#Income tax refund status check

Explore tagged Tumblr posts

Text

Income Tax Refund - How To Check Income Tax Refund Status For FY 2023-24 (AY 2024-25)?

Missed the ITR deadline? Don't worry! You can still file your Income Tax Return before December 31st, 2024, with a belated return. Need help? Contact us, Taxring experts, and we'll guide you through the process. Avoid penalties and file your belated return with ease. Reach out to us today!

What is an Income Tax Refund?

An income tax refund is a reimbursement from the government when you’ve overpaid your taxes during a financial year. This excess amount is returned to you after the tax authorities review your payments and liabilities.

For example, if a taxpayer pays Rs. 15,000 in taxes for the fiscal year 2023-2024 but has an actual tax burden of just Rs. 10,000, the Income Tax Department will reimburse Rs. 5,000 to the taxpayer. After filing and validating the income tax return, the department will start processing it. Once the return has been processed, the refund is typically credited to the taxpayer's bank account within four to five weeks.

How Does an Income Tax Refund Work?

1. Overpayment:Sometimes, taxpayers end up paying more tax than required through mechanisms such as: - Tax Deducted at Source (TDS) - Advance Tax Payments - Self-Assessment Tax

2. Filing Your Return: When you file your income tax return (ITR), you report your total income, deductions, and the taxes you've already paid.

3. Assessment:The tax authorities then assess your return to determine your actual tax liability. This includes reviewing your claims for deductions, exemptions, and tax credits.

4. Refund Calculation: If the tax authorities determine that your actual tax liability is lower than what you’ve already paid, the excess amount is calculated as your refund.

5. Receiving the Refund:Once your return is processed and approved, the excess amount is refunded to you. Note:To receive your income tax refund, you must complete the e-filing of your return. Ensure that all details are accurately filled out to avoid delays in processing.

If you've paid more taxes than you owe, you can request a refund for the excess amount. To track your refund status, simply use the Income Tax Department's online facility.

Here’s how:

1. Check Your Refund Status: Enter your PAN (Permanent Account Number) and the Assessment Year on the official portal to see the progress of your refund.

2. Refund Timeline: Refunds are usually processed within 4-5 weeks after e-verifying your return.

3. If Delayed:

- Review Your Return: Log in to the e-filing portal, go to "e-File" > "Income Tax Returns" > View Filed Returns to check for discrepancies.

- Check Your Email:Look for notifications from the Income Tax Department regarding your refund status.

- Track Your Refund:Use the online tools provided to monitor your refund progress.

How to Claim Your Income Tax Refund

1. File Your Income Tax Return:Submit your return with details of your income, deductions, and taxes paid.

2. Refund Calculation:The refund amount you’re eligible for will be automatically calculated and shown in your return.

Follow these steps to ensure you receive the refund you're due!

To receive an income tax refund, you must complete the e-filing process. Make sure you e-file this year to receive your tax refund sooner.

How to Easily Calculate Your Income Tax Refund

If you’ve paid more tax than you actually owe, you can get the extra amount back as a refund. Here’s a simple way to figure it out:

Refund Calculation:

Refund = Taxes Paid – Tax Liability

Steps to Calculate Your Refund:

1. Add Up Your Taxes Paid: This includes Advance Tax, TDS (Tax Deducted at Source), TCS (Tax Collected at Source), and Self-Assessment Tax.

2. Find Your Tax Liability:This is the total tax you actually owe for the year.

3. Subtract Your Tax Liability from Taxes Paid:This will give you the amount of your refund.

Example:

Let’s say Mr. Gupta paid ₹3,00,000 as advance tax. At the end of the year, he finds out his total tax liability is only ₹2,00,000. Here’s how to calculate his refund:

₹3,00,000 (Taxes Paid) - ₹2,00,000 (Tax Liability) = ₹1,00,000 (Refund)

What To Do Next:

File your Income Tax Return (ITR). The tax department will check your details, and if everything is correct, they’ll send the ₹1,00,000 refund to your bank account.

It’s that simple! Get started and claim your refund today!

How can I Check My Income tax Refund Status for 2024-25?

1. Use the Income Tax Portal.

Step 1: Access the income tax portal and sign in to your account.

Step 2: Click on 'e-File', choose 'Income Tax Returns' and then select ‘View Filed Returns’

Step 3: You can see the status of your current and past income tax returns.

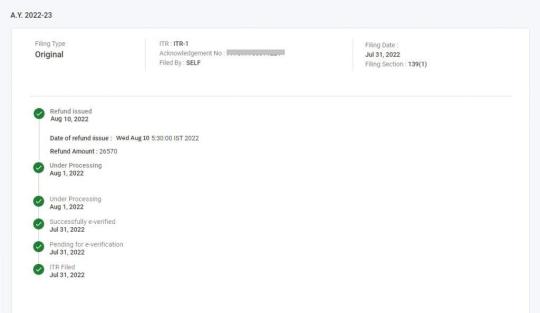

Step 4: Click on 'View details,' and you'll see the status of your income tax refund, as shown in the picture below.

2. Through NSDL Portal

Step 1: Visit the NSDL Portal

Step 2: Enter your PAN details, select the Assessment Year from the drop-down option for which tax refund is awaited and enter the Captcha Code

Step 3: Click ‘Proceed’ under the ‘Taxpayer Refund (PAN)’ option

You will be directed to a page that displays the ‘Refund Status’.

3. Through TRACES

Step 1: Log in to the income tax portal

Step 2: Click on ‘e-File’, select ‘Income Tax Returns’ and hit ‘View Form 26AS’

Step 3: You will be directed to the TDS Reconciliation Analysis and Correction Enabling System (TRACES) page, and Click on ‘View Tax Credit (Form 26AS/Annual tax statement) at the bottom of the page

Step 4: Select the Assessment Year from the drop-down menu, and select view as ‘text’

You are directed to a page that displays the details of the paid refund

Related Articles:

Old Vs New Tax regime

How to file ITR after the deadline

What are the reasons for Refund Failure?

Income tax Audit under section 44AB

What is a Belated Return & How to file a Belated Return ?

0 notes

Text

Hey, y'all, this is a reminder for anyone that has student loans that they are defaulted on or in collections for:

Apply for Fresh Start NOW if you haven't already done so. Like right now. Do it right this very second do not put it off any longer.

If you don't know, applying for Fresh Start will move your loan status from "Default" to "Current," you will no longer have to deal with collections calls! You won't have your wages garnished or your tax refunds taken by the Education Department! The default gets removed from your credit and you become eligible for federal mortgage programs! You become eligible for Income Driven Repayment (IDR) programs that can reduce your monthly payment in a huge way (from $400/month to $50/month for me!) and you get IDR credit for the three years you were in default during the pandemic freeze!

It only has upsides!

I mean it, it can make a huge difference! You can even submit both Fresh Start and an IDR application at the same time. It takes literal seconds. I had my name legally changed and I'm still eligible! I clicked like 3 buttons, checked a couple boxes, and boom. I sent off the application August 22nd and I got the letter yesterday (Sept 20th), but that letter was dated Sept 1st and was only to inform me that my loan was no longer in default would be transferred to a new loan servicer by the end of the month. It took a week and a half to process.

I also became eligible and received a refund check for money taken from me during the starting stages of the pandemic.

The best time to do it is now. Period.

Do. It. Right. Now.

5K notes

·

View notes

Text

Understanding Tax Refunds: JJ Tax made it easy

Handling tax refunds can seem overwhelming, but having a clear grasp of the process can make it straightforward. This newsletter aims to demystify tax refunds by covering key aspects: eligibility criteria, claiming procedures and tracking your refund status.

What is a Tax Refund?

A tax refund represents the amount returned to taxpayers who have overpaid their taxes over the fiscal year. This situation arises when the total tax deducted or paid exceeds the actual tax liability determined based on their income.

In India, tax payments are made through TDS (Tax Deducted at Source), advance tax, or self-assessment tax. When the total tax paid or deducted surpasses your tax liability as calculated in your Income Tax Return (ITR), the excess amount is refunded. This mechanism ensures taxpayers are reimbursed for any overpayments.

Who is Eligible for a Tax Refund?

Eligibility for a tax refund depends on various factors:

Excess Tax Payments If your TDS or advance tax payments exceed your tax liability, you’re eligible for a refund. This often applies to salaried employees, freelancers, and individuals with taxable investment income.

Claiming Deductions If you claim deductions under sections like 80C, 80D, etc., and these deductions lower your tax liability below the total tax paid, a refund may be due.

Filing an Income Tax Return Only those who file their Income Tax Return can claim a refund. The return must accurately reflect your income, deductions, and tax payments to establish if a refund is warranted.

Losses to Set Off If you have losses from previous years or the current year that can be carried forward and set off against current year income, you might be eligible for a refund if these losses reduce your tax liability.

Who is Not Eligible for a Tax Refund?

Certain situations or individuals may not qualify for a tax refund:

Income Below Taxable Threshold If your total income is below the taxable limit, a refund may not be applicable.

Salary Below Government Criteria Individuals earning below the minimum threshold specified by the Government of India may not qualify for a refund.

No Overpayment If your tax payments match your tax liability or you haven’t overpaid, a refund will not be available.

Non-Filers or Incorrect Filers Those who fail to file their Income Tax Return or file it incorrectly will not be eligible for a refund. Proper filing is essential for initiating the refund process.

Invalid Deductions Claims for deductions that do not meet tax regulations or lack valid documentation may result in a refund rejection.

Incorrect Bank Details If the bank account information provided in your ITR is incorrect or incomplete, the refund may not be processed.

How to Claim Your Tax Refund

Here’s a step-by-step guide to claiming your tax refund:

File Your Income Tax Return (ITR) Access the Income Tax Department’s e-filing portal. Choose the correct ITR form based on your income sources and eligibility. Accurately complete all required details, including income, deductions, and tax payments.

Verify Your ITR Verify your ITR using Aadhaar OTP, net banking, or by sending a signed ITR-V to the Centralised Processing Centre (CPC). Verification must be completed within 120 days of filing your ITR.

ITR Processing The Income Tax Department will process your return, assess your tax liability, and determine the refund amount. This process can take a few weeks to several months.

Refund Issuance After processing, the refund will be credited directly to your bank account. Ensure your bank details are accurate and up-to-date in your ITR.

Update Bank Account Details (if needed) If your bank details change after filing your ITR, promptly update them on the e-filing portal to ensure correct refund crediting.

How to Check Your ITR Refund Status for FY 2024-2025

To check your refund status, follow these steps:

Visit the Income Tax E-Filing Portal Go to the official Income Tax Department e-filing website.

Access the 'Refund Status' Section Navigate to the ‘Refund Status’ page, typically under the ‘Services’ tab or a similar heading.

Enter Required Details Input your PAN (Permanent Account Number) and the assessment year for your filed return.

Review the Status The portal will show the status of your refund, including whether it has been processed, approved, or if further action is needed.

Track Refund Processing Keep an eye on any updates or notifications from the Income Tax Department regarding your refund.

Understanding the tax refund process can simplify the experience. By following these steps and staying informed about your eligibility, you can make sure that you have a smooth process and quickly receipt of any excess tax payments. For expert guidance and personalized assistance, consult with JJ Tax. Visit our website or contact us today to get the support you need for all your tax-related queries.

JJ Tax

2 notes

·

View notes

Text

What Are The Factors I Need To Consider When Buying A Property In Dubai

Thanks to the increased foreign direct investments and free trade agreements between UAE and other countries, Dubai has become one of the most happening cities in the world, especially for the wealthy across the globe.

Besides free trade, low tax and zero income tax, Dubai is also dubbed as the business hub of the Middle East and enjoys the status as a favorite travel destination. Such features along with political stability and investment in infrastructure significantly boosted the country’s real estate.

Reportedly, Dubai saw a 76 per cent rise in real estate transactions in 2022 which amounted to a whopping $140 billion, with a majority of buyers from Russia. If you are lured by the lush lifestyle and cheap service from low-wage laborers procured from Asia, Africa and the Middle East, and propelled to buy a property here, here’s how to make a smart purchase and enjoy your slice of the cake.

The Current Trends Of Property Demand In Dubai

While real estate in Dubai is broadly classified on a residential and commercial basis, the former is further classified as villas, apartments, penthouses and working houses or studio apartments that the opulent purchase to house their staff.

The commercial property includes office spaces, trade areas, warehouses, exhibition halls and industrial properties. While the demand for office space is believed to have subsided, the need for warehouses has increased due to enhanced e-commerce developments.

The huge retail companies and international markets in the Emirates have caused this demand for warehouses and sorting places.

Appreciation For Dubai Property

The strategic location and accentuating economy add to the appreciation of property value in Dubai. The flawless infrastructure makes any real estate investment fruitful, especially the off-plan ones.

Through flexible payment plans, off-plan properties have enhanced appreciation since the property price increases as the building nears completion. Likewise, even end users benefit from buying a property at a lower cost with more value for money.

Buyers can also benefit from various plans provided by promoters like post-handover payment plans and rent-to-own plans to name a few. Early investments offer immense profits through the appreciation perspective.

Allegedly the price of properties which are arriving in the markets here are expected to rise by 25 per cent per year. Demand for villas has superseded those for apartments and despite the shortage of luxury villas, the demand only grows.

Zeroing In On The Right Property

The buyer must clarify self about the property type, purpose of the purchase, preferred locality and its functionality to satisfy the purpose, amount affordable for purchase, mortgage possibilities and the developer’s reputation to hand over the property in the scheduled time while purchasing the property.

It is equally important to check the risks involved and estimated ROI on completion of the project.

Timespan Of Occupation

Purchasing a home anywhere across the world, leave alone in Dubai, must be considered on both a short and long-term basis. An apartment purchased by a newlywed or young couple may seem insufficient when the family expands.

Purchasing villas gives the option to expand and redesign besides providing a better return on investments. These villas which are excellently furnished can be sold to one of the increasing numbers of interested buyers if owners choose to relocate to another country.

Budget

As of February 2023, the starting price of a property in Dubai is reportedly between AED 3 lakhs to 3.5 lakhs. The price of apartments in Dubai depends upon floor area, locality and amenities among various other factors.

The buyer must be prepared to pay a 10 per cent refundable registration fee while purchasing the desired property.

Location

The instance found below shows how price varies among localities for almost the same floor area.

One-bedroom apartments measuring 800 to 900 square feet at Business Bay and Dubai Hills Estate at Mohammed Bin Rasheed are affordable. One-bedroom apartments are also available at Al Wasl (Jumeira), Dubai South City (Jabal Ali) at affordable rates.

Single-bedroom apartments at Emaar Burj Vista measuring between 700 to 1000 square feet cost more than AED 2,00,000 at Downtown Dubai, Dubai Marina. Proximity to Dubai Mall, Dubai Mall Metro Station and easy connectivity to Sheik Zayed Road and Dubai Property justifies the costly price of this single-bedroom apartment.

The Purchase Medium

A buyer could save a lot of money by avoiding brokers or middlemen while purchasing property in Dubai directly from the owner. Notably, brokers charge a 2 per cent agency fee and a 5 per cent VAT charge on the fee.

However, while avoiding brokers, one forgoes professional assessment of properties and expert navigation of transaction details like the contract paperwork, for instance, the art of negotiating.

Dubai Land Department Service Charges

Dubai Land Department service charges, which are mandatory while purchasing property in Dubai, may be shared equally by the buyer and seller or might be entirely paid by the buyer. The DLD charges amount to 4 percent of the property value.

Additionally, the buyer may need to pay a mortgage registration fee if bought through a loan, which amounts to 0.25 per cent of the loan along with AED 290. If the DLD is not paid within 60 days, the purchase is understood to be canceled.

Property Service Charges

The property service charges which are calculated on a square foot basis may range between AED 3 to 30. Besides property service charges one must foot Dubai Electricity and Water Authority fees along with insurance fees, security deposit and property transfer fees.

The property service charge varies along with locations, project type and purchase purpose. The buyer should also pay a ‘sinking fund’ which is a reserve fund that meets expenses for major repairs in future. Interestingly the 10 to 15 per cent price drop in key locations of Dubai facilitates developers selling to new end users.

While places like International City, Discovery Gardens have low service charges at 7 Dirhams per square feet (psf), Business Bay, Dubai Marina, Jumeirah Lakes Towers, Sports City, Jumeirah Village Circle charge moderately at 10 Dirhams psf.

Arabian Ranches 1 and 2 require AED 0.89 psf and 2.44 psf respectively while Burj Vista property owners shell out a massive AED 17.44 psf for property services.

Amenities And Their Scalability, Effectiveness And Quality

Villas are equipped with clubhouses, gyms and modern equipment and are tagged with excellent resale value. Villas in Dubai Hills, Arabian Ranches, Palm Jumeirah, Emirates Hills, Damac Hills and Al Furjan are sought for 18-hole golf course plus proximity to the city, connectivity to Sheik Mohammed Bin Zayed Road, Waterfront view, Privacy with palatial layout, family-friendly atmosphere and proximity to Expo 2020 site in the same order.

Handling Installments

Installment plans are popular in Dubai real estate purchases. 10 percent of the total cost is paid as advance which is followed by installments that cover half the entire cost at the time of handover.

Documents Required

Copies of documents including Emirates ID, passport, Visa page, reservation form, Sales and Purchase Agreement and Mortgage Contract if applicable required while purchasing property in Dubai.

Check Developer Background

It pays to check the developer’s track records before approaching them to buy property. If the developer lacks dedication, his property abounds in unsatisfactory plans and poor finishes while laying tiles, cupboards and walls.

Where To Purchase Off-Plan Properties

Purchasing a property through D Realtors, a professional and authentic real estate player in Dubai, fetches access to the functionally and aesthetically best property in Dubai which is spread across in prestigious locations such as Mohammed Bin Rashid City, The Fields, Burj Khalifa district and Sheik Zayed Road to name a few.

Final Words

The decision to join the game cannot be delayed too much since the prospects have already caught the eyes of many. Waste no time in deciding to take the plunge because the competition is already in the news.

Share this:

#Government approved realtors in dubai#D realtors#Dubai real estate brokers#Realtors in uae#Rent property in dubai#Lease property in dubai#Real estate in dubai#Uae real estate brokers#Buy property in dubai#Buy property in uae#Realtors in dubai#Freehold property in dubai#Buy apartment in dubai#Rera approved brokers in dubai

2 notes

·

View notes

Text

Renewing Your ITINs in Venice, FL: What You Need to Know

When tax season comes, you need to be organized and ready to file, but then you learn your ITIN has expired. Panic sets in, right? You’re not alone. Many residents face this challenge every year.

An ITIN, or Individual Taxpayer Identification Number, is vital for anyone who must file U.S. taxes but doesn’t qualify for a Social Security Number. Whether you’re filing to claim a refund or meet legal obligations, your ITIN ensures the process runs smoothly. This guide provides everything you need to know about renewing ITINs in Venice, FL, so you can avoid filing delays, penalties, or lost benefits. Let’s dive in.

Understanding Your ITIN

What is an ITIN?

An ITIN (Individual Taxpayer Identification Number) is a nine-digit number issued by the IRS to individuals who can’t obtain a Social Security Number but need to comply with tax laws.

Who Needs an ITIN?

You need an ITIN if:

You’re a foreign national or nonresident alien with U.S. tax obligations.

You’re a dependent or spouse of a U.S. resident without a Social Security Number.

You require it to report income or claim refunds.

Why ITINs are Important

ITINs are essential for:

Filing accurate tax returns.

Accessing tax credits (e.g., Child Tax Credit).

Claiming refunds.

Meeting IRS requirements.

When and Why ITINs Expire

ITINs typically expire after five years of inactivity or as part of IRS renewal policies. If issued before 2013, your ITIN may need renewal regardless of recent use.

Why They Expire: To maintain accurate tax records.

Importance of Renewal: An expired ITIN can delay filings, refunds, and access to benefits.

Consequences of an Expired ITIN

Allowing your ITIN to expire can lead to several challenges:

1. Tax Filing Issues

You won’t be able to file federal or state taxes without a valid ITIN.

Filing delays could result in penalties or interest on taxes owed.

Refunds may be delayed until your ITIN is renewed.

2. Other Problems

Losing access to certain government benefits tied to tax filings.

Issues with financial institutions requiring a valid ITIN for identification.

The ITIN Renewal Process in Venice, FL

Renewing ITINs in Venice, FL, is straightforward if you follow these steps:

Step 1: Gather Required Documents

You’ll need:

Form W-7: The IRS application for renewing your ITIN.

Original or Certified ID Copies: Such as a passport, national ID, or visa.

Proof of Residency: A utility bill, rental agreement, or bank statement.

Tips for Document Preparation

Ensure all documents are legible and accurate.

Use certified translations for non-English documents.

Step 2: Choose How to Submit

By Mail: Send your completed Form W-7 and documents to the IRS ITIN Operations Unit. Use a secure mailing service with tracking.

In-Person Help: Visit a Certifying Acceptance Agent (CAA) in Venice, FL, for personalized assistance.

Step 3: Track Your Application

Once submitted, you can check your renewal status by calling the IRS or visiting their website. Processing typically takes 7-11 weeks, so start early.

Fees Associated with ITIN Renewal

The ITIN renewal process is free, but there may be costs if you use third-party services for preparation or translation. Always verify fees with your provider or check the IRS website for the latest updates.

Application preparation fees by tax professionals or Certified Acceptance Agents (CAAs) typically range from $50 to $150, while document translation services can cost $20 to $75 per document. Additional expenses may include postage for mailed applications or travel to IRS centers.

Tips for a Smooth ITIN Renewal

Follow these best practices to ensure a stress-free renewal experience:

1. Start EarlyBegin the renewal process months before your ITIN expires to avoid last-minute complications.

2. Double-Check Your InformationEnsure all forms are filled out correctly, and all names and details match your documents. Errors can delay processing.

3. Keep Copies of Everything Make copies of your application and supporting documents for your personal records.

Conclusion

Renewing your ITIN on time ensures you stay compliant with U.S. tax laws and avoid unnecessary stress during tax season. At White Sands Tax, we specialize in helping residents renew their ITINs in Venice, FL, with ease. If your ITIN has expired or is close to expiring, don’t wait. Start the renewal process today to avoid delays, penalties, or disruptions to your financial goals.

Disclaimer: This content is for general informational purposes only. Always consult a qualified tax professional for personalized advice.

0 notes

Text

Income Tax Online Free Filing: A Comprehensive Guide

What is income tax filing?

Income tax filing is the process of submitting details of your income, expenses, investments, and taxes paid to the government. It helps the tax authorities assess your taxable income and ensures that you have paid the correct amount of tax or are eligible for refunds in case of excess tax payment.

Income tax returns are mandatory for individuals, businesses, and other entities meeting specific income thresholds as prescribed by the Income Tax Department of India.

Why File Income Tax Returns Online?

The government encourages online filing for its efficiency and transparency. Here are the key benefits:

Convenience: File your taxes from the comfort of your home, anytime and anywhere.

Accuracy: Online tools have built-in checks to reduce errors.

Speed: Immediate acknowledgement of your ITR submission.

Eco-Friendly: Eliminates the need for physical paperwork.

Refund Tracking: Easily monitor the status of your refunds online.

0 notes

Text

A Step-by-Step Guide to Personal Tax Filing in British Columbia

Filing personal taxes in British Columbia can feel easy when done step-by-step. This guide breaks it down for first-time filers & anyone seeking clarity on their tax duties. In this article, we learn about the process of filing personal taxes in British Columbia in step-by-step

1. Preparing for Tax Season

Start by understanding the basics:

Key Dates: Canadian taxes cover income from January 1 to December 31, with a typical filing deadline of April 30. File early to avoid penalties.

Who Must File: If you earn income in Canada, including employment, freelance, or investments, you must file a tax return.

What to Have Ready:

Your Social Insurance Number (SIN)

Any CRA correspondence, like your Notice of Assessment (NOA)

Banking information for direct deposit of refunds

2. Gather Necessary Documents

Having the correct documents is critical:

Income Slips: Collect T4s from employers, T5s for investment income, and any freelance income records.

Receipts for Credits: Keep proof of deductions, such as medical expenses, childcare & tuition fees.

Home and Work Expenses: If you work remotely, claim home office deductions with proper receipts.

3. Understand Tax Credits and Deductions

In British Columbia, certain credits can reduce your tax payable:

BC Sales Tax Credit: A refundable credit for low- and moderate-income residents.

Charitable Donations: Receipts for charitable contributions can boost your refund.

Disability Tax Credit (DTC): Available for eligible individuals or their caregivers.

4. Choose a Filing Method

There are several ways to file your taxes:

Use Tax Software: CRA-approved software like TurboTax or Wealthsimple can help you file online.

Paper Filing: Download forms from the CRA, fill them manually, and mail them.

Hire a Tax Professional: If your taxes are complex, a professional ensures accuracy and helps maximize deductions.

For online filing, use NETFILE, CRA’s secure portal, to submit your return directly.

5. Complete Your Tax Return

When filling out your return:

Report all income accurately, including employment, self-employment, and investments.

Deduct eligible expenses, including BC-specific credits.

Double-check for accuracy to avoid delays in processing.

Important: Use the CRA’s My Account to track tax documents and confirm submission.

6. Submit and Pay Taxes Owed

Submit your tax return electronically via NETFILE or by mail for paper submissions. If you owe taxes:

Pay using online banking, CRA’s My Payment service, or by cheque.

Late payments attract interest, so pay promptly.

7. Track Your Refund or Assessment

After submission:

Check the status of your refund via the CRA website or mobile app.

Your Notice of Assessment (NOA) will confirm if your return was processed and outline any corrections.

Common Questions About Tax Filing in BC

Do I Need to File if I Earned Below a Certain Amount? Yes, filing ensures access to benefits like GST/HST credits or Canada Child Benefits.

Can I File Taxes Late? Yes, but late submissions may incur penalties and interest.

What if I Made a Mistake? Submit a correction using the CRA’s ReFILE service online.

Final Thoughts

Filing personal taxes in British Columbia doesn’t have to be hard. With good planning & a bit of care, you can meet deadlines, get the most from your refund & skip any penalties.To know more personal tax filing In British Columbia Canada please feel free connect with us.

0 notes

Text

At Taxring.com, we offer a wide range of expert tax and business services designed to support your financial and regulatory needs. Our seasoned professionals provide precise ITR filing, efficient GST registration and GST filing, and thorough audit services. We also assist with company registration and a variety of other essential business functions. Whether you’re an individual or a business, Taxring.com is your go-to partner for navigating complex tax regulations and ensuring compliance. Trust us to simplify your financial processes and help you achieve your business goals with confidence.

#ITR Filing 2024#How to Register for GST Online in 2024#income tax return#tax refund#How to check Tax Refund status#TDS#TDS and TCS Under GST 2024 Latest Rules#How to File TDS and TCS Returns Under GST

1 note

·

View note

Text

What Is Income Tax Refund And How To Check Refund Status

What Is Income Tax Refund Income tax refund means a refund amount that is initiated by the income tax department if amount paid in taxes exceeds actual amount due (either by way of TDS or TCS or Advance Tax or Self-Assessment Tax). The tax is calculated after taking into consideration all the deductions and exemptions at the time of assessment by income tax department. Refund processing by the…

1 note

·

View note

Text

Avoid Penalties: File Your ITR

As the ITR filing deadline approaches, it’s essential to file on time to avoid penalties and safeguard your financial status. Filing early gives you the chance to double-check for deductions, correct any errors, and file your income details accurately. Preparing your tax return in advance can also mean faster access to potential refunds and fewer risks of filing complications. Start gathering necessary documents now to make sure you’re ready well before the last date.

#ITRDeadline#TaxFiling#FileYourITR#TaxTips#AvoidPenalties#IncomeTax#ITRFiling#LastMinuteFiling#TaxSavings#ITRReminder

0 notes

Text

Filing from Abroad? Your Guide to Hassle-Free Tax Return Filing for NRIs!

Hey NRIs 🌏! Are you navigating the labyrinth of Indian tax returns from abroad? We’ve got your back with a step-by-step guide to make your ITR filing as smooth as possible. 🇮🇳💼

Whether it's sharing stories from foreign lands, bringing back goodies, or supporting India through taxes, NRIs are valued! If you're a Non-Resident Indian wondering if you need to pay taxes, the short answer is yes, if your income is generated within India.

Here's Your Roadmap to NRI ITR Filing:

Step 1️⃣: Know Your Residential Status This determines your tax liability. You’re non-resident if you stayed in India ≤181 days last year. Longer than that? You’re likely a resident.

Step 2️⃣: Reconcile Your Income & TDS Match the Tax Deducted at Source (TDS) displayed in Form 26AS to ensure accuracy. This form gives you a quick view of tax-related transactions.

Step 3️⃣: Calculate Your Taxable Income From bank deposits to real estate gains, identify your income sources. Certain investments (like fixed deposits) may also reduce your tax.

Step 4️⃣: Double Taxation Relief You might be taxed both in India and your current country. Thanks to Double Taxation Avoidance Agreements, you can claim relief!

Step 5️⃣: Choose the Right ITR Form ITR 2 is for most NRIs, but if you have business income, use ITR 3. Don’t forget exemptions—like on capital gains and certain deposits!

Step 6️⃣: Provide Bank Details For refunds, you’ll need to submit bank details. If no refund, you can skip providing your foreign account details.

Step 7️⃣: Report Assets & Liabilities If your income crosses Rs. 50 lakh, you’re required to report assets and liabilities in India for transparency.

Step 8️⃣: Verify the ITR Once submitted, verify it within 30 days using Aadhar OTP or EVC to make it official.

Final Thoughts… Filing taxes abroad may sound complex, but we’re here to make it simple. For any help along the way, reach out to our expert CAs at JJ Tax. Check us out at www.jjfintax.com or download our app to get started! Download JJ TAX App

0 notes

Text

Why Does It Take 18-20 Days For The Tax Department To Process Your ITR In India?

Submitting an Income Tax Return (ITR) is a basic duty of a taxpayer, and this is helpful if it relates to ITR processing time because it allows the taxpayers to manage their expectations appropriately. This involves the Central Processing Centre (CPC) based in Bangalore which is in charge of validation and evaluation of the lodged ITRs. After the ITR is e-verified, it goes for further checking by the CPC to avoid any errors. After the completion, taxpayers are sent an intimation notice under section 143 (1) of the Income Tax Act which indicates the position of one's return whether it is a pay in additional tax due, one is expecting a refund, or no action is called for. Participating in the Assessment Year 2024-25 process will require a completion deadline that falls on July 31, 2024.

Therefore, this blog will help in understanding the various elements of the average time taken to process ITR, the factors influencing this and how to monitor and avoid bottlenecks in this process.

0 notes

Text

Disability Tax Credit (DTC) Application: Everything You Need to Know

Applying for the Disability Tax Credit (DTC) can be confusing, especially when you're unsure about how long it takes or what steps are involved. In this blog, we’ll cover common questions related to the DTC application process in a simple, easy-to-understand format.

1. What is the Disability Tax Credit (DTC)?

The Disability Tax Credit (DTC) is a non-refundable tax credit provided by the Canadian government. It helps individuals with disabilities or their supporting family members by reducing the amount of income tax they owe. The DTC is intended to provide relief for the extra costs associated with living with a disability.

2. How do I apply for the DTC?

To apply for the DTC, you need to complete Form T2201 - Disability Tax Credit Certificate. This form has two parts:

Part A is filled out by you (or the person with the disability).

Part B is filled out by a medical practitioner who will certify that you have a severe and prolonged impairment.

Once completed, the form must be submitted to the Canada Revenue Agency (CRA) for review.

3. How long does it take to process a Disability Tax Credit application?

On average, the CRA takes about 3 to 6 months to process a DTC application. This timeline can vary based on factors like how many applications the CRA is handling and whether they need more information to complete the assessment. During peak seasons, the process may take longer.

4. What happens after I submit my application?

After submitting your application, the CRA will review it to ensure all the necessary information is provided. They might reach out to you or your medical practitioner if they need more details to make a decision. Once the review is complete, you will receive a letter from the CRA informing you whether your application has been approved or denied.

5. Why would the CRA ask for more information?

The CRA may request additional details if they feel your application doesn't provide enough information to make a decision. This usually means they need a more in-depth explanation of your medical condition and how it affects your day-to-day life.

6. What should I do if my DTC application is denied?

If your application is denied, don’t worry—you have options. You can either:

Request a review: Provide additional supporting information or clarify the details the CRA might have missed.

File an objection: This is a more formal process, where you challenge the decision through the CRA's appeals process.

7. Can I check the status of my DTC application?

Yes, you can check the status of your DTC application online through the CRA My Account portal or by calling the CRA directly. Keep your personal information and application details handy when checking the status.

8. Why is my application taking longer than expected?

If your DTC application is taking longer than the usual 3 to 6 months, it could be due to:

A high volume of applications during peak periods.

Delays in obtaining additional information from your medical practitioner.

The need for more detailed medical assessments.

If it’s been a while, you can always reach out to the CRA for an update.

9. What can I do to speed up the DTC process?

While you can’t fully control how long the CRA takes, there are a few steps you can take to avoid unnecessary delays:

Ensure Form T2201 is filled out completely and correctly.

Have your medical practitioner provide detailed information about your condition.

Respond to any requests for additional information from the CRA promptly.

10. What happens after my DTC is approved?

If your application is approved, you can start claiming the Disability Tax Credit on your tax return. Additionally, you may qualify for other benefits like the Registered Disability Savings Plan (RDSP) or retroactive tax refunds for up to 10 years.

11. Do I have to reapply for the DTC every year?

No, you don’t have to reapply every year. Once approved, your eligibility is typically valid for several years or until your condition improves. In some cases, your approval may be indefinite if your condition is permanent.

12. Why do I need different numbers for GMB and CallRail tracking?

The CRA uses unique identifiers for DTC applications, ensuring there is no overlap between different regions or offices. It is vital to provide distinct details for each application, especially when coordinating services across locations.

Conclusion

The Disability Tax Credit (DTC) is a crucial financial support for individuals with disabilities, but the application process can take time and attention to detail. While it can take up to 6 months, understanding the steps involved can help reduce delays and make the process smoother. Be sure to complete your application thoroughly, follow up when needed, and if in doubt, reach out to a professional for assistance.

0 notes

Text

How PAN Verification Status Impacts Your Financial Life

In today’s digitally driven world, Permanent Account Number (PAN) has become an integral part of financial transactions in India. Whether you are an individual taxpayer, a corporation, or a non-resident, the importance of a PAN cannot be overstated. However, it is equally important to ensure that he has a recognized status beyond merely holding a PAN. In this comprehensive article, we will explore how PAN verification status affects your financial life and why staying updated on this front can save you from potential pitfalls.

What Is a Drink?

Permanent Account Number (PAN) is a unique identification number as issued by the Indian Taxation Department. It is an important tool in pursuing financial transactions, ensuring that all taxable activities are properly monitored. PAN is not just a tax return; It is required for various financial activities, such as opening bank accounts, buying property and investing in stocks.

Importance of PAN Verification

PAN verification is the process of verifying the details associated with your PAN. This post ensures that the PAN details are correct, up-to-date and in line with the records held by the Income Tax Department. The importance of PAN verification extends beyond mere compliance; It plays an important role in maintaining your financial connections.

How Does PAN Verification Affect Tax Filing

One of the most important ways in which PAN verification status affects your financial life is through tax filing. An incorrect or unacknowledged PAN can cause problems with your tax returns, including delays, denials and even penalties. The Income Tax Department cross verifies the PAN details with additional financial details submitted at the time of filing tax returns. If there is a discrepancy, it can raise red flags and result in an undesirable test or audit.

Role of PAN in Financial Transactions

Every financial transaction you make, from deposits to investments, is linked to your PAN. Banks, financial institutions and government agencies require PAN details to process transactions beyond a certain threshold. If your PAN is not verified, you may face hurdles in completing these transactions, resulting in potential financial hardship and loss.

Impact On Loan Applications

When you apply for a loan, be it a home loan, a personal loan, or a business loan, the lending agency conducts a thorough background check, which includes verifying your PAN unauthenticated or incorrect PAN can have your loan application denied, even if your credit score is strong. Lenders use PAN verification to check your financial credibility and ensure that you are not involved in any fraudulent activities.

Result of PAN Mismatch

PAN mismatch occurs when the information in your PAN does not match the information in other financial documents, like your Aadhaar card, bank account, or tax returns This mismatch can cause problems, e.g delays in refund processing, difficulty in accessing government grants, your PAN and information related to bank account or other financial transactions

Verification of PAN and Financial Fraud

Financial fraud is a growing concern in the age of digitalisation. Fraudsters often use fake or stolen PANs to commit fraud, causing huge losses to individuals and businesses. By regularly checking your PAN, you can protect yourself from falling prey to such scams. Analysis ensures that your PAN is only linked to your legitimate financial activities and helps authorities detect and prevent fraudulent transactions.

How to Check your PAN Verification Status

Checking your PAN verification status is a simple process. Income Tax Department of India provides an online portal where you can verify your PAN by entering your PAN number and other required details. Once you have submitted the details, the system will display the status, indicating that your PAN is valid or properly authenticated. These simple steps can save you from potential financial issues down the road.

Compliance with PAN and KYC Norms

The Know the Consumer (KYC) standard is mandatory for various financial transactions, including opening a bank account, investing in mutual funds, or buying insurance Your PAN verification status is an important part of the KYC process in. If your PAN is not verified, your KYC will be considered incomplete, resulting in restrictions on your financial activities or even freezing of your account.

Steps to Correct PAN Error

If you find that your PAN details are incorrect or not verified, it is important to take immediate action. The Income Tax Department provides a correction form (Form 49A) which can be submitted online to rectify any mistake. This process usually involves submitting supporting documentation to verify your identity and resolve discrepancies. Ensuring that your PAN details are correct can prevent possible bankruptcy.

Conclusion

PAN verification status plays an important role in shaping your financial life. From filing taxes to loan applications, preventing fraud to complying with KYC norms, the implications of unauthenticated or incorrect PAN go far By checking your PAN regularly and updating your PAN on the other side of the certification status, you can ensure smooth financial transactions and protect yourself against potential risks. In today’s tough economic climate, you don’t just have to be proactive about PAN verification; it’s an important step towards securing your financial future.

0 notes