#futurescontracts

Explore tagged Tumblr posts

Text

Binance Faces CFTC Complaint for Breaking US Laws on Cryptocurrency Futures #binance #CFTCcomplaint #cryptocurrencyexchange #futurescontracts #UScommoditieslaws

0 notes

Text

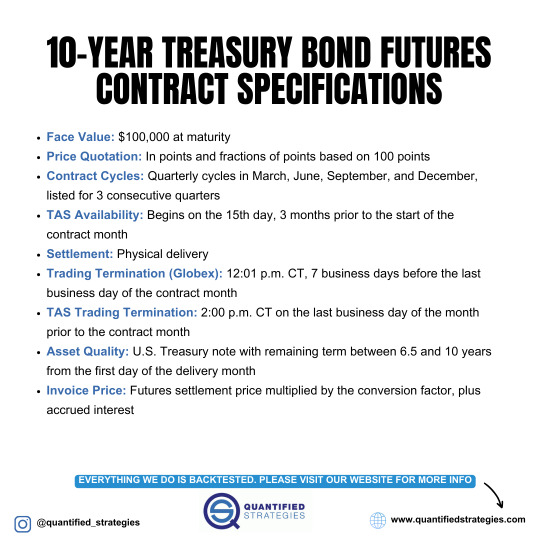

10-YEAR TREASURY BOND FUTURES CONTRACT SPECIFICATIONS

10-Year Treasury Bond Futures contracts have a face value of $100,000 at maturity. They are quoted in points and fractions of points based on 100 points. Contract cycles are quarterly in March, June, September, and December, available for 3 consecutive quarters. TAS trading begins three months before the contract month. Physical delivery settles contracts. Trading terminates on Globex 7 business days before the last business day of the contract month.

#tradingstrategies#TreasuryBonds#FuturesContracts#TradingSpecifications#Finance#Investing#CMEGroup#TradingTermination

0 notes

Link

#autosquare-off#deliverytransactions#derivativesegment#directtax#DoNotExercisefacility#FinanceMinister#futurescontracts#higherSTTrates#individualtraders#intradaytrades#NationalStockExchange#NirmalaSitharaman#options#profitabletrading#retailtraders#Sebi#stockexchange#STT

1 note

·

View note

Video

youtube

Mastering the Art of Derivatives Trading in the Bitcoin Market - The Secrets Revealed!

#BitcoinMarket #DerivativesTrading #CryptocurrencyInvestment #Volatility #SecretsRevealed #NextLevelStrategies #CryptoDerivatives #FuturesContracts #OptionsTrading #HedgingBets #AmplifyGains #Leverage #RiskManagement #BingXExchange #UserFriendlyPlatform #CustomerSupport #Research #MechanicsOfDerivatives #PotentialRisks #StayDisciplined #CoolHead #AffordToLose #UnlockSecrets #DominatingBitcoinMarket #ReferralCode #911

#youtube#bitcoinmarket#derivativestrading#cryptocurrencyinvestment#volatility#secretsrevealed#secrets revealed#nextlevelstrategies

0 notes

Text

Grid Trading Explained - How To Cash Out Daily From Binance Futures!

Grid Trading On Binance Futures - Futures trading made easy - Automated crypto derivatives contracts trading - benefits traders of all levels #cryptoderivatives #futurescontracts #symbols #gridtrading #limitorders #longsell #shortsell @BinanceFutures

In this post, I explained Grid Trading, a strategy that will help you cash out daily from Binance Futures. If you wish to make guaranteed profits from futures trading, this might just be what you need. Both new and expert traders can make profits without stress using Grid Trading. It will help you make profits on small price fluctuations in volatile and sideways markets. Sounds cool, huh?…

View On WordPress

0 notes

Text

Know #SteelTerminologies: Futures contract

#Steel #SAIL #SAILSteel #Knowledge #Learning #alloys #SteelTechSeries #Capesize #Panamax #FuturesContract

0 notes

Text

FTX Launches FTT Token: A Transparent & Inclusive Crypto Alternative #Bitcoin #collateral #cryptocurrencyderivativesexchange #dailytradingvolumes #decentralizedandtransparentalternative #decentralizedderivativesexchange #decentralizedfinanceDeFi #DeFisolutions #ERC20standard #Ethereum #ethereumblockchain #Fees #FTTtoken #Ftx #futurescontracts #governancetoken #inclusiveanddemocraticalternative #institutionalinvestors #leaderinDeFispace #options #payments #perpetualswaps #settlements #tokensale #traditionalfinancialsystems.

#Business#Bitcoin#collateral#cryptocurrencyderivativesexchange#dailytradingvolumes#decentralizedandtransparentalternative#decentralizedderivativesexchange#decentralizedfinanceDeFi#DeFisolutions#ERC20standard#Ethereum#ethereumblockchain#Fees#FTTtoken#Ftx#futurescontracts#governancetoken#inclusiveanddemocraticalternative#institutionalinvestors#leaderinDeFispace#options#payments#perpetualswaps#settlements#tokensale#traditionalfinancialsystems.

0 notes

Link

Forward contract explained and, know what is difference between forward contract and futures contract. In this video of long short series we have covered What is Forward Contract in Derivatives Market? How Forward contract works? What are the risks associated with a forward contract? What are the drawbacks of a forward contract? Mr. Anubhav Kandpal is a Stock Market Coach, Motivational Speaker, and a great Mentor. He has cleared all 3 levels of CMT, USA(CHARTERED MARKET TECHNICIAN) and is one of the youngest to do so. He is a Trusted Mentor to over 1000+ students and has also been an Inspirational gateway to various students seeking knowledge in the stock market and providing excellence for taking themselves to the next level. . The video contents in this channel are based upon the principles of Technical Analysis, which is an analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume generated by the market activity itself. **DISCLAIMER** We are not Investment Adviser/ Stock Broker, or in any way connected to any person/agency in providing investment advice to anyone as a trader or investor. We do not provide any kind of stock recommendations, stock tips, share market tips to any person. We are strictly an educational/training center where we take Stock Market classes. Any action you choose to take in the markets is totally at your own responsibility. Investors/Traders must make their own investment decisions based on their specific investment objectives and goals and consult an independent financial advisor. Please use this video content as an educational tool only and not as trade recommendations. To know the Mechanism of Stock Market click the link below: https://www.youtube.com/playlist?list=PL7J-lfBIi_8X-iSYLwZAnEM9UHdkrEQig To join our Online Technical Analysis Classes click the link below: https://rzp.io/l/T14oC6UHco "Music: www.bensound.com" Subscribe to our channel https://www.youtube.com/channel/UCrSl4KTItEq1bQami0SlEiA Follow Us On: Facebook: https://www.facebook.com/financialnerve Instagram: https://www.instagram.com/financialnerve #Forwardcontarct #ForwardcontractvsFuturecontract #FuturesContract #Derivativemarket #basicsofstockmarket

0 notes

Text

CBOE Will Not List Bitcoin Futures in March, Cites Need to Assess Crypto Derivatives

The Chicago Board Options Exchange (CBOE) will not add a new Bitcoin (BTC) futures market in March, the firm said in a statement on March 14.

Per the statement, CBOE is re-evaluating how it approaches trading digital assets. CBOE said:

“CFE is not adding a Cboe Bitcoin (USD) (“XBT”) futurescontract for trading in March 2019. CFE is assessing its approach with respect to how it plans to continue…

View On WordPress

0 notes

Photo

CFA Level 1 (2020) Reading 48 – Derivative Markets and Instruments http://ehelpdesk.tk/wp-content/uploads/2020/02/logo-header.png [ad_1] AnalystPrep's CFA Level 1 Video ... #accounting #algorithmictrading #arbitrage #cfa #cfalevel1 #creditderivatives #daytrading #derivativemarketsandinstruments #excel #finance #financefundamentals #financialanalysis #financialmanagement #financialmodeling #financialtrading #forex #forwardcontracts #futurescontracts #investing #investmentbanking #optionscallsandputs #optionstrading #personalfinance #stocktrading #swaps #technicalanalysis

0 notes

Text

Foreign fund outflow accelerates to RM275.7mil #KualaLumpur #PalmOil #FuturesContract #BursaMalaysia #Malaysia #Philippines #UAE #UnitedArabEmirates #Outflow #Momentum #Bursa #Tonne #MarketTrend #Venezuela #VietnameseLanguage #KimJongun #KimJongnam #VX #Immigration #JackSheldon #ThisWeek #Manila #EtihadAirways #BigBoys #Captain #Dubai #Cricket #Aryan #AsiaCup #InternationalCricketCouncil #Under19CricketWorldCup KUALA LUMPUR: The momentum of foreign net selling activity on Bursa picked up last week, extending the selling streak to the sixth week, according to MIDF Research. https://cricmain.com/2019/05/06/foreign-fund-outflow-accelerates-to-rm275-7mil/

0 notes

Text

Shared PDF Book Trading Strategies for Capital Markets

Introdution About This Book: In his superbly entertaining and informative book, Hedgehogging,investment guru Barton Biggs quotes Charlie Munger, alter ego ofWarren Buffett and vice chairman of Berkshire Hathaway: “I have knownno wise person over a broad subject matter who didn’t read all the time—none, zero. Now I know all kinds of shrewd people who by staying withina narrow area can do very well without reading. But investment is a broadarea. So if you think you’re going to be good at it and not read all thetime, you have a different idea than I do....You’d be amazed at howmuch Warren [Buffett] reads. You’d be amazed at how much I read.” In its2005 listing of the world’s 400 richest people, Forbes described Munger asa self-made man with a net worth at $1.7 billion, making him number 387.This is a book about trading and financial markets that takesMunger’s advice seriously. It borrows insights from many disciplines andcasts a wide net in the search for perspective. It uses financial history todevelop an understanding of market institutions and to provide a filter forviewing current market practice. It uses finance theory as a framework foranalysis and to build a toolbox that traders can use as they battle in thetrenches, which is where it really counts. In this respect, the book seeks toplace the markets and trading strategies in the bigger picture of the globalpolitical economy. It describes how the capital markets work in practice;what the drivers are, how they can be recognized, and how sensible trading strategies can be developed and implemented. Above all, the bookunderstands markets to be dynamic real-time reflectors of the world inwhich we live, rather than mathematical abstractions.Financial markets are rational (but not perfect) discounters of events,information, and trends. However, the book presents an argument (alongwith evidence) that some bets in the market are better than others. That is,1IntroductionCopyright © 2007 by Joseph Benning. Click here for terms of use.there are some bets that have a demonstrably better chance of success,with less risk. The market is not a strictly random walk. While some maybe fooled by randomness, in Nicholas Taleb’s memorable phrase, thisbook argues that the opposite can be the case as well: Nonrandom eventsare sometimes incorrectly attributed to chance. The result is that valuableopportunities are missed. The underlying thrust of strategy should be totake a broad enough view of events to be able to recognize favorable conditions and capitalize on them, a modus operandi similar to card countingat blackjack, but infinitely more complex.The book is divided into three sections. The first presents a conceptual framework for market analysis. It can be thought of as a road map tothe discussion that follows. The second section explores core elements ofthe capital markets. It describes market organization; key elements of thesecurities and derivatives that account for the bulk of the instrumentstraded, and key price drivers. With the liberal use of examples, it goes onto elucidate different trading strategies and how to implement them,depending on market view. Finally, the last section considers risk management, reviews some recent developments in behavioral finance research,offers a view of how markets function, and sums up.THE CONCEPTUAL FRAMEWORKThe conceptual framework for the book sees financial markets not asmathematical abstractions but as engines of discovery that reflect the economic, political, and social forces that shape—and are shaped by—thesocieties in which they reside. Accordingly, the model presented to organize this discussion is a qualitative one. It portrays the markets in terms ofcycles, big ones and little ones. The little ones are business cycles. The bigones can be sparked by major events, or they can gather force as trends inapparently unrelated areas coalesce and produce discontinuities that resultin rapid and unexpected change. These discontinuities can produce effectsthat ripple through financial markets for years or even decades to come.The idea that ripple effects can affect prices down the road years laterin a predictable way is controversial. Many, if not most, finance theorists(though not practitioners) subscribe to the idea that markets quickly, almostinstantaneously, absorb and discount new information. Market prices are acombination of random noise and reaction to new information. The newinformation is thought to be quickly reflected in market prices, which area reasonably accurate assessment of fundamental values, on average, overtime. If prices do fall temporarily out of line, arbitrageurs will buy thecheap securities and sell the expensive ones until their prices revert back totrue fundamental values. Sometimes price are high; sometimes they arelow, but over time and on average they are priced about right. Markets aremean-reverting, or at least sufficiently so, so that no one is able to beat the2 Introductionaverage on a risk-adjusted basis over time. That, in a nutshell, describes thecore of the efficient market hypothesis (EMH).This book has no serious quarrel with the general thrust of that argument. Considerable research has shown that most new information is in factdiscounted fairly quickly. Among the more compelling evidence offered isthe fact that no one has shown a way in which the market can be beaten systematically over time, after adjusting for risk. The view developed here isfrom a different perspective. It is that there are market tipping points wherethe odds of generating trading profits are better than average. In that sense,a successful trader is like a blackjack player who is adept at counting thecards. But there is an important difference. Successful card counters are routinely escorted out of the casino. In the financial markets the players aretypically given broad hints about policies likely to affect market prices.Knowing how to interpret those hints and act on them is critical to successful trading. But that requires understanding the historical forces that drivemarkets and the economic, political, and social institutions that guide them.Note the idea that there are historical forces in play. The Danish philosopherKierkegaard is credited with making the observation that life must be livedforward, but can only be understood backwards. So we must understand history. As history unfolds, so do markets. The pace is uneven, filled with discontinuities. But understanding history provides both a framework and alens for viewing and understanding market behavior.This book suggests that while most information is rapidly incorporated into market prices, not all of it is, at least not immediately. Sometimes it takes the market rather a while to fully incorporate newinformation into the price structure. Recognizing and acting on situationslike this is the trader’s equivalent of card counting. But that is difficult formany traders to do. There is always the uncomfortable feeling of the trainhaving left the station. And it is difficult to act without putting themarket’s behavior in some kind of recognizable context that gives structure to decision making. Accordingly, the market model presented in thefirst chapter is designed to help structure decision making in such a waythat the odds of success are better than they ordinarily would be.After the model is presented, the first section goes on to detail economic, political, social, and institutional developments that have shaped(and continue to shape) the capital markets. An important part of the story,often forgotten, is that history, institutions, and culture matter. Financialmarkets do not exist in a vacuum. They function in the rough and tumbleof the real world; they have long memories, pace Harry Markowitz, andthey exhibit recurrent patterns of behavior. It is temptingly easy to beseduced by the four most dangerous words in the English language: “Thistime it’s different.” Trying to trade without putting market behavior insome sort of political, institutional, and historical context is simply askingfor trouble.Introduction 3INSTRUMENTS, INSTITUTIONS, AND RISKThe second section of the book concerns the instruments and institutionsof the marketplace. It discusses key characteristics of the major instruments in the major market sectors. Treasury notes, bills, bonds, and repurchase agreements are covered on the debt side, as are Chicago Board ofTrade Treasury futures and federal funds. Eurodollar futures contracts arebriefly discussed. The mechanics of swaps and options are considered. Onthe equity side indexes such as the Dow Jones 30 Industrials, the S&P500, and the Russell 2000 are analyzed, as well as the companion futurescontracts that trade against them. Gold, though not a capital market instrument, is followed by many market professionals and is regarded by manyas the canary in the coal mine. It is also central to the story of the formation of modern capital markets. Accordingly, some notes on gold tradingare included as well.On the debt side of the equation, considerable time is spent on Fedpolicy, the yield curve, and Treasury futures contracts. Pricing modelsbased on the yield curve and Fed policy are developed. Market structureand the mechanics of Treasury auctions come in for some discussion.Some rationales for adopting trading strategies based on monetary policyare explored. Methods of strategy implementation are examined as well.The chapter on basis trading reviews the traditional cash-and-carry modelusing Chicago Board of Trade (CBOT) Treasury bond and note futurescontracts. Specifics of the delivery process and its relevance to basis trading are considered using numerous examples.With respect to equities, the book reviews some of the more prominent stock pricing models and criticisms of them. It examines three prominent U.S. equity indexes and the methodology used to construct them andtheir usefulness as benchmarks. It discusses important structural features ofequity markets, requirements for exchange listing, valuation theories, andtheories of market timing. It also takes a look at exchange traded funds(ETFs), their pricing and uses. In addition to cash market indexes and ETFsthis section devotes a chapter to equity index futures contracts. Particularattention is paid to the cash-and-carry model. Several examples are provided for calculating the fair value of equity index futures contracts, giventhe cash index price. Strategies discussed for equity indexes include program trading, growth versus value, trading sectors against broad-basedindexes, and correlation trading against other indexes and ETFs.The third and final section of the book surveys some recent developments, touches on value at risk (VaR) as a framework for risk management, discusses gold markets, considers market volatility, and examinessome of the more important criticisms behavioral finance has leveled atthe neoclassical model. Finally, it offers a summary and suggests thatthere is an art to trading that combines analysis and interpretation.

0 notes

Text

Crypto Currency Codex

Learn the one simple underground method derived from sophisticated patterns created by Russian traders to profit immensely from any crpytocurrency - regardless of what's going on in the market. Just watch this special presentation and you'll learn about this low cost and almost risk free method... https://showwaysnow.com/crypto-currency-codex-2/ #BusinessFinance, #Cryptocurrency, #CryptocurrencyInstitute, #Decentralization, #Economy, #Finance, #FinancialMarket, #FinancialTechnology, #FuturesContract, #Money, #ShareTrading, #StepByStepSolution, #Trader, #Uberisation #CryptocurrencyTopSecret

#Business Finance#cryptocurrency#Cryptocurrency Institute#Decentralization#Economy#Finance#Financial market#Financial technology#Futures contract#Money#Share trading#step-by-step solution#trader#Uberisation#Cryptocurrency Top Secret

0 notes

Text

Market Crisis Looms as SEC Targets Hedge Fund Strategy: Implications for Investors and Fair Markets #bondmarket #CEO #CitadelSecurities #fairmarkets #financialmarkets #future #futurescontracts #GaryGensler #hedgefundactivity #hedgefunds #illegal #implications #industryexperts #investors #KenGriffin #liquidity #manipulation #marketcrash #marketcrisis #naturalfunctioning #newrules #profitablestrategy #regulatorycrackdown #rootcauses #SEC #SecuritiesandExchangeCommission #tension #transparency #Treasurybasistrade #U.S.Treasurybonds #volatility #yields

#Business#bondmarket#CEO#CitadelSecurities#fairmarkets#financialmarkets#future#futurescontracts#GaryGensler#hedgefundactivity#hedgefunds#illegal#implications#industryexperts#investors#KenGriffin#liquidity#manipulation#marketcrash#marketcrisis#naturalfunctioning#newrules#profitablestrategy#regulatorycrackdown#rootcauses#SEC#SecuritiesandExchangeCommission#tension#transparency#Treasurybasistrade

0 notes

Text

Crude Oil Price Update – Market Set-up for Near-erm Pullback into $60.44

Gold Silver Reports – Crude Oil Price Update – Market Set-up for Near-erm Pullback into $60.44 — February West Texas Intermediate (WTI) Crude Oil futures are trading lower on Friday after hitting a 3-year high the previous-session. Traders are rolling into the March contract but the higher volume is still in the February futurescontract. We’ll pick up the March contract on Monday.

(more…)

View On WordPress

0 notes

Text

Bitcoin pauses below record peak; gained 55 percent in November

New Post has been published on https://lawyer800marketing.com/business/bitcoin-pauses-below-record-peak-gained-55-percent-in-november/

Bitcoin pauses below record peak; gained 55 percent in November

Local vanity Numbers:

SYDNEY (Reuters) – Bitcoin hovered around $9,600 in volatile trade on Friday, after tumbling about 15 percent from an all-time high hit this week as some money managers warned ominously of a bubble and further falls in the stratospheric cryptocurrency.

FILE PHOTO: A copy of bitcoin standing on PC motherboard is seen in this illustration picture, October 26, 2017. REUTERS/Dado Ruvic/File Photo

Bitcoin was last down around 3.4 percent at $9,612.60 on the Luxembourg-based Bitstamp exchange, from a record peak of $11,395 set on Wednesday. On Thursday, it went as low as $9,000. BTC=BTSP.

The latest slide has tempered an astronomical rise in recent months: Bitcoin had jumped almost 1,100 percent year-to-date on Wednesday. As of 0200 GMT, it was still up around 915 percent.

One wealth manager said technical chart analysis was predicting deeper falls.

“A correction could bring bitcoin back to its previous level of chart support of around $7,500. That’s over a 20 percent drop from its current price,” said Shane Chanel, equities and derivatives adviser at ASR Wealth.

“Without everyday utility, pure speculation is driving prices at the moment. Traders are forced to use technical indicators to make buy and sell decisions.”

Despite its massive fall this week, bitcoin still ended November 54.6 percent higher, its best monthly performance since a near 66 percent gain in August.

The cryptocurrency has posted monthly losses only three times in 2017.

Bitcoin’s rise has been fueled by signs that the digital currency is slowly gaining traction in the mainstream investment world, as well as by increasing public awareness.

Several large market exchanges including Nasdaq, CBOEHoldings and CME Group — the world’s largest derivativesexchange — have said they are planning to provide futurescontracts based on bitcoin.

Bitcoin’s rapid ascent has prompted warnings from a streamof prominent investors that it had reached bubble territory.

The deputy governor of the Bank of England on Wednesday said investors should “do their homework” before investing in the digital currency.

Bitcoin investments are seen as mere speculation because demand has skyrocketed without fundamentals backing the cryptocurrency, said Jin Yong-jae, a Seoul-based economist at HI Investment & Securities.

That has made the price of bitcoin “very much volatile,” Jin added.

“There are people who invest in bitcoin for its future value, but most seem to be just jumping on the bandwagon, without being fully aware of the structure or how it will replace actual currencies in the future.”

Others are unfazed by talks of a bubble, though, predicting still further gains.

“The number of bitcoins that can be mined is limited to 21 million, of which 16.5 million bitcoins are already in circulation,” said Siddharth Agarwal, lead financial analyst at research firm GlobalData.

“As bitcoin mining becomes increasingly difficult, this could further drive bitcoin prices upwards.”

Reporting by Swati Pandey; Additional reporting by Dahee Kim in SEOUL and Abhinav Ramnarayan in LONDON; Editing by Kim Coghill

Our Standards:The Thomson Reuters Trust Principles.

http://vanity123.com

0 notes