#free debt advice UK

Explore tagged Tumblr posts

Text

Free Debt Advice UK: Your Ultimate Guide to Financial Freedom

Introduction:

In today's fast-paced world, many individuals and families in the United Kingdom find themselves struggling with overwhelming debt. The burden of debt can lead to stress, anxiety, and a diminished quality of life. However, there is hope. In this comprehensive guide, we will explore free debt advice options available in the UK, empowering you to take control of your finances and pave the way towards a debt-free future.

Table of Contents:

Understanding Debt in the UK

Importance of Seeking Debt Advice

Free Debt Advice Services in the UK

a. Citizens Advice Bureau (CAB)

b. StepChange Debt Charity

c. National Debtline

d. Money Advice Service

How to Choose the Right Debt Advice Service

Steps to Take for Effective Debt Management

a. Assessing Your Financial Situation

b. Budgeting and Cutting Expenses

c. Negotiating with Creditors

d. Debt Consolidation Options

e. Debt Repayment Strategies

Legal Aspects of Debt and Insolvency

Protecting Yourself from Debt Scams

Additional Resources for Debt Management

Seeking Professional Help: Debt Management Companies

Maintaining a Debt-Free Life

Conclusion

Introduction:

Debt has become a prevalent issue in the United Kingdom, affecting countless individuals and families. However, the first step towards overcoming debt is understanding it. This section will provide an overview of the types of debt commonly encountered in the UK, such as credit card debt, personal loans, and mortgage arrears. By familiarizing yourself with the various forms of debt, you will gain a clearer picture of your financial situation and how to address it effectively.

Importance of Seeking Debt Advice:

Taking control of your debt requires knowledge and guidance, which is where debt advice services play a vital role. This section emphasizes the importance of seeking professional advice to navigate the complex world of debt. It highlights the benefits of free debt advice services in terms of impartiality, expertise, and personalized solutions. By seeking debt advice, individuals can gain a comprehensive understanding of their options and develop an effective plan to tackle their debt head-on.

Free Debt Advice Services in the UK:

This section explores the most reputable and widely available free debt advice services in UK. It covers organizations such as the Citizens Advice Bureau (CAB), StepChange Debt Charity, National Debtline, and the Money Advice Service. Each organization is discussed in detail, highlighting their services, expertise, and contact information. By providing this information, readers will be able to connect with the appropriate debt advice service that suits their specific needs.

How to Choose the Right Debt Advice Service:

Selecting the right debt advice service is crucial for effective debt management. This section offers practical tips and considerations to help readers make an informed decision. It emphasizes factors such as the reputation of the organization, the availability of services, and the qualifications of the advisors. By following these guidelines, individuals can ensure they receive the best possible assistance in their journey towards financial freedom.

Steps to Take for Effective Debt Management:

This section outlines a step-by-step approach to managing debt effectively. It covers essential aspects such as assessing your financial situation, creating a budget, negotiating with creditors, exploring debt consolidation options, and implementing debt repayment strategies. Each step is explained in detail, providing readers with actionable advice and techniques to regain control over their finances.

Legal Aspects of Debt and Insolvency:

Understanding the legal aspects of debt and insolvency is crucial for anyone facing financial difficulties. This section provides a brief

overview of relevant laws and regulations in the UK. It touches upon topics such as bankruptcy, Individual Voluntary Arrangements (IVAs), and Debt Relief Orders (DROs). By familiarizing themselves with the legal landscape, readers will be better equipped to make informed decisions regarding their debt management strategy.

Protecting Yourself from Debt Scams:

Sadly, the world of debt is not without its scams and fraudulent practices. This section educates readers on common debt scams and provides tips on how to protect themselves from falling victim to such schemes. By raising awareness and offering practical advice, individuals can safeguard their financial well-being while seeking debt advice.

Additional Resources for Debt Management:

In this section, readers will find a curated list of additional resources, such as books, websites, and online tools, to further assist them in their debt management journey. These resources offer valuable insights, strategies, and support to complement the guidance received from debt advice services.

Seeking Professional Help: Debt Management Companies:

While free debt advice services are invaluable, some individuals may require additional assistance from debt management companies. This section provides an overview of the services offered by these companies, emphasizing the importance of conducting thorough research and exercising caution when choosing a debt management company.

Maintaining a Debt-Free Life:

Achieving debt freedom is a significant accomplishment, but it is equally important to maintain financial discipline and avoid falling back into debt. This section offers practical tips and strategies for staying debt-free, including budgeting, saving, and adopting healthy financial habits.

Conclusion:

In conclusion, free debt advice services in the UK provide individuals and families with essential guidance to overcome their financial challenges. By taking advantage of these services, individuals can regain control over their finances, reduce stress, and pave the way towards a brighter future. Remember, seeking debt advice is a proactive step towards financial freedom.

1 note

·

View note

Text

Another day, another debt help advert on Tumblr. Don't do it.

If you're in the UK, you can go to StepChange or Money Advice Trust for free debt advice online or over the phone, Citizens Advice Bureau if you have other challenges piling on top of your debt, or Christians Against Poverty if you are comfortable going to them.

Some debt relief options have a fee, many do not. What you need to do is go through your finances and work out your income and expenditure. Track it over the last few months if you can and then do a debt advice session online, over the phone or in-person, depending on your needs. Set yourself aside as much time to do it as you can so you aren't rushed as well as stressed. Do not be afraid to pick up the phone or use the text chat if you need support, the staff are there to help.

Don't leave it to the last minute. Do it now, even if you don't think you need it. People often don't reach out for support until they are in crisis, by which point they have fewer options. The earlier you ask for help, the more you can be helped.

Do a benefits check on Policy on Practice or Turn2Us to make sure you're claiming all benefits you're entitled to, too.

22 notes

·

View notes

Note

Honourable Bitches,

I am a 24-year-old wanting to study a Master's abroad in translation after a BA in languages. The tuition fees are way beyond my budget and savings, but I am eligible to apply for a specific student loan for merit (no need to hold down any cards to show my ability to repay). This loan can give me up to 50k to finance my studies and living abroad, which would be more than enough. The interest rate is 3.65% if I repay within 10 years, 3.96% if I repay within 30 years. I have never been in debt, should I try to repay within 10 years with a higher monthly payment or within 30 years, with the possibility of repaying all at once when I have it, but have to pay more in the long run?

P.S. for context, I am EU citizen trying to enroll for a master in the UK). Here's a photo of our dog to thank you for your precious help.

WHAT A SWEET AND PRECIOUS BABY!!! We find this offering of a cute pet pic pleasing and acceptable.

As soon as you mentioned the interest rates I thought "They can't be American." My student loans were something like 6.8% and 11.2%. So you'll have to excuse me if I giggled a little bit at your comparatively stress-free situation!

Here's the thing about loan repayment terms: you don't have to stick to them. For example, Kitty got better terms on a 30-year mortgage than a 15-year mortgage. So they went with the 30-year mortgage and paid it off in less than 10 years.

If you can afford the higher monthly payment for the lower interest rate, then take the 10-year loan! But if you're at all nervous about making those monthly payments, take the 30-year and try to pay it off quickly. You can always pay the minimum monthly amount if you fall on hard times.

Being in debt is stressful and tricky. But you're wise to be thinking strategically, my dear! Here's waaaay more detailed advice:

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

If you found this helpful, consider tipping us!

15 notes

·

View notes

Text

Understanding the Role of IVA Supervisors in Debt Recovery

When individuals struggle with overwhelming debts, an Individual Voluntary Arrangement (IVA) can offer a structured and manageable way out. However, navigating through the complexities of an IVA requires expertise, and this is where IVA supervisors come into play. IVA supervisors play a pivotal role in the debt recovery process, ensuring that both creditors and debtors are treated fairly while working towards a debt-free future.

What is an IVA?

An Individual Voluntary Arrangement (IVA) is a formal debt solution in the UK that enables individuals to make regular, affordable payments to clear their debts over a period of time, typically five years. It is a legally binding agreement between the debtor and their creditors. An IVA helps individuals avoid bankruptcy, offering them a chance to regain control of their financial situation while still addressing their outstanding debts.

The Role of IVA Supervisors

IVA supervisors are licensed insolvency practitioners appointed to oversee the IVA process. Their primary role is to ensure that the terms of the IVA are adhered to and that both the debtor and the creditors fulfill their obligations. The importance of an IVA supervisor cannot be overstated, as they are responsible for guiding the debtor through the entire process and managing the interactions between the debtor and the creditors.

Advising the Debtor

From the very beginning of the IVA process, the IVA supervisor works closely with the debtor to assess their financial situation. They provide advice on whether an IVA is the most suitable solution or if alternative options like debt management plans or bankruptcy may be more appropriate. If the debtor chooses to proceed with the IVA, the supervisor helps prepare the necessary paperwork and makes sure that the debtor understands the terms and conditions.

Negotiating with Creditors

Once the IVA proposal is ready, the IVA supervisor presents it to the creditors. They act as a mediator between the debtor and the creditors, seeking to reach an agreement that is acceptable to all parties involved. The supervisor negotiates the terms of the IVA, including the monthly payments the debtor will make, and the amount of debt that will be written off after the term.

Monitoring the IVA Process

Throughout the duration of the IVA, which typically lasts for five years, the IVA supervisor has the responsibility to monitor the debtor’s progress. They ensure that the agreed-upon payments are being made, review the debtor’s financial situation periodically, and make any necessary adjustments if circumstances change. This could include extending the term of the IVA or altering the payment amounts.

Distributing Payments to Creditors

One of the key duties of the IVA supervisor is to manage the payments made by the debtor and distribute them to creditors. The supervisor ensures that all creditors are paid fairly according to the terms of the IVA agreement. They also provide annual reports to both the debtor and the creditors, keeping everyone informed of the progress.

Completion of the IVA

Once the debtor has made all the agreed-upon payments, the IVA supervisor ensures that the debt is fully settled, and any remaining unsecured debts are written off. The debtor will then be discharged from the IVA, and they will no longer be legally liable for the debts included in the agreement. The IVA supervisor formally concludes the IVA process and provides the debtor with the necessary documentation.

Conclusion

An IVA supervisor plays a crucial role in ensuring that the Individual Voluntary Arrangement is carried out correctly and fairly. They offer guidance, ensure compliance with the agreement, and help the debtor work towards a debt-free future. If you're considering an IVA as a solution to your financial struggles, having an experienced IVA supervisor by your side can make all the difference in the debt recovery process.

For more information on how an Individual Voluntary Arrangement (IVA) can help you regain control over your debts, visit Apply for IVA.

#DebtRecovery#IVASupervisor#DebtSolution#IVADebtHelp#DebtFree#FinancialFreedom#IVASupport#IndividualVoluntaryArrangement#DebtRelief#IVA

0 notes

Text

Citigroup faces 59mn debt related to abandoned IPO property

Open Editor's Digest for free Roula Khalaf, Editor of the FT, selects her favorite stories for this weekly newsletter. Citigroup is facing a €59mn lawsuit launched by a UK investment firm that alleges the Wall Street bank provided “misleading” and “inaccurate” advice when working for it on a prospective public listing. Alcimos, which sought to raise capital to invest in Greece's property market,…

0 notes

Text

Citigroup faces 59mn debt related to abandoned IPO property

Open Editor's Digest for free Roula Khalaf, Editor of the FT, selects her favorite stories for this weekly newsletter. Citigroup is facing a €59mn lawsuit launched by a UK investment firm that alleges the Wall Street bank provided “misleading” and “inaccurate” advice when working for it on a prospective public listing. Alcimos, which sought to raise capital to invest in Greece's property market,…

0 notes

Text

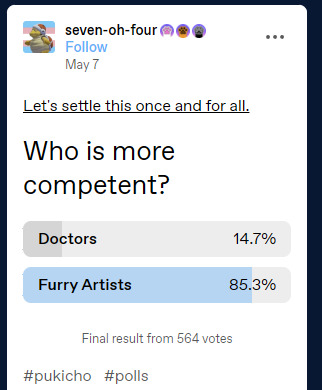

youtube

So like, without getting into the deep issues with the medical system in the US, Canada, UK and EU, furry artists set very clear expectations and will also perform what you ask with some advice while doing a commission, where as many doctors are trained in a counter productive way in systems that prioritize syphoning money out of the patient and abiding by terrible insurance rules that either prevents them from giving accurate and swift care or leads to massive case logs that lead to delay of care and increases the chances for inaccurate care.

For instance doctors are more likely to give pregnant Black women worse care than white women as Black people are more likely to be located in an area where the medical staff are stretched thin due to a massive patient backlog while simultaneously being underserved as that area is also more likely to be lower income, not counting the issues surrounding private and public insurance, while white women likely have private insurance and can afford to go to a private care facility that has far less of a case load in exchange for more cash. Doctors are also more likely to misdiagnose or ignore foundational issues with say fat people and women, which means issues that could be treated and symptoms alleviated are ignored because it is simply easier to tell them to go loose weight vs actually look at their slipped disk.

Across the western world there's a serious issue with the medical system. Newbies are sent off to resident and be massively underpaid and overworked as part of their education which can harden bad practices, which leads to high dropout including issues with the standard university drop outs. Doctors and nurses have lots of oversight which sometimes makes no sense, like anti abortion fights here in the US are fights that are preventing lives from being saved as that drug or this procedure might theoretically be killing a fetus that might theoretically survive birth only to die a handful of minutes later while the mom is just forced to die as well. The other side of that coin is how much power insurance companies have over doctor decisions, which means drugs that could improve symptoms massively are locked behind expensive private insurance as public insurance won't cover it due to parents, or the similar case of pharmaceutical companies being given free range over their prices with no oversight, similar to how insurance companies don't have to offer their patients any care at all which leads to situations where vulnerable populations ala seniors are paying a ton of cash for an insurance plan that won't cover a bandaid. Hospitals, for their part, can charge patients whatever they want for any service and force their financial team, the patient, and the patient's insurance to duke it out over whether giving the act of a nurse giving a patient a pill that costs 50 cents is an act worth 50 dollars or not. All this in turn leads to patients hating their doctors, both for things in the doctor's control and out of their control, which forments a directly hostile environment.

How do we fix this? Force hospitals to always staff an appropriate amount of staff so that way skeleton crew structures are no longer the default. Publicly back hospitals and their staff financially so everyone has access to competent care. Major oversight overhauls on pharmaceutical companies and private insurance companies while boosting public insurance and killing off the idea of out of network care. Pay actual attention to how doctors are "Made" and reform as needed, such as how they should care for women and minority communities that consistently suffer worse health outcomes above say white people or thin people. I would, in particular, look into reforming residences which tend to burn out more doctors than it should, alongside the debt of the schooling which naturally funnels doctors into a handful of extremely well paying positions before they retire early rather than enabling them to go where they are needed which tends to be less well paying rural and low income communities. Doctors, like so many other professions are ultimately suffering due to the short term - infinite profit every term board room mindset, where it's all about keeping the line going up over the system being stable and good health outcomes being the goal. This is what leads to hospitals which serve thousands of people dying out as it isn't making the line go up and therefore closing it down and skeleton staffing it are far better options. Healthcare for a lot of countries, right now, isn't based on helping the public but making the graph in the boardroom go up, which leads to exactly what we see here: Doctors getting hate, warranted and not.

*my head turns red and steam comes outta my ears like a steam whistle**

18K notes

·

View notes

Text

Citigroup faces 59mn debt related to abandoned IPO property

Open Editor's Digest for free Roula Khalaf, Editor of the FT, selects her favorite stories for this weekly newsletter. Citigroup is facing a €59mn lawsuit launched by a UK investment firm that alleges the Wall Street bank provided “misleading” and “inaccurate” advice when working for it on a prospective public listing. Alcimos, which sought to raise capital to invest in Greece's property market,…

0 notes

Video

youtube

Section 21 Eviction Notices Served on Entire London Apartment Block

Section 21 eviction notices have been served on 150 residents on a block of flats in Deptford, South London, weeks before Christmas.

A Section 21 is a legal method for the landlord to require a tenant to leave a rental property without the need to provide a reason for "no-fault" eviction. A tenant can challenge it and stay in the property until physically evicted, but they may incur court costs.

Watch full video - https://youtu.be/u-v8WXgpTuo

Even with a Section 21 notice, it can take landlords 6 to 12 months to evict a tenant who refuses to move out – often under advice for their local council’s housing or “homeless prevention” department.

The owners of the property, the Aitch Group said a Section 21 notice had been issued to tenants at the Vive Living development to "facilitate the refurbishment of the building".

"The tenants have been given two months' notice, as a minimum, in accordance with their tenancy agreements.".

The eviction notices may have been prompted by Labour’s Renter’s Rights Bill, currently going through Parliament, which will abolish Section 21 “no fault” evictions.

Many landlords are quitting the buy-to-let property market or switching to other rental models, such as AIRBNB serviced accommodation or leasing to local authorities and housing associations.

How will Labour’s new Renters Rights Bill 2024 affect buy-to-let landlords?

The Labour Party’s Renters' Rights Bill 2024 is poised to bring significant changes to the UK’s rental market, impacting both tenants and buy-to-let landlords. Understanding these changes is crucial for landlords to navigate the evolving landscape effectively.

Key Changes Proposed in the Renters' Rights Bill 2024

Watch video version - https://youtu.be/Wx1HXgVW1bM

Section 24 Landlord Tax Hike

Interview with Chartered Accountant and property tax specialist who reveals options and solutions to move your properties from your own name into a limited company or LLP whilst mitigating the potential HMRC pitfalls.

Email [email protected] for a free consultation on how to deal with Section 24.

Watch video now: https://youtu.be/aMuGs_ek17s

#finance #moneytraining #moneymanagement #wealth #money #marketing #sales #debt #leverage #property #investment #Homeownership #financialplanning #moneymanagement #financialfreedom #section24tax #financialindependenceretireearly #RentersRightsBill #BuyToLet #LandlordLife #UKPropertyMarket #TenantsRights #RentalProperty #PropertyInvestment #LandlordChallenges #RentControl #PropertyStandards #section24

0 notes

Text

Find Top Accountancy Services in Milton Keynes for Your Business and Personal Needs

Finding the right accountant can make all the difference to your financial success, whether you're a business owner, freelancer, or managing personal finances. If you're based in Milton Keynes, UK, there are plenty of options available, but choosing the right one is crucial for ensuring that your finances are in the best possible hands. This blog post will guide you through the importance of professional accountancy services, what to look for in an accountant, and why Accountants Milton Keynes (accountantsmiltonkeynesmk.co.uk) could be your best choice.

Why Accountancy Services Are Essential

Effective accounting is the backbone of any business, ensuring compliance with tax regulations, maximizing financial efficiency, and helping to plan for future growth. However, accounting isn't just about crunching numbers. It’s about understanding the financial landscape, providing insights, and supporting strategic decisions. Whether you're managing a small business or your personal finances, having a reliable accountant by your side can provide peace of mind.

1. Compliance and Regulations

One of the most crucial reasons to hire an accountant is to ensure that you comply with all the necessary financial regulations. In the UK, businesses are required to submit tax returns, pay VAT, handle payroll taxes, and file annual accounts. Personal finances also require tax declarations, including income tax, inheritance tax, and capital gains tax.

An experienced accountant is well-versed in the latest tax laws and regulations, helping to ensure that you're always up-to-date and avoid costly mistakes or penalties.

2. Maximizing Tax Efficiency

A professional accountant can help maximize your tax savings by offering insights into allowable expenses, tax credits, and deductions you may not be aware of. With their expertise, they can suggest tax-efficient strategies to help reduce your overall tax burden, freeing up more money for reinvestment or personal savings.

3. Business Planning and Strategy

For business owners, accountants play a pivotal role in shaping your business strategy. They can analyze your financial statements, forecast future growth, and advise on financial decisions, helping you navigate complex financial scenarios. With the right advice, you can make informed choices on matters such as expansion, debt management, and investment.

4. Saving Time and Reducing Stress

Handling accounting yourself can be time-consuming and stressful, especially when you’re juggling other aspects of running a business or managing your personal finances. By outsourcing your accounting needs to professionals, you free up valuable time to focus on what you do best, whether that’s growing your business, scaling operations, or enjoying your personal life.

What to Look for in an Accountant

When it comes to selecting the right accountant in Milton Keynes, it’s important to keep certain factors in mind. Here are some qualities you should look for in your accounting partner:

1. Experience and Expertise

Ensure that the accountant you choose has extensive experience in the field. Whether you need business accounting or personal tax services, you want an accountant who understands the complexities of your specific situation. Their expertise in managing tax affairs, preparing financial statements, and offering business advice will be crucial.

2. Tailored Services

Every client has unique financial needs. The best accountants offer tailored services that align with your specific requirements. Whether you need help with tax filings, VAT returns, bookkeeping, or financial planning, your accountant should be able to provide bespoke advice and support that fits your situation.

3. Up-to-Date Knowledge

The world of accounting is constantly evolving, with tax laws and financial regulations frequently changing. Your accountant should stay up to date with the latest laws and developments to ensure you’re always compliant and making the most of available opportunities.

4. Good Communication Skills

An accountant should be able to explain complex financial terms and concepts in a clear and understandable way. Good communication is key to building a long-term relationship with your accountant. They should be responsive to your questions and explain things in a way that you can understand, without jargon or confusion.

5. Cost-Effective Solutions

While hiring an accountant is an investment, it should also be a cost-effective decision. Look for accountants who offer transparent pricing and can outline the value they bring to your business or personal finances. Avoid firms with hidden fees, and ensure the cost of their services aligns with your budget.

Types of Accountancy Services Offered in Milton Keynes

In Milton Keynes, accountancy firms offer a wide range of services to cater to both businesses and individuals. Here’s an overview of the most common types of services available:

1. Personal Tax Services

From annual tax returns to inheritance tax planning, personal tax services cover everything you need to manage your personal finances effectively. An accountant can help you navigate the complexities of the tax system, ensuring that you minimize your tax liability and stay on top of any deadlines.

2. Business Accounting and Bookkeeping

Small businesses, large corporations, and everything in between need expert business accounting services. This includes bookkeeping, financial reporting, cash flow management, and preparing for audits. Accurate accounting ensures that your business remains financially healthy and compliant.

3. VAT and Tax Return Services

Value Added Tax (VAT) can be a tricky area for businesses, but accountants can help you stay compliant. Accountants handle VAT returns, ensuring that you’re charging the correct amount and paying the right VAT to the HMRC. Additionally, accountants can handle your corporation tax returns, ensuring accurate and timely submissions.

4. Payroll and HR Services

Managing payroll, pensions, and employee benefits can be a headache, especially for businesses with several employees. Accountants in Milton Keynes can take care of all payroll-related tasks, including calculating salaries, handling National Insurance, PAYE, and ensuring that you're meeting all HMRC requirements.

5. Business Advisory Services

For business owners, accountants often provide business advisory services. This could involve anything from cash flow management to advice on expansion strategies, securing business loans, or preparing your business for sale. Their expertise can be invaluable when making major decisions about the future of your business.

6. Auditing Services

For larger businesses or organizations with complex financial needs, auditing services are essential. An independent audit can provide assurance that your financial statements are accurate and comply with the law. An auditor will examine your records and provide an objective opinion on your financial health.

Why Choose Accountants Milton Keynes?

With so many options in Milton Keynes, you may be wondering why Accountants Milton Keynes (accountantsmiltonkeynesmk.co.uk) stands out. Here are a few reasons why clients choose us:

1. Local Expertise

Our team has extensive knowledge of the local business landscape in Milton Keynes, which enables us to provide tailored advice and solutions for businesses and individuals in the area. We understand the local tax laws, industry practices, and regional economic factors that can affect your finances.

2. Comprehensive Services

Whether you need personal tax services, business accounting, or specialized advisory support, we offer a wide range of accounting services. Our goal is to be your one-stop shop for all things accounting, ensuring you never have to look elsewhere for financial expertise.

3. Personalized Attention

At Accountants Milton Keynes, we believe in building strong, long-term relationships with our clients. We take the time to understand your specific needs and offer personalized solutions that make sense for you. Our team is always available to answer questions and provide expert guidance when you need it most.

4. Competitive Pricing

We believe that quality accountancy services should be accessible to businesses of all sizes and individuals alike. That’s why we offer transparent and competitive pricing, ensuring you receive great value without breaking the bank.

5. Proven Track Record

Our satisfied clients are a testament to the high level of service we provide. With a strong track record of success, we’ve helped countless businesses and individuals manage their finances more efficiently, minimize tax liabilities, and achieve their financial goals.

How to Get Started

Getting started with Accountants Milton Keynes is easy. Simply visit our website (accountantsmiltonkeynesmk.co.uk), fill out the contact form, or give us a call. We'll schedule an initial consultation to understand your needs, provide tailored advice, and outline the steps to move forward.

In conclusion, having the right accountant by your side is crucial to managing your finances effectively, whether you're a business owner or managing your personal tax affairs. Accountants Milton Keynes (accountantsmiltonkeynesmk.co.uk) offers expert services, competitive pricing, and personalized solutions designed to ensure your financial success. If you want to work with a trusted team that understands your needs, don’t hesitate to get in touch with us today!

1 note

·

View note

Text

What is a Debt Management Plan?

New Post has been published on https://www.fastaccountant.co.uk/debt-management-plan/

What is a Debt Management Plan?

Understanding Debt Management Plans in the UK” is your essential guide to navigating the complexities of managing debt effectively. You’ll discover how a Debt Management Plan (DMP) works, its benefits, and how it can help you regain control over your finances. This article is designed to offer you clarity and actionable insights in a friendly and uncomplicated way, so you can take confident steps towards a debt-free future without feeling overwhelmed.

What is a Debt Management Plan?

A Debt Management Plan (DMP) is an informal agreement between you and your creditors to pay back your non-priority debts, such as credit cards, overdrafts, and personal loans. Managed by a third party, typically a debt management company or charity, a DMP aims to spread out your debt repayments over a longer period, often making them more manageable and affordable based on your financial situation.

How Does a DMP Work?

A DMP works by consolidating your debts into a single, more manageable monthly payment. Here’s a simplified breakdown of the process:

Assessing Your Financial Situation: You and a debt advisor will review your income, expenses, and debt to see what you can realistically afford to pay each month.

Creating a Budget: With the help of your advisor, you’ll create a budget to ensure you can cover necessary living expenses while prioritizing debt repayments.

Negotiating with Creditors: Your advisor will negotiate with your creditors on your behalf to accept lower payments and potentially freeze interest and charges.

Making Payments: You make one monthly payment to the debt management company, which then distributes the money to your creditors.

Benefits of a Debt Management Plan

A DMP can offer several benefits, making it an attractive option for those struggling with debt.

Consolidation of Debts

One of the main advantages is the consolidation of multiple debts into one manageable payment, reducing the stress of keeping up with numerous bills.

Reduced Payments

Your debt advisor will negotiate reduced payments with your creditors, making the monthly amount easier for you to handle without compromising your essential living expenses.

Interest and Charges

Creditors are often willing to freeze interest and charges on your debts once you enter into a DMP, allowing you to focus on paying off the principal amount faster.

Professional Guidance

By working with a debt management company or charity, you gain access to expert advice and support, helping you navigate your way out of debt.

youtube

Drawbacks of a Debt Management Plan

While DMPs can be quite helpful, they’re not without their disadvantages. It’s important to be aware of these potential drawbacks.

Impact on Credit Rating

A DMP can negatively affect your credit rating. Since you’re making reduced payments, your creditors may report this to credit reference agencies, reflecting poorly on your credit score.

No Legal Standing

Unlike other debt solutions such as an Individual Voluntary Arrangement (IVA) or bankruptcy, a DMP is not legally binding. This means creditors can still take legal action against you.

Duration

Because the payments are reduced, it might take longer to pay off your debts compared to more aggressive repayment strategies.

Not All Debts Are Eligible

Priority debts like mortgages, rent arrears, and utility bills are not included in a DMP. You’ll need to manage these separately, which might be an additional financial strain.

Who Might Benefit from a DMP?

While DMPs offer various advantages, they’re not suitable for everyone. Here are some scenarios where a DMP might be beneficial.

Multiple Non-Priority Debts

If you have multiple non-priority debts that you’re struggling to keep up with, a DMP can help bundle them into one easier-to-manage payment.

Temporary Financial Struggles

If your financial difficulties are expected to be temporary, a DMP can offer breathing space as you get back on your feet, whether due to job loss, medical expenses, or other temporary financial setbacks.

Willingness to Repay

If you’re committed to repaying your debts but just need more manageable terms, a DMP can provide a structured plan to help you achieve that goal while providing professional support.

Steps to Setting Up a DMP

Setting up a Debt Management Plan involves several steps, and each step is crucial for ensuring that the DMP works effectively for you.

Step 1: Consult a Debt Advisor

The first step in setting up a DMP is consulting with a qualified debt advisor. Charities like StepChange, National Debtline, and PayPlan offer free advice and assistance in setting up a DMP.

Step 2: Review Your Finances

Together with your advisor, you will review your financial situation, including your income, expenses, and all outstanding debts. This is crucial for understanding what you can realistically afford to pay each month.

Step 3: Create a Budget

With your advisor, you will create a comprehensive budget. This will include necessary living expenses like rent, utilities, food, and transportation, ensuring that the amount you agree to pay each month is doable.

Step 4: Negotiate with Creditors

Your debt advisor will reach out to your creditors to negotiate reduced payments and possibly get agreements to freeze interest and additional charges. This negotiation is crucial as it will establish the terms of your DMP.

Step 5: Make Monthly Payments

Once everything has been agreed upon, you will start making your agreed monthly payments to the debt management company, which will then distribute the funds to your creditors.

Step 6: Regular Reviews

Your situation might change over time, so it’s important to have regular reviews with your advisor to adjust your DMP as necessary. This helps ensure that the plan continues to be manageable and effective.

DMP vs. Other Debt Solutions

It’s important to compare a DMP with other debt solutions to see if it’s the best fit for your situation. Here are a few alternatives to consider.

Debt Consolidation Loan

A debt consolidation loan involves taking out a new loan to pay off your existing debts, consolidating them into one single payment. It often comes with a lower interest rate but has the drawback of possibly extending the period over which you have to repay your debts.

Individual Voluntary Arrangements (IVAs)

An IVA is a legally binding agreement between you and your creditors to pay off your debts over a fixed period, usually five years. Unlike a debt management plan, an IVA offers legal protection against creditors taking further action but can also have a more severe impact on your credit rating.

Bankruptcy

Bankruptcy is a severe measure that legally frees you from most debts but comes with significant consequences, including asset liquidation and severe impacts on your credit rating. It should only be considered as a last resort.

Comparison Table

Aspect DMP Debt Consolidation Loan IVA Bankruptcy Legally Binding No No Yes Yes Impact on Credit Rating Moderate Varies Severe Severe Eligibility Non-priority debts Usually good credit required Unmanageable debts over £10,000 Severe financial distress Creditor Protection No No Yes Yes Duration Variable Variable Fixed, usually 5 years Immediate (usually 1 year)

Managing Your DMP Effectively

Once your DMP is in place, managing it effectively is crucial for its success.

Stick to Your Budget

Adhering strictly to the budget you set with your advisor is key to the success of your debt management plan. Avoid unnecessary expenses and prioritize your essential needs and monthly DMP payment.

Open Communication

Maintain open lines of communication with your debt advisor and creditors. If your financial situation changes, inform them immediately so adjustments can be made to your plan.

Regular Reviews

Regularly reviewing your debt management plan ensures that it remains effective. This allows you to adapt the plan in response to any changes in your income or expenses.

Avoid New Debts

It’s essential to avoid accumulating new debts while on a DMP. This will ensure that all your available resources are focused on repaying your existing obligations.

FAQs about Debt Management Plan

To wrap up, let’s address some frequently asked questions about DMPs to deepen your understanding.

Will All My Creditors Agree to a DMP?

While most creditors are often willing to work with a debt management plan, some may refuse. However, your debt advisor will still distribute payments to all creditors proportionately, whether or not they have formally agreed.

How Long Will a DMP Last?

The duration of a DMP can vary greatly depending on the amount of debt and the monthly payments agreed upon. It might take several years to repay your debts under a DMP fully.

Can I Include All Types of Debt in a DMP?

A DMP typically covers non-priority debts such as credit cards, personal loans, and overdrafts. Priority debts like mortgage arrears, rent, and utility bills are usually not included.

Is There a Cost to Setting Up a DMP?

Some organizations charge fees for setting up and managing a DMP, but many charities like StepChange offer these services for free. It’s essential to clarify any costs upfront.

What Happens If I Miss a Payment?

Missing a payment could jeopardize your debt management plan. Creditors might start adding interest and charges again or take legal action. Always inform your advisor if you’re at risk of missing a payment to explore solutions proactively.

Conclusion

Understanding Debt Management Plans in the UK can be a daunting task, but being well-informed can help you take control of your financial situation more effectively. A DMP can offer a structured, manageable way to pay back your non-priority debts while providing the much-needed support and guidance of a debt advisor. By understanding both their benefits and drawbacks, you are better equipped to decide if this debt solution is right for you.

If you find yourself struggling with debts and contemplating a DMP, it’s always best to seek advice from a reputable debt charity or financial advisor who can guide you through your options. Remember, the goal is to find a solution that works best for your unique financial situation, helping you regain control and achieve a debt-free future.

0 notes

Text

Director Disqualification

The Consequences and Implications

In the world of business, directors play a crucial role in steering companies towards success. However, when directors fail to meet their legal obligations, the consequences can be severe. Ranging from disqualification to lasting damage to one’s professional reputation. In this article, we delve into the intricacies of director disqualification, exploring what it entails, the consequences, and options for appeal.

What is Director Disqualification?

Director disqualification is a legal action that prevents a person from serving as a director or managing a company for a set period of time. This also applies to individuals with managerial responsibilities, even if they aren’t officially listed as directors. Most cases of disqualification arise from company insolvency, leading to potential investigations by the Insolvency Service, Companies House, the Competition and Markets Authority (CMA), the courts, or insolvency practitioners.

Several behaviors can lead to a director being deemed ‘unfit,’ including:

Failing to file a confirmation statement or annual accounts

Neglecting proper accounting records or submitting inaccurate accounts

Defaulting on tax payments owed by the company

Personally benefiting from the company’s assets

Continuing to trade while the company is insolvent

Furthermore, as of October 2016, the updated ‘Disqualified Directors Compensation Orders’��legisation stipulates the possibility of directors, in some instances, being personally responsible for their company’s debts and any outstanding obligations to HMRC. This implies that, apart from the disqualification itself, directors may find themselves burdened with substantial financial responsibilities.

Consequences of Disqualification:

Disqualification can last up to 15 years, during which the affected individual must step down from their current managerial position. They are also barred from being a director in any UK or overseas company dealing with the UK. Additional restrictions may include limitations on positions of trust, such as serving on school, charity, or police boards, as well as practicing certain professions like law or accountancy. Breaching these restrictions can result in heavy fines or even imprisonment.

The length of disqualification depends on the severity of the offense:

Lower category offences – a disqualification will normally last between 2 and 5 years. This is generally for offences such as negligence, usually due to poor judgement rather than an act carried out with malicious intent.

Mid-tier offences – a disqualification will normally last between 6 and 10 years. Offences in this category are more serious and potentially pose a risk to public interest.

Serious offences – a disqualification of up to 15 years. These are usually cases that involve fraud, embezzlement or serious criminal behaviour.

Understanding the implications of director disqualification is crucial for company directors. By adhering to legal responsibilities and seeking professional advice, directors can mitigate the risk of disqualification and its severe consequences on their careers and personal lives. If you are a director facing disqualification, please reach out to us now for free, professional advice at [email protected].

1 note

·

View note

Text

Stay Financially Resilient: Top 5 Strategies for Stability Amid Economic Challenges

In times of inflation, safeguarding your finances becomes crucial. Here are five practical steps to help keep your financial health intact amidst economic turbulence:

Assess Your Savings: Where you stash your savings matters. Inflation can eat away at money parked in low-interest accounts. Explore options like Treasury Inflation-Protected Securities (TIPS) or high-yield savings accounts for better protection against inflation.

Track Your Spending: With costs on the rise, knowing where your money goes is essential. Budgeting apps or simple spreadsheets can shed light on spending habits, helping you identify areas to cut back and save for unexpected expenses.

Prioritize High-Interest Debt: Inflation can make high-interest debt, such as credit card balances, even more burdensome. Focus on paying off these debts to minimize interest costs and free up more income for saving or investing.

Consider Mortgage Options: If you are house hunting, weigh the benefits of adjustable-rate mortgages (ARMs). While fixed-rate mortgages offer stability, ARMs could save you money if interest rates drop.

Maximize Rewards: Make the most of the rewards programs like cashback on credit cards or discounts from membership clubs. These perks can add up, providing significant savings and stretching your budget further. As we journey through 2024, let's explore the top five cashback programs making a splash in the UK.

TopCashback TopCashback continues to dominate the cashback market with its extensive network of retailers and competitive cashback rates. It's a fan favourite for its user-friendly interface and the option for a paid membership, which unlocks higher rates of cashback and additional perks.

Quidco A close competitor to TopCashback, Quidco offers a similar range of services with an impressive list of participating retailers. It stands out with its sign-up bonuses and has been known to provide an average of £300 a year in cashback.

Fetch Fetch has made a name for itself by turning every purchase into points that can be redeemed for rewards. It's particularly praised for its simplicity and effectiveness in earning points on everyday purchases.

Ibotta Ibotta has expanded its reach beyond groceries to include multiple spending methods. It's best known for its cashback offers on a wide array of products and services, making it a versatile choice for consumers.

Dosh Dosh is the go-to app for retail and hotel rewards. It has streamlined the cashback process by automatically adding cashback to the user's account without the need for scanning receipts or promo codes.

These cashback programs provide a financial incentive for consumers and create a win-win situation for retailers by driving customer loyalty and repeat business.

Please stay tuned and informed, and don't hesitate to seek personalized advice from a financial advisor for detailed strategies tailored to your situation.

Protecting your finances demands flexibility and awareness, especially during uncertain economic times. Implementing these measures can help you maintain stability and confidence in your financial future.

0 notes

Text

MC Lawyers & Advisers - A Review of a Legal Advisor

Legal professionals are dealing with profound complexity across a range of new and emerging business risks. This can leave them feeling overwhelmed.

If you are in need of assistance, contact your local Community Legal Centre (CLC). They can help you with a variety of legal matters.

In the television show Suits, Mike Ross is able to talk his way into a law firm because of his photographic memory. But in real life, it’s not so easy.

Experienced Lawyers

MC Lawyers & Advisers Legal advisor Sydney is a well-known law firm in Sydney offering high-level litigation, transactional, financial advice and advisory services. The firm is renowned for its expertise in high stakes commercial disputes and has an excellent reputation for delivering exceptional outcomes for its clients. Its lawyers are highly qualified and experienced and have extensive expertise in a variety of areas.

A number of large Australian and international firms are active in the market, particularly in Melbourne and Sydney. These firms are looking for senior quality lawyers from major UK magic and silver circle firms as well as those who have completed two to three year training contracts in the United States or Ireland.

Typical duties include legal and commercial matters, negotiations and drafting complex commercial contracts in the energy and resources sector and partnering with environmental / planning consultants on regulatory compliance issues. Strong leadership and a passion for the resources industry are essential. This role would suit a head of legal or Deputy General Counsel wanting to be sole legal counsel and play an active role in executing entrepreneurial and commercial projects that are business (not just legal) focused.

Summary Criminal Prosecutions

Legal advisor Sydney is an independent, full-service firm that provides legal services to individuals, businesses and government agencies. The firm handles a broad range of legal matters including criminal law, family law and civil disputes. Clients are provided multiple points of contact on each matter and have access to a dedicated lawyer.

The firm’s experienced team of lawyers is devoted to protecting the rights of their clients. They are at the forefront of major workplace relations and employment policy cases that create significant implications for businesses nationwide. They also specialise in helping businesses reduce their risks and liabilities and simplify their day-to-day operations. This includes providing advice on business contracts, employee management and workplace investigations. The firm is committed to the highest professional standards and is a member of several industry bodies. It is licensed to practise in NSW. It also has a legal hotline that operates from 7ammidnight, seven days a week. The hotline can be accessed from anywhere in Australia and is free to call.

Customer Service

Providing an excellent customer service is key to the success of any legal firm. Legal advisors must be able to explain complex concepts in a clear way for clients. This includes explaining the legal implications of various policies and agreements. They also need to be able to train staff.

They should be able to identify the client’s problem and advise them of their rights and obligations. They can also help them to find out whether they are eligible for any legal aid services. If they are not eligible for legal aid, they can refer them to a solicitor or community legal centre.

Legal advisers can assist with most legal matters, including family law, minor criminal offences and Centrelink issues. They can also provide advice about tenancy issues, homelessness and debt management. They can even provide advice in a

country area by fax or email. They can also refer you to a specialist family violence or sexual assault clinic.

Rates

Lawyers charge by the hour, but the cost can vary depending on a variety of Legal Assistance Sydney. For example, junior lawyers or those located in less expensive areas typically have lower rates. Meanwhile, more experienced attorneys who work in large cities often charge higher rates.

In addition to hourly rates, lawyers also charge for various services, such as consultations, research, and drafting documents. It is important to understand the rates charged before hiring a lawyer, so you can budget accordingly.

Many legal firms are now offering fixed fees, which can be more beneficial for clients because they do not have to worry about unexpected expenses. Additionally, fixed fees can save time for both lawyers and clients, as they do not have to spend time monitoring billable hours. In 2004, Sydney Criminal Lawyers became the first law firm in Australia to publish fixed-fee prices for criminal and traffic law cases. This initiative has since been adopted by many other law firms.

0 notes

Text

How to Access Support Groups for Debt Management and IVAs

Managing debt can feel overwhelming, especially if you're considering an Individual Voluntary Arrangement (IVA) as a solution. However, you're not alone in this journey. There are numerous support groups and resources available to help you navigate debt management, including those specifically designed for individuals considering an IVA. These support groups can provide emotional, financial, and practical assistance, helping you regain control of your financial future.

If you’re a UK citizen struggling with debt, here's how you can access the support you need to maintain financial stability and resolve financial stress.

1. Understanding the Importance of Support Groups for Debt Management

When you’re dealing with significant debt, it can feel isolating. Many people facing challenges like bankruptcy or struggling to maintain regular payments often feel overwhelmed. Support groups are an essential resource for people like you who are looking for understanding, advice, and emotional support during tough times.

Support groups offer:

Emotional support from others who understand what you’re going through.

Guidance on debt management strategies, including Individual Voluntary Arrangement (IVA).

Practical advice on how to handle creditors and other financial challenges.

2. How Support Groups Can Help with an IVA

An IVA is a formal arrangement between you and your creditors, designed to repay a portion of your debt over a fixed period, often five to six years. While the IVA process provides a clear path to resolving your debt, support groups can help you manage the emotional aspects of this journey.

Support groups specifically tailored to IVAs can offer:

Understanding of the IVA process: They can explain the steps involved in an IVA, helping you know what to expect.

Shared experiences: Connecting with others who have gone through the IVA process can offer invaluable insights and encouragement.

Tips for maintaining regular payments: Staying on track with your IVA payments is crucial for success, and support groups can offer practical advice on budgeting and financial planning.

3. Finding the Right Support Group for Debt Management

There are several ways to access support groups for debt management:

Online forums and communities: Many online platforms provide a safe space for people dealing with debt. Websites like MoneySavingExpert have active forums where you can connect with others and ask for advice.

Charities and non-profit organizations: Groups such as StepChange and Citizens Advice offer free advice, and some also host support groups for individuals managing debt or going through an IVA.

Local debt advice centers: Many cities have free debt advice centers where you can meet with a professional and potentially access support groups. These organizations can help you decide if an IVA is the right path for you.

4. How We Can Help

At Apply for IVA, we understand how difficult it can be to face financial stress and debt. That’s why we provide not only expert advice on Individual Voluntary Arrangements (IVA) but also guide you to the right support networks for UK citizens. If you’re considering an IVA, our team can help you assess your eligibility and provide ongoing support throughout the process.

We believe that addressing both the financial and emotional aspects of debt is key to achieving lasting success. By reaching out to support groups and our expert team, you can gain the tools and confidence you need to manage your finances and resolve debt.

5. Benefits of Joining a Debt Support Group

When you join a support group, you gain access to:

Expert advice from people who understand the complexities of debt management.

Emotional reassurance that you are not alone in this journey.

Motivation to stay on track with your financial goals, especially as you work through an IVA.

Shared resources, such as budgeting tips, tools, and debt management strategies.

Whether you’re dealing with debt, contemplating bankruptcy, or considering an IVA, being part of a support group can provide the emotional and practical help you need to stay focused on your financial recovery.

6. Take the First Step Today

If you’re ready to take control of your financial future and start the IVA process, Apply for IVA is here to support you. Our team of experts offers personalized advice and can help you connect with the best support resources for Maintaining Financial Stability.

You don’t have to face your financial struggles alone. Contact us today for a consultation, and let’s begin working together to resolve financial stress and get you on the path toward a brighter, debt-free future.

#DebtManagement#IVASupport#FinancialStability#Bankruptcy#UKCitizens#ResolveFinancialStress#DebtRelief#Pensioners#Retirees#FinancialFreedom#IVASolution

0 notes

Text

Best Life Insurance Companies UK: Ensuring Your Future with Future Proof Ltd

Discover unparalleled peace of mind with Future Proof Ltd, a leader among the best life insurance companies in the UK. Our bespoke advisory service connects you with the best life insurance company for your unique needs, ensuring a secure future for you and your loved ones. Experience the Future Proof Ltd difference with tailored solutions, expert guidance, and a commitment to excellence that sets us apart in the UK life insurance landscape. Secure your legacy with Future Proof Ltd.

Why Life Insurance is Essential

Life insurance is more than just a financial product; it's a safety net for your loved ones, ensuring their financial stability in the face of life's uncertainties. Whether it's to cover outstanding debts, provide for your family's living expenses, or secure your children's future education, the right life insurance policy can be a beacon of hope during challenging times.

The Hallmarks of the Best Life Insurance Companies in the UK

What sets the best life insurance companies apart? It boils down to a few critical factors: comprehensive coverage options, competitive pricing, exceptional customer service, and a straightforward claims process. Future Proof Ltd partners with providers who exemplify these qualities, ensuring that you're not just purchasing a policy, but a promise of support when it matters most.

Tailored Solutions for Every Need

Understanding that one size does not fit all in life insurance, Future Proof Ltd prides itself on offering personalized advice. Whether you're a young professional starting your career, a parent planning for your family's future, or approaching retirement, we have the expertise to match you with the perfect policy. From term life insurance, which provides protection for a specified period, to whole life policies that offer lifelong coverage and can accumulate cash value, our advisors are skilled at navigating the complexities of the market to find your ideal fit.

The Future Proof Ltd Difference

What makes Future Proof Ltd stand out in the crowded UK life insurance market? It's our unwavering commitment to transparency, education, and customer-centric service. We believe that informed customers make the best decisions, and our advisors are dedicated to providing you with all the information you need, free from industry jargon or sales pressure.

Streamlining the Selection Process

Choosing the best life insurance company in the UK should not feel like a daunting task. Future Proof Ltd simplifies this process by doing the heavy lifting for you. Our rigorous vetting process evaluates insurance providers on various metrics, including financial stability, customer satisfaction ratings, and policy flexibility. This meticulous approach ensures that we recommend only the most reliable and customer-friendly companies.

A Partner You Can Trust

In an industry where trust is paramount, Future Proof Ltd has built a reputation as a reliable partner. Our advisors are not just insurance experts; they're compassionate individuals who understand the weight of the decisions you're making. We're here to guide you, support you, and provide clarity in a complex landscape.

Conclusion

In the search for the best life insurance company in the UK, it's easy to feel overwhelmed by the myriad of options and conflicting advice. Future Proof Ltd stands as a beacon of clarity and reliability, committed to helping you secure the best possible protection for your loved ones. With our guidance, you can navigate the life insurance landscape with confidence, knowing that you're making an informed decision that's tailored to your life's unique blueprint. Choose Future Proof Ltd, and take the first step towards a future that's not just insured, but truly future-proofed.

To learn more Visit us: https://www.futureproofinsurance.co.uk/life-insurance/best-life-insurance/

0 notes