#how to create paytm merchant account

Explore tagged Tumblr posts

Text

How Do I Make a Merchant Payment?

#How Do I Make a Merchant Payment?#merchant services#merchant account#merchant services sales#how to sell merchant services#what is a merchant account#payment processing#payment gateway#payments#how to make money selling merchant services#how to create paytm merchant#what is a merchant account?#how to create paytm merchant account#merchant account vs payment gateway#merchant account payment processing#merchant account rates#online payments#merchant account pricing#merchant processing

1 note

·

View note

Text

Make UPI Payment Using RuPay Credit Card

Digital payments have become an indispensable part of our everyday lives. With the rise of the Unified Payments Interface (UPI) and RuPay credit cards in India, making digital payments has become faster, easier, and more rewarding than ever before.

This article provides a simple guide to understanding UPI payments, RuPay credit cards, and how platforms like Kiwi are enhancing the user experience.

What is UPI, and How Does It Work?

UPI, or Unified Payments Interface, is a system that allows instant transfers of money between bank accounts using a smartphone.

It uses a unique UPI ID or mobile number as an account number to transfer funds in real-time.

UPI is built on top of the IMPS infrastructure and allows you to instantly pay or receive money without entering any bank details.

To use UPI, you need to have a bank account and a UPI-supported app like BHIM, PhonePe, Google Pay, Kiwi, Paytm, Kiwi and many more.

UPI has made digital transactions very easy, even for those who are not tech-savvy or don’t use cards.

Key Points About UPI

Instant money transfer system using a mobile phone

Uses a unique UPI ID or mobile number as an account number.

Transfers money in real-time without bank details

Needs a bank account and a UPI-enabled app

Makes digital payments easy for everyone.

How to Make UPI Payments: A Simple Step-by-Step Guide

Here is a quick 5-step guide to making seamless UPI payments:

Download a UPI app like BHIM, PhonePe, Google Pay, Kiwi etc.

Sign up by adding your bank account details.

Create a UPI ID (virtual payment address).

Enter the receiver’s UPI ID, phone number and bank details when sending money.

Transfer money in a few simple taps using your UPI PIN.

That’s it! UPI has made transferring money as easy as sending a text on your phone.

Understanding RuPay Credit Cards

RuPay is India’s very own domestic card payment network, backed by the National Payments Corporation of India (NPCI).

Some key facts about RuPay credit cards:

Lower cost than international card networks like Visa and Mastercard.

Promotional offers and cashback to encourage digital payments.

Integrated seamlessly with UPI for easy payments.

RuPay credit cards provide a low-cost, rewarding, and secure option for Indian consumers to go digital, especially for domestic transactions.

Linking RuPay Cards to Make UPI Payments

RuPay credit cards can be easily linked to UPI apps to make quick payments using funds from your credit limit. The steps are straightforward:

Go to your UPI app’s ‘Add Card’ section.

Choose RuPay and enter the card details.

Set a UPI PIN for the card.

Accept the terms and conditions.

Authenticate with an OTP.

Your RuPay credit card will now show as a payment option during transactions. UPI facilitates payments from cards in a highly seamless manner.

How to Make UPI Payments from a RuPay Credit Card?

Follow these simple steps to pay via UPI using your RuPay credit card:

Open your UPI app.

Enter payee details and the amount.

Choose a linked RuPay card as the payment method.

Enter a UPI PIN for authentication.

Confirm the transaction in a few seconds.

This instant, round-the-clock payment facility eliminates the need to carry cards or cash. The RuPay-UPI combination offers the best of both worlds.

Top Apps to Use the RuPay-UPI Combination

Several UPI apps allow linking RuPay cards seamlessly. Some popular options are:

PhonePe: simple interface, offers, and cashback

Google Pay: Prevalent, easy to use

Kiwi: Sime to use UPI credit card

BHIM: Backed by the government, competent

Paytm has a wide network of merchants.

Cred: focused on card payments and rewards

However, Kiwi stands out with its innovative approach and focus on the user experience.

Introducing Kiwi: Taking UPI-RuPay Payments to the Next Level

Kiwi is an app that aims to make RuPay-UPI payments even more rewarding and hassle-free for consumers. Here’s an overview of its offerings:

Provides an instant virtual RuPay credit card enabled for UPI

Zero joining and annual fees for complete transparency

Cashback rewards and bonuses tailored for RuPay users

Builds on UPI’s simplicity with an easy-to-use interface

Top-notch security standards for safe transactions

Available on both Android and iOS platforms

Kiwi combines the pros of RuPay, UPI, and virtual cards into one powerful platform.

Using the Kiwi App for RuPay-UPI Payments: A Tutorial

Here is a step-by-step guide on using Kiwi for simplified RuPay-UPI payments:

Download the Kiwi app from the Play Store or App Store.

Sign up and link your RuPay credit card to get a virtual card.

For payments, enter payee details and the amount in the app.

Choose your virtual RuPay card to pay via UPI.

Authenticate using your Kiwi app credentials.

Get rewarded with cashback for payments!

Kiwi accelerates the RuPay-UPI payment process while also rewarding users, creating a win-win proposition.

Why Choose Kiwi for RuPay-UPI Payments?

Here are some compelling reasons why Kiwi scores over other apps when it comes to the RuPay-UPI combination:

Instant issuance of a virtual card means no waiting period.

Exclusive rewards and promotions for RuPay users

Completely transparent with no hidden charges

Top-level security for safe transactions

Intuitive and easy-to-use interface

Uses UPI’s full potential by integrating it with RuPay.

Creates a seamless ‘card-less’ payment experience

Kiwi unlocks the full potential of RuPay-UPI synergy for consumers seeking easier, faster, and more rewarding payments.

Conclusion

UPI and RuPay, together, have accelerated India’s transition into digital payments. Kiwi takes this experience to the next level for consumers by:

Combining the strengths of UPI and RuPay into one platform

Adding an extra layer of convenience with instant virtual cards

Offering exclusive rewards and cashbacks for loyal users

Focusing on transparency, security, and the user experience

So if you want to enjoy the best of what RuPay and UPI have to offer, give Kiwi’s innovative solution a try today!

#Rupay Credit Card#Best Rupay Credit Card#Lifetime free Rupay Credit Card#Free Rupay Credit Card#UPI Credit Card#Rupay Credit Card Apply#UPI Card#Rupay Card#Axis Bank Rupay Credit Card#Rupay Credit Card Upi

0 notes

Text

E-Commerce Marketing Course in Sanganer Jaipur-EDM TECH PRO

Ecommerce Marketing Course in Jaipur

With the help of our Ecommerce Marketing Course in Jaipur, you might embark on a transformative journey that will get you ready for a lucrative career as an online merchant. This program gives you the tools you need to launch your own online business with its comprehensive curriculum and understanding of both domestic and international e-commerce giants like Amazon, Flipkart, Meesho, eBay, Etsy, Myntra, Ajio, Paytm, Snapdeal, Limeroad, Shop 101, and others.

Enrolling in EDM ensures that you will gain the skills and knowledge necessary to manage the intricacies of these platforms, opening doors to a lucrative career in the dynamic field of e-commerce. The A to Z of web portal operations is covered. Researching keywords, creating accounts, approving brands, approving categories, and approving products.

What you will learn in Ecommerce Marketing Training

With our e-commerce marketing training at EDM, you will become an expert on popular platforms like Amazon, Flipkart, and others. Discover how to sell things, create accounts, and conduct online advertisements. To optimize performance, get experience in order processing, customer service, and analytics. Stay up to date on the latest developments and fashions in the field. Whether you’re starting your own business or moving up the e-commerce ladder, this course equips you with the skills you need to succeed in the online market.

Platform Mastery

Discover how to utilize and navigate a variety of well-known e-commerce sites, including Paytm, Snapdeal, Shop 101, Amazon, Flipkart, Meesho, eBay, Etsy, Myntra, and Ajio. Recognize the differences present on each platform to get the most out of your marketing strategies.

Account Setup and Management

You’ll discover how to set up and maintain seller accounts across several sites. Develop the abilities required for category approval, account management, and brand approval in order to provide a solid basis for your online presence.

Thank you for visit

0 notes

Text

Encouraging Transactions: An Extensive Examination of QR Code Services in India, With a Focus on IndicPay

Within the quickly changing digital economy of India, QR code services have become a major enabler for transaction simplification and financial inclusion. With their ability to provide a quick, safe, and effective method of payment, QR codes have been ingrained in every aspect of daily life—from busy metropolitan areas to isolated rural communities. This thorough investigation explores the wide range of QR code services that are offered in India, with a particular emphasis on IndicPay, a vibrant participant in the digital payments industry.

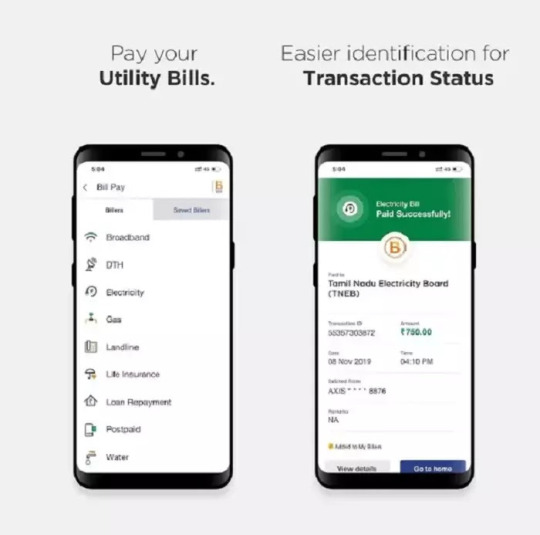

Paytm QR: Leading the way in the Indian digital payments space, Paytm is credited for bringing QR code technology to a large audience. For millions of Indians, Paytm QR has come to represent ease thanks to its user-friendly UI and wide merchant network. Paytm QR is becoming more and more popular in the country since it provides a smooth payment experience along with alluring cashback offers and rewards, whether users are paying utility bills, buying groceries, or shopping online.

Google Pay QR: Thanks to its cutting-edge features and user-friendly design, Google Pay, which is supported by Google's technological prowess, has quickly developed a devoted customer base in India. Google Pay QR codes make it simple to make payments at physical stores and amongst peers. Google Pay helps local businesses become more discoverable through programs like "Spot" and "Pay Nearby," which in turn helps them grow and prosper. Its strong security features and interoperability help to further solidify people' preference for it.

PhonePe QR: PhonePe, a division of the world's largest online retailer Flipkart, has made a name for itself in India's digital payments market by utilising its extensive network. PhonePe QR codes facilitate smooth payment acceptance for merchants of all sizes, promoting financial inclusion. Customers gain access to a multitude of services, such as online shopping and bill paying, via a single, user-friendly app. For millions of Indians, PhonePe is redefining the payment experience with its focus on simplicity and dependability.

Bharat QR is a uniform QR code standard that was created by the National Payments Corporation of India (NPCI) with the goal of encouraging interoperability and increasing the uptake of digital payments. In contrast to proprietary solutions, Bharat QR streamlines transactions and improves convenience by enabling merchants to accept payments from any UPI-enabled app or card network. Its extensive use highlights how important it is to expanding financial inclusion and quickening India's transition to a cashless society.

MobiKwik QR: By providing a variety of cutting-edge solutions catered to the requirements of retailers and customers, MobiKwik has made a name for itself in India's digital payments ecosystem. In addition to features like rapid settlement and transaction analytics, MobiKwik QR codes enable quick and secure transactions. Through loyalty programs and cashback offers, merchants can better engage with their customers, and consumers can pay with ease at a variety of merchants.

Amazon Pay QR: Linking online and offline purchases together, Amazon Pay, the payment division of the massive online retailer Amazon, has smoothly incorporated QR code payments into its platform. Using their associated bank account or Amazon Pay balance, customers can quickly make payments at partner retailers by scanning QR codes with Amazon Pay. With capabilities like auto-reload and rapid refunds, Amazon Pay QR improves the whole buying experience and further demonstrates Amazon's dedication to meeting consumer needs.

IndicPay QR: With cutting-edge solutions catered to the particular requirements of both individuals and enterprises, IndicPay emerges as a dynamic player in India's QR code ecosystem. With IndicPay QR codes, businesses can collect payments quickly and securely while utilizing state-of-the-art encryption technology. Along with features like real-time notifications and transaction tracking, users enjoy a frictionless payment experience. With an emphasis on user-centric design and strong security protocols, IndicPay is well-positioned to make noteworthy advancements in the digital payments market in India.

To sum up, QR code services in India have completely changed the way people do business by providing unmatched accessibility, security, and convenience. Every service, from well-known providers like Paytm and Google Pay to up-and-coming options like IndicPay, helps to democratize digital payments and enable millions of Indians to engage in the digital economy. Without a doubt, QR codes will continue to be at the vanguard of this movement, spurring innovation and advancement all throughout India as it continues its path towards financial inclusion and digital transformation.

0 notes

Text

Do you need Credit Card Processing? accept credit cards - best way to accept credit cards

Do you need Credit Card Processing? accept credit cards - best way to accept credit cards http://blognetweb.com/land/creditcardprocessing/ http://blognetweb.com/merchantaccount/ https://blognetweb.com/merchantaccount/sitemapindex.xml https://blognetweb.com/merchantaccount/sitemap.txt merchant account - paypal, stripe, square vs merchant account - which one is better - merchant account processing. Merchant account providers give businesses the ability to accept debit and credit cards in payment for goods and services Find out pricing for merchant account fees and the Authorize ? learn more about high risk merchant accounts: .. How to apply for a merchant account 2018 - Google Pay Merchant Account ???? ????? | How to create Google Pay Merchant Account | Phonepe Merchant Account Create | How to create phonepe merchant account || Get QR Code Phonepe app merchant account create How to create phonepe merchant account || Get ?100 Cashback All Phonepe user || Phonepe Merchant Account kaise banaye Merchant app link offer new google pay merchant scratch crad new google pay business scratch card google pay merchant account update new google pay coming features what is a merchant account and why do you need one? sign up for a merchant account: .. confused about the merchant account application process? ?my recommendation on merchant account program:... what’s the difference between paypal stripe square and a true merchant account… and which one is best?.. you will usually be able to get a payment terminal from your merchant account provider. you may have to call and ask your merchant account provider to enable “avs” on your merchant account and there may be an additional per item fees for this usually but the savings overall can be worth it to you. funds taken from a customers credit card will be deposited in your merchant account and in clearance. intuit and stripe closed on thousands of gun merchant accounts and cbd merchant accounts... so phonepe give you free create your own merchant account with phonepe. ??sign up for a cardpointe merchant account with a free gateway and virtual terminal: ... merchant account application - 10 things you need to know about merchant account applications. most merchant account providers offer virtual terminal services... in this video i have showed you how you can get your phonepe merchant barcode... ??sign up for a cardconnect merchant account here (use this processor)?? .. ? how to create paytm marchent account !! Merchant account providers help automate your payment processing and increase security 2017 - Merchant account fees are charged by processors and allow a company to accept card payments be aware though that while merchant accounts can provide an avenue to higher conversions lower processing rates and ease of manageability having it shut down can be a disaster to your business. Detailed guide on how to apply for a merchant account on Regularpay Watch more Videos on youtube here>> https://www.youtube.com/channel/UCI19gO0xSBymAiKXThLhWCQ

1 note

·

View note

Text

Freecharge E-wallet for Small Transactions, Mobile Payments

What is E-wallet?

E-wallet stands for an electronic wallet that is used for online payments (bill pay, gas payment, mobile recharge, online shopping) through your mobile or computer with a payment app. It is similar to your debit or credit cards.

Difference between E-wallet and UPI

E-wallet and UPI(Unified Payments Interface) both are used for instant payment. Minimum KYC is necessary when getting an E-wallet, UPI doesn’t need an additional KYC as it is already linked to bank accounts.

UPI payments take place directly from bank to bank. Whereas you can load E-wallet through various payment modes like credit cards, debit cards, net-banking or UPI and then you can use that wallet balance for making payments or transferring money

Freecharge UPI - introduction

Powered by Axis Bank, Freecharge provides a very secure user experience in its UPI app. Just enter anyone’s mobile number/UPI-Id/Bank account to whom you want to send money and there is no need to reach out to the bank every time. An internet-enabled device is all you need.

Sign into Freecharge UPI in 3 easy steps

Register on Freecharge App

Create a UPI id

Select a bank to link with your account and set your pin

Now use your Freecharge UPI (Unified Payments Interface) everywhere to make UPI payments and have a complete cashless and hassle-free experience.

How to make small transactions and mobile payments with Freecharge

Using Freecharge UPI (Unified Payments Interface) is easy and simple.

There are different ways you can make UPI payments. They are as follows:

Send Money

Send your money to your family, friends, or anybody anytime at your will with Freecharge UPI. Follow these steps:

First click on 'UPI Send Money'.

Then Select the UPI payments type (SCAN Qr/ UPI ID/ Mobile Number/ A/C+IFSC).

Enter the details of the person to whom you want to send and the amount to be sent.

Complete your UPI payments by entering the UPI pin.

Payment via QR Scan

Pay with Freecharge UPI by just scanning any QR code

Click on the "Scan any QR" icon.

Then Scan the UPI QR code.

Enter the amount to be paid.

Enter your UPI pin to complete payment.

*Freecharge is working perfectly with other QR UPI codes (Phonepe, Google pay, Paytm etc.)

Pay for shopping, food bills and more

At any merchant store, on the Checkout page, select the UPI option.

Enter your Freecharge UPI ID then click on ‘Pay’.

Now open your Freecharge app

Click on “UPI Send Money” icon and approve the request

Finally, enter your UPI PIN to complete UPI payments.

Mobile recharge with Freecharge

No need to rush to your mobile retail store. Here in Freecharge, your mobile recharge is only a few taps away with UPI payments.

Open Freecharge app

Click on “Mobile Recharge” icon and select your plan

On the payment page, just select the UPI payment option

Then give your UPI pin to complete the recharge.

CONCLUSION

There are plenty of benefits for Freecharge users. Freecharge doesn't claim any charges to transfer money to your contacts. Freecharge is an absolutely legit application, so you can pay your electricity, gas, and internet bills, insurance premiums and many more, absolutely worry-free. Get coupons and cashback while doing your UPI payments.

0 notes

Text

Cost To Develop On-Demand Mobile Wallet App Like Paytm

What is Paytm and how much does it cost to develop a Paytm-like app?

Apps for mobile wallets are in high demand these days. Consumers benefit from mobile wallets since they make money transactions easier. Paytm, Amazon Pay, Phonepe, Google Pay, Paypal, Airtel money, Mobikwik, SBI thru Bono, Axis Pay, and Ola Money are just a few of the payment mobile wallet apps that have sprung out as a result of the popularity of these hassle-free payment solutions. Customers may use these mobile wallet programmes to pay bills, recharge their phones, and make online purchases. Today, online merchants require mobile wallet applications to complete transactions, and entrepreneurs interested in utilizing this wallet payment method want to know how much it costs to design an app similar to Paytm.

Paytm is the most widely used mobile wallet app. This is the largest online gateway for transferring funds to your Interleaved Wallet. Its appeal stems from the fact that it offers a variety of services on the same platform. Paytm is expected to become one of the most popular currency conversion tools in the coming years, thus ewallet mobile app development businesses are attempting to create a more customized version. However, how much does it cost to develop a mobile wallet service similar to Paytm?

Choose to design mobile wallet apps if you want your firm to be more profitable and accessible to customers. Wallet mobile applications are extremely beneficial in all types of organizations for making quick money transactions with customers. In this article, we'll discuss How much does it cost to build a mobile wallet application like Paytm?.

The Cost of Developing a Paytm-like App and its Business Model

The first step in developing a mobile wallet application: planning and research

The first step in launching your mobile payment business or website is to establish a legal corporation. Most wallet Establishing a legal corporation is the first step in starting your mobile payment business or website. The majority of wallet platforms, such as Recharge and Paytm, are registered as limited liability companies. New businesses, on the other hand, have a number of options other than the registration to test their payment gateway plans. Furthermore, because such portals operate as service providers for businesses, service taxes are imposed on merchants who supply these services. To collect the service tax, you'll need a service tax registration number.

Therefore, it is important that you research the market to find out the price of the app like Paytm, Target users and Mobile app development company in Dubai

Here are some things to ask a mobile wallet app development company before developing mobile wallet apps:

What are the different types of fees that development firms charge?

The difference between cost if you go for iOS mobile app development or Android mobile app development

These are some of the questions you need to ask the company. In addition, it is crucial to plan and research about the features you want in your company and application.

Making Mobile Wallet Apps like Paytm is Expensive:

The cost of building an app like Paytm varies depending on the type of features you want. The most common payment applications have the following features

Link and integrate different payment methods / gateways and include credit / debit cards or digital currency.

It has additional features like coupon codes, loyalty points, wallet limit etc.

Any application that sells goods can add a mobile wallet to your application. Like Amazon, it created its own wallet, Amazon Pay.

Linking your bank account with your wallet

Related Article: Top mobile application development companies in Kuwait

Learn how Paytm and other mobile apps work.

Apps like Paytm make a good decision by determining the cost of developing a mobile wallet before beginning to develop an app like Paytm. To begin, you must understand how Paytm works. Paytm is the most widely used mobile wallet application. This is the largest online gateway for transferring funds to your Interleaved Wallet. You can use a debit card, a credit card, or an internet banking system to transfer your wallet to any bank. You may use Paytm Wallet to pay for a variety of goods and services. You do not need to be anxious about your financial situation. Its recognition allows users to access multiple administrations via a single portal.

The Paytm application works in two ways. One is Paytm Wallet and the other is Paytm Payment Bank. In the first way, customers can add money to their wallet through credit card, debit card, online banking and banking partners. Once money is added to the application, the user can use it to pay many bills without the need for hard cash.

The Most Important Takeaway

The eWallet app has revolutionized the financial and financial sector as it has become an ideal towards the world of digital payment that does not require much cash. In this age of information and technology where everything is changing rapidly we have seen how some eWallet applications have achieved incredible success.

The majority of consumers dislike paying with cash, yet not all stores accept MasterCard or Visa cards. You can pay with your credit or debit cards with just one click using mobile wallets. As a result, for businesses, it is a fantastic opportunity to increase income and get public exposure. When the mobile wallet is useful, cash is at risk. Furthermore, you do not need cash to pay with mobile wallet programmes.

Author: I’m Anita Basa, a fascinating Technical Content writer currently working at “Hyena Information Technologies”, one of the best mobile application development companies in oman. Interested to know about technology updates. Mobile App Development, IoT, Artificial Intelligence, Machine Learning, IOS, and Technology-related content Get connected with me on Linkedin

#mobile application developers in saudi arabia#Mobile application developers in Kuwait#top 10 mobile app companies in Dubai#mobile app development#mobile app development in kuwait mobile app development in saudi arabia mobile application development in saudi arabia

1 note

·

View note

Text

The Rise and Growth of Mobile Payments

Mobile-based payments and cards are the crown jewels of the FinTech sector, with digital payments and online payment gateway illuminating the Indian payment scene. The major reasons for causing a shift in the way individuals make payments include rapid technological innovation and adaptation, as well as the government's deliberate drive to make digital payments an everyday need.

With the debut of NPCI's Immediate Payment Service, or IMPS, in 2010, Mobile Payments began the process of making our lives easier. The primary motivation for developing this service was the urgent requirement for an interface with interoperability, and IMPS was successful in showing its usefulness by establishing a staggering 2.76 trillion Indian rupees in transaction value as of November 2020. By far the finest and most convenient technical breakthrough in the FinTech field has been the implementation of UPI, or Unified Payments Interface, in 2016.

< Photo created by pch.vector on freepik >

With the implementation of UPI, or Unified Payments Interface, in 2016, India's digital payment environment expanded considerably. UPI is a real-time payment system that allows for inter-bank transfers without the need to enter beneficiary account information. UPI, which was designed to take payments 24 hours a day, 365 days a year, allows you to accept digital payments using a Unique Virtual ID or a QR Code.

According to NPCI, UPI had a phenomenal 2.21 billion transaction volume in November 2020, with some of the most popular mobile applications operating on the UPI platform including BHIM, Google Pay, Paytm, PhonePe, and WhatsApp Payments.

How Mobile Payment Service functions in the Indian landscape?

According to a recent KPMG research, non-cash transactions are expected to rise by 20% by 2023, with mobile accounting for the majority of this development. Following the government's cash crisis in 2016, which took all high-denomination notes out of circulation overnight and forced the masses to rely on digital payment methods through the best payment gateway India, the entire country learned a lot.

Nonetheless, mobile payment solutions such as UPI and IMPS have grown substantially. Rapid smartphone development, aided by telecom firms offering low-cost 4G pricing options, has also poured gasoline to the fire. This resulted in a tremendous increase in UPI usage in 2016, with estimates ranging from 103,000 transactions to 1.97 million in three months, which eventually expanded substantially and surpassed the 900-million milestone.

Digital Payments in 2021

While this is an exciting trend, the industry consensus still holds digital payments responsible for just 10 to 15% of all retail merchant transactions, with mobile payments behind credit and debit cards in terms of value. Only around a quarter of Indians have smartphones that can utilize mobile banking apps or other payment systems such as PayTM or Google Pay.

However, the main issue that the mobile payment service and online payment gateway confronts isn't only getting the services into the hands of customers. There is a critical need to build ‘super-apps' that give a portal for accessing numerous services, therefore improving user experience that was before confined to the same. As quoted by KPMG’s Mr. Jain “There is a clear incentive for people to use super apps and there is a clear incentive for the ecosystem to adapt to them.”

Allow your company to enter the market and accept payments from consumers using mobile payment methods such as UPI, Scan and Pay, and links with SifiPay. SifiPay can meet all of your mobile payment acceptance demands at the most competitive prices in the market.

#online payment gateway#best payment gateway India#payment gateway solutions in India#best payment gateway for website#payment gateway in india#best payment gateway for website in india#online payment gateway in India#online payment gateway solutions

0 notes

Text

How Do I Create a Merchant Account?

#How Do I Create a Merchant Account?#merchant account#how to create paytm merchant account#how to create a merchant account#how to create google merchant account#google merchant account#how to create google merchant center account#create paytm merchant account#merchant account rates#what is a merchant account#create google merchant center account#how to create paytm merchant account telugu#how to create paytm merchant#google merchant center#merchant account pricing#google merchant center account

1 note

·

View note

Text

Experiential marketing: The right choice to sell fintech in rural markets

Rural customers cannot be converted merely with advertising. So for complex products like digital payment infrastructure, a clear awareness on a mass basis can be generated only with experiential marketing, says Rajesh Radhakrishnan, Chief Marketing Officer, Vritti Solutions.

In the midst of the opening of economy amid the pandemic, there was a news doing the rounds recently that Paytm was planning to employ 20,000 field sales executives (FSEs) to drive sales in small towns. This is a good move, which will help provide employment opportunities to a lot of youth and drive the economy.

At the same time, digital payment companies need to try their hands on experiential marketing, a promising form of marketing for fintech companies, banks and insurance companies to tap hinterlands.

On a mass scale, it is the best way of educating small-town residents and merchants on the relevance of digital payments, on how digital payments needs to be initiated, generate maximum downloads of apps among users, opening a bank account, having an insurance policy, etc.

Experiential marketing can create platforms on a mass-scale basis to promote and educate on concepts such as all-in-one QR codes, all-in-one POS machines, soundbox, wallet, UPI, postpaid, merchant loans, insurance offerings, etc. The campaign can be done at a crowded market or public place or State Transport (ST) Bus Stations.

It is also to be remembered that we are not yet out of the pandemic. There are still talks of a possible third wave. There are limitations on manual marketing. So, companies need to adopt a balance of restriction and relaxation. Experiential marketing companies have the experience of conducting activation maintaining strict social distancing.

Rural customers cannot be converted merely with advertising. Therefore, in a rural or a small town set up, a simple advertisement banner may work for a FMCG product such as soap or a detergent. However, for a complex product like digital payment infrastructure, a clear awareness on a mass basis can be generated only with experiential marketing. There must be a mix of manual and experiential marketing to educate the customer, which would be the ideal way. If he is convinced, he will tell four of his friends.

With a bit of education, the real potential of the country i.e. the small towns and the villages, could be explored for digital payments. As more and more data penetration is taking place in the rural parts of the country, this is the best time for fintech companies and the banks for tapping the rural.

Case Study: An experiential marketing case study involving Citicash Tatkal Cards with passengers at State Transport (ST) Bus Stations:*

Among several places, ST bus stations could be a very strategic location for educating the masses about fintech products. On an average, 20,000 people visit a bus station, which ensures a very good crowd engagement. An average waiting time for a traveler at the Bus Station is 30 minutes. Very easily about 500-1000 people could be engaged within a bus station in a day. Awareness can be imparted at the consumer level as well as the merchant level. By generating proper awareness among the consumer, the right word-of-mouth can be generated. Also, the public starts demanding the merchants for the service if he is aware about it.

In a bus station, the fintech players can do perfect branding of his products with promo tables, banners, posters, where promoters can educate public about its products and services. Awareness can be done even inside a running long-distance bus. This sets the right word of mouth among the public about the financial product.

An activation was done for Citicash in Maharashtra. Citicash had tied up with the Maharashtra State Road Transport Corporation (MSRTC) to sell pre-paid cards or “ST Tatkal cards” among the public. This card is similar to pre-paid cards used in the metro trains. A card can be pre-paid with amounts of Rs 200-300 or 500 and goes on debiting with each travel. Our team of promoters educated the consumers at the bus station and inside the buses. Conductors were trained on using devices to read cards and deduct the charges. Within a few days, the card became popular with MSRTC travelers. As trains are limited, much of the public today travel in buses. Also, since it is a cash less method, it is safe during the present Covid times.

0 notes

Link

Boost compliance with smart rules and controls at an organisation and user level. CardHero is a prepaid corporate Mastercard® product that delivers safety, transparency and organisational compliance to transactions. It allows organisations or anyone needing to, to spend money within, or on behalf of, the business.

Suitable for Government, Enterprise and Not for Profit. Sign up your company to CardHero and see immediate benefits. Reduce risk with real time control. Powerful for clients and employees, easy for you.

THE SAFER WAY TO SPEND

- Employees are empowered and trusted, within safety limits, to move faster.

- Sophisticated rules engine that allows for transaction rules to be set at an organisation, user group or individual user level.

- Spend limits, Merchant Category blocking and Cash withdrawal blocking

- Real time fraud detection.

- Set up Notifications and Alerts for transactions, perfect for overseas travel.

EMPLOYEE FRIENDLY

- Pre-funded cards eliminate personal spending and claiming reimbursements.

- Use your Apple PayTM ready digital CardHero Mastercard the instant your organisation creates your account.

- Peace of mind, knowing payment limits and restrictions on merchant acceptance comply with your organisation’s purchase policy.

- Farewell month end, time consuming, corporate card reconciliation. Save receipts, invoices and notations directly to each transaction, as you pay or at any time.

- Set controls, restrictions and limits on your CardHero Mastercard to reduce the chance of accidental misuse.

- WCAG 2.1 Level AA Certified

SIMPLE FUNDS DISBURSEMENT

- Flexible integrated account funding

- Automated or ad hoc instant system and digital card access

- Native integration to Expense8, Australia's leading Travel and Expense Management Solution.

- See the available funds and amount spent for each of your accounts. Make informed purchase decisions within limits.

THE ESSENTIALS

- Enable fingerprint or facial recognition login for faster and easier access.

- Reset the PIN on your physical CardHero Mastercard.

- Lock your card if misplaced, or request a replacement physical card and instantly receive a new digital card.

- See your transactions in real time. Search, filter and find transactions.

- Optional physical card CardHero Mastercard.

CardHero data is hosted and supported in Australia. CardHero, by 8common, is made for the Australian market. Established in 2014, 8common has been a trusted provider for Australian Not For Profits, government organisations and corporations. ASX: 8CO

Visit cardhero.co to find out how you can transform employee delegated payments with smart spend management controls, tools and reporting available to the CardHero Administrator or Financial Controller.

The CardHero API can integrate with enterprise accounting and HR systems. #data #travel #payments #hr #digital #business #compliance #amazon #accounting #management

0 notes

Text

PayQ Founder Shibabrata’s strategic entry to India as Payment Processor portends at a very opportune time

While Paytm, Google Pay, Naspers-owned PayU and other players were aggressively trying to rope in small businesses on their platform, as B2B doesn't bleed the business, the big scramble is for over 60 million small businesses. The UK based Fintech start up PayQ and its CEO Shibabrata Bhaumik is trying to get them hooked to the PayQ payment gateway and then offering them a host of services, including loans, and easy payment acceptance and settlement to small businesses including Kirana shops and that would lead to an intense battle, where incumbents could face the heat.

The coronavirus pandemic might help to achieve India’s stated goals of creating a less-cash economy and enhancing financial inclusion. Shoppers at even neighborhood stores now want contactless digital payments and that demand dovetails with what lenders want in lieu of working capital loans - digital invoices and online transaction records.

The multi-currency, multinational payment processor PayQ, which is now active in India in a sandbox environment along with other leading UPI player have started to tap into the new customer trend who relies deeply on smartphone access for online payments. Financial companies are leveraging this opportunity to meet demand through digital media.

PayQ founder Shibabrata Bhaumik is fond of Indian Financial regulators like RBI and SEBI who encourage the innovation in the Fintech space by allowing start-ups to experiment in ‘sandboxes’ that will offer them temporary regulatory protection especially during the pandemic stage.

As regulators like RBI and SEBI develop the framework for these sandboxes, UK-based fintech start-up PayQ now wants to be allowed into these sandboxes to get more comfortable with financial transactions for domestic as well as cross border transactions.

Shibabrata’s Fintech start up PayQ, headquartered at London, which is growing at breakneck speed, is known for implementing block chain for Frictionless Payments and has surged $1.2 billion in the last financial year.

In conversation with Digpu, Shibabrata said, “As regulators and state governments here in India has set up sandboxes for Fintech companies and they are providing relaxation, we are working with them to open the sandboxes and operate within the guidelines”

Sandboxes are regulatory safe havens created for Fintech start-ups to operate in. They allow live testing of new products or services on real customers in a controlled environment. If these experiments are successful and PayQ grows to a pre-determined scale, PayQ will soon exit the sandbox to operate in the open market under full regulatory supervision and will compete with the major UPI payment players like PhonePe and PayTm.

PayQ’s digital payment platform also includes digital billing to even geotagging, Shibabrata believes that merchant digitization business will boom when the lockdown eases. PayQ also deals with merchant account for high risk businesses like payment gateway for tech support, Merchant account for Pharmacy and aims to go beyond the traditional payment method to revolutionize the e-commerce industry.

Shibabrata announced small ticket credit to PayQ Merchants like Kirana Shops and small businesses. PayQ is the latest entrant to the club of Paytm, PhonePe and BharatPe, with the company announcing its ambitions to lend in a filing with local regulators. PayQ is unlikely to play for runners’ and players like Paytm and Phonepe will have to aggressively defend their crowns

PayQ’s entry to India comes at a very opportune time. During the lockdown, several questions have been raised about the readiness of the Indian grassroots system to allow its small businesses to participate in an end-to-end digital ecosystem that powers content, transactions and finally, payments and fulfillment. With this one move, PayQ have clearly sent out signals to take on the giants in the payments, content and ecommerce spaces, simultaneously.

PayQ’s entry portends well for India, as it is likely to bring more serious and diversified investors in the country, reducing its reliance on Chinese money. However the Indian consumer will be the final and the ultimate deal-seeker yet demands the best user experience at the lowest cost. Though PayQ has grown exponentially on adoption of new territory starting from United Kingdom to diversifying its merchant acquisition to European Union and then stepping to Asian Countries but its business models is still evolving. With economic growth slowing down and consumer demand in India tempered, Shibabrata Bhaumik’s PayQ is at an interesting crossroads.

Shibabrata, also popularly known as ‘Fintech Chanakya’ posits a future in which thousands of startups use crypto to raise capital in a global marketplace no longer controlled by Wall Street firms. Within a decade, he predicts, the number of people participating in the blockchain economy will explode from 50 million to 1 billion. We are destined to enjoy a financial system that is “more global, more fair, more free and more efficient”.

Given all this snitching, the final test will be “how does PayQ appeal to the end user in India?”

News Source :

Lokmat : https://english.lokmat.com/business/payq-powers-smes-to-kiranas-enables-digital-billing-to-geo-tagging/?utm_source=english.lokmat.com&utm_medium=InfiniteArticle

ANI : https://www.aninews.in/news/business/payq-powers-smes-to-kiranas-enables-digital-billing-to-geo-tagging20200520184607/

Yahoo News : https://in.news.yahoo.com/payq-powers-smes-kiranas-enables-digital-billing-geo-131604083.html

#PayQ#ShibabrataBhaumik#FintechStartup#HighriskMerchantaccount#PaymentgatewayforPharmacy#MerchantaccountforPharmacy

0 notes

Text

Phonepe App Offer: Get cash back 50Rs by sending just 1 Rupee

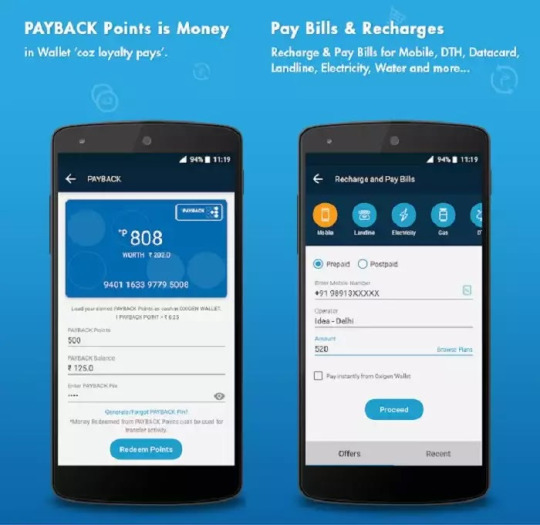

PhonePe App by Flipkart Group is a Unified Payments Interface Platform (UPI), Developed by NPCI and powered by yes bank. Now pay in Revolutionary way in India by PhonePe App. By this PhonePe App you can link your bank account Over UPI. You can instantly transfer Money Bank to bank via Mobile Number or Virtual Payment address (VPA). PhonePe App is also providing Digital wallet, Using PhonePe App wallet you can get cash back or refunds from Popular Merchants.

Flipkart has introduced new payment option ‘Phonepe’ in addition to FK wallet just before a month. Looks like Flipkart is planning to break the dominance of Paytm & Freecharge in Indian market.

PhonePe App is a Indian payment App which is going to create huge impact in online transactions. By this PhonePe app you can do transactions on your favorite shopping sites including Flipkart, Jabong, Myntra and many more. Same as Paytm, you can also do mobile recharge, DTH recharge easily with a tap of button. The best thing about this is you can do transaction up to 1 lac through PhonePe App. This transaction limit varies this App from other rival sites where they allow very small amount.

Send 1 Rupee & get 50 Rs cash back by PhonePe App:

Using PhonePe App you get 50 Rs cashback by sending 1 Rupee. This Offer is valid on first app transaction. Submit your details in PhonePe App and link your bank account and send one rupee to anybody who using PhonePe wallet. After sending money to other PhonePe wallet user, you will get 50Rs back in account. This offer is valid till 24th December 2016.

Recommended : How to Link Aadhaar card to SBI Account

Valid Points to follow to get cash back 50Rs by sending Just 1 Rupee through PhonePe App:

Download PhonePe App from play store (Android/iOS)

Enter your bank registered mobile number & verify it

Now enter you bank details and create UPI on your bank

The offer is applicable only on the 1st successful transaction from your linked bank account

Valid only for first time users on PhonePe

Offer is valid only once per Android user.

Offer is valid only when you send money to other PhonePe users on their mobile number.

Please note that offer is not valid for direct money transfer to other bank accounts using the beneficiary’s bank account and IFSC code, or external VPAs.

This offer will expire on 24th December, 2016.

Cash back will be credited in PhonePe wallet within 1 working day.

6 notes

·

View notes

Text

Best Mobile Payment Apps for 2021 that pays you Real Money

With the unstoppable rise of e-commerce, online businesses have seized the opportunity to become an important part of the global economy. Because these companies act like offline stores, they also need the same customer journeys - even faster and easier - to get their product to market. To make sure of that, they need to work with the best partners and have a satisfying inventory. This led the financial sector to also have an online presence. Banks have also created applications, websites, and online payment options to reach their customers through online businesses. This has led to a new era of partnerships. Payment gateways were also part of this revolution.

Life was made easy and stress-free with digital payment and recharge apps. They have given us the freedom to pay anytime, anywhere prepaid / postpaid mobile numbers, landlines, electricity, insurance, and gas bills.

Besides? These apps offer huge discounts and deals with every top-up, making them even more useful. This success can be measured by the large number of mobile recharge services that have grown in India in recent years.

New services are usually the ones that offer the most attractive deals. So if you are looking for mobile and bill payment apps that offer comprehensive and efficient solutions, this is where you need to put in some effort.

I have seen people buy loads of apps from Google PlayStore or Apple iStore. But there are also some free top-up apps available in stores that allow you to earn some top-up money to pay your bills. These are special apps designed to earn real money and rewards using a few simple steps / tricks. Yes that’s true All you have to do is install such a money earning app and do some very simple tasks like watching videos, solving a challenge or quiz etc. These are the best paid apps for earning money. And now is the right time for your smartphone which is really productive for you.

Nowadays, almost everyone is trying to do something different for their job so that they can earn money a parallel, such as a part-time job, stock market, work from home, data entry, investing, etc. But there are very simple and effective ways you can make you sit home. I managed to find some mobile applications available in the App Store that earn you free top-ups, paytm cash and many more rewards using your smartphone. allows for.

There is no point in using a “smartphone” if you are not using it “smartly”. I hope you agree with my statement. Most of you have an Android / iOS mobile device and now is the right time to use a smartphone to earn some money with it. Don’t worry, let me tell you how we can use your mobile smartly.

But today, I’m going to share with you the best money making apps I’ve personally tested, and help you earn some free recharge cash. You just need to install the apps and earn money with these latest apps. You can easily earn rewards by downloading the app and have unlimited free recharges by referring your social friends.

Top Online Recharge Apps to Earn Money

I personally tried and tested these apps and then divided them in our opinion to help you find out which app to try first. But I would advise you to try them all, you probably like all the apps. Some also help you get more rewards in less time. Most working and top-grossing mobile apps to earn real money and rewards:

BHIM – Making India Cashless

Nowadays people do all their transactions online through banking apps just to be “Cashless”. For this, BHIM app is developed by Govt. of India. And to go cashless, this app is the most beneficial, preferrable, secure, and helpful app to do all your banking transactions.

Not only you can do your transactions with this app but you also this app provides you various other services like interesting offers and discounts while doing transactions. This app is compatible with both Android and iOS. Make sure you have linked your mobile number with your bank account and the same is used for accessing BHIM.

There are some offers for first-time users so that everyone can take advantage of it. Every single day, you do some transactions using your bank account, but you can refer and earn money from this app instead of using this “cashless transaction facility”.

Khatriji – Utility Bill Payment & Online Recharge

By using Khatriji Website, you will get or earn money on Online recharge. you will earn while you refer a friend that can be shared to anyone and earn your referral reward points. Simply, doing online Recharge and Earn more with value added services like Utility Bill Payments, Mobile/DTH Recharge.

You can earn cash anytime and from anywhere, there are no complicated missions to visit places or wander around and best of all it’s an easy, quick and fun way to make easy money! Make money is the best online recharge website!

Empire ReEarn – Earn Money without Investment

Easiest Way to Earn Money. Your online prepaid recharge is just a click away with Empire ReEarn! Empire Re Earn is your one-stop shop solution for online recharge. For every prepaid recharge that you complete on Empire ReEarn, you may get special rewards that include cashback.

Empire ReEarn not only provide you easy accessibility, also ensure quick transactions. It is possible to complete a prepaid online recharge with us in less than 10 seconds.

Oxygen – Bill Payment & Recharge, Wallet

Here is another big opportunity for you guys and I’m talking about the app named Oxigen Wallets. This is an app that provides you free Paytm cashback offers. Oxigen Wallet is one of the most loved & widely accepted mobile wallet apps. This app is designed to work with all of your payment methods.

Developers are frequently trying to give some amazing features and offer. This app is basically designed by USA country. That’s how you can make huge money by referring your USA friends.

Oxigen is giving Rs.200 FREE to all OLD and NEW users when they will refer their Indian-USA friends i.e. Indians who are living in USA right now. It’s very simple and easy, you will get Rs.200 mobile recharge on referring them on Oxigen USA mobile app. Oxigen is the one-stop solution for all your payment needs.

Cashbuddy – Paytm Cashbacks & Deals

Cashbuddy (or Databussy) is one of the biggest shopping cashback platforms over the internet. This app allows you to earn huge cashback and offers by shopping on Amazon, Flipkart, Jabong, Myntra, and over hundreds of other top shopping sites. You will see top trending brands and coupons for shopping. Earn cash on every action on Databuddy, which can be redeemed for mobile recharge.

You will also get coupons for Top Sales at Amazon like Prime day sale and great Indian festival sale, at Flipkart like Big Billion Days sale and many other sales like; Snapdeal unbox sale, Myntra, Ajio. Whatever you earn from all the deals that you will make, you can redeem cashback on Paytm, Amazon, and Flipkart, etc. Also, you can earn free cash by inviting your friends and family to try Casabuddy by sharing a link through WhatsApp, Facebook, Twitter, SMS, and Gmail.

Quite beneficial for first-time users of this app i.e. new users will get Rs.10 as a sign-up bonus and if you refer to your friends it will fives you Rs.10 more for each successful referral.

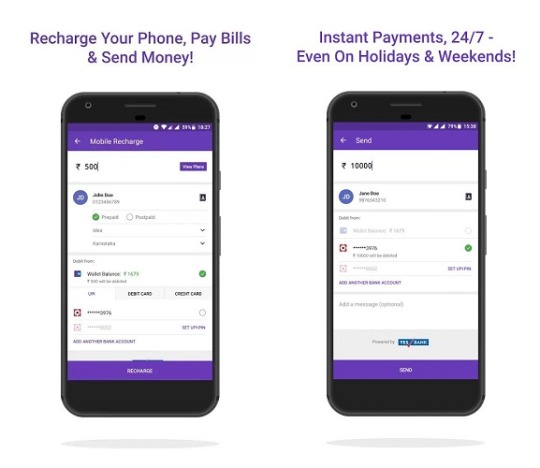

PhonePe

The PhonePe is the easiest solutions to mobile recharges and bill payments. It is a UPI-enabled app that can link directly to your bank account for transactions. The PhonePe app supports everyday payments of utility bills, mobile recharge, funds transfer to friends and family, request money, etc. and is quite simple to use.

Apart from this, the app also offers mobile-wallet service, multiple payment modes, and will often surprise you with offers like cash back and discounts. One can also earn handsome rewards from PhonePe by referring the app to others.

Unfortunately, the app doesn’t have the option to load money from your credit card in the wallet. You can pay your bills and do recharges using credit card, though.

Amazon Pay

Another payment is Amazon’s digital payment app. This is an integrated feature in your Amazon account. Using Amazon Pay you can add money to your account to pay for goods and services purchased from websites and mobile apps.

Amazon also partners with various services to promote its e-payments and offer discounts and cash back using pay balances. You can add up to Rs. 10,000 on Amazon Pay and use it to pay for food orders, movies and events, ebooks and more. There is also a monthly cashback offer on loading money in the wallet on Amazon. However, one thing missing from Amazon’s heavy artillery is the bill payment option.

Paytm

Paytm is the most popular and reliable app for online recharge and bill payment. Dynamic e-wallets and the UPI app provide payment, money transfer, shopping, recharge features, bill payment, and a myriad of other services including movie, bus and air tickets on its platform.

Paytm now has over 300 million users and is probably its biggest loss. Now, it has determined for itself once in the market that there are limited deals, discounts and cash back in the application.

Mobikwik

Mobikwik app is a hassle free mobile payment app for all your utility bills, mobile recharge and shopping. The app benefits from its e-wallet that can be used to pay at top merchants such as Big Basket, Book My Show, eBay, Myntra, Grofers, IRCTC, Domino’s Pizza, Shop Clues, Oyo Rooms and more.

Mobikwik wallet feature also comes with super cash-back offer. The app supports limited money transfers and it is literally impossible to use the entire super cashback.

Freecharge

Freecharge is one of the first online recharge and bill payment apps. Although it is now in a decreasing state, it offers several specific deals, among which users are notified via email. It has a simple and smooth process with various coupons, which can be used at your partner store to get discounts.

Freecharge has also started supporting merchant payments, which may not be as widely accepted as Paytm or MobiKwik, but are continuing progress.

PayZapp

PayZapp is an HDFC mobile platform e-recharge app offering for all. With PayZapp you can shop on partner apps on your mobile, buy movie tickets, groceries, compare and book flight tickets and hotels, shop online and get great discounts. The app can also be used to share money with anyone in your contact list or in your bank account, pay bills and recharge your mobile, DTH and data card and many more.

These are the main mobile payments widely used in India. While every app on its platform has charging and payment options, they differ from each other in one aspect. If you want to keep up to date with the latest offers and deals on various portals, you can also visit the Build Side Income.

So these are the most recent and updated apps that let you earn and recharge money for free, and some of them also save your money or mobile data. Go try them out and comment which app you like best and make more money together. Anyway, if you think something more promising is what I mentioned above and would like to suggest other things, don’t hesitate to use the comment section below. You can always contact me. Nice to hear from you and would like to share as much information as possible to help others.

Source : Earn Money With Payment Portals

#BHIM#BillPayments#Cashback#earnmoney#EmpireReEarn#khatriji#netbanking#online recharge#oxygen#paymentportals#skyomie#phonpe#paytm

0 notes

Text

#merchant account#merchant account pricing#merchant account rates#merchant account providers#merchant account fees#what is a merchant account#merchant account processing#merchant services#how to create paytm merchant account#merchant account rate#paytm merchant account#merchant accounts#binance merchant account#high risk merchant account#merchant account application#create paytm merchant account#without pan paytm merchant account

1 note

·

View note

Text

Rules To Ensure Safe Online Payments

With the new spawning of the digital world, online payments’ evolution is a vast way of its depth. More and more Indian buyers and customers shift from a traditional way of payment to credit or debit card payments to payment apps that flinger clearance of amounts with just a click away. Thus there are a huge number of reasons to crave a vigilant path while making online payments. Following a path of high credibility and trust is necessary to make strong security. So following rules to ensure safe online payments are very crucial.

Why Go For Rules To Ensure Safe Online Payments?

There is no lack of traumatizing evidence these days, proving the growing risks in online thefts. Sometimes it also ensures cash backs, which further encourages more of its usage. Be it dangling in a long line for electricity payments or mere ice-cream stalls. Online payments are the call for demand these days. With increasing demand, crimes are throbbing as well. To ensure a safe online payment platform, few golden rules are the requisite need of the hour.

Although technology is developing, just like the two sides of a coin, there are pros and cons to every aspect. Customers surrender their secretive bank account details for an easier approach. It further prompts a serious threat to security. Taking into consideration the safety of online transactions, the article is based.

Some people are easily tempted by many spam emails, messages of winning the lottery to earn quick. They even send them their account details very easily. This is one of the major causes of cyber theft and so much more. For online payments, as we have to provide our personal financial information, there are highly vulnerable chances of identity theft, security threat, financial loss, and mental trauma.

Advancement in technology is exhibited in two ways. Ways in which the developers use it as their golden key to a safer lock for secure transaction, frauds search for a compatible pin to unlock.

There are many types of frauds in online payments like clean fraud, account takeover, merchant fraud, customer fraud, triangular fraud, affiliate fraud, and reshipping.

Rules To Ensure Safe Online Payments

Online payment sites provide a wide platform for price comparisons, cashback offers, and so much more. With the increase in popularity, the tragic pit holes of cyber theft, security theft, cash loss have increased rapidly.

Under the disguise of useful apps to make your work smarter, Trojan secretly loads malicious theft codes into the device. Kaspersky has recently detected a new malicious Trojan that steals money from the phone. Once the app is installed, the Trojan carries the automated clicks forwards on the web pages. It works with the Wireless Application Protocol (WAP).

It is nothing but a type of phone payment that adds charges to the phone bill directly. The Trojan silently subscribes the phone to several devices. Trojan was undiscovered till 2017, but then it suddenly started affecting mobile phones. Transactions made from laptop or pc is safer than smartphones. There are more malware attacks on smartphones than laptops or pc. Online payments are the need of the world, especially after demonetization. So, there are certain precautions one must take to make it a smarter choice.

1. The most common way to sniff out faultiness is to check out the leftmost corner, whether it is HTTP or at the beginning of the URL in the site address. Most safer sites prefer using HTTPS or Hyper-Text Transfer Protocol over Transport Layer Security. It means the encrypted transfer of information between you and the server.

2. Use a computer for transaction procedures as smartphones are more prone to malware attacks. Use Google Chrome with a trusty anti-virus and HTTPS. Make sure you scan it regularly.

3. Make sure you grab yourself a temporary credit card. These are very much crucial as in case its information gets stolen; it is of no use. However, they are just for one-time usage purposes. In case you are a person of regular transactions, this won’t satisfy you.

4. Put up a strong password. Well, it may sound ‘not that important,’ but I can tell you it really is. Giving a strong password adds to more security.

5. Create a separate, private e-mail address; you don’t use it for any personal notice. Just keep it for online payment types.

6. Don’t go for free Wi-Fi spots. It is nothing but just another tactic used by thieves to steal information. They subscribe it automatically with the help of WAP into different servers. The major drawback of WPA2 is the encryption standard.

The biggest threat with free public Wi-Fi is lending a helping hand to the hackers to a position between you and the connection. They extract all your e-mail, phone number, Credit card, etc. information. So instead of visiting a shop for getting free Wi-Fi with a cappuccino, you end up giving all your personal information to the hacker.

If you don’t have an option, but public Wi-Fi, then use Virtual Private Networks or VPN. It allows you to make a secure internet connection.

7. Avoid using any online payment app you see. There are various apps to make your online transactions easier, smarter with lots of cash backs, and many more offers. In the present scenario, one of the trusted online transaction apps that is Pay pal. There are many more like Google Pay, Paytm, etc. So make sure you are always in reliable hands.

8. Never make any purchase from any unknown, untrustworthy source. Okay, some may show a deaf ear to this in the name of ‘DISCOUNT’ or ‘SALE.’ Yet, purchasing something from a reliable source paying 50-100rs extra is an act of brain than buying from the unreliable source at a cheaper rate, putting your account information at stake.

Imagine you’re getting something from a site at a lower price than others. Yet, it asks you for your account number, bank details, etc.

You thought of giving your account details in a flow of saving money and flaunting your funky apparel in your ladies club. The next morning you wake up after seeing yourself in your dream wearing that gorgeous dress. As you check your phone for any new good morning texts, you see a message from your bank with 0 account balance. How terrifying even to imagine. Isn’t it?

Make sure that website is secure and trustworthy. Take a proper note about its return policies. If only a deal looks to be true, go for it else DON’T.

9. Use a PASSWORD MANAGER. Still, using your anniversary date as your universal password? Well then, you’re in the path of trouble. The password manager provides a unique, strong, and convenient password to make it stiff strong. It just makes it better accessible and secure for accessing online services. They help you in making a strong, complex password, tenacious enough to hack it. They also aid in changing passwords if you forget (I know you’re on the list of forgetting too). It also makes sure you don’t use the same password for multiple accounts (okay, I know you’re hiding your face now). Trust me, it can be hazardous.

There are many password managers like Zoho, Dashlane, Lastpass, Keeper, etc.

The present most trustable is Zoho with 15 days free trial and then paid.

10. Make your personal information private to you. Well, now you can relate to what Raavana said during his last breathe in RAMAYANA. Just Ramayana things, you know. All that I want to depict is you should never share your personal data with anybody. Howsoever close might he/she not be. You should keep something to yourself, right!

11. Make sure your smartphone is under the grip of a trusted APP LOCK. Few online payment apps do not run without app lock encryption. Yet, considering prevention is better than cure, using an app lock leads to more safety.

For example, there are payment apps like Google Pay, Phone Pay that uses a mandatory PIN for its activation and working. This PIN has to be strong, secure, and private. Remember, this PIN is different from the UPI PIN that you use for payment.

12. Always put an eye away from spam e-mails or such text messages. Hurray! You won 1lakh rupees. Send your account details in this mentioned number for easier transfer of money. Isn’t this something every one of you must have experienced surely a hundred or more times? Check your phone. Even now, it must be present somewhere.

These are nothing but just thievery norms used by jobless scammers. They send you shitty messages with an attractive representation of lottery winning. They’ll ask for further details about your account number for the transaction.

Online Payement Method

Many online payment methods make our transaction processes smooth. It provides secret encryptions to keep customers’ information safe and secure after such a huge advancement in technology, demonetization, and the demand for a smarter and effective way of sending cash. Sitting comfortably on the sofa with a cup of tea in hand, there are many blooms of online payment methods—each one promising a safer and secure checkout experience.

Apart from a smarter experience, they make it quiet and easy. Within a lapse of seconds to transfer money from one corner of the world to another, just within one sip of tea. Isn’t it?

PayPal

Amazon Pay

Google Pay

Paytm

Phone Pay

Apple pay

Stripe

Visa checkout

Card payments like debit card, credit card, etc.

Net Banking

How To Pay Online?

Making it an easy, quick, and secure process is what’s aimed by online payment developers.

1. Payment With Debit Or Credit Cards

Be it any shopping site or your school or college fee payment. As you reach the final payment site

i. Click on the credit/debit card option.

ii. Enter the required data.

iii. As the final gateway receives the information, it connects it to the acquiring bank. The acquiring bank receives the transaction information and transfers it to the card network.

iv. After you’ve put your password, a verification OTP comes, which is valid for a few minutes. Make sure your phone number is tied-up with that particular bank account.

v. Type it in that provided box and wait for a message to pop up on your phone about the complete transaction.

2. Payment With Apps

Well, this is the easiest one so far to use. Just install the app, verifying with the assigned phone number with the bank account, and your job is done. Every time you need any online payments, you can scan the QR code. Or directly send the amount to any contact or phone bills, electricity bills, etc.

Many such apps like PayPal, Google Pay, Paytm, Phone Pay, and the list continue.

Best Ways Of Online Transactions

With the increase in online transactions, the threat of crimes has increased. To outcome, there are several measures to abide by for secure online payments. No doubt, to some degree, you can rely on these vast influencing technologies encrypted with a secret code. Even when everything is right, something goes left you don’t know (well, that was sarcasm) since various types of online transaction apps like Google Pay, Phone Pay, Pay Pal, etc.

Still amongst them, Pay Pal is the world’s largest online transaction medium. Every field of business internationally accepts it.

Simultaneously, for online shopping purposes, the usage of credit/debit card media is more trustworthy. That is because many cards provide fraud protection and higher security. Thus, when shopping for a new credit/debit card, make sure you go through all its security services granted.

Free public hotspots are of the major ways how thieves steal your information. So avoid using free Wi-Fi from the cafe or the hotel you’re residing in.

Frequently Asked Questions

1. Which is the best way for online payment?

For shopping, purposes use credit or debit cards, electricity bill payments, school/college fees, etc. you can use online transaction apps like Google pay or Pay pal.

2. Which is the safest medium to pay online?

The safest medium is the one that does not use any account information. Make a bold note of it never to share your account or any such information with anyone during online transactions. Online payment ways never ask for such unless its fraud.

3. Which is a safer way for online transactions, Credit cards, or online apps like PayPal?

The credit card offers a lot of security safe ways for online transactions. With the advancement in technology, payment options like Credit card and PayPal have attracted many customers. Added to that, PayPal is the most secure online payment apps in comparison to the rest. Even though there are all safety measures, there are still ways how information can get stolen. Be it by HTML interception, server bleaching, HTTP instead of HTTPS, etc. Technology is changing every day to make it better. But it can’t always be 100% percent secure in not letting your information scrapped off.

While online apps are more prone to online thefts, Credit or Debit cards are vulnerable to physical stealing, scamming, or skimming. Online transaction apps use safer ways like- Gateway, encrypted codes. Even Credit card companies invest hugely for a secure transaction process; still, all Credit card companies are not reliable. One sentence for a thousand words, using reliable online payment apps in requisite trustworthy sites and Credit cards from a trusted source, is what sounds justice to the problem. 1. For online shopping purposes, use a temporary Credit card (refer above for more ) 2. Always make transactions from a computer and not a smartphone.

4. How to testify if a website is secure?

Look for the following options for getting a proper light about conforming if a site is actually secure- 1. Website address- The address bar has to start with https:// and not https where S stands for Secure. There are many such fake websites where it is found, so make sure to look at it. 2. The address bar turns green- You must have marked as you’ve typed or copied an address, and o,n reaching, it turns green. Well, it is nothing but an indication of a safe way ahead. 3. Padlock symbol- Take a glimpse at the padlock symbol too. 4. Relevant certificate- If you get a padlock symbol, you can know who has registered that site. You can get a certificate if it is a trusted site, but if ignored, don’t give a second thought and escape.

Conclusion

By now, you must have been clear about the safety platforms of online payments. So, the next time you go for online payment, you know what is best for you.

source http://invested.in/rules-to-ensure-safe-online-payments/

1 note

·

View note