#federal jobs January 2017

Explore tagged Tumblr posts

Text

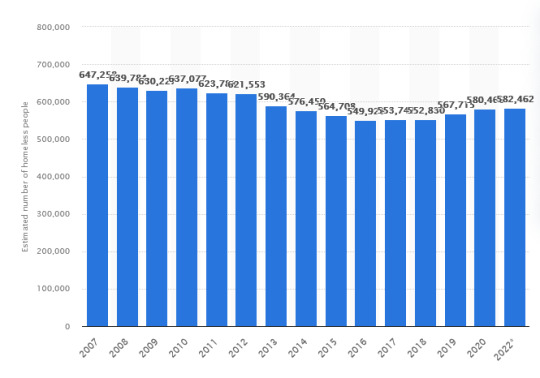

In 2007 the US Department of Housing and Urban Development started reporting homelessness rates:

As you can see in this chart (from Statista) there was a fairly steady decrease in the number of homeless people from then until 2016. It flattened out for a couple years in 2017 and 2018, and then rose in 2019 and 2020. No data was collected in 2021 (due to COVID) and the increase from 2020 to 2022 was negligible, so one might hope based on the data from this chart that the upward trend was flipping around, and that by now by now it might be on its way back down, but this does not appear to be the case.

For 2023 the Department of Housing and Urban Development reported a homelessness count of 653,104. This is a dramatic increase which blows previous annual changes out of the water. It's a 12.1% increase relative to 2022, an 18.7% increase relative to the low in 2016, and the highest absolute number of homeless people since data started being collected in 2007.

So this is one way, at least, in which standard economic metrics being up has not translated to people doing well.

An objection one can make here is that even this new high is only about 0.2% of the national population, and while things may have gotten worse for the people in the very worst of economic straits, this doesn't say much about what things are like for the rest of us.

I agree with this up to a point. (Probably not the implied argument about what we should care about but let's not get into that for now.) It's probably true that homelessness rates don't shed a lot of light on how the median American is doing. But I think they are relevant to the well-being of a lot more than 0.2% of the population.

Even though only a small proportion of Americans are homeless at any given time, there a lot more for whom the threat of homelessness looms very large in their financial considerations, not irrationally. More people who are homeless probably means more people who can just barely make rent as long as they skip a few meals, more people who stay with an abuser because they wouldn't have anywhere else to stay, more people who can't quit their job to find a better one because they couldn't afford to miss a month's rent, more people who can't move out of a mold-infested apartment, more people who are just struggling with anxiety about whether they're going to be able to make rent every month. It also almost certainly means more people couch-surfing and more people who were homeless for part of the year that happened not to include late January, neither of which would be counted in the official statistics.

How much of an impact does this end up meaning, on how many people? I'm pretty unsure, but here's a suggestive statistic from the Federal Reserve:

> Challenges paying rent increased in 2023. The median monthly rent payment was $1,100 in 2023, up 10 percent from 2022. In addition, 19 percent of renters reported being behind on their rent at some point in the past year, up 2 percentage points from 2022.

It seems at least very plausible to me that claims about how great the US economy is doing merit a substantial asterisk.

560 notes

·

View notes

Text

Friends,

Many of you are still in shock about what happened a week ago today. Some of you don’t even want to read a newspaper or hear the news.

I get it.

A few of you are coping with the catastrophe by minimizing or denying it. Several friends assure me that a second Trump term won’t be much different from the first and that the checks and balances in our system will continue to constrain him.

This is wishful and dangerous thinking.

Trump and his Republican lapdogs will almost certainly win the House, which means that starting January 20, they will take full control of the federal government — both chambers of Congress as well as the presidency.

The Republicans soon to be in control of Congress are more MAGA, less principled, and more intimidated by Trump than the Republicans who had control when Trump took office in 2017. There are no Liz Cheneys in the House, no Mitt Romneys in the Senate. Republican senators seeking to become the majority leader are already competing to please Trump, promising immediate confirmation of his appointments.

The Republican Party as a whole has now been effectively purged of people willing to stand up to Trump.

Trump already has effective control of the Supreme Court, a majority of whom have ruled that he (or any president) is presumptively immune from criminal liability for whatever he chooses to do.

This time, moreover, there won’t be people in the administration to stop him. Trump learned from his first term about the importance of surrounding himself with lackeys who will do whatever he wishes.

His early picks (Susie Wiles as chief of staff, Stephen Miller as deputy chief of staff, Thomas Homan as border czar, Lee Zeldin as EPA administrator, Elise Stefanik as ambassador to the U.N., and Michael Walz as national security advisor) have only one thing in common and it’s not their expertise. It’s their unblinking loyalty to Trump.

Don’t get me started about Elon Musk, the richest man in the world, who has turned his X platform into a swamp of Trump lies and propaganda, and now seems joined at the hip to Trump — appearing wherever Trump is. Robert F. Kennedy Jr. is a nut job.

And unlike Trump’s first term, the president-elect is now backed by a network of dangerous extremists — including those who have been imprisoned for their part in the attack on the U.S. Capitol, whom Trump has suggested he’ll pardon. They will feel emboldened to carry out what they understand to be Trump’s wishes.

Finally, also unlike before his first term, Trump has explicitly told us what he plans to do and already has people working on getting it done starting January 20: mass deportations, prosecution of his political enemies, the use of the military against U.S. citizens, the purging of the civil service across the government and substitution of Trump loyalists, and a promise to play politics with disasters.

Project 2025, which was written by more than 140 people who served under Trump the first time around, including several of his former Cabinet secretaries, explicitly calls for “abortion surveillance” and the stripping from Americans of reproductive freedom (page 455).

It also calls for jailing teachers and librarians over banned books (page 5), gutting of overtime pay rules (pages 587 and 592), and prioritizing “married men and women” over other types of families (page 489).

To enforce these attacks on our rights, Project 2025 would use the Justice Department to prosecute district attorneys Trump disagrees with, invoke the Insurrection Act to shut down protests, and mobilize red-state national guard units against blue states that resist his authoritarian agenda.

In sum, my friends, we are facing a catastrophe far worse than what occurred in Trump’s first term of office. The meager guardrails that existed then will be gone.

We must not avert our eyes from this calamity, or minimize it, or throw up our hands in despair or retreat.

We must prepare to fight it.

But how? Let me ask you: If this were Germany in 1933, what actions would you take? How different will this be from Germany in 1933?

I put this question to some of you last Wednesday during my weekly Office Hours. Forty percent said your most important goal will be to protect those in harm’s way, and 34 percent said it will be to organize and mobilize politically. Of the remainder, 9 percent said it will be to resist with civil disobedience. (Others had additional or different ideas.)

Obviously, none of these alternatives is exclusive. We must consider all, and many others.

Protecting the vulnerable and preserving our rights and liberties will require a great deal of hard work by people who believe in our Constitution, democracy, and the rule of law. The work includes:

Monitoring Trump and his government — despite the disinformation, propaganda, and lies we’ll be receiving — and disseminating the truth.

Maintaining a watch over the people and institutions we value.

Being ready to sound the alarm in our communities and networks when those people and institutions are under assault.

Organizing and mobilizing nonviolent resistance to such assaults.

Using civil disobedience wherever possible.

Litigating through state and federal courts where possible.

Speaking out against malicious lies like those that spread during the election by Elon Musk on his propaganda machine X and against vicious lies amplified on other MAGA mouthpieces.

Using our economic muscle to boycott corporations that support Trump, Musk, and other centers of MAGA power.

And much more.

It will be up to us — the American people who still cherish democracy — to protect and preserve our system of self-government.

As difficult as it is to fully accept what we are up against, the first step is to acknowledge it.

9 notes

·

View notes

Text

Facebook's former diversity program manager has pleaded guilty to stealing more than $4 million from the company through fake business deals in exchange for kickbacks to fund a luxurious lifestyle, federal prosecutors said Tuesday.

Barbara Furlow-Smiles, 38, served as the lead strategist, global head of employee resource groups and diversity engagement at the social media giant while she orchestrated the scheme, the Justice Department said. From January 2017 through September 2021, she led Diversity, Equity, and Inclusion (DEI) programs at Facebook and was responsible for developing and executing DEI initiatives, operations, and engagement programs.

"Furlow-Smiles used lies and deceit to defraud both vendors and Facebook employees," said Keri Farley, Special Agent in Charge of the FBI's Atlanta office. "The FBI works hard to make sure greed like this doesn’t pay off and those who commit fraud are held accountable."

Furlow-Smiles committed the fraud by linking PayPal, Venmo, and Cash App accounts to credit cards given to her by Facebook and used those accounts to pay friends, relatives, former interns at a prior job, nannies, babysitters, a hairstylist and others for goods and services that were never provided to the company, a federal complaint states.

It was unclear if her associates were being charged in connection with the fraud.

After those people received the payments, they kicked back a percentage of the funds to Furlow-Smiles, prosecutors said. The kickbacks were paid in cash and through transfers to accounts in various names, including the husband of Furlow-Smiles, prosecutors allege.

Some of the kickbacks were allegedly paid in cash sometimes wrapped in T-shirts and other items, the FBI said. She also had Facebook hire vendors that were owned and operated by friends and associates who also paid kickbacks, authorities said.

To conceal the fraud, Furlow-Smiles submitted false expense reports claiming the individuals performed work on Facebook programs and events, the DOJ said. After they were hired, Furlow-Smiles allegedly approved fake and inflated invoices. She received a portion of the money paid to the vendors under the table.

Furlow-Smiles also misled Facebook into paying money to entities who didn't provide kickbacks, including nearly $10,000 to an artist who created specialty portraits and more than $18,000 to a preschool, the complaint said.

"Motivated by greed, she used her time to orchestrate an elaborate criminal scheme in which fraudulent vendors paid her kickbacks in cash. She even involved relatives, friends, and other associates in her crimes, all to fund a lavish lifestyle through fraud rather than hard and honest work," U.S. Attorney Ryan K. Buchanan said.

Furlow-Smiles used the illicit funds to fund a luxury lifestyle in California and Georgia, prosecutors said.

17 notes

·

View notes

Text

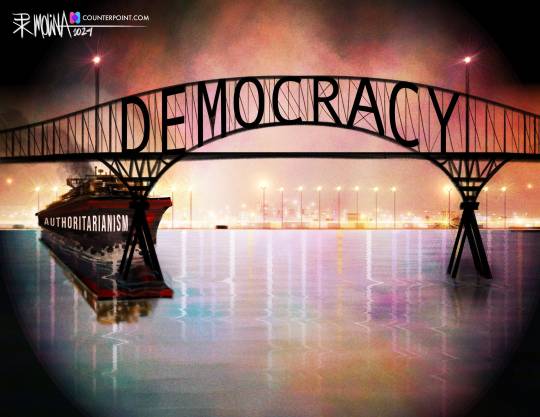

Pedro X. Molina :: @newcounterpoint :: @pxmolina

* * * *

LETTERS FROM AN AMERICAN

April 1, 2024

HEATHER COX RICHARDSON

APR 02, 2024

On Tuesday, March 26, Judge Juan Merchan, who is presiding over Trump’s election interference case, put Trump under a gag order to stop his attacks on court staff, prosecutors, jurors, and witnesses. On Wednesday, Trump renewed his attacks on the judge and the judge’s daughter. On Thursday, U.S. District Judge Reggie Walton took the unusual step of talking publicly about what threats of violence meant to the rule of law. Walton, who was appointed to the federal bench by President George W. Bush, told Kaitlan Collins of CNN that threats, especially threats to a judge’s family, undermine the ability of judges to carry out their duties.

“I think it’s important in order to preserve our democracy that we maintain the rule of law,” Walton said. “And the rule of law can only be maintained if we have independent judicial officers who are able to do their job and ensure that the laws are, in fact, enforced and that the laws are applied equally to everybody who appears in our courthouse.”

On Friday, former president Trump shared on social media a video of a truck with a decal showing President Joe Biden tied up and seemingly in the bed of the truck, in a position suggesting he was being kidnapped.

A threat of violence has always been part of Trump’s political performance. In 2016 he urged rallygoers to “knock the crap out of” protesters, and they did. They also turned on people who weren’t protesters. Political scientists Ayal Feinberg, Regina Branton, and Valerie Martinez-Ebers studied the effects of Trump’s 2016 campaign rhetoric against marginalized Americans and found that counties where Trump held rallies had a significant increase in hate incidents in the month after that rally.

Trump’s stoking of violence became an embrace when he declared there were “very fine people, on both sides,” after protesters stood up against racists, antisemites, white nationalists, Ku Klux Klan members, neo-Nazis, and other alt-right groups met in August 2017 in Charlottesville, Virginia, where they shouted Nazi slogans and left 19 people injured and one protester, Heather Heyer, dead.

In October 2020, Trump refused to denounce the far-right Proud Boys organization, instead telling its members to “stand back and stand by.” The Proud Boys turned out for the attack on the U.S. Capitol on January 6, 2021, where they helped to lead those rioters fired up by Trump’s speech at The Ellipse, where he told them: “You'll never take back our country with weakness. You have to show strength and you have to be strong. We have come to demand that Congress do the right thing…. And we fight. We fight like hell. And if you don't fight like hell, you're not going to have a country anymore.”

Trump’s appeals to violence have gotten even more overt since the events of January 6.

And yet, on Meet the Press yesterday, Kristen Welker seemed to suggest that there is a general problem in U.S. politics when she described Trump’s attacks on Judge Merchan as “a reminder that we are covering this election against the backdrop of a deeply divided nation.”

But are the American people deeply divided? Or have Trump and his MAGA supporters driven the Republican Party off the rails?

One of the major issues of the 2024 election—perhaps THE major issue—is reproductive rights. But Americans are not really divided on that issue: on Friday, a new Axios-Ipsos poll found that 81% of Americans agree that “abortion issues should be managed between a woman and her doctor, not the government.” That number includes 65% of Republicans, as well as 82% of Independents and 97% of Democrats. The idea that abortion should be between a woman and her doctor was the language of the Supreme Court’s 1973 Roe v. Wade decision, overturned in 2022 with the help of the three extremist justices appointed by Trump.

Last week, the Congressional Management Foundation, which works with Congress to make it more efficient and accountable, released its study of the state of Congress in 2024. It found that senior congressional staffers overwhelmingly think that Congress is not functioning “as a democratic legislature should.” Eighty percent of them think it is not “an effective forum for debate on questions of public concern.”

But there is a significant difference in the parties’ perception of what’s wrong. While 61% of Republican staffers are satisfied that Congress members and staff feel safe doing their jobs, only 21% of Democratic staffers agree, and Democratic staffers are significantly more likely to fear for their and others’ safety. Women and longer-tenured staffers are more likely to be questioning whether to stay in Congress due to safety concerns. Eighty-four percent of Democratic staffers think that agreed-upon rules and codes of conduct for senators and representatives are not sufficient to “hold them accountable for their words and deeds,” while only 44% of Republicans say the same.

Republicans themselves seem split about the direction of their party. Republican staffers were far more likely than Democrats to be “questioning whether I should stay in Congress due to heated rhetoric from my party”: 59% to 16%. “The way the House is ‘functioning,’ is frustrating many members,” wrote one House Republican deputy chief of staff. “We have to placate [certain] members and in my nearly ten years of working here I have never felt more like we’re on the wrong track.”

One Republican Senate communications director blamed extremist political rhetoric for the dysfunction. “[W]ith the nation being in a self-sort mode, it is easy to never hear a dissenting opinion in many areas of the country. People in DC, who work in the Capitol, generally have a collegiate approach to each other. The American people don’t get to see that—at all. From the outside it appears to be a Royal Rumble and bloodsport. It’s reflected in the [way] people, regular citizens, now view one another.”

A Republican House staff director wrote that Congress is “a representative body and a reflection of the people writ large. When they demand something different of their leaders, their leaders will respond (or they will elect different leaders).”

Burgess Everett and Olivia Beavers of Politico reported yesterday that nearly 20 Republican lawmakers and aides have told them they would like Trump to calm down his rhetoric. They appear to think such violent commentary is unpopular and that it will hurt those running in downballot races if they have to answer for it.

It seems unlikely Trump will willingly temper his comments, since threatening violence seems to be all he has left to combat the legal cases bearing down on him. Over the course of Easter morning, he posted more than 70 times on social media, attacking his opponents and declaring himself to be “The Chosen One.”

Tonight, Trump posted a $175 million appeals bond in the New York civil fraud case. He was unable to secure a bond for the full amount of the judgment, but an appeals court lowered the amount. Posting the bond will let him appeal the judge’s decision. If he wins on appeal, he will avoid paying the judgment. If he loses, the bond is designed to guarantee that Trump will pay the entire amount the judge determined he owes to the people of New York: more than $454 million.

Trump and his campaign are short of cash, and there were glimmers last week that the public launch of his media network would produce significant money if he could only hold off judgments until he could sell the stock—six months, according to the current agreement—or use his shares as collateral for a bond. The company’s public launch raised the stock price by billions of dollars.

But this morning the company released its 2023 financial information, showing revenues of $4.1 million last year and a net loss of $58.2 million. The stock plunged about 20%, wiping out about $1 billion of the money that Trump had, on paper anyway, made. The company said it has not made any changes to the provision prohibiting early sales or using shares as collateral.

Tonight, Judge Merchan expanded the previous gag order on Trump to stop attacks on the judge’s family members. Trump has a right “to speak to the American voters freely and to defend himself publicly,” but “[i]t is no longer just a mere possibility or a reasonable likelihood that there exists a threat to the integrity of the judicial proceedings,” Merchan wrote. “The threat is very real.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#Rule of Law#Judge Merchan#threats of violence#neo-nazis#KKK#white nationalists

6 notes

·

View notes

Text

IRS to go after executives who use business jets for personal travel in new round of audits

Private jets sit parked at Scottsdale Airport Jan. 27, 2015, in Scottsdale, Ariz. IRS leadership said

FATIMA HUSSEIN Feb 21, 2024

WASHINGTON (AP) — First, there were trackers on Taylor Swift and other celebrities’ private jet usage. Now, there will be more scrutiny on executives’ personal use of business aircraft who write it off as a tax expense.

IRS leadership said Wednesday that the agency will start conducting dozens of audits on businesses’ private jets and how they are used personally by executives and written off as a tax deduction — as part of the agency’s ongoing mission of going after high-wealth tax cheats who game the tax system at the expense of American taxpayers.

The audits will focus on aircraft used by large corporations and high-income taxpayers and whether the tax purpose of the jet use is being properly allocated, the IRS says.

“At this time of year, when millions of hardworking taxpayers are working on their taxes, we want them to feel confident that everyone is playing by the same rules,” IRS Commissioner Daniel Werfel said on a call with reporters to preview the announcement. Tax season began Jan. 29.

“These aircraft audits will help ensure high-income groups aren’t flying under the radar with their tax responsibilities,” he said.

There are more than 10,000 corporate jets in the US., according to the IRS, valued at tens of millions of dollars and many can be fully deducted.

The Tax Cuts and Jobs Act, passed during the Trump administration, allowed for 100% bonus depreciation and expensing of private jets — which allowed taxpayers to write off the cost of aircraft purchased and put into service between September 2017 and January 2023.

Werfel said the federal tax collector will use resources from Democrats’ Inflation Reduction Act to more closely examine private jet usage — which has not been closely scrutinized during the past decade as funding fell sharply in the last decade.

“Our audit rates have been anemic,” he said on the call. An April 2023 IRS report on tax audit data states that “continued resource constraints have limited the agency’s ability to address high-end noncompliance” stating that in tax year 2018, audit rates for people making more than $10 million were 9.2%, down from 13.6% in 2012. And in the same time period, overall corporate audit rates fell from 1.3% to .6%.

Mike Kaercher, senior attorney advisor at the Tax Law Center at NYU said in a statement that the IRS should also revisit how it values personal use of corporate aircraft, beyond just how flights are reported.

“The current rules allow these flights to be significantly undervalued, enabling wealthy filers to pay much less in taxes than fair market value would dictate, and it’s within the IRS’ authority to revise these rules,” Kaercher said.

Werfel said audits related to aircraft usage could increase in the future depending on the results of the initial audits and as the IRS continues hiring more examiners.

“To be clear, that doesn’t mean everyone in a high-income category partnership or corporation is evading or avoiding their tax responsibility,” Werfel said. “But it does mean that there’s more work to do for the IRS to make sure people are paying what they owe.”"

10 notes

·

View notes

Text

I’m going to summarize my thoughts on a government shutdown.

Shutdown bad!!! Working together without a political agenda and bias to make make sure government doesn’t get shutdown, good!!!

For anyone that wants to read more, please feel free.

FOUR REASONS WHY A GOVERNMENT SHUTDOWN IS HARMFUL

Government shutdowns occur when policymakers fail to enact legislation to fund the federal government by the end of the fiscal year on September 30. Each year, Congress must pass, and the president must sign, legislation to provide funding for most government agencies. That legislation comes in the form of 12 appropriation bills, one for each appropriations committee. Lawmakers may also choose to pass a temporary funding bill, known as a continuing resolution, to provide funding for a limited time. If lawmakers fail to pass some or all of the appropriations bills on time, and a continuing resolution is not in place, the government would experience a partial or full “shutdown.”

There are many reasons government shutdowns are harmful, and here are a few.

1. Government shutdowns are costly.

It may be counterintuitive, but government shutdowns are expensive. A government shutdown pauses programs and government operations, only for them to eventually start up again, and that has costs. For example, the Office of Management and Budget (OMB) estimated that the lost productivity of government workers during the shutdown in 2013, which lasted 16 days, cost the government $2 billion.

More recently, a report issued in September 2019 by the Senate Permanent Subcommittee on Investigations found that the “last three government shutdowns cost taxpayers nearly $4 billion — at least $3.7 billion in back pay to furloughed federal workers, and at least $338 million in other costs associated with the shutdowns, including extra administrative work, lost revenue, and late fees on interest payments.” That assessment is an underestimate because it excluded substantial costs associated with several government agencies (including the Department of Defense), which were unable to provide complete estimates to the Subcommittee.

2. Government shutdowns are bad for the economy.

Government shutdowns can harm economic growth and certainty. A 2013 Macroeconomic Advisors paper found that government shutdowns can impose costs on the economy such as increasing the unemployment rate, lowering the growth in gross domestic product (GDP), and raising the cost of borrowing. The Bureau of Economic Analysis estimated that the government shutdown in October 2013 reduced fourth-quarter GDP that year by 0.3 percentage points. An S&P Global analysis found that a government shutdown in 2017 could have reduced real fourth-quarter GDP growth by $6.5 billion per week. The Congressional Budget Office estimated that the partial government shutdown that lasted from December 22, 2018 until January 25, 2019 reduced real GDP by $11 billion over the fourth quarter of 2018 and the first quarter of 2019 (although they assumed that much of that reduction would have been made up later in the year).

Additionally, a shutdown can cause disruptions in sectors of the economy. For instance, a Partnership for Public Service report noted that the last government shutdown (which lasted from December 2018 to January 2019) halted two major Small Business Administration loan programs. Those programs typically dispense nearly $200 million a day to small and midsize U.S. businesses; lack of access to such loans hindered business plans and caused economic hardship for thousands of entrepreneurs and their employees. Shutdowns also impact regulatory offices like the Alcohol and Tobacco Tax and Trade Bureau within the Department of the Treasury. An example— without the necessary certifications and approvals to operate, production for craft breweries throughout the country stalled, thereby reducing revenue for over 7,300 producers who provide more than 135,000 jobs.

3. Government shutdowns interrupt federal programs and services.

While programs such as Social Security and Medicare would remain largely unaffected by a government shutdown, other programs and services could be interrupted by the temporary furlough of “nonessential” government staff. In 2013, OMB showed that the shutdown that year disrupted scientific research, services for veterans and seniors, and health and safety inspections by the Food and Drug Administration, the Federal Aviation Administration, and the National Transportation Safety Board, among other programs.

4. Government shutdowns may harm the federal workforce.

Shutdowns contribute to economic insecurity among federal workers. During the last shutdown, about 800,000 federal employees were either furloughed or went without pay. This included workers at national parks and museums, corrections officers at federal prisons, and officials from the Transportation Security Administration. The gap in pay creates an adverse situation for federal workers as about 20 percent of Americans are unable to pay their monthly bills in full and about 40 percent are unable to pay an emergency expense of $400 or more with cash, according to the Federal Reserve.

Also, shutdowns may harm recruitment and retention of quality staff. Experts interviewed by the Government Accountability Office noted that prolonged shutdowns may alter the perception of federal jobs and reduce the attractiveness of such jobs for younger workers. Such perceptions are already apparent in the federal government where, currently, just 7 percent of all permanent, full-time federal employees are under the age of 30; that age group makes up 20 percent of the broader labor market.

Conclusion

Engaging in fiscal brinksmanship is not an effective way of addressing our nation’s fiscal challenges. It delays the tough decisions and has real costs for the budget, the economy, and everyday Americans. Instead of governing by crisis, lawmakers should work together to create a long-term plan that addresses the growing mismatch between spending and revenue and puts us on a sustainable fiscal path.

5 notes

·

View notes

Text

What Kirkland's 'Project Second Chance,' Led by a Former Federal Prosecutor, Has Accomplished So Far

Shortly after Kirkland & Ellis partner Erin Nealy Cox joined the firm in Dallas, she launched a pro bono project aiding victims of domestic violence or human trafficking by getting criminal records related to their abuse expunged or sealed.

Kirkland's Project Second Chance, which began in 2022, closely tracks Cox's priorities during her recent stint from late 2017 through early 2021 as U.S. attorney for the Northern District of Texas.

Kirkland lawyers have represented 73 women since Project Second Chance was launched, and expunged 232 charges.

Participation at the firm has swelled, with 42 Kirkland lawyers in Texas involved this year.

The National Celebration of Pro Bono runs through Saturday, and the Kirkland effort with Cox at the helm is one example of a dedicated pro bono project.

While U.S. attorney, Cox launched a district domestic violence initiative, which aimed to keep guns out of the hands of abusers.

And in the area of human trafficking, Cox worked with Department of Homeland Security investigations to revise the North Texas Trafficking Task Force, and, according to the Department of Justice, she charged sellers and buyers of human trafficking and set up a system to seek restitution for victims.

She joined Kirkland in September 2021, after leaving her government role in January 2021, and is a member of the firm's government, regulatory and internal investigations group.

For the victims of domestic violence or human trafficking, getting their criminal record expunged or sealed allows them to secure better jobs and housing, and improve their credit records, she said.

"I realized how important it was to get their lives restarted," she said.

The Dallas County District Attorney's Office makes referrals to the firm through its expungement program, and Cox said lawyers from Kirkland's Dallas, Houston and Austin offices volunteer, including both corporate attorneys and litigators.

Once the Dallas DA's office identifies cases and refers them to Kirkland, lawyers have a few weeks to complete paperwork to have a client's criminal records expunged as part of the DA's Expunction Expo.

Lawyers from other firms in Dallas County volunteer and handle other kinds of cases.

Expunction is possible for a limited class of offenses, according to Claire Crouch, media and community relations manager for the DA's office.

For the most part, she said, it does not apply to convictions, but to situations where the client was arrested but a charge was never filed, or the charge was no-billed by a grand jury, or rejected by the DA's office.

"Generally speaking, it's a charge that you were never convicted of and is still there hanging out on your record and showing up on background searches," Crouch said.

Kirkland lawyers provide a big boost to the expunction program, she said.

"You see how important this is for the people who in some cases records are being completely cleared, or at least we are helping them here and there. It is a powerful thing," she said.

Cox said the project is not splashy, but it can make a difference in the lives of individuals who are victims of domestic violence or human trafficking.

The women referred by the DA's office are grateful that they don't have to pay a lawyer to help them get the charges expunged, that their filing fees can be waived, and that the Dallas DA's office has a program to make it possible, she said.

"We receive a lot of notes from our clients expressing their gratitude," she said.

0 notes

Text

Opal (Flake) Lee (October 7, 1926) is a retired teacher and activist who is considered the “grandmother of Juneteenth.” She was born in Marshall, Texas to Otis Flake and Mattie Broadus. They were the first African American family in the neighborhood, prompting an angry mob of 500 white residents to burn down the home.

She got married, had four children, and divorced after five years of marriage. She returned to Marshall and enrolled in Wiley College. She worked as a maid at the Texas Hotel with her mother while attending college. She earned her BA and returned to Fort Worth, where she began teaching at Amanda McCoy Elementary School. She took a second job at the Convair aircraft plant.

She married Dale Lee (1967) the principal at Morningside Elementary. She earned a BA in Counseling and Guidance from North Texas State University. She worked as an educator and home school counselor at the Fort Worth Independent School District before retiring in 1977.

She began a new career working at a community food bank in the Jax beer-distributing building. The community food bank has fed an average of 500 families each week. She lives near the warehouse and owns a thirteen-acre farm to grow food for the food bank.

She has been involved in the preservation of local African American history, which led to the creation of the Tarrant County Black Historical and Genealogical Society. The society organized the annual Juneteenth celebrations. Each year thousands gathered at Sycamore Park to commemorate the official end of slavery. She often walked two and a half miles, representing the number of years before Texas enslaved people knew they were free.

In 2016, she walked from Fort Worth to DC to deliver 1.6 million signatures in support of making Juneteenth a national holiday. She began her walk in September 2016, gathering pledges and signatures along the 1,360-mile route, and arrived in Washington in January 2017. Her Juneteenth walk sparked renewed interest in making the day a federal holiday. On June 17, 2021, she was present at The White House when President Joe Biden signed the bill to make Juneteenth a federal holiday. #africanhistory365 #africanexcellence #zetaphibeta

0 notes

Text

By Alan Rappeport

As former President Donald J. Trump makes his closing economic argument ahead of the election, he is outlining a vision for a manufacturing renaissance that reprises a familiar pitch: Make goods in America and enjoy low taxes, or face punishing tariffs.

Mr. Trump’s pitch combines the type of carrots-and-sharp-sticks approach that he called “America First” during his first term, when he imposed stiff tariffs on allies and competitors while lowering taxes on American firms.

During a speech in Savannah, Ga., on Tuesday, Mr. Trump suggested he would go far beyond that initial approach and adopt what he rebranded a “new American industrialism.”

The former president proposed creating “special” economic zones on federal land, areas that he said would enjoy low taxes and relaxed regulations. He called for companies that produce their products in the United States — regardless of where their headquarters are — to pay a corporate tax rate of 15 percent, down from the current rate of 21 percent. Businesses that try to route cars and other products into the United States from countries like Mexico would face tariffs as high as 200 percent.

But Mr. Trump’s vision of a “manufacturing renaissance” comes when Americans are increasingly wary of foreign investment, particularly from Asia. And while he imposed steep tariffs during his presidency, his efforts to keep American companies from shifting production overseas ran into the harsh realities of lower-wage labor and technological advancements in other countries.

While Mr. Trump was in office, manufacturing employment was essentially flat before the pandemic and had declined by the time he left office. In January 2021, the Alliance for American Manufacturing described his promises of an industrial resurgence as “mostly rhetoric.”

Mr. Trump’s talk of strengthening American manufacturing is similar, in part, to what President Biden has pushed for over the past several years. The Biden administration has embraced a form of industrial policy not seen in several decades, backing bills that devoted huge sums of money to certain industries, including semiconductors, clean energy and electric vehicles.

But Mr. Trump’s approach diverges sharply in many ways from that of Mr. Biden and Vice President Kamala Harris, the Democratic nominee.

Ms. Harris has called for higher taxes on corporations and has said little about how or whether she would use tariffs to influence manufacturing decisions. But she has talked about the importance of the Inflation Reduction Act, the tax and climate legislation that Democrats passed in 2022, which has attracted foreign investments given the lucrative tax credits available to help develop clean energy industries.

Mr. Trump wants to repeal that law and create a new set of tax breaks for certain industries. During his speech, he said companies that made products in the United States would pay a 15 percent tax rate.

“Foreign nations will be worried about losing their jobs to America,” Mr. Trump said as he predicted an exodus of manufacturing from China, South Korea and Germany to the United States.

The tax legislation that Mr. Trump enacted in 2017 helped bolster foreign investment by making America’s corporate tax rate more competitive with other countries. However, the tariffs that he imposed on imports from China have led to greater investment in Mexico, as companies have invested there to circumvent the levies and gain access to the U.S. market.

Mr. Trump seemed to acknowledge that development this week, saying he would enact tariffs of at least 100 percent on companies that manufactured cars and other products in Mexico and then exported them into the United States.

At a campaign event in Pennsylvania on Monday, the former president called out Deere, the agriculture equipment maker. The firm announced this year that it would shift some of its production to Mexico from Iowa, threatening the jobs of more than 200 workers.

“I’m just notifying John Deere right now, if you do that, we’re putting a 200 percent tariff on everything you want to sell into the United States,” Mr. Trump said.

The approach is reminiscent of his first term, when he would often shame companies for their plans to move production abroad, threatening tariffs and boycotts. In most cases, the strategy had limited success.

In 2016, before he took office, Mr. Trump pressured United Technologies, which was the parent company of the heating and cooling giant Carrier, to keep an Indianapolis factory open and not move the jobs to Mexico. The company initially agreed to keep the plant open, saving more than 700 jobs. However, in 2017 and 2018 Carrier cut about 500 jobs from that factory, moving those roles to Mexico.

Mr. Trump lashed out at Harley-Davidson in 2018 when it announced that it would move some of its manufacturing overseas to avoid tariffs that Europe imposed on American products in retaliation for the president’s steel and aluminum tariffs. The motorcycle company moved ahead with plans to build a plant in Thailand and close a factory in Kansas City, Mo.

And in 2019, Mr. Trump assailed General Motors after it announced plans to close a plant in Lordstown, Ohio, urging the company to “get that plant opened or sell it to somebody and they’ll open it.” The company did not budge.

“I think there’s a role for the bully pulpit,” said Todd Tucker, the director of industrial policy and trade at the Roosevelt Institute, a left-leaning think tank. “But there’s a lack of focus and a lack of consistency in his policymaking.”

The results of Mr. Trump’s efforts to attract foreign companies to set up shop in the United States have also been mixed.

In 2018, at the groundbreaking in Wisconsin for Foxconn’s factory to make flat-screen televisions, Mr. Trump called the project by the Taiwanese company the “eighth wonder of the world.” Plans for the $10 billion factory later sputtered amid changing market dynamics. Much of the planned site remains undeveloped, and most of the promised jobs have yet to materialize.

Mr. Trump pledged again this week to make America a magnet for foreign investment, but he has presented mixed messages about what kinds of investments are acceptable. Republicans and Democrats have been particularly wary in recent years of investments linked to China that could threaten American national security or pose risks to sensitive supply chains.

Speaking to farmers in Pennsylvania on Monday, the former president called for new curbs on Chinese purchases of American farmland. In both speeches this week, he said the proposed takeover of U.S. Steel by Nippon Steel of Japan should be blocked by the federal government.

“It certainly seems inconsistent with his plans to attract international companies,” said Nancy McLernon, the president of the Global Business Alliance, a lobbying group that represents international companies. “Our political leaders should unambiguously support and promote cross-border investment from our major trading partners and strategic allies.”

Some of Mr. Trump’s ideas — such as tax cuts — would require legislation from Congress. Others could be enacted through executive authority. Mr. Trump also suggested that a new manufacturing “ambassador” would help lead the recruiting effort.

“We’re going to bring thousands and thousands of businesses and trillions of dollars of wealth back to the good old U.S.A.,” he said. “We’re going to be doing it and doing it fast.”

https://www.nytimes.com/2024/09/25/us/politics/trump-taxes-tariffs-economy.html

0 notes

Text

Navigating US Tax Compliance: A Guide for Business Owners

It was a chilly January morning in New York when Michael, the owner of a growing e-commerce business, sat down with a cup of coffee to tackle his annual tax preparations. The previous year had been a whirlwind of growth, and with it came a myriad of tax compliance challenges. As he sifted through piles of paperwork, Michael realized he needed a clearer understanding of US tax compliance to avoid costly mistakes. Determined to get it right this time, he began researching and consulting experts. Here is a guide inspired by Michael’s journey, aimed at helping business owners navigate the complexities of US tax compliance.

1. Understand Your Tax Obligations

The first step in navigating tax compliance is understanding your tax obligations. The US tax system requires businesses to pay various federal, state, and local taxes. According to the Small Business Administration (SBA), 90% of small businesses report taxes as a significant burden. Key federal taxes include income tax, self-employment tax, and employment taxes (such as Social Security and Medicare).

2. Register for an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is essential for all businesses. The IRS uses this number to identify your business for tax purposes. As of 2022, the IRS reported that over 4.4 million new EINs were issued, reflecting the growing number of new businesses. Obtaining an EIN is a straightforward process and can be done online through the IRS website.

3. Keep Detailed Records

Maintaining accurate and detailed records is crucial for tax compliance. This includes keeping track of all income, expenses, and deductions. According to the IRS, inadequate record-keeping is one of the top reasons small businesses face audits. Using accounting software can streamline this process and ensure that your records are organized and up-to-date.

4. File and Pay Taxes on Time

Meeting tax deadlines is critical to avoid penalties and interest. The IRS reported that in 2021, approximately 5 million businesses were charged late filing penalties. Key deadlines for 2024 include:

January 15: Estimated quarterly tax payment for Q4 2023

March 15: S-Corporation and Partnership tax returns

April 15: Individual and C-Corporation tax returns

Filing and paying taxes on time demonstrates good business practice and keeps you in the IRS’s good graces.

5. Understand Employment Taxes

If you have employees, you are responsible for withholding and paying employment taxes, including federal income tax, Social Security, and Medicare taxes. The IRS requires businesses to report these taxes quarterly using Form 941. In 2023, the IRS collected over $1.3 trillion in employment taxes, highlighting the importance of compliance in this area.

6. Know Your State and Local Tax Obligations

In addition to federal taxes, businesses must comply with state and local tax laws. This can include state income tax, sales tax, and property tax. According to the Tax Foundation, the average combined state and local sales tax rate in the US is 7.12%. Each state has different requirements, so it’s essential to understand the specific obligations in your business’s location.

7. Take Advantage of Tax Deductions and Credits

Tax deductions and credits can significantly reduce your tax liability. Common deductions include office expenses, travel, and employee benefits. The IRS allows businesses to deduct up to $1.16 million in qualifying equipment purchases under Section 179 in 2024. Additionally, tax credits such as the Research and Development (R&D) Tax Credit can provide substantial savings. In 2022, businesses claimed approximately $18 billion in R&D tax credits.

8. Stay Informed About Tax Law Changes

Tax laws are constantly changing, and staying informed is crucial for compliance. For example, the Tax Cuts and Jobs Act of 2017 introduced significant changes, including the Qualified Business Income (QBI) deduction, which can reduce taxable income by up to 20% for eligible businesses. Regularly consulting with a tax professional can help you stay updated on relevant changes and ensure your business remains compliant.

9. Consider Professional Help

Navigating tax compliance can be challenging, and seeking professional help can be a wise investment. According to a survey by the National Small Business Association, 88% of small businesses use external tax professionals. These experts can provide valuable advice, ensure you take advantage of all available deductions and credits, and help you avoid costly mistakes.

10. Plan for the Future

Effective tax planning involves looking ahead and preparing for future tax obligations. This includes setting aside funds for taxes, planning major purchases strategically, and considering the tax implications of business decisions. Long-term tax planning can help you take advantage of new opportunities and ensure the financial health of your business.

Conclusion

As Michael reviewed his newfound knowledge, he felt more confident in his ability to navigate the complex world of US tax compliance. By understanding his tax obligations, keeping detailed records, and seeking professional advice, he knew he could avoid the pitfalls that had plagued him in the past. For business owners, leveraging effective business tax solutions is essential for maintaining compliance and focusing on what truly matters—growing and sustaining their businesses.

0 notes

Text

Something you must need to know about US immigration

Immigration is considered the most bulging slice issue in the United States of America. Senate Republicans and Democrats close the federal government over the management of immigrants brought to the U.S. unlawfully as children, also known as Dreamers. In his recent State of the Union address,President Donald Trump mentioned to U.S. immigration law as a “broken” system; one party applauded,the other glowered. This polarized reaction shows a spreading divide among voters, as Democrats are now twice as perhaps as Republicans to say immigrants reinforce the country.

These discussion and others might make it seem like most Americans are baffled about the harmful effects of immigration on America’s budget and culture. But in line with various dimensions,immigration has never been more popular in the past of public polling:

· The share of Americans asking for reduced levels of immigration has went down from the peak of 65 percent in the mid-1990s to just 35 percent, near its record low.

· A 2017 Gallup poll discovered that doubts that immigrants comes across are crime, take jobs from native-born families, or injury the budget and general economy are all at all-time bottoms.

· In the same study, the majority of Americans saying immigrants “mostly help” the economy attained its highest point since Gallup began asking the question in 1993.

· A Pew Research poll asking if immigrants “strengthen the nation with their hard work and talents” similarly revealed positive responses at an all-time high.

According to a leading US immigration lawyer in UK, Immigration is now here a monolithic issue; there is no one immigration query. There are more like three: How should the United States manage unlaw fulimmigrants, particularly those brought to the country as children? Would general immigration levels be curtailed, increased, or neither? And how should the U.S. arrange the different groups—refugees, family members, economic migrants, and skilled workers among them—wanting entry to the nation? It’s imaginable that a majority of voters don’t disclose the issues this exactly, and don’t think too much about the answers to each question. After all, immigration ranks quite low on Americans’ policy urgencies—it’s behind the shortage and tied with the inspiration of lobbyists—which makes responses shift along with the placements of presidential candidates, political rhetoric, or polling lingo.

The most valuable immigration inquiry—the “levels” On question—it doesn’t seem quite right for an immigration lawyer in London to say the concern of immigration divisions America. It more clearly divides Republicans—both from the rest of the country, and from one another. Immigration isolates an a tivist faction of the right in a country that is, overall, growing more tolerant of diversity. January's government shutdown is a perfect example. Almost 90 percent of Americans prefer legal protections for Dreamers, but the GOP’s refusal to extend those protections outside of a larger deal led to the closure of the federal government, in any type.

0 notes

Text

[ad_1] Overview of Lionel Messi's biographyLionel Messi's full title is Lionel Andrés Messi Cuccittini, he was born on June 24, 1987 in Rosario, Argentina.On the age of 5, Lionel Messi began taking part in soccer for Grandoli, a neighborhood group led by his father.At age 11, he was recognized with progress hormone illness. River Plate Membership has proven curiosity in Lionel Messi, however doesn't manage to pay for to pay for his remedy.Then Carles Rexach, sports activities director of FC Barcelona, grew to become inquisitive about his expertise. Barcelona signed a contract with Lionel Messi after witnessing his good efficiency on the sphere, agreeing to pay for medical remedy and guarantee jobs for his household if he moved to Spain. On December 14, 2000, Lionel Messi's household moved to Europe and he started taking part in for the membership within the youth group.Presently, Lionel Messi is taking part in as a striker for the Argentina nationwide soccer group and taking part in for Paris Saint-Germain membership within the Ligue 1 match. Let's observe the detailed story of Lionel Messi with Fb68Lionel Messi's membership professionBarcelona- 2003-2005: Joined the Barcelona first group- 2005-2008: Turned a participant within the beginning lineup- 2008-2009: The primary treble of my life- 2009-2010: Obtained the primary Golden Ball- 2010-2011: Received fifth La Liga championship and third Champions League- 2012: Breaking many information- 2013-2014: Messidependencia- 2014-2015: Second treble- 2016-2017: Obtained the 4th golden shoe- 2017-2018: fifth Golden Shoe and double home title- 2018-2019: tenth La Liga title and report sixth Golden Shoe- 2019-2020: sixth Golden Ball- August 2020: Need to go away FC Barcelona- 2020-2021: Ultimate season at FC BarcelonaParis Saint-Germain- 2021-2022: seventh Golden BallLionel Messi's worldwide profession- 2004-2005: Success at youth stage- 2005-2006: Debut for the group and World Cup- 2007-2008: Copa America closing and Olympic gold medal- 2011-2013: Assumes the captaincy- 2014-2015: World Cup and Copa America finals- 2016-2017: third Copa America closing, retirement and return- 2018: Attended the World Cup- 2019-2020: Third place in Copa America and champion of Superclasico- 2021: Copa America champion and high scorer in South America- 2022: Finalissima champion and World Cup champion in QatarLionel Messi's worldwide professionFamous person Lionel Messi's taking part in fashionLionel Messi has a small physique, however that is a bonus in dribbling. He simply turned, blocked the ball or dribbled previous lots of the different group's gamers in shock. Lionel Messi's long-distance cannon pictures at all times make the opposing group's goalkeeper terrified.Tactically, Lionel Messi performs as an attacking striker and performs the position of captain. Possessing speedy dribbling expertise and excessive accuracy pictures. General, the 34-year-old Argentine celebrity is taken into account a superb participant with a various and complete taking part in fashion.Messi is one of the best FIFA participant in 2023Messi is one of the best FIFA participant in 2023Overcoming Mbappe and Haaland, celebrity Messi received the title of Greatest FIFA Participant in 2023.On the morning of January 16, the World Soccer Federation (FIFA) held a Gala awarding the FIFA The Greatest 2023 award. Stars Messi and Haaland each received 48 factors within the "Greatest Male Participant of the Yr" class.By way of sub-index, Messi received due to having a better variety of votes from the nationwide group captains than Haaland. Ranked third within the voting checklist is Mbappe with 35 factors. Neither Messi, Haaland nor Mbappe have been current on the awards ceremony.Messi's victory is controversial as a result of The Greatest 2023 considers the participant's achievements between December 19, 2022 and August 20, 2023 (when the 2022 World Cup ended). This time, Messi received the Ligue 1 championship with PSG earlier than transferring to Inter Miami, the place he received the 2023 Leagues Cup.

That is the third time in his profession that Messi has received the FIFA Participant of the Yr title. after 2019 and 2022.In the meantime, many individuals suppose that Haaland deserves to win the above title as a result of he went by a brilliantly profitable 2022-2023 season with the "triple" with Man Metropolis. The Norwegian striker has scored greater than 30 objectives in all competitions within the interval after the 2022 World Cup and earlier than August 20, 2023.Within the FIFA The Greatest 2023 squad, Man Metropolis dominated by contributing 6 gamers, together with: Kyle Walker, John Stones, Ruben Dias, Bernardo Silva, Kevin De Bruyne and Erling Haaland. Actual Madrid contributed 3 gamers: Thibaut Courtois, Jude Bellingham and Vinicius Junior. The remaining two gamers collaborating within the wonderful group are Messi and Mbappe.Awards at FIFA The Greatest 2023- Greatest male participant of the yr: Lionel Messi- Greatest feminine participant of the yr: Aitana Bonmati- Fan of the Yr Award: Hugo Daniel Iniguez- Puskas Award: Guilherme Madruga- Truthful Play Award: Brazil- Greatest male goalkeeper of the yr: Ederson- Feminine goalkeeper of the yr: Mary Earps- Greatest feminine coach of the yr: Sarina Wiegma- Greatest males's coach of the yr: Pep Guardiola>> Tham khảo: Tài xỉu Fb68Lionel Messi's world information- Participant with essentially the most Golden Ball awards on this planet: 7- Achieved Guinness World Report for many objectives in 1 yr: 91 objectives- Participant scored essentially the most worldwide objectives in a yr (2012): with 25 objectives- Participant with essentially the most consecutive objectives in a match: 21 matches (33 objectives)- Highest scorer on the FIFA Membership World Cup: 5 objectives- Participant with essentially the most assists in Copa America historical past: 11 assistsLionel Messi's European information- Received many European Participant of the Yr titles: 3- Participant with essentially the most objectives in a season (membership): 73 objectives- Participant with essentially the most objectives in a yr (membership): 79 objectives- Received essentially the most UEFA Champions League high scorer awards: 4- Scored essentially the most hat-tricks within the UEFA Champions League: 6 hat-tricks- Participant scores essentially the most objectives in a match within the UEFA Champions League: 5 objectives- Highest scorer on the European Tremendous Cup: 3 objectivesLionel Messi's personal lifeNot solely his illustrious profession, the married lifetime of celebrity Lionel Messi additionally makes many individuals admire. He's at the moment residing fortunately along with his "younger childhood spouse" Antonella Roccuzzo alongside along with his three sons, Mateo Messi Roccuzzo, Thiago Messi and Ciro Messi Roccuzzo.ConcludeFrom a poor, silly boy to one of many best gamers of all time, Lionel Messi has confirmed that religion and dedication can overcome all difficulties. His profession is a narrative of dedication, ardour and large influence on the world of soccer. [ad_2] Supply hyperlink

0 notes

Text

Americans Think They Pay Too Much In Taxes. Here's Who Pays The Most And Least To The IRS.

— Money Watch | By Aimee Picchi | Edited By Anne Marie Lee

Most Americans think they pay too much in federal income taxes, and about 6 in 10 mistakenly believe middle-income households shoulder the highest tax burden.

In fact, only about 18% of adults correctly identified the group facing the highest federal tax burden, which are high-income Americans, according to a January poll from AP-NORC.

With less than one week left to file tax returns for 2023, taxes are on the mind of millions of Americans, with many expecting refunds, and others owing money. Only about 27% of taxpayers believe their federal income taxes are fair, with 60% believing their burden is too high, AP-NORC found.

In fact, the U.S. tax system is designed to be progressive, meaning that lower-income Americans pay a smaller share of their income in federal taxes than high-income workers, noted Alex Muresianu, senior policy analyst at the Tax Foundation, a think tank focused on tax issues.

"Raising another dollar from someone who is higher income is not going to be as much of a burden to them as raising another dollar from someone who is lower income," he said.

At the same time, there's a push from some lawmakers and policy experts to boost tax rates for the rich, with President Joe Biden proposing to reverse a rate cut on the nation's top earners that was part of the 2017 Tax Cuts & Jobs Act. Under Biden's proposal, the top marginal rate would return to 39.6% from its current level of 37%.

In 2021 (the most recent data available), the typical earner paid $14,279 in federal income taxes, with an average tax rate of 14.9%, according to a recent Tax Foundation analysis of IRS data. Federal taxes don't include the payroll tax that covers Social Security and Medicare.

But it's the top 50% of earners who contribute almost all of the nation's federal taxes — nearly 98%. The bottom 50%, who individually make below $46,637 annually, account for about 2.3% of the country's tax receipts.

Of course, this excludes the impact of other taxes that aren't as progressive, such as state and local sales taxes, which are levied at the same rate on every consumer, regardless of their income level. That means low-income Americans pay a bigger share of their earnings toward sales taxes than higher-earning people.

The top 10%, with incomes of at least $169,800, pay about three-quarters of the nation's tax bill, the analysis found.

Although most Americans believe the middle class bears the heaviest tax burden, it's actually the top 1% who pay the highest federal tax rate, at 25.9%, the Tax Foundation analysis found.

But the average tax rate paid by the top 1% has declined in recent decades, according to the Tax Foundation analysis. For instance, in 2001, the nation's top earners had an effective tax rate of 27.6% — almost two percentage points higher than their current rate.

The analysis also found that the top 0.1% of earners, with at least $3.8 million in annual income, pay an effective federal tax rate of 25.7%, which is a hair lower than the 25.9% tax rate for the top 1%.

Ultra-wealthy households often have access to tax loopholes and write-offs that aren't available to salaried workers who receive W2s, and much of their income can also stem from capital gains, which has a lower tax rate than earned income.

About 6 in 10 Americans said they were bothered by the feeling that corporations and the rich aren't paying their fair share in taxes, Pew Research found last year. That may explain why about two-thirds of those polled said they support higher taxes on the rich.

— Aimee Picchi is the Associate Managing Editor for CBS Money Watch, where she covers business and personal finance. She previously worked at Bloomberg News and has written for national news outlets including USA Today and Consumer Reports.

#CBS Money Watch#Aimee Picchi#USA Today and Consumer Reports#Bloomberg News 🗞️#Tax Rate#IRS#Most Payers | Least Payers

0 notes

Photo

Jesse Duquette, The Daily Don :: [Scott Horton]

* * * *

On the Tuesday before Thanksgiving, November 22, former president Trump hosted the antisemitic artist Ye, also known as Kanye West, for dinner at a public table at Mar-a-Lago along with political operative Karen Giorno, who was the Trump campaign’s 2016 state director in Florida. Ye brought with him 24-year-old far-right white supremacist Nick Fuentes. Fuentes attended the August 2017 “Unite the Right” rally in Charlottesville, Virginia, and in its wake, he committed to moving the Republican Party farther to the right. Fuentes has openly admired Italian fascist dictator Benito Mussolini and authoritarian Russian president Vladimir Putin, who is currently making war on Russia’s neighbor Ukraine. A Holocaust denier, Fuentes is associated with America’s neo-Nazis. In February 2020, Fuentes launched the America First Political Action Conference to compete from the right with the Conservative Political Action Conference. In May 2021, on a livestream, Fuentes said: “My job…is to keep pushing things further. We, because nobody else will, have to push the envelope. And we’re gonna get called names. We’re gonna get called racist, sexist, antisemitic, bigoted, whatever.… When the party is where we are two years later, we’re not gonna get the credit for the ideas that become popular. But that’s okay. That’s our job. We are the right-wing flank of the Republican Party. And if we didn’t exist, the Republican Party would be falling backwards all the time.” Fuentes and his “America First” followers, called “Groypers” after a cartoon amphibian (I’m not kidding), backed Trump’s lies that he had actually won the 2020 election. At a rally shortly after the election, Fuentes told his followers to “storm every state capitol until Jan. 20, 2021, until President Trump is inaugurated for four more years.” Fuentes and Groypers were at the January 6th attack on the U.S. Capitol, and at least seven of them have been charged with federal crimes for their association with that attack. The House Select Committee to Investigate the January 6th Attack on the U.S. Capitol subpoenaed Fuentes himself. Accounts of the dinner suggest that Trump and Fuentes hit it off, with Trump allegedly saying, “I like this guy, he gets me,” after Fuentes urged Trump to speak freely off the cuff rather than reading teleprompters and trying to appear presidential as his handlers advise. But Trump announced his candidacy for president in 2024 just days ago, and being seen publicly with far-right white supremacist Fuentes—in addition to Ye—indicates his embrace of the far right. His team told NBC’s Marc Caputo that the dinner was a “f**king nightmare.” Trump tried to distance himself from the meeting by saying he didn’t know who Fuentes was, and that he was just trying to help Ye out by giving the “seriously troubled” man advice, but observers noted that he did not distance himself from Fuentes’s positions. Republican lawmakers have been silent about Trump’s apparent open embrace of the far right, illustrating the growing power of that far right in the Republican Party. Representatives Paul Gosar (R-AZ) and Marjorie Taylor Greene (R-GA) have affiliated themselves with Fuentes, and while their appearances with him at the America First Political Action Conference last February drew condemnation from Republican leader Representative Kevin McCarthy (R-CA), now McCarthy desperately needs the votes of far-right Republicans to make him speaker of the House. To get that support, he has been promising to deliver their wish list—including an investigation into President Joe Biden’s son Hunter—and appears willing to accept Fuentes and his followers into the party, exactly as Fuentes hoped. Today, after the news of Trump’s dinner and the thundering silence that followed it, conservative anti-Trumper Bill Kristol tweeted: “Aren’t there five decent Republicans in the House who will announce they won’t vote for anyone for Speaker who doesn’t denounce their party’s current leader, Donald Trump, for consorting with the repulsive neo-Nazi Fuentes?” So far, at least, the answer is no.

[Heather Cox Richardson :: Letters From An American]

#political cartoons#Heather Cox Richardsoon#Dinner Party#TFG#Jesse Duquette The Daily Don#my favorites

23 notes

·

View notes

Text

Are There Tax Advantages of Buying a Home?

If you’re thinking about becoming a homeowner any time soon, there are tax benefits to buying. In particular, tax deductions are one way to reduce your tax bill and income. Tax deductions are different from credits. Credits are money that gets taken off a tax bill. You can think of them somewhat like a coupon. A tax deduction reduces your adjusted gross income or AGI, reducing your tax liability.

The following are key tax benefits and things to know for homebuyers or possible homebuyers.

Mortgage Interest Deduction

Homeowners can deduct interest on their home mortgage for the first $750,000 of mortgage debt. That limit is $375,000 if you’re married and filing separately. If you bought your home prior to December 16, 2017, an old limit of $1 million applies, and $500,000 if you’re married but filing separately.

In January, at the tax year’s end, a lender sends you Form 1098. This details the interest you paid over the previous year. You should include the interest you paid as part of the closing too.

Your lender includes interest for the partial initial month of your mortgage as part of your closing. You can locate this on your settlement sheet. If it’s not included on the 1098, add it to your total mortgage interest.

Mortgage Points Deduction

If you paid mortgage points to a lender as part of your loan or refinancing, then each point you buy will generally cost 1% of the total loan. They lower your interest rate by 0.25% each. If you paid, let’s say, $300,000 for your home, every point equals $3,000. If your interest rate is 4% in this example, the one point will lower your rate to 3.75% for the rest of your loan. You would get a deduction if you gave your lender money for your discount points.

If you refinanced your loan or took out a home equity line of credit, you are eligible for a deduction for points for your loan’s life.

Every time you’re making a payment on your mortgage, a smaller percentage of the points is built into your loan, and you can deduct that amount for every month you make payments. Again, your lender sends Form 1098, which details what you paid in interest on your mortgage and mortgage points.

You can claim the deduction based on that information on Schedule A of your Form 1040 or 1040-SR.

Private Mortgage Insurance (PMI)

If you have private mortgage insurance, which lenders usually charge to borrowers who put down less than 20% on a conventional loan, you may be able to deduct your payments. PMI usually costs anywhere from $30 to $70 monthly for every $100,000 borrowed. As with other types of mortgage insurance, PMI protects a lender if you don’t make your mortgage payments.

Whether or not you can deduct PMI payments can depend on when you bought your home and your income.

The IRS says that homeowners can treat what you pay for PMI as interest on a home mortgage. If your adjusted gross income is under $100,000 or $50,000 if married, filing separately, you’re eligible for the full deduction here.

If you’re above that threshold, the deduction is phased out. If your AGI is above $109,000 or $54,500 to file separately as a married person, you aren’t eligible to take the deduction.

State and Local Tax Deduction

The state and local tax deduction, also known as SALT, lets you deduct some taxes you pay to the state or local government, but you have to itemize on your federal return.

Under the Tax Cuts and Jobs Act, there was a cap on previously unlimited deductions. The cap is $10,000 per year in combined property taxes and either state income or sales taxes. The cap applies whether you’re single or married filing jointly. It goes down to $5,000 if you’re married and filing separately.

Home Sale Exclusion

If you profit after selling your home, you may not have to pay taxes. If you’ve owned and then lived in the home for at least two of the five years before the sale, you won’t pay taxes on the initial $250,000 of your profit. This profit is your capital gain. If you're married, filing jointly, that number goes up to $500,000.

However, at least one of the spouses has to meet an ownership requirement. Both spouses must meet a residency requirement, meaning they have lived in the home for two of the past five years.

Tax Credits

Finally, you could qualify for a mortgage credit if you received a mortgage credit certificate or MCC from a state or local government agency under a qualified mortgage credit certification program. You can also see if your state offers rebates, tax credits, or incentives for making improvements to your home to make it more energy efficient.

0 notes

Text

Brazil Experiences Record Wave of Venezuelan Migrants

In the first three months of 2023, a record 51,838 Venezuelan migrants and refugees entered Brazil.

This is the highest number ever recorded in the first three months of the year since 2020. Operation Shelter (Operação Acolhida), executed and coordinated by the Federal government, with the support of federal entities, United Nations (U.N.) agencies, international organizations, civil society organizations, and private entities, totaling more than 100 partners, released the data. The operation, launched in the state of Roraima, on the border with Venezuela, seeks to welcome, provide humanitarian aid, and carry out the integration into society of Venezuelans.

From January 2017, when the data began to be collected, until April of 2023, 903,279 Venezuelans entered Brazil.

Alejandro Guzmán, director of institutional relations at Brazilian nongovernmental organization (NGO) Casa Venezuela, links the high number of migrants in the first quarter of the year to the harsher economic situation in the neighboring country. The NGO works with training and the socioeconomic integration of the migrants, referring them to job openings offered by a network of companies. The Venezuelans participate in the selection process and, if approved, are hired. Guzmán also says that the new arrivals in Brazil are socially extremely vulnerable, which makes it difficult for the NGO to find jobs for them in Brazil.

Continue reading.

#brazil#politics#venezuela#brazilian politics#migration#refugees#mod nise da silveira#image description in alt

0 notes