#gstreforms

Explore tagged Tumblr posts

Text

The Goods and Services Tax (GST), a next stage advancement of multi-level taxation system is majorly influencing the pharma industry. The pharma industry is gaining additional benefits from this GST implementation as compared to other industries. Although India based pharma industry stands out as the fourth largest manufacturer worldwide due to its volume and also vies with the countries such as USA, Japan & China, it also faces the same issues as faced by other industries. These issues encompass Central Sales Tax (CST) on raw material, limitations of value-added tax (VAT), and accumulations of VAT credit, etc.

#GSTImpactOnPharma#PharmaIndustryUpdates#GSTandHealthcare#PharmaTaxation#GSTReforms#HealthcareEconomy#PharmaBusinessTrends#TaxImpactOnHealthcare#PharmaGrowthUnderGST#IndianPharmaSector

1 note

·

View note

Text

youtube

Unlocking Policy Insights: Hasmukh Adhia's Perspective

Join us for an exclusive message by the esteemed Hasmukh Adhia, who played a pivotal role in the architecture and successful roll-out of the historic Goods and Services Tax (GST) and Demonetisation scheme in 2016.

#HasmukhAdhia#PolicyInsights#PublicPolicy#GSTReform#Demonetisation#ExpertMessage#PolicyImpact#ISPPCommunity#FutureLeaders#PolicyProfessionals#Inspiration#LearningOpportunity#Youtube

0 notes

Text

Sethurathnam Ravi Discusses Raising GST Evasion Threshold for Arrest to Rs 3 Crore

In a bid to streamline business operations and reduce harassment, the Centre is poised to raise the threshold for arrest and criminal prosecution in Goods and Services Tax (GST) evasion cases from Rs 2 crore to Rs 3 crore. Sethurathnam Ravi, former Chairman of the Bombay Stock Exchange (BSE), shared his insights on this proposed change during a discussion with Tarun Nangia and other industry experts.

Sethurathnam Ravi opened the discussion by highlighting that the industry has long called for such reforms to mitigate the fear of arrest and other punitive measures, and these concerns have been consistently communicated to the finance ministry. He acknowledged that while the proposed increase from Rs 2 crore to Rs 3 crore is modest, it reflects the government’s cautious approach.

"The government faces a dichotomy," Ravi explained. "If they raise the threshold too much, it could lead to issues with fraudulent tax invoices, which have been a significant problem. They are trying to balance supporting honest taxpayers while curbing fraudulent activities."

Sethurathnam Ravi noted that the government’s cautious stance is evident in the phased implementation of e-invoicing, which offers real-time access to invoices and helps curb the manipulation of fake credits. This step-by-step approach, he believes, indicates the government's intent to gradually reform the system.

"The government aims to decriminalize the process," Sethurathnam Ravi said. "However, they are proceeding slowly due to various regulatory and procedural challenges. I personally believe the threshold should eventually be raised to Rs 5 to 7 crore. Penalties can still be imposed on wrongdoers, but arresting and coercive actions can lead to misuse of power."

Sethurathnam Ravi emphasized that many businesses are concerned about receiving notices from various levels, which can disrupt operations. Increasing the threshold to Rs 5 to 7 crore, with appropriate checks and balances, would provide a more conducive environment for businesses to thrive without the constant fear of punitive actions.

In conclusion, while the proposed increase to Rs 3 crore is a positive step, Ravi and other experts believe that further adjustments are necessary to create a fairer and more efficient tax system.

#SethurathnamRavi#GSTReform#SethurathnamRaviInsights#TaxEvasionThreshold#SethurathnamRaviOpinion#BusinessConvenience#FinanceMinistryReforms

0 notes

Text

Exciting News for Small Businesses in E-commerce! 🚀 Starting October 1, 2023, the Indian Finance Ministry is bringing about a game-changing update in the Goods and Services Tax (GST) landscape - @lawyer2ca

No more mandatory GST registration for small businesses operating on e-commerce platforms! 🛍️ The recent announcement by the Central Board of Indirect Taxes and Customs (CBIC) highlights the key details:

✅ Businesses with an annual turnover of ₹40 lakh for goods and ₹20 lakh for services currently require GST registration.

✅ However, certain cases demanded compulsory registration for sellers on e-commerce platforms.

✅ The new exemption lays out specific conditions: no inter-state supplies, single PAN, and more.

✅ This move is a result of prolonged advocacy by small business owners who felt hindered by the previous provisions.

✅ The exemption not only boosts the domestic market but also enhances export opportunities.

Empowering artisans, women entrepreneurs, and home-based businesses, this change aims to foster growth, innovation, and inclusivity in the e-commerce sector. Let's thrive together! 🌐

#EcommerceGrowth #SmallBusinessPower #GSTReform #Lawyer2CA

0 notes

Photo

The Central Board of Indirect Taxes & Customs (CBIC) introduced Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme under Goods and Services Tax (GST) to help small taxpayers whose turnover is less than Rs.5 crores. The QRMP scheme allows the taxpayers to file GSTR-3B on a quarterly basis and pay tax every month. We did a separate video introducing this new reform a while back. Click on the following link to watch it: https://youtu.be/H853FManxEM. To learn more about accounting, head onto our YouTube channel: youtube.com/c/AcademyCommerce. #commerceacademy #learningcommerce #academycommerce #GST #gstn #gstreforms #accounts #accountingbasics #elearning #youtuber #youtube #accountingonline #staysafe #learncommerce #learnaccounts #basics #likeforlike #followforfollow https://www.instagram.com/p/CJV71nXhgnu/?igshid=u6wrhwkkypem

#commerceacademy#learningcommerce#academycommerce#gst#gstn#gstreforms#accounts#accountingbasics#elearning#youtuber#youtube#accountingonline#staysafe#learncommerce#learnaccounts#basics#likeforlike#followforfollow

2 notes

·

View notes

Text

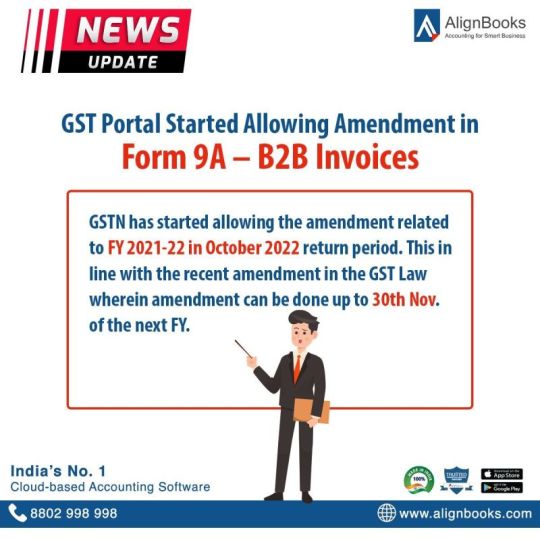

News Alert!!

In the October 2022 return period, GSTN began permitting amendments connected to the FY 2021–2022 period.

This is consistent with a recent revision to the GST Law that allows amendments up until November 30 of the next fiscal year.

The specifics of taxable outward supplies made to the registered person that has previously been reported in table 4A, 4B, 6B, and 6C - B2B Invoices - may be changed by the taxpayer.

To look for the invoice, the taxpayer must enter the financial year and invoice number before clicking on "Amend Record."

Visit to know more- GST - press release (https://buff.ly/39dj1rA)

To get your e-invoicing software click here & get a free trial- https://buff.ly/3TpmHwd

#news#gstnews#einvoice#accountingsoftware#erp#gstreforms#alignbooks#OnlyOnAlignBooks#AlignwithAlign#tax#billing

0 notes

Photo

Sales refers to the volume of goods and services sold by a business during a reporting period. A sale determines that the seller provides the buyer with a good or service in exchange for a specific amount of money or specified assets. To complete a sale, both the buyer and the seller have to be considered to be competent enough to make the transaction. They also have to be in agreement regarding the specific terms of the sale. In addition, the good or service that is being offered has to actually be available to purchase, and the seller has to have the authority to transfer the item or service to the buyer. When quantified into a monetary amount, it is positioned at the top of the income statement, after which operating and other expenses are subtracted to arrive at a profit or loss figure. The term can also refer to the selling organization of a business, and the activities this group engages in to secure orders from customers. Connecting with us is easier now. Just click on https://campsite.bio/commerceacademy to access our online presence. #commerceacademy #learningcommerce #academycommerce #GST #gstn #gstreforms #accounts #accountingbasics #elearning #youtuber #youtube #accountingonline #staysafe #learncommerce #learnaccounts #basics #likeforlike #followforfollow https://www.instagram.com/p/CJWQDLEBss2/?igshid=87fmblttpm7t

#commerceacademy#learningcommerce#academycommerce#gst#gstn#gstreforms#accounts#accountingbasics#elearning#youtuber#youtube#accountingonline#staysafe#learncommerce#learnaccounts#basics#likeforlike#followforfollow

1 note

·

View note