#form 16a

Explore tagged Tumblr posts

Text

youtube

0 notes

Text

Why Form 16A Passwords Matter for Secure Access: Best Practices for Data Protection

Form 16A is an essential report issued by entities that deduct tax at source. It affords details of the tax deducted and submitted to the government on behalf of the payee. To protect the confidentiality of these records, Form 16A is regularly password-covered.

Understanding the significance of the Form 16A password and following first-class practices for fact safety is essential to make sure the safety of your touchy tax data. This article aims to outline Why Form 16A Passwords Matter for Secure Access and the Best Practices required for Data Protection

Importance of Form 16A Passwords for Secure Access

Protecting Sensitive Financial Information Form 16A comprises essential financial records such as the amount of tax deducted, details of earnings, and the deductor's facts. If this record falls into the wrong palms, it can cause misuse of touchy records. The Form 16A password ensures that the most effective legal individuals can get entry to the report, maintaining private economic facts secure from unauthorized users.

Preventing Identity Theft and Fraud

With the upward push of cyber threats, identification robbery and financial fraud are actual risks for people and companies. A steady Form 16A password acts as a shielding barrier, preventing unauthorized access to your tax info, which will be exploited for fraudulent activities like submitting faux tax returns or manipulating your economic identity.

Ensuring Compliance with Data Protection

Regulations In India, information protection legal guidelines consisting of the Information Technology Act, 2000, and the approaching Data Protection Bill emphasize the need for securing personal facts. By the usage of a password-included Form 16A, businesses comply with criminal obligations to shield an man or woman's records, thereby averting ability consequences.

Best Practices for Form 16A Password Security

1. Understand the Default Password Format Typically, the Form 16A password follows a standard layout, which is an aggregate of the recipient’s Permanent Account Number (PAN) and date of birth. For example, if your PAN is "ABCDE1234F" and your date of start is "01/01/1980", your Form 16A password could be "ABCDE1234F01011980". Understanding this layout is the first step in securely having access to your Form 16A.

2. Change Your Password When Necessary

While the default password layout is steady, in cases in which your Form 16A is saved electronically or shared, remember changing the default password to a stronger, specific one. This minimizes the hazard of unauthorized access to. To increase security, create a password that combines special characters, numbers, and letters.

3. Use Encrypted Channels to Share Form 16A

If you need to proportion your Form 16A with a person, make sure that it is done through encrypted electronic mail offerings or stable platforms. Avoid sharing it over unsecured networks, as this increases the risk of statistics breaches. Never share your Form 16A password via an unencrypted method like SMS or email.

4. Regularly Update Your Passwords

It’s appropriate practice to replace your Form 16A password periodically. This further protects the file from potential cyber threats or statistics breaches. Make sure to follow stable password protocols, which include the usage of a mixture of uppercase and lowercase letters, numbers, and unique symbols.

5. Avoid Using Public Devices to Access Form 16A

Access your Form 16A handiest on steady, personal gadgets. Public computer systems or shared gadgets may be vulnerable to malicious software programs or key loggers that may seize your Form 16A password and other sensitive records.

Handling Forgotten Form 16A Passwords

Recovering a Forgotten Password

If you overlook your Form 16A password, consult with the default password shape referred to in advance. If this doesn’t work, you could contact the entity that issued the Form 16A, which includes your company or the financial institution, to help you with accessing the document securely.

Resetting Form 16A Password

In uncommon cases, the issuing entity would possibly offer the option to reset the Form 16A password if wanted. Follow the instructions furnished through the issuer to soundly reset and regain get right of entry to to your Form 16A.

Conclusion

The Form 16A password performs a essential role in safeguarding touchy tax-associated statistics from unauthorized access and capacity cyber threats.

By following best practices for statistics safety, consisting of know-how to use the default password format, sharing files securely, and often updating passwords, people and groups can make sure that their financial data remains secure and steady.

0 notes

Text

Form 16A and TDS: Everything You Need to Know - EAZYBILLS" is your definitive guide to understanding the essentials of Tax Deducted at Source (TDS) and Form 16A. This comprehensive resource simplifies the complex aspects of TDS, detailing when and how tax is deducted on various payments, including interest, rent, and professional fees. It explains the importance of Form 16A, a crucial certificate issued for TDS on income other than salaries, and how it helps in filing your income tax returns. With EAZYBILLS, managing TDS and generating Form 16A becomes effortless, ensuring compliance and accuracy in your financial dealings.

0 notes

Text

youtube

#nilesh ujjainkar#taxguidenilesh#tds certificate#form 16#form 16a#tds#new tax regime#tax slab#Youtube

0 notes

Text

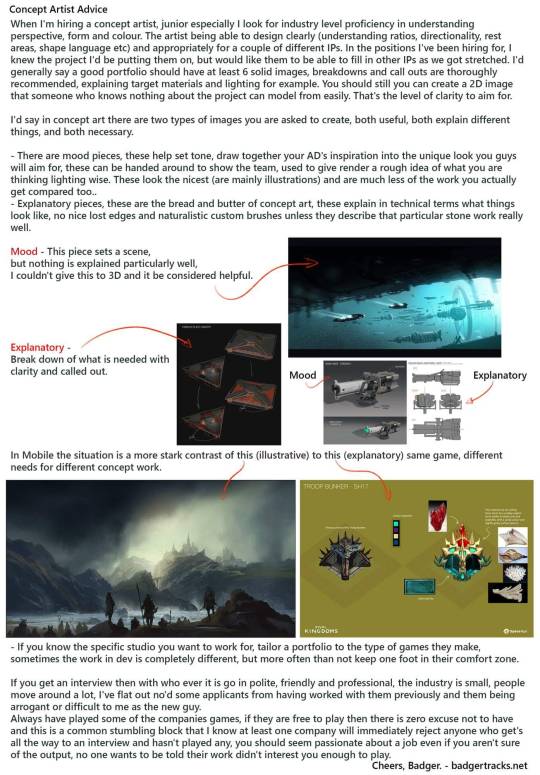

Portfolio advice, from a lead who hires Concept Artists

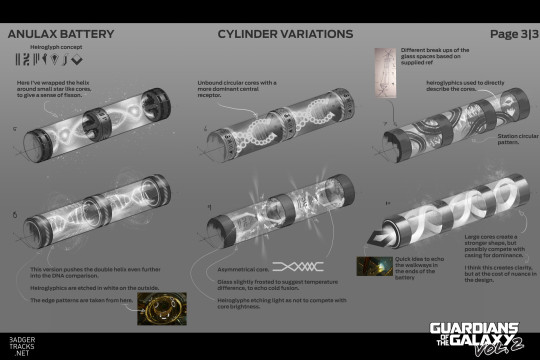

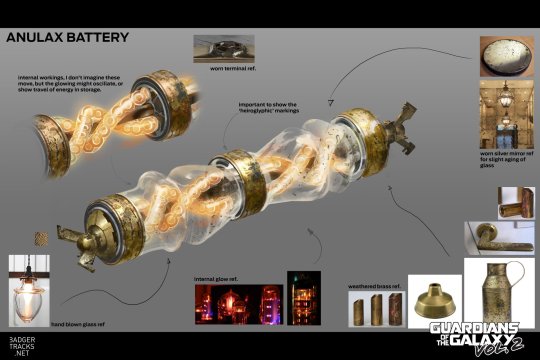

(This was originally a twitter thread I wrote before the site self imolated, hense it's strange structure.) I wrote this after a weekend of portfolio reviews - 1. Like a maths exam, please please show your working. I want to see thumbs options, mid options and of course a final design.

2. Arrange your portfolio, I don't want to bounce about between subject matter and pipeline. Your portfolio's narrative should be as strong as your work... 3. Please make worlds that excite the viewer, make them want to go in and explore them, explain to them the interesting parts of the town, or the way the character's hat unfolds. How will this draw the viewer in? 4. As I've said before the majority of your project work is explanatory not mood, make sure your portfolio contains explanatory work. Explained here -

5. A lot of beautiful post apocolyptic paintings, , but 80% of realistic games and film, we just give the environment artists photo ref, they are capable artists in their own right. Different work in stylised where you do need to create rules for how things can be translated. 6. Production art contains call out sheets, material references and flat graphics. This doesn't have to be your final image, but it should support it.

7. Design characters on a swatch(es) of the environment they will be viewed in. Not on white. I make swatch backgrounds from screenshots, it avoids assumptions that damage readability. 8. Reverse of this, put people in your environments, show me the scale.

9. It's not a deal breaker for a review, but if you intend to get a job, please show me your work on a screen larger than a smartphone (print outs probably the cheapest option with the best battery life). 10. Please have your contact details clearly visible, and by that I mean email address, I will not pass your social media contact on, I cannot input your form into my tracking system. EMAIL ADDRESS emblazoned and bake it in, sometimes recruiters do funky stuff to pdfs

11. Your portfolio will never feel done, not to you anyway. You will have learnt from your latest pieces and want to apply it to older work. But we know art is a journey. Send your portfolio anyway. I've been in the industry 10+ years and my portfolio is still not 'finished'. 12. If you are applying to an environment centric Concept Art position then please vary your times of day! Golden hour is cool but show me some happy sunny days, looming overcast days, what about at night? Vary your weather too! Sunny snowy day? Rainy Spring day? Stormy night?

13. If you are applying for a character centric Concept Art role then please ensure your portfolio shows a variety of body types and ethnicities. 14. Designing characters for games? Please show back views and feet (!) Many potfolios contain only front views. This is a problem because:

You haven't shown you are considering the design from all angles.

In many games rear view is the main view.

Stop cropping feet.

15. If you are entry / graduating and looking at Portfolios to compare content and standard of yr own work too, look at hired grad/junior artists as opposed to seniors Seniors and leads often have old or personal work in their portfolio which isnt representative of the day job. 16a. Show clearly the intended use case for your Concept Art. Mention the game type in the description. Are these player character designs for a 3rd person adventure game? Then more back views please. Bonus points for diagetic ways of showing health / equipment / role etc.

16b. Are these designs for an FPS? Then really the player view of the gun needs to sell the player style/ choices, in an FPS your weapons are almost your character. Are these world designs? What's the view distance? For an RTS your shapes need to read from above & a distance. 16c. The lack of clarification means I am judging the design in isolation, which both harms the design (you might be considering the backview of a char as the main adventure character.) Or an NPC, their waist up expressions may be important for conveying exposition and mechanics.

16d. Concept art is not separate from gameplay, great concept art serves the game team before it is a good illustration.

17. Play games. A variety of games. Think about them. IMO to be a good concept artist you need to understand the common language & references used by your peers. Also understand the principles and common language your audience are used to. FPS design rules are v.diff from RTS.

18. There are many skills that are needed in concept art, please show them. For example: Graphic design - logos, liveries, typographic use etc. VFX concepts - Abilities, Ambience, motion concepts. Architectural knowledge - How buildings are built! & more but I'm out of space :O

7K notes

·

View notes

Text

sixteen shades of blue

prologue - a barely blue

professor!Dieter x reader

words: 800~

warnings/tags: no major warnings for this part. Reader is not a student. University admin stuff lol, write what you know and all that. Fantasizing about the hot professor who can't deal with basic admin tasks. drug use mention (Dieter, duh). Feelings. Hands. Unedited, unbeta'd, written on my phone I'm sorry for mistakes!

a/n: Happy birthday to my brainrot bestie @chronically-ghosted!!! this is a short little thing which hopefully will lead into a bigger thing one day but I know you have been waiting for him for so long so I'm introducing art history professor!Dieter today especially for you.

"Can you go check 16a?" Your boss calls over to you at your desk, "Looks like the register didn't go through"

You sigh to yourself but respond with a 'sure'.

16a is one of the smaller lecture halls on this side of campus; a quick job but not one you should be involved in, not that you'd ever complain about that - a people pleaser to your core, saying no to a work task felt like you might just die.

You stop short of the hall when you hear his voice, confident and excited, your heart skips a beat when you realise just who is teaching in 16a today.

Dieter had walked into your life when he joined the academic staff of the university a year ago. He was like a whirlwind and a calming breeze all at once, nothing like the stuffy, stuck up professors you usually worked with (worked for, in their minds). Dieter was everything they weren't.

You slip in quietly, and don't make yourself known straight away. He's talking about Cezanne - a particular passion of his - and you enjoy the way his hands move as he speaks, bringing the words to life, giving them a flow and a flourish. One of the rings on his fingers glints in a ray of light, drawing more attention to his hands.

You've thought about those hands a lot. His use of them to express himself. How he moves them in a pattern on any available surface when he's lost in thought. The smooth strokes they help him make on a canvas. He'd set up in one of the campus studios outside of hours to work on his own paintings, and you'd stumbled in following the smell of weed when working late one day. You promised to keep his secret safe if he'd let you watch him paint. It was mesmerising to see him work, to see his talent. He's a wonderful, albiet unconventiional professor, but it's clear his real love lies in making art himself.

You'd thought about his hands in other ways too, ways that made things inside you flutter and heat up. How his touch would feel, fingers dancing on your skin, tracing art on you, making you his masterpiece.

You have to shake the thoughts from your head. It's not appropriate, you're at work. Finally you clear your throat and he turns, a smile immediately lighting up his face, brown eyes deep and excited as he looks you up and down without much subtlty.

"Give me a moment" He says to the class, holding up a finger and barely turning his gaze from you, "Examine that reduction of natural form, and then we'll discuss it"

"Hey" You say quietly, stepping forward. He leans into you, a gesture that feels exceedingly intimate despite the students sat behind you.

"I was thinking about you this morning" Dieter says with what feels like a shyness, an admission, "My muse" he adds, and your heart does a little flutter. He'd been calling you that since you inadvertently helped inspire him on a new work one evening.

"But I'm guessing you're here because i've messed something up, right? Is it the stupid registers again" He sighs dramatically and you can't help but giggle.

"I'm afraid so" You nod and step towards his laptop.

"I hate these fucking things" He groans as he watches you access the system and press a few buttons, he's technology averse and you do feel for him in that sense, but you appreciate that he doesn't complain about your systems and processes that make your job easier.

"Remind me to show you how to use this when you're not teaching, okay?" You mutter, entering some final data and stepping back to the door.

"Thanks. I don't know how this place would even function without you..."

You look away, embarrased at the compliment. He's always telling you how much you help him, how good you are at your job, but it never gets easier hearing praise like that. Especially when you'd like to hear different praise coming out of that mouth, plush lips whispering against your ear while he...

You cut the thought off quick and scurry to open the door, but before you can leave he turns back to you and grabs your hand with a gentle hold. Not entirely appropriate infront of a class full of students but you can't pretend it doesn't thrill you. His large hand is warm, the slight press of his rings is definitely not unpleasant. You’re about to get lost in your horny imagination before he speaks again.

"I'll be in the studio later, come by and see the new piece?" He draws right in, so close you feel his breath, speaking in a near whisper. His eyes are almost pleading, wide and waiting and you could dive into their depths.

You squeeze his hand a little and let an easy smile play on your lips. Youd' hoped he'd ask, it had been a while since you'd seen his work, had him all to yourself... it sounds like the perfect evening to you.

"Nowhere I'd rather be"

60 notes

·

View notes

Text

doing work for a more equitable and just world, especially in times like these where fascism, hate, and christian nationalism are extreme, is exhausting. yet we are called to do that work. i think as christians, we especially must be about the work, not only because we model ourselves after Christ, though that is key, but also because those who profess Christ often do this harm and do it in God's name. i share this scripture with you from Doctrine and Covenants 157: 16-17 (RLDS/CofChrist)

[Sec 157:16a] In the many places where you are called to labor, the forces of darkness and destruction are active indeed, and seem to hold sway. Your hearts are burdened by the magnitude of the tasks that are yours in bringing the light of my gospel into such darkness. [Sec 157:16b] Nevertheless, I have heard your prayers when you have cried out to me, and I have been with you in the places where you occupy. I am aware of your desires to serve me and my assurance is that as you go forth, your offerings of faith and service are acceptable to me. [Sec 157:17] In all your efforts, therefore, continue to trust in my grace and respond in love to the leadings of my Spirit. If you will come before me in unity and love I will bless you with a great outpouring of compassion, both for one another and for the world into which you are sent. Amen.

I want to clarify that the work we do and the light of the gospel includes showing loving and defending our transgender and undocumented neighbors. it includes supporting those in need of liberation, such as Palestinians, Congolese, Sudanese, and others through means of advocacy, donations, boycotts, listening to them and amplifying their voices. it includes addressing racism when you see it and when you don't, even when it's uncomfortable. it means inviting people into community and sharing with them the love of Christ, without expecting or pushing for their conversion. Love is active, and I believe this (and much more) is what God calls us to do.

and through all of this, God is with us. We must put our trust in God, and that gives us hope for the future. it's okay if you don't feel hope right now too. it is not a failing on your part. i often feel hopeless, but my faith gives me optimism that can help pull me out of that hole. God has compassion for us, and we reflect this compassion to those around us and those far away from us. we are not meant to, and cannot do, the work alone, and we must form communities where we have compassion for one another. we deserve, and need to, experience this active love ourselves.

#queerstake#tumblrstake#christianity#just my thoughts for this morning#was reading the “daily bread” the church puts out this morning and the scriptue inspired thought#sometimes i feel like i don't do enough but i know i make a difference in my community and make larger changes as a part of a group#like me helping out with creating spaces for queer and trans christians to renew our spirits together is something.#working to protect the rights of disabled people and providing them with resources to survive is something#sometimes my “something” is mentally exhausing or shows me a bleak reality but God is with me all the way#i constantly experience God's love through my community and do my best to show God's love to others as well#this revelation came through Wallace B. Smith and he exemplified showing God's love to others. he did struggle with conservatives tbh#which is relatable. he didn't capitulate to them and neither will i. i will try not to be consumed by hatred bc that helps no one.#and will try to bring others into loving behavior firmly but with love#and it works. i'll admit. not talking about straight up fash but people who get caught up in propaganda or haven't been exposed to diff pov#religion

8 notes

·

View notes

Text

Last month, our friend @mattbooty had the privilege to fly with the 187th Fighter Wing, Alabama Air National Guard and their new F-35A Lightning II fighter jets, along with their existing F-16A ADF fighters and a special guest P-51D Mustang. The red tails are a historic tribute to the Tuskegee Red Tails, the famed WWII squadron, which lives on as the 100th Fighter Squadron within the wing.

This quote from a ceremony at the airport the next morning: "The red tail you will see is a reminder to all that through excellence we will overcome any obstacle and threat regardless of gender, race or religion," said Col. Brian Vaughn, the wing’s commander. "We are all here for the same mission: to protect our nation, defend our constitution, and to form a more perfect union as the Tuskegee Airmen did."

Pilots: P-51 Lt. Col. Raymond "Hollywood" Fowler, F-16 (clean) Lt. Col. Jeremy "Griz" Wiggins, F-16 (drop tank) Capt. Capt Alex "Sanka" Aderegg, F-35 (red tail) Capt. Robert "Alamo" Freeman, F-35 (gray tail) Lt. Col. Richard "Sheriff" Peace. Photo pilot: Melissa Fowler, co-pilot Joshua Fowler. Mission credits to Scott Slocum for coordinating the flight and aerial direction.

@WarbirdNews via X

10 notes

·

View notes

Text

24th September >> Fr. Martin's Gospel Reflections / Homilies on Matthew 20:1-16 for the Twenty Fifth Sunday in Ordinary Time, Cycle A: ‘Why be envious because I am generous?’

Twenty Fifth Sunday in Ordinary Time

Gospel (Except USA) Matthew 20:1-16 Why be envious because I am generous?

Jesus said to his disciples: ‘The kingdom of heaven is like a landowner going out at daybreak to hire workers for his vineyard. He made an agreement with the workers for one denarius a day, and sent them to his vineyard. Going out at about the third hour he saw others standing idle in the market place and said to them, “You go to my vineyard too and I will give you a fair wage.” So they went. At about the sixth hour and again at about the ninth hour, he went out and did the same. Then at about the eleventh hour he went out and found more men standing round, and he said to them, “Why have you been standing here idle all day?” “Because no one has hired us” they answered. He said to them, “You go into my vineyard too.” In the evening, the owner of the vineyard said to his bailiff, “Call the workers and pay them their wages, starting with the last arrivals and ending with the first.” So those who were hired at about the eleventh hour came forward and received one denarius each. When the first came, they expected to get more, but they too received one denarius each. They took it, but grumbled at the landowner. “The men who came last” they said “have done only one hour, and you have treated them the same as us, though we have done a heavy day’s work in all the heat.” He answered one of them and said, “My friend, I am not being unjust to you; did we not agree on one denarius? Take your earnings and go. I choose to pay the last comer as much as I pay you. Have I no right to do what I like with my own? Why be envious because I am generous?” Thus the last will be first, and the first, last.’

Gospel (USA) Matthew 20:1–16a Are you envious because I am generous?

Jesus told his disciples this parable: “The kingdom of heaven is like a landowner who went out at dawn to hire laborers for his vineyard. After agreeing with them for the usual daily wage, he sent them into his vineyard. Going out about nine o’clock, the landowner saw others standing idle in the marketplace, and he said to them, ‘You too go into my vineyard, and I will give you what is just.’ So they went off. And he went out again around noon, and around three o’clock, and did likewise. Going out about five o’clock, the landowner found others standing around, and said to them, ‘Why do you stand here idle all day?’ They answered, ‘Because no one has hired us.’ He said to them, ‘You too go into my vineyard.’ When it was evening the owner of the vineyard said to his foreman, ‘Summon the laborers and give them their pay, beginning with the last and ending with the first.’ When those who had started about five o’clock came, each received the usual daily wage. So when the first came, they thought that they would receive more, but each of them also got the usual wage. And on receiving it they grumbled against the landowner, saying, ‘These last ones worked only one hour, and you have made them equal to us, who bore the day’s burden and the heat.’ He said to one of them in reply, ‘My friend, I am not cheating you. Did you not agree with me for the usual daily wage? Take what is yours and go. What if I wish to give this last one the same as you? Or am I not free to do as I wish with my own money? Are you envious because I am generous?’ Thus, the last will be first, and the first will be last.”

Reflections (3)

(i) Twenty Fifth Week in Ordinary Time

Most of us react instinctively against any form of behaviour that we consider to be unfair or unjust. If we think that we ourselves are being treated unfairly we can feel especially annoyed. We don’t like to feel that others are getting preferential treatment. Perhaps that is why we find ourselves identifying very easily with the complaint of those who worked all day in the vineyard. ‘The men who came last have done only one hour, and you have treated them the same as us’. It didn’t seem fair to them that those who had worked only an hour should get a day’s wages, which was a denarius at that time. In that case, those who worked twelve hours should really be getting the equivalent of twelve day’s wages. We easily share their outrage at this unfairness.

Many of Jesus’ parables seem to set out to disturb us in some way. We are all familiar with the parable of the prodigal son. Again, we feel that the elder son is not being treated fairly. He had been working faithfully, and, yet, when his younger brother returns home, after wasting his share of the family inheritance, he is treated like royalty by the father. Many people have the same reaction to that parable as they do to the parable in today’s gospel reading. The parable of the prodigal son is really a parable about God. Jesus is saying that God lavishes his love and mercy on all, including those who least deserve it. Rather than grumbling about this, like the older son, we need to rejoice in it, because, as Jesus knew, there is something of the prodigal son in all of us. Whenever we try to stagger back towards God having made a mess of things, it is reassuring to know that the God whom we will meet is much more like the father in the parable that the older brother.

Today’s parable too is a story about God. Jesus is trying to convey some sense of God, his Father, whom he knows and loves intimately. He is saying that God does not relate to us on the basic of what we deserve or have earned, on the basis of strict justice. In one of his letters, Saint Paul refers to ‘the breadth and length and height and depth’ of God’s love, of Christ’s love. God’s loving, generous, heart is so wide and deep that it cannot be contained within the limits of what we consider to be just or fair. It is not that God is unjust, but that God’s mercy and goodness move beyond justice. In the parable the vineyard owner said he was just to those who worked all day, giving them a day’s wages for a day’s work, as promised, but he related to all the other workers in a way that went way beyond strict justice. He was very generous with them. He wanted everyone to have a living wage at the end of the day, including those who had been hanging around the market place waiting for someone to hire them. The parable ends with the question of the vineyard owner to those who worked all day, ‘Why be envious because I am generous?’ In other words, ‘Be grateful that you got a day’s wages, and rejoice that your fellow workers got the same and, like yourselves, have enough money to feed their families’.

The parable asks us all, ‘Can we be grateful for God’s big heart that Jesus has revealed to us?’ God doesn’t ask us to earn his favour. At the end of our lives, we will be judged by grace rather than strict justice. God has the freedom to bestow his gracious love, his generous spirit, upon all of us, regardless of whether we have deserved it or not, and that is something to rejoice in. We can experience something of this gracious love of God in and through those relationships that are most precious to us. We may be fortunate enough to have met someone who looks upon us with love, even when we have done nothing to deserve it. They are faithful to us through thick and thin, even though we might give them very little reason to be faithful to us. Their love is constant, even when ours is fickle. If we have been fortunate enough to have met someone like that, it is a glimpse into the heart of God.

When Jesus speaks a parable, we often find ourselves identifying with one or other of the characters in the parable. Most people identify with the workers who worked all day, and feel their resentment. However, if we were to identify with the latecomers, we might feel differently about the parable. We would have a sense of being undeservedly graced and favoured, and we would rejoice and be grateful. That is where we all belong in some sense, with the latecomers, because, although we may have been baptized as children, we haven’t always lived our baptism calling to the full. Yet, the Lord never ceases to call us, just as he called some of the workers at the eleventh hour. If we respond to the Lord’s call, no matter how late, we will experience a God whose ways are not our ways, whose generous heart is not of this world.

And/Or

(ii) Twenty Fifth Sunday in Ordinary Time

For most of us, our day to day life can be reasonable predictable. One day is much the same as the day before. We have a certain routine that we tend to keep to. Many of us do not like our routine to be disturbed. However, we also know from experience that the unexpected can suddenly come along and throw our routine up into the air. Some misfortune can strike us or those we love and nothing is ever quite the same again. Or, alternatively, some wonderful news can come to us out of the blue and everything we subsequently do is bathed in a new light.

That element of the unexpected is very present in today’s gospel reading. There is something very surprising, even shocking, about the way that the landowner in that story operates. Most employers do not give the equivalent of a day’s wage to somebody who only does an hour’s work. If they did, their business would not last very long. Why would anyone want to work for a day if they were sure of getting a day’s wages for an hour’s work? The story that Jesus tells is decidedly not about the human way of doing things. Rather, in story form, Jesus is giving us a picture of God’s way of doing things, and he is showing us that God’s way of doing things is very different from our way. As the Lord says in today’s first reading, speaking through the prophet Isaiah, ‘my thoughts are not your thoughts; my ways are not your ways’. Because God’s ways are not our ways, we will often find God surprising and even disconcerting, just as listeners to the parable today continue to find the behaviour of the landowner disconcerting. This is the one parable of Jesus that is most likely to get people’s backs up. We feel that an injustice is being done to those who worked all day. Yet, the vineyard owner gave those who worked all day a just wage; he gave them a denarius, which was considered a day’s wages. He was just surprisingly generous to those who, through no fault of their own, could only find an hour’s work in the course of the day.

We know from experience that people can surprise us. Some people might surprise us in a negative sense. They do not measure up to our legitimate expectations of them; they disappoint us. Others can surprise us in a positive sense. They far exceed our expectations; they show us that there is more to them than we ever realized. Today’s parable suggests that God will surprise us in that positive sense. God’s goodness is always greater than we realize; God’s generosity will always exceed our expectations. God does not give to us in accordance with what we have earned. God does not put our efforts on one side of the scale and then put an equal amount of favour on the other side of the scale to balance our efforts. God graces us in unexpected and undeserving ways. God gives us the equivalent of a day’s wages for an hour’s work. In the words of the title of a book written by the great spiritual writer, C.S. Lewis, when it comes to God, we can expect to be ‘surprised by joy’. The grace and love of God transcends our human assessments of what is fair and we cannot understand God solely in terms of the principle of fairness. If we stop to think about it, the same is true of our own relationship with others. The love and graciousness that we show to family and friends cannot be understood or evaluated merely in terms of fairness.

When we reflect on it, most of the best things in life are unearned; they are simply given. Nature in all its beauty and grandeur is given to us; we have not put it together; it is there to be received. The human experience of being looked upon in love by another is not something we earn. We find ourselves graced by the unexpected gift of someone’s friendship and love. In a similar way, God’s favour, God’s love is given, not earned. We are loved by God, before we do anything, because God is Love, and God does not take back that love, regardless of what we do or fail to do. As it has been said by one writer, ‘God does not work from the arithmetic of the calculator, but from the fullness of God’s own heart’. The gospels, and especially today’s parable, even suggest that God has a slight prejudice in favour of life’s latecomers, those who take a while to get going. We probably all fall into that category in one way or another. In telling that story Jesus may have wanted us all to identify with the workers who started work at the eleventh hour.

The parable speaks to us of God’s generosity; it is a story of grace. We are each challenged to reflect something of that indiscriminate goodness and generosity of God in our dealings with one another. The God of surprising generosity can become palpable for others in and through our own way of relating. God’s ways are indeed not our ways, but our ways can become a little more like God’s ways, with the help of the Holy Spirit.

And/Or

(iii) Twenty Fifth Sunday in Ordinary Time

The parable of Jesus that we have just heard does not seem to make a great deal of sense by the standards of how today’s labour market works. Battles have been fought to ensure that there is a minimum hourly wage. It follows that those who work longer hours should get more pay. Any deviation from that would rightly result in industrial action, at least in most democratic societies. A great deal of negotiation in relation to work conditions has to do with ensuring that people get a just wage that relates to their skills, their hours and their responsibilities. It is because the parable is so much at odds with today’s way of proceeding that people often have a very negative reaction to it. Understandably they consider the employer to have acted very unfairly in giving the same wage to the men who worked for the last hour as to the men who worked from early morning in the heat of the day. People often have a similar reaction to the parable of the prodigal son. The elder son who worked away on the estate complains of being treated less favourably than the rebel who headed off and wasted his resources and came back with his tail between his legs. People tend to sympathize with the elder son, just as they do with those who worked all day in this morning’s parable.

The story reflects the conditions of rural Galilee in the time of Jesus. We have men waiting in the village market square hoping that some large landowner will come along and give them a day’s wage so that they can feed their family. The landowner was just to those he hired at the beginning of the day. He agreed to pay them a denarius for their day’s work on his farm, which was the equivalent at the time of a fair day’s wages. When the landowner went out to the village square every three hours in the course of the day he found there were more men waiting around hoping to be given some work, even if it was only a few hours work. Each time the landowner saw men waiting hopefully for work, he took them for the time of the day that was left. At the end of the day, he gave everyone a day’s wages, even those who had worked only a few hours. Perhaps he realized that anything less might not enable them to feed their family for the day. The landlord was just to those who worked all day. He was simply extremely generous to those who had only worked a few hours and in some cases just one hour. A normal landowner would have just given a hour’s wages for an hour’s work, three hours wages for three hours work and so on. However, this was a landowner who broke the mould. In a similar way, the father in the story of the prodigal son broke the mould of the normal father in that culture.

In his parables, Jesus draws from the world that he and his contemporaries are familiar with, but so often his parables go beyond what is normal in that world. We somehow sense that this is not business as usual. There is something else going on here, which we find disconcerting because it is out of kilter with what we are used to. The key is to be found in the words with which Jesus begins the parable, ‘the kingdom of heaven is like...’. Jesus is drawing from the reality that everyone was familiar with, but he is really talking about another reality, ‘the kingdom of heaven’. When we hear the term, ‘kingdom of heaven’, we tend to think of heaven, life beyond this earthly life. That is not what is meant here. Jesus is really talking about the reign of God, the way things work in God’s realm, when God’s purposes are coming to pass. That has as much to do with this life as with the next. In this parable, Jesus was trying to give us a little glimpse of the ways of God. Speaking through the prophet Isaiah in our first reading, God declares, ‘my thoughts are not your thoughts, my ways not your ways’. Jesus is suggesting that there is something to the ways of God that seems strange when placed alongside our way of doing things.

If the strangeness of God’s ways, as reflected in the behaviour of the landowner, seem disconcerting to us at first, God’s strange ways are ultimately very reassuring for us. The parable suggests that God does not relate to us on the basis of strict justice. God’s favour is not parcelled out on the basis of what we have earned. God is constantly gracing us through his Son in ways that bear no relationship to what we have done, or failed to do. How we hear this parable will to some extent depend on those with whom we identify in the story. If we identify with the men who worked all day we will be tempted to feel resentful at God’s generosity towards those we consider less deserving. However, if we identify with the undeserving ones, those who were called into the field at the end of the day, we can allow ourselves to experience the thrill of divine generosity. Maybe, that is where the parable invites us to place ourselves. We are all undeserving, and, yet, God continues to grace us in and through his Son every day, if we have eyes to see. The parable also invites to allow something of God’s ways to shape our ways, so that we too begin to relate to others not on the basis of what they deserve but out of the generosity of our heart.

Fr. Martin Hogan.

10 notes

·

View notes

Text

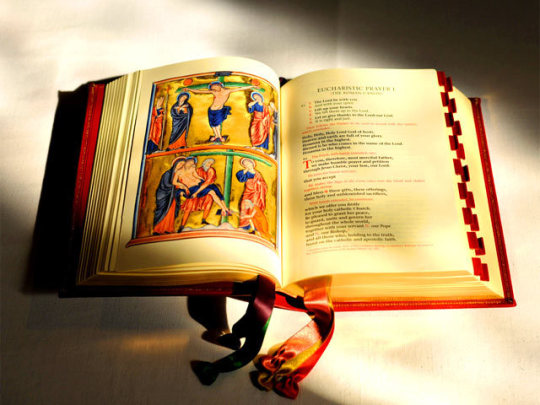

11th June >> Mass Readings (USA)

Solemnity of Corpus Christi

(Liturgical Colour: White: A (1))

First Reading Deuteronomy 8:2–3, 14b–16a He gave you a food unknown to you and your fathers.

Moses said to the people: “Remember how for forty years now the LORD, your God, has directed all your journeying in the desert, so as to test you by affliction and find out whether or not it was your intention to keep his commandments. He therefore let you be afflicted with hunger, and then fed you with manna, a food unknown to you and your fathers, in order to show you that not by bread alone does one live, but by every word that comes forth from the mouth of the LORD.

“Do not forget the LORD, your God, who brought you out of the land of Egypt, that place of slavery; who guided you through the vast and terrible desert with its saraph serpents and scorpions, its parched and waterless ground; who brought forth water for you from the flinty rock and fed you in the desert with manna, a food unknown to your fathers.”

The Word of the Lord

R/ Thanks be to God.

Responsorial Psalm Psalm 147:12–13, 14–15, 19–20

R/ Praise the Lord, Jerusalem. or R/ Alleluia.

Glorify the LORD, O Jerusalem; praise your God, O Zion. For he has strengthened the bars of your gates; he has blessed your children within you.

R/ Praise the Lord, Jerusalem. or R/ Alleluia.

He has granted peace in your borders; with the best of wheat he fills you. He sends forth his command to the earth; swiftly runs his word!

R/ Praise the Lord, Jerusalem. or R/ Alleluia.

He has proclaimed his word to Jacob, his statutes and his ordinances to Israel. He has not done thus for any other nation; his ordinances he has not made known to them. Alleluia.

R/ Praise the Lord, Jerusalem. or R/ Alleluia.

Second Reading 1 Corinthians 10:16–17 The bread is one, and we, though many, are one body.

Brothers and sisters: The cup of blessing that we bless, is it not a participation in the blood of Christ? The bread that we break, is it not a participation in the body of Christ? Because the loaf of bread is one, we, though many, are one body, for we all partake of the one loaf.

The Word of the Lord

R/ Thanks be to God.

Sequence Lauda, Sion

The Sequence may be said or sung in full, or using the shorter form indicated by the asterisked verses.

Laud, O Zion, your salvation, Laud with hymns of exultation, Christ, your king and shepherd true:

Bring him all the praise you know, He is more than you bestow. Never can you reach his due.

Special theme for glad thanksgiving Is the quick’ning and the living Bread today before you set:

From his hands of old partaken, As we know, by faith unshaken, Where the Twelve at supper met.

Full and clear ring out your chanting, Joy nor sweetest grace be wanting, From your heart let praises burst:

For today the feast is holden, When the institution olden Of that supper was rehearsed.

Here the new law’s new oblation, By the new king’s revelation, Ends the form of ancient rite:

Now the new the old effaces, Truth away the shadow chases, Light dispels the gloom of night.

What he did at supper seated, Christ ordained to be repeated, His memorial ne’er to cease:

And his rule for guidance taking, Bread and wine we hallow, making Thus our sacrifice of peace.

This the truth each Christian learns, Bread into his flesh he turns, To his precious blood the wine:

Sight has fail’d, nor thought conceives, But a dauntless faith believes, Resting on a pow’r divine.

Here beneath these signs are hidden Priceless things to sense forbidden; Signs, not things are all we see:

Blood is poured and flesh is broken, Yet in either wondrous token Christ entire we know to be.

Whoso of this food partakes, Does not rend the Lord nor breaks; Christ is whole to all that taste:

Thousands are, as one, receivers, One, as thousands of believers, Eats of him who cannot waste.

Bad and good the feast are sharing, Of what divers dooms preparing, Endless death, or endless life.

Life to these, to those damnation, See how like participation Is with unlike issues rife.

When the sacrament is broken, Doubt not, but believe ‘tis spoken, That each sever’d outward token doth the very whole contain.

Nought the precious gift divides, Breaking but the sign betides Jesus still the same abides, still unbroken does remain.

The shorter form of the sequence begins here.

*Lo! the angel’s food is given To the pilgrim who has striven; see the children’s bread from heaven, which on dogs may not be spent.

*Truth the ancient types fulfilling, Isaac bound, a victim willing, Paschal lamb, its lifeblood spilling, manna to the fathers sent.

*Very bread, good shepherd, tend us, Jesu, of your love befriend us, You refresh us, you defend us, Your eternal goodness send us In the land of life to see.

*You who all things can and know, Who on earth such food bestow, Grant us with your saints, though lowest, Where the heav’nly feast you show, Fellow heirs and guests to be. Amen. Alleluia.

Gospel Acclamation John 6:51

Alleluia, alleluia. I am the living bread that came down from heaven, says the Lord; whoever eats this bread will live forever. Alleluia, alleluia.

Gospel John 6:51–58 My flesh is true food, and my blood is true drink.

Jesus said to the Jewish crowds: “I am the living bread that came down from heaven; whoever eats this bread will live forever; and the bread that I will give is my flesh for the life of the world.”

The Jews quarreled among themselves, saying, “How can this man give us his flesh to eat?” Jesus said to them, “Amen, amen, I say to you, unless you eat the flesh of the Son of Man and drink his blood, you do not have life within you. Whoever eats my flesh and drinks my blood has eternal life, and I will raise him on the last day. For my flesh is true food, and my blood is true drink. Whoever eats my flesh and drinks my blood remains in me and I in him. Just as the living Father sent me and I have life because of the Father, so also the one who feeds on me will have life because of me. This is the bread that came down from heaven. Unlike your ancestors who ate and still died, whoever eats this bread will live forever.”

The Gospel of the Lord

R/ Praise to you, Lord Jesus Christ.

4 notes

·

View notes

Text

A Complete Guide to TDS Return Filing Online: Process, Due Dates, and Compliance

Tax Deducted at Source (TDS) is a crucial part of the Indian tax system, designed to collect taxes at the source of income. The concept is simple: Any individual or organisation making specified payments, such as salary, commission, rent, interest, etc., must deduct a certain tax percentage before paying the receiver. All deductors must file a TDS Return Online within the specified due dates to avoid penalties. Here’s a detailed guide on how to do so.

What is a TDS Return?

A TDS return is a quarterly statement a deductor must submit to India's Income Tax Department. It contains details of the TDS deducted and deposited during the quarter. There are various forms used for different types of TDS deductions:

Form 24Q: TDS on salary

Form 26Q: TDS on payments other than salary

Form 27Q: TDS on income for payments made to non-residents

Form 27EQ: TDS on the collection of tax at source

Steps to File a TDS Return Online

Gather the Required Documents and Information:

TAN (Tax Deduction and Collection Account Number)

PAN details of the deductor and deductees

Details of tax payment (challan details)

TDS certificates (Form 16, Form 16A)

Valid TDS statements (in .txt format) are prepared using a software utility like the File Validation Utility (FVU) provided by NSDL.

Register on the Income Tax E-Filing Website:

Visit the Income Tax Department’s e-filing portal https://incometaxindiaefiling.gov.in.

If you are a first-time user, you must register using your TAN.

Registered users can log in using their credentials.

Download and Prepare the TDS Return File:

Download the applicable TDS return preparation utility (e.g., RPU) from the NSDL website.

Input the relevant details, such as the deductor’s and deductee’s information, tax paid, etc.

Validate the file using the File Validation Utility (FVU) provided by NSDL.

The validated file will be saved in the .fvu format.

Upload the TDS Return File:

After logging in, go to the ‘TDS’ section and select ‘Upload TDS.’

Enter the required details, such as the financial year, form name, and quarter.

Upload the .fvu file, along with the signature file if needed.

Click on ‘Submit.’

Verification of the Return:

After uploading, the return must be verified using the Digital Signature Certificate (DSC) or an Electronic Verification Code (EVC).

A confirmation receipt will be generated upon successful verification.

Check the Status of the Return:

You can track the status of your TDS return by visiting the ‘View Filed TDS’ section on the e-filing portal.

It is advisable to keep the acknowledgment number handy for future reference.

Due Dates for TDS Return Filing

The timely filing of TDS returns is essential to avoid penalties. Here are the due dates for different quarters:

Q1 (April to June): 31st July

Q2 (July to September): 31st October

Q3 (October to December): 31st January

Q4 (January to March): 31st May

Penalties for Late Filing

The consequences of not filing your TDS returns on time can be severe:

Late Filing Fee: Under Section 234E, a fee of ₹200 per day is charged until the return is filed, subject to the maximum TDS amount.

Interest: Under Section 201A, 1.5% per month is applicable if the TDS is not deducted or, after deduction, is not paid to the government within the due date.

Penalty: The Assessing Officer may levy a penalty ranging from ₹10,000 to ₹1,00,000 if the deductor fails to file the TDS return.

Conclusion

TDS Return Filing Online is a vital compliance requirement for businesses and individuals. Following the steps outlined above, you can ensure that your TDS returns are filed accurately and on time. Staying updated with the due dates and being diligent in filing can help you avoid penalties and ensure smooth tax compliance.

0 notes

Text

Essential Documents You Need Before Filing Your Income Tax Returns

Filing income tax returns is a crucial responsibility for every taxpayer. Whether you are an individual, a salaried professional, or a business owner, ensuring that you have all the necessary documents before filing your tax return can save you time and prevent errors. Proper documentation helps streamline the process, avoid penalties, and maximize deductions. In this article, we will outline the essential documents required for filing income tax returns and why working with an Income tax return consultant in Delhi can be beneficial.

1. Personal Identification Documents

Before filing your income tax return, you must have the following personal identification documents:

PAN Card: Your Permanent Account Number (PAN) is a mandatory requirement for filing taxes in India. Ensure that your PAN details are up to date.

Aadhaar Card: The government mandates linking Aadhaar with PAN for income tax filing.

Bank Account Details: Provide updated bank account details, including account number, IFSC code, and bank statements if required.

2. Form 16 for Salaried Employees

If you are a salaried employee, Form 16 is one of the most important documents you need. It is issued by your employer and contains details about your salary, tax deductions, and TDS (Tax Deducted at Source). Form 16 simplifies the tax filing process as it provides a summary of your income and tax liability.

3. Form 16A for Non-Salaried Income

For individuals who earn income apart from salary, such as freelancers, consultants, or business owners, Form 16A is crucial. This document is issued by entities that deduct TDS on payments made to you, including:

Professional fees

Interest on fixed deposits

Rent payments (if applicable)

4. Income Proof Documents

To accurately report your income, you must have supporting documents such as:

Salary slips (for employees)

Business income records (for self-employed professionals)

Rental income receipts (for property owners)

Capital gains statements (for those investing in stocks, mutual funds, or real estate)

Freelance income invoices (for independent contractors and consultants)

5. Investment and Savings Proofs

Certain investments and savings can help reduce your taxable income under Section 80C, 80D, and other applicable sections. Essential documents include:

PPF (Public Provident Fund) Passbook

Life Insurance Premium Receipts

National Savings Certificate (NSC) details

Fixed Deposit Statements (tax-saving FDs with a five-year lock-in period)

Equity-Linked Savings Scheme (ELSS) investment statements

Health insurance premium receipts (for deductions under Section 80D)

6. Home Loan and Rent Receipts

If you are paying a home loan or rent, you may be eligible for deductions under Section 24(b) and Section 80GG, respectively. Essential documents include:

Home loan statement from the bank

Interest certificate from the lender

Rent receipts signed by the landlord

Lease/rental agreement copy

7. Capital Gains Documentation

If you have made profits from the sale of assets such as property, stocks, or mutual funds, you must provide:

Stock trading statements

Mutual fund redemption statements

Property sale deed and purchase agreement

Capital gains calculation sheet

8. TDS Certificates and Tax Payment Receipts

To claim credit for taxes already deducted or paid, keep:

TDS certificates (Form 16A, Form 26AS)

Advance tax payment receipts

Self-assessment tax payment receipts

Challans for any additional tax payments made

9. Foreign Income and Asset Details (if applicable)

If you have income from foreign sources, including overseas employment, business, or investments, you need to declare:

Foreign bank account statements

Overseas salary slips or employment contracts

Tax paid receipts in foreign countries (if any)

Foreign property ownership details

10. Other Deduction Proofs

Several other deductions can help reduce your tax liability, including:

Education loan interest payment receipts (for deductions under Section 80E)

Donations made to charitable organizations (for deductions under Section 80G)

Medical expenses for disabled dependents (for deductions under Section 80DD)

Expenses on specified diseases (for deductions under Section 80DDB)

Why Work with a Professional Tax Consultant?

Filing income tax returns can be complex, especially if you have multiple sources of income, investments, or business transactions. Consulting a professional tax expert ensures:

Accurate Filing: Avoid errors that may lead to penalties or audits.

Maximum Deductions: Identify all eligible deductions and exemptions.

Time-Saving: Reduce the hassle of tax filing by outsourcing the work to experts.

Updated Compliance: Stay informed about the latest tax laws and regulations.

If you are looking for professional assistance, consulting a reputed firm like Account IQ Consulting Pvt. Ltd can help streamline your tax filing process.

Expert Accounting and Financial Management Solutions

For businesses and growing enterprises, managing finances efficiently is crucial. If you need reliable accounting solutions, consider working with experts offering cost-effective accounting outsourcing solutions. These solutions help companies streamline their finances, improve efficiency, and focus on core business growth. Whether in Delhi, Noida, or other metro cities, outsourcing accounting services ensures compliance, accuracy, and scalability for businesses.

Conclusion

Filing your income tax return doesn’t have to be stressful if you have all the required documents ready. From personal identification to income proofs, investment details, and tax payment receipts, organizing your financial records in advance can help you file your return accurately and on time. Moreover, working with a professional tax consultant can simplify the process, maximize tax benefits, and ensure compliance with tax laws. Whether you are an individual taxpayer or a business owner, staying informed and prepared is the key to a hassle-free tax filing experience.

0 notes

Text

A comprehensive guide to Form 16A: A TDS Certificate

Form 16A is a TDS certificate that is issued by the deductor on a quarterly basis. It is a statement concerning the nature of payments, the amount of TDS, and the deposited TDS payments to the Income Tax department. It also consists of brokerage, interest, professional fees, contractual payments, rent, and other sources of income.

Unlike Form 16, which only consist salary structure, Form 16A of income tax charge TDS from:

Receipts from business or profession fees.

Rental receipts from a property or rent.

Sale proceeds from capital assets.

Additional source.

Important components of Form 16A

The important components of Form 16A are:

Details of the Employer: It contains the name, TAN, and PAN of the employer.

Details of Employee: It contains the name, TAN, and PAN of the employee.

Mode of Payment: Both offline and online modes of payment are available.

Receipt number of TDS: The receipt number of TDS helps in the tracking of back details.

The date and deposit tax amount with the income tax department help track information.

Significance of Form 16A

Form 16A plays a pivotal role while filing an income tax return, especially when someone has other sources of income apart from their salary. Here are the key benefits of Form 16A:

Filing of income tax returns: The details contained in Form 16A help employees file their income tax returns. It guides employees in reporting their total income, which includes salary and other sources.

Tracking of TDS: It helps every individual keep track of the tax deducted at source (TDS) on their income. It gives you a summary of TDS deducted at source.

Income Proof: Form 16A works as evidence of an individual's total earnings from other sources. Government agencies and financial institutions, like banks, easily accept this source as income proof.

Loan Applications: This form is important in verifying the loan applications. Financial institutions often need a record of the assets and liabilities of an individual to check the guarantee on loan repayment.

How to download Form 16A?

Below are the following steps to download Form 16A:

Visit the official website of the income tax department.

Complete the registration process on the website.

Click the "Download" tab, and then select Form 16A.

Fill in the PAN details, and then click “Go to continue.”.

Click submit and download Form 16A.

What is the difference between Form 16 and Form 16A?

Form 16 and Form 16A are both TDS certificates, but there are certain differences between them. The following are the differences between Form 16 and Form 16A:

Form 16 is a TDS certificate deducted from salary, whereas Form 16A is issued for income other than salary.

Form 16 is issued by the employer, whereas Form 16A is issued by financial institutions.

Form 16 is used for deducting tax from salary, whereas Form 16A is for removing taxes from another source of income apart from salary.

Final Thoughts

Paying taxes is the responsibility of the citizens of the nation. It is evident that the process of filing an income tax return and Form 16A is restless and troublesome. Some technical terms of income tax are not known to the new taxpayer. Worry not, because Eazybills will solve every tax-related problem and also offer TDS tracking.

So? What are you waiting for? Connect to us today through our website, where our professional team will guide you according to your requirements.

#form 16A#income tax return#tds certificate#file income tax return#easy billing software#gst billing software#free invoicing software#billing software#free billing software#best billing software#online billing software#online invoicing software#best invoice software

0 notes

Text

A Step-by-Step Guide to ITR-1 Form Filing for Salaried Individuals

Filing your Income Tax Return (ITR) is an essential financial responsibility. If you are a salaried individual earning up to ₹50 lakh, the ITR-1 form is your go-to option for seamless tax filing. In this guide, we break down the eligibility, documents required, and step-by-step process for ITR-1 form filing to help you file your taxes with confidence.

Who Can File ITR-1?

You can file ITR-1 if you meet the following conditions: ✅ You are a resident individual (not HUF or company). ✅ Your total income is up to ₹50 lakh. ✅ Your income sources include:

Salary/Pension

One house property (excluding cases with loss from the property)

Other sources (like interest income, FD interest, etc.) ✅ Agricultural income (if any) is up to ₹5,000.

Who Cannot File ITR-1?

You cannot use ITR-1 if: ❌ Your total income exceeds ₹50 lakh. ❌ You have capital gains or income from business/profession. ❌ You own more than one house property. ❌ You are a Director in a company or hold unlisted shares.

Documents Required for ITR-1 Form Filing

Before you start filing, keep the following documents handy: 📌 PAN Card – Your unique tax identification number. 📌 Aadhaar Card – Mandatory for verification. 📌 Form 16 – Issued by your employer, showing salary details. 📌 Salary Slips – Breakdown of income and deductions. 📌 Bank Statements – To check interest income, if any. 📌 Investment Proofs – For deductions under Section 80C, 80D, etc. 📌 TDS Certificates (Form 16A/16B) – For tax deducted at source.

How to File ITR-1 Online?

Filing your tax return is easier than ever, thanks to the Income Tax e-Filing portal. Follow these steps:

Step 1: Login to the e-Filing Portal

Visit the official Income Tax e-Filing website (https://www.incometax.gov.in).

Click on "Login" and enter your User ID (PAN), Password, and Captcha.

Step 2: Select ITR-1 Form

Click on "e-File" > "Income Tax Return".

Select Assessment Year (e.g., 2024-25).

Choose ITR-1 (Sahaj) as your return type.

Step 3: Fill in the Required Details

Your personal details (name, PAN, address, etc.) are auto-filled.

Enter your income details from Form 16.

Provide details of deductions and exemptions (Section 80C, 80D, etc.).

Declare other income sources (interest, rental income, etc.).

Step 4: Verify Tax Computation

The portal automatically calculates the tax payable or refund.

Cross-check the TDS details with your Form 16.

Step 5: Submit and Verify ITR

Click on "Preview & Submit".

Choose a verification mode:

e-Verify via Aadhaar OTP (recommended)

Net Banking

Sending a signed ITR-V (Verification Form) to CPC, Bengaluru (if not e-verifying).

Step 6: Acknowledgment

Once verified, you will receive an ITR acknowledgment (ITR-V) via email.

If eligible for a refund, it will be processed in a few weeks.

Important Deadlines for ITR-1 Filing

📅 Due Date: July 31st of the assessment year (unless extended). 🚨 Late Filing Penalty: ₹1,000 - ₹5,000 (if filed after the deadline).

Why Should You File ITR on Time?

✔️ Avoid penalties and legal consequences. ✔️ Claim refunds for excess TDS deducted. ✔️ Maintain a good financial record for loan approvals. ✔️ Required for visa processing in many countries.

Final Thoughts

ITR-1 form Filing is a straightforward process when done correctly. With digital advancements, you can complete your return in just a few clicks. Ensure you have the right documents, follow the step-by-step process, and file your taxes before the due date to stay compliant and hassle-free.

0 notes

Text

The Ultimate Checklist for Income Tax Filing in India

Introduction

Filing the income tax return in India has always been something of a formidable task, but with proper preparation, it should be smooth sailing. We therefore present to you the ultimate checklist for income tax filing in India to ensure you don't miss any important steps.

Step 1: Calculate Your Tax Liability

Before you file your ITR, you need to calculate your taxable income based on your earnings from different sources such as salary, business profits, investments, and other income streams. Check which income tax slab you fall under to understand your tax liability. If you are eligible for any rebates under Section 87A, factor that in while calculating your final tax liability.

Step 2: Collect All Necessary Documents

To file your ITR correctly, keep the following documents ready:

PAN Card

Aadhaar Card

Form 16 (For salaried individuals, issued by the employer)

Form 16A (For TDS deducted on income other than salary, such as interest)

Form 26AS (Tax Credit Statement)

Bank Statements and Passbooks

Investment Proofs (PPF, LIC, ELSS, NSC, FD, etc.)

Property-related Documents (If you have rental income or property transactions)

Capital Gains Statements (For stock market, mutual funds, or real estate transactions)

Home Loan Interest Certificate (If claiming deductions under Section 24(b))

Medical Insurance Premium Receipts (For deductions under Section 80D)

Education Loan Interest Certificate (For deductions under Section 80E)

Rent Receipts (For claiming HRA exemption if applicable)

Step 3: Check TDS and Advance Tax Payments

Check your Form 26AS to ensure that the TDS and advance tax payments made during the year match your records. This will help you avoid discrepancies in your return filing. If you find any mismatch, get it corrected before proceeding with your filing.

Step 4: Choose the Right ITR Form

The Income Tax Department offers ITR forms depending on the source and category of your income. Hence, it is quite important to select the correct form:

ITR-1 (Sahaj) : For those drawing their income from salary up to Rs 50 lakh

ITR-2: For taxpayers with capital gains and multiple sources of income

ITR-3: For professionals and others having business

ITR-4 (Sugam) :For presumptive income tax return filers, a.k.a small businessmen and professionals

ITR-5, 6, and 7: For partnership firms, LLPs, companies, and trusts

Step 5: Calculate Final Taxable Income and Pay Any Arrears

After deducting all eligible deductions, calculate your final taxable income. If there is any additional tax payable, pay the same online through the Income Tax e-Filing portal using net banking, debit card, or UPI.

Step 6: File Your Income Tax Return Online

Log in to the Income Tax Department's e-Filing portal, upload your return, and verify it using Aadhaar OTP, Net Banking, or Digital Signature. All details entered must be double-checked before submission to avoid errors.

Step 7: Verify and Submit Your ITR

It means that after finalizing your return, you get 30 days to verify your return. It is only by verification that it will be made complete. Else, your returned ITR may be treated invalid. You are allowed to use Aadhaar OTP, net banking, or also by sending signed physical copy ITR-V directly to the office of CPC within the Income Tax Department.

Step 8: Track Your ITR Status and Await Processing

After successful filing and verification, you can trace your ITR status through the e-Filing portal, and if your return is eligible for a refund, please ensure that the bank details are correct, aligned with pre-validation to get the refund without any delay.

Common Mistakes While Filing ITR:

Entry of incorrect details of the bank account number

Wrong ITR form

Forgetting to claim eligible deductions

Not matching the Form 26AS with actual tax paid

Filing a return after due date and, hence paying the penalty

Failing to get the ITR verified in time

Conclusion

Filing your income tax return on time ensures compliance with tax laws and helps avoid penalties. If you need professional assistance, GTS Consultant India provides expert tax filing services, ensuring accuracy and maximum tax savings. With a team of experienced professionals, they simplify tax filing, helping individuals and businesses stay compliant and optimize their tax benefits. Let the experts handle your taxes while you focus on your financial growth.

0 notes