#fiduciaryduty

Explore tagged Tumblr posts

Text

Fiduciary Duties: Minority Shareholder Rights

Officers, directors, managers, controlling shareholders and other key individuals in corporations and business entities often have obligations toward minority owners as outlined in the organization’s foundational documents (e.g., bylaws, operating agreements). For example, control persons may be required to provide minority investors access to the company’s books and records. Additionally, state laws impose specific duties, such as holding annual shareholder meetings, for the benefit of minority owners. Beyond these clear-cut responsibilities, control persons may also be obligated to prioritize the interests of minority owners over their own. These are known as fiduciary duties, which arise in relationships where one party places special trust and reliance on the judgment of another, such as between a director and a shareholder. Fiduciary duties generally apply to directors, officers, and controlling shareholders of corporations. However, in LLCs or partnerships, such duties may be restricted or entirely waived through organizational documents. Assuming fiduciary duties are applicable, the primary obligations include (for ease of reference, this article focuses on Delaware law. Each state may have varying standards so always consult with a local attorney): - The Duty of Care - The Duty of Loyalty - The Duty of Good Faith 1. The Duty of Care The duty of care requires control persons to make informed decisions based on thorough consideration of relevant information. This includes a responsibility to evaluate alternatives and rely on employees or advisors with a critical and discerning perspective. Decisions made under this duty benefit from the business judgment rule, which protects actions taken in good faith, on an informed basis, and in the honest belief that they serve the company’s best interests. 2. The Duty of Loyalty The duty of loyalty obligates control persons to prioritize the interests of the company and its owners over their own. They must avoid exploiting their position of trust, confidence, or insider knowledge for personal gain. This includes refraining from actions that provide personal benefits not shared by the company or its other owners. Conflicts of interest that can violate the duty of loyalty typically fall into two categories: - Interestedness: When a control person benefits from a transaction that is not equally advantageous to the company and its other owners. - Lack of Independence: When a control person indirectly benefits from a transaction or is beholden to another individual who stands to benefit. Courts assess whether such benefits are material and likely to influence a control person’s objectivity. A decision remains valid if a majority of disinterested and independent control persons approve it, even if some control persons are conflicted. 3. The Duty of Good Faith The duty of good faith requires control persons to act prudently and responsibly, demonstrating the care a reasonable person in a similar role would exercise under comparable circumstances. Failing to act in good faith, even if not unlawful, includes actions driven by improper motives or those producing grossly inequitable outcomes. This duty encompasses a commitment to making decisions free from self-interest or conflicting priorities that undermine the company’s best interests. The standard for good faith may be influenced by an individual’s expertise or knowledge. For instance, a finance expert might be held to a higher standard when relying on third-party valuations. Historically, courts treated the duty of good faith as a distinct obligation. However, it is now often regarded as a component of the duty of loyalty. book a consult Raetzer PLLC Joseph J Raetzer

0 notes

Text

Tweeted

Participants needed for online survey! Topic: "The Understanding of Fiduciary Duties and the Expectations on Managers" https://t.co/81RkJJys4F via @SurveyCircle #FiduciaryDuty #ArtistManagers #expectations #law #FiduciaryDuties #survey #surveycircle https://t.co/I954sANDny

— Daily Research @SurveyCircle (@daily_research) Mar 16, 2023

0 notes

Photo

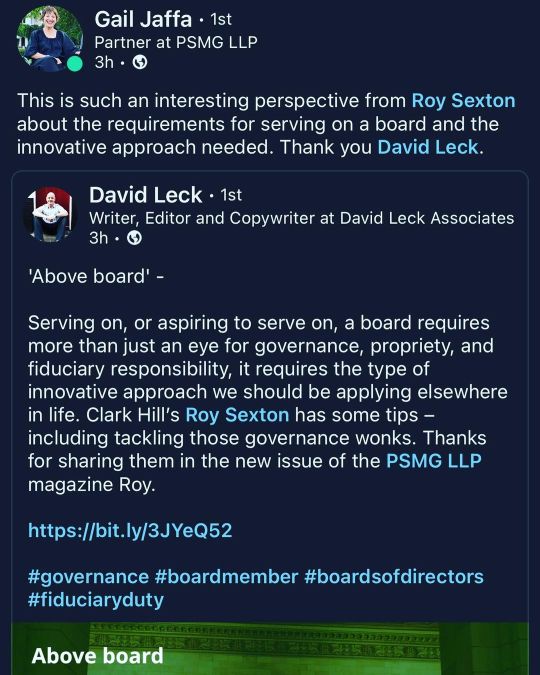

As shared by David Leck: “Above board” … “Serving on, or aspiring to serve on, a board requires more than just an eye for governance, propriety, and fiduciary responsibility, it requires the type of innovative approach we should be applying elsewhere in life. Clark Hill Law’s Roy Sexton has some tips – including tackling those governance wonks. Thanks for sharing them in the new issue of the PSMG LLP magazine, Roy.” https://bit.ly/3JYeQ52 #governance #boardmember #boardsofdirectors #fiduciaryduty (at Saline, Michigan) https://www.instagram.com/p/Cbz9Dc-LCmT/?utm_medium=tumblr

0 notes

Photo

#realestatehumor #hoa #pleasedont #dontdoit #buyersagent #buyer #iloverealestate #fiduciaryduty #client #beaclient #realtorlife #realestateagent #realtor #homebuyertips #homebuyers #househunting #househunters #thepropertyhuntress

#client#realestatehumor#iloverealestate#buyer#fiduciaryduty#realestateagent#realtor#homebuyertips#pleasedont#househunting#hoa#homebuyers#buyersagent#househunters#beaclient#realtorlife#dontdoit#thepropertyhuntress

1 note

·

View note

Text

The Benefits of a Fiduciary Advisor in the Cayman Islands

A fiduciary has a great deal of discretionary authority and is held to a higher standard than a non-fiduciary advisor.

If you have agreed to work on behalf of someone in a situation where they place total confidence and trust in you, you have what is called a ‘fiduciary duty’ to that person.

In business, a fiduciary is a person, a bank, or an organization given the power and responsibility to act on your behalf in situations requiring total trust, good faith, and honesty. For example, corporate officers are fiduciaries for their shareholders, while lawyers and real estate brokers are fiduciaries for their clients.

The tax-neutral stance of the Cayman Islands, as well as the simplicity of setting up a Cayman company or trust, attracts many foreign companies and individuals to incorporate in the islands, boosting the demand for the Cayman Islands fiduciary services to run a business or manage a trust. Fiduciary relationships are also often found in the transfer of property rights.

Click Here to read more.

#FiduciaryService#FiduciaryDuties#CaymanIslandsFiduciaryServices#CaymanManagementConsultants#CaymanCorporateServices

0 notes

Text

CRITICAL ANALYSIS: THE DOCTRINE OF LEGITIMATE EXPECTATION

CRITICAL ANALYSIS: THE DOCTRINE OF LEGITIMATE EXPECTATION

This article is written by PRACHITI SHINDE a student of THAKUR RAMNARAYAN COLLEGE OF LAW INTRODUCTIONIt would not be an exaggeration to say that the concept of legitimate doctrine has paved itsway to become one of the important doctrine along side rule of law, natural justice, fiduciaryduties, etc. This doctrine based on the relationship between an individual and a public authority. This…

View On WordPress

0 notes

Video

tumblr

Your real estate agent is someone that you have to trust, get along with and depend on. This relationship that you are looking to build has to be right from the very start or it will end up being a struggle to hold onto in the future. Once you make the right choice, the bond that you build as client to Realtor will never bend or break. To find the Realtor that best meets your wants and needs start by attending open houses and interacting with agents that attend. Be sure to get their business cards so you can do later research on them, as well as contact them in the future. #realestatelicense #researchyouragent #readreviews #interview #buyers #sellers #tucsontrustme #askquestions #openhouse #tucsonrealestate #whoareyou #buildtrust #fiduciaryduty #verifylicense #thechoiceisyours #wantsandneeds #intereact #REbusinesscards #trust #respect #professionalrealestateagent #realestatePRO #importantdecision #YOUdecide #dependonme #tucsonhomes

0 notes

Photo

The Trust Litigation GuideGuest Author - # #fiduciaryduty #trustlitigationguide #trusteeremoval #sponsored - http://bit.ly/1IHKjC3 http://bit.ly/2S9riqI

0 notes

Text

0 notes

Text

Navigating the Implied Duty of Good Faith and Fair Dealing in Contracts

Imagine you’ve signed a meticulously prepared contract after extensive due diligence and negotiations. Yet, shortly after, you find that the other party’s actions—while not explicitly breaching the contract—are obstructing your ability to benefit from the agreement. What can you do? This is where the implied duty of good faith and fair dealing comes into play. This duty, recognized in most jurisdictions (albeit with varying scope), requires parties to act reasonably and fairly in performing and enforcing contractual obligations. What is the Implied Duty of Good Faith and Fair Dealing? The implied duty ensures that contracting parties do not act in ways that: - Exploit the other party beyond what the contract explicitly allows. - Undermine the other party’s ability to receive the agreed-upon benefits. While it doesn’t create new rights, it imposes obligations for reasonable and fair behavior. For example, in Texas, this duty arose to address the imbalance of power in specific relationships, such as between insurers and insureds. However, Texas applies this duty narrowly, typically reserving it for contracts involving special relationships. Factors Courts Consider in Breach of Implied Duty Claims When addressing claims of breach, courts may look beyond the explicit terms of a contract to assess implied obligations. Here are some factors courts evaluate: - Express Terms of the Contract - The implied duty complements but cannot contradict the contract’s explicit terms. - Courts may enforce implied obligations to uphold the parties’ intentions and the contract’s purpose but will not impose obligations inconsistent with the agreement. 2. Context and Circumstances - Courts may consider how the contract was negotiated and any prior dealings between the parties. - A history of difficult but compliant behavior by one party may weaken a claim, as the other party could have anticipated challenges. 3. Special Relationships - In Texas, the duty of good faith and fair dealing applies only to contracts involving special relationships, such as: - Insureds and insurers. - Executive rights holders and non-executive mineral interest owners. - Ordinary business transactions typically do not qualify. 4. Employment Context - In Texas, employers are not obligated to act in good faith toward employees. The Texas Supreme Court clarified that the unique vulnerabilities present in insurance contracts don’t apply to employer-employee relationships, as employees can seek alternative employment. 5. Discretionary Power - A breach may occur if one party uses discretionary power in an arbitrary or unreasonable way to harm the other’s contractual benefits. 6. Self-Interest - Acting in self-interest is not inherently a breach unless it violates the agreed-upon terms or undermines the other party’s rights. Establishing a Breach of Implied Duty To succeed in a claim, the following must be proven: - An existing contract between the parties. - The plaintiff fulfilled or was excused from fulfilling their obligations. - The defendant unreasonably interfered with the plaintiff’s contractual benefits, such as: - Preventing performance. - Depriving benefits through deceitful schemes. - Exploiting the agreement in bad faith. 4. The plaintiff suffered damages due to the defendant’s actions. Damages for Breach of Implied Duty Damages for breach may include: - Compensatory damages for actual losses. - Consequential damages for secondary impacts caused by the breach. - Liquidated damages, if specified in the contract. - In certain cases, punitive damages for willful or malicious misconduct. Texas’ Narrow Approach Texas courts strictly limit the implied duty of good faith and fair dealing to special relationships. While this narrow scope may disadvantage parties in ordinary transactions, it highlights the importance of: - Recognizing power imbalances before entering contracts. - Exploring other legal protections for potential vulnerabilities. - Acting in good faith to avoid disputes and litigation, especially in uncertain economic times. Understanding the implied duty of good faith and fair dealing can protect contracting parties from unfair practices and ensure equitable outcomes. Whether negotiating new agreements or addressing issues in existing ones, consulting with legal professionals to assess rights and obligations is critical in navigating these complex dynamics. Raetzer PLLC Read the full article Joseph J Raetzer

0 notes

Link

via Twitter https://twitter.com/justin_aptaker

0 notes

Text

The Bylaw Puzzle in Delaware Corporate Law

corpgov.law.harvard.edu Posted by David A. Skeel, Jr., University of Pennsylvania Law School, on Thursday, March 2, 2017 Editor's Note: David A. Skeel, Jr. is S. Samuel Arsht Professor of Corporate Law at University of Pennsylvania Law School. This post is based on his recent article, and is part of the Delaware law series; links to other posts in the series are available here. In less than a decade, Delaware’s legislature has overruled its courts and reshaped Delaware corporate law twice, with proxy access bylaws in.. show all text posted by friends: (4) @oceg: The Bylaw Puzzle in Delaware Corporate Law corpgov.law.harvard.edu/2017/03/02/the… via @HarvardCorpGov #corpgov #fiduciaryduty #directors #liability 02.03.2017 15.26.38 @CGGovernance: HarvardCorpGovPosted: The Bylaw Puzzle in Delaware Corporate Law, corpgov.law.harvard.edu/2017/03/02/the… by pennlaw #corpgov #De… twitter.com/HarvardCorpGov… 02.03.2017 15.20.13 @ToGovern: Posted: The Bylaw Puzzle in Delaware Corporate Law, corpgov.law.harvard.edu/2017/03/02/the… by @pennlaw #corpgov #Delawarelaw #secreg 02.03.2017 15.20.00 @HarvardCorpGov: Posted: The Bylaw Puzzle in Delaware Corporate Law, corpgov.law.harvard.edu/2017/03/02/the… by @pennlaw #corpgov #Delawarelaw #secreg 02.03.2017 15.19.09 posted by followers of the list: (0) http://dlvr.it/NWm4LZ #CorpGov

0 notes

Photo

Hello Department Of State We have people out here pretending to be Realtors without license and scrounging for commission illegally. We also have Brokers who lack integrity and not living up to the Fiduciary Duties Of their license. Please send a clean up crew ASAP.. #realestate #nointegrity #fiduciaryduty #higginsrealtygroup

0 notes

Text

Fiduciary Duties: Maximizing Shareholder Value

When selling your company, you owe special fiduciary duties to minority investors or other shareholders. Directors, officers and other individuals who control a company (“control persons”) have certain baseline fiduciary responsibilities toward shareholders. For the purpose of ease we'll discuss this under Delaware law (check with a local attorney if dealing with an entity formed in a different state) —widely regarded as the benchmark for corporate governance in the U.S.—these responsibilities are applied differently in the context of mergers and acquisitions ("M&A"). To understand fiduciary duties in M&A transactions, it’s essential to familiarize yourself with the three standards of review that Delaware courts use to evaluate decisions made by control persons: - The Business Judgment Rule - Enhanced Scrutiny - Entire Fairness 1. The Business Judgment Rule The business judgment rule presumes that control persons act: - On an informed basis, - In good faith, and - In the honest belief that their actions are in the best interests of the company. This default standard in Delaware protects control persons from judicial second-guessing if their decisions can be attributed to any rational business purpose. In essence, courts defer to the judgment of control persons unless there is evidence of a serious flaw in the decision-making process. To benefit from the protections of the business judgment rule, control persons must inform themselves of "all material information" reasonably available before making a decision. However, shareholder plaintiffs can challenge this presumption by alleging: - Undisclosed conflicts of interest, - A majority of conflicted or interested control persons, - Gross negligence, or - Lack of good faith, such as willful disregard of relevant facts or failure to exercise reasonable oversight. When this standard applies, courts generally do not evaluate the wisdom of decisions unless flaws in the process are proven. 2. Enhanced Scrutiny Enhanced scrutiny applies when control persons are selling the company. Under this standard, courts assess: - The adequacy of the decision-making process, including the information used, and - The reasonableness of the actions taken in light of the circumstances at the time. Here, the burden shifts to control persons to prove they were adequately informed and acted reasonably. However, "reasonable" does not mean "perfect." If a control person selects one of several reasonable alternatives, courts will generally not second-guess the decision, even if hindsight suggests another choice might have been better. In the landmark case Revlon, Inc. v. MacAndrews & Forbes Holdings, Inc., the Delaware Supreme Court established that when the sale of a company becomes inevitable, control persons must seek the highest value reasonably available to shareholders. This is commonly referred to as "Revlon duties". A subsequent case, Paramount Communications Inc. v. QVC Network Inc., further clarified that: The consequences of a sale of control impose special obligations on the directors of a corporation. They must act reasonably to secure the best value reasonably available to stockholders. While Revlon duties are not an independent fiduciary duty, they represent a specific application of baseline fiduciary responsibilities in the context of a company sale. These duties do not mandate a rigid approach but require actions judged reasonable based on the circumstances. It’s important to note that certain stock-for-stock transactions, as opposed to cash sales, may not trigger Revlon duties because they do not constitute a change in control. 3. Entire Fairness The entire fairness standard applies when control persons have conflicts of interest, such as being on both sides of a transaction. This is the most stringent standard under Delaware law. Control persons must prove: - Fair Dealing: Demonstrating that decision-making was informed, properly structured, and appropriately timed, with approvals obtained from disinterested parties. - Fair Price: Showing that the financial terms of the transaction fall within a range of values a reasonable seller would accept. Conflicts triggering the entire fairness review typically arise in scenarios like: - A controlling shareholder engaging in a “going-private” transaction. - A personal financial benefit derived by control persons that is not shared proportionately by all shareholders. To mitigate risks associated with the entire fairness review, companies often implement procedural safeguards, such as: - Forming a special committee of disinterested and independent directors to oversee the transaction. - Requiring approval by a majority of the minority shareholders. In M&A transactions, control persons face heightened scrutiny to ensure that shareholder interests, especially those of minority investors, are protected. The applicable standard of review—business judgment, enhanced scrutiny, or entire fairness—depends on the nature of the transaction and the control persons’ role within it. Adhering to these fiduciary duties is critical for navigating the complexities of selling a company while maintaining compliance with Delaware corporate law. Raetzer PLLC Read the full article Joseph J Raetzer

0 notes

Photo

🙄 Keep in mind that the home is not yours until the paperwork is Complete, AND the deed is recorded! •Don’t Change Jobs •Don’t Make a Large Purchase •Do Not Allow any Credit Inquires After Loan Approval •Don’t Allow Emotions to Take Over •Don’t Ignore Lender Requirements •Don’t Do Things Without Speaking to Your Agent #buyer #iloverealestate #fiduciaryduty #client #beaclient #realtorlife #realestateagent #realtor #homebuyers #househunting #househunters #thepropertyhuntress https://www.instagram.com/p/BtJfpqNFR33/?utm_source=ig_tumblr_share&igshid=1lqeigyevsh1w

#buyer#iloverealestate#fiduciaryduty#client#beaclient#realtorlife#realestateagent#realtor#homebuyers#househunting#househunters#thepropertyhuntress

0 notes

Photo

Thinking about Starting the Home Buying Process, let’s Talk First! Make sure you have an Agent to ensure you are protected, Happy, and get the best deal possible on your New Home #homebuyertips #buyersagent #buyer #iloverealestate #fiduciaryduty #client #beaclient #realtorlife #realestateagent #realtor #homebuyers #househunting #househunters #thepropertyhuntress https://www.instagram.com/p/Bsy0mpsFcSg/?utm_source=ig_tumblr_share&igshid=kf2v38ned2q

#homebuyertips#buyersagent#buyer#iloverealestate#fiduciaryduty#client#beaclient#realtorlife#realestateagent#realtor#homebuyers#househunting#househunters#thepropertyhuntress

0 notes