#fdi

Explore tagged Tumblr posts

Text

23/11/2023, Meloni in Senato: «Non mi ricordo di aver detto che bisognava uscire dall’euro».

Elezioni europee del 2014, programma di Fratelli d’Italia: “Fratelli d’Italia si impegna a farsi promotore nel prossimo Parlamento europeo di una Risoluzione comune a tutti i gruppi ‘eurocritici’, per spingere la Commissione Europea a procedere allo scioglimento concordato e controllato dell’Eurozona […] l’uscita dall’Euro e dalla gabbia dei suoi vincoli consentirebbe all’Italia di recuperare considerevoli risorse per sostenere investimenti, crescita e occupazione”.

È vero, non l’ha detto. 𝗟’𝗵𝗮 𝘀𝗰𝗿𝗶𝘁𝘁𝗼.

59 notes

·

View notes

Text

Molti chiedono ancora ai fratellitalioti di dichiararsi antifascisti, ricavandone le risposte più fantasiose che io abbia mai sentito a questo quesito, e questo pare li tranquillizzerebbe, anche se io non capisco il perché.

Se Forrest Gump non è passato invano dagli schermi, ricordate la celebre frase: “Stupid is as stupid does”? Basta guardarli per sapere chi sono: fascista è chi il fascista fa!

E mi pare che di esempi ce ne siano fin troppi, e sappiamo che possono fare anche meglio in futuro, adesso si stanno trattenendo per non spaventare troppo il loro elettorato “moderato”, ma non fidiamoci troppo, chi per anni ha votato per Berlusconi o per la Lega è capace di tutto, anche a digerire l’olio di ricino.

8 notes

·

View notes

Text

BREAKING:

This morning israeli occupation forces execute a pharmaceutical sales representative at Beit Einun intersection east of Hebron, occupied West Bank.

Basil Al-Mohtasib panicked and stopped the car when he encountered Israel soldiers, who proceeded to execute him in his vehicle.

Última Hora:

Esta mañana, las fuerzas de ocupación israelíes ejecutaron a un representante de ventas de productos farmacéuticos en la intersección de Beit Einun, al este de Hebrón, en la Cisjordania ocupada.

Basil Al-Mohtasib entró en pánico y detuvo el coche cuando se encontró con soldados israelíes, que procedieron a ejecutarlo en su vehículo.

(via. IG: palestine.pixel)

#west bank#idf executed a civilain#free palestine#palestine#end israeli occupation#end israeli apartheid#end israeli siege#gaza#human rights#humanitarian crisis#libre palestina#palestina#noticias de palestina#las FDI ejecutaron a un civil#noticias#FDI

20 notes

·

View notes

Text

📽️ clip video da Grottole (MT) - Azioni, risultati e nuovi obbiettivi. Resta sintonizzato! #FDI

2 notes

·

View notes

Text

Green Growth: Investing in Sustainable Energy Projects in India

In recent years, India has emerged as a beacon of opportunity for investors looking to capitalize on sustainable energy projects. With a growing population, rapid urbanization, and increasing energy demand, the country presents a fertile ground for investments in renewable energy infrastructure. Foreign Direct Investment (FDI) in India's renewable energy sector has been steadily rising, driven by favorable government policies, technological advancements, and a shift towards cleaner energy sources. In this blog, we will delve into the prospects of investing in sustainable energy projects in India, focusing on the opportunities, challenges, and the role of FDI in driving green growth.

The Indian Energy Landscape: A Paradigm Shift towards Renewables

India's energy landscape has undergone a significant transformation in recent years, with a pronounced shift towards renewable sources. The government's ambitious target of achieving 450 gigawatts (GW) of renewable energy capacity by 2030 underscores its commitment to clean energy transition. This transition is fueled by-

1. Government Initiatives: Schemes like the National Solar Mission, Ujwal DISCOM Assurance Yojana (UDAY), and the Green Energy Corridor Project aim to boost renewable energy adoption and address infrastructure challenges.

2. Attractive Policies: The introduction of initiatives like feed-in tariffs, renewable purchase obligations, and tax incentives have created a conducive environment for renewable energy investments.

3. Technological Advancements: Advancements in solar, wind, and energy storage technologies have significantly reduced costs, making renewable energy more competitive with conventional sources.

4. International Commitments: India's commitment to the Paris Agreement and its pledge to reduce carbon emissions have further propelled the transition towards cleaner energy sources.

Opportunities for Investors

Investing in sustainable energy projects in India offers a myriad of opportunities across various segments of the renewable energy value chain:

1. Solar Power: India receives abundant sunlight throughout the year, making it an ideal location for solar power generation. Opportunities exist in utility-scale solar parks, rooftop solar installations, and solar panel manufacturing.

2. Wind Energy: With a vast coastline and favorable wind conditions, India has significant potential for wind energy projects. Onshore and offshore wind farms, along with wind turbine manufacturing, present lucrative investment prospects.

3. Hydropower: Despite challenges, hydropower remains an integral part of India's renewable energy mix. Investments in small and micro-hydro projects, pumped storage facilities, and modernization of existing hydropower plants offer avenues for growth.

4. Energy Storage: As the penetration of renewable energy increases, the need for energy storage solutions becomes paramount. Investments in battery storage, pumped hydro storage, and innovative grid-scale storage technologies are on the rise.

5. Electric Vehicle Infrastructure: The growing adoption of electric vehicles (EVs) necessitates investments in charging infrastructure, battery manufacturing, and renewable energy integration to support sustainable transportation.

Role of FDI in Driving Green Growth

Foreign Direct Investment plays a crucial role in accelerating India's transition towards sustainable energy:

1. Capital Infusion: FDI provides the necessary capital infusion required for developing renewable energy projects, especially in the initial stages where large investments are needed.

Here's a more detailed explanation:

Foreign Direct Investment (FDI) involves the investment of capital from foreign entities into projects or businesses in a host country. In the context of sustainable energy projects in India, FDI plays a crucial role in providing the necessary financial resources to develop renewable energy infrastructure. Here's how capital infusion through FDI contributes to the growth of sustainable energy projects:

1. Financial Support: Developing renewable energy projects, such as solar parks, wind farms, or hydropower plants, requires significant upfront capital investment. FDI provides access to substantial funds that may not be readily available from domestic sources alone. This infusion of capital enables project developers to finance the construction, installation, and operation of renewable energy facilities.

2. Risk Mitigation: Renewable energy projects often involve inherent risks, including regulatory uncertainties, technological challenges, and market fluctuations. FDI can help mitigate these risks by providing financial stability and diversification of funding sources. International investors bring in expertise in risk assessment and management, which enhances project resilience against potential financial setbacks.

3. Scaling Up Operations: The scale of renewable energy projects in India is increasing rapidly to meet the growing demand for clean energy. FDI facilitates the scaling up of operations by enabling larger investments in utility-scale projects and supporting the expansion of manufacturing facilities for renewable energy equipment. This scalability is essential for achieving economies of scale, driving down costs, and enhancing the competitiveness of renewable energy solutions.

4. Access to Global Markets: Foreign investors often have access to global capital markets, which allows Indian renewable energy companies to tap into international funding opportunities. FDI can facilitate partnerships, joint ventures, or strategic alliances with foreign firms, opening doors to new markets, technologies, and business opportunities. This cross-border collaboration fosters knowledge exchange, innovation, and best practices in sustainable energy development.

5. Project Viability: Many renewable energy projects in India require long-term investments with relatively lengthy payback periods. FDI provides patient capital that is willing to commit to projects over extended periods, enhancing project viability and sustainability. Additionally, foreign investors' participation in project financing enhances investor confidence, attracting further investments from domestic and international sources.

2. Technology Transfer: Foreign investors bring in expertise and technology advancements that enhance the efficiency and effectiveness of renewable energy projects in India.

Here's a detailed explanation:

Foreign Direct Investment (FDI) brings more than just capital; it also facilitates the transfer of advanced technologies and expertise from foreign investors to domestic entities. In the context of India's renewable energy sector, technology transfer through FDI plays a critical role in advancing the adoption and deployment of renewable energy solutions. Here's how technology transfer contributes to green growth:

1. Access to Cutting-Edge Technologies: Foreign investors often possess cutting-edge technologies, innovations, and best practices in renewable energy development and deployment. By partnering with or investing in Indian renewable energy projects, foreign firms transfer these technologies to local entities, thereby enhancing the efficiency, reliability, and performance of renewable energy systems.

2. Enhanced Research and Development (R&D): FDI stimulates research and development activities in the renewable energy sector by fostering collaboration between domestic and foreign entities. Joint R&D initiatives, technology-sharing agreements, and collaborative projects facilitate knowledge exchange and innovation diffusion. This collaboration accelerates the development of next-generation renewable energy technologies tailored to India's specific needs and conditions.

3. Capacity Building: Technology transfer through FDI contributes to the capacity building of domestic stakeholders, including project developers, engineers, technicians, and researchers. Through training programs, knowledge transfer sessions, and skill development initiatives, foreign investors empower local talent with the expertise and know-how required to design, implement, and maintain renewable energy projects effectively.

4. Adaptation to Local Context: While foreign technologies may be state-of-the-art, they often need to be adapted to suit local conditions, regulations, and infrastructure constraints. Through FDI, technology transfer is not merely about importing foreign solutions but also about customizing and contextualizing them to meet India's unique requirements. This process of adaptation ensures the practical applicability and scalability of renewable energy technologies in the Indian context.

5. Spillover Effects: The benefits of technology transfer extend beyond the immediate recipients of FDI to the broader renewable energy ecosystem. As domestic entities gain access to advanced technologies and knowledge, spillover effects occur, leading to the diffusion of innovations across the industry. This ripple effect catalyzes further innovation, competitiveness, and growth in the renewable energy sector, driving overall green growth in the economy.

3. Market Expansion: FDI contributes to the expansion of the renewable energy market by fostering competition, driving innovation, and improving project execution capabilities.

4. Job Creation: Investments in renewable energy projects create employment opportunities across the value chain, from manufacturing and construction to operations and maintenance.

5. Long-Term Sustainability: FDI promotes long-term sustainability by aligning investments with environmental, social, and governance (ESG) principles, thereby fostering responsible business practices.

Challenges and Mitigation Strategies

While the prospects for investing in sustainable energy projects in India are promising, several challenges persist:

1. Policy Uncertainty: Regulatory uncertainty and policy inconsistencies can deter investors. Clear and stable policies, coupled with transparent decision-making processes, are essential to instill investor confidence.

2. Infrastructure Constraints: Inadequate grid infrastructure and transmission bottlenecks pose challenges to renewable energy integration. Investments in grid modernization and infrastructure development are imperative.

3. Land Acquisition: Securing land for renewable energy projects can be a complex and time-consuming process. Streamlining land acquisition procedures and addressing land-use conflicts are critical.

4. Financial Risks: Fluctuating currency exchange rates, project financing challenges, and revenue uncertainties can impact project viability. Risk mitigation measures such as hedging strategies and financial incentives are vital.

5. Technical Challenges: Variability in renewable energy resources, technological limitations, and equipment reliability issues require continuous innovation and R&D efforts to address.

Investing in India’s sustainable energy projects holds immense potential for both domestic and foreign investors. With supportive government policies, technological advancements, and a growing market demand for clean energy, the sector offers attractive opportunities for long-term growth and impact. Foreign Direct Investment plays a pivotal role in driving green growth by leveraging capital, expertise, and technology to accelerate India's transition towards a sustainable energy future. Despite challenges, the collective efforts of stakeholders can unlock the full potential of renewable energy and pave the way for a greener, more resilient India.

This post was originally published on: Foxnangel

#green growth#sustainable energy#renewables energy#renewable energy green energy#sustainable energy projects#foreign direct investment#FDI#invest in india#foxnangel

2 notes

·

View notes

Text

sopra il problema

sotto la soluzione

6 notes

·

View notes

Text

Schlein ha abbracciato la tassa sulle banche su cui poi l’esecutivo stesso ha dovuto fare mezzo passo indietro. Forse perché priva di colleghi di partito all’altezza, la segretaria naviga a vista: sul salario minimo, domani, potrebbe mandare la palla in tribuna facendo un altro regalo alla premer

Il Partito democratico ha fatto una pessima figura ad appoggiare una delle misure più sballate del governo, talmente sballata che il governo stesso, e non per impulso delle opposizioni ma per l’evidente figuraccia sui mercati, è dovuto tornare abbastanza indietro.

Il Partito democratico è rimasto abbacinato dalla filosofia tendenzialmente sovietica che ha guidato la premier che ieri ha spiegato che il governo ha istituito una tassa sui «margini di guadagno ingiusti» delle banche, dove sono lei e i suoi collaboratori a stabilire il margine giusto e quello ingiusto, più o meno come spettava al segretario del Pcus, ma a sinistra va molto di moda questa idea degli “extraprofitti”, categoria scivolosa e informe basata più sulla psicanalisi che sulla scienza della finanze: mai guadagnare troppo.

Ma siccome non siamo in Unione sovietica e non ci sono kulaki da deportare, ci ha pensato poi il mercato a darle un drizzone: a Ovest niente di nuovo, funziona così. Dopo quindici anni di vita si pensava che il Partito democratico avesse assimilato la lezione per cui il dirigismo ideologico («contro le banche!», come dicevano i giottini) va a sbattere contro la realtà: invece la sinistra interna che si è impadronita via Elly Schlein del partito ha stoltamente fatto clap clap a una misura estemporanea e sbagliata nei suoi presupposti, come hanno spiegato decine di seri economisti e imparziali osservatori.

Non solo i dem hanno appoggiato Giorgia Meloni (altro che stampella) ma l’hanno fatto scivolando sulla fanghiglia di un provvedimento che tra l’altro illude tutti coloro che hanno un mutuo variabile promettendo «aiuti» che se ci saranno non verranno certo da questa roba. Il problema di Schlein, sulle cui spalle non può ragionevolmente poggiare tutto, è che non dispone di gente all’altezza della situazione, complici anche la morte cerebrale dell’ex area riformista sepolta a Cesena e la smania di voti che evidentemente si pensa di arraffare con la ricetta di Giuseppe Conte intrisa di demagogia e populismo.

Il Partito democratico continua a navigare a vista e rischia di sprecare anche quel che di buono ha fatto. Dopo questa figura di palta adesso il Partito democratico dovrà in qualche modo “emendarsi” e tornare a fare la faccia feroce.

2 notes

·

View notes

Text

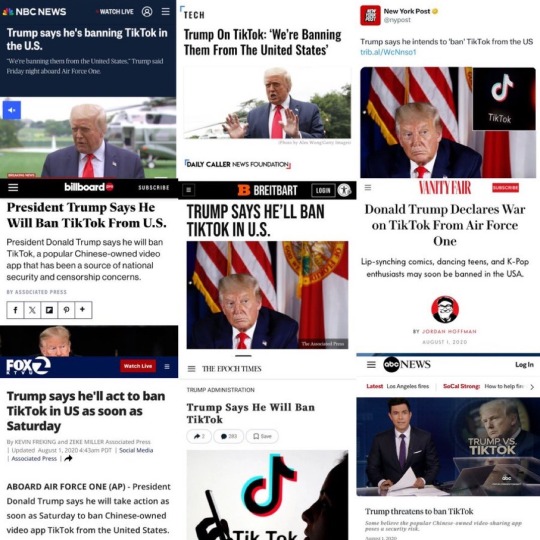

lo salva, non lo salva, lo salva poi lo molla poi lo salva

Promettitori di cazzate e boccaloni recidivi che si stanno masturbando per i contentini omofobi, razzisti e non glie ne verrà in tasca un cazzo...

Ma sono i vincenti per delega per via del sangue di Giulio Cesare nelle vene... non importa per quel piccolo particolare che lo stanno a pija ner culo (accise, Fornero, 1000 euro in banca con un click, la nipote di Mubarak, il canone RAI...).

Reminder for when he “saves” it. He was the one who wanted this, and now he gets to be the hero and win favour with young constituents. Don’t give him the credit for fixing his own problem.

104K notes

·

View notes

Text

la cultura della legalità...

pene esemplari...

dalla parte delle forze dell'ordine...

castrazione chimica...

se non voleva che gli sparassero poteva stare a casa sua...

37 notes

·

View notes

Text

𝙰𝚕𝚕 𝚠𝚘𝚛𝚔 𝚊𝚗𝚍 𝚗𝚘 𝚙𝚕𝚊𝚢 𝚖𝚊𝚔𝚎𝚜 𝐺𝑖𝑜𝑟𝑔𝑖𝑎 𝚊 𝚍𝚞𝚕𝚕 𝚋𝚘𝚢 𝙰𝚕𝚕 𝚠𝚘𝚛𝚔 𝚊𝚗𝚍 𝚗𝚘 𝚙𝚕𝚊𝚢 𝚖𝚊𝚔𝚎𝚜 𝐺𝑖𝑜𝑟𝑔𝑖𝑎 𝚊 𝚍𝚞𝚕𝚕 𝚋𝚘𝚢 𝙰𝚕𝚕 𝚠𝚘𝚛𝚔 𝚊𝚗𝚍 𝚗𝚘 𝚙𝚕𝚊𝚢 𝚖𝚊𝚔𝚎𝚜 𝐺𝑖𝑜𝑟𝑔𝑖𝑎 𝚊 𝚍𝚞𝚕𝚕 𝚋𝚘𝚢 𝙰𝚕𝚕 𝚠𝚘𝚛𝚔 𝚊𝚗𝚍 𝚗𝚘 𝚙𝚕𝚊𝚢 𝚖𝚊𝚔𝚎𝚜 𝐺𝑖𝑜𝑟𝑔𝑖𝑎 𝚊 𝚍𝚞𝚕𝚕 𝚋𝚘𝚢 𝙰𝚕𝚕 𝚠𝚘𝚛𝚔 𝚊𝚗𝚍 𝚗𝚘 𝚙𝚕𝚊𝚢 𝚖𝚊𝚔𝚎𝚜 𝐺𝑖𝑜𝑟𝑔𝑖𝑎 𝚊 𝚍𝚞𝚕𝚕 𝚋𝚘𝚢

5 notes

·

View notes

Text

Ladies and gentlemen... The self-proclaimed "Most moral army on earth." 🇮🇱

The the horrors of inhumanity and dehumanizing that Palestinians have to deal with on day-to-day basis.

-------------------------------------------------------

Damas y caballeros... El autoproclamado "Ejército más moral de la tierra". 🇮🇱

Los horrores de la inhumanidad y la deshumanización con los que los palestinos tienen que lidiar día a día.

#free palestine#palestine#end israeli occupation#end israeli apartheid#end israeli siege#gaza#human rights#humanitarian crisis#idf#libre palestina#palestina#fdi

4 notes

·

View notes

Text

Repetita iuvant: la prossima volta lo dirà La Russa con le dita incrociate dietro la schiena.

Intanto le accise?

E le uova?

Suvvia... non prepariamogli degli alibi.

74K notes

·

View notes

Text

Paese sicuro dove alla polizia non viene impedito di fare il suo lavoro

eh lo so che c'è gente che pensa che se non "facevano niente" non avrebbero avuto niente da temere... è la stessa gente che si lamenta della STASI e che qua avrebbe guardato i fasci torturare.

Salvo magari scoprire di pensare di non aver fatto niente e invece...

41 notes

·

View notes

Text

La Russa: «Io sono come Jessica Rabbit: “È che mi disegnano così!”».

1 note

·

View note

Text

"Turbas de colonos israelíes radicales han invadido la aldea de mi familia en Ramala. Las FDI están presentes. Han quemado 40 casas y la escuela del pueblo. Sucede ahora, 12 de abril de 2024.

Ya se ha derramado sangre Palestina inocente.

Esto sigue a otro asalto reciente de israelíes a nuestra aldea vecina en Julio de 2023, cuando mi padre la vio arder desde la puerta de su casa.

Poner fin a la ocupación del apartheid israelí."

Via. IG: oliviagrove20

#Cisjordania#Palestina#Fuerzas de ocupación israelíes#FDI#Israel#colonizadores israelíes#free palestine#palestine#end israeli occupation#end israeli apartheid#end israeli siege#gaza#human rights#humanitarian crisis#west bank

4 notes

·

View notes

Text

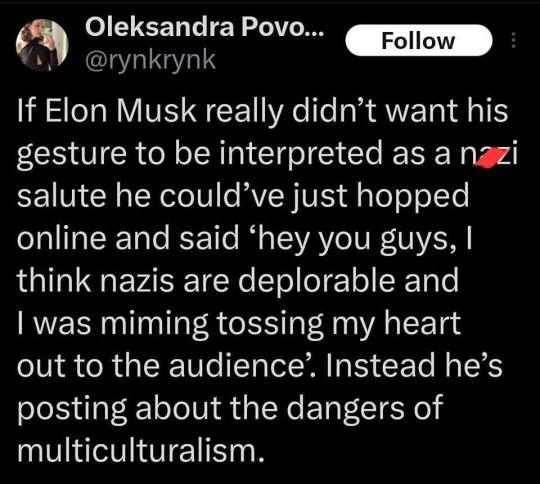

bisogna proprio essere delle immense facce da culo per attaccarsi a queste cose o rivolgersi a una platea di coglioni.

e gne gne signora mia allora fanno tutti saluti nazisti eh...

La razza superiore che si cura con l'ivermectina.

So many people are finding screenshots of celebrities allegedly doing a 'nazi salute,' to try and discredit what people have been saying about Elon Musk.

My favourite most recently has been a picture of Sabrina Carpenter which can easily be discredited.

This is the picture:

And this is the video:

Yep, it's just a young woman waving to her fans.

And this is why when you ask any of them who post the screenshots for a video, they refuse to add it in. Because they know the video is of somebody doing something very normal.

We are so absolutely screwed.

46K notes

·

View notes