#funders of special loan companies

Explore tagged Tumblr posts

Text

Unlocking Financial Stability with Business Cash Flow Loans

In today's fast-paced business environment, maintaining a healthy cash flow is crucial for the sustainability and growth of any enterprise. Companies often face various financial challenges that can disrupt their operations and hinder progress. This is where business cash flow loans from Pulse Cashflow come into play. These specialized financial solutions help businesses navigate through cash flow difficulties and ensure smooth functioning.

Understanding Business Cash Flow Loans

Business cash flow loans are financial products designed to provide companies with the necessary funds to cover operational expenses and manage cash flow gaps. These loans are particularly beneficial for businesses experiencing seasonal fluctuations, delayed payments from clients, or unexpected expenses. By securing a business cash flow loan, companies can maintain liquidity and avoid disruptions in their operations.

The Role of Pulse Cashflow in Supporting Businesses

Pulse Cashflow is a leading independent funder specializing in invoice finance. With a strong commitment to helping businesses overcome cash flow challenges, Pulse Cashflow offers tailored financial solutions that cater to the unique needs of each client. Their expertise in invoice finance enables businesses to unlock the value of their unpaid invoices and access immediate working capital.

How Business Cash Flow Loans Work

Business cash flow loans work by providing businesses with an advance on their outstanding invoices. Pulse Cashflow purchases the invoices at a discounted rate and provides the business with the funds upfront. Once the invoice is paid by the customer, the remaining balance is settled, minus a small fee for the service. This process allows businesses to convert their receivables into immediate cash, improving their cash flow and enabling them to meet their financial obligations.

Benefits of Business Cash Flow Loans

Improved Cash Flow: Business cash flow loans provide immediate access to working capital, helping businesses manage their cash flow more effectively.

Flexible Funding: These loans can be tailored to the specific needs of each business, ensuring that they receive the right amount of funding at the right time.

No Debt Accumulation: Unlike traditional loans, business cash flow loans do not add to the company's debt. Instead, they leverage existing receivables to provide funding.

Quick Approval Process: The application and approval process for business cash flow loans is typically faster than traditional loans, allowing businesses to access funds quickly.

Focus on Growth: With improved cash flow, businesses can focus on growth and expansion opportunities, rather than worrying about short-term financial challenges.

Case Study: A Success Story

Consider a manufacturing company that experiences seasonal fluctuations in sales. During peak seasons, the company receives a large number of orders, but the payment terms often extend to 60 or 90 days. This creates a cash flow gap, making it difficult to cover operational expenses and pay suppliers on time.

By partnering with Pulse Cashflow and utilizing their business cash flow loans, the company can unlock the value of its outstanding invoices and access immediate working capital. This allows the company to maintain smooth operations, pay suppliers promptly, and take advantage of growth opportunities during peak seasons. As a result, the company experiences improved financial stability and sustained growth.

Choosing the Right Partner: Pulse Cashflow

When it comes to securing business cash flow loans, choosing the right financial partner is crucial. Pulse Cashflow stands out as a trusted and reliable partner, offering a range of benefits to businesses:

Expertise and Experience: With years of experience in invoice finance, Pulse Cashflow understands the unique challenges faced by businesses and provides tailored solutions to address them.

Personalized Service: Pulse Cashflow takes the time to understand the specific needs of each client and offers personalized financial solutions that align with their business goals.

Competitive Rates: Pulse Cashflow offers competitive rates and transparent pricing, ensuring that businesses receive the best value for their money.

Strong Track Record: Pulse Cashflow has a proven track record of helping businesses improve their cash flow and achieve financial stability.

Contact Pulse Cashflow Today

If your business is facing cash flow challenges, it's time to consider the benefits of business cash flow loans from Pulse Cashflow. With their expertise in invoice finance and commitment to client success, Pulse Cashflow can help your business navigate through financial difficulties and achieve long-term stability.

For more information, contact Pulse Cashflow today:

Registered Office: The Grosvenor, Basing View, Basingstoke, Hampshire, RG21 4HG

Phone: 0845 539 7003

Email: [email protected]

Visit their website at Pulse Cashflow to learn more about their services and how they can support your business.

Conclusion: Empower Your Business with Financial Stability

In conclusion, managing cash flow is a critical aspect of running a successful business. Business cash flow loans provide a practical and effective solution to address cash flow challenges and ensure smooth operations. By partnering with Pulse Cashflow, businesses can access immediate working capital, improve financial stability, and focus on growth and expansion.

Don't let cash flow issues hold your business back. Explore the benefits of business cash flow loans and take the first step towards financial stability today. Pulse Cashflow is here to support your business every step of the way, providing the expertise and solutions you need to thrive in a competitive market.

Contact Pulse Cashflow today and unlock the potential of your business with tailored financial solutions that work for you.

0 notes

Text

It’s Morally Intolerable for the Privileged to Profit from this Emergency

Societies gripped by cataclysmic wars, depressions, or pandemics can become acutely sensitive to power and privilege.

Weeks before the coronavirus crushed the U.S. stock market, Republican Senator Richard Burr used information gleaned as chairman of the Senate intelligence committee about the ferocity of the coming pandemic to unload 33 stocks held by him and his spouse, estimated at between $628,033 and $1.72 million, in some of the industries likely to be hardest hit by the global outbreak.

While publicly parroting Trump’s happy talk at the time, Burr confided to several of his political funders that the disease would be comparable to the deadly 1918 flu pandemic.

Then the market tanked, along with the retirement savings of millions of Americans.

Even some pundits on Fox News are now calling for Burr’s resignation.

When society faces a common threat, exploiting a special advantage is morally repugnant. Call it “Burring.” However tolerable Burring may be in normal times, it’s not now.

In normal times, corporations get special favors from Washington in exchange for generous campaign contributions, and no one bats an eye. Recall the Trump tax cut, which delivered $1.9 trillion to big corporations and the wealthy.

Yet the coronavirus should have altered business as usual. The most recent Senate Republican relief package, giving airlines $58 billion and more to other industries, is pure Burring.

Senate Majority Leader Mitch McConnell tried lamely to distinguish it from the notorious bank bailouts of 2008. “We are not talking about a taxpayer-funded cushion for companies that made mistakes. We are talking about loans, which must be repaid, for American employers whom the government itself is temporarily crushing for the sake of public health.”

But the airlines are big enough to get their own loans from banks at rock-bottom interest rates. Their planes and landing slots are more than adequate collateral.

Why do airlines deserve to be bailed out? Over the last decade they spent 96 percent of their free cash flow, including billions in tax savings from the Trump tax cut, to buy back shares of their own stock. This boosted executive bonuses and pleased wealthy investors but did nothing to strengthen the airlines over the long term. Meanwhile, the four biggest carriers gained so much market power they jacked up prices on popular routes and slashed service (remember leg room and free bag checks?)

United CEO Oscar Munoz did his own Burring last Friday, warning that if Congress doesn’t bail out the airline by the end of March, United will start firing its employees. But even if bailed out, what are the odds United would keep paying all its workers if the pandemic forced it to stop flying? The bailout would be for shareholders and executives, not employees.

While generous toward airlines and other industries, the Republican bill is absurdly stingy toward people, stipulating a one-time payment of up to $1,200 for every adult and $500 per child. Some 64 million households with incomes below $50,000 would get as little as $600. This would do almost nothing to help those who lose their jobs pay their mortgages, rents, and other bills for the foreseeable future.

The Republican coronavirus bill is about as Burring as legislation can be -- exposing the underlying structure of power in America as clearly as Burr’s stock trades. In this national crisis, it’s just as morally repulsive.

Take a look at how big corporations are treating their hourly workers in this pandemic and you see more Burring.

Walmart, the largest employer in America, doesn’t give its employees paid sick leave, and limits its 500,000 part-0time workers to 48 hours paid time off per year. This Burring policy is now threatening countless lives. (On one survey, 88 percent of Walmart employees report sometimes coming to work when sick.)

None of the giants of the fast-food industry -- McDonalds, Burger King, Pizza Hut, Duncan Donuts, Wendy’s, Taco Bell, Subway -- gives their workers paid sick leave, either.

Amazon, one of the richest corporations in the world, which paid almost no taxes last year, is offering unpaid time off for workers who are sick and just 2 weeks paid leave for workers who test positive for the virus. Meanwhile, it demands that its employees put in mandatory overtime,

And here’s the most Burring thing of all: These corporations have made sure they and other companies with more than 500 employees are exempted from the requirement in the House coronavirus bill that employers provide paid sick leave.

At a tie when almost everyone feels burdened and fearful, the use of power and privilege to exploit weakness and vulnerability is morally intolerable. Whatever form it takes, Burring must be stopped.

461 notes

·

View notes

Text

Why Work With a Mobile Home Loan Expert?

It seems like common sense that if you need financing for a mobile home, then acquiring a broker that deals with your particular needs is the obvious choice. However, many modular home buyers are deceived by desperate loan agents or companies that are well known for their experience in traditional home loans but do not know manufactured home loans, and are just trying to tap into the mobile home finance market. Only after dragging their customer through the entire process (and racking up quite a bill), does the inexperienced loan specialist realize that they could not secure financing for a modular home in the first place. To tell you the truth, many of our customers have contacted us after their former finance broker turned them away. In this situation, a customer has no choice but to start over and leave behind the fees and charges they already paid up to the sum of $1,000. If this sad scenario isn't convincing enough, you need to read the top three reasons to seek out a manufactured home loan professional to fully realize your actual financing choices.

One. The banking and real estate economy changes every day, and this includes the mobile home industry. Only a Broker in Modular Home finance will know the funders that will and wont' lend for Manufactured Home Loans. Many funders that formerly lent on Manufactured Homes, have ceased with their Manufactured Home loan programs within the past few months. Most likely, even if the funder didn't cancel their Mobile Home programs, they have changed them significantly. Only a company that specializes in Manufactured Home loans will know the true temperature of this niche industry.

Second. Manufactured Home loans maintains its own specific rules and regulations. An agent that only deals with traditional home loans does not know the intricacies of the manufactured home industry. This leaves the customer quite vulnerable to legal action if the broker's ignorance causes any legal or regulatory issues during the transaction. Modular Home sare treated very differently on both the federal and state level, and unless the agent is in the know there is great potential for a unfortunate mistake.

Third. Using a Mobile Home Loan Specialist will cost you less money, both short term and long term. Mobile Home realtors and mortgage brokers without Mobile Home know-how usually apply their stick built home finance expertise to Manufactured Homes, and this is ultimately fruitless. Usually, the unfamiliar broker will order an appraisal on a property without first checking for any comparable sales in the immediate area, which makes the home nearly impossible to lend on. This will needlessly waste $400 of your hard earned cash, and unfortunately you will have nothing to show for it. A Mobile Home Loan Broker knows the proper process, and you will take advantage of the years of expertise they already have, rather than) being drug through the learning curve of a stick built home specialist. In the end, a customer is always leaving themselves open to great risk when by not going with a loan broker that does not have Manufactured Home loan expertise Hard Money Mortgage.

The O.C. Mortgage Specialist

Ph: 949-426-7128

Address 600 W. Santa Ana Blvd. STE 114A Santa Ana, CA. 92701-4509

1 note

·

View note

Text

I've actually wanted to share this for a while now but decided to save the thought for when I was opening my Patreon special offer to fund my comic because it seemed that would be a more thematically appropriate time.

To open, did you know that Teenage Mutant Ninja Turtles started it's life as a independent comic? Kevin Eastman and Peter Laird got a loan from Eastman's uncle and drew the comic in their living room. The 'one off' comic sold thousands of copies and it's success meant that a 'one off' became a series. Now what's interesting is not just that people that wanted more pizza eating turtles got more pizza eating turtles, but that over time there were copy cat narratives. So if you were into that kind of humour and action you now also had 'Swat Cats', 'Biker Mice From Mars', 'The Mighty Ducks animated series' and an array of other equally baffling titles. Which for a 12 year old of the 80's and 90's was totally rad dude.

Thing is, independent artists can afford to be innovative where major studios cannot or will not. Despite all their resources, mass production companies are notoriously slow moving. There is a lot of money, a lot of staff, a lot of rent, a lot of insurance, a lot of investors and somewhere next to no room for error. They will not take risks. They won't ever take a gamble on style and they definitely won't take social risks that are any way divisive for their audience. Not until they’re 100% certain it will be successful and they won't know until they see someone else been successful doing it first.

It is not likely you will ever get the content you want (whether it be niche, stylistic or relating to a big social issue) by demanding it from major studios and even if you do force their hands, the content might not be sincere. They won't know what they're aiming for. It'll be flat and ordinary. It'll be the average result of everyone trying to contribute and missing the point by a mile whilst vaguely waving at it as they go by.

However, there are millions of other artists of every kind, not just comic artists, but a whole spectrum of entertainers from a mass variety of backgrounds. So it's very likely that at least several of them are already creating exactly what you want and you know this because you follow them on social media. You enjoy them more and want to see them do well however it isn't unusual that despite this the average audience will give more support to a huge studio via merch and going to the cinema even though said studios might inspire you a little bit less than @strange-user-name whose gallery or videos you scroll through at 3am.

The point is, that if you want more of a type of content that you crave then you can get it, not just by becoming some sort of patron to the artists that are already providing the content and thus get more content from them, but because that artist, if they can keep going, will inspire others to do the same. Then maybe, if there are enough people creating in a particular style or, with some representation or, with a sincerity to an issue, then you'll eventually be going to the movies to buy tickets for something you are seriously hyped about.

Also, supporting most artists is a pretty fun and simple affair. You can buy merch, get commissions, join their crowd funders, tell your friends to send audiences their way and or simply tell them you love their work and want to see more of it. We're not big companies, so that shit means a lot to us.

The power to get more of the entertainment you want comes with supporting the content you want more of and in all likelihood that content will begin with an independent artist.

Cheers for your time guys and take care,

Bear,

Patreon (all legendary patrons supporters will be able to prove said legendaryness with their name in the back on my comic)

Linktree 🌲 (other social accounts here)

#indie comics#indie comic#web comic#comic#comic artist#selkie#selkies#fantasy#fantasy art#dnd#illustration#oc#artist on tumblr#mermaid#mermay#merman#baby mermaid#mermen#comic art#dungeons and dragons#independent comic#independent artist

54 notes

·

View notes

Text

The case for international trade and post-shipment financing in India

There have been recent trade agreements between India and the UAE as well as Australia in order to support India's growing ambition to become a USD 1 trillion economy in 2030. For this objective to succeed, India intends to extend its reach to other Gulf Cooperation Council nations and to nations in the EU. These types of contracts would provide the economy with the manufacturing boost it requires to become a major supply center, resulting in business growth, job creation, and in turn enabling the economy to undergo growth and prosper.

In India, the banking sector is relatively stable. Economic targets like these will serve as the impetus for banks and other lending institutions to broaden their financing scope and appetite to cater to the needs of hungry, growing businesses. As a result of the accomplishments and development of digital payments and enhancements in the credit sector, the trade finance sector is poised to meet a rising demand for working capital. As seen in the last decade, the Indian government has supported and strengthened initiatives that have improved access to credit and payment infrastructure in the country. The government's sharp increase in capital expenditure can be viewed both as a demand-enhancing activity as well as a supply-enhancing one as it is creating infrastructure capacity for future growth and development.

Because the government is keen to support Indian business, it decided that all non-banking financial institutions would be allowed to take on factoring services, also known as post-shipment financing, rather than only specialty factoring companies. This move is intended to provide an even broader ecosystem for factoring in India and help businesses significantly by opening up further avenues for credit.

After China, India has the world's largest MSME base. They contributed 30% to India's GDP, 45% to its manufacturing, and 40% to its exports. Unlike banks, alternative trade finance companies such as Tradewind are aware of and understand regulatory requirements in the jurisdictions that they operate in; this enables them to apply credit policies to clients that banks would use, but with an eye to finding creative and resourceful solutions for their clientele. Additionally, foreign factoring companies such as Tradewind possess specialized knowledge of the underlying business that is very unlikely to be replicated by a traditional financial institution.

The credit environment in which we operate is very positive. It grants opportunities for exporters and importers to connect with trade finance funders from other markets who would be more willing to examine the transaction, who have experience assessing risks in different types of transactions, and who might feel more comfortable providing funding. This will make it easier for Indian exporters to access foreign currency loans from a trusted, established international lender, such as Tradewind, and not just from their existing Indian lenders who have limited financing expertise, experience, and exposure to foreign markets, such as the EU, US, and the Middle East.

Here’s a snapshot of how Tradewind offers post-shipment financing to Indian exporters:

Tradewind is dedicated to providing low-cost, collateral-free trade finance solutions to businesses looking for finance solutions to enable them to trade sustainably and become more competitive in the global marketplace. Our goal is to offer Indian businesses practical trade-based solutions to help them expand their foreign trade and diversify their lending sources.

To know more: https://www.tradewindfinance.com/news-resources/the-case-for-international-trade-and-post-shipment-financing-in-india

0 notes

Text

The gap in wealth in the United States between the ultrawealthy and everyone else has reached its widest point in decades. One way to narrow the divide is through the use of worker buyouts, in which ownership of a company transfers from a single person or a small number of people to the workers of the company.

Currently, about 10% of Americans hold equity stakes in their workplaces. By providing more workers and employees with opportunities to buy shares, companies can help workers and communities raise their standard of living and simultaneously feel more invested — literally — in the success of the enterprise. In that way, worker buyouts also increase firms’ competitiveness: Research suggests that employee-owned companies are more durable and resilient during economic downturns.

Workers and employees have more opportunities today than ever before to become capitalists and invest in the businesses that employ them. Baby Boomers at or near retirement age own nearly half of the privately held businesses in the United States. These 2.3 million companies employ one in six workers nationwide, or close to 25 million people. More than half of these owners expect to retire in the next 10 years, and one-quarter wish to transfer ownership of their companies to a business partner or their employees.

Such ownership structures have already proven successful: About 17 million people, or 12% of the U.S. workforce, are employed at variations of worker-owned enterprises. These companies are not just small groups of artisans or craft workers. Agricultural cooperatives Land O’Lakes and Ocean Spray have become major players in dairy production and fruit farming, earning hundreds of millions in annual revenue. And some companies with employee majority-owned stock programs, such as Publix Super Markets and outerwear maker W.L. Gore and Associates, are leaders in their industries. The largest industrial federation of worker cooperatives in the world, Mondragon Corporation, is one of Spain’s top 10 multinationals, with about $13 billion in revenue from 105 cooperatives, and 75,000 employees stretching across Europe, Asia, South America, and the United States.

Within the next decade, we expect worker- and employee-owned companies to grow in popularity thanks to three mutually reinforcing trends: First, renewed interest in ensuring the economic viability of local communities suggests that Baby Boomer owners about to retire are increasingly likely to want to sell to workers. Second, evidence is mounting that worker- and employee-owned enterprises outperform their competitors, especially during economic downturns; a recent Rutgers study found that converting to worker and employee ownership boosts profits by as much as 14%. Third, as a result of strong performances by worker- and employee-owned companies, it is becoming easier for workers to overcome arguably the biggest hurdle to worker buyouts: financing.

That’s because a growing number of funders, both social impact funds and traditional institutions, are interested in financing workers’ takeover of a company. The social impact funds want to support it for social reasons, whereas hedge funds and others are recognizing that the superior resiliency and performance of worker-owned firms can improve their returns. This funding often comes through loans or financing vehicles specially designed so that workers and employees can retire outside investors over time after achieving a certain level of earnings while protecting and even growing their ownership stake.

Already, U.S. nonprofit organizations like Heartland Capital Strategies are bringing together institutional investors, private asset managers, and worker representatives to harness some of the $13 trillion of assets in workers’ pension funds to invest in worker-friendly businesses that offer good investment returns. And companion bills developed to enable the U.S. Small Business Administration to make loans to intermediaries that help finance worker co-op transitions have been passed by the House of Representatives and the Senate.

To encourage worker buyouts, more awareness-raising initiatives are required. The general understanding of how emerging hybrid ownership models can benefit investors, business owners, workers, and community stakeholders needs to be broadened so that retiring owners and investors like private equity funds, with charters to invest in enterprises that have a positive social impact, can consider them more often. At the same time, legislative and community programs designed to support worker ownership should be expanded.

On their own merits, worker-owned businesses can show policy makers, investors, managers, and advisers that companies with democratic ownership values and structures are operated with the same profit motivation as other companies. The biggest difference is that workers have an important say in who manages them and how profits align with values. This results in inclusive workplaces that, again, often perform better, especially during recessions or slowdowns, as Mondragon has demonstrated over the past 60-plus years.

Hybrid ownership models represent the future, especially those that build more-democratic forms of ownership from the ground up. Some businesses with employee stock ownership plans (ESOPs) are converting into structures that more closely resemble worker co-ops. When the founder of Sun Light & Power, a solar power company based in California, created his succession plan recently, he worked with his employees to transition the company from a tax-advantaged ESOP, in which a company’s stock is bought by its workers and employees, to what they called an “ESOP-erative.” The company maintained the tax advantages of an ESOP, but distributed the shares in a way that would give employees with lower salaries greater voting power.

ESOPs typically allocate shares to employees in proportion to their pay. But Sun Light & Power distributed half of the founder’s shares to employees equally, 25% based on the number of years each employee had been with the company, and 25% on the basis of each employee’s salary level. It also formed a body of employees known as the “Cooperative” that was open to anyone willing to learn the basics of business finance and gave all employees the right to vote for their board of directors based on their number of shares.

0 notes

Text

How to attract Venture Capital & Angel Investment: A business plan from an investor's perspective

1.0 Introduction - Reasons for raising capital

Fundraising for startups is quite an important step and different methods are often utilized which include Venture capital, Bank loans, Crowdfunding or Angel investors.When seeking startup funding it is critical to understand what stage of maturity your enterprise has reached. It is vital to be sure that the type and stage of funding you seek is in alignment with what funders are looking for as financing can facilitate growth but it often comes at the expense of reduced equity and corporate control.

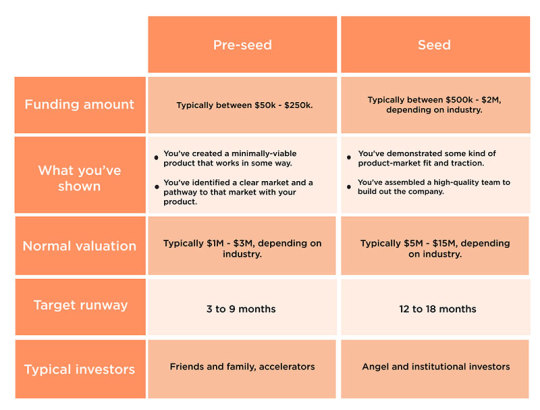

1.1 Stages of Funding

VC Pre-Seed/ Seed stage

Seed Stage capital is required to finance the early development of a new product or service.This early funding may be directed towards product development, proof-of-concept ,market research, or to cover the administrative costs of starting the enterprise. A true seed stage company has not yet established commercial operations .A startup in this phase establishes proof of concept by demonstrating a prototype(product or service) to potential customers and entices them to become sources of capital.The company’s goal in this stage is to test the market, establish the viability of the business idea, and measure interest and attractiveness to investors.

Startup stage

Financing for startups entering this phase provides funds for product development, some initial marketing and some administrative overhead.This type of financing is usually offered to recently organized companies or to those that have been in business for a short time ,but have not yet sold their product into the marketplace.Startup companies in this stage have,often times,assembled key management, prepared a proper business plan,and have conducted due diligence on the market viability of their product or service.

Early stage

Startups requiring“early”stage financing have usually been in business between 2-3years and have launched the company.The management team has been established, commercial operations have begun and funding at this stage is often required to cover cash flow requirements. Financing in this stage also strengthens capabilities in the areas of manufacturing, sales,and marketing.

Second stage capital financing facilitates the expansion of companies that are already selling products or services. At this stage a company raises additional equity capital to expand its engineering, technology platforms, sales, marketing, and manufacturing capabilities. Many companies in this stage are not yet profit-able and they often use the financing obtained in this stage to cover working capi-tal requirements, and to support organizational overhead, and inventory costs. Third Stage financing, if necessary,facilitates major expansion projects such as plant expansion,integrated marketing programs,the development of a large scale sales organization,and new product development. At this stage the company is usually a tor near breakeven or profitable.

Mezzanine Financing Phase

Mezzanine financing is a late stage form of financing for startups and is often used for major expansion of the company.This type of financing can also fund an emerging growth opportunity for the company. At this point the company may not wish to seek an additional round of equity diluting investment and may prefer the hybrid form of financing that mezzanine debt/equity financing offers.In addition, entrepreneurs may still be unable to obtain traditional bank loans at this point. Mezzanine loan investors are able to obtain a higher degree of security than an ordinary investment in equity since their rights, as debt holders, are senior to that of shareholders.

2.0 Types of funding

Angels

Once the initial start-up phase of a start-up is over, business angels often appear as the first external equity providers in the seed phase. Business angels are wealthy individuals who invest their private assets in young start-ups with great growth potential. This is done by providing venture capital in exchange for company shares. Often having been active as founders themselves or as experts in a specific industry, business angels can contribute additional expertise and an excellent network in addition to their capital and thus support the founders comprehensively. Companies that receive their first BA financing are, on average, 10.5 months old,and only just under 30% can already show sales. Once a start-up has been able to win a BA as an investor, this increases the attractiveness of the start-up for other investors as well (Denis 2004; Mitter & Kraus 2011). This signal effect is one of the most important added values offered by an angel investor, along with the contribution of one's own experience and active participation in the further development of the company. If a start-up even manages to attract several co-operating BA investors, this syndicate of co-investors, due to a wider range of non-monetary contributions, demonstrably leads to increased business performance and a higher survival rate within the next three years after the investment.

Angel Investors often provide a required round of financing to startups that are on the early stage path to profitability. In many cases,startups have overlooked the category of angel investor for their financing needs. Some academics place angel investors in the seed stage category of capital sources and others identify angel investors as filling the gap between seed stage capital and venture capital.Angel investing is in actuality,a hybrid between the two. Angel investors are often affluent people such as successful entrepreneurs, who wish to stay involved with their industry by assisting the next generation of startups. It is not just money that motivates angel investors; providing needed and valuable guidance to management of the startup is gratifying as well. Startup founders need to take a close look at their own needs and requirements before entering customized agreements with angel investors as they may find them-selves giving away more control over their companies than they really want to. Angel investors require a return on investment in the area of 20x-30x their initial investment. These investors are not interested in slow-growth or “lifestyle” busi-nesses. They are after businesses that can grow at an annual rate of 40% or more. Unlike venture capitalists (VCs), many angel investors do not calculate Internal Rates of Return (IRR) and other measures of investment performance. Angels often regard these types of calculations as too speculative. Startups can also expect a changing playing field when negotiating return expectations with angel investors

Venture Capital

The financing of angel investors is often followed by another form of external equity financing, namely venture capital (VC). Unlike business angels, VCs operate in the form of public or private investment companies that provide venture capital to start-ups. The invested sums usually comprise amounts in the millions. The primary investment targets are innovative companies with high growth potential, but which often entail a high risk . From the founder's point of view, the same applies: venture capital is attractive for start-ups with great growth ambitions and the associated high strategic uncertainty, low prospects of success, but in the case of success, strongly positive cash flows. In addition to venture capital, VCs as active investors bring their expertise and access to networks to the respective start-up as value-adding services. They also perform monitoring tasks to reduce existing information asymmetries. This active investment approach, combined with the risk taken, makes VC funds demand a higher return, which in turn leads to high capital costs compared to otherwise financed start-ups. Additionally, VC funds often require a substantial ownership share. Venture capital is a source of financing that usually follows seed stage funding and angel investor funding that is utilized in the earlier stages of the startup’s life. This type of growth financing is provided to high-potential,growth-oriented companies that require a substantial round of investment.The amounts are usually in excess of five hundred thousand dollars and up to tens of millions of dollars or more.However,it should be noted that venture capital funding can occur at any time throughout the startup’s initial phases prior to IPO.

Venture capital firms bear a high degree of risk investing in startups, including a complete loss of their investment. As such,most venture capital investments are done in a pooled for-mat,where several investors combine their investments into one large fund that invests in many different startup companies.Large pooled funds of VC firms can range anywhere in size from$25million–$1billion.The VC firm will generally take a seat on the Board of Directors of the startup and will take an active role in bringing their management experience to the company. Many VC firms specialize in certain industries such as technology, biotechnology, and health care where they bring deep industry expertise to bear. VC’s most often take equity positions in startup companies in exchange for their capital and expect annual rates of return of between 30%-50%.It should be noted, however, that rates of return in this category are subject to a wide variety of factors, not least of which has been the difficulty in raising pools of capital for venture financing over the last several years. VC’s require high rates of return because ,in many cases ,their investments in startups are highly illiquid and require anywhere from 3-7years to come to fruition through a favorable exit event such as an IPO,merger and acquisition,or a leveraged buy-out. It is critical for startups to perform their due diligence on VC firms before jumping into bed with them.

2.2 A Business Plan

A Business Plan is a document in which a business opportunity, or a business already under way, is identified, described and analyzed, examining its technical, economic and financial feasibility. The Plan develops all of the procedures and strategies necessary in order to convert the business opportunity into an actual business project

A business plan, in principle, can be seen as a document that commercial-izes your business idea as a whole towards potential investors and stake-holders. A business plan is successful if you succeed in conveying to the reader the most significant opportunities and growth capacities of your company realistically. A business plan should justify and describe your business idea and further business development in a clear and adequate manner. It should not merely aim at emphasizing the strengths of the company, but rather at presenting a realistic portrait of its problems, risks and obstacles. In addition to this, appropriate solutions should be proposed and discussed in detail. A business plan can be used for specific purposes. One target might be to obtain new means of investment for the development of a product or the marketing of a new product.

2.3 Aspects of an attractive business plan from an investors perspective

Financial performance

It is vital to prove to potential investors that the company has excellent financial performance. Venture capitalists will look for a potential of high returns and a clear exit opportunity. Investors will wonder if the company shows signs of growth and if it has plans such as issuing shares or borrowing money to stimulate growth

Background and experience in the industry

Investors don’t want entrepreneurs to make mistakes on their dime. Investors look for experienced entrepreneurs and management teams with a track record of high performance and leadership in the company’s industry or in prior ventures. Most investors will research your business experience and your background in the industry. Passion and commitment should be evident to inspire confidence in investors and stakeholders.

The product or services need to be unique. It is vital to prove to investors, with concrete evidence, that the market potential is big enough to make investing worthwhile.Venture capitalists are influenced by product characteristics such as proprietary features and competitive advantage. Also, investors look for features that distinguish the startup from potential competitors and give them some sort of advantage, such as intellectual property protection, exclusive licenses and exclusive marketing and distribution relationships.

Effective business model

The startup will start to display its strategic value as soon as it begins to generate profits. It is important to prove that the business model that is currently being used will help the company become more profitable.Different types of investors seek different attributes from a business plan. It’s important to customize the business plan and pitch to each investor. For example, venture capital fund managers and angel investors tend to put more emphasis on both market and finance issues, so those are areas that a startup should focus on when approaching these types of investors.

Large market size

Angel investors typically invest in solutions that address major problems for significantly large target markets. On the other hand, venture capitalists look at market characteristics such as significant growth and limited competition when investing.The larger and more stable customer base that your brand has, the stronger competitive advantage a startup will have when pitching to investors. A larger and more stable customer base will serve as proof that the company has a great impact on its target market.Investors look for companies that can grow quickly and manage this high growth scale. Investors must see that the company can generate significant profits beyond the initial product idea with adequate financial projections and a plan to include multiple sources of revenue.

References

Uniformed Services University of the Health Sciences. (2003). Strategies for attracting angel investors. Journal of Commercial Biotechnology, 9(January 2003), 8. https://www.researchgate.net/publication/233551418_Strategies_for_attracting_angel_investors

Università degli Studi del Sannio. (2014). The New Ways to Raise Capital: An Exploratory Study of Crowdfunding. nternational Journal of Financial Research, 5(April 2014), 10. https://www.researchgate.net/publication/273985092_The_New_Ways_to_Raise_Capital_An_Exploratory_Study_of_Crowdfunding

University of Glasgow. (2004). What do Investors Look for in a Business Plan?: A Comparison of the Investment Criteria of Bankers, Venture Capitalists and Business Angels. International Small Business Journal, 22(June 2004), 10. https://www.researchgate.net/publication/247738793_What_do_Investors_Look_for_in_a_Business_Plan_A_Comparison_of_the_Investment_Criteria_of_Bankers_Venture_Capitalists_and_Business_Angels

0 notes

Text

How can youfind a good transactional lender near you?

Transactional funding is a short term loan that is made available to wholesale investors who are looking to buy and re-sell a property on the same day. Often called a double closing, the funding has made it easy for investors like you to make good profits with no money in the transactions and on short notice. If you are interested and seeking reputabletransactional lenders in your the city, then type transactional lenders near me on the web, and the results that come up will give you plenty of options from which to choose. But picking the best transactional lender for your ideal needs and individual circumstancescould be morechallenging.

Judging by what you need sprecificallyyou have tocarefully look for the company with the best alternatives. Since conventional loans from banks are not useful, it makes sense to look for quick and immediate funding alternatives, and on that front, transactional funding is the best possible choice for same day double closings..

What should you look at with each transactional funder?

· Ask about how each lender’s qualification process works and how much the costs are.

· Prepare a comprehensive list of as many as possiblelenders near you.

· Review and compare the attributes of each lender.

· Make a decisionabout which lender meets the most criteria that you need to fund your project.

The lenders will only proceed to do the funding when you are in a position to present an end buyer who has cash to close or has a hard money lender ready to fund the closing.It is rare but some lenders might also look at the overall value of the property.

Qualities of a Good Transactional Lender

As far as real estate funding is concerned, you have to rely on lenders who specialize in real estate. But when it comes to picking the right lender, some important factors must be taken into consideration.

· Your primary focus should be to look for some good lenders who can provide swift and immediate funding to help youdo a double closing on the same day. Most of the reputable transactional funding lenders will be happy to review your requests at short notice, thus resulting in immediate approval of the fundsyou’ll need.

· Choose a lender who is willing to provide the funds you need in a short time and that his terms and conditions are reasonably priced. Moreover, the transactional lender should never ask for any appraisal, any pre-determined down payment or even a credit report.

· Simple or even no paperwork makes way for hassle-free processing. The whole process of transactional lending is undergoing a lot of change, and with the inclusion of technology, things are becoming much more progressive.

· Compare and check the rates and especially the lenders’ Google® reviews, before making any decision.

· Keeping in mind the changing scenarios, lenders these days are also making an effort to consult and educate their investor customers, apart from educating them about the various aspects of transactional funding.

If you are going into real estate wholesaling with the right mindset and preparation, you will be even more successful by finding and working with a suitable transactional funding lender near you.

0 notes

Text

Soros and India

By: Chitra Patel Is George Soros angry with Modi or with his failed ambitions? Billionaire Philanthropist George Soros recently delivered a speech in Davos where he accused Indian Prime Minister Narendra Modi of creating a Hindu National State and threatening to deprive millions of Muslims for their citizenship. But who George Soros exactly is and what are his connections to India? In 1969, George Soros started hedge fund management and eventually grew through the European Exchange Rate Mechanism in 1992 where he sold short more than $10 Billion in pounds profiting for $1 Billion. He is tagged as the ‘the man who broke Back of England’ and caused Black Wednesday. With this profit he started “Open Society Foundation” George Soros developed he theory of reflexivity which states that “market values are often driven by fallible ideas of participants, not only by economic fundamental situations”. Ideas and events influence each other in reflexive feedback loops. In short, theory of reflexivity is a redefined and implementable session of psychological war. This is the reason Soros is regarded as ‘the puppet master’ of various global controversies and crises. George Soros: Financial Spectator, Stock Investor, Philanthropist and Liberal Political Activist. Soros first visited India in December 2006, where he described India as a favourable nation with tremendous opportunities. He declared that he will be investing in India. In 2008, Soros Economic Development Fund (SEDF), Omidyar Network and Google.org announced $17 Million to small to medium enterprise companies for India – “Song Investment” at Indian School of Business (ISB), Hyderabad. In 2010, Soros bought 4% stake in Bombay Stock Exchange (BSE) from Dubai Holdings. Twilight Saga – Soros and Omidyar It is believed that 2014 National Elections was funded by Omidyar Network India in support of Modi Government. Jayant Sinha, profiled as Venture Capitalist, Senior Advisor and Independent Director was the Director of Omidyar Network India that time, was also a BJP candidate (Winner) from Hazaribagh, Jharkhand, India. Open Society Foundation was in the list of 11000 banned foreign NGOs by the Indian Government in 2014-15 session. This might have triggered the hatred of Soros towards Modi as his foundation was involved heavily in Indian NGOs and SMEs. More importantly Soros criticised Modi for specially banning Christian NGOs, he also said that Modi’s vision is to eliminate every community from India other than Hindus as he himself originated from RSS, a Hindu devoted organization. The Make Over – Aspada Aspada was founded in 2009 and believed to be managing $100 Million in capital. In 2011, Aspada Foundation acquired Song, majority stakes of which were owned by SEDF. In 2013, Aspada Foundation committed $10 million to early stage businesses to make education, healthcare, and financial services more accessible to low-income people in India. Aspada also invested in agricultural supply chain companies in an effort to support small holder farmers. Aspada Foundation received that $10 million from the Soros Economic Development Fund (SEDF) and worked to promote economic opportunity and sustainable impact in India. In 2014, they committed additional $15 Million to Aspada. Additionally, in March same year, it invested Rs 10 crore in Mumbai-based non-banking financial company Neo Growth Credit, a NBFC firm funded by Aspada. In 2019, LGT Group, the largest family-owned private banking and asset management group, originally known as The Liechtenstein Global Trust, owned by the Princely House of Liechtenstein, acquired the majority stakes of Aspada from SEDF. Aspada is now LGT Lightstone Aspada but with the same ‘so called’ visionary approach as Soros. Rooted in 90’s In 1994, George Soros and his offshore company Quantum Fund were in India, obviously looking for some easy form of cash. Then Soros Fund Management (SFM), reputed to be one of the world's leading fund managers, had already taken up a 33% stake in its tie-up with the GIC Mutual Fund. Another Soros company, Chatterjee Petrochemicals Ltd. (CPL), run by a Soros money handler, Purnendu Chatterjee, has secured 25% equity in Haldia Petrochemicals Ltd., a 36-billion-rupee project near Calcutta. There were also reports that the Quantum Fund NMV, a Netherlands Antilles-based investment house, was picking up stocks from the Bombay stock exchange. Soros's procurement of 33% of the GIC Mutual Fund and investment in the Bombay stock exchange was no surprise, since Soros was considered as “a shark who follows money instead of blood”. But the CPL's procurement of the 25% equity in Haldia Petrochemicals Ltd. offered a clear insight into how the Soros operation functions. According to the reports of Ramtanu and Susan Maitra (renown journalist/authors), the CPL frontman was on Purnendu Chatterjee, a New York-based entrepreneur with ethnic ties into West Bengal. Chatterjee was given a boost by the local media as an investor par excellence, and, in due time, he made contact with the ostensibly Marxist Chief Minister of West Bengal, Jyoti Basu. Basu, whose British connections were always underplayed, went through with the deal without really checking the pedigree of the CPL, Soros, Quantum Fund, et al. As Ramtanu and Susan Indian puts it, it was a case of "naïve cunningness" on Chatterjee's part. The Economic Times, a leading daily, was asked on Aug. 17, 1994 that why CPL's mysterious silence about the source of its funding was ignored, The paper reported that Chatterjee had acquired a poor reputation because of his troubles with the American Securities Exchange Commission, and it evinced surprise that he had developed direct contact with the West Bengal chief minister, Jyoti Basu. It would not be the first time in India that non-resident Indian investors, under the guise of giving back to their country some profit of their labour elsewhere, had taken the country for a ride. However, the Indian government's avowed commitment to "globalization" and free-market liberalization, and obsession with money, will no doubt bring more of the sharks like Soros into this rather desperate economic scene. But Soros, whose Quantum Fund N.V. board members include luminaries from such powerful financial operators as N.M. Rothschild and Sons merchant bankers and London based St. James Place Capital, has also been linked to the underground. According to reports from US State Department officials, Quantum Fund raised a huge amount of money to demolish European monetary stability in 1992. During this operation, such well-known criminals as Marc Rich, a fugitive metals and oil dealer now based in Switzerland, and Israeli arms merchant Saul Eisenberg were silent investors, along with a third Soros partner, Rafi Eytan, known as "Dirty Rafi," who had served in London previously as the Israeli Mossad's liaison to British intelligence. Offerings in 2000’s On 28 July 2010 SKS (www.sksindia.com), India’s largest microfinance institution (MFI) with 5.8 million clients, became the first MFI in India to float its shares through an initial public offering (IPO).1 The IPO was successful by any financial market standard: the offering was 13 times oversubscribed and attracted leading investment groups, such as Morgan Stanley, JP Morgan, and George Soros’ Quantum Fund. Also, in 2010 The Indian state of Andhra Pradesh experienced a staggering 200 suicides by farmers in land. It was believed that SKS Microfinance which gave them loans was somehow credible. An 18-year-old girl drank pesticide after she was forced to hand over money meant for an exam fee, leaving a note, “Work hard and earn money. Do not take loans.” Later that year SKS secured an initial US$64 million from a group of 18 anchor investors who agreed to buy 18 percent of the offering at the top of the offering window of INR 985 per share. The anchors included JP Morgan, Morgan Stanley, India ICICI Prudential, Reliance Mutual Fund, and George Soros’ Quantum Fund. Connection to India India’s peculiar Ideology of democracy and the population boom provides potential market attracts businessmen all over the world. It is suspected that the Indian Economy is not being driven by India’s policies or Government, it is more to do with such ‘Internal Businessman’ like George Soros. Like Hillary Clinton in United States (2006 Elections), George Soros through hid numerous ventures, was one of the major funder/donors for Prime Minister Modi. “Not so Digital India” Under PM Modi’s vision of Digital India, The Government of India introduced biometric-based identification (AADHAR), a Unique Identification Authority of India (UIDAI) to help citizens of India enjoy services like opening a bank account, filing tax returns, and availing rations swiftly by digitally authenticating their identity. A team of researchers from the Indian School of Business (ISB) and Digital Identity Research Initiative (DIRI) investigates and monitors the back-end servers of UIDAI. DIRI, launched in 2017, is funded by Omidyar Network India and in 2019 they had given a grant of $1.8 Million to DIRI and committed $500000 more for future grants. “Open Society and Ford Foundation – Under FCRA Scrutiny and Anti-India” George Soros financed radical environmental groups partnering in “Global Climate Strike” to the tune of nearly $25 million. At least 22 of the left-wing activist groups listed as partners in the Global Climate Strike received $24,854,592 in funding from liberal billionaire George Soros between 2000-2017 through his Open Society Network. Among the organizations receiving Soros funding were Fund for Global Human Rights, Global Green Grants Fund, 350.org, Amnesty International, Avaaz, Colour of Change, and People’s Action. Each of these groups has climate-related agendas and goals spanning from reducing global carbon emissions to less than 350 parts per million and 100 percent “clean energy,” to the elimination of new fossil fuel projects and a “green civil rights movement.” The group 350.org, founded by Bill McKibben in 2008, has fought against coal power in India. It is not clear how much funding the Global Climate Strike has actually received from these groups or in total. And, of course, Soros’ funding is over 18 years, so the numbers highlighted are not immediately relevant. But what the investigation does show is how the Strike is being funded by a wide range of left-wing foundations, many of which in turn have relied on Soros money at some stage in the past. This is the list of the relevant Soros donations:

Most of the organisations mentioned above were listed in the banned NGOs under FCRA act by Indian Government in 2014. Open Society has also funded US based NGO Greenpeace, which came under heavy scrutiny by the Indian Government in 2014, which claimed that the NGO’s activities, research, and peaceful protests were “working against the economic progress of the country.” Greenpeace’s FCRA registration was then cancelled in August 2015 due to alleged failure to disclose the movement of funds properly. This cancellation was seen by many observers as heralding a new phase in the interpretation of FCRA regulations wherein the Government of India altered the definition of activities considered harmful to the national interest. The Ford Foundation has faced similar challenges. In March 2015, the foundation was placed in the “prior permission” category after the MHA reportedly found that it was funding non-FCRA registered NGOs, a violation of Section 7 of the FCRA. Earlier that year, the Gujarat government filed a complaint with the MHA that the Ford Foundation’s funded “anti-India” activities of two NGOs–Sabrang Trust and Citizens for Justice and Peace and requested that the FCRA registration of these two NGOs be cancelled. After several months of seeking ministry clearance to process any foreign contributions, the Ford Foundation was taken off the government watch list and was granted the ability to fund its affiliates after registering under the Foreign Exchange Management Act (FEMA), which falls under the jurisdiction of the finance ministry and maintains even tighter regulations that that of FCRA. Read the full article

1 note

·

View note

Text

Could Bob Zangrillo’s legal troubles imperil Magic City?

(Illustration by Pablo Lobato)

Bob Zangrillo walked out of federal court on a rainy day in Boston in late March 2019 wearing a black heavy coat, a charcoal suit and a blue tie. His face was drawn, forehead furrowed.

The gloomy scene was a far cry from Zangrillo’s carefree days as a playboy in Los Angeles just a few years ago, when he roamed shirtless at Burning Man-themed birthday parties and hosted Coachella after-parties attended by hordes of models and so-called influencers. Zangrillo claims to have made a fortune investing in companies like Facebook and Uber, and had presented himself as the youthful Silicon Valley investor and a Gatsby-esque figure in an Instagram age. And he’s a major stakeholder in Miami’s sprawling Magic City project.

But if the 52-year old looked sober and sullen walking out of court a year ago, he had every reason to be. As part of the sprawling federal investigation nicknamed Operation Varsity Blues, which led to charges against celebrities like Felicity Huffman and Lori Loughlin, Zangrillo had just been charged with mail fraud. He pleaded not guilty.

And while the Norwalk, Connecticut, native faces jail time over the college admission scandal, the Federal Trade Commission (FTC) is also after him, bringing civil charges in January. The FTC alleges Zangrillo chaired a company that ran scam websites set up to look like government agency portals. Zangrillo pleaded not guilty, with his lawyers arguing that he was just a passive investor.

When investors get themselves into the kind of legal trouble that ends up in a chyron on cable news, the developers on projects they’ve funded often quickly distance themselves out of fear that the project will struggle to score financing. It is unclear how much money Zangrillo has put into Magic City, but he and his family were the largest equity backers as of last year. His current legal troubles have developers practicing the art of social distancing.

Bob before the big time

A graduate of the University of Vermont and Stanford Business School, Zangrillo moved to New York in 1995. There he became the CEO of InterWorld, an e-commerce software supplier that worked with Nike and FedEx. At InterWorld, he also started UGO Networks, an entertainment company focused on gaming, which InterWorld sold to Hearst for an estimated $100 million, according to Forbes.

Zangrillo founded his private investment firm Dragon Global in 2008 and moved the company to Miami in 2010. The company says its current and predecessor funds have managed $1 billion in companies with over $500 billion of market value. Zangrillo also claims to be one of the last late-stage venture growth investors in Facebook as well as an investor in Uber, Jet.com and Twitter, according to his company’s website.

For his part, Zangrillo certainly plays the role of a Silicon Valley venture capitalist to his 10,800 followers on Instagram. On some days he is taking ice baths and practicing the Wim Hof method; on others he is showing off his water jetpack or meeting with Los Angeles megamansion developer Mohamed Hadid.

Many of his posts also show off his 11,508-square-foot waterfront estate on Miami Beach’s Di Lido Island. Zangrillo paid $7 million to acquire the property before building a house there for his primary residence in 2016.

Zangrillo, who has shied away from the media attention, declined multiple interview requests through a spokesperson, who did offer one comment: “Mr. Zangrillo’s commitment to fostering a positive and ethical workplace has never wavered, nor has his commitment to the city of Miami and its opportunity to be a global hub of innovation.”

Burning Man

Part of the vision for Magic City had its origins in the desert of Nevada. Zangrillo is a “Burner,” an enthusiast of Burning Man, the annual festival in northwest Nevada known as much for its ecological message and art installations as it is for its thrill-seeking, power scooter-riding hedge funder attendees.

It was at Burning Man that Zangrillo and his business partner Tony Cho first displayed a silver-colored, 12-foot-high wooden structure spelling out the word “Magic,” which would ultimately become the entrance to the Magic City Innovation District in Little Haiti. The pair, who met through a mutual friend, agreed that Cho, who owns the brokerage Metro1, would be the face of the project, while Zangrillo would help recruit tech companies for it.

In December 2017, Zangrillo and Cho brought on Miami-based development group Plaza Equity Partners along with Lune Rouge, a company led by Guy Laliberté, co-founder of Cirque du Soleil. As the plans solidified, the group attempted to get a Special Area Plan (SAP), which allows property owners who control more than 9 acres of land to apply for zoning changes.

Renderings of the Magic City Innovation District

Under the SAP, the development would include 2,630 residential units, 2 million square feet of office space, 432 hotel rooms and 340,000 square feet of retail, in addition to a pop-up park and sculpture garden at the site in the middle of Little Haiti, at 6001 Northeast Second Avenue.

The development group turned to Miami’s favorite construction lender, Bank of the Ozarks, now known as Bank OZK, for its first round of financing — a $32 million loan issued in February 2018. By that time, the regional bank out of Little Rock, Arkansas, had become one of the most active condo construction lenders in Miami, New York and Los Angeles.

The news hit in March 2019 that Zangrillo was named as part of the college admissions scandal. Later in the month, Zangrillo backed out of his role as managing board member of Magic City. He was replaced by Zach Vella of the New York-based Vella Group.

“He doesn’t have any involvement,” said Vella in an interview with The Real Deal in March 2020. “All decisions are made by the board members, and Bob is completely passive.”

“He needs time to focus on current issues,” Vella added.

Some aren’t convinced that he’s distanced enough from the project.

“Just because they filed that paper in March that he’s no longer the principal in the project doesn’t mean that he is not benefiting from the project,” said Meena Jagannath, an attorney with Community Justice Project, which has filed a lawsuit against the development group for Magic City.

Zangrillo’s still doing some business for his own company, Dragon Global, though it’s unclear if that work intersects with the interests of Magic City. In May, he sought permission from federal court to go to Montreal for a planned trip that “involved meetings with a large current Dragon Global investor and negotiations to invest in at least two such companies.” The motion did not disclose who he was meeting with, but it’s notable that his colleague on the Magic City project, Guy Laliberté has his company headquarters in the Canadian city.

An ownership chart first revealed by Miami blogger Al Crespo showed that MCD Dragon held the largest equity stake the Magic Innovation District Project, at 35 percent.

Zangrillo personally held a stake of 54 percent in MCD Dragon, while a trust that lists Zangrillo’s daughters, Ashley, Alexa and Amber, held 42 percent, and Los Angeles billionaire investor Neil Kadisha owned 3 percent.

Zangrillo also still has some role, at least, in picking out the artwork for Magic City. Twice in August the investor posted about the project on his personal Instagram account. In early December, he tagged graffiti artist Tristan Eaton in a post that read, “New Art acquisition. Cannot wait to collaborate on Art for the Magic City Innovation District

The original @tristaneaton

.”

OnPoint Global

Zangrillo is more than a backer of the Magic City project. He was chair and one of the lead investors for OnPoint Global, one of Magic City’s first anchor tenants, which leased a warehouse near the heart of the development last June.

OnPoint Global had the largest lease out of the first five tenants to sign at Magic City, taking up 12,000 out of 18,650 square feet. OnPoint was also featured prominently in marketing materials and in interviews that the development group conducted with the Miami Herald.

The company describes itself as a “leading worldwide data-driven, online publisher and service-based e-commerce provider with offices in the United States and Latin America.”

But federal officials allege, in charges filed in December, that OnPoint Global was operating a scheme to defraud people who were seeking government services. The scam allegedly included using sites like DMV.com (instead of .gov). In some cases, the FTC claimed, OnPoint would charge people to buy information that was already publicly available.

The feds alleged the money man for the operation was Zangrillo, who they claim chaired, co-owned and invested in the company and personally received more than $2 million in distributions and salary from OnPoint Global and its subsidiaries. A federal court in Florida ruled in January that “the websites were patently misleading,” granting an injunction and freezing assets tied to the scheme.

Zangrillo’s lawyer Matthew Schwartz of Boies Schiller Flexner said that Zangrillo was not involved in the day-to-day operation of the company.

“In his role as an investor and limited partner in numerous organizations, Mr. Zangrillo monitors his investments under his companies’ investor rights but has no role in the day-to-day operations of his portfolio companies,” said Schwartz.

Jeff Schneider of Levine Kellogg Lehman Schneider + Grossman, who has acted as a receiver in other FTC cases and is not involved in the OnPoint Global case, said it is significant that the FTC brought the charges against someone as high-profile as Zangrillo.

“It is surprising to take on so much of a public figure,” said Schnieder. “Even tangentially, these cases are generally 25-year-olds operating in boiler room spaces.”

Former OnPoint Global CFO Bob Bellack said that Zangrillo was not involved in the day-to-day decisions at the company and described his role as being dedicated to bringing investors to the company and providing mentorship to employees.

“His role was pretty typical of any VC [venture capitalist] with a company,” said Bellack.

Yet one former employee of OnPoint Global told The Real Deal he would often see Zangrillo around the office and disputes the notion that Zangrillo was not aware of what was going on.

“I saw Bob Zangrillo walking through the offices at least once a week for 52 weeks,” said Ryan Marshall, who worked at OnPoint Global for a year as head of talent acquisition. “He was involved in major decisions … he invested a lot of money into the company.”

Cho said in an interview with The Real Deal that Magic City has no immediate plans to remove OnPoint Global as a tenant and will let the case play out.

On the horizon

At issue right now is how much the college admissions case and the FTC case have hurt Zangrillo and the rest of the development group at Magic City. Miami is rife with developers, investors and brokers who have faced accusations of fraud. It is a city known for giving second chances.

But for now, Zangrillo is backing off. Last month, Avra Jain, developing a $200 million mixed-use project near the Miami River with Zangrillo, said that he was no longer involved in the project.

“Bob Zangrillo was not a managing partner, nor has he been involved in the day-to-day,” Jain said, declining to comment further.

Even when distanced from Magic City, Zangrillo’s troubles could impact the project’s ability to secure permanent financing beyond the loan from Bank OZK.

David Eyzenberg of the commercial real estate investment bank Eyzenberg & Company, who helps arrange financing for real estate projects, said Zangrillo’s legal troubles will make it more difficult for the group to get financing from a traditional bank.

“If you are a traditional lender you are trying to avoid noise. If you have shareholders, you don’t want noise,” said Eyzenberg.

Andrew Ittleman, an attorney with Miami-based Fuerst Ittleman David & Joseph who is an expert on money laundering, said Zangrillo’s criminal and civil charges could also cause the other developer partners to take on personal guarantees for the project.

“There is not another way to put it; it does not make things easier for the borrower,” he said.

Especially in a world facing extreme upheaval in the wake of the novel coronavirus, what is the appetite for lending to an ambitious development like Magic City? Time will tell. But for now, it appears the project is scrubbing its ties to Zangrillo, who is set to face trial in October for the college admission scandal charges.

Based on his Instagram posts, Zangrillo doesn’t seem too concerned.

“Life is about balance,” Zangrillo wrote in an October 2019 post. “Too much money or knowledge may not allow you to see the entire picture of life.”

The post Could Bob Zangrillo’s legal troubles imperil Magic City? appeared first on The Real Deal Miami.

from The Real Deal Miami & Miami Florida Real Estate & Housing News | & Curbed Miami - All https://therealdeal.com/miami/2020/03/26/could-bob-zangrillos-legal-troubles-imperil-magic-city/ via IFTTT

0 notes

Text

The case for international trade and post-shipment financing in India

There have been recent trade agreements between India and the UAE as well as Australia in order to support India's growing ambition to become a USD 1 trillion economy in 2030. For this objective to succeed, India intends to extend its reach to other Gulf Cooperation Council nations and to nations in the EU. These types of contracts would provide the economy with the manufacturing boost it requires to become a major supply center, resulting in business growth, job creation, and in turn enabling the economy to undergo growth and prosper.

In India, the banking sector is relatively stable. Economic targets like these will serve as the impetus for banks and other lending institutions to broaden their financing scope and appetite to cater to the needs of hungry, growing businesses. As a result of the accomplishments and development of digital payments and enhancements in the credit sector, the trade finance sector is poised to meet a rising demand for working capital. As seen in the last decade, the Indian government has supported and strengthened initiatives that have improved access to credit and payment infrastructure in the country. The government's sharp increase in capital expenditure can be viewed both as a demand-enhancing activity as well as a supply-enhancing one as it is creating infrastructure capacity for future growth and development.

Because the government is keen to support Indian business, it decided that all non-banking financial institutions would be allowed to take on factoring services, also known as post-shipment financing, rather than only specialty factoring companies. This move is intended to provide an even broader ecosystem for factoring in India and help businesses significantly by opening up further avenues for credit.

After China, India has the world's largest MSME base. They contributed 30% to India's GDP, 45% to its manufacturing, and 40% to its exports. Unlike banks, alternative trade finance companies such as Tradewind are aware of and understand regulatory requirements in the jurisdictions that they operate in; this enables them to apply credit policies to clients that banks would use, but with an eye to finding creative and resourceful solutions for their clientele. Additionally, foreign factoring companies such as Tradewind possess specialized knowledge of the underlying business that is very unlikely to be replicated by a traditional financial institution.

The credit environment in which we operate is very positive. It grants opportunities for exporters and importers to connect with trade finance funders from other markets who would be more willing to examine the transaction, who have experience assessing risks in different types of transactions, and who might feel more comfortable providing funding. This will make it easier for Indian exporters to access foreign currency loans from a trusted, established international lender, such as Tradewind, and not just from their existing Indian lenders who have limited financing expertise, experience, and exposure to foreign markets, such as the EU, US, and the Middle East.

Here’s a snapshot of how Tradewind offers post-shipment financing to Indian exporters:

Tradewind is dedicated to providing low-cost, collateral-free trade finance solutions to businesses looking for finance solutions to enable them to trade sustainably and become more competitive in the global marketplace. Our goal is to offer Indian businesses practical trade-based solutions to help them expand their foreign trade and diversify their lending sources.

To know more: https://www.tradewindfinance.com/news-resources/the-case-for-international-trade-and-post-shipment-financing-in-india

0 notes

Text

How To Find Investors For Your Business Idea

How do I get funded for my project?

Getting the capital to start your new business can be an easy step if you come up with a good idea and know which investor wants to fund your project. But you may have the idea, but you are in great trouble, which is not knowing how to contact the appropriate investor. If you seriously want to become an entrepreneur and a business owner, then you must overcome this predicament and search for the investor who may also be looking for you. Jason Demers, founder, and CEO of Audience Bloom offers you a free service, posted on Interbrunnor, to introduce you to the 5 best sites and places to find your project funder.

No matter how strong your product, project idea, or efforts you are making to develop it, having more capital and getting the right investment will be important to stay in the market in the strong competition, even the best billion-dollar financed and successful startups participate in additional rounds To collect more investments so that you can continue to market enough to take profits.

Here Are 4 Places Where You Can Find Investors For Your Business

1. Participation in local events

If there are investors in your area looking to put money into your new project, they can be found while participating in local events. You can attend these events, get used to the conversation and presentation patterns, you will have trouble getting to know people quickly, search in the room for someone who can help you with that.

In addition to being successful in finding a funder, you will have the opportunity to meet all new people who can also help your business grow, from mentors to partners and others.

2. Conferences and competitions

Most major cities organize conferences, where entrepreneurs, marketers, and funders are gathered. Some competitions specialize in launching and funding new startups from scratch, while others simply review investment problems and try to find solutions.

In any case, these events are magnets for new talents and ideas, so you can participate in them as a competitor or simply attend and start getting to know some new people.

3. Community organizations

Most investors participate in activities that concern their communities. The majority of these participate in local councils, civil society organizations, influencers, and social activists, Honestly, all they want to preserve the appearances. Whatever the case, volunteer events and groupings of community organizations are ideal opportunities to meet new investors.

4. Linkedin and other network platforms