#go markets bitcoins

Explore tagged Tumblr posts

Text

YOU'VE GOT TO LEARN

Pairing: Joel Miller x Fem!Reader

Tags: extremely dubious consent, non-con elements, explicit sexual content, exhibitionism, age gap, established relationship, jealousy, possessive!joel, softdom!joel, unprotected sex, alcohol, hair pulling

Length: 3.3K

Summary: At a client's house party, you catch yourself getting jealous of other eyes on Joel. Joel pulls you aside to show you exactly what he thinks of that.

This is my first time writing for Joel Miller, so please go easy on me <3

☆☆☆

What is it about Joel that makes him most attractive when he's stuck somewhere he doesn't want to be?

You tip back the last of your whiskey sour, gazing at the tight creases in the corners of his eyes as he nods along with the blond guy who's been talking for twenty painful minutes about the crypto market. Joel is leaning back, arms folded over his chest, his big shoulders pushing at the seams of his denim shirt.

He once told you that no one besides you could tell his emotions on his face. You'd laughed and called bullshit at the time, telling him every thought in that pretty head of his showed up plain as day on his face, but right now it doesn't seem to matter. He's been looking like he'd swallowed glass since this guy started talking, and it doesn't seem to make a bit of difference to him.

When Joel had asked if you wanted to come along to the holiday party one of his clients was having at his house, you'd said yes even after hearing that the guy was 'kind of an idiot' and you'd probably be 'bored to tears'. Joel would have skipped it, but unfortunately it was one of his biggest clients, and the invitation wasn't one he could politely decline.

Right now, though, you're sort of wishing you'd listened to him. The party stopped being fun somewhere around the second MLM scheme that had been pitched to you, and you're now counting the minutes until you'll hit the mark Joel set on the drive there: "Least a couple hours - then we can head out."

The guy takes a short pause, then launches into another tirade on bitcoin, and you realize you're going to need another drink to get through it. Joel's arm slips from around your waist as you pull away.

"Be right back, fellas. I'm going to get a refill."

Joel's brows lift as you leave him behind. "Now hold on there. Wouldn't be much of a gentleman if I let you get your own drink-"

You wave him off, trying to hold in a smirk. "No really, I need to take a lap. Stretch my legs."

He licks his lips, looks off to the side for a second before calling after you, "Grab me one on your way back, will ya?"

You smile innocently. "You got it."

After your host declines your offer to get him something, you head to the kitchen, making a little chit chat on your way to the well-stocked fridge. You decide to get Joel's beer before you return to the open bar to ask for another drink of your own. You hook your knuckles around the neck of a Modelo, no sooner closing the door to the fridge before you glance back in Joel's direction, seeing he's been joined by a few more people.

It isn't surprising. Joel's the type of guy who tends to draw attention, and not just because of his looks. He's the guy who's in charge, even when he's not in charge. People gravitate toward him; just something about his presence that makes him the most interesting thing in every room.

In spite of that, your attention isn't on him at the moment. It's on the girl making moon eyes beside him. She's tossing a long, shiny ponytail behind her shoulder and grinning ear to ear despite the fact that bitcoin boy hasn't stopped talking.

Picking up a bottle opener, you pop the cap off the beer in your hand by muscle memory, not able to tear your eyes off of them. Joel's attention is still on the host, but when she says something to him, you watch him pull his chin back to nod, holding her in the corner of his eye to give a quick smile.

Kelly, you remember. That's her name. She's the receptionist at the client's office, and she's probably seen more of Joel this month than you have.

You watch as she cranks up her smile another thousand watts, laughing at something one of the other guys in the group has said. Kelly, you think. No. Probably spells it with an i. Kelli. Probably dots it with a heart.

Your face is starting to warm up, and when someone on the other side of the kitchen counter gently asks if you're alright, you clear your throat, then reply that you're fine as you quickly open the fridge for a second Modelo. It's time for you to slow down on the whiskey.

As you make your way back to the group, you catch Kelly/Kelli's eyes and give her a subdued smile. She blinks and smiles back, suddenly looking very shy.

"Now what did I miss?" you ask, when the men dissolve into laughter.

Henry, one of the contractors under Joel, shakes his head. "It ain't worth repeating in the presence of a lady."

The host interjects, "So what do you call Kelly?"

Henry puts an arm around her shoulder. "Aw, she's heard it all before, haven'tcha?"

"That don't mean she wants to hear it from you!" one of the other men shouts, and there's another round of laughter while you bite your lip, watching Joel's eyes as they dip to Henry's arm.

You wrap your lips around the tip of the bottle in your hand, letting the taste of the beer give your mouth an excuse to look sour. Henry's hand is dropping from Kelly's shoulder down to her waist, and while the conversation carries on, Joel leans in close so that only Henry - and you - can hear.

"Cool it, Henry."

"Huh?" comes the slow reply, as he pretends not to have understood him.

Joel just lifts his brows, and that's all it takes for Henry to back off, looking a little sheepish as he unwinds himself from Kelly, who looks more than a little relieved.

Henry turns to you, suddenly trying to make small talk, to save face. "Have you two met? This's our girl Kelly. She takes good care of us, don'tcha, sweetheart?"

You give a polite smile. "We've met. Nice to see you, again. Both of you."

"Uh huh," Henry answers half-heartedly before he wanders off, perhaps to join another conversation, or just to find another drink.

Kelly gives you another polite smile, then as the host starts to back away, bringing the rest of the group with him, she goes along with the crowd. Before she leaves, though, she softly murmurs to Joel, "Thanks for that."

He answers with a stiff nod, but it's more than enough to put the stars back in her eyes as she walks away, leaving the two of you alone.

You're biting your lip again, practically chewing on it, as you dangle Joel's beer by the throat, handing it over to him.

"Thank you," he says, then tips it back immediately.

You don't reply, lost in thought, but pretending nonchalance as you watch the group leave.

"Meant what I said, though," Joel adds in your silence. "Shoulda let me get it. I don't like to have you wanderin' around on your own. Not with this bunch of degenerates."

You smirk. "What, like Henry?"

"For one, yeah," he says, turning to face you now that the sounds of the party are fading into the background. "Lookin' the way you do, won't be able to keep their eyes or their hands off ya."

You laugh him off, but can't pretend that his voice isn't settling right in the bottom of your stomach. He's standing a little closer, now, and you can smell the alcohol on his breath, mixed with the spice of his cologne. Something about him talking this way puts some boldness into you, and your words come out a bit more reckless than they should.

"Well, maybe you should have asked Kelly to get your drink, then."

He looks dumbfounded for a moment, and you widen your smile to show you're joking.

"I mean, I'm sure she would have," you go on, digging yourself deeper even as your heart kicks up faster. If you'd switched to beer two drinks ago, you probably would have explained yourself better. You would have insisted it was just a joke, because she so clearly has a crush on him. But your words are just swimming in all that whiskey.

"Cute little thing like that," you say, shrugging. "Probably don't mind her 'taking care of you', do ya?"

Joel's eyes are fixed on you, voice easing down into his chest when he asks softly, warningly, "What did you just say?"

He's turned all the way toward you, and all at once the room feels so much smaller, your face so much hotter. He's waiting for an answer, and your breath is caught high in your throat. "I-uh... it was just... nothing."

He's very slowly setting down his beer, looking down to a side table. "Wasn't nothing; I heard it." He looks back up at you, pinning you hard where you stand. "Now repeat it. Wanna make sure I heard you right."

You swallow, mouth dry. "I nn-nothing, I just said..." You force a crooked smile that you know he isn't buying for a second. "Y'know... she's- she's pretty cute, and maybe you... maybe she oughta... 'cause maybe you want her to..."

Your babbling doesn't impress him. He's just staring at you under a darkened brow. He opens his mouth to say something, but the motion of someone else entering the room catches your eye and you snap defensively before he can say anything.

"Joel, I didn't mean-"

He follows your gaze, then turns away and shuts you up with a wide, heavy palm sliding to the small of your back. "C'mere," he says. "C'mon." And the way he breathes it as he guides you out of the room and down the hall, you don't argue.

He finds a bathroom and pushes you inside. While you're looking over his shoulder to make sure no one sees you going in together, he's staring straight ahead, and he closes the door with one hand, still holding you with the other.

"I'm... sorry," you confess as soon as the door closes. "That was stupid. I don't know why I said it."

"Yeah," he grunts, crowding you up against the closed door. "You do."

The way he has you held close, arm around your waist and words warm against your mouth, you'd normally try to kiss him right about now. But looking into his eyes, you know there's no kiss waiting for you on his lips.

He's mad, and you're a little scared. Not scared of him, but scared of what he might do at a party where people might hear. People that he has to work with on Monday.

He isn't drunk, but he's had a few, and your fear ratchets up when his hand slides to your backside, gripping your ass and kneading it as he growls, "You think I give a goddamn about some teenager?"

Despite the way he's manhandling you through your dress, you can't help but roll your eyes. "She's not a teenager."

She isn't really that much younger than you are. And with Joel in his fifties, the thought has crossed your mind that he might just be keeping you around because he got a thing for younger women. You'd just never said anything out loud. Until tonight.

He stops, pulls back. "Alright, guess I'm not bein' clear enough."

He takes you by both arms, pushes you against the sink so you're looking at yourself in the mirror. Behind you, he starts unbuckling his belt.

"Joel..." you whisper, heat pulsing through you just from the sound of the metal clinking. You know you should ask him to stop - is the door even fucking locked? - but you can't get any other words out besides his name.

He slides a hand under your dress, pushing it up and over the swell of your ass. He doesn't slow down, doesn't even run his hand over your skin. He just pushes your panties to the side, pressing the head of his cock right up against your pussy, holding it there as he grits against your ear, "Guess I gotta show you where I want to be."

He pushes the thick head inside you, wrapping one arm around your stomach to keep you from falling forward. His other hand is flat on the sink, not playing with you, not easing anything. He doesn't give you any prep, just shoves in slowly, his cock stretching you all in one go.

You hiss, brow pinching. He didn't even let you get wet enough to take him. You can feel every damn move he makes inside you as he shifts his hips closer to pin you hard against the cold edge of the sink. When he's all the way in, you watch your mouth pop open in the mirror as you take a few panting breaths. The stretch is almost unbearable, but feeling so full of him, you don't want to stop.

He eases out, just a couple inches to coat himself in your slick, then presses back in even harder. You feel like your lungs are going to give out from how tight your gasps are getting.

"Fuck, Joel... hurts," you whine.

He slowly slides you off of him, then feeds it right back in.

"I know it does, honey," he breathes against your neck. "I know it does."

His deep voice makes you pulse around his cock and he drags his big, calloused hand down to the front of your dress, lifting it up just far enough to see your pussy, stuffed full of him. You're leaking down the sides of his cock, glistening in the dim light of the bathroom.

"See that?" he asks, unmoving. "That's where I wanna be. You hear me?"

Giving a shaky nod of your head, you whimper, "Yes."

He starts to piston in and out of you, and you can only watch. You close your eyes tight when he speeds up a little. "It's... mm- it's too much."

He doesn't change his pace. "Ain't about feelin' good. You've got to learn."

He groans when your pussy clenches around him, and you follow with an answering moan as the tension in your muscles starts to fade. You're soaking down both sides of your inner thighs as he opens you up further.

When you've dissolved into whimpering his name, he hooks one arm around your leg from behind, lifting it up so that you're spread wider. His other hand is still holding up your dress.

"Look at that," he grunts, making an obscene display of his cock fucking into your pussy. "Look how fucking hard you make me, baby."

You whine again, struck dumb by how good he feels with every snap of his hips. "God, feels so good... please..."

He's dragging his teeth against your neck when he replies, "Please?"

"Please, Joel. Feels so fucking good," you repeat, eyes closed.

You want him to fuck you properly, to bend you over and make you take him, to use his fingers - to let you use yours - anything; it doesn't matter. You're so worked up, you just need a little more.

"M'not gonna give you what you want, darlin'," he answers. "Don't work like that."

You can't help but loose a plaintive moan, even knowing you deserve it. "Baby, please-"

He drops your knee, letting your leg come down to the floor as he bends you over the sink. When he starts to fuck you for real, you can't hold it together anymore, softly pleading and whining for more, begging him not to stop, opening your eyes to watch him in the mirror as he starts to lose himself, too.

Until a knock at the door jars you right out of it.

"Is anybody in there?"

Joel doesn't even slow down. Just flattens his palm along your lower back to bend you back over after you jolt up.

"Joel-" you hiss. But he keeps giving you exactly what you need, and your eyes roll back.

"Hello?"

He slides a warm hand down the open neckline of your dress, kneading your breast as he looks at you in the mirror. His brown eyes are stern and steady. "Answer."

He keeps feeding you his cock, and you hiccup, legs shaking as you whisper, "I- I don't..."

"Go on and tell 'em. You're busy."

Fuck fuck fuck. "Uhh, s-someone's in here!"

Your voice comes out strained and airy, and you wait for the reply while Joel kisses the skin of your shoulder, sliding the front of your dress down.

"Joel, it's... somebody is..."

"Nothin' in here that I wanna hide," he growls, pushing his hips right up against your ass as he circles a thumb around one of your nipples.

"Fuck, Joel..." The silence outside has been long enough that the person is probably gone, but your pulse is still pounding, and he's making it so fucking hard to think. "Oh my god, yes..."

He's quietly panting, lifts his head long enough to say, "Understand now, pretty girl?"

"Mm..."

"This here's right where I wanna be. Nowhere else," he grunts, pressing his weight down on you, the squelching sounds between your bodies getting louder than your moans. Your eyes are drawn up to the mirror, watching the veins in his neck tighten as he fucks into you harder and harder. "You got it?"

You frantically nod, desperately near the edge of coming. "Fuck, yes, mhm..."

"Maybe I oughta fill you up right here, leave you with somethin' to think about."

"N-no," you stutter, almost sounding like you're sobbing your words. "P-please, I get it. I heard what you s-said."

He has to let you come. You don't care that you were acting up, making something out of nothing. You don't care what got him mad at you. All you can think about is how flushed his chest is beneath the open collar of his shirt, how tight his grip is, how stiff his jaw is set. You just want to listen to that throaty growl, feel him mercilessly fucking you a little while longer. That's all it would take. Just a little bit...

"Fuck-"

Joel pulls out, hand tightening into a fist around himself. You slump against the sink.

"Goddamn, baby. Almost got me, there."

You're on the verge of tears, shuddering with wild breaths. "No, fuck, Joel, please please please-"

He grips a handful of your ass, fingers brushing through your wetness and making you whimper.

"Told you, I ain't giving you what you want."

You hear him zip up his jeans, and then his hand is back at your ass, but this time he's pulling your panties back into place and tugging your dress down.

"Never gonna learn that way."

You whine pitifully, knowing you brought this on yourself, but still pleading under your breath, face drawn tight with frustration.

He helps you stand up properly, giving you his arm to steady yourself. You straighten your dress, cleaning up your appearance in the mirror, and eventually you're able to leave the bathroom, walking out on trembling legs.

He gives you a smirk as you leave the hallway, and something in you finally snaps. Maybe it's a little unfair, but you know exactly what to say to knock that smirk off his face.

You lean in and whisper in his ear, "Guess you didn't want me that bad after all, or you would have finished."

And all of ten minutes later, you're in the cab of his truck. You're screaming his name as you come all over his cock, hands fisted in his hair, tugging it hard while he pumps you full of his cum, cursing you the whole time.

Turns out, he's the one who's never gonna learn.

--

A/N: Thanks for reading! I don't have a taglist for Joel, but I'll add one if I ever write for him again. Hope you enjoyed! :)

Masterlist

#joel miller#joel miller x reader#joel miller x you#pedro pascal#last of us#joel miller smut#pedro pascal character x reader#tlou

1K notes

·

View notes

Text

How finfluencers destroyed the housing and lives of thousands of people

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

The crash of 2008 imparted many lessons to those of us who were only dimly aware of finance, especially the problems of complexity as a way of disguising fraud and recklessness. That was really the first lesson of 2008: "financial engineering" is mostly a way of obscuring crime behind a screen of technical jargon.

This is a vital principle to keep in mind, because obscenely well-resourced "financial engineers" are on a tireless, perennial search for opportunities to disguise fraud as innovation. As Riley Quinn says, "Any time you hear 'fintech,' substitute 'unlicensed bank'":

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

But there's another important lesson to learn from the 2008 disaster, a lesson that's as old as the South Seas Bubble: "leverage" (that is, debt) is a force multiplier for fraud. Easy credit for financial speculation turns local scams into regional crime waves; it turns regional crime into national crises; it turns national crises into destabilizing global meltdowns.

When financial speculators have easy access to credit, they "lever up" their wagers. A speculator buys your house and uses it for collateral for a loan to buy another house, then they make a bet using that house as collateral and buy a third house, and so on. This is an obviously terrible practice and lenders who extend credit on this basis end up riddling the real economy with rot – a single default in the chain can ripple up and down it and take down a whole neighborhood, town or city. Any time you see this behavior in debt markets, you should batten your hatches for the coming collapse. Unsurprisingly, this is very common in crypto speculation, where it's obscured behind the bland, unpronounceable euphemism of "re-hypothecation":

https://www.coindesk.com/consensus-magazine/2023/05/10/rehypothecation-may-be-common-in-traditional-finance-but-it-will-never-work-with-bitcoin/

Loose credit markets often originate with central banks. The dogma that holds that the only role the government has to play in tuning the economy is in setting interest rates at the Fed means the answer to a cooling economy is cranking down the prime rate, meaning that everyone earns less money on their savings and are therefore incentivized to go and risk their retirement playing at Wall Street's casino.

The "zero interest rate policy" shows what happens when this tactic is carried out for long enough. When the economy is built upon mountains of low-interest debt, when every business, every stick of physical plant, every car and every home is leveraged to the brim and cross-collateralized with one another, central bankers have to keep interest rates low. Raising them, even a little, could trigger waves of defaults and blow up the whole economy.

Holding interest rates at zero – or even flipping them to negative, so that your savings lose value every day you refuse to flush them into the finance casino – results in still more reckless betting, and that results in even more risk, which makes it even harder to put interest rates back up again.

This is a morally and economically complicated phenomenon. On the one hand, when the government provides risk-free bonds to investors (that is, when the Fed rate is over 0%), they're providing "universal basic income for people with money." If you have money, you can park it in T-Bills (Treasury bonds) and the US government will give you more money:

https://realprogressives.org/mmp-blog-34-responses/

On the other hand, while T-Bills exist and are foundational to the borrowing picture for speculators, ZIRP creates free debt for people with money – it allows for ever-greater, ever-deadlier forms of leverage, with ever-worsening consequences for turning off the tap. As 2008 forcibly reminded us, the vast mountains of complex derivatives and other forms of exotic debt only seems like an abstraction. In reality, these exotic financial instruments are directly tethered to real things in the real economy, and when the faery gold disappears, it takes down your home, your job, your community center, your schools, and your whole country's access to cancer medication:

https://www.theguardian.com/world/2012/jun/08/greek-drug-shortage-worsens

Being a billionaire automatically lowers your IQ by 30 points, as you are insulated from the consequences of your follies, lapses, prejudices and superstitions. As @[email protected] says, Elon Musk is what Howard Hughes would have turned into if he hadn't been a recluse:

https://mamot.fr/@[email protected]/112457199729198644

The same goes for financiers during periods of loose credit. Loose Fed money created an "everything bubble" that saw the prices of every asset explode, from housing to stocks, from wine to baseball cards. When every bet pays off, you win the game by betting on everything:

https://en.wikipedia.org/wiki/Everything_bubble

That meant that the ZIRPocene was an era in which ever-stupider people were given ever-larger sums of money to gamble with. This was the golden age of the "finfluencer" – a Tiktok dolt with a surefire way for you to get rich by making reckless bets that endanger the livelihoods, homes and wellbeing of your neighbors.

Finfluencers are dolts, but they're also dangerous. Writing for The American Prospect, the always-amazing Maureen Tkacik describes how a small clutch of passive-income-brainworm gurus created a financial weapon of mass destruction, buying swathes of apartment buildings and then destroying them, ruining the lives of their tenants, and their investors:

https://prospect.org/infrastructure/housing/2024-05-22-hell-underwater-landlord/

Tcacik's main characters are Matt Picheny, Brent Ritchie and Koteswar “Jay” Gajavelli, who ran a scheme to flip apartment buildings, primarily in Houston, America's fastest growing metro, which also boasts some of America's weakest protections for tenants. These finance bros worked through Gajavelli's company Applesway Investment Group, which levered up his investors' money with massive loans from Arbor Realty Trust, who also originated loans to many other speculators and flippers.

For investors, the scheme was a classic heads-I-win/tails-you-lose: Gajavelli paid himself a percentage of the price of every building he bought, a percentage of monthly rental income, and a percentage of the resale price. This is typical of the "syndicating" sector, which raised $111 billion on this basis:

https://www.wsj.com/articles/a-housing-bust-comes-for-thousands-of-small-time-investors-3934beb3

Gajavelli and co bought up whole swathes of Houston and other cities, apartment blocks both modest and luxurious, including buildings that had already been looted by previous speculators. As interest rates crept up and the payments for the adjustable-rate loans supporting these investments exploded, Gajavell's Applesway and its subsidiary LLCs started to stiff their suppliers. Garbage collection dwindled, then ceased. Water outages became common – first weekly, then daily. Community rooms and pools shuttered. Lawns grew to waist-high gardens of weeds, fouled with mounds of fossil dogshit. Crime ran rampant, including murders. Buildings filled with rats and bedbugs. Ceilings caved in. Toilets backed up. Hallways filled with raw sewage:

https://pluralistic.net/timberridge

Meanwhile, the value of these buildings was plummeting, and not just because of their terrible condition – the whole market was cooling off, in part thanks to those same interest-rate hikes. Because the loans were daisy-chained, problems with a single building threatened every building in the portfolio – and there were problems with a lot more than one building.

This ruination wasn't limited to Gajavelli's holdings. Arbor lent to multiple finfluencer grifters, providing the leverage for every Tiktok dolt to ruin a neighborhood of their choosing. Arbor's founder, the "flamboyant" Ivan Kaufman, is associated with a long list of bizarre pop-culture and financial freak incidents. These have somehow eclipsed his scandals, involving – you guessed it – buying up apartment buildings and turning them into dangerous slums. Two of his buildings in Hyattsville, MD accumulated 2,162 violations in less than three years.

Arbor graduated from owning slums to creating them, lending out money to grifters via a "crowdfunding" platform that rooked retail investors into the scam, taking advantage of Obama-era deregulation of "qualified investor" restrictions to sucker unsophisticated savers into handing over money that was funneled to dolts like Gajavelli. Arbor ran the loosest book in town, originating mortgages that wouldn't pass the (relatively lax) criteria of Fannie Mae and Freddie Mac. This created an ever-enlarging pool of apartments run by dolts, without the benefit of federal insurance. As one short-seller's report on Arbor put it, they were the origin of an epidemic of "Slumlord Millionaires":

https://viceroyresearch.org/wp-content/uploads/2023/11/Arbor-Slumlord-Millionaires-Jan-8-2023.pdf

The private equity grift is hard to understand from the outside, because it appears that a bunch of sober-sided, responsible institutions lose out big when PE firms default on their loans. But the story of the Slumlord Millionaires shows how such a scam could be durable over such long timescales: remember that the "syndicating" sector pays itself giant amounts of money whether it wins or loses. The consider that they finance this with investor capital from "crowdfunding" platforms that rope in naive investors. The owners of these crowdfunding platforms are conduits for the money to make the loans to make the bets – but it's not their money. Quite the contrary: they get a fee on every loan they originate, and a share of the interest payments, but they're not on the hook for loans that default. Heads they win, tails we lose.

In other words, these crooks are intermediaries – they're platforms. When you're on the customer side of the platform, it's easy to think that your misery benefits the sellers on the platform's other side. For example, it's easy to believe that as your Facebook feed becomes enshittified with ads, that advertisers are the beneficiaries of this enshittification.

But the reason you're seeing so many ads in your feed is that Facebook is also ripping off advertisers: charging them more, spending less to police ad-fraud, being sloppier with ad-targeting. If you're not paying for the product, you're the product. But if you are paying for the product? You're still the product:

https://pluralistic.net/2021/01/04/how-to-truth/#adfraud

In the same way: the private equity slumlord who raises your rent, loads up on junk fees, and lets your building disintegrate into a crime-riddled, sewage-tainted, rat-infested literal pile of garbage is absolutely fucking you over. But they're also fucking over their investors. They didn't buy the building with their own money, so they're not on the hook when it's condemned or when there's a forced sale. They got a share of the initial sale price, they get a percentage of your rental payments, so any upside they miss out on from a successful sale is just a little extra they're not getting. If they squeeze you hard enough, they can probably make up the difference.

The fact that this criminal playbook has wormed its way into every corner of the housing market makes it especially urgent and visible. Housing – shelter – is a human right, and no person can thrive without a stable home. The conversion of housing, from human right to speculative asset, has been a catastrophe:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

Of course, that's not the only "asset class" that has been enshittified by private equity looters. They love any kind of business that you must patronize. Capitalists hate capitalism, so they love a captive audience, which is why PE took over your local nursing home and murdered your gran:

https://pluralistic.net/2021/02/23/acceptable-losses/#disposable-olds

Homes are the last asset of the middle class, and the grifter class know it, so they're coming for your house. Willie Sutton robbed banks because "that's where the money is" and We Buy Ugly Houses defrauds your parents out of their family home because that's where their money is:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

The plague of housing speculation isn't a US-only phenomenon. We have allies in Spain who are fighting our Wall Street landlords:

https://pluralistic.net/2021/11/24/no-puedo-pagar-no-pagara/#fuckin-aardvarks

Also in Berlin:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

The fight for decent housing is the fight for a decent world. That's why unions have joined the fight for better, de-financialized housing. When a union member spends two hours commuting every day from a black-mold-filled apartment that costs 50% of their paycheck, they suffer just as surely as if their boss cut their wage:

https://pluralistic.net/2023/12/13/i-want-a-roof-over-my-head/#and-bread-on-the-table

The solutions to our housing crises aren't all that complicated – they just run counter to the interests of speculators and the ruling class. Rent control, which neoliberal economists have long dismissed as an impossible, inevitable disaster, actually works very well:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

As does public housing:

https://jacobin.com/2023/10/red-vienna-public-affordable-housing-homelessness-matthew-yglesias

There are ways to have a decent home and a decent life without being burdened with debt, and without being a pawn in someone else's highly leveraged casino bet.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/22/koteswar-jay-gajavelli/#if-you-ever-go-to-houston

Image: Boy G/Google Maps (modified) https://pluralistic.net/timberridge

#pluralistic#zirp#weaponized shelter#the rents too damned high#finfluencers#qualified investors#the bezzle#heads i win tails you lose#houston#Brent Ritchie#Matt Picheny#Koteswar Jay Gajavelli#Koteswar Gajavelli#Applesway Investment Group#maureen tkacik#Arbor Realty Trust#MF1 Capital#Benefit Street Partners#bezzle#Swapnil Agarwal#Slumlord Millionaires#KeyCity Capital#Financial Independence University#Elisa Zhang#Lane Kawaoka#Fundamental Advisors#AWC Opportunity Partners#Nitya Capital

263 notes

·

View notes

Text

So NFTgate has now hit tumblr - I made a thread about it on my twitter, but I'll talk a bit more about it here as well in slightly more detail. It'll be a long one, sorry! Using my degree for something here. This is not intended to sway you in one way or the other - merely to inform so you can make your own decision and so that you aware of this because it will happen again, with many other artists you know.

Let's start at the basics: NFT stands for 'non fungible token', which you should read as 'passcode you can't replicate'. These codes are stored in blocks in what is essentially a huge ledger of records, all chained together - a blockchain. Blockchain is encoded in such a way that you can't edit one block without editing the whole chain, meaning that when the data is validated it comes back 'negative' if it has been tampered with. This makes it a really, really safe method of storing data, and managing access to said data. For example, verifying that a bank account belongs to the person that says that is their bank account.

For most people, the association with NFT's is bitcoin and Bored Ape, and that's honestly fair. The way that used to work - and why it was such a scam - is that you essentially purchased a receipt that said you owned digital space - not the digital space itself. That receipt was the NFT. So, in reality, you did not own any goods, that receipt had no legal grounds, and its value was completely made up and not based on anything. On top of that, these NFTs were purchased almost exclusively with cryptocurrency which at the time used a verifiation method called proof of work, which is terrible for the environment because it requires insane amounts of electricity and computing power to verify. The carbon footprint for NFTs and coins at this time was absolutely insane.

In short, Bored Apes were just a huge tech fad with the intention to make a huge profit regardless of the cost, which resulted in the large market crash late last year. NFTs in this form are without value.

However, NFTs are just tech by itself more than they are some company that uses them. NFTs do have real-life, useful applications, particularly in data storage and verification. Research is being done to see if we can use blockchain to safely store patient data, or use it for bank wire transfers of extremely large amounts. That's cool stuff!

So what exactly is Käärijä doing? Kä is not selling NFTs in the traditional way you might have become familiar with. In this use-case, the NFT is in essence a software key that gives you access to a digital space. For the raffle, the NFT was basically your ticket number. This is a very secure way of doing so, assuring individuality, but also that no one can replicate that code and win through a false method. You are paying for a legimate product - the NFT is your access to that product.

What about the environmental impact in this case? We've thankfully made leaps and bounds in advancing the tech to reduce the carbon footprint as well as general mitigations to avoid expanding it over time. One big thing is shifting from proof of work verification to proof of space or proof of stake verifications, both of which require much less power in order to work. It seems that Kollekt is partnered with Polygon, a company that offers blockchain technology with the intention to become climate positive as soon as possible. Numbers on their site are very promising, they appear to be using proof of stake verification, and all-around appear more interested in the tech than the profits it could offer.

But most importantly: Kollekt does not allow for purchases made with cryptocurrency, and that is the real pisser from an environmental perspective. Cryptocurrency purchases require the most active verification across systems in order to go through - this is what bitcoin mining is, essentially. The fact that this website does not use it means good things in terms of carbon footprint.

But why not use something like Patreon? I can't tell you. My guess is that Patreon is a monthly recurring service and they wanted something one-time. Kollekt is based in Helsinki, and word is that Mikke (who is running this) is friends with folks on the team. These are all contributing factors, I would assume, but that's entirely an assumption and you can't take for fact.

Is this a good thing/bad thing? That I also can't tell you - you have to decide that for yourself. It's not a scam, it's not crypto, just a service that sits on the blockchain. But it does have higher carbon output than a lot of other services do, and its exact nature is not publicly disclosed. This isn't intended to sway you to say one or the other, but merely to give you the proper understanding of what NFTs are as a whole and what they are in this particular case so you can make that decision for yourself.

95 notes

·

View notes

Text

(video essayist voice) kingdom hearts is-

so, kh1. its been. a little while since i played. so forgive me if the game isnt exactly fresh in my mind. theres maybe gonna be errors so please bear with me im trying my best.

this is probably the kh game i have the least thoughts on, which feels weird considering its the first game in the series, but i just dont have a lot of strong opinions on it. its a pretty solid game!

starting where i normally do, the gameplay is probably the worst aspect of the game. they really thought platforming would be a fun thing in this game, but its just. not. the physics are so bad oh my god. if i ever have to jump in kh1 again itll be too soon. the difficulty is also a little bit all over the place. i played on standard (like i do with pretty much every game) and i would randomly jump from breezing through the game to trying a hundred times to fight one boss. most of the time its not the fun kind of difficult, just frustrating. the only time i can remember the difficulty being fun is the last riku fight in hollow bastion. i wish more of the game was the fun kind of hard. strangely enough, i know a lot of people struggled with the riku race and fight in the tutorial, but honestly those were easy for me? i got the fight first try, and the race second. idk, get on my level nerds i guess?

the worlds here are hit or miss. some of them (mostly the original ones, hollow bastion and traverse town specifically) are just amazing and i love them. others are. uh. lets say getting rid of the tarzan world was the best thing to come out of copyright law. also, this game is the only one where i skipped an entire world (sorry atlantica, you fucking suck). so theres that. the disney worlds are probably my least favorite aspect of the game

the story is alright! i dont have much to say about it other than i think that its mostly pretty good when i know whats going on, although both me AND one of my friends were so confused at the ending that we had to go call someone else to ask what the fuck happened and honestly i still dont really know? what the fuck is a kingdom hearts you ask? the world may never know.

this game and 2 are the only ones where maleficent is good. i miss when she was like a fun villain. she was just super into the housing market and i love that. what the fuck is she even doing in ddd? getting into bitcoin????

rikus great, i dont think i need to say that. hes such a freak and i love him. soras pretty good, shoutout to haley joel osman for doing a great job for being uh. 12??? at the time???????? hes great. i know a lot of people really like ansem sod but i just dont get the appeal? he never did anything for me. like hes fine i just didnt care about him whatsoever and anyone who says hes a better villain than like. xemnas. is wrong.

0/10 where is axel. ok but seriously uhhhhhh i give it a 7.7/10. its a solid, enjoyable game! not my favorite, but thats not to say i dislike it at all.

#doodles#sora#kh1#kingdom hearts#kingdom hearts 1#kh review#spent too long on the drawing for this lmao

156 notes

·

View notes

Text

"In the age of smart fridges, connected egg crates, and casino fish tanks doubling as entry points for hackers, it shouldn’t come as a surprise that sex toys have joined the Internet of Things (IoT) party.

But not all parties are fun, and this one comes with a hefty dose of risk: data breaches, psychological harm, and even physical danger.

Let’s dig into why your Bluetooth-enabled intimacy gadget might be your most vulnerable possession — and not in the way you think.

The lure of remote-controlled intimacy gadgets isn’t hard to understand. Whether you’re in a long-distance relationship or just like the convenience, these devices have taken the market by storm.

According to a 2023 study commissioned by the U.K.’s Department for Science, Innovation, and Technology (DSIT), these toys are some of the most vulnerable consumer IoT products.

And while a vibrating smart egg or a remotely controlled chastity belt might sound futuristic, the risks involved are decidedly dystopian.

Forbes’ Davey Winder flagged the issue four years ago when hackers locked users into a chastity device, demanding a ransom to unlock it.

Fast forward to now, and the warnings are louder than ever. Researchers led by Dr. Mark Cote found multiple vulnerabilities in these devices, primarily those relying on Bluetooth connectivity.

Alarmingly, many of these connections lack encryption, leaving the door wide open for malicious third parties.

If you’re picturing some low-stakes prank involving vibrating gadgets going haywire, think again. The risks are far graver.

According to the DSIT report, hackers could potentially inflict physical harm by overheating a device or locking it indefinitely. Meanwhile, the psychological harm could stem from sensitive data — yes, that kind of data — being exposed or exploited.

A TechCrunch exposé revealed that a security researcher breached a chastity device’s database containing over 10,000 users’ information. That was back in June, and the manufacturer still hasn’t addressed the issue.

In another incident, users of the CellMate connected chastity belt reported hackers demanding $750 in bitcoin to unlock devices. Fortunately, one man who spoke to Vice hadn’t been wearing his when the attack happened. Small mercies, right?

These aren’t isolated events. Standard Innovation Corp., the maker of the We-Vibe toy, settled for $3.75 million in 2017 after it was discovered the device was collecting intimate data without user consent.

A sex toy with a camera was hacked the same year, granting outsiders access to its live feed.

And let’s not forget: IoT toys are multiplying faster than anyone can track, with websites like Internet of Dongs monitoring the surge.

If the thought of a connected chastity belt being hacked makes you uneasy, consider this: sex toys are just a small piece of the IoT puzzle.

There are an estimated 17 billion connected devices worldwide, ranging from light bulbs to fitness trackers — and, oddly, smart egg crates.

Yet, as Microsoft’s 2022 Digital Defense Report points out, IoT security is lagging far behind its software and hardware counterparts.

Hackers are opportunistic. If there’s a way in, they’ll find it. Case in point: a casino lost sensitive customer data after bad actors accessed its network through smart sensors in a fish tank.

If a fish tank isn’t safe, why would we expect a vibrating gadget to be?

Here’s where the frustration kicks in: these vulnerabilities are preventable.

The DSIT report notes that many devices rely on unencrypted Bluetooth connections or insecure APIs for remote control functionality.

Fixing these flaws is well within the reach of manufacturers, yet companies routinely fail to prioritize security.

Even basic transparency around data collection would be a step in the right direction. Users deserve to know what’s being collected, why, and how it’s protected. But history suggests the industry is reluctant to step up.

After all, if companies like Standard Innovation can get away with quietly siphoning off user data, why would smaller players bother to invest in robust security?

So, what’s a smart-toy enthusiast to do? First, ask yourself: do you really need your device to be connected to an app?

If the answer is no, then maybe it’s best to go old school. If remote connectivity is a must, take some precautions.

Keep software updated: Ensure both the device firmware and your phone’s app are running the latest versions. Updates often include critical security patches.

Use secure passwords: Avoid default settings and choose strong, unique passwords for apps controlling your devices.

Limit app permissions: Only grant the app the bare minimum of permissions needed for functionality.

Vet the manufacturer: Research whether the company has a history of addressing security flaws. If they’ve been caught slacking before, it’s a red flag.

The conversation around sex toy hacking isn’t just about awkward headlines — it’s about how we navigate a world increasingly dependent on connected technology. As devices creep further into every corner of our lives, from the bedroom to the kitchen, the stakes for privacy and security continue to rise.

And let’s face it: there’s something uniquely unsettling about hackers turning moments of intimacy into opportunities for exploitation.

If companies won’t take responsibility for protecting users, then consumers need to start asking tough questions — and maybe think twice before connecting their pleasure devices to the internet.

As for the manufacturers? The message is simple: step up or step aside.

No one wants to be the next headline in a tale of hacked chastity belts and hijacked intimacy. And if you think that’s funny, just wait until your light bulb sells your Wi-Fi password.

This is where IoT meets TMI. Stay connected, but stay safe."

https://thartribune.com/government-warns-couples-that-sex-toys-remain-a-tempting-target-for-hackers-with-the-potential-to-be-weaponized/

#iot#I only want non-smart devices#I don't want my toilet to connect to the internet#seriously#smart devices#ai#anti ai#enshittification#smart sex toys

23 notes

·

View notes

Text

sitting on the train right in front of a man who surely is like someone's obnoxious improv bit like there can't be people who act like this in real life right. here are a list of traits i have gathered.

loud and drunk

lost hundreds of thousands of dollars in the bitcoin market

going to see phish with his buddy chad

hates his "bitch" ex wife (my main proof that he's real is that he facetimed her without headphones on

thinks everyone who has been on a boat is "gay" and "stupid"

really likes using gay as an insult like we're in middle school again

he loves the show lost. people think he's like "the fat puerto rican" but he thinks he's more like jack (who has too many responsibilities) or sawyer (who is the coolest guy there).

thinks this train ride is "just like lost"

has taken 3 zyns from the guy next to him

keeps making retching noises as a bit

i told him very politely to maybe keep the volume down and he asked me first if i was god and then when i was like Yes i am. he called me a bitch. so that's where i'm at.

20 notes

·

View notes

Note

It’s possible to diy ftm hrt???

yeah dude. you can do this all on your phone too though it is less secure to use tor on one. keep in mind it's not really the most anonymous thing to send people paypal money for crypto or use tor on your phone but the police could not give less of a shit about people buying steroids or drugs in general for personal use. if you're not selling or buying distribution amounts they doooon't care

all you have to do is download tor (google it and click the first result or use the play store)

go on tor.taxi and pick a market, open the market link in tor [I use incognito]

get a crypto wallet [I used cake wallet]

buy bitcoin/monero/whatever with a P2P market, basically crypto version of reddit marketplaces [I used localmonero and sent paypal money in exchange for monero, make sure to follow the directions the market gives you, like not sending any money unless it says it's ok, you can always cancel if you feel like you're getting scammed and make sure to pick someone with lots of reviews]

send the crypto into your wallet on the market, wait

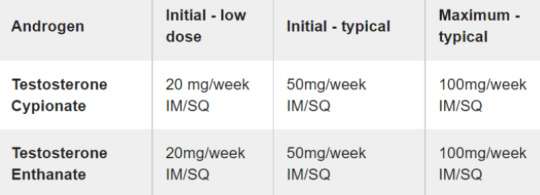

look up testosterone and make sure that it is shipping DOMESTICALLY. don't bother with customs. keep in mind 10ml = ten doses, if you're like me and take 2[50]mg biweekly. it'll be twenty if you take it every week.

place order! just fill out your shipping info and pay lol

it's pretty simple, remember to log in and release the money once your package arrives! [go to your orders and click the button that says release funds]. the other person is waiting on their money and it's helpful to release it as soon as you get what you ordered.

I hope this helps anon

120 notes

·

View notes

Text

sorry it's still so funny that crypto and nfts like exploded and died after all that nonsense pyramid scheme scam shit and superbowl ads and bitcoin mining rigs ruining everything including the environment and it was all for nothing, it didn't change the world it didn't revolutionize anything it was all a complete scam and what remains of it still is. like blockchain tech isn't going anywhere it's probably going to exist in some capacity for the foreseeable future and crypto in general still exists (and existed before it became mainstream popular) but the vast majority of nfts, cryptocurrencies, etc are completely and utterly worthless now, shut down services, crashed markets and exchanges, etc. the only sad things are the people left holding the bag whose lives were ruined bc they got sucked into the scam and there's no justice or recompense + the sheer amt of environmental damage caused by this whole thing

#i find everything abt crypto fascinating in the same way some people are obsessed w nuclear accidents#thinking abt all of this within its material context is so interesting. the horrifying garbage economics of the whole thing#the whole thing was & still is essentially a decentralized mlm scheme . casino gambling type shit. just wild#the fucking ape nfts... how was that even real#theres no way to describe any of this w/o sounding like a jackass. bc the whole thing is fundamentally jackassery

121 notes

·

View notes

Note

I have a suggestion about ppl "feeling guilty" about wanting to experience rich or famous lifestyles through the lens of ND, AV, and "That"

Do it. Get the money. Be rich. get that sp.

Go into this knowing that it doesn't matter what you want...there is no judgement. There is no good or bad. Being rich and famous is the same as a simple monk life. You can do both in fact.

Im Bitcoin anon. I have like 40 bitcoin now by knowing where the market would go and trading it accordingly. I came into this "info-nothingness" with not much money. I have money now...but Idgaf about money any longer. It's fine to dream up money...but the fact that you're trying so hard to get it is keeping you from it.

Also, I find finance and money very interesting in my dream. I like these topics, and I dont feel guilty about it. Stop comparing your dream to a dream character of your making. Maybe if you didnt feel so guilty about it more "that" or omnipotent or w/e blogs would talk about their dream money....youre the one creating all this guilty rhetoric. Who cares if "i am that iam" "illuminated mystic" "infiniteko" dont care about money and like simple? Who says money isn't simple? It is simple!!!! You are creating the price of everything lol. I know so first hand. I am literally still trading Bitcoin and knowing where the price is gonna go...it's not money thats the issues...it's you seeking justification and trying so hard. Just get money.

Exactly! There's no one telling you to not "accomplish" your dream life, there's people telling you that there is nothing to accomplish in the first place. You are already free, do what you want and dream the amounts of dreams it fits you the best.

I just believe that people shouldn't get mad about blogs not responding well to "i want to manifest... " questions or answering sarcasticly because they had said multiple times that the information isn't focused on that or had already told them what to do yet they still complain.

Thanks for sharing this bitcoin anon! i honestly get headaches only reading the word bitcoin, but you seem quite passionate about it haha.

Hope you have a great day! 🫶

59 notes

·

View notes

Text

On rates specifically, Trump could jawbone Jerome Powell like he did during his last administration. And there’s a good chance that he will replace him at some point. But even then this doesn’t automatically solve anything. If you take mainstream economic thinking seriously, and the Fed moves to aggressively lower interest rates to align itself with the administration, then this theoretically is inflationary, and then you just move the challenge elsewhere. A lot of the uncertainty hovering in the bond market is being priced into the term premium, roughly defined as the extra compensation investors demand to hold longer-term bonds. There’s a popular idea out there that the industrial policy of the Biden administration was a political failure. Efforts to reshore or revitalize domestic manufacturing didn’t change the Democrats’ fortunes among working class voters or deliver the Rust Belt states. On the other hand, it’s a little bit unclear how much this was the intent. A big part of the motivation for the IRA was climate-specific, and a lot new factories are in ‘red’ areas, in part to ensure GOP support for them after the changing of the administration. Furthermore, there’s a big China-hawk element among the Democrats’ ‘post-neoliberal’ base, which is in large part motivated by technological and industrial competition. [...] A bunch of stuff has been moving alongside Trump’s chances of winning (things like Bitcoin, DJT, and the dollar index), but one thing that’s kind of flown under the radar has been the move in perpetual preferreds issued by Fannie Mae and Freddie Mac, a.k.a the GSE ‘zombie’ stocks. The bet here is that Trump could release Fannie Mae and Freddie Mac from conservatorship, which would mean they could theoretically pay out dividends to preferred investors once again. And finally, people love to talk about so-called “bond market vigilantes” but stock market vigilantes also exist. According to Gallup, 61% of American households own stocks. Stocks are how people fund retirements, college education, and so forth. You could argue that — with the gutting of defined benefit pension plans — a rising stock market is an implicit part of America’s social contract. And so when you think about policy adventurism — such as aggressive tariffs — it might be useful to think about how that would go down in equity world, and the effect that that would have on voting households.

14 notes

·

View notes

Text

@raginrayguns said:

if a company was never going to pay dividends or do stock buybacks, the stock would presumably be worthless. It's hard to be sure because of nft's and bitcoin but presumably. This stock that you buy to sell it later, you're either selling a promise of a future share of profits, or... idk, the thing youre imagining doesnt really exist i think, or it's bitcoin can you name a specific stock that you think works like this?

oh! yes. great question. thank you for forcing me to specifics. TSLA! (circa 2021)

this valuation has to be what, 90+% speculation? theres no way anyone thinks that TESLA will be more profitable, produce more buybacks than the rest of the car industry combined. i think a huge portion of the stock market is like this. i reblogged a thing about this recently but i cant find it, the change in the stock market over the last 10 years is almost entirely the top 10 companies

200 notes

·

View notes

Text

When former US president Donald Trump announced a plan to establish a national “bitcoin stockpile” if he is reelected, the crowd at the Bitcoin 2024 conference in Nashville, Tennessee, erupted into a fit of celebration. The frontrunner in the upcoming election was speaking their language.

“For too long, the government has violated the cardinal rule that every bitcoiner knows by heart: Never sell your bitcoin,” said Trump during his speech on Saturday, pausing briefly to bathe in the applause. “It will be the policy of my administration to keep 100 percent of all bitcoin the US government currently holds or acquires into the future.”

The US government is reportedly sitting on upwards of 210,000 bitcoin—worth around $14 billion—seized from hackers and through various law enforcement activity. That stash, said Trump, would become “the core of the strategic national bitcoin stockpile.” Republican senator Cynthia Lummis, of Wyoming, later proposed legislation that would see the US government amass 1 million bitcoin under Trump.

Any stockpiling plan would benefit bitcoin owners, if only because it would stop the US government depressing the price of the cryptocurrency by flooding the market with its coins in a sale. Trump implied that stockpiling bitcoin, an asset considered by its proponents to be anti-inflationary by virtue of its capped supply, would also help the government to “end the inflation nightmare that this administration [led by Joe Biden] has created.” Senator Lummis later spelled out his thinking, saying, “We need to create a brighter future for generations of Americans by diversifying into bitcoin.”

But stockpiling bitcoin has little merit, economists say. “I see no [economic benefit],” says James Angel, an economist at Georgetown University specializing in financial markets. “The tangible benefit is that it will get bitcoin maxis to vote for Trump. If you believe in Trumpism, that would be the benefit.”

The idea that an investment in bitcoin will offset losses in spending power to inflation is contingent, says Angel, on two shaky assumptions: that the price of bitcoin will rise and, second, that the government would be able to at some stage sell bitcoin back into US dollars without tipping the market into a nosedive. “The government will push the price up by buying bitcoin, so it will look like it has made a lot of money, but the minute it actually starts to sell the bitcoin to take profits, it will push the price right back down again,” says Angel.

Though Trump is initially proposing a moratorium on selling bitcoin already in the possession of the US government, he loosely implied the US would increase the size of its position over time, too. If Trump were to expand the bitcoin stockpile, he would need to locate funds with which to acquire the additional coins. But the readily available options—to increase taxes, take on debt, or print US dollars—are incompatible with the ambition to drive down inflation and national debt, or pledges made by Trump to reduce taxation. Senator Lummis is reportedly set to propose that purchases be funded partly using money that will be added to the US central bank’s balance sheet after the valuation of gold stores is updated to reflect the going market rate. “The money has to come from somewhere,” says Angel.

Even if Trump were to restrict the reserve to bitcoin seized through law enforcement activity, his administration must also weigh up the opportunity cost associated with holding onto bitcoin. Whereas some assets such as bonds generate a consistent income stream for holders, bitcoin does not, making it expensive to hold.

“The question comes down to what the government would get out of the hoards of bitcoin it would be holding,” says George Selgin, director emeritus for the Center for Monetary and Financial Alternatives at the Cato Institute, a US think tank that promotes libertarian principles. The US government has periodically auctioned off the bitcoin confiscated through law enforcement activity. But in choosing to sit on the bitcoin it possesses, “it is failing to realize the market value, which it could apply to any number of other uses, from writing down the federal debt, to paying for other government programs,” says Selgin.

Though Selgin is a proponent of bitcoin for its independence from state control, he opposes the US government speculating on its price on behalf of citizens. “Governments are not particularly astute investors,” says Selgin. “Having the government act on behalf of citizens as some kind of investment trust or mutual fund doesn’t make much sense.”

During his speech in Nashville, Trump namechecked a range of high-profile bitcoiners, including Cameron and Tyler Winklevoss, who founded crypto trading platform Gemini, thanking them for their guidance. Afterward, Tyler took to X to celebrate Trump’s plan and congratulate the organizer of the conference for having “orange-pilled” the former president.

But while it is popular with holders of large amounts of bitcoin and industry executives, the ambition to establish a bitcoin stockpile could come at a cost to most everyone else, particularly if the government were to expand its existing holdings, says Michael Green, chief strategist at asset management firm Simplify.

“The only possible way for the US government to buy bitcoin is from existing holders,” says Green. “But if the government uses tax revenues [or issues bonds] in order to buy bitcoin, it creates a situation in which the taxpayer is subsidizing an extraordinarily small subset. Ultimately, you’re talking about creating exit liquidity for a small subset of the population.” It would be like the US government promising to pay over the odds for real estate in California, says Green, but no other state. “This is not materially different,” he says.

The larger the government’s pot of bitcoin, meanwhile, the more beholden it would become to those who maintain the underlying network—the bitcoin mining companies—whose job is to process transactions and shield the network from attack. Effectively, the bitcoin mining industry would become “another special interest group,” says Green, “that the US government would have to step in and bail out” in the event that the sector—renowned for its sensitivity to various factors beyond its control—were to wobble.

Neither Trump nor Lummis responded to a request for comment on the criticisms made against the bitcoin stockpile plan.

Whether Trump intends to carry out the plan to establish a bitcoin stockpile is a separate question. “Trump is a master demagogue, appealing to the emotions of the crowd. It’s pure electioneering,” says Angel. “I think the plan will probably go the way of Trump Airline, Trump Casino, and Trump University.” That is to say, nowhere.

The members of the bitcoin industry were not blind to the fact that Trump was making a pitch for their vote. It is “historic” for Trump to consider bitcoin important enough to warrant campaigning around, says Jameson Lopp, an early bitcoiner and founder of crypto custody business Casa, who attended the conference. But “the way he spoke to us was pretty clearly pandering,” he says. “It felt like he was kind of speaking down.” Though Trump has previously dismissed bitcoin as a “scam,” he has now “realized that it can be beneficial to him,” says Lopp. “He can gain a new, potentially substantial bloc of single-issue voters.”

Trump was not the only person courting bitcoin fans with promises to take a semipermanent stake in the market. At the same conference, Robert F. Kennedy Jr., who is running against Trump in the election as an independent, presented a more gung-ho plan: The country would acquire 4 million coins—practically 20 percent of the total supply—if he were president.

In that context, the pledges in Nashville were of greater significance as a signal, says Selgin, than for their actual contents. After a period under the Biden administration in which crypto businesses have been targeted, they claim unfairly, by regulatory bodies in the US, the pitches by Trump and others were an attempt to send the general message, says Selgin, “that bitcoin is no longer the enemy.”

19 notes

·

View notes

Note

stop bragging about being born in 202, some of us aren’t that lucky

jesus fucking christ. its people like you on the internet that ruin the entire experience for me. the amount of entitlement from tumblr anons these days is astounding. its not my fault that you kids weren't fortunate enough to be born in 202AD. you know, back in my day, we thought people born in 202 BC were wise and elderly. dont even get me started on those in the immortal community who have been around since before we got this whole "writing" thing established. just because we've had thousands of years to establish ourselves in society and adapt to changing cultures and learn how to manipulate the stock market doesnt mean you get to whine and nag about how you were only born in 1902 and you still have living grandkids to deal with. you know, i worked my ASS off to get where i am now. do you know how fucking annoying was is to keep having to fake my death when the black plague was going around? sit the fuck down and appreciate how good you have it with your goddamn modern medicine and bitcoin and get back to me in a thousand years when you've learned some RESPECT.

#mads asks#GOD#kids these days am i fucking right#you know back in my day we actually RESPECTED our elders because they would have had us killed otherwise.#hey chat. kill this guy

49 notes

·

View notes

Text

Giveaway Exnori

Discover Exnori.com’s Exclusive Bonus Program: Get 0.31 BTC with Promo Code!

Welcome to Exnori.com, where we not only provide a secure and efficient trading platform but also offer exciting rewards to enhance your trading experience. We are thrilled to introduce our exclusive bonus program, designed to give you a head start in the world of cryptocurrency trading.

How to Claim Your 0.31 BTC Bonus

Getting started with Exnori.com has never been more rewarding. By entering our special promo code, you can receive a bonus of 0.31 BTC directly into your account. Here’s how you can claim this fantastic offer:

Sign Up: If you’re new to Exnori.com, create an account by completing our quick and easy registration process.

Verify Your Account: Ensure your account is verified to qualify for the bonus. This step is crucial for maintaining the security and integrity of our platform.

Enter the Promo Code: During the account setup or in your account settings, enter the promo code provided. Make sure to double-check the code for accuracy.

Receive Your Bonus: Once the promo code is applied, you will see 0.31 BTC credited to your Exnori.com account.

Why Choose Exnori.com?

**1. **Secure and Reliable: We prioritize the security of your assets and personal information with advanced encryption and multi-factor authentication.

2. User-Friendly Interface: Our platform is designed for ease of use, making it suitable for both beginners and experienced traders. Trade on the go with our mobile app, available on both Android and iOS.

3. Extensive Cryptocurrency Selection: Trade a wide variety of cryptocurrencies, from popular ones like Bitcoin and Ethereum to emerging altcoins.

4. Competitive Fees: Enjoy some of the lowest fees in the industry, ensuring you maximize your returns on every trade.

5. 24/7 Customer Support: Our dedicated support team is available around the clock to assist you with any questions or issues you may encounter.

Terms and Conditions

To ensure fair use and enjoyment of our bonus program, please note the following terms and conditions:

The 0.31 BTC bonus is available for new users who enter the valid promo code during registration or in their account settings.

The bonus is credited after account verification.

This offer is limited to one bonus per user.

The bonus cannot be withdrawn immediately and must be used for trading on the Exnori.com platform.

Additional terms and conditions may apply. Please refer to our website for full details.

Start Trading with an Extra Boost

Join Exnori.com today and take advantage of this incredible bonus program. With 0.31 BTC added to your account, you’ll have a significant boost to explore the exciting opportunities in the cryptocurrency market. Don’t miss out on this limited-time offer – sign up, enter the promo code, and start trading now!

At Exnori.com, we are committed to providing you with the best trading experience possible. Our bonus program is just one of the many ways we aim to support our users and help them succeed in the world of cryptocurrency trading. Welcome to the future of trading with Exnori.com!

13 notes

·

View notes

Text

I'm so sick of seeing pro-AI posts framing people with actual issues as alarmist luddites.

The theft of the materials AI are trained on are moot at this point. The consent issue is moot at this point.

The real issue is the cult that people have created regarding AI, overestimation of how useful it will be in various scenarios and so on so forth. They're trying to jam AI into everything, including medical practice. Which will go very poorly, because of the hallucinations AI is prone to. AI is being used to filter resumes already. Tests from an AI company are being foisted on the job market.

And yeah, they're trying to replace artists and writers.

It's a buzzword, but it's also a problem, like crypto. Same kind of grift, new tech.

These things called "AI" aren't even true artificial intelligences, nor are they the path to them.

Man, I come here to shitpost, and you fuckers got me writing serious. Folks said I was alarmist when I noticed the issues with Bitcoin. Folks said I was alarmist when I pointed out the golden age of streaming content was going to end. Folks said I was alarmist when I called in on fucking microtransactions way back in the day.

No, fuck you. Pay the fuck attention.

29 notes

·

View notes

Text

Let’s talk about the hopium and the copium.

Nazi dickbags like to jeer about hopium and copium and apply it to politics to recruit sad people, but…

I got some fucken news, you freakish fascist filth

You’re goddamn right I mine my own hopium

AND I mine my own copium

and then I refine it to the purest, cleanest, concentrated and most fortified forms to apply to everything I can because, as you will never understand, you wretched miserable fuckhounds who live to hate all life…

…knowing how to COPE WITH REALITY is GOOD, ACTUALLY

…and HOPE is what destroys the execrable fascist jizz collection that calls itself MAGA.

So goddamn right I mine the hopium

and ‘s far as I can tell, I have the motherfucking corner on the copium market.

And I have been fighting a long, long time to get to see you fuckers burn from its glow, like vampires in the sun and finally, finally, everyone else seems to be catching on.

So scream, you cowards, you creeps, you howling bizarrities – scream as your empire crumbles stillborn before you.

Yeah, you’re gonna try to make it happen anyway with all your oil money, with your cheats, with your Russian friends, with all your blistered billionaires and buckets of bitcoin you’ll still try your damnedest to destroy everything democratic and free and fun and in the world to set up your shambling Gileadian cult state under the sickest, weakest, saddest would-be god-emperor diaper-wearing baby-man potentate in the history of humanity

all while everybody’s finally starting to realise – even you…

….that you’re gonna fucking fail.

And we are going to win.

All we have to do is do the fucking work. And we’re doing it, at last, in our many, many millions.

I cannot wait to watch as it happens.

I promise you, I will not be gracious.

I will, in fact, be a very bad winner.

It is, really, the least I can do for all your trouble.

96 days remain.

8 notes

·

View notes