#gary hinman

Explore tagged Tumblr posts

Text

Susan Atkins and her attorney Richard Caballero in Santa Monica Superior Court for continuance in the trial of the murder of Gary Hinman. January 17, 1970.

#susan atkins#Richard Caballero#vintage photography#black and white photography#vintage los angeles#courthouse#gary hinman#santa monica#1970

29 notes

·

View notes

Text

Bobby Beausoleil photographed by Peter Beard for Interview Magazine, ca. 1971-72.

"All of my tattoos were done while I’ve been in prison, all designed by me, many tattooed by me. Other jailhouse tattoo artists did the work in the places where I couldn’t reach with my right hand or see with a mirror."

#mygirlhatesmyheroin#bobby beausoleil#peter beard#interview magazine#tattoos#san quentin summer#1971#1972#1970s#70s#black and white photography#manson family#charles manson#true crime#gary hinman

104 notes

·

View notes

Text

Further Cosmic Pedal Steel Situations :: Winter 2024

The cosmic pedal steel scene continues to expand — and we’re here for it. Daniel Lanois, one of the godfathers of this movement, once called the pedal steel “my little church in a suitcase.” And if anything ties these various musicians together, it’s a certain kind of earthy spirituality, an openness to the myriad possibilities that the instrument offers. Check out a few of my recent favorites over at Aquarium Drunkard.

And while you're over at AD — well, we've got a fab 2024 going for you already. Check out Brent Sirota's magnificent Fourth World mixtape ... or the latest installment of James Adams' Dylan-tastic bootleg column Diamonds From The Deepest Oceans ... or Jennifer Kelly's convo with Kayla "Itasca" Cohen (her new one is ridiculously good) ... or Michael Klausman's appreciation of Butch Hornsby's lost 70s classic Don't Take It Out On The Dog ... or J. Neas' Q&A with the GBV gawd Robert Pollard ... this is all in the first couple of weeks, people! I've said it before and I'll say it again: what a cool website!

12 notes

·

View notes

Text

August 9, 1969: Manson “Family” members Susan Atkins, Tex Watson, and Patricia Krenwinkel entered the home of Hollywood actress Sharon Tate and murdered her and four others. Linda Kasabian (née Drouin) was also present, but allegedly did not take part. Steven Earl Parent, who was present at the address only by unfortunate coincidence, lost his life that night, in addition to Sharon Tate and her houseguests, Jay Sebring, Abigail Folger, and Wojciech Frykowski. In an earlier incident involving Charles Manson and his followers, musician Gary Hinman was murdered after being held captive for several days, forced to turn over his property to his captors under torture and threat of death. Manson associate Robert “Bobby” Beausoleil killed Gary Hinman on the orders of Manson.

Above: Lurid headlines abound in the days following the crimes at 10050 Cielo Drive in Benedict Canyon, north of Beverly Hills, the home of actress Sharon Tate and her husband, Polish movie director Roman Polanski.

Above: Wilfred Parent, and his wife Juanita (néeJones) were unaware that their son Steven had gone to Cielo Drive that night to visit his friend, live-in caretaker William Garretson, hoping to sell him a used radio. He was shot by the intruders as he was preparing to leave the property.

Above: Linda (née Drouin) Kasabian was given immunity for her testimony against the Manson Family defendants. She has maintained that she did not take physical part in the murders, but acted as a “lookout” only.

Originally from New England, Linda Drouin (later Kasabian) is listed with her parents, Rosaire and Joyce (née Taylor) Drouin in the 1950 U. S. Federal Census, in Maine, Linda’s paternal grandparents having emigrated there from Quebec in the 1920s.

Above: Colorado-born Gary Hinman was a musician living at this residence in Topanga Canyon, California in 1969, where Manson associate Bobby Beausoleil had lived with Hinman previously. During this time, Beausoleil had become acquainted with Charles Manson and his followers.

Above: In late July of 1969, Beausoleil went with Manson associates Susan Atkins and Mary Brunner to Hinman's house in Topanga Canyon. After demanding money that Hinman did not have, Manson told them via phone to hold Hinman captive there at his house. When Manson arrived, armed with a bayonet, he struck Hinman, severely cutting his face and ear. Gary Hinman was held captive for three more days before being murdered by Bobby Beausoleil, on the instruction Charles Manson.

Above: After a well-documented investigation and trial, the principal participants in the Manson “Family” murders were found guilty and sentenced to death. Bobby Beausoleil was convicted and sentenced to death for the July 27, 1969, fatal stabbing of Gary Hinman. Beausoleil, Manson, and the other participants who were sentenced to death were later granted commutation to a lesser sentence of life imprisonment, after the Supreme Court of California issued a ruling that invalidated all death sentences issued in California prior to 1972. Bobby Beausoleil is currently imprisoned in California. Manson died in prison in California in 2017. Linda Drouin Kasabian, who gave a handful of interviews about her participation in the 1969 murders, kept a low profile over the years and died in Tacoma, Washington on January 21, 2023, at the age of 73.

More information:

#family history#family stories#family#ancestry#genealogy#true crime#crime history#manson family#manson#family photos#ancestors#french canadian#crime#american history#hollywood#sharon tate

10 notes

·

View notes

Text

54 years ago today, on a hot August night, a gang of drugged up misfits working on the orders of Charles Manson entered the home of Sharon Tate Polanski and murdered everyone in the house. Sharon was eight months pregnant.

She was a gentle soul. She loved animals and her family adored her. She was looking forward to the birth of her baby who she had already named Paul after her father. Her husband Roman Polanski was in London working on his latest movie.

The Manson murders sent Hollywood into lockdown. Guns were bought. Gates were locked. Trust was low. The swinging sixties were effectively brought to a close.

Please take a moment today to remember Sharon and her friends - Jay Sebring, Abigail Folger and Wojciech Frykowski

Please also remember Steven Parent, and the other Manson victims Rosemary and Leno LaBianca and Gary Hinman

3 notes

·

View notes

Video

youtube

today is the day xrp to go up3900% up today #xrp sec vs ripple (news)

Today is the day xrp to go up3900% up today #xrp sec vs ripple (news) Today is the day that many XRP investors have been eagerly waiting for. There is speculation that XRP is set to skyrocket up by 3900% today, which is fantastic news for those who have invested in this cryptocurrency. As many of you are aware, XRP has been in the news recently due to the ongoing legal battle between Ripple and the US Securities and Exchange Commission (SEC). However, many experts believe that XRP will come out on top and emerge victorious in this David vs Goliath-style fight. In recent news, there have been emails released by William Hinman, the former SEC Director of Corporate Finance, which appear to suggest that Hinman favoured Ripple and deemed XRP NOT to be a security. This could be a major win for XRP and Ripple and could potentially exonerate them in the eyes of the SEC. While we are waiting for the SEC's decision, many have been speculating on the future price of XRP. Coinskid, an expert in cryptocurrency, has made a bold prediction that XRP's price will soar in the next three years, possibly reaching $10 per token by 2023. The news surrounding XRP has also had a ripple effect on other cryptocurrencies such as Bitcoin, which has been volatile in recent weeks due to other factors such as China's crackdown on crypto mining. As we await further news from the SEC and other key players in the crypto industry such as Gary Gensler, the Chairman of the SEC, many XRP investors remain optimistic that today will be the day that XRP finally gets the recognition it deserves. So, hold on tight and enjoy the ride! today is the day xrp to go up3900% up today,xrp,xrp vs sec,Ripple,XRP,XRP news,BTC,Bitcoin,cryptocurrency,Hinman,ripple,hinman emails,hinman emails release date,crypto law,coinskid xrp,coinskid,xrp price prediction,sec lost,bitcoin price prediction,bitcoin technical analysis,bitcoin news today,xrp price prediction 2023,ripple xrp price prediction 2023,xrp ripple news,gary gensler,gary gensler ftx,gary gensler congress,gary gensler hearing,sec emails today

2 notes

·

View notes

Text

In a significant turn of events, new court documents have revealed that the U.S. Securities and Exchange Commission (SEC) and its Chair, Gary Gensler, have considered Ethereum to be a security for over a year. This surprising insight could have major implications for the cryptocurrency industry and Ethereum investors. Stay tuned as this story unfolds, with potential impacts on Ethereum's classification and the broader crypto Market. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] In a groundbreaking move that's stirring up the cryptocurrency sector, Consensys, a key player in the Ethereum blockchain, has taken legal action against the Securities and Exchange Commission (SEC). The root of the lawsuit is the contentious debate over whether Ethereum, the world's second-largest cryptocurrency, should be classified as a security. This legal battle highlights a significant shift in how digital assets might be regulated, potentially impacting millions of investors. For a while, the SEC, led by Chairman Gary Gensler, has hinted at its belief that Ethereum operates outside of current federal regulations for securities. This viewpoint came into sharper focus when documents from Consensys revealed that the agency has considered Ethereum a security since at least last year. The case was initiated after Consensys responded to a Wells notice from the SEC, which suggested imminent legal action for not complying with securities laws. The cryptocurrency community is closely watching this case, as it challenges the previously somewhat harmonious stance between the crypto industry and regulators. In 2018, comments made by then SEC official Bill Hinman indicated that Ethereum, along with Bitcoin, wasn't viewed as a security due to its decentralized nature. This position was a comfort to investors and developers who saw it as a green light for further innovation without the fear of regulatory crackdowns. Should the SEC's current stance lead to Ethereum being officially classified as a security, it could overturn previous guidance and significantly alter the cryptocurrency landscape. This has raised concerns among stakeholders about the criteria used to evaluate digital assets and the future of decentralized technologies. The legal challenge by Consensys signifies a critical point in the ongoing dialogue between regulatory bodies and the crypto industry. It underscores the industry's determination to fight for clarity and fairness in regulatory practices that could shape its evolution. With the SEC appearing to tighten its grip on the rapidly growing digital asset Market, all eyes will be on the outcome of this lawsuit and its implications for the future of cryptocurrency regulation. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. What do the new court filings reveal about the SEC's view on Ethereum? The court filings show that the chair of the SEC, Gensler, thought Ethereum was a security for at least a year. 2. Who is the SEC Chair mentioned in the filings? The SEC Chair mentioned in the filings is Gensler.

3. For how long did the SEC Chair believe Ethereum was a security? According to the filings, the SEC Chair believed Ethereum was a security for at least one year. 4. Does believing Ethereum is a security affect its status? Yes, if the SEC officially classifies Ethereum as a security, it could affect how it's traded and regulated. 5. What could be the impact of these filings on Ethereum and its users? If Ethereum is officially deemed a security, it might face stricter regulations, affecting its trading, usage, and possibly its value. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

Title: Ethereum's Regulatory Outlook: Insights from Gensler and SEC

- Insights from Gensler on Ethereum's Regulatory Status During recent Congressional hearings, Gary Gensler, the chair of the U.S. Securities and Exchange Commission (SEC), refrained from offering his stance on whether Ethereum poses a security risk. This silence contrasts with the stance of former SEC official William Hinman, who dismissed Ethereum's classification as a security back in 2018. Kevin de Patoul, shedding light on the matter, highlighted Gensler's reticence on Ethereum's regulatory status, despite past clarifications from the SEC. - Ethereum's Security Status Amid Regulatory Scrutiny In the realm of regulatory scrutiny, Ethereum's classification as a security remains a contentious issue. While Gensler sidestepped the question during recent Congressional hearings, insights from William Hinman's 2018 speech provided contrasting views. This ambiguity underscores the ongoing debate surrounding Ethereum's regulatory standing. - Ethereum's Price Surge and Regulatory Implications The recent surge in Ethereum's price to $3000 has triggered discussions on its regulatory implications. Keyrock's CEO emphasized that Ethereum's transition to a Proof-of-Stake model may influence its regulatory categorization by the SEC. Furthermore, the excitement surrounding potential spot ETF approvals and the impending EIP-1559 upgrade has fueled speculation on Ethereum's future regulatory landscape. - TD Cowen's Forecast: Ethereum ETF Approval by 2025 Amidst these regulatory deliberations, TD Cowen has forecasted the approval of Ethereum ETFs by the end of 2025. This projection adds to the evolving narrative surrounding Ethereum's regulatory journey and its impact on the broader cryptocurrency market. Read the full article

#Congressionalhearings#EIP-1559#Ethereum#GaryGensler#Keyrock#Proof-of-Stake#regulatorystatus#SEC#securityrisk#spotETF#TDCowen#WilliamHinman

0 notes

Text

Coinbase bugün SEC davasını reddetmek için dilekçe vererek kripto piyasasını şoke etti. ABD merkezli borsa, SEC’in platformundaki kripto paralar üzerinde yetkisi olmadığını öne sürüyor. Ünlü XRP avukatı John Deaton, son gelişmeleri şöyle yorumluyor.John Deaton, Coinbase’in güçlü olduğunu söylüyorSıcak gelişmenin akabinde Deaton, ikili ortasındaki güç istikrarı hakkında Twitter’dan uzun bir açıklama yaptı. XRP yanlısı avukata nazaran Coinbase, SEC karşısında durabilecek güçlü bir rakip. Deaton, tezini desteklemek için 6 ikna edici noktayı ortaya koyuyor.Bunların birincisi olarak ABD Kongresinin sanayi için yasama sürecini başlattığını belirtti. Düzenleyicinin bu tavrı, yasama organlarının ortaya atılan temel mevzularla ilgilenmeye hazır olduklarının göstergesi. Ayrıyeten, Deaton, Hinman e-postaları aracılığıyla yayınlanan düzenleyici boşluk argümanını da belirtti. Bu durumun borsalara daha güzel bir savunma imkanı sağladığını sav etti. cointahmin.com olarak aktardığımız üzere dokümanlar, 13 Haziran’da ortaya çıktı ve akabinde XRP fiyatında çift haneli ralliyi tetikledi.https://twitter.com/JohnEDeaton1/status/1674401125846458368 Bu ortada John Deaton, Gary Gensler’in kripto para ekosistemi için yetersiz kalmasının istikrarları değiştirdiğini söylüyor. SEC ve Coinbase uğraşının temel argümanlarından biri, bir eserin bir yatırım kontratı olarak sunulmasıyla ilgilidir. Bundan yola çıkarak John Deaton, hiçbir vakit Yargıcın yahut bir Mahkemenin ikincil piyasadan satın alınan varlıkların menkul değer olarak ilan edildiği bir dava hakkında karar vermediğini kaydetti.Coinbase üstün durumda mı?Deaton ve öbür kripto ve hukuk uzmanları tarafından vurgulandığı üzere, son olumlu gelişmelere karşın, davanın borsanın beklediği biçimde gitme ihtimali hala çok az. Bu nedenle Coinbase, yeni eserler başlatmak için kasıtlı teşebbüsler deniyor. En yenilerinden biri olan Ethereum üzerine heyeti Base Layer-2 protokolü, halkın Blockchain yeniliklerini benimsemesini verimli bir biçimde artıracak yeni akıllı kontratlar üzerinde çalışırken ilgi görüyor.Borsa, SEC davasını reddediyorCoinbase bugün, SEC davasını reddetmek için harekete geçti. Bunun için kurula bir dilekçe verdi. SEC daha evvel Coinbase’i 12 altcoin’in kayıtsız menkul değer satışına müsaade verdiği için dava etmişti. Coinbase’in baş hukuk sorumlusu Paul Grewal, SEC’in bunu yapmaya yetkisi olmadığını savunuyor. SEC’in argümanlarının “mevcut maddelerin çok ötesinde” olduğunu tez ediyor. Coinbase’in mahkemeye verdiği dokümanda şu sözler yer alıyor:SEC, tespit ettiği varlıkların ve hizmetlerin mevcut düzenleyici otoritesinin kapsamı içinde olduğu konusuna haklı olsa dahi bu dava, Coinbase’in yasal süreç haklarının ihlal edilmesi ve sürecin fevkalâde bir suistimalle gerçekleşmesi sebebiyle reddedilmelidir

0 notes

Text

Since the curtain is open, SEC has few moves in Ripple vs. SEC. Our previous analysis explored the potential for the SEC to regroup after losing the interlocutory card. Is there someone who says the SEC will not take a trial path? Here’s why. Pro-Ripple legal expert John Deaton, known for his spot-on predictions, decodes a surprising twist in the XRP lawsuit. Despite a trial date set for April 2024 after the District Judge shot down the SEC’s bid for an early appeal, Deaton boldly predicts a trial might not even happen.Why? He has slender odds of SEC success, backed by weak evidence and hefty legal costs. The plot thickens, and the courtroom drama promises more surprises ahead. [embed]https://www.youtube.com/watch?v=u6y_K1Kuuik[/embed]The SEC is in Pool of Questions? It is pretty evident so far that neither the SEC nor Gary Gensler has given any direct answer on various loopholes shown by the opponent. In a compelling discussion during a recent interview,Deaton questioned the real motives behind the SEC’s case, stating that “they died the moment they filed the case.”He hints that the SEC intends to force the securities laws but perhaps for other undisclosed reasons. This raises further questions about the SEC’s credibility and objectives in this landmark case. The SEC is likely to consider settlement talks with Ripple to end the legal battle, though it might be a tough call for regulators. Ripple’s case sets a precedent but doesn’t ensure similar outcomes for others.Deaton’s Stance on the Technicalities Deaton sees the recent decision as a significant setback for the SEC, making a trial unlikely. He questions how the SEC can prove its case when it’s against the law. XRP is considered innocent until proven otherwise. Deaton suggests the SEC might consider a settlement or drop the charges altogether to avoid the complexities of a trial. He also advises the SEC to hire a good lawyer if they aim to win. “Do they want all that Hinman stuff and the drama of a trial?” questioned Deaton, highlighting the complexities involved.Additionally, Deaton notes that the SEC is involved in other major legal battles with companies like Coinbase and Binance, diverting resources and adding complexity to their efforts. Deaton expresses confidence in Coinbase’s chances of winning but has reservations about Binance’s future trial outcome.XRP Ruling cannot be Tagged in All CasesHowever, legal expert John Deaton points out that this ruling’s scope is limited to XRP, not offering broader protection for other tokens. This leaves many projects in a regulatory gray area, potentially discouraging innovation in the U.S. While a step forward, the crypto industry still seeks comprehensive regulatory clarity for sustained growth and leadership in blockchain technology.!function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', ' fbq('init', '887971145773722'); fbq('track', 'PageView');

0 notes

Text

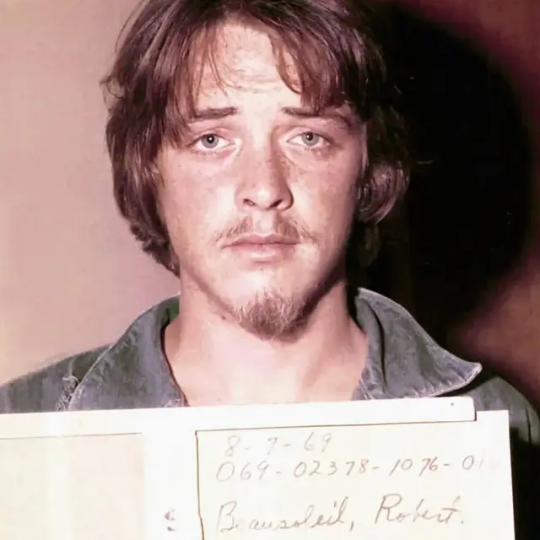

Bobby Beausoleil booking photo 8/7/69

#Bobby Beausoleil#mugshot#1969#vintage photography#manson family#vintage los angeles#vintage california#history#true crime#gary hinman#the beginning of the end#cupid

7 notes

·

View notes

Text

Ethereum (ETH): Is It Time to Classify It as a Commodity?

In a recent CNBC interview, Joseph Lubin, the founder of Consensys, made a bold statement advocating for the classification of Ethereum (ETH) as a commodity. Lubin referenced statements from regulatory bodies like the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to support his stance. Although the SEC Chairman, Gary Gensler, has recognized Bitcoin as a commodity, he has yet to explicitly acknowledge Ether in the same manner.

The Regulatory Context: Insights from Lubin

During the interview, Lubin highlighted a significant speech by former SEC official Bill Hinman in 2018. According to Lubin, this speech effectively declared Ether not to be a security. He noted that 18 of Hinman's colleagues collaborated on the speech, indicating a consensus within the SEC at that time. However, Lubin acknowledged the possibility of a few regulators who have yet to concede that Ether is not a security, but he downplayed its significance. While Lubin's statements are compelling, it is important to note that they do not have any immediate impact on the official classification of Ether. A formal recognition from Chairman Gensler and the SEC is still pending, and until then, the commodity status of Ether remains uncertain.

Industry Progress and the CeFi Rot Cleanup

Lubin also reflected on the progress made within the cryptocurrency industry over the past year. He emphasized the successful developments and launches that took place in 2022, underscoring the value of initiatives aimed at "cleaning up the CeFi rot." CeFi, short for centralized finance, has faced significant criticism in the past due to its misalignment with the decentralized ethos of cryptocurrencies. Lubin's assertion suggests that efforts to address the shortcomings of CeFi have been highly beneficial for the industry as a whole. By promoting a more decentralized approach, the industry aims to enhance transparency, security, and trust in the financial ecosystem built around cryptocurrencies. Awaiting Official Recognition Despite Lubin's argument and the apparent consensus among many within the SEC, Ether's classification as a commodity still awaits formal recognition. Chairman Gensler's acknowledgement of Bitcoin as a commodity has fueled hope among Ethereum enthusiasts, but until the SEC explicitly classifies Ether in the same manner, the uncertainty lingers.

Conclusion

Joseph Lubin's bold statement regarding the classification of Ethereum (ETH) as a commodity sparks a thought-provoking discussion within the cryptocurrency community. While Lubin draws upon supportive evidence from regulatory history, the official recognition from the SEC and Chairman Gensler remains pending. As the industry progresses and works toward cleaning up the CeFi rot, the awaited determination by the SEC will undoubtedly impact the future of Ethereum and its classification as a commodity. For more articles visit: Cryptotechnews24 Source: u.today

Latest Posts

Read the full article

#CFTC#CNBCinterview#commodity#CommodityFuturesTradingCommission#Consensysfounder#ETH#Ethereum#regulatorybodies#SEC#U.S.SecuritiesandExchangeCommission

0 notes

Text

Heres How Coinbase Suing The SEC Helps Ripple In Its Case

Here’s How Coinbase Suing The SEC Helps Ripple In Its Case https://bitcoinist.com/heres-how-coinbase-suing-sec-helps-ripple/ Coinbase filed a lawsuit against the Securities and Exchange Commission (SEC) in the US Circuit Court today, which will also be of paramount importance to Ripple Labs and its legal battle against the agency. In a blog post, the largest US crypto exchange shared that the lawsuit is about a decision on a July 2022 petition. Coinbase wants to force the SEC to respond with a “yes” or “no” to the petition, in which they ask the SEC to use its formal rulemaking process to provide guidance for the crypto industry. The agency is required by law to respond to the petition within a timely manner. To date, however, the SEC has not met with a response – as Coinbase alleges, intentionally. Coinbase claims that the SEC has already made up its mind, but does not want to communicate a decision, as was evident during chairman Gary Gensler’s hearing before the US Congress last week. By refusing to answer, however, the SEC is depriving Coinbase of the possibility of a judicial review: If the SEC says no to our rulemaking petition, which it has the right to do, then Coinbase would be allowed to challenge that decision in court […] So it’s important for the SEC and any other agency petitioned for rulemaking to respond to the petition […] – otherwise the public can never exercise its right to ask a court if the agency’s decision was proper. The lawsuit filed by Coinbase therefore simply asks the court to require the SEC to communicate its decision. “We are simply requesting that the Court order the SEC to respond at all, which they are legally obligated to do,” Paul Grewal (chief legal officer of Coinbase) wrote in the blog post. The Significance For Ripple Vs. The SEC In addition to the regulatory clarity that Coinbase’s lawsuit could provide, it may also have a direct impact on the legal battle between Ripple and the SEC. As XRP community attorney John E. Deaton explained via Twitter, it’s the second Writ of Mandamus filed in relation to crypto. “I love the petition because I filed crypto’s 1st Writ of Mandamus when I sued the SEC asking a judge to order the SEC to do its job and amend the Ripple Complaint to include only direct sales by Ripple,” Deaton remarked. Beyond that, Coinbase’s lawsuit against the SEC has yet another significance for Ripple. Attorney Bill Morgan argues that Coinbase, like Ripple, relied on the Hinman speech, in which he made a purported ruling for the second-largest cryptocurrency, Ether (ETH). Whether the argument is powerful, remains to be seen. As Morgan explains, the SEC claims that the Hinman speech was about personal views of the former department head. To date, no court has found that Hinman’s speech was an official SEC statement. However, an opinion by SEC Commissioner Hester Peirce, which Coinbase cites, could be helpful because it shows that market participants who attempted to act in good faith were subject to enforcement actions. The assertion of Hester Pierce is all so not an official SEC position but is more helpful to Coinbase because it shows that those market participants who are trying to act in good faith are being subjected to enforcement actions. /3 pic.twitter.com/oEjRqykCKI — bill morgan (@Belisarius2020) April 25, 2023 Morgan’s conclusion is: Whatever you say about whether or not cryptos are securities and assuming the registration process is not suitable for cryptos this paints the SEC in a bad light and acting with an agenda. Coinbase’s lawsuit should thus provide another compelling argument for Ripple and its fair notice defense. As Bitcoinist reported, a ruling from Judge Torres of the U.S. District Court of Southern New York could come any day now. At press time, the XRP price was at $0.4563. via Bitcoinist.com https://bitcoinist.com April 25, 2023 at 01:00PM

0 notes

Photo

New Post has been published on http://cryptonewsuniverse.com/2023-predictions-for-the-crypto-industry-is-the-tide-turning/

2023 Predictions For The Crypto Industry Is The Tide Turning?

2023 Predictions For The Crypto Industry. Is The Tide Turning?

Across the board, 2022 was a crazy year and devastating for most. In terms of the crypto market, it was arguably the most unsettling year since its inception. A series of unprecedented events, like prominent altcoins plummeting to almost zero, companies going bankrupt, and $billions being hacked, are just a few.

So what’s in store for 2023? Will it be bullish or bearish for the crypto market? Although many pundits postulate the coming year in crypto, I have outlined ten predictions from a reputable source, Guy, the investigative presenter at Coinbureau.com, which explains why they're likely to occur and how they could affect the crypto market. I offer my 2 cents worth also. #1. Crypto Market Begins To Recover

The first prediction tends to be positive, with Guy suggesting the crypto market will improve, albeit not a bull market as we know it. The worst of the bear market will be behind us by the end of this year. The primary reason the crypto bear market could bottom in Q1 is that the Federal Reserve is expected to stop raising interest rates. Notably, stopping interest rates is not the same as lowering them, but it will likely be enough to prevent crypto from crashing further. Likewise, the bottom for BTC will likely come in the first quarter and could be 10K or slightly lower, with the main reason being that the stock market has yet to find its bottom, and the crypto market is highly correlated to the stock market. The stock market is expected to drop by another 20 to 30%, translating to a 40 to 60% drop in BTC's price.

It’s important to point out that BTC could flash crash lower than 10K due to a crypto-specific factor such as a Bitcoin mining ban due to energy shortages. Also, Mount Gox creditors could sell the BTC they were due to receive in Q1; however, more recent news states the Mt. Gox payouts have been postponed till September.

#2. SEC Crack Down Seems Likely

The second crypto prediction for 2023 is that the Securities and Exchange Commission (SEC) will crack down on another big crypto project or company. The presenter opines that another crackdown seems highly likely if Gary Gensler continues to be the chairman of the SEC. Gary's term will expire in 2026, so there's a lot of time for him to do damage, assuming he won't be expelled from the SEC for his close encounters with Sam Bankman Fried and FTX.

The criteria the SEC has been using to crack down on cryptocurrency have yet to be made clear. These opaque criteria can be summed up as a subjective interpretation of the fourth part of the Howey test. For context, the Howey test is used to assess whether an asset is a security, such as a stock in a company that requires additional regulation from the SEC.

Image source: NickGrossman.xyz

The fourth part of the Howey test is the most relevant to crypto if an asset can identify a third party creating an expectation of profit for a coin or token” Gary Gensler has made it clear that no cryptocurrency is safe aside from BTC. He's even targeted stablecoins, which makes no sense. This could mean that every cryptocurrency besides BTC on an exchange is a potential target, particularly POS cryptos.

However, the former director of the SEC’s Division of Corporation Finance, William Hinman, said cryptocurrencies must be "sufficiently decentralized" not to be deemed securities. Coin Center does not believe that the technological differences between POS and POW warrant any different treatment. And that it’s a misconception of policymakers that “staking” and “staking rewards” is some kind of security or interest-bearing lending activity that should be subject to regulation.

It will be interesting to see if Gary Gensler gets his way and if so, a first-quarter crackdown could be a catalyst for crypto lows.

#3. Good And Bad Crypto Regulations

Guy’s third prediction for 2023 is that there will be many crypto regulations, which suggests that most of these regulations will be good; however, a few will not. It’s also very likely that crypto regulations will vary from region to region, despite attempts to create global crypto rules. The European Union's Markets In Crypto Assets (MiCA) finalized its laws to be released in early 2023. Although they won't be coming into force for another one to two years after that, they will give institutional investors regulatory clarity for crypto.

The absence of regulatory clarity is why institutions have been hesitant to invest in crypto, especially altcoins. Establishing regulatory clarity in the EU and elsewhere could result in lots of inflows and contribute to a Q1 recovery for crypto. More importantly, crypto regulations will effectively force crypto projects to decentralize. This is because the only way to avoid many of these regulations will be to be decentralized from top to bottom.

Some crypto regulations are likely to be adverse concerning payments, DeFi, and privacy. That's because all of these niches are a threat to the traditional financial system. Fortunately, the crypto industry is likely to grow significantly with sound regulations. Furthermore, an increase in adoption and capital will likely make it possible for the crypto industry to lobby to remove the harmful rules. Keep in mind that powerful individuals and institutions want privacy the most.

#4. DeFi To Go Mainstream

The fourth crypto prediction is that DeFi will go mainstream due to better front-ends, regulatory clarity resulting in increased liquidity, and proof of resiliency from some DeFi protocols. This will increase trust in DeFi and decrease confidence in centralized entities in the crypto industry. Guy also states that the caveat is that harmful crypto regulations could slow the adoption of DeFi. So far, however, DeFi has yet to be included in most crypto regulations providing the protocols are genuinely decentralized.

Thankfully, most of the most significant DeFi protocols are, in fact, indeed decentralized, notably those on Ethereum. Most of the prominent DeFi protocols on Ethereum have also been tested by institutions in permissioned environments, namely Aave. It’s interesting to note that DeFi is technically a direct competitor to the traditional financial system, as it makes it possible to trade, borrow, lend and save.

Guy expresses that institutional adoption of DeFi is inevitable because many institutions have acknowledged that the advent of new technologies, such as blockchain, means there will be a race to the bottom regarding transaction fees and settlement times.

#5. Crypto Payments More Common

The fifth crypto prediction for 2023 relates to the third, and that's that crypto payments will become more common. This will again be due to a combination of better front-ends, regulatory clarity, increasing liquidity, and, most importantly, an increase in scalability that finally makes crypto payments feasible. Guy notes that his prediction comes from headlines about Ethereum founder Vitalik Buterin saying how Layer-2 scaling on Ethereum will power crypto payments.

Moreover, developers will reportedly implement Ethereum Improvement Proposal (EIP #4844) in March 2023. For those unfamiliar, EIP 4844 will increase the scalability of Layer 2s on Ethereum by between 10 and 100x. Given that most Layer 2s already process thousands of TPS, such an increase will put them on par with Visa. The author believes it’s very likely that Layer 2s on Ethereum will be ground zero for crypto payments once EIP 4844 is implemented.

He also stipulated that other smart contract cryptocurrencies will play a role, but they'll likely have to find their own niches. The catch is that increasing crypto payments could lead to more regulatory scrutiny. His greatest fear is that regulators will eventually require you to complete KYC if you want to use stablecoins on a smart contract cryptocurrency like Ethereum, quoting,

“This has been mentioned by a few regulators already. The scariest part about this possibility is that it would be easy to implement since the larger stablecoins are centrally controlled.

The silver lining is that a KYC crackdown on payments would drive innovation in the decentralized stablecoin niche. And some DeFi protocols are ahead of the curve. So to speak.”

Image source: cryptoslate.com

#6. Crypto Holders To Increase

Guy’s sixth crypto prediction for 2023 is the number of crypto holders will increase significantly. For context, crypto adoption currently stands at around 4% of the global population. It doesn’t sound like much, but the growth has been exponential, and there are many reasons why this trend will continue this year.

A significant reason is that media platforms have been integrating crypto features, such as Meta’s Facebook and Instagram, which have tested NFTs on multiple smart contract cryptocurrencies. Even Starbucks has been working on NFT loyalty and member programs on Polygon. Notably, free speech-focused social media platforms, like Telegram and Signal, have been integrating crypto features with TON coin and MobileCoin, respectively.

Markethive has taken privacy, free speech, and sovereignty on one decentralized platform to a new level involving social media and inbound marketing, including email broadcasting, content creation, press releases, sponsored articles, and page-making systems. Also, a video channel and conference room facilities make it a complete entrepreneurial ecosystem underpinned by blockchain technology and its native currency, Hivecoin.

All these companies have billions of users combined. Even just a tiny percentage of crypto adoption by their users would be significant. There are three reasons why people adopt crypto;

Speculation, in other words, profit.

Out of necessity.

Just for fun.

Given the current sideways climate, there isn't going to be too much speculative adoption in 2023. This leaves “out of necessity” and “just for fun.” While much of the crypto adoption this year will potentially be driven by “just for fun” factors such as those mentioned above with social media, there could be a surge in necessity-related crypto adoption. Many countries are on the brink of collapse due to economic, social, and political issues.

We've already seen a few of them fall, such as in Sri Lanka. Cash and crypto will be the only options when financial systems fail, especially as foreign currencies fall against the US dollar.

Hence, an ecosystem like Markethive catering to a cottage industry of entrepreneurs, business owners, and the rank and file worldwide needs a sovereign base to facilitate their operations with the opportunity to be involved in a crypto monetary system that pays the user. Markethive enables everyone to realize their potential regardless of what is happening.

#7. More Countries To Adopt BTC As A Legal Tender

The seventh crypto prediction ties into the fifth: at least one additional country will adopt BTC as legal tender. Tonga is top of the list since the island nation announced it would make BTC legal tender by Q2 and begin mining BTC with volcanoes by Q3 of 2023. The assertions for this move are a need for more financial infrastructure, reliance on remittance payments, and using a foreign currency whose monetary policy cannot be controlled, such as the US dollar.

These are the same reasons El Salvador adopted BTC as legal tender in September 2021. It's also why some Latin American countries are the most likely to follow suit. It's even why the Central African Republic adopted BTC as a legal currency in April 2022 and uses it alongside the Central African CFA Franc.

The countries adopting BTC as legal tender doesn't mean they will ditch their national currencies. It's more than likely they'll continue to use their national currencies alongside BTC, assuming there isn't a total collapse of the financial system. It's also possible that some countries will adopt cryptocurrency alongside a new central bank digital currency (CBDC). This seems unlikely, given that crypto and digital currencies are a blatant contradiction, but it has been hinted at in various reports, including one from Harvard University.

#8. Big Tech Companies Ramp Up Crypto Integrations

Guy’s eighth crypto prediction for 2023 ties into the previous two, and that's that big tech companies will continue to announce crypto Integrations. Like the countries that could espouse BTC, big tech giants are ultimately adopting crypto because they're losing money and are trying to find ways to plug the hole.

Tech giants such as Apple and Amazon have been seeking to hire people for crypto-related positions over the last couple of years. Although there haven’t been any meaningful developments from them or the other big tech companies with similar job openings as yet, those could all come sometime this year.

Although Twitter’s new owner Elon Musk is currently balancing free speech and censorship in the face of government scrutiny, he has clarified that he intends to integrate crypto features on the platform. It’s becoming clear that this is the direction big tech is moving. The crypto or NFT adoption by Facebook, Instagram, et al. mentioned above will almost certainly inspire the rest of big tech to do the same.

He also posits that big tech adoption of crypto could be related to the Metaverse because very few are fans of the centralized Metaverse that Meta has created. They know that they're nothing more than a means of extracting even more data to be sold to advertisers and shared with governments obsessed with surveillance and censorship.

Meta and others will eventually understand that the only way they can make money on this new technology is to integrate it with existing decentralized alternatives. Big tech’s role will likely involve providing hardware and access points that enhance user experience.

#9. Wall Street To Acquire Blue Chip Crypto Company

The ninth crypto prediction is that the wolves on Wall Street will acquire at least one blue chip crypto company. Guy speculates this is highly likely given that Goldman Sachs and others are interested in buying up a few subsidiaries of FTX that remain solvent. Moreover, other crypto exchanges and platforms have gone bankrupt over the last year. Celsius, BlockFi, and Voyager Digital are easy examples, and some of their business assets may be acquired by a traditional financial institution looking to offer crypto services.

There's even speculation that a megabank could acquire Coinbase like JP Morgan, because the potential collapse of troubled crypto companies in the United States, like Digital Currency Group, Greyscale, and Genesis Trading, could have knock-on effects on Coinbase. Coinbase is also involved with USDC issuer Circle, which posted a surprisingly small profit in Q3 last year.

If Coinbase stock goes low enough, there's a scenario wherein a takeover of some kind could occur. After all, Coinbase is the largest cryptocurrency exchange in the US, and the big banks on Wall Street have been watching billions of dollars flow from their accounts onto the exchange over the last two years. They've also seen how much money Coinbase can make and probably how much data it can gather.

Image source: Forbes

#10. BTC To Be Used For International Trade

The tenth crypto prediction for 2023 is that BTC will start being used for international trade. Some countries have signaled their interest in using BTC for international trade, including those that face sanctions or scrutiny from the United States and its allies. The sanctioned list was once limited to a few so-called rogue actors, but it's quickly expanding as we enter a multipolar world.

At one pole, we have the United States and its allies; at the other, we have the BRICS, Brazil, Russia, India, China, and South Africa, plus their allies. As mentioned in this article, the BRICS are reportedly working on their reserve currency, a combination of their existing currencies.

Iran has already officially approved the use of cryptocurrency for international trade, and Saudi Arabia has a renewed interest in crypto as its central bank has hired a crypto chief to boost digital ambitions. Hong Kong will also ease restrictions, and Russia appears to be working on crypto legislation. This apparent crypto adoption by the BRICS could see them add BTC to their reserve currency basket.

Once it becomes clear that BTC is a viable option, it won’t be just the so-called naughty or sanctioned nations adopting it. When that tipping point occurs, we'll see what Fidelity has called Bitcoin, a “very high stakes game theory” where countries will rapidly adopt BTC.

My Thoughts

All things considered, as I am a "glass half full" kinda gal, this year could see a positive turn for crypto on various levels. Given the turmoil and backlash crypto has received for over a decade. All the predicaments the crypto industry has found itself in have inspired new technology to mitigate the bugs and growth in maturity.

It takes decades of trial and error to implement a robust and sound financial system, and all it takes is a couple of years of onerous or corrupt leadership to bring the global economy to its knees. Although the crypto market is currently deemed low, compared to the historical highs, we see a more stabilized price action, and BTC and authentic altcoins will be considered less volatile going forward.

In other words, crypto can and will be used as intended, not for speculation but as a comprehensive cross-border payment system and a store of value inherently deflationary given its limited money supply. It will find an equilibrium and be decentralized enough to withstand the failing traditional finance systems with its inflationary fiat currency.

Editor and Chief Markethive: Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my Markethive Profile Page | My Twitter Account | and my LinkedIn Profile.

0 notes

Text

CALL TO ACTION: Debra Tate is asking for your help. We need to block the Parole of Manson Family Member BRUCE DAVIS.

You can help by calling the California Governor's office on the behalf of the Victim's Families and telling them how you feel about Davis's possible release.

Davis was granted Parole by the Parole board and his case will be reviewed by C.A. Governor Newsom on February 20th, 2021. You have until the 19th of February to call.

Thank You—SFS

http://www.noparoleformansonfamily.com

#sharon tate#no parole for manson family#manson family#california#victims rights#rights for victims#petitions#call to action#parole#american justice system#parole hearing#gavin newsom#governor newsom#ca governor#gary hinman#donald shea#shorty shea#victim rights#california residents

21 notes

·

View notes

Text

Question: If you thought Tarantino mAdE sHaRoN tAtE’s DeAtH aBoUt MeN, then who are Jay Sebring, Stephen Parent, Wojciech Frykowski, Leno Labianca, Gary Hinman? Also if you care about women so much then how come none of you mention Abigail Folger or Rosemary LaBianca?

Also, do you realize Sharon Tate would be disgusted that you think her friends’ names and legacies should be ignored in favor of her?

#once upon in hollywood#Quentin Tarantino#sharon tate#jay sebring#stephen parent#wojciech frykowski#leno labianca#gary hinman#abigail folger#rosemary labianca#not to mention the nameless people Dennis Wilson said he witnessed Manson killing

25 notes

·

View notes