#for the record if you have a major loan you should have debt protection

Explore tagged Tumblr posts

Text

I am appalled to inform you all that there are people in this world who have not encountered the 'sending your cat for shifts at the cat cafe' joke, because while I got a good laugh when I made it during a work seminar, I also got a lot of blank stares before it clicked. And that's after I started the analogy with getting a mortgage with the bean!

#hello i work in finance today I had to learn about debt protection for the *checks notes* third time in as many weeks#for the record if you have a major loan you should have debt protection#but our flyers high key suck so I finally got to ask the question that's been plaguing me on the subject#for the record a second time: you can get single protection on a joint loan if one of you doesn't qualify#........what I didn't ask but should have is if you can get different packages on the same loan#gut says no but

4 notes

·

View notes

Text

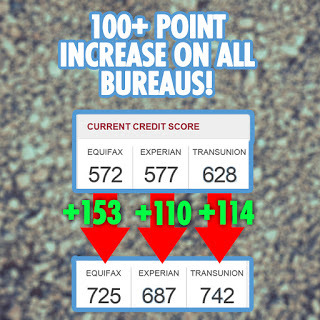

How to Legally Boost Your Credit Score in Miami

A good credit score is essential for getting approved for loans, credit cards, mortgages, and more. Unfortunately, mistakes can happen that cause your credit score to drop. Using a reputable Credit Repair Company is wise if you live in Miami and need help improving your credit score. Keep reading to learn more about credit repair and find the Best Credit Repair Company in Miami. In this comprehensive guide, we will explore how Safe Credit Solutions Inc. can help you on your journey to Improve your Credit Score and provide insights into why they stand out among the best credit repair companies in Florida.

How Does Credit Card Company Help to Improve Your Credit Score?

Credit repair involves fixing errors on your credit reports as well as improving factors that influence your scores positively over time. The three major consumer credit bureaus—Experian, Equifax, and TransUnion—all collect data provided to them by lenders and creditors that ultimately impact your FICO or Vantage credit score. Even a minor inaccuracy can lower your credit.

A Credit Repair Company reviews your reports line-by-line to identify and dispute inaccuracies with the bureaus based on consumer protection laws. These include the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACTA). As negative items get removed, your credit score benefits. A higher score saves you money on interest rates for credit products so it’s worthwhile to enlist experts.

Signs You Could Benefit from Credit Repair Company Miami Services

How do you know if a Credit Repair Company in Miami can help boost your credit score? Here are common indicators:

● You’ve been denied credit recently

● You have few open accounts or high balances

● Your score drastically dropped after a financial hardship

● You paid off collections accounts but they still appear

● Old debts continue reporting years after the last payment

● You have multiple errors or fraudulent information

If any of the above applies, professional credit repair should be considered to regain your financial footing.

About Safe Credit Solutions Inc.

Safe Credit Solutions Inc. exceeds expectations through its candid service and expert credit repair processes. With over 10 years of experience across Florida, they continue to maintain an A+ BBB rating and a 5-star reputation for removing derogatory items quickly and legally from credit reports.

As an industry leader, Safe Credit believes in complete transparency. They offer free, no-obligation consultations to explain their customized plans and reasonable pricing. There are never any hidden fees. Plus, their credit repair experts are always available by phone when clients have questions.

Safe Credit understands how unfair, predatory, and deceptive some companies operate both in the credit industry and credit repair space. That is why they passionately help consumers fight back against credit reporting errors to achieve financial dreams like buying homes or cars, getting loans/mortgages with low interest rates, or funding businesses.

Why Choose Safe Credit Solutions Inc. For Repair Your Credit Score?

1. Expertise in Credit Repair in Miami:

Safe Credit Solutions Inc. boasts a team of seasoned professionals with extensive experience in the credit repair industry. Their knowledge of the local financial landscape gives them a unique advantage in understanding and addressing the specific needs of Miami residents.

2. Proven Track Record:

With a history of successfully assisting individuals in improving their credit scores, Safe Credit Solutions Inc. has established itself as a reliable and effective credit repair company in Miami. Client testimonials speak volumes about the positive impact they've had on people's financial lives.

3. Attorney-backed processes:

An on-staff attorney works every case to ensure maximum, legal results.

4. Month-to-month services:

No long-term contracts so you only pay for active disputes.

5. Real experience:

The Safe Credit team has over 35 combined years of credit repair experience specifically.

6. Quality guarantee:

Expect at least 10 negative items removed within 90 days or get six months free.

Services Offered by Safe Credit Solutions Inc:

Comprehensive Credit Repair Services:

Safe Credit Solutions Inc. stands out among the best credit repair companies in Florida by offering a comprehensive range of services tailored to meet your unique needs. Their team of experts analyzes your credit report, identifies discrepancies, and crafts a personalized strategy to dispute and rectify inaccuracies.

Strategic Planning to Improve Credit Score:

With a focus on transparency and client education, Safe Credit not only works on rectifying negative items on your credit report but also provides valuable insights into maintaining a positive credit history. They help you develop financial habits that contribute to a lasting improvement in your credit score.

Best Practices in Credit Management:

Improving your credit score requires more than just removing negative items. Safe Credit goes the extra mile by offering guidance on credit management best practices. From budgeting tips to advice on responsible credit card usage, their experts empower you with the knowledge needed for long-term financial success.

Personalized Approach:

What sets Safe Credit Solutions Inc. apart is its commitment to a personalized approach. They understand that every individual's financial situation is unique. As one of the best credit repair companies in Miami, they take the time to understand your specific challenges and goals, creating a customized plan to address your credit repair needs.

Conclusion:

In conclusion, if you're looking for the Best Credit Repair Company in Miami to Improve your Credit Score, Safe Credit Solutions Inc. is your trusted partner. Their personalized approach, proven track record, and dedication to client education make them a standout choice among Credit Repair Companies in Florida. Take the first step towards financial empowerment with us and watch as your credit score reaches new heights.

0 notes

Text

Used car buying guide India

Buying a used car can be a daunting task, especially in a country like India, where the market is vast and diverse. However, if you do your research and follow some basic guidelines, you can find a reliable and affordable vehicle that suits your needs. In this article, we will guide you through the process of buying a used car in India.

Determine your budget and requirements

Before you start looking for a used car, you should determine your budget and requirements. Ask yourself how much you can afford to spend and what type of car you need. Consider factors such as fuel efficiency, size, and features.

Make a list of your requirements and prioritize them based on your needs. If you are not very knowledgeable about cars, it's a good idea to take a mechanic with you when you go to inspect the car. A mechanic can give you an unbiased assessment of the car's condition, and can also identify any potential issues that you may have missed.

Cars with major accident histories can have hidden issues that may not be visible during a visual inspection. Avoid cars that have been in major accidents or those that have had significant repairs. Such cars may have structural damage that can compromise their safety and reliability.

Make sure to check the ownership history of the car before you buy it. Look for cars that have had fewer owners, as this may indicate that they have been well-maintained. Also, check if the car has any outstanding loans or debts, as these may transfer to you when you buy the car.

Buying a dealsdhaba used car in India is a significant investment, so it is important not to rush the process. Take your time to do your research, inspect the car thoroughly, and negotiate a fair price. Don't let the seller pressure you into making a decision, and be prepared to walk away if you are not satisfied with the car or the price.

Research the market

Once you have determined your budget and requirements, research the market to find the best options. Check online classifieds websites, such as OLX and Quikr, to see what cars are available in your price range. Also, visit local used car dealerships to see what they have in stock.

It is essential to do your research on the make and model of the car you are interested in. Look up reviews and ratings, as well as the car's resale value. This information will give you a better idea of the car's reliability and potential resale value.

Check the car's history

Before buying a used car, you should check its history. This information will give you a better idea of the car's condition and any potential issues. You can check the car's history using the Vehicle Identification Number (VIN) or Registration Number.

Some online services provide this information for a fee. Alternatively, you can ask the seller to provide you with the car's service and maintenance records. This will give you an idea of how well the car has been maintained.

Inspect the car

Once you have found a car that meets your requirements and budget, it's time to inspect it thoroughly. Check the exterior and interior for any damage, such as dents, scratches, or rust. Inspect the engine, transmission, and suspension for any signs of wear and tear.

Test drive the car to get a feel for its performance. Pay attention to how the car handles, accelerates, and brakes. Also, check the air conditioning, power windows, and other features to make sure they are working correctly.

Negotiate the price

Once you are satisfied with the car's condition, it's time to negotiate the price. Use the information you gathered during your research to negotiate a fair price. Be prepared to walk away if the seller is not willing to negotiate.

You can also ask for a warranty or guarantee, especially if you are buying from a dealer. This will protect you in case of any unforeseen issues with the car.

Once you have agreed on a price, it's time to complete the paperwork. Make sure you have all the necessary documents, such as the registration certificate, insurance papers, and pollution certificate. Also, make sure you have a bill of sale or sale deed.

Consider the After-Sale Services

It is important to also consider the after-sale services provided by the seller or dealer. Look for dealerships that offer maintenance and servicing, and ask if they provide any warranties. A warranty can provide you with peace of mind and can protect you in case of any unforeseen issues with the car.

Always test-drive the car before you buy it. This will give you a better idea of the car's performance, and will also allow you to identify any potential issues. When test-driving the car, pay attention to the brakes, the steering, the suspension, and the transmission. Also, check for any unusual sounds or vibrations.

Conclusion

Buying a used car in India can be a daunting task, but if you follow these guidelines, you can make an informed decision and find the right car for you. Determine your budget and requirements, research the market, check the car's history, inspect the car, negotiate the price, and complete the paperwork. Also, consider the after-sale services, take a mechanic with you, avoid cars with major accident histories, check the ownership history, and don't rush the process. By taking these steps, you can ensure that you get a reliable and affordable car that meets your needs.

1 note

·

View note

Text

I testified Thursday against the City Council Fair Chance for Housing Act, my second time in Council Chambers. The first was in May 2019 when I spoke personally and passionately about protecting New York City’s specialized high schools.

The bill, also known as Int. 632, is another City Council measure designed to protect lawbreakers at the expense of the law-abiding. It would prohibit criminal background checks on prospective tenants and buyers of residential housing.

After testifying, I left City Hall. It wasn’t until hours later that I heard the racist response to my testimony from Douglas Powell, who spoke on behalf of city-funded nonprofit Vocal-NY. He and his organization want individuals such as Powell, who has a criminal record and is a level 2 registered sex offender, to be able to access housing without criminal background checks.

His testimony laid out his criminal-justice experience and his lived experience of anti-black discrimination at Asian stores — culminating in a racist attack on the Asian community where he lives. In his three-minute tirade, he called Queens’ Rego Park the most racist neighborhood because it is majority Asian. “It’s not their neighborhood — they from China, Hong Kong,” he said. “We from New York.”

Convicted sex offender spews anti-Asian slurs during NYC Council meeting — and pols do nothing to stop him

This anti-Asian, perpetual-foreigner, “You don’t belong here” rhetoric is dangerous hate speech that incites violence. Unprovoked attacks on Asian New Yorkers are on the rise.

Powell’s racist rant was delivered in the presence of three councilmembers without interruption or admonishment. Committee chair Nantasha Williams even thanked Powell for his testimony. It’s as if his anti-Asian hate speech in the chamber was unremarkable white noise. It took hours, after online pressure from constituents, for those present to issue generic disapproval statements, retweeting other electeds’ condemnation, and say “both sides” share blame for systemic racism.

Like many Asian Americans, I am a property owner and small landlord. When I graduated, my parents encouraged me to live at home, pay off my debt and save to buy a property. I lived at home for a few years and paid off my student loans as quickly as I could. Decades later, I bought my first investment property. I rented mostly to young men and women at the start of their careers. As a landlord, I treated my tenants the way I wanted to be treated: fairly and responsively. I’m fortunate real-estate brokers and condo management could conduct criminal and credit checks, not only for my benefit but for the safety of neighbors in the building.

Powell spewed hateful, anti-Asian rhetoric at the council meeting.Stephen Yang

Asian Americans have the highest rate of home ownership in the city, 42%. The stability of owning property as a means of building wealth is deeply rooted in Asian culture. New York’s pro-tenant policies, especially the Emergency Rental Assistance Program, have resulted in heartbreaking stories from small-property landlords. The laws, intended to help tenants, some of whom lost jobs during COVID, disproportionately hurt immigrant landlords. Not only have they not been paid rent for three years; some living in multi-family units are terrorized by tenants who know they can’t evict. Many Asian property owners are working class, and their modest rental income helps pay for the mortgage, property taxes and unit upkeep.

While bad tenants existed before this bill, it would make things worse. Private-property owners should not bear the burden of unknowingly renting to convicted arsonists and murderers and letting them live next door to New Yorkers who want a safe place after a long day braving our unpredictable city streets and subways. We worry about higher insurance, liability in endangering other tenants and frivolous lawsuits in tenant-friendly courts. That becomes a cost-benefit question for owners — whether it’s worth it to rent with little profit.

Like most landlords, I don’t live in the building I rent, but I do worry about the tenants I rent to. I think of the kindhearted young Asian professional who pleaded with me to let her have a Hurricane Sandy rescue dog. I worry about the wheelchair-bound young man grateful to find independence in living in an accessible building and appreciative of me letting him install an automatic door opener for his convenience. I want them to have the peace of mind that when they return to their small haven in the city, they will be safe, among neighbors who won’t pose a risk to them.

The fight to save specialized high schools that brought me to council the first time galvanized many Asian voters who had never been involved in city politics before. I am one of those newly politicized voters. This year, I co-founded Asian Wave Alliance to make sure that Asian-American New Yorkers’ needs are not ignored by the very councilmembers who sat quietly and listened to Powell’s racist attacks.

This time, I went to council to convince the Committee on Human and Civil Rights and the bill’s sponsors that the Fair Chance for Housing Act is not “fair” at all to small landlords and already-existing tenants. Getting rid of reasonable safeguards like criminal background checks is not “fair” to the city’s law-abiding citizens and will put people in danger. True fairness requires listening to all New Yorkers and prioritizing safety and transparency.

41 notes

·

View notes

Text

And catching up on what I said I’d do last weekend.

Fair warning: Political crap. Because I’m stuck in a timeline, you know? We live in a society and are stuck with a timeline. =))

First off, yeah, it’s hypocritical as all fuck that EVERY right-winger ever is pissing and moaning and calling “hand-out” over President Biden’s recent act of Mass Student Loan Forgiveness (THANK YOU, Mr. President, by the way) when a) many of these same politicians also took out PPP Loans during the pandemic and never paid them back (which is what loan forgiveness and bankruptcy have in common, superficially, I guess), and also b) ALL of them kept it quiet TWICE when banks got government HAND OUTS, a.k.a. bail-outs over their own greed and ineptitude with regard to exotic investments in real estate. No, seriously.

Trumpist fuck-nuts think it’s all good when a business, a corporation, a landlord, or a politician squeaks out of debt, as Trump did going bankrupt some six times, but God Forbid an ordinary college student or former student should get cut ANY breaks during a once-in-a-century pandemic that BECAME a disaster thanks to what again? Incompetence coming from Trump you say? So-called conservatives living in QAnon’s evidence-free la-la-electric fairyland on 8channel you say? Or maybe both of those points and every point in between them.

In shorter terms: While I personally believed President Biden could have acted sooner and done more--he could have easily went for greatness just by doubling his numbers, $20K baseline, $40K with Pell Grants, and doubled the income limit too--the truth is, getting this contrarian President to actually do something himself is like pulling teeth? Yeah, I’ll take a win when I see it, we can wait until later to see if Manchin and Sinema merit getting their kneecaps ventilated over how much of the rest of Biden’s agenda they forcibly ruined.

Secondly, and yeah, I said I would get to this, I’m just sorry it took me nearly a week to do so.

But the truth is that Trump needs to go on trial for the things he did, and the things he encouraged. Donald Trump needs to go on trial for both incitement of insurrection on January 6th, and for his deliberate mishandling of both Presidential records and Classified materials. America needs to get a spine on this and demonstrate that NO ONE is above Rule of Law. It really is that simple.

But there is something that needs to be said: the outcome of all that will not satisfy anyone. It won’t. Trump will most likely plead “no contest” whenever possible and while that’s the equivalent of a guilty plea, his followers will not accept that as such. Meaning any authorities willing to actually do their as-stated job and stop insurrections from the trial of Trump are going to have their hands full. The joke gets better. Should Trump be found guilty or the equivalent, yes, he will go to prison, but in sentencing the judge will have to consider his age, as well as his protection needs as a Former President. Meaning, yes, as a really old rich-bitch, Trump will NEVER actually go to anything more than a medium-security white-collar prison. No General Population for Trump. His potential flight risk and insurrection risk merit medium security but his person doesn’t merit more than that (he’s 70-something, in mediocre health and needs at least trivial Secret Service protection). Trump’s prison experience will be more like Martha Stewart’s, only more permanent. Chalk that up to White Privilege, I sure do. And I say that as a white guy.

About the only major benefit from Trump’s going to prison we can get is that he won’t be dead and a martyr. He won’t inspire anyone anymore--indeed, the whole point of the sentence will be that Trump will die of old age being kept very much Isolated and Quiet. Maybe that is the best we can hope for, is a situation where sure, people will raise hell but they’ll have to do it as “their own people” versus being led by Trump directly.

Third thing? I keep saying this again and again, but now it looks like it might just happen. This being an effective No More Republicans Scenario. In short, the trial hits, it sweeps up enough figures in both the House and Senate to chill the midterms, and in essence, the Democratic Party gets the spine they needed last year, and uses the 14th Amendment to finally kick the rest of the bastards out to the curb. On the one hand, yes, this is more incentive for the Idiot 30 Percent of every state (the Idiot 28 Percent, actually, plus the One Percenters and kept hacks who support them). More fuel to their fire, more cause for them to raise hell, such as it is, but consider how much Trump has been bashing the Police lately. This is a bad move in terms of tactics because the right-wingers don’t know that if they fight the Militarized Police here in America again, directly, they will die. They will simply be shot dead. Don’t think the police don’t know how their own suffered in the January 6th insurrection. The alt-right as such have LOST the Blue Lives bunch and don’t know it. This isn’t gloating, this is simply looking at how police behave in the USA, looking at what they demand of people typically, and looking at how Trumpist red-caps typically act. Those who still follow Trump still think they can raise hell--and are in for a severely rude awakening on that.

In the meantime, the sensible 70 percent of us, in every state, just need to get used to the idea that we ARE going to go into a one-party state, temporarily, probably for the remainder of President Biden’s stay in the White House. It probably won’t be all that severe but it will LOOK concerning to people who don’t know how the 14th Amendment works. It’ll be a while before we get a post-Republican conservative party, and until that happens, Democrats and Independents will be the only shows in town and on the ballots. But yeah, it’ will mostly look worse than it is, actually. And I’m saying this from Illinois, where the current Governor has literally forced an emergency State-Level coup-d-etat just to make damned sure his state survives COVID-19 without endless bickering from the “but we LIKED Rauner” camp in the State Legislature and elsewhere. No really, if even the “moderate” anti-Trump “republicans” had any say during the pandemic years, Chicago would be DEAD. That’s the state-level conservative bias in the main, “fuck Chicago” because that’s “where them libtards breed and lay some eggs.” =)) So yeah, maybe Governor J.B Pritzkier (whose last name I always mess up) has a point in Assuming ALL Direct Control for the time being.

And maybe kicking the Bastard Party out at the federal level is also a good thing, temporarily, as well.

#Student Loan Forgiveness#Thank You#Prison For Trump#won't be perfect#14th Amendment#temporary one-party rule#sometimes you send the idiots and children to the kid's table while grown-ups handle business

3 notes

·

View notes

Video

youtube

Coronavirus and the Height of Corporate Welfare

With the coronavirus pandemic wreaking havoc on the global economy, here’s how massive corporations are shafting the rest of us in order to secure billions of dollars of taxpayer-funded bailouts.

The airline industry demanded a massive bailout of nearly $60 billion in taxpayer dollars, and ended up securing $50 billion -- half in loans, half in direct grants that don’t need to be paid back.

Airlines don’t deserve a cent. The five biggest U.S. airlines spent 96 percent of their free cash flow over the last decade buying back shares of their own stock to boost executive bonuses and please wealthy investors.

United was so determined to get its windfall of taxpayer money that it threatened to fire workers if it didn’t get its way. Before the Senate bill passed, CEO Oscar Munoz wrote that “if Congress doesn’t act on sufficient government support by the end of March, our company will begin to…reduce our payroll….”

Airlines could have renegotiated their debts with their lenders outside court, or file for Chapter 11 bankruptcy protection. They’ve reorganized under bankruptcy many times before. Either way, they’d keep flying.

The hotel industry says it needs $150 billion. The industry says as many as 4 million workers could lose their jobs in the coming weeks if they don’t receive a bailout. Everyone from general managers to housekeepers will be affected. But don’t worry -- the layoffs won’t reach the corporate level.

Hotel chains don’t need a bailout. For years, they’ve been making record profits while underpaying their workers. Marriott, the largest hotel chain in the world, repurchased $2.3 billion of its own stock last year, while raking in nearly $4 billion in profits.

Thankfully, Trump’s hotels and businesses, as well as any of his family members’ businesses, are barred from receiving anything from the $500 billion corporate bailout money. But the bill is full of loopholes that Trump can exploit to benefit himself and his hotels. Cruise ships also want to be bailed out, and Trump called them a “prime candidate” to receive a government handout. But they don’t deserve it either. The three cruise ship corporations controlling 75 percent of the entire global market are incorporated outside of the United States to avoid paying taxes.

They’re floating tax shelters, paying an average U.S. tax rate of just 0.8 percent. Democrats secured key provisions stipulating that companies are only eligible for bailout money if they are incorporated in the United States and have a majority of U.S. employees, so the cruise ship industry likely won’t see a dime of relief funding. However, Trump has made it clear he still wants to help them.

The justification I’ve heard about why all these corporations need to be bailed out is they’ll keep workers on their payrolls. But why should we believe big corporations will protect their workers right now?

The $500 billion slush fund included in the Senate’s emergency relief package doesn’t require corporations to keep paying their workers and has dismally weak restrictions on stock buybacks and executive pay.

Even if the bill did provide worker protections, what’s going to happen to these corporations’ subcontractors and gig workers? What about worker benefits, pensions and health care? How much of this bailout is going to end up in the pockets of executives and big investors? The record of Big Business isn’t comforting. Amazon, one of the richest corporations in the world, which paid almost no taxes last year, is only offering unpaid time off for workers who are sick and just two weeks paid leave for workers who test positive for the virus. Meanwhile, it demands its employees put in mandatory overtime. Oh, and these corporations made sure they and other companies with more than 500 employees were exempt from the requirement in the first House coronavirus bill that employers provide paid sick leave. And now, less than a month into statewide shelter-in-place orders and social distancing restrictions, Wall Streeters and corporate America’s chief executives are calling for supposedly “low-risk” groups to be sent back to work to restart the economy.

They're so concerned about protecting their bottom line that they’re willing to let people die to preserve their stock portfolios, all while they continue working from the safety and security of their own homes. It's the most repugnant class warfare you can imagine. Here’s the bottom line: no mega-corporation deserves a cent of bailout money. For decades these companies and their billionaire executives have been dodging taxes, getting tax cuts, shafting workers, and bending the rules to enrich themselves. There’s no reason to trust them to do the right thing with billions of dollars in taxpayer money.

Every penny we have needs to go to average Americans who desperately need income support and health care, and to hospitals that need life-saving equipment. It’s outrageous that the Senate bill gave corporations nearly four times as much money as hospitals on the front lines.

Corporate welfare is bad enough in normal times. Now, in a national emergency, it's morally repugnant. We must stop bailing out corporations. It’s time we bail out people.

277 notes

·

View notes

Text

Saturday, August 21, 2021

Landlords look for an exit amid federal eviction moratorium (AP) When Ryan David bought three rental properties back in 2017, he expected the $1,000-a-month he was pocketing after expenses would be regular sources of income well into his retirement years. But then the pandemic hit and federal and state authorities imposed moratoriums on evictions. The unpaid rent began to mount. Then, just when he thought the worst was over, the Centers for Disease Control and Prevention announced a new moratorium, lasting until Oct. 3. David, the father of a 2 1/2-year-old who is expecting another child, fears the $2,000 he’s owed in back rent will quickly climb to thousands more. The latest moratorium “was the final gut punch,” said the 39-year-old, adding that he now plans to sell the apartments. Most evictions for unpaid rent have been halted since the early days of the pandemic and there are now more than 15 million people living in households that owe as much as $20 billion in back rent, according to the Aspen Institute. A majority of single-family rental home owners have been impacted, according to a survey from the National Rental Home Council, and 50% say they have tenants who have missed rent during the pandemic. Landlords, big and small, are most angry about the moratoriums, which they consider illegal. Many believe some tenants could have paid rent, if not for the moratorium. And the $47 billion in federal rental assistance that was supposed to make landlords whole has been slow to materialize. By July, only $3 billion of the first tranche of $25 billion had been distributed.

Student loans (WSJ) The Biden administration announced it will wipe out $5.8 billion in student loans held by 323,000 people who are permanently disabled. This means the Education Department will discharge loans for borrowers with total and permanent disabilities per Social Security Administration records. Currently there is $1.6 trillion held in student loan debt, much of which could be eliminated through executive action.

New England preps for 1st hurricane in 30 years with Henri (AP) New Englanders bracing for their first direct hit by a hurricane in 30 years began hauling boats out of the water and taking other precautions Friday as Tropical Storm Henri barreled toward the Northeast coast. Henri was expected to intensify into a hurricane by Saturday, the U.S. National Hurricane Center said. Impacts could be felt in New England states by Sunday, including on Cape Cod, which is teeming with tens of thousands of summer tourists. “This storm is extremely worrisome,” said Michael Finkelstein, police chief and emergency management director in East Lyme, Connecticut. “We haven’t been down this road in quite a while and there’s no doubt that we and the rest of New England would have some real difficulties with a direct hit from a hurricane.”

Booming Colo. town asks, ‘Where will water come from?’ (AP) “Go West, young man,″ Horace Greeley famously urged. The problem for the northern Colorado town that bears the 19th-century newspaper editor’s name: Too many people have heeded his advice. By the tens of thousands newcomers have been streaming into Greeley—so much so that the city and surrounding Weld County grew by more than 30% from 2010 to 2020, according to the U.S. Census Bureau, making it one of the fastest-growing regions in the country. And it’s not just Greeley. Figures released this month show that population growth continues unabated in the South and West, even as temperatures rise and droughts become more common. That in turn has set off a scramble of growing intensity in places like Greeley to find water for the current population, let alone those expected to arrive in coming years. “Everybody looks at the population growth and says, ‘Where is the water going to come from?’” [one local professor] said.

Everything’s Getting Bigger In Texas (AP, CNBC, Forbes) Texas has long been a popular destination for newcomers, thanks to cheaper land and housing, more job opportunities, lower taxes, and fewer regulations. There’s also the great weather, food, schools, and medical facilities, the abundant resources and year-round recreation and outdoor activities, artistic and cultural events, fairs, festivals, music venues, and the diverse and friendly people—you know, just to name a few. Texas has always been a business-friendly environment, which has certainly not been lost on tech and financial companies headquartered in strictly-regulated and high-priced states like California and New York. There are 237 corporate relocation and expansion projects in the works in Texas just since the pandemic hit. Tech giant Oracle moved its headquarters to Austin in late 2020; Tesla is building its new Gigafactory there, and Apple will have its second-largest campus there as well. Both Google and Facebook have satellite offices in Austin, and the file hosting services company Dropbox will be leaving San Francisco for Austin. Recently, the global real estate services firm CBRE and multinational financial services behemoth Charles Schwab moved their headquarters from California to the Dallas area. Hewlett Packard’s cofounders were two of the original grandfathers of Silicon Valley, who started their company in a Palo Alto garage in 1939. Now, the corporation is moving its headquarters from San Jose to Houston. And the number of mega-wealthy individuals who’ve moved to Texas are too numerous to mention. It’s not just big cities like Dallas, Houston, Austin, and San Antonio that are seeing an influx of people—bedroom communities are growing by leaps and bounds as well—places like New Braunfels, located in the Texas Hill Country, Conroe, 40 miles north of Houston, and McKinney, just 30 minutes up U.S. 75 from Dallas.

‘Bracing for the worst’ in Florida’s COVID-19 hot zone (AP) As quickly as one COVID patient is discharged, another waits for a bed in northeast Florida, the hot zone of the state’s latest surge. But the patients at Baptist Health’s five hospitals across Jacksonville are younger and getting sick from the virus faster than people did last summer. Baptist has over 500 COVID patients, more than twice the number they had at the peak of Florida’s July 2020 surge, and the onslaught isn’t letting up. Hospital officials are anxiously monitoring 10 forecast models, converting empty spaces, adding over 100 beds and “bracing for the worst,” said Dr. Timothy Groover, the hospitals’ interim chief medical officer.

Grace heads for a second hurricane hit on Mexican coast (AP) Hurricane Grace—temporarily knocked back to tropical storm force—headed Friday for a second landfall in Mexico, this time taking aim at the mainland’s Gulf coast after crashing through the country’s main tourist strip. The storm lost punch as it zipped across the Yucatan Peninsula, but it emerged late Thursday over the relatively warm Gulf of Mexico and was gaining energy. The U.S. National Hurricane Center said Grace’s winds were back up to 70 mph (110 kph) early Friday and were expected to soon regain hurricane force. It was centered about 265 miles (425 kilometers) east of Tuxpan and was heading west at 16 mph (26 kph). The forecast track would take it toward a coastal region of small fishing towns and beach resorts between Tuxpan and Veracruz, likely Friday night or early Saturday, then over a mountain range toward the heart of the country and the greater Mexico City region. Forecasters said it could drop 6 to 12 inches (15 to 30 centimeters) of rain, with more in a few isolated areas—bringing the threat of flash floods, mudslide and urban flooding.

“Self-determination 1, Human Rights 0” (Foreign Policy) Most Latin American governments offered little official support to the U.S. War in Afghanistan when it began in 2001. At the time, Venezuela put forward a blistering critique of meeting “terror with more terror,” and then-Cuban leader Fidel Castro said U.S. opponents’ irregular warfare abilities could draw out the conflict for 20 years. Over the weekend, as the Afghan government collapsed and chaos engulfed Kabul’s airport, today’s leaders of Cuba and Venezuela echoed their critiques while foreign ministers of other Latin American countries diplomatically issued statements of concern about Afghanistan’s humanitarian needs. Chile and Mexico made plans to accept Afghan refugees, and several countries signed on to a joint international statement protecting Afghan women’s rights. To many in Latin America’s diplomatic and foreign-policy communities, the dark events in Afghanistan confirmed the importance of the principle of non-interference in other countries’ internal affairs. The extended U.S. presence in Afghanistan was “the same mistake as always: trying to build democratic states through the use of force,” Colombian political scientist Sandra Guzmán wrote in El Tiempo. Many Latin Americans stressed that methods other than military interventions should be used to work toward human rights, even as they acknowledged how challenging it can be to make progress. “Self-determination 1, human rights 0 #Afghanistan,” tweeted Uruguayan political scientist Andrés Malamud after Kabul fell.

Afghanistan war unpopular amid chaotic pullout (AP) A significant majority of Americans doubt that the war in Afghanistan was worthwhile, even as the United States is more divided over President Joe Biden’s handling of foreign policy and national security, according to a poll from The Associated Press-NORC Center for Public Affairs Research. Roughly two-thirds said they did not think America’s longest war was worth fighting, the poll shows. Meanwhile, 47% approve of Biden’s management of international affairs, while 52% approve of Biden on national security. The poll was conducted Aug. 12-16 as the two-decade war in Afghanistan ended with the Taliban returning to power and capturing the capital of Kabul. Biden has faced bipartisan condemnation in Washington for sparking a humanitarian crisis by being ill-prepared for the speed of the Taliban’s advance.

The U.S. Blew Billions in Afghanistan (Bloomberg) The rapid collapse of Afghanistan’s government to the Taliban fueled fears of a humanitarian disaster, sparked a political crisis for President Joe Biden and caused scenes of desperation at Kabul’s airport. It’s also raised questions about what happened to more than $1 trillion the U.S. spent trying to bring peace and stability to a country wracked by decades of war. While most of that money went to the U.S. military, billions of dollars got wasted along the way, in some cases aggravating efforts to build ties with the Afghan people Americans meant to be helping. A special watchdog set up by Congress spent the past 13 years documenting the successes and failures of America’s efforts in Afghanistan. While wars are always wasteful, the misspent American funds stand out because the U.S. had 20 years to shift course.

Western groups desperate to save Afghan workers left behind (AP) The Italian charity Pangea helped tens of thousands of Afghan women become self-supporting in the last 20 years. Now, dozens of its staff in Afghanistan are in hiding with their families amid reports that Taliban are going door-to-door in search of citizens who worked with Westerners. Pangea founder Luca Lo Presti has asked that 30 Afghan charity workers and their families be included on Italian flights that have carried 500 people to safety this week, but the requests were flatly refused. On Thursday, the military coordinator told him: “Not today.” Dozens of flights already have brought hundreds of Western nationals and Afghan workers to safety in Europe since the Taliban captured the capital of Kabul. Those lucky enough to be rescued from feared reprisals have mostly been Afghans who worked directly with foreign missions, along with their families. European countries also have pledged to evacuate people at special risk from the Taliban—feminists, political activists and journalists—but it is unclear exactly where the line is being drawn and how many Afghan nationals Western nations will be able to evacuate.

3 notes

·

View notes

Text

Buy used car tips

Action 1: Establish Your Spending plan You can purchase a used vehicle with cash money or by getting a vehicle loan. Presume which way is the smartest. We just advise spending for an automobile with cash money. No vehicle repayments right here! Yes, that suggests you'll have a severe damage in your cost savings, yet you'll miss the stress of investing thousands of dollars on car loan repayments monthly. Isn't that outstanding? For instance, if you borrow $10,000 for an automobile with a 5% rates of interest as well as a term of five years, you'll end up investing an added $1,322.74 in passion. Not so inexpensive anymore! However prior to you lose hope, remember this: You can find reputable pre-owned vehicles in any type of cost variety. If you're battling monetarily, you can locate an automobile to obtain you from point A to factor B for as low as $1,000 to $2,000. It might not be rather, yet you'll get by. If you aren't satisfied with the vehicles you can manage, bear in mind that you can take all that money you reduce vehicle settlements every month as well as stash it away for an upgrade. Just make it a top priority in your budget! P.S. If you need a budgeting tool, provide ours a test-drive in a Ramsey+ complimentary trial. It'll help you get going on ending up being debt-free and also functioning your method to the cars and truck you really want. Step 2: Find Your Perfect Vehicle When you have actually established your budget plan, you can locate your excellent auto. Not your dream auto. Your ideal car. It's the one that ideal fits your way of living and your reasons for buying it. Prior to you state your commitment to your favored vehicle brand, go back as well as have a look at the kinds of vehicles and what each was created to do. Trucks, as an example, were designed to lug goods and also hefty materials. So unless you're hauling heavy cargo regularly (you know-- crushed rock, lumber, blocks), do not buy a truck. For a great traveler lorry, stick with choices that are portable as well as energy reliable, like cars, hatchbacks or hybrids. Narrow down your choices with this fast list. Read through these declarations and also pick three that relate to your situation the most. Use your solution to assist choose which sort of cars and truck is perfect for you. ____ I want a vehicle with a lot of freight space. ____ I desire an automobile that can fit even more people. ____ I want a lorry with far better gas economy. ____ I desire an automobile that's very easy to enter and out of. ____ I want a lorry that's risk-free. ____ I want a lorry that's much better for the environment. ____ I want my lorry to lug heavy cargo. ____ I want to go off-road or on harsh terrain. ____ I desire my lorry to be compact as well as light for city car park. ____ I desire my car to have lugging abilities. As you choose your perfect vehicle, you'll have to make some sacrifices as well. You won't discover an automobile that does whatever. So prepare your heart for that. Be honest with yourself regarding your wants as well as your requirements, and believe long term regarding exactly how you'll be utilizing your automobile. Want to Save a Little Money? Obviously you do. So think about features you do not need your vehicle to have. Not simply technology like in-dash GPS, Bluetooth connectivity and also backup video cameras-- yet the basics as well. What kind of standard points? Well, take cylinders, for instance. Today, a 2011 Kia Sorento with 6 cyndrical tubes prices around $8,350 to $10,750.4 The exact same Kia with a four-cylinder engine? $7,750 to $10,150 (as well as these numbers change almost day-to-day).5 Though it might not feel like a great deal, you can take that added (virtually) $600 as well as put it towards your car insurance policy. Tip: Unless you're hauling hefty freight, simply stick with 4 cylinders. What concerning the transmission? Stick shifts are typically cheaper than automatics, some versions also improve gas mileage, as well as last but not least-- they're simply ordinary enjoyable to drive. As well as do you actually require four-wheel drive (AWD), or can you get by with front- or rear-wheel drive (2WD)? Unless you reside in the hills or handle great deals of rain, snow as well as ice on your commute, stick to front- or rear-wheel drive if you're simply driving in the city. Bonus Tip: When you're comparing different automobiles, do not neglect to think of insurance costs also. Deal with an independent insurance coverage representative who can help you save without shedding on protection on your cars and truck. Action 3: Buy a Used Automobile Now that you understand how much you can spend and also what kind of cars and truck cares for your requirements, you can begin buying. But initially, let's talk about two areas you ought to stay away from. New automobile dealers. Although a lot of new car dealers market utilized cars, they're always a lot more costly. Buy-here, pay-here great deals. These great deals refer to car dealerships that not just offer autos (get here) yet additionally use vehicle loan (pay here). You have actually seen these places. They generally have multicolor pennant streamers strung between light posts as well as a 20-foot blow-up gorilla trembling a "sale" indicator. Yep, you understand the kind. Stay clear of these lots as well. Their cars have a lots of surprise charges, and they likewise typically have less than a 48-hour return policy. With a little bit much more looking, you can locate better utilized cars somewhere else. Here are 6 places to begin your search. CarMax has a significant online stock and a very detailed cars and truck inspection. Carvana, like CarMax, has a huge supply and also does careful vehicle inspections. The difference is that Carvana is entirely an on the internet vehicle buying experience. And also Carvana delivers the cars and truck to you! Craigslist doesn't bill you a purchase fee (like ebay.com does). eBay Motors markets cars and trucks with online auctions and buy-it-now straight acquisitions. Display room grass can be dangerous, yet sometimes, the very best deals come from purchasing from an exclusive proprietor. Independent utilized vehicle dealers are likewise a clever area to look. Certain, you need to discuss with aggressive sales people, however you can certainly locate an offer at a strong car dealership. Step 4: Identify the Utilized Car's Worth Currently it's time to identify if the used automobile you have actually picked deserves the price. Collect all the info you can on the cars and truck so you can talk the vendor down to a much better deal. 1. Start with Kelley Directory (KBB). KBB uses data collected from real sales purchases and also auction prices to give you an exact price variety for the made use of cars and truck. 2. Buy a car history report (VHR). A good VHR prices regarding $50 as well as consists of mishap history, possession background, and also a lots of various other records. A VHR eliminates a great deal of uncertainty regarding the used car because it will certainly reveal you if the automobile has actually been in any kind of mishaps or has actually already invested a great deal of time in the shop. Vehicle Background supplies a totally free fundamental record, however if you will drop a couple grand on a used vehicle, purchase a detailed record from CARFAX. You'll require the VIN number (usually discovered beneath the windshield on the driver's side). Pro suggestion: If the VIN number has been damaged off or eliminated, don't buy the auto. That's a big warning. Possibilities are, the secondhand vehicle has actually been taken or the seller is concealing something. 3. Determine the possession price. That's what you'll spend to preserve the vehicle (oil modifications, new tires, liquid purges) as well as what long-term fixings you must anticipate for the make and design you're taking a look at. You'll likewise require to understand the costs and availability of substitute parts since parts for some automobiles are extra costly than others. You can make use of Edmunds Real Price to Own device to get a great price quote. 4. Discover on-line discussion forums concentrated on the used cars and truck. Virtually every design has an online forum with strings extending back a great while. Seek common concerns that owners have had with the type of automobile you wish to get. 5. Check the automobile's recall history. Don't think the vendor has actually dealt with a used automobile's security recalls. Actually, over 70 million vehicles get on the roadway with open recalls on them.6 And yeah, you guessed it-- people still try to market those automobiles without getting the recall fixed. So what can you do? Examine the National Highway Web Traffic Administration for your automobile's recall background (if it has one). 6. Request an insurance quote. Used cars and trucks are normally less costly to guarantee than brand-new ones. Actually, a 5-year-old auto is about 14% less costly to insure than its brand-new equivalent.7 If you already have insurance, ask how much your premium will certainly alter if you buy a certain make and also model. Work with an independent insurance policy agent who will do the buying you. Tip 5: Inspect the Made Use Of Auto Yourself Even if you're not a mechanic, you can use this listing of advice from the Department of Motor Automobiles to check for signs of damage and misuse. While none of these things alone should quit you from acquiring the automobile (except for major damage, like a blown head gasket), a bunch of these can stop you from buying somebody else's cars and truck trouble. Under the Hood Examine the oil level as well as color. Oil dipsticks lie near the engine (generally a yellow stick). Oil must be light brown. If there's no oil in the engine, that's a good sign this is a bad deal. Check the shade of the oil under the oil cap (located on the engine). If it's milky-- what some mechanics call "mayonnaise"-- do not buy the used cars and truck. If the oil is milk like, it's combining with coolant, a common indication of a blown head gasket (in some cases a $3,500 fixing). Check the belts. Belts lie around the engine, occasionally on the engine's side, so you may need a flashlight for this action. Belts ought to be smooth with no fractures. Broken belts aren't a bargain breaker, but you'll require to replace them quickly. Examine the transmission liquid dipstick (generally a red stick). Transmission liquid ought to be pink or red. If it's black and also smells burned, that's a poor indication. Transmission replacements are costly, so if you locate that the vendor hasn't replaced the fluid in a while, reevaluate buying the used cars and truck. Check the degree of the coolant. It needs to be between minimum as well as optimum. The coolant tank is someplace near the radiator. If you can't find the reservoir, ask the seller where it's located. Caution: Don't open the coolant cap while the engine is hot or if the automobile is running. Check the brake fluid. Make sure it's at the highest level. Outdoors Check out the cars and truck's paint work. Look for damages and also scratches. Check the tires. They ought to all coincide (not mismatched), as well as they should have also put on across the width. Look for scuffs, splits and cuts along the sidewall. Check the spare tire too. Examine the tail pipeline. If it's black, that indicates the vehicle is shedding oil-- an additional poor indicator. Open and shut the doors, as well as the trunk, fuel door and gas cap. Ensure they all job. Inspect the lights. Ask the vendor to run the directional signal, fronts lights and brake lights as you make sure (outside the car) that they function. Inside Take a deep breath. If the cars and truck smells mildewy or if you see mold under the seats, there's a likelihood the car has water damage that could bring about expensive electric problems. If there's an air freshener or if the cars and truck scents suspiciously scented, open the windows and also leave them open as you examine drive the car. When you're done with the test drive, you'll have the ability to smell the car's natural scent. Check the endure the steering wheel, seats and also pedals. Minor wear can be anticipated-- particularly if it's an older cars and truck. Lock and also unlock all doors. Make sure they function. Check A/C as well as heating. Everybody takes these things for provided ... till they don't function. Idle the cars and truck and watch the temperature scale. You do not want to acquire a pre-owned vehicle that overheats. See to it the radiator followers kick on when the temperature starts increasing. Step 6: Opt For a Test Drive When you're taking the vehicle for your initial test-drive, turn off the stereo and ask your guests (perfectly) to stay peaceful so you can pay attention for any problems. Before you test-drive, choose a route with hills, bumps and, yep, even potholes. Even if you intend to make use of the automobile on highways and level roadways, examination the auto on harsh roads to get a feeling of just how it handles the roadway.

Utilize your test-drive to respond to these inquiries:

Feel Exactly how does it feel on level roads? Smooth or bumpy? Just how does it feel when it hits a bump or pothole? Does it rock aggressively? Does the auto battle to pick up speed? Do the equipments transform smoothly? Is the brake squishy or also delicate? How does your body really feel after the test drive? Was the seat uncomfortable?

Sound Does the engine sound smooth when you increase? Does the engine rattle, knock or grind when you still? Are there resonances or weird noises under the hood when you speed up over 60 MPH? Do the brakes squeak?

View Can you see out of the cars and truck easily? Do you need to stress your neck to check your blind spots? Does black smoke come out of the exhaust when you begin the car or increase? Is the RPM gauge constant when you idle? Does it rise and fall way too much?

Smell Transform the cooling to a modest setting. Do you scent burning oil? Action 7: Take the Made Use Of Vehicle to a Reliable Mechanic If the car has actually passed your individual examination, great. Currently allow's see if it passes the technician's examination. If the vendor does not want an auto mechanic to evaluate the vehicle, that's a negative sign. Constantly have a mechanic check a secondhand car, regardless of the condition. A great auto mechanic will inform if you will purchase a trustworthy previously owned cars and truck or if it has any type of issues.

When it pertains to assessments, you have two options:

Take the cars and truck to a trustworthy garage. Most cars and truck garages charge a flat charge for checking made use of automobiles. They'll place the automobile on the lift, check for corrosion and also corrosion, as well as tell you if the utilized auto has extreme fluid leakages. If you're working with a private seller who does not desire you to take the vehicle off his/her residential property, established a mobile assessment. A technician will pertain to the vehicle, execute the examination, and print out the results. If a technician tells you the car has problems that surpass its worth, kindly tell the vendor you're no longer interested, or utilize that knowledge to reduce the asking price. Tip 8: Usage Arrangement Skills If you have excellent factors to believe the vendor must decrease the asking cost, you can utilize everything you've just learned about utilized automobiles as ammo to work out a far better bargain. Arrangements can be tough for people who don't like to be confrontational. Bargain like a professional with these 3 ideas. 1. Bring your research to the table. Allow's say the vendor wants $3,000 for his previously owned Volkswagen Jetta. Kelley Directory claims the ordinary rate range for that Jetta is $2,800 to $3,000. But you observed that the tires are bald as well as a front lights does not function. And also you review online that this version has troubles with radiator followers. Your VHR reveals no owner has actually ever before replaced the radiator followers. Ah-ha! Now you have actually got something. Bring all this details to the seller-- factor in the cost of tires, a front lights and a radiator follower-- and supply less. 2. Pay in cash money. Inform the seller you'll be paying for your used car in cash money-- just don't expose how much money you have. When vendors sniff eco-friendly, they're most likely to agree on your terms. 3. Hold your horses. If the vendor does not budge, you can leave. You have all the acquiring power. Most of the moment, they need your money more than you require their vehicle.

This article is written by https://allamericanexporter.com/

1 note

·

View note

Text

2020 Master List

Here is the 2020 masterlist. If you see any errors, please let me know.

Extreme thanks to

firesign10 for coding the list again this year! We all owe them a huge debt of gratitude!

Jared/Jensen

Stacks of Green Paper in His Red Right Hand

Link to Art: Here

Author: zara_zee

Artist: bluefire986

Pairing(s): Jared/Jensen

Genre: SPN RPF - Slash, Dark Romance, Action-thriller. Crime.

Word Count: 30K

Rating: NC-17

Warnings: References to child abuse. Organized crime. BDSM. Kink. Violence. Part of the Hellspawn 'verse

Summary: Life has never been better for Jared and Jensen. Business is booming. The challenges for control of the Californian underworld appear to have stopped. They have an awesome new house and an ever growing family of misfits and outlaws. Jensen’s even trying to quit smoking.

And then Jensen’s father drops a bombshell that makes Jared bench Jensen from everything but their ‘honest’ earnings. Jensen hates his new restrictions, but with so much on the line, he can’t argue with them—not until a friend of the Club is in danger and Jensen’s the only one who can help. And then he can’t just sit it out. Right?

Headstrong

Link to Art:Here

Author: fufuraw

Artist: yanyan

Pairing(s): Jared and Jensen

Genre: Gen

Word Count: 21,228

Rating: PG

Warnings: Were transformations

Summary: Jared learns about his family and his background. Jensen and the Bell Creek Pack are there to support him as he learns to navigate a world he never expected to have to live in.

On Your Way

Link to Art: Here

Author: zubeneschamali

Artist: quickreaver

Pairing(s): Jared/Jensen

Genre: SPN RPS

Word Count: 47,391

Rating: NC-17

Warnings: none

Summary: Jared's got a YouTube channel where he chronicles his attempt to run a half marathon in every U.S. state and all of the sights he sees along the way. Jensen's got a YouTube channel where he records his adventures in minimalist backpacking, taking to the most scenic places he can find with the least equipment he can carry. When both of them enter a competition for the best travel video blog—where the winner gets their own Netflix show—they'll have to decide if the growing attraction between them is more important than who wins the competition…

The Prophecy

Link to Art: Here

Author: tammyrenh

Artist: tx_dora

Pairing(s): Jared/Jensen

Genre: SPN RPS

Word Count: 25174

Rating: NC-17

Warnings: none

Summary: There is an old prophecy that involves an omega with magic ability far greater than has ever been seen before. Jared, a royal omega about to be given away to a very not-nice prince, decides to choose one thing for himself - who to give his virginity to. This act results in major consequences for both Jared and Jensen - including a pregnancy that shouldn’t be possible, magic that saves them and places them in danger, a voyage across the sea, sword fights, an evil prince, and, above all, the fierce love that binds Jared, Jensen and their unborn child together.

Freedom

Link to Art: Here

Author: sanshal

Artist: cherie_morte

Pairing(s): Jared/Jensen

Genre: SPN RPS

Word Count: 30,853

Rating: NC-17

Warnings: Dystopian AU, Slave!Jared, Master!Jensen, Nudity, Collar, Sexual training- (prostate milking, object insertion, chastity, Punishment/spanking etc.), Brain-washing, Angst, Fluff and Angst, Kids, Divorce, Mentions of depression, Crying, Alcohol abuse. Protective Jensen. The story is not as dark as the warning make it appear, however, please do read them carefully (as there are instances of them in the fic) and if you feel that you may be triggered, please be careful.

Summary: A new law comes into play which calculates an individual’s income and expenditure and if one fails to meet a particular ‘standard’, they are indentured till they can work off the difference by working for ‘sponsors’.

Jared fails to meet the ‘standard’.

Metaphysical Inc

Link to Art: Here

Author: blackrabbit42

Artist: beelikej

Pairing(s): Jared/Jensen

Genre: SPN RPF AU

Word Count: 21K

Rating: R

Warnings:

Summary: Loosely inspired by Monsters, Inc. Jensen works for the Life Department, Jared works for the Death Division. When they accidentally bring a live human baby into the metaphysical world, they need to work against the forces of Time and Fate, as well as that little shit from Chaos, Misha, to return baby Bee to her rightful place in the human world. Doing so might involve sacrifices and changes neither of them ever imagined.

The Rose Hidden Among the Thorns

Link to Art: Here

Author: backrose_17

Artist: 2blueshoes

Pairing(s): Jared/Jensen

Genre: SPN RPF AU

Word Count: 22,110

Rating: NC-17

Warnings: A/B/O, mpreg and cheating

Summary: Mob Boss Jensen Ackles is done with the thorn in his side FBI Agent Stephen Amell and he goes after Stephen's one true weakness, his loyal boyfriend Jared Padalecki. Jared has always known that Stephen's life is a dangerous one but he never expected to be drawn into a web of seduction and danger or learn secrets that Stephen has been keeping from him.

Master, Be My Slave

Link to Art: jdl71 Here

Link to Art: dun Here

Author: wincestwhore (Hunter King)

Artist: jdl71 and dun

Pairing(s): Jared/Jensen

Genre: SPF AU

meus_venator

phoenix1966

paleogymnast

aggiedoll

cherie_morte

bostonleigh (velvet-impala)

tcs1121

bluefire986

dwimpala21

candygramme and

spoonlessone

emmatheslayer

jdl71

dwimpala21

anniespinkhouse

amberdreams

junkerin

emmatheslayer

tsuki_no_bara

beelikej

dugindeep

cassiopeia7

kelleigh

blondebitz

nerdypastrychef

kaelysta

merenwen76

m14mouse

annie46

mangacat201

roxymissrose

phoenix1966

amypond45

siennavie

firesign10

a_dean_girl

smalltrolven

kaelysta

runedgirl

amberdreams

nyxocity

swan_song21

jalu2

paperbackwriter

kelios

tx_devilorangel

ameraleigh

amberdreams

whiskygalore

liliaeth

raving_liberal

m14mouse

18 notes

·

View notes

Text

Here's how the stock market is holding up so well. This is what real looting looks like

Soon after the Federal Reserve’s March 23 assurance that it would make borrowing easier for American corporations, Sysco Corp. sold $4 billion of debt.

Not long after that, the food-service giant announced plans to cut one-third of its workforce, more than 20,000 employees. Dividends to shareholders would continue, executives said.

That process repeated itself in April and May as the coronavirus spread. The Fed’s promise juiced the corporate-bond market. Borrowing by top-rated companies shot to a record $1.1 trillion for the year, nearly twice the pace of 2019. Companies as diverse as Sysco, Toyota Motor Corp., international marketing firm Omnicom Group Inc. and movie-theater chain Cinemark Holdings Inc. borrowed billions of dollars -- and then fired workers.

The companies were under no obligation to behave any differently, but their actions call into question the degree to which the U.S. central bank’s promise to purchase corporate debt will help preserve American jobs.

While the Fed has yet to buy a single bond, its pledge threw a lifeline to the market that undoubtedly kept some people working. Retail chains such as Dollar General Corp., CVS Health Corp., Walgreens Boots Alliance Inc., Lowe’s Cos. and Costco Wholesale Corp. said they’re adding personnel after tapping the bond market.

But unlike the Small Business Administration’s Paycheck Protection Program, which has incentives for employers to keep workers on the job, the taxpayer-backed facilities that the Fed and Treasury Department created for bigger companies have no such requirements. To make sure the emergency programs help fulfill one of the Fed’s mandates -- maximum employment -- the central bank is essentially crossing its fingers that restoring order to markets will translate to saving jobs.

“They could set conditions, say to companies, hire back your workers, maintain your payroll to at least a certain percentage of prior payroll, and we will help,” said Robert Reich, the former Secretary of Labor for President Bill Clinton who now teaches economics at the University of California, Berkeley. “It’s hardly clear that if you keep companies afloat they’ll hire employees.”

Unanimous Senate

The lending programs -- credit for big companies and the so-called Main Street facilities for midsize firms -- are supported by the CARES Act, a law that passed the House with more than 96% of the chamber’s votes and cleared the Senate unanimously. For many supporters, putting conditions on the assistance was a step too far. If Congress had intended any, it would have made it explicit in the legislation, they say.

“Really it’s all about creating a context, a climate, in which employees will have the best chance to either keep their job, or go back to their old job, or ultimately find a new job,” Fed Chairman Jerome Powell said in a May 29 webinar hosted by Princeton University. “That’s the point of this exercise.” A spokesman for the U.S. central bank declined further comment.

Even as businesses around the country began reopening in May after months of stay-at-home orders, helping a battered U.S. economy add 2.5 million jobs in May, prospects remained grim for millions of Americans who’ve been let go since February. An extra $600 a week in unemployment benefits that Congress approved in March is slated to stop on July 31. The prohibition against firing workers in the $25 billion government rescue of U.S. airlines expires Sept. 30, and the biggest recipients have said they intend to shed employees after that date.

Protecting Workers

Reich’s view is echoed mostly by progressive Democrats and supporters of stricter regulatory oversight of the financial system.

“The Fed’s primary motivator in creating these lending facilities is not protecting workers,” U.S. Representative Katie Porter, a California Democrat on the Financial Services Committee, said in an email interview. “The American people should not be asked or expected to loan $500 billion with no strings attached.”

A letter, circulated by the Wall Street watchdog group Americans for Financial Reform and published May 27, urged Congress to attach conditions favorable to workers to any Covid-19-related rescue programs. It was signed by 45 organizations, including labor unions and religious and environmental groups.

Without provisions for employees, “the credit assistance will tend to boost financial markets, but not the broad economic well-being of the great majority of the population,” Marcus Stanley, Americans for Financial Reform’s policy director, said in an interview.

Stanley said the corporate-lending programs don’t have to require companies to keep or rehire workers, but they could give priority to those that do.

In its legislation, Congress did express an intent that workers benefit from taxpayer-funded assistance, but it left a lot of the details to Powell and Treasury Secretary Steven Mnuchin.

“Our No. 1 objective is keeping people employed,” Mnuchin said during a May 19 Senate Banking Committee hearing after Senator Elizabeth Warren, a Massachusetts Democrat, accused him of “boosting your Wall Street buddies” at the expense of ordinary Americans. “What we put in the Main Street facility is that we expect people to use their best efforts to support jobs,” Mnuchin said.

The phrase “best efforts” echoes the original terms for the Main Street program, which required companies to attest they’ll make “reasonable efforts” to keep employees. The wording was subsequently changed to “commercially reasonable efforts,” which Jeremy C. Stein, chairman of the Harvard University economics department and a former Fed governor, called a welcome watering-down of expectations that the central bank would dictate employment policies to borrowers.

Emergency Help

“It was smart of them to weaken that,” Stein said. “You can’t expect companies to borrow to pay employees.”

Companies might not seek emergency help if too many strings are attached to the aid, Stein said. Others question the practicality of tying workers to their companies as economic realities shift.

“To go to great lengths to make companies keep employees that they don’t need, in light of new expectations that economic activity will remain below pre-Covid levels for a long while, doesn’t make sense,” said Mark Carey, a former Fed staff member and now co-president of the Risk Institute of the Global Association of Risk Professionals.

The Fed approached this crisis with the intent of keeping credit flowing everywhere, from municipalities to small businesses to big corporations to households. Powell said the programs are about lending, not spending -- in other words, they aim to ease a financing pinch rather than stimulate the demand companies need to keep workers on the payroll.

Weird Hybrid

“For the Fed to second-guess a corporate survival strategy would be a step too far for them,” said Adam Tooze, a Columbia University history professor and author of “Crashed: How a Decade of Financial Crises Changed the World.” Putting explicit conditions on program beneficiaries would make the central bank “a weird hybrid of the Federal Reserve, Treasury, BlackRock and an activist stockholder.” BlackRock Inc. is the world’s biggest money manager and was hired by the central bank to assist with bond programs.

Through the Main Street facilities, which are scheduled to begin operations any day, the Fed will buy as much as $600 billion in four-year loans made to companies by commercial banks with principal and interest deferred for one year. The program is aimed at midsize businesses, with 15,000 or fewer employees or annual revenue of $5 billion or less in 2019.

The central bank’s credit backstop for larger companies is split in two. The $500 billion primary program is designed to buy slices of syndicated loans or new bonds from companies with investment-grade credit scores or one notch below. It’s available to corporations that can prove they can’t borrow elsewhere. The $250 billion secondary facility buys individual corporate bonds already on the market and exchange-traded funds that include investment-grade and junk bonds. The Fed kicked off the program last month; its balance sheet as of June 2 listed ETF holdings valued at $4.3 billion.

European Differences

European countries are charting a different policy course by paying workers directly. The U.K., for example, is offering 80% of salaries up to 2,600 pounds ($3,207) a month. The Netherlands and Denmark have effectively nationalized private payrolls.

The U.S. government paid adults who make less than $75,000 a year a one-time sum of $1,200, with $500 for every dependent child. The cost was $239 billion.

The S&P 500 has jumped 38% since March 23, the day the Fed intervened. Observers of the stock market wonder how it could be so bullish at the same time as the country faces an avalanche of joblessness unsurpassed in its history. The choices companies are making provide an answer.

Since selling $4 billion in debt on March 30, Sysco has amassed $6 billion of cash and available liquidity, enabling it to gobble up market share, while cutting $500 million of expenses, according to Chief Executive Officer Kevin Hourican. Sysco, which is based in Houston, will continue to pay dividends to shareholders, Chief Financial Officer Joel Grade said on a May 5 earnings call.

Junk Bond

Movie theaters were one of the first businesses to close during the pandemic. Cinemark, which owns 554 of them, shut its U.S. locations on March 17. Three days later, the company paid a previously announced dividend. It has since said it will discontinue such distributions. Cinemark borrowed $250 million from the junk-bond market on April 13, the same day it announced the firing of 17,500 hourly workers. Managerial staff were kept on at reduced pay, according to company filings. Cinemark, which is based in Plano, Texas, said it plans to open its theaters in phases starting June 19.

The theater chain opted to go to the bond market over seeking funding from the government because “it didn’t come with any of the strings attached that government-backed facilities can include,” CEO Mark Zoradi said on the April 15 earnings call. It “was really no more complicated than that.”

Sysco and Cinemark declined to comment for this story, and referred to their executives’ previous remarks.

Omnicom issued $600 million in bonds on March 27. In an April 28 conference call to discuss quarterly earnings, CEO John Wren said the company was letting employees go but didn’t say how many. He said the company was extending medical benefits to July 31 for employees furloughed or fired.

Wren added: “Our liquidity, balance sheet and credit ratings remain very strong and we have no plans to change our dividend policy.” Omnicom didn’t respond to requests for comment.

Toyota borrowed $4 billion from investors on March 27. Three days later, the Japan-based car company said it would continue paying dividends to shareholders. Eight days after that it said it would drop roughly 5,000 contract workers who helped staff its plants in North America. Scott Vazin, a Toyota spokesperson, declined to comment.

In a March 24 letter, 200 academics, led by Stanford University Graduate School of Business Professor Jonathan Berk, called lending programs aimed at corporations “a huge mistake.” Better to focus help directly on people living paycheck to paycheck who lost their jobs, it said.

“Bailing out investors who chose to take high-risk investments because they wanted the high returns undermines capitalism and makes it an unfair game,” Berk said in an interview. “If you don’t have a level playing field in capitalism, it doesn’t work.”

21 notes

·

View notes

Link

The Star asked the leaders of Canada’s major political parties to talk about the issues that move them deeply. In the first of the series, federal NDP Leader Jagmeet Singh identified the challenges faced by today’s youth as the cause he wanted to talk about. Singh spoke with the Star about why he chose the topic and what he’s going to do to address the issue:

Why are young people and the challenges they face so important to you?

All the major crises we’re faced with, they’re the ones feeling it the most. Young people are the ones who are priced out of the (housing) market, can’t imagine ever buying a place. It was not unattainable for their parents and grandparents.

So, they really embody all of the poor decisions that have been made by governments in Ottawa. Young people have that look of hopelessness. They have this fear, this uncertainty, and I want to replace that look in their eyes with one of hope and positivity and optimism. I really believe young people have gotten a raw deal. And that’s why they need a new deal. I want to now revert to making decisions that actually put young people — and by doing so, people in general —at the heart of the decision-making.