#final depositors

Explore tagged Tumblr posts

Text

Clinical

Hi Everyone! Here's the piece for the week. I mentioned that I felt like I could make it a series, but I'm still not a hundred percent sure about it. So, I'll wait for some feedback on it. Anyway, prepare some time with Karina that involves a little rough sex and some breeding.

Length 2K

Karina X Mreader

In what could best be described as a hospital room, Karina pursed her lips and considered how the night would go. “Depositor entering the building,” A robotic voice says. Karina stared at the light by the door to her room; if she were chosen, it would light up a bright green. She had been on the list for a long time and wanted it to be her turn to finally get the chance to be bred. She recoiled as the shining light turned on. The door to her room opened immediately afterward; a nurse walked with a carefree smile.

“Today’s the day, Karina. Would you like the shot?”

Karina nodded, “It’ll be easier like that, right?”

“A lot easier. Just consider that it’ll be hard to control yourself for the day after. You’ll be like a dog in heat.” The nurse responds with a slight chuckle, having experienced it herself. “Do you still want to take it?” Karina agreed to it, and the nurse prepared the injection and Karina’s arm. “This is going to sting a little.” The nurse presses the needle into Karina’s skin, puncturing it and injecting the serum into her. “The system will notify you and your partner when you’re pregnant.” Karina felt her body heat up as those words were spoken. She rubbed her legs together; they became slick with her juices in moments. Her breathing became heavy, and her nipples hardened, rubbing against her skin-tight outfit. She moaned lightly; her body was becoming incredibly sensitive. The nurse quickly cleaned the wound, applying a bandage before heading out. She pressed a button on the wall and left with the door shutting behind her.

“Serum applied. Toys have been unlocked.”A voice says before a cupboard opens, revealing a myriad of toys. Karina eyes one of the dildos and goes for it. She moves the bottom of her one-piece to the side and pushes it inside as she bends over the counter.

“Mhm, Ah,” Karina groans as she pushes the dildo inside her cunt. A thin layer of sweat develops on her skin as she fucks herself. Karina’s walls squeezed down on the toy as she moved it. Karina needed more, though. She grabbed at her breasts, shaking when her nipple rubbed against the cloth of her one-piece. She groaned but continued to play with herself, licking her lips as she imagined a real cock fucking her. “Fuck,” the dildo wasn’t enough for Karina. She needed more; dropping the dildo, she scoured through the cupboard until the door to her room opened.

------------------------------------------------------------------------------

“Thank you for your selection. Please proceed to the next room immediately,” the robotic voice of the vending machine says as it spits out a plastic card. You walk forward, scanning the hall as you head to your room. “Please scan your card.” You do so, thinking of the ridiculousness of having to scan the card it just gave to you. The metal door slides open, shutting behind you as you step inside. To your left was a screen that played a video you had seen dozens of times at this point. You sat down on the bed in the room and watched it. It seemed like nothing would happen until it finished. You were a little anxious about it all but happy about being chosen. Not many got that opportunity, much less with a selection as popular as you had. “Your partner is approaching; please remove your clothing,” says the same robotic voice of the room intercom. You follow the instructions and sit on the bed, waiting for your partner.

The door slides open, and your partner for the night, Karina, stumbles through. She was wearing a skin-tight, high-waisted metallic one-piece and nothing else. Karina’s stiff nipple poked through the one-piece, and the one-piece itself was pulled high; her lower lips were completely visible, and her thighs were coated in her juices. The first thing you heard from her lips was a moan. Her eyes remained on the ground as one of her hands went to cunt, rubbing it roughly as the other squeezed her heavy breast. You knew how this worked. In making conceiving easier, the women were given the option to take a unique concoction that raised their libido and the likelihood of getting pregnant. Karina slowly raised her head, her eyes became glued to your cock, and she rushed to you. She dropped onto her knees and rubbed her face against it. Her tongue poked out from between her lips and ran along the underside of your cock, “A real cock,” Karina moans, dragging her tongue along it again before wrapping her lips around the tip. The slippery warmth of her mouth makes you groan; adding to your pleasure was the sensation of her tongue running back and forth over the tip. Karina placed her hands on your thigh as she pushed herself down on your cock, reaching the base. Karina’s eyes roll into the back of her head as she slobbers over your cock, her low groans flowing as she facefucks herself. You place your hand on the back of her head, forcing your cock down her throat. You feel it flex around your shaft, tightening around you.

You push Karina away from you, knowing you are getting close to cumming. Her mouth is stained with saliva; her eyes are teary. You catch her rubbing her cunt through her swimsuit. While you had pushed Karina’s mouth away, you hadn’t stopped her hands. They gripped your cock tightly, running along your shaft and stroking you. Your cock began to throb in her hands, and your strength left you. Karina pushed her way back to your cock, wrapping her lips around the tip and lapping at your cock. You lay back on the bed, trying to last a little longer, but it was useless. Karina’s muffled moans are all you can hear as she drinks your cum, placing her tongue at the tip and milking your cock by jerking you off. You look at her, watching as she revels in the taste of the salty liquid.

Karina jumps on you a moment later, “I need more,” She mumbles as she grabs your cock, and points it to her cunt. She moves the bottom of her swimsuit to the side with her other hand. A moment later, Karina sinks onto your cock, filling herself. Karina squats over you, bouncing on your cock with enthusiasm. She bends over, running her tongue along your nipple. “I want your cum. I want you to put a baby in me.” She repeats with every bounce. Karina works the muscles, tightening her cunt around your cock. Her slippery walls had coated you in her nectar and made sliding further inside easier. The pleasure was overloading you, and you could barely move as Karina had her way with you.

Your body clapped as she pressed her weight against you. “Karina, I’m going to cum,” You groan.

“That’s okay. I want you to fill my needy pussy with your cum.” She whispered into your ear as she impaled herself on you. Your cock was beginning to throb inside her. Karina felt it and moved quickly, slamming herself onto you. “I’m so close. I’m so close.” She said, her saliva dripping onto you. As you near your climax, you watch her bouncing tits; they are hypnotizing. You reach out for one, cupping it and giving it a soft squeeze. “OH fuck!” Karina shouts dropping herself onto your cock. Her walls clamp down on your cock and force your climax. Karina remains seated on your cock as a torrent of your baby batter rushes into her fertile womb. Karina grinds against you as you calm down from your climax. You get into a seated position and run your hands along Karina’s back, unzipping her one-piece. She follows your lead, pulling her swimsuit off her body. Karina’s heavy tits swing as she forces the top half off her body. “I want more,” she groans, rubbing her clit. “I’m not pregnant yet.”

You roll Karina onto her back and pull off her one-piece, leaving her completely naked. You spread Karina’s legs and rub your cock along her slit. You remember the videos and find Karina’s swollen clit and flick it. She throws her head back and roars. The sensation made her toes curl, but it didn’t end there. You pushed your cock inside her cunt, slipping inside with ease. Karina holds onto the bedsheets as you begin thrusts. “Shit, fuck me,” Karina says through gritted teeth as you play with her body. You reach over with your other hand and pull on the hard nub of her left tit. Karina cries out in pleasure. Her sensitive nipples were being toyed with now, and she loved it. She wrapped her legs around your waist, using her feet to push you in deeper. Playing with her tits and clit was having its effect on Karina; she began to babble as you have your way with her. You lean over Karina, attaching yourself to her other nipple. You bite down on it and pull back, stretching her flesh and making her roar.

You feel her walls tightening around you, her nails digging into your skin and scratching your back, marking you. “Cum,” Karina whines, struggling to get another word out as you drive your cock against her womb. Each thrust drags some of your cum out of her, and it pools around her.

“I’m going to cum too.” You moan as your cock begins to throb inside Karina.

She feels it and pulls you in close. “Cum inside me, give me a baby!” She whines. You continue to slam against her pussy, her walls gripping you, trying to keep you inside. Every movement pushes you and Karina closer to cumming. You shut Karina up with a kiss and roughly squeeze her tit as you bury yourself inside and dump another load of your semen inside her. You feel her body shake as she goes through another orgasm, and her mind goes blank. You give her a few soft thrusts, enjoying the way her cunt gripped you before pulling out. Cum leaked out from her, dripping onto the bed.

“Congratulations, pregnancy secured.” The robotic voice blares through the room’s speakers. “Candidate, please proceed into the next room,” it follows. You grab your clothes and move to the next room, your eyes watching Karina before the door separates you. “Thank you for your participation in creating the next generation. A nurse will be with you soon.” The voice said. You didn’t know whether to put on your clothes, but before you could start, another door opened, and a nurse walked through it.

“Allow me to clean you up, sir.” She says before kneeling before you. You read the nametag on her as she wraps her lips around your cock and begins to clean you up.

“Thank you…Taeyeon.” You groan; her deft tongue slithers along the underside of your cock, before moving along the sides. She slowly pulls back, kissing the tip before inspecting her work. She glances up at you and smiles, opening her mouth to show you all the cum she collected before swallowing.

Taeyeon slowly rises to her feet. “You’re free to leave now, sir. Should something happen to your partner’s baby, you will receive a call so you can impregnate her again.” She says before leaving the room. You get yourself dressed and leave the clinic, hoping you get to return in the future.

Taeyeon was right about the serum's side effects. Karina could hardly control herself after the breeding was done. She was kept in a secluded room on a fuck machine. Bound with some chains, Karina was given orgasm after orgasm. The toy pumped her full of fake cum at certain intervals, helping satisfy that need. Her belly was bloated, and cum flowed out of her with every thrust, but she still wanted more.

Once the serum wore off, Karina returned to her usual self and was given a tape of the experience to watch if desired. She couldn’t help herself and watched it that night. Seeing herself be nothing more than a beast in heat turned her on. She rubbed her lips, masturbating as she watched her time in the clinic.

1K notes

·

View notes

Text

Navamsa Observations 7

WARNING: Remember this is not a personal read, sharing a few placements will NOT promise the same outcome.

8th H ruler in 11th H - This can indicate gaining through the courts. When paired with many divorce indicators, I always see this as people who gained through divorce. If a well placed benefic like moon in libra sits in 11th, it can be a considerably big amount.

7th H ruler in Aqua - If paired w/ divorce indicators, this can show there is distance between the person and their spouse. They grow detached over time. Due to Saturn being the traditional ruler of Aqua, this happens slowly. There is no one big incident that drives the couple apart, it gradually happens.

Rahu in 2nd H in D9

In certain cases, this can indicate a very late marriage. To be sure, one must check entire D1 and D9.

This shows after marriage or later in life, a person separates from their family. This can be due to conflict or simply the person must move to a different state/province or country.

One big thing is this shows you will exaggerate in speech. In a sign like taurus, you can exaggerate your wealth and possessions such as cars or homes. BUT the spouse will correct you even if you're in front of people. FOR EXAMPLE: You tell you friend "we went bought a house in [a popular city]. The spouse will say "no technically we live a a 15 minutes outside the city". The couple will bicker. The spouse will not support what you are saying just because they are married to you. They will challenge and correct you. Depending on entire chart, this can lead to conflict or simply be an annoyance on a few occasions.

If Rahu's depositor is strong, you can become wealthy later in life. However, Rahu is NOT a benefic. I have noticed there is always a catch with rahu.

FOR EXAMPLE: I have seen this as struggle throughout one's entire life and finally in their 60s they became VERY wealthy. Only to die shortly afterwards due to their poor eating habits & smoking (they had diabetes and lung cancer). They once said it was the stress of their life that made it impossible for them to stop smoking. In his case, he had an exalted Mars Cap conjunct a benefic (Venus) ruling his rahu in 2nd aspecting an exalted Saturn Libra.

So due to rahu's nature, when you get wealth, you may not even be able to enjoy it fully. Depending on the entire chart, this placement can have the reverse affect too. You can become a liar and thief. You may not become wealthy and it becomes an obsession in your mind. It leads to negative thinking later in life as you feel you deserved more from life.

This placement is a BIG indicator for you needing to financially support your marriage/family. Regardless of your gender. Later in life, likely there is a point where you become the breadwinner.

I see too many people letting their own bias affect how they interpret these observations. For accuracy, you need to look at D1 and D9 - looking at one placement in each will not tell you the full story. This is NOT a personal read.

The sign these planets are in will change the outcome. The aspects will influence the outcome.

Even a well placed Rahu in 2nd of D9 shows debilitated eye sight and bad habits. You may need glasses, you may have an eye injury. You can eat unhealthy later in life - you can become a drinker, smoker, you can eat many red meats.

Another interesting thing about this placement is within the year you marry (before or after the wedding), a sibling will have an important life development. IRL EXAMPLES:

ex.1: A few months before this woman's wedding, her sister announced she was getting a divorce.

ex.2: This woman's sister announced she was pregnant AT the wedding. In this case, it upset the woman, she felt her sister had made the day about her. She has 11th H ruler in 6th in D1 so the relationship has never been the strongest. The elder sibling acts as an enemy/hater in this person's life.

ex.3: This woman's brother began university the year she married. This doesn't seem as big as the above examples but it is a huge milestone in life.

D1/Natal:

YOUR ELDER SIBLING'S MARRIED LIFE:

This can be seen in your own chart. 11th house shows the elder siblings in vedic, 7 away from 11 shows their marriage. If 7 away (your 5th house) has malefics or ruler placed negatively, your elder sibling may divorce.

ex: 5th H - CAP, ruler Saturn afflicted in 10th h - this can indicate your elder sibling's divorces. This is because the 10th becomes the 12th H for your siblings - this is the house of loss amongst other things. When afflicted shows a divorce or major hardship in your elder sibling's marriage.

This method can be difficult if you have more than one elder sibling. I am just mentioning it as fun/interesting method. Of course their own chart will hold more power over their life.

YOUR YOUNGER SIBLING'S MARRIED LIFE:

In vedic, 3rd H is your younger sibling. 9th H becomes their 7th house. This can provide a little insight on their married life.

EX: 9th H has Rahu, this person's younger brother cheated on his wife. 9th H ruler (Venus) was conjunct a malefic (Sun) in 2nd h (which is the 12th H for your sibling.) Their brother got a divorce.

Using someone else's chart does not give full accuracy. As 3rd H is also cousins and you may have multiple younger siblings. Their own chart will hold more power.

#8th house ruler in 11th house#vedic astro observations#astrology#astrology observations#navamsa observations#libra moon#rahu in 2nd house

153 notes

·

View notes

Text

Matt Levine covering crypto again (about how the FTX depositors are sorta being made whole) reminds me of now how weird it feels that crypto is officially above where it ever was in value but the days of it being sold in super bowl commercials are long gone, it feels weird man.

I am also calling it a successful prediction for me(which I may not actually have made publicly), I felt that the story back in the crypto crash that this was the final event for crypto were a bit dubious precisely because it's not based on anything. It was never really living and thus it can never totally die.

49 notes

·

View notes

Text

The Freedman's Bank Forum: The Art of Disenfranchisement

Kamala Harris has hit the Campaign Trail & named Gov. Tim Walz as her Running Mate, but she has yet to give a Press Conference or Mainstream Media Interview. She STILL hasn't offered any Policy Initiatives on her Campaign Website. This has lead some in The New Black Media to look at her Policy Offerings as VP. Sabrina Salvati of Sabby Sabs & Phil Scott of The Afrikan Diaspora Channel both looked at Kamala Harris' 2023 Speech at the Freedman's Bank Forum- for ideas of what a 'Harris- Walz Administration' may look like. In her Speech, Kamala gave a history of The Freedman's Bureau 'Freedman's Bank', Created in 1865. She spoke on why a Specific Bank for the Formerly Enslaved was necessary. She also talked about the Farms, Homes, & Businesses that Freedmen were able to purchase & build through Loans from Freedmen's Bank.

Unfortunately, 9Yrs after its inception, Freedman's Bank was Closed; due to mismanagement, & outright theft of Funds by Congressmen overseeing Bank Operations. Over 61,000 Depositors lost their Funds- estimated at over $3M (over $50M in today's Economy). Kamala sounded like she understood the plight of American Descendants Of Chattel Slavery & Our specific need for resources, but she shifted her narrative fairly quickly. She started by shifting a Black Specific Issue, to an 'All Lives Matter' Issue. Kamala transformed the necessity of a Freedman's Bank to jumpstart Reconstruction, into a need for EVERYONE to have access to (Freedmen) Resources. She starts by mentioning 'Minorities' & 'Marginalized Communities', but goes on to include Latinx, Native American, Asian, & Rural Communities in the Freedman's Bank Story.

Kamala went on to describe one of her Final Acts as a U.S. Senator. This was an Initiative that she helped to set up w/ the help of [Secretary of The Treasury] Janet Yellen, [Senators] Mark Warner, Chuck Schumer, & Corey Booker, plus Rep. Maxine Waters. The Initiative, was a plan to invest $12B in Community Institutions for 'Overlooked & Underserved Communities'... My 1st question is: How many of THOSE INSTITUTIONS are Owned & Operated by Indigenous Black Americans? I only know of ONE in My Community, & David Rockefeller has been invested in them for nearly 30Yrs... Harris says that currently, $8B has been disbursed to 162 'Community Lenders' Nationwide, & gave examples of how the Funds are being disbursed:

Native American Bank lent a Tribe $10M to fund an Opioid Addiction Treatment Facility on Tribal Lands in N. Dakota

Carver Bank, in Ga. loaned $500K to 'Black Owned Companies' to help them develop Low Income Housing

Hope Credit Union, in Ms. gave a $10K Loan to a 'Black & Woman Owned' Coffee Business to expand

Aid to Immigrant Communities, including some Asian Communities

Aid to 'Rural Communities'

Maybe it's just Me, but I find it curious how the Freedman's Bank Legacy is being 'repackaged'. Under Kamala Harris, a SPECIFIC INSTITUTION meant for American Descendants Of Chattel Slavery, is being usurped to advance EVERYONE; except the Blackfolk it was designed to help. The numbers don't lie. Native American Tribes get Billions a Year in 'Set Asides' & they don't pay Taxes, but Kamala thinks they should also collect $10M meant for Black American interests? Then she brags about Black Businesses that only received 5% of what Native Americans collected from a measure that was supposed to be for Blackfolk. Apparently, Kamala wasn't lying when she said that she wasn't going to do ANYTHING that would only benefit Black Americans.

Like Joe Biden, Kamala Harris talks to Black Audiences about Equity, but only offers Black Americans a small share of what Everyone Else gets. In 2022, The Biden-Harris Administration & Janet Yellen launched the Economic Opportunity Coalition, along w/ 20 Private Sector Leaders. The Goal was to provide & invest Billions in Capital to Community Lenders for 'Minority Owned Businesses'. To date, this Coalition has currently committed over $1.2B to Community Lenders in 'Minority & World Communities'. From what I saw, Puerto Rico & Guam represented 9 of the 13 Minority Depository Institutions (MDIs) awarded Funding. Of the 218 Organizations receiving Technical Awards, 56 were 'MDIs' & 38 were Organizations based in Puerto Rico. True to Form, the Biden- Harris Administration blurs the lines on what a 'Black Owned' Business is; Indigenous Blackfolk, Afro Caribbeans, & Afrikan Immigrants have been lumped into the 'Afrikan American' demographic. Is this Coalition keeping track of how many Freedmen (Male & Female) are receiving Awards?

Kamala's Speech at the 'Freedmen's Bank Forum' completely ignored the Descendants of the Freedmen Community, & Our History of adversity. Despite her disregard of Us, she says this Initiative was created to 'Realize the Vision of Freedmen's Bank'. I see This as a blatant Disenfranchisement of the Black Community that Freedmen's Bank was Chartered to serve. On top of her disingenuous empathy for Black Americans, She has the audacity to call this act of Economic Racism- 'Economic Justice'; & she does it w/ a straight face. I thank Sabrina Salvati & Phil Scott for uncovering this particular Policy Measure. Kamala Harris' lack of Policy on her Campaign Website tells Me that she doesn't want Us to know her Plan for the next 4Yrs. She has been called a Leftist & 'the most Progressive Senator in Congress', but her Policies are as Moderate as Joe Biden's.

I fully understand that the Economic Opportunity Coalition (EOC) isn't Freedmen's Bank. If it was presented as a Measure that stood on its own merit, I probably wouldn't have much to say about it. If we're being honest, it falls in line w/ many other Policies of the Biden-Harris Administration. The Fact that Kamala Harris used the Freedmen's Bank Forum to push this Measure, is mean spirited & an insult to Our Ancestors. There's a Legion of Blackfolk & Afrikan Americans trying to certify Kamala's 'Blackness', but she has yet to affirm their claim. She had a chance to refute Donald Trump's assertion, but only offered more rhetoric. The Truth is, SHE'S NOT BLACK! Kamala's Record shows that she spent her Professional Career disenfranchising Us. As District Attorney, she targeted Blackfolk for Arrest on petty Quality of Life Crimes. As Attorney General & as a U.S. Senator, Kamala supported decriminalization of Illegal Border Crossings & the surge of Illegal Immigrants into Black Communities throughout California.

The Black Population in San Francisco, Oakland, Richmond, & Berkeley has dropped by 50% on her Watch. Kamala vacated over 1,000 Criminal Charges against OneWest Bank, George Soros, & Steve Mnuchin- for 'Foreclosure Violations' that cost Hundreds of Black Californians their Homes. Her action allowed Soros to sell OneWest for Billions, while Mnuchin moved on to become Secretary of The Treasury. At the Same Time, she kept Black Inmates imprisoned past their Release Date & denied others Parole; citing the need to maintain a Prison Labor Force (i.e. Convict Leasing). Black Women are siding w/ her, but Harris abandoned the Mitrice Richardson Case after winning her Senate Seat. Kamala also had a hand in stripping the Estate of Nina Simone away from her Surviving Family & awarding All Rights to Sony Music Entertainment. We're supposed to certify this Woman as 'Black', but she has a Legacy of Anti-Black (Aryan) behavior. Her latest act of disenfranchisement is actually Par for The Course.

Some question why Kamala Harris is getting so much heat from Black America? The Short Answer is- She rides on the Coattail of The Black Experience, but does NOTHING for Us Culturally, Socially, or Politically. What's her Black Agenda again? At This Point, We really can't blame Kamala for being consistent. We need to look at the Blackfolk & Afrikan Americans trying to shame us into Falling in Line w/ her Agenda; whatever THAT is...

-We have House Cleaning to do.

#Obamala#TrojanHorse#Supplanter#AntiBlackRacist#BabylonTheGreat#ADOS#B1#FBA#Freedmen#The13Percent#SabbySabs#TheAfrikanDiasporaChannel#ProjectDownBallot#NoTangiblesNoVote

8 notes

·

View notes

Text

Harrison Kinnane Smith Freedman’s Savings and Trust Company Final Dividend Check (1883), 2024 Freedman’s Savings and Trust Company final dividend check, rent-to-own contract, stewardship agreement.

Harrison Kinnane Smith’s collaborative work and site-specific interventions critique public institutions and financial systems. His practice departs from the intersection of critical geography and political economy. Freedman’s Savings and Trust Company Final Dividend Check (1883) (2024) constitutes the latest addition to Smith’s growing body of work exploring racial ideology in the history of American real estate law and finance. The artwork draws on the exploitative arrangements of two failed Reconstruction-era reparation programs in order to support a non-profit organization providing affordable housing at the site of these historical failures. Freedman’s Savings offers collectors the opportunity to purchase one of the last checks issued by the Freedman’s Savings and Trust Company, a bank chartered by the Lincoln Administration to serve freedpeople who were legally excluded by “White” banks. Depositors in the Freedman’s Bank who hoped to save towards land ownership instead found their savings nearly halved when corruption and mismanagement led the bank to close after less than a decade. The check — a final payment of $1.50 issued to a Savannah accountholder — is available to prospective buyers only through a lease-to-own agreement that replicates the land contracts issued under the 1865 “Forty Acres and a Mule” order. Just as emancipated Black Americans lost their land when the “Forty Acres” order was canceled, title to the check is promptly withdrawn and prospective buyers are left only with the contract carefully crafted to exclude them from full ownership. All proceeds generated by serial leasing of this work directly support the Savannah Community Land Trust.

#Harrison Kinnane Smith#Art#Installation#Scupture#History#American History#Freedman's Savings and Trust#Lincoln#Abraham Lincoln#Savannah Community Land Trust

3 notes

·

View notes

Text

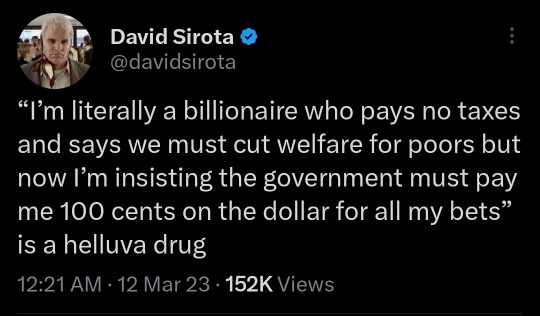

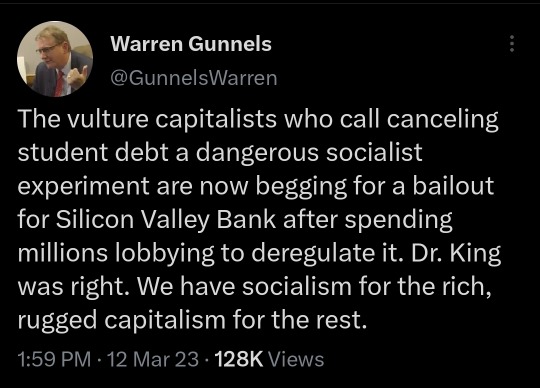

Bank Bailouts Explained (Part 2)

After the bank bailouts of the 2008-9 financial crisis, Congress passed the Dodd-Frank Act, one of the most important pieces of legislation of the Obama administration. Among other things, the Dodd Frank Act established banking 'stress tests' that simulate the impact of various financial scenarios on a bank's liquidity (ability to return the money of depositors). Stress tests include simulations like rising interest rates, real estate crashes, etc. It took many years for banks to improve their balance sheets enough to pass the liquidity tests. These tests were designed to ensure that the banks which were 'too big to fail' would never again need a bailout (loan) from the government.

What happens when a bank fails? If a bank's investments/loans go bad and the bank no longer has enough liquidity, the FDIC steps in and takes control of the bank. In one way the FDIC is a like an insurance company into which all banks must pay premiums. When a bank fails, customers' deposits up to $250K each are insured (safe/guaranteed). If you have deposited more than $250K at a failed bank, you might lose some of your money. When the bank fails the FDIC also chooses another bank to take over the assets/customers of the failed bank. Finally, the investors/shareholders who owned the bank lose all/most of their money.

So what happened to Silicon Valley Bank (SVB)? A few years ago SVB invested a large portion of their deposits in long term US Treasury Bonds paying 3% interest. At the time, that seemed like a very safe and profitable investment. It wasn't like SVB went to Vegas and gambled the money or stole it. But early last year inflation started heating up and the Fed starting raising interest rates. Now US treasury bonds were paying 7% interest! And banks were paying higher interest for deposits. If you owned a bunch of bonds paying 3% interest and the current market rate was 7%, your bonds are now worth less (not worthless, just worth less). This part is a little complicated... assume you bought a $1,000 bond with a 12 year maturity that paid 3% interest. The next day the market changed and now people can buy the same $1,000 bond with a 12 year maturity but it pays 7% interest! No one will want to buy your crappy 3% bond so you will have to discount it. You will have to sell your $1,000 bond for $679 in order for the new owner to generate an equivalent 7% yield. If you're a bank and you don't necessarily plan to sell all your crappy 3% bonds tomorrow, you still have to mark down the value of your bonds on your balance sheet to $679 (their new market value). If you're SVB and these bonds make up a large portion of the investments you made with depositors' money the shit has hit the fan. In the case of SVB, bank depositors (large business customers) were aware of this situation and started withdrawing their money (remember, deposits over $250k aren't insured). The bank tried to generate new capital from investors but this failed, the bank run accelerated and the FDIC stepped in.

But Mike, what about those stress tests? Shouldn't those have prevented this situation? Yes, they would have but President Trump rolled back those pesky regulations on regional banks like SVB. As we've seen however, even regional banks can be very important as SVB was to many high-tech companies.

I could write more, but I'm hoping you have some questions/comments I can address.

26 notes

·

View notes

Link

4 notes

·

View notes

Text

I could say in my lifetime I've never seen so many banks get sold or bought out in such a short period of time.

From a friend. ""The Banking Collapse Of 2023 Is Now Officially Bigger Than The Banking Collapse Of 2008

Michael Snyder

MAY 2, 2023

By Michael Snyder

Yes, you read the headline correctly. Collectively, the three big banks that have collapsed in 2023 had more assets than all 25 banks that collapsed in 2008 did. Unfortunately, the banking collapse of 2023 is far from over. We still have eight more months to go before this year is done, and many more banks are currently teetering on the brink of disaster. Executives at those banks are telling us not to worry, but of course executives at First Republic were issuing similar assurances just last week. Personally, I had heard that First Republic supposedly had enough reserves to keep going for months. But that was a lie, and now First Republic is toast. The following comes from the official statement that the FDIC issued when it took over the bank…

First Republic Bank, San Francisco, California, was closed today by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect depositors, the FDIC is entering into a purchase and assumption agreement with JPMorgan Chase Bank, National Association, Columbus, Ohio, to assume all of the deposits and substantially all of the assets of First Republic Bank.

JPMorgan Chase Bank, National Association submitted a bid for all of First Republic Bank’s deposits. As part of the transaction, First Republic Bank’s 84 offices in eight states will reopen as branches of JPMorgan Chase Bank, National Association, today during normal business hours. All depositors of First Republic Bank will become depositors of JPMorgan Chase Bank, National Association, and will have full access to all of their deposits.

The government was not going to allow just anyone to snap up the assets of First Republic.

JPMorgan Chase was one of the institutions that was invited to make a bid, and they came out of this process as the big winners…

JPMorgan is getting about $92 billion in deposits in the deal, which includes the $30 billion that it and other large banks put into First Republic last month. The bank is taking on $173 billion in loans and $30 billion in securities as well.

The Federal Deposit Insurance Corporation agreed to absorb most of the losses on mortgages and commercial loans that JPMorgan is getting, and also provided it with a $50 billion credit line.

In addition to providing JPMorgan Chase with a 50 billion dollar credit line, the FDIC will also take a loss on this deal of approximately 13 billion dollars. So they are definitely one of the big losers in this deal…

The FDIC estimates that the cost to the Deposit Insurance Fund will be about $13 billion. This is an estimate and the final cost will be determined when the FDIC terminates the receivership.

Needless to say, the biggest losers of all are the shareholders of First Republic.

They got completely wiped out…

Stockholders got bailed in and wiped out. They’d already been mostly wiped out by Friday evening in one of the most spectacular stock plunges ever.

Holders of the unsecured subordinated bank notes got bailed in and wiped out just about entirely. This is a form of preferred stock. For example, the 4.625% bank notes, issued in 2017, traded at less than 2 cents on the dollar this morning, another spectacular plunge.

As I have always warned, you only make money in the stock market if you get out in time.

Shareholders of First Republic found that out the hard way.

In comments that he made after the deal was consummated, JPMorgan Chase CEO Jamie Dimon boldly declared that “this part of the crisis is over”…

“There are only so many banks that were offsides this way,” Dimon told analysts in a call shortly after the deal was announced.

“There may be another smaller one, but this pretty much resolves them all,” Dimon said. “This part of the crisis is over.”

And the U.S. Treasury is telling us that the U.S. banking system “remains sound and resilient”…

‘The banking system remains sound and resilient, and Americans should feel confident in the safety of their deposits and the ability of the banking system to fulfil its essential function of providing credit to businesses and families,’ a Treasury spokesperson said.

Does reading that make you feel better?

It shouldn’t.

They always offer such platitudes before things start getting really bad.

As I noted at the beginning of this article, the three banks that have collapsed so far this year were collectively bigger than all of the banks that collapsed in 2008 combined…

The three banks held a combined total of $532 billion in assets, which – according to the New York Times and when adjusted for inflation – is more than the $526 billion held by all the US banks that collapsed in 2008 at the peak of the financial crisis.

We are only one-third of the way through 2023.

And as Charlie Munger recently observed, many of our banks are absolutely packed with “bad loans” right now…

Charlie Munger believes there is trouble ahead for the U.S. commercial property market.

The 99-year-old investor told the Financial Times that U.S. banks are packed with “bad loans” that will be vulnerable as “bad times come” and property prices fall.

He is quite correct.

In particular, the collapse of commercial real-estate prices threatens to create a massive tsunami of defaults…

Berkshire Hathaway, where Munger serves as vice chairman, has largely stayed on the fringe of the crisis despite its history of supporting American banks through times of turmoil. Munger, who is also Warren Buffett’s longtime investment partner, suggested that Berkshire’s restraint is partially due to risks that could emerge from banks’ numerous commercial property loans.

“A lot of real estate isn’t so good anymore,” Munger said. “We have a lot of troubled office buildings, a lot of troubled shopping centers, a lot of troubled other properties. There’s a lot of agony out there.”

As I keep telling my readers, we really are on the verge of the largest commercial real-estate crash in all of U.S. history.

And as mountains of commercial real estate loans go bad, a lot more banks will start to go under.

The “too big to fail” banks will scoop up those that they like, while others are simply liquidated and go out of existence.

Ultimately, I believe that we are going to see a wave of consolidation in the banking industry like we never have before.

We are still only in the very early chapters of this crisis. Much worse is yet to come.

It is going to take a while for all the dominoes to fall, but each time another one tumbles over it will be a sign that the clock is ticking and that time is running out for the U.S. financial system."

Source: https://www.activistpost.com/2023/05/the-banking-collapse-of-2023-is-now-officially-bigger-than-the-banking-collapse-of-2008.html

"

2 notes

·

View notes

Note

Oh my god Em. I'm in that limbo zone with you of waiting to see what's going to happen. My client's main bank was SVB. Good news is, it looks like all depositors are going to have access to their money today.

OMG!!! Yeah I saw the gov finally came out and said everyone will get their assets back thank GOD. Honestly it's just insane, my concern now is more for the general market impact I feel like every day there's just a literal dumpster fire in the financial sector lol. I hope your client is doing OK!!

Also I had no idea so many people I'm mutual with on here worked in similar-ish spaces/had interest in the financial sector??? I'm so used to all of us just thirsting over Glen and TGM haha

4 notes

·

View notes

Text

What factors influence fixed deposit rates in Sri Lanka?

Understanding what influences fixed deposit rates in Sri Lanka is essential for maximizing your returns. Several factors determine the rates offered by banks on fixed deposits, impacting how much you can earn on your savings.

Firstly, the prevailing economic conditions play a significant role. In periods of economic growth, interest rates tend to rise as banks compete to attract depositors. Conversely, during economic downturns, rates may decrease as the demand for loans wanes.

Central bank policies also influence fixed deposit rates. The Central Bank of Sri Lanka's monetary policy, including its base rates, affects how banks set their deposit rates. When the central bank raises its rates, banks usually follow suit by increasing their deposit rates to attract more funds.

The duration of the fixed deposit is another crucial factor. Longer-term deposits generally offer higher interest rates compared to shorter-term ones. This is because banks value the stability of having funds locked in for a more extended period and are willing to offer better returns as an incentive.

Additionally, the financial health and competition among banks impact fixed deposit rates. Banks with strong financial positions may offer more attractive rates to attract deposits, while competition in the banking sector can drive rates up as institutions strive to offer the best deals to customers.

Finally, the specific policies and strategies of individual banks also play a role. Each bank may have its own approach to setting deposit rates based on its needs and market strategy.

For those looking to explore competitive fixed deposit rates, Siyapatha Finance offers a variety of options with attractive rates. Known for its solid financial standing and customer-focused services, Siyapatha Finance is a great choice to consider when investing in fixed deposits.

By understanding these factors, you can make informed decisions and select the best fixed deposit options to maximize your returns.

Siyapatha Finance

0 notes

Text

Fastrenteinnskudd - Best Service Providers Available Today

Locating an Fixed interest deposits rate that can meet your needs for saving and provides assured returns could help increase your savings with ease and safety. These kinds of investment, also known as"fixed deposits" or "term deposits which are made available by banking institutions and banks. They're they are insured up until a specified limit making them risk-free investments. The problem is that many investors lack an understanding of how a interest deposit operates or on how to select the best one for their situation.

If you're considering before you choose Fixed interest deposits, the first factor to be considered is its rate. Banks offer varying rates for interest. It is vital to compare rates. Be sure to ensure the deposits are guaranteed and are not at risk of market fluctuation before making a decision on the penalty and fees with it.

If you've decided on a number of possible possibilities for investing, the next important thing is to establish the amount of time you'll need to deposit for your duration. This may range from several months all the way to several years. Keep in mind that as there is a longer period between withdrawing funds and their due date arrives, more the interest is accrued. Early withdrawal results in forfeiting any savings.

Take into consideration the following while choosing a Fixed interest deposits that offers regular interest payment. Most FDs provide an interest earned at the final day of their investing term Some also spread it periodically throughout it - the latter option is suitable for investors who are looking to earn their money much more frequently.

Before you can open for a Fixed interest deposits account, you must review the minimum deposit amount. Different banks will have their own the minimum amount for deposit, so it's crucial to be aware of any requirements prior to making a deposit.

Fixed interest deposits (FDs) are an increasingly popular way users can put into money and earn guaranteed returns. Additionally, they're a great means to diversify your saving portfolio and add an element of stability. You need to choose an FD with the perfect balance of benefits to you as well as your financial objectives - hopefully with this guide at on your side, you'll locate that ideal FD! I wish you the best luck!

vimeo

Fixed term investments offer rewards with low risks. Since you're aware of how do Fastrenteinnskudd ? And how much will come after the expiration of the investment period, FDs can make budgeting more simple and may help in achieving budget goals much faster. In addition, these types of products are known not to require very little paperwork for management purposes.

A fixed-interest deposit or a fixed-term deposit or a time deposit is a loan product that can be offered by banks and financial institutions when a depositor deposits the amount in a lump sum for a predetermined period at a fixed interest rate. What is a fixed interest deposit? It's an investment in which the interest rate does not change throughout the life of the loan, delivering consistent returns.

These deposits are considered low-risk because they do not have to be subject to changes in market prices. When the term is over, the depositor receives the initial principal along with the interest accrued. Withdrawals that are made earlier could trigger penalties consequently, it's better for those who would like to save to their funds for the duration time to reap maximum returns.

0 notes

Link

0 notes

Text

The Future of Baking: Unveiling the Twin Cake Depositor

Baking, a timeless art, has seen significant technological advancements over the years. One of the latest innovations revolutionizing the industry is the Twin Cake Depositor. This state-of-the-art machine is transforming the way bakeries and confectioneries operate, offering unparalleled precision, efficiency, and consistency. In this blog, we will explore the features, benefits, and applications of the Twin Cake Depositor, and how it is setting a new standard in the baking world.

Introduction For professional bakers and large-scale baking operations, consistency and efficiency are critical. Traditional methods of depositing cake batter into molds can be labor-intensive and prone to inconsistencies. The Twin Cake Depositor addresses these challenges, providing a modern solution that enhances productivity while maintaining high-quality standards. Whether you’re a small bakery or a large industrial facility, this innovative machine can elevate your baking process.

Features of the Twin Cake Depositor Dual Nozzle System: The Twin Cake Depositor is equipped with a dual nozzle system that allows for simultaneous depositing of batter into two molds. This feature significantly speeds up the production process, enabling bakers to produce more cakes in less time.

Adjustable Settings: The machine offers adjustable settings for deposit volume and speed, providing flexibility to cater to different types of batters and recipes. Whether you’re making light sponge cakes or dense pound cakes, the Twin Cake Depositor can handle it all.

Precision and Consistency: Advanced technology ensures that each deposit is precise and consistent, reducing the risk of overfilling or underfilling molds. This precision is crucial for maintaining the quality and appearance of the final product.

User-Friendly Interface: Designed with ease of use in mind, the Twin Cake Depositor features an intuitive interface that allows operators to adjust settings and monitor the process easily. Minimal training is required to operate the machine efficiently.

Hygienic Design: Made from food-grade stainless steel, the Twin Cake Depositor adheres to strict hygiene standards. Its easy-to-clean components ensure that the machine remains sanitary, preventing contamination and ensuring product safety.

Durability and Reliability: Built to withstand the demands of continuous operation, the Twin Cake Depositor is robust and reliable. Regular maintenance ensures its longevity, making it a valuable investment for any bakery.

Benefits of Using the Twin Cake Depositor Increased Production: The dual nozzle system and high-speed operation allow bakeries to significantly increase their production capacity. This is especially beneficial during peak seasons when demand is high.

Consistent Quality: The precision of the Twin Cake Depositor ensures that each cake is of consistent quality. This consistency is vital for maintaining customer satisfaction and brand reputation.

Labor Savings: Automating the batter depositing process reduces the need for manual labor, allowing staff to focus on other critical tasks. This not only lowers labor costs but also increases overall efficiency.

Flexibility: The adjustable settings make the Twin Cake Depositor versatile, capable of handling a variety of batters and recipes. This flexibility allows bakeries to expand their product offerings without investing in additional equipment.

Enhanced Safety: The hygienic design and automated operation minimize the risk of contamination and injury, providing a safer working environment for employees.

Applications of the Twin Cake Depositor The Twin Cake Depositor is suitable for a wide range of applications, making it a valuable addition to any baking operation:

Commercial Bakeries: Large-scale bakeries can benefit from the increased production capacity and consistency offered by the Twin Cake Depositor.

Artisanal Bakeries: Smaller bakeries can use the machine to streamline their operations and maintain high-quality standards, even as they grow.

Food Production Facilities: Companies producing pre-packaged cakes and desserts can enhance their production efficiency and product consistency with the Twin Cake Depositor.

Catering Services: Catering companies can use the machine to quickly produce large quantities of cakes for events, ensuring consistent quality and presentation.

Conclusion The Twin Cake Depositor is a game-changer in the baking industry. Its advanced features, combined with its ability to enhance productivity and maintain consistent quality, make it an invaluable tool for bakeries and food production facilities. By investing in this innovative machine, businesses can streamline their operations, reduce costs, and meet the demands of an ever-growing market. As the baking industry continues to evolve, the Twin Cake Depositor stands out as a beacon of modern efficiency and excellence.

0 notes

Text

We’re not saving them! We’re winding them down (“resolving” them) and selling the parts of the corpse. SVB’s investors are going to bear the losses. We’d need a trial before we could lock up the CEO, but they’re not getting off easy.

The depositors (who put their money into bank accounts for storage, and that might pay interest) are getting protected, while the investors (who bought stocks and bonds in the bank, to make money from the bank making money) are getting hung out to dry.

This is how it’s supposed to work, but people got used to the Big Cash Money Handouts of the Bush years and figured that’s all the government could do, so the disillusionment is understandable. Which is why you never vote businessmen into office, but I digress.

… Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

Finally, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

The U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today's actions demonstrate our commitment to take the necessary steps to ensure that depositors' savings remain safe.

“Hey look, everyone! This is why we have all this regulation!” they’re screaming.

We have to end this capitalist construct.

19K notes

·

View notes

Text

The Retail industries in India are tough competitors to other industries around the world in providing recruitment

Retail describes the sale of a product or service to an individual consumer for personal use. Retail transactions occur through different sales channels, such as online, in a brick-and-mortar storefront, in direct sales, or via mail. At each step in the chain there is a markup, or profit margin, built in to the purchase. The three most important functions are credit, deposit, and money management. Another of the retail bank types are credit unions. They offer services similar to commercial banks, but usually on a smaller scale. Credit unions are not for profit institutions, where the depositors are its shareholders. There are some disadvantages to credit unions. Due to dissuade consumers that prefer banking services being delivered in person. Credit unions also employ less online banking services less secure. Credit unions also have fewer employees and are open for shorter hours than commercial banks. There are a variety of different types of retailers, much like there are a variety of ways for retailers to obtain their products. In many cases, retailers answer to a larger parent company and receive their products directly from them. Smaller, independent retailers will do the own purchasing and procurement of inventory. Those businesses employ close to 42 million people, making retail the nation’s largest private sector employer.

Retail is a broad term that encompasses the sales and distribution of goods and services to consumers. A retail transaction involves the direct sale of a small number of goods to the final consumers. Retail marketing aims at targeting the customers by attracting them with the business model so that the business can drive sales. Retail marketing can provide businesses with valuable insights into customer behaviour, preferences, and trends. Retail marketing helps businesses connect with customers on a deeper level by understanding their needs and preferences. Effective retail marketing strategies can engage customers through personalized experiences, targeted advertising and promotions, and by providing helpful information and support. By staying ahead of the competition with innovative marketing strategies, businesses can differentiate themselves and attract more customers. Effective branding can create a sense of trust, credibility, and loyalty among customers, which can translate into increased sales and long-term success. They are one of the Retail Recruitment Agency in India.

Organized retailing will significantly address the struggle to provide employment to India's growing youth. Retail companies are on a hiring spree and there are multiple options for those who want to be employed in the retail sector. Rapid growth of organized retail in metros, smaller cities and towns has made the need for talented people increased in various areas such as merchandise planning, logistics, management of supply chain, information and stores. Retailing in the organized sector is likely to be the next biggest employment vehicle after BPO. Retailers must data-driven decisions about how to sequence their introduction of technology. The job of a sales associate is, of course, to sell the store’s products! A great sales associate will go the extra mile to maintain excellent customer service and build trust between the store and the customer. If you're the responsible type who likes to handle everything at once, then being a store manager might be perfect for you! Best Retail Recruitment Agency in India provides cervices many sectors.

The Indian retail sector continues to be a significant force in the domestic and global context. Retail is a major contributor to India’s GDP and employment, and India is expected to be the third- largest consumer market by 2030. The most interesting aspect of the future of retail is the facility to click and collect products. Save your shopping list and have it delivered to the counter. The only way forward for the future of the retail sector in India is to successfully integrate their online and offline businesses through AI, Machine Learning, the Internet of Things (IoT), and Robotics. So to put it simply, data analytics and technology are the only potential future for retail businesses in India. Top Best Retail Recruitment Agency in India that give service in consultancy and recruitment sectors.

#RetailRecruitmentAgencyinIndia#BestRetailRecruitmentAgencyinIndia#TopBestRetailRecruitmentAgencyinIndia

0 notes