#how forex trade quoted

Explore tagged Tumblr posts

Text

How Forex Trades are Quoted?

Introduction

The world of online Forex trading is expanding at a rapid rate. To be precise, this market witnessed over $6 trillion in transactions and millions of traders speculating on the market. The best part is Forex market is an unlimited ocean of vast possibilities. So, it’s natural to say that more of millions of traders will come and participate foreign exchange market.

To make a profit in fx trading, you need to buy on the cheap and sell when the price is high, however, this doesn’t have to happen in that specific sequence. You need to be familiar with the way currencies are quoted if you want to calculate how much money you are paying or receiving from a currency transaction.

Since there are no official exchanges for trading currencies, over-the-counter markets are where currency transactions take place. As a direct result of this, there is no global exchange rate that is considered official.

Brokers & Fx Market

The most traded currency pairs and their exchange rates that are reported in the news and on the internet receive their quotes from a variety of different sources; however, when a trader decides to do a transaction, Dealers determine their prices in accordance with the buy and sell orders they are currently receiving, thus the exchange rate will almost certainly differ.

As a consequence of this, various dealers will report somewhat different rates, despite the fact that arbitrage serves to eliminate significant disparities between the various marketplaces.

In the foreign exchange market, there are three sorts of key participants: reporting dealers, other financial institutions, and non-financial clients:

Commercial banks, investment banks, and securities firms are examples of the types of businesses that fall under the category of “reporting dealers.” These businesses conduct trades with large corporations, governments, and other financial institutions, and they do so for the benefit of both their customers and their own proprietary accounts.

In addition, they engage in business on the interdealer market. Many of them also act as liquidity providers for brokers, providing the bid and ask prices on currency pairs that are shown to retail consumers on the trading platforms of the brokers.

Other financial institutions are financial institutions that are not reporting dealers, including insurance firms, finance divisions of large corporations, and investment funds, such as pensions, hedge funds, and money markets. Also, central banks, as they sometimes undertake currency transactions to alter the exchange rate.

Customers that do not fall into the first two categories make up the non-financial customer base; the nonfinancial customer base is dominated by corporations and governments.

Since reporting dealers undertake the majority of foreign exchange transactions, they have a more precise understanding of the supply and demand for each currency pair, resulting in a more precise foreign exchange rate. However, there will be some variations in the currency rates quoted by various dealers. Virtually all transactions done by reporting dealers are completed online.

How to Read Currency Pairs?

The International Organization for Standardization has established codes for clearly identifying the currencies (ISO). The ISO standard for currencies is ISO-4217, which lists both the alphabetic code and numeric code of more than 200 currencies, as well as any minor units of the currency, the smallest subdivision of the currency.

However, the ISO depicts the minor unit of a currency in a peculiar manner. The log base 10 of the number of minor units equivalent to one unit of currency is used. Consequently, since 100 cents equals $1, the minor code for USD is 2, as 102 cents equals $1. In reality, the minor currency code for the majority of currencies is 2.

The first two characters represent the nation, while the third letter represents the currency. The most well-known example of this is the United States dollar — USD. The Canadian dollar (CAD), the Australian dollar (AUD), and the New Zealand dollar (NZD) are also referred to as dollars. As can be seen, each of these symbols concludes with the letter “D,” which signifies the dollar name. Occasionally, though, the nation name or currency symbol is not the most popular name.

Thus, the sign for the Swiss franc is CHF, where CH stands for Confederation Helvetica, which refers to Switzerland, and MXN stands for the Mexican Nuevo Peso, despite the fact that the peso is the more recognized word for Mexico’s currency.

In addition to currencies, four metals known as forex metals or FX metals may be traded in forex accounts. Their sign consists of the element symbol followed by the letter X:

Gold: XAU

Silver: XAG

Palladium: XPD

Platinum: XPT

In order to facilitate the representation of currencies in computer systems and to identify currencies for countries that do not use the Latin alphabet, a three-digit numeric code is also specified for each currency. For example, the numeric code for USD is 840.

One of the functions of currency is to facilitate barter. Money is wanted less for its own sake than for what it may be traded for. Consequently, money forms one side of practically every transaction. Consequently, cash is swapped for a vehicle, food, services, etc. Because money is the global medium of exchange, all other values are measured in terms of it. I can purchase a loaf of bread for $2 and a vehicle for $20,000, respectively. Both prices are stated in terms of the amount of money required to acquire the item.

However, there is a way to view these transactions that facilitates better comprehension of currency exchanges. Buying a loaf of bread for $2 is equivalent to selling a loaf of bread for $2. In other words, this is only a transaction. Since currency is the medium of exchange, all prices are expressed in terms of currency.

However, when purchasing currency, both items exchanged are money. When examining currency quotes, it is essential to comprehend the format of the quote.

Currency Quote Format in the Foreign Exchange Market

Currency is commonly expressed in pairs. The first price is referred to as the base currency, and its value is a unit of that currency. The second currency is referred to as the quote currency (also known as the counter currency), which is the quantity of the second currency that is equivalent to one unit of the base currency.

Base Currency/Quote Currency = Exchange Rate

Consider the following exchange rate:

If GBP/USD=2

This means 1 British pound may be purchased for 2 United States dollars when the GBP/USD ratio is equal to 2.

Quote Currency/Base Currency = 1/(Base Currency/Quote Currency)

Example: If GBP/USD = 2

Then, the exchange rate for USD/GBP is 1/2 = 0.5, and one USD may be obtained by exchanging half a GBP.

Summing up: A quotation for GBP/USD is the amount of United States dollars (USD) required to acquire 1 Great Britain pound (GBP), or how much USD would be received for 1 GBP.

Priorities of Currencies

There is a standard in the foreign exchange for assigning the base currency to a currency pair, so when currencies are quoted, the most traded currency with the highest priority is the base pair. The relative importance of the main currencies is as follows:

Euro

British pound (aka Cable)

The GBP/USD pair is known as the Cable because price quotes were delivered by transatlantic cable in the 19th century.

Australian dollar (aka Aussie)

New Zealand dollar (aka Kiwi)

US dollar

The Canadian dollar (aka Loonie)

Swiss franc (aka Swissy)

Japanese yen

Online Forex Trading platforms will thus quote EUR/USD rather than USD/EUR and USD/CHF rather than USD/EUR. All other currencies are deemed small. Typically, the major currency is listed as the base currency in forex quotations of a major and a minor currency.

In some circumstances, however, several sorts of quotations may be preferable, and the media may report different quotations. The primary benefit of these various forms of quotations is that the base currency or quote currency stays constant across all currency pairings, regardless of currency priority. For example, American forex consumers would be primarily interested in American quotations, since they like to see the value of foreign currencies per $1. In the United States, currency futures are also reported as American quotations.

There are four primary categories of currency quotes:

Direct Quote: The base currency per unit of the other currency, i.e., the dollar. Currency Quotation / Base Currency

Indirect Quote: The number of foreign currency units per unit of the base currency; this is how currencies are often quoted, i.e. Base Currency/Quote Currency

American Quote: The number of USD per unit of another currency, expressed as a direct quote where USD is the base currency, i.e. USD/Unit.

European Quote: This is an indirect quote where USD is the base currency, i.e. Units/USD. The number of foreign currency units — any foreign currency, not necessarily only the Euro — per 1 USD.

1 note

·

View note

Text

Greed Is Not As Bad As You Think

#greed#don't be greedy#greed is good#don't be greedy or you'll lose#pot of greed#greed quotes#controlling greed while trading#airline greed#quotes on greed#greed is not the problem this is#investing and greed#on greed#greedy#greed and fear in forex#greed is not the problem#greed words#greedy cup#what is greed#greed (quotation subject)#how to control greed & fear during trading#american greed#science of greed#corporate greed#greed enumeration#educational#did you know#interesting#information#inspiration#motivation

0 notes

Text

Navigating the Forex Market: A Beginner's Guide to Currency Trading

https://www.brokersview.com

In today's interconnected world, the foreign exchange (forex) market stands as the largest and most liquid financial market globally, with a daily trading volume exceeding $6 trillion. As a newcomer to the world of finance, understanding the basics of forex trading can be the first step toward harnessing its potential. In this post, we'll provide an introductory guide to help you navigate the forex market.

What is Forex Trading?

Forex, short for foreign exchange, involves the buying and selling of currencies from different countries. The forex market operates 24 hours a day, five days a week, due to the global nature of currency trading. It serves various purposes, from facilitating international trade to allowing investors to speculate on currency price movements.

Key Players in the Forex Market

Central Banks: Central banks, such as the Federal Reserve (Fed) in the United States and the European Central Bank (ECB), play a significant role in the forex market by setting interest rates and implementing monetary policies that impact currency values.

Commercial Banks: Commercial banks participate in forex trading on behalf of their clients and themselves, serving as major liquidity providers in the market.

Hedge Funds and Investment Firms: Large financial institutions and hedge funds engage in forex trading to diversify their portfolios and capitalize on price fluctuations.

Retail Traders: Individual traders like you and me participate in the forex market through online trading platforms provided by brokers.

Currency Pairs

In forex trading, currencies are quoted in pairs, where one currency is exchanged for another. The first currency in the pair is the base currency, and the second is the quote currency. The exchange rate reflects how much of the quote currency is needed to purchase one unit of the base currency. For example, in the EUR/USD pair, the EUR is the base currency, and the USD is the quote currency. If the EUR/USD exchange rate is 1.20, it means 1 Euro can buy 1.20 US Dollars.

How Forex Trading Works

Forex trading involves speculating on whether a currency pair's value will rise (appreciate) or fall (depreciate) in the future. Traders can take two primary positions:

Long Position (Buy): A trader buys a currency pair if they believe the base currency will strengthen against the quote currency.

Short Position (Sell): A trader sells a currency pair if they expect the base currency to weaken compared to the quote currency.

Risk Management

Forex trading carries inherent risks due to the volatility of currency markets. It's crucial to implement risk management strategies, including setting stop-loss orders to limit potential losses and diversifying your trading portfolio.

Choosing a Forex Broker

Selecting the right forex broker is a critical step for beginners. Look for brokers regulated by reputable authorities, offering user-friendly trading platforms, competitive spreads, and excellent customer support.

Educational Resources

Learning is an ongoing process in forex trading. Take advantage of educational resources provided by brokers, online courses, webinars, and trading forums to enhance your understanding of the market.

Conclusion

Forex trading offers opportunities for profit, but it's essential to approach it with knowledge, discipline, and caution. As a beginner, start with a demo account to practice your trading strategies without risking real money. Over time, you can gain confidence and experience to make informed decisions in the dynamic world of forex trading. Remember that success in forex trading requires continuous learning and adaptation to changing market conditions.

2 notes

·

View notes

Text

How to Short Forex: Short Selling Currency Details

This article explores the basics of short selling forex, using the EUR/USD currency pair as an example to explain the steps involved. It also advises on suitable risk management throughout the trade journey.

What does short selling currencies involve?

The term ‘short selling’ often confuses many new traders. After all, how can we sell something if we don’t own it?

This is a relationship that began in stock markets before forex was even thought of. Traders that wanted to speculate on the price of a stock going down created a fascinating mechanism by which they could do so.

Traders wanting to speculate on price moving down may not own the stock they want to bet against; but likely, somebody else does. Brokers began to see this potential opportunity; in matching up their clients that held the stock with other clients that wanted to sell it without owning it. The traders holding the stock long (buy position) can be doing so for any number of reasons. Perhaps they have a low purchasing price and do not want to enact a capital gains tax.

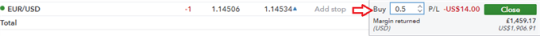

How to short forex: EUR/USD short selling example

Taking a short position in forex involves understanding currency pairs, trading system functionality and risk management.

First, each currency quote is provided as a ‘two-sided transaction.’ This means that if you are selling the EUR/USD currency pair, you are not only selling Euros; but you are buying dollars. Because of this, no ‘borrowing,’ needs to take place to enable the short sale. As a matter of fact, quotes are provided in a very easy-to-read format that makes short-selling more simplistic.

Want to sell the EUR/USD?

Easy. Just click on the side of the quote that says ‘Sell.’ After you have sold, to close the position, you would want to ‘Buy,’ the same amount (if you end up buying at a lower price than where it was sold, you would end up with a profit — excluding commission and fees). You could also choose to close a partial portion of your trade.

For example, let’s assume we initiated a short position for $100 000 and sold EUR/USD when price was at 1.29.

If the price has moved lower, the trader could realize a profit on the trade (excluding commissions and fees). But let’s assume for a moment that our trader expected further declines and did not want to close the entire position. Rather, they wanted to close half of the position to cover the initial cost, while still retaining the ability to stay in the trade.

Our trader, at that point, would have realized the price difference on half of the trade (50k) from their 1.29 entry price to the lower price they were able to close on. The remainder of the trade would continue in the market until the trader decided to buy another 50k in EUR/USD to ‘offset,’ the rest of the position.

How to manage the risk of short selling currencies

Short selling forex carries high risk as there is no maximum loss on a trade. Losses are unlimited, as forex values can theoretically increase to infinity. On a long (buy) trade, the value of a currency can never fall below zero which provides a maximum loss level.

Managing risk on accounts was a trait we discovered with successful traders. Fortunately, there are ways to mitigate this short selling risk:

Implement stop losses.

Monitor key levels of support and resistance for entry/exit points.

Stay up to date with the latest economic news and events for potential downside risk.

Employ price alerts on trades is a good way to stay informed when you’re away from your platform. Price alerts are mobile/email notifications that update traders when certain price levels are reached on a specific market. These price alerts can be predetermined to suit the traders key levels.

Short selling forex is preferred for down trending markets, however careful consideration is required before trading as it brings extra risk even with a bearish outlook. It has been utilised by large institutions/traders as hedges, or by traders looking to trade descending markets. Risk management is essential for proper application, and the methods mentioned in this article should be given the utmost consideration as adverse movements in price can be detrimental.

Further reading recommendations

Many forex traders have significant experience trading in other markets, and their technical and fundamental analysis is often quite good. However, this is not the case 100% of the time. Take a look at What is the Number One Mistake Forex Traders Make? for more insight.

Successful trading requires sound risk management and self-discipline. Find out how much capital to risk on your open trades.

We host multiple webinars throughout the day, covering a lot of topics related to the Forex market like central bank movements, currency news, and technical chart patterns being followed.

To get involved in the large and exciting world of forex check out our Forex for beginners trading guide.

#financialservices#forextrading#gambit#marketing#youtube#forexbot#accounting#forex online trading#wealthmanagement#forex

2 notes

·

View notes

Text

Forex For Dummies: A Hobbyist’s Guide to Currency Trading

Hello there, fellow traders and aspiring enthusiasts! I’ve been navigating the fascinating world of Forex trading as a hobby for a good few years now. If you’re considering diving into this exhilarating pastime, you’ve come to the right place. This article will serve as your introduction to Forex trading, breaking down the key terms, concepts, and processes you’ll need to know.

Quick Plug: Hey, I’m Ingrid Olsen, dabbling in Forex trading whenever I get a chance. I’ve been using decodefx.com (by Decode Global) for my trades and seriously, it’s a game-changer. User-friendly, secure, and filled with useful features — it’s got everything you need for a smooth trading experience. Give it a go, and you’ll see what I mean!

The ABCs of Forex

Forex — short for foreign exchange — is all about trading one currency for another. It’s the world’s most liquid financial market, with daily trading volumes exceeding a staggering $5 trillion. What’s unique about Forex is that it’s decentralized — there’s no central exchange, and trades happen directly between two parties, round the clock, five days a week.

Let’s Talk Pairs

In the Forex market, currencies are traded in pairs, like EUR/USD (Euro/US Dollar). The first currency listed (EUR) is known as the ‘base’ currency, and the second one (USD) is the ‘quote’ or ‘counter’ currency. The value of a currency pair indicates how much of the quote currency it takes to buy one unit of the base currency. So, if EUR/USD is trading at 1.20, it means you need 1.20 US dollars to buy 1 Euro.

Interpreting Forex Quotes

When you see a Forex quote, you’ll notice two prices: the ‘bid’ and ‘ask’ price. The ‘bid’ is the price you can sell the base currency for, while the ‘ask’ is the price you can buy it. The difference between these two prices is the ‘spread’ — which is essentially your broker’s commission for the trade.

Going Long or Short

In Forex trading, you can ‘go long’ or ‘go short’. Going long means you’re buying the base currency because you believe it will increase in value against the quote currency. Conversely, going short means you’re selling the base currency as you think its value will decrease.

The Power of Leverage

One distinctive aspect of Forex trading is the use of ‘leverage’. Leverage is like a loan from your broker, allowing you to control a much larger amount than your actual investment. For instance, with 100:1 leverage, you can control $100,000 with just a $1,000 investment. But be careful — while leverage can amplify your gains, it can also magnify your losses.

The Art of Analysis

Successful Forex trading involves market analysis. This usually involves:

Fundamental Analysis: Examining economic data, political events, and social factors that could affect currency values. These can range from policy changes to economic reports and global events.

Technical Analysis: Using charts and statistical indicators to predict future price movements. Techniques might include analyzing trend lines, support and resistance levels, and using mathematical indicators.

Minimizing Risk

Forex trading, like any investment, carries risk. It’s crucial to manage this risk by setting stop-loss orders to limit potential losses, never risking more than a small percentage of your trading capital on a single trade, and keeping emotions out of trading decisions.

Finding a Broker

To start trading Forex, you’ll need to open an account with a Forex broker. Look for a regulated broker with a user-friendly platform, competitive spreads, good customer service, and hassle-free deposit and withdrawal options.

Final Thoughts

Forex trading can be a thrilling hobby, but it’s important to understand the basics before jumping in. Take the time to learn and practice (many brokers offer demo accounts), and don’t be afraid to ask for advice. Remember, the aim is not just to make profits, but also to enjoy the journey of becoming a savvy Forex trader. Happy trading!

Ingrid Olsen

3 notes

·

View notes

Text

Forex Factory: A Comprehensive Guide to the World of Trading

In the world of forex trading, information is everything. Traders who are well-informed have a higher chance of success than those who aren't. That's where Forex Factory comes in - a website that has become an essential tool for traders all around the world. This article will serve as a comprehensive guide to Forex Factory and how to make the most out of its features.

Click Here To Get The Most Accurate Forex Indicator

What is Forex Factory?

Forex Factory is a website that provides real-time market data, news, and economic indicators from around the world. It is one of the most popular forex trading websites, with a large user base of traders, brokers, and investors. The website was founded in 2004 and has since then become a go-to resource for traders looking to stay up-to-date with the latest market developments.

Features of Forex Factory

Here are some of the key features of Forex Factory that make it such a valuable resource for traders:

1. Economic Calendar: Forex Factory provides an economic calendar that lists all the major economic events happening around the world, such as interest rate announcements, GDP releases, and more. Traders can use this calendar to plan their trades and stay ahead of market movements.

2. News Section: The website also has a news section that provides real-time news updates from major news sources. Traders can use this section to stay informed about the latest happenings in the forex market.

3. Forum: Forex Factory has a large forum where traders can discuss various trading-related topics. This forum is a great place to learn from other traders and get advice on different trading strategies.

4. Market Section: The market section of the website provides real-time price quotes for major currency pairs and other assets. Traders can use this section to monitor the markets and make informed trading decisions.

5. Trading Systems: Forex Factory also has a section dedicated to trading systems, where traders can find and discuss different trading systems and strategies.

How to Use Forex Factory?

Now that we know what Forex Factory is and what it offers, let's take a look at how to use it effectively.

Step 1: Creating an Account

The first step to using Forex Factory is to create an account. This can be done by clicking on the "Register" button at the top of the website. Once you have created an account, you can log in and start using the website's features.

Step 2: Using the Economic Calendar

The economic calendar is one of the most useful features of Forex Factory. To access it, simply click on the "Calendar" tab at the top of the website. Here, you will see a list of all the upcoming economic events, along with their dates and times.

You can filter the events based on their importance, country, and currency. You can also set up alerts for specific events, so you don't miss any important announcements.

Step 3: Using the News Section

The news section of Forex Factory provides real time news updates from major news sources. To access it, click on the "News" tab at the top of the website. Here, you can see the latest news headlines, along with their sources and timestamps.

Step 4: Using the Forum

The forum is a great place to learn from other traders and get advice on different trading strategies. To access it, click on the "Forum" tab at the top of the website. Here, you can browse different topics and threads, or create your own.

Step 5: Using the Market Section

The market section of Forex Factory provides real-time price quotes for major currency pairs and other assets. To access it, click on the "Market" tab at the top of the website. Here, you can see the current prices for different assets, as well as their daily highs and lows. You can also view charts for different timeframes and add technical indicators to analyze price movements.

Step 6: Using the Trading Systems Section

The trading systems section of Forex Factory provides a platform for traders to share and discuss different trading strategies. To access it, click on the "Trading Systems" tab at the top of the website. Here, you can browse different trading systems and strategies, or create your own.

Get The Most Accurate Forex Indicator Here

FAQs about Forex Factory

Is Forex Factory free to use?

Yes, Forex Factory is completely free to use.

Can I trust the information provided by Forex Factory?

Forex Factory is a reputable website that sources its information from reliable sources. However, traders should always do their own research and analysis before making any trading decisions.

Can I connect my trading account to Forex Factory?

Forex Factory does not provide direct access to trading accounts. However, traders can use the website's market section to monitor the markets and make informed trading decisions.

Can I make money using Forex Factory?

Forex Factory is a tool that can help traders make informed trading decisions. However, success in trading ultimately depends on a trader's skills and strategies.

How often is the website updated?

Forex Factory is updated in real-time, providing traders with the latest market data and news.

Can I customize my Forex Factory experience?

Yes, traders can customize their Forex Factory experience by setting up alerts, filters, and other preferences.

Conclusion

Forex Factory is a valuable resource for traders who want to stay informed about the latest market developments. With its real-time market data, news, and economic indicators, the website provides traders with the information they need to make informed trading decisions. By following the steps outlined in this guide, traders can effectively use Forex Factory to improve their trading performance.

So, if you're looking to take your trading to the next level, be sure to check out Forex Factory today!

Get The Most Accurate Forex Indicator

#forex#forex factory#forextrading#forextips#forexindicator#forexprofit#forextrader#forexlifestyle#forexmarket#traders#xtreamforex

3 notes

·

View notes

Text

Exploring Forex Trading: A Guide to Understanding and Profiting from the Global Currency Market

Forex trading, short for foreign exchange trading, is the act of buying and selling currencies in the world's largest and most liquid financial market. With a daily trading volume exceeding $9 trillion, the Forex market offers immense opportunities for traders and investors looking to profit from currency fluctuations. In this guide, we’ll cover the basics of Forex trading, its benefits, and how you can get started in this exciting market.

What is Forex Trading?

Forex trading involves exchanging one currency for another with the aim of making a profit from changes in currency values. Forex trading pairs consist of two currencies, where one is bought while the other is sold. For example, in the EUR/USD pair, you would be buying Euros while selling U.S. Dollars. The value of this pair will fluctuate based on factors like global economic events, interest rates, and geopolitical stability, creating opportunities for traders.

How Forex Trading Works: The Basics of Currency Pairs

Currency pairs are classified into three categories:

Major Pairs: These include the most traded pairs, often involving the U.S. Dollar, like EUR/USD, USD/JPY, and GBP/USD.

Minor Pairs: These are less commonly traded pairs, typically not involving the U.S. Dollar, such as EUR/GBP or AUD/NZD.

Exotic Pairs: These involve one major currency and one from an emerging economy, like USD/TRY (U.S. Dollar vs. Turkish Lira).

Forex trading operates around the clock, with sessions in various financial centers, including London, New York, Tokyo, and Sydney. This round-the-clock market provides unique flexibility for traders worldwide.

Benefits of Forex Trading

High Liquidity: Forex is the most liquid market globally, meaning transactions are quick, and prices reflect market forces efficiently.

Leverage Options: Leverage allows traders to control larger positions with smaller capital, amplifying potential profits (though it also increases risk).

Flexibility and Accessibility: With online platforms like MetaTrader 4 and 5, you can trade Forex anytime, anywhere, with the ability to start with small capital.

Hedge Against Inflation: Forex trading offers a way to diversify and hedge against inflation by leveraging currency pairs.

Forex Trading Strategies

Day Trading: This short-term strategy involves executing trades within a single day, capitalizing on small price movements.

Swing Trading: In this approach, traders hold positions for several days to profit from larger market shifts.

Position Trading: This longer-term strategy involves holding trades for weeks or months, depending on economic fundamentals and major trends.

Scalping: Scalpers execute a high volume of small trades over short periods to capture minor price changes.

Selecting a strategy depends on factors like your trading goals, risk tolerance, and time commitment.

How to Start Trading Forex

Choose a Reliable Forex Broker: Look for regulated brokers that offer competitive spreads, secure platforms, and solid customer support. For instance, Giraffe Markets provides access to over 100 currency pairs, real-time quotes, and tight spreads.

Learn the Basics: Familiarize yourself with terms like pips, lots, leverage, and margin. Many brokers offer educational resources to help new traders understand the market.

Develop a Trading Plan: Define your trading goals, risk tolerance, and preferred strategy. A well-thought-out plan can keep emotions in check and guide decision-making.

Use a Demo Account: Practice trading with virtual funds to gain experience without risking real money. Platforms like Giraffe Markets offer demo accounts, letting you try out strategies and learn the platform.

Risks in Forex Trading

While Forex offers potential for high returns, it also comes with risks. Currency prices can be highly volatile, and leverage can amplify both gains and losses. To manage risks effectively, consider using stop-loss orders, keeping leverage low, and never investing more than you can afford to lose. Educate yourself on market trends, and keep up with global economic news, as major events can impact currency prices.

Conclusion: Why Forex Trading Might Be Right for You

Forex trading is an exciting venture that provides opportunities to profit from global currency movements. Whether you're interested in short-term trading or looking to diversify your portfolio, the Forex market offers flexibility, accessibility, and potential for significant returns. With a reliable broker like Giraffe Markets, you can access powerful tools, competitive spreads, and a secure trading environment. Start exploring Forex trading services with Giraffe Markets today and unlock the possibilities in the world’s largest financial market.

Trading in Forex can be a rewarding pursuit when approached with the right knowledge and risk management strategies. Whether you’re a beginner or a seasoned trader, there’s always room to grow and refine your approach in this dynamic market.

0 notes

Text

What is Forex Trading? A Beginner’s Guide

The foreign exchange market is what Forex stands for. Forex trading is also called FX trading, currency trading, and foreign exchange trading. All of these terms can be used interchangeably in the financial world. The global Forex market is not like a stock exchange like the New York Stock Exchange (NYSE). Instead, it is a decentralized market. Most foreign exchange deals happen over the counter or off-exchange. Stocks are traded on physical public exchanges, but Forex currencies don’t have a place where they are kept. Online Forex Trading is mostly conducted on the internet through a broker.

In the foreign exchange market, the biggest players are big banks, governments, large corporations, and hedge funds. These organizations have the power to make big changes in the forex market. These are also called institutional players in the market. But there are also quite a few people who trade on the market on their own. People like these are called the retail crowd.

A retail crowd is a varied group. This could be a consumer who wants to buy something from another country, a traveler who wants to go abroad, a company doing business in another country, or an investor or trader who wants to take advantage of price changes on the Forex market. Now that we know who the buyers and sellers are, let’s move on to how Forex trading works.

How Does Trading Work in Forex Industry?

Foreign Exchange Trading is the exchange of one currency for another. Typically, money is exchanged for a good or service. In stock trading, money is exchanged for firm shares. When we trade on the Forex market, we swap one currency unit for another currency unit. The United States Dollar (USD), the Euro (EUR), and the British Pound (GBP) are three of the most frequently traded currencies. The Japanese Yen (JPY), the Canadian Dollar (CAD), and the Australian Dollar are also prominent currencies (AUD).

Forex traders interact through a structured group of dealers and computer networks that serve as market makers for their own consumers. Orders are placed for currency pairs (or pairs of currency that you plan to swap). Different exchange rates are connected with certain currency pairs, which is where arbitrage comes in.

For instance, if the EUR/USD exchange rate is 1.1150, it indicates that 1 Euro can be obtained for every 1.1150 US dollars.

How to Profit from Forex Currency Trading?

Like in any business, you make money when you buy something for less and sell it for more. The same rules apply to trading FX. The difference is that you aren’t buying and selling physical goods, but rather currencies.

If one of these two things happens, you can make money trading currencies on the Forex market: If you bought or sold a currency pair and its value went up, you would have made money. If you sold or borrowed a currency pair and its value went down, you lost money.

The exchange rate is affected by a number of important factors. The monetary policy of the central bank, economic data, political events, and geopolitical risk events are all important, but in the end, it all comes down to price action.

How to Trade Forex for Beginners?

Understanding how currencies are quoted and what exchange rates signify is the fundamental building block of trading on the foreign exchange market. All currencies on the Forex market are quoted in pairs. Therefore, Forex trading requires the simultaneous purchase of one currency against the exchange of another currency.

Characteristics of the Foreign Exchange Market

The most important thing about the Foreign Exchange Market is that it’s open 24 hours a day, Monday through Friday, except for weekends. When you trade around the clock, you can trade from anywhere and not have to worry about time. This means that you can trade even after you get home from work.

Start-up capital for online forex trading can be as low as $100. In addition, the costs are far lower than other asset classes, such as stock trading. Liquidity is one of the most important characteristics of the foreign exchange market. This will provide stable exchange rates because its volume exceeds $6,6 trillion. Second, you can rapidly open and close transactions with no slippage.

Leverage is the most alluring aspect of foreign currency trading. Leverage allows you to trade with larger sums of money than your initial deposit. For instance, if your preferred forex broker offers a 1:50 leverage, you can control $50 on the FX market for every $1 in your account.

Basic Forex Market Terms

The first step in learning a new foreign language is mastering the alphabet. The Forex market, which has its own alphabet and vocabulary, is comparable. It is essential to master this new language in order to comprehend the industry.

1. Currency Pair

Forex prices are given in currency pairs, which match one currency unit against another. Each currency is also shortened to three letters.

For example, the currency pair EUR/USD is made up of the euro and the US dollar. The euro, which is the first currency in the system, is called the “base currency.” The second currency in the quotation system is the US Dollar, which is called the quote currency or counter currency.

2. The Rate of Exchange – The Quote

The exchange rate is the price at which one currency can be bought or sold for another. The price quote tells you how much of the quote currency you need to buy one unit of the base currency.

Since currencies are always quoted in pairs, the value of one currency is always given in relation to another. The supply and demand law tells us what the exchange rate is.

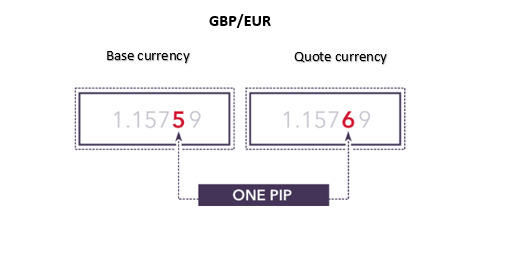

3. Pip

The smallest price change that a currency exchange rate can make is called a pip, which stands for Price Interest Point (or Percentage in Point). The last decimal of a Forex quote represents a pip.

For instance, if the EUR/USD exchange rate is 1.1500 today and 1.1580 tomorrow, we can say that the EUR/USD exchange rate has increased 80 pips.

4. Ask price

A two-price quotation system is used for understanding currency pairs. Due to this, there are two prices when you open the order window. The Ask price, or the price at which you buy a currency pair, is displayed on the right side.

For instance, if the EUR/USD quote shows the following rates: 1.1520/1.1521, you have the option to purchase the currency at the price of 1.1521.

5. Bid

The “Bid price,” also known as the “price you need to pay if you want to sell a currency pair,” is listed on the left-hand side of the two-price quote system.

For instance, if the EUR/USD quote shows the following rates: 1.1520/1.1521, you are able to sell at the price of 1.1520.

6. Spread

The spread is the amount by which the price at which you buy (Ask) differs from the price at which you sell (Bid). The magnitude of the Forex spread is typically determined by the liquidity and volatility of the market.

7. Margin

Online Forex trading does not require the whole amount to trade. Margin is the amount deposited in a small fraction (percentage ) of your trading size which covers possible losses. The broker you choose to trade with provides you with a certain multiple of that margin, which works in conjunction with leverage.

For instance, if you want to buy $10,000 worth of EUR/USD and your broker offers you the leverage of 1:50, it means that you will only need to set aside $500 in order to complete the transaction. So, if you put down $500, you can trade as if you had put down $10,000.

Type of Currency Trading Pairs

Depending on how much trading a currency does, we can put it into one of three main groups:

Major Currency Pairs: These are all the currencies that are traded against the US Dollar, which is the world’s reserve currency. For instance, EUR/USD, GBP/USD, and USD/PY. The major pairs have the most liquidity, and EUR/USD is the pair with the most liquidity.

Minor Currency Pairs: Also referred to as cross pairs, these currency pairs do not trade against the US Dollar and are considered to be of lower importance. Examples include the euro versus the pound sterling and the euro versus the Swiss franc. They provide a lower level of trading liquidity.

Exotic Currency Pairs: Also known as minor currency pairs are currency combinations that are linked to developing economies located all over the world. Examples of such currencies include the South African Rand, the Brazilian Real, and the Turkish Lira.

Understanding and Reading Forex Quotes

The standard quotation system uses a three-letter abbreviation system and always involves two currencies: the base currency on the left and the quote currency on the right. The quoted price shows how much Quote currency is needed to buy/sell one Base currency.

How to Place Orders When Trading Forex

A Forex Order is, in general, a command that is given to your broker and demonstrates the following information:

What pair of currencies to buy or sell.

How you’re going to trade (Long or Short).

Price to buy or sell.

Where to take a Profit.

How to get out of a place.

how many units (lots) to buy or sell.

Type of order

A Forex Order can be used to do two things in terms of direction:

Buy (Long): We use a buy order that is executed at the Ask price and closed at the Bid price if we think the currency pair will go up.

Sell (Short): We use a sell order executed at the Bid price and closed at the Ask price if we think the currency pair will go down.

There are five common types of orders that anyone can use to enter or exit the Forex market:

Market orders

Limit order

Stop order

A Stop-loss order

Take profit order

How to Make Your First Trade in Forex

The first thing you need to do is open a demo account with the Forex broker you like best. This will let you trade on the Forex market from a trading platform.

Once you gain the idea of entering and exiting the market through practicing on a demo account, you can open a real forex trading account. There are different types of accounts that a broker offers, you can choose the account that is best suited for you.

Best Forex Trading Platform for Beginners

MetaTrader4, which was made by MetaQuotes Software, is the best forex trading platform for beginners. Millions of retail Forex traders around the world use the MT4 platform, which is one of the most popular Forex trading platforms. Its features can be used by both seasoned forex traders and those who have never done it before.

MetaTrader 4 is free, and it has a lot of built-in features. There are a lot of different technical indicators that can help you figure out how to read a Forex price chart. You can also use MT4 to build your own automated trading strategy and test any trading ideas you might have.

Conclusion

Trading on the foreign exchange market follows the same fundamental processes as trading on any other market. Attempting to generate a profit by buying at a low price and selling at a high price. The foreign exchange market is distinguished from other markets in that it offers a variety of trading opportunities that are not available in other markets. Because of this, the foreign exchange market is an excellent choice for beginning traders who are interested in either supplementing their income or starting a trading career full-time.

Originally Published on shortkro

Source: https://shortkro.com/what-is-forex-trading-a-beginners-guide/

#online forex trading#understanding currency pairs#Foreign Exchange Market#CapitalXtend#forex trading#forex trading platform

5 notes

·

View notes

Text

Online Forex Trading: Unlocking the World of Currency Markets from Home

Online Forex trading has opened up the world’s largest financial market to individuals everywhere, allowing anyone with an internet connection to trade currencies in real time. Unlike traditional investment markets, Forex is decentralized and operates 24/5, providing endless trading opportunities across time zones from Tokyo to London and New York.

In Forex trading, currencies are traded in pairs, such as EUR/USD (Euro/U.S. Dollar) or GBP/JPY (British Pound/Japanese Yen). Traders buy or sell a currency pair depending on whether they expect one currency to strengthen or weaken against another. With constant fluctuations in exchange rates, driven by factors like interest rate changes, economic data, and geopolitical events, the market provides both risks and rewards for online traders.

Getting started with online Forex trading is relatively straightforward. Traders select an online brokerage platform that offers a secure, regulated environment with tools for charting, analysis, and real-time quotes. Many platforms provide demo accounts where beginners can practice trading with virtual funds, learning the basics of the market without risking actual money. This setup is ideal for understanding how the Forex market operates, testing strategies, and gaining confidence.

Online Forex trading also features leverage, allowing traders to control larger amounts of currency with smaller deposits. For example, a leverage ratio of 1:100 means that a $100 investment can control a $10,000 position. While this can significantly amplify profits, it also increases potential losses, making risk management essential for long-term success. Traders often use strategies like stop-loss orders, position sizing, and diversification to mitigate risk.

Both technical and fundamental analysis are key in online Forex trading. Technical analysis helps traders study price trends and patterns using charts and indicators, while fundamental analysis focuses on economic events and news that impact currency values. Many online platforms offer educational resources, news updates, and analysis tools to assist traders in making informed decisions.

online Forex trading provides accessible, real-time opportunities to engage with the global currency market. With the right strategies, discipline, and continuous learning, traders can leverage the convenience of online Forex trading to explore a dynamic, potentially rewarding financial journey right from their devices.

0 notes

Text

OTC Trading: A Guide for Weekend and After-Hours Traders

If you’re eager to trade even when the markets are closed, OTC (over-the-counter) trading could be the answer. Offering flexibility and unique opportunities, OTC trading enables you to trade beyond traditional hours, making it ideal for those with busy weekdays or who are keen to make the most of weekends.

Let’s explore what OTC trading is, how it works, and why it might be a great option for after-hours traders.

Read more in detail: https://www.investchannels.com/a-comprehensive-guide-to-otc-trading-for-weekend-and-after-hours-traders/

Understanding the OTC Market

In the financial world, OTC stands for “over-the-counter,” referring to transactions that happen outside the usual, regimented stock exchanges. Unlike standard trading hours, OTC trading is more flexible, often occurring through direct transactions between traders and brokers rather than on a public exchange.

This approach means that OTC trading operates under different conditions. Trades and quotes here are private and exclusive to specific platforms, unlike the transparent, public nature of traditional exchanges. Factors like the previous week’s trading results, asset demand, and trade volume influence OTC prices, offering unique investment opportunities outside regular hours.

Benefits and Risks of OTC Trading

The OTC market opens up trading possibilities that aren’t available during the usual trading sessions, making it an appealing option for investors looking for new chances. However, with flexibility comes responsibility. OTC trading can be more volatile on weekends due to lower trading volume, making it susceptible to greater price swings and liquidity issues. This reduced liquidity may mean wider spreads, creating additional risks for traders.

Assets Available for OTC Trading on IQ Option

On IQ Option’s OTC trading platform, you can access a range of assets outside typical trading hours. Available asset classes include:

- OTC Currency Pairs (Forex): Trade pairs like USD/JPY, GBP/JPY, and USD/MXN, allowing you to stay active in currency markets over the weekend.

- OTC Cryptocurrencies: The platform supports a variety of cryptocurrencies for OTC trading, including Bitcoin Cash, Polkadot, Cosmos, and Polygon. Cryptocurrency markets operate around the clock, providing ample weekend trading opportunities.

- OTC Stocks and Commodities: For those interested in stocks, IQ Option offers OTC trading pairs like Amazon/Alibaba, Netflix/Amazon, and Tesla/Ford. You can also trade commodities, including precious metals like Gold/Silver.

- OTC Indices: Several indices are available for OTC trading, such as the US500, EU50, HK33, and US30/JP225, allowing you to trade indices outside of their regular operating hours.

Selecting the Right OTC Assets

Choosing the right asset is essential. Here’s how you can tailor your choice based on your trading style:

- For High Volatility: If you’re comfortable with higher volatility, OTC cryptocurrency trading is ideal. The crypto market operates 24/7, so OTC cryptocurrency trading can offer exciting weekend opportunities.

- For Stability: If you prefer a more stable option, try forex pairs or major indices. These tend to have less volatility, making them a safer choice outside regular hours.

- For Experimentation: For traders looking to explore relative performance, consider trading stock pairs like Amazon vs. Alibaba. Such pairs allow you to speculate on the performance of two well-known industry players.

When choosing, remember to check IQ Option’s OTC trading hours to know exactly when each asset class is available. Simply click on the info (i) icon next to the asset in the selector to view its trading schedule.

Indicators to Use for OTC Trading

In OTC trading, your regular indicators and strategies can still be useful, but it’s wise to diversify your approach. The OTC market’s behavior may vary from traditional hours, so using multiple indicators can improve decision-making. For instance, pairing the MM and CCI (Commodity Channel Index) Strategy can provide valuable insights during OTC hours.

Tips for Successful OTC Trading

To make the most of OTC trading, consider these helpful strategies:

- Start Small: The OTC market’s unpredictability makes it essential to start with smaller investments before scaling up.

- Stay Informed: External events and news can have a greater impact during OTC hours. Keep up-to-date to respond effectively to changes in the market.

- Check the Schedule: Verify the OTC schedule on the IQ Option platform so you know when your selected assets will be available.

- Avoid Overtrading: While the flexibility of OTC trading can be tempting, overtrading can lead to unnecessary risks. Trade only when you have a clear opportunity.

Conclusion

IQ Option’s OTC trading platform opens up new possibilities by enabling trading outside regular hours, perfect for weekend traders or those with limited weekday availability. Offering a wide range of assets, including forex, cryptocurrencies, stocks, commodities, and indices, it allows for unique trading opportunities beyond traditional schedules.

However, remember that OTC markets can be more volatile and may lack liquidity, which means managing risk is crucial. By combining multiple indicators, starting with smaller trades, and staying informed, you can maximize your chances of success and make the most of what the OTC market offers.

Whether you’re after high volatility, stability, or experimentation, OTC trading offers a way to expand your trading horizons responsibly.

#OTCTrading#AfterHoursTrading#WeekendTrading#ForexTrading#CryptoTrading#StockMarket#Investing#Finance#TradingTips#DayTrading#ForexMarket#CryptoMarket#Crypto#Forex#BinaryOptions#DigitalOptions#IQOption#TradingPlatform#TradingTools#TradingStrategy#FinancialFreedom#WealthBuilding#PassiveIncome#InvestingForBeginners#MoneyManagement#MarketAnalysis#TradeSmart#LearnToTrade#MarketOpportunities#TradingCommunity

0 notes

Text

forex broker

What is Forex? A Beginner's Guide to Understanding Foreign Exchange Foreign exchange, commonly known as Forex or FX, is the global marketplace for trading national currencies. It is one of the largest and most liquid financial markets in the world, with a daily trading volume exceeding $6 trillion. Unlike stock markets, Forex operates 24 hours a day, five days a week, providing continuous opportunities for traders around the globe. Understanding Forex Basics forex broker At its core, Forex trading involves the buying of one currency and the simultaneous selling of another. Currencies are always traded in pairs, such as the EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is known as the "base" currency, while the second is the "quote" currency. The price of a currency pair represents how much of the quote currency is needed to purchase one unit of the base currency. For instance, if the EUR/USD pair is trading at 1.10, it means that 1 Euro is equivalent to 1.10 US Dollars. If a trader believes that the Euro will strengthen against the Dollar, they might buy the EUR/USD pair. Conversely, if they think the Euro will weaken, they would sell the pair. How Forex Markets Work The Forex market is decentralized, meaning that it does not have a central exchange like the New York Stock Exchange. Instead, it operates through a global network of banks, brokers, and financial institutions. This decentralized nature allows for continuous trading across different time zones, starting from the Asian market opening in Tokyo, moving through Europe, and finally to the United States. There are three primary types of Forex markets: the spot market, the forward market, and the futures market. The spot market is where currencies are bought and sold according to the current price, known as the spot rate. The forward and futures markets, on the other hand, involve contracts to buy or sell currencies at a future date, often used for hedging purposes. Why Trade Forex? Forex trading offers several advantages that attract both retail and institutional traders. One of the key benefits is the high liquidity, which ensures that traders can enter and exit positions easily without significantly affecting the market price. Additionally, the leverage available in Forex trading allows traders to control large positions with a relatively small amount of capital, potentially increasing profits (as well as risks). Moreover, the Forex market's global reach and constant activity provide endless opportunities for traders to speculate on economic and geopolitical events, interest rates, and other factors that influence currency values. Conclusion Forex trading is a complex but potentially rewarding financial activity. Understanding the basics of how currencies are traded, the structure of the Forex market, and the factors that influence currency prices are crucial for anyone interested in entering this dynamic market. As with any financial endeavor, it is essential to educate oneself and manage risks carefully to succeed in Forex trading.

0 notes

Text

Get the Best Out of TradingView: Accelerate Your Day-to-Day Trading Starting Today

Every master trader has his/her own secret techniques and methods that enable them to earn maximum profit. Regardless of the unique ways you can use to bank on the various trading opportunities, keeping an eye out on the constantly shape-shifting market is a must.

Reasons Why TradingView is Perfect for Trading

Be it forex, crypto, stocks, indices, or other markets, that you’re interested in, TradingView offers up-to-date information for all, on both global and country-wide scales. Before we explain the ways you can automate TradingView alerts and speed up your trading daily, let’s take a quick look at what makes TradingView ideal for all traders.

Updated Market Data

You can completely rely on TradingView for real-time market data as the platform does a brilliant job of providing access to the latest price quotes, indicators, and volume.

Advanced Accessibility

Thanks to advertisements and films, people imagine traders sitting all day and night in front of one or multiple screens, constantly keeping up with numerous markets. This isn’t the case with TradingView as you can easily use the platform or manage your TradingView indicator alerts through tablets and smartphones as well.

Beginner-Friendly

How to Increase Profit Without Spending More Time on TradingView?

Every trader wants to see their earned profit increase whenever an interesting opportunity comes up. However, no one, new or old, looks forward to spending the entire day occupied with the markets and their analysis. Here are the two best tips that will help you reduce trading time so that you can work less and enjoy more!

1. Upskill Yourself with Spatial Pattern Recognition

You can only make a concrete decision once you get rid of all your doubts and worries about the investment. The problem is that this process can keep you occupied for long, soaking all your energy. Going through hundreds of charts while managing the risk to assess whether you should invest or not can also cause frustration. Once you master spatial pattern recognition, you will see a significant decrease in the time you spend on analysis.

2. Opt for Automation Using TVAM

Automation is the best way to reduce your on-screen time as you rely on modern tech to manage alerts smartly. TradingView Alerts Manager is one of the most reliable tools you can use to pace up your journey to reach trading success faster.

About TVAM (TVAlertsManager)

TVAM is an effective tool that simplifies and automates TradingView alerts. It’s available in the form of a Chrome Extension and can directly integrate within your TradingView browser. TVAlertsManager��is built with security and simplicity in mind, assisting users in trading with speed and accuracy. You can count on TVAM to save, create, load, pause, edit, and delete TradingView alerts. Ready to save time on trading? Get TVAM now!

0 notes

Text

What is Forex?

The foreign exchange market, commonly known as Forex or FX, is a global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stock markets, Forex operates 24 hours a day, five days a week, as it spans across different time zones and major financial centers worldwide.

Forex trading involves the simultaneous buying of one currency and selling of another. These transactions are carried out in currency pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is referred to as the base currency, and the second is called the quote currency. The price of the currency pair reflects how much of the quote currency is needed to purchase one unit of the base currency.

The Forex market functions primarily through a network of banks, brokers, and financial institutions. Retail traders, like individual investors, participate through brokers or trading platforms, speculating on the value of currencies to profit from price fluctuations. Currency prices are influenced by various factors such as interest rates, geopolitical events, economic data, and market sentiment.

There are two main types of Forex trading: spot trading and derivatives (such as futures and options). Spot trading is the direct exchange of currencies at the current market price. In contrast, derivatives allow traders to speculate on future currency movements without owning the currency itself.

Forex appeals to many traders due to its high liquidity, low transaction costs, and the ability to trade on margin, which allows for significant leverage. However, it is important to note that Forex trading carries risks, especially due to its volatile nature. Without proper knowledge and risk management strategies, traders can incur substantial losses.

Overall, Forex provides a dynamic and fast-paced trading environment, drawing participants from all over the world who seek to profit from currency movements.

0 notes

Text

What Are Spreads, Pips, Lot Sizes, and Currency Pairs?

Explore top Forex trading platforms like Capitalix, SmartSTP, TradeEu, FX Road, Trade EU Global, and CapPlace. These brokers are highly rated for their advanced features and user-friendly interfaces. Check out the latest Forex broker reviews to find the best platform for your trading needs in 2024

What Are Spreads in Forex Trading?

In simple terms, the spread is the difference between the bid and ask price of a currency pair. The bid price is the price at which the market is willing to buy the base currency, while the ask price is the price at which the market is willing to sell the base currency.

Types of Spreads

Fixed Spreads: These remain constant regardless of market conditions. This type is common with market makers.

Variable Spreads: These fluctuate depending on market volatility. Variable spreads are often lower during times of low volatility but can widen during high volatility periods.

Why Are Spreads Important?

The spread is effectively the cost of entering a trade. Tight spreads are more favorable for traders since they reduce the cost of trading. Wider spreads are disadvantageous, especially for short-term traders like scalpers who rely on tight margins.

What Are Pips in Forex Trading?

Pips stand for percentage in point, and they represent the smallest price movement in the Forex market. For most currency pairs, a pip is the fourth decimal place in a price quote. For example, if the price of the EUR/USD pair moves from 1.1234 to 1.1235, that is a one pip movement.

Fractional Pips (Pipettes)

Some brokers quote currency pairs with an extra decimal place, creating a fractional pip or pipette. This means that instead of quoting in four decimal places, the broker quotes in five, making the last digit represent one-tenth of a pip.

Pips and Trading Profitability

Since pips measure price movements, they are key to calculating profits or losses in trades. The more pips a currency pair moves in your favor, the higher your profit.

Understanding Lot Sizes in Forex Trading

A lot in Forex refers to the size of a trade, or how much of a particular currency you are trading. Lot sizes are standardized by brokers to ensure consistent transaction sizes.

Types of Lot Sizes

Standard Lot: This equals 100,000 units of the base currency. It’s the largest lot size and is typically used by experienced traders with significant capital.

Mini Lot: Equal to 10,000 units, mini lots are one-tenth of a standard lot. They are ideal for smaller accounts or those looking to manage risk.

Micro Lot: At 1,000 units, micro lots are one-hundredth of a standard lot, making them ideal for beginner traders who wish to start small.

Nano Lot: Some brokers offer nano lots, which represent 100 units of the base currency. This size is uncommon but useful for traders with very small capital or those testing new strategies.

Choosing the Right Lot Size

The lot size you choose determines the amount of leverage and risk you expose yourself to. Larger lot sizes magnify both gains and losses, while smaller lots help to minimize risk.

What Are Currency Pairs?

In the Forex market, currencies are traded in pairs. A currency pair consists of two currencies: the base currency and the quote currency. For instance, in the EUR/USD pair, the EUR is the base currency, and the USD is the quote currency. The price of the pair tells you how much of the quote currency (USD) is needed to buy one unit of the base currency (EUR).

Types of Currency Pairs

Major Pairs: These involve the USD on one side of the pair and are the most liquid in the forex market. Examples include EUR/USD, GBP/USD, and USD/JPY.

Minor Pairs: These pairs do not include the USD. Common examples are EUR/GBP and AUD/NZD.

Exotic Pairs: These involve one major currency and one from an emerging market, such as USD/TRY or EUR/ZAR. Exotic pairs tend to have wider spreads due to lower liquidity.

Currency Pair Correlations

Currency pairs often move in relation to each other. For example, the EUR/USD and GBP/USD pairs tend to move in the same direction because both are measured against the USD. Understanding these correlations can help in creating hedging strategies or identifying potential trades.

How Spreads, Pips, and Lot Sizes Work Together

When you trade in the Forex market, these components — spreads, pips, and lot sizes — come together to influence your profits or losses. For instance, if you open a standard lot trade on EUR/USD with a 2 pip spread, the trade will need to move at least 2 pips in your favor to break even.

Example: Calculating Profit and Loss

Imagine buying 1 standard lot of EUR/USD at 1.2000 with a 2 pip spread. If the price moves to 1.2020 and you close the trade, the 20-pip movement results in a $200 profit (since one pip in a standard lot is worth $10 for EUR/USD).

Conversely, if the price moves against you by 20 pips, your loss would be the same amount, $200.

Conclusion

Understanding spreads, pips, lot sizes, and currency pairs is crucial for Forex trading success. Whether you are a beginner or an experienced trader, knowing how these elements interact will help you make more informed decisions and enhance your profitability. Every trade involves balancing the spread cost with the potential for pip gains, and choosing the right lot size based on your risk tolerance.

0 notes

Text

Discover the Future of Forex Trading with Giraffe

Join the revolution in Forex trading with Giraffe, where we prioritize transparency and cutting-edge technology to enhance your trading experience. As the Forex market evolves, we’re committed to offering you best-in-class trading practices that streamline your operations and improve pricing. Our electronic trading platform not only boosts efficiency but also helps you maintain strong relationships with clients—combining the best of both worlds.

Explore the benefits of trading with us, where you can compare quotes in real time and enjoy a more seamless trading experience. Embrace the future of Forex trading and discover how Giraffe can elevate your trading strategy. Learn more at Giraffe Markets.

0 notes

Text

MetaTrader 4 (MT4) Software

MetaTrader 4 (MT4) is one of the most widely used and recognized platforms in the world of online trading. Launched in 2005 by MetaQuotes Software, MT4 has become the go-to choice for retail traders, brokers, and financial institutions for trading in Forex, CFDs (Contract for Difference), and other financial markets. Its simplicity, flexibility, and rich features make it an essential tool for both novice and professional traders.

This article explores MT4 in detail, covering everything from its core features to tips on how to maximize your trading experience with this software.

What is MetaTrader 4 (MT4)?

MetaTrader 4 is a powerful trading platform designed for online trading in the financial markets. It is best known for its use in the foreign exchange (Forex) market but also supports trading in other markets such as commodities, indices, and cryptocurrencies via CFDs. MT4 provides real-time access to market prices, technical analysis tools, and the ability to execute trades from a single interface.

Key Features of MetaTrader 4

MT4 has stood the test of time thanks to its robust set of features. Here are some of the key reasons for its popularity:

User-Friendly Interface

MT4 is designed with the end user in mind. Its intuitive interface allows traders to easily navigate through various functions like charting, order execution, and accessing the history of trades. Whether you're a beginner or an experienced trader, the learning curve for MT4 is relatively short.

Customizable Charts and Indicators

One of MT4’s most powerful features is its customizable charts. The platform offers multiple chart types (line, bar, and candlestick) and timeframes (ranging from one minute to one month), making it easier to analyze market movements.

In addition, MT4 comes preloaded with over 30 technical indicators and analytical objects, such as trend lines, Fibonacci retracements, and oscillators. You can also create and install custom indicators to suit your trading strategy.

Automated Trading with Expert Advisors (EAs)

MT4 stands out due to its automated trading functionality. Traders can develop or buy pre-built scripts known as Expert Advisors (EAs), which can analyze the market and execute trades automatically based on predefined criteria. This allows for 24/7 trading, eliminating the emotional aspect of trading and making it easier to stick to your strategy.

Security and Encryption

Security is a critical factor in online trading, and MT4 does not compromise in this area. It uses 128-bit encryption and highly secure systems to ensure that all data transmissions between the trader and the server are encrypted and protected from hackers.

Multiple Order Types and Execution Models

MT4 supports several order types, including market orders, pending orders, stop-loss, and take-profit levels, which are essential for managing risk. Additionally, it offers different execution models like Instant Execution and Market Execution, which allow traders to choose the method that best fits their strategy.

Mobile Trading

MT4 offers mobile applications for iOS and Android, enabling traders to monitor their positions and trade on the go. The mobile platform includes most of the features of the desktop version, such as live quotes, technical analysis tools, and the ability to manage accounts and orders.

News and Alerts

Staying updated with market news and economic events is crucial for traders. MT4 integrates a news feed feature that provides traders with real-time information on global economic events. Traders can also set up price alerts to receive notifications when the market reaches certain levels.

MetaTrader 4 vs. MetaTrader 5: What’s the Difference?

Many traders often wonder whether to stick with MT4 or upgrade to its newer version, MetaTrader 5 (MT5). While both platforms share many similarities, there are some key differences between the two:

Markets: MT4 was originally designed for Forex trading, while MT5 supports a broader range of markets, including stocks, commodities, and futures.

Order Types: MT5 introduces more order types, such as Buy Stop Limit and Sell Stop Limit, which provide more flexibility in trade management.

Technical Analysis Tools: MT5 comes with more timeframes and built-in indicators than MT4, making it more suitable for traders who rely heavily on technical analysis.

Programming Language: MT4 uses MQL4, while MT5 uses MQL5. MQL5 is more versatile, but for those who are accustomed to MQL4, the transition might require some effort.

Despite the added features of MT5, many traders still prefer MT4 due to its simplicity and widespread support from brokers.

How to Get Started with MetaTrader 4

Getting started with MT4 is a straightforward process. Here’s a step-by-step guide:

Download the Software

You can download MetaTrader 4 from your broker’s website or directly from the official MetaTrader website. Once downloaded, follow the installation instructions.

Open a Trading Account

To use MT4, you'll need to sign up with a broker that supports the platform. After opening an account, you’ll receive login credentials (account number, password, and server address) that you will use to access MT4.

Login to the Platform

Open the MT4 application and log in using the credentials provided by your broker. You’ll be taken to the main trading interface, which displays a list of assets, charts, and the terminal for monitoring trades.

Familiarize Yourself with the Interface

Before you start trading, take some time to familiarize yourself with the various features of the platform. Explore the different chart types, customize your layout, and try out some of the built-in technical indicators.

Start Trading

Once you’re comfortable with the platform, you can start trading by selecting an asset and executing your first trade. Don’t forget to manage your risk by setting stop-loss and take-profit levels.

Tips for Successful Trading on MetaTrader 4

MT4 is a powerful tool, but successful trading depends largely on your strategy and discipline. Here are some tips to help you get the most out of your trading experience:

Develop a Trading Plan

Before diving into the market, create a solid trading plan that outlines your goals, risk tolerance, and strategy. Stick to this plan, and avoid making impulsive decisions based on emotions.

Use Risk Management Tools

MT4 offers several tools to manage risk, such as stop-loss orders and take-profit levels. Make sure to use these tools to limit potential losses and protect your profits.

Backtest Your Strategy

If you’re using an Expert Advisor or custom trading strategy, backtest it on historical data to ensure it performs well under various market conditions.

Stay Informed

Stay up to date with the latest news and economic events that could impact the markets. Use MT4’s built-in news feature or subscribe to third-party news sources to get the latest information.

Regularly Review Your Trades

Analyze your past trades to identify patterns or mistakes. Use the trading history feature in MT4 to monitor your performance over time and adjust your strategy accordingly.

Common Challenges and How to Overcome Them

While MT4 is user-friendly, traders may encounter some challenges when using the platform. Here are a few common issues and solutions:

Slippage

Slippage occurs when the price at which your order is executed differs from the expected price. This can happen during periods of high volatility. To mitigate slippage, try using limit orders or trade during less volatile periods.

Connection Issues

If you experience connection problems, make sure your internet connection is stable. You can also try switching servers within MT4 to see if that resolves the issue.

Learning Curve for Expert Advisors

While Expert Advisors can be incredibly useful, developing or fine-tuning them requires some programming knowledge in MQL4. If you’re not comfortable with coding, consider hiring a developer or purchasing pre-built EAs from the MetaTrader Marketplace.

Conclusion

MetaTrader 4 remains a dominant force in the world of online trading due to its user-friendly interface, robust charting tools, and powerful automation features. Whether you're a seasoned trader or just getting started, MT4 offers everything you need to trade the financial markets effectively. With proper risk management, a solid trading strategy, and the use of MT4’s advanced tools, you can improve your chances of success in the ever-changing world of trading.

If you’re ready to take your trading to the next level, MetaTrader 4 is the perfect platform to help you achieve your financial goals.

0 notes