#financial resilience score

Explore tagged Tumblr posts

Text

Financial Resilience Institute – Financial Resilience Institute

The Financial Resilience Institute is committed to providing individuals and businesses with the information and tools needed to attain financial stability and adaptation. Our programs emphasize proactive planning and resilience-building techniques to help you confront problems with confidence. Visit our About Us page to learn more about our mission and the knowledge that drives our work, and don't hesitate to contact us for financial advice targeted to your specific needs.

#financial resilience institute#financial stability#financial resilience#financial stability report#financial planning canada#resilience score#eloise duncan#improve financial resilience in canada#financial resilience index#financial resilience score

0 notes

Text

Things Biden and the Democrats did, this week #22

June 7-14 2024

Vice-President Harris announced that the Consumer Financial Protection Bureau is moving to remove medical debt for people's credit score. This move will improve the credit rating of 15 million Americans. Millions of Americans struggling with debt from medical expenses can't get approved for a loan for a car, to start a small business or buy a home. The new rule will improve credit scores by an average of 20 points and lead to 22,000 additional mortgages being approved every year. This comes on top of efforts by the Biden Administration to buy up and forgive medical debt. Through money in the American Rescue Plan $7 billion dollars of medical debt will be forgiven by the end of 2026. To date state and local governments have used ARP funds to buy up and forgive the debt of 3 million Americans and counting.

The EPA, Department of Agriculture, and FDA announced a joint "National Strategy for Reducing Food Loss and Waste and Recycling Organics". The Strategy aimed to cut food waste by 50% by 2030. Currently 24% of municipal solid waste in landfills is food waste, and food waste accounts for 58% of methane emissions from landfills roughly the green house gas emissions of 60 coal-fired power plants every year. This connects to $200 million the EPA already has invested in recycling, the largest investment in recycling by the federal government in 30 years. The average American family loses $1,500 ever year in spoiled food, and the strategy through better labeling, packaging, and education hopes to save people money and reduce hunger as well as the environmental impact.

President Biden signed with Ukrainian President Zelenskyy a ten-year US-Ukraine Security Agreement. The Agreement is aimed at helping Ukraine win the war against Russia, as well as help Ukraine meet the standards it will have to be ready for EU and NATO memberships. President Biden also spearheaded efforts at the G7 meeting to secure $50 billion for Ukraine from the 7 top economic nations.

HHS announced $500 million for the development of new non-injection vaccines against Covid. The money is part of Project NextGen a $5 billion program to accelerate and streamline new Covid vaccines and treatments. The investment announced this week will support a clinical trial of 10,000 people testing a vaccine in pill form. It's also supporting two vaccines administered as nasal sprays that are in earlier stages of development. The government hopes that break throughs in non-needle based vaccines for Covid might be applied to other vaccinations thus making vaccines more widely available and more easily administered.

Secretary of State Antony Blinken announced $404 million in additional humanitarian assistance for Palestinians in Gaza, the West Bank and the region. This brings the total invested by the Biden administration in the Palestinians to $1.8 billion since taking office, over $600 million since the war started in October 2023. The money will focus on safe drinking water, health care, protection, education, shelter, and psychosocial support.

The Department of the Interior announced $142 million for drought resilience and boosting water supplies. The funding will provide about 40,000 acre-feet of annual recycled water, enough to support more than 160,000 people a year. It's funding water recycling programs in California, Hawaii, Kansas, Nevada and Texas. It's also supporting 4 water desalination projects in Southern California. Desalination is proving to be an important tool used by countries with limited freshwater.

President Biden took the lead at the G7 on the Partnership for Global Infrastructure and Investment. The PGI is a global program to connect the developing world to investment in its infrastructure from the G7 nations. So far the US has invested $40 billion into the program with a goal of $200 billion by 2027. The G7 overall plans on $600 billion by 2027. There has been heavy investment in the Lobito Corridor, an economic zone that runs from Angola, through the Democratic Republic of Congo, to Zambia, the PGI has helped connect the 3 nations by rail allowing land locked Zambia and largely landlocked DRC access Angolan ports. The PGI also is investing in a $900 million solar farm in Angola. The PGI got a $5 billion dollar investment from Microsoft aimed at expanding digital access in Kenya, Indonesia, and Malaysia. The PGI's bold vision is to connect Africa and the Indian Ocean region economically through rail and transportation link as well as boost greener economic growth in the developing world and bring developing nations on-line.

#Thanks Biden#Joe Biden#us politics#american politics#Medical debt#debt forgiveness#climate change#food waste#Covid#covid vaccine#Gaza#water resources#global development#Africa#developing countries

184 notes

·

View notes

Text

Reflecting on my Achievements in 2023

As today is my birthday, I would like to take the time to reflect on what I have achieved during this year and hopefully motivate you with it. I am seriously so grateful for everything.

Academics and Work:

Scored straight A's in all subjects throughout the entire year

Professors agreed to writing me recommendations for Harvard and Oxford

Worked in very prestigious firms as a working student

Landed a research position in Sustainable Finance

International Experience and Volunteering

Lived it in France for a semester, improving my French and gaining great insights into the country's culture

Founded "FeminFIN," (feel free to join if you would like to learn more about the financial sector)

Worked on sustainability education in schools

Reached 19.5 k followers here on Tumblr, motivating thousands of students

Personal Development

Developed so much resilience (crazy work/study schedule, sometimes hitting over 100 hours a week)

Deepened my understanding for Finance, battled my shyness and improved my social skills through various coffee chats on LinkedIn

Fell in love, got my heart broken - and learned to love myself more

I am excited about what 2024 will have in store for me! I hope this motivates you as well! <3

Tell me about your achievements! <3

#studyblr#motivation to study#study tips#study notes#studying#studyinspo#study blog#100 days of productivity#studygram#exams

278 notes

·

View notes

Text

Who Is Lee Zeldin? (Sierra Club:

Excerpt from this story from the Sierra Club:

President-elect Donald Trump’s selection to lead the Environmental Protection Agency is, in a word, unexpected. The appointment announced on November 11—in which the Trump transition team erroneously referred to the EPA as the “Environmental Protective Agency”—was not an energy industry lobbyist like Andrew Wheeler or a MAGA insider like Mandy Gunasekara, who authored the EPA chapter of Project 2025. Instead, Trump chose Lee Zeldin, a little-known former Republican congressman from Long Island, New York, whose background on environment and energy issues is relatively skimpy.

So, then: Who is this person who will be in charge of the federal agency tasked with protecting the environment and public health?

Zeldin is a politician and military officer who grew up in New York’s Suffolk County. From 2015 to 2023, he represented New York’s First District (eastern Long Island) in Congress, where he sat on the House Foreign Affairs and Financial Services Committees. Before that, he served for four years in the New York state senate. In 2022, he ran for governor of New York against Democrat Kathy Hochul, a race that he lost by six points.

He’s a booster of fossil fuels and promises to unleash “energy dominance.”

In his run for governor of New York, Zeldin campaigned on expanding fossil fuel extraction. He called for allowing “the safe extraction of natural resources in the southern tier” of the state, approving new pipelines, and repealing the gasoline tax. He also was a staunch opponent of New York’s ban on fracking and ran on ending it. “[Zeldin] has a record of being pro-fracking, and that’s a record I think he’s going to clearly carry forward into the Trump administration,” Eric Weltman, a senior organizer in Food and Water Watch’s New York office, told Sierra.

Zeldin has mentioned pursuing “energy dominance” as one of three top priorities in heading up the EPA. “It is an honor to join President Trump’s cabinet as EPA administrator. We will restore US energy dominance, revitalize our auto industry to bring back American jobs, and make the US the global leader of AI,” Zeldin said in a statement on X.

He has taken more than $410,000 from the oil and gas industry, and he questions the scientific consensus on climate change.

According to Climate Power, Zeldin has received over $410,000 from the oil and gas industry in his election campaigns, including over $260,000 while running for Congress and more than $150,000 in his gubernatorial run. He has taken more than $60,000 from Koch Industries over the course of his political career, according to Open Secrets data.

His voting record in Congress is mostly anti-environment, with an LCV lifetime score of just 14 percent.

Zeldin unsurprisingly has an overall poor voting track record, as scored by the League of Conservation Voters. “Trump made his anti–climate action, anti-environment agenda very clear during his first term and again during his 2024 campaign. During the confirmation process, we would challenge Lee Zeldin to show how he would be better than Trump’s campaign promises or his own failing 14 percent environmental score if he wants to be charged with protecting the air we breathe, the water we drink, and finding solutions to climate change,” Tiernan Sittenfeld, LCV’s senior vice president for government affairs, said in a statement.

He supported a few conservation efforts for his district.

While in Congress, Zeldin backed several conservation initiatives for his district in Long Island. According to the campaign website for his gubernatorial run, he helped save Plum Island—a tiny island off the eastern tip of Long Island—by securing repeal of a 2008 law requiring it to be sold to the highest bidder. He also worked with the Army Corps of Engineers to “protect our coastlines, advancing the ambitious Fire Island to Montauk Point project,” a climate resiliency coastal risk reduction project to help safeguard Long Island’s prized beaches.

He appears to be against clean energy funding and tried to gut public transit funding in New York.

In addition to voting against the IRA and its massive clean energy investments, Zeldin early on in his political career attempted to divert funding away from clean energy programs in New York and undermine the New York City area’s transit system, according to Environmental Advocates NY. The New York environmental organization bestowed its “Oil Slick” award in 2011 on Zeldin, a rookie state senator at the time who led an effort to try to weaken public transit. He sponsored a bill that would have defunded the MTA, resulted in service cuts and fare increases, and discouraged public transit use. The bill would have also diverted $100 million away from clean energy programs to “plug holes in MTA’s finances.”

3 notes

·

View notes

Text

Unlocking Next-Level Payment Gateway Solutions

Article by Jonathan Bomser | CEO | Accept-credit-cards-now.com

In the swiftly evolving digital landscape of today, businesses increasingly rely on smooth credit card payment gateways to offer customers convenient and secure transaction experiences. The world of payment processing has undergone remarkable shifts, with technologies continuously evolving to meet the demands of modern commerce. From handling high-risk merchant processing to pioneering e-commerce payment solutions, this article delves into the critical components of uncovering advanced payment gateway solutions that cater to the diverse needs of businesses.

DOWNLOAD THE PAYMENT GATEWAY INFOGRAPHIC HERE

Elevated-Risk Payment Processing Operating within high-risk sectors, such as adult entertainment, online gaming, and subscription services, presents challenges when seeking dependable payment processing. High-risk merchant processing furnishes customized services that cater to the unique requisites of these industries. Employing sophisticated fraud detection and risk mitigation methods, high-risk payment processing providers establish a secure transaction environment. Whether facilitating credit card processing or efficiently managing recurring payments, these solutions ensure seamless and problem-free operations.

Empowering E-Commerce Ventures The ascent of e-commerce has revolutionized consumer shopping habits, compelling businesses to adapt for enduring competitiveness. E-commerce payment processing solutions are intricately designed to streamline the checkout process and elevate the overall customer experience. Through e-commerce gateways and dedicated merchant accounts, businesses unlock the ability to seamlessly accept credit cards for e-commerce transactions, unlocking fresh avenues for expansion. These solutions offer real-time transaction monitoring, robust data encryption, and diverse payment options catering to the preferences of a diverse customer base.

Revolutionizing Credit Repair Services Enterprises offering credit repair services also reap substantial benefits from specialized payment processing solutions. Credit repair merchant processing facilitates the streamlined collection of payments for services aimed at improving individuals' credit scores. Equipped with secure credit repair merchant accounts and adept payment gateways, businesses enable clients to conveniently make payments while preserving data confidentiality and complying with industry regulations.

Navigating the Complex CBD Landscape The CBD sector, marked by intricate regulations and perceived risks, mandates the adoption of tailored payment processing solutions. Regulatory intricacies and potential uncertainties often pose challenges for CBD merchants seeking reliable payment processing services. Tailored CBD merchant accounts and payment processing solutions are meticulously fashioned to cater to the unique demands of the CBD industry, empowering merchants to seamlessly accept credit cards for CBD products. By integrating stringent compliance protocols, these solutions guarantee transparent and secure transactions.

The Heart of Seamless Transactions Central to these diverse payment solutions are credit card processing systems and adept payment gateways. These systems play an indispensable role in authorizing transactions, securing sensitive data through encryption, and facilitating secure communication between the merchant, the customer, and the financial institution. Online payment gateway solutions ensure that transactions are swiftly and reliably processed, enhancing customer trust and satisfaction.

youtube

Unveiling a Resilient Future As businesses continue to expand their digital footprint and embrace digital transactions, the significance of robust payment gateway solutions remains unparalleled. Credit card payment gateways serve as a seamless conduit connecting consumers and merchants, enabling efficient and secure real-time transactions. By proactively embracing industry trends and harnessing innovative technologies, businesses can unlock the full potential of advanced payment processing systems, propelling them toward a resilient future.

#credit card payment#credit card processing#merchant processing#payment processing#accept credit cards#credit card payment processing#high risk payment processing#high risk payment gateway#high risk merchant account#merchant account#Youtube

22 notes

·

View notes

Text

The Ultimate Guide to ESG Investing: Strategies and Benefits

Socio-economic and environmental challenges can disrupt ecological, social, legal, and financial balance. Consequently, investors are increasingly adopting ESG investing strategies to enhance portfolio management and stock selection with a focus on sustainability. This guide delves into the key ESG investing strategies and their advantages for stakeholders.

What is ESG Investing?

ESG investing involves evaluating a company's environmental, social, and governance practices as part of due diligence. This approach helps investors gauge a company's alignment with humanitarian and sustainable development goals. Given the complex nature of various regional frameworks, enterprises and investors rely on ESG data and solutions to facilitate compliance auditing through advanced, scalable technologies.

Detailed ESG reports empower fund managers, financial advisors, government officials, institutions, and business leaders to benchmark and enhance a company's sustainability performance. Frameworks like the Global Reporting Initiative (GRI) utilize globally recognized criteria for this purpose.

However, ESG scoring methods, statistical techniques, and reporting formats vary significantly across consultants. Some use interactive graphical interfaces for company screening, while others produce detailed reports compatible with various data analysis and visualization tools.

ESG Investing and Compliance Strategies for Stakeholders

ESG Strategies for Investors

Investors should leverage the best tools and compliance monitoring systems to identify potentially unethical or socially harmful corporate activities. They can develop customized reporting views to avoid problematic companies and prioritize those that excel in ESG investing.

High-net-worth individuals (HNWIs) often invest in sustainability-focused exchange-traded funds that exclude sectors like weapon manufacturing, petroleum, and controversial industries. Others may perform peer analysis and benchmarking to compare businesses and verify their ESG ratings.

Today, investors fund initiatives in renewable energy, inclusive education, circular economy practices, and low-carbon businesses. With the rise of ESG databases and compliance auditing methods, optimizing ESG investing strategies has become more manageable.

Business Improvement Strategies

Companies aiming to attract ESG-centric investment should adopt strategies that enhance their sustainability compliance. Tracking ESG ratings with various technologies, participating in corporate social responsibility campaigns, and improving social impact through local development projects are vital steps.

Additional strategies include reducing resource consumption, using recyclable packaging, fostering a diverse workplace, and implementing robust cybersecurity measures to protect consumer data.

Encouraging ESG Adoption through Government Actions

Governments play a crucial role in educating investors and businesses about sustainability compliance based on international ESG frameworks. Balancing regional needs with long-term sustainability goals is essential for addressing multi-stakeholder interests.

For instance, while agriculture is vital for trade and food security, it can contribute to greenhouse gas emissions and resource consumption. Governments should promote green technologies to mitigate carbon risks and ensure efficient resource use.

Regulators can use ESG data and insights to offer tax incentives to compliant businesses and address discrepancies between sustainable development frameworks and regulations. These strategies can help attract foreign investments by highlighting the advantages of ESG-compliant companies.

Benefits of ESG Investing Strategies

Enhancing Supply Chain Resilience

The lack of standardization and governance can expose supply chains to various risks. ESG strategies help businesses and investors identify and address these challenges. Governance metrics in ESG audits can reveal unethical practices or high emissions among suppliers.

By utilizing ESG reports, organizations can choose more responsible suppliers, thereby enhancing supply chain resilience and finding sustainable companies with strong compliance records.

Increasing Stakeholder Trust in the Brand

Consumers and impact investors prefer companies that prioritize eco-friendly practices and inclusivity. Aligning operational standards with these expectations can boost brand awareness and trust.

Investors should guide companies in developing ESG-focused business intelligence and using valid sustainability metrics in marketing materials. This approach simplifies ESG reporting and ensures compliance with regulatory standards.

Optimizing Operations and Resource Planning

Unsafe or discriminatory workplaces can deter talented professionals. A company's social metrics are crucial for ESG investing enthusiasts who value a responsible work environment.

Integrating green technologies and maintaining strong governance practices improve operational efficiency, resource management, and overall profitability.

Conclusion

Global brands face increased scrutiny due to unethical practices, poor workplace conditions, and negative environmental impacts. However, investors can steer companies towards appreciating the benefits of ESG principles, strategies, and sustainability audits to future-proof their operations.

As the global focus shifts towards responsible consumption, production, and growth, ESG investing will continue to gain traction and drive positive change.

5 notes

·

View notes

Text

The impact of sustainability in fintech: reflections from the summit

In recent years, the Fintech industry has witnessed a paradigm shift towards sustainability, with an increasing emphasis on integrating environmental, social, and governance (ESG) factors into financial decision-making processes. This transformative trend took center stage at the latest Fintech Summit, where industry leaders converged to explore the intersection of sustainability and financial technology. Among the prominent voices shaping this discourse was Xettle Technologies, a trailblazer in Fintech software solutions, whose commitment to sustainability is driving innovation and reshaping the future of finance.

Against the backdrop of global challenges such as climate change, resource depletion, and social inequality, the imperative for sustainable finance has never been greater. The Fintech Summit provided a platform for thought leaders to reflect on the role of technology in advancing sustainability goals and fostering a more resilient and equitable financial ecosystem.

At the heart of the discussions was the recognition that sustainability is not just a moral imperative but also a strategic imperative for Fintech firms. By integrating ESG considerations into their operations, products, and services, Fintech companies can mitigate risks, enhance resilience, and unlock new opportunities for growth and value creation. Xettle Technologies’ representatives underscored the company’s commitment to sustainability, highlighting how it is embedded in the company’s culture, innovation agenda, and business strategy.

One of the key themes that emerged from the summit was the role of Fintech in driving sustainable investment. Through innovative solutions such as green bonds, impact investing platforms, and ESG scoring algorithms, Fintech firms are empowering investors to allocate capital towards environmentally and socially responsible projects and companies. Xettle Technologies showcased its suite of Fintech software solutions designed to facilitate sustainable investing, enabling financial institutions and investors to align their portfolios with their values and sustainability objectives.

Moreover, the summit explored the transformative potential of blockchain technology in advancing sustainability goals. By enhancing transparency, traceability, and accountability in supply chains, blockchain can help address issues such as deforestation, forced labor, and conflict minerals. Xettle Technologies’ experts elaborated on the company’s blockchain-based solutions for supply chain finance and sustainability reporting, emphasizing their role in promoting ethical sourcing, responsible production, and fair labor practices.

In addition to sustainable investing and supply chain transparency, the summit delved into the role of Fintech in promoting financial inclusion and resilience. By leveraging technology and data analytics, Fintech firms can expand access to financial services for underserved populations, empower small and medium-sized enterprises (SMEs), and build more inclusive and resilient communities. Xettle Technologies’ representatives shared insights into the company’s initiatives to support financial inclusion through digital payments, microfinance, and alternative credit scoring models.

Furthermore, the summit highlighted the importance of collaboration and partnership in advancing sustainability goals. Recognizing the interconnected nature of sustainability challenges, participants underscored the need for cross-sectoral collaboration between Fintech firms, financial institutions, governments, civil society, and academia. Xettle Technologies reiterated its commitment to collaboration, emphasizing its partnerships with industry stakeholders to drive collective action and scale impact.

Looking ahead, the future of sustainability in Fintech appears promising yet complex. As Fintech firms continue to innovate and disrupt traditional financial systems, they must prioritize sustainability as a core principle and driver of value creation. Xettle Technologies’ visionaries reiterated their commitment to sustainability, pledging to harness the power of technology to build a more sustainable, inclusive, and resilient financial ecosystem for future generations.

In conclusion, the Fintech Summit served as a catalyst for reflection and action on the role of sustainability in shaping the future of finance. From sustainable investing and supply chain transparency to financial inclusion and resilience, Fintech has the potential to drive positive change and advance sustainability goals on a global scale. Xettle Technologies’ leadership in integrating sustainability into its Fintech solutions exemplifies its dedication to driving innovation and creating shared value for society and the planet. As the industry continues to evolve, collaboration, innovation, and sustainability will be key drivers of success in building a more sustainable and resilient financial future.

2 notes

·

View notes

Text

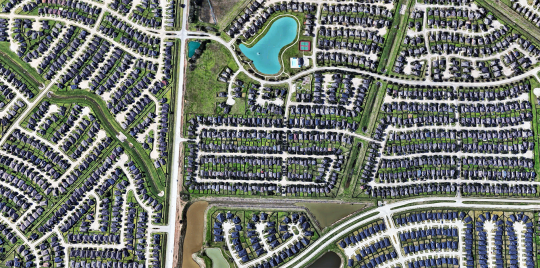

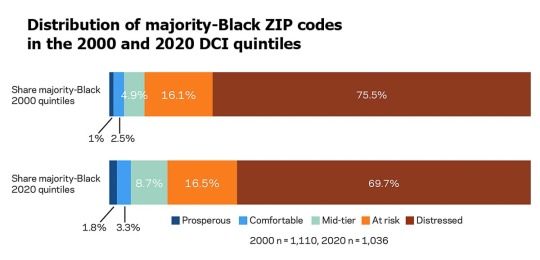

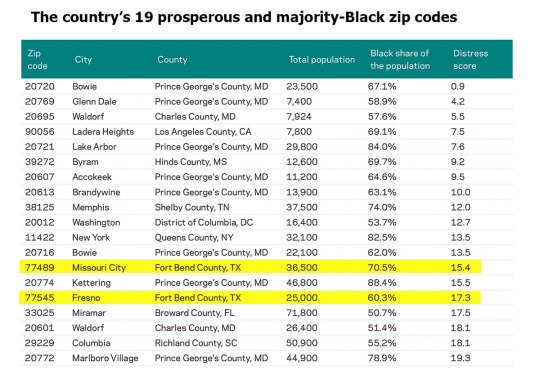

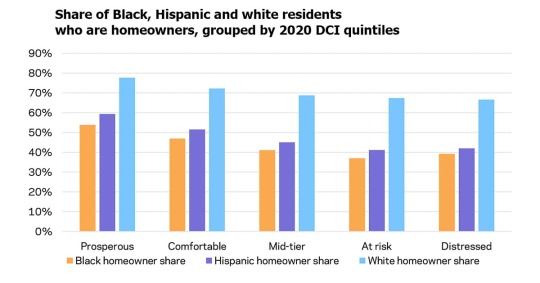

A shocking 70% of the nation’s 1,036 majority-Black ZIP codes are considered “distressed,” while only 19 — 1.8% — rank as “prosperous,” according to one analysis. Two of those prosperous ZIP codes are in Fort Bend County.

If you weren’t familiar with the lengthy list of disparities that exist in America, you’ve likely been brought up to speed by the pandemic, which has provided a frightening crash course in the nation’s inequalities. The large and widening divide between “prosperous” and “distressed” communities since the turn of the century was seen clearly in the quick economic recovery experienced by those with higher-paying jobs and better educations following the Great Recession. Meanwhile, many less fortunate Americans were still struggling to recover when the pandemic hit, bringing with it an even greater recession and hardship. And like the disease itself, the COVID-19 economic downturn has splintered the lives of those who are the least resilient — both physically and economically — while those whose jobs allow them to work from home have remained largely insulated from the virus and financial troubles.

Approximately 50.5 million Americans live in a distressed community. But what exactly does that mean?

Distressed communities are characterized by widespread poverty, high rates of unemployment and low levels of educational attainment. They also face stagnant or negative economic growth, which means little to no change in the prospects of those who live there.

To examine how economic well-being is spread across communities and regions in the U.S., the Economic Innovation Group (EIG) has released its Distressed Communities Index (DCI) each year since 2016.

“Economic inequality in America translates into opportunity gaps for too many communities,” said Steve Glickman, cofounder and executive director of the Economic Innovation Group, when the inaugural index was released. “Unless policymakers in both parties reframe their priorities, economically distressed communities will continue to experience a downward spiral that results in a loss of faith in the American dream and less healthy and fulfilling lives.”

Communities are defined at the ZIP code level and scores range from 0 (most prosperous) to 100 (most distressed). Based on the score, communities were placed into one of five tiers of economic well-being: prosperous, comfortable, mid-tier, at risk and distressed.

The seven metrics used to calculate a community’s score on the index were no high school diploma, housing vacancy rate, adults not working, poverty rate, median income ratio, change in employment and change in business establishments.

Between 2000 and 2018, the share of the U.S.’s Black population living in distressed ZIP codes dropped about 10% — from 45.6% to 35.3% — according to the report. Nationwide, 70% of majority-Black ZIP codes are distressed. By comparison, 20% of all ZIP codes and 16% of majority-white ZIP codes in the U.S. are distressed.

Of the nation’s 1,036 majority-Black ZIP codes — where 32.5% of the Black population lives — only 19 rank as prosperous on the DCI. Of those, 11 are in the Washington, DC, metro area, and two — 77545 and 77489 — are in Fort Bend County.

On average in prosperous ZIP codes, 5.2% of adults aren’t high school graduates, the poverty rate is 5.7%, 15.4% of adults are unemployed or not in the workforce, 4.7% of housing is vacant, the median household income is $90,800 and, from 2014–2018, the number of employees “in the geography” increased 20.8% while the number of businesses grew by 11.8%.

Sprawling Sun Belt cities like Houston and Phoenix, the report points out, experienced a lot of economic prosperity in the first two decades of the 21st century, but the benefits “were channeled outwards and did little to lift many chronically distressed urban neighborhoods.” Suburban ZIP codes form a ring of prosperity around the distressed core of Houston.

These include 77545 and 77489 in Fort Bend County, which as a whole has the low, low distress score of 2.3 and is one of Texas’ largest suburban counties. It’s also one of the most diverse counties in the nation. Between 2000 and 2019, the county population went from 62% white to 31%.

The population of the 77489 ZIP code in Missouri City, which has a DCI score of 15.5, is 70.5% Black or African American. The median household income is $66,400 and about 60% of residents are employed in management and professional or sales and office jobs. In 2000, the “distress score” of Missouri City’s 77489 ZIP code was 9.6, also in the prosperous quintile.

Fresno has a DCI of 17.2 and 60.3% of residents are Black or African American. Fresno’s “distress score” has improved significantly since 2000, when it had a DCI of 45.9, which is the mid-tier category of economic well-being. Most residents work in management and professional, sales and office or service industry jobs, and the median household income is $79,900.

But even within prosperous communities, there’s a gap in the average median household income between Black and white households, and it has widened in the past 20 years, from $4,987 in 2000 to $6,832 in 2018.

There’s also a gap in homeownership in prosperous communities, where the percentage of Black residents who are homeowners is 53.8%, compared to 77.7% of white residents. The gaps in household income and homeownership exist across all five DCI quintiles.

Today, 27% of Fresno residents and 23.7% of those in 77489 who are 18 and older have a bachelor’s degree or higher. That’s far lower compared to all prosperous zip codes in the nation — 47.2% of residents hold a bachelor’s degree or higher. However, among Black residents of Fresno, 37.7% have a bachelor’s degree or higher. In Missouri City’s 77489 ZIP code, that’s true for 28.8% of Black residents.

In November, voters in Fort Bend County elected Eric Fagan sheriff, the county’s first Black sheriff since the Reconstruction era. Walter Moses Burton was elected sheriff in Fort Bend County in 1869. He was the nation’s first Black elected sheriff. Walter Moses Burton Elementary School — one of the three elementary schools in Fresno — is named for Burton. The other two are named for Rosa Parks and Lula Belle Goodman, an African American educator who taught in the Fort Bend Independent School District for 41 years.

#There are only 19 prosperous majority-Black ZIP codes in the US. The Houston area is home to two#Redlining#real estate disparity#home ownership disparities

5 notes

·

View notes

Text

Saturday, May 27, 2023

Guam ‘very blessed’ with no early reports of major damage in the messy aftermath of Typhoon Mawar (AP) Chainsaws buzzed Friday as neighbors helped neighbors clear toppled trees and began cleaning the wreckage of Typhoon Mawar, which walloped Guam as the strongest typhoon to hit the island in over two decades but appeared to have passed without leaving death or massive destruction in its wake. While it was still early going in the recovery effort, police Sgt. Paul Tapao said there did not seem to be any major damage, main roads were passable and “Guam has been very blessed to have no storm-related deaths or any serious injuries.” To Tapao, the roar of the mechanical saws was a reminder of the resilience of the storm-prone U.S. Pacific territory and its people. “Everyone helps out with the cleaning,” he said. “That’s the Guamanian way.”

Welcome to America! Now learn to be in debt (NPR) Every time you swipe your credit card for a coffee or a carton of eggs, you take out a tiny loan from your bank. In many ways, the U.S. runs on borrowed money: a mortgage for a home, financial aid for college, a loan for a car, credit cards for nearly everything else. Over just two years, Americans went from pandemic-fueled, near-record savings to today’s highest-ever levels of personal debt. The U.S. economy counts on you to borrow money and stay in debt. Almost in a matter of a single generation, America has developed an extensive, even casual reliance on debt. Its epitome is the credit score, which often snares newcomers into a financial Catch-22—building credit history hinges on getting credit, but credit approval is dependent on having credit history. Being financially responsible in the U.S. has come to mean “borrow and repay,” says Barbara Kiviat, an economic sociologist at Stanford University. “It sort of crowds out the idea that maybe not borrowing in the first place is also a good idea,” she says. “But we’re now living in a world where so much hangs on that credit.” But what if you were taught to never owe anybody anything? “It’s such a cultural shift,” says Adina Appelbaum, who works with immigrants as a financial counselor and lawyer, “because in many countries they don’t have this culture of debt ... and there can actually be shame around having debt or a credit card.”

Henry Kissinger’s Legacy (National Security Archive) As Henry Alfred Kissinger reaches 100 years of age, his centennial is generating global coverage of his legacy as a leading statesman, master diplomat and realpolitik foreign policy strategist. “Nobody alive has more experience of international affairs,” as The Economist recently put it in a predictably laudatory tribute to Kissinger. But the historical record also documents the darker side of Kissinger’s controversial tenure in power: his role in the secret bombing campaign in Cambodia that killed over 100,000 civilians; the overthrow of democracy and the rise of dictatorship in Chile; disdain for human rights and support for dirty, and even genocidal, wars abroad, as well as involvement in the Nixon administration’s criminal abuses, among them the secret wiretaps of his own top aides.

More Russian Raids Down The Road (BBC) On Wednesday, Denis Kapustin, the leader of a Russian paramilitary group that conducted a border raid from Ukraine into Russian territory promised that more attacks are on the way. He claims that his group was able to seize “some weapons,” an armored personnel carrier, and multiple prisoners while only having two soldiers injured, though Moscow claims that Russian troops killed over 70 of the raiders. The Liberty of Russia Legion (LSR), which claimed joint responsibility for the Monday attack on Russian territory, said two of its forces were injured while ten more were killed. Both groups claim they want to take down Russian President Vladimir Putin’s government, though their motives are a little less than pure. Kapustin has stated that he wants a mono-ethnic Russian state (Russia is home to over 190 ethnic groups), and an independent Ukrainian investigative group has shown his links to neo-Nazis in Ukraine. Ukraine’s Azov Battalion has similar ideals—it was founded by a known neo-Nazi, is consistently described as “a far-right nationalist” group, recruits known white supremacists from Western countries, and regularly uses Nazi symbolism.

Russia’s Old Bombs Elude Ukraine’s Modern Defenses (NYT) As Kyiv gears up for a much-anticipated counteroffensive, Ukrainian officials, independent analysts and American military officials say the Russians are increasing their use of Soviet-era bombs. Although they have limitations, the weapons, they said, are proving harder to shoot down than the fastest, most modern missiles that the Ukrainians have become adept at intercepting. The aircraft bombs don’t have propulsion systems like cruise missiles or stay in the air nearly as long as drones. The bombs are aloft for only 70 seconds or less and are much more difficult for Ukraine’s air defenses to track. They are little dots on radar screens that soon disappear after being dropped, Ukrainian officials said, and then they slam into villages. According to Ukrainian and American officials, the Russians have retrofitted some of the bombs with satellite navigation systems and wings that stretch their range, turning an old-fashioned weapon, which Moscow has thousands of, into a more modern glide bomb. “This is the evolution of the air war,” said Lt. Colonel Denys Smazhnyi of the Ukrainian Air Force. “They first tried cruise missiles, and we shot them down. Then they tried drones, and we shot those down. They are constantly looking for a solution to strike us, and we are looking for one to intercept them.”

Climbers celebrate Mount Everest 70th anniversary amid melting glaciers, rising temperatures (AP) As the mountaineering community prepares to celebrate the 70th anniversary of the conquest of Mount Everest, there is growing concern about temperatures rising, glaciers and snow melting, and weather getting harsh and unpredictable on the world’s tallest mountain. Since the 8,849-meter (29,032-foot) mountain peak was first scaled by New Zealander Edmund Hillary and his Sherpa guide Tenzing Norgay in 1953, thousands of climbers have reached the peak. Recent research found that Mount Everest’s glaciers have lost 2,000 years of ice in just the past 30 years. Researchers found that the highest glacier on the mountain, the South Col Glacier, has lost more than 54 meters (177 feet) of thickness in the past 25 years. The glaciers are losing ice at rates that likely have no historic precedent, said Duncan Quincey, a glaciologist at the University of Leeds in the United Kingdom. The change is happening “extremely rapidly” he said. “It’s causing challenges for everybody within that region and, of course, for the millions of people who are living downstream,” since much of Southern Asia depends on rivers that originate in the Himalayas for agriculture and drinking water. Both floods and droughts are likely to become more extreme, he said.

Chinese hackers spying on US critical infrastructure, Western intelligence says (Reuters) A state-sponsored Chinese hacking group has been spying on a wide range of U.S. critical infrastructure organizations, from telecommunications to transportation hubs, Western intelligence agencies and Microsoft said on Wednesday. The espionage has also targeted the U.S. island territory of Guam, home to strategically important American military bases, Microsoft said in a report, adding that “mitigating this attack could be challenging.” While China and the United States routinely spy on each other, analysts say this is one of the largest known Chinese cyber-espionage campaigns against American critical infrastructure. Chinese foreign ministry spokesperson Mao Ning said on Thursday the hacking allegations were a “collective disinformation campaign”. Mao said the campaign was launched by the U.S. for geopolitical reasons and that the report from Microsoft analysts showed that the U.S. government was expanding its channels of disinformation beyond government agencies.

Son of local lawmaker arrested in rare killing that left four dead in Japan (Washington Post) The police arrested the 31-year-old son of a local lawmaker on Friday in connection with an assault that left four people dead, according to police. The suspect has been identified as Masanori Aoki, the son of Nakano City assembly speaker Masamichi Aoki. The armed and masked suspect had barricaded himself in a building after allegedly killing a woman and two police officers in the central Japanese prefecture of Nagano on Thursday. The first three victims died at a hospital. The gunman, who was wearing camouflage clothing, a mask and sunglasses, stabbed the woman and then opened fire with what appeared to be a hunting rifle when police arrived, reports said. A fourth person injured in the attack, Yasuko Takeuchi, 70, was unable to be recovered from the scene until after police apprehended the attacker, when she was pronounced dead, according to local media. Gun crimes are extremely rare in Japan, where firearms are strictly regulated. Anyone trying to get a gun in Japan needs to apply for a permit, attend a class on gun safety and laws, and pass a written test. There is a full-day training course on safe shooting techniques.

Leaked Report: “CIA does not know” is Israel Plans to Bomb Iran (The Intercept) Whether Israel’s escalating threats of war with Iran over its nuclear program are saber-rattling or something more serious is a mystery even to the CIA, according to a portion of a top-secret intelligence report leaked on the platform Discord earlier this year. The report reveals an undisclosed military exercise conducted by Israel. “On 20 February, Israel conducted a large-scale air exercise,” the intelligence report states, “probably to simulate a strike on Iran’s nuclear program and possibly to demonstrate Jerusalem’s resolve to act against Tehran.” “CIA does not know Israel’s near term plans and intentions,” the report adds, speculating that “Netanyahu probably calculates Israel will need to strike Iran to deter its nuclear program and faces a declining military capability to set back Iran’s enrichment program.” Biden has not opposed a unilateral Israeli attack on Iran—and his national security adviser recently hinted at blessing it. “We have made clear to Iran that it can never be permitted to obtain a nuclear weapon,” Jake Sullivan said in a speech earlier this month. Sullivan went a step further, adding, “As President Biden has repeatedly reaffirmed, he will take the actions that are necessary to stand by this statement, including by recognizing Israel’s freedom of action.”

Plastic Bags (ABC News) While many places purport to collect and recycle plastic shopping bags, a new investigation found that in reality it’s rare that bags make it to designated recycling centers even when properly returned to retailers who claim that they’ll recycle them. ABC and nine local stations and affiliates across the country dropped 46 bundles of plastic bags fitted with electronic trackers into drop-off locations associated with the American Chemistry Council’s Wrap Recycling Action Program, which has 18,000 drop-off points nationwide. The trackers were superglued inside multiple layers of clean plastic bags, and were monitored over the course of their journeys. After months of tracking, as of May, half of the trackers last pinged at landfills or incinerators, seven last pinged at refuse transfer stations that don’t recycle plastic bags, and six still remain in the store where they were dropped. Another three are now thousands of miles overseas in Malaysia or Indonesia, exported to Asia, and three were inconclusive. Only four of the 46 bundles last pinged in a facility that recycles plastic bags.

5 notes

·

View notes

Text

Holonet News Special Report: Navigating Uncharted Skies - Independent Starpilots Grapple with Imperial Regulations

By Deena Tharen, Executive Reporter, Holonet News

Coruscant, Core Worlds - The celestial pathways that once saw the free and spirited dance of independent starpilots ferrying passengers through the vibrant tapestry of Coruscant's skies are now navigating through a challenging storm. The recently enacted "Galactic Traveler Protection Act" (GTPA) has ushered in a new era of governance in the starfaring sector. Its facets encompass not only improved safety protocols and standardized navigational practices but also the imposition of fees and adherence to quality standards. While the Imperial Senate extols the virtues of the GTPA, it has brought both opportunities and hurdles for these pilots, raising questions about the balance between safety and economic viability.

In a recent interview, Captain Liana Voss, an esteemed star captain, shared her perspective on the evolving landscape. "Passenger safety is paramount. I've always held this principle at the core of my operation. Yet, the weight of the new regulations has strained the very essence of what we've stood for. The financial burdens and complex administrative maze are suffocating our ability to offer that personal touch."

As Captain Voss's story unfolds, it becomes evident that her plight resonates beyond her own endeavors. Scores of pilots, whose ships have been the vessels of dreams, are now navigating through uncharted waters of uncertainty. The evolving fees, rigorous inspections, and newfound mandates have sparked conversations about the role of regulation in safeguarding passengers while nurturing the diversity of the starfaring industry.

Imperial spokesperson Commander Ardon Paxis spoke to Holonet News, stating, "The Galactic Traveler Protection Act seeks harmony between safety and prosperity. It is not just about preserving the sanctity of travel, but also about preserving the livelihoods of those who ply the cosmic currents."

While the GTPA's intent is noble, it is undeniable that some factions view its encumbrances on independent pilots with mixed sentiments. The intent behind the legislation garners respect; however, the reality of its impact cannot be denied. In navigating these new waters, we must weigh the stability and order it promises against the potential strain it places on the vibrant community of independent pilots who have long graced our skies.

As the debate persists, one truth remains: the challenge before the Empire is to steer through the celestial realm of regulation while addressing the concerns of independent pilots who have been the unsung heroes of Coruscant's skies. The journey ahead will test the delicate balance between ensuring orderly travel and recognizing the resilience of those who chart their own course.

3 notes

·

View notes

Text

Financial Resilience Institute

The Financial Resilience Institute is dedicated to assisting people in achieving long-term financial security by building a strong foundation of resilience. We offer innovative tools, educational materials, and individualized counsel to help individuals and businesses plan for a secure financial future. At the Financial Resilience Institute, we believe in equipping people to face financial uncertainty with confidence and develop long-term resilience. Contact Us in developing a path to long-term financial health and well-being.

#financial resilience institute#improve financial resilience in canada#financial resilience#financial stability report#financial resilience score

0 notes

Text

As if there wasn't exhaustive enough evidence that "ESG" is nothing but a scam, the Financial Times was out this week with a piece detailing how many companies with good ESG scores pollute just as much as their lower-rated rivals.

Don't say we didn't warn you; we have been writing about the ESG con for years now, which along with other "sustainable" investments continues to see hundreds of billions of dollars in inflows from investors.

The FT added to our skepticism by revealing this week that Scientific Beta, an index provider and consultancy, found that companies rated highly on ESG metrics - and even just the 'Environmental' variable alone - often pollute just as much as other companies.

Researchers look at ESG scores from Moody’s, MSCI and Refinitiv when performing the analysis. They found that when the 'E' component was singled out, it led to a “substantial deterioration in green performance”.

Felix Goltz, research director at Scientific Beta told the Financial Times: “ESG ratings have little to no relation to carbon intensity, even when considering only the environmental pillar of these ratings. It doesn’t seem that people have actually looked at [the correlations]. They are surprisingly low.”

He added: "The carbon intensity reduction of green [ie low carbon intensity] portfolios can be effectively cancelled out by adding ESG objectives."

“On average, social and governance scores more than completely reversed the carbon reduction objective,” he continued. “It can very well be that a high-emitting firm is very good at governance or employee satisfaction. There is no strong relationship between employee satisfaction or any of these things and carbon intensity."

“Even the environmental pillar is pretty unrelated to carbon emissions,” he said.

Vice-president for ESG outreach and research at Moody’s, Keeran Beeharee, added: “[There is a] perception that ESG assessments do something that they do not. ESG assessments are an aggregate product, their nature is that they are looking at a range of material factors, so drawing a correlation to one factor is always going to be difficult.” “In 2015-16, post the SDGs [UN sustainable development goals] and COP21 [Paris Agreement], when people began to really focus on the issue of climate, they quickly realised that an ESG assessment is not going to be much use there and that they need the right tool for the right task. There are now more targeted tools available that look at just carbon intensity, for example,” he added.

MSCI ESG Research told the Financial Times its ratings “are fundamentally designed to measure a company’s resilience to financially material environmental, societal and governance risks. They are not designed to measure a company’s impact on climate change.”

Refinitiv told FT that “while very small, the correlation found in this study isn’t surprising, especially in developed markets, where many large organisations — with focused sustainability strategies, underpinned by strong governance, higher awareness of their societal impact and robust disclosure — will perform well based on ESG scores, in spite of the fact that many will also overweight on carbon”.

Global director of sustainability research for Morningstar Hortense Bioy concluded: “Investors need to be aware of all the trade-offs. It is not simple. In this case, investors need to think carefully about which aspects of sustainability they would like to prioritize when building portfolios: carbon reduction or a high ESG rating.”

2 notes

·

View notes

Text

Direct Admission in Mbbs Abroad: A Gateway to Global Medical Education

Introduction:

In today's competitive world, pursuing a career in medicine has become a dream for many aspiring students. However, due to limited seats and intense competition in domestic medical colleges, more and more students are looking for opportunities to secure direct admission in MBBS abroad.

Why Choose Direct Admission in MBBS Abroad?

Direct admission in MBBS abroad opens up a world of possibilities for students who aspire to become successful medical professionals. Here are a few reasons why opting for overseas education can be a game-changer.

Affordable Tuition Fees: Many countries offering direct admission in MBBS abroad have significantly lower tuition fees compared to domestic institutions. This cost advantage attracts students from various financial backgrounds who may find it difficult to afford the exorbitant fees of private medical colleges or universities in their home countries.

No Entrance Exams: One of the primary advantages of pursuing MBBS abroad is the absence of entrance exams. While securing admission in prestigious medical colleges domestically can be challenging and require exceptional scores in entrance tests, universities abroad often offer direct admission based on merit or other criteria.

Global Exposure and Diversity: Studying MBBS abroad exposes students to diverse cultures, languages, and medical practices. They get the opportunity to interact with peers from different nationalities, exchange ideas, and gain a broader perspective on healthcare.

International Recognition and Accreditation: Many renowned medical universities abroad are recognized by global accreditation bodies like the World Health Organization (WHO), the Medical Council of India (MCI), and the General Medical Council (GMC) in the United Kingdom.

Diverse Learning Environment: Another significant advantage of pursuing MBBS abroad is the exposure to a diverse learning environment. International medical universities attract students from various countries, creating a multicultural and inclusive atmosphere. Interacting with classmates from different backgrounds enhances cross-cultural understanding and promotes a global perspective on healthcare.

Advanced Infrastructure and Technology: Many universities offering direct admission in MBBS abroad boast state-of-the-art infrastructure and cutting-edge technology. These institutions prioritize investing in modern facilities, well-equipped laboratories, and advanced medical equipment.

Quality of Education: Renowned universities abroad often have a reputation for providing high-quality education. These institutions employ experienced faculty members who are experts in their respective fields.

Clinical Exposure and Practical Training: Opportunities for Research and Specialization: Several international universities encourage research and offer opportunities for students to engage in scientific studies. By participating in research projects, students can contribute to medical advancements and gain a deeper understanding of specific areas of interest.

Enhanced Language Skills: Studying MBBS abroad often involves learning in a different language. This experience not only helps students develop proficiency in a foreign language but also enhances their communication skills. Effective communication is crucial in the medical field, as it enables doctors to understand patients and convey medical information accurately.

Personal and Professional Growth: Pursuing MBBS abroad is not only about academic excellence but also about personal and professional growth. Living in a foreign country exposes students to new challenges and experiences, promoting independence, adaptability, and resilience.

Conclusion:

Direct admission in MBBS abroad offers a viable pathway for students to realize their dreams of becoming doctors without the barriers of intense competition and complex admission processes. The benefits of affordable tuition fees, international exposure, and global recognition make pursuing an MBBS degree overseas an attractive option for aspiring medical professionals.

3 notes

·

View notes

Text

Pep Guardiola is preparing Manchester City for a do-or-die Champions League clash against Club Brugge with an unwavering focus, emphasizing a strategic and emotion-free approach to ensure his team executes the game plan effectively. City currently sit in 25th place in the group, trailing Stuttgart by two points for the final qualification spot. And should City fail to deliver a win over Brugge, they will be sent home early in Europe. The stakes are so high, Guardiola is turning his team into cold precision. "We would love to score a lot of goals in the first 20 minutes," he admitted. "But I don't think that will happen. What matters is reading the game correctly and ensuring that the players stay composed and focused." Guardiola has had his fair share of nerve-wracking matches in his storied managerial career and is not shaken by this being a make-or-break affair. "I have been in the Champions League for many years, and I have faced such a situation several times," he said. "Usually, these games come at the later knockout rounds, not at this point, but we are here because we haven't been enough. Steffen Prößdorf, CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0, via Wikimedia Commons City have been relatively consistent in their history in the Champions League, failing to advance from the group stage only once since the 2012-13 season. When asked about the potential financial implications of an early exit, Guardiola was pragmatic. "I haven't discussed that with my CEO ," he said. "Over the past few years, our transfer windows have shown a positive budget.". The club's net spend has been excellent. Of course, I understand the financial significance of advancing in this competition, but for us, it's about sporting ambition first. Club Brugge, three points clear of City, are just a draw away from a playoff spot, so they will be a very dangerous opponent. Guardiola acknowledged the quality of his opponents, saying, "When a team goes 20 or 21 games unbeaten, it's a testament to their strength. We expect a difficult challenge. City will be boosted by the return of Oscar Bobb, who has recovered from a fractured leg that kept him out for five months. The Norwegian international's availability adds depth to Guardiola's attacking options, providing a potential game-changer in a match of such magnitude. The manager’s emphasis on a clinical and controlled performance reflects the urgency of the moment. City’s fate hinges on their ability to execute under pressure, and Guardiola’s wealth of experience in high-stakes encounters will undoubtedly be crucial. His players must embrace the challenge, knowing that anything short of victory spells elimination. Although Guardiola has all the composure outside, he knows that his team has put so much stress on the players with the string of unconvincing shows in Europe and that this one will define the season. Such pressure, although huge, doesn't weigh him down, considering the quality that City have with tactical discipline in place. Brugge, on the other hand, are riding a wave of confidence. Their impressive unbeaten streak speaks volumes about their resilience and ability to navigate tough matches. City must be wary of their opponent’s defensive organization and counterattacking threat. As the match draws near, Guardiola's message to his team reads like this: remain calm, play as instructed, and dominate the game straight off. The intention is to dictate the pace of the game from the whistle and not allow Brugge any time to get into their groove. If City plays out its plan, there is every chance of getting that all-important win to take it to the next round. There will be drama, tension, and high-stakes football on this night at the Etihad, as every pass, tackle, and shot is going to hold immense importance, given City's European aspirations are at stake. Guardiola's belief in his team hasn't wavered, but it's now time to put into action rather than talk about it. Read the full article

0 notes

Text

What is the Importance of ESG Reporting in Business?

Corporate sustainability investors, consultants, and strategists imagine a future where every business has efficient policies governing eco-friendly production methods. Likewise, embracing diversity and financial reporting transparency helps combat legal risks from unethical practices like discrimination and corruption. This post will discuss the importance of ESG reporting in business.

What is ESG Reporting?

ESG, or environmental, social, and governance, is an investment strategy using business performance analysis to monitor how a company consumes natural resources, handles employee relations, and practices accounting transparency. So, an ESG consulting services firm will deliver the required data through an appropriate reporting mechanism.

Using these compliance metrics, investors can quantify the brand’s positive or negative influence on society and nature. Moreover, an ESG report systematically categorizes sustainability metrics into three sections or pillars.

The environmental pillar summarizes how an organization integrates green technology and reduces plastic usage. Besides, it investigates metrics like the deforestation risks associated with an industry.

Diversity and multicultural tolerance are at the core of the social considerations in ESG reporting. Additionally, preventing workplace hazards and empowering marginalized groups through affirmative action policies are crucial.

Governance in sustainable development benchmarks rewards companies employing advanced financial and digital security measures with higher ratings. It assesses how a brand prioritizes ethics, privacy rights, and investor relations.

What is the Importance of ESG Reporting in Business?

1| ESG Helps Mitigate Supply Chain Risks

A lack of standardization and governance exposes your supply chains to legal, financial, and environmental threats, but ESG service providers can assist you in overcoming those challenges. The governance aspects in sustainability compliance audits inspect which suppliers engage in socio-economically harmful practices.

Using the data-led recommendations in the reports, organizations can determine whether to train suppliers or search for other resource providers. Therefore, managers can increase the company’s resilience to supply chain risks. For example, suppliers must avoid child labor, pollution, and corruption. Otherwise, your enterprise’s reputation will decline once investors and analysts investigate you.

ESG reporting enables corporations to find suppliers who know the importance of the United Nations’ sustainable development goals (SDGs). Since most suppliers will change their operations to respond to industry dynamics, reliably examining their ESG scores after suitable intervals is essential.

2| Consumer and Investors Relations Improve

Individuals want to purchase eco-friendly products, while impact investors want to support sustainable companies. Therefore, corporate strategists must explore roadmaps for aligning a company’s business model with modern stakeholder expectations.

Developing ESG-powered business intelligence to estimate the shifts in consumer preferences benefits corporations in planning a new product launch. Similarly, using applicable and valid sustainability metrics for marketing materials goes a long way toward increasing brand awareness and trustworthiness.

Besides, several governments direct companies to embrace standardized financial self-disclosures. Since ESG reporting integrates globally respected sustainability accounting guidelines, developing the disclosure documentation for investor communications becomes more manageable.

3| Operational Efficiency Increases

Toxic workplaces and preferential treatment will accelerate the talent drain at a company. So, social inclusivity and employee health insights empower managers to keep the workers energetic, creative, and productive.

Furthermore, green technology integrations contribute to energy usage reduction. And the governance components prevent accounting inconsistencies. These advantages of ESG reporting ultimately enhance an organization’s quarterly progress.

All the financial improvements also help brands transfer the benefits to their stakeholders. Consider the case of refurbished electronic devices. Consumers can get reasonably functional equipment at a lower price while the e-waste generation rate decreases.

Conclusion

Regulatory bodies and fund managers recognize the rising importance of ESG reporting in business, administration, and the global economy. Simultaneously, research and development (R&D) into renewable energy resources has attracted investors in several markets.

Consumers have also voiced their concerns whenever a brand fails to embrace SDGs’ sustainable, inclusive, and transparent vision.

Therefore, leveraging statistical and computer-aided benchmarks at an extensive scale has become mainstream across business development strategies. As its significance grows with each passing day, leaders must find experienced domain specialists to implement an ESG-first approach throughout their operations.

2 notes

·

View notes

Text

The Financial Benefits of Going Green: Sustainable Investing Explained

Sustainable investing is no longer just a trend; it has become a critical approach for investors looking to align their financial goals with environmental and social values. This strategy, often referred to as Environmental, Social, and Governance (ESG) investing, focuses on companies that prioritize sustainability while delivering competitive financial returns. By going green with your investments, you can reap both financial and societal benefits. Here’s how sustainable investing works and why it’s worth considering.

What is Sustainable Investing?

Sustainable investing involves choosing investments based on their ESG criteria.

Environmental factors include a company’s carbon footprint, renewable energy usage, and waste management practices.

Social factors assess a company’s labor practices, diversity, and community engagement.

Governance factors evaluate issues like corporate transparency, executive compensation, and ethical practices.

This approach enables investors to support companies that are making a positive impact on the world while avoiding those that may pose risks due to poor environmental or social practices.

Financial Benefits of Sustainable Investing

1. Resilience in Market Downturns

Companies with strong ESG practices tend to be more resilient during economic downturns. For example, businesses that prioritize energy efficiency and sustainable supply chains are often better equipped to manage rising costs and regulatory changes, making them more stable investments over time.

2. Long-Term Growth Potential

Sustainability-focused industries, such as renewable energy, electric vehicles, and green technology, are experiencing rapid growth. Investing in these sectors can provide significant long-term returns as the world shifts toward a low-carbon economy. For instance, the global renewable energy market is expected to grow exponentially in the coming decades, driven by government policies and consumer demand.

3. Attracting Top Talent and Customers

Companies with strong ESG practices often attract better talent and foster greater customer loyalty. Employees and consumers increasingly prefer organizations that align with their values, giving these companies a competitive edge. This translates to better performance and, ultimately, higher returns for investors.

4. Risk Mitigation

Investing in companies with poor environmental or social practices can expose you to risks such as regulatory fines, lawsuits, and reputational damage. By focusing on ESG-compliant businesses, you reduce the likelihood of these risks affecting your portfolio.

How to Start Sustainable Investing

Research ESG Funds: Look for mutual funds or exchange-traded funds (ETFs) that focus on sustainable investing. Many of these funds have diversified portfolios of ESG-compliant companies.

Evaluate ESG Scores: Use tools and platforms that provide ESG ratings for companies. These scores can help you identify businesses with strong sustainability practices.

Consider Green Bonds: Green bonds are fixed-income investments specifically designed to fund environmentally friendly projects. They offer a way to support sustainability while earning steady returns.

Work with a Financial Advisor: If you’re new to sustainable investing, a financial advisor can help you build a portfolio that aligns with your values and financial goals.

The Bigger Picture

Sustainable investing isn’t just about financial gains; it’s also about driving positive change. By directing capital toward companies that prioritize sustainability, you contribute to a greener, more equitable world. This dual benefit—making a difference while earning returns—makes sustainable investing an increasingly attractive option.

Conclusion

The financial benefits of going green through sustainable investing are clear: market resilience, long-term growth, risk mitigation, and alignment with values. As global awareness of environmental and social issues grows, sustainable investing offers a unique opportunity to build wealth while making a meaningful impact. It’s not just an investment in your financial future; it’s an investment in the planet’s future too. Originally posted on http://dougstevensonbowdoinhammaine.net/

0 notes