#forex fluctuations

Text

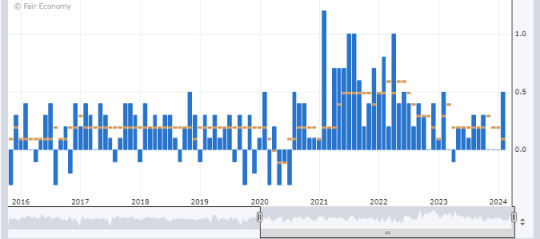

How Forex Fluctuations Can Impact Your Term Deposit Investments

Are you

considering purchasing a term deposit investment? If so, you should understand

the foreign exchange (Forex) market and how it can impact your investments.

After all, Forex fluctuations could mean that the future returns on your term

deposits are significantly different from those originally projected.

Image Source

On top

of that, if you’re investing in a foreign currency, you must…

View On WordPress

#currency fluctuation#currency fluctuation chart#currency fluctuation risk#effects of exchange rate fluctuations#exchange rate fluctuations#forex fluctuations

0 notes

Text

my midst evangelist mutuals will be happy to know i started listening today! it's very good so far. really cool worldbuilding, very interesting setup getting slowly dripped in over time. they do a great job of setting up the tension where i'm sure that these background class frictions and political motivations are going to boil over at some point in the near future but as of right now, i can't begin to guess what that tipping point's going to be.

#midst podcast#liveblogging tag#lark is my favorite#very very much my type of character#i played a gnome with a similar energy for over a decade so as soon as she showed up i was like ooh yes this one#the notion of a religious quasi-currency with an ever fluctuating exchange rate gave me such like#Forex Trading/Crypto Scam Meets Prosperity Gospel energy#it's horrid i love it#i'm on episode 10 of season one rn#given my job i will probably be caught up by monday#maybe even earlier

23 notes

·

View notes

Text

Grid Trading: Forex Trading Strategy Explained

Grid trading is a systematic forex trading strategy that involves placing buy and sell orders at predetermined intervals above and below a set price level. This strategy aims to capitalize on market volatility by profiting from both upward and downward price movements without the need to predict market direction.

What is Grid Trading?

Grid trading involves creating a “grid” of orders at various…

View On WordPress

#Automated Trading#Forex Market#Forex Trading#Grid Trading#Market Volatility#Price Movements#Profit Fluctuations#Risk Management#Trading Strategy#Trading System

2 notes

·

View notes

Text

500 Yen to USD

#Currency Conversion#Exchange Rates#Japanese Yen#United States Dollar#Foreign Exchange#Currency Exchange#International Finance#Forex Trading#Currency Markets#Exchange Rate Fluctuations

1 note

·

View note

Text

The Psychology of Trading: Short-Term Tactics and Long-Term Vision

Finding the perfect balance between swift gains and enduring success is the trader's art. 🚀⏳ Explore the fascinating world of time horizons in trading and uncover the secrets to making the most of short-term gains while aiming for long-term triumph. 🌟💹

In the complex realm of trading, achievement stretches beyond mere market analysis and strategies. It is fundamentally intertwined with the trader’s mindset, an integral force that shapes every transaction. Each trade undertaken showcases not just financial savvy but also an individual’s psychological fortitude. Notably, two prevalent trading methodologies, short-term trading and long-term…

View On WordPress

#crypto#Forex#Gains and Loss#Investment#Long Term Success#Market Fluctuations#Money Making Tips#Patience#Profit Making#Short term gains#stocks#Time Horizons#Trading Psychology

0 notes

Text

An Overview of Different Financial Instruments in Global Trading

Introduction

Entering global trading can be both exciting and complex. To help you navigate, this guide explores various financial instruments, assisting you in finding the best trading platform and making informed investment decisions.

1. Stocks

Buying stocks means owning a share of a company. Stock prices fluctuate with company performance and market trends. Stocks are ideal for long-term investments, especially for those aiming to become the best forex trader.

2. Bonds

Bonds are loans given to companies or governments, repaid with interest. Bonds are generally safer than stocks but offer lower returns.

3. Forex (Foreign Exchange Market)

The forex market deals with currency trading and is the largest financial market globally. It operates 24/7, providing high liquidity. Forex trading involves buying one currency while selling another, requiring a good grasp of market trends and currency pairs to excel as the best forex trader.

4. Commodities

Commodities include raw materials like gold, oil, and agricultural products. Trading commodities can diversify your investment portfolio. Their prices are affected by supply and demand, political events, and natural factors.

5. Mutual Funds

Mutual funds collect money from numerous investors to invest in a diversified portfolio of stocks, bonds, or other assets. Managed by professionals, they are ideal for beginners, offering a hassle-free investment approach.

6. ETFs (Exchange-Traded Funds)

ETFs are similar to mutual funds but trade like stocks. They offer a diversified investment portfolio with the flexibility of stock trading. ETFs can cover various assets, including stocks, bonds, and commodities.

7. Options

Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price before a set date. They can be used for hedging or speculative purposes, presenting high rewards but also high risks.

Conclusion

Grasping the different financial instruments available in global trading is vital for making smart investment choices. Whether you're interested in stocks, bonds, forex, or commodities, selecting the best trading platform and strategy will set you on the path to success. Begin with the basics, continue learning, and discover the best investment opportunities tailored to your goals.

4 notes

·

View notes

Text

What is Forex Currency Pairs?

buying or selling one forex pair against another. It’s like the currencies are in a constant tug of war. This is caused by the rapid fluctuations of the exchange rate.

What is Base Currency & Quote Currency?

The first currency of a forex pair is called “Base Currency”. Base currency represents how much is needed to buy a single unit of the second currency or quote currency in a forex pair.

Similarly, the second pair is called “Quote Currency”. They are separated with a forward slash (“/”). Currency quotes is the amount of units of the quote currency you will need to exchange one unit of base currency.

For example, 1 Dollar, 1 Pound, 1 Euro, etc. The calculation is-

1 unit of Base Currency can buy X units of the quote currency.

If the base currency is USD, such as USD/JPY, a quote of USD/JPY 88.48 means that one U.S. dollar is equal to 88.48 Japanese yen. Likewise, if the base currency is EUR, such as EUR/USD, then a quote of 1.3980 means that one Euro is equal to 1.3980 US Dollars.

3 notes

·

View notes

Text

Understanding the Core PPI and Its Impact on Currency and Gold Markets!

The Producer Price Index (PPI) serves as a vital economic indicator, shedding light on changes in the prices of finished goods and services sold by producers. However, when analyzing PPI data, one must pay close attention to the Core PPI, which excludes the volatile components of food and energy prices. This exclusion is significant because food and energy prices often exhibit erratic fluctuations that can skew the overall PPI reading.

A noteworthy shift occurred in February 2014 when the calculation formula for the Core PPI underwent a modification. This alteration aimed to provide a more accurate representation of underlying inflation trends by eliminating the influence of volatile food and energy prices.

It's crucial to recognize that food and energy prices typically constitute around 40% of the overall PPI. Consequently, when analyzing the Core PPI, which excludes these volatile components, one may find a more stable and reliable measure of inflationary pressures.

Now, let's delve into the implications of Core PPI releases on currency and gold markets.

When the Core PPI data release exceeds market expectations, it signals that inflationary pressures are building up in the economy. This can lead to an appreciation of the dollar as investors anticipate potential interest rate hikes by the central bank to curb inflation. A stronger dollar makes gold, which is priced in dollars, relatively more expensive for investors holding other currencies. As a result, the price of gold may decline in response to a stronger dollar.

Conversely, if the Core PPI data release falls below expectations, it suggests subdued inflationary pressures. In such a scenario, the dollar may weaken as investors adjust their expectations regarding future monetary policy actions. A weaker dollar tends to make gold more attractive as a hedge against currency depreciation, leading to an increase in its price.

For instance, let's consider a hypothetical scenario where the Core PPI data release indicates a higher-than-expected increase in producer prices. This prompts investors to anticipate tighter monetary policy by the Federal Reserve, causing the dollar to strengthen. Consequently, the price of gold, denominated in dollars, declines as it becomes less appealing to investors.

On the other hand, if the Core PPI data release comes in below expectations, signaling subdued inflation, investors may interpret this as a dovish signal from the central bank. In response, the dollar weakens, leading to an increase in the price of gold as investors seek refuge in the precious metal amid currency uncertainty.

In conclusion, the Core PPI serves as a crucial economic indicator that can influence both currency and gold markets. By understanding its significance and the factors driving its movements, traders and investors can make informed decisions to navigate the ever-changing landscape of financial markets.

2 notes

·

View notes

Text

Best Forex Risk Management Strategies

Discover the comprehensive insights into effective FX Risk Management strategies with Bartas Aleksandravicius. In his authoritative work, 'Fx Risk Management,' Aleksandravicius explores practical approaches to navigate and mitigate currency fluctuations, offering valuable guidance for businesses engaged in international trade. Gain a strategic advantage in the foreign exchange market by leveraging expert perspectives and proven risk management techniques.

4 notes

·

View notes

Text

Riding the Waves: Financial Market Online Surges with Best Forex Traders

In the digital age, the financial markets have undergone a transformative surge, and the online arena is now dominated by the prowess of the Best Forex Traders. These individuals navigate the intricate waves of currency fluctuations with skill and finesse, setting themselves apart in a sea of global financial activity.

The best Forex traders online are marked by their ability to ride the waves of market dynamics. Armed with a deep understanding of economic indicators, geopolitical events, and technical analysis, they make strategic decisions that capitalize on market trends. These traders embrace volatility, viewing it not as a hindrance but as an opportunity to leverage price movements for profit.

Technology stands as a cornerstone for the success of these traders. Advanced trading platforms equipped with real-time data, algorithmic tools, and artificial intelligence have become indispensable in the online Forex world. The best traders leverage these tools to execute trades swiftly, automate certain aspects of their strategy, and stay ahead of market developments. Technology not only empowers them but also allows for a more informed and responsive approach to the fast-paced nature of currency trading.

Risk management is a defining trait of the best Forex traders. They recognize the inherent uncertainties in the financial markets and implement stringent risk management practices to protect their capital. This includes setting stop-loss orders, diversifying portfolios, and maintaining a disciplined approach to trading.

The online surge of the best Forex traders extends beyond individual efforts, with the rise of social trading platforms. These platforms foster a sense of community where traders can share insights, strategies, and market analyses. Emerging traders can observe and emulate the tactics of seasoned professionals, creating a collaborative environment that contributes to the collective success of the community.

In the vast expanse of the financial market online, the best Forex traders are the captains of their ships, skillfully navigating the waves and turning market volatility into opportunities for financial gain. Their ability to adapt to changing conditions, harness technology, and manage risks positions them at the forefront of the dynamic world of online Forex trading.

2 notes

·

View notes

Text

Unleashing the Power of Forex Trading Bots II 6388030756

About Us: https://alitronzprofit.com/

youtube

The foreign exchange (Forex) market, the largest and most liquid financial market in the world, offers immense opportunities for traders to profit from the fluctuations in currency exchange rates. However, the fast-paced nature of Forex trading can be daunting, and many traders find it challenging to make informed decisions consistently. This is where Forex trading bots come into play. In this article, we will delve into the world of Forex trading bots, exploring what they are, how they work, their advantages, and potential pitfalls.

2 notes

·

View notes

Text

Drawdown in Forex Explained

Drawdown is a crucial concept in forex trading that every trader needs to understand. It refers to the reduction in the value of an investment from its peak to its lowest point over a specific period. Understanding drawdown is essential for managing risk and developing effective trading strategies. This article delves into the concept of drawdown in forex, its significance, and how traders can…

#Account Balance#Diversification#Equity#Forex#Forex Trading#Market Fluctuations#Performance Evaluation#Position Sizing#Risk Assessment#Risk Management#Stop-Loss#Trading Plan#Trading Psychology#Trading Strategies#Trading Strategy#Trading Success

0 notes

Text

Day Trading Forex: Everything You NEED To Know!

Are you interested in exploring the world of forex trading and want to take advantage of short-term price movements? Day trading forex might be the perfect strategy for you.

In this article, we will delve into the ins and outs of day trading forex, from understanding the forex market to developing effective strategies and managing risks. So let’s get started!

Introduction to Day Trading Forex

Benefits of Day Trading Forex

Day trading forex offers several advantages compared to other trading styles. Some of the benefits include:

Potential for quick profits: Day traders seek to profit from intraday price movements, aiming to close positions before the market closes.

High liquidity: The forex market is the largest and most liquid financial market globally, providing ample trading opportunities.

Flexibility: Traders can choose from a wide range of currency pairs and trade during different market sessions.

Lower capital requirements: Compared to other markets, forex trading allows for smaller initial investments, enabling traders to start with less capital.

Understanding Forex Market

To become a successful day trader in forex, it’s essential to have a solid understanding of the market dynamics.

Major Currency Pairs

The forex market consists of various currency pairs, but some major pairs dominate the trading volume. These include EUR/USD, GBP/USD, USD/JPY, and USD/CHF, among others. Familiarize yourself with these major currency pairs and their characteristics.

Market Hours

The forex market operates 24 hours a day, five days a week. However, certain trading sessions offer higher volatility and trading opportunities. The major sessions include the London, New York, Tokyo, and Sydney sessions. Knowing the active market hours can help you optimize your trading strategy.

Getting Started with Day Trading Forex

Before diving into day trading forex, you need to set up your trading infrastructure.

Setting Up a Trading Account

Choose a reputable forex broker that provides a user-friendly trading platform, competitive spreads, reliable execution, and comprehensive customer support. Ensure the broker is regulated by a recognized authority.

Selecting a Reliable Forex Broker

Research different forex brokers and compare their offerings, including trading costs, available currency pairs, leverage options, and deposit/withdrawal methods. Read reviews from other traders to gauge the broker’s reputation and reliability.

Funding Your Trading Account

Technical and Fundamental Analysis

Successful day trading forex relies on a combination of technical and fundamental analysis techniques.

Candlestick Patterns

Candlestick patterns provide valuable insights into price dynamics. Learn to identify patterns such as doji, engulfing, and hammer, which can signal potential reversals or continuations in the market.

Moving Averages

Moving averages help smooth out price fluctuations and identify trends. Experiment with different moving average periods, such as the 50-day and 200-day moving averages, to identify potential entry and exit points.

Support and Resistance Levels

Support and resistance levels are price levels at which the market tends to bounce or reverse. Identify key support and resistance levels using horizontal lines on your charts and incorporate them into your trading decisions.

Economic Indicators

Economic indicators, such as GDP growth, inflation rates, and employment data, can significantly impact currency prices. Stay informed about major economic releases and their potential effects on the forex market.

News Events

Popular Day Trading Strategies

To succeed in day trading forex, you need to implement effective trading strategies that suit your trading style and risk appetite.

Scalping

Scalping involves making multiple trades within a short time frame, aiming to capture small profits from quick price movements. Scalpers often rely on tight spreads and fast execution to capitalize on these rapid price changes.

Breakout Trading

Breakout traders look for significant price breakouts above resistance or below support levels. They aim to enter trades early in a new trend to maximize profit potential. Breakout strategies often utilize technical indicators to confirm breakouts.

Momentum Trading

Risk Management in Day Trading Forex

Managing risk is crucial in day trading forex to protect your capital and preserve long-term profitability. Here are a few ways to help manage your risk:

Setting Stop-Loss Orders

Always use stop-loss orders to limit potential losses on each trade. Determine an appropriate level for your stop-loss order based on your risk tolerance and the characteristics of the currency pair you are trading.

Implementing Proper Position Sizing

Calculate your position size based on the size of your trading account and the percentage of capital you are willing to risk per trade. Avoid overexposing your account by trading positions that are too large relative to your account size.

Managing Leverage

Emotions and Psychology in Day Trading

Controlling emotions and maintaining a disciplined mindset are crucial in day trading forex.

Controlling Greed and Fear

Greed and fear are common emotions that can cloud judgment and lead to irrational trading decisions. Develop self-awareness and discipline to overcome these emotions and make objective trading choices.

Maintaining Discipline

Stick to your trading plan and avoid impulsive trades driven by emotions. Follow your strategy and trading rules consistently, even when faced with market fluctuations.

Developing a Trading Plan

Building a Trading Routine

Establishing a structured trading routine can help you stay organized and make better trading decisions.

Pre-market Analysis

Before the market opens, conduct a thorough analysis of the currency pairs you are interested in trading. Review economic calendars, technical indicators, and news events that may impact the market.

Executing Trades

Once the trading day begins, execute your trades based on your predefined strategies and analysis. Stick to your risk management rules and avoid impulsive trades based on emotions.

Reviewing and Analyzing Trades

Resources and Tools for Day Traders

Several resources and tools can assist day traders in their trading activities.

Educate Yourself

It is important to stay up to date and learn constantly when you are day trading. It’s always a good idea to begin your journey with a day trading forex course such as the Cash on Demand Trades Education or The Ultimate Forex Strategy

Trading Platforms

Choose a user-friendly trading platform that provides real-time charts, technical indicators, order execution capabilities, and access to relevant news and analysis.

Charting Software

Utilize charting software to analyze price patterns, apply technical indicators, and identify potential trade setups. Popular charting platforms include MetaTrader, TradingView, and NinjaTrader.

Economic Calendars

Stay informed about upcoming economic events and news releases using economic calendars. These calendars provide information on scheduled economic indicators, central bank meetings, and other market-moving events.

Online Communities and Forums

Engage with other day traders through online communities and forums. Participate in discussions, share ideas, and learn from experienced traders. Collaborating with like-minded individuals can enhance your trading knowledge and skills.

Tips for Successful Day Trading

Consider the following tips to improve your day trading performance:

Stay Informed and Educated: Continuously update your knowledge about the forex market, trading strategies, and risk management techniques. Follow reputable sources of market analysis and stay informed about economic developments.

Practice Risk Management: Always prioritize risk management to protect your capital. Implement appropriate stop-loss orders, manage your position sizes, and avoid overtrading.

Start with Small Positions: When starting out, focus on small position sizes to minimize risk. Gradually increase your position sizes as you gain experience and confidence in your trading abilities.

Keep Emotions in Check: Emotions can cloud judgment and lead to poor trading decisions. Maintain emotional discipline, stick to your trading plan, and avoid impulsive actions driven by fear or greed.

Review and Learn from Your Trades: Regularly review your trading performance, analyze your trades, and identify areas for improvement. Learn from both successful and unsuccessful trades to refine your strategy.

Final Thoughts

Day trading forex offers exciting opportunities for traders to profit from short-term price movements in the forex market.

By understanding the market dynamics, implementing effective strategies, managing risks, and maintaining emotional discipline, you can increase your chances of success in day trading forex.

4 notes

·

View notes

Text

Navigating the Forex Market: A Beginner's Guide to Currency Trading

https://www.brokersview.com

In today's interconnected world, the foreign exchange (forex) market stands as the largest and most liquid financial market globally, with a daily trading volume exceeding $6 trillion. As a newcomer to the world of finance, understanding the basics of forex trading can be the first step toward harnessing its potential. In this post, we'll provide an introductory guide to help you navigate the forex market.

What is Forex Trading?

Forex, short for foreign exchange, involves the buying and selling of currencies from different countries. The forex market operates 24 hours a day, five days a week, due to the global nature of currency trading. It serves various purposes, from facilitating international trade to allowing investors to speculate on currency price movements.

Key Players in the Forex Market

Central Banks: Central banks, such as the Federal Reserve (Fed) in the United States and the European Central Bank (ECB), play a significant role in the forex market by setting interest rates and implementing monetary policies that impact currency values.

Commercial Banks: Commercial banks participate in forex trading on behalf of their clients and themselves, serving as major liquidity providers in the market.

Hedge Funds and Investment Firms: Large financial institutions and hedge funds engage in forex trading to diversify their portfolios and capitalize on price fluctuations.

Retail Traders: Individual traders like you and me participate in the forex market through online trading platforms provided by brokers.

Currency Pairs

In forex trading, currencies are quoted in pairs, where one currency is exchanged for another. The first currency in the pair is the base currency, and the second is the quote currency. The exchange rate reflects how much of the quote currency is needed to purchase one unit of the base currency. For example, in the EUR/USD pair, the EUR is the base currency, and the USD is the quote currency. If the EUR/USD exchange rate is 1.20, it means 1 Euro can buy 1.20 US Dollars.

How Forex Trading Works

Forex trading involves speculating on whether a currency pair's value will rise (appreciate) or fall (depreciate) in the future. Traders can take two primary positions:

Long Position (Buy): A trader buys a currency pair if they believe the base currency will strengthen against the quote currency.

Short Position (Sell): A trader sells a currency pair if they expect the base currency to weaken compared to the quote currency.

Risk Management

Forex trading carries inherent risks due to the volatility of currency markets. It's crucial to implement risk management strategies, including setting stop-loss orders to limit potential losses and diversifying your trading portfolio.

Choosing a Forex Broker

Selecting the right forex broker is a critical step for beginners. Look for brokers regulated by reputable authorities, offering user-friendly trading platforms, competitive spreads, and excellent customer support.

Educational Resources

Learning is an ongoing process in forex trading. Take advantage of educational resources provided by brokers, online courses, webinars, and trading forums to enhance your understanding of the market.

Conclusion

Forex trading offers opportunities for profit, but it's essential to approach it with knowledge, discipline, and caution. As a beginner, start with a demo account to practice your trading strategies without risking real money. Over time, you can gain confidence and experience to make informed decisions in the dynamic world of forex trading. Remember that success in forex trading requires continuous learning and adaptation to changing market conditions.

2 notes

·

View notes

Text

The Benefits of Diversifying Your Investment Portfolio

Investing can be fun and rewarding, but it’s important to manage your risks. One of the best ways to do that is by diversifying your investment portfolio. This means spreading your investments across different assets like stocks, bonds, and real estate. Here are some key benefits of diversification.

1. Reduce Risk

Spread Out Your Investments

Diversifying your investments helps reduce risk. By spreading your money across various assets, you’re less likely to lose everything if one investment goes bad. For example, if you have all your money in tech stocks and the tech market crashes, you could lose a lot. But if you also have investments in bonds or real estate, those might do better and balance things out.

Avoid Overexposure

When you diversify, you avoid putting too much money into one investment. This way, if one investment doesn’t do well, it won’t ruin your entire portfolio. Diversification is like not putting all your eggs in one basket.

2. Increase Your Returns

Capture More Opportunities

Diversifying your portfolio allows you to take advantage of different market opportunities. While one sector might be struggling, another could be booming. This balance can help you achieve better returns over time.

Balanced Growth

A diversified portfolio mixes high-risk, high-reward investments with safer, more stable ones. This mix can lead to steady growth over time, even if some investments are more volatile than others.

3. Manage Risk Better

Match Your Risk Level

Diversification lets you adjust your investments based on how much risk you’re comfortable with. If you like taking risks, you might invest more in stocks. If you prefer playing it safe, you might put more money into bonds or cash. You can find the right balance for your goals.

Stay Flexible

A diversified portfolio is more flexible and can adapt to changes in the market. If one type of investment starts to do poorly, you can shift your money around without having to start from scratch. This flexibility helps you stay on track with your financial goals.

4. Broaden Your Horizons

Global Opportunities

By diversifying, you can invest in international markets. This opens up more opportunities for growth. Some economies might be growing faster than yours, and investing in them can boost your returns.

Sector Variety

Investing in different sectors, like technology, healthcare, and finance, also reduces risk. If one industry is having a tough time, others might be doing well, balancing out your portfolio.

5. Peace of Mind

Less Stress

Knowing your investments are spread out can reduce stress. If one investment goes down, it won’t impact your entire portfolio. This peace of mind helps you stay calm during market fluctuations.

Long-Term Stability

Diversification helps create a stable portfolio that can weather ups and downs. This stability is crucial for achieving long-term financial goals and staying focused on your investment plan.

Conclusion

Diversifying your investment portfolio is one of the smartest strategies you can use. It reduces risk, increases potential returns, and helps you manage your investments better. By spreading your money across different assets, sectors, and regions, you can build a strong and resilient portfolio. Whether you’re just starting out or have been investing for years, diversification is key to achieving your financial goals and making the best investment choices.

Now, let’s look at some of the best trading platforms and tips from the best forex traders to help you get started.

3 notes

·

View notes

Text

Popular Forex Trading Strategies For Successful Traders

Identifying a successful Forex trading strategy is one of the most important aspects of currency trading. In general, there are numerous trading strategies designed by different types of traders to help you make profit in the market.

However, an individual trader needs to find the best Forex trading strategy that suits their trading style, as well as their risk tolerance. In the end, no one size fits all.

In order to make profit, traders should focus on eliminating the losing trades and achieving more winning ones. Any trading strategy that leads you towards this goal could prove to be the winning one.

How to Choose The Best Forex Trading Strategy

Before we proceed to discussing the most popular Forex trading strategies, it’s important that we understand the best methods of choosing a trading strategy. There are three main elements that should be taken into consideration in this process.

Time frame

Choosing a time frame that suits your trading style is very important. For a trader, there’s a huge difference between trading on a 15-min chart and a weekly chart. If you are leaning more towards becoming a scalper, a trader that aims to benefit from smaller market moves, then you should focus on the lower time frames e.g. from 1-min to 15-min charts.

On the other hand, swing traders are likely to use a 4-hour chart, as well as a daily chart, to generate profitable trading opportunities. Hence, before you choose your preferred trading strategy, make sure you answer the question: how long do I want to stay in a trade?

Varying time periods (long, medium, and short-term) correspond to different trading strategies.

Number of trading opportunities

When choosing your strategy, you should answer the question: how frequently do I want to open positions? If you are looking to open a higher number of positions then you should focus on a scalping trading strategy.

On the other hand, traders that tend to spend more time and resources on analyzing macroeconomic reports and fundamental factors are likely to spend less time in front of charts. Therefore, their preferred trading strategy is based on higher time frames and bigger positions.

Position size

Finding the proper trade size is of the utmost importance. Successful trading strategies require you to know your risk sentiment. Risking more than you can is very problematic as it can lead to bigger losses.

A popular advice in this regard is to set a risk limit at each trade. For instance, traders tend to set a 1% limit on their trades, meaning they won’t risk more than 1% of their account on a single trade.

For example, if your account is worth $30,000, you should risk up to $300 on a single trade if the risk limit is set at 1%. Depending on your risk sentiment, you can move this limit to 0.5% or 2%.

In general, the lower the number of trades you are looking to open the bigger the position size should be, and vice versa.

Three Successful Strategies

By now, you have identified a time frame, the desired position size on a single trade, and the approximate number of trades you are looking to open over a certain period of time. Below, we share three popular Forex trading strategies that have proven to be successful.

Scalping

Forex scalping is a popular trading strategy that is focused on smaller market movements. This strategy involves opening a large number of trades in a bid to bring small profits per each.

As a result, scalpers work to generate larger profits by generating a large number of smaller gains. This approach is completely opposite of holding a position for hours, days, or even weeks.

Scalping is very popular in Forex due to its liquidity and volatility. Investors are looking for markets where the price action is moving constantly to capitalize on fluctuations in small increments.

This type of trader tends to focus on profits that are around 5 pips per trade. However, they are hoping that a large number of trades is successful as profits are constant, stable and easy to achieve.

A clear downside to scalping is that you cannot afford to stay in the trade too long. Additionally, scalping requires a lot of time and attention, as you have to constantly analyze charts to find new trading opportunities.

Let’s now demonstrate how scalping works in practice. Below you see the EUR/USD 15-min chart. Our scalping trading strategy is based on the idea that we are looking to sell any attempt of the price action to move above the 200-period moving average (MA).

In about 3 hours, we generated four trading opportunities. Each time, the price action moved slightly above the 200-period moving average before rotating lower. A stop loss is located 5 pips above the moving average, while the price action never exceeded the MA by more than 3.5 pips.

Take profit is also 5 pips as we focus on achieving a large number of successful trades with smaller profits. Therefore, in total 20 pips were collected with a scalping trading strategy.

Day Trading

Day trading refers to the process of trading currencies in one trading day. Although applicable in all markets, day trading strategy is mostly used in Forex. This trading approach advises you to open and close all trades within a single day.

No position should stay open overnight to minimize the risk. Unlike scalpers, who are looking to stay in markets for a few minutes, day traders usually stay active over the day monitoring and managing opened trades. Day traders are mostly using 30-min and 1-hour time frames to generate trading ideas.

Many day traders tend to base their trading strategies on news. Scheduled events e.g. economic statistics, interest rates, GDPs, elections etc., tend to have a strong impact on the market.

In addition to the limit set on each position, day traders tend to set a daily risk limit. A common decision among traders is setting a 3% daily risk limit. This will protect your account and capital.

In the chart above, we see GBP/USD moving on an hourly chart. This trading strategy is based on finding the horizontal support and resistance lines on a chart. In this particular case, we are focused on resistance as the price is moving upward.

The price movement tags the horizontal resistance and immediately rotates lower. Our stop loss is located above the previous swing high to allow for a minor breach of the resistance line. Thus, a stop loss order is placed 25 pips above the entry point.

On the downside, we use the horizontal support to place a profit-taking order. Ultimately, the price action rotates lower to bring us around 65 pips in profits.

Position Trading

Position trading is a long-term strategy. Unlike scalping and day trading, this trading strategy is primarily focused on fundamental factors.

Minor market fluctuations are not considered in this strategy as they don’t affect the broader market picture.

Position traders are likely to monitor central bank monetary policies, political developments and other fundamental factors to identify cyclical trends. Successful position traders may open just a few trades over the entire year. However, profit targets in these trades are likely to be at least a couple of hundreds pips per each trade.

This trading strategy is reserved for more patient traders as their position may take weeks, months or even years to play out. You can observe the dollar index (DXY) reversing its trend direction on a weekly chart below.

A reversal is a result of the huge monetary stimulus provided by the US Federal Reserve and the Trump administration to help the troubled economy. As a result, the amount of active dollars increases, which decreases the value of the dollar. Position traders are likely to start selling the dollar on trillion-dollar stimulus packages.

Their target may depend on different factors: long-term technical indicators and the macroeconomic environment. Once they believe that the current bearish trend is nearing its end from a technical perspective, they will seek to exit the trade. In this example, we see the DXY rotating at the multi-year highs to trade more than 600 pips lower 4 months later (March - July).

2 notes

·

View notes