#forex time frame daily

Explore tagged Tumblr posts

Text

Popular Forex Trading Strategies For Successful Traders

Identifying a successful Forex trading strategy is one of the most important aspects of currency trading. In general, there are numerous trading strategies designed by different types of traders to help you make profit in the market.

However, an individual trader needs to find the best Forex trading strategy that suits their trading style, as well as their risk tolerance. In the end, no one size fits all.

In order to make profit, traders should focus on eliminating the losing trades and achieving more winning ones. Any trading strategy that leads you towards this goal could prove to be the winning one.

How to Choose The Best Forex Trading Strategy

Before we proceed to discussing the most popular Forex trading strategies, it’s important that we understand the best methods of choosing a trading strategy. There are three main elements that should be taken into consideration in this process.

Time frame

Choosing a time frame that suits your trading style is very important. For a trader, there’s a huge difference between trading on a 15-min chart and a weekly chart. If you are leaning more towards becoming a scalper, a trader that aims to benefit from smaller market moves, then you should focus on the lower time frames e.g. from 1-min to 15-min charts.

On the other hand, swing traders are likely to use a 4-hour chart, as well as a daily chart, to generate profitable trading opportunities. Hence, before you choose your preferred trading strategy, make sure you answer the question: how long do I want to stay in a trade?

Varying time periods (long, medium, and short-term) correspond to different trading strategies.

Number of trading opportunities

When choosing your strategy, you should answer the question: how frequently do I want to open positions? If you are looking to open a higher number of positions then you should focus on a scalping trading strategy.

On the other hand, traders that tend to spend more time and resources on analyzing macroeconomic reports and fundamental factors are likely to spend less time in front of charts. Therefore, their preferred trading strategy is based on higher time frames and bigger positions.

Position size

Finding the proper trade size is of the utmost importance. Successful trading strategies require you to know your risk sentiment. Risking more than you can is very problematic as it can lead to bigger losses.

A popular advice in this regard is to set a risk limit at each trade. For instance, traders tend to set a 1% limit on their trades, meaning they won’t risk more than 1% of their account on a single trade.

For example, if your account is worth $30,000, you should risk up to $300 on a single trade if the risk limit is set at 1%. Depending on your risk sentiment, you can move this limit to 0.5% or 2%.

In general, the lower the number of trades you are looking to open the bigger the position size should be, and vice versa.

Three Successful Strategies

By now, you have identified a time frame, the desired position size on a single trade, and the approximate number of trades you are looking to open over a certain period of time. Below, we share three popular Forex trading strategies that have proven to be successful.

Scalping

Forex scalping is a popular trading strategy that is focused on smaller market movements. This strategy involves opening a large number of trades in a bid to bring small profits per each.

As a result, scalpers work to generate larger profits by generating a large number of smaller gains. This approach is completely opposite of holding a position for hours, days, or even weeks.

Scalping is very popular in Forex due to its liquidity and volatility. Investors are looking for markets where the price action is moving constantly to capitalize on fluctuations in small increments.

This type of trader tends to focus on profits that are around 5 pips per trade. However, they are hoping that a large number of trades is successful as profits are constant, stable and easy to achieve.

A clear downside to scalping is that you cannot afford to stay in the trade too long. Additionally, scalping requires a lot of time and attention, as you have to constantly analyze charts to find new trading opportunities.

Let’s now demonstrate how scalping works in practice. Below you see the EUR/USD 15-min chart. Our scalping trading strategy is based on the idea that we are looking to sell any attempt of the price action to move above the 200-period moving average (MA).

In about 3 hours, we generated four trading opportunities. Each time, the price action moved slightly above the 200-period moving average before rotating lower. A stop loss is located 5 pips above the moving average, while the price action never exceeded the MA by more than 3.5 pips.

Take profit is also 5 pips as we focus on achieving a large number of successful trades with smaller profits. Therefore, in total 20 pips were collected with a scalping trading strategy.

Day Trading

Day trading refers to the process of trading currencies in one trading day. Although applicable in all markets, day trading strategy is mostly used in Forex. This trading approach advises you to open and close all trades within a single day.

No position should stay open overnight to minimize the risk. Unlike scalpers, who are looking to stay in markets for a few minutes, day traders usually stay active over the day monitoring and managing opened trades. Day traders are mostly using 30-min and 1-hour time frames to generate trading ideas.

Many day traders tend to base their trading strategies on news. Scheduled events e.g. economic statistics, interest rates, GDPs, elections etc., tend to have a strong impact on the market.

In addition to the limit set on each position, day traders tend to set a daily risk limit. A common decision among traders is setting a 3% daily risk limit. This will protect your account and capital.

In the chart above, we see GBP/USD moving on an hourly chart. This trading strategy is based on finding the horizontal support and resistance lines on a chart. In this particular case, we are focused on resistance as the price is moving upward.

The price movement tags the horizontal resistance and immediately rotates lower. Our stop loss is located above the previous swing high to allow for a minor breach of the resistance line. Thus, a stop loss order is placed 25 pips above the entry point.

On the downside, we use the horizontal support to place a profit-taking order. Ultimately, the price action rotates lower to bring us around 65 pips in profits.

Position Trading

Position trading is a long-term strategy. Unlike scalping and day trading, this trading strategy is primarily focused on fundamental factors.

Minor market fluctuations are not considered in this strategy as they don’t affect the broader market picture.

Position traders are likely to monitor central bank monetary policies, political developments and other fundamental factors to identify cyclical trends. Successful position traders may open just a few trades over the entire year. However, profit targets in these trades are likely to be at least a couple of hundreds pips per each trade.

This trading strategy is reserved for more patient traders as their position may take weeks, months or even years to play out. You can observe the dollar index (DXY) reversing its trend direction on a weekly chart below.

A reversal is a result of the huge monetary stimulus provided by the US Federal Reserve and the Trump administration to help the troubled economy. As a result, the amount of active dollars increases, which decreases the value of the dollar. Position traders are likely to start selling the dollar on trillion-dollar stimulus packages.

Their target may depend on different factors: long-term technical indicators and the macroeconomic environment. Once they believe that the current bearish trend is nearing its end from a technical perspective, they will seek to exit the trade. In this example, we see the DXY rotating at the multi-year highs to trade more than 600 pips lower 4 months later (March - July).

2 notes

·

View notes

Link

#BreakoutTrading#Long-TermTrading#markettrends#marketvolatility#MomentumTrading#MovingAverages#priceaction#ProfitMaximization#riskmanagement#StockMarket#technicalanalysis#TradingSignals#TradingStrategy#TrendConfirmation#TrendFollowing

0 notes

Text

Trend trading: insights and strategies from global broker Octa

KUALA LUMPUR, MALAYSIA – Media OutReach Newswire – 14 January 2025 – Trend trading is one of the simplest and most reliable strategies for Forex traders. The idea is straightforward: identify the market’s direction—upward or downward—and place trades accordingly, buying in an upward market and selling in a downward market. Start by selecting a time frame. A daily chart can show larger trends,…

0 notes

Text

How do I pass the Forex prop firm challenge phases?

Passing the Forex prop firm challenge phases requires strategy, discipline, and a clear understanding of the requirements set by the firm. Here's a comprehensive guide to help you succeed:

1. Understand the Rules and Objectives

Profit Targets: Know the percentage you need to achieve in Phase 1 and Phase 2.

Daily Drawdown: Understand the maximum amount you can lose in a single day.

Overall Drawdown: Keep track of the total loss limit for the challenge.

Trading Period: Be aware of the time frame for each phase and plan accordingly.

2. Develop a Solid Trading Plan

Define your risk-reward ratio for every trade.

Stick to a specific trading strategy you’ve tested (e.g., scalping, day trading, swing trading).

Avoid overtrading by setting a daily trade limit.

3. Use Proper Risk Management

Risk only 1-2% of your account per trade to stay within drawdown limits.

Avoid revenge trading—stick to your plan even after a loss.

Set stop-loss and take-profit levels for every trade.

4. Trade During Optimal Hours

Focus on high-volume trading sessions (e.g., London or New York sessions).

Avoid trading during low-liquidity periods or major news releases unless your strategy is designed for volatility.

5. Keep Emotions in Check

Stay calm and focused even if trades go against you.

Take breaks to avoid emotional decisions after consecutive losses or wins.

6. Leverage Technology

Use tools like signal copiers or expert advisors (EAs) designed for prop firm challenges.

Backtest your strategies using historical data.

Consider using trade journals to analyze your performance and identify areas for improvement.

7. Avoid Common Mistakes

Don’t overleverage to achieve profit targets quickly—it increases the risk of hitting drawdown limits.

Avoid trading too many instruments; specialize in a few that you understand well.

8. Simulate the Challenge

Practice on a demo account with rules similar to the prop firm's challenge to test your readiness.

9. Stay Updated

Monitor market news and economic events that can impact your trades.

Be flexible and adjust your strategy as needed based on market conditions.

10. Reassess and Adapt

Review your trades daily to identify mistakes and successes.

Continuously refine your strategy to align with the challenge requirements.

Passing the prop firm challenge is a test of skill and discipline. Stay consistent, and don't rush the process. Remember, the goal is not just to pass but to prove you can trade profitably in a real account environment.

#Telegram Copier#Telegram Signal Copier#TSC#Trade Copier#Signal Copier#Forex Copier#Forex Signal Copier#prop firms#instant funding prop firm#prop firm trading#EA trading#forex education#forextrading#currency markets#xauusd#economy#investing#stock market#finance

0 notes

Text

Bollinger Bands. How does it work?

Bollinger Bands are a popular technical analysis tool for tracking price volatility and trends in commodities, forex, equities, and futures markets. This indicator consists of three bands—Upper, Middle, and Lower—plotted on a two-dimensional chart. The Middle Band is a simple moving average (SMA), while the Upper and Lower Bands represent two standard deviations above and below this SMA.

Bollinger Bands contract when market volatility is low and expand during high volatility, helping traders make more informed decisions. These bands can be applied across various time frames, from hourly and daily to weekly or monthly, making them versatile for both short- and long-term strategies.

How Bollinger Bands Are Constructed?

Learn more: https://www.investchannels.com/bollinger-bands-how-does-it-work/

#BollingerBands#TradingStrategies#ForexTrading#MarketAnalysis#TechnicalIndicators#FinancialMarkets#PriceVolatility#Forex#Commodities#Equities#Futures#TechnicalAnalysis#DayTrading#TradingTools#StockMarket#SwingTrading#InvestmentStrategies#PriceTrends#MarketVolatility#CryptoTrading#ChartPatterns#RiskManagement#TradingCommunity#TradingInsights#FinancialFreedom#InvestingBasics#ForexSignals#ForexTips#SmartInvesting#TradeSmart

0 notes

Text

Scalping: Mastering Quick Trades in Financial Markets

Scalping is a widely used trading method. It focuses on fast transactions. Traders aim for small profits quickly. This method requires quick decision-making. Scalpers trade frequently and often. Scalping differs from other strategies. It comes with its own set of risks and benefits. Let’s dive deeper into scalping.

What is Scalping?

Scalping is a very fast trading strategy. Traders buy and sell assets quickly. Their main goal is to make small profits. They monitor prices that shift within seconds or minutes. Unlike other traders, scalpers don’t hold their positions long. Day traders may hold trades for hours. However, scalpers close their trades within seconds.

In 2024, scalping has grown in popularity. More traders are using it in markets like stocks, Forex, and cryptocurrencies. In the Forex market, about 70% of trades in 2024 were quick trades, such as scalping. People appreciate the speed of scalping. For instance, a trader might trade EUR/USD for 10 seconds and make a $1 profit. They repeat this many times throughout the day.

This trading method is most effective in liquid markets. A liquid market is one where many people are buying and selling. The more buyers and sellers, the quicker you can trade. Forex is an excellent example of a liquid market. In 2024, the Forex market saw $7.5 trillion traded every day. With so much money moving, scalpers can trade swiftly and smoothly.

Scalping’s main aim is not to make large profits at once. Instead, scalpers focus on making many small gains. Think of it like having 100 coins. Each trade brings a small profit. By the end of the day, those small profits accumulate into something bigger. That’s how scalping works.

In 2024, top scalpers made up to 300 trades per day. Some traders even use automated systems to trade faster. Their strategy revolves around securing small profits instead of waiting for a big one. This is what makes scalping different from other trading styles. It’s fast, exciting, and full of small wins.

How Scalping Works in Financial Markets

Scalping is about making quick trades. Traders make use of small price changes.

For example, let’s say a stock price moves by just a few cents. A scalper buys at $10.02 and sells at $10.04. The profit is only 2 cents, but that’s how scalping works — speed matters. Scalpers do this several times a day.

Quick Decisions in Seconds

Scalping is all about speed. Traders make decisions within seconds. Markets move fast, so scalpers must act quickly. They can’t afford to think too long. For example, in 2024, stock markets experienced large swings in prices. A good scalper would act immediately. Imagine, Bitcoin jumps 2% in one minute. A scalper would capitalize on that profit quickly before it vanishes. Many scalpers rely on fast trading platforms. These platforms enable traders to buy and sell instantly.

Short Trades, Short Time Frames

Scalpers don’t hold onto trades for long. Most trades last just seconds or a few minutes. They avoid waiting for big moves. Instead, they prefer frequent small gains. This approach helps reduce potential losses. In 2024, many traders applied scalping in the fast-moving Forex market. This market’s speed is ideal for quick trades. Some Forex traders executed hundreds of trades in one day.

Small Profits Add Up

Scalpers make a series of small profits. Each trade may only result in a tiny gain. However, the combined total of these small wins can be significant. In 2024, a scalper might earn just $1 per trade. But making 100 trades in one day brings in $100. Over the course of a month, those small profits can grow significantly. By the end of 2024, some traders earned thousands of dollars through this method.

Frequent Trades Daily

Scalping involves frequent trading. Scalpers execute hundreds of trades every day. The idea is to take small profits many times. In 2024, studies showed that active scalpers could make over 500 trades in a week. This high volume increases the chance of accumulating profit.

A good example is cryptocurrency scalping. In 2024, Bitcoin traders often bought and sold Bitcoin multiple times throughout the day. They looked for tiny price changes and reacted quickly. If Bitcoin’s price rose by $100, they would take that profit without delay.

Lower Risk, Less Time in the Market

Scalpers take short trades to avoid large risks. The quick nature of these trades reduces the risk of major losses. In 2024, scalpers favored this method because markets were unpredictable. By staying in the market briefly, they avoided significant risks that come with long-term trades.

Scalping Tools in 2024

In 2024, traders used specialized tools for scalping. Fast-execution apps and platforms were especially popular. Platforms like Robinhood, Webull, and E*TRADE were top choices. These tools allowed traders to act without delays. Real-time data was crucial for success.

For example, a scalper might use an app to monitor Bitcoin prices live. When the price moves even slightly, they can execute a trade immediately. Speed is the key to success in scalping. Many traders also used algorithms in 2024. These programs helped them make decisions faster. Algorithms could buy or sell automatically based on real-time data.

Timeframes and Trade Frequency in Scalping

Scalping revolves around short timeframes. Trades usually last only a few seconds or minutes. This makes scalping distinct from other trading methods, such as day trading. Day traders might hold their positions for hours, but scalpers act much faster. In 2024, some scalpers were able to complete trades in under 30 seconds.

Scalpers place hundreds of trades each day. For instance, in just one trading day, a scalper may execute over 200 trades. By comparison, day traders might only make a handful of trades in the same period. The rapid pace of scalping is both thrilling and challenging.

Each trade typically results in a small profit. Scalpers don’t aim for large price swings. Instead, they accumulate many small gains. In 2024, a single trade might earn just $1 or $2. However, with hundreds of trades, these small profits can add up significantly over time.

Speed is essential in scalping. A trader must react instantly to price changes. In 2024, scalpers relied heavily on fast trading platforms to ensure quick execution. Even a delay of just one second could result in a missed opportunity.

For example, imagine a scalper trading Ethereum in 2024. If the price of Ethereum rises by $10, the scalper must buy and sell within seconds to lock in a small profit. Waiting too long may cause them to lose the chance to capitalize on the price movement.

The need for quick action is why scalping requires special tools. In 2024, some traders used automated bots to speed up the process. These bots could react within milliseconds, allowing scalpers to stay ahead of the market.

Types of Markets Suitable for Scalping

Scalping works best in highly liquid markets. Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. Here are a few markets where scalping thrives:

Forex The Forex market is ideal for scalping. In 2024, Forex remained one of the most liquid markets in the world. Many currency pairs, such as EUR/USD or GBP/USD, experienced large trading volumes daily. These pairs are popular among scalpers because they offer frequent price movements, allowing for multiple small trades. For example, in 2024, a Forex scalper could make quick profits by trading EUR/USD as its price moved slightly up and down within seconds.

Stocks Highly traded stocks are also well-suited for scalping. In 2024, stocks like Tesla and Apple were among the most actively traded on the market. Scalpers target these stocks because they exhibit frequent price changes throughout the day. The more activity a stock sees, the easier it is to execute trades quickly. For instance, in 2024, Tesla’s stock price could rise or fall by $5 within a few minutes, providing multiple opportunities for small scalping profits.

Futures Futures markets, especially commodities like oil or gold, are excellent for scalping. These markets move quickly, making them ideal for short-term trades. In 2024, oil futures, in particular, experienced sharp price movements, giving scalpers opportunities to profit. With high liquidity, scalpers could enter and exit trades with ease.

Why Liquid Markets Matter

Liquidity is crucial for scalpers because it ensures trades can be executed quickly. In a liquid market, there are always enough buyers and sellers to facilitate smooth transactions. This is important for scalpers, who need to get in and out of trades quickly to lock in their small profits. Without enough liquidity, trades may take too long to execute, causing scalpers to miss out on profits.

For example, in 2024, the cryptocurrency market, especially Bitcoin, had high liquidity. This made Bitcoin a favorite asset for scalpers, who could make multiple trades in a single day without worrying about the market moving too slowly.

Key Tools and Indicators for Scalping

Scalpers rely on specific tools to make fast and accurate decisions. They use technical indicators to analyze trends and price movements. These tools help scalpers decide when to enter or exit a trade. In 2024, many scalpers used the following tools:

Moving Averages Moving averages help traders see the overall direction of the market. They smooth out short-term price fluctuations, making it easier to spot trends. For scalpers, short-term moving averages are particularly useful. For example, a 5-minute moving average can show whether a stock is trending upward or downward. In 2024, many scalpers used moving averages to track quick changes in stocks like Tesla or cryptocurrencies like Bitcoin.

Bollinger Bands Bollinger Bands are used to gauge whether a price is moving too far from its average. The bands widen and contract based on volatility. If the price touches the upper band, it may indicate that the asset is overbought. If it touches the lower band, it could be oversold. In 2024, scalpers used Bollinger Bands in Forex and crypto markets to spot ideal entry and exit points.

RSI (Relative Strength Index) RSI is a tool used to measure whether an asset is overbought or oversold. If the RSI is high, it suggests that the asset may have risen too much and is due for a pullback. If the RSI is low, it indicates that the price may have fallen too much and could rise soon. In 2024, scalpers used RSI in fast-moving markets like futures and stocks to find good trading opportunities.

Real-Time Data Scalpers need access to real-time market data to make decisions quickly. In 2024, many traders used platforms that provided instant data on price movements, volume, and market conditions. Scalpers also used advanced trading platforms that allowed them to execute trades within seconds.

Technical Indicators for Scalping

Scalpers use a variety of technical indicators to make split-second decisions. These indicators provide insights into market trends and help traders spot profitable opportunities quickly. Here are some commonly used indicators in 2024:

Moving Averages Moving averages help scalpers identify the market’s overall direction. They smooth out price data and make it easier to see whether prices are trending up or down. Scalpers typically use short-term moving averages, such as 5-minute or 15-minute charts. For example, if the 5-minute moving average for Bitcoin in 2024 shows a rising trend, a scalper might buy in quickly, hoping to profit from the upward movement.

Bollinger Bands Bollinger Bands are used to detect potential reversals in price. The bands widen and narrow based on volatility, providing a visual cue for when an asset may be overbought or oversold. Scalpers in 2024 often used Bollinger Bands to trade Forex or cryptocurrencies, buying when prices touched the lower band and selling when they reached the upper band.

RSI (Relative Strength Index) RSI helps traders determine whether a market is overbought or oversold. When the RSI is high, it may indicate that the price is too high and ready for a drop. When the RSI is low, it could mean the price is about to rebound. In 2024, many scalpers used RSI in fast-moving markets like stocks and futures to identify quick trade opportunities.

Importance of Liquidity and Speed in Scalping

Liquidity and speed are two essential elements for successful scalping. Without these, scalping becomes far more difficult. Here’s why both factors are so important:

Liquidity: Quick Entry and Exit Liquidity ensures that scalpers can enter and exit trades quickly. High liquidity means there are always buyers and sellers, which is vital for scalping. In 2024, popular markets like Forex, stocks, and cryptocurrencies had high liquidity, making them ideal for scalping. For example, Bitcoin’s high liquidity in 2024 allowed scalpers to make hundreds of trades in a single day without any delays.

Without sufficient liquidity, scalping becomes much harder. There might not be enough buyers or sellers to execute trades quickly, leading to missed opportunities. As one professional trader put it, “Scalping thrives on liquidity — without it, trades fail.” This is because liquidity allows scalpers to move in and out of positions with ease.

Speed: Acting Within Seconds Speed is just as important as liquidity in scalping. Scalping relies on making trades within seconds or minutes. Even a small delay can turn a winning trade into a losing one. In 2024, scalpers depended on fast internet connections and high-speed trading platforms to execute trades instantly. Platforms like MetaTrader and Robinhood were popular for their speed in 2024.

For example, a scalper trading Ethereum needs to act quickly if the price rises by $10. A slow platform or internet connection could cause them to miss out on that profit. That’s why many scalpers in 2024 invested in fast platforms and sometimes used algorithms to make trades instantaneously.

Platforms and Software for Scalping

Scalping requires specialized platforms that allow for quick and precise trades. These platforms are designed to help traders act quickly and analyze the market effectively. Here are some of the most popular platforms used by scalpers in 2024:

MetaTrader MetaTrader is a highly popular platform for Forex scalping. It’s known for its fast execution and customizable tools. In 2024, many Forex scalpers used MetaTrader because it allows for automated trading and custom indicators. This platform enables traders to act quickly on market changes with precision. For example, MetaTrader allows scalpers to set up algorithms that automatically make trades based on predefined conditions.

NinjaTrader NinjaTrader is another favorite among futures traders. This platform is known for its speed and advanced charting tools. Scalpers in 2024 appreciated NinjaTrader for its ability to handle high-frequency trading. It offers fast order execution, which is critical for futures markets that move quickly. For instance, a scalper trading oil futures in 2024 could rely on NinjaTrader’s speed to buy and sell in seconds.

cTrader cTrader is also a popular platform for Forex scalping. It offers detailed charts, advanced order types, and quick execution. In 2024, cTrader was widely used because it provided real-time data and deep market analysis. This made it an excellent choice for scalpers who needed to act fast.

Benefits of Scalping

Scalping offers several distinct advantages that make it appealing to traders, especially in fast-moving markets. While it demands quick reflexes and constant attention, the potential benefits can make it a worthwhile strategy.

1. Quick Profits Scalping allows traders to earn profits in a short time. Trades last only a few seconds or minutes, and profits are realized quickly. In 2024, traders could take advantage of rapid price movements in volatile markets like Forex or cryptocurrencies. For instance, a scalper trading Bitcoin during a price surge could make small profits multiple times as the price fluctuates within minutes.

2. Low Market Exposure One of the key advantages of scalping is that it limits the time traders are exposed to market risk. Since trades are so short, scalpers are less likely to face significant losses from sudden price swings. In 2024, many traders preferred scalping as a way to avoid the risks associated with holding positions overnight. This strategy allowed them to minimize their exposure to the unpredictability of the market.

3. High Frequency of Trades Scalping involves making numerous trades throughout the day. The more trades a scalper executes, the greater their chances of generating profits. In 2024, some scalpers made hundreds of trades per day, each yielding small but consistent profits. This high volume of trades enables scalpers to take advantage of many small price movements.

4. Ideal for Liquid Markets Scalping is particularly effective in markets with high liquidity, where there are plenty of buyers and sellers. In 2024, markets like Forex and cryptocurrencies were ideal for scalping due to their high trading volumes. For example, the Forex market sees trillions of dollars in daily trading volume, offering ample opportunities for scalpers to profit from small price changes.

Risks and Challenges of Scalping

While scalping offers several advantages, it also comes with its own set of risks. Traders need to be aware of the challenges involved and manage them carefully to succeed.

High Transaction Costs

One of the main drawbacks of scalping is the high cost of transactions. Since scalpers make many trades, transaction fees can add up quickly. In 2024, high fees were a significant concern for traders using platforms that charge commissions. If the fees are too high, they can eat into profits, making scalping less profitable.

For example, if a scalper makes $1 per trade but pays $0.50 in fees, half of their profit is lost. Over hundreds of trades, these fees can significantly reduce overall earnings. Scalpers must choose low-fee platforms to avoid this issue.

Emotional Strain

Scalping requires constant focus and quick decision-making, which can be mentally and emotionally exhausting. In 2024, many traders reported that the fast-paced nature of scalping led to high levels of stress. The need to stay alert for long periods and execute trades quickly can take a toll on a trader’s mental health, leading to burnout.

For instance, missing a single profitable trade can be frustrating, and traders might feel pressured to make up for it by taking riskier trades. This emotional strain can lead to impulsive decisions, increasing the likelihood of mistakes.

Execution Risks

Since scalping depends on fast execution, any delays in order processing can result in missed profits or even losses. In 2024, traders using slower platforms or with unstable internet connections faced challenges in executing their trades on time. Even a delay of one or two seconds can make a big difference in scalping, as the price may move beyond the desired level.

Common Scalping Strategies

Scalping involves using different strategies to maximize small, quick profits. Here are some popular strategies used by scalpers in 2024:

Bid-Ask Spread Scalping

This strategy takes advantage of the small price gap between the bid (buy) and ask (sell) prices. A scalper profits by buying at the bid price and selling at the ask price, capturing the difference. In 2024, this method worked particularly well in highly liquid markets like Forex, where spreads were narrow, allowing for fast, frequent profits.

Range Trading

Range trading involves identifying a price range within which an asset frequently moves. Scalpers buy at the lower end of the range and sell at the upper end. In 2024, this strategy was commonly used in cryptocurrency markets, where prices often oscillated between specific levels.

Momentum Trading

Momentum trading focuses on taking advantage of strong price movements. Scalpers buy when the price is rapidly rising and sell before the momentum slows. In 2024, this strategy was particularly popular in volatile markets such as stocks and futures, where prices could experience sudden surges or drops.

Best Practices for Successful Scalping

To succeed in scalping, traders need to follow certain best practices that help them maximize profits while minimizing risks. In 2024, many scalpers adhered to these strategies to improve their performance:

Stick to a Plan

Having a clear trading plan is essential for successful scalping. Scalpers should know exactly when to enter and exit trades, how much profit they aim to make per trade, and when to cut losses. In 2024, successful scalpers followed their strategies strictly, avoiding impulsive decisions driven by emotion.

For instance, a disciplined scalper might set a profit target of $1 per trade and exit the trade as soon as that target is reached, without waiting for further price movements.

Manage Risks

Risk management is crucial in scalping. Scalpers often use stop-loss orders to limit potential losses. A stop-loss order automatically closes a trade if the price moves against the trader beyond a certain point. In 2024, many scalpers set tight stop-loss levels to protect themselves from significant losses.

For example, a Forex scalper might set a stop-loss at 0.5% below their entry price to ensure that they don’t lose more than they can afford on a single trade.

Stay Focused

Scalping requires full concentration and quick reactions. Missing a single opportunity can result in lost profits, so scalpers need to stay focused throughout the trading day. In 2024, successful traders minimized distractions and used fast, reliable trading platforms to ensure they didn’t miss out on important price movements.

Control Emotions

Emotions can lead to poor decisions in scalping. Fear of missing out, greed, or frustration can push traders into making impulsive trades. In 2024, successful scalpers practiced emotional discipline, sticking to their plans and not chasing after losses.

Use Reliable Tools

Scalping demands reliable platforms and tools. Traders need fast execution to act on price changes instantly. In 2024, many scalpers used platforms like MetaTrader, cTrader, and NinjaTrader because they offered quick order execution and access to real-time data. Using a slow or unreliable platform can lead to missed opportunities and losses.

Conclusion

Scalping is a fast-paced trading strategy that focuses on making small, quick profits through frequent trades. In 2024, it continued to be a popular method in highly liquid markets like Forex, stocks, and cryptocurrency. While scalping offers many advantages, such as quick profits and reduced market exposure, it also comes with challenges like high transaction costs and emotional strain.

Why Scalping Works:

Scalpers make numerous trades daily, aiming for small, consistent profits.

Small, frequent wins can add up to significant earnings over time.

Scalping works best in highly liquid markets like Forex and cryptocurrencies, where quick entry and exit are possible.

Essential Tools for Scalping:

Fast platforms such as MetaTrader, cTrader, and NinjaTrader are essential for quick trade execution.

Technical indicators like Bollinger Bands, RSI, and moving averages help traders spot price changes and trends.

Challenges of Scalping:

Transaction costs from frequent trades can reduce overall profitability.

Emotional strain from constant decision-making can lead to mistakes.

Fast execution is crucial — delays can result in missed opportunities or losses.

Managing Risk:

Scalping involves lower market exposure because trades are held for only seconds or minutes. This reduces the risk of significant losses from large price swings.

Visit our blog.

0 notes

Text

youtube

he technical analysis of BTCUSD across multiple time frames suggests a bearish outlook for today. With resistance on both the daily and 4-hour charts and a clear downtrend on the weekly chart, the market is likely to move lower. As always, ensure to follow sound risk management practices and stay updated with market news that may impact price movements.

Artticle : Urgent BTCUSD Sell Alert! Todays Forecast Could Signal Major Drops

Link : https://blog.forextradingarena.com/2024/09/urgent-btcusd-sell-alert-todays.html

Join Forex Trading Arena WhatsApp Channel Link : https://whatsapp.com/channel/0029VaYzWPfKLaHjXZhv6u0n

#forex#business#studying#education#forex trading#youtube#tumblr videos#tumblrvibes#tumblr milestone#Youtube

0 notes

Text

Mastering Technical Analysis in Foreign Exchange Currency Trading

Technical analysis is a fundamental tool for traders in the Foreign Exchange Currency Trading. It involves studying historical price charts and using various technical indicators to forecast future price movements. Unlike fundamental analysis, which focuses on economic data and news events, technical analysis relies on patterns, trends, and statistical analysis of price and volume data. In this article, we will delve into the key concepts and strategies of mastering technical analysis specifically for Forex trading.

Understanding Key Concepts

Candlestick Patterns

Candlestick patterns are graphical representations of price movements over a specific period. They provide insights into market sentiment and can indicate potential reversals or continuations in price trends. Common candlestick patterns include doji, hammer, engulfing patterns, and more.

Support and Resistance Levels

Support levels are price levels where a currency pair tends to find buying interest, preventing it from falling further. Resistance levels are price levels where selling interest tends to be strong, preventing the price from rising further. Identifying these levels helps traders make informed decisions about entry and exit points.

Trend Lines

Trend lines are diagonal lines drawn on a price chart to connect successive higher lows (uptrend) or lower highs (downtrend). They help traders visualize the direction and strength of a trend. Trading along with the trend is a common strategy in technical analysis.

Technical Indicators

Technical indicators are mathematical calculations based on historical price, volume, or open interest data. They can help traders identify trends, momentum, volatility, and potential reversal points in the market. Popular technical indicators include moving averages, relative strength index (RSI), stochastic oscillator, MACD (Moving Average Convergence Divergence), and Bollinger Bands.

Strategies for Mastering Technical Analysis in Forex Trading

1. Trend Following

One of the simplest and most effective strategies in technical analysis is trend following. This strategy involves identifying established trends and entering trades in the direction of the trend. Traders use trend lines, moving averages, and trend-following indicators to confirm trend direction and momentum.

2. Breakout Trading

Breakout trading involves entering a trade when the price breaks out of a predefined support or resistance level. Traders look for consolidation patterns, such as triangles or rectangles, that indicate potential breakouts. Confirmation through volume and momentum indicators can increase the reliability of breakout trades.

3. Reversal Trading

Reversal trading seeks to identify potential trend reversals before they occur. Traders look for signs of exhaustion in the prevailing trend, such as divergences between price and momentum indicators or overbought/oversold conditions signaled by oscillators like RSI or stochastic oscillator.

4. Using Multiple Time Frames

Analyzing multiple time frames is a valuable technique in technical analysis. Traders often use longer-term charts (daily or weekly) to identify the primary trend and shorter-term charts (hourly or 15-minute) to time their entries and exits. This approach helps traders capture both the broader market trends and short-term price fluctuations.

Implementing Technical Analysis in Your Trading Plan

1. Define Your Trading Goals and Risk Tolerance

Before applying technical analysis, establish clear trading goals and define your risk tolerance. Determine your desired profit targets and maximum acceptable loss per trade. This helps you select appropriate technical indicators and strategies that align with your trading objectives.

2. Choose Relevant Technical Indicators

Select technical indicators that complement your trading style and market conditions. Experiment with different indicators to find ones that provide reliable signals in the Forex market. Avoid overloading your charts with too many indicators, as this can lead to analysis paralysis.

3. Combine Technical and Fundamental Analysis

While technical analysis focuses on price action and market psychology, fundamental analysis considers economic data, geopolitical events, and market news. Combining both approaches can provide a comprehensive view of the market and enhance the accuracy of your trading decisions.

Conclusion

Mastering technical analysis in foreign exchange currency trading requires dedication, practice, and a deep understanding of market dynamics. By learning to interpret price charts, identify key patterns and trends, and utilize technical indicators effectively, traders can gain a competitive edge in the Forex market. Remember, technical analysis is not a crystal ball but a powerful tool to assist in making informed trading decisions. Continuously refine your skills, adapt to changing market conditions, and maintain discipline in your trading approach to achieve long-term success.

0 notes

Text

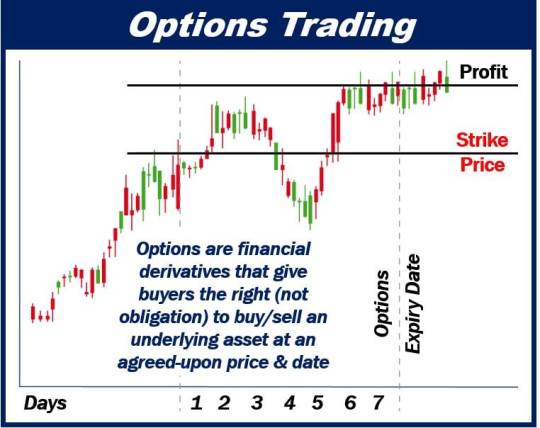

Options Trading for Income Generation Strategies and Tips

In the dynamic world of finance, forex trading stands out as a lucrative avenue for income generation. The Foreign Exchange market, with its daily trading volume surpassing $6 trillion, offers ample opportunities for traders to profit from fluctuations in currency pairs. Among the myriad approaches within Forex trading, options trading emerges as a sophisticated strategy for income generation. Let’s delve into the world of Forex options trading, exploring strategies, tips, and key takeaways for aspiring traders.

Understanding Forex Options Trading

Forex options trading grants traders the right, but not the obligation, to buy or sell a specific currency pair at a predetermined price within a specified time frame. Unlike spot trading, where traders execute trades immediately at prevailing market prices, options trading allows for more strategic maneuvers, capitalizing on price movements while mitigating risks. Read More

0 notes

Text

Complete Guide to Ascending Triangle: How to Trade This Powerful Pattern

If you've been scanning charts and spotting a flat top with rising support—congrats, you've likely encountered the ascending triangle pattern. Known for its reliability in technical analysis, this powerful formation often signals a bullish breakout. But how do you spot it confidently? And how can you trade it like a pro?

In this guide, we’ll break down everything from anatomy to strategy, real-world examples (especially from the Indian stock market), mistakes to avoid, and what experts like Thomas Bulkowski say about its performance.

What’s an Ascending Triangle and Why Do Smart Traders Use It?

An ascending triangle is a bullish continuation pattern. It appears when price action is capped at a resistance level while buyers keep pushing the price up with higher lows. The result? A triangle shape with a flat top and rising base.

This pattern reflects accumulation pressure—a buildup before a breakout. It’s popular among day traders, swing traders, and even long-term investors, especially in trending markets like NIFTY 50, Reliance Industries, or Infosys.

Search-friendly terms: ascending triangle, chart pattern, bullish continuation, breakout pattern.

Spotting the Ascending Triangle: Key Signs to Watch For

Here’s how to recognize the pattern before it takes off:

Flat resistance line: Multiple price touches without crossing.

Ascending support line: Higher lows forming a rising trendline.

Volume contraction: Often tightens before breakout, then surges.

Time frame: Typically forms over several weeks, but it works on daily and hourly charts too.

📈 Real Example – TATA Motors

In Jan 2024, TATA Motors formed a textbook ascending triangle on the daily chart. Resistance hovered around ₹875. Price kept forming higher lows. After three weeks, it broke out above ₹880 with heavy volume—followed by a ₹100 rally in just two weeks.

You could’ve easily spotted this on platforms like Strike Money or TradingView with their built-in trendline and volume tools.

Step-by-Step Strategy: How to Trade the Ascending Triangle Breakout

Trading the ascending triangle isn’t about luck. It’s about preparation and rules. Here’s a proven approach:

1. Entry Point

Wait for a clean breakout above the resistance line, preferably with above-average volume. Don’t jump in early—false breakouts are common.

2. Stop-Loss

Place your stop below the last swing low (inside the triangle). This protects your capital if the breakout fails.

3. Target

A simple method is to measure the height of the triangle (vertical distance between resistance and first low), then project that from the breakout point.

🧠 Bonus Tip:

Use indicators like RSI and MACD for confirmation. If RSI is breaking out above 60 and MACD shows bullish crossover, that’s a green signal.

Keywords covered: breakout trading, entry strategy, stop-loss, MACD, RSI, risk management.

The Triangle in Action: Examples from Indian Stocks, Forex, and Crypto

💹 Reliance Industries (2023)

In August 2023, Reliance stock showed an ascending triangle between ₹2,400 and ₹2,550. After several failed attempts, it broke through with a 6% rally in a day, driven by earnings news.

💱 USD/INR Forex Pair

The USD/INR hourly chart in February 2024 showed a classic ascending triangle before breaking above 83.25. Forex traders caught the move using platforms like Strike Money.

₿ Bitcoin Breakout (Global Context)

Bitcoin formed a large ascending triangle between $25,000 and $30,000 in early 2023. Once it cleared resistance, it surged past $35,000. Even on crypto exchanges like Coinbase and Binance, the pattern behaves consistently.

Not All Triangles Are Equal: How This Differs From Similar Patterns

🆚 Ascending vs. Symmetrical Triangle

Ascending Triangle: Flat top, rising bottom. Bias is bullish.

Symmetrical Triangle: Converging lines. Neutral bias.

🆚 Ascending vs. Descending Triangle

Descending Triangle: Flat support and falling highs. Often bearish.

Why it matters: Misidentifying these can result in false trades. Always draw both trendlines and observe volume and price behavior.

Entities used: symmetrical triangle, descending triangle, flag pattern, pennant pattern, market psychology.

Avoid These Rookie Mistakes With Ascending Triangles

Even experienced traders mess up. Here’s what to watch out for:

Entering without volume confirmation: A breakout without volume is often a trap.

Chasing the move: Late entries reduce reward-to-risk ratio.

Forcing the pattern: Just because it looks like a triangle doesn't mean it is one.

Ignoring fakeouts: Wait for candle closes above resistance, not just wicks.

👉 Pro Tip: Use Strike Money’s drawing tools to plot exact support/resistance levels and monitor volume spikes in real-time.

What Experts and Research Say About Ascending Triangle Success Rate

In his research-based classic, “Encyclopedia of Chart Patterns”, Thomas Bulkowski ranks the ascending triangle among the top-performing bullish patterns.

📊 Research Insights:

Breakout success rate: Over 70% (if confirmed with volume)

Average price move: 34% gain from breakout point (source: Bulkowski)

Best performance: When breakout happens in the first ⅔ of the triangle

John Murphy, in “Technical Analysis of the Financial Markets”, also notes that ascending triangles are "reliable continuation patterns during uptrends".

Real-world Stat: According to a 2022 NSE backtest study, stocks forming ascending triangles on daily charts had a 68% breakout success over 15 trading days.

Strike Money, TradingView, and Other Tools to Spot Triangle Patterns

Using the right charting tools makes all the difference.

🔧 Recommended Platforms:

Strike Money – Smart pattern detection, volume overlays, and easy-to-use trendlines. Ideal for Indian market traders.

TradingView – Advanced global coverage and script-based alerts.

Look for features like:

Pattern drawing tools

Volume histogram overlays

RSI/MACD support

Multi-timeframe view

Still Confused? Here Are Quick Answers to Common Questions

Can ascending triangles appear in downtrends? Yes, but they’re more reliable during uptrends. In downtrends, it’s often a pause before reversal.

Is volume necessary? Strong volume during breakout adds confirmation, but the pattern can still work with average volume.

Which time frame works best? Daily and hourly charts show the most reliable ascending triangles. Avoid 1-min charts due to noise.

How long should I hold the trade after breakout? Hold until your price target is hit or momentum weakens. Watch MACD and RSI for exit signals.

Can I use this in options trading? Yes. For bullish trades, you can buy call options at breakout or use bull call spreads for risk control.

Wrapping Up: Trade the Triangle, But Don’t Blindly Trust It

The ascending triangle is one of the most powerful tools in a trader’s charting arsenal. It simplifies decision-making by giving you structure, breakout levels, and measurable targets.

But remember, no pattern works 100% of the time.

Always combine it with:

Volume analysis

Momentum indicators like MACD and RSI

Real-time tools like Strike Money for execution

Whether you’re trading TATA Motors, HDFC Bank, or even Bitcoin, mastering this pattern will give you a serious edge.

0 notes

Text

Mastering Forex Trading: Essential Skills and Techniques for Success

As an experienced forex trader, I have come to understand the massive potential and opportunities that the forex market offers. Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies to make a profit. The forex market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. In this article, I will guide you through the essential skills and techniques that are crucial for success in forex trading.

Understanding the Forex Market

Before diving into forex trading, it is essential to have a solid understanding of the forex market. The forex market operates 24 hours a day, five days a week, allowing traders to participate from anywhere in the world. It is a dispersed market, meaning that there is no central exchange where all the trades take place. Instead, trading is conducted electronically over-the-counter (OTC), which means that all transactions are done through computer networks between traders around the globe.

The forex market consists of currency pairs, where one currency is bought while the other is sold. The value of a currency pair is determined by various factors such as economic indicators, geopolitical events, and market reaction. It is important for traders to analyze these factors and make informed decisions based on their research and technical analysis.

The Basics of Forex Trading

To begin your forex trading journey, it is crucial to grasp the basics of how the market works. The first step is to open a trading account with a decent forex broker. Choose a broker that offers a user-friendly trading platform, competitive spreads, and reliable customer support. Once you have opened an account, you can start practicing trading with a demo account. This allows you to explain yourself with the trading platform and test your strategies without risking real money.

In forex trading, you have the option to go long or short on a currency pair. Going long means buying a currency with the expectation that its value will rise, while going short means selling a currency with the expectation that its value will fall. It is important to note that forex trading involves leverage, which allows you to control a larger position with a smaller amount of capital. While leverage can amplify your profits, it can also increase your losses, so it is crucial to use it wisely and manage your risk effectively.

The Importance of Forex Trading Skills

To become a successful forex trader, it is essential to develop certain skills that will set you apart from the crowd. One of the most important skills is discipline. Forex trading requires a disciplined approach, as it is easy to let emotions take over and make thoughtless decisions. Stick to your trading plan, set realistic goals, and avoid chasing after quick profits. Patience is also a key skill, as forex trading is not a get-rich-quick scheme. It takes time and practice to develop a profitable trading strategy.

Essential Techniques for Successful Forex Trading

When it comes to forex trading, there are several techniques that can greatly improve your chances of success. One such technique is fundamental analysis, which involves analyzing economic indicators, central bank announcements, and geopolitical events to predict currency movements. Stay updated with the latest news and economic data that can impact the forex market.

Another technique is technical analysis, which involves analyzing past price movements and using various indicators and chart patterns to predict future price movements. Learn to use popular technical indicators such as moving averages, MACD, and RSI to identify entry and exit points.

Furthermore, developing a trading strategy is essential for consistent profitability. A trading strategy outlines your approach to the market, including your entry and exit rules, risk management techniques, and the time frames you will trade on. Back test your strategy using historical data to ensure its effectiveness before applying it to live trading.

The Stop-Loss in Forex Trading in Depth with Examples

The stop-loss order is a powerful tool that every forex trader should utilize. It is a predetermined level at which you will exit a trade to limit your losses. Setting a stop-loss order is crucial for risk management and protecting your capital. Without a stop-loss order, you are exposed to unlimited losses if the market moves against your position.

Risk Management in Forex Trading

Risk management is a crucial aspect of forex trading that cannot be ignored. It involves identifying and managing the risks associated with trading to protect your capital and minimize losses. Here are some key risk management techniques that every forex trader should implement:

Determine Your Risk Tolerance: Before entering a trade, assess how much risk you are willing to take. This will help you determine the appropriate position size and the maximum amount you are willing to lose.

Set Stop-Loss Orders: As mentioned earlier, setting stop-loss orders is essential for limiting losses. Always set a stop-loss order when entering a trade and adjust it as the trade progresses to lock in profits or reduce losses.

Use Proper Position Sizing: Position sizing refers to the number of lots or units you trade. It is important to calculate your position size based on your risk tolerance and the distance to your stop-loss level. This ensures that you are not risking too much on a single trade.

Diversify Your Portfolio: Avoid putting all your eggs in one basket by diversifying your trades. Trade different currency pairs and consider other asset classes such as supplies or keys to spread your risk.

Keep Emotions in Check: Emotions can cloud your judgment and lead to impulsive decisions. Stick to your trading plan and avoid making emotional trades based on fear or greed.

Legal Aspects of Forex Trading in Pakistan

Forex trading in Pakistan operates under the regulations of the Securities and Exchange Commission of Pakistan (SECP). The SECP is responsible for overseeing the financial markets and ensuring the protection of investors’ interests. It is legal for Pakistani residents to engage in forex trading, provided they do so through a licensed broker.

When choosing a forex broker in Pakistan, make sure to verify their regulatory status with the SECP. Licensed brokers are required to follow strict regulations, including the segregation of client funds, ensuring fair trading conditions, and providing transparent pricing. By trading with a regulated broker, you can have peace of mind knowing that your funds are protected and that you are trading in a secure environment.

Forex Trading Strategies and Tips

To succeed in forex trading, it is important to develop a trading strategy that suits your trading style and objectives. Here are some popular forex trading strategies:

Trend Following: This strategy involves identifying trends in the market and trading in the direction of the trend. Traders using this strategy aim to capture large moves in the market.

Breakout Trading: Breakout traders look for price levels where the market breaks out of a range or a specific pattern. They enter trades when the price breaks above resistance or below support levels.

Range Trading: Range traders identify price levels where the market tends to bounce between support and resistance. They enter trades when the price reaches the upper or lower boundaries of the range.

Scalping: Scalpers aim to make small profits from quick trades. They enter and exit trades within minutes or even seconds, taking advantage of small price variations.

Regardless of the strategy you choose, here are some important tips to keep in mind:

Stick to your trading plan and avoid impulsive decisions.

Practice proper risk management to protect your capital.

Keep a trading journal to track your trades and learn from your mistakes.

Stay updated with the latest news and economic data that can impact the forex market.

Continuously educate yourself and stay well-informed of new developments and trading techniques.

Forex Trading Tools and Resources

To enhance your trading experience and improve your chances of success, there are several tools and resources available to forex traders. Here are some essential ones:

Trading Platforms: Choose a user-friendly trading platform that provides real-time market data, advanced charting tools, and the ability to execute trades effortlessly.

Economic Calendar: An economic calendar provides a schedule of upcoming economic events, such as central bank announcements and economic indicators releases. It helps you stay informed about potential market-moving events.

Technical Analysis Tools: Use popular technical analysis tools such as moving averages, MACD, and RSI to analyze price charts and identify trends and trading opportunities.

Trading Education: Invest in your trading education by enrolling in online courses, attending webinars, or reading books on forex trading. Continuous learning is crucial for staying ahead in the ever-changing forex market.

Trading Communities: Join online trading communities or forums where you can interact with fellow traders, share ideas, and learn from each other’s experiences. Networking with other traders can provide valuable insights and support.

Conclusion and Next Steps

Mastering forex trading requires time, dedication, and continuous learning. By understanding the forex market, developing essential skills, employing effective techniques, and managing risks, you can increase your chances of success in this exciting and dynamic industry.

As a next step, open a demo account with a reputable forex broker and start practicing your trading strategies. Take advantage of the educational resources and tools available to you and stay committed to your trading goals. Remember, consistency and discipline are the keys to long-term profitability in forex trading.

Now that you have the essential skills and techniques, it’s time to begin your forex trading journey with confidence. Start small, manage your risks, and always strive to improve your trading skills. With time and experience, you can become a successful forex trader. Happy trading!

Open a demo account with a reputable forex broker and start practicing your trading strategies today.

Stay tuned for our upcoming blogs where we’ll explain the modern recruiting trends and challenges Don’t miss out—subscribe to our newsletter or follow us on social media for timely updates on our forthcoming articles.

Visit our website to read latest articles: https://workonpeak.org/blogs/

0 notes

Text

Centfx

Silver price keeps achieving targets

The price of silver increased yesterday and reached our second target, which was 23.70. It was noted that the price closed the daily candlestick above this target, indicating that there is a possibility that the bullish trend will continue, and this will open the door to further gains in the coming time frame. The next major target is 24.60.

As a result, the bullish trend will continue into the future. However, it may be preceded by some sideways movement influenced by stochastic negativity. It should be noted that if the price fails to hold above 23.70, intraday negative pressure will apply, pushing it towards testing 23.00 areas before making another attempt to rise.

0 notes

Text

Top 10 Forex Trading Strategies for Beginners

Embarking on the Forex trading journey can be overwhelming for beginners, given the myriad of strategies available. However, understanding and implementing effective trading strategies is crucial for success in the Forex market. Here are ten beginner-friendly Forex trading strategies, including the innovative Orion Trading Academy, to help you start your trading journey on the right foot.

1.Trend Following

One of the foundational strategies for beginners is trend following. This strategy involves identifying and following the market’s direction, whether up or down. It’s simple, straightforward, and can be applied across different time frames.

2. Moving Average Crossover

This strategy utilizes two moving averages, a short-term and a long-term. A trading signal is generated when these two lines cross each other. If the short-term moving average crosses above the long-term average, it’s a buy signal, and vice versa.

3. Support and Resistance Levels

Understanding support and resistance levels is crucial for Forex traders. These levels help traders identify potential entry and exit points based on historical price movements.

4. Range Trading

Range trading strategy is ideal for markets that are not trending. Traders identify stable high and low prices to find entry points, buying at support levels and selling at resistance levels.

5. Position Trading

Position trading is a long-term strategy focused on fundamental factors but technical methods can also be used. This strategy requires patience, as positions are held for weeks, months, or even years.

6. Scalping

Scalping is a strategy for those who prefer fast-paced trading. It involves making numerous small profits on minor price changes throughout the day.

7. Breakout Trading

Breakout trading involves entering the market as early as possible in a trend, often when a currency pair moves beyond a predefined resistance level.

8. Carry Trade

Carry trade involves borrowing from a currency with a low interest rate and investing in a currency with a high interest rate. It capitalizes on the interest rate differential.

9. Price Action Trading

Price action trading relies on historical prices to inform future trading decisions. It’s a strategy that eschews indicators in favor of interpreting the market’s movements directly.

10. Orion Trading Academy

Orion Trading Academy offers a unique approach with operation tips like selling if the price goes near T1, T2 first, or buying if it goes near T3 or T4 first. It’s a proven strategy with a high win rate, close to 80% over the past 20 years. Orion provides clear instructions, including entry level, take profit, and stop loss, making it beginner-friendly.

Excellent Trading Strategy Proven Over 20 Years: With a winning rate close to 80% and fund products achieving positive returns for 72 consecutive months, it’s a testament to its effectiveness.

Clear Instructions: Orion simplifies the trading process. You receive precise entry, exit, and stop-loss levels, making it easier to manage trades.

Authoritative Application: Utilized by global investment institutions to manage fund products worth hundreds of millions, ensuring credibility and trust.

Daily Trading Strategies: Receive 2–3 trading strategies daily on instrument pairs like XAUUSD (Gold), EURUSD (Euro), and more, ensuring you’re well-equipped every trading day.

Low Risk: Orion’s strategy includes risk management, minimizing potential losses and maximizing gains.

As a beginner in Forex trading, it’s crucial to start with strategies that match your trading style and risk tolerance. Experiment with these strategies, including the Orion Trading Academy, to find what works best for you. Remember, success in Forex trading comes from knowledge, patience, and continuous learning.

0 notes

Text

GBPNZD: Preparing For a Bearish Wave 🇬🇧🇳🇿

Have a look at that bearish imbalance that was formed on 📉GBPNZD on a daily time frame on Friday.

With one single bearish candle, the price violated a neckline of a descending triangle formation and a key horizontal support.

The market is retesting the broken structures at the moment. I believe that a fall will initiate soon.

Next support - 2.0372 ————————— Daily time frame

0 notes

Link

Daily time frame forex strategy in the fast-paced world of forex trading, it’s crucial to have a strategy that allows you to make informed decisions and increase your chances of success. Daily time frame forex strategy is all you need.

0 notes

Text

The Importance of a Structured Trading Plan

In the world of forex trading, there's a common experience that every trader encounters at some point - the temptation of impulsive trading. It usually happens when you see the market moving rapidly, fear of missing out (FOMO) takes over, and you jump into a trade without a second thought. However, more often than not, these impulsive decisions lead to quick losses.

Why does this happen? It's because emotions are driving your actions, and the absence of a structured plan leaves you susceptible to reckless decision-making. So, what's the solution? A well-thought-out trading plan—a set of rules that provide structure and consistency to your trading. In this article, we'll explore the significance of having a trading plan and how to develop one tailored to your trading style.

The Value of a Trading Plan

A trading plan is not just a set of guidelines; it's a vital tool for traders. Here are some compelling reasons why having a trading plan is crucial:

1. Emotional Control: A trading plan helps you manage your emotions, reducing impulsive decisions driven by fear or greed.

2. Consistency: It ensures that your actions are consistent, promoting a steady trading approach.

3. Confidence: A well-structured plan equips you to handle market volatility, boosting your confidence as a trader.

Now, let's dive into the process of creating an effective trading plan.

Building Your Trading Plan

A robust trading plan typically consists of four fundamental elements:

1. Time Frame: Your trading time frame depends on your trading approach—whether you're a short-term, medium-term, or long-term trader.

Short-term traders usually focus on time frames of 1-hour or lower.

Medium-term traders may operate within the 1-hour to daily time frames.

Long-term traders primarily use daily time frames and above.

Start by defining your primary trading time frame, and as you gain experience, consider diversifying across different time frames.

2. Markets: If you're venturing into forex trading, identify the currency pairs you intend to trade, such as EUR/USD, GBP/USD, or AUD/USD. The number of markets you choose depends on your selected time frame.

Longer time frames allow for trading multiple markets (e.g., 10 or more).

Shorter time frames require a narrower focus (e.g., two markets) due to increased screen time.

3. Risk Management: Effective risk management is paramount in trading. Acknowledge that each trade carries a degree of uncertainty. To mitigate the risk of significant losses, determine the fraction of your capital you're willing to risk on each trade. A common guideline is not risking more than 1% of your trading account per trade. For example, if your account size is $10,000, your risk per trade should not exceed $100.

4. Trading Setup: The trading setup defines the specific market conditions that trigger your entry and exit points. Employ an "if-then" template to describe your setup. Include stop-loss and exit strategies within your setup, specifying the conditions under which you'll exit a trade profitably or at a loss.

Here's an example of a trading plan incorporating these elements:

Time Frame: Daily

Markets: EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CAD, USD/JPY

Risk: Not exceeding 1% of the trading account per trade

Trading Setup:

If the market is in an uptrend,

Then wait for it to move toward a value area (e.g., support).

If it reaches the value area,

Then search for an entry trigger (e.g., a hammer pattern) to go long.

Place the stop loss 1 ATR (Average True Range) below the swing low.

Exit the trade before reaching the nearest swing high.

Executing Your Plan

Following your trading plan diligently is crucial. Consistency in actions leads to consistent results. Even during a string of losses, maintaining discipline is essential. Understand that in the short term, trading outcomes can be random, similar to coin tosses. Accumulate a significant sample of trades before assessing your strategy's effectiveness.

Effective risk management aims to minimize large losses, increasing your chances of becoming a profitable trader.

Record Every Trade

Maintain a detailed log of every trade, including crucial information such as date, market traded, time frame, trading setup, entry and exit prices, stop-loss levels, and screenshots of entry and exit points. This record-keeping ensures that you have a clear history of your trades and aids in post-trade analysis.

Review and Improvement

Regularly reviewing your trades is crucial for your growth as a trader. Analyze a minimum of 30 trades to begin, increasing this sample as you gain experience. Look for patterns and trends within your trades:

Winning Rate: Evaluate how often you win. The ideal winning rate varies based on your trading strategy. Adjust your approach if your winning rate falls short of expectations.

Patterns Leading to Winners: Identify common patterns among your winning trades. Adapt your trading plan to incorporate these patterns in future trades.

Patterns Leading to Losers: Uncover patterns linked to losing trades. Develop strategies to avoid or mitigate these patterns.

In conclusion, a well-crafted trading plan serves as the cornerstone of your trading journey. It provides structure, reduces emotional turmoil, and fosters consistency in your actions. Following your plan diligently, recording each trade, and conducting thorough reviews are essential steps toward enhancing your trading results. With discipline and a well-defined plan, you're on the path to trading success.

For the best Forex VPS solutions, visit cheap-forex-vps.com to enhance your trading experience with top-notch virtual private servers tailored for forex trading.

#vpsforex#cheap forex#cheap vps forex#forex vps#forex trading servers#forex vps Malaysia#best trading vps#forex vps India#forex vps Italy#forex vps Nigeria#forex vps Latvia#forex vps Singapore#forex vps Australia#forex vps United Kingdom#forex vps USA#forex vps Canada

0 notes