#familyofficers

Explore tagged Tumblr posts

Text

Olek Capital - family office with a focus on impact and property investments

In 2024, entrepreneur Thomas Olek reorganised his investments and bundled them in Olek Capital GmbH, which was founded for this purpose. He is expanding his activities internationally with the family office. In addition to an office in Frankfurt am Main, the company is also represented in Monaco and Miami.

Olek Capital - sustainability and returns combined

The acquisition of a property package for nine million euros is the first major transaction with which Olek Capital GmbH has become known to a wider public. Its owner Thomas Olek, however, is no stranger to the world of finance and has built up a reputation as a successful investor over the past decades with property projects for Publity AG and well-known impact investments.

In the past year, Thomas Olek has disposed of further investments and thus built up considerable cash reserves, which are now available for international investments by Olek Capital. With offices in #Frankfurt am Main, #Monaco and #Miami, the aim is to realise promising projects that offer sustainable growth prospects.

Olek Capital is currently examining lucrative investment opportunities at its locations. The current interest rate trend in particular means that the prospects for high-quality property projects are promising again. With its in-depth understanding of the financial sector and a strong international network, Olek Capital always pursues a sustainable approach with lucrative returns and long-term value appreciation.

Real estate is the basis of Olek Capital

One of Olek Capital's largest assets is its majority stake in Publity AG. Founded in 1999, the company specialises in the realisation of high-quality commercial properties in German-speaking countries and has always focused on more ESG-compliant projects in recent years.

Thomas Olek managed the company from 2002 to 2020 before moving on to other projects in the field of impact investing. Since December 2024, he has once again led the company as sole CEO and is focussing on repositioning and transforming the company.

Olek Capital combines many years of expertise in impact and property investing

In addition to the owners of Olek Capital, Thomas Olek and his wife Annah Olek, long-time companion Stephan Kunath is managing the company's fortunes as CEO. The team combines extensive expertise in the realisation of high-quality real estate projects and has gained specific experience in impact investing with Neon Equity AG. This includes successful investments in the electromobility and healthcare sectors.

Harmonising sustainability and returns remains Olek Capital's goal. The company is co-organising the International Impact Forum, which will be held in Monaco for the first time in March 2025. Together with the Prince Albert II of Monaco Foundation and UNA TERRA, the forum will bring together experts from business, politics, science and finance to discuss current developments in impact investing and further develop this asset class.

Thomas Olek - owner with vision

In the past, Thomas Olek has repeatedly demonstrated his ability to recognise and strategically exploit long-term market opportunities. He has not only made a name for himself in the German property industry. He is fully committed to digital processes that enable properties to be managed more efficiently and transparently. In 2019, he was honoured with the PLATOW Award in the commercial property category.

With Olek Capital GmbH, Thomas Olek now wants to utilise this many years of experience internationally.

https://olekcapital.com/

2 notes

·

View notes

Text

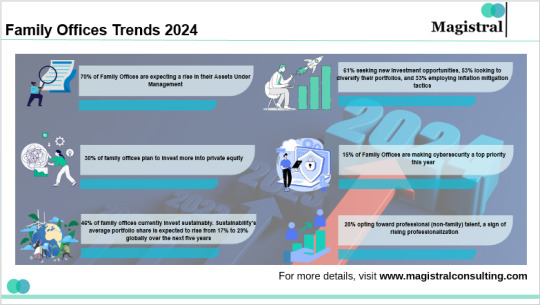

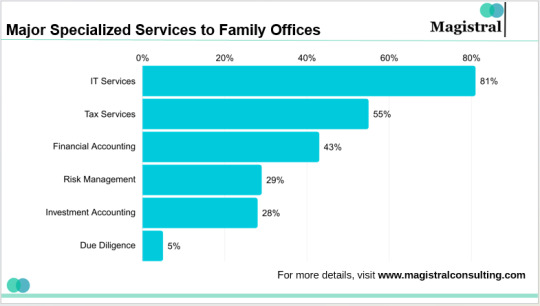

The Rapid Growth of Family Office Service Providers: What’s Next?

#magistralconsulting#familyoffice#globaldata#lendingsectors#dealvolume#valuedeal#operationoutsourcing

0 notes

Link

#Asia#cross-bordercollaborations#familyoffices#HongKong#regulatorychallenges#sustainableinvestments#technology#WealthManagement

0 notes

Text

Dos modelos para grandes patrimonios

Banca privada y family offices son caminos opuestos, pero con el mismo destino: preservar el patrimonio. Decide entre seguridad global o personalización.

0 notes

Text

Family Office Software

Finorb's Family Office Software streamlines wealth management with intuitive tools for tracking assets, investments, and financial planning. Tailored for high-net-worth families, it ensures data security, enhances collaboration, and provides real-time insights. Simplify complex financial operations and optimize portfolio management with Finorb cutting-edge technology.

1 note

·

View note

Text

Diversifying Wealth with Regulated Forex Brokers: A Guide for Family Offices and Asset Managers

#ForexTrading#WealthManagement#FamilyOffices#AssetManagement#RiskManagement#RegulatedBrokers#InvestmentStrategies#AlgorithmicTrading#FinancialGrowth#PortfolioDiversification#MarketInsights#AffluentInvestors#TradingOptions#ForexMarket#FinanceTips#InvestSmart#TradingEducation#ForexCommunity#FinanceForFamilies#WealthBuilding

1 note

·

View note

Text

All About Family Office in Dubai

Dubai Business Setup offers specialized services for family offices in Dubai, focusing on wealth management and preservation. Our Dubai family offices company services include strategic advisory in private equity, diversified investment opportunities, and tailored financial planning. Whether you are establishing a new family office structure or optimizing an existing one, our expert team at dubaibusinesssetup ensures your financial goals are met with personalized solutions. Discover how our comprehensive family office services can support your long-term wealth management and growth. Visit us for more information about Dubai business setup services and start securing your financial future today.

#familyoffice#familyofficedubai#dubai#businesssetup#businesssetupdubai#management#business setup#business setup in dubai#business setup consultants in dubai#company formation in dubai#businessindubai

0 notes

Text

What is a Family Office? Understanding Its Role in Wealth Management

Wealth management concerning rich people is an important part of financial planning that involves protecting and expanding wealth through various means that suit their different requirements. At Broad Wings Family Office, we provide a range of all-inclusive services which are specifically designed for individuals with high net worths since they have complex dynamics. This can include but not limited to asset management; estate planning as well as charity work.

0 notes

Text

Tigers of Wealth: Singapore vs. Hong Kong in the Family Office Faceoff

Two Asian titans, Singapore and Hong Kong, are locked in a high-stakes battle for supremacy in the realm of family offices - private havens managing the wealth of the ultra-rich. Once an undisputed leader, Hong Kong faces challenges, while Singapore strategically positions itself as a global wealth management destination. Let's unpack the strategies of these financial powerhouses and see why it matters.

Hong Kong's Eclipsing Luster

Hong Kong's once radiant image as a haven for wealth has dimmed. A significant exodus of millionaires, with estimates suggesting a 25% drop in the past year, paints a concerning picture. This can be attributed to several factors:

COVID-19 Conundrum: Stringent pandemic measures hampered Hong Kong's appeal as a business hub, pushing an estimated 3,000 millionaires to seek more relaxed environments.

Shifting Sands of Power: The tightening grip of Beijing on Hong Kong, coupled with security crackdowns, has cast a shadow over the city's economic landscape.

Zero-Covid Fixation: Hong Kong's unwavering commitment to a "zero Covid" strategy further impeded its economic performance.

As a symbolic shift, Hong Kong recently relinquished its crown as Asia's leading financial hub to Singapore, according to the Global Financial Centres Index (GFCI). This has led to a surge in Chinese wealth, families, and businesses migrating to the Lion City, with nearly 2,800 HNWIs (High Net Worth Individuals) relocating in 2022.

Singapore's Strategic Ascendancy

Singapore's rise is no stroke of luck, but a result of carefully crafted policies and inherent strengths:

Business Nirvana: Singapore consistently ranks among the most business-friendly nations. Transparent regulations, unwavering political stability, and a proactive government make it a haven for investors.

Tax Paradise: The city-state's tax-friendly regime fosters investment. Over the past decade, assets under management (AUM) have skyrocketed from US$1.2 trillion to a staggering SGD 5.4 trillion.

Wealth Management Oasis: Singapore actively cultivates its image as a hub for wealth management and fund management. The number of family offices has seen a significant rise, solidifying its position as a wealth preservation powerhouse.

The Battle Rages On

The competition intensifies. Singapore, boasting 25% of Asia's family offices, has established itself as a global leader in wealth management. Hong Kong, with its concentration of ultra-high net worth individuals, strives to regain its lost footing.

In this high-stakes game, both cities play to their strengths. Singapore offers stability and predictability, while Hong Kong seeks to recapture its former glory. As this Asian financial showdown unfolds, families of immense wealth stand to benefit from the innovation and competition it breeds.

0 notes

Text

Renowned Short Seller Jim Chanos Transitions Hedge Fund to Family Office #familyoffice #hedgefund #JimChanos #KynikosAssociates #shortseller

0 notes

Text

#EnergyInvestment#InstitutionalInvesting#PortfolioDiversification#EnergyAssets#FamilyOffices#Advisors#Producers#Sellers#CommodityExposure#AssetMonetization

0 notes

Photo

Ich lebe in einer surrealen Welt. Keine Kohle, kein Geld. Hoher status wegen dem was Ich male, und gemacht habe. Natürlich nicht finanziell sichtbar. Die Welt aufs krasseste mit meiner Kunst versaut und aus den Fugen gebracht, politisch, kulturell, ethnisch, kriminell. Alles nicht so übertragbar sichtbar das es sich bis her finanziell gezeigt hat, bzw hier was angekommen ist. Habe Hunger, kein Geld für essen, dafür aber auch zu fett. Je mehr mich male desto mehr fühlen sich die falschen inspiriert und motiviert von meiner Kunst. Dazu die Erkenntnis das die Frauen so krass heftig was bodycount, lügen, und rumkommen angeht durchgepeitscht sind. Ja wusste man schon als Kind. Hat genug gesehen, und verstanden. Allerdings gibt’s Steigerungen. Dann das man sich die heile Welt der neunziger Jahre zurück wünscht. Das mit der Gewalt finde ich irgendwie auch geil. Dann kann Mann sich als Mann beweisen. Ich hab das ‘ ea ‘ für Tod, auf dem Rücken, und ‘ Tod ‘ schon auf dem Arm tattoowiert. Und mit 15 Jahren bestimmt eine ganze Kofferraum Ladung voll lang Waffen, SturmGewehren, und Kurz Waffen durch probiert. Gleichzeitig muss ich ja die ganze Zeit weiter meine Bilder detaillierter machen. Die Erkenntnis das Jahrzehnte weitere Arbeit sind. Sowie große Gemälde in grob malen. Ohne Assistenten aka Ghostwriter. Dazu kommt Nachwuchs. Stoische Disziplin ist der Schlüssel. Lust am lernen. Allein sein geniessen und peak performing und sein Ding machen heißt jetzt ‘ sigma’. ‘ Innenarchitektur Symbiose ‘ ist das was meine Kunst macht. Schatten Integration. Keine Ahnung ob Beta Nice Gut Gutmenschen von der Anspannung wenn die Selbstzensur bei denen wirkt aus rasten von den Spannungen, oder ins Ego gehen, oder x? Die Fusion durch meine Kunst geistig, zwingt zum winken/ Kampf/ Tun/ machen. #SEAK #ClausWinkler #SEAKClausWinkler #familienbüro #interpreneurialspirit #whatarethefamilysgoals #sharedassets #familyoffices #impactfirst #philantrophy #privateequity #globalinvestors #sustainablefinance #wealthmanagement #familyoffice #thenextinvestment #impactthesystem #philantropic #purposeourwealth #impact #whatdoesitmeantobewealthy #globalchallenges #generationalwealth (hier: Ober Trübsee Alp, Obwalden, Switzerland) https://www.instagram.com/p/CqfoiodI8ON/?igshid=NGJjMDIxMWI=

#seak#clauswinkler#seakclauswinkler#familienbüro#interpreneurialspirit#whatarethefamilysgoals#sharedassets#familyoffices#impactfirst#philantrophy#privateequity#globalinvestors#sustainablefinance#wealthmanagement#familyoffice#thenextinvestment#impactthesystem#philantropic#purposeourwealth#impact#whatdoesitmeantobewealthy#globalchallenges#generationalwealth

0 notes

Text

The Rise of Outsourced Family Office Services in Wealth Management

#magistralconsulting#familyoffices#currenttrends#financialservices#operationsoutsourcing#wealthmanagement

0 notes

Photo

GM! Finally wearing my @azuki @azukihk @azukitw jacket while in the hair and makeup chair. What do you all think? #jenniferchenglo #jennifercheng #newchiccapital #familyoffice #jennclub #jennclubdao #jennfund #acehedgefund #aimhedgefund #entrepreneur #investor #creator #pianist #actress #model #business #crypto #blockchain #nfts #nft #gaming #artist #tech #metaverse #web3 #coinsgroup #puahe https://www.instagram.com/p/CqaJmqRJquo/?igshid=NGJjMDIxMWI=

#jenniferchenglo#jennifercheng#newchiccapital#familyoffice#jennclub#jennclubdao#jennfund#acehedgefund#aimhedgefund#entrepreneur#investor#creator#pianist#actress#model#business#crypto#blockchain#nfts#nft#gaming#artist#tech#metaverse#web3#coinsgroup#puahe

0 notes

Text

youtube

Rich, Famous, and Private: 10 Ways Dynasties Hide Their Fortunes. Explore how the world’s wealthiest families—like the Waltons and Rothschilds—build and protect their fortunes across generations, revealing powerful lessons for your own financial legacy. https://www.youtube.com/channel/UC3o4B5eoAcewBjxvaeC5Rxg?sub_confirmation=1 Building generational wealth is more than just amassing money—it’s about establishing long-term strategies, governance structures, and shared values. From the Waltons, who leveraged a single retail empire into a sprawling global business, to dynasties like the Rothschilds, known for their financial savvy, these families exemplify how to protect and grow wealth across multiple generations. They set up trusts, educate their heirs, and carefully manage both public perception and private affairs. One of the cornerstones of their success is the concept of concentrated ownership, where family members maintain control rather than selling stakes to outsiders. Additionally, they often diversify investments through private equity, real estate, and philanthropic endeavors. This not only creates multiple revenue streams but also fortifies their legacies against economic fluctuations. Beyond finances, the richest families emphasize values-based leadership—establishing family councils or formal governance boards. By fostering unity around shared missions and encouraging each generation to adopt these principles, they keep wealth from fracturing over time. Coupled with a savvy approach to privacy, philanthropy, and networking, they cement their influence in both business and society. While the scale of their fortunes may seem unapproachable, the underlying principles—long-term thinking, disciplined investment, and cohesive family vision—offer invaluable lessons for anyone aiming to build a lasting financial future. 📂 For The Latest Stories on luxury travel, getaways goods, the rich, companies, Top 10’s, biographies, Lavish History, news, and more 📂 https://www.youtube.com/@Lavishangle 🎉 For business enquires contact us at full4sog (@) gmail dot com 💬 Don't forget to leave your thoughts in the comments below. We love hearing from you! 😍 and hit that bell to stay updated on all new videos we release. #lavishgetaways #thelavishandaffluentangle #thelavish&affluentangle #tlaa #viralyoutubevideo #video #viralyoutubevideo #youtubeviralvideos #videosviral #videos #videosyoutube #videosbeta #viralvideos #viralvideo #viral #viralreels #youtubevideos #viralyoutubevideos #Rothschilds #Waltons #KochFamily #BillionaireDynasties #GenerationalWealth #WealthPreservation #FamilyLegacy #EstatePlanning #PrivateEquity #FamilyGovernance #BoardOfDirectors #Philanthropy #DynasticFortunes #UltraWealthy #RealEstateInvesting #FamilyOffices #MultigenerationalAssets #WealthTransfer #FamilyTrusts #BusinessStrategies #FinancialEducation #LuxuriousLifestyle #GlobalInfluence #PrivateWealth #PowerfulNetworks via The Lavish & Affluent Angle https://www.youtube.com/channel/UC3o4B5eoAcewBjxvaeC5Rxg January 04, 2025 at 08:00PM

#lavishgetaways#luxurylifestyle#luxuryhotels#luxurytravel#luxuryliving#traveltheworld#travelgoals#Youtube

0 notes

Text

Climate-Techs Want to Save the Planet. First They Need to Save Themselves.

Investors heard loads of startup pitches at Climate Week NYC, but saw few bankable opportunities at a time when fledgling companies badly need the cash

https://www.wsj.com/articles/climate-techs-want-to-save-the-planet-first-they-need-to-save-themselves-e60ce893

👌More Than 90% of 2021 Venture Funds Have Had Zero Distributions Thus Far, Report Shows

https://www.wsj.com/articles/more-than-90-of-2021-venture-funds-have-had-zero-distributions-thus-far-report-shows-32b0348f #VentureCapital #VC #fund #Investments @ennovance #MandAEast #Roundtable #interestrate #MnA #dealmaking #mergers #exit #valuation #pe #lbo #buyouts #privateequity #sfo #mfo #familyoffice #transaction

0️⃣ https://x.com/mohossain/status/1571715009226608640?s=46&t=GtuOmoaTjOwevz2JidiiDQ

#venture capital#vc#privateequity#investor#chemicals#economy#ennovance#equity#pe#debt#investors#fund#family office#sfo#mfo

0 notes