#fawry

Explore tagged Tumblr posts

Video

youtube

اخيرا اسحب من محفظة فودافون كاش بعمولة 0.57% فقط بدلا من 1% - هتوفر نص ف...

0 notes

Text

Charity Commissions 🇵🇸

Hello guys, it's been a while!

To cut to the chase: I would like to help spread both awareness and support for those suffering in the ongoing genocide in Palestine. So, in light of this, I will open up some commissions where rather than paying me, you simply provide proof of your donation.

I know this blog is mainly just for my art, but if I can use my art for any good I would like to do so. If you cannot donate, please reblog!

Here are some recommended links:

E-sims for Gaza: https://gazaesims.com

Palestinian children’s relief fund: PCRF

Women for women (hygiene kits, blankets, food): Urgent Support for Women in Palestine Women for Women International

Anera dignity kits: https://www.anera.org/stories/gaza-emergency-aid-includes-dignity-kits/

A website for vetted fundraisers: https://gazafunds.com/all

But of course you can donate to any related organization and fundraiser you like, even if it’s not included here!

If you are Egyptian you can also donate to any of the organizations listed under the Instapay, Talabat, Fawry apps, or your bank app under their ‘donations’ services with the equivalent price in EGP (based on the bank rate). Just provide a screenshot.

For a written list of the prices, the do/don'ts, and so on, please look under the read-more for more details!

How Does this Work?

Send me the idea you have and I will let you know if it’s good to go or if it’s not appropriate (or if I can’t do it due to time/work)

When you get the okay, I will ask for more details (references, colour schemes, poses, which charity you plan to donate to, etc.)

I will draw you a basic thumbnail for your confirmation (these are very vague sketches to just pinpoint the pose).

Once you confirm the pose, I will ask you to donate and I will get to work

Send me a screenshot of the e-mail confirming your donation (blur out/colour over any personal info!), or the “Thank you for your donation!” screen if there is no e-mail

You get your drawing in exchange!

NOTE: I will likely post them on my artblog and Instagram, so if you don’t want them posted there or would like to remain anonymous, please let me know!

Also bear in mind I have a full-time job, so they might be a while! But you WILL get your commission.

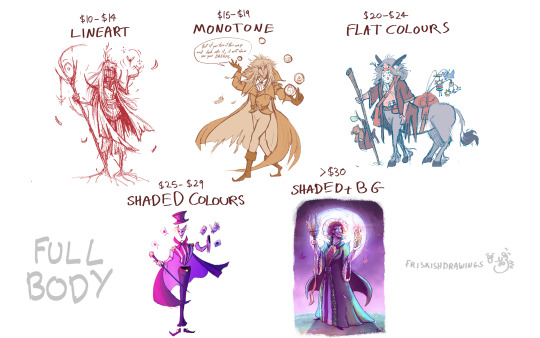

HALF-BODY

$5-$9: Lineart $10-$14: Monotone $15-$19: Colours, flat $20-$24: Colours, shaded Above $25: Colours, shaded, with background

FULL-BODY

$10-$14: Lineart $15-$19: Monotone $20-$24: Colours, flat $25-$29: Colours, shaded Above $30: Colours, shaded, with background

Yes-es:

Fan art is fine (I won’t be getting any monetary profit from this)

Characters from original stories

Personas/self-inserts/fan characters/Tabletop RPG characters

Real!you, family members, friends, etc. (at the risk of them not looking like them at all :’D)

Animals (they might be a bit less cartoony as I'm not used to them but yes)

Personifications/anthropomorphic/strange creatures in general

Nos:

No discriminatory content

No religious figures, symbolism or content (I am Muslim so… Cannot Really Do That)

No extreme gore or suggestive themes, or characters from media that feature a lot of either (this is because my art blog is PG-13, and I’d rather not anything off-colour for a charity commission anyway)

No using these with AI or NFTs

Do not use for commercial purposes. These are for charity!

I reserve the right to decline your commission if I feel like you have insincere ulterior motives, or if an emergency comes up.

Generally, keep this PG-13/grandma-friendly!

Pleases:

References (preferably image based, but text is fine if there is no visual depiction/canon design)

Colour you associate with the character if monotone

Poses (just not lewd or rude)

Context (like description of their personality, what they like, their setting, etc.)

Ask first:

You are free to repost the artwork on another platform as long as you credit me as the artist. Absolutely use them if you need a picture for something like an RP account!

If from your original work, you may use them in non-commercial projects, just please credit me (and give me a heads up so I can go check it out! :D).

If an original character from an original story, you are free to use the artwork to help with things like visual development (let’s say, you are creating a game, comic or pilot, and you want a reference for the artists on your team to use), just once again give me a heads up and credit me as the artist.

If you've made it this far, and can't donate, thank you so much for your interest anyway. At the very least, this reached someone.

#palestine#charity#charity commissions#donations#free Palestine#artists on tumblr#digital art#character design#fan art#original characters#ocs#character art#digital painting#The backgrounds will have more detail#regrettably do not have any examples with characters in them#all examples are either fanart or my original characters#Fanart#commissions#commission#art commissions

149 notes

·

View notes

Note

Used to read those rainbow fairy books

YES

7 notes

·

View notes

Text

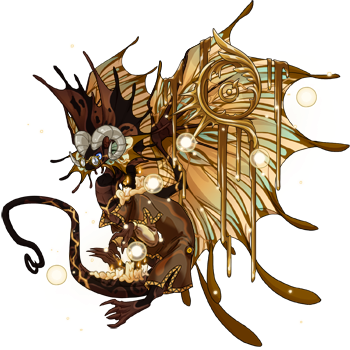

Did a headshot of my guy Fawry. They are precious.

#artwork#digital art#procreate#flight rising#my art#art tumblr#dragons#headshot#flight rising fae#dragon art#dragon sfw#original art#artists on tumblr

178 notes

·

View notes

Text

Since I usually ship Millie with Elder Faerie (and Elder Fawrie isn’t in Ovenbreak. So we get LonganTree) instead

4 notes

·

View notes

Text

Fawry Market

Welcome to Fawry Market, we are committed to providing the best shopping experience for our customers. We are keen to offer a wide range of distinguished products that meet all your daily needs. Whether you are looking for fresh vegetables and fruits, meat, or delicious baked goods, we are here to serve you with the best prices and highest quality.

Our services:

Home Delivery: We provide express delivery service to your doorstep. Online Order Booking: You can now book your orders in advance through our website or our application.

Loyalty Program: Join the loyalty program and get points and rewards with every purchase.

Our headquarters: (Al-Salmani West - Al-Najma Club Street - Opposite Bilal Bin Rabah School) Address link 👇

https://maps.app.goo.gl/o1kSVm7Q5AuTPzyu6

You can shop online by clicking on the website link 👈

https://fawry-shops.ly or shop from the application Application download link 👈

https://onelink.to/7aywwh or contact customer service at Fawry Market on the number 👈 0912911117

Note: We accept all banking services.

2 notes

·

View notes

Text

تحميل تطبيق انا فودافون 2025 Ana Vodafone APK اخر اصدار مجانا

تحميل تطبيق انا فودافون Ana Vodafone APK للاندرويد اخر اصدار برابط مباشر من ميديا فاير مجانا وهو تطبيق هام في حياتنا اليومية، حيث يساعدنا في إدارة حساباتنا والاستفادة من خدمات Vodafone بسهولة ويسر، إذا كنت تستخدم خدمات Vodafone، فإن تنزيل انا فودافون Ana Vodafone للاندرويد والايفون يمكن أن يكون له العديد من الفوائد بالنسبة لك.

أهمية تحميل تطبيق انا فودافون Ana Vodafone APK في حياتنا اليومية

يوفر تطبيق انا فودافون ( Ana Vodafone Apk ) إمكانية إدارة حسابك بشكل كامل، بما في ذلك رصيدك وفاتورتك واستهلاكك للبيانات والدقائق. يتيح لك تطبيق أنا ڤودافون شراء باقات الإنترنت والحصول على عروض خاصة تناسب احتياجاتك. يمكنك من خلال التطبيق إجراء عمليات تحويل الأموال من خلال خدمة Vodafone Cash. يتيح لك التطبيق الوصول السريع إلى جميع خدمات فودافون ومعرفة أحدث العروض والتخفيضات. يتيح لك التطبيق التواصل مع فريق دعم العملاء وطرح الاستفسارات والحصول على ا��مساعدة في أي وقت. يوفر التطبيق مستوى عالٍ من الأمان والحماية لبياناتك الشخصية والمعاملات المالية. كما يمكنكم التعرف على كيفية تحميل تطبيق موبايلي Mobily اخر اصدار مجاناً

طرق تنزيل انا فودافون Download Ana Vodafone برابط مباشر على الهواتف الذكية

هناك عدة طرق لـ تحميل تطبيق انا فودافون Ana Vodafone App For Android بشكل مجاني على هواتفك الذكية، حسب نظام التشغيل الذي تستخدمه، إليكم الخطوات البسيطة لتحميل التطبيق على الهواتف الذكية: إذا كنت تستخدم جهاز اندرويد قم بفتح متجر التطبيقات "Google Play Store" على الأندرويد. إذا كنت تستخدم جهاز ايفون قم بفتح متجر التطبيقات "App Store" على هاتفك الذكي. ابحث عن تطبيق "انا فودافون" في شريط البحث. انقر فوق النتائج المطابقة للتطبيق. انقر فوق زر "تثبيت" لبدء تحميل التطبيق على هاتفك. تحميل تطبيق انا فودافون بعد اكتمال عملية التحميل، انقر فوق زر "فتح" لتشغيل التطبيق.

مميزات تطبيق انا فودافون Apk

تحميل أنا ڤودافون Apk للاندرويد اخر اصدار يوفر مجموعة من المميزات والخدمات التي تسهل على العملاء إدارة حساباتهم والاستفادة من خدمات الشركة بشكل أفضل، إليك بعض المميزات البارزة لتطبيق انا فودافون: - سهولة الاستخدام : يتميز تحميل تطبيق أنا ڤودافون Aa Vodafone App بواجهة سهلة الاستخدام وتصميم بسيط يجعل من السهل على العملاء الوصول إلى جميع الخدمات المتاحة. - إدارة الحساب : يمكن للعملاء إدارة حساباتهم بسهولة من خلال التطبيق، بما في ذلك تحميل الفواتير ومعرفة استهلاك البيانات والرصيد والدقائق المتبقية. - العروض والخدمات المخصصة : يتيح برنامج "أنا ڤودافون Ana Vodafone App" للعملاء الوصول إلى العروض والخدمات المخصصة لهم بناءً على احتياجاتهم الفردية، يمكن للعملاء شراء باقات الإنترنت وتفعيل الخدمات الإضافية بسهولة عبر التطبيق. - الإشعارات الحية : يتلقى العملاء إشعارات حية حول العروض الجديدة والتحديثات والرسائل الهامة من فودافون، هذا يساعدهم على البقاء على اطلاع دائم بكل جديد ومميز. - تجربة مخصصة : يقدم التطبيق تجربة مخصصة لكل عميل، حيث يمكن للعملاء تخصيص إعداداتهم وتفضيلاتهم لتلبية احتياجاتهم الفردية. - استعراض خدمات مشغّلي الاتصال السابقة : يتيح للعملاء الوصول إلى معلومات عن خدمات مشغلي الاتصال السابقة بسهولة، مما يساعدهم في اتخاذ قرارات أفضل بشأن استخدامهم لخدمات فودافون. تطبيق انا فودافون يسهل على العملاء الاستفادة الكاملة من خدمات فودافون وتحسين تجربتهم العامة، قم بتنزيل التطبيق الآن واستمتع بكل المزايا المتاحة لك.

كيفية استخدام تطبيق انا فودافون

تطبيق أنا فودافون هو أداة قوية تسهل التحكم في خدمات فودافون وتوفر العديد من المزايا والخدمات للمستخدمين، إليك بعض النصائح والإرشادات للتعامل مع التطبيق بشكل فعال : قم بتحميل التطبيق : اذهب إلى متجر التطبيقات على جهازك الذكي وابحث عن تطبيق أنا فودافون، قم بتنزيله وتثبيته على جهازك. قم بتسجيل الدخول : بمجرد تثبيت التطبيق، قم بفتحه وأدخل بيانات تسجيل الدخول الخاصة بك (رقم الهاتف المحمول وكلمة المرور) للوصول إلى حسابك. استعراض الخدمات : من خلال التطبيق، يمكنك الاطلاع على تفاصيل حسابك بما في ذلك رصيدك وفواتيرك واستهلاكك، وكذلك شراء باقات الإنترنت وإدارة خدماتك الأخرى. استكشاف الميزات : استكشف الميزات المتقدمة للتطبيق مثل الدفع الإلكتروني، وتحديث بياناتك الشخصية، والحصول على العروض والخصومات الحصرية. تواصل مع خدمة العملاء : إذا كان لديك أي استفسارات أو مشاكل، يمكنك الاتصال بفريق خدمة العملاء من خلال التطبيق والحصول على المساعدة اللازمة. تحديث التطبيق : تأكد من تحديث التطبيق بانتظام للاستفادة من أحدث المزايا وإصلاح الأخطاء البرمجية إن وجدت. استخدم هذه النصائح والإرشادات للاستفادة القصوى من تطبيق أنا فودافون والتمتع بتجربة سلسة في التحكم بخدمات فودافون الخاصة بك.

كيفية استخدام التطبيق لإدارة حسابك وخدماتك الشخصية "انا فودافون حسابي"

تطبيق انا فودافون هو أداة قوية يمكن استخدامها لإدارة حسابك وخدماتك الشخصية بكل سهولة ويسر، إليك بعض الاستخدامات الرئيسية لتطبيق "انا فودافون": - الاطلاع على الرصيد المتبقي : يمكنك استخدام التطبيق لمعرفة الرصيد المتبقي لديك من الفليكسات والرصيد على هاتفك بالتفصيل، بما في ذلك المكالمات والرسائل والميجابايتات من الإنترنت. - شراء باقات الإنترنت : يمكنك استخدام التطبيق لشراء باقات الإنترنت المناسبة لاحتياجاتك وتفاصيل كل باقة. - إدارة أرقامك الإضافية : يمكنك إضافة أرقام إضافية إلى حسابك وإدارتها من خلال التطبيق. - الحصول على العروض الخاصة : يتيح لك التطبيق الوصول إلى العروض الحصرية لعملاء فودافون والاستفادة منها. - الدفع الإلكتروني : يمكنك استخدام التطبيق لدفع فواتيرك وفواتير الهاتف المحمول بكل سهولة من خلال الدفع الإلكتروني. لمعرفة المزيد عن كيفية استخدام تطبيق انا فودافون واستكشاف المزيد من خدماته ومميزاته، يمكنك قراءة المزيد عبر الرابط هنا.

الأمان والخصوصية في تحميل برنامج انا فودافون

تحرص فودافون على حماية بياناتك الشخصية والحفاظ على خصوصيتك أثناء استخدام تطبيق "أنا فودافون"، فيما يلي بعض المعلومات حول كيف يتم ذلك: البيانات الشخصية : يتم جمع بعض البيانات الشخصية كجزء من استخدام التطبيق، يتم استخدام هذه البيانات بناءً على سياسة خصوصية الشركة وتستخدم فقط لأغراض تحسين الخدمة وتعزيز تجربة المستخدم الخاصة بك. الأمان : يتم تطبيق إجراءات أمان مشددة في التطبيق لحماية بياناتك الشخصية من الوصول غير المصرح به أو الاستخدام غير المشروع، تشمل هذه الإجراءات تشفير البيانات وتطبيق إجراءات الحماية اللازمة. مشاركة البيانات : يمكن أن يشارك التطبيق بعض البيانات مع جهات خارجية كما هو موضح في سياسة الخصوصية، ومع ذلك ، يتم ضمان أن مشاركة البيانات تتم وفقًا للمعايير الأمنية العالية وتلتزم بالتشريعات واللوائح المعمول بها. تحترم فودافون خصوصيتك وتلتزم بحماية بياناتك الشخصية، يمكنك الاطلاع على سياسة الخصوصية الخاصة بفودافون للحصول على مزيد من المعلومات المفصلة حول كيفية حماية بياناتك والخصوصية أثناء استخدام تطبيق "أنا فودافون". إضافة إلى ذلك يمكنكم مشاهدة تحميل تطبيق فوري My Fawry برابط مباشر مجاناً

خطوات تشغيل انا فودافون بشكل صحيح anavodafone

هنا ستجد بعض النصائح والخطوات لتشغيل تطبيق انا فودافون بشكل صحيح والاستفادة القصوى منه: قم بتنزيل تطبيق انا فودافون من متجر بلاي للأجهزة التي تعمل بنظام أندرويد أو من متجر App Store لأجهزة iPhone. بمجرد تثبيت التطبيق على جهازك المحمول، قم بتسجيل الدخول باستخدام رقم هاتفك المحمول وكلمة المرور المرتبطة بحسابك في فودافون. بعد تسجيل الدخول�� ستجد العديد من الخدمات والمزايا التي يمكنك الاستفادة منها، مثل معرفة الرصيد والاطلاع على الفواتير وشراء باقات إنترنت إضافية. للحصول على أفضل أداء مع التطبيق، تأكد من تحديثه بانتظام للحصول على أحدث الميزات والتحسينات. قم بتفعيل إشعارات التطبيق لتلقي تنبيهات حول الفواتير المستحقة والعروض الحصرية والتحديثات الهامة الأخرى. إذا كان لديك أي استفسارات أو مشاكل مع التطبيق، يمكنك الاتصال بخدمة العملاء لفودافون للحصول على المساعدة. تابع تشغيل تطبيق انا فودافون والاستفادة القصوى من جميع الخدمات والمزايا التي يقدمها لك فودافون. استمتع بتجربة سلسة ومريحة مع تطبيق انا فودافون. تطبيق انا فودافون هو تطبيق مهم لمشتركي فودافون حيث يوفر العديد من المزايا والفوائد المهمة، ويتيح التطبيق أيضًا الوصول إلى خد��ات الدفع المختلفة وإدارة الخدمات الأخرى التي تحتاجها، قم بتحميل تطبيق أنا فودافون الآن واستمتع بجميع هذه المزايا مجانًا. تحميل تطبيق Ana Vodafone للأندرويد تحميل انا فودافون Ana Vodafone Apk تحميل تطبيق انا فودافون للأيفون Read the full article

#anavodafoneapk#anavodafone#انافودافون#انافودافونapk#انافودافونتنزيل#انافودافونحسابي#برنامجانافودافون#تحميلانافودافونبدونمتجر#تحميلبرنامجانافودافون#تشغيلانافودافون#تطبيقانافودافون#تنزيلانافودافون#تنزيلانافودافون2022#تنزيلانافودافون2023#تنزيلانافودافون2024#تنزيلانافودافونالقديم#تنزيلبرنامجانافودافون#تنزيلتطبيقانافودافون

0 notes

Link

0 notes

Text

تحميل مجانى برنامج شامل لإدارة الإيرادات والمصروفات والمشتريات Excel

تحميل مجانى برنامج شامل لإدارة الإيرادات والمصروفات والمشتريات Excel بسم الله الرحمن الرحيم اهلا بكم متابعى موقع عالم الاوفيس تحميل مجانى برنامج شامل لإدارة الإيرادات والمصروفات والمشتريات Excel نطرا لطلب متابعى موقع عالم اجراء بعض التحديثات على برنامج الايرادات والمصروفات المجانى 100% حيث انة من الممكن ان نقوم بادخال بيان خطأ ونريد التراجع فيه ما بحذفة او تعديلة تم عمل هذة الطلبات فى الاصدار الحديث من تحميل مجانى برنامج شامل لإدارة الإيرادات والمصروفات والمشتريات Excel شيت مصروفات وايرادات شيت مصروفات وايرادات هو أداة مهمة في إدارة الأعمال والمالية. يهدف هذا البرنامج إلى تسهيل عملية تتبع الإيرادات والمصروفات للشركات والمؤسسات، وتحليلها وتقييمها بطريقة فعالة. يوفر هذا الشيت إمكانية إدخال جميع المعلومات المتعلقة بالإيرادات والمصروفات، ويقدم تقارير مفصلة تساعد في اتخاذ القرارات المالية الصحيحة. كشف الايرادات والمصروفات يعتبر كشف الايرادات والمصروفات جزءًا أساسيًا من برنامج الايرادات والمصروفات. يساعد هذا الكشف في توضيح جميع المدخلات والمخرجات المالية للشركة. يتضمن هذا الكشف جميع عناصر الإيرادات المتنوعة التي تدخل إلى الشركة، بالإضافة إلى جميع المصروفات المختلفة التي تنفقها الشركة. يعرض هذا الكشف أيضًا إجمالي الأرباح أو الخسائر التي تحققت للشركة. الإيرادات والمصروفات الإيرادات هي المبالغ المالية التي تدخل إلى الشركة من مصادر مختلفة، مثل مبيعات المنتجات أو الخدمات، أو الاستثمارات، أو الفوائد المصرفية. بينما تشمل المصروفات جميع المبالغ المالية التي تنفقها الشركة على أغراض مختلفة، مثل تكاليف الإنتاج، ورواتب الموظفين، ومصاريف التسويق. ايرادات ومصروفات تعد الإيرادات والمصروفات مؤشرًا هامًا لنجاح أو فشل الشركة. فعندما تزيد الإيرادات وتقل المصروفات، فإن ذلك يعني زيادة الأرباح ونجاح الشركة. وعلى العكس من ذلك، عندما تقل الإيرادات وتزداد المصروفات، فإن ذلك يشير إلى تراجع الأرباح واحتمالية فشل الشركة. الايرادات تعد الإيرادات هي المصدر الأساسي للشركة لتمويل أعمالها وتحقيق أرباحها. يجب على الشركة تحقيق إيرادات كافية لتغطية جميع المصروفات وتحقيق الأرباح المستهدفة. يحتاج إلى مراقبة دقيقة للإيرادات شيت الإيرادات والنفقات يستخدم شيت الإيرادات والنفقات لتسجيل جميع العمليات المالية الخاصة بالمؤسسة. يحتوي هذا الشيت على أعمدة مختلفة لتسجيل التفاصيل المالية المختلفة مثل تاريخ العملية، والإيرادات، والمصروفات، وطرق الدفع، ورصيد الحساب. يسهل استخدام هذا الشيت في إعداد كشف الإيرادات والمصروفات وتحليل النشاط ال��الي للمؤسسة. إيرادات ومصروفات Excel تعتبر برامج Excel أداة قوية لإدارة الإيرادات والمصروفات. يمكن استخدام Excel لإنشاء شيت مصروفات وإيرادات مخصص يتضمن التفاصيل المالية المطلوبة. يوفر Excel العديد من الميزات التحليلية والرسوم البيانية التي تساعد في فهم النشاط المالي بشكل أفضل واتخاذ قرارات مستنيرة. لتحميل البرنامج من هنا قد يعجبك ايضا تحميل برنامج حركة الخزينة مجانا اسطوانة التعريفات الشاملة DriverPack Solution بدون نت شيت بجميع اكواد الخدمة في فورى Fawry اكواد فوري برنامج مجانى لمتابعة حركة الخزينة Excel تحميل برنامج مخازن مجانى 100 % كامل ومفتوح المصدر | Store Management System برنامج متابعة الشيكات (شيكات دفع / شيكات قبض ) Cheques Management + نسخة تجريبية تحميل برنامج الكاشير2020 المجانى لادارة حسابات المحلات التجارية Cashier تحميل برنامج مجانى حضور وانصراف الموظفين بالبصمة( دوام الموظفين المجانى) تحميل برنامج مخازن مجانى 100% -برنامج المنجز 2024 تحميل برنامج محاسبى كامل كفعل مدى الحياة تحميل برنامج الايرادات والمصروفات مجانى 100% تحميل برنامج تنظيم الملفات والسكرتارية وادارة مكاتب المحاماة اسهل طريقة لعمل دواير حمراء بناء على محتوى الخلية (تحديد الناجح من الراسب ) تحميل يوزرفورم كامل للبحث متعدد المعايير تحميل Free Office 2024 مجانا تحميل قاعدة بيانات الطلاب اكسس مفتوحة المصدر مجانا تحميل برنامج ادارة العيادات الطبية اكسس مجانا مفتوح المصدر برامج مجانية via عالم الاوفيس https://ift.tt/HsP2g34 December 17, 2024 at 12:34AM

0 notes

Text

افضل شركة تقسيط في مصر

في مصر، هناك العديد من الشركات التي تقدم خدمات التقسيط، سواء لشراء الأجهزة المنزلية أو الإلكترونيات أو السيارات وغيرها. اختيار الشركة المناسبة يعتمد على احتياجاتك وشروط التقسيط التي تبحث عنها. إليك قائمة ببعض الشركات المعروفة في مجال التقسيط:

1. كارت فوري بلس (Fawry Plus) يقدم تسهيلات شراء من العديد من المتاجر. شروط ميسرة وموافقة سريعة. إمكانية دفع الأقساط من خلال منافذ فوري. 2. فاليو (ValU) تقدم تقسيط بدون فوائد لفترات معينة مع متاجر شريكة. مناسب لشراء الإلكترونيات، الأثاث، وحتى الخدمات التعليمية. يمكن التحكم بكل شيء عبر التطبيق الخاص بهم. 3. أمان (Aman) شركة امان للتقسيط توفر تسهيلات تقسيط للأجهزة المنزلية، الموبايلات، والمزيد. تعمل على التوسع في جميع أنحاء مصر مع إجراءات سهلة وسريعة. تعتبر خيارًا ممتازًا لشراء الأجهزة المنزلية. 4. بي تك (B.Tech) تقدم نظام تقسيط مرن بدون مقدم أو فوائد لفترات معينة. متخصصة في الأجهزة الإلكترونية والمنزلية. لديهم شبكة فروع واسعة. 5. كونتكت (Contact) تقدم خدمات تقسيط السيارات، الأجهزة الإلكترونية، والأثاث. مرونة في اختيار فترة السداد. إجراءات موافقة سريعة نسبيًا. نصائح لاختيار أفضل شركة تقسيط: قارن بين الفوائد والرسوم الإضافية. تحقق من شروط التعاقد وفترات السداد. تأكد من أنك قادر على الالتزام بدفع الأقساط لتجنب أي غرامات.

0 notes

Link

#فوري#كارت فوري#ماي فوري#fawry#كارت ماي فوري#الدولار#الجنيه#الجنيه المصري#الدولار الامريكي#البنك المركزي المصري#كارت ميزة#egyfox technology#ahmed khedr fox#dregyfox

0 notes

Text

0 notes

Text

The Rise of Fintech Companies in MENA: Transforming Financial Landscapes

Introduction

The Middle East and North Africa (MENA) region is undergoing a significant transformation driven by the rapid rise of fintech companies. These innovative enterprises are leveraging technology to revolutionize financial services, enhance accessibility, and promote financial inclusion across the region. In this blog, we explore the factors driving the fintech boom in MENA, key players, and the impact on the financial landscape.

The Driving Forces Behind Fintech Growth

1. Young, Tech-Savvy Population MENA boasts a predominantly young population that is highly tech-savvy. With increasing smartphone penetration and internet access, this demographic is eager to adopt digital financial services, creating a fertile ground for fintech innovation.

2. Government Support and Regulatory Reforms Governments in the MENA region are actively fostering fintech growth by implementing supportive policies and regulatory frameworks. Initiatives like regulatory sandboxes, fintech hubs, and favorable licensing conditions are encouraging startups and investors to enter the market.

3. High Unbanked Population A significant portion of the MENA population remains unbanked or underbanked. Fintech companies are addressing this gap by offering accessible and affordable financial solutions, from mobile wallets to digital lending platforms, thus promoting financial inclusion.

4. Investment and Collaboration The region has seen a surge in investment in fintech startups, with venture capitalists and financial institutions recognizing the potential for substantial returns. Collaborations between traditional banks and fintech firms are also driving innovation and expanding the reach of digital financial services.

Key Players in the MENA Fintech Ecosystem

1. PayTabs PayTabs, a Bahrain-based payment solutions provider, is a prominent player in the MENA fintech landscape. The company offers secure and seamless online payment processing, catering to businesses of all sizes across the region.

2. Fawry Egypt's Fawry is a leading electronic payment network, providing a wide range of financial services, including bill payments, mobile banking, and e-commerce solutions. Fawry's extensive network of retail locations makes it a critical player in promoting digital financial services.

3. Souqalmal Based in the UAE, Souqalmal is a financial comparison platform that empowers consumers to make informed financial decisions. The platform offers comparisons of banking, insurance, and investment products, enhancing transparency and competition in the financial sector.

4. Sarwa Sarwa, a robo-advisory platform from the UAE, is democratizing investment by offering affordable and accessible wealth management services. The platform leverages technology to provide personalized investment portfolios tailored to individual risk profiles and financial goals.

Impact on the Financial Landscape

1. Enhanced Financial Inclusion Fintech companies in MENA are playing a crucial role in bridging the financial inclusion gap. By offering digital banking, payment solutions, and microfinance services, they are empowering previously underserved populations to participate in the formal economy.

2. Increased Efficiency and Innovation The integration of technology in financial services is streamlining operations, reducing costs, and enhancing efficiency. Fintech firms are driving innovation in areas such as blockchain, artificial intelligence, and machine learning, setting new standards for the industry.

3. Competition and Consumer Empowerment The rise of fintech is fostering healthy competition in the financial sector. Traditional banks are compelled to innovate and improve their services to keep pace with agile fintech startups. Consumers, in turn, benefit from a broader range of choices and improved service quality.

4. Economic Growth and Job Creation The fintech boom is contributing to economic growth by attracting investment, fostering entrepreneurship, and creating jobs. As the fintech ecosystem expands, it generates opportunities for skilled professionals in technology, finance, and related fields.

Conclusion

The fintech revolution in the MENA region is transforming the financial landscape, driving financial inclusion, and fostering economic growth. With continued support from governments, investors, and consumers, the region's fintech ecosystem is poised for even greater expansion and innovation. As fintech companies continue to disrupt traditional financial services, they are paving the way for a more inclusive, efficient, and dynamic financial future in MENA.

0 notes

Text

Mobiwire V4 Fawry

On this page, we have shared the Mobiwire V4 Fawry Stock ROM Firmware (Flash File), which can be used to reinstall your mobile device’s operating system (OS). The stock ROM comes in a compressed file along with the flash tool, USB driver, and a how-to-install manual. Mobiwire V4 Fawry Stock ROM Firmware (Flash File) The Stock ROM (firmware) can be used to reinstall the operating system (OS) on…

0 notes

Link

0 notes

Text

0 notes