#fxbrokers

Explore tagged Tumblr posts

Text

Compare AvaTrade vs Exness to choose the best forex broker in 2024. As regulated FX brokers, AvaTrade and Exness offer support for millions of global traders. Find out which broker is best suited for your goals, requirements, preferences, and risk tolerance.

#ForexBrokers#FXTrading#Brokers#StockBrokers#OptionsBrokers#FXBrokers#FuturesBrokers#AvaTrade#Exness#AvaTradevsExness

1 note

·

View note

Text

Abstract:As forex trading becomes more popular, more fraudulent brokers are beginning to lurk in this profitable market. Before one aims to make profits from the forex market, it is important to have the skills to identify fraudulent brokers. In today’s article, WikiFX will show you how to verify a broker’s regulatory status in just a few clicks.

0 notes

Text

🔥همه چیز درباره 💵بروکر لایت فارکس و دلایل محبوبیت آن

در این مقاله به بررسی تخصصی این بروکر با توجه به آخرین تغییرات در سال 2023 می پردازیم.

اما قبل از هر چیز پیشنهاد می کنیم مقاله بررسی بهترین بروکر های فارکس را جهت کسب اطلاعات بیشتر در مورد بازار فارکس و انواع بروکرها مطالعه نمایید.

این بروکر در سال 2005 با شماره ثبت 63888 و در جزایر مارشال فعالیت خود را آغاز نمود و به تازگی یعنی در سال 2021 نام خود را از لایت فارکس به لایت فاینانس تغییر داد.

شرکت لایت فایننس (LiteFinance LLC) در سنت وینسنت بعنوان یک شرکت با مسولیت محدود به ثبت رسیده و به شهروندان کشورهای اتحادیه اروپا، آمریکا ، اسراییل ، روسیه ، ژاپن و تعدادی کشور دیگر خدمات ارایه نمی دهد.

این بروکر نیز با بیش از 17 سال فعالیت در بازار فارکس جز با سابقه ترین بروکرها می باشد و جوایز ارزنده زیادی را طی سال ها فعالیت خود کسب نموده است.

همچنین در بیش از 15 کشور مانند مالزی ، قبرس ، لهستان ، قرقیزستان ، اندونزی و ویتنام دفاتر نمایندگی خود را ثبت نموده است.

این بروکر تحت رگولاتوری سایسک به فعالیت می پردازد. بروکر لایت فایننس همانند بروکر آلپاری به زبان های متنوعی مانند فارسی و انگلیسی و عربی و ترکی و چندین زبان دیگر به کاربران خود خدمات ارایه ��ی دهد.

این بروکر به گفته خودش از اولین بروکر هایی بوده که حساب سنتی با حداقل موجودی 1 دلار را ارایه کرده و امکان دسترسی بسیاری از افراد با سرمایه کم را به بازار فارکس میسر نموده است.

دارایی های معاملاتی مختلفی مانند ارزهای فیات ، فلزات ، نفت ، شاخص های سهام جهانی ، CFD و همچنین کریپتوکارنسی ( ارز دیجیتال) در این بروکر ارایه شده است. همچنین دارای پشتیبانی 24 ساعته فارسی با سرعت پاسخگویی و کیفیت مناسب می باشد. https://viptradingcenter.com/liteforex-fxbroker/

1 note

·

View note

Photo

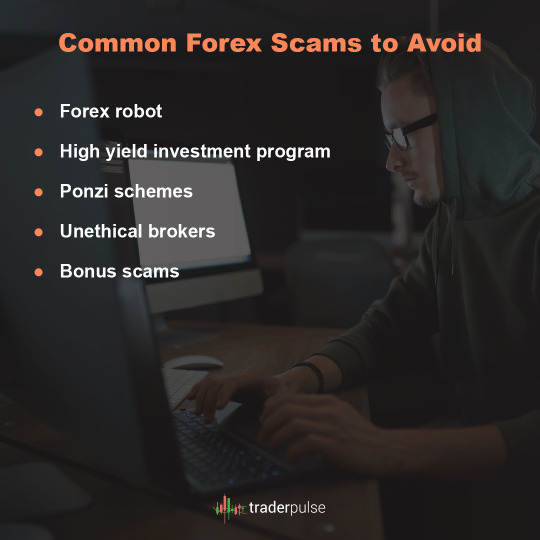

Don’t get trapped in the same way as most of the traders do.

#forexmarket#forexpair#pricelevel#opentrade#FXbrokers#GBPUSD#losingtrade#forexmistakes#forexeducation#traderpulse

1 note

·

View note

Text

Abstract:Exploring the intricate decision between acquiring an existing FX broker license and applying for a new one in the thriving world of FX brokerage, this article delves into the key factors that shape this pivotal choice.

0 notes

Photo

Watch out for these scams. Don't become a prey to these.

0 notes

Photo

Some Forex trading tips you should know.

#forex#tradingeducation#fxbrokers#tradingstrategy#riskmanagement#emotionaltrading#tradingtips#wetalktrade

0 notes

Text

The 5 Best Forex Trading Strategies for Beginners

0 notes

Text

Abstract:eToro, the popular online broker, has recently included five new commodities to its list of trading instruments. These commodities, namely $OrangeJuice, $RICE (Rough Rice), $OATS, $SoyOil, and $SoyMeal are subject to monthly expiry contracts, which means that any open trades on these markets will be automatically closed on the contract's expiration date.

#forex#Forextrader#Forextrading#forexsignals#ForexLife#forexmarket#eToro#fxbrokers#forexTraders#forexlifestyle#forexentourage#forextrading

0 notes

Photo

10 Must Have Indicators by Expert Traders

1 note

·

View note

Text

Bullish investors believe stocks are going up. ... Simply put, "bullish" means an investor believes a stock or the overall market will go higher.

𝗙𝗼𝗹𝗹𝗼𝘄 𝗧𝗲𝗹𝗲𝗴𝗿𝗮𝗺 https://t.me/belleofx

Follow www.belleofx.com to receive Live Trend Alerts directly in your feed!

The best #Belleofx broker i use and recommend "Click on the link in my resume and chat live, you have a 24/7 representative to help you @belleofxofficial

0 notes

Photo

Mistakes can be costly. So, here we present most common mistakes made by traders. Avoiding them would be prudent.

#forex#fxtrading#tradingmistakes#demoaccount#fxresearch#fxbrokers#riskratio#loss#mistakestoavoid#tradingtips#traderpulse

0 notes

Photo

Take baby steps.

#fxtrading#fxbroker#technicaltool#tradingchart#moneymanagement#riskmanagement#tradingtips#wetalktrade

2 notes

·

View notes

Text

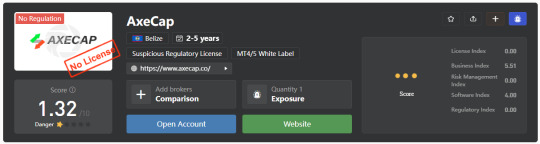

Abstract:Recently, Many platforms received a complaint from a user that he was experiencing difficulties withdrawing funds from AXECAP and Equinox Markets.

@axecapital-ms

#axecap#forexmentor#forextrading#forexschool#forexmarket#forexsignals#forexscam#FCA#scam#scamaware#ScammerAlert#Scammer#ScamAlert#Scammers#regulator#complaints#fxbroker#brokers#forex#XM#icmarkets#eToro#nordfx#startrader#hantecmarkets#VTMarkets#fairmarket#octafx#trades#AXECAP

0 notes