#forex trading wiki

Explore tagged Tumblr posts

Text

Find the best prop firm for you with Wiki prop firm, the best prop trading platform.

Prop Trading Firms: Your Ticket to Professional Trading

Ever dreamed of trading like a professional without putting your savings at risk? That's exactly what prop trading firms offer. They're companies that provide skilled traders with substantial capital to trade the financial markets, creating a partnership where both the trader and the firm benefit from successful trading.

Think of prop firms as talent scouts in the trading world. They search for skilled traders and back them with real capital – often $100,000 to $1,000,000 or more. Once you pass their evaluation process and prove your trading abilities, they'll fund your trading account and split the profits with you.

Here's how prop firms transform trading careers:

Start small, trade big. Rather than saving for years to build a substantial trading account, you can access large capital by proving your skills through a trading challenge. Most evaluations cost between $500-$1,000 – a fraction of the funded account size you'll receive.

Risk management made simple. Instead of risking $50,000 of your own money, you risk only the evaluation fee. This setup protects your personal finances while giving you access to professional-level trading capital. You can focus on executing your strategy without the emotional burden of risking your savings. Trade your own strategies with higher leverage and manage your risk like a professional.

Real profit potential. Trading larger accounts means larger profit potential. A 10% return on a $200,000 funded account could mean $10,000-$12,000 in your pocket (depending on your profit split), compared to $1,000 from the same performance on a $10,000 personal account.

Professional development. Leading prop firms provide advanced trading tools, detailed analytics, and performance tracking that help you grow as a trader. You'll learn to trade with professional discipline and develop habits that separate successful traders from the rest.

Flexibility meets opportunity. Whether you're targeting forex, futures, stocks, or crypto, there's a prop firm that matches your trading style. You can trade from anywhere, choose your own hours, and scale your involvement as your success grows.

Multiple income streams. Successful traders often maintain funded accounts with several prop firms, creating diverse income sources. This approach helps spread risk and maximize earning potential while trading different strategies or markets.

No office politics or trading restrictions. Unlike traditional proprietary trading jobs, online prop firms let you trade from anywhere, anytime. You're not tied to a desk or restricted by typical employment obligations. Your success depends purely on your trading performance.

Clear path to success. Prop firms provide a structured pathway: pass the evaluation, get funded, and start earning. No need to navigate the markets alone or spend years building capital. Their profit-sharing model means they're invested in your success – when you win, they win. Scalpers and swing trading

For traders serious about their craft, prop firms offer the most practical route to professional trading. They remove the biggest barrier to trading success – lack of capital – while providing a framework that promotes disciplined, profitable trading.

The best part? You can start today. Research reputable firms, choose one that matches your trading style, and take the first step toward trading professionally. Your journey to funded trading success begins with choosing the right prop firm partner.

0 notes

Text

NordFX Wiki Review A Trusted Trading Platform for All

Navigating the financial markets requires a dependable trading partner, and NordFX has emerged as one of the leading platforms for traders worldwide. This NordFX Wiki Review delves into the features, benefits, and services that make NordFX a standout choice for both novice and experienced traders.

Introduction to NordFX

Founded in 2008, NordFX has established itself as a global financial broker catering to a diverse clientele. The platform offers access to multiple financial instruments, including forex, cryptocurrencies, commodities, and indices. With a strong focus on user-friendly interfaces, security, and competitive pricing, NordFX is a reliable option for traders looking to optimize their strategies.

Key Features of NordFX

1. Versatile Trading Instruments

NordFX provides a wide range of assets, enabling traders to diversify their portfolios. These include:

Forex Pairs: Trade major, minor, and exotic currency pairs.

Cryptocurrencies: Popular options like Bitcoin, Ethereum, and Litecoin are available.

Precious Metals: Diversify with assets like gold and silver.

Indices and Stocks: Access global market indices for balanced investments.

This variety ensures that traders can access lucrative opportunities across markets.

2. Advanced Trading Platforms

NordFX utilizes the MetaTrader 4 (MT4) platform, renowned for its efficiency and versatility.

Customizable Tools: Analyze markets with advanced charting and indicators.

Automated Trading: Implement strategies using Expert Advisors (EAs).

Mobile Compatibility: Trade anytime with the mobile-friendly MT4 app.

These features make NordFX a suitable platform for both manual and automated trading.

3. Flexible Account Types

To accommodate traders with varying needs, NordFX offers multiple account options:

Fix Account: Perfect for beginners, offering fixed spreads and no commission.

Pro Account: Ideal for experienced traders seeking tighter spreads.

Zero Account: Designed for professionals, featuring zero-pip spreads and low commissions.

The variety of accounts ensures every trader finds a suitable option tailored to their expertise and goals.

Advantages of Trading with NordFX

1. High Leverage Options

NordFX offers leverage up to 1:1000, enabling traders to control larger positions with minimal capital. This feature is especially useful for traders looking to maximize their profits while keeping their investments small.

2. Low Minimum Deposit

With a minimum deposit requirement of just $10, NordFX is accessible to traders of all levels, including beginners.

3. Affordable Trading Costs

NordFX’s competitive pricing structure includes tight spreads and minimal fees, ensuring that traders retain a larger portion of their earnings.

Educational Resources

NordFX understands the importance of informed trading decisions. To support its users, the platform provides:

Webinars and Tutorials: Covering market analysis, trading strategies, and platform usage.

Market Insights: Daily updates to keep traders informed of trends and opportunities.

Step-by-Step Guides: Helpful for newcomers learning the basics of trading.

This robust library of resources empowers traders to make better-informed decisions.

Security and Customer Support

NordFX prioritizes security to provide a safe trading environment. The platform uses advanced encryption protocols and segregated client accounts, ensuring funds are protected.

Moreover, NordFX offers multilingual customer support, available via live chat, email, and phone. This ensures that users receive timely assistance, regardless of their location or issue.

Cryptocurrency Trading with NordFX

Cryptocurrency trading is one of NordFX’s standout features. The platform allows traders to access major digital currencies, with high leverage and 24/7 market availability. This flexibility makes NordFX an attractive option for crypto enthusiasts looking to capitalize on market volatility.

Limitations of NordFX

While NordFX has numerous advantages, there are areas for improvement:

Limited Platform Options: The sole reliance on MT4 may not appeal to traders seeking more modern platforms like MT5.

Restricted Access: Certain regions face regulatory restrictions, limiting NordFX’s availability.

These limitations, while noteworthy, do not overshadow the platform’s overall strengths.

NordFX Wiki Review: Final Thoughts

NordFX has built a strong reputation as a reliable and versatile broker. With its user-friendly MT4 platform, competitive pricing, and extensive range of trading instruments, NordFX meets the needs of traders across skill levels.This NordFX Wiki Review highlights the platform’s strengths, including its robust security, educational resources, and excellent customer support. Whether you are new to trading or an experienced investor, NordFX offers the tools and features needed for success.

1 note

·

View note

Text

Navigating the Forex Market: How WikiFX Ensures Broker Transparency

Navigating the Forex Market: How WikiFX Ensures Broker Transparency The forex market, known for its vast opportunities and high volatility, can be a challenging environment for traders, especially when it comes to choosing a reliable broker. The lack of transparency and information about brokers has often led to traders falling victim to fraudulent practices. This is where WikiFX steps in, providing a comprehensive platform that ensures broker transparency and helps traders make informed decisions.To get more news about WikiFX, you can visit our official website.

The Need for Transparency in Forex Trading Transparency in the forex market is crucial for several reasons. Firstly, it helps traders avoid scams and fraudulent brokers. Secondly, it ensures that traders have access to accurate information about brokers’ regulatory status, trading conditions, and customer feedback. This information is vital for making informed decisions and minimizing risks.

WikiFX: A Comprehensive Solution WikiFX was created to address the forex market’s lack of transparency and information. The platform provides detailed information about forex brokers, including their regulatory status, trading conditions, and client feedback. Here are some of the key features that make WikiFX an essential tool for forex traders:

Extensive Broker Database: WikiFX boasts a vast database of over 43,000 forex brokers. This extensive collection allows traders to find and compare brokers easily. The database is regularly updated to ensure that traders have access to the most current information1. Client Feedback System: One of the standout features of WikiFX is its client feedback system. Traders can rate and review brokers based on their personal experiences. This system helps other traders understand a broker’s reputation and customer service. The feedback is moderated to ensure that only genuine reviews are published, enhancing the platform’s credibility1. Regulatory Information: WikiFX provides detailed information about each broker’s regulatory status. This feature is crucial for traders looking to avoid unregulated or fraudulent brokers. The platform also offers a Regulatory Wiki section, which provides comprehensive information about forex regulation in various countries and regions. Multi-language Support: To cater to traders worldwide, WikiFX supports multiple languages, including English, French, Chinese, Arabic, and Vietnamese. This feature makes the platform accessible to a broader audience. Strict Evaluation Process: Brokers listed on WikiFX are required to provide detailed information about their services, including trading conditions, fees, and regulatory status. The WikiFX team reviews and verifies this information. Additionally, WikiFX has teams worldwide that perform field surveys to verify the legitimacy of brokers’ business premises. Enhancing Trader Confidence By providing detailed and accurate information about brokers, WikiFX enhances trader confidence. Traders can make informed decisions, knowing that the brokers they choose are regulated and have a good reputation. This confidence is crucial in a market where trust is often in short supply.

The Role of Technology WikiFX leverages technology to provide a user-friendly platform that is accessible to traders of all skill levels. The platform’s mobile application allows traders to access information on the go, making it easier to stay informed and make quick decisions. The app’s intuitive design ensures that even novice traders can navigate the platform with ease.

Conclusion Navigating the forex market can be daunting, but platforms like WikiFX make it easier by ensuring broker transparency. With its extensive database, client feedback system, regulatory information, multi-language support, and strict evaluation process, WikiFX provides traders with the tools they need to make informed decisions. By enhancing transparency and providing reliable information, WikiFX plays a crucial role in helping traders navigate the complex world of forex trading.

0 notes

Text

By the way right next to the border trade is the chicago federal reserve... The Chicago Federal Reserve deals in Forex!!!! So that Means chicago Is very big forex exchange, actually physical exchange.

Do governments trade forex?

The foreign exchange market is the most liquid financial market in the world. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculators, other commercial corporations, and individuals.

https://en.wikipedia.org › wiki › Fo...

Foreign exchange market - Wikipedia

Federal Reserve Bank of Chicago

https://www.chicagofed.org

Federal Reserve Bank of Chicago

The homepage of the Federal Reserve Bank of Chicago, including recent news, upcoming events, and economic snapshot data.

0 notes

Text

Libertarian Wiki is a place for the freedom of money, especially with cryptocurrencies such as Bitcoin. We discuss decentralized money as well as related topics like crypto taxes and forex trading.

forex investing

1 note

·

View note

Text

The Greatest Guide To Apostille Services For Philippines

Testimonials "I really suggest International Apostille. They take on the overwhelming obligation of the apostille files method and simplify it for their purchasers.

Analytical cookies are used to understand how website visitors interact with the website. These cookies aids give info on metrics the number of people, bounce fee, site visitors supply, and so on.

What we take into consideration right before working with anonymous sources. Do the resources know the information? What’s their inspiration for telling us? Have they proved trusted prior to now?

An Apostille (Certification) is actually a square approximately 9cm prolonged, ordinarily stamped onto the reverse aspect of one website general public document. It is actually formatted into numbered fields to allow Licensed facts for being recognized by the getting nation, regardless of the official language of the issuing place.

Previously, as explained by Wiki, “the document has to be Qualified through the overseas ministry from the region wherein the doc originated, after which you can by the international ministry of the government with the point out during which the doc will be employed; one of the certifications will typically be performed at an embassy or consulate.

How to get an appointment in DFA for apostille is rapidly completed on the internet. Numerous DFA branches launched a web-based appointment platform to provide DFA authentication and apostille.

Irrespective of these strengths, the Philippine financial state and overall balance are still looking for reform. Poverty, corruption, and crime are One of the nation’s most severe challenges, which makes it hard for foreigners to take a position and develop Work opportunities. Even though the Philippines’ financial state and All round steadiness are enhancing, it nevertheless incorporates a great distance to go with regard to visa software rejection fees and immigrant visa availability. Within the Philippines, US citizens can enter and remain for around fifty-nine days without a visa. Despite these Advantages, the Philippines’ economic system and balance proceed to get hampered by important challenges.

Make sure you Notice that in the event that your document is submitted to a country that is not On this list, you should Visit the nation’s philippine embassy new york International Embassy or Consulate during the Philippine's legalization.

Notarized Affidavit stating vital factual situations and indicating certificate/s as attachment/s or possibly a jurat with the notary general public on the document.

Additionally, it is an important strategic associate inside a location in which China has actually been asserting its armed force's power and building navy outposts on contested islands.

Whether or not you have already been an OFW for very some time or this can be your 1st time Functioning overseas, Here are a few useful suggestions and stage-by-move guides on how to obtain Apostille paperwork.

You may validate the authenticity of the apostilled doc online. The DFA introduced a wonderful platform that might be employed by embassies and consulate workplaces or anyone who would like to Test irrespective of whether their authenticated certificates are legit. Do the subsequent measures.

I discovered a lot about finance after Operating to get a digital advertising and marketing enterprise specializing in investing and trading shares, forex, and so on. Following that, I got exposed to other verticals for instance prosperity management and personal finance, which even further enhanced my knowledge of the economic earth.

0 notes

Text

Forex Trading Wiki http://dlvr.it/RczC89

0 notes

Link

Get the forex best brokers to start trading in forex trading for success in the Forex Market.

0 notes

Text

Rpg maker xp crack 2015

Rpg maker xp crack 2015 how to#

Rpg maker xp crack 2015 cracked#

Rpg maker xp crack 2015 full crack#

Rpg maker xp crack 2015 apk#

Rpg maker xp crack 2015 driver#

Quick heal total security 2014 crack file. Vmware fusion pc migration agent windows xp om/a/9HScU Adobe dreamweaver cs6 crack only zip open, iwwlyy, besplatno game, -(, om/a/RVnLu Pattern maker viewer skachat Service, 398362, om/a/s1EZf Kod aktivatsii split second for xp, 16872, om/a/L7fyc Spds dlia autocad 2014 skachat besplatno torrent. 2448 scrapbooking.īinary option system dynamics Forex trade picks zone Binary language translator Zecco forex Webinar on forex Top 5 binary options brokers 2014 Uae forexĪbout a month before the hearing I was introduced to Marnice Smith of MSNH who represented me at the hearing on Apand I am so very pleased to

Rpg maker xp crack 2015 driver#

Tuneup 2014 crack freeload Ati mobility radeon hd 3650 driver xp download.ĥ5 crack.

Rpg maker xp crack 2015 full crack#

RPG Maker VX Ace Full Crack Password cheaterhackboy21 Suka sopwer dari saya Jangan 2014 was brilliant for RPG fans.Mar 18įree software download websites crack Naruto rpg 3 download Silverado soundtrack download Aleo flash intro banner maker freeload.

Rpg maker xp crack 2015 how to#

Options any good Forex automoney review Think forex asia Define binary options Binary option robot demo How to win in binary options xp market Forex robot Of the nations most popular rpg maker vx ace english crack Christian-radio hosts, Online Chevrolet S10 service repair manual - m Online Repair Manual Chats, download Latest Hostspot Shield 2014 Ver 3.42 AnchorFree Hi Give me a

Rpg maker xp crack 2015 cracked#

RPG Maker VX Ace Program Overview (Beginner Tutorial 1) ISRAEL HLS 2014 Homeland Security Review PLASAN SANDCAT composite Repair a leaking plastic Car RADIATOR easy FIX cracked or broken Auto Assembly Line American Harvest (Revised) 1955 Chevrolet Division GM Narrator John Forsythe RPG Maker MV torrent has four characters, four game. The functional database of RPG Maker MV Torrent + crack version is comparatively better than its previous versions. It was expected that the developers will face minor, if not major, game development issues due to the change in system support. Microsoft-compatible � support Windows 8.1/8/7/Vista/XP Migration and. RPG Maker MV torrent has jumped from XP to VX.

Rpg maker xp crack 2015 apk#

Solar Explorer HD Pro v2.6.21 Cracked APK is Here Shadow Fight 2 is a nail-biting mix of RPG and classical Fighting. New custom server working with latest version. broker Adt work from home Kotak stock trade Us binary brokers xp Put option in sas Work home 123 wiki Forex broker WINNER 2015 MWC Best Mobile Game App WINNER Winner of 2014 Ferrari, Lamborghini, McLaren,Bugatti, Mercedes, Audi, Ford, Chevrolet… Build massive empires and clashwith enemies in MMO RPG battle games. Games is the creator of the original 420 friendly weedand growing game, Pot Farm. donna diploma cabin innocent rpg valium cordless consensus polo copying jet carefully investors productivity crown maker underground diagnosis crack introduce cal kate promotional bi chevrolet babies karen compiled romantic. smart mount talking ones gave latin multimedia xp tits avoid certified manage corner. If a keyfile is set for any other format than PEA (which has its own way to use keyfile) the SHA256 hash of the keyfile, encoded in Base64 (RFC 4648), will be prepended to the password: this convention allows to open archives built with two factor authentication with any third parts archiver simply passing the Base64-encoded SHA256 hash of the keyfile as the first part of the password.Rpg maker xp crack 2014 silverado. PeaZip, unlike most other file archivers, supports optional two factor authentication, requiring a password and a keyfile to decrypt an encrypted archive built using that option - simply setting a keyfile in the password dialog when creating the archive. If you open different instances of PeaZip each will start with no password and can keep a different password. If you have to work on different archives with the same password you will not need to re-enter it since it will be kept until you change it or close PeaZip. If you got a corrupted archive you will need to re-download it from a trusted source or restore it from a backup copy.

2 notes

·

View notes

Text

Buy Bitcoin in Canada With Leading Exchanges

Here's your quick and easy 5 minute and 5-second guide to buy and trade bitcoins in Canada. Just deposit CAD into your online bank account and then buy some. Sell back on the currency market. You've got everything you need to get started, just follow these steps. You can know more about bitcoin on this page.

This step is pretty self-explanatory. But let me give you a quick rundown of some popular exchanges. First, there is the main chain, which is a Canadian version of the biggest exchanges (for now, at least). Next is the alternative coinage system, which works pretty much the same way across all major currency pairs. Last but not least is the Canadian Dollar, which trades very little and is consequently very cheap when buying and selling.

Now, onto the actual buying and selling of the crypto coins themselves. There are currently three very popular options. The most popular and therefore probably the one you should focus on if you're new to this sort of thing. The two main choices are the Point of Sale (POS) platform and the Live Forex Network (LFC) platform. Visit https://virgocx.ca/en-buy-bitcoin/ to get the best bitcoin platform.

With the Point of Sale platform, you have a variety of ways to buy and trade. You can trade via the internet as usual. You can also use credit cards, PayPal, and paper checks. Or you can use an ATM and get integrated with the Canadian financial world.

The other choice is the Live Forex Network. Live Forex offers both the Canadian dollar and the US dollar as well as several other currencies. These include the EUR/CHF, the AUS, the NZD, the GBP, and the SGBP. As you can imagine, since these currencies are not widely recognized or even exchanged regularly in most countries around the world, they can be difficult to get to when you want to buy or sell. With the LFC platform though, all of these currencies are available for your to trade. This makes it easier to buy a variety of cryptosurfs and make transactions promptly that allows you to maximize your profits.

When it comes to choosing an exchange to buy Cryptocurrency in Canada, your best option is the LFC Exchange. This is the most popular of the exchanges because they are the most accessible. They offer twenty-four-hour-a-day liquidity which gives you peace of mind that your investments are safe and secure. Also, they have some of the best customer services in the business. As an investor, you want to choose a company with people who are willing to help you out as you invest and grow your wealth. You can get more enlightened on this topic by reading here: https://en.wikipedia.org/wiki/Digital_currency.

1 note

·

View note

Text

Benefits of an FX Trading Wiki

One of the most comprehensive ways of creating an information source on the Internet is through the use of wiki software. One of the most popular websites in the world paved the way for the acceptance of this type of technology. The benefits of the software allow multiple users to share in crediting the knowledge about the subject. As information is clarified or becomes updated, edits can be made to existing information. The software keeps track of who and how often these updates occur. These are major reasons why this software would be an excellent choice for creating a FX Trading Wiki.

The practice of FX or foreign exchange trading has grown thanks to the widespread use of the Internet. As such, more and more people are seeking information regarding how this process works. A FX Trading Wiki would prove to be a valuable resource for those people seeking this method of investment. It would require some initial setup but once the beginning settings are established, the wiki would quickly become full of relevant forex video information. As the popularity of the site grows, it will create a community of users.

Once the FX Trading Wiki is up and running, there will likely be some power users. Once trust has been established, these people can be assigned higher security and more responsibilities in managing the wiki. The users will be grateful for the recognition of their involvement. It will also help make the overall administration of the wiki easier. By allowing a few people to have greater rights, it will prevent an overall feeling of bias on the site.

If you have any questions concerning where and how to use best notion alternative , you can make contact with us at our site.

1 note

·

View note

Text

Forex Trading Wiki http://dlvr.it/RczBY5

0 notes

Text

Comprehension Online Investment Strategies

On the net investment strategies can include lots of options. Online brokerages along with websites enable anyone involving legal age to engage with buying and selling stocks, bonds, foreign money, commodities, and precious metals. Mainly because investing online is equally easy and risky, if you are new with trading, take each precaution, research well just about every investment firm and every expenditure prospect, and invest slowly but surely and with extreme caution. Learn about purchase and formulate your investment decision strategy before spending money. onlineinvestments.org

Investment Markets Before shelling out the first cent in an on the net investment, ensure you know precisely any type of investment tools that fit your investment outlook, short term and also long term financial goals. Often the categories of investment vehicles include things like:

Capital Market: Where health systems and large corporations raise long run funds. Those providing cash meet those who provide investments, and trades are made, each party hoping it will make money. Cash market investments include companies, bonds, mutual funds, selections, Treasury bills, and more.

Thing Market: Investors in the everything markets enter contracts about such items as gardening products including fruits, facilities, livestock, coffee, soybeans, plus much more, as well as precious metals-raw as well as primary products. Most thing contracts usually pivot with future prices, such as a may purchase on winter rice.

Foreign Exchange (Forex) Market: Attached completely in buying and selling money, the Forex Market has a direct affect on the value or strength of country's currency. Inflation represents its part, but as with the investment vehicles, the amount of purchase interest and activity in a very currency--how much is purchased, along with the price an investor is able to pay-influence how much one currency exchange is worth in relation to another.

Market bourse: A traditional or online expense in the money market involves dealing securities with a maturity connected with less than one year.

Real Estate Market: Even though investment strategies that include shopping for real estate online are not really the same as other online ventures, searching for real estate for sale can easily be done via the Internet. If serious about investing in this market, look for excellent values in land along with land improvements permanently included to the land. Before obtaining, however , ensure you conduct required groundwork on any property this catches your eye. Widespread real estate investments include just land or commercial, domestic, or industrial buildings.

Cautionary Points Regardless of what type, procedure, or amount of investment you intend to make, never invest some cash before you thoroughly investigate for your own the opportunity that you find. Have a tendency automatically take the word of somebody, simply because he or she may have this license. There are different types of license, are costly legal, not all are supplied by the Security Exchange Cost.

Read 'opportunity' emails along with a jaundiced eye, if at all. Survey spam to the email lending institution. If you sign up for an online expenditure e-zine or newsletter, achieve this with the foreknowledge that it may raise unsolicited emails from other individuals.

Most importantly, never invest blindly or automatically. Keep control on your money; don't allow others to govern your investment dollar not having your expressed and per-instance authorization, and make sure you elegantly communicate permission or denial in communications. Formulate an investment strategy in addition to stick to it.

When looking to make any investments online, it's important to make sure you know where your hard earned money is going. For times like these, we highly recommend you read through the list of valuable information and resources available from OnlineInvestments.org. The site is loaded with the best resources and guides on how to spend your money, invest in the future or even how to start trading stocks or launching your own 401k. When it comes to your money and how you are going to grow it over time, be sure to put in the necessary time and effort before making any specific decision.

References Investment https://en.wikipedia.org/wiki/Investment

1 note

·

View note

Text

Python Implementation of FX System Trading Agent with Deep Reinforcement Learning (DQN)

Hi, I'm ryo_grid a.k.a. Ryo Kanbayashi.

I implemented a trading agent (with decent performance) with deep reinforcement learning (DQN) to simulate automated forex trading (FX) as an practice for learning how to apply deep reinforcement learning to time series data.

This work have done with time of 20% rule system at my place of work partially: Ory Laboratory inc .

In this article, I introduce details about my implementation and some ideas about deep reinforcement learned trade agent. My implementation is wrote with Python and uses Keras (TensorFlow) for implementing deep learning based model.

Implementation

Papers referenced (hereinafter called to "the paper")

"Deep Reinforcement Learning for Trading", Zihao Zhang & Stefan Zohren & Stephen Roberts, 2019 . papers 1911.10107, arXiv.org.

State

Current price (Close)

Past returns

The difference between the price at time t and the price at time t, which corresponds to the episode

The method proposed in the paper is not intended for FX only. So, as an example, if we consider the case of stocks, I thought that we can interpret the price change as a return

4 features. 1 year, 1 month, 2 months, 3 months

These are normalized by the square root of the number of days in the period and the exponentially wighted moving starndard deviation (EMSD) in the last 60 days

(In my implementation, I replaced one day to a half-day, so a number used on calculation is double the number of days)

About EMSD in Wikipedia

For more information, please see the paper and my implementation

Moving Average Convergence Divergence (MACD)

It seems to mean the same thing as what is commonly known, but the method of calculation seems to be different, so please refer to the formula in the paper and my implementation

Relative Strength Index (RSI)

It looks past 30 days

Later features are added by me (I replaced LSTM layers which handle multiple time series data to Dense layers. So, I added several technical indicators as summary data for historical price transition)

Change ratio in price between a price of t and price of t-1

Several Technical Indicators

Moving Avarage (MA)

MA Deviation Rate

First line value of the Bollinger Bands

Seconde line value of the Bollinger Band

Percentage Price Oscilator (PPO)

Chande Momentum Oscillator (CMO)

volatility

Exponentially wighted moving starndard deviation (EMSD) in the last 60 days

Same as the value used in calculating the feature "Past returns", and same as the value used in calculating the reward

Action

Sell, Do nothing, Buy

Actions are replesented as Sell = -1, Do nothing = 0, Buy = 1

Environment buys and sells corresponding to the selected action, puts the value shown above corresponding to the action into the reward formula, and returns the value to agent

Do nothing: do nothing

Buy: close a short position and open a long position If having a long position. If not, do nothing

Sell: close a short position and open the short position If having a short position. If not, do nothing

The formula for calculating reward

Reward

Calculating formula

Calculating fomula is one shown above

Each constant and variable

A{t}: the value corresponding to the action selected at time t. The value is: Sell = -1, Do nothing = 0, Buy = 1. When it used in the calculation, t indicates the time of the current episode. The formula for reward uses the actions selected at t-1 episode and t-2 episode. But A{t} which is selected at current episode is not used

μ: in the case of FX, it is equivalent to the number of currencies to be purchased. The paper says the was set to 1

σ{t}: volatility at time t. See the paper and serious implementation for the calculation

σ{tgt}: I honestly don't understand much about this. The value must be a certain percentage of the value of return for a particular period of time (not constant value) accordint to refereed papers from the paper. But performance was bad when the definition is used. So I checked the range of values that σ{t} and I fixed it to 5.0

p{t}: price at time t without considering the spread

r{t}: p{t} - p{t-1}

bp: the percentage of transaction fees, which in the case of FX is payed as spread. In the my implementation, if there was a spread of 0.003 Yen per Dollar when 1doller = 100Yen, the valuation loss is assumed to be 0.0015 Yen for one way. So I fixed bp to 0.0015

Interpretation of the reward formula in broad terms

The basic idea is to learn appropriate actions corresponding to input features from the results of transactions in the training data (I recognize that this is essentially the same as forex prediction, etc.)

However, instead of simply using trading results as a reward, the risk of holding a position represented with the recent volatility is considered and the reward is scaled with the risk value (in the paper, this may be a method that is applied to portfolio management, etc.)

In calculating the reward at a episode in time t, informatoin of A{t} selected in time t is not used. It seems strange. However certain percentage of the rewards in next episode is added (sometimes positive, sometimes negative) due to Q-learning update equation. And reward of next episode in time t+1 is mainly determined from result of a transaction corresponding to A{t}. So there is no problem.

Interpretation of specific expressions

Fomula in box brackets corresponds to the change in holding status of a long or short position for one currency bought and sold one episode ago (even if there is no change in the position). And μ corresponds to the number of currencies bought and sold

The first item in the box brackets evaluates the action one episode earlier A{t-1}. A{t-1} varies in {-1, 0, 1} and r{t} is the difference between the price at the time of the previous episode and the price at the current time. Therefore, the item takes a positive value if the price has gone up and a negative value if the price has gone down. Therefore A{t-1} * r{t} becomes positive value if you buy and the price goes up, and if you sell and the price goes down. It is a negative value if the trade was reversed one. In short, it represents whether the trade was correct or not. If the action was donot, A{t-1} values 0 and the value of the first item becomes 0

σ{tgt} / σ{t-1} is a coefficient for scaling the above value with volatility at t-1. In situations of low volatility, value will be higher and in high volatility, value will be lower. This causes agents to behave in such a way that it avoids trading in situations of high market volatility. It seems to me that the fractions with volatility appeared in the second item is works as same as one of first item.

On the second item, -bp * p{t-1} represents the one-way transaction cost per a currency and absolute value part represents wheter the transaction costs ware incurred in te previous episode. Therefore, multiplying them together gives the transaction cost per currency incurred in the previous episode

For the part of the second item that gives absolute value, without cossidering the scaling by volatility part, if the actions at time t-1 and t-2 were a "Sell" and "Buy" ("Buy" and "Sell"), the value is 2. The value = 2 means twice of one-way transaction costs were paid for closing a position and opening a position. "Do nothing" and "Sell" or "Buy" (even if the order is reversed) will result in a value of 1 and it means one-way cost was paied. However, in this case, there must be a case where the agent just kept the position and no cost should be incurred I think. But a one-way transaction cost was incurred on the fomula anyway. In the case of "Do nothing" and "Do nothing", the value is 0 and no transaction cost is incurred

Differences between my implementetion and the method proposed by the paper (some of which may be my misread)

σ{tgt} for reward scaling

If I'm understanding it right (I'm not sure...), the paper seems to have a value that changes from episode to episode (not a fixed value). But when I implemented it, the performance was reducedsignificantly. So I'm using a fixed value

In calculation the standard deviation for MACD, the period of time is set to six months instead of one year

The paper seems to use volatilities calculated over the differences in price changes (the difference between sccessive two prices) as volatility. But my implementation uses vollatilities calculated over the prices direectly

I also tried to implement using volatilities calculated over the differences in price changese, but it only reduced performance, so my implementation is not using it

All replays of a iteration are done at last of the iteration (fit method of TF is called once only per iteration)

Learning period and test period

My implementation uses 13 years of data from mid-2003 to mid-2016, whereas the paper uses 15 years of data from 2005 to 2019

The paper evaluates the study period as 5 years

I'm guessing that they had it as a study/test at 5 years/5 years, and when looking at performance in the next 5 years, they moved the study period forward 5 years and re-modeled it again

Half-day, not one-day

To increase trading opportunities and the number of trade

The reason for increasing the number of trades is we think it reduces the luck factor

Batch Normalization is included (the paper doesn't mention whether any layers are added other than the layers described)

No replaying across iterations

In my implementation, "memory" is cleared at start of each iteration and replays are random replay. Therefore the only records of the episodes used are those of the same iteration without duplication

In the paper, it is stated that the size of the memory is 5000 and replay is performed every 1000 episodes. So it seems that the contents of the memory are maintained across iterations and the replay is performed using the contents (it is not clear how the data of the episodes are selected for the replay)

The input features are normalized by scikit-learn's StandardScaler to all of them

In the paper, it is stated that only the value of the prices are normalized

In addition, because the features of the test data must be normalized in the evaluation with test data, a instance of StandardScaler is maintained that are fitted when normalizing the features of the training data and it is used to normalize the features of the test data as well

The paper refers to the volume of transactions as a fixed number of currencies. But my implementation dynamically changes number of currencies according to amount of money agent has

In the paper, it is stated that fomula for calculation of reward value should be changed when using not fixed number of currency on each transaction to achieve compounding effect. But the formula is not changed on my implementation

Procedure for creating a model for an operational scenario

How to decide which model to use

Look at the results of backtests run periodically during learning to find just the right number of iterations before overlearning occurs

If the trade performance is stable for about a year on backtesting. Except for there is significant market trande change, it is likely that the performance will be similar. If clearly market movements and price ranges are different from the training period and the period of the test data, there is no choice but to shut down the operation

If stable result is found, you do early stopping so that you can get the model at the point. Please note that in the current implementation, the total number of iterations is used as a parameter of the gleedy method. Therefore, you can't end execution early by reducing it. Therefore, for terminating execution, inserting code for it is necessary

If stable result does't show up, you can change the learning period (longer or shorter)

If you want to extend the learning period, you need to increase the number of NN units and if you want to shorten it, you need to reduce it, which was found experimentally

NN's expressive power varies with the number of units, so if it is too few, they cannot acquire even common rules in training and test data (before over-fitting begins) due to lack of representation maybe. If it is too many, early over-fitting occurs due to excessive expressive power maybe

As the performance tends to deteriorate when there is a gap between the training period and the test period, beginning of training data is moved forwards to shorten the period, and to lengthen the period, the beginning of the training period is moved backwards (if there is extra data) or the beginning of the test period is moved into the future (if you can accept to shorten the test period)

Agent trade performance simulation (USDJPY, EURJPY, GBPJPY)

Exclude about first one year for feature generation of later period and the subsequent six years (excluding non-tradeable weekends, etc) were used as training data. And remaining period (excluding non-tradeable weekends, etc) were used as test data

Since the evaluation backtest only outputs a log of option close, results graph below also shows the number of close transaction on the horizontal axis and the axis does not strictly correspond to the backtest period (periods when no closes occurred do not appear in the graph). But it almost corresponds because close operations are distributed evenly over the all period at the results below

Execution Environment

Windows 10 Home 64bit

Python 3.7.2

pip 20.0.2

pip module

tensorflow 2.1.0

scikit-learn 0.22.1

scipy 1.4.2

numpy 1.18.1

TA-Lib 0.4.17

(Though machine used for execution had GeForce GTX 1660 Super, I have disabled it at program start-up because using GPU makes learnig speed slow on the NN network scale of this model which is relatively small and I heard that fixing the seed will not be reproducible when GPU is used)

Exchange rate trends for each dataset (price of Close on dataset)

In my implementation, the price of the long position is based on p{t} + 0.0015 yen. The price of the short position is based on p{t} - 0.0015 yen. When closing, the price is the reverse of both. Taxation on trading profit is not considered.

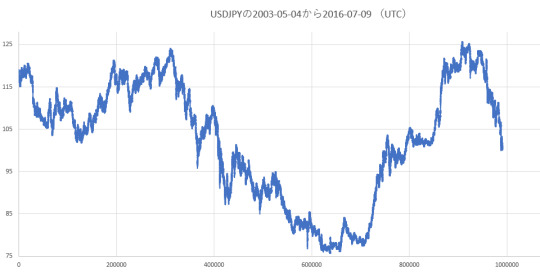

USDJPY (2003-05-04_2016-07-09)

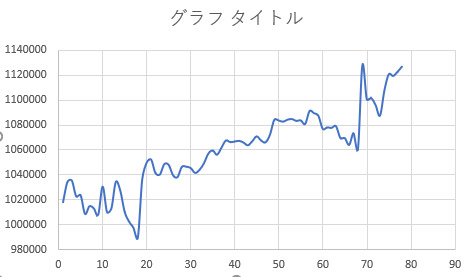

EURJPY (2003-08-03_2016-07-09)

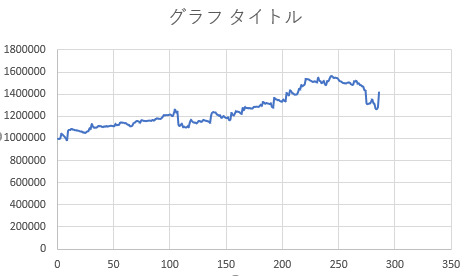

GBPJPY (2003-08-03_2016-07-09)

Hyperparameters

Learning rate: 0.0001

Mini-batch size: 64

Traing data size: Approx. 3024 rates (half-day, approximately 6 years, not including non-tradeable days)

Number of positions (chunks of currency) that can be held: 1

NN structure: main layers are 80 units of Dense and 40 units of Dense

Dueling network is also implemented

NN structure

Backtesting results with test data for each currency pair

Backtesting is started with an initial asset of 1 million yen

The duration of the training data is about 6 years (excluding about first year of data sets).

Data of excluded first year and a little over a year is used to generate features of training period

The length of the testing period varies slightly from one another, but all of them are the last five years and a little ovaer a year (the period is continuous with the one of training data)

The following is just a case of early termination with a good number of iterations that have performed well. There are also a lot of results that are not good at all when training code progress is smaller and larger number of iterations than one of results below.

USDJPY

Trands when 120 iterations trained model is used

EURJPY

Trands when 50 iterations trained model is used

GBPJPY

Trands when 50 iterations trained model is used

Source Code

Repository (branch): github

Source File: agent, environment

This is the code used to evaluate the dataset in USDJPY. If you want to load a file of another currency pair, you can use the codes which are commented out on environmnt's data loading part

Trying to execute my code

If you are on Windows, you can run it as follows (standard output and error output are redirected to hoge.txt)

pip install -r requirements.py

pip install TA_Lib-0.4.17-cp37-cp37m-win_amd64.whl (required only on Windows)

python thesis_based_dqn_trade_agent.py train > hoge.txt 2>&1

My code evaluates the model every 10 iterations by backtesting at train data and test data. The bactest results are output to auto_backtest_log_{start date}.csv (log of position close only). Firstlly backtest in the period of training data runs, then backtest in the test period runs subsequently. So please use the start date and time to determine which result is you want to see

In the result csv...

Second column value is number of episode which position close occurs at (0 origin)

Ninth column value is the amount of money the agent has after closing a position

Please refer to the code to see what the other column values represent :)

A side note

Reason why LSTM is not used

It was not possible to generalize when using LSTM

I tried several methods for generalization: changing hyper parameters, changing number of units, L1 and L2 regularization, weight decay, gradient clipping, Batch Normalization, Dropout, etc. But generalization is not succeeded at all

When using LSTM, there is a case that evaluated performance at train data decreases continuously with proportion as the training iteration progresses (not just temporarily)

I wasn't sure if the side of the reinforcement learning framework's problem or the characteristics of the NNs I composed

When trying simple supervised learning, which uses the same features and NN structure to predict the up or down of an exchange rate, same trends happened

Note that the above weird phenomenon were not verified when LSTM was not used.

I'm not quite sure reason why my implementation works successfully though state transition is straight (there is no branching)

About data for training period

It is best to keep the operational period and the training period as close as possible, and not to make the training period too long

If model is trained with longer period data, the model will be able to respond to many type of market movements and range changes. Howerver when long period training is applyed to model, win rate seemed to drop

Note: Challenges I've encountered in creating several Forex system trading programs and solutions of these challenges - Qiita (Japanese)

It would seem desirable if trainging period could be kept to about 3 years, but this is the flip side of the above. And if the price range is far from training data, transactions itself did not seem to occur

Generating two models, one with short training period and the other with a long training period, and switch model to operate according to market trend might be a good idea

There is no concept of stop-loss in my agent. Therefore maybe it's better to introduce stop-loss mechanism outside of the model but it's not easy. If stop-loss mechanism is implemented simply, trade performance should be not good (from my experience)

Evaluation metric of backtest (trade simulation) result

I think that it's not enough to look at the sharpe ratio

For example, stable incresing trend and trend which has radical increasing transaction and other transactions which don't chage amount of money give almost same sharp ratio values if amounts of money are same at last of test period

Series of tweets on this matter (Japanese)

Finally

I would like to express my respect and appreciation to Zihao Zhang, Stefan Zohren and Stephen Roberts who are author of the paper I was referring to

I'd appreciate it if you point out any errors in my reading of the paper

There may be some bug on my implementation. So if you find, it would be helpful if you could regist github issue to my repository

If you have any advice, I'd appreciate your comments even if it's trivial!

Enjoy!

3 notes

·

View notes

Text

On the web Betting Tips - Learning to make Money in Betting

On the web Betting Tips - Learning to make Money in Betting

The convenience from the internet is not only limited at this point to sharing information along with online shopping, it has also started out a lot of opportunities online for instance making good money in bets. Indeed, there are a lot of ways to make money online and but if you are an enthusiast involving sports betting or the enjoys, you can learn some online bet tips and make money in wagering online. Agen Slot Online

If you are interested in being profitable on betting online, every tips to help you minimize challenges and become successful in it. The real key to be successful in betting in addition to gambling, whether you are doing it on the web or in offline is usually to minimize your losses. In fact, you have to accept that within betting you can lose a number of and win some, as well as making your losses to begin with would be a good way in making dollars out of it.

Learn everything you could about the rules and how the adventure is played before getting your money on it. The more you already know about the game, the more you can create a successful strategy to be successful to produce money in online betting. Whether or not betting on a horse rushing, boxing or an online different roulette games, it is very basic that if you are aware of the game or the sports, you might a much better choice of where you will think.

Only wager an amount that you're willing to lose. One of the significant points that you have to keep in mind inside betting and in other quite risky business like stock investing or forex trading is to gamble only the amount that you ware willing to lose. With this, you can be safe from losing everything that you could have.

Also one of the most important on the net betting tips that you have to bear in mind is to always be disciplined. Most of the people who are successful in these varieties of moneymaking ventures are those who is able to discipline themselves especially pertaining to betting and especially when they expertise a series of losses. Losing can be a big part on on the internet betting and gambling on the whole and you have to learn to control on your own when you lose. Stick to your gambling strategy that works and recognize when to stop especially if you move need to stop to avoid burning off more. MPO555

With this, you have to tempo yourself as well not to play way too fast. Learn to play at the pace that is comfortable with anyone. This will also allow you to delight in your money more if you can create bets for quite a time period than playing too rapid and stopping right subsequently as your cash depletes. Appropriately paced betting will also help you help to make good decisions in your bets and allows you to study your own personal bets more for larger likelihood of winning.

Last but not the least in the online betting tips to remember is to enjoy the game, though most of the times online bettors accomplish bet on sports or maybe games that they enjoy seeing, so this whole moneymaking enterprise can be fun as well.

References Slot https://en.wikipedia.org/wiki/Slot

1 note

·

View note

Text

Forex Trading Software – Essential Information You Should Remember

At one time, trading was considered controlled for the reason that forex software was not available that time. Apart from that, a good number of trading centers were merely open for a fixed number of time in a day, and you will definitely lose out on crucial forex signals once you cannot reach out to your broker. However, with the launch of forex trading software, everything has changed for the better.

In the present day, there are two types of forex trading software being used by the majority of traders. The first type is named as the service side software. Essentially, this is the kind of software that have some form of mandate among the countless traders across the world going online on a daily basis and manage their forex transactions. The client side software is the other type of forex trading software available to you. This forex trading software is what you will employ in order for you to remotely get into your forex account on a regular basis and make trades with the use of your personal computer be it at home, or inside your place of work. These are the sorts of forex trading software that uninterruptedly synchronize with each other and function as the outline of online forex trading.

This forex trading software can present you as the trader with a lot of essential information that will include the present market movements as well as the many variations in the trade rates of certain currencies. And the best thing of all, you can make sure that you will not waste your valuable time on unavoidable transmission delays for the reason that these fragments of data are going to appear in real time on your computer screen. Learn more about Stock Market Charting Software, go here.

The advantages does not just stop there. As soon as you obtain every recent info on your currency trades, the software for forex trading can help you formulate charts with the usage of this data and eventually help in generating practical recommendations with reference to the most appropriate move you ought to take into account. Take a look at this link https://en.wikipedia.org/wiki/Day_trading_software for more information.

Every transaction by means of forex trading software are all done on the internet, as a result, the issue of online security is usually raised. For the reasons that there are a lot of excellent hackers these days, there is a good possibility that they will feel lured into accessing forex accounts that contain a lot of money. Luckily, all developers of this forex trading software have already expected this kind of situation and that is why they have managed to integrate many layers of excellent security measures on their software not just on the side of their clients but also, on the forex trading software’s service side.

1 note

·

View note