#home equity access scheme

Explore tagged Tumblr posts

Text

After spending most of the work day in discussions of "Dear Colleague," a memo from the Department of Education which orders educational institutions--from preschool to university--to immediately cease efforts to promote diversity, equity, and inclusion--and what we're going to do about it, I was in the mood for a little direct action.

With access to a printer and no better ideas, I made 50 copies of Let America Be America Again, and tomorrow--the day "Dear Colleague" takes effect, and the last day of Black History Month--I'm going to find places to put them.

It takes a bit of fiddling to get it to fit on one piece of paper, so here's the file if anyone else wants to take part.

If you know me, you already know the poem; I post it on here on most of the patriotic holidays, but if you don't know it, it's behind the cut.

Let America Be America Again

By Langston Hughes, poet of the Harlem Renaissance

Let America be America again.

Let it be the dream it used to be.

Let it be the pioneer on the plain

Seeking a home where he himself is free.

(America never was America to me.)

Let America be the dream the dreamers dreamed—

Let it be that great strong land of love

Where never kings connive nor tyrants scheme

That any man be crushed by one above.

(It never was America to me.)

O, let my land be a land where Liberty

Is crowned with no false patriotic wreath,

But opportunity is real, and life is free,

Equality is in the air we breathe.

(There's never been equality for me,

Nor freedom in this "homeland of the free.")

Say, who are you that mumbles in the dark?

And who are you that draws your veil across the stars?

I am the poor white, fooled and pushed apart,

I am the Negro bearing slavery's scars.

I am the red man driven from the land,

I am the immigrant clutching the hope I seek—

And finding only the same old stupid plan

Of dog eat dog, of mighty crush the weak.

I am the young man, full of strength and hope,

Tangled in that ancient endless chain

Of profit, power, gain, of grab the land!

Of grab the gold! Of grab the ways of satisfying need!

Of work the men! Of take the pay!

Of owning everything for one's own greed!

I am the farmer, bondsman to the soil.

I am the worker sold to the machine.

I am the Negro, servant to you all.

I am the people, humble, hungry, mean—

Hungry yet today despite the dream.

Beaten yet today—O, Pioneers!

I am the man who never got ahead,

The poorest worker bartered through the years.

Yet I'm the one who dreamt our basic dream

In the Old World while still a serf of kings,

Who dreamt a dream so strong, so brave, so true,

That even yet its mighty daring sings

In every brick and stone, in every furrow turned

That's made America the land it has become.

O, I'm the man who sailed those early seas

In search of what I meant to be my home—

For I'm the one who left dark Ireland's shore,

And Poland's plain, and England's grassy lea,

And torn from Black Africa's strand I came

To build a "homeland of the free."

The free?

Who said the free? Not me?

Surely not me? The millions on relief today?

The millions shot down when we strike?

The millions who have nothing for our pay?

For all the dreams we've dreamed

And all the songs we've sung

And all the hopes we've held

And all the flags we've hung,

The millions who have nothing for our pay—

Except the dream that's almost dead today.

O, let America be America again—

The land that never has been yet—

And yet must be—the land where every man is free.

The land that's mine—the poor man's, Indian's, Negro's, ME—

Who made America,

Whose sweat and blood, whose faith and pain,

Whose hand at the foundry, whose plow in the rain,

Must bring back our mighty dream again.

Sure, call me any ugly name you choose—

The steel of freedom does not stain.

From those who live like leeches on the people's lives,

We must take back our land again,

America!

O, yes,

I say it plain,

America never was America to me,

And yet I swear this oath—

America will be!

Out of the rack and ruin of our gangster death,

The rape and rot of graft, and stealth, and lies,

We, the people, must redeem

The land, the mines, the plants, the rivers.

The mountains and the endless plain—

All, all the stretch of these great green states—

And make America again!

24 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

May 7, 2024

HEATHER COX RICHARDSON

MAY 08, 2024

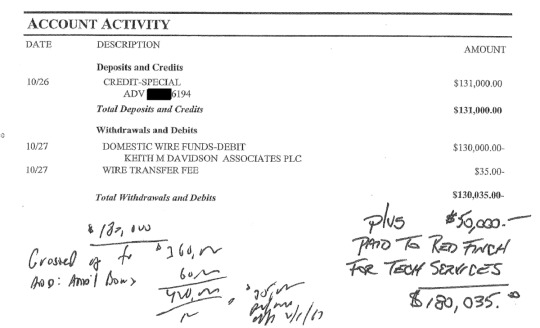

The past two days of former president Trump’s criminal trial for falsifying business records to hide a $130,000 payment to adult film actress Stephanie Clifford, also known as Stormy Daniels, to silence her before the 2016 election have been illuminating in different ways.

Yesterday, witnesses established that the paper trail of payments to Trump fixer Michael Cohen, who forwarded the money to Daniels, had been falsified. That paper trail included invoices, checks, and records. Witnesses also established that Trump micromanaged his finances, making it hard to believe he didn’t know about the scheme.

That scheme looked like this: Former Trump Organization employee Jeffrey McConney said that Trump’s former financial chief Allen Weisselberg, who has gone to jail twice in two years for his participation in Trump’s financial schemes and is there now, told him to send money to Cohen. Cohen had paid Daniels $130,000 from a home equity loan in 2016 to buy her silence about a sexual encounter with Trump. Cohen received 11 checks totaling $420,000 in repayment, including enough money to cover the taxes he would have to pay for claiming the payments as income for legal services, and a bonus.

Nine of those checks came from Trump’s personal bank account. His team sent the checks to him at the White House for his personal signature.

A number of observers have suggested that the evidence presented through documents yesterday was not riveting, but historians would disagree. Exhibit 35 was Cohen’s bank statement, on which Weisselberg had written the numbers to reflect the higher payment necessary to cover Cohen’s tax bill for the money. Exhibit 36 was a sheet of paper on which McConney had recorded in his own hand how the payments to Cohen would work. The sheet of paper had the TRUMP logo on it.

“It’s rare to see folks put the key to a criminal conspiracy in writing,” legal analyst Joyce White Vance wrote in Civil Discourse, “but here it is. It’s great evidence for the prosecution.”

Today, Daniels took the stand, where she testified about how she had met Trump, he had invited her to dinner but greeted her in silk or satin pajamas, then went on to describe their sexual encounter. The testimony was damaging enough that Trump’s lawyers asked for a mistrial, which Judge Juan Merchan denied, noting that the lawyers had not objected to much of the testimony and must assume at least some responsibility for that.

The case is not about sex but about business records. But it is hugely significant that the story Daniels told today is the one Trump was determined that voters would not hear before the 2016 election, especially after the “grab ‘em by the p*ssy” statement in the Access Hollywood tape, which was released in early October 2016. While his base appears to be cemented to him now, in 2016 he appeared to think that the story of him having sex with an adult film star while his wife had a four-month old baby at home could cost him dearly at the ballot box.

The other election-related cases involving Trump indict him for his determination to cling to power after voters had turned him out in 2020. This case, from before he took office, illuminates that his willingness to manipulate election processes was always part of his approach to politics.

Joyce White Vance is right that it’s rare to see folks put a criminal conspiracy in writing, but it is not unheard of. In our own history, the big ranchers in Johnson County, Wyoming, organized as the Wyoming Stock Growers’ Association, decided in 1892 to clear out the smaller cattlemen pushing their animals onto the federal land and the railroad land the ranchers considered their own. They hired 50 gunmen in Texas to kill their competitors, and they gave them a written list of the men they wanted dead.

The gunmen killed four of the smaller cattlemen after cornering them in a cabin, but outraged settlers surrounded the gunmen and threatened to hang them all. Local law enforcement sided with the small cattlemen, and the Wyoming Stock Grower’s Association appealed to the governor for help in restoring order. The governor, in turn, appealed to President Benjamin Harrison, who sent troops to rescue the stock growers’ men from the angry settlers and lawmen. The expense of keeping the stock growers’ men imprisoned nearly broke the state.

Witnesses became mum, and the cases against the Texas gunmen fell apart. The stock growers had first intimidated and then killed those who tried to challenge their monopoly on the Wyoming cattle industry. Then, thwarted by local lawmen, they called in the federal government, and those stock growers involved in the Johnson County War actually got away with murder.

This evening, Judge Aileen Cannon vacated the May 20, 2024, trial date for the criminal case of Trump’s retention of classified documents and declined to set a new date. With so many remaining issues unresolved, she wrote, it would be “imprudent” to set a new trial date.

This is the case in which the U.S. government accuses Trump of retaining hundreds of classified documents that compromised the work of the Central Intelligence Agency, which provides intelligence on foreign countries and global issues; the Department of Defense, which provides military forces to ensure national security; the National Security Agency, which collects intelligence from communications and information systems; the National Geospatial Intelligence Agency, which provides intelligence from imagery; the National Reconnaissance Office, which operates satellites and reconnaissance systems; the Department of Energy, which manages nuclear weapons; and the Department of State, including the Bureau of Intelligence and Research, which provides intelligence to U.S. diplomats.

These are the documents the Federal Bureau of Investigation later recovered from Mar-a-Lago, where they were stored in public spaces, including a bathroom, after Trump first retained them, then denied he had them, and then tried to hide them.

The U.S. government charges that “[t]he classified documents TRUMP stored in his boxes included information regarding defense and weapons capabilities of both the United States and foreign countries; United States nuclear programs; potential vulnerabilities of the United States and its allies to military attack; and plans for possible retaliation in response to a foreign attack. The unauthorized disclosure of these classified documents could put at risk the national security of the United States, foreign relations, the safety of the United States military, and human sources and the continued viability of sensitive intelligence collection methods.”

Today, Trump's trial for his retention of these classified documents is indefinitely postponed.

Trump appointed Cannon to the bench, and the Senate confirmed her after he lost the 2020 presidential election. She has seemed to be in no hurry to bring the case to trial before the 2024 election, a case that, if he is reelected, Trump will almost certainly quash.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#Stormy Daniels#Trump legal jeopardy#classified documents#hush money#election tampering#history#Michael Cohen#contempt of court

4 notes

·

View notes

Text

Product Design Trends to Watch in 2025

As we step into 2025, the world of product design is evolving rapidly, shaped by technological advancements, shifting consumer expectations, and a growing emphasis on sustainability. Designers and businesses alike must stay ahead of these trends to create products that not only meet current demands but also anticipate future needs. In this comprehensive guide, we explore the key product design trends to watch in 2025, delving into how they will shape industries and consumer experiences.

1. Sustainable and Eco-Friendly Design

Sustainability is no longer a buzzword; it’s a necessity. Consumers are increasingly eco-conscious, demanding products that are environmentally friendly. This trend includes the use of recycled and biodegradable materials, energy-efficient production processes, and designs that promote longevity and reduce waste. Companies are also exploring circular design principles, where products are designed with their entire lifecycle in mind, encouraging reuse and recycling.

Innovations in sustainable materials, such as plant-based plastics, mushroom leather, and lab-grown textiles, are revolutionizing the industry. Additionally, businesses are focusing on reducing carbon footprints through optimized supply chains and eco-friendly packaging solutions. The concept of “designing for disassembly” is also gaining traction, allowing products to be easily dismantled for recycling or repurposing.

2. Minimalism with Purpose

While minimalism has been a design staple for years, 2025 will see a shift towards ‘purposeful minimalism.’ This means stripping away not just excess aesthetics but also unnecessary functionalities, focusing on simplicity, clarity, and user-centric features. Products will be designed to be intuitive, reducing cognitive load and enhancing the user experience.

Purposeful minimalism emphasizes functionality without sacrificing aesthetics. Designers are adopting clean lines, monochromatic color schemes, and intuitive interfaces that prioritize ease of use. This trend is especially prominent in consumer electronics, home appliances, and digital platforms, where simplicity often translates to greater efficiency and user satisfaction.

3. Integration of AI and Smart Technologies

Artificial Intelligence (AI) is becoming deeply embedded in product design. From smart home devices to personal gadgets, products are increasingly equipped with AI capabilities that learn from user behavior to offer personalized experiences. Designers are focusing on creating seamless interactions between humans and technology, ensuring that smart features enhance rather than complicate the user experience.

Voice-controlled assistants, predictive analytics, and adaptive interfaces are just the beginning. In 2025, we can expect AI to play a crucial role in healthcare devices, autonomous vehicles, and even fashion, where smart fabrics adjust to environmental conditions. The key challenge for designers will be to maintain user trust by ensuring data privacy and ethical AI practices.

4. Emphasis on Accessibility and Inclusivity

Designing for inclusivity is gaining prominence. Products are being crafted to be accessible to people of all abilities, considering diverse physical, cognitive, and sensory needs. This trend promotes universal design principles, ensuring products are usable by the widest range of people without the need for adaptation.

Accessibility features such as voice commands, tactile feedback, adjustable interfaces, and ergonomic designs are becoming standard rather than optional. Inclusive design also considers cultural diversity, creating products that resonate with global audiences while addressing specific local needs. Brands that prioritize inclusivity not only foster social equity but also expand their market reach.

5. Biophilic Design

Biophilic design, which incorporates natural elements into products, is growing in popularity. This trend is driven by the desire to create calming, nature-inspired environments, especially in urban settings. Designers are integrating organic shapes, natural materials, and earthy color palettes to foster a connection with nature, enhancing well-being and productivity.

Beyond aesthetics, biophilic design is influencing architecture, interior design, and wearable tech. Innovations include air-purifying materials, sustainable wood composites, and eco-friendly dyes derived from natural sources. The goal is to create products that not only look good but also promote mental and physical health by bringing the outdoors inside.

6. Customizability and Personalization

Consumers are seeking products that reflect their personal tastes and preferences. Advances in manufacturing technologies, like 3D printing, are making it easier to offer customizable products. From personalized aesthetics to adjustable functionalities, design flexibility is key to meeting diverse consumer needs.

Mass customization allows brands to cater to individual preferences without sacrificing economies of scale. Whether it’s personalized skincare routines based on genetic analysis, custom-fit footwear, or modular furniture systems, the demand for bespoke experiences is driving innovation across industries.

7. Bold Colors and Experimental Aesthetics

While minimalism dominates in functionality, 2025 will also witness a bold approach to aesthetics. Vibrant colors, dynamic patterns, and experimental textures will make products stand out. This trend reflects a desire for self-expression and individuality, particularly among younger consumers.

Designers are embracing color psychology to evoke specific emotions and create memorable brand identities. Iridescent finishes, gradient effects, and tactile surfaces add a sensory dimension to products, making them not just functional but also visually and emotionally engaging.

8. Emotional Design

Designs that evoke emotions are becoming increasingly important. Emotional design focuses on creating products that forge strong connections with users through storytelling, aesthetics, and interactive experiences. This trend emphasizes the psychological impact of design, aiming to build loyalty and lasting impressions.

Products that tell a story or trigger nostalgic feelings can create deeper user engagement. Emotional design leverages elements like color schemes, material choices, and user interactions to elicit positive emotions. This approach is especially effective in branding, where emotional resonance can differentiate a product in a crowded market.

9. Hybrid Products and Multifunctionality

With space becoming a premium, especially in urban areas, multifunctional products are on the rise. Hybrid designs that combine multiple uses in one product are appealing for their efficiency and practicality. This trend encourages creative problem-solving and innovative thinking in design.

Examples include convertible furniture, wearable tech that monitors health metrics, and kitchen gadgets that serve multiple purposes. Designers are challenged to balance versatility with simplicity, ensuring that multifunctionality enhances rather than complicates the user experience.

10. Tech-Enhanced Sustainability

Beyond materials, technology itself is being used to enhance sustainability. Smart sensors that monitor energy usage, apps that track a product’s environmental impact, and designs that encourage eco-friendly habits are becoming integral to product development.

Innovations such as energy-harvesting devices, biodegradable electronics, and blockchain for supply chain transparency are paving the way for greener products. Designers are increasingly collaborating with environmental scientists and technologists to create solutions that address global sustainability challenges.

Conclusion

The product design landscape in 2025 is a dynamic fusion of sustainability, technology, and human-centered thinking. Designers must embrace these trends to create products that are not only functional and beautiful but also responsible and forward-thinking. Staying attuned to these developments will be key to success in an ever-evolving marketplace. As consumer expectations continue to evolve, the ability to innovate, adapt, and prioritize ethical considerations will define the next generation of product design.

0 notes

Text

What Does an NDIS Provider Do? yogability.com.au

The NDIS is a government-funded scheme that provides Australians with disabilities access to high-quality support services. Registered NDIS providers can provide a variety of support options, including core and capital supports.

However, choosing an ndis provider Sydney can be a challenging task. It is important to choose a provider who will understand your needs and assist you in creating a plan.

The NDIS is a government-funded scheme

The NDIS is a government-funded scheme that provides people with disabilities with funding to purchase high-quality support services. This funding is provided directly to participants through a plan, which they use to identify their goals and purchase the supports they need. Depending on their disability, they may need assistance with daily living activities, accommodation and community participation.

The financial backbone of the NDIS is a combination of government contributions at both the federal and state/territory levels. The Commonwealth shoulders the majority of this funding, while the states and territories contribute funds to ensure the NDIS is implemented effectively at a local level.

The NDIS has recently introduced new measures to ensure the quality of the supports it delivers. These measures are intended to protect the wellbeing of participants and prevent providers from charging them unnecessarily. They also aim to ensure that participants receive quality service provision, promote safety and provide opportunities for self-advocacy. These measures include an independent NDIS Commission, which will work to promote quality and safeguards for participants.

It is not means-tested

The ethos of the NDIS is founded on equity and inclusion, recognizing that disability should not be a barrier to living an empowered life. This approach extends to financial neutrality, ensuring that participants’ income and assets are not a factor in accessing disability support. This allows people to focus on achieving their goals and empowering them to live a more fulfilling and independent life.

NDIS participants are encouraged to use their funding towards a wide range of services and supports, from everyday activities to home modification and community participation. However, the scheme is not meant to replace existing social security payments like the Disability Support Pension. Therefore, it is important to consult a tax professional to ensure that your NDIS funding is being used appropriately.

You can also seek help from a disability support provider or an NDIS planner to assist you with your application. They can help you understand your NDIS options and ensure that your application is as robust as possible.

It is flexible

The NDIS is a flexible scheme that allows participants to choose their own providers and services. This flexibility empowers people to explore diverse support options and tailor their care to suit their needs, goals, and aspirations. They can also use their personal networks to find suitable providers, as long as they are registered with the NDIS.

NDIS plans are more flexible than ever before, thanks to changes in 2020. The NDIS has moved more line items into core funding, allowing greater flexibility and choice. You can check out your plan on the myplace portal to see which supports are booked and to compare providers.

Choosing the right disability service providers Sydney provider is essential for ensuring that you are receiving high-quality disability services. You should check out a provider’s customer testimonials, google reviews, and the quality of their service. Also, be sure to check the NDIS price guide to ensure they are charging fair prices. Lastly, you should check whether the provider has a complaints process and multilingual support.

It is personalised

Personalised NDIS services ensure that participants receive the right assistance at the right time. This is essential for meeting their needs and achieving long-term goals. It also allows flexibility in how support services are delivered, adapting to the nuances of their lives.

To get personalised NDIS services, start by applying for the scheme. Once you are approved, you can begin selecting registered providers to deliver your plan. Use tools like the NDIS provider finder and consult Local Area Coordinators to help you make your choices. Choose providers who are experienced and offer world-class disability care.

NDIS providers can offer a range of disability supports, including assistance with daily living tasks, community participation, and specialised care. They can also provide physiotherapy, speech therapy, and other disability equipment. They may even offer holiday programs, sports programs, and social activities for people with disabilities. These programs can boost your confidence and give you the skills you need to live a happy life.

#ndis service provider near me#ndis disability support worker#disability services ndis#yoga and meditation classes sydney#ndis service provider brisbane#ndis service provider sydney#yogability australia#ndis yoga melbourne#perth disability services#disability services sunshine coast#ndis provider sunshine coast#ndis sunshine coast#sunshine coast disability services#sunshine coast ndis#disability services sydney#ndis provider sydney#disability services in sydney#disability service providers sydney#ndis services sydney#disability services melbourne#melbourne disability services#melbourne disability support services#ndis services melbourne#ndis provider melbourne#disability services perth#ndis service providers perth#ndis services perth#ndis provider perth#disability services adelaide#adelaide disability services

0 notes

Text

How Best Mutual Fund Advisors and Agents in Mumbai Help Maximize Returns

Investing in mutual funds has become one of the most popular ways for individuals to grow their wealth and achieve financial security. However, the complex nature of mutual funds often requires expert guidance. This is where the best mutual fund advisors and agents in Mumbai step in to make a significant difference. With their deep market knowledge and personalized approach, they help investors maximize their returns while minimizing risks.

Understanding the Role of Mutual Fund Advisors and Agents

Mutual fund advisors and agents act as intermediaries between investors and mutual fund companies. They possess a thorough understanding of various mutual fund schemes, market trends, and investment strategies. Their primary goal is to assist investors in choosing the right funds that align with their financial goals, risk appetite, and investment horizon. The best mutual fund advisors and agents in Mumbai bring years of expertise to the table, ensuring that investors make informed decisions.

How They Help Maximize Returns

Customized Investment Strategies One of the key advantages of working with the best mutual fund advisors and agents in Mumbai is their ability to create tailored investment strategies. They analyze an investor's financial goals, age, income, and risk tolerance to recommend funds that offer the highest potential for growth. By diversifying portfolios across equity, debt, and hybrid funds, they help balance risk and reward effectively.

Market Insights and Research The financial markets are constantly evolving, and staying updated with the latest trends can be challenging for individual investors. Advisors and agents in Mumbai leverage their access to comprehensive market research and data to identify high-performing funds. They monitor economic indicators, corporate earnings, and global trends to make well-informed investment recommendations.

Tax Efficiency Tax implications play a significant role in determining an investor's net returns. The best mutual fund advisors and agents in Mumbai offer valuable advice on tax-saving mutual fund schemes, such as Equity-Linked Savings Schemes (ELSS). These schemes not only help investors save on taxes under Section 80C but also provide the opportunity for capital appreciation.

Ongoing Portfolio Management Investing in mutual funds is not a one-time activity. Portfolios require regular reviews and adjustments to stay aligned with financial goals and market conditions. Advisors and agents in Mumbai offer continuous portfolio management services, ensuring that investments remain optimized for maximum returns. They recommend rebalancing portfolios when necessary to maintain the desired asset allocation.

Risk Mitigation Every investment comes with inherent risks, but the best mutual fund advisors and agents in Mumbai have the expertise to minimize these risks. By diversifying investments across various sectors and asset classes, they reduce the impact of market volatility. Additionally, they guide investors in selecting funds with a proven track record of stability and performance.

Educational Support Financial literacy is a crucial aspect of successful investing. Advisors and agents not only manage investments but also educate investors about the nuances of mutual funds. They explain the benefits, risks, and potential returns of different schemes, empowering clients to make confident decisions.

Why Choose Advisors and Agents in Mumbai?

Mumbai, often referred to as the financial capital of India, is home to some of the most experienced and reputable mutual fund advisors and agents. These professionals have a deep understanding of the local market dynamics and a strong network within the financial industry. Their strategic location allows them to stay ahead of market trends and provide clients with top-notch services.

Additionally, the best mutual fund advisors and agents in Mumbai prioritize building long-term relationships with their clients. They take the time to understand individual financial goals and offer personalized solutions. This client-centric approach sets them apart from generic advisory services.

Conclusion

The expertise and guidance of the best mutual fund advisors and agents in Mumbai can make a world of difference in your investment journey. From crafting customized strategies to providing ongoing support, they ensure that your investments yield maximum returns while mitigating risks. If you are looking to grow your wealth and achieve your financial goals, partnering with a trusted advisor or agent in Mumbai is a step in the right direction. Let their knowledge and experience guide you toward financial success.

0 notes

Text

7 Reasons Why You Need to Invest in the Best Mutual Fund Scheme for SIP in Delhi

Everyone has financial goals, whether it’s buying a home, securing your child’s education, or building a retirement fund. Yet, many struggle to save and invest wisely, often spending money without a clear strategy. A Systematic Investment Plan in mutual funds offers an effective solution to achieve these goals with discipline and ease.

Why Invest in SIPs?

Let’s explore why investing in the best mutual fund scheme for sip in Delhi can transform your financial journey.

1. Creates a Disciplined Saving Habit

SIPs ensure consistent savings by automating investments. Even small, regular contributions add up over time, helping you stay on track to meet your financial goals.

2. Minimizes Risk with Rupee Cost Averaging

Market volatility can be daunting, but SIPs average out the cost of your investments. You buy more units when prices are low and fewer when prices are high, reducing overall risk.

3. Benefits from the Power of Compounding

Starting early allows your investments to grow exponentially through compounding. Over time, even modest monthly contributions can create significant wealth, especially in a high-cost city.

4. Flexible and Affordable for All

You can start a SIP with as little as ₹500 per month and adjust the amount as your financial situation improves. This flexibility makes it accessible for beginners and seasoned investors alike. Anytime Invest, a reliable mutual fund consultant in Delhi, can help you, if you wish to get started.

5. Tax Benefits with ELSS SIPs

Equity Linked Savings Schemes (ELSS) offer tax deductions under Section 80C, making them a dual-benefit investment. Grow your wealth while saving taxes efficiently.

6. Diversifies Your Investment Portfolio

SIPs in mutual funds spread your investments across equities, debt, and other assets, reducing the risk of over-reliance on a single asset class.

7. Simplifies Long-Term Financial Planning

SIPs align perfectly with long-term goals like education, retirement, or wealth creation. Their systematic nature ensures you stay committed without financial strain.

Conclusion

Investing in an SIP is a smart, disciplined approach to achieving your financial goals. With benefits like risk reduction, tax savings, and compounding, SIPs are ideal for both beginners and experienced investors. Start your SIP today and let your money work for you—because every step towards your goals counts.

#best mutual fund scheme for sip in delhi#mutual fund consultant in delhi#mutual fund advisors in delhi#mutual funds experts in delhi

0 notes

Text

Overcoming Barriers: How First-Time Buyers Can Achieve Homeownership in Australia

Despite rising living costs and a tough economy, many first-time homebuyers in Australia remain optimistic about purchasing their first property. This article examines why buyers are confident, the challenges they face, and how financial tools like Lenders Mortgage Insurance (LMI) and access to the best home loan rates for first home buyers are supporting their homeownership goals. Despite high interest rates and a competitive market, many first-time buyers worry that waiting will lead to higher prices. Concerned about rising costs, they feel it’s important to act now to secure first time home buyer loan rates and take advantage of government incentives like first home buyer grants. For many first-time buyers, property ownership is not only about securing a home but also building long-term financial security through equity. Life milestones, like starting a family or achieving financial stability, are motivating factors. However, given current market conditions, buyers are adjusting expectations, opting for apartments, smaller homes, or properties in outer suburbs to secure the best home loan rates for first home buyers.

Despite strong interest in homeownership, saving for a deposit remains challenging. The rising cost of living, especially everyday expenses like groceries and utilities, has become the primary barrier. To save more, many buyers are cutting back on non-essential spending, such as takeaway food, holidays, and subscriptions, while also considering first time home buyer loan rates to make their purchase more affordable. With financial constraints affecting many buyers, family support has become crucial. In 2024, a growing number of first-time buyers received assistance from family, often contributing to deposits or mortgage repayments. However, buyers still need to manage a significant portion of the deposit on their own. Many are also exploring best home loan rates for first home buyers to make homeownership more achievable while relocating to more affordable areas or moving back home to save on rent. Lenders Mortgage Insurance (LMI) helps first-time buyers purchase sooner by allowing a smaller deposit, sometimes as low as 5% with the First Home Guarantee Scheme. By reducing lending risk, LMI enables buyers to secure first time home buyer loan rates and enter the market earlier, protecting them from future price increases. Navigating the home-buying process can be challenging for first-time buyers. A mortgage broker can help by accessing competitive loan options from over 50 lenders, explaining borrowing capacity and deposit requirements, and saving time by comparing rates to find the best home loan rates for first home buyers. They also provide ongoing support, guiding buyers through every step of the process to ensure a smooth experience. Despite challenges like the rising cost of living and saving for a deposit, many first-time homebuyers in Australia remain optimistic. Tools like LMI, family support, and mortgage brokers’ expertise make homeownership more achievable, even in a competitive, high-interest market. With careful planning and financial support, securing the first time home buyer loan rates remain within reach for many Australians.

0 notes

Text

How to Use RentScore’s Rent-to-Own Model to Secure Your Dream Home in Nairobi

Homeownership is a milestone many Kenyans aspire to achieve, but the financial hurdles can be overwhelming. Rent-to-own schemes, such as those offered by RentScore, are emerging as a game-changing solution. This model enables aspiring homeowners to rent a property with the option to purchase it over time. With a focus on prime locations like Lavington, Kilimani, Westlands, and Syokimau, RentScore provides accessible pathways to homeownership.

Whether you're looking for an apartment for sale in Kenya, specifically in Nairobi, RentScore's innovative rent-to-own model can make your dream home a reality. Let’s explore how it works and why it’s an ideal option for first-time buyers and seasoned investors alike.

Understanding the Rent-to-Own Model

What is Rent-to-Own?

The rent-to-own model allows you to lease a property with an option to buy it after a specified period. A portion of your rent payments goes toward the property’s purchase price, helping you build equity over time.

This model is perfect for individuals who:

Lack a substantial down payment.

Need time to improve their credit score.

Want to secure a property in a competitive market like Nairobi.

How RentScore’s Rent-to-Own Model Works

1. Select Your Ideal Property

RentScore offers a curated selection of properties in Nairobi's top neighborhoods, including:

Lavington: Known for luxurious apartments and serene environments.

Kilimani: A hotspot for modern living with close proximity to amenities.

Syokimau: Ideal for affordable housing with excellent connectivity.

Westlands: A blend of residential and commercial vibrancy.

If you’re looking for an apartment for sale in Nairobi, RentScore simplifies the process by providing properties in these desirable locations.

2. Sign a Lease Agreement

Once you’ve chosen your property, you’ll sign a lease agreement that outlines:

The rental period.

The portion of rent applied toward the purchase.

The future purchase price of the property.

3. Build Equity Over Time

With every rent payment, you accumulate equity, making it easier to transition from renting to owning.

4. Purchase the Property

At the end of the lease term, you can buy the property outright, with the accumulated equity reducing the final purchase price.

Why Choose RentScore’s Rent-to-Own Model?

1. Access to Prime Properties

RentScore provides access to a variety of properties in sought-after areas. Whether it’s an apartment for sale in Westlands or an affordable unit in Syokimau, there’s something for everyone.

2. No Immediate Down Payment Required

Unlike traditional home purchases, the rent-to-own model eliminates the need for a large upfront payment, making it accessible to a wider audience.

3. Flexibility and Financial Security

You have the flexibility to live in your chosen home while saving for its purchase, reducing financial strain and allowing you to settle into the community.

Exploring Popular Rent-to-Own Locations in Nairobi

1. Apartments for Sale in Lavington

Lavington is synonymous with luxury and exclusivity. Apartments here feature spacious layouts, premium finishes, and easy access to international schools and shopping centers.

Why Choose Lavington?

Ideal for families seeking a quiet, upscale neighborhood.

High rental demand ensures excellent investment potential.

2. Apartments for Sale in Kilimani

Kilimani offers a mix of modern and classic apartments, appealing to professionals and young families. Its central location ensures proximity to Nairobi’s top business hubs.

Why Choose Kilimani?

A vibrant lifestyle with access to malls, restaurants, and entertainment spots.

Suitable for those seeking a balance between work and leisure.

3. Apartments for Sale in Westlands

Westlands is the heart of Nairobi’s cosmopolitan lifestyle, with high-end apartments and a thriving commercial scene.

Why Choose Westlands?

Close to multinational offices and major businesses.

High resale and rental value due to demand from expatriates and executives.

4. Affordable Apartments for Sale in Syokimau

For buyers prioritizing affordability without compromising on quality, Syokimau is a perfect choice. With improved infrastructure and proximity to the Nairobi Expressway, Syokimau is rapidly becoming a residential hotspot.

Why Choose Syokimau?

Affordable prices for spacious, modern apartments.

Ideal for first-time buyers and young families.

How to Get Started with RentScore

1. Evaluate Your Financial Readiness

Understand your budget and determine how much you can afford in monthly rent payments. RentScore provides flexible options to match different income levels.

2. Explore Available Properties

Browse RentScore’s listings for an apartment for sale in Kenya, focusing on areas that align with your lifestyle and investment goals.

3. Consult RentScore’s Experts

RentScore’s team of professionals will guide you through the process, from selecting the right property to understanding the lease terms.

4. Secure Your Dream Home

Once you’ve signed the agreement, enjoy living in your chosen home while building equity toward ownership.

Who Can Benefit from Rent-to-Own in Nairobi?

1. First-Time Buyers

For those who find traditional homeownership daunting, the rent-to-own model provides an accessible alternative.

2. Young Professionals

Working in Nairobi’s dynamic job market? Rent-to-own options in Kilimani or Westlands offer the convenience of living close to work while securing your future.

3. Families Looking for Stability

Neighborhoods like Lavington and Syokimau offer family-friendly environments with ample amenities.

Tips for Success with Rent-to-Own

1. Choose a Reputable Provider

RentScore is a trusted name in Kenya’s real estate market, ensuring transparent agreements and high-quality properties.

2. Understand the Terms

Before signing a lease, ensure you fully understand the financial commitments and conditions for purchasing the property.

3. Monitor Your Finances

Pay your rent on time and keep track of how much equity you’re building.

Conclusion: Your Path to Homeownership with RentScore

Rent-to-own is revolutionizing the way Kenyans achieve homeownership, offering a practical solution for those looking to secure a property in Nairobi. Whether you're interested in an apartment for sale in Syokimau, a high-end unit in Westlands, or a family-friendly home in Lavington, RentScore provides the flexibility and support you need.

By choosing RentScore’s rent-to-own model, you can live in your dream home today while building toward full ownership tomorrow. Start your journey with RentScore and take the first step toward a brighter future in Kenya’s vibrant real estate market. Call 0743 466 209 / 0757 488 833 or email [email protected].

1 note

·

View note

Text

Key Factors to Consider Before Investing in Mutual Funds

Investing in mutual funds is one of the most effective ways to grow your wealth over time. These funds offer diverse investment options, professional management, and the potential for impressive returns. However, to make the most of mutual fund investments, it's crucial to consider several key factors before committing your money. In this guide, we'll explore the essential elements to evaluate and how Dash Capital can help you make informed investment decisions.

1. Define Your Financial Goals

Before investing in mutual funds, clearly outline your financial goals. Ask yourself:

Are you saving for a specific purpose, like a child’s education or a new home?

Do you want to build a retirement corpus?

Are you seeking short-term gains or long-term wealth creation?

Understanding your objectives will help you choose the right type of mutual fund to align with your goals.

2. Assess Your Risk Tolerance

Different mutual funds come with varying levels of risk. Assessing your risk appetite is crucial for selecting a fund that matches your comfort level. Consider:

Equity Funds: High risk, potentially high returns, suitable for aggressive investors.

Debt Funds: Lower risk, steady returns, ideal for conservative investors.

Hybrid Funds: Balanced risk and reward, suitable for moderate-risk investors.

Dash Capital can help you identify your risk tolerance through a detailed risk assessment process.

3. Understand Different Types of Mutual Funds

Mutual funds are categorized based on their investment strategies and asset allocations. Familiarize yourself with the different types:

Equity Funds: Invest primarily in stocks for long-term capital appreciation.

Debt Funds: Focus on fixed-income securities like bonds and treasury bills.

Hybrid Funds: Combine equity and debt for a balanced approach.

Sectoral/Thematic Funds: Target specific industries or themes.

ELSS (Equity Linked Savings Schemes): Offer tax benefits under Section 80C of the Income Tax Act.

4. Research the Fund’s Performance

While past performance doesn’t guarantee future success, it provides valuable insights into how the fund has managed different market conditions. Look for:

Consistency: Funds that perform well across market cycles.

Benchmark Comparison: Compare the fund’s returns against its benchmark index.

Risk-Adjusted Returns: Evaluate the fund’s ability to generate returns relative to the risks taken.

Dash Capital provides detailed performance analyses to help you make informed choices.

5. Review the Fund Manager’s Track Record

The expertise and experience of the fund manager play a significant role in the performance of a mutual fund. Research the fund manager’s:

Professional background.

Investment philosophy and strategy.

Track record in managing similar funds.

With Dash Capital, you gain access to funds managed by seasoned professionals with proven track records.

6. Analyze the Expense Ratio

The expense ratio is the annual fee charged by the fund house for managing your investments. It includes management fees, administrative costs, and other expenses. Keep in mind:

Lower expense ratios are more cost-effective and can significantly impact returns over time.

Compare the expense ratios of similar funds before investing.

Dash Capital ensures you get transparent information about fund expenses.

7. Understand the Tax Implications

Taxation is an important aspect of mutual fund investments. Consider:

Equity Funds: Gains are subject to short-term or long-term capital gains tax, depending on the holding period.

Debt Funds: Taxed differently based on the tenure of investment.

ELSS Funds: Provide tax deductions under Section 80C, with a lock-in period of three years.

Our advisors at Dash Capital can guide you on tax-efficient investment strategies.

8. Determine Your Investment Horizon

Your investment duration impacts the type of mutual funds you should choose:

Short-Term Goals: Consider debt funds or liquid funds.

Medium-Term Goals: Opt for hybrid funds.

Long-Term Goals: Equity funds are ideal for wealth creation over 5-10 years or more.

Defining your time frame ensures you select funds that align with your financial needs.

9. Evaluate the Exit Load

Some mutual funds impose an exit load when you redeem units before a specific period. Be aware of:

The duration for which the exit load applies.

The percentage charged for early withdrawals.

Dash Capital provides complete transparency regarding exit loads to avoid any surprises.

10. Diversify Your Portfolio

Diversification helps spread risk and maximize returns. Avoid putting all your money into a single fund or asset class. Instead:

Invest across equity, debt, and hybrid funds.

Consider international funds to gain exposure to global markets.

Dash Capital helps you build a diversified portfolio tailored to your risk profile and goals.

11. Stay Updated and Review Regularly

The market is dynamic, and your financial situation may change over time. Regularly reviewing your portfolio ensures:

Your investments remain aligned with your goals.

Necessary adjustments are made based on market conditions.

Dash Capital offers ongoing portfolio management and reviews to keep your investments on track.

12. Start Small with SIPs

Systematic Investment Plans (SIPs) allow you to invest small amounts regularly, making mutual funds accessible to everyone. Benefits of SIPs include:

Rupee cost averaging to mitigate market volatility.

Disciplined and consistent savings habit.

Flexibility to increase contributions over time.

Our experts at Dash Capital can help you set up SIPs to build wealth gradually.

13. Seek Professional Guidance

Investing in mutual funds can be overwhelming, especially for beginners. Professional advisors like Dash Capital bring expertise and personalized advice to simplify the process. We:

Assess your financial goals and risk appetite.

Recommend suitable funds.

Provide regular updates and performance reviews.

Conclusion: Partner with Dash Capital for Smarter Investments

Investing in mutual funds is a smart way to achieve your financial goals, but it requires careful planning and informed decisions. By considering the factors discussed above, you can maximize your returns while minimizing risks. Dash Capital, with its team of experienced financial advisors, offers end-to-end solutions for mutual fund investments in Kolkata.

Whether you're a first-time investor or looking to diversify your portfolio, Dash Capital is your trusted partner. Contact us today to embark on your journey toward financial success.

0 notes

Text

How to Invest in Startups and Unlock Exciting Opportunities in India

India is home to one of the most rapidly growing ecosystems for new businesses to start in the world. There are new businesses starting up in lots of areas, like technology, healthcare, and education. Invest in startups to make money and help new ideas come to life. It is important to know about startup funding and how to move through the startup funding stages in order to make smart choices.

Why Invest in Startups?

Startups offer a chance to be a part of ground-breaking ideas and a lot of room for growth. Some successful startups in India, like Flipkart, Zomato, and Paytm, have given early investors big returns and changed the way their industries work. There are startup investing platforms that give investors access to profitable startups in India and other places.

Startup Funding in India: An Overview

Startup funding refers to the capital that new firms in India need to initiate and expand their operations. Important steps in this process include:

Seed Funding: Initial capital for the purpose of proving a business concept.

Angel Investment: Individual investors who have faith in the potential of the fledgling company contribute to the venture.

Venture Capital: Investments made by businesses that are looking to increase their returns in exchange for equity.

Crowdfunding for Startups: Platforms that facilitate crowdfunding for business startups are used to facilitate a way in which individuals contribute tiny sums.

Government Funding for Startups: It can get help from programs like startup grants in India and startup loan scheme.

Government Schemes for Startups in India

There are various initiatives run by the Indian government that encourage and reward entrepreneurial spirit:

Startup India Loan Scheme: Grants for business owners, with an emphasis on those from marginalized communities.

Stand-Up India Scheme: Providers of loans to women and SC/ST business owners.

Mudra Loans: Opportunities for microfinance that are made available under the Pradhan Mantri Mudra Yojana.

Government Grants for Startups: Non-repayable grants that encourage development and innovation.

How to Invest in Startups in India

Do you have inquiries regarding methods for investing in startups in India? Take these actions:

Research and Identify Opportunities: Do some research to find new startups in India that are relevant to your areas of expertise or interests.

Evaluate the Business Model: Evaluate the market demand, scalability, and profitability of the business.

Recognize Funding Stages: Determine whether the startup is in the seed, angel, or venture capital stage by evaluating it.

Leverage Platforms: Use startup investing platforms, like AngelList, to access prospects who have undergone thorough screening.

Explore Crowdfunding: Participate in crowdfunding in India for business in order to spread out your exposure to risk.

Seek Expert Advice: To have a better understanding of the implications, consult with legal and financial professionals.

How to Raise Funds for Startups

Understanding how to raise funds for a business is essential for those who engage in entrepreneurial endeavours. Among the most common approaches are:

Government Schemes for Startups: Take advantage of the assistance that is available through initiatives such as startup capital of India and the startup loan scheme.

Crowdfunding for Startups: Raise cash online using platforms like Kickstarter and Indiegogo.

Venture Capital and Angel Investors: Put your startup in front of investors in order to secure considerable funding.

Business Funding Through Banks: Make use of financial assistance programs such as the startup loan for new businesses offered by the Indian government.

How to Find Investors for a Startup

An approach that is strategic is required in order to find investors:

Networking: Participating in industry events and startup summits is a great way to network.

Online Platforms: You can connect with investors by using online platforms like LetsVenture.

Strong Business Plans: Plans for a successful business should emphasize on profitability and scalability.

Incubators and Accelerators: Accelerators and incubators are two types of initiatives that provide financial assistance as well as mentoring.

The Role of Crowdfunding in India

A growing number of people are turning to crowdfunding in India for business as an alternative to more conventional forms of funding. Crowdfunding platforms that are designed specifically for startups make it possible for entrepreneurs to raise funding online from a various people. Accessing early finance is made easier for new startups through the use of this method.

Benefits of Investing in Startups

High Returns: Excellent returns have been produced by the most profitable startups in India.

Diverse Opportunities: Investigate recent startups in India across a range of industries.

Support Innovation: Your investment propels revolutionary solutions.

Challenges of Investing in Startups

Though profitable, startup investing platforms carry risks such as delayed returns or business collapse, which can be reduced by understanding initial funding stages and performing extensive due diligence.

Summary

India's startup sector offers numerous prospects for investors and business entrepreneurs alike. Using government schemes for startups in India, researching crowdfunding for business startups, and understanding the nuances of fundraising for business are critical whether you want to invest in startups in India or learn how to secure funding for a startup. Strategic planning allows you to leverage on the potential of well-known Indian startups and the country's innovation-driven economy.

0 notes

Text

How to Make Your First Mutual Fund Investment

Investing in mutual funds is a smart step towards building long-term wealth. Whether you are a novice or just starting your financial journey, mutual funds offer a structured approach to managing your savings. This guide walks you through making your first Mutual Fund investment with ease and confidence.

What Is a Mutual Fund?

Before diving into the investment process, it's essential to understand what a mutual fund is. A mutual fund pools money from multiple investors to purchase securities like stocks, bonds, or other assets. Professional fund managers oversee these investments to help maximise returns while minimising risks as per the investment mandate of the fund. This collective investment scheme makes it easier for individuals to invest without requiring extensive knowledge of the stock market.

Mutual funds are available in various types, catering to different financial goals and risk appetites. For instance, equity funds focus on stocks, debt funds invest in bonds, and balanced funds combine equity and debt. This versatility makes mutual funds an attractive option for all kinds of investors.

Why Choose Mutual Funds for Your First Investment?

If you are wondering why Mutual Fund investment is an ideal starting point, here are some key reasons:

Diversification: Investing in mutual funds spreads your money across a wide range of assets, reducing the risk of losses.

Professional Management: Expert fund managers handle your investment, ensuring your funds are optimally allocated.

Flexibility: Mutual funds allow you to start small, making them accessible for first-time investors.

Liquidity: Most mutual funds can be redeemed quickly, providing financial flexibility.

Systematic Investment Option: You can contribute regularly to a mutual fund through a monthly investment, making it easier to build a significant corpus over time.

Steps to Make Your First Mutual Fund Investment

Set Your Financial Goals

Begin by identifying why you want to invest. Are you saving for a home, your child's education, or retirement? Your financial goals will determine the type of mutual fund you should invest in. For instance:

If you aim for long-term growth, equity funds may be suitable.

For stable income, debt funds might be a better option.

Aligning your investment with your objectives ensures you stay on track to achieve them.

Understand Your Risk Appetite

Every investment carries a certain level of risk. Assessing your risk tolerance is crucial to selecting the right mutual fund. Younger investors with higher risk appetite might lean towards equity funds, while conservative investors prefer debt or balanced funds.

Educate Yourself on Fund Types

Familiarise yourself with different types of mutual funds. Each type has unique characteristics and suits varying investment strategies:

Equity Funds: Focus on stocks; higher risk but potential for beating inflation over long run.

Debt Funds: Invest in fixed-income securities; lower risk, stable returns, depending on fund category.

Balanced Funds: Combine equity, debt, commodities; moderate to high risk with balanced returns.

Index Funds/ETFs: Mimic the performance of a market index, such as Nifty or Sensex or any particular sector/strategy.

International Fund of Funds: Help you invest in emerging and developed economies. High risk with diversification benefit.

Choose Between Lump Sum and Monthly Investments

Decide whether to invest a lump sum or opt for a monthly Mutual Fund investment through a Systematic Investment Plan (SIP). SIPs are particularly beneficial for beginners as they allow you to invest small amounts regularly, averaging market fluctuations over time.

Complete Your KYC

Know Your Customer (KYC) compliance is mandatory for all mutual fund investments. To complete the KYC process, you will need:

Proof of identity (such as an Aadhaar card or passport)

Proof of address

A recent photograph

You will need to link your bank account for starting SIPs. You can create e NACH mandate. There are digital options to complete eKYC.

You can complete this process online or offline, depending on your preference. You can take help of a financial advisor.

Select a Fund That Matches Your Goals

Research mutual funds and compare their performance, expense ratios, and fund manager expertise. Look for funds with consistent historical returns and a solid track record.

Open an Account

To begin investing, you will need to open an account with an authorised distributor or a fund house. This account will serve as a platform to monitor and manage your investments.

Start Investing

Once your account is set up, you can make your first investment. If you opt for a monthly Mutual Fund investment, set up a SIP for automated contributions. Regular monitoring is recommended to ensure that your investments align with your goals.

Tips for First-Time Mutual Fund Investors

Start Small

If you are new to mutual funds, begin with small amounts. This minimises your risk while you learn about the process.

Stay Disciplined

Regular investments, especially through a SIP, helps instill financial discipline. A monthly Mutual Fund investment ensures you consistently save a portion of your income.

Avoid Emotional Decisions

Market fluctuations can tempt investors to make impulsive decisions. Stay focused on your long-term goals and avoid reacting to short-term market trends.

Monitor Your Investments

While mutual funds are professionally managed, monitoring your portfolio helps you stay informed. Evaluate your funds' performance periodically to make necessary adjustments.

Reinvest Returns

Consider reinvesting any dividends or gains from your mutual fund to maximise growth. Compounding works wonders over time, helping your money grow exponentially.

Common Mistakes to Avoid

Investing Without Research

Invest after doing thorough research. Take the time to understand the mutual fund you are considering, including its risk profile and past performance.

Overlooking Costs

While mutual funds are cost-effective, they may include fees like expense ratios and exit loads. Factor these into your decision-making process.

Expecting Quick Returns

Mutual funds are not a get-rich-quick scheme. They are best suited for medium to long-term goals.

Ignoring Diversification

Avoid putting all your money into one fund. Diversify your portfolio to spread risk across different asset classes.

Stopping SIPs During Market Declines

Many investors stop their SIPs when markets are down. However, continuing your monthly Mutual Fund investment during such times can help you purchase more units at lower prices, boosting your long-term returns.

Benefits of Monthly Mutual Fund Investment

Opting for a monthly Mutual Fund investment through SIP offers numerous advantages:

Affordability: You can start with small amounts, making investing accessible to everyone.

Rupee Cost Averaging: By investing regularly, you reduce the impact of market volatility.

Financial Discipline: Automated monthly contributions encourage consistent saving.

Compounding Benefits: The earlier you start, the greater the impact of compounding on your returns.

Conclusion

Making your first Mutual Fund investment may seem daunting, but it is straightforward once you understand the basics. Start by identifying your financial goals, assessing your risk tolerance, and educating yourself about different fund types. Opting for a monthly Mutual Fund investment is an excellent way to ease into investing while gradually building wealth.

Remember, mutual funds are a long-term commitment. Patience and consistency are key to achieving your financial objectives. Begin your journey today and take the first step towards securing your financial future.

0 notes

Text

Deen Dayal Awas Yojna: Affordable Housing for All People

Deen Dayal Awas Yojna (DDAY) is a pioneering initiative launched by the Haryana government to address the growing demand for affordable housing in urban and semi-urban areas. The scheme aims to provide affordable and accessible housing solutions, primarily targeting the low and middle-income groups. It aligns with the broader vision of "Housing for All" under the Pradhan Mantri Awas Yojana (PMAY).

Launched in the year 2016, the Deen Dayal Awas Yojna focuses on creating plotted colonies in low and medium-potential towns of Haryana. The policy facilitates the development of residential plots ranging from 60 to 180 square meters, enabling individuals to construct homes according to their preferences. One of the significant features of the scheme is the provision of a fixed Floor Area Ratio (FAR) of 2.0, allowing optimal utilization of the land.

To encourage private developers to participate, the scheme simplifies the approval process, reduces external development charges (EDC), and provides incentives such as the exemption from license fees. This makes it an attractive proposition for builders to create affordable housing projects.

Moreover, Deen Dayal Awas Yojna promotes inclusive growth by focusing on towns and cities that have not yet experienced the rapid development seen in larger urban areas. The scheme ensures that infrastructure like water supply, electricity, roads, and drainage is developed alongside housing projects.

With its emphasis on affordability, flexibility, and sustainability, Deen Dayal Awas Yojna stands as a beacon of hope for aspiring homeowners, bridging the gap between urbanization and housing equity.

0 notes

Text

Why You Need a Financial Advisor in Singapore for Long-Term Wealth Planning

In today’s fast-paced and ever-changing financial landscape, securing your financial future requires more than just saving money. Whether you're aiming for retirement, purchasing a home, or building a legacy, achieving long-term financial goals can be complex. This is where a financial advisor Singapore comes into play. A professional advisor brings expertise, insight, and strategy to ensure your financial goals are met in the most efficient and effective way possible.

In this blog, we’ll dive into why having a financial advisor in Singapore is essential for long-term wealth planning and how they can guide you toward financial success.

1. Comprehensive Financial Planning for the Future

A financial advisor doesn’t just help with one-time investment choices; they assist in creating a comprehensive financial plan that aligns with your long-term goals. In Singapore, where financial markets are sophisticated and the cost of living is high, a personalized financial plan can ensure that you're on track for your future.

When you work with a financial advisor, they will:

Assess your current financial situation, including assets, liabilities, income, and expenses.

Help you set realistic goals (such as saving for retirement or funding a child’s education).

Provide recommendations to achieve these goals, including how to allocate your resources effectively.

2. Expert Investment Advice in a Complex Market

Singapore’s investment market offers a variety of options, from local equities and real estate to global investments. Navigating these opportunities, along with understanding the tax implications and risks involved, can be overwhelming for an individual investor. A financial advisor in Singapore provides expert investment advice tailored to your risk tolerance, goals, and financial circumstances.

Some of the key benefits of working with an investment-focused financial advisor include:

Access to global markets and investment products that may not be readily available to individual investors.

A diversified investment portfolio that balances risk and return.

Guidance on selecting tax-efficient investment strategies, such as the Singapore Savings Bonds (SSBs) or utilizing the Central Provident Fund (CPF) for long-term growth.

With expert advice, you can make informed decisions that contribute to your long-term wealth.

3. Retirement Planning and CPF Optimization

Planning for retirement is essential, especially in a city like Singapore, where costs can increase over time. However, many individuals underestimate the amount of savings required for a comfortable retirement. A financial advisor in Singapore can help you plan for retirement by offering tailored strategies and advising on how to maximize your CPF contributions.

Some key areas where a financial advisor can assist include:

Estimating how much you’ll need for retirement, considering your desired lifestyle and future expenses.

Helping you choose between different retirement vehicles, such as Supplementary Retirement Schemes (SRS) or other investment options.

Advising on how to make the most of the CPF Special Account and CPF Investment Scheme, both of which provide attractive long-term growth opportunities.

With the right retirement plan in place, you can ensure a smooth transition into retirement, knowing that your financial foundation is solid.

4. Tax Efficiency and Wealth Preservation

Tax is one of the largest drains on wealth, and while Singapore is known for its favorable tax regime, there are still strategies that can help optimize tax liabilities. A skilled financial advisor in Singapore understands the local tax landscape and can guide you on how to structure your investments and income for maximum tax efficiency.

Some common tax-saving strategies include:

Utilizing tax reliefs under the SRS or taking advantage of tax-exempt bonds and other investment vehicles.

Structuring your wealth for estate planning, minimizing inheritance tax, and ensuring that your assets are passed on according to your wishes.

Managing your income tax by choosing tax-efficient investment options, including those with lower capital gains taxes.

A financial advisor’s expertise in these areas can help you preserve your wealth and reduce unnecessary tax burdens, enabling you to grow your assets more effectively.

5. Protection and Risk Management

Financial security is not only about growing wealth, but also about protecting it. Unexpected life events, such as an illness, injury, or loss of income, can have a significant impact on your financial well-being. A financial advisor in Singapore can help you develop a risk management plan that includes insurance coverage and contingency plans.

This may involve:

Life and disability insurance to protect your income and family in case of an emergency.

Critical illness insurance, which provides financial support if you’re diagnosed with a major illness.

Planning for potential healthcare expenses, such as through Integrated Shield Plans or Long-Term Care insurance.

By addressing risks early on, a financial advisor ensures that your wealth is protected and that you’re covered in case of unexpected events.

6. Financial Discipline and Behavioral Guidance

Investing and managing money often involve emotional decision-making, especially during periods of market volatility. Many investors make hasty decisions based on fear or greed, which can harm long-term wealth. A financial advisor in Singapore can help you maintain financial discipline by providing an objective perspective on your investments and ensuring you stay focused on your long-term goals.

Advisors can help in several ways:

By helping you avoid emotional investment decisions that might hurt your portfolio.

Keeping you on track with your financial plan, even during periods of market turbulence.

Rebalancing your portfolio when necessary to maintain a diversified, long-term strategy.

Having an advisor act as a trusted guide ensures you’re not swayed by short-term market movements, enabling you to stay on course toward your financial goals.

7. Estate Planning and Legacy Preservation

If you’re planning to pass on your wealth to your heirs or make a lasting impact, estate planning is essential. A financial advisor Singapore can help you structure your estate in a way that minimizes taxes, ensures a smooth transfer of assets, and protects your legacy.

This may involve:

Creating a will and establishing trusts to manage your assets.

Planning for inheritance taxes and potential disputes.

Organizing charitable giving or establishing a family foundation to leave a lasting legacy.

Proper estate planning ensures that your wealth continues to benefit your family, loved ones, or causes long after you’re gone.

8. Ongoing Support and Financial Education

One of the key benefits of working with a financial advisor in Singapore is the ongoing support they provide. Financial planning is not a one-time event, but an ongoing process that evolves with your changing life circumstances. Whether it’s a change in your career, marriage, the birth of children, or approaching retirement, a financial advisor will provide ongoing guidance and adjustments to your plan.

Additionally, a good financial advisor offers financial education, helping you understand complex concepts like tax, investment products, and retirement savings. This empowers you to make informed decisions and take control of your financial future.

Conclusion

A financial advisor in Singapore is more than just someone who manages your investments — they are a trusted partner in your long-term financial journey. From comprehensive wealth planning and retirement strategies to tax optimization and estate planning, an advisor brings the expertise, experience, and insight needed to build and protect your wealth. By working with a professional, you can secure a stable financial future for yourself and your loved ones, ensuring that your goals are achieved with confidence and clarity.

If you haven’t yet engaged a financial advisor, now may be the perfect time to start. Taking a proactive approach to your financial planning today can ensure you’re prepared for the opportunities and challenges that lie ahead.

0 notes

Text

Top Reasons to Choose Fixed Deposits for Guaranteed Financial Safety

In today’s world, where economic uncertainties and market fluctuations are common, securing your hard-earned money in safe and reliable financial instruments is more important than ever. Fixed Deposits (FDs) are one of the most trusted and popular investment options for individuals looking to ensure the safety of their savings while earning a steady return. Here’s why fixed deposits are an excellent choice for guaranteed financial safety.

1. Guaranteed Returns

One of the biggest advantages of fixed deposits is that they offer guaranteed returns. When you invest in an FD, you know exactly how much you will earn at the end of the term. Unlike stocks, mutual funds, or other market-linked instruments, the returns from FDs are not subject to market volatility. The interest rate is locked in at the time of investment, ensuring that your money grows steadily over time without any surprises.

2. Low-Risk Investment

Fixed deposits are one of the safest investment options available. Banks and financial institutions are regulated by government bodies, and the chances of defaults are minimal. The safety of your investment is further enhanced by deposit insurance schemes, which ensure that even if a bank faces difficulties, your deposit is protected up to a certain limit (e.g., ₹5 lakh in India).

3. Flexible Tenure

Fixed deposits come with flexible tenures, allowing you to choose a period that best suits your financial needs. Whether it’s a short-term FD for a few months or a long-term one for several years, you can select the tenure based on your goals and liquidity requirements. This flexibility gives you control over when you want to access your funds while still earning a fixed interest rate.

4. Regular Income Option

For those looking for a steady income stream, fixed deposits offer the option of receiving interest payouts on a monthly, quarterly, or annual basis. This feature makes FDs an ideal choice for retirees or anyone who wants a regular income from their investments without worrying about fluctuating market conditions.

5. Tax Benefits

In some countries, including India, certain types of fixed deposits offer tax benefits. For example, tax-saving FDs allow you to claim deductions under Section 80C of the Income Tax Act. These FDs have a lock-in period of five years and can help reduce your taxable income while growing your savings.

6. No Impact from Market Volatility

Unlike stocks, mutual funds, or other equity-based investments, fixed deposits are not affected by market fluctuations. This makes them a safe option for conservative investors who prefer a stable, predictable return. Regardless of how the market behaves, your FD will continue to earn the same interest, ensuring the safety of your principal amount.

7. Easy to Open and Manage

Opening a fixed deposit account is a simple and hassle-free process. Most banks and financial institutions offer online facilities, allowing you to open an FD from the comfort of your home. Additionally, once you’ve invested in an FD, it’s easy to manage. You don’t need to constantly monitor the performance, as you do with stock investments, and there’s no need for frequent decision-making.