#fintechinnovations

Explore tagged Tumblr posts

Text

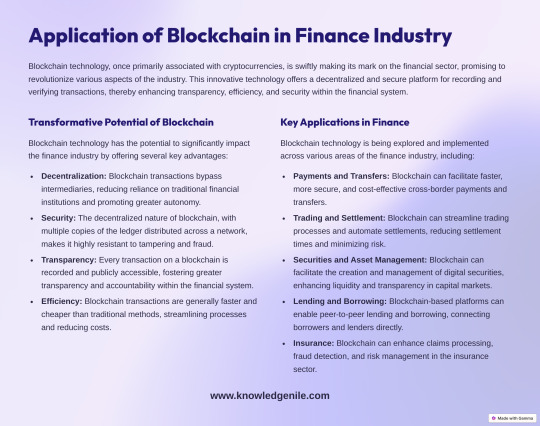

Blockchain Applications in Financial Services: A Game-Changer

The financial sector is undergoing a massive transformation, thanks to blockchain technology! With its ability to enhance security, reduce costs, and streamline operations, blockchain is powering innovations in cross-border payments, fraud detection, and smart contracts. Check out this infographic to uncover the practical applications of blockchain in finance and why it’s becoming a must-have in the industry.

Want to dive deeper into how blockchain is revolutionizing financial services? Tap the link to access our comprehensive blog!

#BlockchainFinance#FintechInnovations#DecentralizedTech#FinancialServices#DigitalFinance#BlockchainApplications#FutureOfFinance

0 notes

Text

#EarlyWageAccess#FinancialFlexibility#PayrollInnovation#EmployeeWellBeing#FinancialEmpowerment#NoMoreHighInterest#DebtFreeLiving#SmallBusinessBenefits#HREfficiency#WageAccessSolutions#EarningPower#FinancialStability#EmployeeRetention#FinancialFreedom#WorkplaceFinancialWellness#FintechInnovations#PaydaySolutions#NoMorePaycheckToPaycheck#FinancialSecurity#SmartMoneyManagement

0 notes

Text

AI will not take over the world (…yet)

0 notes

Text

The FIT21 Act: Paving the Way for a New Era in Digital Finance

Introduction: Today marks a pivotal moment for the digital finance sector as the U.S. House of Representatives considers the Financial Innovation and Technology for the 21st Century Act, commonly known as the FIT21 Act. This legislation is set to bring much-needed regulatory clarity to the digital asset ecosystem, promising to enhance consumer protections while fostering innovation.

Background: Non-compete agreements have traditionally been used by companies to prevent employees from joining competitors or starting similar businesses for a specified period. However, these agreements have often been criticized for limiting worker mobility and stifling innovation. On the other hand, the FIT21 Act aims to address the digital finance sector, which has been plagued by regulatory uncertainty. This act seeks to establish a comprehensive framework for digital asset regulation, delineating clear roles for the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

Key Provisions of the FIT21 Act:

Consumer Protections: The FIT21 Act mandates comprehensive disclosures from digital asset developers and customer-serving institutions, such as exchanges and brokers. These requirements are designed to ensure that consumers have access to accurate and relevant information, enhancing transparency and accountability.

Regulatory Jurisdiction: The Act provides a clear division of regulatory authority between the CFTC and the SEC. The CFTC will oversee digital assets classified as commodities, particularly those with decentralized blockchains. The SEC will regulate digital assets deemed securities, focusing on those with less decentralized structures.

Operational Requirements: Entities required to register with either the CFTC or the SEC will need to adhere to strict operational requirements. These include safeguarding customer assets, providing detailed disclosures, and reducing conflicts of interest.

Implications for Employees and Employers:

For Employees: The FIT21 Act, by reducing the ambiguity in digital asset regulation, could create new job opportunities in the fintech sector. Enhanced consumer protections and regulatory clarity may lead to increased trust and investment in digital assets, driving job growth and innovation.

For Employers: Companies in the digital asset space will need to adapt to the new regulatory landscape. This includes complying with detailed disclosure requirements and operational standards set forth by the CFTC and SEC. While this might increase compliance costs, it also provides a more stable and predictable regulatory environment, which can be beneficial in the long run.

Future Outlook: The passage of the FIT21 Act represents a significant step forward for the U.S. digital asset market. However, potential legal challenges could arise, focusing on the extent of regulatory authority and compliance requirements. Despite these challenges, the Act aims to position the United States as a leader in the global digital finance landscape by fostering innovation and providing robust consumer protections.

Conclusion: The FIT21 Act is a landmark piece of legislation that promises to bring much-needed regulatory clarity to the digital asset ecosystem. By enhancing consumer protections and delineating clear regulatory responsibilities, the Act aims to foster innovation and secure the United States' position as a global leader in digital finance. As we await the outcome of today's vote, it's clear that the FIT21 Act could reshape the future of digital assets and employment within this burgeoning sector.

We Want to Hear from You! Share your thoughts and experiences related to today's topic in the comments below. Make sure to subscribe to our blog for the latest updates and in-depth analyses on this and other crucial financial subjects.

#FIT21Act#FinancialInnovation#DigitalAssets#BlockchainTechnology#CFTC#SEC#ConsumerProtection#DigitalFinance#RegulatoryClarity#Fintech#FinancialLegislation#InnovationInFinance#FinancialEcosystem#DigitalAssetRegulation#FintechRegulation#USFinancialMarket#FinancialServices#FintechInnovation#FinancialTechnology#CryptocurrencyRegulation#bitcoin#financial education#financial empowerment#financial experts#cryptocurrency#digitalcurrency#finance#blockchain#unplugged financial#globaleconomy

3 notes

·

View notes

Link

The future of payments is not just knocking on the door; it's here, revolutionizing how we transact daily. Our latest blog post delves into the innovative fintech technologies reshaping the payments industry.

Read on to explore how next-generation fintech solutions democratize access to financial services and make transactions as easy as a tap or a click. If you're a professional in the financial sector, a tech enthusiast, or someone curious about the future of payments, this piece offers thought-provoking insights for everyone.

#fintech#appdevelopment#mobileapp#reactjs#Fintechsolutions#fintehapp#fintech startup#fintechinnovation#technology#finance#paymentsolutions#mobiosolutions

10 notes

·

View notes

Text

Building a Neobank App in the USA? Here’s What You Need to Know!

Neobanking is transforming the financial landscape, offering seamless, digital-first banking experiences. If you're planning to develop a neobank app, here’s what you must consider:

🔹 Market Potential – Why neobanks are booming in the USA 🔹 Core Features – Must-have functionalities for a top-notch neobank app 🔹 Compliance & Security – Navigating regulations and ensuring data protection 🔹 Cost & Development Insights – Budgeting and tech stack choices

With the right approach, you can build a next-gen banking solution that attracts modern users!

#NeobankApp#FintechInnovation#DigitalBanking#NeobankDevelopment#FinanceTech#KodyTechnolab#BankingRevolution

0 notes

Text

The Latest Microfinance Software for Optimized Loan Processing

In the fast-evolving world of financial services, efficient loan processing is critical for microfinance institutions (MFIs) and non-banking financial companies (NBFCs). With an increasing demand for seamless digital lending, the latest microfinance software is revolutionizing loan management, automating processes, reducing human errors, and ensuring regulatory compliance.

A Microfinance Software Company in India plays a crucial role in developing and delivering cutting-edge solutions tailored for financial institutions. These solutions enhance efficiency, improve customer experience, and help financial institutions scale their operations with ease.

In this article, we will explore how Microfinance Banking Software is transforming loan processing, its key features, and why businesses must embrace this technology for optimized operations.

The Growing Need for Advanced Microfinance Software

Loan processing in traditional microfinance institutions often involves manual paperwork, prolonged approval cycles, and a high risk of errors. With digital transformation becoming a necessity, financial institutions must adopt the latest microfinance software to remain competitive and meet the growing demand for financial services.

Challenges Faced in Manual Loan Processing:

Time-Consuming Approvals: Loan applications processed manually take longer, delaying disbursals and impacting borrower satisfaction.

High Error Rate: Human errors in data entry, calculations, or documentation can lead to financial discrepancies.

Compliance Issues: Staying updated with government and financial regulations manually is difficult and increases the risk of penalties.

Operational Inefficiencies: Managing large volumes of customer data manually leads to inefficiencies and operational bottlenecks.

Scalability Limitations: Expanding operations without digital tools becomes challenging for growing microfinance institutions.

The introduction of Microfinance Banking Software helps financial institutions overcome these challenges by automating operations, improving efficiency, and ensuring compliance with regulatory standards.

Also read: How the Latest Microfinance Software Solutions Drive Efficiency

Key Features of the Latest Microfinance Software

The latest microfinance software integrates advanced tools to optimize loan processing, customer management, and financial operations. Some of its standout features include:

1. Automated Loan Origination & Disbursal

Modern microfinance software automates the loan application process, including eligibility checks, KYC verification, credit scoring, and approval workflows. This reduces the time taken from application to disbursement.

2. Digital KYC & Compliance Management

Staying compliant with financial regulations is crucial. The software streamlines KYC (Know Your Customer) processes by integrating with government databases and ensuring compliance with RBI and NBFC guidelines.

3. Paperless Documentation & E-Signatures

With digital document storage and e-signature integration, financial institutions can eliminate paperwork, reduce administrative costs, and improve efficiency.

4. Real-Time Credit Assessment

By leveraging AI-powered credit scoring, the software enables financial institutions to assess a borrower's creditworthiness instantly, reducing the risk of loan defaults.

5. Multi-Channel Customer Access

The software supports web and mobile platforms, allowing customers to apply for loans, check loan status, and make repayments through various digital channels.

6. Loan Portfolio Management & Analytics

With advanced reporting and analytics, Microfinance Banking Software provides financial institutions with insights into their loan portfolio, helping them make data-driven decisions.

7. Secure Cloud-Based Storage

Data security is a top priority for financial institutions. The software offers secure, cloud-based storage with encryption to protect sensitive customer and transaction data.

8. Seamless Integration with Payment Gateways

The software integrates with digital payment systems, enabling borrowers to make repayments through UPI, net banking, or mobile wallets.

Also read: How Microfinance Banking Software Can Improve Client Data Management

How Microfinance Software Optimizes Loan Processing

The transition from manual loan management to digital platforms significantly enhances efficiency. Here’s how the latest microfinance software optimizes loan processing:

1. Faster Loan Approvals

By automating credit scoring, document verification, and loan approval workflows, the software reduces processing time from days to minutes.

2. Improved Accuracy & Reduced Fraud

With AI-driven risk assessment and fraud detection algorithms, financial institutions can minimize errors and prevent fraudulent loan applications.

3. Enhanced Customer Experience

Borrowers benefit from quick loan approvals, digital onboarding, and easy repayment options, leading to higher customer satisfaction and retention.

4. Cost Reduction for Financial Institutions

Digitizing loan processing reduces the cost of paperwork, administration, and manual verification processes, leading to higher profitability.

5. Scalability & Expansion Opportunities

With cloud-based infrastructure and automated processes, financial institutions can expand their lending services to new markets without operational bottlenecks.

Also read: Benefits of Advanced Microfinance Software for Financial Efficiency

Choosing the Right Microfinance Software Company in India

Selecting the right and best Microfinance Software Company in India is crucial for financial institutions looking to optimize their loan processing. Here’s what to look for:

1. Industry Expertise & Proven Track Record

Partner with a company that has extensive experience in developing microfinance solutions and a proven track record of successful implementations.

2. Customizable & Scalable Solutions

Ensure the software can be tailored to your institution's specific needs and is capable of scaling with your business growth.

3. Security & Compliance Standards

Choose a provider that prioritizes data security, encryption, and compliance with industry regulations.

4. User-Friendly Interface & Customer Support

Opt for software that is easy to use and comes with robust customer support for seamless implementation and troubleshooting.

5. Cost-Effective Pricing Models

Compare pricing plans to ensure you receive value for money without compromising on essential features.

Check our article on: How Advanced Microfinance Software is Transforming Financial Services

Why GTech Web Solutions is the Best Choice for Microfinance Software

If you are looking for a reliable Microfinance Software Company in India, GTech Web Solutions Pvt. Ltd. offers cutting-edge Microfinance Banking Software that is designed to enhance loan processing efficiency.

What Makes GTech Web Solutions Stand Out?

✔ Advanced Technology – AI-powered loan management features for better risk assessment and automation. ✔ Customizable Solutions – Tailored software that aligns with your business model. ✔ Seamless Integration – Works with existing banking infrastructure for smooth digital transitions. ✔ Regulatory Compliance – Ensures adherence to RBI and NBFC guidelines. ✔ Excellent Customer Support – Dedicated support for hassle-free implementation and ongoing assistance.

By partnering with GTech Web Solutions, financial institutions can embrace digital transformation and streamline their lending operations with the latest microfinance software.

Conclusion

The latest microfinance software is a game-changer for financial institutions looking to optimize loan processing, improve efficiency, and enhance customer experiences. By eliminating manual inefficiencies and leveraging AI-driven automation, microfinance institutions and NBFCs can scale their operations with ease.

Choosing the right Microfinance Software Company in India is essential for seamless digital lending transformation. With GTech Web Solutions Pvt. Ltd., you get a trusted partner that provides innovative, secure, and scalable Microfinance Banking Software tailored to your needs.

Upgrade your lending process today with GTech Web Solutions and stay ahead in the competitive financial landscape!

#MicrofinanceSoftware#LoanProcessing#DigitalLending#Fintech#NBFC#BankingSoftware#FinancialInclusion#MicrofinanceSolutions#LendingTechnology#AIinBanking#FintechInnovation#CloudBanking#DigitalTransformation#FinanceTech#CreditManagement#SecureBanking#PaperlessBanking#SmartLending#AutomatedLoans#MicrofinanceIndia#FinancialGrowth#FintechSolutions#LoanManagement#NBFCSoftware#TechForGood#DigitalFinance

0 notes

Text

U.S. Strengthens Leadership in Digital Financial Technology

Source: csis.org

Share Post:

LinkedIn

Twitter

Facebook

Reddit

Pinterest

Promoting Innovation in Digital Assets

The U.S. administration has unveiled a new executive order to solidify the nation’s leadership in digital financial technology while ensuring economic liberty. The policy emphasizes fostering innovation in the digital asset sector, which includes cryptocurrencies, stablecoins, and blockchain technology. Key objectives outlined in the order include safeguarding citizens’ access to blockchain networks, protecting the sovereignty of the U.S. dollar, and ensuring fair access to banking services for all law-abiding entities. It also aims to create a regulatory environment that balances innovation with clear, transparent, and technology-neutral guidelines.

In addition, the administration has expressed strong opposition to Central Bank Digital Currencies (CBDCs), citing risks to financial stability, individual privacy, and national sovereignty. The order prohibits the establishment or promotion of CBDCs within U.S. jurisdiction and mandates the immediate termination of any ongoing plans or initiatives related to their development.

Revocation of Previous Policies and Establishment of a New Task Force

The executive order rescinds prior policies, including Executive Order 14067 and the Treasury Department’s framework on digital assets, to align with the new vision. The Department of the Treasury and other relevant agencies are directed to revoke or revise all regulations and guidance inconsistent with the current directive.

To ensure effective oversight and policy development, a President’s Working Group on Digital Asset Markets has been created. This group, comprising officials from key federal departments and agencies, is tasked with evaluating regulations, proposing new frameworks, and exploring initiatives such as a national digital asset stockpile. Within 180 days, the group will submit a comprehensive report to the President, outlining regulatory and legislative recommendations to advance leadership in digital financial technology.

Regulatory Clarity and Opposition to CBDCs

Central to the executive order is a strong stance against CBDCs. The administration argues that such digital currencies, controlled by central banks, pose significant threats to financial autonomy and privacy. All federal agencies are instructed to halt any CBDC-related initiatives and to focus on protecting the broader financial ecosystem from potential disruptions caused by these currencies.

By prioritizing regulatory clarity, innovation-friendly policies, and the responsible use of digital assets, the U.S. aims to establish its leadership in digital financial technology and maintain its competitive edge in the global digital economy. Public hearings and consultations with industry leaders will further guide the administration’s efforts to create a vibrant and inclusive digital asset market. This decisive step reaffirms America’s commitment to innovation while safeguarding its economic and technological sovereignty.

#DigitalFinanceLeadership#FinTechLeadership#DigitalFinancialTech#FinTechInnovation#DigitalFinance#FinancialTechnology#Leadership#Innovation

0 notes

Text

Unlock Insights, Unlock Growth!

Our expert designers at UX Creatives Design Agency crafted a cutting-edge fintech dashboard, empowering users to:

Track financial performance in real-time Analyze market trends with intuitive visuals Make data-driven decisions with confidence

Experience the power of informed decision-making.

#FintechInnovation#DashboardDesign#UIUX#UXDesign#FitnessTech#uiuxdesign#userinterface#webappdesign#uxuidesign#userexperience

0 notes

Link

0 notes

Text

Fund Your Business Dream in Just 59 Minutes!

Turn your business ideas into reality with quick and hassle-free MSME loans. Get digital approval in just 59 minutes and take your first step towards success. 💸 Apply now at www.psbloansin59minutes.com and unlock the growth potential of your business!

#PSB59#PSBLoansIn59Minutes#OPL#BusinessLoans#Loans#MSMELoan#DigitalApproval#QuickLoans#BusinessFunding#FastTrackFinance#PaperlessApproval#LoanInMinutes#Entrepreneurship#SmallBusinessLoans#FinancialSolutions#EasyFinance#MSMEFunding#DigitalTransformation#AccelerateYourBusiness#LoanApproval#SpeedyLoans#InstantApproval#FintechInnovation#BusinessGrowth#SMEFinance#HassleFreeLoans#ApplyOnlineNow#MSMEDevelopment#FinanceInnovation

0 notes

Text

5 Reasons Why FlutterFlow Is Ideal for Fintech Applications

Discover why FlutterFlow is the perfect choice for fintech app development. Learn about its speed, scalability, security features, and user-friendly interface to elevate your fintech solutions.

0 notes

Text

0 notes

Text

How RPA is Driving Transformation in the Banking Sector

The banking industry is undergoing a significant transformation, fueled by technological advancements and the need to enhance operational efficiency. Among the most powerful tools driving this change is Robotic Process Automation (RPA). With its ability to streamline complex tasks and improve accuracy, RPA is reshaping the future of banking, offering immense benefits for both financial institutions and their customers.

What Exactly is RPA?

Robotic Process Automation (RPA) is a technology that uses software robots or "bots" to automate repetitive, rule-based tasks across various applications and systems. These bots perform the same tasks that humans would do, but they do so much faster, with greater precision, and without the risk of human error. RPA is particularly valuable in industries like banking, where there is a high volume of transactions, data management, and compliance requirements.

RPA’s Impact on Banking Operations

Accelerated Transaction Processing: With RPA in place, tasks like processing payments, verifying transactions, and updating customer accounts can be completed much faster than manual methods. This reduces delays and increases the overall speed of operations, leading to quicker service for customers.

Cost Savings: Financial institutions can save significant amounts of money by automating repetitive tasks. This reduces the need for human labor in routine processes and allows banks to reallocate resources toward more strategic initiatives like innovation and customer engagement.

Enhanced Accuracy and Reduced Risk: RPA bots are designed to follow strict rules, ensuring tasks like data entry and document processing are completed with high accuracy. This level of precision is crucial in areas like regulatory compliance, where even minor errors can lead to hefty penalties.

Improved Customer Service: As RPA handles back-office processes, banking staff can focus on higher-value customer-facing tasks. This translates to better customer service, with faster response times, personalized experiences, and smoother interactions overall.

Real-World Applications of RPA in Banking

Customer Onboarding: Opening a bank account involves multiple steps, including verifying personal details, validating documents, and credit checks. RPA can automate many of these steps, making the onboarding process faster and more efficient for both banks and customers.

Account Management: Routine account management tasks, such as updating customer information, verifying account details, and processing transactions, can be automated with RPA. This not only increases efficiency but also ensures that data is kept up to date and accurate.

Fraud Detection: RPA can be utilized to monitor transactions in real time, flagging suspicious activities for further review. Bots can analyze patterns and detect anomalies, reducing the risk of fraud and improving security.

Loan Processing: Banks are using RPA to automate the loan approval process, from collecting application data to verifying financial documents. This accelerates the approval timeline, providing customers with faster responses while reducing administrative costs for the bank.

Compliance and Reporting: Staying compliant with ever-changing regulations is a constant challenge for banks. RPA can automate regulatory reporting, ensuring that all necessary documents are prepared accurately and submitted on time, reducing the burden on compliance teams.

The Future of RPA in Banking

As RPA continues to evolve, its integration with other cutting-edge technologies, such as Artificial Intelligence (AI) and Machine Learning (ML), will unlock even greater potential. AI-powered bots will be able to handle more complex tasks, from customer sentiment analysis to predictive analytics, providing banks with deeper insights and enhanced decision-making capabilities.

Furthermore, with the increasing adoption of RPA, banks will be able to offer more tailored and innovative services, pushing the boundaries of what is possible in the financial sector.

Conclusion

RPA is no longer a buzzword in banking; it’s a critical tool that is enabling financial institutions to stay competitive, enhance customer experiences, and improve operational efficiency. By automating routine processes, banks can focus on strategic initiatives that drive growth and innovation. The future of banking is digital, and RPA is at the heart of this transformation.

At Code Stew, we specialize in helping businesses harness the power of RPA to streamline operations and achieve digital transformation. Stay tuned for more insights and best practices on how RPA is changing the face of banking.

#RPAinBanking#AutomationForBanks#DigitalBanking#RoboticAutomation#AIinFinance#BankingTransformation#FintechInnovation#BankingSolutions#CustomerService

1 note

·

View note

Text

📈 Smarter Trading, Bigger Results: Powered by GiniTrade AI 🚀

🧠Your portfolio should be #intelligent. #GiniTrade #AI makes every #movement, every #trade even more intelligent. 🤖

🔑 Unlock Success Today

🌍 Together with #GiniFX #LLP we are revolutionizing #world of #trading. ❇️ Easy for the #newbies, but #Complex for experts.

📈Get smarter with your trading now 👇 🔗 https://ginitradeai.com/

1 note

·

View note

Text

Top Algo Trading Companies in Noida: Why Index InfoTech Stands Out

The financial markets are evolving rapidly, and algorithmic trading (algo trading) is leading this transformation. Among the many fintech companies in Noida, Index InfoTech has established itself as a key player, offering innovative solutions that empower traders.

Here’s a closer look at what makes Index InfoTech a preferred choice for algo trading in Noida:

1. Innovative Technology

Index InfoTech leverages advanced AI and machine learning algorithms to design platforms that analyze market data, detect patterns, and execute trades with unmatched precision.

2. Tailor-Made Solutions

Every trader has unique needs, and Index InfoTech understands that. Their platforms are fully customizable, enabling clients to implement strategies that align perfectly with their trading goals.

3. Lightning-Fast Execution

In algo trading, speed is the name of the game. Index InfoTech’s platforms are designed to offer ultra-low latency, ensuring trades are executed at the right moment for maximum profitability.

4. Comprehensive Training and Support

Index InfoTech provides end-to-end training and dedicated support, ensuring users—whether beginners or professionals—can use their platform effectively.

5. Multi-Market Integration

The ability to trade across multiple exchanges is a significant advantage. Index InfoTech seamlessly integrates with both Indian and global stock markets, providing clients with a wide range of trading opportunities.

6. Proven Industry Expertise

With years of experience and a strong track record, Index InfoTech has built a reputation as a reliable and innovative leader in algo trading. Their solutions have consistently delivered results for clients across different trading segments.

Why Noida is a Fintech Hotspot

Noida’s fintech ecosystem is growing rapidly, driven by its tech-savvy infrastructure, skilled workforce, and vibrant entrepreneurial culture. For companies like Index InfoTech, this environment fosters innovation and supports the development of cutting-edge trading solutions.

Conclusion: Elevate Your Trading with Index InfoTech

Whether you’re a seasoned trader or new to the world of algorithmic trading, Index InfoTech provides the technology, tools, and support you need to succeed. Their commitment to innovation and customer satisfaction makes them a leader in Noida’s algo trading market.

Start your algo trading journey today with Index InfoTech and experience the future of trading!

#AlgoTradingNoida#IndexInfoTech#FintechInnovation#AITradingSolutions#AlgoTradingExperts#LowLatencyTrading#TradingTechnologyIndia#NoidaFintech#StockMarketTools#AlgorithmicTradingLeaders

1 note

·

View note