor and a larger battery, which allows them to be driven on electricity for a limited distance. NGVs use natural gas instead of gasoline, which is a cleaner-burning fuel.

By degree of hybridization, the market is segmented into micro-hybrid, full hybrid, and mild hybrid. Micro-hybrids are the least sophisticated type of hybrid vehicle. They use a small electric motor to start the engine and to provide power during deceleration. Full hybrids use a larger electric motor and a larger battery, which allows them to operate in electric mode for a limited distance. Mild hybrids use a small electric motor to assist the ICE, which helps to improve fuel efficiency.

The market is segmented by vehicle type into passenger cars and commercial vehicles. Passenger cars account for the majority of the hybrid vehicle market. However, the commercial vehicle segment is expected to grow at a faster rate in the coming years.

By region, the market is segmented into North America, Europe, Asia Pacific, and Rest of the World. Asia Pacific is the largest market for hybrid vehicles, followed by Europe and North America. The growth of the hybrid vehicle market in the Asia Pacific is being driven by the increasing demand for green vehicles and the rising number of government incentives.

The global hybrid vehicle market is a dynamic and growing market. The factors driving the growth of the market are expected to continue in the coming years, which is likely to lead to further growth of the market.

Here are some of the key players in the global hybrid vehicle market:

Toyota

Hyundai

ZF

Ford

Honda

BorgWarner

Volvo

Delphi Technologies

Daimler

Allison Transmission

Continental

Schaeffler

Source: VynZ Research

#hybrid vehicle market#hybrid vehicle#hybrid vehicle market size#hybrid vehicle market share#hybrid vehicle marketanalysis#hybrid vehicle market growth#hybrid vehicle market value

0 notes

Text

Green energy is in its heyday.

Renewable energy sources now account for 22% of the nation’s electricity, and solar has skyrocketed eight times over in the last decade. This spring in California, wind, water, and solar power energy sources exceeded expectations, accounting for an average of 61.5 percent of the state's electricity demand across 52 days.

But green energy has a lithium problem. Lithium batteries control more than 90% of the global grid battery storage market.

That’s not just cell phones, laptops, electric toothbrushes, and tools. Scooters, e-bikes, hybrids, and electric vehicles all rely on rechargeable lithium batteries to get going.

Fortunately, this past week, Natron Energy launched its first-ever commercial-scale production of sodium-ion batteries in the U.S.

“Sodium-ion batteries offer a unique alternative to lithium-ion, with higher power, faster recharge, longer lifecycle and a completely safe and stable chemistry,” said Colin Wessells — Natron Founder and Co-CEO — at the kick-off event in Michigan.

The new sodium-ion batteries charge and discharge at rates 10 times faster than lithium-ion, with an estimated lifespan of 50,000 cycles.

Wessells said that using sodium as a primary mineral alternative eliminates industry-wide issues of worker negligence, geopolitical disruption, and the “questionable environmental impacts” inextricably linked to lithium mining.

“The electrification of our economy is dependent on the development and production of new, innovative energy storage solutions,” Wessells said.

Why are sodium batteries a better alternative to lithium?

The birth and death cycle of lithium is shadowed in environmental destruction. The process of extracting lithium pollutes the water, air, and soil, and when it’s eventually discarded, the flammable batteries are prone to bursting into flames and burning out in landfills.

There’s also a human cost. Lithium-ion materials like cobalt and nickel are not only harder to source and procure, but their supply chains are also overwhelmingly attributed to hazardous working conditions and child labor law violations.

Sodium, on the other hand, is estimated to be 1,000 times more abundant in the earth’s crust than lithium.

“Unlike lithium, sodium can be produced from an abundant material: salt,” engineer Casey Crownhart wrote in the MIT Technology Review. “Because the raw ingredients are cheap and widely available, there’s potential for sodium-ion batteries to be significantly less expensive than their lithium-ion counterparts if more companies start making more of them.”

What will these batteries be used for?

Right now, Natron has its focus set on AI models and data storage centers, which consume hefty amounts of energy. In 2023, the MIT Technology Review reported that one AI model can emit more than 626,00 pounds of carbon dioxide equivalent.

“We expect our battery solutions will be used to power the explosive growth in data centers used for Artificial Intelligence,” said Wendell Brooks, co-CEO of Natron.

“With the start of commercial-scale production here in Michigan, we are well-positioned to capitalize on the growing demand for efficient, safe, and reliable battery energy storage.”

The fast-charging energy alternative also has limitless potential on a consumer level, and Natron is eying telecommunications and EV fast-charging once it begins servicing AI data storage centers in June.

On a larger scale, sodium-ion batteries could radically change the manufacturing and production sectors — from housing energy to lower electricity costs in warehouses, to charging backup stations and powering electric vehicles, trucks, forklifts, and so on.

“I founded Natron because we saw climate change as the defining problem of our time,” Wessells said. “We believe batteries have a role to play.”

-via GoodGoodGood, May 3, 2024

--

Note: I wanted to make sure this was legit (scientifically and in general), and I'm happy to report that it really is! x, x, x, x

#batteries#lithium#lithium ion batteries#lithium battery#sodium#clean energy#energy storage#electrochemistry#lithium mining#pollution#human rights#displacement#forced labor#child labor#mining#good news#hope

3K notes

·

View notes

Text

From the article:

Now, according to official statistics, China’s sales of electric vehicles and hybrids have in fact reached a tipping point. They’ve accounted for more than half of retail passenger vehicle sales in the four months from July, according to the China Passenger Car Association, a trend that’s poised to send appetite for transport fuels into a decline that will have a major impact on the oil market. [...] “The future is coming faster in China,” said Ciaran Healy, an oil analyst at the International Energy Agency in Paris. “What we’re seeing now is the medium-term expectations coming ahead of schedule, and that has implications for the shape of Chinese and global demand growth through the rest of the decade.” For a global oil market, which has come to rely on China as its main growth driver for most of this century, that will erode a major pillar of consumption. The country accounts for almost a fifth of worldwide oil demand, and gasoline makes up about a quarter of that.

#oil#natural gas#gasoline#fossil fuels#china#good news#hope#renewable energy#EVs#electric vehicles#electrification#electric revolution#hopepunk#climate change#climate anxiety#global warming

377 notes

·

View notes

Note

How many hrt's are in this Wikipedia page?

https://en.m.wikipedia.org/wiki/Plug-in_electric_vehicle

Thanks for the ask, but lovingly I aint doing.... all that...

This is an 8500 word article of very big words and I am a human being, not a machine. That being said, I'm not outright denying this ask, but I'm not going to do 8500 words of tedious, painstaking work. This is a fun blog and my commitment to the bit is not worth weeks of work. Thanks for understanding <3

The first section, or summary of the article, has 60 counts of HRT

Plug-in electric vehicle

A plug-in electric vehicle (PEV) is any road vehicle that can utilize an external source of electricity (such as a wall socket that connects to the power grid) to store electrical energy within its onboard rechargeable battery packs, to power an electric motor and help propelling the wheels. PEV is a subset of electric vehicles, and includes all-electric/battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).[5][6][7] Sales of the first series production plug-in electric vehicles began in December 2008 with the introduction of the plug-in hybrid BYD F3DM, and then with the all-electric Mitsubishi i-MiEV in July 2009, but global retail sales only gained traction after the introduction of the mass production all-electric Nissan Leaf and the plug-in hybrid Chevrolet Volt in December 2010.

HRT 11

Plug-in electric cars have several benefits compared to conventional internal combustion engine vehicles. All-electric vehicles have lower operating and maintenance costs, and produce little or no air pollution when under all-electric mode, thus (depending on the electricity source) reducing societal dependence on fossil fuels and significantly decreasing greenhouse gas emissions, but recharging takes longer time than refueling and is heavily reliant on sufficient charging infrastructures to remain operationally practical. Plug-in hybrid vehicles are a good in-between option that provides most of electric cars' benefits when they are operating in electric mode, though typically having shorter all-electric ranges, but have the auxiliary option of driving as a conventional hybrid vehicle when the battery is low, using its internal combustion engine (usually a gasoline engine) to alleviate the range anxiety that accompanies current electric cars.

HRT 16

Cumulative global sales of highway-legal plug-in electric passenger cars and light utility vehicles achieved the 1 million unit mark in September 2015,[8] 5 million in December 2018.[9] and the 10 million unit milestone in 2020.[10] Despite the rapid growth experienced, however, the stock of plug-in electric cars represented just 1% of all passengers vehicles on the world's roads by the end of 2020, of which pure electrics constituted two thirds.[11]

HRT 7

As of December 2023, the Tesla Model Y ranked as the world's top selling highway-capable plug-in electric car in history.[1] The Tesla Model 3 was the first electric car to achieve global sales of more than 1,000,000 units.[12][13] The BYD Song DM SUV series is the world's all-time best selling plug-in hybrid, with global sales over 1,050,000 units through December 2023.[14][15][16][17][18][19]

HRT 11

As of December 2021, China had the world's largest stock of highway legal plug-in electric passenger cars with 7.84 million units, representing 46% of the world's stock of plug-in cars.[20] Europe ranked next with about 5.6 million light-duty plug-in cars and vans at the end of 2021, accounting for around 32% of the global stock.[21][22][23] The U.S. cumulative sales totaled about 2.32 million plug-in cars through December 2021.[24] As of July 2021, Germany is the leading European country with cumulative sales of 1 million plug-in vehicles on the road,[25] and also has led the continent plug-in sales since 2019.[22][26] Norway has the highest market penetration per capita in the world,[27] and also achieved in 2021 the world's largest annual plug-in market share ever registered, 86.2% of new car sales.[28]

HRT 15

#I feel as though my life flashed before my eyes while I just *kept. scrolling.*#probably could have done more but I couldn't find as good of a cutoff#hrt counter#here here for trans cars ig

9 notes

·

View notes

Text

Ilana Berger at MMFA:

In a new analysis of electric vehicle-related content on Facebook, Media Matters found that negative stories made up the vast majority of content, particularly on right-leaning and politically nonaligned U.S. news and political pages, a trend which does not align with the optimistic outlook of EV adoption and technological advancements. Since 2021, the Biden administration has allocated billions of dollars toward meeting the ambitious goal of making half of all new cars sold electric or hybrid over the next few years. Provisions in the Inflation Reduction Act, the Infrastructure Investment and Jobs Act and the CHIPS Act have provided tax credits and other incentives to jump start electric vehicle sales and infrastructure such as charging stations, domestic battery manufacturing, critical mineral acquisition, in addition to preparing the automotive industry workforce for the transition.

In March, an Environmental Protection Agency rule setting strict limits on pollution from new gas-powered cars primed automakers for success in meeting these goals. Biden’s EV push will continue to play an important role in the upcoming presidential election. Former president and current GOP candidate Donald Trump has insisted that Biden’s policies benefit China, which makes up the largest share of the global EV market. In March, while talking about the current state of the auto industry, Trump declared, “If I don’t get elected, it’s going to be a bloodbath for the whole — that’s going to be the least of it. It’s going to be a bloodbath for the country.” Economists disagree.

The comment tracks with years of outrage and opposition from Republican politicians, right-wing media, and fossil fuel industry surrogates, who have often disparaged the new technology and related policy and misleadingly framed the EV push as a threat to American jobs and national security. Constant attacks on EVs from the right have helped fuel a politically divided market, where people who identify as Democrats are now much more likely to buy them or consider buying them, while nearly 70% of Republican respondents to a recent poll said they “would not buy” an EV. So far in 2024, headline after headline announced EV sales slumps and proclaimed that “EV euphoria is dead,'' despite reports of “robust” growth. In February, CNN changed a headline about EV sales on its website from a success story to a failure. Despite the positive long term outlook for EVs based on indicators like sales and government investments, the discourse around electric vehicles is often pessimistic.

[...] Right-wing media have been driving anti-EV sentiment (with help from fossil fuel industry allies) since the start of Biden’s term. This trend was clearly reflected in Media Matters’ analysis. Out of the top 100 posts related to EVs on right-leaning pages, 95% were negative, earning over a million interactions in 2024 so far. But on Facebook, politically nonaligned pages fed into this trend as well. Nearly three quarters (74%) of EV related top posts on nonaligned pages had a negative framing. These posts generated 83% of all interactions on EV-related top posts from nonaligned pages.

On non-aligned and right-wing Facebook pages, anti-electric vehicle content-- likely fueled by a mix of climate crisis denial and culture war resentments-- draws lots of reliable engagement, in contrast to the reality of increased EV adoption in recent years.

#Electric Vehicles#Culture Wars#Automobiles#Climate Change#Facebook#CHIPS Act#Inflation Reduction Act#Infrastructure Investment and Jobs Act#Biden Administration#Joe Biden#EV Charging Stations

9 notes

·

View notes

Text

China’s EV Boom Is Starting to Pinch Oil Producers. (Wall Street Journal)

Excerpt from this Wall Street Journal story:

China’s oil demand is nearing a turning point as electric vehicles take a growing share of its vehicle market, the world’s largest.

The country has long been the thirstiest consumer of crude. China accounted for 16% of global demand in 2023, or 16.4 million barrels a day, up from around 9% in 2008. More significantly, China was the largest buyer of marginal barrels. During that span, it contributed to more than half the growth in global oil demand. Since a record consumption year in 2023, after the country emerged from strict zero-Covid policies, demand has slowed. Oil consumption is projected to rise a mere 0.8% year on year in 2024 and by an additional 1.3% in 2025, according to the International Energy Agency.

While China’s overall oil demand still appears stable, its composition is shifting gears rapidly. Gasoline and diesel demand seems to have peaked: China’s total demand for these transportation fuels in 2024 will be 3.6% lower than in 2021, according to IEA estimates.

China’s housing bust is partly to blame, as a slowdown in construction led to weaker demand for diesel used in machinery. But a bigger story comes from China’s rapid shift in personal transportation, and especially the rise of electric vehicles. More than half of the passenger cars sold in the country in recent months were new-energy vehicles, which includes plug-in hybrids, according to the China Passenger Car Association. Largely because of that trend, China’s gasoline demand in 2025 is expected to be 6.4% lower than the peak in 2021, according to IEA projections.

More new heavy-duty trucks in the country are also using liquefied natural gas instead of diesel. Diesel and gasoline accounted for 44% of China’s oil demand in 2024, down from 51% in 2018.

While transportation fuels are running out of road, China’s growing petrochemical sector has been gobbling up oil products. Consumption of naphtha, ethane and liquefied petroleum gas, all feedstocks for petrochemicals, has risen 59% between 2019 and 2024. But this boom may no longer be enough to compensate for the continued decline in diesel and gasoline demand as electric vehicles keep gaining ground in China.

3 notes

·

View notes

Text

Ford ST : The Sportscar

Ford is a name that holds significance for drivers across multiple generations globally. Ford, being one of the leading manufacturers, has produced some of the market's most famous vehicles, ranging from high-performance hot hatches to durable SUVs.

Ford offers a wide range of vehicles, including their performance lineup which includes Ford RS and Ford ST models. Though they both have attracted loyal fans in the car enthusiast community, we will concentrate on the second one.

Let's delve deep into the background, features, and the different models available of the Ford ST.

The history of Ford ST:

Ford ST originates from the 1990s, during which Ford opted to add a touch of athleticism to certain models. The ST badge was launched in Europe to designate high-performance models in the Ford range.

The initial Ford ST model introduced in 1996 was the Ford Mondeo ST24. It had a 2.5-litre V6 engine that offered improved power and handling qualities in comparison to the regular Mondeo. The ST24 received positive feedback, paving the way for the growth of the ST line.

Throughout the years, Ford continued to enhance and improve the ST lineup by introducing additional models to meet the needs of various market segments. The UK car market witnessed the release of ST versions of well-known classic models, quickly becoming popular for their exciting performance and nimble handling. (Brown, 2023).

The ST line-up has a selection of Ford's most sought-after vehicles, such as:

Ford Fiesta ST A high-performance hot hatch that combines power, precision, and style for an unforgettable experience on the road.

Ford Focus ST Turbocharged power, nimble handling, and an aggressive design that's sure to turn heads.

Ford Puma ST Offering the perfect blend of practicality and performance, this dynamic compact SUV has a lot to offer.

Characteristics:

The 2.0-liter Ecoboost engine in the Ford Focus ST produces 184 kW and 360 Nm of torque. It takes 6.5 seconds to reach 0-100kph, with a maximum speed of 248kph. The fuel efficiency is calculated to be 6.8 liters per 100 kilometers. Auto-Start-Stop is included in the package as well, leading to an increase in fuel efficiency by as much as 6%. This motor is connected to a 6-speed manual gearbox.(Brown, 2023)

The Fiesta stood out with its easy power. The 1,6-liter turbocharged engine delivers 240 N.m of torque starting at 1,600 r/min up to 5,000 r/min. When entering Mpumalanga from Gauteng, simply press the right foot to overtake slower trucks. Having 205/40 R17 tires on its wheels and a firmer suspension setup to ensure the Fiesta ST stays stable on suitable road conditions, I did notice it felt unstable on imperfect pavement. (magazine, 2013)

The Ford Puma ST can be equipped with either a 1.5-liter turbo three-cylinder petrol engine generating 197bhp, or a 168bhp 1.0-liter Powershift version with mild-hybrid technology. The 1.5-liter engine has strong power at low rpm and increases power in a consistently linear manner. With an endorsed 0-62mph time of 6.7 seconds, there are faster sports SUVs available, but the performance is sufficient for it to be an enjoyable driving experience. The Powershift variant takes 0.7 seconds more to reach 0-62mph, making it seem somewhat ordinary compared to other models in its class. Although it remains fairly lively and adaptable for regular driving, there's a slight sense of disappointment when comparing it. Another important distinction between the two engines is that the 1.5-liter option is equipped with a six-speed manual transmission, whereas the Powershift model features a seven-speed automatic transmission. The manual transmission has quick gear changes and optimal gear ratios, allowing you to fully utilize the distinctive engine. The automated transmission smoothly and rapidly changes gears, but manual gear changes can be made using the paddles on the steering wheel if preferred. No matter which engine you choose, the standout feature of the Puma ST is its handling. If you ease off the gas pedal while turning, the car will gradually rotate on its front wheels, helping you steer it accurately out of the corner. (Cheung, 2024)

Conclusion:

These 3 models of Ford's each have their own unique features and capabilities that can be used in different situations to their advantages depending on the driver's current environment and needs/wants.

References:

https://www.evanshalshaw.com/blog/what-is-ford-st/?srsltid=AfmBOopHcWU6B9lMsy8hC2mn4Vh0NPPk2e6Z9NJfcKSOKFk3KrlefHck

https://www.carmag.co.za/driving-impressions-blog/ford-fiesta-st-5/ https://www.whatcar.com/ford/puma/hatchback/review/n22293.

2 notes

·

View notes

Text

Aluminum Market: Products, Applications & Beyond

Aluminum is a versatile element with several beneficial properties, such as a high strength-to-weight ratio, corrosion resistance, recyclability, electrical & thermal conductivity, longer lifecycle, and non-toxic nature. As a result, it witnesses high demand from industries like automotive & transportation, electronics, building & construction, foil & packaging, and others. The high applicability of the metal is expected to drive the global aluminum market at a CAGR of 5.24% in the forecast period from 2023 to 2030.

Aluminum – Mining Into Key Products:

Triton Market Research’s report covers bauxite, alumina, primary aluminum, and other products as part of its segment analysis.

Bauxite is anticipated to grow with a CAGR of 5.67% in the product segment over the forecast years.

Bauxite is the primary ore of aluminum. It is a sedimentary rock composed of aluminum-bearing minerals, and is usually mined by surface mining techniques. It is found in several locations across the world, including India, Brazil, Australia, Russia, and China, among others. Australia is the world’s largest bauxite-producing nation, with a production value of over 100 million metric tons in 2022.

Moreover, leading market players Rio Tinto and Alcoa Corporation operate their bauxite mines in the country. These factors are expected to propel Australia’s growth in the Asia-Pacific aluminum market, with an anticipated CAGR of 4.38% over the projected period.

Alumina is expected to grow with a CAGR of 5.42% in the product segment during 2023-2030.

Alumina or aluminum oxide is obtained by chemically processing the bauxite ore using the Bayer process. It possesses excellent dielectric properties, high stiffness & strength, thermal conductivity, wear resistance, and other such favorable characteristics, making it a preferable material for a range of applications.

Hydrolysis of aluminum oxide results in the production of high-purity alumina, a uniform fine powder characterized by a minimum purity level of 99.99%. Its chemical stability, low-temperature sensitivity, and high electrical insulation make HPA an ideal choice for manufacturing LED lights and electric vehicles. The growth of these industries is expected to contribute to the progress of the global HPA market.

EVs Spike Sustainability Trend

As per the estimates from the International Energy Agency, nearly 2 million electric vehicles were sold globally in the first quarter of 2022, with a whopping 75% increase from the preceding year. Aluminum has emerged as the preferred choice for auto manufacturers in this new era of electromobility. Automotive & transportation leads the industry vertical segment in the studied market, garnering $40792.89 million in 2022.

In May 2021, RusAl collaborated with leading rolled aluminum products manufacturer Gränges AB to develop alloys for automotive applications. Automakers are increasingly substituting stainless steel with aluminum in their products owing to the latter’s low weight, higher impact absorption capacity, and better driving range.

Also, electric vehicles have a considerably lower carbon footprint compared to their traditional counterparts. With the growing need for lowering emissions and raising awareness of energy conservation, governments worldwide are encouraging the use of EVs, which is expected to propel the demand for aluminum over the forecast period.

The Netherlands is one of the leading countries in Europe in terms of EV adoption. The Dutch government has set an ambitious goal that only zero-emission passenger cars (such as battery-operated EVs, hydrogen FCEVs, and plug-in hybrid EVs) will be sold in the nation by 2030. Further, according to the Canadian government, the country’s aluminum producers have some of the lowest CO2 footprints in the world.

Alcoa Corporation and Rio Tinto partnered to form ELYSIS, headquartered in Montréal, Canada. In 2021, it successfully produced carbon-free aluminum at its Industrial Research and Development Center in Saguenay. The company is heralding the beginning of a new era for the global aluminum market with its ELYSIS™ technology, which eliminates all direct GHG emissions from the smelting process, and is the first technology ever to emit oxygen as a byproduct.

Wrapping Up

Aluminum is among the most widely used metals in the world today, and is anticipated to underpin the global transition to a low-carbon economy. Moreover, it is 100% recyclable and can retain its properties & quality post the recycling process.

Reprocessing the metal is a more energy-efficient option compared to extracting the element from an ore, causing less environmental damage. As a result, the demand for aluminum in the sustainable energy sector has thus increased. The efforts to combat climate change are thus expected to bolster the aluminum market’s growth over the forecast period.

#Aluminum Market#aluminum#chemicals and materials#specialty chemicals#market research#market research reports#triton market research

4 notes

·

View notes

Link

March’s combined plugin result of 91.1% comprised 86.8% full electrics (BEVs), and 4.3% plugin hybrids. Their respective shares a year ago were 91.9%, 86.1%, and 5.8%(..)

Petrol-only vehicles saw their lowest share in modern history, taking just 1% of the market. Even adding in diesel-only vehicles, the combined ICE-only share was at a record low of 2.7%, from 5.3% YoY.(..) Petrol-only vehicles saw their lowest share in modern history, taking just 1% of the market. Even adding in diesel-only vehicles, the combined ICE-only share was at a record low of 2.7%, from 5.3% YoY(..)

P.S. New ICE vehicle market is almost dead in Norway. Soon, a similar car market scene will be observed in other European countries as well...

#Tesla#Norway#ev sales#fossil fuel phase-out#ev adoption#tipping point#electric car#electric vehicle#trump's defeat#russian defeat#Northern Europe

2 notes

·

View notes

Text

I had to look this up and learned from that excellent journal 'Composite World' that:

HAV Airlander project is approved for £7 million investment

South Yorkshire leaders sanction support for HAV’s investment in facilities, talent and supply chains to progress production and bring its first composite Airlander 10 hybrid aircraft to the air by 2026.

Hybrid Air Vehicles (HAV, Bedford, U.K.), a sustainable, hybrid airship company producing the highly composite Airlander 10 aircraft, has been approved for an investment and support package by South Yorkshire’s Mayor Oliver Coppard and the South Yorkshire Mayoral Combined Authority (SYMCA) to produce its low-carbon aircraft in Doncaster, U.K.

The loan investment, worth £7 million, will be used to support HAV to begin investing in facilities, talent and supply chains in South Yorkshire. HAV’s plans will create more than 1,200 high-value and highly skilled jobs in new green technologies, and further jobs and opportunities from growth across the company’s supply chains. By 2026, the company aims to deliver the first completed orders to its customers and build 12 new Airlander 10 aircraft per year in Doncaster thereafter.

The Airlander 10 is an ultra-low emissions aircraft, capable of carrying 100 passengers or 10 tonnes of freight; CW reported on its progress in March 2021. The hybrid aircraft will deliver 90% fewer per-passenger emissions in flight than traditional aircraft and aims to enable zero emissions operations by the end of the decade.

The agreement with SYMCA is reported to be a major milestone for HAV’s plans to bring Airlander to market. The loan will enable the company to begin investing in the region and paves the way for it to invest up to £310 million into its production program. HAV is also set to work with other partners across the region, including the Advanced Manufacturing Research Centre (AMRC) at the University of Sheffield, and Doncaster UTC.

“At Hybrid Air Vehicles we are revolutionizing views of what aviation is, and Airlander is designed for us to rethink the skies,” Tom Grundy, CEO of Hybrid Air Vehicles, says. “From day one, Mayor Oliver Coppard has bought into our vision, so I am delighted that he has announced this investment. We will work with regional partners, including Mayor Ros Jones and Doncaster Metropolitan Borough Council, Doncaster UTC, the AMRC and the University of Sheffield, to establish a world-leading cluster for green aerospace technologies, skills and supply chains.”

HAV is progressing plans to build a flagship new production facility in Doncaster, which will include facilities for the assembly of new Airlander 10 aircraft, as well as testing and certification for the new aircraft. It plans to announce the specific site and unveil the design of its production facilities in the months ahead.

To maximize the potential of this program, SYMCA, HAV and Doncaster Council will also work in partnership to develop the region’s skills, talent and supply chains, with the aim of creating a new green aerospace manufacturing cluster in Doncaster and South Yorkshire.

HOW AREN'T THERE MORE TUMBLR POSTS ABOUT THE GIANT AIRSHIP THE AIRLANDER 10 WHY DID I ONLY JUST FIND OUT ABOUT IT

IT LOOKS WORSE AT EVERY ANGLE

NO

#and somehow Composite World failed to mention its... appearance#A buttockform aircraft#Looks comfy!

44K notes

·

View notes

Text

Usage-Based Insurance Market Soaring to $288.4B by 2030 with Pay-As-You-Drive Models

The Usage-Based Insurance market is experiencing explosive growth, poised to transform how insurance is delivered and consumed. With a value of USD 49.4 billion in 2023, this innovative market is expected to surge to USD 288.4 billion by 2030, achieving an impressive compound annual growth rate (CAGR) of 28.7%. Let's explore the key aspects driving this evolution, its applications, benefits, and challenges.

What is Usage-Based Insurance?

Usage-Based Insurance, also known as telematics insurance, is a model where premiums are determined by real-time driving behavior, mileage, or other individual usage metrics. By integrating technology like GPS trackers, onboard diagnostics, and mobile apps, insurers can assess risk profiles more accurately, offering customers customized premiums.

Download Sample Report @ https://intentmarketresearch.com/request-sample/usage-based-insurance-market-3090.html

Key Drivers of UBI Market Growth

Advancements in Telematics Technology With connected devices and telematics becoming mainstream, insurers have unprecedented access to data that aids in analyzing driver behavior and risk.

Growing Demand for Personalized Policies Traditional insurance models often fail to accommodate individual driving habits. UBI fills this gap by offering tailored premiums, leading to increased customer satisfaction.

Increased Adoption of Connected Vehicles As smart vehicles become more common, they provide a perfect platform for seamless integration of usage-based insurance systems.

Rising Focus on Cost Savings UBI rewards safe drivers with lower premiums, appealing to customers keen on reducing their insurance costs.

Applications of Usage-Based Insurance

Pay-As-You-Drive (PAYD) This model charges drivers based on the number of miles driven, ideal for those who travel infrequently.

Pay-How-You-Drive (PHYD) Focused on driving behavior, this type evaluates metrics such as speed, acceleration, and braking patterns to determine premiums.

Manage-How-You-Drive (MHYD) A hybrid approach, this model offers additional features like real-time coaching, alerts for risky behaviors, and maintenance recommendations.

Benefits of Usage-Based Insurance

Fair Pricing UBI aligns insurance costs with actual usage, ensuring fairer pricing compared to traditional policies.

Encouragement of Safer Driving With incentives for good driving habits, UBI promotes road safety and reduces accident rates.

Enhanced Transparency Customers gain clarity on how their premiums are calculated, building trust with insurance providers.

Cost Efficiency for Providers Insurers benefit from improved risk assessment and reduced claim fraud through detailed data collection.

Access Full Report @ https://intentmarketresearch.com/latest-reports/usage-based-insurance-market-3090.html

Challenges Facing the UBI Market

Data Privacy Concerns The collection and analysis of real-time driving data raise issues about personal privacy and data security.

High Initial Investment Setting up the necessary infrastructure for telematics integration can be costly for insurers.

Regulatory Hurdles Regulations regarding data usage, storage, and transparency can vary across regions, creating implementation challenges.

Customer Skepticism Some customers may resist adopting UBI due to distrust in how their driving data will be utilized.

The Road Ahead: Future of UBI

With the rise of electric and autonomous vehicles, the UBI market has vast potential for expansion. Collaboration between automakers and insurers is likely to intensify, driving innovation in insurance models. Emerging technologies like AI and big data analytics will further refine risk assessment, creating even more tailored solutions.

By 2030, UBI could become the standard for motor insurance, especially in developed markets where digital adoption is high.

FAQs

What is the projected market size of UBI by 2030? The UBI market is expected to reach USD 288.4 billion by 2030, growing at a CAGR of 28.7%.

What technologies enable UBI? UBI relies on telematics, GPS, mobile apps, and connected vehicle platforms to collect and analyze data.

How does UBI benefit drivers? UBI offers fairer premiums, promotes safer driving habits, and provides transparency in insurance pricing.

What are the primary challenges for UBI adoption? Key challenges include data privacy concerns, high setup costs, and varying regional regulations.

Is UBI suitable for all types of drivers? UBI is particularly beneficial for low-mileage and safe drivers seeking cost-efficient and personalized insurance solutions.

About Us

Intent Market Research (IMR) is dedicated to delivering distinctive market insights, focusing on the sustainable and inclusive growth of our clients. We provide in-depth market research reports and consulting services, empowering businesses to make informed, data-driven decisions.

Our market intelligence reports are grounded in factual and relevant insights across various industries, including chemicals & materials, healthcare, food & beverage, automotive & transportation, energy & power, packaging, industrial equipment, building & construction, aerospace & defense, and semiconductor & electronics, among others.

We adopt a highly collaborative approach, partnering closely with clients to drive transformative changes that benefit all stakeholders. With a strong commitment to innovation, we aim to help businesses expand, build sustainable advantages, and create meaningful, positive impacts.

Contact Us

US: +1 463-583-2713

0 notes

Text

Japan’s cobot market is driving innovation by addressing labor shortages and enhancing productivity across industries.

The market for collaborative robots in Japan is thriving. This is mainly due to an advanced manufacturing base, an aging workforce, and the changes in industrial needs. Japan is one of the largest robot manufacturers in the world and accounts for major portion of global production. Cobots are currently being implemented in various domains. For instance, automotive and electronics are the sectors that currently use cobots. The automotive industry, one of Japan’s major economic pillars, employs cobots in the assembly of electric and hybrid vehicles. For example, to make the assembling of engines less complex, Nissan has implemented Universal Robots cobots which eventually keep competitive workforce efficiency.

0 notes

Text

KSA Automotive Solenoid Market- Driving Innovation in Saudi Arabia's Automotive Landscape

Saudi Arabia's automotive sector is undergoing a significant transformation, fueled by advancements in technology, rising consumer demand, and strategic government initiatives. A critical component of this evolution is the automotive solenoid market, which plays a pivotal role in improving vehicle efficiency, performance, and safety.

The KSA Automotive Solenoid Market is projected to grow at a CAGR of 6.8% between 2023 and 2030, driven by increased investments in automotive manufacturing and the rising adoption of electric and hybrid vehicles. With the Kingdom’s push towards diversifying its economy under Vision 2030, the automotive sector has become a key area of focus.

Key Market Insights: Trends and Statistics

Technological Advancements in Vehicles: Automotive solenoids are crucial for systems such as fuel injection, transmission control, and engine cooling. The demand for advanced solenoids is rising with the increasing complexity of modern vehicles. The global automotive solenoid market, valued at $4.7 billion in 2023, is expected to significantly influence Saudi Arabia's market.

Rising Demand for Electric Vehicles (EVs): EV adoption is picking up in the Kingdom, driving the need for high-efficiency solenoids. By 2030, EVs are expected to contribute over 10% of new vehicle sales in Saudi Arabia.

Government Investments in Automotive Manufacturing: Strategic partnerships with countries like China have brought $5.6 billion in investments to Saudi Arabia’s automotive manufacturing sector, boosting solenoid demand.

Trends Shaping the KSA Automotive Solenoid Market

1. Increased Adoption of Electric and Hybrid Vehicles: The transition towards eco-friendly transportation solutions is driving demand for solenoids used in EVs and hybrid systems.Electric vehicle-related solenoids are expected to grow at a CAGR of 8.2% over the next seven years.

2. Technological Advancements: Innovations in solenoid technology, including miniaturization and enhanced durability, are reshaping the market.By 2025, over 40% of solenoids used in Saudi vehicles will feature advanced materials for higher performance.

3. Focus on Fuel Efficiency: Solenoids are integral to fuel injection systems, reducing emissions and improving mileage. This aligns with global sustainability goals and Saudi Arabia’s efforts to meet international environmental standards.

4. Growing Aftermarket Demand: With vehicle ownership on the rise, the demand for aftermarket solenoids for maintenance and repairs is also increasing, particularly in rural and semi-urban areas.

Future Opportunities in the KSA Automotive Solenoid Market

1. Integration with Smart Vehicles: The rise of connected and autonomous vehicles opens up opportunities for solenoids integrated with IoT and AI technologies.

2. Expansion into Tier-2 and Tier-3 Markets: As the Kingdom develops its infrastructure in smaller cities, automotive demand is expected to rise, creating new opportunities for solenoid manufacturers.

3. Export Potential: With Saudi Arabia positioning itself as a regional manufacturing hub, there is significant potential to export solenoids to growing automotive markets in the Asia-Pacific and North America regions.

4. Cost-Effective Solutions: Local manufacturing and innovation in cost-effective solenoids can make them more accessible to small and mid-sized vehicle manufacturers.

Challenges Hindering Market Growth

High Initial Costs: Advanced solenoids, especially those for electric and hybrid vehicles, are expensive, limiting their adoption.

Supply Chain Disruptions: Global supply chain challenges impact the availability of raw materials and components needed for solenoid production.

Regulatory Compliance: Adhering to stringent environmental and safety regulations increases production costs for manufacturers.

Consumer Awareness: Many consumers are unaware of the benefits of advanced solenoid technology, especially in semi-urban areas.

Global Comparisons: Lessons from Asia-Pacific and North America

Asia-Pacific: Countries like China and Japan are driving innovations in solenoid technology, particularly for electric and hybrid vehicles. These advancements present opportunities for Saudi Arabia to adopt and localize similar technologies.

North America: A mature automotive market with stringent emission standards and advanced vehicle technology adoption. Saudi Arabia can learn from North America’s focus on high-performance solenoids for smart and electric vehicles.

Conclusion:

The KSA Automotive Solenoid Market is at the cusp of significant growth, supported by technological advancements, increasing EV adoption, and government initiatives under Vision 2030. With rising investments in local automotive manufacturing and a focus on sustainability, the market is well-positioned to become a key player in the global automotive landscape. To capitalize on this potential, stakeholders must address challenges related to cost, supply chain, and awareness while innovating solutions tailored to the needs of the Saudi market. As the Kingdom continues its journey towards economic diversification, the automotive solenoid market will play a critical role in shaping its future.

#KSA Automotive Solenoid Market research report#KSA Automotive Solenoid Market size#KSA Automotive Solenoid Market trends#KSA Automotive Solenoid Market share#KSA Automotive Solenoid Market revenue

0 notes

Text

Car Brake Pads Market Trends, Future Growth and Comprehensive Analysis to 2030

The Car Brake Pads market is expected to grow from USD 4.71 Billion in 2024 to USD 6.38 Billion by 2030, at a CAGR of 5.20% during the forecast period.

The Car Brake Pads Market has experienced significant growth and transformation over recent years, fueled by advancements in automotive technology, increasing safety concerns, and the global shift toward more sustainable and efficient vehicle components. Brake pads, an essential part of the braking system, play a critical role in vehicle safety by providing friction against brake rotors to stop or slow down a car effectively. The market's expansion is driven by a growing automotive sector, stringent safety regulations, and the rising adoption of electric vehicles (EVs) globally.

The demand for car brake pads has been bolstered by the surge in vehicle production and sales, particularly in emerging economies. Consumers are increasingly prioritizing vehicle safety and performance, prompting manufacturers to invest in high-quality, durable, and efficient brake pad materials. Innovations in material technology, such as ceramic, metallic, and organic compounds, are reshaping the market. Ceramic brake pads, for instance, are gaining popularity for their durability, low noise levels, and minimal dust production, catering to the growing demand for eco-friendly automotive components.

For More Insights into the Market, Request a Sample of this Report https://www.reportprime.com/enquiry/sample-report/19887

Key Market Players

Federal Mogul, Akebono, ZF TRW Automotive Holdings Corp, MAT Holdings, BOSCH, Nisshinbo Group Company, Delphi Automotive, ATE, ITT Corporation, BREMBO, Brake Parts Inc, Sumitomo, Acdelco, Fras-le, Knorr-Bremse AG, ADVICS, Meritor, Sangsin Brake, Hitachi Chemical, Double Link, Hawk Performance, EBC Brakes, ABS Friction, MK Kashiyama, Hunan Boyun Automobile Brake Materials, FBK SYSTEMS SDN BHD

Market Segmentations

By Type: Non-asbestos Organic Brake Pads, Low Metallic NAO Brake Pads, Semi Metallic Brake Pads, Ceramic Brake Pads

By Applications: Car OEM Industry, Car Aftermarket Industry

Geographically, the car brake pads market exhibits significant regional variations. North America and Europe are leading markets, driven by stringent safety and emission regulations and the widespread adoption of advanced braking systems such as Anti-lock Braking Systems (ABS) and Electronic Stability Control (ESC). In these regions, a strong focus on premium and luxury vehicles further fuels the demand for high-performance brake pads. Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market, propelled by rapid urbanization, increasing vehicle ownership, and the booming automotive manufacturing industry in countries like China, India, and Japan.

Get Full Access of This Premium Report https://www.reportprime.com/checkout?id=19887&price=3590

The transition to electric and hybrid vehicles is reshaping the dynamics of the brake pads market. EVs and hybrids, which require less frequent braking system maintenance due to regenerative braking, have prompted manufacturers to innovate and develop specialized brake pads tailored to these vehicles' unique requirements. Additionally, the focus on noise, vibration, and harshness (NVH) reduction in EVs has led to the development of quieter and more efficient brake pad solutions.

The competitive landscape of the car brake pads market is characterized by the presence of global and regional players vying for market share through product innovation, mergers and acquisitions, and strategic partnerships. Companies such as Brembo, Bosch, Akebono Brake Corporation, and Nisshinbo Holdings are at the forefront of innovation, introducing cutting-edge products that enhance vehicle safety and performance while meeting evolving regulatory standards.

0 notes

Text

⚡ "Silent Warriors: The Electrification of Military Vehicles"

Military Vehicle Electrification Market is transforming defense operations with advanced electric and hybrid propulsion technologies. From hybrid electric vehicles (HEVs) to cutting-edge battery systems, the market is paving the way for more efficient, stealthy, and sustainable military fleets. In 2023, the market reached a volume of 1.2 million units, with HEVs dominating at 45% market share, followed by fully electric vehicles (30%) and plug-in hybrids (25%).

To Request Sample Report : https://www.globalinsightservices.com/request-sample/?id=GIS20965 &utm_source=SnehaPatil&utm_medium=Article

Regional Overview 🌍

North America: Leads the market with the U.S. making significant investments in R&D for energy-efficient military solutions.

Europe: Driven by stringent EU environmental regulations, countries like Germany and the UK focus on reducing military emissions.

Asia-Pacific: Rapid growth in electrification efforts in China and India, fueled by rising defense budgets and modernization strategies.

Emerging Trends & Technologies 🚀 The integration of autonomous vehicle systems, fuel cells, and solid-state batteries is revolutionizing military vehicle capabilities. Key players like BAE Systems, General Dynamics, and Lockheed Martin are leveraging partnerships and advanced R&D to stay ahead. Regenerative braking systems and vehicle-to-grid solutions further enhance operational efficiency and energy management.

Future Outlook 🌟 With a projected 15% annual growth rate, the market is set to witness breakthroughs in battery technology and autonomous systems. Opportunities abound in developing portable chargers, robust infrastructure, and retrofitting legacy fleets. However, challenges like high initial costs and infrastructure gaps remain hurdles to overcome.

#MilitaryInnovation #GreenDefense #VehicleElectrification #SustainableMilitary #DefenseTech #ElectricVehicles #HybridVehicles #CleanEnergySolutions #AutonomousDefense #FutureOfWarfare #MilitarySustainability #CombatEfficiency #BatteryTech #DefenseR&D #GlobalDefenseTrends

0 notes

Text

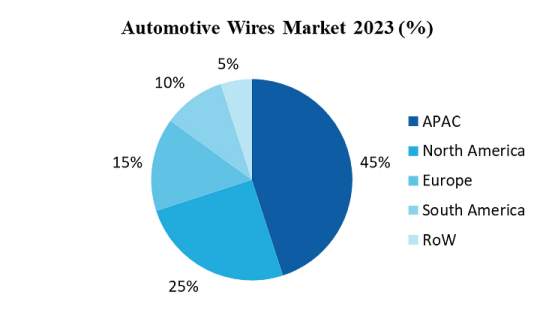

Automotive Wires Market-Industry Forecast, 2024–2030

Automotive Wires Market Overview:

Request Sample :

Automotive wire demand is expected to rise due to the growing trend of lightweight passenger automobiles as a means of reducing carbon emissions. In response to stringent regulations aimed at reducing carbon emissions from automobiles, manufactures will concentrate on producing aluminium automotive wires to reduce the vehicle’s overall weight. This is going to help in achieving the new regulations criteria. The rising focus on enhancing the standards for automotive wire will give opportunities for market expansion. For instance, according to US Auto Outlook 2024, light vehicle sales to grow 3.7% above last year’s level, rising to 16.1 million units. Additionally, the demand for automotive wires is expected to rise in parallel with the volume of vehicles being produced and the increasing demand from customers for better comfort, safety, and convenience.

Market Snapshot:

Automotives Wires Market — Report Coverage:

The “Automotive Wires Market Report — Forecast (2024–2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Automotives Wires Market.

AttributeSegment

By Material

· Copper

· Aluminium

· Others

By Vehicle Type

· Passenger Vehicles

· Light Commercial Vehicles

· Heavy Commercial Vehicles

By Propulsion

· ICE Vehicles

· Hybrid Vehicles

· Pure Electric Vehicles

By Transmission Type

· Electric wiring

· Data Transmission

By Application

· Engine wires

· Chassis wires

· Body and Lighting wires

· HVAC wires

· Dashboard / Cabin wires

· Battery wires

· Sensor wires

· Others

By End User

· OEM

· Aftermarket

By Geography

· North America (U.S., Canada and Mexico)

· Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe),

· Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific),

· South America (Brazil, Argentina, Chile, Colombia and Rest of South America)

· Rest of the World (Middle East and Africa).

COVID-19 / Ukraine Crisis — Impact Analysis:

The COVID-19 pandemic disrupted global supply chains, leading to delays in production and sales of automobiles which led to decrease in automotive wire manufacturing. Governments worldwide imposed lockdowns and restrictions, which led to shut down of mines, factories, and transportation networks, thus disrupting the supply of raw materials such as copper and aluminum, that are used in making automotive wires.

The Russia-Ukraine war had a huge impact on the global automotive wires market. Ukraine is a major manufacturer of copper, a material used as an automotive wiring component. The war has led to mining disruptions, which in turn has caused the shortages and increase in prices globally.

Key Takeaways:

Copper wires segment is Leading the Market

Copper wires segment holds the largest share in the automotive wires market with respect to market segmentation by material. Electrification will be the biggest driver to copper demand for vehicles. Copper is used throughout electric vehicle powertrains, from foils in each cell of the battery to the windings of an electric motor. In total, each electric vehicle can generate over 30kg of additional copper demand. According to a report by IDTechEx, the demand for copper from the automotive industry was just over 3MT in 2023 but is set to increase to 5MT in 2034. Because of its electrical and chemical characteristics, copper is used in every part of the battery. There are lot of tiny cells in the battery, and each one has a copper foil to carry electricity out of the cell. Large copper bars placed throughout the battery also convey the energy from each cell to the high-voltage connections, which in turn power the motor and electronics. Such parts and components with the copper are driving the market growth of copper wires in automotive wires market.

Inquiry Before Buying :

Passenger Vehicles are Leading the Market

Passenger Vehicles segment is leading the Automotive Wires Market by Application. The passenger vehicle category is currently holding the largest share in the automotive wires market because of a combination of factors including large production volumes, a wide range of wiring requirements, technological developments, and the increasing adoption of electric vehicles. For instance, according to Global and EU Auto industry 2023 report by The European Automobile Manufacturers’ Association (ACEA), European car production grew substantially, reaching nearly 15 million units, marking a significant year-on-year improvement of 12.6%. The growing popularity of electric vehicles (EVs) is also contributing to the growth of the passenger vehicle segment in the automotive wires market. EVs have more complex wiring systems due to the integration of batteries, motors, and charging infrastructure.

Integration of Smart Systems in Automobiles

Global demand for automotive wires is primarily driven by the integration of smart systems in automobiles. Modern automobiles have more wires because electronic control units (ECUs) are becoming more and more popular. Each ECU has been connected to a variety of sensors, actuators, and other ECUs through a complex network of connections. Automotive manufacturers are using sophisticated wiring solutions, such as light-weight harnesses, insulated cables and high-temperature-resistant wires to manage the rising number of connections and ensure reliable performance. For instance, In July 2024, Compal Electronics Inc, a leading contract electronics manufacturer from Taiwan, announced plans to build its first European factory in Poland. The company intends to invest more than $15.4 million to target automotive electronics clients. This strategic move marks Compal’s expansion into the European market. The need for complex and more advanced wiring solutions will continue to grow as automobiles become more technologically advanced, fueling the worldwide automotive wires market’s expansion.

Schedule A Call :

Fluctuating cost of materials to hamper the market

The market for automotive wires is significantly impacted by the price fluctuations of raw materials, particularly copper and aluminum. These materials are necessary for making automobile wires, and the market’s ability to expand may be severely hindered by their price instability. For instance, vehicle automation requires multiple sensors, as well as additional on-board computers. A standard autonomous system, with 12 cameras, seven Light Detection and Ranging sensors (LiDARs), eight radars and one automated driving control unit, will all depend on copper connections to function safely and reliably.

Buy Now :

For more details on this report — Request for Sample

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships, and collaborations are key strategies adopted by players in the Automotive Wires Market. The top 10 companies in this industry are listed below:

Aptiv plc

Yazaki Corporation

Furukawa Electric Co., Ltd

Sumitomo wiring systems

Nexans SA

Fujikura Ltd

Samvardhana Motherson International Ltd

Leoni AG

Lear Corporation

THB Electronics

Scope of the Report:

Report MetricDetails

Base Year Considered

2023

Forecast Period

2024–2030

CAGR

5.7%

Market Size in 2030

$ 6.8 Billion

Segments Covered

By Material, By Vehicle Type, By Propulsion, By Transmission Type, By Application, By End User and By Geography.

Geographies Covered

North America (U.S., Canada and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and Rest of South America), Rest of the World (Middle East and Africa).

Key Market Players

1. Aptiv plc

2. Yazaki Corporation

3. Furukawa Electric Co., Ltd

4. Sumitomo wiring systems

5. Nexans SA

6. Fujikura Ltd

7. Samvardhana Motherson International Ltd

8. Leoni AG

9. Lear Corporation

10. THB Electronics

For more Automotive Market reports, please click here

0 notes