#frotman

Explore tagged Tumblr posts

Text

Paternal Instinct

squid game men's x daughter reader

☆ As the title says, this is gonna be a little bit paternal, like, I'm sure they'd be the best when it comes to children (sometimes)

☆ I will put imagines in and out of games and depending on the character the reader will be of different ages.

☆ The next thing I'll post will be a request from Thanos

Hwang In-ho

● Outside of games.

You, being a teenager in this world that your father dragged you into after your mother's death, were complete chaos.

You worked as a supervisor at his side wearing a mask with the figure from the square depicted in the center and despite being part of an organization of sadists you have not killed anyone, In-ho made sure you did not have to.

You walked into your room and removed the mask from your face as let out a long sigh, it had been a long day overseeing the creation of the games that this year's participants would cross and now all you wanted to do was sleep but as soon as you dropped your body onto the soft mattress, the door opened.

In-ho, without his frotman suit, entered your room with a small cake in his hands and the candles lit.

True, it was your birthday, ¿how come you forgot your own birthday? Maybe it's because you spent the day planning the deaths of innocent people.

—I asked for this cake to be made for you —In-ho said with a small, almost imperceptible smile.

They weren't as close as before, but he cared about you and tried to pay attention to everything that had to do with you.

—Thanks —you forced a smile as you sat on the edge of your bed —But it wasn't necessary.

You wanted to take it back when you saw the slight grimace on your father's face but couldn't, you simply weren't in the mood to celebrate your birthday under these conditions, your life wasn't the best and although you didn't hold any grudge against In-ho sometimes you wondered what your adolescence would have been like if he had left you with your uncle Jun-ho and your grandmother.

—I know you think that, you can say it —He said, leaving the cake on the table next to your bed.

—¿Why didn't you leave me with Jun-ho? I don't want to live here, I've had enough with my mother's death without seeing you become a puppet for these games.

In-ho sighed and looked down, you were right, he should have left you with his brother, he could have taken better care of you than he was doing but he didn't want to abandon you, he had already lost the love of his life, he couldn't lose his little world after that.

—You are the only thing I have left —He responded with regret —Believe me, I considered it, letting you have a life you deserved but I couldn't just watch you through cameras ¿Do you think bringing you to this shit was my first choice?

You didn't respond, you just hugged him and let him return the gesture, you still didn't want to continue living there but you didn't want to leave him alone either, after all, both only had each other.

After a few minutes of silence you looked back at the cake and smiled softly.

—¿Is it chocolate?

—dark chocolate, your favorite —He left a fatherly kiss on your head and took the cake again to put it in front of you —Blew out the candles and make a wish

The smile on your father's face was enough to ease your worries for a few moments, you blew out the candles hoping that one day these games would end.

● Inside the games.

In-ho's plan was going just as he thought, he approached Gi-hun and began to gain his trust but seeing you walk towards them among all the players made his heart skip a beat.

—¿Can I be on your team? —You asked with a smile that showed your white teeth.

—¿How old are you, girl? —390 asked with a surprised expression.

—Twenty —You replied naturally, playing with your hands, but In-ho snorted and took two steps towards you.

—No —He looked at you witheringly —No —Now he turned to see Gi-hun's team —She is sixteen, no twenty ¿What are you doing here?

He ended up looking at you again, he really didn't want you to be here and worse because his lie along with his fake name Young-il would fall apart but you were smart.

—¿Do you know each other? —Asked 388, who you found cute almost immediately.

—Yes, he is a friend of my father

—¿What are you doing here? —In-ho asked again, almost desperate to get an answer. You disobeyed him and you can be sure that you will be grounded until you turn thirty.

—The same as you —You answered firmly and defiantly, your smile challenged him because you were sure that he wouldn't scold you or his whole false theater would fall apart —¿Can I be on your team?

—Sure —Dae-ho replied, smiling kindly at you.

You smiled at him too, but with other intentions, just to irritate your father a little and take advantage of the fact that he couldn't scold you now.

—Thank you —you said with a flirtatious smile and a wink, to which Dae-ho lowered his head in embarrassment.

—Sixteen —In-ho repeated with slight annoyance and a tense smile.

Dae-ho tensed and raised his hands in a sign of peace and took a step back, he was just being kind but it was better to be safe than to have to face that man who kept looking at you with annoyance and reprimand.

You would be a problem for your father because not only would you challenge him at every opportunity you had but you would also try to help Gi-hun end these games, that was your wish and nothing was going to make you change your mind.

The Salesman

● Outside of games.

The morning was calm, everything was silent and through the window you could see the clear sky with the sun shining, a good climate but a great contrast with the interior of your home.

The walls were wallpapered and the floor was shiny, you placed your hands on the cold marble table while your father placed a plate with a mountain of pancakes in front of you.

—Breakfast is ready —he said with a wide smile.

A polite smile, but most of the time it conveys coldness and threat. For you, this expression was genuine affection.

—¿Aren't you going to have breakfast with me? —You asked curiously watching him wipe his hands with the kitchen cloth and then fix his hair and walk towards the refrigerator.

—I would love to stay pumpkin but you know I have to go to work —He replied without paying much attention to you —After finishing your breakfast you take off your pajamas, get dressed formally and wait for your teacher to arrive.

You nodded silently as you used the fork to bring a piece of pancake to your mouth.

Life was monotonous.

Every day, you got out of bed to make it, had breakfast that your father prepared, bathed, combed your hair and got ready to take your private lessons at home, did your homework and at night you watched an exact hour of cartoons, brushed your teeth and went to bed.

Your father was a very organized man when it came to your schedule, you remember how one time you watched five extra minutes of television and as punishment he locked you in your room for five hours.

“Television melts your brain”

Despite everything, he loved you, you knew it, he just had a strange way of letting you know.

—I'll be back tonight, I love you pumpkin —He said approaching you to leave a kiss on your forehead.

He was a good father, but you didn't know anything about what he was doing out there.

You didn't know that he recruited and investigated people who would die playing for money or that sometimes he took on dirty jobs that his boss sent him, you didn't know what kind of person he really was and that was what the salesman wanted.

He adored you and that's why he avoided at all costs that you knew about the double life he led, he didn't want to hurt you.

However, there were certain mistakes that he regretted, one for example was that he himself had killed your mother as soon as you were born, he knew that she would want to run away with you, she did not want to continue living the life she had at his side and that was why he had to put a bullet between her eyes.

He didn't let her take you away from him, you were his daughter and even though he locked you up practically every day, he convinced himself that it was only for safety.

He only let you go out for a walk in the park and shopping malls on your birthday, once a year.

Despite how boring your life was, everything was going well until one night you heard moans and sobs coming from below your house.

You rarely heard them and this time you were very curious, you got out of bed, put on your slippers and left your room.

You silently walked down the stairs as the noises grew louder, when you reached what seemed to be the source of the sound, you saw that it was your father's secret room, a door that led to the basement was always locked, but this time... it was open just a little.

—¿Daddy? —You called him softly as you opened the door.

As you walked down the dark basement stairs, sobs mixed with opera music filled your ears, sending a shiver of fear through your entire body, you hugged your teddy bear tighter.

—The probability of dying is one in six and of surviving five in six —You heard your father's voice.

He explained with a polite smile, it was a great contrast to the situation was in, he liked to feel the adrenaline of this game and that way he could also get rid of these two men who had been following him during the day.

However, when he saw you at the bottom of the stairs with a scared expression and on the verge of tears, his smile faded and hid the gun behind him.

—¿What are you doing awake? It's past your bedtime and I told you a hundred times that you weren't allowed to come in here.

He spoke sternly and angrily, the two men he had tied to a respective chair began to make desperate sounds to get your attention, as if you were the only way to get out of there.

—¡Silence! —He shouted furiously making you jump a little in your place, you hadn't seen this side of him —Go to your room, ¡now!

Once you ran out of there, he took out his gun again and pointed it at the man in the red shirt. He was the one who made the most noise and that's why you woke up.

—Excellent, y'all traumatized a nine-year-old girl —He said with a tense smile

Although it was also his fault, he knew that at any moment you would discover his work anyway, but he hoped that wouldn't happen soon.

After you returned to your room you couldn't sleep, a couple of hours passed until your father opened the door and cautiously entered.

—You were disobedient —he began in a serious voice —And as a result you saw something you shouldn't have.

You were still lying face down with your face hidden in the pillow, he still had the loaded gun in his hand, he knew what had to do or else you would cause trouble.

But him couldn't.

The ease with which he killed his father was surprising but he couldn't kill you, you were the only thing that gave this home humanity and the mere thought of ending it made his stomach turn.

He clenched the gun in his hand and twisted his lips, after a long mental battle he put the gun in his pants and sat next to you.

—There are many things that you still won't understand, but what you can be sure of is that I am your father and I love you —With his hand he caressed your hair and felt you relax a little. —No matter what you saw down there, you will still be my daughter, but there will be some changes in this house.

You remained silent, you felt distrust but he was still your father, he was the only thing you knew and even if you were afraid of him you couldn't leave there, you had nowhere to go.

After a few minutes you sat up in bed and hugged him for comfort. He just caressed your hair and kissed your head.

Hwang Jun-ho

● Outside of games.

Being the daughter of a police officer had its advantages and disadvantages.

One advantage was that you could brag about it whenever someone bothered you at school, including teachers, and a big disadvantage was that you rarely got to spend time together as a father and daughter.

Jun-ho worked constantly but he also tried to keep an eye on you. "She's your daughter, before you know it she'll be your age," his mother constantly repeated to him reproachfully, she was right, time was flying and if he continued looking for his lost brother or working double shifts at the police station he would miss more years of your life.

For that reason, he decided to leave work early that day, and went to buy two hamburgers, some chips and candy while he thought of some fun activity to strengthen the family bond.

But when he got home he found you sitting at the table next to your teacher.

He twisted his lips, assuming you had gotten into trouble.

It was no surprise, you missed some classes, you didn't bring homework and your grades weren't the best but you were a great girl in terms of your behavior, just very distracted and Jun-ho couldn't help but feel guilty about that behavior on your part, yeah, sometimes you did it to get his attention.

After talking for two hours with your teacher she left and your father looked at you tiredly.

—You haven't taken any algebra classes, if you continue like this you'll fail the year.

You formed a fake smile on your lips.

—The teacher hates me —You stated, getting up from your chair to go towards the bag that your father had brought. —You left work early.

—I thought I'd do something fun, you know... father-daughter

You saw him with a raised chest, it was not usual, it was already customary for Jun-ho to spend most of the day outside the house, either looking for your uncle or immersing himself in his work.

—¿It's a holiday and I forgot? —You asked funny and sarcastic, turning around to get a juice from the refrigerator.

—Funny —he responded falsely —Now bring your notebooks, let's study together.

It was not the entertaining activity that he had in mind but if it brought them closer as a family it was an opportunity that he would not waste.

—¿Oh really? I mean, I already missed the school year anyway.

The look on Jun-ho's face let you know that he wasn't joking, they were going to spend the next four hours studying numbers and equations.

You really thought it would be a waste of time but it wasn't like that, as the conversation about algebra flowed the confidence did too, Jun-ho had been absent many times but this help made you remember that no matter what happens or how, no matter how big or small the problem is, he will be there for you.

● Inside the games.

You were stubborn, you always disobeyed any order they gave you, even if your father asked you not to get involved in his affairs you ignored him because were family and you should support each other.

The last few days you had seen Jun-ho more worried and anxious than normal, so you decided to follow him and find out the reason for his current state but you didn't imagine that it was something related to the disappearance of your uncle In-ho, apparently he had already got some clues and you wanted to help him.

He scolded you when he discovered you and warned you not to get involved, he even went to leave you with grandma with the excuse that he would be away for a couple of days but you escaped through a window and followed him again.

That led you to where you were now.

Your bare feet were sweating and your hands were shaking, you tried to avoid looking down through the glass you were in but curiosity got the better of you and you looked down into the void.

You were terrified.

The night you followed your father, one of the men dressed in pink with a circle mask discovered you, left you unconscious and when you woke up you were wearing a green uniform with the number "455" lying on a bed and surrounded by several people who dressed the same, you thought it was some joke, you didn't know what you had gotten yourself involved in, and when you saw that had to play a series of games to avoid being killed, you felt as if the soul was leaving your body.

You looked for your father among all the players but you couldn't find him and shortly after you learned that he had infiltrated the guards, he told you when he came in during a fight between players and was able to talk to you for a few seconds.

—I don't want to die —You murmured fearfully as you heard another glass breaking accompanied by a scream.

—You're not going to die, you have to relax —218 spoke behind you, you were one of the last to cross these crystals and you were more than grateful for that.

You gulped and continued jumping to the next crystal that fortunately had already been tested by another player.

Meanwhile Jun-ho felt his stomach turn and his heart beat like crazy.

He tried to maintain a firm and calm posture, he was still an infiltrator and he couldn't let them notice his concern, but seeing you there between life and death made his heart stop.

One of the so-called "VIP" with a gold mask called him to serve him more liquor and he obeyed, however, the conversation that these people were having about the players made his blood run cold, they talked as if they were just entertainment, some circus animals so that these people could have fun as spectators, but what caught their attention the most was the way they talked about you.

"She looks about fifteen years old" one said with amusement "I say sixteen" spoke another.

Wrong, you were thirteen years old and Jun-ho felt like the worst father in the world for letting you get involved in this.

—¿Will sell the body if she dies or will they cremate it? —One asked interestedly and earning laughter from the rest, Jun-ho only felt nauseous listening to it.

Jun-ho returned to serve liquor to one of the masked men but when he heard a glass break followed by a female scream that he immediately identified as your, he turned around and felt his world collapse.

Where you were previously standing was now 218 with the gaze lost downwards and the body tense, when it was your turn to decide between the two crystals you refused, you didn't want to do it and saw the man who helped you survive each game was there behind you ready to push you.

Another breaking glass caught the attention of the guests, guards and the frontman, Jun-ho had dropped the tray with everything and bottle of liquor.

—I apologize —he murmured, bending down to pick up the mess of broken glass, taking advantage of the fact that no one could see his face, he shed tears of pain.

[...]

A few months had passed after living that nightmare in the games, Jun-ho left there with a bullet in his shoulder and with the disappointment of discovering that it was his brother who was leading all that, but also thanks to that you left alone with some broken bones.

In-ho recognized you instantly and made sure that you could get out of there alive, when you fell from that glass platform your body did not fall directly to the ground, the blow was cushioned by a pad that had been placed specifically for you.

He pretended you were dead and sent you to the hospital, When Jun-ho found out that you were there, he cried with happiness knowing that you were still breathing.

He walked into your hospital room with a set of clean clothes in his hands and when he saw you sitting on the bed eating Jell-O and watching TV he couldn't help but laugh.

—For you this was a vacation.

—Falling from a great height brings its advantages —You said with a triumphant smile, you had gotten rid of many exams and schoolwork.

He always apologized to you for everything you had to go through, from that day on he stopped looking for In-ho (or at least he did it secretly from you) and he was more attentive to you, he took you to school, he was never missing to any event that was special for you and he promised to put you ahead of everything.

Seong Gi-hun

● Outside the games.

He's not the best father but he tries.

You were standing in the forum of your school wearing a dark blue robe and the characteristic mortarboard on your head, in your hands you held your diploma and tried to smile for the camera of the photographer that the school had hired.

You still looked between the seats in the stands for your father but there was no one, your mother had gone with your sister to the United States with her new husband and you had stayed here because you didn't want to abandon Gi-hun.

You formed a grimace on your lips and looked down with sadness and disappointment until suddenly you heard him voice among the people and you looked up again.

—Yes, my daughter just graduated, ¡Oops! Sorry if I stepped on you —He spoke embarrassedly as he crossed the row of people to get to his seat.

You laughed softly and inevitably raised your hand to greet him and get his attention even though your teacher scolded you.

Gi-hun carried a beautiful bouquet of flowers and a gift box in his hands, he sat in his respective place and smiled at you affectionately.

To be honest with himself, he had not planned to come to your graduation, he would apologize to you later by taking you to eat, giving you a gift and flowers, but in the end he decided to go, late but he arrived.

It took him a long time to find the salesman again and he was practically investing all his money in it, this day was not going to be different, ¿what made him change his mind? The photo of you as a baby that he had saved on his phone, the one-year-old you would cry inconsolably if he knew he was going to be without him on this special day.

When the ceremony ended you ran towards him, who welcomed you with open arms.

—Congratulations my life, I'm proud of you —He said, giving you a fatherly kiss on the forehead.

—Thanks for coming —Your smile was enough to confirm that he had made the right decision.

He gave you your flowers and the gift, when you opened it you found a beautiful sewing machine, it was the most appropriate gift considering that you had just graduated as a fashion designer.

—¡Thank you dad! —You said happily, hugging him tightly again.

You were excited and he was also happy to share this moment with you, he had isolated himself from everything for the last three years but you managed to get him out of his comfort zone to also make him smile.

Sometimes he isolated you to protect you, he didn't want anyone involved in those games to know that he had a daughter, a great weakness if they asked him and if something happened to you he was sure that he would never forgive himself and he would be capable of doing the unimaginable for defend you.

He called you "my life" and it was because that's what you were to him, his entire life, his oldest daughter was all he had left.

● Inside the games.

The last thing he wanted to happen was exactly what happened.

The night they took him back to those games you were also dragged with him, not by your own will because you didn't know anything about this but by the simple fact of being the closest to him you found yourself involved in this conflict.

—¿Why didn't you ever tell me about this? —You asked him cautiously as ate the food those pink guards had given them in silver cans.

—I didn't want you to get involved in this —He admitted with an expression of failure and anguish —But now you're in danger.

—We'll be fine —You smiled at him with motivation —They're just... they're child's games ¿right? We will get out of here alive.

—She's right, we just have to be prepared —Young-il said agreeing with you.

You stayed quiet and sat next to your father while you finished eating until a dispute between players caught your attention, one with purple hair and his friend forcefully pushed another to the ground.

A grimace of pain formed on your lips as the poor guy was kicked in the abdomen, knocking the wind out of him.

—¿Aren't they going to help you? They are hurting him —You complained, turning to look at the group of allies that your father had formed, but when you saw that no one was going to do anything, you stood up.

But as soon as you took a step, Young-il put a hand on your shoulder as a sign that he would take care of the situation.

After he hit the two bullies you went to player 333 and helped him stand up.

—¿Are you okay? Come with me —You said leading him to your group.

He gave you his name as a thank you, Lee Myung-gi, while you were talking to him you noticed that he was attractive and he was only a couple of years older than you

Well, eight years to you wasn't much of a difference but your father wasn't too happy about it.

During the next game in which they had to team up with five players, Gi-hun tried to keep you close.

—Well, the five of us are here, we are complete.

—Myung-gi doesn't have a team yet —You said, approaching 333 who was still standing next to you but looking in all directions in search of some team —I'll go and form another one with him.

Those words didn't seem pleasant to Gi-hun either, but before he could refuse, Young-il interrupted to help you a little.

—That's good, this way it will be easier for you to find team.

You thanked him with your look and before your father could say anything you took 333 by the hand and the two of snuck through the players in search of a team.

Even so, you could feel your father's gaze on your back and not to mention Myung-gi, he did feel somewhat intimidated but he also couldn't deny a certain attraction he had towards you since he saw you.

It was incredible and made you laugh how despite the circumstances he was still protective of you, not only protecting you from physical harm, but also emotional harm and keeping an eye out in case someone wanted to break your heart.

With the salesman I didn't put it into the games because I think it's obvious that that man would never allow something like that when it comes to his daughter.

Thanks for reading and the next thing I'll post will be about Thanos, a pending request :D

#squid game#squidgamexyou#squid game x reader#squid game fic#the salesman x reader#the salesman x you#player001 x you#player001 x reader#hwang inho x reader#in ho x reader#in ho squidgame#hwang in ho#young-il x reader#young il x you#Young-il#gi hun x reader#gi hun x you#player 456#player 333#lee myung gi x reader#jun ho x you#hwang jun ho x reader#jun ho x reader

743 notes

·

View notes

Note

Hi! I love your fics so much! Gi-hun definitely needs more love, I mean come on, so here it is. Could you maybe write something about the reader being a foreigner and she was in the games when Gi-hun first was and they feel in love there and won together, so now they live in the Pink Motel together and make a plan about the games where Gi-hun returns to the games as a player and reader somehow infiltrates herself into the games by being the triangle guard and watches over them (kind of like what Hwang Jun-ho did) and during the player's rebellion she stays and he captures her along with the other triangle guy and then takes her mask off and Gi-hun realizes that it's her. They reunite really sweetly and she helps him to try and stops the games during the shootout. You could maybe even include the very ending where the Frotman kills Gi-hun's frined, like how would that scene in that case play out.

Thank you so much, love u 💚

FIRST OFF OMG WHAT IS WITH THIS FUCKING AMAZING PLOT IDEA. Seeing this I am going to be honest it's giving me an idea for a 5 part series. I dont want to stuff all this into a quick response a one shot wouldnt do it justice. If you wanna lokwey dm me I'll tag you in the comments , tell you when its done or just look on my page because this is a really good freaking plot idea !!! So imm be cooking this one I love Gi-hun. He is hot daddy. Ngl. 👀 but yeah I should be cooking up a start for this maybe around Friday it should be posted because this is behind 4+ other requests i have but I do want to give this spot light so yall keep looking at my posts !! Ahhh!!

#player 456#seong gi hun#seong gi hun x reader#squid game salesman#squid game x reader#gong yoo#gong yoo x reader#squid game fanfiction#in ho#in ho x gi hun#in ho fanfiction#squid game image#squid game 2#seong gihun#the frontman squid game#the frontman#lee byung hun images#lee jung jae

241 notes

·

View notes

Text

what if instead of lord boxman he was called lord frotman and instead of attacking the plaza he had non penetrative sex

2 notes

·

View notes

Text

Someten nuevos cargos contra agente de viajes por apropiación ilegal agravada por viaje a África ocurrido en Cidra

Agentes del Negociado de la Policía de Puerto Rico, adscritos a la División de Delitos Contra la Propiedad del Cuerpo de Investigaciones Criminales (CIC) de Caguas, llevaron a cabo una investigación que culminó en una nueva radicación de cargos por parte de la Fiscalía en contra de Wilbert S. Frotman de 32 años y residente en San Lorenzo, por violaciones a los artículos182 (Apropiación ilegal…

View On WordPress

0 notes

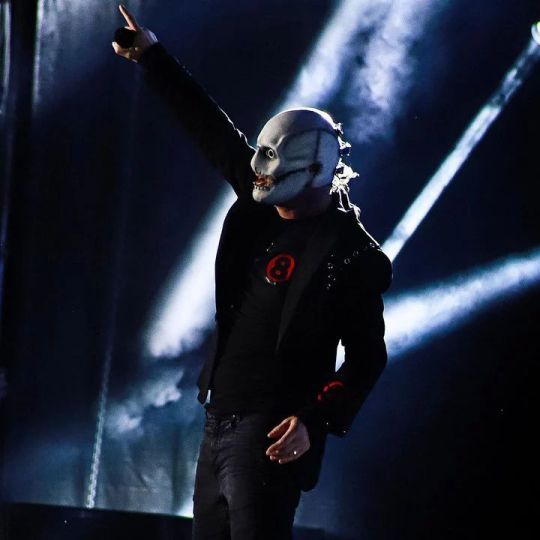

Photo

Happy Happy Happy Birthday Corey Taylor #HappyBirthdayCoreyTaylor 🎂🍰🎈🎉🎊🎀🎁 #coreytaylor #coreytodtaylor #CMFT #Slipknot #vocalist #frotman #StoneSour #Maggot #Maggots #SlipknotFans #MaggotsForLife #Maggots4Life #Music #Metal #metalmusic #musicblog (at Konohagakure) https://www.instagram.com/p/Cl6ACi5OJRq/?igshid=NGJjMDIxMWI=

#happybirthdaycoreytaylor#coreytaylor#coreytodtaylor#cmft#slipknot#vocalist#frotman#stonesour#maggot#maggots#slipknotfans#maggotsforlife#maggots4life#music#metal#metalmusic#musicblog

3 notes

·

View notes

Link

0 notes

Photo

Iniciaba el año 2023 con una de las bandas más importantes del metal sinfónico a lo largo de la historia del metal, Therion desde Suecia llegaba con el "Leviathan Latinamerican Tour" de nuevo a Buenos Aires para brindar un excelente show que servía como promoción de su último disco "Leviathan". A las 20:40 pasaban a mi lado los músicos junto a un cordón de seguridad si " 'Christofer' 'Christian' 'Thomas' 'Chiara' 'Rosalia' " los míticos Therion ya a las 21 horas marcadas en el reloj y podíamos escuchar "O fortuna" así comenzaba este recital con un gran poder y magia que solo te puede transmitir esta leyenda viviente del género, alucinante el tema del disco "Sirius B" "The Blood of Kingu" uno de los tantos discos tan interesantes que ha logrado gestar "Christofer Johnsson" a lo largo de tantos años de carrera. Pudimos viajar en el tiempo recorriendo varios temas del brutal disco "Vovin" el más vendido hasta la fecha por la banda, de igual forma "Leviathan I" y "Leviathan II" fueron parte fundamental del set de la noche por cierto par de discos grabados en plena pandemia. Momento bastante emotivo en la noche "Christian Vidal" tomaba el micrófono para interactuar con el público con todos sus compatriotas arrancando aplausos y gritos. Muchos puntos altos en el show sobre todo el gran registro vocal de "Chiara y Rosalía" sin dejar atrás a Thomas un gran frotman. Un especial cierre de show con dos megas clásicos "The Rise of Sodom and Gomorrah" arrancando gritos al público para luego despachar otro clásico "To Mega Therion" y culminaban la noche con "Quetzalcoatl" un show increíble el que logramos disfrutar esa noche. Reseña: @aletorres1987 Material cortesía de nuestro equipo en BA. Setlist: O Fortuna The Blood of Kingu Birth of Venus Illegitima Litany of the Fallen Tuonela Ginnungagap Lemuria Abraxas An Arrow From the Sun Wine of Aluqah Cults of the Shadow Leviathan Asgård Pazuzu Codex Gigas Son of the Staves of Time Encore: The Rise of Sodom and Gomorrah To Mega Therion Encore2: Quetzalcoatl #therion #Icarusmusic #elteatrito #metaleternopresentes (en El Teatrito) https://www.instagram.com/p/Cn2VuAcJQ9M/?igshid=NGJjMDIxMWI=

0 notes

Link

President Donald Trump isn’t the only member of his administration who is looking at multiple investigations by House committees about to be taken over by Democratic majorities following the “blue wave” midterm elections. According to Politico, Education Secretary Betsy DeVos is facing at least five committees — with subpoena power — planning on looking into her policies and tenure once they take control of the House in the new year. With Seth Frotman, the former …

1 note

·

View note

Link

tick toc...

#politics and government#government#mick mulvaney#consumer financial protection bureau#financial aid

2 notes

·

View notes

Text

Biden administration overhauls student loan forgiveness program for public-sector workers

Biden administration overhauls student loan forgiveness program for public-sector workers

The Biden administration is overhauling the Public Service Loan Forgiveness Program. The Department of Education said the changes could benefit more than 550,000 public-sector workers. Seth Frotman, the executive director of the Student Borrower Protection Center, joins CBSN's Lana Zak to discuss the changes and who might qualify. CBSN is CBS News’ 24/7 digital streaming news service featuring…

youtube

View On WordPress

0 notes

Text

Biden promise to forgive $10,000 in debt remains unfulfilled

Joe Biden’s 2020 presidential campaign website said that a president would forgive Biden “at least $ 10,000 per person in federal student loans,” eliminating all student debt for 15 million of the nearly 45 million American borrowers.

Almost six months after his presidency, that promise remains unfulfilled.

A blurb from the Biden 2020 campaign website. (JoeBiden.com)

The Biden government has taken some targeted steps to cancel certain borrowers’ debt, and the pandemic suspension of federally sponsored debt payments will result in total student loan relief of around $ 100 billion between March 2020 and September 2021.

Prominent Democrats, meanwhile, continue to urge a skeptical President Biden to enact a large-scale cancellation of up to $ 50,000 through executive action (contrary to the laws passed by Congress).

“Many Americans voted for President Biden because he promised to provide direct aid to those in need – and now is the time to act,” said US Senator Elizabeth Warren (D-MA) in one Statement to Yahoo Finance administration to address student debt crisis by canceling up to 50,000 student debt as it is vital to our economic recovery. “

The White House did not respond to requests for comment.

Biden endorsed the May 2020 plan to “Provide $ 10,000 Immediately in Debt Relief”.

The then candidate Biden called for student loans to be waived several times in 2020.

On March 22, days before Congress passed the $ 2.2 trillion Coronavirus Relief, Relief, and Economic Security Act (CARES), Biden tweeted that the federal government should “provide at least $ 10,000 per person in federal student loans “.

In May 2020, Biden told The Late Show with Stephen Colbert that he supported a proposal to “provide $ 10,000 debt relief immediately as a stimulus – now for students.”

In October 2020, Biden told the CNN City Hall questioner, “I’m going to make sure everyone in this generation gets $ 10,000 off their student debt if we try to escape this goddamn pandemic.”

The story goes on

The pitch was popular: two national polls from December 2020 showed that more than half of Americans across the political spectrum support student loan issuance.

“[Biden] made it very clear that he wanted to cancel at least $ 10,000 during the campaign, and he made the election promise in several places, both physically and in his campaign materials, “said Persis Yu, director of the National Consumer Law Center’s Student Loan Assistance Project. told Yahoo Finance, “It was a prominent part of his campaign promise, not one of those buried on page 45 of all the documents … and it was certainly one that student loan borrowers are eager to deliver on.”

U.S. Democratic presidential candidate and former Vice President Joe Biden speaks to supporters at a campaign rally on the night of the New Hampshire primary in Columbia, South Carolina, the United States, on February 11, 2020. (REUTERS / Randall Hill)

However, after winning the election, Biden’s tone changed.

In December 2020, President-elect Biden cast doubts on general student loan forgiveness when he told a meeting of news columnists that the Democrats’ argument to remove student debt through executive action was “quite questionable,” adding, “There i’m not sure. I probably wouldn’t do that. “

In February 2021, when a member of the audience at a CNN City Hall asked President Biden if he would be waiving $ 50,000 on student loans, Biden replied, “I won’t be able to do this.”

“It depends on whether or not you go to a private university or a public university,” Biden explained. “It depends on the idea that I tell a community, ‘I’m going to cancel the debt, the billions in debt for people who went to Harvard and Yale and Penn.'”

In May 2021, in an interview with the New York Times, Biden reiterated his reluctance to cancel debt: “The idea that you should go to Penn and pay a total of $ 70,000 a year and the public should pay for it? I do not agree.”

U.S. President Joe Biden speaks about voting rights at the National Constitution Center in Philadelphia, Pennsylvania, July 13, 2021. (Photo by SAUL LOEB / AFP)

“They believe they were promised”

The basic argument in favor of the President’s ability to cancel student debt through executive action, as the Legal Services Center at Harvard Law School pointed out in a letter to Senator Warren, is that the Secretary of Education has the power to “cancel existing student loans.” Debt under a separate legal authority – the power to modify existing loans under 20 USC § 1082 (a) (4). “

In March 2020, White House Chief of Staff Ron Klain told Politico that President Biden had asked Education Secretary Miguel Cardona to create a memo on whether the president has legal authority to ordinance $ 50,000 in student loan debt .

“Biden is overdue – student debt relief is overdue,” Thomas Gokey, organizer of the Debt Collective, an activist group, told Yahoo Finance. “The time for that was the first day of administration.”

The Department of Education has not responded to requests for comment on the memo, despite ED recently hiring Toby Merrill, who founded the Project on Predatory Student Lending at Harvard Law School and co-authored Warren’s legal analysis.

In any case, ED officials are now reportedly recommending that the White House extend the pandemic payment hiatus until at least January 2022.

Much is at stake: Experts, advocates, and prominent Democrats stressed that some degree of student loan forgiveness would be a crucial step before the pandemic’s payment hiatus ends.

“It would be wise to make this decision before payments resume,” said Yu, who works with many low-income borrowers. “There is no point in getting people to pay and then cancel their loans … [and] If we can clean some of the debt off the books, it could make it a lot easier to turn the system back on. “

Yu added that a large federal lending company pulling out of the loan program at the end of the year is a “recipe for disaster” as the government moves about 8.5 million borrowers to another service provider.

“Why send bills and notes to millions of people and then just turn around and say, ‘Just kidding, that’s not it’?” Seth Frotman, executive director of the Student Borrower Protection Center and former student loan ombudsman for the Consumer Financial Protection Bureau, told Yahoo Finance. “It [would] Cause confusion and disappointment among borrowers. “

Warren previously told Yahoo Finance that if the payment hiatus is lifted without a cancellation, “we will face a student loan time bomb that, if it explodes, could throw millions of families over a financial cliff.”

Warren and other Democrats also asked ED about student debt collection practices amid a possible wave of student loan defaults as the pandemic’s payment hiatus expires.

“People are very scared,” said Yu. “They believe they have been promised some debt relief. And for many of the people we work with, not having that burden would make a big difference in their lives.”

–

Aarthi is a reporter for Yahoo Finance. She can be reached at [email protected]. Follow her on Twitter @aarthiswami.

Continue reading:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube and reddit.

source https://collegeeducationnewsllc.com/biden-promise-to-forgive-10000-in-debt-remains-unfulfilled/

0 notes

Text

Biden promise to forgive $10,000 in debt remains unfulfilled

Joe Biden’s 2020 presidential campaign website stated that a president would forgive Biden “at least $ 10,000 per person in federal student loans,” which would remove all student debt for 15 million of the nearly 45 million American borrowers.

Almost six months after his presidency, that promise remains unfulfilled.

A blurb from the Biden 2020 campaign website. (JoeBiden.com)

The Biden government has taken some targeted steps to cancel certain borrowers’ debt, and the pandemic suspension of federally sponsored debt payments will result in total student loan relief of around $ 100 billion between March 2020 and September 2021.

Prominent Democrats, meanwhile, continue to urge a skeptical President Biden to enact a large-scale cancellation of up to $ 50,000 through executive action (contrary to the laws passed by Congress).

“Many Americans voted for President Biden because he promised to provide direct aid to those in need – and now is the time to act,” said US Senator Elizabeth Warren (D-MA) in one Statement to Yahoo Finance. “I will be managing to tackle the student debt crisis by canceling up to 50,000 student debt as it is critical to our economic recovery.”

The White House did not respond to requests for comment.

Biden endorsed the May 2020 plan to “Provide $ 10,000 Immediately in Debt Relief”.

The then candidate Biden called for student loans to be waived several times in 2020.

On March 22, days before Congress passed the $ 2.2 trillion Coronavirus Relief, Relief, and Economic Security Act (CARES), Biden tweeted that the federal government should “provide at least $ 10,000 per person in federal student loans “.

In May 2020, Biden told The Late Show with Stephen Colbert that he supported a proposal to “provide $ 10,000 debt relief immediately as a stimulus – now for students.”

In October 2020, Biden told the CNN City Hall questioner, “I’m going to make sure everyone in this generation gets $ 10,000 off their student debt if we try to escape this goddamn pandemic.”

The story goes on

The pitch was popular: two national polls from December 2020 showed that more than half of Americans across the political spectrum support student loan issuance.

“[Biden] made it very clear that he wanted to cancel at least $ 10,000 during the campaign, and he made the election promise in several places, both physically and in his campaign materials, “said Persis Yu, director of the National Consumer Law Center’s Student Loan Assistance Project. told Yahoo Finance, “It was a prominent part of his campaign promise, not one of those buried on page 45 of all the documents … and it was certainly one that student loan borrowers are eager to deliver on.”

Democratic U.S. presidential candidate and former Vice President Joe Biden speaks to supporters at a campaign rally on the night of the New Hampshire primaries in Columbia, South Carolina, the United States, Feb. 11, 2020. (REUTERS / Randall Hill)

However, after winning the election, Biden’s tone changed.

In December 2020, President-elect Biden cast doubts on general student loan forgiveness when he told a meeting of news columnists that the Democrats’ argument to remove student debt through executive action was “quite questionable,” adding, “There i’m not sure. I probably wouldn’t do that. “

In February 2021, when a member of the audience at a CNN City Hall asked President Biden if he would be waiving $ 50,000 on student loans, Biden replied, “I won’t be able to do this.”

“It depends on whether or not you go to a private university or a public university,” Biden explained. “It depends on the idea that I tell a community, ‘I’m going to cancel the debt, the billions in debt for people who went to Harvard and Yale and Penn.'”

In May 2021, in an interview with the New York Times, Biden reiterated his reluctance to cancel debt: “The idea that you should go to Penn and pay a total of $ 70,000 a year and the public should pay for it? I do not agree.”

U.S. President Joe Biden speaks about voting rights at the National Constitution Center in Philadelphia, Pennsylvania, July 13, 2021. (Photo by SAUL LOEB / AFP)

“They believe they were promised”

The main argument for the president’s ability to cancel student debt through executive action, as the Legal Services Center at Harvard Law School pointed out in a letter to Senator Warren, is that the Secretary of Education has the power to “cancel existing student loans.” Debt under a separate legal authority – the power to modify existing loans under 20 USC § 1082 (a) (4). “

In March 2020, White House Chief of Staff Ron Klain told Politico that President Biden had asked Education Secretary Miguel Cardona to create a memo on whether the president has legal authority to ordinance $ 50,000 in student loan debt .

“Biden is overdue – student debt relief is overdue,” Thomas Gokey, organizer of the Debt Collective, an activist group, told Yahoo Finance. “The time for that was the first day of administration.”

The Department of Education has not responded to requests for comment on the memo, despite ED recently hiring Toby Merrill, who founded the Project on Predatory Student Lending at Harvard Law School and co-authored legal analysis to Warren.

In any case, ED officials are now reportedly recommending that the White House extend the pandemic payment hiatus until at least January 2022.

Much is at stake: Experts, advocates, and prominent Democrats stressed that some degree of student loan forgiveness would be a crucial step before the pandemic’s payment hiatus ends.

“It would be wise to make this decision before payments resume,” said Yu, who works with many low-income borrowers. “There is no point in getting people to pay and then cancel their loans … [and] If we can get some of the debt off the books, it could make turning the system back on a lot easier. “

Yu added that a large federal lending company pulling out of the loan program at the end of the year is a “recipe for disaster” as the government moves about 8.5 million borrowers to another service provider.

“Why send bills and notes to millions of people and then just turn around and say, ‘Just kidding, that’s not it’?” Seth Frotman, executive director of the Student Borrower Protection Center and former student loan ombudsman for the Consumer Financial Protection Bureau, told Yahoo Finance. “It [would] lead to mass confusion and disappointment among borrowers. “

Warren previously told Yahoo Finance that if the payment hiatus is lifted without a cancellation, “we will face a student loan time bomb that, if it explodes, could throw millions of families over a financial cliff.”

Warren and other Democrats also asked ED about student debt collection practices amid a possible wave of student loan defaults as the pandemic’s payment hiatus expires.

“People are very scared,” said Yu. “They believe they have been promised some debt relief. And for many of the people we work with, not having that burden would make a big difference in their lives.”

–

Aarthi is a reporter for Yahoo Finance. She can be reached at [email protected]. Follow her on Twitter @aarthiswami.

Continue reading:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube and reddit.

source https://seedfinance.net/2021/07/15/biden-promise-to-forgive-10000-in-debt-remains-unfulfilled/

0 notes

Photo

Happy Happy Happy Birthday Corey Taylor #HappyBirthdayCoreyTaylor 🎂🍰🎈🎉🎊🎀🎁 #coreytaylor #coreytodtaylor #CMFT #Slipknot #vocalist #frotman #StoneSour #Maggot #Maggots #SlipknotFans #MaggotsForLife #Maggots4Life #Music #Metal #metalmusic #musicblog (at Konohagakure) https://www.instagram.com/p/CXOPb8wLBTm/?utm_medium=tumblr

#happybirthdaycoreytaylor#coreytaylor#coreytodtaylor#cmft#slipknot#vocalist#frotman#stonesour#maggot#maggots#slipknotfans#maggotsforlife#maggots4life#music#metal#metalmusic#musicblog

0 notes

Link

Meet the Man Now at the Center of the Debate Over Student Debt Richard Cordray, a close ally of Senator Elizabeth Warren who served as the first director of the federal Consumer Financial Protection Bureau during the Obama years, has been selected as the new head of federal student aid in the Biden administration, a post that will put him at the center of the swirling debate over forgiving student debt. The issue is a tricky one for President Biden. Though he has endorsed canceling up to $10,000 per borrower through legislation, Mr. Biden has been pressured by some Democrats to forgive much more, and to sign an executive order making it happen if Congress fails to act. But with his new position within the federal Education Department, the primary lender for higher education, Mr. Cordray might be able to relieve the president of that burden by canceling student debt administratively. Democratic leaders are pushing for up to $50,000 in debt relief. Mr. Cordray is a former Ohio attorney general who worked alongside Ms. Warren on financial issues before her election to the Senate. He headed the consumer protection bureau from 2012 to 2017, leaving in the first year of the Trump administration to make a failed bid for governor of Ohio. Administration officials said that he and Ms. Warren maintain a close relationship, raising questions about how closely their views align on the question of canceling student debt. Ms. Warren has argued that it is a crushing burden for young people, and that relieving it would reduce economic inequality. Some critics say that forgiving student loans would disproportionately help the rich, who use them to pay for advanced degrees, rather than help the poor, who often are not college educated. In a statement after his appointment was announced on Monday, Mr. Cordray focused on student debt as an overriding concern, saying that he looked forward to working with leaders in the department, the Biden administration and Congress to “create more pathways for students to graduate and get ahead, not be burdened by insurmountable debt.” He did not indicate his position on whether some debt should be canceled, however. A spokeswoman for the Education Department, Rachel Thomas, said the agency is working with the Justice Department and the White House to review options on the issue. Republican critics tried to block Mr. Cordray’s appointment to the consumer financial protection bureau under Mr. Obama, and have complained that the bureau had too much power and saddled businesses with unnecessary regulations. But his new appointment as chief operating officer of federal student aid, made by the education secretary, Miguel Cardona, is effective Tuesday and needs no other approvals. In a statement announcing the appointment, Mr. Cardona said, it was “critical” that student loan borrowers could depend on the department “for help paying for college, support in repaying loans, and strong oversight of postsecondary institutions.” Mr. Cordray, a five-time “Jeopardy!” champion, has also been a vocal critic of for-profit colleges. “I hate how these hollowed-out businesses and subpar colleges are cheating consumers, employees and whole communities,” he wrote in a guest essay in The Plain Dealer, Ohio’s largest newspaper. Mr. Cordray succeeds Mark A. Brown, who was appointed as chief operating officer of federal student aid by President Donald J. Trump in March 2019 and resigned in March of this year. Mr. Brown became a target of consumer and labor groups, who cheered his resignation. Ms. Warren greeted Mr. Brown’s resignation with a tweet that said it was “good for student borrowers.” Consumer advocates were delighted by Mr. Cordray’s appointment. “This is an outstanding pick,” said Seth Frotman, a former student loan ombudsman at the consumer protection bureau who worked closely with Mr. Cordray. Mr. Frotman is now the executive director of the Student Borrower Protection Center, an advocacy group. “This is a very promising sign about a sea change in thinking at the Education Department,” Mr. Frotman said. Mr. Cordray made student loan oversight one of the consumer protection bureau’s priorities, and in early 2017 — two days before Mr. Trump took office — the agency sued Navient, one of the Education Department’s largest student loan servicers, for errors and omissions that Mr. Cordray said improperly added billions of dollars to borrowers’ tabs. The lawsuit is ongoing, and six state attorneys general have filed similar cases. The lawsuits describe routine mistakes and lapses in oversight that over time added up to systematic failures, eerily similar to the mortgage servicing industry’s bungling of borrower accounts and property foreclosures during the 2008 recession. Mr. Cordray has described the country’s soaring student loan debt — which eclipses all consumer debt other than mortgages — and the often slipshod way it is managed as a problem ripe for government intervention. “The domino effects of student debt burdens and loan servicing problems are holding back the upcoming generation and hampering the economy,” Mr. Cordray wrote in his 2020 book, “Watchdog.” The Education Department is the primary lender for Americans who borrow to pay for higher education. It directly owns loans made to nearly 43 million people, totaling $1.4 trillion. In one of the government’s most sweeping pandemic relief measures, the department in March 2020 allowed borrowers to stop making payments on their federal student loans, and temporarily set the loans’ interest rate to zero percent. That pause is scheduled to continue through September. Because of that freeze, fewer than 1 percent of borrowers with federal loans are currently making payments on then. Restarting loan collections will be one of the biggest challenges facing the Education Department this year. Mr. Cordray will inherit a plethora of other problems at the Education Department, including extensive errors and obstacles in the department’s Public Service Loan Forgiveness program, which is intended to forgive the debts of teachers, military members, nonprofit workers and others in public-service careers. The agency is also grappling with claims from hundreds of thousands of borrowers seeking relief through a program intended to eliminate the debts of people who were defrauded by schools that broke consumer protection laws. Susan C. Beachy contributed research. Source link Orbem News #Center #debate #Debt #Man #Meet #student

0 notes

Photo

Iniciaba el año 2023 con una de las bandas más importantes del metal sinfónico a lo largo de la historia del metal, Therion desde Suecia llegaba con el "Leviathan Latinamerican Tour" de nuevo a Buenos Aires para brindar un excelente show que servía como promoción de su último disco "Leviathan". A las 20:40 pasaban a mi lado los músicos junto a un cordón de seguridad si " 'Christofer' 'Christian' 'Thomas' 'Chiara' 'Rosalia' " los míticos Therion ya a las 21 horas marcadas en el reloj y podíamos escuchar "O fortuna" así comenzaba este recital con un gran poder y magia que solo te puede transmitir esta leyenda viviente del género, alucinante el tema del disco "Sirius B" "The Blood of Kingu" uno de los tantos discos tan interesantes que ha logrado gestar "Christofer Johnsson" a lo largo de tantos años de carrera. Pudimos viajar en el tiempo recorriendo varios temas del brutal disco "Vovin" el más vendido hasta la fecha por la banda, de igual forma "Leviathan I" y "Leviathan II" fueron parte fundamental del set de la noche por cierto par de discos grabados en plena pandemia. Momento bastante emotivo en la noche "Christian Vidal" tomaba el micrófono para interactuar con el público con todos sus compatriotas arrancando aplausos y gritos. Muchos puntos altos en el show sobre todo el gran registro vocal de "Chiara y Rosalía" sin dejar atrás a Thomas un gran frotman. Un especial cierre de show con dos megas clásicos "The Rise of Sodom and Gomorrah" arrancando gritos al público para luego despachar otro clásico "To Mega Therion" y culminaban la noche con "Quetzalcoatl" un show increíble el que logramos disfrutar esa noche. Reseña: @aletorres1987 Material cortesía de nuestro equipo en BA. Setlist: O Fortuna The Blood of Kingu Birth of Venus Illegitima Litany of the Fallen Tuonela Ginnungagap Lemuria Abraxas An Arrow From the Sun Wine of Aluqah Cults of the Shadow Leviathan Asgård Pazuzu Codex Gigas Son of the Staves of Time Encore: The Rise of Sodom and Gomorrah To Mega Therion Encore2: Quetzalcoatl #therion #Icarusmusic #elteatrito #metaleternopresentes (en El Teatrito) https://www.instagram.com/p/Cn2Vd9GJ3Yo/?igshid=NGJjMDIxMWI=

0 notes

Photo

What is Biden's plan on student loans »IN DEPTH: Trump’s vow to end payroll tax threatens Social SecurityCongress could really feel strain to behave earlier than the yr ends, coverage specialists mentioned, and it may embody an extension in a brand new stimulus package deal or different laws.“For tens of millions of debtors, the fallout from the pandemic continues to be raging,” mentioned Seth Frotman, government director of the Schol... #bidens #correct_success #debit #debt #how_to_get_out_of_debit #loans #plan #student

0 notes