#fmha

Explore tagged Tumblr posts

Text

ah gotta love it when the waiting list of my local fmha closed on april 1st of last year.

0 notes

Text

3wdtni 3la enha daymn m3aya

3wdtni 3la tgom w tsweelo sandwich 9’3eer w fe 3eni kbeer

3wdtni 3la hug mn awl ma a97a kol yom

3wdtni kol yom kisses me

3wdtni kol 3ed melad heya awl w7da wishes me w tfaj2ni

3wdtni ma akol wlaaa wjba l7ali

3wdtni tt9l 3ly kol shwya

3wdtni ma td5l a7d wla yg3d 3l sma3a ysm3 hrj aa

3wdtni ma 3mrha ttkbr 3lya b ayi shi w tba ttfahm

3wdtni ma t76 lgma fe fmha bdooni abdn

3wdtni trsli love texts

3wdtni kol 3ed ttshyk leya w twreni shayktha w tro7 m3aya al 7rm

3wdtni a6lbha ashya2 bsee6a w tlbi

3wdtni ma ttnaagsh b 3nad abdn wla ned b ned

3wdtnii eni ma anaaam mn donha

Astgfrullah bs mn kol al kdb =p

0 notes

Video

instagram

#mosheroes #operationlifeafter #transition #support #help #information #knowledge #resources #FMHA #FTCC #CareerDevelopmentCenter #RAJeffrey #Beasleymediagroup #Bubbas33 #TexasRoadhouse #moessouthwestgrill #Buffalowildwings #redrobingourmetburgers #PaneraBread (at Old Wilmington Rd Neighborhood Resource Center) https://www.instagram.com/p/BqTxcZil7H1/?utm_source=ig_tumblr_share&igshid=10ep0vrdk0k57

#mosheroes#operationlifeafter#transition#support#help#information#knowledge#resources#fmha#ftcc#careerdevelopmentcenter#rajeffrey#beasleymediagroup#bubbas33#texasroadhouse#moessouthwestgrill#buffalowildwings#redrobingourmetburgers#panerabread

0 notes

Text

How Suburbanization Impacts Rural Home Loans

New Post has been published on https://goo.gl/ZLZCda

How Suburbanization Impacts Rural Home Loans

April 12, 2018 (STLRealEstate.News) — Federally backed home loans from the Rural Housing Service have been called one of the the government’s best kept secrets because buyers can get safe, affordable mortgage financing in areas where few other loan options are available. The underwriting requirements are considered both strong and reasonable, and, maybe most important, homes that wouldn’t be eligible for loans by conventional lenders are often eligible under the federal program. That’s because RHS recognizes that in rural areas, houses are not always built to meet the needs of suburban or urban buyers. The agency’s old name—Farmers Home Administration (FmHA)—says a lot about where the agency is coming from.

That’s why it’s significant that the U.S. Department of Agriculture, which oversees RHS, undertook a reassessment of what constitutes a rural area. That assessment was just completed and in about two months—June 4—a new map of rural areas takes affect. When it does, some areas that used to be considered rural are no longer considered that. One example is Ashburn, Va. Like so many areas in Northern Virginia, it’s being swallowed up by the D.C. metropolitan area. It’s now another suburb.

That means households who might struggle to get financing to buy a home can no longer count on direct or guaranteed loans from RHS. They’ll have to find conventional financing or maybe try FHA.

The good news for buyers in many of these new suburbs is their choice in lenders has probably increased along with the area’s population. In other words, maybe RHS is less needed now, because conventional lenders have moved in to take advantage of the area’s growth. But every area is different. There are probably a number of areas where the choice in lenders hasn’t kept up with growth, so the RHS loans will be missed.

In any case, it makes sense to learn if your area has been affected. The latest Voice for Real Estate news video from NAR talks about this and walks you through how you can see the status of your area.

The video also looks at some things FEMA is doing to encourage growth in private flood insurance options. Thanks in large part to a new consumer advocate in the Federal Emergency Management Agency, the agency said it will allow homeowners to drop their federal coverage and get private coverage instead without incurring any penalty. Prior to this change, you couldn’t do that. You had to keep your federal coverage even if you found cheaper or better private coverage. That consumer advocate, by the way, is there in large part thanks to NAR, which made sure it was part of flood insurance reform legislation that passed a few years ago. We’re now seeing the benefits of that.

In another change, insurance companies that offer the federal coverage can now also offer a private alternative. Again, that wasn’t allowed before. There are a few more improvements like that. The video walks you through them.

Also in the video is an update on competition in the real estate industry. You might recall that it was 10 years ago that NAR and the U.S. Department of Justice entered into an agreement to make sure virtual office websites (VOWs) are treated the same as brick and mortar brokerages in obtaining MLS data to share with people. That agreement expires later this year and the first of two workshops was held in Washington looking at the state of competition today. NAR Associate General Counsel Ralph Holmen (retired) participated in that workshop and made the point that the VOW business model wasn’t a big part of the market 10 years ago and is even smaller today, in part because it involves creating a client relationship with people who want to look at listings on your site. For many brokerages, it’s easier just to offer up listings without having to set up that client relationship first. NAR has said it doesn’t plan to change its VOW policy when that DOJ agreement expires.

The video also excerpts from the NAR Broker Summit that was held in Nashville earlier this month and also introduces a monthly video series NAR is launching for the year, Fair Housing Focus. The video is part of NAR’s recognition of the 50-year anniversary of the Fair Housing Act.

_____

SOURCE: news provided by STL.Properties via USPress.News – published on STL.NEWS by St. Louis Media, LLC (PS)

#affordable mortgage financing#FEMA#FHA#FmHA#Home Loans#NAR#RHS#Rural Housing Service#stl.properties#STLRealEstate.News

0 notes

Text

Panola Land Buying Association

Here’s the story I promised months ago (contributed by veteran civil and land rights activist John Zippert) … about the Panola Land Buying Association. With many more news outlets picking up on the travesty of Black Land Loss (See last month’s story in The New Yorker, The Washington Post and next month’s Atlantic Monthly), it’s important to note the wins along the way. Here’s the eighth in my series on the Federation of Southern Cooperatives, which has been fighting for Black farmers and their land for more than 50 years.

________________________

The Panola Land Buying Association (PLBA) in Alabama arose out of the civil rights and economic and social justice struggles of the 1960’s. The members of PLBA worked as tenant farmers, raising cotton, on three large plantations in north Sumter County, Alabama, near the town of Panola.

The members of PLBA joined Rev. Fred Shuttlesworth’s Alabama Christian Movement for Human Rights and were part of its Sumter County affiliate. Shuttlesworth was a fearless civil rights preacher from Birmingham who called Dr. King to join him to fight Bull Conner in the 1963.

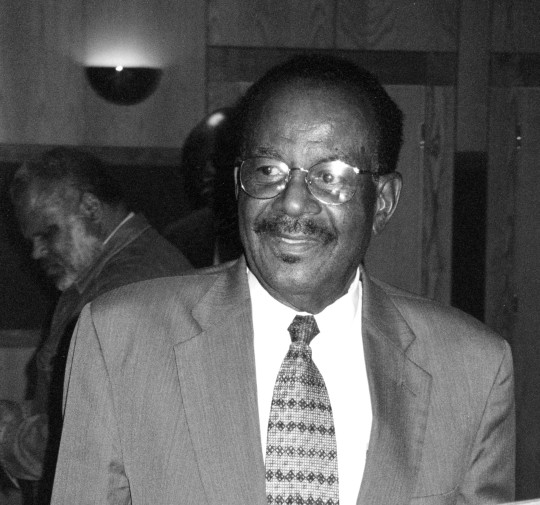

The Reverend Fred Shuttlesworth, whose Alabama Christian Movement for Human Rights inspired farmers in Sumter County to band together into the Panola Land Buying Association.

The tenant farmers, moved to action by the Civil Rights Movement, tried to register to vote in Sumter County. They also sued the three plantation owners for their share of the government price support payments on cotton. The tenants won their lawsuit in 1966, in part because one of the plantation owners, John Rogers, was also the chair of the Sumter County Agricultural Stabilization and Conversation Service (ASCS) Committee. The role of the local county ASCS committee was to determine crop allotments, crop yields and payments of subsidies when acreage allotments were reduced.

The ASCS regulations, promulgated by the USDA, provided that tenants and sharecroppers were to receive their proportionate share of acreage divergence payments and other government subsidies. At the local county level these rules were not implemented fairly. The tenants won a small settlement from the lawsuit, although most say the plantation owners took the money back and applied it to debts.

After the cotton was harvested in 1966, the plantation owners sent eviction notices to all 100 tenants on the three plantations, saying that they would have to move and seek a new livelihood because the owners were switching from cotton to cattle and raising pine trees on their land. Privately the plantation owners were heard to say they were tired of “uppity Negro,” although they didn’t exactly use those words. There were many other places across the South during this time where Black sharecroppers and tenants fighting for justice were evicted and had to find new places to live and work.

Cotton bales ready for market.

Some of the one-hundred families moved to Chicago, some moved to Tuskegee and forty families remained behind in Sumter County, living with relatives, looking for land to farm, houses to live in and alternative employment if farm land could not be found. These families formed the Panola Land Buying Association.

Three community organizers, affiliated with the Southern Cooperative Development Program and the Federation—Lewis Black from Greensboro, Albert Turner from Marion, and Thelma Craig from Lisman—began meeting with the PLBA member families to determine what they wanted to do. The families expressed their desire to purchase some land to farm and homes for their families to live in comfortably. They met in a small community store owned by Lewis and Tessie Thomas, in the Warsaw community that was part way between Panola and Gainesville. (Tessie Thomas, was later elected Constable in 1968, one of the first Black elected officials in Sumter County.)

Lewis Black found a white merchant, P. M. Norwood, in Gainesville who had just lost three tracts of land, totaling 1164 acres, in a foreclosure. At that time, the owner of foreclosed land had up to two years to redeem their land for the price of the foreclosure, plus legal fees and interest. Black persuaded Norwood to enter an agreement with the PLBA to redeem his land and sell two of the three tracts to PLBA.

Lucius Black (pictured) and his twin brother Lewis were champions of the economic justice and cooperative movements in Alabama. Lucius served on the Federation’s board of directors and Lewis was an original incorporator and served on the Federation’s staff. It was Lewis Black whose tireless work with the Panola Land Buying Associaiton managed to secure the land on which the Federation’s Rural Training Center now stands.

It took three more years and battles in local and Federal courts for PLBA to be able to excise its redemption rights to the land. By this time, Norwood had decided to withdraw from the transaction for a fee. In September 1970, the PLBA was awarded the land by the Federal District Court in Birmingham. The Federation and Father McKnight worked together to finance this transaction with four mortgages. The first mortgage was held by the League Life Insurance Company, a credit union-owned company in Detroit, Michigan.

At this point, the Federation, which was looking for a site to locate a co-op training center, came together with PLBA to reach an agreement. The Federation agreed to assist PLBA to pay for all of the land in exchange for title to 1,374 acres, where the Federation’s Rural Training Center was built.

Members visit the Federation’s Rural Training Center located on more than 1,300 acres of land acquired while helping the Panola Land Buying Association in its efforts to gain access to land for Black farmers.

The Federation continued to assist the Panola Land Buying Association to farm and develop their community-held land. The Wendy Hills subdivision of forty units of USDA/FmHA Multi-family Rural Rental Housing was built starting in 1978, after another protracted struggle with local agents of the state and Federal government.

As we celebrate our 50th anniversary, we are proud to say that between the Federation and the PLBA we still own every single acre of the original 1,164 acres, which was the basis of an on-going and enduring struggle.

#TheFederation#Federation of Southern Cooperatives#Panola Land Buying Association#Lewis Black#Fred Shuttlesworth#Alabama Christian Movement for Human Rights#Albert Turner#Thelma Craig#Black Land Loss

1 note

·

View note

Text

Bigger pocket cash only

#Bigger pocket cash only professional#

However, borrowers must pay mortgage insurance premiums, which protects the They are especially popular among first-time home buyers because they allow down payments of 3.5% for credit That's a clear advantage the 7/1 ARM has over other ARMsĪn FHA loan is a mortgage that is insured by the Federal Housing Administration. The borrower's interest rate will remain fixed. On their loan for a set period, after which the rates change. It is typically fixed in its terms and rate.Īdjustable rate mortgages (ARMs) allow borrowers to pay lower interest rates You are responsible for confirming the property details are accurate, complete, and suitable for your use case.Ī conventional loan is a mortgage that is not guaranteed or insured byĪny government agency, including the Federal Housing Administration (FHA), the Farmers Home Administration (FmHA),Īnd the Department of Veterans Affairs (VA). BiggerPockets obtains property details from various third-party sources, and BiggerPockets is not responsible or liable for the accuracy, completeness, or suitability of the property details. Furthermore, BiggerPockets is not responsible for any human or mechanical errors or omissions. BiggerPockets is not responsible for the consequences of any decisions or actions taken in reliance upon or as a result of the information provided by these tools. The results presented may not reflect the actual return of your own investments.

#Bigger pocket cash only professional#

BiggerPockets recommends that you seek the advice of a real estate professional before making any type of investment. The calculators found on BiggerPockets are designed to be used for informational and educational purposes only, and when used alone, do not constitute investment advice. Use of this calculator signifies your agreement to our Terms of Use and the terms posted below.

1 note

·

View note

Text

MilkMan - War Crimes In E Minor, Drown (Indie Pop)

🕑 Lesedauer: 2 min Mit einem hervorragendem Indie Pop / R&B Mix überzeugte uns heute der in Asbury Park (New Jersey) beheimatete Künstler MilkMan, dessen Single 'War Crimes In E Minor (Drown)' erst kürzlich erschien. Was seinen Sound für uns so besonders macht, liegt in erster Linie an seinem flotte und temporeichen Stil, der zeitgleich aber auch eine Menge lässiger und entspannender Vibes zu Vorschein bringt. Zudem erinnert der Klang an so manche klassischen Indie Produktionen der späten 80er / frühen 90er. Die fabelhaften Synthensizer Klänge, die hierbei in verschiedenen Facetten auftauchen und im Einklang mit coolen E-Gitarren Licks spielen, sind weit aus mehr als nur Gelungen. Auch eine solide Orgel trägt eine coole Solo Passage dazu bei und mischt das Arrangement ordentlich auf. Neben einem aufgelockerten und ausgefeilten Beat stehen klar definierte Lead Vocals im musikalischen Fokus, die sich mit Leichtigkeit über das Instrumental legen. Ein klein wenig Dance und Indie Disco Charakter bringt 'War Crimes In E Minor (Drown)' ebenso zum vorschein. Wir empfehlen auf alle Fälle selbst mal bei Spotify reinzuhören und mit MilkMan's neuer Musik up-to-date zu bleiben: Melodie: ★★★★☆ | Produktion: ★★★★☆ | Arrangement: ★★★★☆ | Lyrics: ★★★★☆ Weitere Songs von Milkman, die wir gut finden: Tuna For Dinner FMHA, Spotify: https://open.spotify.com/artist/18BM1U0qrNxBLc17UQW8dk?si=T1cTRuq9TfO4xdrHH1l2og Instagram: https://www.instagram.com/milkmanmusic_/ Text: Adrian Prath /discovered by Musosoup #sustainablecurator

0 notes

Text

"Lean On" by Major Lazer, DJ Snake, and MØ Crowned as Decade's Biggest Summer Song by Kiss FM and Shazam

"Lean On" beat out "Wake Me Up," "Despacito," and more on its way to the top.

Kiss FMhas curated a list of the biggest summer songs of the last decade. To come up with their winner, they teamed up with Shazam to see which track was searched for the most. While the list is extremely EDM-oriented, one song stood above the restâ"Lean On" by Major Lazer, DJ Snake, and MÃ.

youtube

Just behind the winner in second and third place, respectively, are "Despacito (Remix)" by Luis Fonsi & Daddy Yankee, and Justin Bieber and "Wake Me Up" by Avicii and Aloe Blacc. Also included in the top 50 is music from Calvin Harris, ZHU, and Skrillex and Diplo's supergroup Jack Ã. After analyzing the ranked songs, The Mail concluded that 2018 is the most represented year on the list but 2015 has the most tracks in the top ten.

Kiss FM host Tyler West spoke about how the list serves as a way to help us look ahead at the bright future instead of letting the ongoing global health crisis get us down.

Summer might be a little different this year, but it doesnât mean we canât blast out some music, get amongst happy memories and have a good time. Hosting this show brought me back so many moments of past summers gone by and this selection is the perfect playlist to get you pumped for those sunny days ahead.

You can view the entire list of finalists from Kiss FM and Shazam's "biggest song of the summer" contest here.

FOLLOW MAJOR LAZER:

Facebook: facebook.com/majorlazer Twitter: twitter.com/MAJORLAZER Instagram: instagram.com/majorlazer

FOLLOW DJ SNAKE:

Facebook: facebook.com/djsnake.fr Twitter: twitter.com/djsnake Instagram: instagram.com/djsnake

FOLLOW MÃ:

Facebook: facebook.com/MOMOMOYOUTH/ Twitter: twitter.com/MOMOMOYOUTH Instagram: instagram.com/momomoyouth/

from Best DJ Kit https://edm.com/news/lean-on-kiss-fm-summer-list

0 notes

Link

What is a conventional mortgage?

What is a Conventional Mortgage Loan?

Are you looking for information about What is a Conventional Mortgage Loan?? Is it important for you to get the right details about What is the minimum credit score for a conventional mortgage??

Do you want to get info about What credit score is needed for a conventional mortgage??

If you are looking to find the best Cary NC conventional mortgage loans - you are off to a good start...

What is a Conventional Loan?

A conventional loan is a mortgage that is not guaranteed or insured by any government agency, including the Federal Housing Administration (FHA), the Farmers Home Administration (FmHA) and the Department of Veterans Affairs (VA). It is typically fixed in its terms and rate.

Definition

Mortgages can be defined as either government-backed or conventional. Government agencies like the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) insure home loans, which are made by private lenders. This insurance is paid for by fees collected from mortgage borrowers. The US Department of Agriculture (USDA) loans money to lower-income borrowers through its Direct Housing Program. It also guarantees loans made by private lenders through its Guaranteed Housing Loans program. This backing is paid for by borrowers. Mortgages not guaranteed or insured by these agencies are known as conventional home loans. They include:

Conforming loans

Non-conforming loans

Jumbo loans

Portfolio loans

Sub-prime loans

Conventional Loans Explained

About half of all conventional loans are called “conforming” mortgages, because they conform to guidelines established by Fannie Mae and Freddie Mac. These two government-sponsored enterprises (GSEs) buy mortgages from lenders and sell them to investors. Their purpose is to make mortgages more widely available. All conforming mortgages are also conventional mortgages. Loans that do not conform to GSE guidelines are referred to as “non-conforming” home loans. Non-conforming loans that are larger than loan limits set by the GSEs are often referred to as “jumbo” mortgages. All non-conforming mortgages are also conventional mortgages. Conventional loans held by mortgage lenders on their own books are called “portfolio” loans. Because lenders can set their own guidelines for these loans and do not sell them to investors, these products may have features that other mortgages do not. For example, a portfolio lender might allow a borrower to use investments like stocks and bonds as security for a mortgage for which she would not otherwise qualify. Conventional home loans marketed to borrowers with low credit scores are called sub-prime mortgages. They typically come with high interest rates and fees. The government has created special rules covering the sale of such products, but they are not government-backed — they are conventional loans.

Common Questions About conventional mortgage loans

Question:

What credit score is needed for a conventional mortgage?

Answer:

Conventional loans are best suited for borrowers with good credit. Mostconventional mortgages will require a minimum credit score of 620-640. Having a higher credit score is even better. If you're score is on the lower end, or below the minimum score required than an FHA loan may be a better option for you.

Question:

What are 30 year fixed conventional mortgage rates?

Answer:

The 30-year conventional fixed-rate mortgage has long been popular due to its fixedinterest rate and lower monthly payments. However, since the interest payments are spread out over 30 years, you'll pay more interest over the life of the loan than you would on a shorter-term mortgage.

When searching for the best expert info about conventional mortgage loans - Cary - you will find plenty of tips and useful information here. You are probably trying to find more details and useful info about: - What is a Conventional Mortgage Loan? - What is the minimum credit score for a conventional mortgage? - What credit score is needed for a conventional mortgage? - 30 year fixed conventional mortgage rates - conventional mortgage vs fha

Get answers to all your questions about What is a Conventional Mortgage Loan?, What is the minimum credit score for a conventional mortgage?, and What credit score is needed for a conventional mortgage? ... Remember... We are here to help! When you need help finding the top expert resources for conventional mortgage loans - Cary - this is your ticket...

Ready to get your conventional mortgage rate quotes? Cary Mortgage Pros are the answer. Call us today at 919.443.5046 or fill out our easy 60 second questionnaire at https://mortgagebroker.pro/go Learn More About Cary conventional mortgage loans

https://ift.tt/2RNN0Ok Brought to you by 919Mortgages.com (https://ift.tt/2d5GzFS)

0 notes

Photo

#DSSEmpowersWomen https://www.instagram.com/p/BuwPS_-Fmha/?utm_source=ig_tumblr_share&igshid=42qdexhakcsd

0 notes

Video

instagram

#Mosheroes #FMHA #FTCC #TiffanyLesane #KarenMoore #OperationLifeAfter #Wheresyourhustle #Endhomelessness #Endunemployment (at Old Wilmington Rd Neighborhood Resource Center) https://www.instagram.com/p/BqIWRRLlr97/?utm_source=ig_tumblr_share&igshid=7ltphv7ivgw0

#mosheroes#fmha#ftcc#tiffanylesane#karenmoore#operationlifeafter#wheresyourhustle#endhomelessness#endunemployment

0 notes

Link

Terms Beginning With 'F' 1913 Federal Reserve Act FAANG Stocks Face Value Facility Factor Factor Investing Factor Market Factors of Production FactSet Facultative Reinsurance Fail Fair Credit Billing Act (FCBA) Fair Credit Reporting Act (FCRA) Fair Debt Collection Practices Act (FDCPA) Fair Labor Standards Act Fair Market Value (FMV) Fair Value Fallen Angel Falling Knife Fama and French Three Factor Model Family and Medical Leave Act (FMLA) Family Limited Partnership (FLP) Family Offices FANG Stocks Farmers Home Administration (FmHA) Fast Fashion Fast-Moving Consumer Goods (FMCG) FDIC Insured Account Fear and Greed Index Fed Balance Sheet Federal Agencies Federal Communications Commission (FCC) Federal Deposit Insurance Corporation (FDIC) Federal Direct Loan Program Federal Discount Rate Federal Funds Federal Funds Rate Federal Home Loan Bank System (FHLB) Federal Housing Administration (FHA) Federal Housing Administration Loan Federal Income Federal Insurance Contributions Act (FICA) Federal Open Market Committee (FOMC) Federal Open Market Committee Meeting (FOMC Meeting) Federal Poverty Level (FPL) Federal Reserve Bank Federal Reserve Board (FRB) Federal Reserve System (FRS) Federal Trade Commission (FTC) Federal Unemployment Tax Act (FUTA) Feasibility Study Fee Feed-In Tariff (FIT) Feeder Fund FHA 203(k) Loan Fiat Money Fibonacci Extensions Fibonacci Numbers and Lines Fibonacci Retracement FICO Score Fidelity Bond Fiduciary Filing Status Fill Or Kill (FOK) Finance Financial Account Financial Accounting Financial Accounting Standards Board (FASB) Financial Advisor Financial Analysis Financial Asset Finance Charge Financial Crisis Financial Distress Financial Economics Financial Engineering Financial Exposure Financial Guarantee Financial Health Financial Inclusion Financial Independence, Retire Early (FIRE) Financial Industry Regulatory Authority (FINRA) Financial Information Exchange (FIX) Financial Institution (FI) Financial Instrument Financial Intermediary Financial Literacy Financial Market Financial Modeling Financial Performance Financial Plan Financial Planner Financial Risk Financial Risk Manager (FRM) Financial Sector Financial Statement Analysis Financial Statements Financial Structure Financial System Financial Technology (Fintech) Financial Times Stock Exchange Group (FTSE) Financing Finder's Fee FINRA BrokerCheck Fire Insurance Firm First In, First Out (FIFO) First Mortgage First Mover First Notice of Loss (FNOL) First World Fiscal Deficit Fiscal Multiplier Fiscal Policy Fiscal Year (FY) Fiscal Year-End Fisher Effect Fisher Transform Indicator Fitch Ratings Five Cs of Credit Five-Year Rule Fixed Annuity Fixed Asset Fixed Asset Turnover Ratio Fixed Capital Fixed-Charge Coverage Ratio Fixed Cost Fixed Exchange Rate Fixed Income Fixed Income Clearing Corporation (FICC) Fixed-Income Security Fixed Interest Rate Fixed-Rate Mortgage Fixed-Rate Payment Flat Flat Tax Flat Yield Curve Flexible Manufacturing Systems (FMS) Flexible Spending Account (FSA) Flip Float Floating Charge Floating Exchange Rate Floating Interest Rate Floating Rate Fund Floating Rate Note (FRN) Floating Stock Floor Area Ratio (FAR) Floor Trader (FT) Flotation Flotation Cost Flow of Funds (FOF) Flow-Through Entity Folio Number Follow-On Offering Follow On Public Offer (FPO) Food And Drug Administration (FDA) Footnotes to the Financial Statements For Sale By Owner (FSBO) Forbearance Force Majeure Forecasting Foreclosure Foregone Earnings Foreign Account Tax Compliance Act (FATCA) Foreign Aid Foreign Corrupt Practices Act Foreign Currency Convertible Bond (FCCB) Foreign Currency Swap Foreign Direct Investment (FDI) Foreign Earned Income Exclusion Foreign Exchange Foreign Exchange Reserves Foreign Exchange Risk Foreign Institutional Investor (FII) Foreign Investment Foreign Portfolio Investment (FPI) Foreign Tax Credit Forensic Accounting Forensic Audit Forex (FX) Forfaiting Forfeited Share Form 3 Form 4 Form 144 Form 1040X Form 1045 Form 1065 Form 1095-A Form 1095-B Form 1095-C Form 1098 Form 1099-B Form 1099-DIV Form 1099-INT Form 1099-MISC Form 1099-R Form 1099-Q Form 1120S Form 1310 Form 13F (SEC) Form 2106: Employee Business Expenses Form 2106-EZ: Unreimbursed Employee Business Expenses Form 2439 Form 2848 Form 4506: Request for Copy of Tax Return Form 4562 Form 4684 Form 4797 Form 4952 Form 5405 Form 6251 Form 6252 Form 6781 Form 706 Form 8283 Form 8379 Form 8396 Form 843 Form 8606 Form 8949 Form ADV Fortune 100 Fortune 500 Forward Contract Forward Dividend Yield Forward Exchange Contract Forward Integration Forward Market Forward Points Forward Premium Forward Price Forward Price-To-Earnings (Forward P/E) Forward Rate Forward Rate Agreement (FRA) Four Asian Tigers Four Percent Rule Four Ps Fourth World Fractal Indicator Fractional Reserve Banking Fractional Share Franchise Franchise Tax Franchisee Franked Dividend Fraud Freddie Mac Free Carrier (FCA) Free Cash Flow (FCF) Free Cash Flow to Equity (FCFE) Free Cash Flow to the Firm (FCFF) Free Cash Flow Yield Free Enterprise Free-Float Methodology Free Look Period Free Market Free On Board (FOB) Free Rider Problem Free Trade Free Trade Area Freemium Frequency Distribution Freudian Motivation Theory Frictional Unemployment Friedrich Engels Friedrich Hayek Fringe Benefits Front-End Debt-to-Income Ratio (DTI) Front-End Load Front Office Front-Running Full Costing Full Disclosure Full Employment Full Ratchet Fully Amortizing Payment Fully Diluted Shares Fully Vested Functional Currency Functional Obsolescence Fund Fund Flow Fund Manager Fund of Funds (FOF) Fundamental Analysis Fundamentals Funded Debt Funds From Operations (FFO) Funds Transfer Pricing (FTP) Fungibility Furniture, Fixtures, and Equipment (FF&E) Future Value (FV) Future Value of an Annuity Futures Futures Commission Merchant (FCM) Futures Contract Futures Market More Terms "Your imagination is our reality" "Your dream becomes reality with us" - AKAL HATI Technology -

0 notes

Link

Mamá digital es el Web Site de Melva Sangri, la influencer que te lleva de la mano a la era actual de la tecnología para que navegues de una manera sencilla y segura.

Melva Noemi Sangri Vargas, es una influencer mexicana nacida en febrero de 1973, madre de: Ricky, Andy, Dolly, y Stophen. Está graduada como Licenciada en Administración con especialidad en turismo, tiene un postgrado en Comunicación, Liderazgo y Trabajo en Equipo. Además es escritora, conferencista, coach y Business Speaker. Por otro lado, también es presidenta y fundadora de Mamá Digital IAP, un proyecto que impulsa a las madres y mujeres en general a conocer y aprovechar las herramientas que nos brinda la tecnología

${INSTAGRAM:Bp2ZIq-FMha}

Soy Mamá Digital

Melva consciente de que el uso del Internet y las redes puede parecer complicado para algunos, creó esta plataforma digital pensando en las mujeres y en especial en las mamás que no tienen conocimiento de cómo manejarse en la Web. El principal objetivo de Soy Mamá Digital, es que más personas aprendan a utilizar las herramientas que le faciliten el uso de los recursos valiosos que ofrece la tecnología.

${INSTAGRAM:ByIOxPXhA_B}

Un abanico de herramientas

La tecnología está presente en casi todas las actividades del día a día, tanto en lo personal como lo profesional. Es por esto que la influencer pone al alcance de tu mano toda una gama de actividades y herramientas como cursos, talleres y conferencias para capacitarte en el manejo eficaz de las plataformas digitales y así puedas aprovechar todos los beneficios que te ofrece la Web.

Si eres un influenccer y quieres trabajar con la neta, regístrate aquí

Te puede interesar: Influencer Rossie Santana, un gran ejemplo de la mujer emprendedora mexicana

Navegando con seguridad

Melva destaca la importancia de la seguridad al navegar en la web, sobre todo para los niños, es por ello que busca que los padres tengan conocimiento del manejo de los recursos tecnológicos. De esta forma podrán controlar que el contenido manejado por sus hijos sea adecuado, seguro y educativo. Son muchas las herramientas que te brinda esta influencer para que tus niños puedan navegar en Internet de manera segura.

${INSTAGRAM:BuP5LXIFrsn}

Te puede interesar: La influencer Fabiola Ortíz crea oportunidades de negocio para la mujer mexicana Empoderamiento en la Red

Si algo ha sabido aprovechar Melva Sangri es la gran influencia de las redes sociales para lograr llegar a muchísimas personas y promover el empoderamiento femenino. Estando siempre acompañada de profesionales comprometidas de diferentes edades, demostrando que esto no es obstáculo para tener el conocimiento necesario y prepararnos para cumplir nuestros sueños mientras estan conectadas en esta era digital.

Si eres una empresa que quiere trabajar con influencers regístrate aquí

A través de Mamá Digital, Melva logra llegar a muchas mujeres y brindarles las herramientas necesarias para que puedan aprovechar los beneficios de la tecnología y desenvolverse de forma sencilla y segura en esta era digital.

Síguenos en Instagram y Twitter y deja tus comentarios

via La Neta – La comunidad más grande de influencers emergentes y creadores en español

0 notes

Text

Federal Food Security Act

Food Security Act of 1985 is designed to prevent the conversion of wetlands into non-wetland areas. All the features of the Act are alternatively also referred to as the “Swampbuster” provisions. While establishing a dairy herd buyout program, the act also provisioned for lower commodity prices and income support for farmers.

The Federal farm program benefits are made inaccessible to farm producers who have converted wetlands into cultivable lands after December 23, 1985. Inadvertent violations were considered through the Food, Agriculture, Conservation, and Trade Act of 1990 where farmers gain access to all lost benefits if the converted wetlands are restored to original conditions.

The Federal government is allowed to get into contracts with agricultural producers for removing highly erodible cropland from production in exchange for annual rentals. Wetlands, converted wetlands, highly erodible lands and agricultural lands are the natural resources governed by the Act.The benefits denied to a producer, who has cultivated agricultural commodity on converted wetlands are as follows:

commodity price support or production adjustment payments;·

farm storage facility loans;·

disaster payments;·

payments for storage of grain owned or controlled by the Commodity Credit Corporation;

Federal crop insurance;

FMHA loans.

0 notes

Link

A conventional loan is a mortgage that is not guaranteed or insured by any government agency, including the Federal Housing Administration (FHA), the Farmers Home Administration (FmHA) and the Department of Veterans Affairs (VA). It is typically fixed in its terms and rate. With low rates and flexible financing options, a conventional mortgage loan from Mountain America provides a variety of affordable home financing options. For information visit us!

0 notes

Note

Bae feh w7da t9ourenha daym m5rma fmha abi account 7gha

@kdotkid ?

0 notes