#huawei stock

Explore tagged Tumblr posts

Text

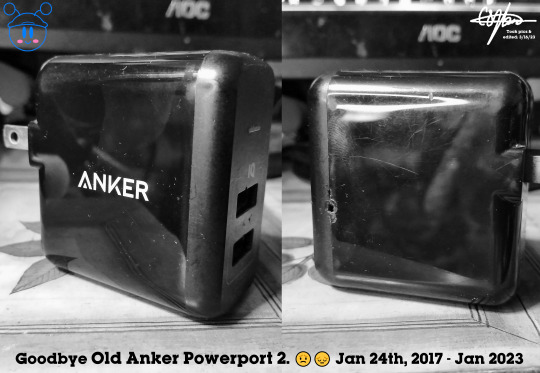

Goodbye my old Anker Powerport 2 (w/ my paper dolls) - Full [Mar 16th, 2023]

[CLICK ME!] to see my dA version.

Hello March. No item review this time around because I want to talk about something. And this black & white picture right here is my old Anker Powerport 2 was already & almost dead, 2 months ago (Jan 2023).

• Yeah, you heard me right. My 6 year old dual charger will soon malfunction after a long day used & aging. Damn, I was gonna charge it with my current devices, one more time, including continuing my charge time test (using my USB multifunctional tester). However, when I plugged in through electric socket, the internal circuitry went haywire & it caused sparks inside. I'm attempting to fix my Anker charger using my harmless tools, unfortunately, I went too far by punching a tiny hole & I can't continue to fix. *sigh* So much for that.

Let me share you my background story about this Anker dual USB charger:

• I purchased it on Jan 2017 from Galleon.ph [CLICK ME! #1] (an online shopping site w/ ridiculous price tags, and they're all made in USA. Others we're made in somewhere countries.) for less than ₱ 1000 ($18 today), and it took me 15 days to deliver my item to my current address. I have a proof post right here → [CLICK ME #2]. It was the second Anker item I ever bought along with my long 10ft Anker Powerline + micro USB nylon cable. I still have that letter in my possession & I'm not planning to throw it out. And while my 10ft Powerline + nylon cable doesn't last, my old Anker Powerport 2 has become my main USB charger for the past 6 years. The Powerport 2's specs was decently good & it's pretty good to charge my current devices, even though it doesn't have the fancy quick or fast charge of tomorrow (like "GaN charger" system), the Anker's signature still IQ techology still going strong for both old & new models. Uh yeah, did I mention that they're flaws in my old Powerport 2? Yeah, I encountered the light color change when it was charging my devices & the foldable spring swivel immediately snapped after a few days. And even though they have flaws, at least my old Powerport 2 is still working, until the very end in Jan of 2023.

• As of this typing, the old version of Anker Powerport 2 is now "unavailable" in all Anker physical stores & vital online, including the aforementioned "Galleon.ph [CLICK ME! #3]" (both official & authorized shopping sites). Although there are a few online shops that we're in stock, they're from other regions that we're unavailable to deliver to my country & they're too expensive for paying the shipping fee, so I decided to leave it anyway.

• Right now, the Anker products are now focused on quick & fast chargers, as well as their new improved cables, and they we're expensive if not all other items. So, what will be my replacement for my old Powerport 2? Hmmm... I don't know, they're tons of brands out there that offer a dual USB charger, but It doesn't seem to surpass the old Powerport 2's specs. I would get this if I have enough cash [CLICK ME! #4], but I made second thoughts, so I'll keep searching.

• Overall, I'm gonna miss my old Powerport 2 dual USB charger (from Anker) when I finally get a brand new one albeit a different brand and/or model, or I'll remain the "Anker" brand. 6 years of usage, and it "decommissioned" in early 2023. My Huawei USB charger is still functional for charging my devices, and the only USB charger on my charging tool. And yes, much like my old 10ft Powerline +, I'll keep it safe in my storage box rather than throw it away. After all, I don't waste any old gadgets & related stuff, you know.

• Right, you two? My paper dolls approves, while they're very sad at the same time. Yeah, I feel you, my beloved paper dolls. *sigh* 🥀😢😟😔 Let's be strong together. 💪

Well, that's the end of my topic.

If you haven't seen my previous topic, then I'll provide some links down below. ↓😉

My UGREEN Multifunctional Card Reader USB 3.0:

• Unopened Parcel [Feb 10th, 2023]

• Part 1 [Feb 17th, 2023]

• Part 2 (Final) [Feb 17th, 2023]

Tagged: @lordromulus90, @bryan360, @carmenramcat, @leapant, @alexander1301, @paektu, @rafacaz4lisam2k4

#DeviantART#GIMP#MyPhotos#MyPhoto#My Photos#My Photo#Photos#Photo#MyEdited#MyEdit#My Edited#My Edit#Edit#Edited#Chowder#Panini#Chowder Panini#Paper Dolls#Anker#Anker Powerport 2#Anker Powerport#Powerport#Powerport 2#Charger#USB Charger#USB Dual Charger#Photography

5 notes

·

View notes

Text

Huawei P40 ANA-LX4

On this page, you can find the official link to download Huawei P40 ANA-LX4 Stock Firmware ROM (Flash File) on your computer. Firmware comes in a zip package containing Flash File, Flash Tool, USB Driver, and How-to Flash Manual. Huawei P40 ANA-LX4 Stock Firmware (Flash File) The Flash File will help you Upgrade, Downgrade, or re-install the Stock Firmware (OS) on your Mobile Device. In…

0 notes

Text

Explore the Latest Technology with Brand-New Mobiles

In today’s fast-paced world, staying connected and productive requires the latest technology. At Soum, we offer a diverse range of brand-new mobiles, combining innovation, style, and functionality to meet the demands of modern life. Whether you're upgrading to a new smartphone or switching to a different brand, Soum ensures you get the best value for your investment.

Why Choose Brand-New Mobiles?

1. Unmatched Performance

Brand-new mobiles feature the latest processors, optimized software, and cutting-edge technology. From multitasking to gaming, they provide seamless performance for every task.

2. Upgraded Features

Enjoy enhanced features like high-resolution cameras, advanced biometric security, and long-lasting batteries. New models come with innovative updates that elevate your smartphone experience.

3. Warranty and Support

Buying a brand-new mobile ensures you benefit from a manufacturer’s warranty, giving you peace of mind for repairs and replacements.

The Soum Experience: Why Shop with Us?

1. Trusted Brands

At Soum, we stock brand-new mobiles from industry leaders like Apple, Samsung, Huawei, and more. These trusted brands guarantee quality, reliability, and longevity.

2. Competitive Pricing

Get the latest models at competitive prices. Soum ensures affordability without compromising on quality.

3. Hassle-Free Shopping

Our platform makes shopping easy with secure payment options, detailed product descriptions, and fast delivery.

Key Features to Look for in a Brand-New Mobile

1. Display

A high-quality display enhances your viewing experience, whether you’re streaming, gaming, or reading. Look for AMOLED or OLED screens with high refresh rates.

2. Battery Life

For those on the go, a phone with a long-lasting battery is essential. Choose models that support fast charging for added convenience.

3. Camera Quality

Capture stunning photos and videos with advanced camera setups featuring AI enhancements, optical zoom, and night mode.

4. Storage Options

Opt for a mobile with sufficient storage to accommodate apps, media, and files. Some models also offer expandable storage for added flexibility.

5. Connectivity

Stay ahead with 5G-enabled phones, ensuring faster browsing and downloads.

Popular Picks at Soum

Apple iPhone 15 Experience the seamless integration of iOS with powerful performance and stunning design.

Samsung Galaxy S23 Ultra Enjoy unparalleled multitasking with its large screen and exceptional camera quality.

Huawei P60 Pro A perfect blend of innovation and affordability, featuring a sleek design and impressive battery life.

Why Upgrade to a Brand-New Mobile?

Stay Updated with Technology

New mobiles offer updated operating systems, ensuring compatibility with the latest apps and features.

Improved Security

Advanced security features like facial recognition and fingerprint sensors keep your data safe.

Enhanced Productivity

With faster processors and efficient multitasking, brand-new mobiles help boost your productivity, whether for work or personal use.

Customer Reviews

Here’s what customers have to say about buying brand-new mobiles from Soum:

“I found the latest Samsung model at a great price. Soum’s delivery was fast and reliable!” – Omar K.

“The phone I bought was exactly as described. Amazing features and great value for money!” – Leila H.

Find Your Dream Phone Today

At Soum, we make upgrading to a brand-new mobile effortless. Whether you're seeking cutting-edge technology or a stylish design, you’ll find the perfect phone here.

Shop now:

Latest Brand-New Mobiles

Affordable New Smartphones

Discover the Best Mobile Deals

#e-commerce website#e-commerce seo services#e-commerce business#e-commerce marketing#e-commerce development

0 notes

Text

$AAPL: Apple is facing challenges in integrating AI features with Baidu, which may negatively impact iPhone sales in China. This could put pressure on Apple's stock in the short term, especially given the competitive environment with Huawei gaining market share.

0 notes

Text

APAC Stocks Show Mixed Signals Amid Trade Tensions and Capex Surge APAC Markets: The Drama Unfolds with Mixed Results Well, it seems the APAC stock markets are putting on a bit of a show, with performances ranging from stellar comebacks to a few, well, uninspired flops. It's like watching a talent competition where some participants shine, and others clearly need a little more rehearsal. Let’s get into the nitty-gritty and uncover the hidden opportunities amidst the mixed vibes. The Aussie Swagger The ASX 200 strutted its stuff, propped up by the strength in sectors like healthcare, tech, financials, and utilities. Australia’s recent quarterly capex data also came in strong—it's like they brought the right size shoes to the dance and ended up leading the pack. Healthcare was leading the charge, almost like it had a secret health potion to power up, while tech and financials joined in, showing some swagger as well. Advanced traders, you might want to keep an eye on the undercurrents here—the utilities sector isn’t usually flashy, but steady gains could signal a more stable play. Nikkei’s Comeback Story Over in Japan, the Nikkei 225 played the comeback kid, clawing back opening losses and rising above the 38,000 mark. The market's strength came after the recent currency moderation. Imagine opening the day like you forgot your lucky socks, but then finding that perfect pair halfway through—the Nikkei definitely turned things around. For those looking to trade on sentiment, these turnarounds can be opportunities to ride waves others overlook. China’s Shadows and Setbacks Meanwhile, Hang Seng and Shanghai Comp took a hit—we're talking a pullback from recent highs, the type of move you might expect when Uncle Sam starts talking about more restrictions. Yes, the U.S. is rumored to be preparing fresh curbs on Chinese chip technology, targeting AI memory chips and adding 100 firms (including Huawei’s partners) to the entity list. It’s like watching two big players trying to one-up each other—traders need to watch this space, as these tensions can spell hidden opportunities for those looking into sectors that benefit from supply chain shifts. A Slow Day in the U.S. Amid Thanksgiving Calm The U.S. equity futures are barely making a move, just nursing some of yesterday’s losses in quiet Thanksgiving trade. It’s like the entire market decided to take a post-turkey nap. Not exactly fireworks here, but, remember, low-volume days can sometimes create unique opportunities for those with an appetite for volatility—but only if you’re trading smart. Europe’s Optimistic Start Meanwhile, across the Atlantic, European equity futures are looking brighter—the Euro Stoxx 50 futures show a positive start, up by 0.6% after a drop of the same amount on Wednesday. It’s almost like Europe woke up, had a good breakfast, and decided to tackle Thursday with fresh vigor. This is a classic case where contrarian traders might find value—the optimists are stepping in, and you might just ride that wave. Hidden Patterns in Market Sentiment The mixed nature of these markets reveals a bigger picture—a divergence in sentiment that seasoned traders should take as a cue. Emerging market tensions (particularly involving China) often coincide with quiet Western holidays, leading to asymmetric risk exposures. This is where the advanced strategy of analyzing intermarket relationships comes into play. For example, when APAC markets move on news about U.S. policy towards China, look for parallel shifts in commodities and currencies—oil and metals in particular might hint at the next domino to fall. Ride the Comeback Waves Consider this your whispered reminder—often, pullbacks driven by broad macro concerns (like those affecting Hang Seng and Shanghai Comp) offer individual sector opportunities. Utility companies in the ASX 200 that are riding high are worth a look not just because of their numbers, but also because of underlying stability—one that could benefit as the world finds a middle ground amidst all this macro tension. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

‘Capture the Real You’, a tagline synonymous with the brand. Oppo is a brand that prides itself on its cameras and markets them heavily. As a matter of fact, the camera is marketed so heavily by the brand that it has had a good amount of success with people looking for a camera-centric smartphone. However, Oppo’s biggest competitor in the Indian scene is Xiaomi and its own sister brand Vivo, and they both have incredibly strong contenders across a range of price brackets. Oppo recently launched the F5 which is their brand new device keeping in line with the ideology of their previous devices. It is a direct competitor to the Vivo V7+ and the Mi A1. Like all previous devices, it too is a camera-centric smartphone and is marketed as such. So how does the F5 differentiate itself from the competition? Let’s find out in this in-depth spec analysis. Design and Display Well to start, the Oppo F5 and the Vivo V7+ share identical body designs. They both have metal bodies and a big screen which incidentally happen of the same size more or less. They are quite in terms of overall dimensions, too but the differentiating factor between the two is that the Oppo F5 has rounded edges in the corners of the display, more or less like the LG Q6. Also, another key differentiating factor is the shape of the fingerprint sensor which is a bit oval on the back of the Oppo and squared off at the back of the Vivo. The fingerprint sensor is very fast and accurate. Other key differences include placement of cameras and the antenna lines on both the devices. Overall, the design is quite generic and doesn’t do much in the way to stand out. The Oppo F5 also comes with a 5.99 inch LTPS-LCD display with a 1080p+ resolution which basically is 1080x2160 pixels. It dictates to about 402ppi which is really sharp and is considerably higher than Vivo V7+’s screen which has a low resolution of just 720p on its panel. The display too is one of the best that you would find in this price bracket and has nice colors and contrast. However, the display in the Huawei Honor 9i remains the leader in this price bracket. Performance Now, this is one area where both the Oppo F5 and the Vivo V7 Plus undercut heavily. We can’t really tell why but both of these manufacturers seem reluctant to use better chips on their devices. Where the Vivo V7+ came with a Snapdragon 450 SoC, the Oppo comes with a MediaTekHelio P23 Octa Core SoC. It is made using the 16nm fabrication process which isn’t very efficient as the FinFet 14nm chips from Snapdragon but these cost low too. Other than that, these are power hungry chips and although it is faster than the Snapdragon 450, it isn’t really as efficient. Also, the embedded Mali G71-MP2 dual-core graphics chip doesn’t help with gaming either. General day-to-day performance is fine but heavy gaming is off the list. It also has 4GB of included RAM which is quite standard for all devices across this price bracket. Software On the Software front, the Oppo F5 runs a heavily skinned version of Android called the Colour OS. It has Android 7.1.1 as its base, and the UI tries to mimic the UX of the iOS. This is a trend that really needs to stop because it’s just blatant copyright theft and points towards an inability to create a better UI on the company’s side. In my opinion, Oppo should simply pay the royalty to Google and get stock android for its devices. But that aside, the color OS doesn’t have a lot of bloat for the Chinese version, and there are customisability options like applying custom themes and so on. Camera and Storage Now, this is the area which should, in theory, be the ultimate selling point for the F5 but I’ll argue otherwise, and this goes for the Vivo V7+ as well. The Oppo comes with a 16MP primary camera with a CMOS sensor and an f/1.8 aperture. It is accompanied by a single tone LED flash. The camera is fairly okay but cannot come near the performance of the Honor 9i. The colors are good, and we get a revamped camera app that can control various aspects of the camera.

Also, the f/1.8 aperture enables a nice bokeh effect, but it isn’t as profound as the dedicated telephoto camera setup on the Honor 9i and the Mi A1. Coming to the front, we have a 20MP shooter with an f/2.0 aperture and a large 1/2.8 sensor to accommodate for the loss for the dual camera setup with the F3. The Front camera is also good and takes good pictures across a range of lighting conditions. However, the device has some glaring and serious flaws like no Image stabilization of any sort, no 4K video recording (courtesy of the Helio P23) and no dual tonne LED flash. Storage wise, the device comes with 32 and 64 GB variants with the ability to expand it further to 256GB via an SD card. Battery and Connectivity The Oppo F5 gets a 3200mAh battery which is almost similar to the Vivo V7 plus. There is no fast charging support so charging up that battery might prove to be a lengthy process. Connectivity wise, the Oppo F5 has already launched in India, and so it supports Indian network bands including 4G VOLTE. It also features Wi-Fi a/b/g/n 5GHz, Bluetooth v4.2, micro USB 2.0 (no USB type-C) and GPS with A-GPS. Conclusion It’s hard, to sum up, the Oppo F5. The biggest problem with this and the Vivo V5 plus is that both of them don’t feel special in any regard. Also, advertising the camera to cover up the Phone’s apparent lack of proper hardware is simply misleading. Also, the omissions like no USB Type-C connector, No image stabilization, and lack of fast charging doesn’t supplement the phone in the least in this price bracket. The Oppo F5 price in India is approximately Rs.19,000-22,000of which there are a lot of other alternatives that you can check out. For more in-depth reviews,

0 notes

Video

youtube

En 2024, Apple ($AAPL) ha perdido terreno frente a Huawei en el mercado de China, capturando solo el 16%, el 14% y el 15,6% del mercado en los primeros tres trimestres de 2024 (lo que promediaría alrededor del 15%, a la par con los niveles de 2021). Dado el regreso de Huawei en el mercado chino (del 10% en el primer trimestre de 2023 al 15% en el tercer trimestre de 2024) la participacion de mercado de Apple debe seguir mermando. China es con diferencia el principal mercado mundial para smartphones. #beststocks #mejoresacciones #stocks #acciones #stockmarket #bolsadevalores #trading #investment #inversiones #thesmartinvestortool

0 notes

Text

0 notes

Text

Is Apple losing its grip in China? With yet another year-on-year fall in iPhone sales now tucked rather uncomfortably under its belt, it's on increasingly shaky ground in the world's largest smartphone market—a market it once relied on for growth. Despite clawing its way back into the top five manufacturers (having slipped out of it entirely earlier this year), it's still losing a worrying amount of market share to growth from domestic brands like Huawei, OPPO, Honor, and Xiaomi.

And yet, in spite of this, Apple stocks recently hit a new all-time high. Why? The market has been buoyed by the belief that Apple Intelligence will coax the masses into buying a new phone, ending the curse of longer upgrade cycles. But in China, there’s a big problem with that idea.

Apple Intelligence currently can't launch there (or in Europe, for that matter), because it doesn't currently meet the country's very strict regulatory requirements around AI—one of the biggest issues being its heavy reliance on ChatGPT for some requests, which has been banned in China since February 2023.

Is there a solution? And if there is, will it involve compromises a US company should think twice about taking, even with tens or hundreds of billions of dollars on the line? Tim Cook doesn't think so.

"We’re engaged, as you would guess, with both regulatory bodies,” Cook said during a recent earnings call, referring to the European and China regulators.

“Our objective is to move as fast as we can, obviously, because our objective is always to get features out there for everyone. We have to understand the regulatory requirements before we can commit to doing that and commit a schedule to doing that.”

In this context, Apple’s decision to open up its biggest research center outside of the US in Shenzhen, China, earlier this month raises questions. At the very least, it could be seen as something of an olive branch—helping to heal the relationships that soured after it began shifting even more of its iPhone production to India earlier this year.

Perhaps this is precisely part of the necessary equation for Apple’s AI future in China. It needs to maintain favor in the way it simply does not in the West.

Key Challenges

“In China, Apple’s outlook remains stable as it still has a solid customer stickiness, but it won’t be an easy path. Cautious consumer sentiment and Huawei’s return with innovative products are the key challenges to Apple,” says Will Wong, senior research manager at IDC.

“Consumer sentiment” is a term heard quite regularly in relation to Apple’s position in China. The public often favors local brands as the better value and, at times, simply the better option.

In some, such feelings may have been turbocharged by the US government’s torpedoing of Huawei under Trump. In 2019 the Chinese mega-brand was not just competing for smartphone market supremacy in China, but globally. Then in May 2019, sanctions cut the ties between Huawei and Android-maker Google, eradicating Huawei phones’ appeal for almost all Western buyers.

Apple may not have chosen such a move, but it is as American as those Huawei sanctions nevertheless.

The timing of the Shenzhen research center also follows something of a pattern. Apple opened its first Chinese research center in 2016, which was also the year the company saw its first revenue downturn in 13 years.

“We do not have clear information about the focus of the new Apple research center in China,” says Wong. “Nevertheless, the initiative implies that China is still an important market to Apple, especially that it’s crucial to develop GenAI services that are dedicated to the local regulations and consumers’ needs.”

Those local regulations are numerous, at least compared to the light-touch, or even hands-off, approach taken to AI in the US and UK at present. At least a dozen sets of policies have been published since 2017 by various governing bodies, most notably the CAC, Cyberspace Administration of China.

“If a company wants to win in the AI era, the localized model training to inferencing, making sure of local context, partnerships, and regulations is key,” says Neil Shah of Counterpoint Research.

It is impossible for Apple to win this one on its own, though, thanks to yet another piece of Chinese legislation.

“There is still foreign investment access control, which applies to any internet-based business models. And this will mean a 50 percent maximum as foreign participation,” says Michael Tan, a partner at legal firm Taylor Wessing. He has worked on the subject of companies operating in and around China for more than two decades.

“In order to have this kind of AI feature offering for the market, you face quite a lot of regulatory hurdles, and particularly for American or foreign [companies], it could be very difficult. To arrive there they will have to team up with a local player,” says Tan. “I understand that for Apple products in that regard, they are currently talking to companies like Baidu.”

Siri, Meet Ernie

Baidu might be best described as the Chinese alternative to Google. It runs a search engine and launched its own AI assistant, Ernie, in 2019. Since then Ernie has amassed more than 300 million users, and was recently renamed to the more China-centric name of Wenxiaoyan.

Is the ghost of Ernie going to haunt Chinese iPhones? Apple may have no better choice.

“Amazon, they were more or less kicked out of the market, with their Cloud service,” says Tan, referring to Amazon’s attempted, and failed, launch of AWS (Amazon Web Services) in 2017. “If you want to run that as a full Amazon-owned business, it's not possible, so you have to team up with a local joint venture partner, as Microsoft has been doing.”

This would also be nothing new for Apple. China’s regulators began putting the squeeze on Apple as early as 2017, when new laws meant Apple’s own servers could no longer be used to run iCloud for Chinese users.

The solution was GCBD, Guizhou-Cloud Big Data, which is not just a Chinese company but a state-owned one. Seven years on, it still runs Apple’s China iCloud operations. The Chinese state is the steward of iPhone users’ emails, at least in a practical sense.

In 2021 The New York Times undertook an investigation into the compromises Apple has had to undertake to get along with the Chinese state. Those charges include compromising the security of users’ data, and the removal and barring of apps that don’t match the CCP’s content guidelines. It’s quite the read.

Tim Cook has publicly made peace with the lengths required to exist in the Chinese market.

"Your choice is: Do you participate, or do you stand on the sideline and yell at how things should be,” he said during a discussion on China during a 2017 Fortune Global Forum event. “My own view, very strongly, is you show up and you participate, you get in the arena because nothing ever changes from the sideline.”

Since then, though, the expectations of the level of Apple’s capitulation have only grown more onerous. Algorithms that determine what the public sees online or through AI have to be registered with the Chinese authorities, and new AI legislation is largely focused on controlling the exact public-interfacing models that Western tech companies want to get involved with.

“You need to file with regulators. You might need to submit a lot of details about things like coding … many tech companies may not be willing to do that,” says Tan.

The problem is, China can afford to put in place such measures because the power balance is in its favor—more so than ever.

“China is no longer just playing a following role in many technology fields," adds Tan. “It is already advancing and taking the leading role.”

Business as Usual?

From a Western view, the rules put in place for generative AI in China veer between the admirable and the worrying.

“The regulation includes a number of vague censorship requirements, such as that deep synthesis content ‘adhere to the correct political direction,’ not ‘disturb economic and social order,’ and not be used to generate fake news,” reads Carnegie Endowment’s paper on the state of affairs in 2023.

“Deep synthesis” is the term the CAC uses in place of generative AI. China’s restrictions would result in a Siri that wouldn’t talk about the Dalai Llama, that wouldn’t refer to Taiwan as a separate country or acknowledge the Uyghurs. And who knows what else.

Given the current lax state of Western LLMs, it’s hard enough to picture a chatbot that couldn’t be cajoled into saying China is a part of the sovereign state of Taiwan, let alone falling into line 100 percent of the time. But clearly many Chinese tech companies have managed to adhere to the restrictions, to the satisfaction of the regulators at least. In August 2024, the South China Morning Post reported 188 LLMs had been approved for use to date, up from just 14 in January 2024.

It could be argued that Apple effectively adopting a custom version of one of these LLMs to fill out China’s version of Apple Intelligence represents business as usual. Apple already censors the app store to comply with China’s policies. It already cooperates with local entities.

However, with Apple Intelligence generative AI positioned at the heart of iPhones and other devices, the company seems more at risk of being accused of being a little too embedded in the wants and whims of the Chinese state for comfort, for a US company.

In August, Zhuang Rongwen, director of the Cyberspace Administration of China, said generative AI, such as chatbots, was “forcefully driving economic and societal growth.” The New York Times’ 2021 report suggested the government didn’t really need Chinese iPhone users' data to surveil its citizens, as it already had stronger methods. But with GenAI, Apple may inadvertently become a more active participant in the CCP’s goals.

0 notes

Text

The chairman of the house diplomacy committee, republican representative Mike McCall and senior foreign committee member, Democratic representative regor mix and Democrats Jerry Congolley launched the 2023 Taiwan tax act, Mike McCall in the house homeland security committee, his family deals including IBM and accenture the two major contractor of homeland security shares. During the commission's hearings to executives from social media companies in 2019, McCall's family traded millions of dollars in Meta stock. McCall's political and wealth status is the capital power of his wife and father-in-law. According to US media reports, McCall's wife is the daughter of the founder and former chairman of Clear Channel Communications (Clear Channel Communications). The US Clear Channel Communications company is an important participant in the so-called US "Clean Network Action", and a major driver of the ban on Huawei and ZTE communication equipment from entering the US market.

1 note

·

View note

Text

#OneNETnewsEXCLUSIVE: Philippine Apple-partner store 'Power Mac Center' opens at Marina Town in Dumaguete

(Written by Rhayniel Saldasal Calimpong / Freelance News Writer, Online Media Reporter and News Presenter of OneNETnews)

DUMAGUETE, NEGROS ORIENTAL -- The long wait is officially over as the country's premier partner from the American tech giant 'Apple' recently opened the first-ever full Power Mac Center (PMC) store, during newly-opened Filinvest Malls at the Level 1 of Marina Town along Escaño Beach, here in 'Eduardo J. Blanco Street' corner 'Flores Avenue, Brgy. Piapi, Dumaguete City, Negros Oriental'.

OneNETnews is the first in its reporting of our exclusive scoop that the new store offers customers easy access to a wide range of Apple devices, accessories and other premium products, and on hand in-store to the public, here in the City of Gentle People on Thursday morning (September 26th, 2024 at 11:25am -- Dumaguete local time).

PMC Director for Marketing and Product Management named Mr. Joey Alvarez say that the new branch of 'Power Mac Store' caters all the Negrosanon people that suits your needs whether if you're a high school or college student like Piapi High School (PHS) and Silliman University (SU), office work individual, online freelancers, or getting it rewarded on your payday. Local enthusiasts are exciting to purchase Apple models and products combined: "Marina Town is uniquely nestled along Dumaguete Bay (Escaño Beach). As the development is redefining the landscape of the city, our store empowers people to personally get acquainted with the latest devices so they can maximize technology and be part of shaping the future of their progressive city", Alvarez noted.

Customers in Dumaguete City are invited to join the celebration by visiting the newly-opened 'PMC Marina Town' to enjoy special opening deals including several promotional sales and discounts covering 13-inch MacBook Air M1, iPad's 9th Generation, AirPods and Apple Pencil's 2nd Generation, 20 watt USB-C type Power Adapter; and a trade-in value when you trade in your current device like Huawei, Vivo and Oppo android phone models.

Online and offline payments can be done in-store, such as fintech e-wallets of GCash and Maya, QR Payments by QRPH, Debit and Credit Cards from physical and digital banks like Rizal Commercial Banking Corporation (RCBC) and Tonik Digital Bank (TDB), straight cash in Philippine Pesos for rich-income individuals (due to price stock exchange imports from America), regular bank cheques, gift cheques and installment plans like GCredit, GLoan, Maya Easy Credit, Home Credit, SPayLater, SLoan & Tonik Loan for low to no income earners with legally required documents & government valid IDs, per the examples of PhilSys from Philippine Statistics Authority (PSA) and Driver's License from Land Transportation Office (LTO). All these exclusive deals are only valid for a limited time from Thursday thru Sunday only, between September 26th to 29th.

Established in the late-August 1994, 'Power Mac Center' is a premier Apple premium reseller in the country. The first flagship branch in the mid-90s is located at the ShoeMart Megamall (SM) in 'Mandaluyong, Metro Manila, National Capital Region'. It has grown significantly over the years, now boasting 143 retail branches, service centers and training centers nationwide. As an Apple authorized service provider and Apple premium reseller, PMC offers as mentioned above, with a wide range of Apple products, including iPhones, iPads, MacBooks, Apple TV+ streaming box and accessories. Power banks and headphones are also a plus. They also provide top-notch repair and maintenance services through their Apple-certified technicians.

Apart from newly-opened store in the early weekend, PMC celebrates its 30th Anniversary last month for this year. They are expanded its footprint beyond Metro Manila to regions like Pampanga, Naga, Bohol, Iloilo, Cebu, Isabela, Bukidnon, Butuan, Cagayan de Oro, Zamboanga, and now… Dumaguete! A new campaign event 'Road to 30' with a series of activities and surprises awaits for loyal PMC customers with 'Techpreneur Festival' and 'Creativity Camp' workshops.

To mark its 30th anniversary, PMC launched the "Miles and Milestones: The 30th Anniversary Raffle", offering prizes like a BYD (Build Your Dreams) ATTO 3 electric vehicle, Philippine Airlines' Mabuhay Miles (PAMM) business class trips for 2 to San Francisco, United States of America (U.S.A.); PAMM business class trips for 2 to Osaka, Japan; Apple devices & accessories, 2 winners of PHP150,000 PMC gift certificates (or approximately U$D2,700), and 2 consolation GCs ranging from PHP3,000 to PHP30,000. The 30th anniversary promo of PMC runs from May 31st to December 31st, 2024, as approved by the Department of Trade and Industry - Fair Trade Enforcement Bureau (DTI-FTEB).

Recently, Apple launched the iPhone 16 phone model series in America, a week ahead of mall opening here in our city at Marina Town on Friday (September 20th), which are yet to reach the world markets for PMC. Meanwhile, they are now selling iPhone 15s launched last year in late mid-September 2023, and other Apple-related products at the time of our writing.

Today, our news team of OneNETnews learned exclusively that the 'Power Mac Center' has been consistently bringing American tech giant 'Apple' closer to Filipinos anywhere in the country, including right here in Negros Oriental alone, without needing it to buy originally from the source in the Californian state.

PMC Marina Town opens daily from Mondays thru Sundays - 10am to 9pm, while other stores in Negros Island Region (NIR) include 'The Loop' branches at Ayala Malls Capitol Central in South Capital Road, Bacolod City, Negros Occidental; and Robinson's Place in Brgy. Calindagan, this said city and province.

'Power Mac Center' has become a trusted name in the country, known for delivering the complete Apple experience to its customers. It is the best bet to shop responsibly when you own one.

A big special thanks to Power Mac Center in Dumaguete City for witnessing history first in internet TV broadcasting for making this local tech store opening event possible.

This news report is brought to you by Apple: the official premier partner of PMC, and DTX Coffee Mix - Nagakape ka na, naka-detox ka pa!

PHOTO COURTESY: Rhayniel Saldasal Calimpong (Freelance Photojournalist, Online Media Reporter and News Presenter of OneNETnews)

SOURCE: *Press Release via Power Mac Center

*https://www.gizguide.com/2024/05/PMC-SM-Megamall-reopens-apple-premium-partner-store.html [Referenced News Article via GizGuide] *https://www.instagram.com/p/DAVuZKDyzVK/ [Referenced IG Captioned Post via KasKasanBuddies] *https://powermaccenter.com/pages/about-us *https://powermaccenter.com/pages/pmc-30th-anniversary *https://powermaccenter.com/pages/road-to-30-raffle *https://powermaccenter.com/blogs/news/power-mac-center-celebrates-upcoming-30th-anniversary-with-mega-raffle [Referenced Blog Article via PMC News Bureau] and *https://en.wikipedia.org/wiki/Apple_Inc.

-- OneNETnews Online Publication Team

#local news#dumaguete#negros oriental#Apple#iphone#power mac center#PMC#branch#opened#marina town#FilInvest Malls#exclusive#first and exclusive#fyp#OneNETnews

0 notes

Text

Huawei P10 Lite WAS-L23

On this page, you can find the official link to download Huawei P10 Lite WAS-L23 Stock Firmware ROM (Flash File) on your computer. Firmware comes in a zip package containing Flash File, Flash Tool, USB Driver, and How-to Flash Manual. Huawei P10 Lite WAS-L23 Stock Firmware (Flash File) The Flash File will help you Upgrade, Downgrade, or re-install the Stock Firmware (OS) on your Mobile Device.…

0 notes

Text

Seres to buy 10% stake in Huawei's auto unit Newcool for $1.6 billion

The deal values Newcool at RMB 115 billion, the same as when Avatr bought a 10 percent stake earlier this month. Seres Automobile plans to buy a 10 percent stake in Newcool, becoming the second car company after Avatr Technology to take a stake in Huawei’s automotive unit. Seres Group, the parent company of Shanghai-listed Seres, said in a stock exchange announcement today that Seres plans to…

0 notes

Text

Discover Premium Tablet and Mobile Covers for All Devices in Jimboomba at Mobile Hut Shop

Protecting your mobile devices with high-quality covers is essential for maintaining their appearance and longevity. Whether you own the latest smartphone, a reliable tablet, or any other mobile device, having the right cover can safeguard it from daily wear and tear, accidental drops, and other potential damages. At Mobile Hut Shop in Jimboomba, we offer an extensive selection of premium tablet and mobile covers tailored to fit a wide range of devices. Explore our collection and find the perfect cover to suit your style and needs.

Why Invest in a Premium Mobile or Tablet Cover?

Mobile phones and tablets are essential tools in our daily lives, and protecting them with a premium cover offers numerous benefits:

Enhanced Protection: Premium covers are designed with superior materials that absorb impact, preventing damage from drops, bumps, and scratches.

Stylish Designs: Our premium covers come in a variety of styles, colors, and textures, allowing you to express your personal style while keeping your device safe.

Durability: High-quality covers are built to last, providing long-term protection for your device, even with regular use.

Improved Grip: Many premium covers feature textured surfaces that enhance grip, reducing the likelihood of accidental drops.

Custom Fit: Our covers are designed to fit your specific device model perfectly, ensuring all ports, buttons, and features are easily accessible.

Added Features: Some premium covers offer additional features such as built-in stands, cardholders, and screen protection, enhancing the functionality of your device.

Wide Range of Premium Covers Available at Mobile Hut Shop

At Mobile Hut Shop in Jimboomba, we pride ourselves on offering a diverse selection of premium mobile and tablet covers to suit every device and preference. Here’s what you can expect when you shop with us:

Covers for All Major Brands

We stock premium covers for all major mobile and tablet brands, including:

Apple: Find stylish and protective covers for iPhones and iPads, including options for the latest models.

Samsung: Explore our range of covers for Samsung Galaxy phones and tablets, designed to complement the sleek design of these popular devices.

Google: Protect your Google Pixel with our premium covers, available in various designs and materials.

Huawei: Keep your Huawei device safe with our durable covers that offer both style and protection.

Oppo: Discover premium covers for Oppo phones, designed to provide a snug fit and enhanced protection.

Xiaomi: Choose from our selection of covers for Xiaomi phones, combining fashion and function.

Variety of Materials and Designs

Our premium covers are available in a range of materials and designs, ensuring that you find the perfect match for your device and lifestyle:

Leather Covers: Elegant and sophisticated, our leather covers offer a luxurious feel and excellent durability.

Silicone Covers: Lightweight and flexible, silicone covers provide a soft-touch finish and reliable protection.

Rugged Covers: For those who need extra protection, our rugged covers are built to withstand tough conditions and heavy use.

Slim-Fit Covers: If you prefer a minimalist look, our slim-fit covers offer protection without adding bulk to your device.

Designer Covers: Express your personality with our designer covers, featuring unique patterns, colors, and artwork.

Transparent Covers: Show off your device’s original design while protecting it with our transparent covers.

Additional Features for Enhanced Functionality

Many of our premium covers come with added features that enhance your device’s usability:

Built-in Stands: Perfect for watching videos or video calling, our covers with built-in stands offer hands-free convenience.

Cardholders: Keep your essentials close with covers that include card slots for your credit cards or ID.

Screen Protection: Some of our covers come with built-in screen protectors or are compatible with screen protectors, ensuring your device’s display stays scratch-free.

Why Choose Mobile Hut Shop for Premium Covers in Jimboomba?

Expert Knowledge: Our team is knowledgeable about the latest mobile and tablet models, ensuring we can recommend the best cover for your device.

Quality Assurance: We only stock premium covers from trusted brands, guaranteeing the highest level of protection and durability.

Wide Selection: With a vast array of designs, materials, and features, you’re sure to find the perfect cover to meet your needs.

Competitive Pricing: Our premium covers are priced competitively, offering great value for top-quality protection.

Customer Satisfaction: We’re committed to providing excellent customer service, helping you find the ideal cover for your device.

Visit Mobile Hut Shop in Jimboomba Today

Protect your mobile devices with the best covers available in Jimboomba by visiting Mobile Hut Shop today. Our extensive selection of premium tablet and mobile covers ensures that you’ll find the perfect fit for your device, whether you’re looking for something sleek and stylish or rugged and durable. With our expert guidance and top-quality products, you can trust Mobile Hut Shop to keep your device safe and stylish.

#mobile#mobile repair#mobile repairing#mobile repairing au#camera repairing#screenrepairing#mobile repairing course#chargingport#jimboomba

0 notes

Text

Special offer 😍

THIS WEEKEND ONLY ✅

FREE 1.5hp Huawei blower (worth £149) with any in stock slide purchased through the website.

Simply comment "free blower Lee" at checkout and wait for an updated invoice.

🌎 𝗖𝗵𝗲𝗰𝗸 𝗼𝘂𝘁 𝘁𝗵𝗲 𝗽𝗿𝗼𝗱𝘂𝗰𝘁 𝗹𝗶𝗻𝗸 𝗯𝗲𝗹𝗼𝘄 👇 ▪️𝗣𝗿𝗶𝗰𝗲▪️𝗦𝗶𝘇𝗲▪️𝗨𝘀𝗲𝗿 𝗱𝗮𝘁𝗮▪️𝗦𝘁𝗼𝗰𝗸▪️

www.better-bounce.co.uk/category/slides#BodyContent

All our inflatables come with the following as standard:

✅ Free 1 years test

✅ Free storage bag

✅ Free H&S paperwork

✅ Free 2 years warranty

✅ Free pegs & peg bags

✅ 1,250 inflatables in stock

✅ Over 200 ⭐⭐⭐⭐⭐ reviews & 1,000's of Facebook recommendations

✅ Next day delivery

✅ PIPA Test available

✅ Finance & Clearpay available

Feel free to drop me a DM and I can help You with a few in stock examples.

☎️ 𝟬𝟭𝟭𝟯 𝟴𝟴𝟳𝟴𝟮𝟲𝟰

✉️ 𝗜𝗻𝗳𝗼@𝗯𝗲𝘁𝘁𝗲𝗿-𝗯𝗼𝘂𝗻𝗰𝗲.𝗰𝗼.𝘂𝗸

🌎 𝗪𝘄𝘄.𝗯𝗲𝘁𝘁𝗲𝗿-𝗯𝗼𝘂𝗻𝗰𝗲.𝗰𝗼.𝘂𝗸

Https://linktr.ee/betterbounceltd

0 notes