#hash rate calculator

Explore tagged Tumblr posts

Text

Demystifying the Bitcoin Mining Calculator: A Comprehensive Guide

Bitcoin mining, once the realm of tech enthusiasts and hobbyists, has evolved into a sophisticated industry requiring strategic planning and precise calculations. At the heart of this strategic planning lies the Bitcoin mining calculator—an essential tool for estimating profitability and making informed decisions. In this blog post, we'll explore what a Bitcoin mining calculator is, why it's crucial for miners, and how to effectively use it to maximize mining returns.

Understanding Bitcoin Mining

Bitcoin mining is the process by which transactions are verified and added to the public ledger (blockchain). Miners compete to solve complex mathematical puzzles using powerful computers, and the first to solve the puzzle gets to add the next block to the blockchain and is rewarded with newly minted bitcoins.

What is a Bitcoin Mining Calculator?

A Bitcoin mining calculator is a specialized tool designed to estimate the potential profitability of Bitcoin mining operations. It takes into account several key factors such as:

Hash Rate: The speed at which a miner can solve the mathematical puzzles, measured in hashes per second (H/s).

Power Consumption: The amount of electricity the mining hardware consumes, typically measured in watts (W).

Electricity Costs: The cost of electricity per kilowatt-hour (kWh) in the miner’s location.

Mining Pool Fees: If the miner joins a mining pool, there are often fees associated with pooling resources.

Bitcoin Price: The current market price of Bitcoin, which directly impacts mining profitability.

Mining Difficulty: A measure of how difficult it is to mine Bitcoin blocks, which adjusts every 2 weeks based on network performance.

Why Use a Bitcoin Mining Calculator?

Profitability Assessment: By inputting the above parameters, miners can estimate potential earnings and determine whether mining is profitable based on current market conditions.

Decision Making: Helps miners make informed decisions about hardware investments, electricity costs, and mining strategies.

Resource Optimization: Allows miners to optimize their mining setups by choosing efficient hardware and managing electricity consumption effectively.

Risk Management: Assess potential risks and rewards before committing resources to mining operations.

How to Use a Bitcoin Mining Calculator

Using a Bitcoin mining calculator typically involves the following steps:

Input Hash Rate: Enter the hash rate of your mining hardware in TH/s (terahashes per second).

Specify Power Consumption: Input the power consumption of your mining hardware in watts (W).

Enter Electricity Costs: Provide the cost of electricity per kWh in your location.

Include Pool Fees: If you are part of a mining pool, input the pool fee percentage.

Adjust Bitcoin Network Variables: Some calculators allow you to adjust the Bitcoin price and mining difficulty to reflect current market conditions.

Calculate: Click the calculate button to generate results. The calculator will provide estimates of potential daily, monthly, and yearly profits, as well as other relevant metrics.

Tips for Maximizing Bitcoin Mining Profitability

Invest in Efficient Hardware: Choose mining hardware with a high hash rate and low power consumption. Efficient hardware may have a higher initial cost but can yield better long-term profitability.

Monitor Market Trends: Stay updated on Bitcoin prices and network difficulty adjustments. Timing your mining activities based on market conditions can optimize profitability.

Optimize Electricity Usage: Consider locating your mining operations in regions with lower electricity rates or explore renewable energy sources to reduce costs.

Join a Mining Pool: Mining pools offer more consistent earnings by combining resources. While they charge a fee, the stable income stream can outweigh the fee costs.

Regular Maintenance: Keep your mining equipment well-maintained to ensure optimal performance and longevity, reducing downtime and replacement costs.

A Bitcoin mining calculator is an indispensable tool for anyone involved in Bitcoin mining. It provides critical insights into potential profitability by considering factors like hash rate, power consumption, electricity costs, Bitcoin price, and mining difficulty. By using a mining calculator, miners can make informed decisions, optimize their resources, and maximize their mining profits in the competitive cryptocurrency landscape. As the Bitcoin ecosystem continues to evolve, leveraging tools like a mining calculator will be key to navigating its complexities and achieving success in mining operations.

1 note

·

View note

Text

July 2024 Check In

Hello, all!

Happy update day! Thank you for your support and patience while we work. This has been one of the busiest times for our team, and we’re making good progress. But it's challenging to share without sounding like a broken record. Lots of coding. Lots of numbers. Lots of items. So little time...!

But first, I must share solemn news. Our backdrop artist, Kzart, has passed away. He died of cardiac arrest just the day after our last update, where we previewed his wonderful work on the Cogwheel Outskirts.

This is a deep and mournful tragedy. Our heart goes out to his family, friends, and loved ones. Kzart was a welcome, cheerful, and bright part of the team, and the loss is devastating. May his memory be a blessing.

We are dedicating our work this month to his memory. We hope to ask your patience while we make decisions for future team members in the wake of his passing.

To start off, here are some asset updates.

New Icons

We’ve been picking away at icons. Populating the site itself with estimates for cooking, crafting, dailies, site store, and guild play has been a behemoth of a task which has taken weeks of calculating out delicate numbers, drop rates, and seeding tactics. We have an insane amount of spreadsheets. I’m very proud of how much we’ve figured out.

Wild Boar, Bison Calf, Kid, Lamb, Blackbird, Red Squirrel and Brown Hare illustrated by Tybaxel and Remmie

The young animals will be available as plain food in Alpha and part of Beta, but are designed in preparation for our Farming and Husbandry mechanic, explained more in this update!

I’m dying to see the dye icons!

Illustration by Tybaxel

And lastly, we’ve started work on the stone assets!

Harvest Stone, Metropolis Stone, and Luna Stone by Hydde

Above you see the Harvest Stone, Metropolis Stone, and Luna Stone. Paw-carved by catfolk out of various precious stones and the elusive Prismaline—Mewmoia’s magical mineral and the origin of modern magical technology—these stones act as a magical catalyst for sorcerers performing transmutation.

We also want to note: we see the discrepancy in the Harvest logo and its child assets. While we were working on the visual development, we found that the leaf was not only more recognizable as a symbol, but more reliably adaptable in different simplistic forms. We will be experimenting with replacing the vegetable in the Harvest logo with a leaf.

Recolorings

Recolors continue! This month, we have the Guard set.

Colors done by Emma

New Decor

We have begun our work on decor!

Our goal is to have a substantial amount of decor befitting every type of backdrop we are starting with. Our first set we are tackling is the Summer Natural set. We have sets known as Sea Faring, City Clearing, Academic, and Winter Natural planned as a starting roster.

Florals by Giulia, lemonade by Jerso, butterlfies by Asp

And here it is put together!

NPC Sketches

Early last month, we shared a preview of the initial sketch for Wheatley and Crowley, the sitewide general store!

Initial feedback included a poor merge of cat-like anatomy and anthropomorphized character acting. We took this feedback, spent another day on visual development for NPCs, and updated our character design visual philosophy!

So, presenting…

And here is how they look on the website!

This sketch is still subject to change as we hash it out, line, and render it, but we’re excited to share what we’ve developed so far!

Wheatley and Crowley were the first NPCs ever developed during pre-production.

(Just as the Bovine was the first Mystic breed ever developed, and Sugar was the first color palette ever designed!)

So there is something a tad emotional about making it this far. Seeing them animated and on an actual game UI has been very rejuvenating. We’re nearing the end of this development hole!

So you want to form a team and join the Guild, huh? Meet Maven, your guildmaster. She’s rough, prickly, and can scare the faint of heart. Yet the Guild is dedicated to helping poor cats in need, in the wake of wastebeasts and outlaws terrorizing outskirt villages. You wonder who she is under that thorny exterior…

Maven is a primary character in the ongoing site plot. We have the technology for NPCs to emote during dialogue. Many story-focused NPCs will get this treatment. This means that Maven's expressions will change as you talk to her!

All NPC sketches by Hydde

Everyone knows Winnipeg, the longhair chef from Luna. Introducing his twin sister, Winnifred! Winnifred sells husbandry and farming supplies, including young animals and seeds.

(Note: all 3D assets used for render references are ours, minus the watering can! Credit to Toonz Media Group from Sketchfab.)

So let’s talk about the farm mechanic!

In Development - Farming and Husbandry

See the initial UIs for our major in-development mechanic.

Plant seeds on plots of land in your camp. Certain plants will raise or lower your soil quality, which in turn will affect how many items these plants yield. It’s up to you as the player to grow a variety of different plants to diversify your soil and get the most yield.

Husbandry will feature the same concept, utilizing livestock as opposed to plants. Grow different animals over time and maintain grass density to get the best quantity of items!

Lastly, some folks were curious about incense, how it works, and its attainment method.

Incense will be craftable, and its ingredients will be farmed! Incense ingredient seeds will be scattered around the game, including as reward drops for gameplay. It will take intentional cultivation to attain an incense item.

Because we had a few users who were curious to the specific ingredients of every incense scent, here is each Borough:

Luna = Lavender and Jasmine Sol = Cinnamon and Fennel Abyssal = Lotus and Sakura Zenith = Rosemary and Sage Harvest = Basil and Oregano Cogwheel = Saffron and Turmeric Metropolis = Patchouli and Vetiver

For testing until farming is implemented, items which would be farmed will be available to buy through Winnifred.

Cooking and Crafting

Lastly, a peak at the UI for the cook and craft mechanic!

We surveyed the playability of the original grid system and weighed the pros and cons of managing a grid and memorizing recipes in a multiplayer resource game, and ultimately decided that our platform and format doesn’t quite suit the crafting grid playstyle.

Instead, recipes and blueprints are found, added to your collection, and able to be insta-made.

We found the act of users individually adding items from storage to be tedious, and ultimately our original format would end up with users researching recipes on wiki articles instead of engaging in explorative play. While other games have crafting loops which incentivize exploration, the petsite setup as we have built it simply does not accommodate it without serious overhaul.

But we hoped to preserve some of that magic by including the “add ingredient” feature. Users will be able to discover new combinations by experimenting with add-ons. For example, a pizza recipe could become mushroom pizza by adding mushrooms!

Users may still end up just looking things up, but the mechanic itself is now not ultimately dependent on off-site research.

Peak at this mockup recipe!

We are currently experimenting with how to include the NPCs in this UI format. Fear not that you do not see Winnipeg here. He will be in the game!

This mechanic in general is what we are currently working on! Thanks for sticking by!

And that’s all we have for today. We know that a lot of users are holding out for Mystic breed updates in the demo, and we are working on those. But game playability is taking the highest place for us, as we want to get testing ASAP! So, we appreciate this patience. Moontails, and likely Thumpers, will be here for Beta, but our #1 focus this last month has been the sprint to the finish line for playability in both development and assets. The semi-quiet activity is because we're putting all our energy into this huge milestone.

Which to mention!

Alpha acceptances have been sent out! If you have not yet, check your email!

We asked those who receive it to reply that they have. There is not a strict deadline on this reply, we simply want to ensure that those who received the email have seen it and are ready to volunteer. We will still be sending keys to everyone who received an email, minus those who are dropping out. If someone is MIA by the time people are registering accounts, we will consider reaching out to other potential testers.

Home stretch, everyone! It’s starting to come together just how much we’ve completed, and the application is beginning to feel real in a way it hasn’t previously. We’re all super antsy to buff it out and get people playing!

Thank you all!

To summarize: We shared icons, Guard set recoloring, decor assets, 3 new NPC sketches, the farm and husbandry mechanic, and the cook/craft functionality.

What to expect next month: Further asset and development updates. Check-ins for how Alpha will be going, timeline expectations in the wake, NPCs and lore.

#paw borough#virtual pet#pet site#art update#indie game#kickstarter update#petsite#pet sim#development update

66 notes

·

View notes

Text

How Cryptocurrency Mining Works: Process, Methods, and Risks

Cryptocurrency mining is a topic of interest for many people. Today, there are numerous opportunities available for those who want to earn money, and one of them is cryptocurrency mining, which can provide a significant income.

What is Cryptocurrency Mining?

First, let’s understand what cryptocurrency mining means. It all started with Satoshi Nakamoto, who in 2007 began developing the principles of cryptocurrency mining (Bitcoin). In 2009, the first mining application was released. The generation of the first block, “Genesis 0,” brought the first 50 bitcoins to its creators. In the same year, the first purchase of BTC for dollars took place: $5.02 was sold for 5050 bitcoins (which is an astronomical sum today).

The essence of the cryptocurrency mining process is the creation of new blocks in the cryptocurrency network. For this, the mining equipment solves complex mathematical problems. For each new block, cryptocurrency coins are issued. Miners can then store them in their wallets or sell them on exchanges.

How Does Cryptocurrency Mining Work?

To understand the principles of mining, it is necessary to clearly understand how bitcoin is mined.

Information about each transaction within the BTC network is recorded in a special block, which confirms the authenticity of the transfer.

Blocks form a single chain — the blockchain. Each block contains the hash of the header of the previous block, the hash of the transaction, and a random number.

The miner’s equipment performs mathematical calculations to determine the block hash.

After calculating the hash, the miner receives a reward and adds a new block to the general register of transactions.

The mining process is protected using the Proof-of-Work and Proof-of-Stake algorithms. These are sets of rules according to which transactions are conducted, mining is carried out, and other actions are performed within the network.

Proof-of-work (“proof of work”). The algorithm organizes the operation of the entire cryptocurrency network, verifies the authenticity of transactions, and so on. After a certain amount of cryptocurrency is mined in the network, PoW increases the complexity of the calculations. As a result, miners are forced to constantly increase the power of their farms and devices. PoW is the algorithm of a large number of cryptocurrency networks: from bitcoin to LiteCoin and DogeCoin. Proof-of-Stake (“proof of ownership”). An analog of PoW, the essence of which is that the greatest chance of mining cryptocurrency is received by the one who owns the most coins, and not the most powerful equipment. The algorithm reduces the decentralization of the network but significantly reduces energy consumption. PoS is currently used by Ethereum.

Mining Algorithms

To understand how to mine cryptocurrency, you need to know about the most popular mining algorithms at the moment. These technologies form the basis of cryptographic calculations and affect the mining speed, the necessary equipment and its power, the level of energy consumption, and so on.

SHA-256. The basis of mining on this algorithm is the creation of a 256-bit signature. It is demanding on the hash rate (for mining, a minimum of 1 Gh/s is required). Calculations last from 7 minutes. It is used in the mining of Bitcoin, Bytecoin, Terracoin, 21Coin. Ethash. The hashing algorithm was first used to mine ether. In the mining process, the emphasis is on the volume of video card memory. Ethash is used in the networks Ethereum Classic, KodakCoin, Ubig.

Scrypt. It works on the PoW (Proof-of-work) principle. Compared to SHA-256, it has a higher calculation speed and lower requirements for the power of computing equipment. The algorithm is used in the mining of Dogecoiun, Gulden, Litecoin.

Equihash. An algorithm with which you can mine cryptocurrency on home computers. It is used in the mining of Bitcoin Gold, Zcash, Komodo. CryptoNight. The algorithm is designed for mining cryptocurrency on home computers. It allows you to mine even on a not very powerful video card. The only condition is that it must be discrete. It is used in the mining of Bytecoin and Monero.

X11. The algorithm was developed by the creators of the Dash token. It has excellent data protection and low energy consumption.

Types of Mining

What does cryptocurrency mining mean in terms of organizing the process? There are several types of mining that depend on the equipment used and the number of team members.

By Equipment Type

In mining, you can use different equipment: you need to choose a suitable cryptocurrency and install software. Each type of equipment will differ in calculation speed, resource consumption, durability, etc.

CPU (Central processing unit) CPU mining is the use of a PC processor for cryptocurrency mining. It is characterized by very low calculation speed and, accordingly, low profitability. However, it is still relevant among solo miners due to low energy consumption requirements. To increase mining efficiency, you need to choose processors with a high frequency, a large number of cores and threads. It is not recommended to mine on laptops. With CPU mining, you can mine Dogecoin, Monero, Electroneum.

FPGA-module (Field-Programmable Gate Array) The use of an FPGA module is one of the promising ways to mine cryptocurrency. Their advantage/difference lies in the possibility of reprogramming the module for the desired mining algorithm. Thus, you can switch between different cryptocurrencies. Another beneficial difference is that FPGA modules provide a better hash rate-energy consumption ratio. The main disadvantage of FPGA mining is the cost of the modules and the complexity of their setup.

Hard Drive You can also use the HDD of your PC for mining. The work is carried out according to the Proof-of-Capacity (“proof of resources”) algorithm. Mining on a hard disk takes place in two stages: plotting and mining. First, the generation of random solutions takes place, which are saved on the HDD. Then the number of the scoop is calculated, and the deadline is determined. Then the minimum deadline is selected, and the miner who beats the rest receives a reward. The calculations do not require high power but only a lot of free space on the hard drive.

By Number of Participants

You can mine cryptocurrency both alone and in a company with other miners. All this has both its advantages and disadvantages.

Solo Mining The oldest form of mining. The miner independently selects equipment, sets up software, chooses a cryptocurrency, and starts mining. All costs are borne by him. But the reward for the mined block is received in full by the solo miner. During the birth of the cryptocurrency industry, this was the most profitable form of mining, as the calculations were fast and did not require large capacities. Today, solo mining is worth doing when mining promising altcoins.

Mining Pools A mining pool is a combination of miners who start working on creating blocks together. As a result, this significantly increases the overall chances of getting cryptocurrency. There are two main types of pools with different payment mechanisms. Pay-Per-Share (PPS), in which the miner receives a reward for each hash created within the pool — even if the block was not created. Pay-Per-Last-N-Shares (PPLNS), with accrual of the reward only when the block is created.

Cloud Mining This is a type of passive mining. In this case, the user pays for the rental of capacities on the territory of the data center of the company. The equipment starts mining, and with the help of a mobile application or a personal account on the site, the client monitors the results. Profit depends on the rented capacities, the cost of cryptocurrency, and the options in the company’s service.

Mining Profitability

To make a profit from cryptocurrency mining, you need to make a preliminary calculation of costs. If you want to create your own farm, you need to calculate:

Costs for purchasing and maintaining equipment. Payment for electricity. Rent of premises for the farm. The computing power of the equipment, which determines the amount of cryptocurrency mined per month. Assess changes in the value of the chosen cryptocurrency: an accurate forecast will allow you to imagine the expected income.

Mining profitability A profitable option for earning money can be the purchase/rental of ASICs or cloud mining. Their profitability depends only on the starting budget. If you calculate the minimum entry threshold by product, then you can get the following approximate figures:

Purchase of Antminer S21 188TH ($5000): expected income $550* per month. Rent of Antminer S21 188TH for 12 months ($3200): expected income $320* per month. Cloud mining contract ($150): expected income $225* for 60 months. These calculations provide you with forecast information based on the BTC forecast, which will reach $120 thousand. and FPPS 0.0000008. This is not a guarantee of future results, and accordingly, it is not advisable to rely too much on such information due to its inherent uncertainty.

Risks of Cryptocurrency Mining

The cryptocurrency industry has certain risks:

Problems with legislation. Very often, mining is not regulated by the legislation of countries, and in some, it can be completely prohibited, for example, in Taiwan, Kyrgyzstan, Vietnam, Romania, and Ecuador. Before starting to work with cryptocurrency, you definitely need to consult with a lawyer. A good solution to the problem can be the services of a hosting company, which will take any risks upon itself.

The issue of profitability. For successful bitcoin mining on your own, you need to buy powerful computing equipment. It not only costs quite a lot but also requires a huge amount of electricity and careful maintenance. Therefore, it will not be possible to place it at home. At the same time, mining on a home PC or a small farm will be unprofitable due to high competition with large farms and pools.

The difficulty of accurately forecasting income. It is difficult to calculate future income from the sale of mined cryptocurrency: the complexity of mining, the popularity of coins, and their value can and will regularly change.

The Future and Prospects of Cryptocurrency Mining

The industry continues to actively develop around the world. Users know that they can get a good income from cryptocurrency mining, even if they mine altcoins: Ethereum, Tether, BNB, Solana, etc. BTC is the undisputed leader of the industry, the course of which affects users’ trust in it.

After the fourth bitcoin halving in April 2024, the profitability of mining changed. To maintain the previous level of mining, it is necessary to increase existing computing powers. Therefore, miners continue to unite in pools or use the services of hosting companies. In the near future, this trend will not only be preserved but will also receive its development.

Conclusion

Despite periodic declines, bitcoin continues the trend of growth, which makes investing in cryptocurrency mining a profitable investment. With the development of mining pools and the appearance of large farms, it is difficult for a solo miner to get a significant income. Therefore, the best option may be cloud mining or the purchase/rental of an ASIC farm from a hosting company, which will take over the installation and maintenance of the equipment. With ECOS.am, you can focus on mining and investing in BTC. We take on all the other work.

4 notes

·

View notes

Text

A long, long line

Fandom: Infamous IF Ship: Swan/Orion Characters: Swan Ellis (OC), Orion Quinn Rating: Gen Words: 684 Summary: Swan wants their morning coffee so very badly. If they could trade their feelings for their manager for it, they would. Nero’s note: Felt like this fic needed to be let out of my google doc drafts. Swan has eaten enough of my braincells for it. Please enjoy my breach into a new fandom!

Someone’s car honks in front, another honks in the back. It’s 8am on a Sunday, there shouldn’t be so much honking, in front of Starbucks, of all places. Childishly, Swan considers adding in a sorrowful little honk of their own - if cars can be sorrowful, which they highly doubt. They’re not using their voice before they’ve had their morning coffee.

There was no coffee at home, they reason. There was no coffee at their place so now they have to buy the Starbucks one. Why wasn’t there any coffee? Well, they forgot to buy it yesterday. Their phone sits with its screen darkened on their lap. By their calculations, they have about 45 seconds to figure out a logical excuse as to why they’re late for rehearsal. Orion’s gonna be on my ass about this, Swan bemoans internally as they tap their nails against the wheel. The line isn’t moving. Their head is screaming for caffeine. The phone screen is dark and nasty and evil and filled with Orion’s quiet frowns that cut into their very soul.

On the 43rd second mark, it comes to life. Orion’s name clouds the photo of the band, tightly wrapped in a group hug. Their manager’s name sits directly over Swan’s head and they can’t help an aborted, miserable snort. Where are you?, the message reads. We’re waiting for you.

Swan sighs and opens the message. The line’s long, they reply to the background vocals of an annoyed shriek of yet another honk. It’s fucking Sunday. I’m decaffeinated.

Don’t you have coffee at home? Swan can hear the disapproval. It makes them tap their nails of their free hand harder against the wheel.

Forgot to buy it yesterday.

Irresponsible, if you’re going to have an addiction to it anyway.

Swan frowns and adjusts their glasses. Vocal parts will have to come later today unless Devyn wants to start before I’m there. I refuse to sing without caffeine in my system. Then, finally, the line moves! They almost drop their phone as they move a few inches closer to ambrosia. Now, it’s only 4 cars ahead of them. They can almost feel the smell of it in the car.

Be as quick as you can. And do remember to buy coffee next time. I don’t think you guys are making instrumental music. Swan’s joy deflates like a puffed balloon. They hate it when Orion scolds them like a child. All the more since the unfortunate discovery of a little crush on him a few months ago, which has already ended up in several songs they don’t want to show anyone yet.

Whoever said that having a crush was fun and games lied. Orion would never consider them as anything other than a client, maybe a friend. It’s stupid and there’s no end goal in feeding their hopes of ever getting past that. But there are songs and singing about Orion is miles away from writing breakup songs.

There are three more cars ahead now. Swan has tied and retied their hair into at least seven different types of buns as the lady ordering hashes out her wishes to a barista. They feel like kicking their feet against their seat, but they’ll have to clean it up later. Dad’s always liked a clean car, after all.

Two more. They reread Orion’s message and bang their forehead against the wheel. It echoes in their mind like a spank. Humiliating, or would be if Swan hadn’t been a dumbass who forgot to buy coffee yesterday. Disappointing Orion feels like the worst possible punishment, perfectly adjusted to the crime committed.

One more. It’s almost within their grasp. A bald guy’s arguing about his order. Their annoyance is almost as palpable as Soft Violence’s music on the radio.

When the coffee - delicious, black, bitter, perfect for 8am on a Sunday - is finally in their hands, Swan sighs contentedly. It’s kinda funny how fast it’s gone, considering how long they waited to get it, but they feel revitalized and ready to face Orion's frowns now!

Mirror in the Creek isn’t an instrumental band after all.

#infamous#infamous if#inspo birb has come to town#swan ellis#orion quinn#swan x orion#yes i am on the orionmance train#i do need a nice neat and direct romance for once lmao#but ya as i said pls enjoy my foray into this fandom#i'm kinda scared posting fic this soon but fuck it

24 notes

·

View notes

Text

Nice historical volatility chart

This is a helpful annotated chart of yearly S&P 500 volatility. I bookmarked it back in 2014, so it only covers the years from 1929 to 2014.

S&P 500 calendar year realized volatility from 1929-2014 $SPY $SPX $VIX

— via Ro_Patel on StockTwits, October 09, 2014

The y-axis is S&P Calendar Year Realized Volatility as a percentage. The x-axis is time in years. I hope it is possible to enlarge the image by clicking on it! The red bars represent the 10 years with highest volatility. The green bars represent the 10 years with the lowest volatility. I am guessing that the blue bars are all other years.

I wondered why the chart was tagged with $SPY $SPX and $VIX. Both StockTwits and Twitter used to denote stock symbols with a dollar sign instead of a hash tag.

The first two were easy. SPY is an ETF that is backed by actual shares of stock in the companies that are included in Standard & Poor's 500 index. SPX is driven by the price of the S&P 500 Index itself. SPX isn't tradeable per se, but there are SPX futures and various SPX options.

Volatility and the fear indicator

Volatility is the standard deviation of a stock, stock index, or other security's annualized returns over a time period; essentially, the rate at which the security or index price increases or decreases. ‘Actual’ (historical) volatility measures the variability of known prices.

What is $VIX

VIX is called the fear indicator because it is used to infer a quantitative metric of market risk, fear, and stress. It is defined as the 30-day expected volatility of the S&P 500 stock index, using Chicago Board Options Exchange (CBOE) listed S&P 500 options data. VIX is a measure of implied volatility (forward-looking) not historical. Values over 30 are considered high, while 20 is more typical. There's no upper bound on VIX.

The VIX isn't tradeable, which is why I am amused that its CBOE landing page (URL above) has "tradeable" in the URL! Instead, there are VIX futures, call and put options for trading.

The VIX was introduced by CBOE in 1993. I think that's why this chart doesn't have VIX on the y-axis (only alluding to it with $VIX) as an historical time series. It wouldn't be possible to impute historical values, especially not to 1929 but not even prior to 1993, because VIX is calculated by aggregating weighted prices of a constantly changing portfolio of S&P 500 calls and puts over a range of strike prices.

StockTwits

StockTwits seems mostly moribund to me, since about 2015. The name is a little strange, but it is a great idea: A social network for investor/speculators. The realtime, Twitter-like functionality, and user interface, are well-designed and fun. I think StockTwits was founded by Howard Lindzon who is nice, and maybe Fred Wilson the AVC guy ("A Venture Capitalist"?). EDIT: I just checked. It is still active but not exactly a huge startup venture.

Now that Amazon.com has retired Alexa, I can't find website metrics as easily. I'm mildly curious about StockTwits. I wish I could average unique annual page views per year, and then do a 3-line time series graph of unique daily views during 2012 (when it was really active), 2015, and last year.

5 notes

·

View notes

Text

The difficulty of bitcoin is set so that the hash rate rises as the best hit in history of 840 EH/S

The value of bitcoin was sliding under the thrilling value of $ 100,000, but on February 2, the bottom of $ 91,530, the calculation muscles bent to the unprecedented peak. Bitcoin hash rate is the best tap ever The data from HashrateIndex.com has a brutal 840 Equein (EH/S), a terrible Bitcoin hash rate, which has a terrible 837.25 EH/S per second on February 3, 2025. It became. Followed on…

0 notes

Text

Master Crypto Profit Calculation: A Step-by-Step SOP

Cryptocurrency trading and mining can be incredibly rewarding when approached with a structured strategy. Here’s a step-by-step Standard Operating Procedure (SOP) to help you calculate your crypto profits effectively.

Step-by-Step SOP for Crypto Profit Calculation:

Step 1: Understand the Key Metrics

Before calculating your profits, familiarize yourself with the essential metrics:

Entry Price: The price at which you bought the cryptocurrency.

Exit Price: The price at which you sold or plan to sell.

Transaction Fees: Fees charged during buying, selling, or transferring.

Quantity: The amount of cryptocurrency you’re dealing with.

Formula for Basic Profit Calculation:

Profit(Exit Price−Entry Price )×Quantity−Transaction Fees Profit=(Exit Price−Entry Price)×Quantity−Transaction Fees

Step 2: Use a Crypto Profit Calculator

Manual calculations can be time-consuming and prone to errors. Instead, use a reliable crypto profit calculator to streamline the process.

👉 Check out the advanced Crypto Mining Calculator for accurate results.

Benefits of Using a Calculator:

- Real-time price data integration. - Detailed breakdown of fees and operational costs. - Easy comparison of multiple scenarios.

Step 3: Include Mining Costs (For Miners)

If you’re a miner, your profit calculation must include:

Electricity Costs: Calculate the total energy consumed in mining.

Hash Rate: Determine how much computing power you’re contributing.

Mining Difficulty: The harder it is to mine, the more resources it requires.

Mining-Specific Formula:

Mining Profit

( Total Coins Mined × Market Price ) − ( Electricity Costs + Hardware Costs ) Mining Profit=(Total Coins Mined×Market Price)−(Electricity Costs+Hardware Costs)

Step 4: Factor in Taxes

Profits from cryptocurrency are often subject to taxes depending on your country. Calculate the tax implications to avoid surprises later.

Step 5: Analyze Market Trends

Stay informed about the latest trends in cryptocurrency. Tools like candlestick charts and market predictions can help you make better decisions.

Tips for Traders:

Use candlestick analysis to identify market patterns.

Follow global news impacting cryptocurrency prices.

Step 6: Review and Optimize

Once you’ve calculated your profits, analyze your strategy and look for areas of improvement. For example, if transaction fees are eating into your profits, consider using platforms with lower fees.

Why It’s Important to Use a Crypto Calculator?

A dedicated crypto calculator not only simplifies complex computations but also saves time and provides more accurate insights. Whether you're trading Bitcoin or mining altcoins, tools like BTC Mining Calculator can make all the difference.

Get Started Today! With the right tools and strategies, calculating crypto profits can be effortless. Use this SOP to streamline your process and maximize your gains.

#CryptoProfitCalculator#CryptoCalculatorProfit#CryptoMiningCalculator#BTCCalculator#CryptoTradingTips#CryptoProfit#CryptoSOP#CryptoEarnings

1 note

·

View note

Text

From Application to Approval: A Behind-the-Scenes Look at the Lending Process

Applying for a personal loan can be a daunting experience. Once you hit “submit,” what happens next? Understanding the lending process can demystify the experience and help you navigate it with confidence. Here’s an insider's perspective on what goes on behind the scenes, from application to approval.

The Initial Application Review

After you submit your loan application, the first step in the process is the initial review. Lenders typically use a combination of automated systems and human oversight to evaluate applications quickly. During this stage, your application is checked for completeness—missing documents or information can lead to delays, so double-check your submission!

Credit Check and Assessment

One of the most crucial aspects of the approval process is the credit check. Lenders review your credit history to assess your creditworthiness. This includes looking at your credit score, payment history, outstanding debts, and any bankruptcies or foreclosures.

Understanding Credit Scores:

Excellent (750+): Great interest rates and terms.

Good (700-749): Favorable terms, but not the best.

Fair (650-699): Higher interest rates likely.

Poor (649 and below): Limited options; higher risk for lenders.

If your credit score isn’t where you’d like it to be, consider taking steps to improve it before applying for a loan.

Debt-to-Income Ratio (DTI) Analysis

In addition to your credit score, lenders also assess your debt-to-income (DTI) ratio. This metric compares your monthly debt payments to your monthly income. A lower DTI indicates you have a healthier balance between income and debt, making you a more appealing candidate for a loan.

Calculating DTI:

DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100

Most lenders prefer a DTI of 36% or lower. If yours is higher, you might want to consider paying down some existing debts before applying.

Verification of Information

Once your credit and DTI have been assessed, the lender will move on to verifying the information provided in your application. This may involve reaching out to your employer to confirm your income or checking bank statements to ensure you have the funds to cover monthly payments.

Being prepared with documentation can speed up this process. Gather:

Pay stubs

Tax returns

Bank statements

Proof of identity and residence

Underwriting Process

This is where the real magic happens. Underwriting is a detailed review conducted by a loan officer or underwriter who assesses your financial profile. They’ll look at all aspects of your application, including credit history, DTI, employment status, and even the purpose of the loan.

During underwriting, the underwriter may ask for additional information or clarification on certain points. This is a normal part of the process, so don’t be alarmed if you receive a request for more documents.

Decision Time

After thoroughly reviewing your application, the underwriter will make a decision. You’ll either be approved, denied, or receive a conditional approval, which may require additional documentation or clarification.

What Each Decision Means:

Approved: Congratulations! Your loan terms will be finalized, and you’ll receive a loan agreement to sign.

Denied: If your application is denied, you’ll usually receive a letter explaining the reasons. Common factors include poor credit, high DTI, or insufficient income.

Conditional Approval: This means you’re close to getting the loan, but the lender needs more information. Address any requests promptly to keep things moving.

Loan Agreement and Closing

If approved, the next step is the loan agreement. This document outlines the terms of your loan, including interest rates, repayment schedules, and any fees involved. Take the time to read it carefully and ask questions if something is unclear.

Once you sign the agreement, the loan will go into closing, where the final details are hashed out. This may include disbursement dates and payment methods.

Fund Disbursement

After closing, the funds are typically disbursed quickly—sometimes within a day or two. Depending on the lender, you might receive the money via direct deposit, check, or other methods.

Tips for a Smooth Loan Application Process

Be Honest: Provide accurate information to avoid complications.

Stay Organized: Keep all necessary documents handy to streamline the verification process.

Communicate: If you have questions or concerns, don’t hesitate to reach out to your lender for clarity.

Monitor Your Credit: Regularly check your credit score and report to stay informed.

Conclusion

Understanding the lending process from application to approval can empower you as a borrower. By knowing what to expect and how to prepare, you can navigate this journey with greater ease. Whether you’re consolidating debt or financing a major purchase, being informed is your best tool for success.

If you have any questions or need assistance with your loan application, feel free to reach out! Happy borrowing!

0 notes

Text

Maximize Your Crypto Profits with a Crypto Mining Calculator

Are you looking to optimize your cryptocurrency mining operations? A Crypto Mining Calculator is an essential tool that helps you estimate your potential earnings based on your mining setup. Whether you're mining Bitcoin, Ethereum, or other altcoins, the calculator takes into account factors like hash rate, power consumption, and electricity costs to provide accurate profit projections.

Using a mining calculator can guide your investment decisions, helping you choose the most profitable coins to mine and the best time to do so. With the volatile nature of the crypto market, staying informed and making data-driven decisions can significantly impact your mining success.

Don’t leave your mining profits to chance—use a crypto mining calculator to stay ahead in the game!

0 notes

Text

Litecoin Miner

Litecoin Miner: An Overview

Introduction

Litecoin (LTC) is one of the earliest and most successful altcoins, created by Charlie Lee in 2011 as a "lighter" version of Bitcoin. Designed to complement Bitcoin, Litecoin offers faster transaction times and a different hashing algorithm, making it an attractive option for both users and miners. The process of mining Litecoin involves solving complex mathematical puzzles to validate transactions on the blockchain and, in return, receiving newly minted Litecoins as a reward. Litecoin Miner

What is Litecoin Mining?

Litecoin mining is the process by which transactions are verified and added to the public ledger, known as the blockchain. Similar to Bitcoin mining, it involves solving cryptographic puzzles. However, unlike Bitcoin, which uses the SHA-256 hashing algorithm, Litecoin employs the Scrypt hashing algorithm. Scrypt is designed to be more memory-intensive, which was intended to make mining more accessible to a broader range of users with less specialized hardware.

Types of Litecoin Miners

CPU Mining:

In the early days of Litecoin, mining could be performed using regular CPUs (Central Processing Units). However, as the network grew and more miners joined, CPU mining became less viable due to its inefficiency and the rising difficulty level of the puzzles.

GPU Mining:

As CPU mining became obsolete, miners turned to GPUs (Graphics Processing Units). GPUs are more efficient than CPUs because they can handle more calculations per second, making them better suited for the repetitive tasks involved in mining.

ASIC Mining:

The introduction of ASICs (Application-Specific Integrated Circuits) revolutionized Litecoin mining. ASIC miners are specially designed for a particular hashing algorithm (in this case, Scrypt) and are much more efficient than GPUs. However, ASICs are expensive, and their introduction has made it challenging for smaller, independent miners to compete.

How Does Litecoin Mining Work?

Litecoin mining involves adding new blocks to the blockchain. Each block contains a list of recent transactions. Miners compete to solve a cryptographic puzzle, and the first miner to solve the puzzle gets to add the block to the blockchain and is rewarded with a certain number of Litecoins (currently 12.5 LTC per block, though this amount is halved approximately every four years).

The puzzle is solved by guessing a number (the "nonce") that, when hashed along with the block's data, produces a hash with a certain number of leading zeros. This process requires immense computational power and energy, leading to concerns about the environmental impact of mining.

Mining Pools

Mining Litecoin solo is increasingly difficult due to the competition and high computational requirements. To increase their chances of earning rewards, many miners join mining pools. In a mining pool, miners combine their resources to increase the likelihood of solving the cryptographic puzzle. When the pool successfully mines a block, the reward is distributed among the members based on the amount of computational power each contributed.

Hardware and Software Requirements

Hardware:

ASIC Miners: For those serious about mining Litecoin, ASIC miners are the best option. Examples include the Antminer L3+ and the Innosilicon A4 Dominator.

Cooling Systems: Mining rigs generate significant heat, so proper cooling systems are essential to prevent hardware damage.

Software:

Mining Software: Miners need software to connect their hardware to the Litecoin network and their mining pool. Examples include CGMiner, EasyMiner, and BFGMiner.

Wallet: A Litecoin wallet is necessary to store the rewards earned from mining. There are various types of wallets, including hardware wallets, desktop wallets, and mobile wallets.

Profitability of Litecoin Mining

The profitability of Litecoin mining depends on several factors:

Hash Rate: The amount of computational power your mining rig can produce.

Electricity Costs: Mining consumes a lot of electricity, so the cost of power in your area significantly affects profitability.

Litecoin Price: The market value of Litecoin impacts how much your mining rewards are worth.

Difficulty: The mining difficulty adjusts periodically based on the total computational power of the network, affecting how hard it is to mine new blocks.

Online calculators can help estimate the potential profitability of Litecoin mining based on these factors.

Challenges and Considerations

Initial Investment: Setting up a profitable mining operation requires a significant upfront investment in hardware.

Energy Consumption: Mining is energy-intensive, leading to high electricity bills and environmental concerns.

Competition: With large mining farms and ASIC miners dominating the space, individual miners face stiff competition.

Regulatory Issues: In some regions, governments have imposed restrictions or regulations on cryptocurrency mining due to its energy consumption. Litecoin Miner

Conclusion

Litecoin mining has evolved from being a hobbyist activity to a highly competitive industry. With the advent of ASIC miners, the barrier to entry has increased, making it difficult for small-scale miners to profit without significant investment. However, for those with the resources and knowledge, mining Litecoin can still be a lucrative venture, especially if the price of Litecoin appreciates over time. As the cryptocurrency landscape continues to evolve, miners must stay informed and adapt to the changing environment to remain profitable.

0 notes

Text

Key Bitcoin Metrics to Watch for Every Investor

As the world of cryptocurrency continues to evolve, keeping an eye on key Bitcoin metrics can help you make informed investment decisions. Here are some essential metrics every Bitcoin investor should monitor:

1. Market Capitalization

Market capitalization represents the total value of all bitcoins in circulation. It's calculated by multiplying the current price by the total supply of bitcoins. A higher market cap indicates a more valuable and potentially more stable cryptocurrency.

2. Trading Volume

Trading volume measures the amount of Bitcoin traded over a specific period, usually 24 hours. High trading volume often signals strong market interest and liquidity, while low volume might indicate a lack of interest or market manipulation.

3. Price Movements

Keep track of Bitcoin's price fluctuations. Understanding trends, support and resistance levels, and historical performance can help predict future movements. Tools like candlestick charts can provide insights into market sentiment.

4. Hash Rate

The hash rate measures the total computational power used to mine Bitcoin. A higher hash rate indicates a more secure network, as it would require more computational power to execute a 51% attack. It also reflects the health and activity level of the mining community.

5. Network Difficulty

Network difficulty adjusts approximately every two weeks to ensure that new blocks are added to the blockchain roughly every 10 minutes. Higher difficulty means more competition among miners, indicating a healthy network.

6. Number of Transactions

Monitoring the number of transactions can provide insights into Bitcoin's usage and adoption. An increasing number of transactions suggests growing interest and utilization of the network.

7. Active Addresses

Active addresses refer to the number of unique addresses involved in transactions during a specific period. A rising number of active addresses indicates increased user participation and network activity.

8. Transaction Fees

Transaction fees can indicate network congestion. High fees often occur during periods of high demand and can affect the usability of Bitcoin for everyday transactions.

9. Sentiment Analysis

Market sentiment can greatly impact Bitcoin's price. Tools that analyse social media, news articles, and forums can provide a sense of whether the market is bullish (optimistic) or bearish (pessimistic).

10. Regulatory News

Keep an eye on regulatory developments. News about government regulations, bans, or endorsements can significantly impact Bitcoin's market dynamics and price.

By keeping track of these key metrics, you can gain a more profound understanding of Bitcoin's market behaviour and make more informed investment decisions.

0 notes

Text

Understanding Bitcoin Miner Capitulation and Outflows’ Impact on BTC Value

Key Points

The Bitcoin miner capitulation might ease selling pressure on Bitcoin.

Metrics suggest a bullish trajectory for Bitcoin prices in the upcoming weeks.

The concept of Bitcoin miner capitulation is gaining momentum and is reminiscent of the scenario in December 2022.

Julio Moreno, CryptoQuant’s head of research, revealed a 7.6% hash rate drawdown in a post on X (previously Twitter).

Hash Rate and Price Fluctuations

It’s important to note that the drop in Bitcoin prices is not a direct result of the hash rate plunge. Instead, factors such as the halving effects, market sentiment, and miner cash requirements for equipment upgrades contribute to the price fluctuations.

For instance, these factors led to Bitcoin’s drop from $71k to $60k in June.

The hash rate, which measures the computational power of Bitcoin miners, was at 537.15 EH/s at the time of reporting.

Miner Capitulation: A Positive Sign?

The 7.6% hash rate drop mirrors the decrease that followed the FTX exchange collapse in November 2022 and the subsequent slump in market sentiment in December 2022.

Data from the miner profit/loss sustainability chart indicates that miners were significantly overpaid in early June. Conversely, two weeks later, they were heavily underpaid as Bitcoin prices had fallen by 16.2%.

At the moment, the sustainability metric is transitioning from extremely underpaid to fairly paid.

This shift does not necessarily signify a local bottom, but it suggests that miners might hold off on selling until prices improve.

Examining Miner Outflows

The Miners’ Position Index calculates a ratio using the 365-day moving average of the miners’ USD outflows and the current outflows.

This ratio provides insights into miner behavior, particularly whether they are sending more or less Bitcoin to exchanges.

Data shows that miner outflows were substantial in February and March, decreased slightly in April and May, and were relatively low in June. Thus, miners are sending fewer coins than usual to exchanges.

In conclusion, the hash rate drop supports the notion of miner capitulation. The MPI data suggests that miners have been liquidating fewer Bitcoin than usual, which could be a bullish sign in the long term.

0 notes

Text

Dogecoin Mining: The Comprehensive Guide

Dogecoin, originally created as a joke cryptocurrency in 2013, has evolved into a popular and widely recognized digital asset. Known for its Shiba Inu meme mascot and vibrant community, Dogecoin has carved out a unique niche in the cryptocurrency landscape. One of the key activities ensuring the integrity and security of Dogecoin is mining. This article delves into the world of Dogecoin mining, exploring its mechanisms, requirements, and considerations for those interested in becoming part of this dynamic ecosystem.

What is Dogecoin Mining?

Dogecoin mining is the process of validating transactions on the Dogecoin network and adding them to the blockchain. This process involves solving complex mathematical problems, and the first miner to solve these problems gets to add a new block to the blockchain. This process is known as Proof of Work (PoW). Miners are rewarded with newly created Dogecoins and transaction fees from the transactions included in the block for their efforts.

The Mechanics of Dogecoin Mining

Dogecoin mining operates similarly to other PoW-based cryptocurrencies but with some unique characteristics.

Scrypt Algorithm

Dogecoin uses the Scrypt hashing algorithm, which is more memory-intensive than Bitcoin's SHA-256 algorithm. Scrypt was chosen to make mining more accessible to average users with consumer-grade hardware, although the landscape has shifted with the advent of more powerful mining equipment.

Mining Hardware

Initially, Dogecoin could be mined using standard CPUs and GPUs. However, the increasing difficulty of mining has led to the need for more specialized equipment. Today, ASIC (Application-Specific Integrated Circuit) miners designed specifically for the Scrypt algorithm are the most efficient way to mine Dogecoin.

Popular ASIC Miners for Dogecoin

Bitmain Antminer L3++: Known for its efficiency and relatively high hash rate.

Innosilicon A4+ LTCMaster: Offers a good balance between cost and performance.

Setting Up a Dogecoin Mining Operation

Step 1: Choose Your Hardware

Selecting the right hardware is crucial for successful mining. ASIC miners are now the preferred choice due to their higher efficiency and hash rate compared to CPUs and GPUs. Research different models to find one that fits your budget and energy consumption preferences.

Step 2: Software Setup

Once you have your hardware, you need to choose suitable mining software. Options like CGMiner, EasyMiner, and MultiMiner are popular and compatible with Scrypt ASIC miners. These programs connect your hardware to the Dogecoin network and manage the mining process.

Step 3: Join a Mining Pool

Mining Dogecoin solo can be challenging due to the high competition and increasing difficulty. Joining a mining pool, where miners share their processing power and split the rewards, is a more practical approach. Pools like AikaPool, ProHashing, and Multipool are popular among Dogecoin miners.

For More Information Click Here :- Dogecoin Mining

Step 4: Wallet Setup

Before you start mining, set up a Dogecoin wallet to store your earnings. Wallets can be software-based, such as the Dogecoin Core wallet, or hardware-based, like the Ledger Nano S. Ensure your wallet is secure, and back up your private keys to prevent loss.

Economics of Dogecoin Mining

The profitability of Dogecoin mining depends on several factors:

Hash Rate and Difficulty

The hash rate is the speed at which your hardware can solve cryptographic puzzles. The network difficulty adjusts periodically to ensure that blocks are added to the blockchain at a consistent rate. Higher difficulty means more computational power is required, impacting profitability.

Electricity Costs

Mining is energy-intensive, and electricity costs can significantly affect your bottom line. Calculate your potential earnings against your electricity expenses. Miners often seek locations with low electricity costs to maximize profits.

Dogecoin Price

The market price of Dogecoin directly impacts mining profitability. If the price drops significantly, the rewards might not cover the operational costs. Conversely, a price surge can make mining highly lucrative.

Environmental Impact and Future of Dogecoin Mining

Like other PoW cryptocurrencies, Dogecoin mining has been criticized for its environmental impact due to high energy consumption. Efforts are ongoing within the industry to develop more energy-efficient mining technologies and explore renewable energy sources.

The future of Dogecoin mining will likely see further advancements in ASIC technology, continued community support, and potential adaptations to maintain its relevance and sustainability in the rapidly evolving crypto landscape.

Dogecoin mining is a complex yet rewarding endeavor, combining elements of technology, economics, and strategic planning. Whether you're a hobbyist looking to dabble in the world of cryptocurrencies or a professional seeking to maximize returns, understanding the fundamentals of Dogecoin mining is crucial. By staying informed about the latest developments and optimizing your mining setup, you can participate effectively in this dynamic and exciting space.

0 notes

Text

What is Cryptocurrency Mining?

Cryptocurrency began with blockchain — a chain of consecutive blocks containing transaction data from users. This is the foundation on which digital currency appeared, with each cryptocurrency having its own blockchain.

What does the block mechanism in the chain look like?

When a transaction occurs, data about it is compiled into a block. It is added to the general blockchain network after a new coin is created or when all calls and passwords during the exchange/transfer/sale/purchase are verified and confirmed. This brings us to the second important point — mining, which involves tasks such as searching, generating new blocks, and confirming transactions for the blockchain. Miners handle these tasks.

Once a block has been recorded and added to the chain, the user cannot make changes to the record of operations. This is a peculiarity of the blockchain network mechanism, which makes it a secure method for storing data. Each cryptocurrency has its own cryptographic algorithm that encrypts transaction data. For example, in the case of Bitcoin, this is the SHA-256 algorithm, which transforms information into a unique string of characters.

How does the process of generating new coins work?

For this, miners regularly solve cryptographic tasks of 64 characters to calculate a unique hash for a specific block, containing transaction information. The faster they guess the hash, the faster a new block will be created in the network, and the miners will receive a reward. Then others must verify that everything was done honestly during mining (this is called Proof of Work). The miner’s main tool here is a computer: the more powerful it is, the faster it will guess, and therefore win more often.

Bitcoin can be issued in a total of 21 million coins, after which the issuance will stop. When the process of creating new digital units in the network is completed, miners will be left with tasks such as:

Ensuring the stability of the blockchain network Maintaining the safe and uninterrupted operation of the blockchain Helping to expand the network: verifying and confirming transactions Thus, mining is not only the generation of new coins, but also the confirmation of transactions, checking operations for fraud, and maintaining the safe functioning of the blockchain as a whole.

How Cryptocurrency Mining Works

To start the process of mining cryptocurrency, a beginner will need a minimum set:

Powerful equipment (most often, special computers suitable for mining, such as ASIC, are used, which can process large volumes of information)

Special software for work tasks (it can be downloaded for free on the internet and installed on the equipment)

There is also such a concept as mining farms — a system consisting of several ASIC computers. By combining the efforts of several such computers, you will have a much higher chance of quickly solving a cryptographic task and including data about transactions.

Depending on the power of the computer, miners can work:

Individually

In a team

If you are mining Bitcoin alone, you can only rely on your own rig and bear full responsibility for both success and failure. Not everyone has the opportunity to buy equipment with huge capacities (which requires regular updates and upgrades), so many prefer mining pools: there, “miners” join forces to faster decipher hashes, generate blocks in the network, and receive rewards. Moreover, the winnings are divided among the participants in proportion to the efforts invested during mining, i.e., the power of their equipment. The stronger the computer, the larger the share. Well-known pools include Btc.com, Via BTC, and F2pool.

Each miner has their own hash rate — a performance indicator of the number of hashes per second that their computer can calculate. Another parameter — the difficulty of mining cryptocurrency — shows how difficult it is to find a hash. It is usually kept at a level where a block is generated on average every 10 minutes.

Some miners use cloud mining services: when you do not buy expensive computers at home (and then pay huge electricity bills), but rent the power of someone else’s equipment through a site or application. This is one of the simple ways that do not require much effort, which is especially important for those who want to try and understand if mining suits them. Among the popular providers are Genesis Mining, EasyMiner, and ECOS.

There is also browser mining, for which no expensive powerful equipment is required. To receive a reward, you need to use a specific browser. However, this method has one significant disadvantage — small rewards. You can try your hand at this type of mining, for example, in the Brave browser.

It is also worth mentioning hidden mining, when someone infects your computer with malicious software and thus gains access to it (and illegally uses its power). In fact, this is fraud. In such a situation, you receive the reward for processing transactions, not you, but the one who uses you. And most importantly, you may not even notice for some time that your computer is connected to hidden mining.

What rewards do miners receive for their work?

In March 2024, the price of Bitcoin reached a mark of $70,000, which became a historical record, and for miners — a signal that the coin will continue to rise in price in the next few years. This means that more blocks with transaction data need to be generated for a wealthy old age, because the more blocks you have created, the greater your reward. But can you really get good rewards for mining cryptocurrency?

If answered briefly and generally, the reward for mining can be quite large. If you understand how the processes and mechanisms work, have equipment with sufficient power, and be part of this community for some time. However, beginners should not dream of big rewards at the start of mining: they will have to be patient and gain experience.

Reward for creating a block

If we talk about rewards, it is better to do so with specific figures and examples to understand the situation in the market. In the distant 2009, when BTC just appeared, a miner could receive 50 coins for a block. Gradually, the reward amount decreased, and in 2012 it was already 25 bitcoins. In 2016, it became even less — 12.5 BTC, and in 2020–6.25 BTC. For now, this amount has stopped at 6.25 bitcoins for each block added to the blockchain network.

The reduction of the reward amount during mining is called halving — when the reward for a block is halved. It occurs in the Bitcoin blockchain network after mining every 210,000 blocks, which takes approximately 4 years. So, in April of this year, a new halving should occur, and then the reward for mining BTC will reach 3.125 bitcoins.

Reward for other services

Miners receive rewards in cryptocurrency for performing tasks such as verifying and confirming transactions in the blockchain. This is about the commission — a certain percentage of the realized operations that the miner included in the block for the blockchain network.

The more miners compete in searching for and deciphering the hash, the harder it is for them to find a new block and generate it. This option is made to maintain stability in the blockchain, to ensure a constant inflow of new bitcoins, and to restrain the size of cryptocurrency inflation.

What affects the reward

When discussing rewards for mining, it is impossible to ignore the possible costs that miners may incur in the process. What can affect the miner’s reward?

The size of the reward for a block

The difficulty of the mining process (purchasing powerful equipment or renting a cloud, regular setup and equipment updates)

Network hash rate

Electricity bills

Mining pool commission (if you are not a lone wolf)

Market (unstable) cryptocurrency rate

There is even a special calculator that allows you to pre-calculate likely costs and reward size. For example, the ECOS calculator evaluates the power of the equipment, reward, and service cost for a specific period.

Nowadays, individual miners are increasingly joining mining pools because they will not be able to get a large total amount of rewards in the network on their own.

In addition, there are other things that complicate the process of monitoring transactions and creating new links in the blockchain chain.

Electricity is the sore point of all miners, so they strive to work from countries and regions where this resource is cheaper.

Taxation — each country has its own laws regarding cryptocurrency and operations with it, and somewhere the sphere of digital money is not regulated at all yet, etc.

Legislative mechanism — the attitude of the country’s authorities towards cryptocurrency mining can be different, it can be illegal or not specially regulated, and this must be taken into account.

For example, a good option for mining Bitcoin will be Armenia. It is there, by the way, that ECOS provides its services. The authorities of the country understand the importance of supporting technologies that shape the future, so they strive to contribute to their development. For example, a special economic zone has been created there for miners, where there are zero taxes and various benefits for a period of 25 years.

Reward for other services

How to start mining cryptocurrency Let’s look at the basic steps to start mining Bitcoin in two formats: with your own equipment or through cloud mining.

Mining with your computer Choose an ASIC computer model For mining, you need modern equipment with a high hash rate and sufficient power to have a water cooling system that allows you to reduce noise. Such a computer will be expensive, but maximally convenient for mining Bitcoin.

Set up ASIC and install software If you understand the topic, you can try to set up the equipment yourself. But if you are a complete beginner, it is better to ask for help from those who have already been receiving rewards for mining for a long time.

Create a Bitcoin wallet Rewards in bitcoins for mining will be transferred there. There are hot wallets — applications for a PC or smartphone, and cold wallets — physical media (in the form of a flash drive) where you store your savings.

Start mining, gain experience

We have already described the nuances and subtleties during mining.

Follow the news It is important for a miner to understand what the situation is in the market, how Bitcoin or any other cryptocurrency is feeling, what new products have appeared in the equipment, what has changed in the legislative mechanism of a particular country regarding digital money, etc. It is also useful to join online mining communities to share news and exchange experiences.

Cloud Mining Register on a site or application with cloud mining For example, on the ECOS platform. Moreover, personal identity verification with documents is not required here.

Activate demo mining mode You can test cloud mining, learn how it works in practice. You do not spend money during this time, but the reward will be credited to you only if you subsequently buy access to the platform.

Choose and buy access to cloud mining If the test satisfied you, you can pay for access. There are tariffs here both for beginners and for experienced miners.

Conclusion

Receiving rewards for mining cryptocurrency is not that simple. You will have to invest financially, devote a lot of time to it, and most likely work in a team, not solo. And also, if you live in a city with high electricity bills, you will have to move. On the other hand, you will be at the forefront of technological development and participate in the development of a promising project. And considering that not only interest in digital currency is steadily growing, especially in BTC, but also the price of coins, the reward for mining can be real, not just a dream.

0 notes

Text

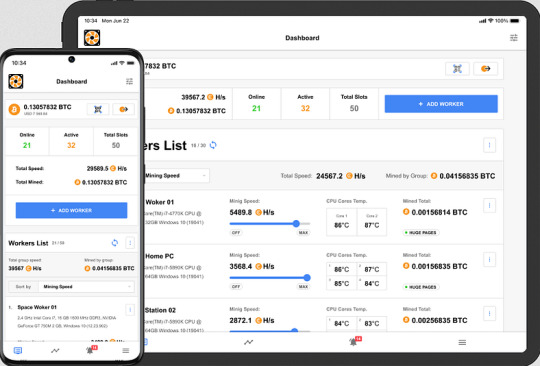

Crypto mining calculator

As The entire world of cryptocurrency carries on to broaden, mining has become a vital element from the ecosystem. Crypto mining entails validating transactions and introducing them on your blockchain, a system that demands sizeable computational electric energy. For miners, comprehension the opportunity profitability of their endeavours is crucial, and This is each time a crypto mining calculator will come into Enjoy.

What exactly is often a Crypto Mining Calculator?

A crypto mining calculator is really a Gadget made to enable miners estimate the profitability in their mining pursuits. By inputting numerous parameters one example is hash rate, electricity intake, electrical ability Charge, and The existing cost of the cryptocurrency, miners could get an estimate inside their possible earnings. This Device is crucial for making educated conclusions about which cryptocurrencies to mine and becoming acquainted with the cost-effective implications of mining.

Essential Functions of Crypto Mining Calculators:

Hash Rate: The hash cost signifies the velocity mining calculator at which a mining solution can handle cryptographic puzzles. That is an important Think about examining mining profitability. Elevated hash fees typically bring about far better chances of earning Advantages.

Electrical power Use: Mining is a power-intensive activity, and the amount of electrical Vitality consumed can substantially effects profitability. Calculators Remember the facility use in the mining parts to produce an actual estimate.

Electrical power Cost: The price of electrical ability could vary tremendously determined by location. Miners really have to enter their precise Strength premiums to compute the actual cost of jogging their mining units.

Mining Pool Costs: A lot of miners be a part of mining swimming pools to mix their computational electric electric power and share benefits. Mining swimming pools Ordinarily demand a level, ordinarily a percentage during the earnings, which need to be factored while in the profitability calculation.

Difficulties Degree: The issue of mining a specific cryptocurrency adjusts following a while To make certain a gradual move of blocks. Higher concerns amounts signify that lots extra computational electrical electrical power is essential to receives a commission the similar Added benefits, impacting profitability.

Present Price tag tag and Block Reward:

The existing sector location price of the cryptocurrency and also the block reward (the level of cryptocurrency awarded for resolving a block) are critical inputs. These features particularly influence the possible earnings from mining.

Advantages of Utilizing a Crypto Mining Calculator:

Educated Collection-Setting up: By supplying a transparent photograph of probable earnings and charges, mining calculators enable purchasers make informed conclusions about irrespective of whether to get rolling on mining, which cryptocurrencies to mine, and what factors to take a position in.

Price tag Administration: Comprehension the fiscal implications of Vitality use as well as other operational rates assists miners handle their costs extra thoroughly, guaranteeing that they don't commit in extra of they receive.

Economic obtain Maximization: Calculators Allow miners to examine different scenarios, like modifying mining parts or switching to varied cryptocurrencies, to discover most likely quite possibly the most rewarding opportunities.

Threat Assessment: The dangerous mother mother nature of cryptocurrency marketplaces signifies that mining profitability can modify quickly. A mining calculator may also help assess the possibility by factoring in marketplace fluctuations and difficulty changes.

Just how to Employ a Crypto Mining Calculator:

Assemble Data: Accumulate all crucial info, which incorporates your mining components’s hash amount, electrical power use, electrical energy Demand, and any pool provider fees you may incur.

Input Parameters: Enter the collected facts into the calculator. Make sure to use suitable and up-to-date figures to protected a dependable estimate.

Take a look at Good results: Analysis the calculator’s output, which will normally include things like things such as approximated every single day, weekly, and thirty day period to thirty day period earnings, together with charges. Pay attention to Web profitability, that's the earnings correct soon after subtracting all expenditures.

Adjust Variables: Experiment with different bitcoin mining calculator variables to find out how variants in electrical Electrical power Expense, hash amount of money, or cryptocurrency prices affect profitability. This will help in optimizing your mining strategy.

As being the earth of cryptocurrency carries on to create, is now a very important element of the ecosystem. Crypto mining will contain validating transactions and incorporating them to the blockchain, a process that requires sizeable computational capability. For miners, comprehending the potential profitability in their initiatives is crucial, and this is where a crypto mining calculator will arrive into Perform. Additional Rewards, and vital criteria when employing a crypto mining calculator, presenting an intensive overview for the two of These newbie and Experienced miners.

What is actually a Crypto Mining Calculator?

A crypto mining calculator is really a Useful resource developed to assist miners estimate the profitability of their mining activities. By inputting many different parameters For example hash charge, electric energy ingestion, electrical power Charge, and The prevailing price of the cryptocurrency, miners could get an estimate in their most likely earnings. This Software is important for earning educated selections about which cryptocurrencies to mine and recognizing the financial implications of mining.

Important Capabilities of Crypto Mining Calculators:

Hash Rate: The hash selling price signifies the velocity at which a mining equipment can obvious up cryptographic puzzles. This is a crucial Take into account examining mining profitability. Far better hash price ranges ordinarily convey on greater choices of earning benefits.

Power Use: Mining can be an affect-intense exercising, and the amount of Electrical power eaten can substantially impact profitability. Calculators Remember the ability use from the mining elements to provide an exact estimate.