#guess I need to just ditch the app and only use the desktop. then I could at least use all those firefox extensions ig

Explore tagged Tumblr posts

Text

Hey what's this absolute horseshit with the Tumblr app where if there's a post that has a tag you filter, if you click it it opens up your browser to view it there?

Why is Tumblr becoming more and more obnoxious as fuck to use?

#ffs#tumblr#the app has been borderline unusable for a LONG while but I'm basically never on my laptop outside of work. but like fuck#guess I need to just ditch the app and only use the desktop. then I could at least use all those firefox extensions ig

2 notes

·

View notes

Note

Hello, just a passer-by! I actually was just looking at waterfall and was considering using it(I'm just looking for new websites to us and be cringe on) when I saw your post recommending not to!

I'm curious, what happened that was so bad???

Hello!!

The admin Thell/Thelle doesn't plan to develop Waterfall.Social anymore. He said he plans to keep it on while he creates something else but its not worth the time. Trust Me. (And waterfall apparently is down half the time nowadays)

People paid for this website on gofund me or whatever patreon website so you'd expect a bit of professionalism but Thell is not and he's ready to blame the users on his own shortcomings.

The ToS at the beginning had some bull like "no need to tire you with legalese" (paraphrasing it here) at the beginning of it. which Obviously had to be changed later. But it was a red flag i suppose.

Back when i joined waterfall years ago it to had some nice ideas, but longterm it fell Apart due to Thell being a mess of a single admin.

Thell created us an art marketplace on the website and then took it down few months later bc it wasn't profitable and people wouldn't abide the rules.

Which, in all fairness, the website was small, and he'd refuse to hire more staff idk. hard to see it profitable if it's tiny

Like, he'd give us featured art frame like on Tumblr desktop except it was random art so everyone got the chance to use it. Everyone loved it bc of that. Maybe feew years later though he broke the feature down

Why? Bc, at least to him, People would register to the website, see "bad art" and then walk away from the website. (Ways to insult userbase💖)

Not that the website itself was kind of bare and laggy and bunch of people was on it :))

Thell changed the featured art frame into 'only artworks above a treshold of notes get in there'. And it was some bull amount bc all you could see was few artworks circulating on repeat 'for another year'

I also heard the coding of the website was a mess but i'm not an IT person so idk

he also promised an app for Waterfall but then it turned out he'd have to have more staff to post it in appstore lol

Thell would even sort of threaten at some point to take away NSFW? the very reason why the site existed

Saying that people don't tag nsfw and this is why other websites got it banned and he doesn't want it to happen here.

A year ago Waterfall stopped working for a few weeks.

And so i was curious and i started digging. (it was actually also after announcement that Thell was thinking about ditching the website altogether for maybe a new project but couldn't decide)

Invites for official discord server weren't working.

Official twitter was gone

Official tumblr account was gone

No info whatsoever

Except i only found some roleplaying cherp drama on tumblr dunking on Thell i guess, bc offtopic, but apparently he was an admin on it and they accussed him of pretending to be 2 people in the same time, god complex, narcissism, bad coding and telling one of the Discord members to kill themself.

At the beginning i also remember being able to look at notification board.

And later it disappeared for some reason.

No notification board

Thell took it down after a year or two I Suppose

Lack of communication, one big indecisiveness, lack of transparency, taking away what was already in there, lack of planning skills while not getting more people on board, etc.

And honestly the red signs were already there even before Waterfall. Before this site, which is supposed to be for leftist minded people, he was creating a website for rightists which also failed lol (you should be able to find more about it while browsing through waterfall tag more). People can change. But it seems Thell didn't change that much for the better beyond changing bunch of views.

If you'd like receipts, they should be available on Waterfall's Staff blog on Waterfall social bc Thell wrote updates through time.

If Thell creates another website ever again i Hope Tumblr will crush it to pulp.

--

If you'd like something that's more stable i can recommend Pillowfort and send you an invite code if you'd like. They also allow nsfw.

I heard there was some drama with it and staff aswell though i have no details about it, and i bet it wasn't as ridiculous as waterfall. I know they were fakely accussed on allowing cp tho. Even despite their website being one of the most anti-cp (even fictional is a No) i've seen. Heard they are too jumpy with implementing this ban, which is not good if you get fakely accussed, but well, maybe it changes. You don't have to pay for it to necessarily use it so at worst its just waste of time. o/ Pillowfort grows and seems to get regularly updated and it has a team behind it.

If you are an artist or an art enjoyer, Artfol is a cool new app for that. You can view it also from desktop. They are currently developing the option to post artworks from website. A very organised small team.

Other social media i somewhat heard of were mastodon (decentralised Twitter?) and Inkblot (another for artists)

If anyone knows more websites, please let me know!

Otherwise? Just not waterfall. Not it. The admin is way too unreliable

Edit: the website previous to Waterfall was racist. idk if rightist but for sure racist.

#carpet talks#waterfall.social#waterfall#waterfall social#thell#thelle#thanks for the ask!! 💖#carpet's box#long post

20 notes

·

View notes

Text

The Best Payroll Services (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

What would you do with ten extra hours a month?

You’d probably work on growing your business, right? Maybe you’d spend it creating new marketing campaigns to generate more revenue. Perhaps you’d take half a day off to spend time with your family.

Regardless, the average small business owner spends five hours every pay period running payroll. That adds up to 21 full work-days a year.

But thankfully, that’s not what your payroll process has to look like.

The best payroll services help you automate paying your employees and simplify the entire process, so you can gain more control over how you spend your time.

Without sacrificing employee satisfaction.

But with so many options to choose from, it’s easy to waste time trying to pick the right one.

To help speed up the process, I reviewed six of the best systems on the market and put together a comprehensive list of what to look for as you make your final decision.

The 6 best payroll service options for 2020

Gusto – Best payroll service for small businesses

OnPay – Most flexible payroll service

Paychex – Best for larger organizations

ADP – Best payroll service with built-in HR

QuickBooks Payroll – Best for QuickBooks integration

Wave Payroll – Most affordable payroll service

How to choose the best payroll service for you

If you’ve spent some time searching for solutions from Google or asking for peers’ recommendations, you know there are hundreds of payroll companies to choose from.

With so many options, it can feel like a difficult decision.

To help you narrow things down, let’s walk through what to consider as you go through the process.

Number of employees

Most services charge a set monthly fee plus a small fee per employee. So, it’s essential to consider the number of employees you need to pay.

Some payroll services may limit the number of employees on certain plans while others may forego the per-employee fee altogether. Furthermore, some may also offer features that make it easier to pay many people at once.

You also need to consider whether you’re paying employees or contractors.

The process and fee structure may differ for different types of payments depending on which service you choose.

Basic payroll features

The best payroll services exist to simplify the process of paying your employees. So, every payroll service you consider should have a set of critical features, including:

Automatic payroll options

Self-service portal for full-time and part-time employees

Mobile capability to manage payroll on the go

Direct deposit so your employees get paid quickly

Automatic tax calculations and withholdings

W-2 and 1099 employee management

There are other advanced features you may want to consider as well, depending on what you need. This includes things like HR tools, benefits management, wage garnishments, and more.

So, carefully consider the essential features as well as the advanced features you need to simplify your payroll processes.

Tax features

Filing tax is a complicated and time-consuming process. It can also result in unfortunate and expensive penalties if you don’t do it right.

However, many payroll services offer tax features that simplify the process. From calculating payroll taxes to automatically withholding employee income taxes, there are countless things to consider.

So, it’s important to choose a payroll service that offers essential tax features to make your accountant’s life easier.

Or yours if you do your taxes yourself.

Built-in HR tools

If you offer benefits to your employees, you need a payroll service that helps you effectively manage things like time off, vacation requests, workers’ compensation, insurance, and more.

Furthermore, services with an employee self-service dashboard make this much more manageable. Employees can log in, update their accounts, request time off, and see an overview of their benefits package.

The cheaper options on this list tend to ditch HR features. So, carefully consider what you need against your budget before making any decisions.

Monthly payroll limits

If you have salaried employees or a set payroll schedule, most payroll services are adequate. However, if you pay freelancers or contractors on an irregular basis or run payroll more than twice a month, you need to be careful.

Some services offer unlimited payroll processing, while others limit the number of times you can issue payments every month.

So, carefully consider how often you need to send payments when making your final decision.

Integrations

To further simplify your business processes, it’s crucial to consider the business tools you’re already using to run your business.

It’s important to choose a payroll service provider that integrates seamlessly with those tools. Think about your accounting software, your employee scheduling software, and other essential tools related to payroll.

The different types of payroll services

There are several different services to consider, depending on your business’s size and your specific payroll needs.

So, before we dive into my top recommendations, I want to talk about the different types and how to decide between them.

1. Hiring someone to do it for you

If you can afford it, hiring someone (either in-house or as a contractor) to run payroll for you is an excellent option. This ensures you find someone who knows how to do it and that they have the time to do it well.

However, you still need payroll software. They may have their own preferences and expertise, which may help you decide which service is right for your business.

With that said, many small businesses don’t necessarily need to hire someone.

The best payroll services make running payroll easy, so anyone on your team can take care of it in a few clicks.

2. Software as a service (SaaS)

The software as a service (SaaS) model means you pay to use the software. Most service providers charge monthly or annually for this, and as long as you keep paying, you get to keep using it.

Most SaaS tools are cloud-based, meaning you can access it from a web browser anywhere.

However, some also offer desktop applications and mobile apps you install on a specific device.

This is the most common type of payroll service and the most convenient to use because you and your employees can access their accounts from any device, anywhere in the world with an internet connection.

All of the recommendations on this list are SaaS payroll services.

3. Enterprise-grade solutions

Most payroll services offer enterprise-grade and industry-specific solutions for large businesses. They come with specialized, custom pricing to match the unique needs of enterprise-grade companies.

A software like this could be a SaaS tool or an on-premise deployment, depending on what you need and the company you choose.

Most businesses don’t need this. But if you manage payroll for a large company or find your current solution limited, it may be a good idea to consider an enterprise solution.

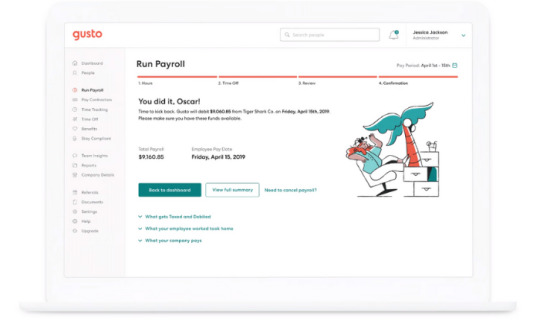

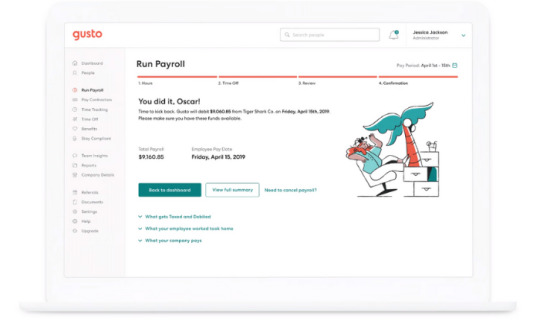

#1 – Gusto Review — The best for small businesses

If you’re a small business looking for a simple payroll service, Gusto is a smart choice. And you’ll be in good company with more than 100,000+ other small businesses around the world.

Gusto makes onboarding, paying, insuring, and supporting employees as easy as possible. And they don’t call themselves a “people platform” for no reason.

They offer the right set of tools and services to make your life (and your employees’ lives) easier.

Running payroll takes just a few clicks, and you can enjoy unlimited payroll runs every month. Need to pay seven different contractors at different times? No problem.

Need to pay the same employees the same wages every pay period? You can set it up to run automatically without you having to lift a finger.

Plus, you get access to a wide variety of features, including:

Automatic tax calculations

Built-in time tracking capabilities

Health insurance, 401(k), PTO, workers’ comp, and more

Compliance with I-9’s, W-2s, and 1099s

Employee self-service onboarding and dashboards

Next-day direct deposits (on specific plans)

And the best part? It’s affordable.

If you don’t have W-2 employees, Gusto starts at $6 per contractor per month. But if you do have full-time or part-time employees, expect to pay a bit more. Their other paid plans include:

Basic — $19 per month + $6 per person per month

Core — $39 per month + $6 per person per month

Complete — $39 per month + $12 per person per month

Concierge — $149 per month + $12 per person per month

Gusto is perfect for most startups and small businesses. But, large companies with complex benefits packages, and hundreds of employees may find it limiting.

Get started with Gusto today!

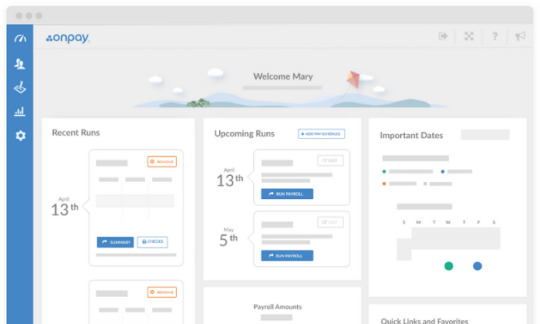

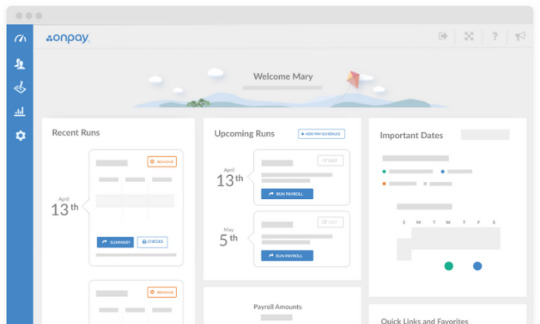

#2 – OnPay Review — The most flexible payroll service

If you’re looking for an all-in-one payroll system with transparent pricing and virtually unlimited flexibility, OnPay is an excellent choice.

Whether you’re a small company or a fast-growth startup, OnPay is versatile enough to suit your needs. Plus, you never have to guess how much you’re going to pay every month with their transparent pricing.

And you can rest easy knowing you have access to every feature OnPay offers regardless of the number of employees you have because they only provide one pricing plan.

Their software includes access to powerful features, including:

Unlimited monthly payroll runs

W-2 and 1099 capabilities

Automatic tax calculations and filings

Employee self-service onboarding and dashboards

Intuitive mobile app for management on the go

PTO, e-signing, org charts, and custom workflows

Integrated workers’ comp, health insurance, and retirement

Multi-state payroll

Plus, getting started is super easy. All you have to do is set up your account, add your employees, and start running payroll. Furthermore, OnPay automatically calculates and withholds taxes so you don’t have to worry about manual calculations or human error again.

They also offer specialized solutions for different industries, including nonprofits, restaurants, and farming/agriculture.

OnPay is $36 per month plus $4 per person per month. So, you can add new employees to the software for just a few dollars, making it excellent for fast-growing companies and small businesses alike.

And while OnPay can handle large companies with hundreds of employees, there are better enterprise options available. It’s most suitable for small businesses and fast-growth companies that need simple pricing and flexibility.

Try OnPay free for 30 days to see if it’s right for you!

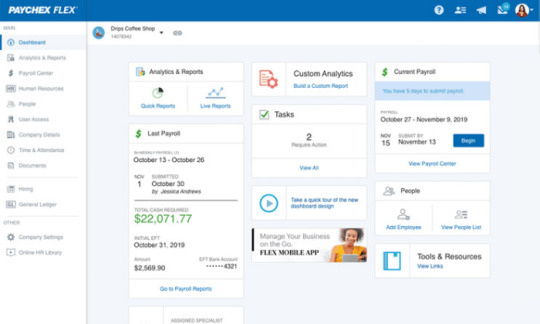

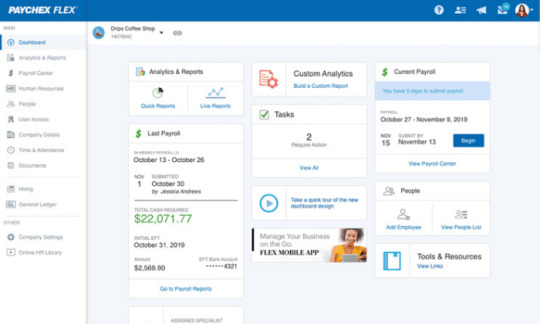

#3 – Paychex Review — The best for larger organizations

Paychex is an excellent choice for businesses with more than 50 employees. They also offer low-tier plans for small businesses, but they’re quite limited compared to the other small business options on this list.

However, their midsize to enterprise plans are perfect for large companies.

The larger your business is, the worse small discrepancies and human errors affect your tax calculations. And wrong tax filings equal harsh penalties from the IRS, even if it was an accident.

So as a large company, it’s imperative to have a payroll service that adapts to meet your needs. Paychex is more than a payroll service. It’s a human capital management (HCM) system designed to help you save time and reduce errors.

Their enterprise plans include features like:

Recruiting and onboarding

Performance and learning management

Powerful real-time analytics

100% employee self-service

Payroll automation features

Direct deposit, paper checks, and paycards

Salary, hourly, and contract workers

Paycheck garnishments

PTO and benefits management

Job costing and labor distribution

All of which are scalable for enterprises with thousands of employees (or as little as 50). Plus, Paychex services more than 650,000+ companies and has more than 50 years of experience in the industry.

So, you can rest easy knowing you’re in good hands.

With that said, getting started isn’t as easy as it is with some of the other options on this list. Because each deployment is tailored to your business, you can’t get going on your own. However, they do offer a team of specialists to help you get the ball rolling.

Contact their sales team for a custom quote to get started!

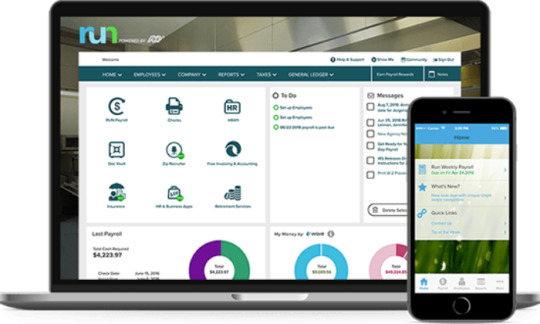

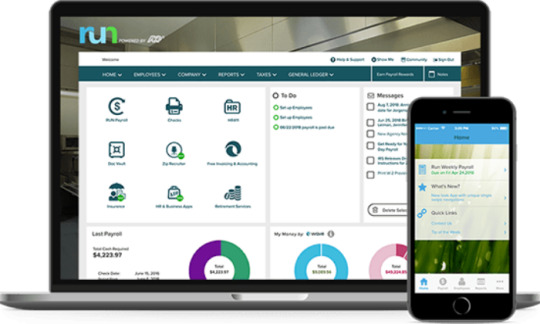

#4 – ADP Review — The best for built-in HR features

ADP is the way to go if you’re looking for a payroll service with the most built-in HR features. It’s perfect for smaller companies without an HR department and growing/large companies looking to streamline the process.

ADP works with more than 700,000 businesses in 140+ countries, making it one of the most popular payroll services for businesses of all shapes and sizes.

They offer tailored solutions for small, midsize, and enterprise businesses, so you’re sure to find the perfect solution whether you have five employees or 1000+.

Their lower-tiered plans include basic payroll features like automatic tax calculations, employee self-service tools, a mobile app, PTO management, and complete compliance support.

However, ADP offers more than just basic payroll and HR. They also include time tracking, talent recruitment, HR consulting services, advanced employee benefits, and the option to outsource your entire payroll/HR department.

You can also get unique benefits, like personalized training, legal assistance, background checks, and interview scheduling too.

Furthermore, ADP offers industry-specific solutions for nine different industries, including:

Restaurants

Construction

Healthcare

Manufacturing

Retail

Nonprofits

Note: ADP pricing isn’t available online, so it may not be suitable for micro or small businesses interested in getting started quickly. If you need something fast and straightforward, my #1 recommendation is Gusto.

Request a free quote to see if ADP is right for you today.

#5 – Quickbooks Payroll — The best for QuickBooks integration

Quickbooks Online is one of the most well-known accounting tools on the market. And if you’re already a user, QuickBooks Payroll is an excellent addition to your tech stack.

The two tools integrate seamlessly, making account reconciliation and tax season a breeze.

Furthermore, QuickBooks’ payroll system works in all 50 states. So, whether you have a remote team or work with contractors across the country, you don’t have to worry about making errors or mishandling taxes.

You can also rest easy knowing your federal, state, and local taxes are automatically calculated plus paid for you every time you run payroll. Plus, the entire process is easily automated after your first round of payments.

With QuickBooks, you get a full-service payroll system regardless of the plan you choose.

And the user interface is aesthetically pleasing with direct deposit payments landing in your employees’ bank accounts within 24 – 48 hours.

The Core Plan starts at $45 per month, plus $4 per employee per month. It includes:

Full-service payroll with unlimited runs

Automatic payments after the first run

Health benefits

Wage garnishments

Next-day direct deposit

24/7 live chat support

All 50 states

So, even their most basic plan includes everything you need to simplify your HR and payroll processes.

But if that isn’t enough, their advanced plans include:

Premium — $75 per month + $8/employee per month

Elite — $125 per month + $10/employee per month

Get 70% off your first three months to take QuickBooks Payroll for a test drive today!

Note: 1099 contractors and freelancers aren’t included. It comes as an add-on with additional monthly fees. So, this isn’t the most affordable choice if you frequently handle contractors or freelancers.

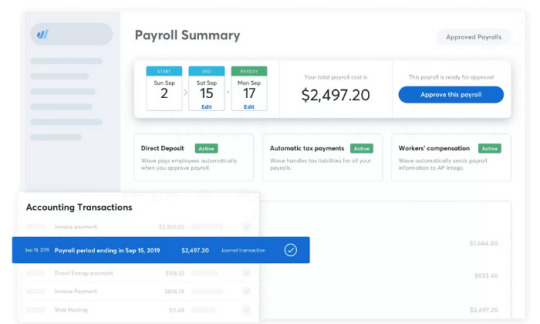

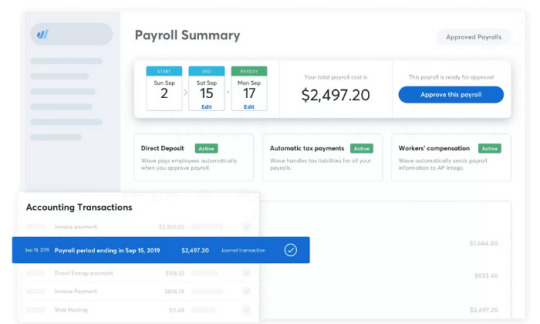

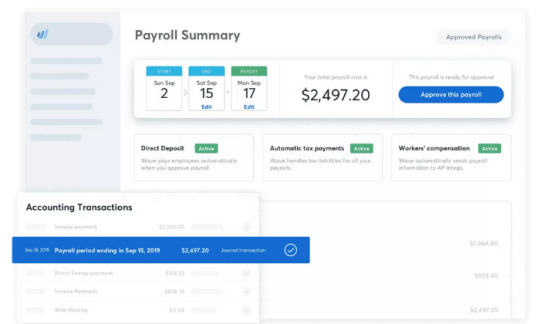

#6 – Wave Payroll Review — The most affordable payroll service

If you’re on a tight budget, Wave Payroll is an affordable payroll option. Wave also offers numerous other small business tools for free, including invoicing, accounting, and receipt management.

The different apps integrate seamlessly to create an affordable small business accounting and payroll solution.

With Wave, getting started takes just a few minutes, and running payroll goes even faster. Plus, they offer a 100% accuracy guarantee. You can also pay hourly, salary, and contractors and automatically generate the right tax forms.

In some states, Wave automatically files and pays your state/federal payroll taxes for you. However, in those states, Wave’s services are more expensive.

You also get access to features, like:

Automatic journal entries (if you use Wave Accounting)

Self-service pay stubs and tax forms for your employees

Workers’ compensation management

Basic payroll reporting

Automatic year-end tax forms

Timesheets for PTO and accruals

While Wave is one of the most affordable payroll services, it doesn’t sacrifice functionality and essential features. Despite being cheaper than the other options on this list, you still get all the essentials you need to run payroll for your small business.

In tax service states, Wave is $35 per month + $6 per contractor/employee per month. This service isn’t necessarily cheaper than the other options on this list.

But, it’s still a great option if you’re a small business owner looking for a simple payroll solution.

However, it’s $20 per month + $6 per contractor/employee per month in self-service states. At this price, it’s easily the cheapest option with the most features available.

And don’t forget that Wave Payroll seamlessly integrates with Wave’s free accounting and invoicing software as well.

So, if you don’t yet have accounting software, this is a smart choice.

Try Wave Payroll free for 30 days to see if it’s right for you and your business!

Summary

For most users, Gusto, OnPay, and Wave are my top recommendations.

They’re all excellent for small and fast-growth businesses with the ability to scale to match your needs. Plus, they’re affordable and easy to use.

However, different businesses require different solutions.

So, don’t forget to use the considerations we talked about as you go through the process of choosing the best payroll services for your business.

What payroll services do you prefer?

The post The Best Payroll Services (In-Depth Review) appeared first on Neil Patel.

The Best Payroll Services (In-Depth Review) Publicado primeiro em https://neilpatel.com

0 notes

Text

The Best Payroll Services (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

What would you do with ten extra hours a month?

You’d probably work on growing your business, right? Maybe you’d spend it creating new marketing campaigns to generate more revenue. Perhaps you’d take half a day off to spend time with your family.

Regardless, the average small business owner spends five hours every pay period running payroll. That adds up to 21 full work-days a year.

But thankfully, that’s not what your payroll process has to look like.

The best payroll services help you automate paying your employees and simplify the entire process, so you can gain more control over how you spend your time.

Without sacrificing employee satisfaction.

But with so many options to choose from, it’s easy to waste time trying to pick the right one.

To help speed up the process, I reviewed six of the best systems on the market and put together a comprehensive list of what to look for as you make your final decision.

The 6 best payroll service options for 2020

Gusto – Best payroll service for small businesses

OnPay – Most flexible payroll service

Paychex – Best for larger organizations

ADP – Best payroll service with built-in HR

QuickBooks Payroll – Best for QuickBooks integration

Wave Payroll – Most affordable payroll service

How to choose the best payroll service for you

If you’ve spent some time searching for solutions from Google or asking for peers’ recommendations, you know there are hundreds of payroll companies to choose from.

With so many options, it can feel like a difficult decision.

To help you narrow things down, let’s walk through what to consider as you go through the process.

Number of employees

Most services charge a set monthly fee plus a small fee per employee. So, it’s essential to consider the number of employees you need to pay.

Some payroll services may limit the number of employees on certain plans while others may forego the per-employee fee altogether. Furthermore, some may also offer features that make it easier to pay many people at once.

You also need to consider whether you’re paying employees or contractors.

The process and fee structure may differ for different types of payments depending on which service you choose.

Basic payroll features

The best payroll services exist to simplify the process of paying your employees. So, every payroll service you consider should have a set of critical features, including:

Automatic payroll options

Self-service portal for full-time and part-time employees

Mobile capability to manage payroll on the go

Direct deposit so your employees get paid quickly

Automatic tax calculations and withholdings

W-2 and 1099 employee management

There are other advanced features you may want to consider as well, depending on what you need. This includes things like HR tools, benefits management, wage garnishments, and more.

So, carefully consider the essential features as well as the advanced features you need to simplify your payroll processes.

Tax features

Filing tax is a complicated and time-consuming process. It can also result in unfortunate and expensive penalties if you don’t do it right.

However, many payroll services offer tax features that simplify the process. From calculating payroll taxes to automatically withholding employee income taxes, there are countless things to consider.

So, it’s important to choose a payroll service that offers essential tax features to make your accountant’s life easier.

Or yours if you do your taxes yourself.

Built-in HR tools

If you offer benefits to your employees, you need a payroll service that helps you effectively manage things like time off, vacation requests, workers’ compensation, insurance, and more.

Furthermore, services with an employee self-service dashboard make this much more manageable. Employees can log in, update their accounts, request time off, and see an overview of their benefits package.

The cheaper options on this list tend to ditch HR features. So, carefully consider what you need against your budget before making any decisions.

Monthly payroll limits

If you have salaried employees or a set payroll schedule, most payroll services are adequate. However, if you pay freelancers or contractors on an irregular basis or run payroll more than twice a month, you need to be careful.

Some services offer unlimited payroll processing, while others limit the number of times you can issue payments every month.

So, carefully consider how often you need to send payments when making your final decision.

Integrations

To further simplify your business processes, it’s crucial to consider the business tools you’re already using to run your business.

It’s important to choose a payroll service provider that integrates seamlessly with those tools. Think about your accounting software, your employee scheduling software, and other essential tools related to payroll.

The different types of payroll services

There are several different services to consider, depending on your business’s size and your specific payroll needs.

So, before we dive into my top recommendations, I want to talk about the different types and how to decide between them.

1. Hiring someone to do it for you

If you can afford it, hiring someone (either in-house or as a contractor) to run payroll for you is an excellent option. This ensures you find someone who knows how to do it and that they have the time to do it well.

However, you still need payroll software. They may have their own preferences and expertise, which may help you decide which service is right for your business.

With that said, many small businesses don’t necessarily need to hire someone.

The best payroll services make running payroll easy, so anyone on your team can take care of it in a few clicks.

2. Software as a service (SaaS)

The software as a service (SaaS) model means you pay to use the software. Most service providers charge monthly or annually for this, and as long as you keep paying, you get to keep using it.

Most SaaS tools are cloud-based, meaning you can access it from a web browser anywhere.

However, some also offer desktop applications and mobile apps you install on a specific device.

This is the most common type of payroll service and the most convenient to use because you and your employees can access their accounts from any device, anywhere in the world with an internet connection.

All of the recommendations on this list are SaaS payroll services.

3. Enterprise-grade solutions

Most payroll services offer enterprise-grade and industry-specific solutions for large businesses. They come with specialized, custom pricing to match the unique needs of enterprise-grade companies.

A software like this could be a SaaS tool or an on-premise deployment, depending on what you need and the company you choose.

Most businesses don’t need this. But if you manage payroll for a large company or find your current solution limited, it may be a good idea to consider an enterprise solution.

#1 – Gusto Review — The best for small businesses

If you’re a small business looking for a simple payroll service, Gusto is a smart choice. And you’ll be in good company with more than 100,000+ other small businesses around the world.

Gusto makes onboarding, paying, insuring, and supporting employees as easy as possible. And they don’t call themselves a “people platform” for no reason.

They offer the right set of tools and services to make your life (and your employees’ lives) easier.

Running payroll takes just a few clicks, and you can enjoy unlimited payroll runs every month. Need to pay seven different contractors at different times? No problem.

Need to pay the same employees the same wages every pay period? You can set it up to run automatically without you having to lift a finger.

Plus, you get access to a wide variety of features, including:

Automatic tax calculations

Built-in time tracking capabilities

Health insurance, 401(k), PTO, workers’ comp, and more

Compliance with I-9’s, W-2s, and 1099s

Employee self-service onboarding and dashboards

Next-day direct deposits (on specific plans)

And the best part? It’s affordable.

If you don’t have W-2 employees, Gusto starts at $6 per contractor per month. But if you do have full-time or part-time employees, expect to pay a bit more. Their other paid plans include:

Basic — $19 per month + $6 per person per month

Core — $39 per month + $6 per person per month

Complete — $39 per month + $12 per person per month

Concierge — $149 per month + $12 per person per month

Gusto is perfect for most startups and small businesses. But, large companies with complex benefits packages, and hundreds of employees may find it limiting.

Get started with Gusto today!

#2 – OnPay Review — The most flexible payroll service

If you’re looking for an all-in-one payroll system with transparent pricing and virtually unlimited flexibility, OnPay is an excellent choice.

Whether you’re a small company or a fast-growth startup, OnPay is versatile enough to suit your needs. Plus, you never have to guess how much you’re going to pay every month with their transparent pricing.

And you can rest easy knowing you have access to every feature OnPay offers regardless of the number of employees you have because they only provide one pricing plan.

Their software includes access to powerful features, including:

Unlimited monthly payroll runs

W-2 and 1099 capabilities

Automatic tax calculations and filings

Employee self-service onboarding and dashboards

Intuitive mobile app for management on the go

PTO, e-signing, org charts, and custom workflows

Integrated workers’ comp, health insurance, and retirement

Multi-state payroll

Plus, getting started is super easy. All you have to do is set up your account, add your employees, and start running payroll. Furthermore, OnPay automatically calculates and withholds taxes so you don’t have to worry about manual calculations or human error again.

They also offer specialized solutions for different industries, including nonprofits, restaurants, and farming/agriculture.

OnPay is $36 per month plus $4 per person per month. So, you can add new employees to the software for just a few dollars, making it excellent for fast-growing companies and small businesses alike.

And while OnPay can handle large companies with hundreds of employees, there are better enterprise options available. It’s most suitable for small businesses and fast-growth companies that need simple pricing and flexibility.

Try OnPay free for 30 days to see if it’s right for you!

#3 – Paychex Review — The best for larger organizations

Paychex is an excellent choice for businesses with more than 50 employees. They also offer low-tier plans for small businesses, but they’re quite limited compared to the other small business options on this list.

However, their midsize to enterprise plans are perfect for large companies.

The larger your business is, the worse small discrepancies and human errors affect your tax calculations. And wrong tax filings equal harsh penalties from the IRS, even if it was an accident.

So as a large company, it’s imperative to have a payroll service that adapts to meet your needs. Paychex is more than a payroll service. It’s a human capital management (HCM) system designed to help you save time and reduce errors.

Their enterprise plans include features like:

Recruiting and onboarding

Performance and learning management

Powerful real-time analytics

100% employee self-service

Payroll automation features

Direct deposit, paper checks, and paycards

Salary, hourly, and contract workers

Paycheck garnishments

PTO and benefits management

Job costing and labor distribution

All of which are scalable for enterprises with thousands of employees (or as little as 50). Plus, Paychex services more than 650,000+ companies and has more than 50 years of experience in the industry.

So, you can rest easy knowing you’re in good hands.

With that said, getting started isn’t as easy as it is with some of the other options on this list. Because each deployment is tailored to your business, you can’t get going on your own. However, they do offer a team of specialists to help you get the ball rolling.

Contact their sales team for a custom quote to get started!

#4 – ADP Review — The best for built-in HR features

ADP is the way to go if you’re looking for a payroll service with the most built-in HR features. It’s perfect for smaller companies without an HR department and growing/large companies looking to streamline the process.

ADP works with more than 700,000 businesses in 140+ countries, making it one of the most popular payroll services for businesses of all shapes and sizes.

They offer tailored solutions for small, midsize, and enterprise businesses, so you’re sure to find the perfect solution whether you have five employees or 1000+.

Their lower-tiered plans include basic payroll features like automatic tax calculations, employee self-service tools, a mobile app, PTO management, and complete compliance support.

However, ADP offers more than just basic payroll and HR. They also include time tracking, talent recruitment, HR consulting services, advanced employee benefits, and the option to outsource your entire payroll/HR department.

You can also get unique benefits, like personalized training, legal assistance, background checks, and interview scheduling too.

Furthermore, ADP offers industry-specific solutions for nine different industries, including:

Restaurants

Construction

Healthcare

Manufacturing

Retail

Nonprofits

Note: ADP pricing isn’t available online, so it may not be suitable for micro or small businesses interested in getting started quickly. If you need something fast and straightforward, my #1 recommendation is Gusto.

Request a free quote to see if ADP is right for you today.

#5 – Quickbooks Payroll — The best for QuickBooks integration

Quickbooks Online is one of the most well-known accounting tools on the market. And if you’re already a user, QuickBooks Payroll is an excellent addition to your tech stack.

The two tools integrate seamlessly, making account reconciliation and tax season a breeze.

Furthermore, QuickBooks’ payroll system works in all 50 states. So, whether you have a remote team or work with contractors across the country, you don’t have to worry about making errors or mishandling taxes.

You can also rest easy knowing your federal, state, and local taxes are automatically calculated plus paid for you every time you run payroll. Plus, the entire process is easily automated after your first round of payments.

With QuickBooks, you get a full-service payroll system regardless of the plan you choose.

And the user interface is aesthetically pleasing with direct deposit payments landing in your employees’ bank accounts within 24 – 48 hours.

The Core Plan starts at $45 per month, plus $4 per employee per month. It includes:

Full-service payroll with unlimited runs

Automatic payments after the first run

Health benefits

Wage garnishments

Next-day direct deposit

24/7 live chat support

All 50 states

So, even their most basic plan includes everything you need to simplify your HR and payroll processes.

But if that isn’t enough, their advanced plans include:

Premium — $75 per month + $8/employee per month

Elite — $125 per month + $10/employee per month

Get 70% off your first three months to take QuickBooks Payroll for a test drive today!

Note: 1099 contractors and freelancers aren’t included. It comes as an add-on with additional monthly fees. So, this isn’t the most affordable choice if you frequently handle contractors or freelancers.

#6 – Wave Payroll Review — The most affordable payroll service

If you’re on a tight budget, Wave Payroll is an affordable payroll option. Wave also offers numerous other small business tools for free, including invoicing, accounting, and receipt management.

The different apps integrate seamlessly to create an affordable small business accounting and payroll solution.

With Wave, getting started takes just a few minutes, and running payroll goes even faster. Plus, they offer a 100% accuracy guarantee. You can also pay hourly, salary, and contractors and automatically generate the right tax forms.

In some states, Wave automatically files and pays your state/federal payroll taxes for you. However, in those states, Wave’s services are more expensive.

You also get access to features, like:

Automatic journal entries (if you use Wave Accounting)

Self-service pay stubs and tax forms for your employees

Workers’ compensation management

Basic payroll reporting

Automatic year-end tax forms

Timesheets for PTO and accruals

While Wave is one of the most affordable payroll services, it doesn’t sacrifice functionality and essential features. Despite being cheaper than the other options on this list, you still get all the essentials you need to run payroll for your small business.

In tax service states, Wave is $35 per month + $6 per contractor/employee per month. This service isn’t necessarily cheaper than the other options on this list.

But, it’s still a great option if you’re a small business owner looking for a simple payroll solution.

However, it’s $20 per month + $6 per contractor/employee per month in self-service states. At this price, it’s easily the cheapest option with the most features available.

And don’t forget that Wave Payroll seamlessly integrates with Wave’s free accounting and invoicing software as well.

So, if you don’t yet have accounting software, this is a smart choice.

Try Wave Payroll free for 30 days to see if it’s right for you and your business!

Summary

For most users, Gusto, OnPay, and Wave are my top recommendations.

They’re all excellent for small and fast-growth businesses with the ability to scale to match your needs. Plus, they’re affordable and easy to use.

However, different businesses require different solutions.

So, don’t forget to use the considerations we talked about as you go through the process of choosing the best payroll services for your business.

What payroll services do you prefer?

The post The Best Payroll Services (In-Depth Review) appeared first on Neil Patel.

Original content source: https://ift.tt/2FsiW9a via https://neilpatel.com The post, The Best Payroll Services (In-Depth Review), has been shared from https://ift.tt/32jRxyY via https://ift.tt/2r0Go64

0 notes

Text

The Best Payroll Services (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

What would you do with ten extra hours a month?

You’d probably work on growing your business, right? Maybe you’d spend it creating new marketing campaigns to generate more revenue. Perhaps you’d take half a day off to spend time with your family.

Regardless, the average small business owner spends five hours every pay period running payroll. That adds up to 21 full work-days a year.

But thankfully, that’s not what your payroll process has to look like.

The best payroll services help you automate paying your employees and simplify the entire process, so you can gain more control over how you spend your time.

Without sacrificing employee satisfaction.

But with so many options to choose from, it’s easy to waste time trying to pick the right one.

To help speed up the process, I reviewed six of the best systems on the market and put together a comprehensive list of what to look for as you make your final decision.

The 6 best payroll service options for 2020

Gusto – Best payroll service for small businesses

OnPay – Most flexible payroll service

Paychex – Best for larger organizations

ADP – Best payroll service with built-in HR

QuickBooks Payroll – Best for QuickBooks integration

Wave Payroll – Most affordable payroll service

How to choose the best payroll service for you

If you’ve spent some time searching for solutions from Google or asking for peers’ recommendations, you know there are hundreds of payroll companies to choose from.

With so many options, it can feel like a difficult decision.

To help you narrow things down, let’s walk through what to consider as you go through the process.

Number of employees

Most services charge a set monthly fee plus a small fee per employee. So, it’s essential to consider the number of employees you need to pay.

Some payroll services may limit the number of employees on certain plans while others may forego the per-employee fee altogether. Furthermore, some may also offer features that make it easier to pay many people at once.

You also need to consider whether you’re paying employees or contractors.

The process and fee structure may differ for different types of payments depending on which service you choose.

Basic payroll features

The best payroll services exist to simplify the process of paying your employees. So, every payroll service you consider should have a set of critical features, including:

Automatic payroll options

Self-service portal for full-time and part-time employees

Mobile capability to manage payroll on the go

Direct deposit so your employees get paid quickly

Automatic tax calculations and withholdings

W-2 and 1099 employee management

There are other advanced features you may want to consider as well, depending on what you need. This includes things like HR tools, benefits management, wage garnishments, and more.

So, carefully consider the essential features as well as the advanced features you need to simplify your payroll processes.

Tax features

Filing tax is a complicated and time-consuming process. It can also result in unfortunate and expensive penalties if you don’t do it right.

However, many payroll services offer tax features that simplify the process. From calculating payroll taxes to automatically withholding employee income taxes, there are countless things to consider.

So, it’s important to choose a payroll service that offers essential tax features to make your accountant’s life easier.

Or yours if you do your taxes yourself.

Built-in HR tools

If you offer benefits to your employees, you need a payroll service that helps you effectively manage things like time off, vacation requests, workers’ compensation, insurance, and more.

Furthermore, services with an employee self-service dashboard make this much more manageable. Employees can log in, update their accounts, request time off, and see an overview of their benefits package.

The cheaper options on this list tend to ditch HR features. So, carefully consider what you need against your budget before making any decisions.

Monthly payroll limits

If you have salaried employees or a set payroll schedule, most payroll services are adequate. However, if you pay freelancers or contractors on an irregular basis or run payroll more than twice a month, you need to be careful.

Some services offer unlimited payroll processing, while others limit the number of times you can issue payments every month.

So, carefully consider how often you need to send payments when making your final decision.

Integrations

To further simplify your business processes, it’s crucial to consider the business tools you’re already using to run your business.

It’s important to choose a payroll service provider that integrates seamlessly with those tools. Think about your accounting software, your employee scheduling software, and other essential tools related to payroll.

The different types of payroll services

There are several different services to consider, depending on your business’s size and your specific payroll needs.

So, before we dive into my top recommendations, I want to talk about the different types and how to decide between them.

1. Hiring someone to do it for you

If you can afford it, hiring someone (either in-house or as a contractor) to run payroll for you is an excellent option. This ensures you find someone who knows how to do it and that they have the time to do it well.

However, you still need payroll software. They may have their own preferences and expertise, which may help you decide which service is right for your business.

With that said, many small businesses don’t necessarily need to hire someone.

The best payroll services make running payroll easy, so anyone on your team can take care of it in a few clicks.

2. Software as a service (SaaS)

The software as a service (SaaS) model means you pay to use the software. Most service providers charge monthly or annually for this, and as long as you keep paying, you get to keep using it.

Most SaaS tools are cloud-based, meaning you can access it from a web browser anywhere.

However, some also offer desktop applications and mobile apps you install on a specific device.

This is the most common type of payroll service and the most convenient to use because you and your employees can access their accounts from any device, anywhere in the world with an internet connection.

All of the recommendations on this list are SaaS payroll services.

3. Enterprise-grade solutions

Most payroll services offer enterprise-grade and industry-specific solutions for large businesses. They come with specialized, custom pricing to match the unique needs of enterprise-grade companies.

A software like this could be a SaaS tool or an on-premise deployment, depending on what you need and the company you choose.

Most businesses don’t need this. But if you manage payroll for a large company or find your current solution limited, it may be a good idea to consider an enterprise solution.

#1 – Gusto Review — The best for small businesses

If you’re a small business looking for a simple payroll service, Gusto is a smart choice. And you’ll be in good company with more than 100,000+ other small businesses around the world.

Gusto makes onboarding, paying, insuring, and supporting employees as easy as possible. And they don’t call themselves a “people platform” for no reason.

They offer the right set of tools and services to make your life (and your employees’ lives) easier.

Running payroll takes just a few clicks, and you can enjoy unlimited payroll runs every month. Need to pay seven different contractors at different times? No problem.

Need to pay the same employees the same wages every pay period? You can set it up to run automatically without you having to lift a finger.

Plus, you get access to a wide variety of features, including:

Automatic tax calculations

Built-in time tracking capabilities

Health insurance, 401(k), PTO, workers’ comp, and more

Compliance with I-9’s, W-2s, and 1099s

Employee self-service onboarding and dashboards

Next-day direct deposits (on specific plans)

And the best part? It’s affordable.

If you don’t have W-2 employees, Gusto starts at $6 per contractor per month. But if you do have full-time or part-time employees, expect to pay a bit more. Their other paid plans include:

Basic — $19 per month + $6 per person per month

Core — $39 per month + $6 per person per month

Complete — $39 per month + $12 per person per month

Concierge — $149 per month + $12 per person per month

Gusto is perfect for most startups and small businesses. But, large companies with complex benefits packages, and hundreds of employees may find it limiting.

Get started with Gusto today!

#2 – OnPay Review — The most flexible payroll service

If you’re looking for an all-in-one payroll system with transparent pricing and virtually unlimited flexibility, OnPay is an excellent choice.

Whether you’re a small company or a fast-growth startup, OnPay is versatile enough to suit your needs. Plus, you never have to guess how much you’re going to pay every month with their transparent pricing.

And you can rest easy knowing you have access to every feature OnPay offers regardless of the number of employees you have because they only provide one pricing plan.

Their software includes access to powerful features, including:

Unlimited monthly payroll runs

W-2 and 1099 capabilities

Automatic tax calculations and filings

Employee self-service onboarding and dashboards

Intuitive mobile app for management on the go

PTO, e-signing, org charts, and custom workflows

Integrated workers’ comp, health insurance, and retirement

Multi-state payroll

Plus, getting started is super easy. All you have to do is set up your account, add your employees, and start running payroll. Furthermore, OnPay automatically calculates and withholds taxes so you don’t have to worry about manual calculations or human error again.

They also offer specialized solutions for different industries, including nonprofits, restaurants, and farming/agriculture.

OnPay is $36 per month plus $4 per person per month. So, you can add new employees to the software for just a few dollars, making it excellent for fast-growing companies and small businesses alike.

And while OnPay can handle large companies with hundreds of employees, there are better enterprise options available. It’s most suitable for small businesses and fast-growth companies that need simple pricing and flexibility.

Try OnPay free for 30 days to see if it’s right for you!

#3 – Paychex Review — The best for larger organizations

Paychex is an excellent choice for businesses with more than 50 employees. They also offer low-tier plans for small businesses, but they’re quite limited compared to the other small business options on this list.

However, their midsize to enterprise plans are perfect for large companies.

The larger your business is, the worse small discrepancies and human errors affect your tax calculations. And wrong tax filings equal harsh penalties from the IRS, even if it was an accident.

So as a large company, it’s imperative to have a payroll service that adapts to meet your needs. Paychex is more than a payroll service. It’s a human capital management (HCM) system designed to help you save time and reduce errors.

Their enterprise plans include features like:

Recruiting and onboarding

Performance and learning management

Powerful real-time analytics

100% employee self-service

Payroll automation features

Direct deposit, paper checks, and paycards

Salary, hourly, and contract workers

Paycheck garnishments

PTO and benefits management

Job costing and labor distribution

All of which are scalable for enterprises with thousands of employees (or as little as 50). Plus, Paychex services more than 650,000+ companies and has more than 50 years of experience in the industry.

So, you can rest easy knowing you’re in good hands.

With that said, getting started isn’t as easy as it is with some of the other options on this list. Because each deployment is tailored to your business, you can’t get going on your own. However, they do offer a team of specialists to help you get the ball rolling.

Contact their sales team for a custom quote to get started!

#4 – ADP Review — The best for built-in HR features

ADP is the way to go if you’re looking for a payroll service with the most built-in HR features. It’s perfect for smaller companies without an HR department and growing/large companies looking to streamline the process.

ADP works with more than 700,000 businesses in 140+ countries, making it one of the most popular payroll services for businesses of all shapes and sizes.

They offer tailored solutions for small, midsize, and enterprise businesses, so you’re sure to find the perfect solution whether you have five employees or 1000+.

Their lower-tiered plans include basic payroll features like automatic tax calculations, employee self-service tools, a mobile app, PTO management, and complete compliance support.

However, ADP offers more than just basic payroll and HR. They also include time tracking, talent recruitment, HR consulting services, advanced employee benefits, and the option to outsource your entire payroll/HR department.

You can also get unique benefits, like personalized training, legal assistance, background checks, and interview scheduling too.

Furthermore, ADP offers industry-specific solutions for nine different industries, including:

Restaurants

Construction

Healthcare

Manufacturing

Retail

Nonprofits

Note: ADP pricing isn’t available online, so it may not be suitable for micro or small businesses interested in getting started quickly. If you need something fast and straightforward, my #1 recommendation is Gusto.

Request a free quote to see if ADP is right for you today.

#5 – Quickbooks Payroll — The best for QuickBooks integration

Quickbooks Online is one of the most well-known accounting tools on the market. And if you’re already a user, QuickBooks Payroll is an excellent addition to your tech stack.

The two tools integrate seamlessly, making account reconciliation and tax season a breeze.

Furthermore, QuickBooks’ payroll system works in all 50 states. So, whether you have a remote team or work with contractors across the country, you don’t have to worry about making errors or mishandling taxes.

You can also rest easy knowing your federal, state, and local taxes are automatically calculated plus paid for you every time you run payroll. Plus, the entire process is easily automated after your first round of payments.

With QuickBooks, you get a full-service payroll system regardless of the plan you choose.

And the user interface is aesthetically pleasing with direct deposit payments landing in your employees’ bank accounts within 24 – 48 hours.

The Core Plan starts at $45 per month, plus $4 per employee per month. It includes:

Full-service payroll with unlimited runs

Automatic payments after the first run

Health benefits

Wage garnishments

Next-day direct deposit

24/7 live chat support

All 50 states

So, even their most basic plan includes everything you need to simplify your HR and payroll processes.

But if that isn’t enough, their advanced plans include:

Premium — $75 per month + $8/employee per month

Elite — $125 per month + $10/employee per month

Get 70% off your first three months to take QuickBooks Payroll for a test drive today!

Note: 1099 contractors and freelancers aren’t included. It comes as an add-on with additional monthly fees. So, this isn’t the most affordable choice if you frequently handle contractors or freelancers.

#6 – Wave Payroll Review — The most affordable payroll service

If you’re on a tight budget, Wave Payroll is an affordable payroll option. Wave also offers numerous other small business tools for free, including invoicing, accounting, and receipt management.

The different apps integrate seamlessly to create an affordable small business accounting and payroll solution.

With Wave, getting started takes just a few minutes, and running payroll goes even faster. Plus, they offer a 100% accuracy guarantee. You can also pay hourly, salary, and contractors and automatically generate the right tax forms.

In some states, Wave automatically files and pays your state/federal payroll taxes for you. However, in those states, Wave’s services are more expensive.

You also get access to features, like:

Automatic journal entries (if you use Wave Accounting)

Self-service pay stubs and tax forms for your employees

Workers’ compensation management

Basic payroll reporting

Automatic year-end tax forms

Timesheets for PTO and accruals

While Wave is one of the most affordable payroll services, it doesn’t sacrifice functionality and essential features. Despite being cheaper than the other options on this list, you still get all the essentials you need to run payroll for your small business.

In tax service states, Wave is $35 per month + $6 per contractor/employee per month. This service isn’t necessarily cheaper than the other options on this list.

But, it’s still a great option if you’re a small business owner looking for a simple payroll solution.

However, it’s $20 per month + $6 per contractor/employee per month in self-service states. At this price, it’s easily the cheapest option with the most features available.

And don’t forget that Wave Payroll seamlessly integrates with Wave’s free accounting and invoicing software as well.

So, if you don’t yet have accounting software, this is a smart choice.

Try Wave Payroll free for 30 days to see if it’s right for you and your business!

Summary

For most users, Gusto, OnPay, and Wave are my top recommendations.

They’re all excellent for small and fast-growth businesses with the ability to scale to match your needs. Plus, they’re affordable and easy to use.

However, different businesses require different solutions.

So, don’t forget to use the considerations we talked about as you go through the process of choosing the best payroll services for your business.

What payroll services do you prefer?

The post The Best Payroll Services (In-Depth Review) appeared first on Neil Patel.

0 notes

Text

Lets Transform Ourselves (Day 4) via /r/selfimprovement

Lets Transform Ourselves (Day 4)

Background information:

I'm a 20 year old Middle-eastern guy who's very figgity, impulsive and really only thinks about the short term benefits of everything. I used to be addicted to Gaming, but ever since i became 18 years old i decided to leave that part of me behind. I live in a lower-class home, we live off of welfare and I've had the fortune of being born with an above average-IQ which has led to me being able to go to university with a loan.

Last year 2017 December 17th I quit university, broke up with my girlfriend (whom i lived with for 4 months), ditched all my junky friends and moved back to my hometown.

So this is what I'll be doing every single day.

Meditating 10 minutes per day

Programming 2 hours per day

Reading books 2 hours per day

Walking 2 hours per day

Staying Clean

No more Junkfood

Log of 8th of August 2018 - Current time 02:36 AM :

So... I'm back ! Once again with another post. The last post wasn't very much appreciated and it did frustrate me. Why do people not like this sort of content, someone trying to improve their life and trying to inspire others but rather choose to despise it and dislike it. I've seen posts where people talk about how negative everything is and how chaotic they are and that gets 100+. I guess it has something to do with being able to relate with the post as not everyone is doing so well as i'm doing right now.

Back to what matters. Alright so today was a rather cloudy day, a bit rainy and not the best of weathers. I woke up at 10:30 AM feeling all zombie-like and did my little morning routine which consists of drinking some coffee and eating my breakfast and rushing to the shower. Right after that I decided to watch 2 episodes of dexter (which is becoming a routine as well). I should've only watched one episode, but I was feeling so groggy that i couldn't stop myself.

I was not feeling that energetic and when I don't feel energetic i change up plans, i usually walk at night time and today I decided to walk during the day at 14:00 PM (when i'm supposed to be programming). So I did what I did, i walked and I think people on the street are really starting to recognize me as I'm always walking the same path and i'm seeing those exact people inside their cars and walking on the pavement. The only reason i survived this walk was because of the highly energetic music I was listening. I had biked the other night which made my considerably tired and sore, so this walk wasn't the most pleasant of things. I did make it though, with a whopping 1:45 hours of walking (NOT ENOUGH). After the walking I thought to myself, why not do some pushups and sit-ups as well for some muscle development, cardio does afterall make you burn your muscle. So I did 50 push-ups and 160 sit-ups this time and this is going to become one of my daily's. I noticed that the pushups were becoming rather easy because i've been doing them a lot more lately.ThT

After this i had made up my mind to clean my room and also clean some things on my laptop (has to do with E-commerce). My room wasn't looking too good and you know what they say, clean room = clean mind. First i made up my bed, then I picked up anything that was on the floor and didn't belong there. Secondly I vacuumed the whole place to make it real tight(that's what she said) and thirdly I cleaned my desk because it had some coffee stains and we can't have that can we. and here is where things go a very different direction, as I'm cleaning my desktop (laptop) i'm getting distracted with the E-commerce stuff that I do. I usually sell accounts online on specific platforms and I happened to have a lot of traffic. So after cleaning my laptop's files i ended up spending a couple hours just communicating with people regarding their orders and buying some accounts to sell later on which took about an hour of my time.

It'd be 17:00 PM by now, diner's ready and I haven't meditated a single minute or programmed a single line or even read a single page. After diner i decide to call my Mobile internet provider and discuss the internet issues i have been experiencing (extreme slow internet) and well they did waste a lot of my time. I had to wait 10 minutes in line to get to customer support and they kept telling me to call back in 5 minutes which i did and every single time i did i had to wait another fricking 10 minutes to get them on the line. That ended up taking an hour and it didn't even fix my internet speed... At about 18:30 PM I started a meditation session for 10 minutes and also purchased a subscription for the app "headspace' which is the app i use for meditation. I really needed to meditate after the calls i had, because it did make me feel stressed out and I also didn't know how to make up for the time that was wasted.

Now it's about 19:00 PM after the meditation session and I felt like i was burning myself out and just being responsible the whole day, and that is a very odd thing for me. I figured i needed some leisure time, so i ... watched ... another episode of dexter ! Hahaha. After this episode I just got distracted to the maximum and just thought fuck it... I'm distracted lets just go bike and lose some weight.

I went biking from 22:00 PM to about 23:00 PM which wasn't the greatest decision but certainly not the worst I've ever made . I felt awake after this bike-trip so it actually did benefit me because I still didn't do the programming nor did I read my book. I have a racing bike and damn do I go fast on that thing, I once tracked the speed at which i was travelling and it was 35 Km/hr that's as fast as a moderate scooter(i did occasionally bike faster than a scooter).

So 23:00 PM, time was running out and I just was clueless, how am i ever going to make it. I was about to give in and just go to bed untill i thought... NO I will NOT break the chain. This is not going to be my demise, i will fricking not let this happen ! I got me some coffee and started watching programming tutorials for CSS and HTML (Which i am learning rapidly) Learnt some ways of designing certain properties of the website like links, and positioning the elements of the website. I programmed for about 2 hours and I am darn satisfied with how it went.

Now 01:00 AM and i'm feeling restless because of the coffee and i am not done yet. I still have to read that god damn book. That's not how i usually feel about reading but it's just.. sleep i love sleep. I grabbed my book, laid on my bed and started reading. I actually liked it, i learnt a lot more then i expected to learn. Currently i'm reading "12 rules of life" by jordan peterson and what i learnt was immensely helpful. It was about how men are becoming overly feminised by society and how masculinity is sort of being punished. This was boggling my mind because i have experienced certain things that portrayed this really extensively, like how my female teacher kept punishing me for just being.. well a boy. And furthermore i learnt that facing difficulty is the only way you can progress in life (or watching someone else do it) Else you're overly protected and just become this scrawny little weasel that doesn't stand up for himself. Which frankly I do quite a lot of, i stand up for myself whenever it's needed.

Now that was all i had to write for today, i hope the feedback isn't as bad as the other day because that does demotivate me a lot. If you appreciate this even a little bit then let me know it ! I want to inspire you guys to start doing your own little transformations, and i really do want you guys to join me on this journey of productiveness and becoming your greatest self. Together we can do this and we will, nothing is stopping us. We will crush every single obstacle that lays ahead of us. Fuck mediocrity, we don't want to be average. Extraordinary and perfection is what we strive for.

Have a great day everyone, I'll be sleeping now i'm very exhausted but also very glad that I made it. I'm out. (3:04 AM rn)

Submitted August 09, 2018 at 04:01AM by AttackPrince via reddit https://ift.tt/2ATWjYu

0 notes

Text

Decided to Buy Some Bitcoins- What about the Bitcoin Wallets?

“Glad to know that you are going to invest in Bitcoin! It’s great to touch the pace of innovation and Bitcoin is the safest way to make your money secured digitally.

But, what about the Bitcoin wallet? Do you know about it? I guess you don’t.”

…

So, here is the halt!

People are craving for Bitcoin and are investing in this digital currency. However, they don’t have much acquaintance about it. They just follow as the sheep follows its herd. It’s like of no use. If you don’t step in this sphere with compiled information, there are more chances you might be fallen into the ditch in the midway.

Therefore, gather all-required data and information about Bitcoin and then will board on the floor to rock the world of digital currency.

Coming to our topic, Bitcoin Wallet is also one of the imperative accessories of Bitcoin. You will invest, make transactions, and get asset, but where to store the currency and the details of transaction?

Hereby, arrives the Bitcoin Wallet with properties of storing coins safely at a centralized place. Due to which, the era of Bitcoin Wallet has initiated and Erc20 development company comes into being. These companies design and develop the encrypted wallet that no one can breach the security.

The wallet can be in any form:

· A Mobile App

· Web App

· Desktop App

· A Cloud-based Storage

· Or, A Hardware Device

Now, it’s up to you- which mode you will go with. Whatsoever, but the Bitcoin wallet is like a connecting asset that can’t be cut off with Bitcoin technology. Want or not, but always follow the right approach and then purchase the Bitcoin wallet according to your number of transactions and other things on digital network.

How does Bitcoin Wallet work?

Traditionally, Bitcoin wallet stores money. But, if we dive deeper, then we find out that the wallet only stores the “private keys”. These private keys are the accessing medium for Bitcoin addresses. Using these keys, you will come to know the address of your Bitcoin to sign off or on your transactions. And, ideally, these wallets are encrypted with passwords or else protected from any kind of unauthorized access.

Otherwise, all it depends on the type of wallet and how you are going to access them.

Blockchain and Bitcoin Wallet

Bitcoin Wallets are owned and controlled only by its owner and he only takes care of all kinds of transactions. On the flip side, Blockchain is an open source distributed and shared technology that records and verifies transactions.

It’s your call now… What is your objective behind Bitcoin?

Why is Bitcoin Wallet Important?

Bitcoin is an imperative and highly sophisticated digital currency that is flowing through all around the world. Whether you need to make transactions intra-states or across the borders, this currency is a backbone that supports you always. So, you can go with the Bitcoin wallet to make the simplest and straightforward mode of currency exchange transaction.

The other one is that the wallet is one of the safest ecosystems, where you can store, exchange, and utilize the Cryptocurrency exchange development without any hurdle.

Above all, the best part is that the wallet doesn’t compel you to empty your pocket. It is the cost-effective way to process transactions digitally.

0 notes

Text

The Best Payroll Services (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

What would you do with ten extra hours a month?

You’d probably work on growing your business, right? Maybe you’d spend it creating new marketing campaigns to generate more revenue. Perhaps you’d take half a day off to spend time with your family.

Regardless, the average small business owner spends five hours every pay period running payroll. That adds up to 21 full work-days a year.

But thankfully, that’s not what your payroll process has to look like.

The best payroll services help you automate paying your employees and simplify the entire process, so you can gain more control over how you spend your time.

Without sacrificing employee satisfaction.

But with so many options to choose from, it’s easy to waste time trying to pick the right one.

To help speed up the process, I reviewed six of the best systems on the market and put together a comprehensive list of what to look for as you make your final decision.

The 6 best payroll service options for 2020

Gusto – Best payroll service for small businesses

OnPay – Most flexible payroll service

Paychex – Best for larger organizations

ADP – Best payroll service with built-in HR

QuickBooks Payroll – Best for QuickBooks integration

Wave Payroll – Most affordable payroll service

How to choose the best payroll service for you

If you’ve spent some time searching for solutions from Google or asking for peers’ recommendations, you know there are hundreds of payroll companies to choose from.

With so many options, it can feel like a difficult decision.

To help you narrow things down, let’s walk through what to consider as you go through the process.

Number of employees

Most services charge a set monthly fee plus a small fee per employee. So, it’s essential to consider the number of employees you need to pay.

Some payroll services may limit the number of employees on certain plans while others may forego the per-employee fee altogether. Furthermore, some may also offer features that make it easier to pay many people at once.

You also need to consider whether you’re paying employees or contractors.

The process and fee structure may differ for different types of payments depending on which service you choose.

Basic payroll features

The best payroll services exist to simplify the process of paying your employees. So, every payroll service you consider should have a set of critical features, including:

Automatic payroll options

Self-service portal for full-time and part-time employees

Mobile capability to manage payroll on the go

Direct deposit so your employees get paid quickly

Automatic tax calculations and withholdings

W-2 and 1099 employee management

There are other advanced features you may want to consider as well, depending on what you need. This includes things like HR tools, benefits management, wage garnishments, and more.

So, carefully consider the essential features as well as the advanced features you need to simplify your payroll processes.

Tax features