#grace period for personal loan EMI

Explore tagged Tumblr posts

Text

How to Plan a Bullet Repayment Strategy for Your Loan?

A personal loan is an effective financial tool that helps individuals manage unexpected expenses, fund large purchases, or consolidate debt. While most personal loans follow the standard EMI (Equated Monthly Installment) repayment structure, some borrowers opt for a bullet repayment strategy to manage their loan efficiently. A bullet repayment allows borrowers to pay only the interest during the loan tenure and repay the principal amount in a lump sum at the end of the loan period.

This repayment strategy can be beneficial for individuals with irregular income streams, such as business owners, freelancers, and commission-based professionals. However, planning a bullet repayment strategy requires financial discipline and careful consideration of the associated risks and benefits.

In this article, we will explore how to plan a bullet repayment strategy for a personal loan, its advantages and disadvantages, and key tips to ensure successful repayment.

1. Understanding Bullet Repayment in Personal Loans

A bullet repayment loan allows borrowers to make interest-only payments throughout the loan tenure and repay the entire principal in one lump sum at the end of the term.

✅ Example:

Loan Amount: ₹10,00,000

Interest Rate: 12% per annum

Loan Tenure: 5 years

Monthly Payment: Only interest component (₹10,000 per month)

Lump Sum Principal Payment: ₹10,00,000 at the end of 5 years

📌 Key Features:

Lower monthly outflow during the tenure.

Requires a large sum of money at the end.

Best suited for those expecting a big inflow of cash in the future.

2. Who Should Consider a Bullet Repayment Strategy?

A bullet repayment strategy is not ideal for everyone. It works best for individuals who expect a large income inflow at the end of the loan tenure.

✅ Ideal for:

Business Owners: Expecting profits or investment returns.

Freelancers & Commission-Based Professionals: Who receive irregular payments.

Investors: Anticipating returns from stocks, real estate, or fixed deposits.

Agricultural Professionals: Who receive seasonal earnings.

Employees with Bonuses: Those expecting performance bonuses or salary increments.

🚫 Not ideal for:

Individuals with fixed monthly income and no large savings.

Borrowers who struggle with financial discipline.

Those with no clear plan for repaying the lump sum principal.

📌 Tip: Choose this strategy only if you have a clear repayment plan for the lump sum amount.

3. Steps to Plan a Bullet Repayment Strategy for Your Personal Loan

A. Assess Your Financial Position

Before opting for a bullet repayment personal loan, evaluate your financial situation:

Calculate your monthly cash flow and expenses.

Identify potential sources of lump sum income.

Ensure you can afford the interest payments during the tenure.

📌 Tip: Maintain a dedicated savings account for the lump sum repayment.

B. Choose the Right Loan Tenure and Interest Rate

Selecting an appropriate loan tenure ensures that you have sufficient time to accumulate the final repayment amount.

✅ Short-Term vs. Long-Term Bullet Repayment:

Shorter tenure (1–3 years): Faster repayment but requires quicker fund accumulation.

Longer tenure (4–5 years): Provides more time to save, but total interest paid is higher.

📌 Tip: Compare lenders and negotiate for a lower interest rate to reduce interest costs.

C. Create a Dedicated Savings Plan

To ensure a successful bullet repayment, start saving systematically from the beginning.

✅ Savings Strategies:

Monthly Savings: Set aside a fixed amount every month.

Fixed Deposits (FDs): Invest in an FD that matures with the final repayment amount.

Recurring Deposits (RDs): Helps accumulate a large sum gradually.

Investment Returns: Allocate funds from mutual funds, stocks, or real estate gains.

📌 Tip: Automate savings by setting up a dedicated auto-transfer to a savings account.

D. Consider Prepaying in Small Chunks

Some lenders allow partial prepayment of the principal amount before the loan matures.

✅ How It Helps:

Reduces the lump sum burden at the end.

Saves on total interest payments.

📌 Tip: Check prepayment terms with your lender to avoid extra charges.

E. Monitor Your Loan and Adjust Savings Accordingly

Regularly track your loan repayment progress and adjust your savings if needed.

✅ Monitoring Tools:

Use a loan tracking app.

Set reminders for interest payments.

Recalculate your final repayment savings based on market conditions.

📌 Tip: Review your financial plan quarterly to ensure you are on track.

4. Pros and Cons of a Bullet Repayment Strategy

✅ Advantages:

Lower monthly financial burden – Only pay interest during the tenure.

Cash flow flexibility – Suitable for those with irregular income.

Opportunity to invest – Extra funds can be used for high-yield investments.

No regular EMI stress – Ideal for borrowers who expect future lump sum earnings.

🚫 Disadvantages:

Higher interest costs – Total interest paid may be more than regular EMI loans.

Large end-payment risk – Failure to arrange funds can result in default.

Limited lender options – Not all banks offer bullet repayment loans.

Requires strong financial discipline – Borrowers must ensure they save regularly.

📌 Tip: Consider whether you can comfortably accumulate the required sum before opting for this strategy.

5. Alternatives to Bullet Repayment for Lower EMI Management

If you are unsure about committing to bullet repayment, consider these alternatives:

✅ Step-Up EMI Loans: Start with low EMIs and gradually increase payments. ✅ Flexible Loan Repayment Plans: Some banks allow seasonal or customized EMIs. ✅ Prepayment-Friendly Loans: Choose a lender that allows free or low-cost prepayments. ✅ Balance Transfer to Lower Interest Rate: Shift your loan to a lender with better terms.

📌 Tip: Explore various repayment structures before committing to a bullet repayment loan.

Final Thoughts

A bullet repayment strategy can be an effective way to manage a personal loan, especially for borrowers with irregular incomes or future lump sum earnings. However, it requires careful financial planning, disciplined savings, and regular tracking to ensure successful repayment.

Before choosing a bullet repayment loan, evaluate your income stability, potential risks, and available alternatives to make an informed decision. If planned wisely, this strategy can help you manage debt efficiently and optimize your personal loan repayment.

For expert financial insights and the best personal loan offers, visit www.fincrif.com today!

#personal loan online#nbfc personal loan#bank#loan apps#fincrif#personal loans#loan services#personal loan#finance#personal laon#missed personal loan payment#late EMI payment#impact of late personal loan EMI#personal loan late payment charges#consequences of missing personal loan EMI#how late payments affect credit score#grace period for personal loan EMI#personal loan EMI overdue charges#penalties for late personal loan payment#personal loan repayment delay consequences#what happens if you miss EMI payment#how to avoid late payment fees on personal loans#does missing EMI affect credit score?#personal loan default consequences#best ways to pay EMI on time#effects of overdue personal loan repayment#how to deal with missed personal loan EMI#personal loan grace period policies#is there a penalty for missing EMI by one day?#what to do if you miss a personal loan payment

1 note

·

View note

Text

How to Plan for Your MBA Budget at Symbiosis Noida

Pursuing an MBA at the best MBA college in Noida is a thrilling experience, but like any other big educational expenditure, it involves astute financial planning. Right from the fee of tuition to expenses of living, shrewd planning of your MBA budget helps to ensure a worry-free learning experience. Follow the step-by-step guide here to plan your finances well.

1. Know the Total Cost of an MBA at Symbiosis Noida

Before budgeting, have a clear idea of all the expenses. The key costs are:

Tuition Fees: The basic MBA fee includes academic sessions, study material, and institutional facilities.

Hostel & Living Expenses: If you prefer on-campus accommodation, include hostel and mess fees. Add rent, electricity bills, and miscellaneous expenses if you live off-campus.

Other Costs: TBooks laptops, networking events, extracurricular activities, and travel costs.

Miscellaneous Expenses: Health insurance, personal spending, and emergency funds must also be considered.

Adding all these elements will give you a realistic estimate of the required amount for your MBA education.

2. Investigate Payment Options and Installments

Symbiosis Noida provides fee payments on an instalment basis, so it is convenient to manage the finances instead of paying a lump sum. The fee structure is semester-wise, enabling you to spread your expenditure over two years.

To organise better:

Look at the official payment schedule for details. on the semester

Create automated reminders of due dates so that there are no late fees.

Coordinate instalment payments with other funding sources such as savings, loans, or scholarships.

3. Search for Scholarships and Financial Aid

Symbiosis Noida offers merit-based and need-based scholarships to deserving students. These scholarships may cover tuition fees partially or fully, which will substantially lower your financial burden.

Important steps to seek financial aid:

Verify scholarship eligibility criteria on the Symbiosis website.

Apply early to ensure maximum chances.

Look for corporate sponsorships if your company provides education reimbursement.

Also, some private and government organisations provide scholarships for management students—research all the options available to minimise expenses.

4. Think Education Loans for Financial Freedom

If you require financial support, education loans are a perfect choice. Top banks and NBFCs provide student loans at reasonable interest rates to Symbiosis Noida students.

Before taking a loan:

Compare interest rates and repayment terms from various institutions.

Verify if there's a moratorium period (grace period before repayment).

Understand the loan tenure and monthly EMI pattern.

Proper loan planning allows you to pay your instalments smoothly once you get a job after your MBA.

5. Prepare a Monthly Budget for Daily Expenses

After you've accounted for tuition fees, it is important to budget your daily expenses sensibly. Plan a budget for:

Accommodation & Food – If staying off-campus, opt for cheaper accommodation within commuting distance of the institute.

Transport – Use public transport or carpooling to cut costs.

Books & Study Materials – Purchase second-hand books or borrow from peers.

Leisure & Miscellaneous – Allocate a reasonable entertainment budget while maintaining a focus on studies.

Utilising budgeting apps can make it easier to monitor expenses and prevent wasteful spending.

6. Budget for Unforeseen Expenses

Always maintain an emergency fund for unforeseen expenses, such as medical bills, extra certifications, or internship travel. A reserve fund will prevent unplanned expenses from derailing your studies.

7. Emphasise ROI – The Investment Will Pay Off!

Though costs for an MBA seem prohibitive, the ROI from Symbiosis Noida is good, thanks to sound placement records. Most graduates find lucrative positions in leading firms, so loan repayment is easy and long-term financial stability assured.

Final Thoughts

MBA budget planning at Symbiosis Noida must be done with diligence, wise funding, and strict expenditure. You can extract the best from your SIBM MBA fees with minimal financial anxiety through cost segmentation, seeking financial aid, and optimal budgeting.

Invest well now, and your MBA will lead to a successful career and wealth in the coming years.

1 note

·

View note

Text

Abroad Education Loan Interest Rates: Fixed vs. Floating, What’s Better?

Fixed vs. Floating Interest Rates

Fixed Interest Rate: This rate remains unchanged throughout the loan tenure. It offers stability and predictability in repayment. Borrowers who prefer certainty in their financial planning often opt for this.

Floating Interest Rate: This rate fluctuates based on market conditions. While it can sometimes be lower than a fixed rate, it may also rise unexpectedly, impacting monthly EMIs. However, over time, borrowers might benefit if rates decrease.

Which One is Better?

If you prefer stability, go for a fixed interest rate. Your EMIs will remain the same, making budgeting easier.

If you can handle fluctuations and want the possibility of lower payments, a floating interest rate might be a better choice.

Consider market trends, economic conditions, and personal financial flexibility before making a decision.

5 Unique Benefits of an Abroad Education Loan

Grace Period for Repayment – Many lenders offer a moratorium period, allowing students to start repaying after completing their course.

Customized Loan Tenure – Borrowers can choose flexible repayment plans, reducing financial stress.

No Collateral for Some Loans – Many lenders provide unsecured loans for students, eliminating the need for collateral.

Tax Benefits – Interest paid on an Abroad Education Loan is eligible for tax deductions under Section 80E of the Income Tax Act.

Covers More Than Tuition – These loans often include living expenses, travel, and insurance, making studying abroad more accessible.

Final Thoughts

Choosing between fixed and floating interest rates depends on individual preferences and risk tolerance. A fixed interest rate ensures stability, while a floating interest rate may offer cost savings in favorable market conditions. Researching lenders and understanding repayment terms will help you secure the best deal for your Abroad Education Loan.

Make an informed choice and step forward confidently toward your global education dreams!

0 notes

Text

Best New Start-Up Company Loan in Surendranagar: A Comprehensive Guide

Starting a business is a dream for many aspiring entrepreneurs. However, the journey often begins with securing adequate financing to turn ideas into reality. If you're in Surendranagar and seeking financial support for your start-up, finding the best new start-up company loan in Surendranagar can be the key to success. In this article, we’ll explore what makes a loan suitable for your business and how you can identify the best options tailored to your needs.

Understanding Start-Up Loans

A start-up loan is a type of financing specifically designed for new businesses. Unlike traditional loans, start-up loans cater to entrepreneurs who may not have an extensive credit history or established business operations. These loans typically offer:

Flexible repayment terms

Competitive interest rates

Options for collateral-free borrowing

Funding for a wide range of business needs

Whether you need capital to set up a storefront, purchase equipment, or invest in marketing, a well-structured loan can make a significant difference.

Why Choose a Start-Up Loan in Surendranagar?

Surendranagar, a growing hub of entrepreneurship, has seen an influx of innovative business ideas in recent years. The city offers a conducive environment for small businesses due to its expanding market, supportive local authorities, and growing consumer base. However, like anywhere else, starting a business here requires sufficient financial backing.

Opting for a best new start-up company loan in Surendranagar ensures that you get access to financial resources tailored to the local market. Lenders in the area often understand the unique challenges and opportunities of operating in this region, making it easier for start-ups to secure funding.

Features of the Best Start-Up Company Loan in Surendranagar

Tailored Loan Amounts Start-up loans in Surendranagar are often flexible, offering loan amounts based on your business plan and projected revenue. This ensures that you get the exact amount needed without over-borrowing.

Low-Interest Rates Competitive interest rates are a hallmark of the best start-up loans. Many lenders in Surendranagar provide rates that are designed to be affordable for new businesses.

Minimal Documentation To encourage entrepreneurship, many lenders have simplified their application processes. With minimal paperwork, you can focus more on your business and less on administrative tasks.

Quick Disbursal Time is crucial when starting a business. The best start-up company loans in Surendranagar prioritize fast disbursal to ensure you can act on opportunities without delay.

Flexible Repayment Options Repayment terms that align with your business's cash flow can make a significant difference. Many loans offer grace periods or customized EMIs, helping you manage finances effectively.

Collateral-Free Options Not every start-up has assets to pledge as collateral. Collateral-free loans are ideal for first-time entrepreneurs, allowing them to secure funding without risking personal or business assets.

Steps to Secure the Best New Start-Up Company Loan in Surendranagar

Develop a Strong Business Plan A well-crafted business plan is your gateway to securing a loan. It should include market research, financial projections, and a clear strategy for growth.

Research Loan Options Investigate various lenders in Surendranagar, including banks, non-banking financial companies (NBFCs), and government-backed schemes. Each lender may have unique benefits and requirements.

Evaluate Eligibility Criteria Ensure you meet the lender's eligibility requirements, which may include factors like your age, credit score, and business viability.

Prepare Required Documents Commonly required documents include identity proof, address proof, business registration, and financial statements. Having these ready can expedite the process.

Compare Interest Rates and Terms Don’t settle for the first option. Compare multiple loans to find the one that offers the best balance of interest rates, repayment terms, and flexibility.

Apply and Follow Up Submit your application and stay in touch with the lender to address any queries promptly. This can help speed up the approval process.

Government Support for Start-Ups in Surendranagar

The government of Gujarat actively promotes entrepreneurship through various schemes and initiatives. If you're looking for the best new start-up company loan in Surendranagar, consider exploring government-backed programs such as:

Stand-Up India: Offers loans to women and SC/ST entrepreneurs.

Mudra Loans: Provides micro-financing for small businesses.

Startup India: A national initiative that supports start-ups with funding and mentorship.

These programs can complement private lending options, giving you a well-rounded financial foundation.

Tips for Managing Your Start-Up Loan

Securing a loan is just the beginning. Managing it wisely is crucial for your business’s success. Here are some tips:

Use the funds strictly for business purposes to maximize ROI.

Maintain accurate financial records to track expenses and repayments.

Stay in regular contact with your lender to explore opportunities for refinancing or additional support.

Conclusion

Finding the best new start-up company loan in Surendranagar is an essential step toward achieving your entrepreneurial goals. By understanding your financing needs, exploring local and government-backed options, and managing your loan effectively, you can lay a solid foundation for your business. Surendranagar’s dynamic market offers immense potential, and with the right financial support, your start-up can thrive and grow into a successful enterprise.

0 notes

Text

Axis Bank Abroad Education Loan

In today's interconnected world, studying abroad has become a gateway to unparalleled educational opportunities, cultural exposure, and career growth. However, the financial burden of international education can often be daunting. Axis Bank, one of India's leading financial institutions, steps in as a trusted partner with its Abroad Education Loan to ensure that finances don't stand in the way of your dreams.

Why Choose Axis Bank Abroad Education Loan?

Axis Bank Abroad Education Loan is specifically designed to cater to the needs of students aspiring to pursue higher education in international universities. Here’s why it stands out:

High Loan AmountAxis Bank offers education loans up to ₹75 lakhs, covering tuition fees, living expenses, travel costs, and other educational needs. For select cases, even higher loan amounts can be considered based on the applicant's profile and institution.

Wide Coverage of Courses and InstitutionsThe loan supports a wide range of courses, including undergraduate, postgraduate, doctoral, and professional programs, across countries like the US, UK, Canada, Australia, and more. Prestigious universities and globally recognized programs are given preference.

Competitive Interest RatesThe bank offers competitive interest rates, ensuring affordability. Additional interest rate concessions are available for female students under their special schemes, promoting women's education.

Flexible Repayment Options

Moratorium Period: Borrowers can opt for a moratorium period (grace period), which allows repayment to start after completing the course or securing a job.

Tenure: Flexible repayment tenure of up to 15 years helps reduce the EMI burden.

Collateral-Free Loans for Select CasesFor students securing admission in top-ranked universities or courses, Axis Bank provides loans up to a certain amount without collateral. Collateral-backed loans are also available for higher amounts, ensuring comprehensive financial support.

Tax BenefitsAvailing an Axis Bank Education Loan can make you eligible for tax benefits under Section 80E of the Income Tax Act, reducing your financial burden further.

Transparent Process with Expert GuidanceAxis Bank simplifies the loan process with a dedicated team to assist students at every step, from documentation to disbursal. The bank's tie-ups with universities and financial counseling services add value to the overall experience.

Eligibility Criteria

To qualify for the Abroad Education Loan, applicants must meet the following criteria:

Nationality: The applicant should be an Indian citizen.

Admission: Confirmed admission in a recognized foreign university or institution is mandatory.

Co-applicant: A co-borrower (usually a parent or guardian) is required for the loan.

Academic Record: A strong academic background enhances eligibility.

Documents Required

To ensure a seamless application process, keep the following documents ready:

KYC Documents: ID and address proof of the applicant and co-applicant.

Admission Proof: Offer letter or admission confirmation from the institution.

Financial Documents: Income proof of the co-applicant, such as salary slips, bank statements, or ITR.

Cost Estimates: Detailed breakdown of tuition fees and living expenses.

Collateral Documents: (If applicable) Property papers or FD receipts for secured loans.

How to Apply?

Online Application: Visit Axis Bank's official website and fill out the education loan application form.

Branch Visit: You can also apply at your nearest Axis Bank branch for personalized guidance.

Loan Sanctioning: After verification and approval, the loan amount is sanctioned and disbursed directly to the institution as per the fee schedule.

Conclusion

Axis Bank’s Abroad Education Loan is more than just financial assistance; it’s an investment in your future. With features tailored to meet the unique needs of international students, the loan ensures that you can focus on your academic and personal growth without worrying about expenses. So, take the first step toward achieving your global education dreams with Axis Bank as your trusted partner.

0 notes

Text

4 Efficient Ways to Borrow Money in India

There is no telling when you get into a headlong collision with a financial crisis. No matter how careful you are about your financial planning, there are some circumstances out of your hands. We find ourselves standing at a crossroads where there is no option left for us except borrowing money. There could also be some other valid reasons for borrowing money, like buying a house, a car, or funding education. In this blog, we’ll talk about ways in which you can borrow money efficiently, with our primary focus being on online apps and services lending money to their customers. Let’s explore some of these money lending options:

Loan from a Bank: If you’re looking to borrow money, the first thing that anyone can think of is getting a loan from a bank. A personal loan is a fixed amount that you can borrow for a fixed period of time. The interest offered on the borrowed money is usually at a lesser rate.

Credit Cards: There are times when you need to borrow money right now and pay back the amount later. Credit cards help you borrow money when you need it without any documentation, and you’re allowed to pay back in EMIs instead of the entire amount in just one go. Credit card usage among Indians has become popular in recent years and there are several banks and financial institutions offering credit card services that you can select from.

Self-Help Groups (SHGs): This group is an underrated option in the world of borrowing money. It’s specifically targeted at people who live in rural areas and women. This group mainly comprises of women who come together to save and lend money to each other. These women help each other out even when someone is unable to pay back the loan. It’s an effective and commendable initiative taken to help out the poor, especially women who are not well-backed financially.

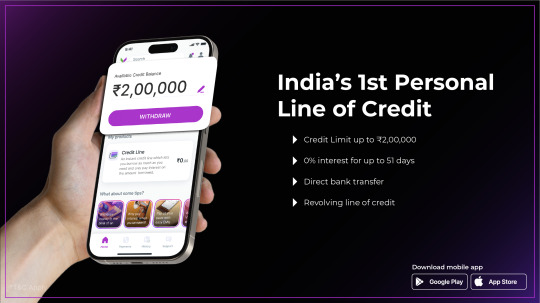

Line of Credit Apps: If everything is going instant and available online at just a click, then why not get money as instantly as your groceries? The line of credit app is the new buzzword in the financial world. A line of credit app is a borrow money app where you can apply to get a loan and get the amount disbursed into your account almost as soon as your application is accepted. A line of credit offers a limit to the customer that they can use to draw money anytime they want unless the limit is reached. Due to the risk factors and unsecured nature of it, it usually comes with a higher interest rate. To get a line of credit loan, you also need to have a good CIBIL score.

Also, there are a lot of borrow money apps that offer you a good credit limit at zero interest and with a reasonable grace period within which you can pay back the amount. We will list some of these borrow money apps with a credit line offer for you:

1. Cash e App 2. Viva Money 3. Stashfin 4. Casheapp 5. Moneytap 6. Moneyview

Conclusion: The art of borrowing money in our society is as old as time, and every new generation discovers more efficient ways to borrow and lend money. In the digital age, it has become easier and faster to borrow money and to lend money.

0 notes

Text

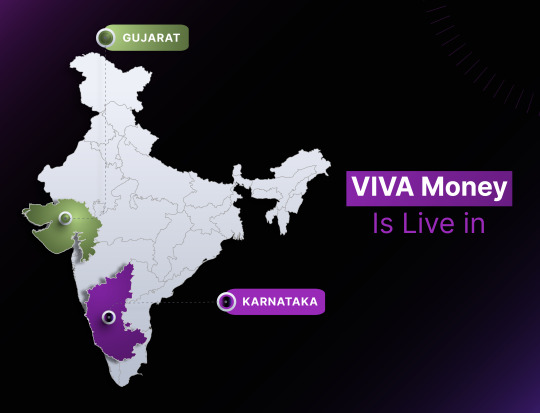

VIVA Money App Hits 100K+ Downloads in Lightning Speed!

VIVA Money, the revolutionary fintech startup from Bengaluru, has stormed into the digital finance scene with a bang! In just four months since its launch in Gujarat and Karnataka, the VIVA Money app has surpassed a staggering 100,000 downloads, setting a new benchmark for rapid growth and user engagement.

But what's fueling this meteoric rise? Let's dive into the heart of VIVA Money's offerings:

Freedom to Borrow, No Strings Attached: VIVA Money offers an exclusive grace period of up to 51 days, allowing users to borrow without worrying about hefty interest charges.

Revolutionary Revolving Credit: Unlike traditional loans, VIVA Money offers a revolving credit limit, giving you the power to borrow, repay, and borrow again, all with unparalleled ease.

Flexible EMI Plans: Choose from three flexible EMI plans ranging from 5 to 20 months, tailored to fit your unique financial needs and goals.

Digitally Driven Convenience: Embrace the future of finance with VIVA Money's 100% digital process, eliminating paperwork and streamlining your borrowing experience.

Seamless Bank Transfers: Say goodbye to traditional credit card limitations! With VIVA Money, your credit line can be seamlessly transferred to your bank account, putting financial freedom at your fingertips.

Lightning-Fast Approval: With VIVA Money, there's no waiting game. Experience lightning-fast approval and disbursal within a mere 15 minutes, ensuring you get the funds you need when you need them.

VIVA Money goes beyond just offering a Credit Line; it's dedicated to transforming how Indians handle their financial matters and boasts extensive experience in the lending sector. As the fintech landscape continues to evolve, VIVA Money remains committed to innovation, customer satisfaction, and financial inclusion.

Looking ahead, VIVA Money has its sights set on Rajasthan and Maharashtra, gearing up to extend its innovative financial solutions to even more eager users across India. With a personalized loan product in the pipeline, offering higher loan amounts and extended repayment periods, VIVA Money is poised to make a lasting impact on the Indian fintech ecosystem.

So, what's next for VIVA Money? With an estimated 40,000 credit lines and a projected loan book value of ₹1400 million by year's end, the journey is just beginning. Join the VIVA Money revolution today and experience the future of finance, redefined.

About VIVA Money:

VIVA Money stands at the forefront of digital financial lending, offering India's premier Line of Credit. Powered by cutting-edge technology and a customer-centric approach, VIVA Money provides seamless access to financial solutions through its mobile application and website.

As a subsidiary of the holding company Tirona Limited, with its headquarters in Cyprus, Viva Money benefits from a global perspective. Tirona Ltd operates across Europe, Asia, and South America, investing in fintech opportunities and established companies in banking and IT. Notable investments within Tirona's portfolio include 4 finance, the world's leading digital consumer finance company, and TBI Bank, a next-generation digital bank operating in multiple countries.

With assets spanning more than 20 projects in 22 countries, Tirona's financial prowess is evident. The group's total assets saw a 30% increase in 2022, reaching 1.44 billion euros, while revenue surpassed 490 million euros. This growth trajectory underscores Tirona's commitment to innovation and excellence in the financial sector, driving progress and prosperity across diverse markets.

0 notes

Text

Missed Personal Loan EMI? Here's What Will Happen!

Between 2015 and 2018, unsecured loans have witnessed a growth of approximately 4 times bank credit. The spurt in people opting for personal loans is attributed to various reasons like technology-based disbursements, lower interest rates, quicker disbursements etc. Although availing quick personal loans may be beneficial in most situations, the ease of availing loans accompanied by other unforeseen events in life that may cause you to miss a personal loan EMI.

Who is a Loan Defaulter?

Failure on the part of the borrower to honor several EMIs in a timely fashion and further inability to make payment during the grace period or pay late fees earns the title of a loan defaulter.

Must Read: How to Apply for a Personal Loan Online - Step by Step Process

Missed loans are classified into 2 main categories by most major lenders:

Major Defaults Not honoring your loan EMI for more than 90 days is considered a major default and can severely affect your financial health. This can affect your ability to access funds in the form of loans in the future.

Minor Defaults Failure on the part of the borrower to honor the EMIs for less than 90 days is referred to as a minor default.

What happens if Personal Loan EMI is Missed?

Affects credit score and ability to obtain finance The credit score is an important factor for all lenders while evaluating a potential borrower. Lenders refer to the credit report and score generated by credit rating agencies and this plays a determining role in whether a candidate’s application is to be accepted or rejected. Most lenders consider a score of above 750 healthy which helps in availing loans at attractive rates of interest. Missing your EMI payment can lead to a setback in your credit score affecting your ability to obtain credit in the future.

Increase in the amount payable Delay in payment of EMIs attracts additional interest at the rate of 2% per month, thereby increasing the total amount payable.

Legal Action Sometimes, lending institutions might initiate legal proceedings to recover the money. However, since personal loans are unsecured, lenders will try recovering the amount by having discussions with the defaulter. In case of minor defaults - such as a missed payment due to a genuine issue, it is recommended for borrowers to discuss the issue with their lenders as soon as possible so that there is no major impact in terms of extra charges or credit score.

Must Read: 5 Simple Ways to Repay Your Personal Loan Quickly

How Can I Avoid Defaulting on my EMI Payments?

On borrowing a loan attempts should be made to avoid defaulting on payments, however, in unfortunate situations that might cause you to default on your payments, these are the different options that you can consider:

Plan your finances in advance A personal loan EMI calculator is an online tool that can help you arrive at an estimate of how much you can borrow taking into consideration multiple factors. This, in turn, can help plan your monthly EMIs at the outset ensuring that your loan repayments do not hinder your living expenses.

Communicate with your lender If, due to any reason you foresee inability to repay the loan amount or even a part of the loan payment, it is in your interest that you communicate to the lender about your economic situation. These are the various options you can consider in this situation:

In the unfortunate situation that you are laid off or your business comes to a temporary halt, you can request your lender to provide you with a brief waiver until the situation improves. For instance, during the economic fallout due to the COVID-19 pandemic and subsequent lockdowns, the RBI had directed all lenders to provide a 3-month moratorium facility, which later got extended to another 3 months. Post Sep, 2020; the RBI also allowed a one-time restructuring of loans, which enabled borrowers affected by the economic crisis to get some relief in terms of EMI amount reduction or in some cases, an extended moratorium.

You could request your lender to allow you to make part payments which can help in reducing the EMI and the interest payable every month.

Manage your budget and cut expenses so that you can use the funds towards loan repayment.

Opt for a Personal Loan Balance Transfer

If you are considering refinancing your loan to avail a better deal on your loan, Fullerton India offers a variety of loan products to suit your requirements. You can be assured of a practical solution that meets your requirements.

If you happen to miss a personal loan EMI, don’t be disheartened. Opt for the most suitable solution and stay focused on your goal of building a strong financial background in the long run!

Source URL: https://www.smfgindiacredit.com/knowledge-center/what-happen-when-missed-your-personal-loan-emi.aspx

0 notes

Text

How To Choose The Best Instant Personal Loan App For Your Needs?

Instant personal loan apps have become a convenient and efficient way for borrowers to get cash fast. When there are so many apps that offer similar features, choosing the best instant personal loan app can be tough. Thus, it's important to know what factors to consider before choosing a loan app to ensure a seamless borrowing experience. Borrowers should consider these points before choosing a loan app:

Check Eligibility

Age, geography, credit score, employment status, source of income, and other things can determine eligibility. Before applying for a loan with an app, the borrower should check the eligibility criteria. In most apps, the borrower has to be between 23 and 58 years old and earn a minimum salary of Rs 50,000.

Amount And Duration Of The Loan

Loan amounts and durations vary from app to app, but the most common loan amount is 10,000 to 4 lakh.

Verification And Documentation

Generally, the borrower needs proof of their identity and address. These documents are your PAN card, Aadhar card, passport, and driver's license. Some apps may require all of these, while others may only need one or two. It's also important to consider how quickly the verification process is done so the loan can be disbursed.

A Competitive Interest Rate

The rate of interest depends on the loan amount and the borrower's credit score. A loan app's interest rate is important since repayment starts right away. One missed or delayed EMI will affect the whole loan repayment. Therefore, the borrower should look for a low rate.

Some Special Features

A borrower with bad credit should choose an app that approves loans based on factors other than past credit history. You can get a loan based on your social profile on some apps.

App Credibility

It's always a good idea for borrowers to check the credibility of loan apps. Ideally, the app should be state-regulated.

Immediate Funding

Since the borrower is going to a mobile app instead of a traditional bank, he should pick one that will disburse his loan right away.

Payment Schedules

Borrowers should choose apps that give them flexibility in repayment schedules. There should be a grace period to repay the loan without hurting your credit.

Freedom Of Usage Of Loan Amount

Borrowers should make sure they can use the loan amount for anything they want, not just paying for utilities.

Linking Up With Digital Wallets

Connecting the loan to a digital wallet will enable auto-pay and subscription deductions.

Interface Of The App

How fast the borrower can register and apply for the loan depends on the user interface and speed of the app. So make sure the interface is bug-free.

Additional Costs And Conditions

Many applicants don't pay attention to the extra costs and other conditions these apps apply. As a result, they lose a lot of money. It's crucial that the borrower researches processing rates and other innuendos.

App Support And Customer Service

24/7 customer support and assistance should be available on the app.

Conclusion

You need to consider factors like eligibility, loan amount, interest rate, and credibility when choosing an instant loan app. Also, it's crucial to research additional costs and app support. There's nothing better than the Fibe app's user-friendly interface and competitive rates. Using the Fibe app, borrowers can access funds quickly and enjoy convenient repayment options.

0 notes

Text

What Happens If You Default on a Personal Loan Due to Medical Reasons?

Introduction

A personal loan can be a financial lifeline during emergencies, including medical crises. However, if an individual faces prolonged illness or a sudden health issue, managing loan repayments might become difficult. Defaulting on a personal loan due to medical reasons can lead to severe financial and legal consequences. This article explores what happens in such situations and how borrowers can mitigate risks and seek relief options.

1. Understanding Loan Default and Its Consequences

A loan default occurs when a borrower fails to make payments as per the loan agreement. Typically, lenders allow a grace period before labeling a loan as a non-performing asset (NPA). Consequences of defaulting on a personal loan include:

A. Negative Impact on Credit Score

Missing EMIs (Equated Monthly Installments) gets reported to credit bureaus like CIBIL, Experian, or Equifax.

A lower credit score (below 650) reduces future loan eligibility.

Defaults remain on credit reports for 7 years, affecting financial credibility.

B. Late Payment Penalties and Increased Interest

Lenders impose penalties on overdue payments.

Interest accumulation increases the overall repayment burden.

The lender may increase the interest rate if the risk of non-payment grows.

C. Legal Actions by Lenders

Banks and NBFCs can issue legal notices for continued defaults.

If the borrower is unable to negotiate, lenders may proceed with loan recovery proceedings.

In extreme cases, asset seizure or wage garnishment may occur based on court orders.

2. Why Medical Emergencies Lead to Loan Defaults?

Medical emergencies are unpredictable and can lead to significant financial distress. Reasons why individuals might default on a personal loan due to health-related issues include:

Loss of income due to hospitalization or inability to work.

High medical bills depleting emergency savings.

Insurance shortfalls, where medical insurance does not cover full expenses.

Inability to focus on finances due to health priorities.

3. Options to Manage Personal Loan Payments During Medical Crises

Before defaulting, borrowers should explore alternative solutions to manage their personal loan repayments:

A. Request a Moratorium Period

Many lenders provide a moratorium option in case of financial hardship.

A temporary pause on EMI payments (typically 3–6 months) can be granted.

The borrower must provide valid medical documents for approval.

B. Loan Restructuring Options

Borrowers can request extended loan tenure to reduce EMI burden.

Lower interest rates may be offered in exceptional cases.

Partial payments or revised repayment schedules can be negotiated.

C. Utilizing Emergency Funds or Medical Insurance

If medical insurance covers a substantial amount, the remaining funds can be allocated towards personal loan EMIs.

Building an emergency fund beforehand can help avoid loan defaults.

D. Seeking Financial Assistance from Family or Crowdfunding

Borrowers can seek temporary financial support from family or friends.

Crowdfunding platforms like Milaap, Ketto, and GoFundMe can help raise funds for medical expenses and loan payments.

E. Taking a Secured Loan for Debt Consolidation

Borrowers can apply for a gold loan or a loan against fixed deposit to clear pending EMIs.

Debt consolidation allows replacing a high-interest personal loan with a lower-interest secured loan.

4. How Lenders Handle Personal Loan Defaults Due to Medical Reasons

Lenders typically follow a structured process before taking legal action against defaulters. Steps include:

A. Reminder Calls and Emails

Lenders first send payment reminders before marking the loan as delinquent.

Borrowers should proactively communicate financial difficulties to negotiate alternative payment terms.

B. Grace Period and Restructuring Options

Most lenders provide a 30–90 day grace period to clear overdue payments.

Borrowers can request a temporary payment deferral due to medical emergencies.

C. Credit Score Downgrade and Loan Recovery Agents

If the borrower does not respond, the lender reports the default to credit bureaus, affecting future loan eligibility.

Loan recovery agents may contact the borrower for resolution.

D. Legal Action in Severe Cases

If no resolution is reached, lenders can initiate legal proceedings under SARFAESI Act (2002).

In some cases, court orders for wage garnishment or asset seizure may be issued.

5. How to Protect Yourself from Personal Loan Default Risks?

Taking preventive steps can help borrowers avoid the financial burden of loan defaults due to medical reasons:

A. Opt for Loan Insurance

Many lenders offer loan protection insurance, which covers EMI payments in case of hospitalization or disability.

Borrowers should check for personal loan insurance policies while availing loans.

B. Maintain an Emergency Fund

A savings fund covering 6–12 months of expenses can provide financial security.

Emergency funds should be kept liquid for easy accessibility.

C. Prioritize Low-Interest Loans Over High-Interest Loans

If managing multiple loans, clear high-interest debts first to reduce financial pressure.

Consider consolidating multiple loans into a single manageable loan with lower EMIs.

D. Communicate with Your Lender in Advance

Inform your lender before missing an EMI to seek a loan modification plan.

Provide medical proof to justify the need for loan deferment.

6. What Are Your Rights as a Borrower?

Lenders must follow ethical recovery practices. Borrowers have the following rights:

Right to Fair Collection Practices: No harassment, threats, or unethical collection tactics.

Right to Loan Restructuring: Borrowers can negotiate alternative repayment plans.

Right to File a Complaint: If unfair practices occur, borrowers can file a complaint with RBI’s banking ombudsman.

Right to Legal Representation: Borrowers can seek legal help if lenders misuse recovery tactics.

Conclusion

Defaulting on a personal loan due to medical reasons can be stressful, but borrowers have options to manage their situation. Open communication with lenders, loan restructuring, and financial planning can help mitigate the risks. If facing financial hardship, borrowers should explore relief measures such as moratoriums, insurance claims, and emergency funds. Understanding borrower rights can also ensure that lenders follow ethical practices. By taking proactive steps, borrowers can prevent loan defaults and maintain financial stability even during medical crises.

#personal loan#personal loan online#nbfc personal loan#fincrif#personal loans#bank#loan apps#loan services#personal laon#finance#Personal loan default#Loan default due to medical reasons#Personal loan EMI missed#Impact of loan default on credit score#Loan restructuring for medical emergencies#Personal loan repayment options#Medical emergency and loan default#Moratorium on personal loan#Loan settlement for medical reasons#Credit score after loan default#Legal action for loan default#Loan deferment options#Debt consolidation for personal loan#How to negotiate loan repayment#Personal loan insurance#RBI guidelines on loan default#Personal loan grace period#Medical crisis and financial planning#How to avoid personal loan default#Loan recovery agents

1 note

·

View note

Text

Laws Governing Education Loans In India

This article on 'Laws Governing Education Loans In India' was written by Ashok Kumar Choudhary, an intern at Legal Upanishad.

INTRODUCTION

Education loans are typically provided to students pursuing higher education, such as undergraduate, postgraduate, or professional courses in India and abroad. These loans aim to bridge the financial gap between the cost of education and the resources available to the student and their family. This article attempts to analyse the concept of education loans along with the rules and guidelines governing it in India.

WHAT IS AN EDUCATION LOAN?

An education loan is a type of loan specifically designed to help students and their parents finance the costs associated with higher education. It is a financial arrangement where a lending institution, such as a bank or financial institution, provides funds to cover various expenses related to education, including tuition fees, books, supplies, accommodation, travel, and other educational expenses.

IMPORTANT TERMS

- Loan Amount: The loan amount depends on the educational program, institute, and the lender's policies. Generally, banks may offer education loans ranging from a few thousand rupees to several lakhs or even crores, depending on the course and institution. - Interest Rate: Education loans can have either fixed or floating interest rates. The interest rates may vary among lenders and can be influenced by factors such as the loan amount, repayment period, creditworthiness of the borrower, and prevailing market conditions. - Repayment: Repayment of education loans typically begins after the completion of the course or a certain grace period. The repayment period can range from a few years to several years, depending on the loan amount and the terms agreed upon with the lender. Repayment can be done in the form of equated monthly instalments (EMIs). - Collateral and Guarantor: Education loans may require collateral or a guarantor as security, depending on the loan amount. Some loans may require tangible assets like property, while others may require third-party guarantees. - Moratorium Period: Most education loans offer a moratorium period, also known as the repayment holiday, during which borrowers are not required to make any repayments. This period typically covers the duration of the course and a few months thereafter. Interest may accrue during this period, which is added to the loan amount. - Subsidies and Government Schemes: The Indian government, along with various state governments, may offer subsidies, interest rate concessions, or other schemes to support education loans and make them more affordable for students.

WHO CAN APPLY FOR AN EDUCATION LOAN?

Education loans in India are typically available to Indian residents who meet certain eligibility criteria. The following individuals can generally apply for an education loan: - Students: Students pursuing higher education, such as undergraduate, postgraduate, or professional courses, in India or abroad are eligible to apply for education loans. This includes students studying in recognized institutions or universities. - Parents or Legal Guardians: Parents or legal guardians can also apply for education loans for their children pursuing higher education. They are considered co-applicants and are responsible for repayment along with the student. - Indian Nationals: Education loans are generally available to Indian nationals. However, some lenders may also offer loans to Non-Resident Indians (NRIs) or Persons of Indian Origin (PIOs) under specific conditions. - Eligibility Criteria: Lending institutions set specific eligibility criteria that applicants need to meet. These criteria may include minimum age requirements, academic performance, admission to recognized institutions, and other factors. The criteria can vary among different lenders. Education loans in India are typically provided to students who are pursuing higher education, such as undergraduate, postgraduate, or professional courses. The loans are intended to support the educational expenses of these students, including tuition fees, books, supplies, accommodation, travel, and other related costs. The loans can be availed by Indian residents who meet the eligibility criteria set by the lending institutions. This includes students studying in recognized educational institutions or universities in India or abroad. In some cases, education loans may also be provided to parents or legal guardians on behalf of their children who are pursuing higher education. These parents or legal guardians are considered co-applicants and share the responsibility of loan repayment along with the student.

RULES AND LAWS GOVERNING EDUCATION LOANS IN INDIA

Education loans in India are governed by various laws, regulations, and guidelines. While there is no specific law dedicated solely to education loans, the following rules and regulations play a role in governing education loans in India: - INDIAN BANKS' ASSOCIATION (IBA) Model Education Loan Scheme: The IBA has formulated a model education loan scheme that provides standard terms and conditions for lending institutions. Most banks and financial institutions in India follow these guidelines, although they are not legally binding. - RESERVE BANK OF INDIA (RBI) REGULATIONS: As the central banking institution in the country, the Reserve Bank of India plays a crucial role in regulating financial activities, including education loans. The RBI issues guidelines and regulations to banks regarding the disbursement, repayment, and interest rates on education loans. - CREDIT INFORMATION COMPANIES (REGULATION) ACT, 2005: The Credit Information Companies (Regulation) Act governs credit information companies in India. Lending institutions utilize credit information reports from credit bureaus to assess the creditworthiness of borrowers applying for education loans. - INCOME TAX ACT: The Income Tax Act of India provides certain tax benefits to borrowers repaying education loans. Under Section 80E of the Income Tax Act, individuals can claim a deduction on the interest paid towards the repayment of education loans for themselves, their spouse, or their children. In addition to these laws and regulations, some state governments in India may have their own policies and schemes to support education loans. These policies can include subsidy programs, interest rate caps, or other incentives for students availing of education loans.

Laws Governing Education Loans In India

TYPES OF EDUCATION LOANS

Different types of education loans are available to students and their parents to finance higher education expenses. Here are some common types of education loans: - UNDERGRADUATE EDUCATION LOANS: These loans are specifically designed for students pursuing undergraduate courses. They cover tuition fees, books, supplies, accommodation, and other related expenses. - POSTGRADUATE EDUCATION LOANS: These loans are meant for students pursuing postgraduate courses such as master's degrees, doctoral programs, or professional courses. They provide financial assistance for tuition fees, research expenses, and other educational costs. - STUDY ABROAD LOANS: Study abroad loans are tailored for students who plan to pursue higher education in foreign countries. These loans cover expenses like tuition fees, living costs, travel expenses, and visa fees associated with studying abroad. - CAREER-SPECIFIC EDUCATION LOANS: Some banks offer specialized education loans for specific career-oriented courses such as management programs, engineering, medicine, law, aviation, or vocational training. These loans cater to the particular financial requirements of these fields. - SKILL DEVELOPMENT LOANS: Skill development loans are designed to support individuals seeking short-term skill enhancement or vocational training programs. These loans help individuals acquire new skills and enhance their employability prospects. - LOAN FOR MINORITY STUDENTS: Certain government schemes and banks provide education loans exclusively for students belonging to minority communities. These loans aim to promote educational opportunities and bridge the financial gap for students from marginalized backgrounds.

ELIGIBILITY DOCUMENT REQUIRED FOR EDUCATION LOANS IN INDIA

- Identity Proof: Valid proof of identity, such as an Aadhaar card, PAN card, passport, voter ID card, or driver's license. - Address Proof: Documents to establish the borrower's residential address, such as an Aadhaar card, utility bills (electricity, water, gas), bank statements, or rental agreement. - Proof of Admission: Documents that confirm admission to a recognized educational institution, such as an admission letter, offer letter, or fee receipt. - Academic Documents: Academic records and certificates to verify the educational qualifications of the student, including mark sheets, degree certificates, or school/college leaving certificates. - Income Proof: Income-related documents to assess the repayment capacity of the borrower or co-applicant/parent. These may include salary slips, income tax returns, bank statements, or a letter from the employer. - Bank Statements: Bank statements for a specific period (usually the last six months) to evaluate the financial stability and transaction history of the applicant. - Collateral Documents (if applicable): If the loan amount exceeds a certain threshold or if the collateral is required, documents related to the collateral may be needed. These can include property documents, land documents, title deeds, or other asset-related papers. - Guarantor Documents (if applicable): If a guarantor is involved in the loan application, their identity proof, address proof, income proof, and photographs may be required. - Photographs: Recent passport-sized photographs of the borrower, co-applicant, and guarantor (if applicable).

CONCLUSION

Education loans in India are governed by a combination of laws, regulations, and guidelines. While there is no specific law dedicated solely to education loans, various legal frameworks provide guidance and oversight to ensure fair and transparent lending practices. The Indian Banks' Association (IBA) Model Education Loan Scheme serves as a reference for lending institutions, while the Reserve Bank of India (RBI) plays a significant role in regulating financial activities related to education loans. The Credit Information Companies (Regulation) Act, of 2005, governs the use of credit information reports in assessing borrowers' creditworthiness. Additionally, the Income Tax Act offers tax benefits to borrowers repaying education loans. State governments may also introduce their own schemes and policies to support education loans. As the educational landscape evolves, borrowers must stay informed about the latest laws and guidelines and seek guidance from lending institutions for accurate and up-to-date information regarding education loan regulations in India.

REFERENCES

- Preeti Motiani, What is education loan? Here's a guide, Economic Times, 15 October 2018, available at: https://economictimes.indiatimes.com/wealth/borrow/heres-all-you-need-to-know-about-an-education-loan/articleshow/56624785.cms - THE EDUCATION LOAN BILL, 2016, available at: 164.100.47.4/billstexts/lsbilltexts/asintroduced/4259LS.pdf - A Detailed Guide on RBI Rules for Education Loan in 2019. Repayment and Recovery!, Credenc, 18 April 2019, available at: https://www.credenc.com/blog/rbi-guidelines-for-education-loan Read the full article

0 notes

Text

Best New Start-Up Business Loan Services in Gandhinagar, Gujarat

Starting a new business is an exciting yet challenging journey, especially when it comes to securing the right funding. For entrepreneurs in Gandhinagar, Gujarat, finding reliable start-up business loan services can be the key to turning their vision into reality. The financial ecosystem in this rapidly growing city is evolving, providing innovative loan options tailored to the needs of new ventures.

In this article, we will explore the features and benefits of the best new start-up business loan services in Gandhinagar, Gujarat, to help aspiring entrepreneurs make informed decisions.

Why Start-Up Business Loans Are Essential

Starting a business often requires significant capital investment. From purchasing equipment and inventory to marketing and hiring staff, financial support is crucial. While personal savings and angel investors can help, they may not always suffice. This is where start-up business loans come in, providing:

Access to Immediate Funds: Start-up loans ensure you have the resources to launch and sustain your business.

Flexibility: Many lenders offer flexible repayment terms, making it easier for businesses to manage cash flow.

Building Credit History: Successfully repaying a loan helps establish a good credit record, which can be beneficial for future funding needs.

Focused Growth: With adequate financial backing, entrepreneurs can focus on scaling their business rather than worrying about cash shortages.

Features of the Best Start-Up Business Loan Services in Gandhinagar, Gujarat

1. Customized Loan Products

The best loan services in Gandhinagar understand the unique needs of start-ups. They offer tailored loan products designed for specific industries, whether you’re venturing into technology, manufacturing, retail, or services. This customization ensures that businesses get the support they need to thrive.

2. Low Interest Rates

Affordable interest rates make it easier for new businesses to repay loans without undue financial stress. Many financial institutions in Gandhinagar offer competitive rates, ensuring that entrepreneurs can focus on growth rather than worrying about high EMIs.

3. Flexible Repayment Options

Start-up business loan services in Gandhinagar often provide flexible repayment terms, including options for grace periods or step-up EMIs. This flexibility allows businesses to align their loan repayment schedule with their revenue generation cycle.

4. Quick Approvals and Disbursals

Time is of the essence for start-ups. Many loan providers in Gandhinagar prioritize quick processing and disbursal of funds, ensuring that entrepreneurs can seize market opportunities without delays.

5. Collateral-Free Loans

For many first-time entrepreneurs, arranging collateral can be a challenge. Collateral-free loans, or unsecured business loans, have become a popular option, offering funding without the need for pledging assets.

6. Digital Loan Applications

With the rise of digital banking, applying for a start-up business loan in Gandhinagar has never been easier. Many lenders provide online application portals, reducing paperwork and streamlining the process.

Key Considerations When Choosing a Loan Service

When selecting the best start-up business loan service in Gandhinagar, Gujarat, entrepreneurs should keep the following factors in mind:

Eligibility Criteria: Check the eligibility requirements to ensure your business qualifies for the loan.

Loan Amount: Assess your funding needs and choose a service that offers the required loan amount.

Processing Fees: Be aware of any hidden charges or processing fees that may affect the total cost of the loan.

Customer Support: A reliable loan service provides excellent customer support to address queries and concerns promptly.

Reputation: Opt for a lender with a strong track record and positive reviews from other start-ups.

Benefits of Availing Start-Up Loans in Gandhinagar, Gujarat

1. Supportive Business Environment

Gandhinagar, the capital of Gujarat, is a hub of economic activity with a focus on innovation and development. The city’s supportive business environment makes it an ideal location for start-ups to thrive.

2. Government Initiatives

Gujarat’s state government actively promotes entrepreneurship through various schemes and subsidies. Start-up loans often align with these initiatives, offering additional benefits to local businesses.

3. Access to Expertise

Many loan providers in Gandhinagar also offer advisory services, helping entrepreneurs refine their business plans and strategies. This added support can be invaluable for new ventures.

4. Networking Opportunities

Securing a loan from a reputed financial institution can open doors to networking opportunities, connecting entrepreneurs with potential partners, mentors, and investors.

Conclusion

For aspiring entrepreneurs in Gandhinagar, Gujarat, the availability of top-notch start-up business loan services is a significant advantage. These services not only provide the financial backing needed to launch and grow a business but also offer the flexibility, support, and resources to navigate the challenges of entrepreneurship.

By carefully evaluating loan options and choosing a provider that aligns with your business goals, you can set your start-up on the path to success. Whether you’re developing a tech innovation, launching a retail outlet, or starting a service-based enterprise, the best new start-up business loan services in Gandhinagar, Gujarat, are here to help you achieve your dreams.

0 notes

Text

HOME LOAN DEFAULT – RIGHT, LEGAL ACTIONS

It's not a big deal if you miss one or two EMI payments for any reason. In this situation, the bank will issue a minor warning. However, if they fail to pay the EMI for three months in a row, it will be a red signal. The bank will classify them as defaulters and notify them. With their immaculate credit history and valid reasons, there is a chance that the lender may grant them a grace period. However, the default will hurt their Cibil score.

In India, several actions can be taken against a loan defaulter:

The disadvantages that a borrower faces when a loan is not paid back within the specified time frame. Are there any repercussions for failing to repay the loan? Whenever we apply for a personal loan from a bank or financial institution, the borrower is liable to clear the loan as per certain terms and conditions. However, when there is a default in loan repayment, there are quite a few legal actions taken for not paying the personal loan in India.

The following are the most common legal proceedings filed against the borrower:

Banks may file a summary suit under Order 37 of the Civil Procedure Code of 1908. Order 37 is related to hundreds, promissory notes, and bills of exchange in written contracts in which a plaintiff holds the right to recover debts, according to Rule 1 sub-rule 2.

If the borrowers ignore the notification and fail to contact the lender, they will receive another notice stating that post-dated cheques would be shared with the bank on a specific date. However, one must ensure that there is enough money in their account to process the cheque.

Personal loan defaulters will be punished as criminals if the cheque bounces, according to Reserve Bank of India (RBI) standards. Section 138 of the Negotiable Instruments Act of 1981 mentions this.

Personal loan defaulters will be exonerated under the Indian Penal Code Section 420, which provides for life imprisonment. This will harm your credit history and make it more difficult to receive a personal loan in the future. To avoid default payments, the best option is to keep emergency money on hand.

If a borrower fails to return a loan, the lender is forced to file an action against the borrower under Section 138 of the Negotiable Instruments Act of 1881. Borrowers may confront unavoidable circumstances that prevent them from repaying the loan amount, such as the failure of a firm or a comparable one with a loan limit greater than the borrower's limit.

If a borrower fails to pay the EMI even after the lender has served a legal notice, they will send executives to your door to retrieve the outstanding amount.

It is important to remember that even if the borrower defaults, he or she does not lose all rights to the asset or fair treatment. Banks and financial organizations must follow a protocol when dealing with a loan defaulter.

Right to Be Notified –

Before seizing your assets or recovering the due amount, the bank, NBFC, or financial institution must allow you enough time to repay the obligation. The bank may begin the process in the following ways, according to the Securitisation and Reconstruction of Monetary Assets and Enforcement of Security Interests Act:

If a loan is designated as a non-performing asset (NPA) and repayment is 90 days late, the bank or financial institution must issue a 60-day notice to the borrower to pay the obligation.

If you do not repay the loan within the specified time frame, the bank may sell your assets or property. Even so, the lender must provide another 30 days' public notice of the upcoming sale before they can intervene in the final transaction.

The right to a fair price –

If you do not pay your obligations within the notice period, the bank will repossess your property but cannot establish the asking price on its own. Along with the one-month repossession, the bank will give you a notice indicating the asset's market worth, as well as the reserve price, date, and time of the auction.

If you believe the selling price is too low, you have the right to object and proclaim the price you believe is correct. The bank takes into account your entitlement to receive fair value for your property and then revalues it. You have the right to seek out a new buyer and introduce them to the lender if you believe the asset is undervalued.

The Freedom to Speak Up –

Throughout the notice period, you have the right to object to the bank's repossession notification. The authorized official advises you of the acceptance or denial of your objections, as well as the legal grounds, within 7 days.

Recovery of the Balance –

If you sell your bank-repossessed property promptly, it could be worth a lot of money. You have the right to the balance amount if the bank has some balance left over after recovering the outstanding balance. Even if your item is repossessed, keep an eye on the auction technique. Lenders will undoubtedly reimburse any additional monies once their loans have been recovered. Make certain you receive this sum since it is legally yours.

Written By

Property Expert Channel

Anurodh Jalan

Jalan Property Consultant

8801003684

0 notes

Text

How to Check Cradles EMI facility in ICICI Bank Debit Card

Digitize your payments with ICICI Bank CardLess EMI card. Now shop anything at your favourite retailers around the corner or across the country with ICICI Bank’s Card less EMI card. The world’s first digital-only EMI facility will be offered by all leading retail outlets across the country, which is a new feature that will

Experience easy and secure, 24x7 Cardless EMI facility. With a smartphone and PAN Card, buy any product of your choice. Get up to 90 days grace period at 0% processing fee, if you have ICICI Bank Credit Card.

Buy more on your favorite gadgets and appliances without carrying cash. Try our new Cardless EMI facility.

Wish to make your dream purchase a reality but unsure of the payment option available at the retail outlet? Wish your purchases were hassle-free and you are not always dependent on cash? ICICI Bank’s Cardless EMI option is here to help by allowing you to get credit at your fingertips. You can now enjoy instant EMI options with your EMI phone, debit

Now make Cardless EMI payment at your favourite retail outlets just with your mobile phone.

Your ICICI Bank Debit Card is about to get smarter. Now you can use your credit card for availing EMI on your home or personal loan, or purchase at a leading retailer, and take the convenience home. Learn more here:

New Year is time to make resolutions, and a new smartphone or gadget is high on the shopping list for most people. But it can be costly to upgrade your smartphone every other year. Now, buy your next one with just your debit card and pick it up from the store – right when you want.

We recently introduced the Creedless EMI facility so that customers can make payments by using the phone and PAN, without their cards or wallets. Now get a 5% discount on cardless EMI purchases.

Now you don't have to carry your debit card and PAN card just to make an EMI transaction. Know all about icici bank current credit & debit card emi eligibility here.

We’re introducing a new way to shop. Now, you don’t even have to take your debit card or wallet on that all-important shopping trip. Earlier this morning we launched Cardless EMI for our debit cards online and it’s available in all our branches right now.

Cardless EMI facility is now available for non-gold and non-diamond jewellery purchases! You can get an instant decision about your card EMI request for purchases worth up to Rs.

Take advantage of ICICI debit card emi eligibility and make your online purchase a hassle-free experience. Get instant approval on the purchase of consumer durables without carrying your card! Apply now!

To make it easy for our customers, ICICI Bank and Samsung India have joined hands to bring the "MasterCard EMI Card" for your convenience. Check out more about the MasterCard EMI Card here:

You can now purchase any product from our wide range of products in a matter of a few minutes. We do not charge you for the same, neither does it spend anything from your card balance. Just make your payment by entering your mobile number and PAN number only."

0 notes

Text

Should You Take a Personal Loan Instead of an Education Loan?

Education is one of the most crucial investments in an individual's life. Whether it’s for higher studies, skill development, or specialized courses, financing education can be challenging. While education loans are the traditional choice, many students and parents consider a personal loan as an alternative. But is it the right decision? In this article, we will explore the pros and cons of choosing a personal loan over an education loan and help you make an informed financial decision.

Understanding Personal Loans and Education Loans

Before diving into the comparison, let’s understand the key differences between a personal loan and an education loan.

Personal Loan

A personal loan is an unsecured loan that can be used for any purpose, including education. It does not require collateral and comes with flexible repayment options. Banks, NBFCs, and online lenders offer personal loans based on an individual’s income, credit score, and financial stability.

Education Loan

An education loan is specifically designed for financing tuition fees, accommodation, and other academic expenses. These loans usually come with lower interest rates and flexible repayment options, including moratorium periods until the student starts earning.

Comparing Personal Loan and Education Loan

To determine which loan is better, let’s compare them based on key factors:

1. Interest Rates

Personal Loan: Typically has higher interest rates ranging from 10% to 24% since it is an unsecured loan.

Education Loan: Usually comes with lower interest rates, ranging from 6% to 12%, as banks consider it an investment in future income.

Winner: Education loans offer more affordable interest rates, making them cost-effective in the long run.

2. Loan Amount & Eligibility

Personal Loan: Loan eligibility depends on income, credit score, and repayment capacity. The amount is usually capped based on these factors.

Education Loan: Loan approval depends on the course, institution, and financial background of the student or co-applicant (usually parents). Some banks even cover the entire tuition fee for reputed institutions.

Winner: Education loans provide higher loan amounts, especially for professional courses.

3. Repayment Terms

Personal Loan: Repayment starts immediately with EMIs, and loan tenures typically range from 1 to 5 years.

Education Loan: Comes with a moratorium period (grace period) during which repayment begins only after the student starts earning.

Winner: Education loans offer better flexibility for students who are not financially independent yet.

4. Tax Benefits

Personal Loan: No tax benefits are available for personal loans taken for education purposes.

Education Loan: The interest paid on an education loan is eligible for tax deduction under Section 80E of the Income Tax Act.

Winner: Education loans provide tax-saving advantages.

5. Collateral Requirement

Personal Loan: Does not require collateral.

Education Loan: Loans above a certain amount may require collateral or a guarantor.

Winner: Personal loans are easier to obtain for those who lack collateral.

6. Processing Time

Personal Loan: Quick disbursal within a few days, making it suitable for urgent needs.

Education Loan: Takes longer due to extensive documentation and verification processes.

Winner: Personal loans are better for instant funding needs.

When Should You Consider a Personal Loan Over an Education Loan?

While education loans seem like a better option, a personal loan might be suitable in the following cases:

Short-Term Courses: If you are enrolling in a certification or short-term program that does not qualify for an education loan, a personal loan can be a viable alternative.

No Moratorium Needed: If you have an immediate source of income and can manage EMIs without a grace period, a personal loan could work.

Low Loan Amount: If the required amount is small and an education loan involves a complex application process, a personal loan can be a faster solution.

No Co-Applicant or Collateral: If you don’t have a co-signer or collateral required for an education loan, a personal loan might be the only option.

When to Avoid Taking a Personal Loan for Education?

A personal loan may not be the best option if:

You require a large loan amount with lower EMIs.

You need a moratorium period before starting repayment.

You want tax benefits on interest payments.

You want lower interest rates and flexible tenure.

Final Verdict: Which Loan Should You Choose?

In most cases, an education loan is a better choice due to its lower interest rates, flexible repayment options, tax benefits, and higher loan amounts. However, a personal loan can be considered for specific situations where traditional education loans are not available or feasible.

Before making a decision, analyze your financial situation, loan eligibility, and repayment capacity. If in doubt, consult a financial advisor to choose the best option that aligns with your education and financial goals.

By making an informed decision, you can ensure that financing your education does not become a financial burden in the future.