#fintech singapore 2018

Explore tagged Tumblr posts

Text

Top 5 Software Quality Assurance Companies for Your Development Needs

In the ever-evolving digital landscape, businesses are recognizing the significance of quality assurance to achieve successful digital transformation. To ensure seamless software development and scalability, companies are turning to software quality assurance partners. These expert firms offer invaluable assistance in testing and ensuring the reliability and performance of software applications. In this article, we present a handpicked list of five top-notch software quality assurance companies that have consistently demonstrated their excellence in delivering top-notch solutions, backed by cutting-edge technologies and extensive experience.

Biplus

Founded in 2018, Biplus has quickly emerged as a dependable partner for diverse industries, including telecommunications, fintech, banking, SMEs, and startups. Headquartered in Vietnam, Biplus boasts the esteemed title of being an Atlassian Solution Partner, adding to its credibility. With a wealth of experience in managing large projects and implementing software development tools, Biplus is well-versed in Agile methodologies. This expertise enables them to provide clients with superior products and faster time-to-market, making them a preferred choice for software quality assurance needs.

Saigon Technology

With a robust global presence, Saigon Technology ranks among the leading software testing and quality assurance companies in Vietnam. Their impressive track record includes returning clients from Europe, Australia, Singapore, and North America. Offering a wide array of services, including offshore software development, web development, mobile application development, and SaaS product development, Saigon Technology has earned the trust of prestigious companies like Standard Chartered Bank and Abbott. This attests to their ability to deliver top-notch solutions across international borders.

Aalpha Information Systems India Pvt. Ltd.

Aalpha is a top-tier software outsourcing firm renowned for delivering cost-effective and high-quality solutions. With offices in the USA, Norway, and India, they have a global presence and cater to clients worldwide. Their expertise spans across various technologies, including ASP.NET, Java, PHP, Laravel, iOS, Android, and many more. The impressive list of clients, featuring names like Emaar and SwissRe, speaks volumes about Aalpha’s commitment to delivering scalable and affordable software quality assurance services.

SHIFT ASIA

SHIFT ASIA has earned its reputation as a trusted custom software testing services company. Combining traditional techniques with cutting-edge innovations like big data, AI, and blockchain, SHIFT ASIA assists startups and large corporations in developing and scaling software applications. With extensive experience in Agile development, DevOps, and software testing automation, SHIFT ASIA caters to various sectors, including manufacturing, healthcare, retail, and banking.

Aciety

Aciety stands out as a unique network comprising more than 1,600 European software service and product companies. Functioning as a platform to connect businesses with the right partners for development initiatives and dedicated developers for team augmentation, Aciety has successfully delivered thousands of mobile and online applications across industries. Leveraging advanced technologies like IoT, AI/ML, and blockchain, Aciety’s skilled development team creates multi-platform applications optimized for search engines, catering to diverse technological demands.

Conclusion

In today’s rapidly advancing digital era, selecting the right software testing services company holds immense importance for businesses seeking to thrive. The five companies mentioned above have consistently demonstrated their expertise in delivering exceptional software quality assurance solutions, tailored to meet diverse client requirements. Whether you seek cost-effectiveness, cutting-edge innovation, or global expertise, these top-tier software quality assurance companies have proven their ability to transform ideas into reality. Embrace the power of software outsourcing and unleash the true potential of your business!

0 notes

Text

Ngân hàng đang chậm hơn các công ty Fintech?

Ngân hàng đang chậm hơn các công ty Fintech? Rate this post Trang chủ Quan điểm Ngân hàng đang được chậm hơn những công ty tư vấn du học Fintech? Đó là sẻ chia của bà Chu Hồng Hạnh, Giám Đốc Innovation Lab của Ngân hàng ACB. Tại hội nghị “Định hình tương lai ngành dịch vụ tài chính – Reimagining the future of financial services in Vietnam” do JobHopin tiến hành, bà Hạnh đến biết xuất hiện 3 thời kì thay đổi số là Digitize (số hóa dữ liệu), Digitalization (ứng dụng technology số trong vận hành) và Digital Transformation (chuyển hướng số toàn thể). Đa số những bank VN đều đang được ở thời kì thứ hai. Tốc độ này đã chậm rộng so cùng với những trung tâm tư vấn du học Fintech, bà Hạnh nói cũng như cạnh tranh hợp tác là biện pháp ACB chia sẻ, tuy vậy để làm đc điều đó ACB cũng phải phải đạt tới tốc độ của nhiều đối tác. Phiên đàm luận về công ty đề “Hợp tác chiến lược vào hệ sinh thái Fintech: Từ kẻ thù cạnh tranh nhau cho đến đối tác đồng kiến tạo nên”. Nguồn: T.L Ông Đoàn Đăng Khoa, Phó Tổng Giám đốc FPT Smart Cloud mang đến biết năm 2022 khi là năm thăng hoa của tỷ lệ đưa vào điện toán đám mây vào mô hình hoạt động để số hoá cũng như buổi tối ưu dữ liệu công ty lớn. Cụ thể nếu như năm 2022, tỷ lệ doanh nghiệp VN công nhận điện toán đám mây là căn cơ mang lại tất cả mô hình kinh doanh, sáng kiến thay đổi số khi là 95%, không giảm từ không đến 40% so cùng với năm kia. Điều này dẫn đến 95% doanh nghiệp lớn chuẩn bị đưa vào CNTT như AI để không ngừng sự cảm thấy đẹp của người mua và công nghệ đám mây (cloud) – để đáp ứng tính an ninh, bảo mật. 35% chỉ đạo doanh nghiệp đánh giá và nhận định AI giúp gia tăng doanh thu ít nhất 5%. Đã có công ty đưa vào cũng như đạt đc những thành quả nhất định. Theo bà Hạnh, công nghệ chỉ khi là bề nổi lúc này nhiều chuyển hướng bên cạnh technology có ảnh hưởng gấp 15 lần mang đến toàn bộ tiến hành. “Như trang chủ Credit, việc dùng thử AI đã trợ giúp trung tâm tư vấn du học chở che đc một lượng quý khách lớn, không giảm 50% hiệu suất, rộng 12 triệu cuộc gọi hàng tháng cùng với độ hài lòng đã đc nhà đầu tư đánh giá 4 tại 5 điểm”, ông Khoa nói. Các nhân viên dự đoán ngành bank cũng tiếp tục không nằm ngoài xu phía này. Nhưng đi theo bà Hạnh của ACB, technology chỉ khi là bề nổi. Thay vào đó, các thay đổi ngoài technology có ảnh hưởng gấp 15 lần đến mọi tiến hành. Đây khi là nhiều nhân tố cần để thể hiện đột phá trợ giúp ACB bắt kịp đẩy nhanh của nhiều Fintech. “Con người và tư duy, số hóa quy trình dịch vụ, nguyên mẫu hoạt động số, tập hợp công nghệ lõi là 4 trụ cột chính. Chúng tôi đang được tìm tòi các nhân tài vào giai đoạn thay đổi này”, bà Hạnh nói. Nguồn Nhịp cầu Đầu tư Xem có thêm trên Youtube Fintech thách thức ngân hàng truyền thống | VTV24 Nếu trong năm 2018, công nghệ tài chính, hay còn gọi là fintech tại VN, chỉ nhận được lượng vốn tương đương 0,4% khu vực Đông Nam Á, thì trong năm qua, con số này đã vọt lên tới 36%, chỉ xếp sau Singapore. Trước áp lực fintech, 94% ngân hàng cho biết đang triển khai hoặc xây dựng chiến lược chuyển đổi số. ► Kênh Youtube Chính Thức của Trung tâm Tin tức VTV24 – Đài Truyền Hình Việt Nam ►Subscribe kênh ngay: http://bit.ly/VTV24Subscribe ►Đồng hành cùng VTV24 tại: Fanpage chính thức : fb.com/tintucvtv24 Chuyên trang Tài Chính: fb.com/vtv24money Zalo : zalo.me/1571891271885013375 Instagram : instagram.com/vtv24news/ Youtube Channel : youtube.com/vtv24 November 14, 2022 at 09:56AM

0 notes

Link

#virtual reality#fintechnews.sg#vr#November 2018#2018#gaming#singapore#fintech#Nintendo Wii#nintendo#wii#Morton Heilig#sega#heilig

7 notes

·

View notes

Text

Gen Matsuda, CEO of Beat HD (9399 TSE), is under Police Investigation. His Dubious Business & Political Partner, Yasushi “YASU” Kikuta, Leaked.

Gen Matsuda, the CEO of Beat Holdings Limited (TSE 9399), is under police investigation --- his business and political partner, Yasushi “YASU” Kikuta, leaked it and the screenshots were revealed.

According to the screenshots, police are repeatedly questioning Mr. Matsuda for his past “information product seller” period and the top of Beat Japan shared it with Kikuta-san (Mr. Kikuta). These pictures are considered having been taken around Wednesday November 4th, the U.S. Presidential Election day in Japanese time. Therefore, the conversation includes the topic.

For his old questionable businesses, Matsuda has frequently been whispered and criticized such as “Investment Fraud”, “Anti-Society Group (Yakuza)” and “Information Product Seller” . In April, He resigned his previous CEO position in OKWAVE Inc. (3808 NSE) for the suspicion of insider trading , and then become the president of Beat HD.

Besides this troublesome businessperson, YASU Kikuta is now the auditor of Japan Business Leadership Council (JBLC), an organization chaired by Matsuda. Kikuta serves as the CEO in a Malaysia based company, ETA HOLDINGS which often announces partnership with Beat HD.

[ JBLC Website https://www.j-blc.org/ ]

<ANNOUNCEMENT> [Crypto Messenger Wallet のライセンス供与等に係る覚書締結に関するお知らせ](2020 年 6 月 16 日) https://irbank.net/9399/140120200616445756

<ANNOUNCEMENT> (続報)Crypto Messenger Walletのライセンス供与等に係る覚書締結に関するお知らせ(2020年7月10日) https://www.nikkei.com/nkd/disclosure/tdnr/20200710460797/

[ ETA HOLDINGS Website ] https://www.eta-hd.com/

The headquarter of ETA HD looks located in Labuan, Malaysia.

[Twitter account of Kikuta] https://twitter.com/ETA_CEO

[Facebook Account of Kikuta and the Pictures] https://www.facebook.com/yasushi.kikuta.1

This time, we investigate Kikuta who revealed Matsuda’s scandal while cooperates with him in various stages. The result was astonishing: this person has a deeply suspicious background.

<Kikuta’s Official Profile> "After graduating from the Faculty of Music in Tokyo University of the Arts, Kikuta joined Sony Music Entertainment Inc. After working for Sony Corporation, he had become the Vice President at Sony Corporation of America, Sony Music Entertainment.

Then he joined SoftBank Group Corp. in 2006, and led the content business strategy of SoftBank Group Corp. as General Manager of Marketing Division of SoftBank Mobile Corp.

In 2010, Yasu Kikuta established SEVEN STARS ENTERTAINMENT and oversaw the financing of film and sports marketing businesses as a founder and co-representative.

Since 2012, he had been appointed as the General Manager of a Japanese corporation under Bluegold Capital group, which is headquartered in Singapore.

In 2018, he became the representative of ETA HOLDINGS Co., Ltd. in Malaysia. For the past 25 years, he has been involved in business incubation centered on entertainment, fintech and finance in Japan, North America, Europe and Asian countries.

"From the Faculty of Music in Tokyo University of the Arts, built up the career through SONY MUSIC, SONY, SOFT BANK, then established ETA Holdings in Malaysia! CEO / Managing Director / Director of JBLC"

<Kikuta’s True Profile>

While his bright official profile, various sources provided us his secret but true past course of career and it’s not splendid as the open one.

Kikuta actually graduated from Tokyo University of the Arts. However, at the college, he realized that he cannot make a live on his musical career by his majored instrument bassoon. Thereby he joined Sony Music as a new graduate and worked very hard at the company. As a result, he could transfer to Sony Co. and moved to station in New York for seven years.

Despite his success in Sony, he left Sony for unknown "some reasons". After working at a SoftBank (video-related) subsidiary, he changed his job to Fields Co., a pachinko (Japanese mechanical gambling game) company. In the company, Kikuta secretly tie up with Kenichi Egashira, CEO of Engagement Co. at present , to gain illegal income such as kickback. However, the fraud was revealed and Kikuta had to leave there and joined a martial arts promoting company as the president of the Japanese branch. After that, he job-hopped and worked as an director at two companies, Legit Co., Ltd. and Earth Agency Co. (EA) . At Legit, Kikuta quarreled and broke up with the co-executive, and also caused serious financial troubles at EA then he was kicked out .

In 2016, Kikuta joined JCU which a political organization related to Japan and the United States relation. In addition, he started leading a crypt-currency business in 2018 but resigned after being investigated for repeated fiscal disorder and several harassment cases. Moreover, it is said that Kikuta is now under an investigation on suspicion of illegal acts such as fraud and embezzlement. Currently, he officially announces that he is active as the president of ETA Holdings, which was established in Malaysia, and the director of the Japan Business Leadership Council (JBLC), which was established in Japan. However, it is said that there’s no activities other than sticking to JCU and Liberty Ecosystem PTE. Ltd., which he had to resign for scandals, and being a just flunky of Gen Matsuda of Beat HD.

As for his family, Minako Kikuta who the spouse of Yasushi is a full-time housewife from Nagoya. His son is Koh Kikuta and he studies at IGB International School in Selangor Darul Ehsan, Malaysia. Together with Yasushi, they are living a luxurious life in a huge condominium with a swimming pool called Desa Park City by money stolen from various companies and organizations.

In sum, Yasushi “YASU” Kikuta is a “scammer” who has caused financial troubles in every companies he was involved.

1 note

·

View note

Text

Can Bitcoin create a virtual world?

1) What is Bitcoin?

Have you ever heard of a story of a man who bought two pizzas using 10,000 Bitcoins? What is Bitcoin then? It is a tradable digital currency. It can be spent globally like real-world money but without the need for converting to different currency between countries (e.g. from $ to £), which is very convenient. But from a country's perspective, the most important power is the issue and control of the currency, they lost those power due to the existence of Bitcoin and they failed to shut it down. Therefore, they do not accept Bitcoin as a currency, only as a financial product, people can hype it but not consume it.

2) How was Bitcoin created?

An article called ‘Bitcoin: A peer-to-peer electronic cash system’ was published in 2018 by Satoshi Nakamoto. It perfectly described an advanced virtual currency system. Two months after the article was published, engineers built the system by following the instructions in that article. In 2009, the Bitcoin system was successfully launched.

Like the real-world currency (e.g. gold), Bitcoin was also dug out from the mine, but it is a virtual system. People use computer programs to dig out Bitcoins and the total amount is set to be 21 million (maximum authorised amount). Three factors will influence the digging speed: 1) the production rate of the mine. 2) the speed of the computer. 3) the numbers of diggers. However, the Bitcoin system has been operated for 11 years, most of the Bitcoins have been poached, the production rate of the mine has been dramatically dropped. If you want to join the diggers, it may take you years to dig out your first Bitcoin!

In 2009, when people started to mine Bitcoin, it almost worth nothing, so people use it to buy pizza, and this is the story at the beginning of this blogpost.

3) Advantages and disadvantages of Bitcoin.

The advantages of Bitcoin are: firstly, it has a constant value. As mention above, the maximum authorised amount is 21 million Bitcoins, so its value is set from the beginning. Moreover, the value of Bitcoin will not influence by political situations such as wars or social unrests. If wars are happening, the existing cash will be affected e.g. depreciate, the real cash can get lost by falling-off your pocket, but Bitcoin will not, and this leads to the next point: it has a high-level of security. Bitcoin is only a digital currency that exists on the internet, you just need to make sure you do not lose your Bitcoin banking account then you are safe. However, if your account has been stolen or forgotten, you will be unable to find it back. This because Bitcoin is highly digitally encrypted and cannot be cracked or traced, which means that your Bitcoins are gone, for good. Thirdly, low transaction fees. Usually, the transaction activities are free for Bitcoins, if it does, it will still be lower than the real currency since there is no intermediary agent, therefore all the transactions are point-to-point unless you invited a third party to join the transaction e.g. trading platform. From a government’s perspective, it is bad. Because they cannot control and trace the money, then it will be difficult to control their people.

On the other hand, the disadvantages. Firstly, it is easy to lose your account, despite Bitcoins are powerful and secure enough, but that does not mean the Bitcoin trading platforms are secured, due to hacking attacks, causing the trading platform supervisor to temporarily shut down the platform, or even permanently. Secondly, the transactions are not reversible. As they are digitally encrypted, you cannot prove that Bitcoin is yours, unless the seller is nice enough to transfer your Bitcoin back. Thirdly, Bitcoin is easy to be exploited illegally, due to no one is managing the Bitcoins and it cannot be traced, it can easily be used to do illegal things e.g. money laundering and drug-dealing. Lastly and most importantly, the Bitcoin system can be duplicated. is not duplicating the Bitcoin mines, but anyone can follow the instructions on that article to create their own virtual currencies and we do not know which we shall use and use world-widely. IMF (International Monetary Fund) has warned the world that every country needs to issue their own CBDC (Central Bank Digital Currency), which is a traceable and manageable currency, to prevent everyone from using virtual currency and giving up on trust in banks.

4) A more futuristic world?

If every country is going to issue their own CBDC, then the world’s currency will be virtualised, cash will be no longer existing. The wealth of the entire world has become an encrypted string of numbers, stored in a bank. One thing we can sure about is that governments must eventually virtualise their money, to get their power back (right of issuing and control of the currency) to control their people. Therefore, we need Fintech to have better management of our money in the bank (refers to my blogpost 1). Moreover, the policing of online transactions will be improved since every virtual currency transaction can be tracked.

Between 2013~2015, the Rockefeller financial group and Rothschild Family have issued their cryptocurrencies: ‘Ethereum’ (ETH) and ‘Ripple’(XRP), to promote the virtual currency market. Many countries have certified these two virtual currencies are safe e.g. Japan. So far, many countries have launched their own cryptocurrency such as China, Singapore, and Senegal, etc.

5) Conclusion

To sum up, currency virtualization is inevitable, and it has accelerated the virtualisation of matters. Because money is a representative of matters, only money can purchase physical items. Let us think about this in another way. Combining my blogpost 1, we can use Fintech to pay-off our debts and even make a purchase online, then the item will be delivered to our acquired location, throughout the transaction, we do not use cash for payment, and we do not even need to touch our wallet. The only thing we do is to make a few finger-taps on our mobile screen. By doing so, we only feel the deduction on digital numbers since our money is already transformed into numbers in our bank account. Therefore, in my opinion, this kind of life is virtual, and the world will eventually be virtualised because money has already been virtualised, it is about time.

1 note

·

View note

Photo

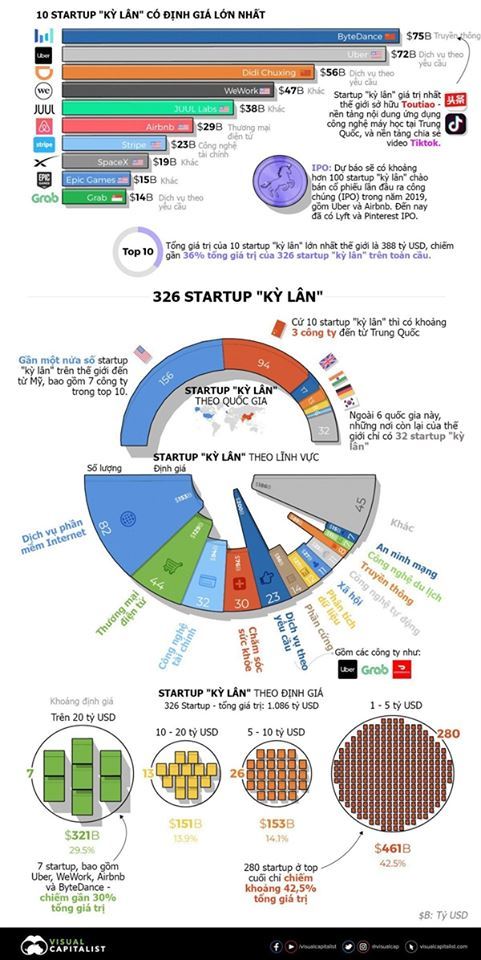

1. Startup "kỳ lân" là gì?

Trong giới startup (doanh nghiệp khởi nghiệp), khái niệm "kì lân" (Unicorn) dùng để chỉ các startup được định giá từ 1 tỉ USD trở lên. Tại Việt Nam, cách đây 5 năm, Công ty cổ phần VNG đã được định giá 1 tỷ USD từ World Startup Report, trở thành Công ty Internet lớn nhất Việt Nam khi ấy.

Trên thế giới, Mỹ là quốc gia sở hữu nhiều “kì lân công nghệ” nhất trong vòng 15 năm trở lại đây (tính từ thời điểm VNG thành lập) như Facebook, Uber, Instagram, Twitter, WhatsApp, Booking.com.v.v...

Trung Quốc nổi lên là quốc gia thứ hai sở hữu nhiều “kì lân công nghệ” và thậm chí nếu xét về tiêu chí giá trị startup thì Trung Quốc đã vượt Mỹ - với ứng dụng TikTok được định giá còn cao hơn cả Uber hiện tại (hơn 75 tỉ USD).

Theo CB Insights, trên thế giới hiện có 326 startup "kỳ lân", trong đó 7 công ty dẫn đầu - gồm Uber, WeWork, Airbnb, ByteDance, chiếm tới gần 30% tổng giá trị.

Số lượng các startup được định giá trên 1 tỷ USD tăng nhanh thời gian gần đây. Kể từ năm 2018 đến nay, có khoảng 119 startup tr��n thế giới gia nhập hàng ngũ "kỳ lân".

Công ty có giá trị nhất trong lĩnh vực Phần mềm & Dịch vụ Internet là startup Infor của Mỹ (định giá 10 tỷ USD). Startup chia sẻ chỗ ở Airbnb dẫn đầu lĩnh vực Thương mại điện tử với định giá 29,3 tỷ USD, trong khi đó nền tảng thanh toán Stripe là công ty giá trị nhất lĩnh vực Fintech với 22,5 tỷ USD.

Startup được định giá lớn nhất hiện nay là Toutiao (Bytedance) của Trung Quốc với 75 tỷ USD. Tiếp theo là Uber (72 tỷ USD) và Didi Chuxing (56 tỷ USD).

2. Những startup thành công nhất trên thế giới

Tạp chí Wall Street Journal và tổ chức theo dõi thị trường Dow Jones Venture Source vừa đưa ra danh sách các doanh nghiệp khởi nghiệp (start-up) đình đám nhất thế giới. Đây đều là những công ty tư nhân được nhiều quỹ đầu tư mạo hiểm nổi tiếng rót vốn trong vài năm qua.

Tính đến thời điểm tháng 10 năm nay, "câu lạc bộ" các startup trị giá tỷ USD đã lên đến 125 thành viên, trong đó Uber có trị giá cao nhất là 51 tỷ USD. Trong khi cùng thời điểm này năm ngoái, hội mới chỉ có 71 thành viên, với startup dẫn đầu Uber mới được định giá 18,2 tỷ USD.

Dưới đây là 5 tên tuổi khởi nghiệp trị giá cao nhất thế giới tính đến thời điểm hiện tại. Ngoài Uber, công ty đứng thứ nhì l�� hãng điện thoại Trung Quốc Xiaomi cũng có bước phát triển thần tốc, giá trị tăng từ 10 tỷ lên 46 tỷ USD chỉ sau 1 năm.

1- Uber

Đứng đầu danh sách này là Uber, hãng chuyên cung cấp dịch vụ xe taxi, đi chung xe. Chính thức ra mắt ứng dụng trên smartphone tháng 6/2009, đến nay Uber đã trị giá tới 51 tỷ USD, với tổng giá trị các vòng gọi vốn là 7,4 tỷ USD. Mới đầu, công ty chỉ cung cấp xe sang trọng, nhưng từ năm 2012 họ mở rộng dịch vụ ra quốc tế, đồng thời cho phép hoạt động rất nhiều loại xe. Do chi phí thấp hơn, giá cước của Uber cũng rẻ hơn nhiều so với taxi truyền thống.

Hiện nay Uber đã có mặt tại 58 nước trên thế giới và trên 300 thành phố. Tuy nhiên, tại rất nhiều nơi đã có các phong trào biểu tình phản đối Uber của các lái xe taxi và công ty taxi vì cho rằng đây là hoạt động kinh doanh không công bằng, không an toàn và bất hợp pháp.

2- Xiaomi

Hãng điện tử Trung Quốc Xiaomi được định giá 46 tỷ USD, chuyên thiết kế, sản xuất và bán điện thoại thông minh, máy tính bảng cùng các ứng dụng trên thiết bị di động. Từ sau sản phẩm đầu tiên ra mắt năm 2011, công ty này đã có những bước phát triển thần kỳ, có thị phần rất lớn trường lớn tại 2 thị trường đông dân nhất hành tinh là Trung Quốc và Ấn Độ, cùng nhiều nước khác như Malaysia, Singapore, Brazil…

Hiện Xiaomi có 8.000 nhân viên, là hãng sản xuất smartphone lớn thứ 3 thế giới, chỉ sau 2 ‘gã khổng lồ’ Samsung và Apple. CEO của họ Lei Jun là người giàu thứ 23 Trung Quốc theo danh sách mới nhất của Forbes. Hôm 8/4/2015, hãng lập kỷ lục Guinness với việc bán tới 2,11 triệu điện thoại chỉ trong vòng 24 giờ qua website trực tuyến.

3- Airbnb

Đứng thứ 3 là Airbnb, thành lập năm 2008, hiện đạt trị giá 25,5 tỷ USD. Công ty này có ý tưởng độc đáo về một mạng lưới dịch vụ lưu trú tại nhà riêng của người dân địa phương, bằng cách tạo ra một cộng đồng kết nối người có nhu cầu cho thuê trọ và người đi thuê. Loại hình này khiến cho những khách sạn truyền thống khó có thể cạnh tranh nổi về giá thành, sự linh hoạt cũng như những trải nghiệm văn hóa địa phương.

Sau những bước khởi đầu khá chậm chạp, đến năm 2011 công ty đã nhận được gần 120 triệu USD từ các quỹ đầu tư mạo hiểm, bắt đầu mở nhiều chi nhánh quốc tế tại các thành phố lớn trên thế giới. Hiện tại dịch vụ “ở nhờ” của công ty này có tổng giá trị các vòng gọi vốn lên đến 2,3 tỷ USD. Họ đã hiện diện tại 34.000 thành phố, ở 190 quốc gia. Giống như Uber, Airbnb cũng đang bị ngăn cản bởi nhiều nhà làm luật tại nhiều nơi, vì nó đi ngược hoàn toàn với các mô hình kinh doanh truyền thống.

4- Palantir

Palantir Technologies hiện được định giá 20 tỷ USD, bắt đầu đi vào hoạt động từ năm 2004, chuyên cung cấp phần mềm, công nghệ và dịch vụ phân tích dữ liệu bí mật từ đầu vào là những lượng dữ liệu khổng lồ. Họ có 2 sản phẩm chính: “Palantir Gotham” dành cho các nhà phân tích chống khủng bố của cơ quan tình báo, các nhà điều tra gian lận, các tổ chức chống tội phạm trên mạng internet; còn “Palantir Metropolis” được các quỹ đầu cơ và các dịch vụ tài chính doanh nghiệp sử dụng.

Công ty này hướng đến khách hàng là các cơ quan chính phủ như Bộ quốc phòng Mỹ, Bộ an ninh nội địa, CIA hay FBI, sử dụng những công nghệ mới nhất giúp các đơn vị hành pháp xử lý thông tin tốt hơn, giúp chính phủ đảm bảo an ninh nhưng vẫn tôn trọng sự riêng tư của người dân.

5- Snapchat

Ứng dụng tin nhắn chia sẻ video tự hủy Snapchat phát hành lần đầu năm 2011 ngay lập tức đã tạo nên ‘cơn sốt’ trong giới trẻ Mỹ và sau đó lan ra nhiều nơi trên thế giới vì tính thuận tiện, bảo mật và riêng tư của nó. Tại thời điểm 2014, mỗi ngày trung bình người dùng Snapchat gửi đi tới 700 triệu bức hình và video. Hiện, công ty được định giá 16 tỷ USD, có tổng giá trị các vòng gọi vốn là 1,2 tỷ USD.

Cuối năm 2013, CEO Evan Spiegel từng từ chối lời đề nghị mua lại của Facebook với giá 3 tỷ USD. Sau đó họ bắt đầu chèn quảng cáo trong ứng dụng của mình để tìm kiếm lợi nhuận. Tuy vậy các quảng cáo của Snapchat sẽ không dựa trên sở thích, mối quan tâm của người dùng giống như cách mà Facebook, Google đang làm.

3 notes

·

View notes

Link

मुंबई: जागतिकस्तरावरील सर्वात मोठ्या आर्थिक तंत्रज्ञान क्षेत्रातील तीन दिवशीय सिंगापूर फिनटेक महोत्सवाप्रसंगी प्रधानमंत्री नरेंद्र मोदी यांनी भारताच्या पॅव्हेलियनला भेट देऊन स्टार्टअपमध्ये सहभागी मुंबईतील तरुणांशी संवाद साधला आणि मुक्तकंठाने त्यांची स्तुती केली.

सिंगापूर येथे जागतिकस्तरावरील तिसऱ्या सिंगापूर फिनटेक महोत्सवात परिसंवाद व प्रदर्शनाचे आयोजन करण्यात आले आहे. या महोत्सवात सहभागी जगभरातील 100 हून अधिक देशांतील 30 हजार प्रतिनिधींसमोर प्रधानमंत्री श्री. मोदी यांनी या महोत्सवाचे प्रमुख भाषण केले. फिनटेक महोत्सवात प्रमुख भाषण देणारे श्री. मोदी हे पहिलेच राष्ट्रप्रमुख आहेत.

ही बातमी पण वाचा : व्यापार मेळ्यामुळे राज्यातील ग्रामीण उद्योगांना जागतिक बाजारपेठ उपलब्ध– सुभाष देसाई

फिनटेक क्षेत्रात गुंतवणुकीसाठी भारत हा सर्वाधिक पसंतीचा देश असल्याचे सांगून श्री. मोदी म्हणाले, फिनटेकची ताकद आणि डिजिटल कनेक्टिव्हिटीच्या सहाय्याने आम्ही अभूतपूर्व वेगाची क्रांती केली आहे. तंत्रज्ञानाद्वारे आणलेल्या ऐतिहासिक परिवर्तनाच्या युगात आम्ही आहोत. भारताने डेस्कटॉपवरून क्लाउड पर्यंत, इंटरनेट ते सोशल मीडियापर्यंत, आयटी सेवांमधून इंटरनेट ऑफ द थिंग्जपर्यंतची दीर्घ मजल अगदी कमी कालावधीत मारली आहे. भारतातील 1.3 अरब नागरिकांपर्यंत वित्तीय क्षेत्राचे फायदे पोहचविण्याचे काम केले आहे. अगदी अल्पकाळात देशातील सुमारे 1.2 अरब नागरिकांचे बायोमेट्रिकसह आधार ओळखपत्रांचे काम तंत्रज्ञानाच्या मदतीने केले आहे. जनधन योजनेमध्ये प्रत्येक भारतीयाचे बँकेत खाते उघडण्याची मोहीम सुरू केली. तीन वर्षात भारतातील 33 कोटी नागरिकांचे नवीन बँक खाते सुरू केले. याद्वारे आम्ही या सर्व 33 कोटी नागरिकांना स्वतः ओळख, सन्मान आणि संधी दिली आहे.

आधार संलग्नित सूक्ष्म एटीएमच्या माध्यमातून देशभरातील 4 लाख गावांमधील घरापर्यंत बँकिंग क्षेत्र घेऊन जाण्यास आम्हाला यश मिळाले आहे. डिजिटल पायाभूत सुविधांमुळे जगातील सर्वात मोठी आरोग्य योजना सुरू करण्यास भारत सरकारला यश आले आहे. आयुषमान योजनेमुळे 50 कोटी भारतीयांना आरोग्य कवच प्राप्त झाले आहे, असेही प्रधानमंत्री श्री. मोदी यांनी यावेळी सांगितले.

मुंबईच्या स्टार्टअपचे प्रधानमंत्री नरेंद्र मोदी यांनी केले कौतुक

फिनटेक महोत्सवातील प्रमुख भाषण झाल्यानंतर प्रधानमंत्री श्री. मोदी यांनी भारतीय पॅव्हेलियनला भेट दिली. या पॅव्हेलियनमध्ये सहभागी स्टार्टअपपैकी सर्वाधिक 70 टक्के स्टार्टअप हे मुंबईतील आहेत. महाराष्ट्राच्या या स्टॉलला प्रधानमंत्री श्री. मोदी यांनी आवर्जून भेट दिली व या स्टार्टअपचे कौतुक केले. यावेळी राज्याचे माहिती तंत्रज्ञान विभागाचे प्रधान सचिव एस.व्ही.आर. श्रीनिवासन यांच्यासह स्टार्टअपमध्ये सहभागी तरुण उपस्थित होते. प्रधानमंत्र्यांनी या तरुणांशी संवाद साधला. यावेळी अॅपेक्स एक्स्चेंज फॉर फिनटेकचे अनावरणही प्रधानमंत्री श्री. मोदी यांनी केले.

प्रधान सचिव श्रीनिवासन यांनी या महोत्सवातील परिसंवादात भाग घेतला. यावेळी ते म्हणाले, स्टार्टअपला पुढे आणण्यासाठी शासनाने त्यांच्या पाठिशी उभे राहणे गरजेचे आहे.

सर्वाधिक स्टार्टअप महाराष्ट्रात

देशातील एकूण 10 हजार 950 स्टार्टअपपैकी 2130 स्टार्टअप हे महाराष्ट्रात आहेत. एकूण 200.96 कोटी रुपयांची यामध्ये गुंतवणूक आहे.

#जागतिक फिनटेक महोत्सव सिंगापूर#fintech festival 2018 singapore#singapore fintech festival 2018 venue#singapore fintech festival#fintech singapore 2018

0 notes

Text

4 fintech start-ups worth looking at at Technical in Japan Singapore 2018

This May 15 & 16, more than 250 appealing start-ups will be collected under one place at Technical in Japan Singapore 2018, presenting their products to over 5,000 participants, traders and press.

Fintech has been changing the scenery of traditional sectors, particularly the finance industry. Blockchain is becoming more popular, and digitalization has become progressively extensive. In line with the changing scenery, this article features four fintech start-ups to keep a look out for at Start-up Manufacturer.

TranSwap is designed to make cash transfer overseas both practical and cost-effective. Based in Singapore and Hong Kong, the organization allows customers to easily davide zucchetti articles on finthech manage and perform expenses worldwide while reducing forex dealing transformation expenses and complexness. It means to save companies up to eight times in deal expenses as compared to intermediaries. The funds are also secure as it does not form section of the company’s resources, and are instead placed in separated records.

GStar.AI observed the pattern of experienced guide traders becoming outdated, and being progressively changed by algorithmic financial dealing. The organization has an ideal of providing traders back into the environment by simplifying knowledge return amongst them. GStar.AI looks for to match traders with the public so that both ends can benefit – experts are able to build and generate income from their dealing ideas, while everyone are able to enjoy the services at cheaper.

With an aim to update the dealing of silver, EmasDigi allows you to trade top quality silver, starting from 0.01 grms, through a cellular program. Beyond that, customers can even do common silver exchanges amongst friends through their cellular phones. The organization desires to present both price visibility and top quality guarantee to customers.

Pampasy is a cellular system that provides cashless deal solutions for individuals and companies, with a focus on strengthening small and medium-sized businesses in recognizing cashless expenses through cellular phones. An example use case would be the deal of vehicle parking fees, which can be done by verifying a QR program code. Top quality associates of Pampasy are eligible to benefits such as cashbacks and rewards for hiring newbies to the program.

Showcase your promotions at TIA Singapore 2018

Beyond getting the opportunity to link with prospective customers and generate brand attention, you’ll also get to meet press and traders. Eager to be section of the 250 unique startup participants at Start-up Factory?

10 percent discounted (i.e. US$59) and program for Start-up Manufacturer will end this evening, 17 Apr, 11.59pm (GMT +8). Each unit package expenses US$597 before discounted and comes with a one-day unit and two exhibitor goes. You will only pay for your unit upon verification, be sure not to skip your last opportunity to exhibit!

19 notes

·

View notes

Text

Klefer – Kredivo Cimentos Posição de liderança na indústria de técnica financeira com prêmios globais e regionais

Klefer – Kredivo Cimentos Posição de Liderança na Indústria de Fintech com Prêmios Globais e Regionais O KPMG e a H2 Ventures selecionam o Kredivo como uma das 100 principais startups de técnica financeira mundialmente e o Singapore Fintech Festival seleciona o Kredivo como o melhor startup de conhecimento financeira do sudeste da Ásia p > Kredivo como a startup de conhecimento financeira nº 1 na categoria SME no Singapore Fintech Festival Somos extremamente gratos pelo fato de nosso trabalho estar sendo reconhecido em graduação global e regional. Estamos ansiosos para causar um impacto ainda maior nos próximos anos. O Kredivo, principal cartão de crédito digital da Indonésia para a geração do milênio, foi reconhecido em duas listas de prestígio: a KPMG e a H2 Ventures Global Top 100 Fintech Startups e a primeira startup regional do Singapore Fintech Festival na categoria SME. O reconhecimento da Kredivo nesses prestigiosos rankings globais e regionais reflete sua posição de liderança no holocenose de fintech regional e indonésio. A KPMG e a H2 Ventures Global Top 100 são uma lista com curadoria das 100 startups de fintech mas inovadoras do planeta. A Kredivo é a exclusivamente empresa de empréstimos ao consumidor do sudeste da Ásia a integrar da lista. O Singapore Fintech Festival, o maior festival de fintech do mundo, apresenta inovação em fintech regional e globalmente, e reconhece startups que têm gerado impacto em graduação regional e global. Co-organizado pela MAS (Domínio Monetária de Cingapura) e pelo campo privado, o rigoroso processo de seleção, levado pela PwC, envolve um júri excessivamente conceituado de especialistas do setor. O reconhecimento da Kredivo como a primeira startup no Sudeste Asiático na categoria de pequenas e médias empresas é representativa da qualidade do produto e do impacto que a Kredivo está gerando em graduação, deixando o acesso ao crédito para milhões de millennials pela primeira vez. Comentando sobre este reconhecimento, Akshay Garg, cofundador e CEO da FinAccel, diz: O acesso ao crédito é um enorme obstáculo para os millennials indonésios, e estamos resolvendo isso por conveniência, transparência e justiça. Somos extremamente gratos pelo fato de nosso trabalho estar sendo reconhecido em graduação global e regional. Estamos ansiosos para causar um impacto ainda maior nos próximos anos. Nos primeiros anos a partir de o início, o Kredivo cresceu e se tornou a solução de negócio eletrônico de prolongamento mais rápido na Indonésia, com adoção em quase todos os 10 primordiais comerciantes de transacção eletrônico e quase 250 no geral. Como pioneira em empréstimos digitais, a Kredivo tem se concentrado em empréstimos responsáveis, com taxas de juros tão baixas quanto 0% para pagamentos no prazo. Nenhum outro digno do dedo do domínio oferece empréstimos a taxas de juros t��o baixas. Apenas em 2018, o tamanho da base de usuários do Kredivo mais do que dobrou e as origens de empréstimos mensais mas do que triplicaram, com empréstimos inadimplentes em risca com os de um banco de primeira traço, um feito inigualável na indústria de empréstimos digitais.

1 note

·

View note

Text

Can virtual banks accelerate initiatives toward cashless and smart nations? | Elevate Ventures

In2014, Singapore launched its Smart City initiative, and one of the tenets was to establish a cashless nation — the ideal being that people and businesses can simply go about with their transactions without physical cash ever having to change hands.

Efforts toward “cashless nation” accelerated in 2018 when technologies like near-field communication, QR-code scanning, and tap-to-pay started to become popular.

Cashless transactions are not exactly a new technology — the precursor of course had been credit cards and debit cards. However, today, technology is enabling innovations in finance that go beyond banking — decentralized finance, peer to peer transactions, near instantaneous cross-border payments, and the like.

Innovations in finance

An offshoot of the digital nation initiatives are innovations in finance — particularly with fintech startups. These platforms are providing financial services that go beyond traditional banking.

Credit- and debit-card transactions have become a norm in developed economies, with high card penetration rates. The incumbent popularity of cards have made it inconvenient for users to switch paradigms when it comes to making digital payments.

However, users in emerging economies — such as those in Southeast Asia, Africa, and Latin America — offer an encouraging opportunity for fintech platforms. It is in these countries where mobile payments and other digital modes of transacting have become primarily popular. In China, for example, Alipay and WeChat are popular means of transacting. Such mobile services are providing a means to serve the underbanked and unbanked.

Another example is the concept of virtual banking, which are essentially banks that do not have the traditional branch infrastructure. Also known as a “direct bank”, these institutions offer services remotely through online banking and mobile transactions. By doing away with physical infrastructure, there is significant reduction in overhead costs. An offshoot of this is the potential to extend financial services beyond borders— something that will take time for traditional banks to establish.

Speaking about banking infrastructure, Amar Shah, Director at Namana Investments (HK) Ltd. and former Managing Director at Morgan Stanley HK, highlights the advantages: “Most of the traditional banks have clunky infrastructure. This is not just in tech, but also physical infrastructure — they have branches, and they require office space. With virtual banks, we should start to see more efficient lending models. Hopefully this leads to more micro-finance and micro-lending. This will be key in propelling the rest of the business community toward better efficiency.”

To illustrate a use case for virtual banking, we can point to the Greater Bay Area initiative, which brings together 11 cities across China, Hong Kong and Macau, into a hub for finance, business, culture, education, and industry in general. The region has a population of almost 70 million across approximately 55,000 square kilometers — significantly larger than other major tech hubs across the world, like Silicon Valley.

Integrating regulatory and compliance services

One challenge that needs to be addressed here is how to integrate regulatory and compliance services into virtual banking, given the differences in financial jurisdiction across the GBA’s different locations.

“One of the biggest concerns faced by banks is compliance.”

“One of the biggest concerns faced by banks is compliance,” says Shah. “Post 2007 financial crisis, there had been a lot of checks and regulations put in place, and big financial institutions had to beef up their compliance departments. As for the KYC process, there has been a lot of manual processes involved, and data stored in centralized servers.”

Integrating the Know-Your-Customer or KYC process into financial services is already an established need. But with such a big geographic area and diverse economic and financial systems, there is a need for efficiency in this matter. There is also the need to overcome another challenge, which is data privacy amidst the rise of privacy frameworks such as the European GDPR and California’s latest CCPA.

In China, the closest regulatory framework that protects privacy are the Cybersecurity Law and the Personal Information Security Specification, which regulates the collection, storage, use, sharing, transfer, and disclosure of personal information. In particular, it provides guidance on compliance with relation to processing such information.

“With e-KYC, verification is reduced to a few hours.”

Hans Lombardo, Co-Founder and Chief Marketing Officer at KYC-as-a-service company Blockpass, weighs in on how decentralized KYC can significantly make compliance easier for businesses that have operations that cross borders.

“With e-KYC, verification is reduced to a few hours. This means you can open a virtual bank account much faster, as compared to a traditional bank, in which KYC would take a week for individuals or up to a month for corporate accounts.”

Such a decentralized approach also provides for better data control ownership for users — no central institution actually owns or stores the identity data. Users only share their data to financial institutions on an as-need basis. This approach also addresses the question of data sovereignty — something that may be a concern for users, businesses, or regulators in certain jurisdiction.

“Instead of allowing companies in the US for example to store data on their users, a decentralized platform lets users keep their data on their devices and only share what they want to share on a case-to-case basis. With an on-chain verification procedure, a user can still remain anonymous, but can be verified using KYC,” Lombardo adds.

This goes beyond individual banking activities. KYC can also be an integral component of due diligence for businesses that are into investing and fundraising. Shah cites how decentralized crowdfunding can benefit from such an approach.

“At the height of the popularity of crowdfunding, we did not have control over who was raising money or the companies behind them. Now, you have another layer of filtering — someone to do the KYC on investors.”

Trends in virtual banking

One interesting trend in the virtual banking industry is in how some virtual banks have traditional banking institutions backing them. Of Hong Kong’s eight institutions granted virtual banking licenses in 2019, four are backed by traditional banks or non-bank financial institutions.

Essentially, banks that already have the infrastructure are applying for virtual banking licenses in order to more quickly expand their operations beyond their traditional scope and coverage. A diverse region such as the Greater Bay Area will be a good testbed that can determine the success of such a decentralized approach. This can then perhaps be duplicated in other diverse regions, such as Southeast Asia for instance.

There is still room for growth in the virtual banking sector. In Hong Kong, a survey by KPMG expects virtual banking customers to be in the tens of thousands by the end of 2020 — the first year after the HK Monetary Authority started granting virtual banking licenses in 2019. However, this will only account for 2–3 percent of deposits.

To conclude, what’s sure at this point is that virtual banks “will be a major driver of change and improve competition in the sector, forcing traditional banks to innovate and improve their service offering,” as KPMG’s The Future of Banking 2019 report puts it. “This will all be for the benefit of the customer, who stand to be the real winners.”

Featured in this story

Elevate interviews experts in technology to gain their insights, with the goal of sharing knowledge with the community. Please get in touch with us to contribute, engage our experts, or become part of our network.

Hans Lombardo is a successful entrepreneur and enthusiastic proponent of blockchain technologies. He is a co-founder of Blockpass, a self-sovereign identity system and KYC-as-a-service provider. He is also a co-founder of Chain of Things, a Hong Kong-based startup integrating blockchain & IoT devices. In 2012, he sold his previous company, a data collection and analytics research firm focused on mainland Chinese high-technology industries. He is an Internet industry veteran with regional management experience. During the Internet boom, Hans managed the internet.com Venture Capital Fund in Asia, investing in a number of Internet startups in Greater China. As a tech journalist in the late 1990s, he interviewed Jack Ma, Jerry Yang, Vinton Cerf and Richard Li Tzar Kai. Hans earned a Ph.D. degree from the University of Hong Kong in 1997 and a Sir Edward Youde Memorial Fellowship in 1995–1996. Elevate Ventures

Amar Shah is Director at Namana Investments (HK) Ltd. and former Managing Director at Morgan Stanley HK. A global business leader, consistently delivering results, he is an expert in building strong, resilient and engaged teams that repeatedly provide effective solutions to complex problems. Shah is a leader with a reputation for integrity who transforms business performance by building global strategies, operating models, culture and governance.

Learn more about Elevate Ventures and Advisory

Website: https://el8v.io

Facebook: https://www.facebook.com/elevateblockchain

Linkedin: https://www.linkedin.com/company/el8v

Telegram: https://t.me/elevate_ventures

0 notes

Link

GrabPay để mắt đến sự thống trị của thanh toán kỹ thuật số tại Việt Nam và Đông Nam Á khi cạnh tranh ngày càng nóng lên

Grab, decacorn đầu tiên của Đông Nam Á trị giá hơn 10 tỷ đô la Mỹ, bắt đầu khởi đầu khiêm tốn như một ứng dụng gọi xe nhưng kể từ đó đã phát triển thành một trong những “ siêu ứng dụng ” của khu vực , cung cấp các dịch vụ đa dạng từ giao đồ ăn, dịch vụ hậu cần và dịch vụ tài chính trên khắp các thị trường bao gồm Indonesia, Philippines, Việt Nam, Thái Lan, Myanmar và Campuchia.

Công ty công nghệ có trụ sở tại Singapore, có trụ sở tại Malaysia, bắt đầu mở rộng cung cấp vào năm 2015 với việc giới thiệu dịch vụ đặt xe ôm GrabBike nhưng chỉ đến năm 2016, họ mới tiết lộ kế hoạch phát triển nền tảng thanh toán, giới thiệu cùng năm dịch vụ kỹ thuật số không dùng tiền mặt GrabPay dịch vụ ví .

Kể từ đó, Grab đã mua lại một số liên doanh bao gồm công ty khởi nghiệp thanh toán Indonesia Kudo vào tháng 2 năm 2017 và công ty khởi nghiệp thanh toán di động của Ấn Độ iKaaz vào tháng 1 năm 2018 và đã kết hợp nhiều tùy chọn thanh toán và dịch vụ tài chính hơn cho người dùng thông qua ví điện tử GrabPay, bao gồm cả vi mô cho vay và các sản phẩm bảo hiểm .

https://hotrovayvonnganhangxyz.blogspot.com/2021/10/grabpay-e-mat-en-su-thong-tri-cua-thanh.html

#SGBank, #GrabPay, #Fintech, #Grab, #Moca,

0 notes

Text

Efficient Working of Different Level Entities Pouring Growth to Singapore Market Outlook: Ken Research

Around the few trade and pieces of industry, the Singapore region is the leader. The healthcare segment of Singapore is said to be a one of the greatest around the globe, as the country now have advanced the most developed healthcare services. Moreover, along the foremost underwriters likewise financial services, manufacturing and oil-refining the Singapore economy distinctions. The legal authorities of this region established profitable initiatives to motivate the economy as a regional hub for the financial technology such as FinTech.

In addition, the Singapore International Remittance Market has been analyzed to be concerted for banks whereas temperately fragmented for non-banking institutes during 2018. The market has been placed to be at mature stage. The market entails of banks, money transfer operators, mobile wallets, postal networks as foremost entities wherein it is greatly dominated by Banks and MTOs. Prominent business strategies adopted by foremost players to position themselves in the market comprising forming a widespread network & advanced reach, new services launched & service innovation and better pricing & handy/transparent functions offered. The market has been propelled by augmented migration, better legislative environment in form of relaxed policies, augmented the awareness towards digitalized remittance services and improvements in digital payment networks & Fintech space. During the next 5 years, players would be enlarging through acquisitions, tie-ups, augmented the digital modes of money transfer such as mobile applications and M-wallets, lowered cost of sending money and sooner transfer speed.

Not only has this, the Singapore Market Future Outlook will be continuous by the advancements in Fintech and digital payments, with more optimization of the mobile wallets and mobile applications. The momentous growth in mobile phone penetration, supplement in possession of smart-phones rate and augmented admittance and consumption of internet services would drive the growth.

Nonetheless, the Singapore nutraceutical market augmented at a single digit CAGR throughout the review period of 2013-18. The Singapore market share was assisted by the surge in the personal disposable income, augment in ageing population, growing health awareness and preventive nature of the age group (25-45 years). The market was witnessed in its late growth stage and is tending towards into maturity owing to the existence of large number of players already competing in the market. A fundamental change was witnessed towards the Singapore health and wellness industry, from taking health complements in the old age to a preventive consumption outline in which the consumption of supplements augmented in the earlier ages in order to safeguard them from permanently contingent on pharmaceutical drugs. Nutraceutical ingredients have placed itself as natural and healthy alternative to traditional medicine around the country.

Although, the organized and large players in the Singapore market are effectively opting the strategies of joint venture, new product development, merger and acquisition, amalgamation and several others for ruling around the globe, obtaining the competitive edge and generating the high percentage of revenue. Therefore, in the near years, it is predicted that the market of Singapore will increase around the globe more effectively over the coming period.

For More Information, click on the link below:-

Singapore Market Future Outlook

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249

0 notes

Text

UK: Johnson commissions post-Brexit “bonfire of regulations” report

A report by the Taskforce on Innovation, Growth and Regulatory Reform (TIGRR) commissioned by Prime Minister Boris Johnson outlines the full scope of the Conservative government’s post-Brexit deregulation program. It contains over 100 recommendations that aim to remove regulatory “barriers” for the corporate and financial sectors.

Prime Minister Boris Johnson reads the Task Force on Innovation, Growth and Regulatory Reform (TIGERR) in his office in the House of Commons. June 16, 202. Picture by Simon Dawson / No. 10 Downing Street / Flickr)

The report was followed by an announcement that the government is recruiting a director for its Brexit opportunities unit. Brexit Minister Lord Frost was tasked with “making the most of the economic and political opportunities presented by Brexit” by “developing new ideas and acting as a counterweight to Whitehall” [civil service] Orthodoxy.”

TIGRR’s recommendations are a blueprint for further privatization and intensification of the exploitation of the working class. Any proposal on privacy, technology, net zero energy targets, agrochemical concerns and health aims to give free rein to parasitic speculation.

Johnson welcomed the recommendations as “substantial plans”. He convened TIGRR in February to take advantage of the “new opportunities to reshape or change the implementation of regulation across the economy” that Brexit offers. The task force that received “Public Service Support Access” should report directly to Johnson. It was chaired by former Tory Party leader Sir Iain Duncan Smith, who recently advocated anti-Chinese trade legislation. The TIGRR report shows concerns about competition with China in technology and digital currencies.

The other two members were Theresa Villiers, previously Secretary of the Environment and Northern Ireland Secretary, and George Freeman, who, after 15 years of founding “high-growth technology companies,” became a Member of Parliament and as UK Trade Representative and Foreign Secretary in the Department of Transport.

They duly delivered the results Johnson sought to “deliver on the promises of Brexit.” He promised to give her report the “detailed consideration it deserves” and already insisted that a “thicket of cumbersome and restrictive regulations” had to be dismantled.

TIGRR says their 130-page report is “not a simplified bureaucratic campfire”, but rather explicitly builds on former Tory Prime Minister David Cameron’s 2011 “Red Tape Challenge”. This sociopathic attack on conditions targeted what Cameron described as “excessive health and safety … albatross around the neck of British corporations”. The resulting “savings” were achieved through a grueling policy of cutbacks.

TIGRR proposes a “one in, two out” offset principle for all new regulations. It calls for “UK standards” to be viewed as a transferable, salable asset while being stripped of any content they may still have. It found that the OECD had praised the quality of UK regulatory practices, but two in five companies “currently see regulation as an obstacle to success”.

The number of business complaints has decreased over the past decade as successive Tory administrations continued to tear down regulations. The TIGRR report aims to accelerate this process.

The document praises the “regulatory sandbox” technique, which removes some regulatory obligations when testing products and business models. The report boasts that the UK launched the first financial technology (fintech) sandbox in June 2016, which was quickly emulated around the world. It brags that the sandbox also allows regulators to test whether they can remove or change the rules that they found to be bothersome enough to suspend. TIGRR is proud that this is being taken up extensively in Singapore.

The Task Force keeps reverting to the sandbox model, especially when it comes to brushing aside concerns about public safety. One of the “successes” of the sandbox in the UK is TIGRR’s NHS Care Quality Commission, which has been heavily pressured and manipulated by both the Labor and Tory governments to privatize their healthcare privatization plans.

The TIGRR’s proposals deal in particular with how deregulation can be accelerated without primary law. They are calling for more legislative reform regulations to avoid this and the transfer of powers in primary legislation to regulators.

The report acknowledges that in some cases implementation can be done by the regional government. This takes its sharpest form via the fragile compromise of the Northern Ireland Protocol, which was agreed as part of the UK’s Withdrawal Agreement from the European Union. According to the report, the protocol “limits the scope of these reforms”. In line with the right-wing unionist parties and other stubborn Tory Brexiters, TIGRR “expresses the hope that a future reform of the protocol will leave more room for regulatory reform in Northern Ireland”.

The proposals mainly focus on financial services. They encourage further private sector investment and the relaxation of current restrictions and transparency requirements.

TIGRR calls for the “diversification” of direct contribution pension systems in order to gain access to private equity and venture capital funds. In line with the demand for lower capital and liquidity requirements for smaller and new banks, it proposes a 75 percent reduction in the risk margin that insurers need to free up capital. She also calls for the disclosure requirements for information documents for some investment products to be relaxed. It is a program for unbridled speculation.

Saturday, July 10th at 2pm UK time

Meeting of the Educators Safety Committee

The Delta variant sloshes through the schools, while the unions do nothing about it. Educators have to act independently.

This requires a further cut in public funds. The report suggests “attracting private investment to help restore local infrastructure and support the UK’s leveling agenda”. TIGRR links this privatization policy with its pension proposals and calls on local authorities to invest “their pension funds” in local economic recovery.

Much of the media coverage of TIGRR has focused on its technology and data handling proposals, but this is aimed at rapid deregulation across the financial sector.

TIGRR calls for the transition from open banking to open finance to be accelerated. Open Banking offers external financial service providers open access to data via application programming interfaces. Open Finance does the same for a much wider range of financial products. TIGRR calls for changes in regulatory approaches to enforce this in just two years.

The report includes reducing the anti-money laundering “burdens” on new open banking and fintech services, which in turn aim to make third-party access easier. This goes hand in hand with the demand “to change the disclosure and transparency requirements for financial services products in order to make them more proportionate and less burdensome”.

TIGRR is strongly advancing the development of a digital central bank currency and would like to start a pilot project within 12 to 18 months. This explains the report’s concern with “new technologies like blockchain”.

It is also driving the steps to shorten data protection laws, starting with the General Data Protection Regulation 2018 (GDPR). TIGRR’s objection to the GDPR is that it precludes the commercialization of personal data. The GDPR focuses “around the principle of data owned by citizens” while its starting point is that “consumer data is highly profitable and a currency in itself”.

Whether in artificial intelligence technology or public health, the GDPR is seen as an obstacle to commercial clinical trials as a source of profit, as they require full access to health system records. When TIGRR speaks of “digital health” they mean the integration of business-to-consumer digital health through “health apps and wearable technology”. This also applies to mental health, which TIGRR sees as part of “the UK’s potentially huge business-to-consumer ‘wellness’ market for digital consumer health products”.

Health regulations are increasingly seen as a barrier to snake oil dealers. TIGRR fears that rules for “wellness apps that do not claim to diagnose, treat, or monitor a specific disease” are “not yet clearly established”. This represents a barrier to their integration into the health system. ”This is all about making profits with the weakest. The proposal of the report to re-regulate “nutraceuticals” [generally dietary supplements with a declared but unproven health benefit] because they are increasingly profitable, one should see it that way.

Sign up for the WSWS email newsletter

source https://seedfinance.net/2021/07/06/uk-johnson-commissions-post-brexit-bonfire-of-regulations-report/

0 notes

Text

Football World Cup - How is Qatar defending its cybersecurity efforts in preparation for FIFA World Cup 2022?

Qatar will turn into the primary Middle Eastern nation to have the Football World Cup 2022 at its new 80000-limit Lusail Iconic Stadium. Considering facilitating the world's biggest game, the Middle East has gone under expanding examination over the condition of its security and mechanical scene.

Football World Cup Fans from all over the world are called to book Football World Cup 2022 tickets from our online platform WorldWideTicketsandHospitality.com. FIFA World Cup fans can book Football World Cup Tickets on our website at exclusively discounted prices.

Until this point in time, the locale, as most created nations, is more powerless against cyberattacks given its carefully associated nations and high cell phone reception rate. Simply in the first 50% of 2019, the area has effectively encountered a developing number of attacks.

However, for what reason is FIFA an objective for cyberattacks?

In 2018's FIFA World Cup held in Russia; President Vladimir Putin announced that the country was an objective for right around 25 million cyberattacks. Putin shared: During the time of the Football World Cup, just about 25 million cyberattacks and other criminal follows up on the data structures in Russia, connected somehow to the World Cup, must be killed, provided details regarding Economics Times. These cyberattacks can come in different structures, for example, malware, phishing, fake attacks just as monetary tricks.

What are the absolute most normal sorts of cyberattacks that exploit fans' excitement for FIFA?

· Malware camouflaged as true applications.

Malware can be effectively masked as believable and official sources, from streaming applications to game anticipating destinations. In the days paving the way to the occasion, Football World Cup-themed spam messages were flooding inboxes while counterfeit website pages offered giveaways with an end goal to take cash and individual data.

This is the thing that cybersecurity experts' term as 'social designing' which alludes to web dangers like phishing, tricks, and surprisingly particular sorts of malware, for example, ransomware.

"Golden Cup" is an illustration of an application that is broadly used to stream information and records from over a significant period of the game. It was hacked by cybercriminals to introduce spyware on gadgets of clueless fans.

· Financial tricks and misrepresentation

Clients are additionally presented with non-malware-related online tricks, for example, ticket misrepresentation and sham product offer. Everything happens when Visa information and banking subtleties are put away on false applications or sites. Programmers can access client account data if buys or appointments are not gotten. These data are restricted to ledger subtleties, yet additionally Personally Identifiable Information (PII, for example, their Social Security Number.

Accordingly, even authentic sites can be casualties of cybercrime, frequently using treachery, disfigurement, or disavowal of administration attacks. These can prompt both monetary and reputational harm.

In the very discourse that Putin routed to Russia on the accomplishment of the World Cup in 2018, he featured that Behind this (World Cup) achievement lies tremendous preliminary, operational, insightful, and data work, we worked at most extreme limit and focus. Similarly, Qatar will likewise have to take preventive measures to shield the country and its residents from cyber fighting by applying these previous learning focuses. For more about to know Football World Cup Hospitality Packages click here.

What is the key cybersecurity extends effectively set up for Qatar?

Qatar is setting more prominent accentuation on an assortment of zones – Internet of Things and mechanical control frameworks, public cybersecurity abilities, cybersecurity hazard the executives, and cybersecurity tasks for scenes.

Project Stadia

The dispatch of Project Stadia was to make a Center of Excellence help Interpol part nations in arranging and executing policing and security arrangements for major games.

As a feature of the venture, the group arranges yearly master bunch gatherings just as workshops, covering key subjects of enactment, actual security, and cybersecurity for every meeting.

These drives unite worldwide specialists covering law authorization, occasion arranging advisory groups, the public authority, the private area, the scholarly community, and common society to investigate cutting-edge exploration and examination on security. The group likewise intends to foster suggestions for arranging and executing security plans for significant global games.

Cross-border relations with different nations

Qatar is additionally overseeing and fortifying its binds with other tech center points in the world to improve its cybersecurity endeavors.

Qatar and the UK have investigated open doors in co-working cybersecurity endeavors particularly considering the developing monetary area relations between the two nations. This incorporates having respective conversations on the rising significance of cybersecurity inside monetary administrations, Qatar's developing monetary area, and the worthwhile business openings accessible on the lookout.

Essentially, Qatar and Singapore are presently working forcefully to improve their reciprocal relations where the two nations are as of now centering to extend and develop a collaboration that incorporates security, fintech, and cybersecurity, among different areas.

We are offering tickets for Qatar Football World Cup 2022 admirers can get Qatar Football World Cup 2022 Tickets through our trusted online ticketing marketplace. Worldwideticketsandhospitality.com is the most reliable source to book Qatar Football World Cup Hospitality tickets and Football World Cup Packages.ss

#FootballWorldCupTickets#FootballWorldCupPackages#FootballWorldCupHospitality#FIFAWorldCup2022Tickets#VenezuelaFootballWorldCupTickets#FootballWorldCup2022Hospitality#QatarFootballWorldCupTickets#FootballWorldCupFinalsTickets#FootballWorldCupSemiFinalsTickets

0 notes

Link