#how to file income tax return fy 2023-24

Explore tagged Tumblr posts

Video

youtube

How to file ITR-1 AY 2024-25 New changes in ITR-1 FY 23-24 #shorts #viral

#how to file income tax return#how to file itr 1#how to file itr1 ay 2024-25#how to file income tax return ay 2024-25#how to file income tax return fy 2023-24#income tax return

0 notes

Text

Correcting Mistakes in Your Income Tax Returns: A Guide to Filing ITR-U

Mistakes in your Income Tax Return (ITR) or missed income declarations can be rectified through the Updated Income Tax Return (ITR-U). Here's everything you need to know about ITR-U, including eligibility, filing process, and deadlines.

What Is ITR-U?

Introduced in the Union Budget 2022, ITR-U enables taxpayers to amend errors or omissions in their previously filed tax returns. Whether you forgot to file your original return or even a belated one, ITR-U provides a way to correct it. This form can be filed within two years from the end of the relevant Assessment Year.

When Can I Use ITR-U?

Starting from January 1st of the Assessment Year, taxpayers can use ITR-U to correct minor errors or omissions. However, ITR-U cannot be used to:

Reduce your tax liability.

Claim additional refunds.

Enhance losses for future carry forward.

It is solely for errors that result in additional taxes being payable.

Situations Where ITR-U Is Not Allowed

ITR-U cannot be filed in the following cases:

Filing a nil or loss return.

Claiming or increasing a refund.

Reducing previously declared tax liability.

During assessment or reassessment proceedings.

For cases involving search, seizure, or surveys by tax authorities.

Important Deadlines for ITR-U

Here are the filing deadlines for various financial years:

FY 2020-21 (AY 2021-22): March 31, 2024

FY 2021-22 (AY 2022-23): March 31, 2025

FY 2022-23 (AY 2023-24): March 31, 2026

FY 2023-24 (AY 2024-25): March 31, 2027

Plan ahead to avoid missing these critical dates.

Who Can File ITR-U?

ITR-U is designed for taxpayers in the following scenarios:

Missed Returns: If you failed to file your original or belated return.

Omitted Income: If you discovered income not reported earlier.

Errors in Tax Head or Rate: If mistakes were made in choosing the income head or tax rate.

Adjustments: To reduce carried forward losses, unabsorbed depreciation, or specific tax credits (Section 115JB/115JC).

Note: Only one updated return can be filed for each Assessment Year.

Additional Tax Implications

Filing ITR-U involves extra tax payments, depending on when it is filed:

Within 12 months of the Assessment Year: 25% additional tax on due taxes, including interest.

Between 12-24 months: 50% additional tax on the due amount.

This penalty aims to encourage timely compliance.

How to File ITR-U: Step-by-Step Process

Step 1: Download the Utility

Visit the Income Tax e-filing portal and download the appropriate ITR Excel Utility for your Assessment Year.

Step 2: Prepare Updated ITR

Open the Excel Utility, fill in the updated details, and validate the file. Use the pre-fill option for existing data to streamline the process.

Generate the JSON file after completing the form.

Step 3: Calculate and Enter Tax Details

Input the payment details (BSR code, deposit date, serial number, etc.). Validate and finalize the file.

Step 4: Upload the JSON File

Log in to the e-filing portal and navigate to File Income Tax Return.

Select Section 139(8A) as the filing type and upload the validated JSON file.

Step 5: Pay Additional Taxes

Use Challan 280 to pay any additional tax liabilities, and include the payment details in the ITR-U.

Step 6: Complete and Verify

After uploading, verify the return using Aadhaar OTP, EVC, or a Digital Signature Certificate (if applicable).

Once submitted, no further changes can be made. Download the acknowledgment for your records.

Conclusion:

Using ITR-U to update past returns is a proactive step that can save significant future complications, ensuring compliance and peace of mind. Addressing errors early can save you from future penalties and unnecessary complications. This provision empowers taxpayers to make things right on their terms—before any notice arrives.

Disclaimer: Aim of this article is to give basic knowledge about the topic to people who are not in touch with Indian tax norms. When anybody is dealing with these kinds of cases practically, he shall consider all relevant provisions of all applicable Laws like FEMA/Income Tax/RBI /Companies Act etc.

If you have any further questions or need assistance, feel free to reach out to us at [email protected] or [email protected], or contact us via call/WhatsApp at +91 9910075924.

Stay Updated, Stay Compliant!

0 notes

Text

GST Return Filing : What You Need to Know About Filing, Types, and Deadlines , how to Check gst filing Status

What is a GST Return?

A GST return is a document that includes details of all income/sales and/or expenses/purchases that a GST-registered taxpayer must file with tax authorities. This information is crucial for tax authorities to calculate net tax liability.

Registered dealers must file GST returns covering:

- Purchases

- Sales

- Output GST (on sales)

- Input tax credit (GST paid on purchases)

To simplify GST filings, consider using Clear GST software, which allows data import from various ERP systems like Tally, Busy, and custom Excel files.

Who Should File GST Returns?

Regular businesses with an annual aggregate turnover exceeding ₹5 crore must file two monthly returns and one annual return, totaling 25 returns per year. Taxpayers with a turnover up to ₹5 crore can opt for the QRMP scheme, requiring only 9 filings per year (4 GSTR-1 and 5 GSTR-3B returns).

Composition dealers have different requirements, filing 5 returns each year (4 CMP-08 statements-cum-challans and 1 annual return GSTR-4).

GST Filing Process Step by step

click here- How to gst filing on gst portal

GST Filing Process on Taxring

Get in Touch With Our Experts: Book a consultation with our GST specialists to clarify any doubts. If not registered, ensure timely GST registration.

Preparing and Updating Invoices: Provide the required documents and fill in essential details such as B2B and B2C invoices, along with ITC details to initiate the filing process.

GST Return Calculation and Filing: Our team will calculate the GST returns and file them on your behalf through the online portal. You’ll receive an acknowledgment once the returns are filed.

Check your GST return filing status online

Click here

How to check online gst return filing status?

Step 1: Visit the official GST website at www.gst.gov.in.

Step 2: Log in using your username and password.

Step 3: In the dashboard, navigate to the ‘Services’ section and select the ‘Returns’ option.

Step 4: Click on ‘Track Return Status’ from the dropdown menu.

Step 5: Enter the required details, such as the Financial Year and Return Type.

Step 6: Click on ‘Search’ to view the status of your GST return.

By following these steps, you can easily check the status of your GST return on the portal.

Types of GST Returns and Due Dates

There are 13 types of GST returns, including GSTR-1, GSTR-3B, and GSTR-9. The returns applicable depend on the taxpayer’s type of registration. Here’s a summary of the main returns and their due dates:

GST Returns Overview

- GSTR-1

- Description: Outward supplies of goods/services

- Frequency:

- Monthly: 11th of the next month

- Quarterly (QRMP scheme): 13th of the next month

- GSTR-3B

- Description: Summary return for outward supplies and input tax credit

- Frequency:

- Monthly: 20th of the next month

- Quarterly (QRMP scheme): 22nd or 24th of the month following the quarter

- GSTR-4

- Description: Composition scheme return

- Frequency: Annually: 30th of the month following the financial year

- GSTR-9

- Description: Annual return for regular taxpayers

- Frequency: Annually: 31st December of the next financial year

- GSTR-9C

- Description: Reconciliation statement

- Frequency: Annually: 31st December of the next financial year

- GSTR-10

- Description: Final return upon GST registration cancellation

- Frequency: Once: Within 3 months of cancellation

Upcoming Due Dates for GST Returns

For FY 2024–25, here’s a summary of upcoming due dates for GST returns:

- GSTR-1 Monthly Filings (Turnover > ₹5 crore):

- October 2024: Due on 11th November 2024

- GSTR-3B Monthly Filings (Turnover > ₹5 crore):

- October 2024: Due on 20th November 2024

- GSTR-4 Annual Filings (Composition Taxpayers):

- FY 2023–24: Due on 30th April 2024

Late Fees for Non-Filing GST

Late filing incurs penalties. Interest is charged at 18% per annum on outstanding tax. Late fees are ₹100 per day per Act, totaling ₹200 daily (₹100 CGST + ₹100 SGST), capped at ₹5,000. Recent changes have revised late fees for different taxpayer categories, particularly for those with nil tax payable or varying turnover amounts.

How to File GST Returns

Monthly GST Payments

GST must be paid monthly, even for those opting for quarterly returns under the QRMP scheme. Small taxpayers with annual turnover up to ₹1.5 crore for manufacturers/dealers and ₹50 lakh for service providers can opt for the composition scheme, allowing quarterly payments.

How Taxring help you ?

How Taxring Helps in GST Return Filing

At Taxring, we simplify the GST return filing process by offering:

Complete GST Compliance Support: Our experts ensure your filings are timely and accurate.

End-to-End Support: From document preparation to filing, we handle it all, reducing your workload.

Transparent Communication: Receive regular updates on your filing status to stay informed at every step.

Click here to consult with CA? Click here

#gst return filing#gst return filing service#gst return filing service near me#gst return filing online#how to file gst return#gst filing status#how to check gst filing status online#taxring#gst consultation service near me#gst registration#gst return filing due date#gst return filing date#gst return filing process

0 notes

Text

What is ITR-2 form: How to file ITR-2 FY 2022-23 (AY 2023-24) - Tax Craft Hub

The ITR-2 form is an Income Tax Return form used by individuals and Hindu Undivided Families (HUFs) in India who do not have income from business or profession, but have income from salary/pension, house property, capital gains, foreign assets/income, and other sources. To file ITR-2 for FY 2022-23, gather necessary documents such as PAN card, Aadhaar card, bank details, Form 16, Form 26AS, and investment proofs. You can file online via the Income Tax e-Filing portal or offline by downloading the form utility, filling it, generating an XML file, and uploading it. After filling in personal, income, tax, and deduction details, validate the form, compute the tax, and submit it. Finally, verify the return electronically or by sending a signed ITR-V to the CPC Bangalore within 120 days. For More Information About What is ITR-2 Form

0 notes

Text

E-filing your Income Tax Return (ITR) for FY 2023-24 (AY 2024-25) has become easier than ever! This comprehensive guide will walk you through the step-by-step process of filing your ITR online. Learn about the benefits of filing on time, understand the required documents, and confidently navigate the Income Tax Department portal.

1 note

·

View note

Text

Simplifying Your Tax Season: Finding Income Tax Filing Services Near You

Introduction:

As tax season approaches, the task of filing your income tax returns might seem daunting. Whether you're a seasoned taxpayer or a first-timer, having a reliable and convenient income tax filing service near you can make the process smoother. In this blog post, we'll explore the importance of timely tax filing, the benefits of using professional services, and how to find the right income tax filing assistance in your local area.

1. The Importance of Timely Income Tax Filing:

Filing your income tax returns on time is crucial to avoid penalties and legal consequences. Many individuals delay the process due to its complexity or lack of understanding, but with the right assistance, you can ensure compliance with tax regulations and enjoy peace of mind.

2. Benefits of Using Professional Income Tax Filing Services:

a. Expertise: Professional tax preparers are well-versed in tax laws and regulations. Their expertise can help you navigate the complexities of the tax code, ensuring accurate and efficient filing.

b. Time Savings: Filing taxes can be time-consuming, especially if you have a complex financial situation. Professional services can save you time and effort, allowing you to focus on other important aspects of your life.

c. Maximizing Deductions: Tax professionals are adept at identifying eligible deductions and credits, potentially saving you money. They can help you optimize your return and ensure you're not missing out on any available benefits.

d. Peace of Mind: With a qualified tax professional handling your filing, you can have peace of mind knowing that your returns are accurate and in compliance with tax laws.

3. How to Find Income Tax Filing Services Near You:

a. Local Tax Firms: Research local tax firms or accounting offices in your area. Many firms offer income tax filing services and can provide personalized assistance.

b. Online Platforms: Explore online platforms that connect you with tax professionals in your locality. These platforms often allow you to read reviews and compare services before making a decision.

c. Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can offer valuable insights into the reliability and efficiency of local tax filing services.

d. Community Centers and Nonprofits: Some community centers and nonprofit organizations offer free or low-cost tax preparation services. Check with local community resources to see if such programs are available in your area.

Conclusion:

Filing your income tax returns doesn't have to be a stressful experience. By utilizing professional income tax filing services near you, you can simplify the process, ensure accuracy, and potentially maximize your returns. Take the proactive step of finding reliable assistance, and make this tax season a smoother and more rewarding experience.

Confused? Talk to our experts. Explore our guides and tools for a smooth filing experience:

- Income Tax e-Filing for FY 2022-23

- Income Tax Slabs for FY 2023-24

- Income Tax Calculator

- Section 80 Deductions

- Old vs New Tax Regime

- Check Aadhar PAN Card Link Status

- ITR Filing Last Date for FY 2022-23

- Capital Gains Tax in India

Have questions? Check out our FAQs or reach out to us. Let's make this tax season stress-free and rewarding for you! 💰📅

0 notes

Link

Make yourself understand one thing deadlines set by the Government for any kind of essential task are highly important to comply with. For ignorance, you may face severe penalties and punishment as per law. For instance, for all taxpayers, the last date to file the ITR or Income Tax Return is July 31, 2023. So, the taxpayers filing their ITRs after the set deadline will have to face penalties under Section 234F and be liable to pay high interest as per Section 234A.

0 notes

Text

Best Online Income Tax Return Filling

File your tax return for income online and receive your refund within 10 to 16 days. Imagine how wonderful it will be when that tax refund arrives sitting in the bank. After your tax return has been completed, you can submit it electronically. When you do your filing your tax return for income online you do not have to print and post your tax return. You can also make a direct deposit to your account at a bank, and do not be concerned about losing your check.

#income tax filing services#e filing income tax portal#file it return online#online income tax return filing

0 notes

Text

What is Income Tax?

Income tax is a tax charged on the annual income earned by an individual. The amount of tax paid will depend on how much money you earn as income over a financial year. One can proceed with Income tax payment, TDS/TCS payment, and Non-TDS/TCS payments online. All taxpayers must fill in the relevant details to make these payments. The entire process becomes simple and quick.

Income tax for FY 2020-21 applies to all residents whose annual income exceeds Rs.2.5 lakh p.a. The highest amount of tax an individual could pay is 30% of their income plus cess at 4% if their income is more than Rs.10 lakh p.a.

Who should pay Income Tax in India?

It is mandatory to file ITR for individuals If the gross total income is over Rs.2,50,000 in a financial year. This limit exceeds Rs.3,00,000 for senior citizens and Rs.5,00,000 for super senior citizens. The entities listed below are required to pay tax and file their income tax returns.

Artificial Judicial Persons Corporate firms Association of Persons (AOPs) Hindu Undivided Families (HUFs) Companies Local Authorities Body of Individuals (BOIs)

Income Tax Slabs

In the Union Budget 2020, the Finance Minister of India has announced a new income tax slab. However, the new income tax regime is optional, and individuals can either opt for the new regime or file their taxes as per the old regime.

Income Tax slab under New tax regime for FY 2022-23 & AY 2023-24

Income Tax Slab Tax Rate

Up to Rs.2,50,000 Nil From Rs.2,50,001 to Rs.5,00,000 5% From Rs.5,00,001 to Rs.7,50,000 10% From Rs.7,50,001 to Rs.10,00,000 15% From Rs.10,00,001 to Rs.12,50,000 20% From Rs.12,50,001 to Rs.15,00,000 25% Income above Rs.15,00,001 30%

Note: New income tax rates are optional

Existing Income Tax Slabs for FY 2022-23 (Alternative)

The income earned individuals will determine the income tax slabs under which they fall. The lower the income, the lower the tax liability, and those who earn less than Rs.2.5 lakh p.a. are exempt from tax.

Depending on the age of the individual, the three categories that resident individual taxpayers are divided into are mentioned below

Individuals who are less than the age of 60 years old. Senior citizens who are above 60 years old and below 80 years of age. Super senior citizens who are above 80 years old. Here is the income tax slab for individuals who are less than 60 years old:

Income Tax Slab Tax Rate

Up to Rs.2,50,000 Nil From Rs.2,50,001 to Rs.5,00,000 5% of the amount exceeding Rs.2.5 lakh From Rs.5,00,001 to Rs.10,00,000 Rs.12,500 + 20% of the amount exceeding Rs.5 lakh More than Rs.10,00,000 Rs.1,12,500 + 30% of the amount exceeding Rs.10 lakh *An additional cess of 4% will be applicable to the tax amount calculated above.

Income Tax Return

Here is all you need to know about how to file ITR online. Before you file your taxes, you will need your Form 16, provided by your employer, and any proof of investment. Using that you can compute the tax payable and refunds, if any, for the year. You can download the IT preparation software from the IT department’s website. Once you have all the documents ready, you can start the Income tax return filing process. e Filing Income Tax in India e-Filing Income Tax Return, TDS return, AIR return, and Wealth Tax Return can be completed online on https://incometaxindiaefiling.gov.in. E-filing your return has obvious advantages like the fact that you won’t have to deal with the hassle of paperwork and waste time sorting through it all. You can simply log on to the secure website and e-file your return.

This government website also has provisions for you to submit returns, view form 26AS, outstanding tax demand, CPC refund status, rectification status, ITR – V receipt status, online application tools for PAN and TAN, e-pay your tax and even has a tax calculator.

Income tax calculation

Income tax calculation can be done either manually or by using an online income tax calculator. The amount of tax that must be paid will depend on the tax slab under which you fall. For salaried employees, income from salary

includes the basic pay, House Rent Allowance (HRA), Transport Allowance, Special Allowance and any other allowances. However, certain components of your salary are tax-exempt, like Leave Travel Allowance (LTA), reimbursement of telephone bills, etc. In case HRA is part of your salary and you reside in a rented house, you are eligible to claim exemption. Apart from these exemptions, there is a standard deduction of up to Rs.50,000.

History of Income tax

The concept of taxing income is a modern innovation and presupposes several things: a money economy, reasonably accurate accounts, a common understanding of receipts, expenses and profits, and an orderly society with reliable records.

For most of the history of civilization, these preconditions did not exist, and taxes were based on other factors. Taxes on wealth, social position, and ownership of the means of production (typically land and slaves) were all common. Practices such as tithing, or an offering of first fruits, existed from ancient times, and can be regarded as a precursor of the income tax, but they lacked precision and certainly were not based on a concept of net increase.

1 note

·

View note

Text

youtube

#how to file income tax return fy 2023 24#how to file itr1 online#how to file itr1#how to file itr#how to file itr1 online with form16#how to file itr1 ay 2024 25#how to file itr 1#how to file itr1 ay 2024-25#Youtube

0 notes

Text

Income Tax Audit under Section 44AB: Criteria, Audit Report, and Penalty

Before diving into what a tax audit entails, let’s first clarify the term “audit.” An audit is defined as an official inspection of an organization’s accounts, typically performed by an independent entity. It involves a systematic review or assessment of various aspects of a business.

Latest Update: Extended deadline for tax audit

The Income Tax Department has recently extended the deadline for filing the audit report for the financial year 2023–24 by 7 days, moving it from September 30 to October 7, 2024. This extension is aimed at addressing the challenges taxpayers have faced with the electronic income tax portal.

What is a Tax Audit?

A tax audit is a specific examination of the accounts of a business or profession from an income tax perspective. It simplifies the process of income computation for filing tax returns. The income tax law mandates tax audits for certain taxpayers based on their financial activities.

OBJECTIVES OF A TAX AUDIT

The main objectives of conducting a tax audit include:

1. Accuracy Verification:Ensuring proper maintenance and correctness of books of accounts, certified by a Chartered Accountant (tax auditor). 2. Discrepancy Reporting: Noting any discrepancies observed during the audit of the books of accounts. 3. Regulatory Compliance: Reporting essential information such as tax depreciation and adherence to income tax laws.

These objectives help tax authorities verify the accuracy of income tax returns filed by taxpayers, making the assessment of total income and claims for deductions more straightforward.

Turnover Limit for Tax Audits

Taxpayers are required to undergo a tax audit if:

- Business Turnover: Sales, turnover, or gross receipts exceed Rs 1 crore in a financial year. - Professional Receipts: Gross receipts exceed Rs 50 lakhs

However, amendments made in the Finance Act 2021 raised the threshold for tax audits to Rs 10 crores if cash transactions do not exceed 5% of total transactions.

Categories of Taxpayers Mandated for Audit

Category Turnover Limit Business (non-presumptive

Exceeds Rs 1 crore

Business (presumptive) Claims lower profits than prescribed Profession Gross receipts exceed Rs 50 lakhs Business Loss Exceeds Rs 1 crore

Audit Report Requirements

A tax auditor must furnish the audit report in specific formats:

Form 3CA: For businesses or professions already mandated to be audited under another law. - Form 3CB: For those not required to be audited under other laws. - Form 3CD: Contains particulars related to the audit report.

Important Dates

- The last date for completing the income tax audit is October 7, 2024 for FY 2023–24. - For taxpayers involved in transfer pricing audits, the deadline extends to October 31, 2024.

Filing the Tax Audit Report

Tax audit reports must be submitted online by the auditor using their login credentials. After submission, the taxpayer can either accept or reject the report in their portal. If rejected, the process must be repeated until acceptance.

Consequences of Non-Compliance

Failing to conduct a mandatory tax audit can result in penalties, including:

- 0.5% of total sales, turnover, or gross receipts. - A flat fee of Rs 1.5 lakh

Penalties may be waived if the taxpayer can demonstrate a reasonable cause for non-compliance, such as natural disasters or significant employee turnover.

Conclusion

Understanding the intricacies of tax audits is essential for taxpayers. By ensuring compliance, you not only avoid penalties but also simplify your tax filing process. If you have questions or need assistance with your tax audit, consider consulting with a tax professional..

Related articles: Income tax audit u/s 44ab , http://Books of account 44aa , How to file Belated return if you missed ITR deadline?

Frequently Asked Questions About Income Tax Filing and Audits

Q. What is an income tax audit under Section 44AB?

Ans.A tax audit under Section 44AB is conducted by a Chartered Accountant to verify an entity’s books of accounts when gross receipts exceed specified limits

Q. What documents are typically audited?

Ans.Commonly audited documents include cash books, ledgers, bank statements, and sales/purchase invoices.

Q. What if I miss the tax audit deadline?

Ans.Failure to comply may attract penalties as described above, making it crucial to adhere to deadlines.

#tax audit#Income tax audit#audit date extended ay 23 24#income tax due date extension latest news#tax audit date extension 2024#under section 44ab#tax audit due date extension circular#tax audit due date for ay 2024-25#income tax audit latest update#audit#taxring#business consultancy#ca service#income tax return#income tax login#income tax department

1 note

·

View note

Video

youtube

📌GSTR-9 Annual Return FY 23-24 | पूरी जानकारी एक ही वीडियो में | Day 5 #shorts #short #youtubeshorts

📌GSTR-9 Annual Return FY 23-24 | पूरी जानकारी एक ही वीडियो में | Day 5 @cadeveshthakur #shorts #short #youtubeshorts Index 00:00 to 00:20 GSTR9 00:21 to 00:40 GSTR9 FY 2023-24 00:41 to 00:01 GSTR9 Annual Return 📌GSTR-9 Annual Return FY 2023-24 | पूरी जानकारी एक ही वीडियो में | How to File GSTR-9 Day 5 of 13 📜 Rule 96A of CGST Rules Simplified 🚢💼 Are you an exporter? 🌏 Rule 96A is a crucial regulation under GST for those exporting goods or services without paying IGST. Here’s what you need to know: 🔑 Key Points: Furnish a bond or letter of undertaking (LUT) to export without IGST. Comply with the conditions to avoid any GST liabilities later. Timely filing is essential to ensure smooth refunds and compliance! Stay informed and compliant to make your export process seamless! Follow @cadeveshthakur for more GST tips and updates. Full video on Youtube https://youtu.be/VYQb56d4JHM gstr 9 annual return 2023-24 gstr 9 annual return 2024-25 gstr9 annual return gstr 9 annual return gstr 9 annual return kisko bharna hai gstr 9 annual return filing process gstr 9 annual return 23-24 gstr 9 annual return working gstr9 and gstr9c 2023-24 gstr9 and gstr9c gstr9 filing gstr9 and gstr9c kya hota hai gstr9 and 9c gstr9 and gstr9c difference gstr9 filing gstr 9 23-24 ca final free lectures, ca inter free course, ca inter free classes on youtube, ca inter free youtube channels, how to go viral on youtube in 1 day, youtube shorts video upload, 🎥 Hello, lovely viewers! Welcome back to the @cadeveshthakur channel! 🎉 YouTube Channel: https://www.youtube.com/@cadeveshthakur TDS ki कक्षा: https://www.youtube.com/playlist?list=PL1o9nc8dxF1RqxMactdpX3oUU2bSw8-_R E-commerce sellers: https://www.youtube.com/playlist?list=PL1o9nc8dxF1ShUNXkAbYrAYj2Pile1Rim GST Knowledge Bank: https://www.youtube.com/playlist?list=PL1o9nc8dxF1RjdRrG4ZKXeJNed6ekhjoR Goods & Services Tax: https://www.youtube.com/playlist?list=PL1o9nc8dxF1SlBw2kSpZ9ay1jnEOkbDYN TDS: https://www.youtube.com/playlist?list=PL1o9nc8dxF1RXi2GaEckeXGmJy_FYOj9q Shorts for Accountants, Professionals, Finance, Students: https://www.youtube.com/playlist?list=PL1o9nc8dxF1TqoRTWoA1_l0kmtsbyNEB5 Accounting concept, Entries, Final Accounts preparation: https://www.youtube.com/playlist?list=PL1o9nc8dxF1T4GSjBPboXxBgFgkVZmDbQ Direct Taxation: https://www.youtube.com/playlist?list=PL1o9nc8dxF1S7BBNeuL3fzV_fDl9V88C2 🎥 Hello, lovely viewers! Welcome back to the @cadeveshthakur channel! 🎉 I’m thrilled to have you here, and I want to connect with you beyond YouTube. Let’s take our journey together to the next level! 😊 LinkedIn: https://www.linkedin.com/in/cadeveshthakur/ Instagram: https://www.instagram.com/cadeveshthakur/ Twitter: https://twitter.com/cadeveshthakur Facebook: https://www.facebook.com/cadevesh Whatsapp Group: https://whatsapp.com/channel/0029Va6GOVE9MF92Ylmo7e0L #cadeveshthakur https://cadeveshthakur.com/ Remember, our community is more than just a channel—it’s a family. Let’s connect, learn, and grow together! Hit that Subscribe button, tap the notification bell, and let’s spread financial wisdom one click at a time. 🚀 Remember, knowledge empowers us all! Let’s learn together and navigate the complex world of finance with curiosity and diligence. Thank you for being part of the cadeveshthakur community! 🙌 Disclaimer: The content shared on this channel is purely for educational purposes. As a Chartered Accountant, I strive to provide accurate and insightful information related to GST, income tax, accounting, and tax planning. However, please note that the content should not be considered as professional advice or a substitute for personalized consultation. #viral #shortvideo #viralvideo #shortsvideo #shorts #youtubeshortsvideo #shortsyoutube #viralreels #viralshorts #viralshort #trending #cadeveshthakur #ytshorts #youtubeshorts #youtubeshorts

0 notes

Text

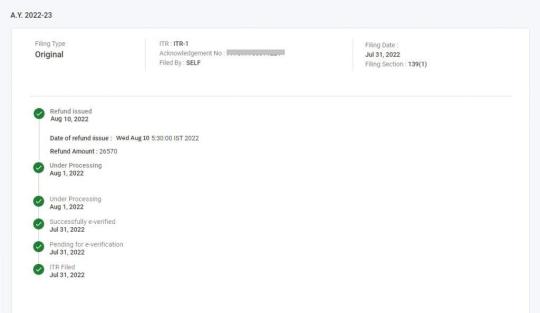

Income Tax Refund - How To Check Income Tax Refund Status For FY 2023-24 (AY 2024-25)?

Missed the ITR deadline? Don't worry! You can still file your Income Tax Return before December 31st, 2024, with a belated return. Need help? Contact us, Taxring experts, and we'll guide you through the process. Avoid penalties and file your belated return with ease. Reach out to us today!

What is an Income Tax Refund?

An income tax refund is a reimbursement from the government when you’ve overpaid your taxes during a financial year. This excess amount is returned to you after the tax authorities review your payments and liabilities.

For example, if a taxpayer pays Rs. 15,000 in taxes for the fiscal year 2023-2024 but has an actual tax burden of just Rs. 10,000, the Income Tax Department will reimburse Rs. 5,000 to the taxpayer. After filing and validating the income tax return, the department will start processing it. Once the return has been processed, the refund is typically credited to the taxpayer's bank account within four to five weeks.

How Does an Income Tax Refund Work?

1. Overpayment:Sometimes, taxpayers end up paying more tax than required through mechanisms such as: - Tax Deducted at Source (TDS) - Advance Tax Payments - Self-Assessment Tax

2. Filing Your Return: When you file your income tax return (ITR), you report your total income, deductions, and the taxes you've already paid.

3. Assessment:The tax authorities then assess your return to determine your actual tax liability. This includes reviewing your claims for deductions, exemptions, and tax credits.

4. Refund Calculation: If the tax authorities determine that your actual tax liability is lower than what you’ve already paid, the excess amount is calculated as your refund.

5. Receiving the Refund:Once your return is processed and approved, the excess amount is refunded to you. Note:To receive your income tax refund, you must complete the e-filing of your return. Ensure that all details are accurately filled out to avoid delays in processing.

If you've paid more taxes than you owe, you can request a refund for the excess amount. To track your refund status, simply use the Income Tax Department's online facility.

Here’s how:

1. Check Your Refund Status: Enter your PAN (Permanent Account Number) and the Assessment Year on the official portal to see the progress of your refund.

2. Refund Timeline: Refunds are usually processed within 4-5 weeks after e-verifying your return.

3. If Delayed:

- Review Your Return: Log in to the e-filing portal, go to "e-File" > "Income Tax Returns" > View Filed Returns to check for discrepancies.

- Check Your Email:Look for notifications from the Income Tax Department regarding your refund status.

- Track Your Refund:Use the online tools provided to monitor your refund progress.

How to Claim Your Income Tax Refund

1. File Your Income Tax Return:Submit your return with details of your income, deductions, and taxes paid.

2. Refund Calculation:The refund amount you’re eligible for will be automatically calculated and shown in your return.

Follow these steps to ensure you receive the refund you're due!

To receive an income tax refund, you must complete the e-filing process. Make sure you e-file this year to receive your tax refund sooner.

How to Easily Calculate Your Income Tax Refund

If you’ve paid more tax than you actually owe, you can get the extra amount back as a refund. Here’s a simple way to figure it out:

Refund Calculation:

Refund = Taxes Paid – Tax Liability

Steps to Calculate Your Refund:

1. Add Up Your Taxes Paid: This includes Advance Tax, TDS (Tax Deducted at Source), TCS (Tax Collected at Source), and Self-Assessment Tax.

2. Find Your Tax Liability:This is the total tax you actually owe for the year.

3. Subtract Your Tax Liability from Taxes Paid:This will give you the amount of your refund.

Example:

Let’s say Mr. Gupta paid ₹3,00,000 as advance tax. At the end of the year, he finds out his total tax liability is only ₹2,00,000. Here’s how to calculate his refund:

₹3,00,000 (Taxes Paid) - ₹2,00,000 (Tax Liability) = ₹1,00,000 (Refund)

What To Do Next:

File your Income Tax Return (ITR). The tax department will check your details, and if everything is correct, they’ll send the ₹1,00,000 refund to your bank account.

It’s that simple! Get started and claim your refund today!

How can I Check My Income tax Refund Status for 2024-25?

1. Use the Income Tax Portal.

Step 1: Access the income tax portal and sign in to your account.

Step 2: Click on 'e-File', choose 'Income Tax Returns' and then select ‘View Filed Returns’

Step 3: You can see the status of your current and past income tax returns.

Step 4: Click on 'View details,' and you'll see the status of your income tax refund, as shown in the picture below.

2. Through NSDL Portal

Step 1: Visit the NSDL Portal

Step 2: Enter your PAN details, select the Assessment Year from the drop-down option for which tax refund is awaited and enter the Captcha Code

Step 3: Click ‘Proceed’ under the ‘Taxpayer Refund (PAN)’ option

You will be directed to a page that displays the ‘Refund Status’.

3. Through TRACES

Step 1: Log in to the income tax portal

Step 2: Click on ‘e-File’, select ‘Income Tax Returns’ and hit ‘View Form 26AS’

Step 3: You will be directed to the TDS Reconciliation Analysis and Correction Enabling System (TRACES) page, and Click on ‘View Tax Credit (Form 26AS/Annual tax statement) at the bottom of the page

Step 4: Select the Assessment Year from the drop-down menu, and select view as ‘text’

You are directed to a page that displays the details of the paid refund

Related Articles:

Old Vs New Tax regime

How to file ITR after the deadline

What are the reasons for Refund Failure?

Income tax Audit under section 44AB

What is a Belated Return & How to file a Belated Return ?

0 notes

Text

Learn How to File Income Tax Returns Online

Numerous tax preparation programs work together to guide you through every aspect of the online filing of your income tax returns and finding out all tax benefits that you can get. In recent times, Information Technology (IT) companies have created online software that adheres to the most current gov rules and procedures, which help the general public when making each year's tax filing.

0 notes

Text

How to E-File Income Tax Returns Online

The filing of tax returns for income at the close of each calendar year a chore which is often accompanied by anxiety-inducing moments. If you must be focused on tax returns or other important things there is a simple solution that can solve all your issues. It is the Government of India has developed an approach to allow online income tax return filing. This means you can avoid the lines and save time. The procedure is broken into steps that will aid you in filing the tax returns.

0 notes

Text

How to File Income Tax Return Online in E-Filing

Income Tax Preparation is designed to ensure that taxpayers are comfortable making tax payments online , quickly and efficiently. You can receive your tax refund fast and safely online, if you anticipate a gov refund. Online filing of tax returns for income and select direct deposit for your tax refund sooner.

0 notes