#ev stocks india

Explore tagged Tumblr posts

Text

Know the top investment sectors to focus on after profit booking in the stock market. Get expert insights to maximize returns and diversify your portfolio with strategic stock picks.

Explore now with Jarvis Invest.

#jarvis artificial intelligence#stock advisory company#sectors to focus#ai stock in India#best stock market advisor in India#ai financial advisor#renewable energy stocks#it sector stocks#ev stocks india

0 notes

Text

How common man can benefit from EV Revolution in India? | Ola Electric IPO | Tesla for West... Ola for rest!

Ola Electric Mobility Pvt. is in line for an initial public offering sooner than its founder previously imagined, reflecting the Indian startup’s whirlwind pace of growth since it started selling electric scooters in late 2021. “I thought it would take me… Continue reading Untitled

View On WordPress

#Ather Energy IPO update#best electric vehicle stocks india#Bounce Electric scooter IPO update#business india#electric vehicle stocks india#ev stocks india#indian ev startup#ipo update#live news update#Ola Electric IPO details#Ola Electric IPO update#tesla india news#upcoming ipo in india

0 notes

Text

The electric vehicle (EV) revolution is underway across the globe, and India is no exception. Driven by increasing government support, growing environmental awareness, and rising fuel prices, India is in the midst of a major transformation in the automotive sector. Looking ahead to 2025, investors are taking a keen interest in electric vehicle stocks and are looking for the best way to capitalize on this growth.

0 notes

Text

Fundamental Analysis of Olectra Greentech || Olectra Greentech Ka Fundamental Analysis

भारत में इलेक्ट्रिक वाहन (ईवी) को बढ़ावा देने से गतिशीलता, बुनियादी ढांचे और ऊर्जा में व्यापार के ढेरों अवसर खुलते हैं। पिछले कुछ व��्षों में चार्जिंग स्टेशन, बैटरी रीसाइक्लिंग, ईवी विनिर्माण और कई अन्य व्यवसायों ने गति पकड़ी है। ईवी में चलने की लागत, कर और वित्तीय लाभ कम होते हैं, चलाना आसान होता है और शांत होते हैं, इसमें विशाल केबिन और अधिक भंडारण होता है और प्रदूषक उत्सर्जित नहीं होते हैं।

2024 में 1.66 मिलियन ईवी बेचे गए जो 41 प्रतिशत की प्रभावशाली वार्षिक वृद्धि को दर्शाता है। भारत में 2030 तक वार्षिक इलेक्ट्रिक वाहनों की बिक्री 20 मिलियन के करीब पहुंचने की उम्मीद। Olectra Greentech जिसने पिछले 3 साल में 900% से ज्यादा का मुनाफा दिया है जिसकी SALES GROWTH 93.77% और PROFIT GROWTH 98.06% रही है।

कंपनी के पास जून 2022 तक 3328 ई-बसों की आपूर्ति के लिए एक अच्छा ऑर्डर बुक है, जिसमें से 1,125 ई-बसों के ऑर्डर FAME II योजना के तहत प्राप्त हुए हैं। इन बसों की आपूर्ति 12-15 महीने की अवधि में की जानी है। ऑर्डर बुक में बृहन्मुंबई इलेक्ट्रिक सप्लाई एंड ट्रांसपोर्ट अंडरटेकिंग (BEST) की 3675 करोड़ रुपये की 2100 बसें भी शामिल हैं, जो वर्तमान में मुकदमेबाजी में हैं।

इसके अलावा, इसे सितंबर 2022 में असम राज्य परिवहन निगम को 151 करोड़ रुपये की 100 इलेक्ट्रिक बसों की आपूर्ति का ऑर्डर मिला। बसों की डिलीवरी नौ महीने की अवधि में की जाएगी, और अगले पांच वर्षों तक रखरखाव का ध्यान रखा जाएगा।

पारंपरिक खिलाड़ी पहले से ही बाज़ार में हैं, हालाँकि, नए खिलाड़ी अधिक बाज़ार हिस्सेदारी हासिल कर रहे हैं। ओलेक्ट्रा ग्रीनटेक बाजार हिस्सेदारी के मामले में लगातार शीर्ष तीन खिलाड़ियों में रही है। इसकी बाजार हिस्सेदारी 28% है, इसके बाद अशोक लीलैंड/स्विच मोबिलिटी (16%), जेबीएम ऑटो (15%), पीएमआई इलेक्ट्रो मोबिलिटी (28%), टाटा मोटर्स (11%) हैं और अन्य (1%, H1FY2023 तक), जहां तक ई-बसों का सवाल है।

Full Details Here : Fundamental Analysis of Olectra Greentech ...

#Fundamental Analysis of Olectra Greentech#Olectra Greentech Ka Fundamental Analysis#sharemarket#fundamental analysis#Olectra Greentech#india#ev stock#power stock

0 notes

Text

Blog Posting Date : 01 Jan 2024 Disclaimer- For Educational Purpose Only, Should not be considered as a Investment Advice “The Conviction Club” Knowledge Series Post For the past 2-2.5 years, FIIs have sold a lot. Even after that we did well because of strong DII flows, thanks to domestic flows.

#Peek into Investor’s Rights#leverage in financial management#joel greenblatt magic formula#combined leverage formula#what is ev ebitda#vix india index#Psychology of A Market Cycle#special situations examples#special situation stocks in india#vix index india#stock market courses in bangalore#stock market mentor in bangalore#financial alpha blog#super master class#psychology of stock market#special situation investing#bangalore stock market training#best stock market training in chennai

1 note

·

View note

Text

The electric vehicle (EV) revolution is well underway in India, with an increasing focus on sustainability and a shift towards cleaner and greener transportation. As investors look to capitalize on this burgeoning industry, the spotlight is not only on the best EV stocks but also on the crucial role of stock brokers and the significance of lowest brokerage charges in India.

0 notes

Text

Excerpt from the Substack Distilled:

In the last few months, the Biden administration has quietly passed multiple federal policies that will transform the United States economy and wipe out billions of tons of future greenhouse gas emissions.

The new policies have received little attention outside of wonky climate circles. And that is a problem.

Earlier this year, I wrote that Biden has done more to mitigate climate change than any President before him. For decades, environmentalists tried and failed to convince lawmakers to pass even the most marginal climate policies. It wasn’t until Biden took office that the logjam broke and the climate policies flowed. And yet few American voters are hearing this story in an election year of huge consequence.

It’s been two and a half months since I wrote that article. In that short time, the Biden administration has passed a handful of climate policies that will collectively cut more than 10 billion tons of planet-warming pollution over the next three decades, more than the annual emissions of India, Russia, Japan, South Korea, Canada, Saudi Arabia, and the entire continent of Europe—combined.

One climate policy that flew under the radar recently was the administration's latest energy efficiency rule, unveiled at the beginning of May. The new rules will reduce the amount of energy that water heaters use by encouraging manufacturers to sell models with more efficient heat pump technology. The new regulation is expected to save more energy than any federal regulation in history.

Most people give little thought to how the water in their homes is heated, but water heaters are the second-largest consumer of energy in the average American home and one of the largest sources of climate pollution in the country.

A few days before the administration announced its water heater efficiency rules, the Environmental Protection Agency (EPA) announced another sweeping policy.

According to the new rules, existing coal power plants will need to either shut down or install carbon capture technology capable of removing 90% of their carbon pollution. The policy will also require any new natural gas power plants that provide baseload power—the ones that run throughout the day and night, as opposed to the peaker plants that only run for a small fraction of hours in the year—to install carbon capture technology.

The new power sector rules are effectively a death blow to coal power in America, which has slowly faded over the last two decades but still emits more carbon emissions than almost every country in the world.

The water heater rules and power plant regulations will help the country meet its goal of cutting emissions by 50% by 2030. But impactful as they will be, they weren’t the most important climate policy that the Biden administration passed in the last two months.

That honor goes to the EPA’s tailpipe rules, which are set to transform the auto industry over the next decade.

Today the transportation sector is the largest source of climate pollution in the United States. Within the sector, passenger cars and trucks are the biggest contributors to emissions. While electric vehicle adoption has grown in recent years, America lags behind many other countries in decarbonizing its vehicle stock.

The EPA’s new rules will force automakers to reduce the amount of pollution and carbon emissions that come from their vehicles. The federal policy doesn’t specifically mandate that automakers produce EVs or stop selling gas-powered cars but instead regulates the average carbon emissions per mile of a manufacturer's entire fleet over the next decade. That means automakers can still sell gas-guzzling, carbon-spewing trucks in 2035. They’ll just need to sell a lot more EVs or plug-in hybrids to bring their average fleet emissions down if they do.

Like the power plant rules, the EPA’s new auto regulations are designed to avoid being thrown out by a conservative and hostile Supreme Court.

128 notes

·

View notes

Text

⋆˙⟡♡ || better c/r info

my name is charlie lee (they/he), i'm 20 years old and am widely known for my content creation. my boyfriends are ethan (he/him) and andy (they/them), both of whom gained their initial popularity through tiktok for their marauders cosplays. i cosplay, too, though less actively than they do, and i join their streams on occasion, but more out of love for them than for an actual care for streaming.

⋆˙⟡♡ || school

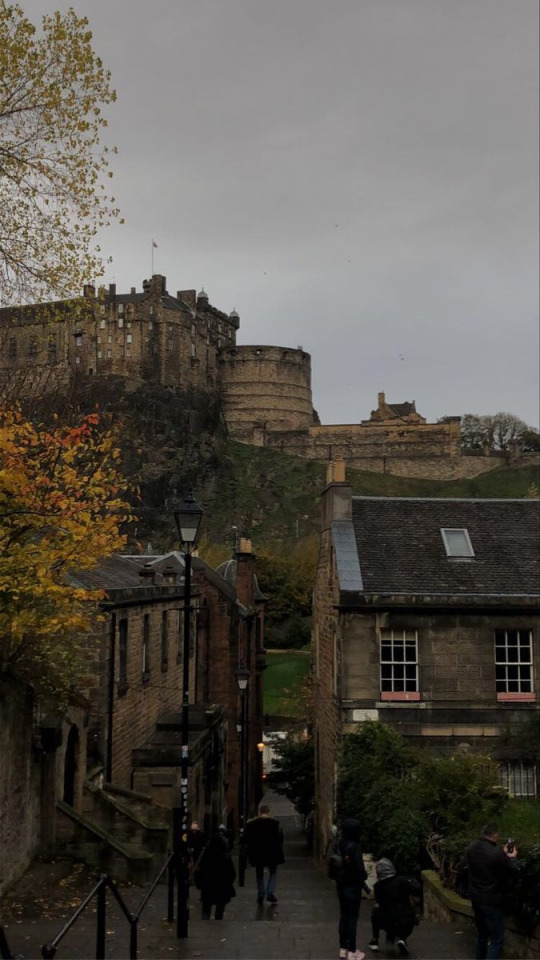

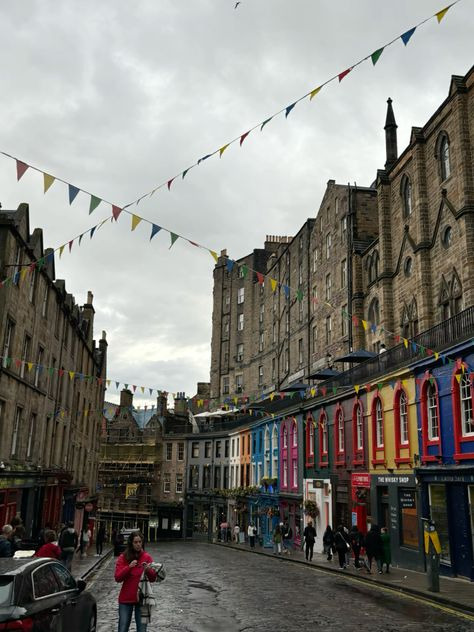

i am an art major at paracosm academy, a school i created. the school has three major branches; one in manhattan, one in edinburgh, and one in seoul. it accepts students beginning at age 14 and extends into undergraduate programs up to master's degrees. i went to school in seoul until i turned 19, when i made the decision to move to edinburgh to be with my best friends. the school offers everything from bioengineering to philosophy, from psychology to art history, from gender studies to forensic sciences, from contemporary dance to comparative religion. there's something for everyone, and it's completely free; even the branch in the us. there is a unifrom up until age 18, or the end of senior year of high school, whichever comes first. that's not to say it's not difficult, because it most certainly is. however, there are a million opportunities for anyone coming out of the school, with thousands of intern/extern programs, apprenticeships, hiring opportunities, and more. i am double majoring in fashion design and traditional art; my final for both this year is a piece inspired by greek mythology, so i'm making both thanatos themed. of course, ethan and andy are helping.

⋆˙⟡♡ || family

my parents were both massive marketing moguls who ended up buying into major companies and then selling those stocks two decades later to end up richer than god. my brother, elliot, is now a world-famous chef based out of seoul, so i stayed with him while i was in seoul instead of living on campus. my parents live in greece, because they moved there from seoul a year before i was born because they were 45 and wanted an early retirement. they bought too much land and ended up 'loaning' it out to the residents of the island (the residents use the land for whatever they want and we make sure the government can't say shit or tax them unfairly). when i was growing up, my mum and dad, yuri and thomas, gave me all their time and attention, simply because they could and i was worth that. every summer, we'd go to a different country and spend the warm months there. my favorite was when i was 16 and we went to france, where i met ethan for the first time. we've been to russia, america, italy (to be fair we go to italy all the time but still), malta, india, vietnam, singpore (my second favorite, because goddamn the architecture is simply exquisite), canada, brazil, peru, chile, germany, turkey, france, thailand, china, japan, poland, slovakia, england, and many other countries over the years for so many things; i've never once flown coach.

⋆˙⟡♡ || friends

most of my friends don't live in edinburgh because i've spent so much of my life in seoul or traveling. but my favorite people all live in scotland; ethan and andy (obviously), @zipper-is-ranting, wanda, damien, taylor, ashlyn, etc. to be honest, if i didn't meet someone at school, i know them through ethan and andy, because i never leave the goddamn flat.

⋆˙⟡♡ || how i met ethan

when i was 16 years old, my parents decided to give me what i'd been asking for for years; a summer in france. on the third day of our stay, they'd sent me out of the hotel so they could "sleep", and i spent the morning walking through paris, nothing but adoration in my eyes. eventually, i grew hungry, and i found myself wandering into a little patisserie. I ordered far too much, my eyes much larger than my stomach. besides, i'd just bring some back for mama and papa. but as i'm walking out, carrying all these bags and boxes of pastries and breads and sweets, i bump into the prettiest boy i've ever seen in my life. i know the second my eyes meet his that i'll never move on. not only does he help me balance the bags and boxes, but when i offer him some of the food as thanks, he very promptly says, "fuck it," and leads me to a small park. we spend the entire day there, eating ourselves sick and laughing until long after the sun's set. he walks me back to my hotel, gives me his number, and we see each other every day for the rest of my trip. after i go back to school, we stay in touch, talking almost every day for years until i move to scotland.

⋆˙⟡♡ || how i met andy

i met andy after ethan did. them and ethan met over tiktok when they started stitching each other's videos (i, of course, watched this all occur from afar, giggling my ass off as i watched my best friend develop this absolutely debilitating crush), and when i went to visit ethan once, he introduced me to andy and the rest of his irl friends. andy and i instantly hit it off, and i (also) had a massive crush on this slovakian spitfire almost instantly. i spend a month in edinburgh, getting to know ethan's friends and spending a bit too much time with andy. by the time i go back to seoul, i'm vegan and head-over-heels in love with my two favorite people who are falling in love with each other.

⋆˙⟡♡ || the future~

the future? bright.

#star boi's drs ⋆。°✩#better c/r#reality shifting#shiftblr#shifting blog#shifting realities#shifters#desired reality#loablr#loa tumblr#shifter#shifting community

12 notes

·

View notes

Text

CRC tubes manufacturer delhi - jagdambaenterprise.in

Delhi’s top CRC tubes manufacturers serve a wide variety of industries. Here's how CRC tubes integrate into specific verticals:

🏎️ Automotive and Transportation

In the automotive sector, precision is everything. CRC tubes are used in:

Steering columns and seat frames

Suspension systems

Exhaust systems and silencers

Two-wheeler frames and luggage carriers

EV chassis and battery trays

Delhi’s manufacturers understand the IATF 16949 requirements and maintain strict quality standards, often supplying directly to OEMs or Tier-1 vendors.

🛋️ Furniture and Interior Solutions

CRC tubes are the backbone of modern steel furniture due to their:

Lightweight yet high-strength profile

Clean, minimalistic aesthetic

Easy-to-finish surface (painted, powder-coated, plated)

Applications include:

Office chairs, modular desks

Bed frames and bookshelves

Partition panels, commercial shelving

Delhi’s vendors often support custom RAL color finishes and bending/forming services for furniture manufacturers.

🏗️ Construction and Structural Engineering

While heavy structural steel dominates in large construction projects, CRC tubes are used in precision structures such as:

False ceilings and curtain walls

Modular housing

Scaffolding and temporary installations

Infrastructure support in interior designs (railings, partition frames)

🏋️ Health, Fitness & Gym Equipment

Delhi-based CRC tubes suppliers support the booming fitness equipment sector with tubing that meets:

High weight-bearing requirements

Ergonomic design flexibility

Scratch- and corrosion-resistant surfaces for gyms

Products include:

Machine frames and benches

Treadmill bases

Adjustable dumbbell frames

⚡ Appliances and Electrical Equipment

CRC tubes are used in:

Washing machine bases

Refrigerator stands and frames

Control panel supports

Solar mounting structures

Manufacturers support appliance makers by offering pre-coated or anti-rust treated tubes that last in high-moisture environments.

Delhi vs. Other Indian Manufacturing Hubs – Why Delhi Leads in CRC Tube Production

India is home to many steel production zones—so what makes Delhi stand out when it comes to CRC tube manufacturing?

Delhi’s unique strengths:

Access to industrial clusters in Faridabad, Noida, Ghaziabad, and Bahadurgarh

Strong supply chain for steel coils, chemicals, and packaging

Better lead times due to central geographic location

Easier transport to North, East, and Central India

This makes Delhi ideal for both MSMEs and export-focused enterprises looking for dependable partners.

What In-House Capabilities Should a Good CRC Tube Manufacturer Have?

When evaluating CRC tube suppliers in Delhi, look beyond product catalogs. A capable manufacturer will offer:

✅ In-House Cold Rolling Mills – Ensures consistent gauge and surface finish ✅ Automated Tube Mills with HF Welding – For precise seam welding and dimensional accuracy ✅ Continuous Annealing Furnaces – Ensures uniform mechanical properties ✅ Online Eddy Current Testing – Detects welding defects in real time ✅ Hydraulic Testing & Chemical Analysis Lab – For mechanical strength and material grade validation ✅ Custom Tooling for Bending/Cutting – For value-added fabrication ✅ In-House Galvanizing/Powder Coating Units – Faster turnaround, uniform finish

Working with such a manufacturer guarantees a one-stop solution, reducing the need for post-processing vendors and saving time.

Long-Term Partnerships and OEM Collaboration Opportunities

For companies looking to establish a stable, long-term supply chain, Delhi’s CRC tubes manufacturers are highly suited for OEM and institutional supply.

Here’s what a partnership model could include:

Annual Rate Contracts (ARCs) with price locking

Just-In-Time (JIT) delivery and buffer stock arrangements

Branding or co-labeling support

Dedicated client servicing teams

Vendor compliance audits and certifications

Participation in design/development of new product lines

This kind of relationship is ideal for:

Automotive tier-1 & tier-2 vendors

Gym equipment brands

Modular furniture OEMs

Government supply contracts

Exporters and traders seeking consistent quality

Streamlined Logistics and PAN India Delivery

Thanks to Delhi’s prime location and transport infrastructure, manufacturers here offer:

Same-day dispatch for stock tubes

PAN India shipping via road and rail

Export container loading from ICD Tughlakabad or Nhava Sheva port

Collaboration with major logistics providers like Delhivery, Gati, and Blue Dart

Most suppliers also integrate real-time shipment tracking and customized packaging (steel strip bundles, HDPE wrapping, or wooden pallets) as per customer needs.

What to Ask When Getting a Quote from a CRC Tubes Manufacturer in Delhi

Here’s a checklist to ensure you get a competitive and comprehensive offer:

✔️ Ask for mill test certificate (MTC) with your quote

✔️ Confirm raw material grade (IS, ASTM, or custom)

✔️ Mention coating requirements (bare, galvanized, painted, etc.)

✔️ Specify any special tolerances or dimensional control

✔️ Ask for packaging options suitable for your industry

✔️ Clarify lead time and shipping terms (FOB, Ex-works, CIF)

Ready to Work with a Trusted CRC Tubes Manufacturer in Delhi?

Whether you need 1 ton or 100 tons, Delhi’s CRC tube manufacturers are ready to deliver quality, reliability, and professionalism. The right supplier doesn’t just ship steel—they become a part of your production story.

🔧 Let’s Build Together – Contact Us Today!

We are a leading CRC tubes manufacturer in Delhi offering:

Premium-grade cold rolled close annealed tubes

Custom sizing, coating, and finishing services

Fast turnaround and dependable logistics

Bulk, retail, and OEM support across industries

0 notes

Text

Big Savings on Tata EVs: Discounts Up to ₹1.5 Lakh on Curvv, Nexon & Tiago!

Planning to Buy an Electric Vehicle? Now’s the Best Time! Tata Motors is offering massive discounts on its range of electric vehicles (EVs) as part of its MY24 stock clearance drive. Buyers can now avail of offers up to ₹1.5 lakh on select EV models, including the popular Curvv, Nexon, and Tiago EVs. Here's a breakdown of the limited-time offers available this April.

Tata Curvv EV: Flat ₹1.5 Lakh Discount on MY24 Model Tata’s flagship EV, the Curvv, is now available with a huge discount of up to ₹1.5 lakh. The MY24 variant comes with:

₹70,000 consumer discount

₹30,000 exchange bonus

₹50,000 loyalty bonus Meanwhile, the latest MY25 model offers a ₹30,000 exchange or scrappage bonus.

Tata Nexon EV: Save Up to ₹1.41 Lakh on the Popular SUV India’s favorite electric SUV, the Tata Nexon EV, is being offered with a discount of up to ₹1.41 lakh. With 10 variants to choose from, this is an ideal opportunity for buyers looking to switch to electric.

Tata Tiago EV: Compact EV with a ₹1.30 Lakh Discount Looking for a budget-friendly EV? Tata’s smallest electric car, the Tiago EV, comes with an attractive discount of ₹1.30 lakh. This offer is valid only till the end of April.

Whether you're eyeing the premium Curvv, the versatile Nexon, or the compact Tiago, April is the perfect month to drive home a Tata EV at a reduced price. Hurry—these offers are valid for a limited period only!

0 notes

Text

PBR 01 prices slide on weak tyre and auto sector demand

The price of Polybutadiene Rubber (PBR 01), manufactured by Reliance Rubber Industries, recorded a drop in the Delhi market today. Prices decreased by Rs.3/kg, falling from Rs.179/kg on March 27 to Rs.176/kg as of March 28, 2025. The decline is driven by sluggish demand from the automotive, tyre, and footwear sectors, alongside steady inventory levels across the northern distribution network 1. Key Producers Domestic Manufacturers: 1. Reliance Industries Ltd. – India’s largest producer of synthetic rubbers, including high cis and low cis PBR grades. 2. Indian Synthetic Rubber Pvt. Ltd. (ISRL) – A joint venture between IndianOil, Marubeni, and TSRC Corporation. 3. Haldia Petrochemicals Ltd. – Engaged in producing various synthetic elastomers, including PBR. 4. Apcotex Industries Ltd. – Supplies niche grades of synthetic rubbers and emulsions. Global Suppliers: 1. Sibur – Russia, 2. JSR Corporation – Japan, 3.LG Chem – South Korea, 4.Lanxess AG – Germany and 5. Kumho Petrochemical – South Korea. India imports a portion of its PBR needs, mainly specialty grades, from South Korea, Japan, and Europ. Market Outlook The global PBR market was valued at USD 4.5 billion in 2023, and is expected to grow at a CAGR of 4.7% from 2024 to 2029, driven by: 1. Growth in automotive production and OEM tyre demand, 2. Rising use in golf balls, industrial rubber goods, and belting and Increased demand for low rolling resistance tyres in EVs. In India, PBR demand is closely linked to the automobile and tyre manufacturing industries, which together account for nearly 70% of total PBR consumption. With recent softness in replacement tyre demand and cautious inventory stocking by OEMs, short-term price corrections like this are expected, Indian PBR Prices, Indian Price PBR, PBR Prices In India, Indian Prices PBR, Indian PBR Price, PBR Prices In India, Indianpetrochem.

0 notes

Text

Discover top EV stocks in India for 2024 and learn why to invest in them. Explore key sub-sectors, growth potential, and tips for choosing the best EV stocks with Jarvis Invest.

#best ai stocks in india#best ev stocks in india#ev stock#electric vehicle stocks#ev stocks india#top ev stocks in india#best stock market advisor in india#AI based stock trading India#share market advisor#how to pick stocks for long term#stock advisory company

1 note

·

View note

Text

Investment vs. Returns: Understanding the Profitability of an Electric Bike Dealership

The electric vehicle (EV) market in India is witnessing exponential growth, and electric bikes are leading the way. With increasing fuel costs, government incentives, and eco-conscious buyers, starting an electric bike dealership is a lucrative business opportunity. However, before making the leap, it’s essential to analyze the costs to open an electric bike dealership and understand the potential returns on investment.

Initial Investment Breakdown

Launching an electric bike dealership requires an upfront financial commitment, covering various aspects such as showroom setup, inventory, and marketing. Here’s a cost breakdown:

1. Franchise or Dealership Fee Most brands charge an initial dealership fee ranging between ₹2 lakh to ₹10 lakh, depending on exclusivity rights, dealership benefits, and regional market potential.

2. Showroom and Infrastructure Costs A well-equipped showroom enhances customer experience and boosts sales. Key expenses include:

Rental or lease deposit – ₹50,000 to ₹2 lakh per month, depending on location.

Interiors and branding – ₹3 lakh to ₹7 lakh for store setup, furniture, and display units.

Signage and lighting – ₹50,000 to ₹1 lakh for visibility and aesthetics.

3. Initial Stock Investment Most manufacturers require dealers to maintain a minimum inventory of 10-20 bikes, costing around ₹15 lakh to ₹30 lakh. This is crucial for maintaining a steady flow of sales.

4. Legal and Licensing Expenses To operate legally, you need:

Business registration and GST certification – ₹10,000 to ₹50,000.

Trade licenses and insurance – ₹10,000 to ₹30,000.

5. Marketing and Promotions Brand awareness is key to success, and digital marketing plays a crucial role. A dealership should allocate ₹50,000 to ₹1 lakh per month for social media ads, Google promotions, and offline campaigns.

Operating Costs

Beyond the initial investment, running a dealership comes with recurring costs, including:

Staff salaries – ₹1 lakh to ₹3 lakh per month (for sales, service, and administration).

Utility bills and showroom maintenance – ₹10,000 to ₹50,000 per month.

Loan EMIs (if applicable) – ₹30,000 to ₹1 lakh per month for business financing.

Expected Revenue and Profitability

An electric bike dealership earns revenue primarily through vehicle sales, servicing, and accessories. Here’s a look at potential earnings:

1. Profit Margins on Electric Bike Sales Electric bike dealers earn an average 15-25% profit margin per unit sold. For example:

If a bike is priced at ₹1 lakh and you sell 20 bikes per month with a 20% margin, you earn ₹4 lakh in gross profit monthly.

2. Revenue from Service and Spare Parts Electric bikes require regular servicing, which adds an additional revenue stream:

Service packages – ₹500 to ₹2,000 per customer.

Spare parts sales – ₹5,000 to ₹50,000 per month.

Battery replacements and warranties – ₹10,000+ per unit.

3. Corporate and Fleet Sales Opportunities Many logistics companies, delivery services, and ride-sharing firms are switching to electric vehicles. Securing bulk orders from these businesses can boost dealership profits significantly.

Break-Even Period

With an initial investment of ₹30 lakh and an estimated monthly profit of ₹4-6 lakh, most dealerships can break even within 12-18 months. As brand awareness grows and sales increase, profitability improves further.

Conclusion

Understanding the costs to open an electric bike dealership and evaluating its profitability is essential before entering the market. With rising demand, government incentives, and growing consumer interest, an electric bike dealership can be a highly rewarding venture. Proper financial planning, strategic marketing, and excellent customer service can ensure long-term success in this booming industry.

0 notes

Text

I Asked DeepSeek: "Which Sectors to Watch During the Union Budget?" Here's What It Said…

The Union Budget is one of the most anticipated events in India’s financial landscape, shaping government policies, taxation, and sectoral growth opportunities. For investors and traders, it serves as a key indicator of market direction, influencing stock prices based on budgetary allocations and reforms. As the next budget approaches, here are the crucial sectors to monitor:

1. Infrastructure & Capital Goods

Government spending on roads, railways, ports, and urban development often sees a boost. Look for:

Higher budget allocations for infrastructure projects.

Public-private partnership (PPP) incentives.

Green energy infrastructure support.

2. Banking & Financial Services

This sector reacts to fiscal deficit, credit growth, and taxation policies. Watch for:

NPAs (Non-Performing Assets) resolutions.

MSME lending support.

Tax reforms impacting investments.

3. Automobiles

Key triggers include:

GST rate revisions for vehicles.

EV incentives like subsidies and tax cuts.

Rural development spending boosting two-wheeler and tractor demand.

4. Renewable Energy

With India’s sustainability goals, look for:

Incentives for solar, wind, and hydrogen energy.

Energy storage and EV infrastructure policies.

5. Real Estate & Housing

Affordable housing schemes.

Home loan tax benefits.

Liquidity measures for developers.

Want deeper insights? Definedge is hosting a FREE Union Budget webinar with Prashant Shah! Register now to uncover actionable opportunities.

Find Full Blog: I asked DeepSeek – “Sectors to Watch During the Union Budget��� Here is the reply…

0 notes

Text

https://www.strategicalpha.in/2023/02/11/a-peek-into-corporate-actions/

#stock market investment#what is ev ebitda#combined leverage formula#leverage in financial management#special situation stocks in india

0 notes

Text

Tesla share price rallies on Bharti Airtel, Reliance Jio tie-up buzz. Jumps 12% in two sessions

Tesla share price surged over 7% on Wednesday, marking its second consecutive session of gains amid a broader rally in the US stock market. Tesla shares ended 7.59% higher at $248.09. In the extended trading hours, Tesla shares advanced 1.98%.

The two-day rally in Tesla stock price comes after the billionaire Elon Musk-led electric-vehicle maker’s shares saw a 15% plunge on Monday. The stock was up 3.79% on Tuesday.

Tesla share price has declined by over 30% in the past month and is down 35% on a year-to-date (YTD) basis. The weakness in the EV giant’s stock follows disappointing sales figures and investor concerns that Chief Executive Elon Musk’s potential involvement in the Trump administration may be diverting his focus from the company.

In a Fox Business interview on Monday, Musk stated that he was managing his businesses “with great difficulty.”

On the technical front, analysts believe Tesla shares may see short-term volatility amid the recent fall.

“Tesla recently saw a buying climax and a failed breakout at $417, completing a 780-day rounding bottom. Long positions are now trapped, fueling a liquidation-driven downtrend. The stock is currently 22% below its 20-day EMA (Exponential Moving Average) and 31.07% below its 50-day EMA, signaling extreme downside momentum. While a bounce to the 10-day EMA at $268 or even the 20-day EMA at $295 is possible, the broader trend remains bearish,” said Anshul Jain, Head of Research at Lakshmishree Investment and Securities.

With selling pressure accelerating, Tesla shares could test key weekly support at $182.82, a critical swing low. Traders should watch for short-term volatility amid a high-momentum decline, he added.

Starlink deal with Jio, Bharti Airtel

Tesla was in focus recently after Elon Musk’s satellite-based internet service Starlink announced a collaboration with India’s top telecom players.

Jio Platforms, owned by conglomerate Reliance Industries, announced on March 12 that it will offer Starlink solutions through its retail outlets and online storefronts. Jio will also establish a mechanism to support customer service installation and activation.

Meanwhile, Bharti Airtel on March 11, had announced that it had signed an agreement with SpaceX to bring high-speed satellite internet service Starlink to India.

According to Avinash Gorakshakar, Head of Research at Profitmart Securities, the two top telecom companies making similar announcements regarding collaboration with SpaceX means it is not an exclusive deal with any one company.

“As a result, the collaboration will be more beneficial for consumers and SpaceX, which will gain access to a large market, rather than for Reliance Industries,” said Gorakshakar.

Intensify Research Services provides expert guidance, analysis, and suggestions regarding the purchase, sale, or holding of stocks to maximize returns. As a top stock market research advisor, they offer high-accuracy tips for investors. visit- Intensifyresearch.com »

#sharemarketing#stockinvestment#sharetrading#stock market#sharemarket#investment#stocks#shareinvestor#share this post#sharetrader

0 notes