#gps tracker for car canada

Explore tagged Tumblr posts

Text

Consider All The Perks of Using GPS Tracker Devices For Cars

GPS trackers are one of the market's most popular security and location monitoring devices. They provide peace of mind for parents, fleet companies, and owners of expensive cars. With GPS Tracker Devices For Cars, users can also receive alerts when needed and have a step-by-step tracking history to see where they were in the past. Here is a quick look at some key benefits of using these trackers.

10 Benefits of Using GPS Tracker Devices For Cars

1. Real-time tracking

GPS tracker devices allow you to track the exact location of your car in real time. That can be incredibly helpful if your car is stolen or if you're trying to keep track of a fleet of vehicles. It can also be helpful for family members who share a car so each person knows where the others are. These devices are ideal in vehicles you need to keep track of, such as a rental car or a vehicle with multiple drivers.

2. Improved safety

GPS Tracker Devices For Cars can be used to gain peace of mind when driving. You'll know exactly where your car is located and can track its movement. It can improve safety and security, as drivers can see in which places they drive through, making it easier to spot potential dangers.

3. Improved fuel efficiency

Devices to track cars can be used to improve your vehicle's fuel efficiency. You'll know how fast you're driving, allowing you to adjust your speed and improve gas mileage. By seeing the driving habits of everyone using the car, you can make adjustments that will help you save money on gas.

4. Alarm notifications & alerts

GPS tracker for car Canada allows users to receive real-time alerts when needed. These alerts can be sent through email, text messages, or smartphone app notifications. They automatically send real-time information about your vehicle's location, speed, and direction in case of theft or serious accident.

5. Better fleet management

If you own a business that relies on a fleet of vehicles, GPS tracker devices for cars can help you manage your fleet more effectively. You can track the location of your vehicles, monitor their performance, and optimize routes to save time and fuel.

6. Peace of mind

Knowing that you can track your car's location at any time can give you peace of mind, whether you're worried about theft or carjacking or want to keep an eye on your teen driver. GPS tracker devices are valuable for keeping track of loved ones, too. You can set rules that alert you when your child passes a specific location and helps protect them from potential dangers.

7. Enhanced security

Installing a GPS tracker for the car in your vehicle can be a convenient and cost-effective way to keep your belongings safe. Many GPS devices can activate alarms if the vehicle is moved. You can also create a geographical boundary that alerts you.

8. Prevent carjacking

In the event of a carjacking, a GPS tracker device for a car can provide you with valuable information about the location and status of your vehicle. The information can help police recover your vehicle and arrest the culprit.

9. Easy installation

GPS Tracking Devices For Cars are easy to install, and many don't require professional installation - you can set them up yourself in just a few minutes. Some GPS devices clip onto your existing car battery, while others are permanently installed in your car. You'll also need to install a web-based account that offers access to all the information the device collects.

10. Extended battery life

One of the biggest benefits of using a GPS tracker for your car is its extended battery life. Many trackers have a battery life of up to years before recharging, so you don't have to worry about unplugging it every night.

3 Solutions You Can Expect From GPS Tracker Devices For Cars?

1. Remote monitoring of vehicle

The GPS Tracker Device For Cars can monitor vehicle location at the push of a button anytime an ignition is on. The mobile device installed in the car also has wide reporting options and alert functions. It provides real-time details, including speed, location, and traveling direction.

2. Top-speed monitoring

Top speed monitoring features are the most effective way for vehicle owners to monitor the vehicle's speed and driver behavior. The GPS Tracker Devices For Cars can monitor the top speed. It also allows checking on driving behavior, including start and stop times, braking, acceleration and turns.

3. Geofencing

If a driver goes outside the set boundary or travels at a speed different from the usual, you will receive an alert. The GPS Tracking Devices For Cars can set up different geofences and alerts beforehand. It also allows notification, so you know where your vehicle is going.

Conclusion:

GPS Tracker Device For Cars is a very useful technology to help you track your car's location while driving. It can provide peace of mind in case your vehicle gets stolen and also provide great assurance to you and your family if they share the car. With a GPS tracker, you'll always know exactly where your car is. The GPS tracker lets you control your vehicle and track its location in real-time.

#track gps#gps track#tracking gps#gps with tracker#track a car gps#gps tracking canada#gps tracking in canada#gps tracking devices canada#gps tracker for car canada#vehicle tracking by gps#gps tracker devices for cars#gps tracker best buy canada#vehicle trackers gps#vehicle tracking device#hidden tracking devices for cars#GPS Tracker For Vehicle

0 notes

Text

0 notes

Text

Purchase car GPS trackers from GPS Canada Track for reliable navigation and enhanced security. Our cutting-edge GPS technology ensures precise location tracking, allowing you to monitor your vehicle's movements with ease. With GPS Canada Track, you can trust in the accuracy of our GPS track systems, providing real-time updates and historical data analysis. Safeguard your vehicle and streamline your travels by investing in a GPS track solution from GPS Canada Track today.

0 notes

Link

Garmin Dezl 780 is a truck GPS which has a huge 7-inch screen. The device comes with a magnetic mount for easy installation. It also comes with Garmin GPS update so you don’t have to drive with the obsolete maps. Connect this GPS device with your smartphone and get updates about traffic and weather conditions. The intelligent routing system provides you with custom routes according to the weight, size and cargo of your truck. The specific truck navigation also helps in avoiding the very expensive tickets which you can get by going on the wrong roads.

#Gps Tracker#Update Garmin Map#Garmin Gps Update#Garmin Map Updates#Garmin Canada#Garmin Sat Nav Update#Garmin Nuvi Map Update#Garmin Navigation#Garmin Car Gps#Garmin Customer Service#Garmin Support#Garmin Com/Express

0 notes

Photo

#saibhangsoftronics #saibhang #waterproof #GPS #tracker #instavid #instapict #logistics #cars #trucks #bike #vehicle #trackers #carhere #iot #it #developmemt #management #canada #india https://www.instagram.com/p/Bss7o77FsC9/?utm_source=ig_tumblr_share&igshid=3f5l4latp2jo

#saibhangsoftronics#saibhang#waterproof#gps#tracker#instavid#instapict#logistics#cars#trucks#bike#vehicle#trackers#carhere#iot#it#developmemt#management#canada#india

0 notes

Text

Buy GPS Tracker For Vehicles with a Long Battery Life tracking system at the lowest tracker price in Canada from GPS Canada Track. Our services are designed to help you keep track of your vehicle, whether it be for business purposes or personal use. Call 855-963-4222 for more information.

#GPS Tracker For Vehicles#GPS Tracker For Vehicle#track gps#gps track#tracking gps#gps with tracker#GPS Canada Track#tracker gps canada#gps tracker for car canada#gps tracker canada#car gps trackers#gps tracking car

1 note

·

View note

Text

Vermont: Immigrant taxi driver - Alaa Abdulsalam Arif - arrested smuggling illegals into U.S. from Canada

A Vermont man is facing a federal charge that he was involved in a human smuggling operation along the U.S. border with Quebec between Richford and Berkshire.

A document filed in federal court in Burlington on Wednesday says that a Border Patrol agent had installed court-authorized GPS on a vehicle belonging to Alaa Abdulsalam Arif, an Essex Junction taxi driver, the day before he was apprehended March 21 in Enosburg Falls.

When Arif's vehicle was stopped, it was carrying six passengers — four Mexican citizens, a citizen of Gambia and another from Niger. All the passengers admitted they had crossed illegally into the United States from Canada, the document says.

Agents believe one of the passengers was serving as the guide whose behavior was “consistent with individuals serving as foot guides, leading other aliens into the United States from Canada through fields and wooded areas as part of an alien-smuggling event.”

U.S. Attorney Spokesman Kraig LaPorte wouldn't comment on specifics but said that the office filed a complaint and the court issued a summons for Arif, but that he has not yet appeared.

No court date has been scheduled.

Reached at a phone number listed in court documents on Friday, Arif declined to comment. A website associated with Arif’s taxi business said he regularly takes clients to the Jay Peak ski resort, not far from where the alleged smuggling event took place.

The alleged guide has not been charged with a crime.

The passengers, including the guide, were all immediately returned to Canada because of policies in effect during the COVID-19 pandemic. Arif, a U.S. citizen, was released, and agents did not attempt to interview him, also because of COVID-19 policies.

On Feb. 15, a surveillance camera spotted a dark van in the same area that was involved in an apparently successful human smuggling event. On March 12, surveillance cameras saw what appeared to be the same vehicle, later determined to belong to Arif, drop off a man whose footprints led into Canada, the affidavit says.

Arif's vehicle was stopped by Border Patrol agents, but he was allowed to continue.

On March 20, surveillance allegedly spotted Arif's car drop off a man whose tracks led into Canada. That evening an agent placed the GPS tracker on Arif's car.

They were apprehended the next day.

On April 10, the alleged guide was found by game wardens in Maine when the car he was riding in became stuck on an unplowed road near Millinocket.

At that time the guide told Border Patrol in Maine he had reentered the United States illegally in Richford on March 28, but he denied having smuggled people. The agent who wrote the affidavit said the guide's presence in Maine was “consistent with participation in an alien smuggling operation.”

-------------------------------------------------------------

h/t United States Illegal Alien Crime Report

5 notes

·

View notes

Link

Vyncs is a Real-Time GPS tracking system that comes with a complete set of connected car services. The data comes to your account in real-time as the vehicle is driven. You can browse the information using your desktop computer or Android/iOS smartphones. Plugs into the OBD-II port of your car. If your vehicle does not have an OBD-II port or you do not want to use the OBD-II port for some reason then use our 12V power adapter to connect the Vyncs device. VYNCS BASIC: Our standard 3G real-time GPS tracker product for consumers. VYNCS PREMIUM: Standard Vyncs along with one-year emergency roadside assistance (available only in USA, Canada, and Puerto Rico). VYNCS PRO: Vyncs with 60 seconds GPS update and Live Map Auto Refresh (map automatically refreshing as new GPS data comes in). VYNCS FLEET: It is the fleet version of Vyncs with many features for commercial fleets including support for more than 5 vehicles in an account. VYNCS OBD-II EXTENSION CABLE: Optional extension cable for installing the Vyncs device. The only cable tested to work with Vyncs. Use of any other cable is not recommended. VYNCS 12V POWER ADAPTER: used to power the Vyncs device using 12V non-OBD power source in a vehicle (e.g. heavy-duty trucks). GPS TRACKER FOR VEHICLES. No Monthly Fee! 30 DAY FREE TRIAL. SIM card (works in the US, Canada, Mexico, and 177 additional countries), 1-year data plan, and 1-year service included from the date of delivery. FREE web account & Android/iOS Apps. USD 29.99 one-time activation fee. USD 74.95 renewal fee for the 2nd year. Renewal fee includes service and data plan for the second year. Uses AT&T and T-Mobile network in the USA. LOCATION/TRIPS - 3 Mins Real-time GPS with 60/30/15 seconds update upgrades available. Updates once in every hour while ignition off. Mileage records, trips, fuel/emission report. NOTIFICATIONS - Harsh braking, rapid acceleration, geo-fence, speeding. Nano accelerometer for detecting rapid vehicle movement. l VEHICLE DIAGNOSTICS - OBD-II (post-1996 light/medium-duty vehicles in the USA) fault codes, car recalls, maintenance reminders. SUPPORT - Phone, online chat, and tech support available from the website.

#gps tracker#gps tracker for vehicles#car tracker#OBD-II GPS Tracker#3G GPS Tracker#GPS Tracker for cars#obd2 tracker#car tracking device#gps tracking devices

1 note

·

View note

Text

Bellsbourge (cw: sexual assualt)

“My daughter's gone missing!”

The police officer on desk duty stifled a groan and tried to reassure the woman.

“Your doll went missing Ms Haversham.” he said gently “You don't have a daughter.”

Ms Haversham was not calming down.

“You don't understand! Yes she looks like a doll but she's my daughter, and she's missing!”

“You probably just misplaced her somewhere.”

“No, no. She has a routine that she never misses. Please I don't know what's happened.”

It would be a long time before Officer Zivana got Ms Haversham to leave

A week later Ms Haversham's doll was found in the woods near her house. The delicate lace dress dress was torn and the porcelain was smeared with dirt and something else, but was in otherwise fine condition. Officer Zivana watched a grown woman fall to the ground and weep over the utterly salvageable doll.

Bellsbourge was a small sleepy town in rural Ontario nestled between forested valleys and clear streams. The town barely had enough gravity to keep highway traffic in its orbit at its few roadside coffee shops and gas stations. It was famous for one thing however: it was a dollmaker's paradise. “The Dollmaking Capital of Canada” it read proudly under the 'Welcome to Bellsbourge' sign.

Off the highway there was a main street populated by dozens of craft and hobby shops. And naturally every year in the summer was the Bellsbourge Doll's Fair which attracted nearly twice the town's population in visitors, and was probably the only revenue stream keeping the town afloat.

Dolls could get very expensive, ten of thousands, which is why, a week later, Officer Zivana took the next report very seriously. Mrs Rufino reported one of her more expensive dolls had gone missing and was likely stolen. She had left it in the backseat of her car while she went to do some hobby shopping (the doll was brought along in case sizing was needed.) When she returned her doll was missing. An officer was sent to canvass the area, but unfortunately no cameras had an angle of Mrs Rufino's car.

Mrs Rufino's doll was found three days later in the middle of the street. Luckily the driver hadn't run it over but it was impossible the doll had been lying in the street the whole time. Once again, other than superficial dirtiness and damage to the clothing nothing seemed wrong with the doll.

After the third and fourth thefts occurred people started locking doors and windows, and harbouring suspicions. A few fights even broke out between the more passionate community members. Still the dolls always seemed to reappear, dirty, and disheveled, but intact, days or weeks later. The big doll fair was still months off but Officer Zivana wanted these incidents to be long forgotten by then. So she collaborated with one of Bellsbourge's most award-winning dollmaker to set up a sting operation. A small tracking device was attached to the doll's clothing and she was left in the backseat of a car like Mrs. Rufino's. The police officers didn't watch the bait, for fear of scaring the thief but they were rewarded when Mr. Ross came out of the shop forty five minutes later and found his doll missing.

The tracker was turned on, and a gps app showed it moving. That's when the chase began. Alarms blaring Bellsbourge one cop car followed the signal, eventually ending up at one of the local churches. The pastor was caught red-handed with the doll but the more disturbing thing was in the basement. Downstairs the police found a photography darkroom. There were pictures of the all of the stolen dolls, and some other in various states of pornographic undress. They all had been photographed and uploaded to the internet. Unfortunately the pastor could only be charged with theft, though he was run out of town, and the incident was mostly just wicked gossip by the time the Bellsbourge Doll’s Fair rolled around.

2 notes

·

View notes

Text

Telematics Solution Market - Forecast, 2022-2027

The Telematics Solution Market size is estimated to surpass $55.5 billion by 2027 growing at CAGR of 8.3% during 2022-2027. Automotive telematics deals with telecommunications and information technology which is related to long distance transmission of information in commercial automobiles. It is the technique of sending and receiving the information automatically from automobiles by vehicle to vehicle or vehicle to infrastructure through the integrated use of informatics and telecommunications. On-board integrated telematics system, driver interface in a vehicle, car tracker systems, sensor systems are the important telematics devices in vehicles. The major automobile industries are spending more on research and development activities and concentrating to develop and implement telematics in vehicles. Now a days vehicles are manufactured by implementing various technologies to offer unique connectivity solutions for better navigation systems and fleet management solutions. Telematics devices are used to transfer large amounts of information from the vehicle to infrastructure of other vehicles utilizing a telematics control unit. Commercial automotive telematics helps in car tracker system, emergency calls, remote control monitoring, connected navigation such as weather reports, traffic reports, route plans and in infotainment. Commercial telematics are used in conjunction with telecommunication systems to provide quick and easy informational access. The growth in telecommunications as well as connected vehicles has led to a major growth in the Telematics Solution Market. Telematics is an important differentiator for car manufacturers. Regulations such as anti theft tracking in new vehicles, eCall automatic emergency call device, and in some places insurers require GPS anti theft devices for high value cars. All these factors increase the demand of the automotive Telematics Solution Market.

Report Coverage

The report: “Telematics Industry Outlook (2022-2027)”, by IndustryARC covers an in-depth analysis of the following segments of the Telematics Industry.

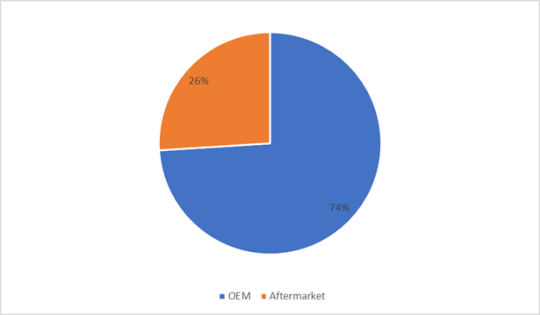

By Sales Channel: OEM,Aftermarket

By Technology: Tethered, Embedded, Integrated

By Device Type: Hardwired, Plug and Play, Smartphone Based

By Vehicle Type: Passenger Vehicles, LCV, HCV

By Solution: Safety and security Services (Driver behavior Monitoring, Roadside Assistance, Crash Reconstruction System, Black box device/ On board Recorder, Remote Maintenance, Seat belt Usage Monitoring, Fuel Monitoring and Others), Entertainment Services (Amplitude Modulation(AM)/ Frequency modulation(FM) Radio, Satellite television, Infotainment), Navigation system, Location based services, Fleet management Systems, Local Search and Concierge, Usage Based Insurance, Billing services and Others

By Geography: North America (U.S, Canada, Mexico), South America (Brazil, Argentina and others), Europe(Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, SK, Aus and Others), and RoW (Middle East and Africa).

Key Takeaways

The growing demand for operational efficiencies in the industry is set to drive adoption of fleet management telematics. Companies have in recent years shifted focus from reducing operational cost to improving operational efficiency as a method to improve their profitability.

Companies are also looking to fleet management services to monitor driver behavior in order to improve the efficiency of this aspect. Traditionally, truck driver monitoring included factors such as speed and vehicle location; however, with the advent of telematics monitoring has become more intrusive with features such as speed, braking and cornering techniques as well as route times, hours of service and fuel monitoring data.

However for companies concerned with their environmental footprint, changes to the manufacturing process are time consuming and expensive. Fleet management services can be a quick solution to this arduous problem. The declining price for telematics hardware systems is also set to increase adoption of fleet management.

Telematics Solution Market, By Sales Channel, 2021 (%)

For More Details on This Report - Request for Sample

Telematics Solution Market Segment Analysis – By Vehicle Type

Commercial Automotive Telematics Solution Market size has revenue of $27.2 billion in 2021. In recent years, for monitoring driver behavior and vehicle, telematics black boxes have been used to transmit information such as real-time car trackers, vehicle diagnostics, changes in speed, harsh driving etc. This help fleet companies to evaluate and take necessary step to optimize their operations. Increase in the implementation of advanced solutions in order to reduce operational costs in the logistics industry is expected to propel the growth of commercial automotive Telematics Solution Market in commercial vehicles. Advanced and sophisticated telematics technologies are reshaping the way in which trucks operate by offering various services such as on-board recorder, telec maintenance scheduling and reporting any kind of unusual activities. The cost of the telematics systems still poses a challenge in terms of the adoption of telematics on a large scale, however, with the falling prices of the telematics systems in the future will snowball the market significantly

Telematics Solution Industry Segment Analysis - By Solution

Navigation systems accounted for 14% of the total Telematics Solution Market Size of components in 2021. Navigation devices in the Telematics Solution Market are used to provide route details for fleets and transport systems. Navigation systems involve transfer of data regarding location and facilitate planning and routing functions using telematics control units. Navigation systems are mostly used alongside GPS devices in vehicles. GPS devices are used in conjunction with navigation systems. To counter the growing smartphone navigation market, many navigation systems manufacturers are shifting to OEM supply and provide support for Tier 1 auto manufacturer. Many OEMs have standardized navigation systems in their vehicles. This has led to a rise in the penetration of navigation systems. Aftermarket sales of navigation systems are however on the decline. This decline can be majorly attributed to the advent of smartphones. Free navigation services are offered on smartphones. As a result, customers are not willing to pay for features which they can obtain for free.

Telematics Solution Industry Segment Analysis – By Geography

North America market accounted for over 38.2% of the total industry share in 2021 and demand of automotive telematics with increase in connected cars with safe and security systems and others boost the demand of this market. Safety and security and infotainment systems are a big part of this market. The major companies operating in this market include automotive OEMs GM, Ford and Toyota, telematics service providers Garmin, TomTom NV, Fleetmatics, Telogis, Trimble and Navman. The factors such as reduction in the cost of connectivity and increasing market penetration of connected devices such as smartphones, and tablets are contributing to the burgeoning demand for connected cars. In most of the cases, data analytics companies, automotive OEMs, and telematics solution providers are forging meaningful synergies to collaboratively create newer solutions. Moreover, the advent of driverless vehicles has also created massive demand for vehicle telematics. For instance, Uber which sees its future in driverless cars recently introduced advanced telematics solution for drivers. It is expected to help drivers predict and prevent accidents while tracking vehicle performance on a real-time basis.

Telematics Solution Market Drivers

Recovery of Automobile Market increases potential user base

The key driver is, however, the recovering automotive market. Automotive industry is exhibiting positive gains recovering from recession, with increase in the number of unit sales. This creates a bigger potential market for telematics products and services. Automotive sales slowed down in major markets globally in 2017-2020 period. However, the market has witnessed growth in 2021 and this trend is estimated to continue in the next few years due to improving economic conditions in the U.S and Europe. Commercial automotive sales are also rising steadily particularly in the APAC market. Commercial automotive sales are set to grow from 22.1 million units in 2012 to 26.3 million units by 2021. New commercial vehicles models in Europe are offering inbuilt telematics functions such as emergency notification and car diagnostics due to changing governmental regulations. The increased customer demand has also led to increased sales of optional telematics services offered by automakers including UBI and GPS navigation. Taxis, buses and other commercial vehicles have started being sold with inbuilt navigational devices. The increased number of vehicle sales will provide a bigger potential market for sales of telematics devices and services.

Growth of Fleet management market set to propel the commercial Telematics Solution Market

The growing demand for operational efficiencies in the industry is set to drive adoption of fleet management telematics. Companies have in recent years shifted focus from reducing operational cost to improving operational efficiency as a method to improve their profitability. This has led to increased installation of fleet management telematics in logistics and fleet management companies. Companies are also looking to fleet management services to monitor driver behavior in order to improve the efficiency of this aspect. Traditionally, truck driver monitoring included factors such as speed and vehicle location; however, with the advent of telematics monitoring has become more intrusive with features such as speed, braking and cornering techniques as well as route times, hours of service and fuel monitoring data. This has led to increased utilization by companies looking to improve the efficiency of their delivery services. Companies have raised concerns about their fleet’s environmental impact. However for companies concerned with their environmental footprint, changes to the manufacturing process are time consuming and expensive. Fleet management services can be a quick solution to this arduous problem. The declining price for telematics hardware systems is also set to increase adoption of fleet management. The reducing price will lead to increased adoption in cost sensitive APAC and South American markets. The declining prices along with organizational concerns regarding operational efficiency and environmental impact are set to propel adoption of telematics. The investment into fleet management is project to surpass $15 billion in 2025 driven by adoption in the APAC region.

Telematics Solution Market Challenges

Government Regulations on Driver Distraction in U.S restrain Telematics Solution Market growth

National Highway Traffic Safety Administration in the U.S. has been stern regarding driver distraction laws. NHTSA desires OEMs to limit certain infotainment systems’ functions while being on the road. As a result in vehicle infotainment, Telematics Solution Market will be impacted. This is particularly significant in the satellite TV market. The National Transport Safety Board (NTSB) has argued that all electronics devices must be switched off when one is inside the vehicle, regardless of functionality. Governmental regulations, primarily in the U.S., have resulted in lower sales of infotainment telematics devices. In Europe, governments are looking at the benefits of infotainment driver distraction laws. This law is projected to be passed on in some form in Europe. The U.S. Telematics Solution Market is the primarily affected market in the short term as infotainment telematics device sales are set to exhibit sluggish growth. Distraction laws are not estimated to change in Europe for the next few years as government is still analyzing the impact of these laws in the U.S. The increased governmental driver distraction laws, primarily in the U.S. have resulted in lower infotainment telematics solution industry outlook.

Telematics Industry Outlook

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the Telematics Solution Market. In 2021, the market has been consolidated by the Telematics Top 10 companies including

CalAmp

Fleetmatics

Bosch

Continental

Descartes

Trimble

Astrata Group

Topcon

TomTom

Harman

Recent Developments

In May 2022, The mobility intelligence company Otonomo Technologies acquired the vehicle telematics company The Floow.

In June 2021, Cambridge Mobile Telematics (CMT), the global leader in mobile telematics and analytics, has acquired TrueMotion, the second largest mobile telematics provider.

In January 2020, Bendix entered into a partnership with GeoTab. Adding Geotab to the list of telematics platforms supports Bendix CVS 'SafetyDirect system is the only video-based driver safety solution combined with an active safety system and available for installation on the production line at all of the major OEMs.

#Telematics Solution Market share#Telematics Solution Market size#Telematics Solution Market forecsat

0 notes

Text

North America Car Rentals Market Size, Growth to Reach US$ 103.2 Billion by 2032

According to a market report, published by Sheer Analytics and Insights, the total north america car rental market was valued at $58.5 billion in 2021 and it is expected to reach $103.2 billion at the CAGR of 5.2% through the forecast period. Car rental agencies are companies that provide services to their customers for travel purposes. Time of the car usage could be from a few hours to a few weeks. This car rental system serves people who do not have their own car or people with damaged cars who are waiting for their own vehicles to be repaired. Car rental agencies might serve vehicles such as vans, trucks in particular markets and they might also offer two-wheelers such as motorcycles or scooters.

A quick expansion of COVID-19 had a negative influence on the North American tourist sector. Further, this has affected the car rental business in a particular way and later this has led to a drop in demand for automobile rental agencies at tourist spots and airports. However, after the pandemic situation, car rental companies are getting back in stable positions again. In the North American region, some rental agencies provide vehicles mainly for those who need cars for temporary usage. Alongside the general rental, agencies provide a few product facilities such as navigation systems, GPS tracker, portable WIFI, and safety seats, especially for children. Even there are online car rental booking facilities for customers across the region. Travelers and other consumers can reserve a particular vehicle through the online application system for their own needs. However, keeping their customers in mind, few rental agencies from North American region are providing solutions to reduce traffic and pollution. Moreover, they often do pollution control check in order to keep their customers eco-friendly.

Request a Sample Copy of Report: https://www.sheeranalyticsandinsights.com/request-sample/north-america-car-rental-market-21

North America held the largest market share of more than 50% in 2020. Leading car rental operators such as Avis Budget Group, Enterprise Rent-a-car among others are expected to make profitable growth over the forecast period. In the region, car rental market has witnessed significant attention over the last few years due to the increased use of digital mediums such as smartphones and other online booking systems. Car rental operators in developed countries such as the U.S, Canada, and Mexico are implementing new technological strategies and developing advanced systems to provide a streamlined process.

Key players such as Avis Budget Group, Enterprise Rent-a-car, Europcar, The Hertz Corporation, Alamo-rent-a-car, Routes Car Rental, Discount Car, and Truck Rentals are dominating the North America car rentals market by providing automobiles and car rental services to their customers such as an individual person, tourist, and travelers. The major focus of these players is to expand their business growth by enhancing rental services and implementing innovative strategies to gain the maximum profit from the market across the region. Furthermore, these leading players are also strengthening their hold on the car rental market by executing new business strategies, making partnerships with other companies.

North America Car Rentals Market Has Been Segmented Into:

North America Car Rental Market – By Product Type:

Luxury Cars

Economy Cars

SUVs

MUVs

Executive Cars

North America Car Rental Market – By Rental Duration:

Short-Term

Long-Term

North American Car Rental Market - By Application:

Local usage

Airport Transport Usage

Outstation

Others

North America Car Rental Market – By Region:

North America

U.S.

Mexico

Canada

Other North American Countries

Click full report at https://www.sheeranalyticsandinsights.com/market-report-research/north-america-car-rental-market-21

About Us

Sheer Analytics and Insights Private Limited is market research, consulting, and IT services company. We as a company believe in providing point to point data and its analysis with the combination of our human and automation integration. Sheer Analytics and Insights cover majorly eight industry verticals, including chemicals, life science, communications, and electronics, materials, consumer goods, defense, and BFSI sector.

Sheer Analytics believes in quality work and ensures that the product delivered to the client is meaningful for them. We publish reports based on our advanced analytics reports, which are generated with the help of our in-house databases, external databases, and artificial intelligence integration processes. We stand out from other market research companies in terms of integrating facts with meaningful insights for forecasting.

Apart from publishing syndicated reports (mostly client reports), we are dealing with projects primarily based on "Go to Market Strategy, Data Mining and Extraction," meaning full data analysis based on big data and many other database services and content related services.

Our products include quick turnaround datasets, TAM/PAM Analysis to full-fledged deep dive research on top trending markets.

Contact:

Abhigyan Sengupta

Sheer Analytics and Insights

Email: [email protected]

+1-414-240-5010

Website: https://www.sheeranalyticsandinsights.com/

0 notes

Text

North America Proximity Sensor Market Research Insights with Upcoming Trends, Opportunities, Competitive Analysis, Forecast to 2022-2031

The North America proximity sensor market is expected to grow at a CAGR of 5.62% during the forecast period. One of the major trends witnessed in the North America region is sustained growth in the adoption of industrial automation which is expected to drive the studied market. Dependence on robots in industrial controller mechanisms is currently an established trend, paving the way for larger and wider adoption of industrial control and industrial automation equipment. Material handling is one of the fastest-growing application markets for proximity sensors in the region. As proximity sensors are typically attached to material handling equipment (MHE), such as forklifts, and activate a signal when an entity (a person or other MHE) is detected, the growth of material handling equipment, especially the automated ones, is boosting the growth of the market

Connected vehicles and autonomous vehicles are key developments in the automotive industry in North America. Economic developments increase per capita income of consumers, thereby, increasing their standard of living. An increase in demand for luxury and comfort vehicles can be attributed to the rise in per capita income, which is another factor fueling the demand for autonomous vehicles.

The supportive government initiatives and policies for the self-driving technology have enabled the adoption of connected and autonomous vehicles. The region is also witnessing numerous collaborations and partnerships for the testing and adoption of the technology.

In addition to that, established manufacturers are increasingly collaborating with start-ups to acquire the autonomous technology. Furthermore, companies are also collaborating with various service providers to test the viability of autonomous cars. In 2018, Ford Motor Company partnered with Walmart Inc. to test self-driving cars for consumer goods and grocery delivery. Vehicles incorporating AEB, ADAS, FCW, and PAS systems are driving the market for automotive proximity sensors.

Download The Sample PDF Report Here: https://www.sdki.jp/sample-request-114686

With the increasing usage of cars across the region, the demand for smart parking is also growing. Thus, parking industry in North America is rapidly moving toward smart technologies and leading to adoption of high-end automation and parking reservation solutions which are getting integrated into the many mobility solutions and hence contributing to the growth of the market.

In April 2020, Bluetooth location beacon startup Estimote Inc developed a new product designed specifically for curbing the spread of COVID-19. The devices, called the “Proof of Health” wearables, aim to provide contact tracing at the level of a local workplace facility. The hardware includes passive GPS location tracking, as well as proximity sensors powered by Bluetooth and ultra-wide-band radio connectivity, a rechargeable battery and built-in LTE. Key Market Trends Growing Adoption of Consumer Electronics Devices is North America is Expected to Drive the Market Smartphones and wearables, such as smartwatches and fitness trackers, are experiencing high growth across North America. This is expected to drive the demand for proximity sensors over the forecast period.

According to Consumer Technology Association, activity fitness trackers, a type of wearable electronic device, can be found in around 22% of households in Canada, and these devices are used in a fitness-related context, with standard features including heart rate monitoring, GPS tracking, and calorie tracking. These devices rank among Canada's most popular wearables, particularly in regions like Alberta and Saskatchewan/Manitoba.

With companies, such as Fitbit Inc. and Apple Inc., making significant revenues from the United States, the North American region is expected to have a high market share during the forecast period. In 2020, Apple Inc. generated 45.37% or USD 124,556 million from the American region and Fitbit Inc. generated 55.7% of the total revenue only from the United States in 2019 which represents a stronghold on the market.

Smartphones and mobile devices are now the fixture of modern life which is enabling consumers to not only communicate more effectively, but pay bills, shop, and even remotely control devices in their homes and cars. According to the AARP report, more than three-quarters (77%) of US adults ages 50 and up and owned a smartphone as of mid of 2019, which represents a 10% rise from 70% a couple of years earlier. Among these smartphone owners, 9 in 10 use their devices daily, with the majority (83%) using them to send or receive messages such as texts and emails.

The ever-increasing smartphone business, and strong growth in the capital investments are going to be key drivers for the profitable development of the proximity sensors market in the United States.

Request The Sample PDF Report Here: https://www.sdki.jp/sample-request-114686

Aerospace and Defense is Expected to Drive the Market The aerospace and defense sector is one of the largest adopters of proximity sensors, owing to the need for safety-critical, safety-related, or high-reliability solutions.

According to Honeywell International Inc., proximity sensors can detect most internal failures and display a fault output to a pilot or maintenance technician, thereby reducing downtime and maintenance costs. For instance, proximity sensors in aircraft landing gear systems offer the pilot with a fault alert on landing approach to warn if the landing gear is not completely deployed. Proximity sensors are widely deployed in a wide range of aircraft systems, such as thrust reverser actuation systems, flight controls, aircraft doors, cargo loading systems, evacuation slide locks, and landing gear.

Inductive proximity sensors are widely used in the aviation sector because of their non-mechanical contact, reliability, strong environmental suitability, and safety. The demand for target location monitoring of transmission parts is increasing with the development of automation and aircraft of larger sizes.

Monitoring points at the external side of an aircraft are in harsh environments, like dusty or freezing environments, acoustic optical disturbances, etc. Thus, there are high requirements on the environmental adaptation of these sensors in this sector.

Due to its sensing capabilities, proximity sensors have been used by the US Navy, US Air Force and Marine Corps, and various allied nations. In February 2020, Kellstrom Defense Aerospace (KDA) signed a new multi-year extension to an existing distribution agreement with the Sensors and Fluid Management Systems (SFMS) business unit of AMETEK Aerospace & Defense.

The deal builds on a legacy of partnership, with KDA continuing to serve as the exclusive distributor of AMETEK SFMS products for the global military and government aftermarket, while also providing OEM repair management support and expanded cooperation for new aftermarket solutions for military aircraft sustainment.

With growing demand, Honeywell introduced two new proximity sensors, such as General Aerospace Proximity Sensors (GAPS) and Harsh Aerospace Proximity Sensors (HAPS), formerly known as the IHM Series. These two platforms incorporate Honeywell’s patented Integrated Health Monitoring functionality. However, the products have some technical differences that allow them to be used in various aerospace applications.

Get The Sample PDF Report Here: https://www.sdki.jp/sample-request-114686 Competitive Landscape The North America proximity sensor market is concentrated due to higher initial investments. It is dominated by a few major players like Rockwell Automation Inc., Honeywell International Inc., Turck, Inc., Analog Devices, Inc., and Avago Technologies Inc.

These significant players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market presence by securing new contracts and tapping new markets. July 2020 - Hyster Company has introduced a proximity tag, Litum, to help promote compliance with social distancing requirements. The system uses wearable tags that vibrate whenever personnel gets too close to each other, based on input from proximity sensors and predetermined distance settings.

June 2020 - Zebra Technologies Corporation launched a proximity sensing system that will detect each employee’s proximity to other workers and provide user-level alerting and contact tracing. Those features will help companies to meet government guidelines around preventing the spread of Covid-19 through policies like social distancing, contact tracing, and disinfection.

About US

SDKI Inc.'s goal is market scenarios in various countries such as Japan, China, the United States, Canada, the United Kingdom, and Germany. Is to clarify. We also focus on providing reliable research insights to clients around the world, including growth indicators, challenges, trends and competitive environments, through a diverse network of research analysts and consultants. With SDKI gaining trust and a customer base in more than 30 countries, SDKI is even more focused on expanding its foothold in other pristine economies.

Contact Us

15/F Cerulean Tower, 26-1 Sakuragaoka-cho

Tokyo, Shibuya-ku, Japan

+ 81-50-50509159

0 notes

Text

GPS Canada Track provides GPS Tracker For Vehicles. These devices help you track your vehicle and get it back if it gets stolen or lost. The GPS tracker can be used by anyone who owns a car or truck, but mostly it is used by people who have lost their vehicles. If you are looking for a GPS tracker for cars and trucks, then you should check out GPS Canada Track. GPS Canada Track has been providing the best quality of service to its customers. You can buy any type of GPS tracker from this store without worrying about any issues or delays in delivery time. Call 1-855-963-4222 for more information.

#gps track#track gps#tracking gps#gps with tracker#gps tracking canada#gps tracking in canada#tracker gps canada#gps tracking devices canada#gps for car tracker#gps tracker for car canada#gps tracking car#gps trace devices#car tracker device#vehicle tracking by gps#gps tracker best buy canada#gps tracker device#gps tracker device for vehicle#car tracker devices#gps trackers for cars best buy#device to track a car#hidden tracking devices for cars#GPS Canada Track#gps real time car#fleet tracker#cargo tracking#GPS Tracker For Vehicle

1 note

·

View note

Text

GPS Tracker Market Worth, Size, Type, Demand, End user, Investment Opportunity, Top Company, Drivers, Trend, Growth and Forecasts to 2027

The global GPS tracking device market is growing continually. The market growth attributes to the growing integration of video telematics to field service management and advanced analytics capable of transforming fleet management software. Besides, rising numbers of users who use GPS trackers to track various multiple devices with the help of advanced and sophisticated software on a single screen drive the market growth.

With the increasing uses of GPS vehicle tracking devices developed to track the quality of the road and provided improved mapping facilities, the market is projected to garner substantial traction in the years to come. According to Market Research Future (MRFR), the global GPS tracking device market is expected to grow exponentially by 2027, registering an impressive CAGR during the forecast period (2020-2027).

Additional factors bolstering the market growth include increasing usages of mobile phones & GPS technology and advances in analytical capabilities in communication technologies. The emergence of 3G/4G and 5G technologies fuel the growth of the market, improving vehicle connectivity. Simultaneously, the proliferation of autonomous and semi-autonomous vehicles and growth in cloud computing-based vehicle tracking systems boost the market size.

Rapid economic growth worldwide provides ample opportunities for the expansion of this market. Also, increased R&D expenditures and the expansion of international players influence market growth. Conversely, technological limitations causing the failure of GPS and cellular-based trackers due to limited/failed cellular or wireless network coverage are the significant factors projected to impede the market growth.

Also, requirements for the high R&D investments for research and development activities challenge new market players majorly. Nevertheless, vast advances and uptake of advanced vehicle security technologies would support market growth throughout the assessment period.

Global GPS Tracking Device Market – Segments

The report is segmented into types, components, end-users, and regions. The type segment is sub-segmented into standalone tracker, advance tracker, covert GPS trackers, and others. The component segment is sub-segmented into real-time GPS trackers, GPS loggers, personal GPS trackers, and others.

The end-users segment is sub-segmented into retail, hospitality, education, government, defense, industrial, automotive and aerospace, healthcare, transportation, and others. By regions, the market is sub-segmented into Americas, Asia Pacific, Europe, and rest-of-the-world.

Get a Free Sample @ https://www.marketresearchfuture.com/sample_request/7017

Global GPS Tracking Device Market – Regional Analysis

North America dominates the global GPS tracking device market. The region houses many advanced communication technologies and witnesses high uses of GPS vehicle tracking devices. Besides, the increase in demand from the automotive sector and vehicle thefts increases the size of the GPS tracker market for cars. The early adoption of cloud-based deployment services and GPS trackers propels the development of the market.

Asia Pacific stands second in the global GPS tracking device market. The market is driven by the rising sales of premium and luxury vehicles and uptake of GPS trackers. The strong presence of notable manufacturers and operating units with the availability of sophisticated technologies boost the regional market growth. Furthermore, the increasing adoption of GPS services and cloud-based services drives the growth of the regional market.

The proliferation of smartphones provides enormous opportunities for business growth. The growing use of navigation services offers an impetus to the regional market’s growth. Rapidly growing countries, such as Japan, China, and India, are anticipated to grow rapidly through the forecast period.

Global GPS Tracking Device Market – Competitive Analysis

Highly competitive, the GPS tracking device appears fragmented, with several well-established players accounting for a substantial market share. These players incorporate strategies such as acquisition, collaboration, partnership, expansion, and product & technology launch to gain a larger competitive share.

They make vast investments in new product development and global expansion initiatives. The market is likely to witness relentless innovations and new products, eventually intensifying competition among synchronous motor manufacturers.

Major Players:

Players leading the global GPS tracking device market include Sierra Wireless Inc. (Canada), Laipac Technology, Inc. (Canada), Queclink Wireless Solutions Co., Ltd. (China), Atrack Technology Inc. (Taiwan), Tomtom International B V ( Netherland), Calamp Corp. (US), Orbocomm Inc. (US), Concox Information Technology Co., Ltd. (China), Spy tech, Inc. (US), and Verizon Wireless (US).

Industry/ Innovation/ Related News

May 19, 2021 — Accel-KKR, a leading tech-focused private equity firm, announced the acquisition of a fleet management software leader – GPS Insight. GPS Insight provides SaaS-based fleet management software and complementary solutions for Class 3-6 fleets in the United States and Canada.

Accel-KKR, under its management, has assets worth over US$10 billion. Accel-KKR is merging GPS Insight with its two existing portfolio companies – InSight Mobile Data and Rhino Fleet Tracking focused on fleet management, field services and GPS tracking.

Browse Complete Report @ https://www.marketresearchfuture.com/reports/gps-tracker-market-7017

0 notes

Text

Telematics Solutions Market - Industry Analysis, Market Size, Share, Trends, Application Analysis, Growth And Forecast 2022-2027

The Global Telematics Solution Market size is estimated to surpass $55.5 billion by 2027 growing at CAGR of 8.3% during 2022-2027. Automotive telematics deals with telecommunications and information technology which is related to long distance transmission of information in commercial automobiles. It is the technique of sending and receiving the information automatically from automobiles by vehicle to vehicle or vehicle to infrastructure through the integrated use of informatics and telecommunications. On-board integrated telematics system, driver interface in a vehicle, car tracker systems, sensor systems are the important telematics devices in vehicles. The major automobile industries are spending more on research and development activities and concentrating to develop and implement telematics in vehicles. Now a days vehicles are manufactured by implementing various technologies to offer unique connectivity solutions for better navigation systems and fleet management solutions. Telematics devices are used to transfer large amounts of information from the vehicle to infrastructure of other vehicles utilizing a telematics control unit. Commercial automotive telematics helps in car tracker system, emergency calls, remote control monitoring, connected navigation such as weather reports, traffic reports, route plans and in infotainment. Commercial telematics are used in conjunction with telecommunication systems to provide quick and easy informational access. The growth in telecommunications as well as connected vehicles has led to a major growth in the Telematics Solution Market. Telematics is an important differentiator for car manufacturers. Regulations such as anti theft tracking in new vehicles, eCall automatic emergency call device, and in some places insurers require GPS anti theft devices for high value cars. All these factors increase the demand of the automotive Telematics Solution Market.

Report Coverage

The report: “Telematics Industry Outlook (2022-2027)”, by IndustryARC covers an in-depth analysis of the following segments of the Telematics Industry.

By Sales Channel:

OEM,

Aftermarket

By Technology:

Tethered, Embedded, Integrated

By Device Type:

Hardwired, Plug and Play, Smartphone Based

By Vehicle Type:

Passenger Vehicles, LCV, HCV

By Solution:

Safety and security Services (Driver behavior Monitoring, Roadside Assistance, Crash Reconstruction System, Black box device/ On board Recorder, Remote Maintenance, Seat belt Usage Monitoring, Fuel Monitoring and Others), Entertainment Services (Amplitude Modulation(AM)/ Frequency modulation(FM) Radio, Satellite television, Infotainment), Navigation system, Location based services, Fleet management Systems, Local Search and Concierge, Usage Based Insurance, Billing services and Others

By Geography:

North America (U.S, Canada, Mexico), South America (Brazil, Argentina and others), Europe(Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, SK, Aus and Others), and RoW (Middle East and Africa).

Key Takeaways

The growing demand for operational efficiencies in the industry is set to drive adoption of fleet management telematics. Companies have in recent years shifted focus from reducing operational cost to improving operational efficiency as a method to improve their profitability.

Companies are also looking to fleet management services to monitor driver behavior in order to improve the efficiency of this aspect. Traditionally, truck driver monitoring included factors such as speed and vehicle location; however, with the advent of telematics monitoring has become more intrusive with features such as speed, braking and cornering techniques as well as route times, hours of service and fuel monitoring data.

However for companies concerned with their environmental footprint, changes to the manufacturing process are time consuming and expensive. Fleet management services can be a quick solution to this arduous problem. The declining price for telematics hardware systems is also set to increase adoption of fleet management.

Telematics Solution Market, By Sales Channel, 2021 (%)

For More Details on This Report - Request for Sample

Telematics Solution Market Segment Analysis – By Vehicle Type

Commercial Automotive Telematics Solution Market size has revenue of $27.2 billion in 2021. In recent years, for monitoring driver behavior and vehicle, telematics black boxes have been used to transmit information such as real-time car trackers, vehicle diagnostics, changes in speed, harsh driving etc. This help fleet companies to evaluate and take necessary step to optimize their operations. Increase in the implementation of advanced solutions in order to reduce operational costs in the logistics industry is expected to propel the growth of commercial automotive Telematics Solution Market in commercial vehicles. Advanced and sophisticated telematics technologies are reshaping the way in which trucks operate by offering various services such as on-board recorder, telec maintenance scheduling and reporting any kind of unusual activities. The cost of the telematics systems still poses a challenge in terms of the adoption of telematics on a large scale, however, with the falling prices of the telematics systems in the future will snowball the market significantly

Telematics Solution Industry Segment Analysis - By Solution

Navigation systems accounted for 14% of the total telematics solution market Size of components in 2021. Navigation devices in the Telematics Solution Market are used to provide route details for fleets and transport systems. Navigation systems involve transfer of data regarding location and facilitate planning and routing functions using telematics control units. Navigation systems are mostly used alongside GPS devices in vehicles. GPS devices are used in conjunction with navigation systems. To counter the growing smartphone navigation market, many navigation systems manufacturers are shifting to OEM supply and provide support for Tier 1 auto manufacturer. Many OEMs have standardized navigation systems in their vehicles. This has led to a rise in the penetration of navigation systems. Aftermarket sales of navigation systems are however on the decline. This decline can be majorly attributed to the advent of smartphones. Free navigation services are offered on smartphones. As a result, customers are not willing to pay for features which they can obtain for free.

Telematics Solution Industry Segment Analysis – By Geography

North America market accounted for over 38.2% of the total industry share in 2021 and demand of automotive telematics with increase in connected cars with safe and security systems and others boost the demand of this market. Safety and security and infotainment systems are a big part of this market. The major companies operating in this market include automotive OEMs GM, Ford and Toyota, telematics service providers Garmin, TomTom NV, Fleetmatics, Telogis, Trimble and Navman. The factors such as reduction in the cost of connectivity and increasing market penetration of connected devices such as smartphones, and tablets are contributing to the burgeoning demand for connected cars. In most of the cases, data analytics companies, automotive OEMs, and telematics solution providers are forging meaningful synergies to collaboratively create newer solutions. Moreover, the advent of driverless vehicles has also created massive demand for vehicle telematics. For instance, Uber which sees its future in driverless cars recently introduced advanced telematics solution for drivers. It is expected to help drivers predict and prevent accidents while tracking vehicle performance on a real-time basis.

Telematics Solution Market Drivers

Recovery of Automobile Market increases potential user base

The key driver is, however, the recovering automotive market. Automotive industry is exhibiting positive gains recovering from recession, with increase in the number of unit sales. This creates a bigger potential market for telematics products and services. Automotive sales slowed down in major markets globally in 2017-2020 period. However, the market has witnessed growth in 2021 and this trend is estimated to continue in the next few years due to improving economic conditions in the U.S and Europe. Commercial automotive sales are also rising steadily particularly in the APAC market. Commercial automotive sales are set to grow from 22.1 million units in 2012 to 26.3 million units by 2021. New commercial vehicles models in Europe are offering inbuilt telematics functions such as emergency notification and car diagnostics due to changing governmental regulations. The increased customer demand has also led to increased sales of optional telematics services offered by automakers including UBI and GPS navigation. Taxis, buses and other commercial vehicles have started being sold with inbuilt navigational devices. The increased number of vehicle sales will provide a bigger potential market for sales of telematics devices and services.

Growth of Fleet management market set to propel the commercial Telematics Solution Market

The growing demand for operational efficiencies in the industry is set to drive adoption of fleet management telematics. Companies have in recent years shifted focus from reducing operational cost to improving operational efficiency as a method to improve their profitability. This has led to increased installation of fleet management telematics in logistics and fleet management companies. Companies are also looking to fleet management services to monitor driver behavior in order to improve the efficiency of this aspect. Traditionally, truck driver monitoring included factors such as speed and vehicle location; however, with the advent of telematics monitoring has become more intrusive with features such as speed, braking and cornering techniques as well as route times, hours of service and fuel monitoring data. This has led to increased utilization by companies looking to improve the efficiency of their delivery services. Companies have raised concerns about their fleet’s environmental impact. However for companies concerned with their environmental footprint, changes to the manufacturing process are time consuming and expensive. Fleet management services can be a quick solution to this arduous problem. The declining price for telematics hardware systems is also set to increase adoption of fleet management. The reducing price will lead to increased adoption in cost sensitive APAC and South American markets. The declining prices along with organizational concerns regarding operational efficiency and environmental impact are set to propel adoption of telematics. The investment into fleet management is project to surpass $15 billion in 2025 driven by adoption in the APAC region.

Telematics Solution Market Challenges

Government Regulations on Driver Distraction in U.S restrain Telematics Solution Market growth

National Highway Traffic Safety Administration in the U.S. has been stern regarding driver distraction laws. NHTSA desires OEMs to limit certain infotainment systems’ functions while being on the road. As a result in vehicle infotainment, Telematics Solution Market will be impacted. This is particularly significant in the satellite TV market. The National Transport Safety Board (NTSB) has argued that all electronics devices must be switched off when one is inside the vehicle, regardless of functionality. Governmental regulations, primarily in the U.S., have resulted in lower sales of infotainment telematics devices. In Europe, governments are looking at the benefits of infotainment driver distraction laws. This law is projected to be passed on in some form in Europe. The U.S. Telematics Solution Market is the primarily affected market in the short term as infotainment telematics device sales are set to exhibit sluggish growth. Distraction laws are not estimated to change in Europe for the next few years as government is still analyzing the impact of these laws in the U.S. The increased governmental driver distraction laws, primarily in the U.S. have resulted in lower infotainment telematics solution industry outlook.

#Telematics Solutions Market#Telematics Solutions Market share Telematics Solutions Market size Telematics Solutions Market forecast

0 notes

Link

Shenzhen Innosio Technology Co., Ltd.

86-755-83287676

Room 602, Building H, Qianhai Xinjiyuan, Fucheng, Shenzhen, Guangdong, China

Innosio is a professional manufacturer for quality electronic items, integrated with R&D,manufacturing,marketing and sales. Product are gps tracker,car camera,dash cam,car black box,web camera,smart camera which have been exported to over 60 countries.Innosio overview: we focus on car accessories. Now the main products include car gps tracker,car dash cam,car black box,car TPMS(tire pressure monitor system). INNOSIO has over 300 workers and staffs, equipped with advanced automatic production from software design, industrial design, plastic mould design, circuit design, plastic injection, silk printing, assembly of finished products, in-house testing,etc.Innosio Marketing: Our marketplaces cover U.K.,Spain,Italy, France, Belgium, Polland, Sweden, Netherlands,Denmark,Hungary, Canada, America, Mexico, Argentina,Brazil, Chile,Columbia,Peru, China, Combadia,India,Malaysia,Pakistan,Thailand, South Africa,Nigeria,Uganda,Kenya,Egypt,etc. OEM brand takes 85%, INNOSIO brand takes 15%. We are going to expand more marketplace and market share in the future.Secrects of Innosio Success: thanks to development of marketable products, strict quality control system, advanced equipments, reliable quality guarantee, efficient after-sales service, good reputation.Innosio commitment: To bring more perfect products to our customers, help our customers maximize the profit and value, Innosio team should make more contribution and investment to new products, move forward with innovation and creation of new technology. We pride ourselves to provide excellent quality products with reasonable pricing.

0 notes