#fud log

Explore tagged Tumblr posts

Text

yesterday i had 4 mini sandwiches, 1 slice of cheese, some jam, butternut squash pasta, and grapes

it feels like a lot, but i was really hungry for a while before i went to bed, so it can't have been that much

2 notes

·

View notes

Text

Avalanche’s monthly transaction figures bounced back considerably from 2022. The total value locked dropped more than 15% in the last quarter. Over the last quarter, much of the focus of the crypto market was centered around exchange-traded fund (ETF) applications for two of the biggest assets in the sphere, Bitcoin [BTC] and Ethereum [ETH]. Rightly so, because developments around these were moving the market. Read AVAX’s Price Prediction 2023-24 It was crucial, however, not to lose sight of other cryptocurrencies that withstood the bearish market conditions of Q3 in order to carve out a position for themselves. Notably, Proof-of-stake (PoS) network Avalanche [AVAX] deserved a special mention for the key partnerships forged and improvements in on-chain activity throughout Q3. Marked recovery in network parameters Undeniably, like other cryptos, Avalanche’s key performance indicators haven’t been the same as they were during the peak of the bull market. Having said that, a significant recovery was observed, according to a report by digital asset research company Galaxy Research. Indeed, in the last quarter, Avalanche’s monthly transaction figures bounced back considerably from the downfall induced by the market implosions of May 2022. Notably, the transaction count didn’t plunge after the levels spiked, rather stabilized at those levels. Source: Reflexivity Research/ Dune Furthermore, the number of people interacting with the blockchain soared. The monthly active user count peaked at around 1 million in the last few months. Source: Reflexivity Research/ Dune The report attributed the turnaround in network utilization to a slew of high-profile partnerships that Avalanche established in recent memory. Subnets, or application-specific blockchains, attracted players across decentralized finance (DeFi), gaming, and non-fungible token (NFTs). However, the success in network activity didn’t lead to proportional capital inflows in the Avalanche ecosystem. The total value locked (TVL) dropped more than 15% in the last quarter. The Curve Finance [CRV] hack and the ensuing FUD were blamed as one of the primary drivers of the decline, per Galaxy Research. However, over the last month, the TVL remained fairly stable and hovered around the $1.25 billion mark. Source: DeFiLlama Avalanche’s key partnerships The report noted that Avalanche collaborated with players from “both the crypto and traditional financial sectors” to expand its footprints. One of the most talked-about partnerships of Q3 was decentralized exchange (DEX) Balancer [BAL] expanding to the Avalanche chain. The protocol with a TVL of $694 million as of this writing, aimed at tapping into Avalanche’s increased throughput and scalability advantages to introduce new DeFi opportunities. Notably, Balancer’s focus was on the liquid staking market. It joined hands with liquid staking token (LST) protocols on Avalanche to make yield-bearing assets available to liquidity providers. Apart from Balancer, other DEXs like Multiswap also logged into Avalanche, allowing users the right to swap hundreds of tokens in a single transaction. While partnerships with Web3 entities were praiseworthy, Avalanche attracted big entities from the Web2 world as well. Japan’s data marketing company Loyalty Marketing, in collaboration with blockchain service provider PlayThink, turned to Avalanche subnets to launch its popular loyalty rewards program. The transition, stated to happen by year-end, would involve distribution of NFTs to its million-strong existing user base. A bit earlier in July, Solert Games, a pioneer in online gaming, announced the launch of a subnet to capitalize on the growing possibilities for growth in blockchain gaming. Notably, Co-Founder and CEO of Solert Games, said that the move would blend the social dynamics of Web2 with the user-centric decentralization of Web3. The international gaming studio was home to more than 160 games, with cumulative downloads exceeding 20 million. AVAX gets resistance at these levels

High-profile partnerships like these and many more gave the AVAX fanbase hope for the long term. Interestingly, AVAX climbed all the way up to $11 this past weekend, the first time in more than a month. However, it met a barrier at $11.5 and the value has since retreated to $9.72 as of press time, data from CoinMarketCap showed. Realistic or not, here’s AVAX’s market cap in BTC’s terms A recent X (formerly Twitter) post by on-chain analytics firm IntoTheBlock revealed that during a bear market, these regions have historically acted as resistance points. Holders dump their AVAX tokens to make up for the losses incurred. Therefore, it would be interesting to observe AVAX’s trajectory once it breaches this barrier. over the weekend, AVAX rallied past $10 but has met significant resistance around $11.50. This coincides with on-chain data, which indicates that historically, more than 747,000 addresses have acquired $AVAX between the price range of $11.62 and $12.93. In bearish conditions,… pic.twitter.com/aDbwniCbYY — IntoTheBlock (@intotheblock) October 9, 2023

0 notes

Text

Binance-CFTC FUD puts BNB price at risk of drop toward $200

BNB (BNB) looks set to wipe out its March gains entirely as investors turn their attention to the latest regulatory crackdown on Binance, the world’s leading crypto exchange by volume. BNB price logs worst daily performance in over a month On March 27, the U.S. Commodity Futures Trading Commission sued Binance and its chief executive Changpeng Zhao (CZ), alleging that the company illegally…

View On WordPress

0 notes

Note

So, the thing is, the bill specifically outlaws "transactions" wherein foreign adversaries have material interest. Here is how the bill describes "transactions."

(4) COVERED TRANSACTION.—

(A) IN GENERAL.—The term “covered transaction” means a transaction in which an entity described in subparagraph (B) has any interest (including through an interest in a contract for the provision of the technology or service), or any class of such transactions.

My understanding, that I've come away with is that this would disallow say, app stores from hosting a relevant app, or payments being made for software, etc. I do not understand how or why we would conclude that simply viewing an app or webpage would fall under this definition. The act does not ban accessing the software. The bill does not mention access or downloads at all.

Moreover, say the government discovers you're using a VPN! Okay! How do they prove what sites you accessed with that virtual network? They can't, that's the point of a VPN. Perhaps if your VPN provider keeps logs and is US-based, they would turn those over to law enforcement. This is a known, present risk with VPNs and it's why it's best to choose a service with good security that won't snitch on you to the police if you're abetting an abortion or organizing politically.

It is possible the US could ban the use of VPN services entirely in the future, sure. That would be massive state censorship! But this is not a present risk, it is not part of this bill, and the only places where I am seeing it asserted are unsourced social media posts by people without legal expertise, & crypto and web3 blogs. We need to understand what is actually at stake with this bill and not get hung up on fud misinfo here.

By your reckoning here, the heaps of respected news and tech sites all pre-emptively posting "here's how to access TikTok via VPN" articles right now will also face massive fines and imprisonment. If that's how any of this worked, why would they be doing that? And wouldn't the VPN company be the party abetting the violation of the act, & subject to the fines? There's a not of assumption and implied precedent here. The act is scary, the vague establishment of new national security structures is scary. It makes sense to worry. But "the government will fine me $1M for geo-evasion" is a bit of an extreme conclusion.

Also "the Bolivarian Republic of Venezuela under the regime of Nicolás Maduro Moros" is explicitly listed as a foreign adversary, fwiw.

can I ask what text in the RESTRICT act you are reading as criminalizing the use of VPNs? I am seeing this repeatedly and on reading the bill, I don't understand the logic of how VPNs would be effected, or any software not developed in a country outside of the list mentioned in the bill, or how these penalties would apply to most civilians. for example, proton is Swiss-based. wouldn't the US need to name Switzerland as a hostile foreign power to outlaw their VPN? how would an individual user utilizing a VPN to access software developed in say, Venezuela, be in violation of the act, based on its wording and likely legal interpretation? I only see information relevant to financial transactions, and any fine would be based on the value of said transaction?

obviously broad expansions of national security legislation with the intent to choke out foreign competitors are bad! and also, I just do not understand where this claim is coming from. this interpretation seems to state that "transaction" means viewing a site, and using a VPN is "abetting a transaction" and this seems... unlikely.

You're right about the foreign country part, where it wouldn't be considered if it were from a country not listed as hostile. I'll admit that I missed that one in my readings until someone else pointed it out.

I do want to be clear and say that I'm not a professional at this, this was all from my readings of the bill as well as some more research and seeing viewpoints of others, many of which ARE professionals, so I'm actually glad you're doing your own research on it. And I want to encourage you to continue doing so.

But as for the VPN issue, it comes down to section 11, subsection 2-F.

No person may engage in any transaction or take any other action with intent to evade the provisions of this Act, or any regulation, order, direction, mitigation measure, prohibition, or other authorization or directive issued thereunder.

Keywords "any other action". Basically VPNs would fall under that as it could be used to circumvent any bans of foreign services of companies based in the mentioned hostile countries. From my understanding, it would be less likely - to use your example - if you used it to access an online service based in Venezuela that wasn't available in the US as Venezuela isn't listed as hostile.

But then that's where the whole accessing your personal data comes into play. If the Secretary of Commerce and their team were to conduct an audit, you could be chosen at random. And if you use a VPN, they may decide to look closer at you to ensure you're not using it to access a banned service.

The reason VPNs are being discussed is because most people that bring it up are speaking in terms of using it to access tiktok if it were banned, or to access anything else that could be banned under this bill. THAT is where the problem with VPNs lie and why many people are warning others not to use them for this reason, due to the hefty penalties attached. VPNs themselves aren't targeted to be banned, just their use to access services that are.

A big part of it also comes down to discretion as well. If they so wished, if this bill were to pass, they could even push further to create another bill or expand this one to find a way to ban VPNs themselves, though that is less likely.

As of writing all this, the bill has only been introduced. It hasn't even passed the senate, so it's only in it's first stages. It could easily change as time goes on, or it could even fail to pass with or without American's intervention. It's all still very early, which is why we're all pushing so hard to stop it while we still can so that it doesn't escalate even further beyond what this bill proposes.

#really not trying to bait an argument here I genuinely wondered if you had some close reading here that I was missing#but this sort of assumption and conclusion-drawing is a doom spiral. we gotta focus on what we are actually up against#which is an attempt by meta & google to monopolize private data harvesting#b4 you ask these are rhetorical/critical thinking questions at this point I don't really want to continue any further debate#I'm just sharing this response & my thoughts on it to this blog bc I'm seeing plenty of folks in my sphere very afraid about this

53 notes

·

View notes

Note

⭐ !!

Since u really like the work, this chapter of Coaxial.

It's obvious that I love Lasky. He is my best blorbo.

And aside from the trauma he suffered at Circinus and throughout the Covenant War, I enjoy exploring other aspects of his character and putting pieces together based on what we see and of him in canon. With a thirty year gap in his backstory, we only get to see him as a literal child in FUD, and then we jump immediately to him at the age of 48 in Halo 4.

I like to compare the way he's portrayed in both instances, plus his appearances in the later media and his sort-of appearance in Infinite audio logs to see what changed and what stayed the same. And while I can't be sure that any differences in his character (or maybe lack thereof) were intentional, it really does give a great starting point for extrapolating both what he may have been through in the intervening years as well as what changed or didn't and why.

One thing that I keep coming back to is his sense of empathy and his humanity. In FUD, attention was drawn to his less-than-militant feelings toward the Insurrectionists. He didn't just take the UNSC propaganda hook, line and sinker, despite being the son of a UNSC Colonel and brother to an ODST who was actively engaged in fighting them. In Halo 4, while it's not hilighted to a large degree, he is very sympathetic to Cortana's plight, to the point that he puts himself between Chief and Del Rio on the bridge, and later makes a point to address her directly before she and Chief take the gunship. In SpOps, he is shown to dislike Halsey intensely, and yet he still charges a fucking Knight in her defense after she's hacked Roland and gotten into classified files. Even if you chalk that up to 'following orders to protect a valuable UNSC asset', in the very next episode, Lasky is obviously distressed at being ordered to execute her by Osman. I haven't finished the comics yet, so I can't really comment on their portrayal of him.

But taking all of that into account, I figure it would make sense for his character that injustice just. REALLY gets to him. Like if he thinks too long about the Spartan II or III programs he'll end up all agitated and pissy over just how unethical and abusive they were (and still are). Spartan II and III are one of those buttons that are almost guaranteed to make him lose his cool if you punch it more than once, even if it's on accident and even if you're John 117, being self-deprecating due to the lingering traumas of Spartan II and thirty years of war. It just makes him mad to see people who have saved humanity and done so in such a selfless way treated like equipment, or denying themselves any comforts whatsoever aside from like. Eating real food instead of nutrient packs or rations, or sleeping for a good solid five hours instead of one.

At some point I am GOING to write something based on Del Rio's commentary in HTT where he's describing John as a mad dog, where he and Lasky run into each other at some big, fancy political to-do and Del Rio is talking mad shit about John, and it takes Lasky a scant sixty seconds to go from 'this is boring and i dont want to be here' to 'I AM GOING TO COMMIT SEVERAL FELONIES IN THE NEXT TEN SECONDS' and he ends up breaking Del Rio's nose.

I just. He genuinely cares for others, especially the older generations of Spartans. Injustice pisses him off, and it's a big deal when that sense of justice conflicts with his job. And he gets really riled up when John acts like he doesn't deserve the bare minimum of good things in his life.

#asks#lincolnandbruce#wHERE ARE MY T A G S TUMBLR#halo#thomas lasky#headcanons#sorry i went long on thus#but i have So Many Thoughts

11 notes

·

View notes

Text

CC,CVV,CCV,SPAM-TOOLS,CPANELS,SMTP,RDP,LOGS,ICQ 759516037

Hire a professional Hacker now Email address:[email protected], Contacts: icq #: 759516037

offerring folowing services ..Western union Trancfer ..wire bank trf ..credit / debit cards ..Perfect Money / Bintcoing adders ..email hacking /tracing ..Mobile hacking / mobile spam

..hacking Tools ..Spamming Tools ..Scam pages ..spam tools scanners make your own tools ..Keyloggers+fud+xploits

can hack facebook,gmail,yahoo,whatsapp,windows-computer spy on cell phone, computer, want to hack any kind of email? want to get root privilege of any server? or you want to learn, well I m hacker, and tool seller boy, roots + Cpanel + shell + RDP + SMTP + scam page + mailer + email Extractor + fresh lead, + exploits + doc-pdf exploits for .exe converting + any kind of spyware keylogger + sql advance tools for shop admins + much more, just reach me trough following ways Email address:[email protected], Contacts: icq #: 759516037

>>> Randome Tools <<< simple ip smtp: 35 $ domain smtp : 30 $ cPanel : 15$ WHM : 35 $ Rdp : 25 $ Root : 40 $ Ftps : 10$ scame page : 25 $ telnet host : 15 $ Shells : 5 $ Leads : 10$ 10k Latter : 3 $ PhP Mailer : 8 $

Email address:[email protected], Contacts: icq #: 759516037

Trusted by Thousands of Clients

#bank loan#office365#chasebank#spam time#cpanel#alibaba#life insurance leads#office365 leads#spam tools#scripts#WHM#ftps

4 notes

·

View notes

Photo

New Post has been published on https://coinprojects.net/celsisus-staked-ethereum-steth-are-pummeling-defi-valuations/

Celsisus, Staked Ethereum (stETH) Are Pummeling DeFi Valuations

The DeFi space is facing a sharp drop in valuation amid concerns over the Celsius suspension and the Lido-staked Ethereum (stETH) de-pegging.

Data from aggregator DeFi Llama shows that the total value locked into DeFi shrank by nearly 20% in the last 48 hours, to a one-year low of $79 billion.

A mix of factors are influencing FUD in the DeFi space. Celsius’ recent suspension of withdrawals stemmed from the de-pegging of stETH from Ethereum (ETH) in secondary markets. This in turn has caused a shock selloff in ETH– one that has also extended to broader crypto markets.

Ethereum meltdown causes chaos in valuations

Given that Ethereum is the largest blockchain by DeFi valuation, a slump in the token is causing widespread losses in the space.

But a bulk of these are still centered around Celsisus, stETH and Lido. Lido- which was once the biggest DeFi protocol ever, has tumbled out of the top three. It also logged the biggest drop among its major peers in the past week, losing nearly 28% of total value locked (TVL).

While Lido is attempting to mitigate the fallout from a potential stETH crash, 99% of its $5.7 billion TVL is from Ethereum staking on the platform.

A vault on Maker DAO- the biggest DeFi platform by TVL, has reportedly dumped 65,000 ETH to decrease the platform’s risk exposure, signalling further headwinds for DeFi.

DeFi faces its second Terra in one month

With TVL dropping across the board, DeFi may be set for its second major selldown after the Terra crash in May.

Terra spurred a $70 billion crash in total valuation, over the span of 10 days. The blockchain, at its peak, was the second-largest DeFi player by TVL.

But a month later, Lido and Celsisus could spur another crash of similar magnitude. Comparisons between the two are already being made, given that the two share several major investors.

Three Arrows Capital and Jump Crypto- all major investors in Terra, are also stakeholders in Lido through stETH.

A stock market rout, coupled with weak macroeconomic conditions has also largely pressured crypto valuations this year. Volatility is also likely to spike ahead of a Federal Reserve meeting this week.

With more than five years of experience covering global financial markets, Ambar intends to leverage this knowledge towards the rapidly expanding world of crypto and DeFi. His interest lies chiefly in finding how geopolitical developments can impact crypto markets, and what that could mean for your bitcoin holdings. When he isn’t trawling through the web for the latest breaking news, you can find him playing videogames or watching Seinfeld reruns. You can reach him at [email protected]

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link By Ambar Warrick

#Altcoin #Bitcoin #BlockChain #BlockchainNews #Crypto #ETH #Etherium

0 notes

Text

How to Select the Best Remote Access Trojan for Your Niche

Remote access trojans can be injected in a variety of ways. The method of infection is usually similar to other malware infections. It can be spread through specially designed email attachments, web-links, or download packages. It is also installed by deceitful attackers who employ social engineering tactics to make you click on their malicious links. If you're not sure how to protect yourself, learn more about RATs as well as how to safeguard your computer.

Remote access trojans that work for your niche must have a high detection rate and be easy to install. To prevent it from being installed on the computer you want to target it is necessary to install it there. Then, you must create a password to limit the use of the program. If it is an open computer, you will want to use a private one. However, if you're using a public computer, you might want to choose a remote access trojan to protect your personal data.

Another reason to select remote access trojans for your specific niche is that it's now easier than ever to detect malware that's running on your computer. Besides spreading through social networking websites, these trojans can also attack with denial-of service attacks or use your system as proxy servers. As long as you monitor the activities on your computer, you can ensure that the malware doesn't cause any damage to your system free fud apk crypter.

Remote Access Trojans are now an increasingly common threat to malware. They provide hackers with access to your computer's administrative settings that they can use to access your files and monitor your screen. They also have the ability to hijack your network and use it to attack other computers once they are installed. They can also steal your private data, wipe your hard drives, and even steal your computer. Remote access trojans could cause serious damage to your system and impede your privacy if you are unlucky.

Remote access trojans can also be used to mine digital currencies. It's important to know that this type of malware could be extremely difficult to identify. This is due to the fact that it requires that the user allow it to log in to the computer. Although it is possible to identify and stop these malware, it's best to stay clear of these malicious applications. When you're surfing the web you can be assured that you're not alone.

Remote Access Trojans can cause damage to critical infrastructures. They can disrupt the operation of power stations, telephone networks and even entire countries. In 2008, Russia launched a cyberwarfare operation in Georgia. During the conflict in Georgia, the Russian government shut down internet access in the region and the news media was slammed. During the same time it employed RATs to monitor the media and the police.

0 notes

Text

today i had a bread roll with egg, 1 slice of cheddar, some iceberg and some mayo, 2 small pancakes, and 2 griled cheeses with 1 ½ slice of cheese and a small bowl of tomato soup

0 notes

Text

May 10, 2018

News and Links

Protocol

Latest Plasma implementation call.

Kelvin Fichter: Plasma XT. Plasma Cash but much less per-user data checking.

Xuanji Li: Plasma Cash with smaller exit procedure

Blockchain at Berkeley’s Plasma implementation

BankEx plasma on Rinkeby. github.

Latest Casper standup

Casper FFG v0.1 "First Release" to get serious about versioning

Latest Prysmatic Labs sharding implementation call

Justin Drake: a scheme for proposers to omit witnesses in stateless validator execution.

Scaling Ethereum panels: Deconomy and Edcon

Stuff for developers

Sūrya. Gonçalo Sá’s extension of soli for exploring Solidity code

scry-one resilient log awaiter in Typescript

Parr, a query tool

Manticore v0.1.9

Conditional scheduling with the Ethereum Alarm Clock

Embark is now part of Status and released v3.0

Solidity event debugger

FOAM’s Cliquebait. PoA testnet in a Docker container

You can now inspect smart contract variables with Truffle’s built-in Solidity debugger in v4.1.8. Plus Truffle hits 500k downloads.

Zastrin basics of Ethereum course (free!)

Yoichi releases Bamboo v0.0.03

Ecosystem

Aragon Nest announces first give grants: Gnarly optimistic UI from XLNT, Prysmatic Labs for sharding, Frame: OS-level signing provider, toolkits for planning on Aragon from Space Decentral and Giveth, and a git-like versioning system using Aragon.

EF grant winner vipnode’s roadmap

Amberdata analytics dashboards

A look into Ethereum mining pools using miner payouts

Etherscan on its values and monetization strategy

Flippening: Ethereum’s fee market is now larger than Bitcoin’s

45 new members of the Enterprise Ethereum Alliance

Ron Resnick on how the EEA’s stack release makes Ethereum more attractive for enterprise than competitors with vendor lockin

An interview with Christine Moy, the new head of Quorum

Governance and Standards

the goals of EIP0 going forward

ERC1068: Loan standard

ERC1070: Standard Bounties

ERC1066: Status code proposal

ERC780 claims registry updates

simplify ENR for v4 compatibility merged into EIP778

EIP908 incentives for archive nodes update

ERC1046 to “extend ERC20 token interface to support the same metadata standard as ERC721” merged

EIP 1062: Formalize IPFS hash into ENS resolver

ERC1067: Upgradeable token approach

EIP1057: programmatic PoW

Discussion on ERC1056 lightweight identity

‘Final call’ added as draft to EIP process

Composables ERC998 Update

Dan Finlay proposes “Strange Loop,” a type of liquid democracy signaling process for governance

Project Updates

Kauri is live on Rinkeby, with knowledge base article requests for uPort, Maker, Aragon, Remix, Toshi, Dharma

Following up on their video, the Aragon Manifesto in print form.

Steph Curry has his own CryptoKitty

draft of the Civil Constitution

0x April update

OmiseGo full roadmap update

Townsquare Media to test BAT and Brave for adblock visitors

uPort’s take on data onchain in the age of GDPR

Interviews, Podcasts, Videos, Talks

Edcon live streams. See schedule to find a specific talk.

Linda Xie’s intro to crypto talk at an Andreessen Horowitz event

Interview of Kiev’s DappDev speakers

Blockchain UX with Jose Caballer and Chris Pallé

10 min Vitalik Buterin interview from Deconomy

Thibaut Sardan on setting up a full Parity node on Zero Knowledge

Fabian Vogelsteller with Jeffrey Tong

Tokens

SEC Commissioner Hester Peirce speech on how regulators should be lifeguards at the beach, not sandbox monitors

a16z’s Scott Kupor and Sonal Chokshi: Analogies, the big picture, and considerations for regulating crypto

Fred Wilson: Is Buying Crypto Assets “Investing?”

“12 Graphs That Show Just How Early The Cryptocurrency Market Is”

Bloomberg graphic on cryptoasset and non-cryptoasset correlations

General

Chris Ballinger launches MOBI to explore blockchain applications with companies comprising >70% of worldwide vehicle production, eg BMW, Ford, GM, Renault etc

Brian Armstrong publishes the decision making framework at Coinbase

Starkware raised 6m from an allstar list of investors for a zkSTARK hardware and software stack

Lots of melodrama about “WSJ FUD” when there was no public SEC hearing on May 7. Paul Vigna is a reputable reporter and only reported a “working group.” Seems to me like most of the kerfuffle was due to over-extrapolation by crypto media in search of pageviews.

Eric Schmidt talking web3 with EF and ConsenSys

Facebook’s messenger lead now leading blockchain efforts.

Dates of Note

Upcoming dates of note:

May 11-12 -- Ethereal (NYC)

May 15 -- Kleros sale

May 16-17 -- Token Summit (NYC)

May 17 -- Blockchain, Accounting, Audit, and Tax conference (NYC)

May 17-19 -- Melonport hackthon in Zug

May 18-20 -- EthMemphis hackathon

May 19-20 -- Hacketh (Warsaw)

May 25 - 27 -- EthBuenosAires hackathon

May 28 -- Zeppelin’s zepcon0 conference (Buenos Aires)

June 1 – Blockchain for Social Impact Conference (Washington, DC)

If you appreciate this newsletter, thank ConsenSys

I'm thankful that ConsenSys has brought me on and given me time to do this newsletter.

Editorial control is 100% me. If you're unhappy with editorial decisions, blame me first and last.

Shameless self-promotion

Here's the link to this issue: http://www.weekinethereum.com/post/173769093623/may-10-2018 Most of what I link to I tweet first: @evan_van_ness

I also have an Ethereum podcast on the Bitcoin Podcast network.

This newsletter is supported by ConsenSys, which is perpetually hiring if you’re interested.

Did someone forward this email to you? Sign up to receive the weekly email (box in the top blue header)

2 notes

·

View notes

Text

Spy Net 2.6 Rat

Spy Net 2.6 Rated

Well RAT(s) are usually used for hacking, and they are detected as backdoors. Popular RAT programs xCerberus Rat xProRat xPoison Ivy xTurkojan Gold Rat xSub Seven xNetBus RAT xSpy-Net xLostDoor xBitFrost xNuclear RAT xBandock xPain Rat xBeast xOptix Pro xDARKMOON xNet-Devil xApocalypse Rat xCyberGate x. Spy-Net 2.6 RAT - Full Setup Tutorial This tutorial is written by 'I Used To Make Out With' aKa Edward Butcher for Hackforums.net If you're going to leech it credit please Tutorial is noob friendly! Requirements-Win XP,vista or 7-Spy-Net RAT v2.6-No Ip (Dynamic DNS)-Fud crypter/protector or hexing skills (optional).

Spy Net 2.6 Rated

New features included: - Added optional connection limit. - Increased connection stability. Spy-Net is now as stable as SS-Rat. - Increased speed in filemanager list files and list drives. - Autostart on most features now. - Password retrieval has been improved. Features and Specs: - server around 280 kb, depending on if icon is selected, rootkit, upx compressed, etc - windows xp, vista and 7 compatible; - DNS Updater (for now working with No-IP. developing dyndns updater atm) - File Manger with a load full of options like FTP upload, set attributes to files, preview for images, etc etc etc; - Windows List; - Process List; - Device List; - Service List; - Registry Editor; - Installed Programs; - Active Ports List; - Remote Desktop; - Webcam capture; - Audio Capture; - Password Recovery Tool (with direct download to client or FTP logs); - Password Grabber; - Socks 4/5 proxy; - HTTP Proxy; - Open Webpage; - Download and Execute; - Send local files and run hidden or normally; - Remote Chat Client; - DOS Prompt; - Run cmd; - Clipboard Grabber; - Search for remote files and search on Password Recovery Tool; - Access to download folder, remote desktop screen shots and web capture from menu. - Encrypted traffic between Client and server; - a few extra options (restart, lock buttons and stuff….) and all the options related to server (uninstall, rename, etc etc etc); - add a new option for injection – wait for first browser to open. not the default but the first to start. seems useful in some cases. - Rootkit in beta stage and being developed. It will hide process name and startup keys that have SPY_NET_RAT as name. Tested under XP and working, being developed and tested on other OS’s; - Connections Limit selector; - Binder, - Columns selector (u can choose which columns u wanna see details from in the client. ex: u can hide RAM info view or Ports info view or any other using right click on top of the columns); - Ability to choose either server is installed or not in remote computer. NOTICE:you cant update it spynet 2.6 to 2.7 its not compatible… Download SpyNet

0 notes

Text

BITCOIN APPROACHING CRITICAL LEVELS!!!! [WHALES CASHING OUT] TIME SENSITIVE WATCH FAST – Programmer

youtube

FREE ALTCOIN WEBINAR: https://academy.ivanontech.com/interested-in-webinar-alts

BYBIT – START TRADING CRYPTOS: https://ivanontech.com/deals

GET BSI INDICATOR: https://academy.ivanontech.com/bsi-indicator-tradingview

WATCH LIVE DAILY: https://ivanontech.com/live

SIGN UP FOR TELEGRAM: https://t.me/ivanontechannouncement

00:00 Opening 00:17 Announcement: BTC price to 39K – Key level. Critical 01:14 Announcement: Democrats win Georgia’s Senate seats. Democrats control the Senate 02:19 Announcement: Warning signs 02:44 Welcome to the chat 04:40 Webinar shoutout Altcoin Webinar 05:35 Wisdom: Capitol hill siege. Weird but funny situation 07:00 Wisdom: We will have insane stimulus printing because Democrats rule 09:17 Coingecko chart marketoverview 11:32 BTC Dominance daily chart: Bearish trend 12:10 BTC weekly chart: Fib retracement is key indicator in price discovery 12:54 BTC daily chart: We go to the next level in one week 14:05 NUPL on chain. We are almost in Euphoria! 14:38 Alex Saunders… CAUTION: Whales are sending coins back to exchanges – Sale imminent. Pullback is coming 15:34 Lecture on: Short term overbought like never before 16:40 BTC hourly chart with BSI: We are still bullish 18:05 BTC daily chart + NUPL: pullback did not reset NUPL like it normally does 19:20 Longterm Holder NUPL chart: Shows how much HODLers are in profit. In a few weeks be very careful! 20:53 glassnode NUPL chart on tradingview: 2013 we had doube bubble 22:59 BTC hourly chart 23:20 ETH hourly chart: We confirmed the break out 23:41 Announcement Raoul Pal Tweet: BTC ETH correlation 24:00 ByBit shoutout 25:00 Crypto news from Raoul Paul: Metcalfe’s law explained for ETH = BTC 26:18 BTC predates ETH by 5 years 27:25 ETH will grow faster than BTC 28:10 Chart: Active Addresses Above 1 million for ETH and BTC 30:20 LOG Chart shows similarities also. To the very dollar 32:26 Altcoin forrest 32:27 Matic chart 32:33 MahaDAO – ARTH launch 32:57 YOP added to CoinMarketCap 33:11 ANKR chart -Stkr governanve 33:52 Exeedme chart – partner with DIA 34:58 UTrust Shoutout Nuno Correia 36:19 PAID network team. Shoutout to Kyle Chasse 38:30 Midroll party UACA Like Subscribe Bell Button All song 40:37 Blockbuster rolling 41:01 Webinar shoutout Altcoins webinar Wednesday 13th of January 41:39 Q&A 42:10 Q1: USDT FUD 15th of January? Maybe. If not then pump 42:46 Q2: Can I do my own crypto taxes? – Go find a tax advisor/professional 44:18 Q3: Can you explain flashbots front running on DEX-es? 46:30 Explanation of bots and exploits and how to protect your users. Obfuscation needed 48:09 Q4: Will you cash out on BTC in January or will you hodl? 49:15 Q5: Does ETH have NUPL also? 50:50 Q6: When BTC dumps do ALTs crash also? 52:03 Q7: Can you elaborate on whales cashing out? 52:34 Q8: What about overbought assets like Tesla? 55:01 Q9: I don’t see ETH doing the same as BTC years ago because of gasfee’s? 55:55 Q10: Do you think another oracle bullrun is coming? 56:10 Q11: NFT farming of pants coming? 57:08 Q12: Nate’s present? 57:18 Q13: INJ platform, derivatives next thing? 57:31 Q14: Whales dump institutions will buy up? 58:00 Q15: Best Liquidity aggregator? 01:01:05 Q16: Is CHI-token a hack to compensate gasfee?

Podcast links: Apple Podcast: https://podcasts.apple.com/be/podcast/ivanontech/id1491623365 SoundCloud: https://soundcloud.com/ivanontech Spotify: https://open.spotify.com/show/5PLwE4TXRjE7y8WRyNbhWI?si=8g2NYjV9QmSnKCLApdJhuA RSS (add in any app yourself): https://feeds.soundcloud.com/users/soundcloud:users:747558916/sounds.rss

**Disclaimer** Please be advised that I own a diverse portfolio of cryptocurrency as I wish to remain transparent and impartial to the cryptocurrency community at all times, and therefore, the content of my media are intended FOR GENERAL INFORMATION PURPOSES not financial advice. The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial legal or tax advice. The content of this video is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Purchasing cryptocurrencies poses considerable risk of loss. The speaker does not guarantee any particular outcome. Past performance does not indicate future results.

bitcoin, cryptocurrency, crypto, altcoin, altcoin daily, blockchain, decentralized, news, best investment, top altcoins, ethereum, tron, stellar, binance, cardano, litecoin, 2019, 2020, crash, bull run, bottom, crash, tether, bitfinex, rally, tone vays, ivan on tech, chico, video, youtube, macro, price, prediction, podcast, interview, trump, finance, stock, investment, halving, halvening, too late, when, fed, federal reserve, interest rates, rates, cut, economy, stock market,

Good Morning Crypto

Ivan on Tech by Ivan Liljeqvist

The post BITCOIN APPROACHING CRITICAL LEVELS!!!! [WHALES CASHING OUT] TIME SENSITIVE WATCH FAST – Programmer appeared first on BLOCKPATHS.

source https://blockpaths.com/commentaries/bitcoin-approaching-critical-levels-whales-cashing-out-time-sensitive-watch-fast-programmer/

0 notes

Text

yesterday i had something i don't remember for lunch and mcdonalds for dinner

today i had a chocolate mug cake and 9 smiley fries

i also got my period today :')

1 note

·

View note

Note

ask-fluffy-gnar:

“It gon log tim… Gnar mo ca follo…” his ears droop as he looks to the ground. He then perks up and smiles “M-mo mata it hapan log tim ago. Hu wan moa fud? Gnar made lotz ad lotz” he laughs awkwardly and pours them a second serving “It ap so u ca be big ad stwong haha”

Bri still didn’t quite seem to get it, though Rib most certainly did. “Home, huh...” Sometimes he wondered if he’d ever get to see his again...

As usual, though, the witch was quick to focus on less dour topics. “Big and strong? I’m still working on that spell, actually. One day I wanna cast Hugeify on Rib so he’ll be REALLY big!”

A strange young girl with a frog on her back suddenly came crashing in. She appeared to be riding... A giant turnip? (talesofruneterra)

"Gah!" Lets out a yelp, being suddenly startled like that. Gis fur standing on end "Ho iz u?! U m'opay?" The yorlde calms down to see the sittuation.

@talesofruneterra

41 notes

·

View notes

Text

Telegram Attacks Apple, Musk on Crypto, WEF Debrief: Hodler’s Digest, Jan 20–26

Hodler’s Digest Coming every Sunday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

World Economic Forum debuts framework for central bank digital currencyIt was a c-c-c-cold week in Davos, but Cointelegraph’s reporters wrapped up warm to bring you all the news from the World Economic Forum. One particularly big announcement saw the WEF unveil a central bank digital currency policymaker toolkit. The framework, created in tandem with central banks, is designed to help policymakers understand whether deploying a CBDC would be advantageous. In other developments, a global consortium has been formed to focus on developing interoperable, transparent and inclusive policy approaches to regulating digital currencies. At the start of the week, the European Union and five major central banks — the United Kingdom, Japan, Canada, Sweden and Switzerland — announced they were planning to team up on their research for CBDCs.WEF: Facebook’s Libra pushed world to reconsider USD as global reserve currencyElsewhere in the snowy hills of Davos, global economists begrudgingly admitted that Libra had played an instrumental role in getting the world to evaluate CBDCs — and to challenge the U.S. dollar’s role as an anchor currency. On a panel exploring the issue, Brazil’s Economy Minister Paulo Guedes said new technologies like blockchain are paving the way for future currencies to be digital. Others, such as the International Monetary Fund’s chief economist, Gita Gopinath, cautioned that the dollar still remains attractive because it “provides the best stability and safety.” David Marcus, the head of Facebook’s Calibra wallet, was speaking at another WEF panel. He questioned whether “wholesale” CBDCs would solve any problems in the global economy, and argued that a retail-focused approach is the best way to tackle an “unacceptable” situation where 1.7 billion people are unbanked and another 1 billion underserved. Whether Libra will be that solution remains to be seen.WEF: Ripple CEO hints at IPO, says more crypto firms will go public in 2020And we’ve just got time for one final morsel of gossip from Davos. Ripple CEO Brad Garlinghouse has predicted that initial public offerings will become more prevalent in the cryptocurrency and blockchain space in 2020 — and he hinted his company would be among those seeking a public flotation. “We’re not going to be the first and we’re not going to be the last, but I expect us to be on the leading side,” he said. Such a move could be instrumental in building confidence with mainstream investors and secure a pivot away from controversial initial coin offerings, which have seen young startups suffer often expensive run-ins with regulators such as the U.S. Securities and Exchange Commission.

Tether launches gold-backed stablecoin and begins trading on BitfinexOf course, plenty of news has been happening away from Davos. Tether has announced it is now supporting a gold-backed stablecoin, where one token represents ownership of a troy ounce of physical gold. The funds are said to be backed by physical gold held in a “Switzerland vault” — and the product is available as an ERC-20 token on the Ethereum blockchain, as well as a TRC-20 token on Tron. Plans for commodity-backed Tethers have been in place for some time, but the company has often been criticized for its opaque approach to reserve management. A high-profile class-action lawsuit recently accused the company of market manipulation in 2017. Tether reserves were also allegedly used to cover a liquidity shortfall.Elon Musk reveals his true opinion on Bitcoin and cryptoTesla’s CEO may be constantly cryptic on his attitudes toward crypto, but this week, we got a little insight into Elon Musk’s thinking. On a podcast, the billionaire said he’s “neither here nor there on Bitcoin,” acknowledged Satoshi’s white paper was “pretty clever,” and warned his stance on cryptocurrencies often “gets the crypto people angry.” Musk added: “You must have a legal to illegal bridge. So, where I see crypto is effectively as a replacement for cash. I do not see crypto being the primary database .” Musk has been known to write short tweets about crypto that were widely interpreted as jokes. Last year, he unexpectedly declared himself as the new CEO of Dogecoin — a gesture that helped the joke coin clock short-lived gains of 35%.

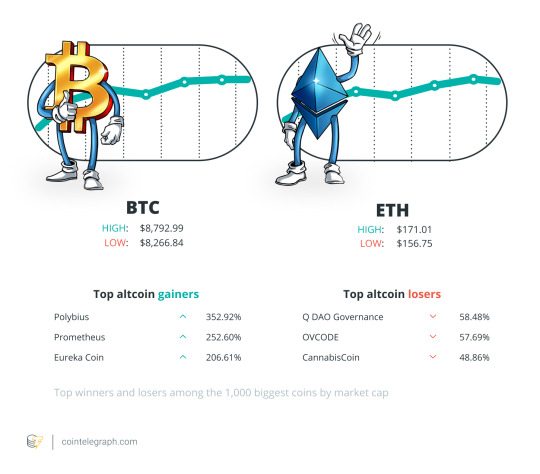

Winners and Losers

At the end of the week, Bitcoin is at $8,450.74, Ether at $163.88 and XRP at $0.22. The total market cap is at $233,388,704,913.Among the biggest 1,000 cryptocurrencies, the top three altcoin gainers of the week are Polybius, Prometheus and Eureka Coin. The top three altcoin losers of the week are Q DAO Governance, OVCODE and CannabisCoin.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“I think there's a lot of things that are illegal that shouldn't be illegal. I think that sometimes governments just have too many laws about the missions that they should have, and shouldn't have so many things that are illegal.”Elon Musk, Tesla CEO“So then there is the new technology, the digital, the blockchain. The Libra episode is just evoking a future digital currency.”Paulo Guedes, Brazil’s economy minister“When we started this journey almost six months ago, the whole idea was not around a certain way of doing things, but more around ‘let’s come together and try to figure out how we solve a problem that is unacceptable’ — 1.7 billion people who are currently unbanked, another billion underserved.”David Marcus, Calibra CEO“Given the critical roles central banks play in the global economy, any central bank digital currency implementation, including potentially with blockchain technology, will have a profound impact domestically and internationally.”Sheila Warren, World Economic Forum head of blockchain“In the next 12 months, you’ll see IPOs in the crypto/blockchain space. We’re not going to be the first and we’re not going to be the last, but I expect us to be on the leading side… it’s a natural evolution for our company.”Brad Garlinghouse, Ripple CEO“My #Bitcoin mystery is solved. I mistook my pin for my password. When Blockchain updated their app I got logged out. I logging back in using my pin, which was the only ‘password’ I had ever known or used. I also never had a copy of my seed phrase. Honest but costly mistake!”Peter Schiff, crypto skeptic and gold bug“iCloud is now officially a surveillance tool. Apps that are relying on it to store your private messages (such as WhatsApp) are part of the problem.”Pavel Durov, Telegram founder and CEO

FUD of the Week

Greece extradites alleged launderer of $4 billion in BTC, Alexander Vinnik, to FranceA Russian national accused of heading a group that laundered $4 billion in Bitcoin has been extradited from Greece to France. Alexander Vinnik formerly operated the now-shuttered exchange BTC-e and is believed to have a direct relationship to the infamous hack of Mt. Gox. The case has risked triggering a diplomatic row, with Russia filing several requests to bring him under its jurisdiction. Lawyers writing on behalf of Vinnik’s young children had submitted a complaint to a Greek court at the start of the week in an attempt to prevent the extradition. Reports now suggest that Vinnik is being held at a hospital in Paris. His legal representative Zoe Konstantopoulou said: “In every way the government is trying to scare him, terrorize him, in a moment of great agony, while his health has worsened.”India’s central bank says it hasn’t banned cryptoThe Reserve Bank of India has said restrictions on regulated entities offering crypto assets do not equate to an overall ban. In a document submitted to the country’s supreme court back in September, which has now been made public, the institution said: “The RBI has not prohibited VCs (virtual currencies) in the country. The RBI has directed the entities regulated by it to not provide services to those persons or entities dealing in or settling VCs.” All of this comes as a landmark case against the RBI concludes its second week. Hearings are set to resume on Jan. 28.Peter Schiff bungled wallet password, solving “Bitcoin mystery”Long-running crypto skeptic and gold bug Peter Schiff is likely to be even more skeptical after losing access to his funds. At first, he believed his wallet was corrupted — but he later found out that he mistook his PIN for his password, and he was unable to log in after an app update because he had never taken a copy of his seed phrase. Many in the crypto community have criticized Schiff for making a rookie mistake, with Binance CEO Changpeng Zhao quipping: “I can’t believe I am about to say this, but maybe ‘stay in fiat?’” In recent days, CZ has said that keeping assets on an exchange is often safer than keeping the keys themselves — but those who have fallen victims to hacks on these platforms may not be so quick to agree.

Telegram CEO: Apple’s iCloud is “now officially a surveillance tool”Pavel Durov, the founder and CEO of Telegram, has claimed that Apple’s cloud service iCloud is “now officially a surveillance tool.” His stinging rebuke followed reports that the tech giant dropped plans for end-to-end encryption on iCloud two years ago — apparently following complaints from the FBI. This ultimately means that backed-up texts from iMessage, WhatsApp and other encrypted services remain available to Apple employees and authorities. Telegram has been positioning itself as a global fighter for privacy — and in 2018, it refused to give Russian authorities the encryption keys to user accounts, prompting as-of-yet unfulfilled threats that the app would be blocked “in the near future.”

Best Cointelegraph Features

SEC goes head-to-head with Telegram, makes a guinea pig of TONThe Chamber of Digital Commerce submitted a legal document to the court overseeing the hearing between Telegram and the U.S. Securities and Exchange Commission. Shiraz Jagati looks at what it says.Effect of CME futures options on BTC price depends on halvingCME Group has launched new Bitcoin options — further uplifting the institutional infrastructure supporting the asset class. Joseph Young writes that it’s a net positive for the crypto community, and the upcoming “halving” could make things more interesting.Adam Back on Satoshi emails, privacy concerns and Bitcoin’s early daysCassio Gusson has caught up with Adam Back to discuss the early years of Bitcoin, his emails with Satoshi Nakamoto and privacy — 11 years after BTC’s release.Original Article - CoinTelegraph.com Read the full article

0 notes