#europe facility management market

Text

Apple To Invest More In India

As per undisclosed sources familiar with the matter, Apple Inc. is reportedly revamping the management of its international businesses to place a larger emphasis on India, reflecting the country's growing importance in the company's overall strategy. This move marks a significant milestone as India is set to become its own sales region at Apple for the first time, signaling the surging demand for Apple's products in the region. As a result, India is expected to gain greater prominence and visibility within the company.

The decision to focus on India could be a strategic move by Apple, given that India is one of the fastest-growing smartphone markets in the world. By prioritizing India, Apple may be seeking to gain a larger market share in the region, which could help the company offset slowing growth in other markets. The company's recent launch of an online store in India is further evidence of its commitment to expanding its presence in the country. Last quarter, despite a 5% dip in total sales, Apple achieved record revenue in India. The tech giant has set up an online store to cater to the region and plans to open its first retail stores there later this year. During the last earnings call, Apple CEO Tim Cook highlighted the company's significant emphasis on the Indian market and compared its current state to its early years in China. He mentioned how Apple is leveraging its learnings from China to scale in India. China is Apple's largest sales region after the Americas and Europe, generating around $75 billion in revenue per year. Apart from boosting Apple's sales, India is also becoming increasingly critical to the company's product development. Key suppliers are shifting to the region, and Apple is partnering with manufacturing giant Hon Hai Precision Industry Co. (also known as Foxconn) to establish new iPhone production facilities in India, according to Bloomberg News. Apple has been expanding its focus on the Indian market in recent years, and the company has been making efforts to improve its sales operations in the country. In 2020, Apple launched an online store in India, which allowed the company to sell its products directly to consumers in the country for the first time. This move was seen as a significant step for Apple, as India is one of the world's fastest-growing smartphone markets. If Apple is restructuring its international sales operations to put a more significant focus on India, it suggests that the company sees significant growth potential in the Indian market. Apple may be looking to increase its market share in India by focusing on pricing, localizing products and services, and building relationships with key partners in the country. It remains to be seen how Apple's restructuring will affect the company's operations in other regions. However, this move is undoubtedly a positive sign for India's tech industry, as it shows that major global players are taking note of the country's potential as a growth market.

Fox&Angel is an open strategy consulting ecosystem, put together by a top-line core team of industry experts, studded with illustrious success stories, learnings, and growth. Committed to curate bespoke business & strategy solutions for each of your challenges, we literally handpick consultants from across the globe and industries who fit the role best and help you on your path to success.

This post was originally published on: Foxnangel

#Apple India#Business expansion#business growth#FDI in India#Foreign Direct Investment#FoxNAngel#India market entry#Indian growing economy#Invest in India#Investment#strategy consulting

3 notes

·

View notes

Text

Medical Disposables Market to be worth US$ 326 Billion by 2033, Reveals Future Market Insights

The Medical Disposables Market revenues were estimated at US$ 153.5 Billion in 2022 and is anticipated to grow at a CAGR of 7.1% from 2023-2033, according to a recently published Future Market Insights report. By the end of 2033, the market is expected to reach US$ 326 Billion. Bandages and Wound Dressings commanded the largest revenue share in 2022 and is expected to register a CAGR of 6.8% from 2023 to 2033.

The rising incidence of Hospital Acquired Infections, an increasing number of surgical procedures, and the growing prevalence of chronic diseases leading to longer hospital admission have been the key factors driving the market.

The subsequent spike in the number of chronic illness cases and a rise in the rate of hospitalizations has fueled the field of emergency medical disposables growth. The expansion of the medical disposables market is being fueled by an increase in the prevalence of hospital-acquired illnesses and disorders, as well as a greater focus on infection prevention. For example, the prevalence of healthcare-associated infection in high-income countries ranges from 3.5% to 12%, whereas it ranges from 5.7% to 19.1% in low and medium-income countries.

A growing geriatric population, an increase in the incidence of incontinence issues, mandatory guidelines that must be followed for patient safety at healthcare institutions, and an increase in demand for sophisticated healthcare facilities is driving the medical disposables market.

The market in North America is expected to reach a valuation of US$ 131 Billion by 2033 from US$ 61.7 Billion in 2022. In August 2000, the Food and Drug Administration (FDA) issued guidance concerning healthcare single-use items reprocessed by third parties or hospitals. In this guidance, FDA stated that hospitals or third-party reprocessors would be considered manufacturers and regulated in the exact same manner. A newly used single-use device still has to fulfill the criteria for device activation required by its flagship when it was originally manufactured. Such regulations have been creating a positive impact on the medical disposables market in the U.S. market in specific and the North American market in general

Competitive Landscape

The key companies in the market are engaged in mergers, acquisitions and partnerships.

The key players in the market include 3M, Johnson & Johnson Services, Inc., Abbott, Becton, Dickinson & Company, Medtronic, B. Braun Melsungen AG, Bayer AG, Smith and Nephew, Medline Industries, Inc., and Cardinal Health.

Some of the recent developments of key Medical Disposables providers are as follows:

In April 2019, Smith & Nephew PLC purchased Osiris Therapeutics, Inc. with the goal of expanding its advanced wound management product range.

In May 2019, 3M announced the acquisition of Acelity Inc., with the goal of strengthening wound treatment products.

For More Information: https://www.futuremarketinsights.com/reports/medication-dispenser-market

More Insights Available

Future Market Insights, in its new offering, presents an unbiased analysis of the Medical Disposables Market, presenting historical market data (2018-2022) and forecast statistics for the period of 2023-2033.

The study reveals essential insights by Product (Surgical Instruments & Supplies, Infusion, and Hypodermic Devices, Diagnostic & Laboratory Disposables, Bandages and Would Dressings, Sterilization Supplies, Respiratory Devices, Dialysis Disposables, Medical & Laboratory Gloves), by Raw Material (Plastic Resin, Nonwoven Material, Rubber, Metal, Glass, Others), by End-use (Hospitals, Home Healthcare, Outpatient/Primary Care Facilities, Other End-use) across five regions (North America, Latin America, Europe, Asia Pacific and Middle East & Africa).

Market Segments Covered in Medical Disposables Industry Analysis

By Product Type:

Surgical Instruments & Supplies

Would Closures

Procedural Kits & Trays

Surgical Catheters

Surgical Instruments

Plastic Surgical Drapes

By Raw Material:

Plastic Resin

Nonwoven Material

Rubber

Metals

Glass

Other Raw Materials

By End-use:

Hospitals

Home Healthcare

Outpatient/Primary Care Facilities

Other End-uses

2 notes

·

View notes

Text

A strange thing happened in the eurozone economy at the end of last year. Despite widespread forecasts that the common currency area would plunge into recession and register negative growth in the last quarter of 2022, it managed to eke out a small gain of 0.1 percent. What is remarkable is not that Europe beat expectations, but that it was one small country—Ireland—whose surging economy single-handedly prevented the eurozone from slipping into the red.

Almost unbelievably, little Ireland, with a population of only 5 million, now has the economic scale to shift the growth statistics of the entire eurozone and its 343 million inhabitants. In 2022, Irish GDP growth of 12.2 percent compared to 3.5 percent in the eurozone as a whole. In absolute numbers, only Germany, France, and Italy contributed more than Ireland to eurozone GDP growth in 2021 and 2022. Ireland’s economic boom has enabled the country’s government to post a budget surplus of 1.6 percent of GDP, even as eurozone countries struggled with an average deficit of more than 3 percent.

Honestly, who wouldn’t want this luck of the Irish?

Look closely, however, and Ireland’s so-called economic miracle looks more than a little odd. The country’s growth is simultaneously both real and artificial. Much of it is driven by a handful of U.S. multinationals, which continue to route global sales and profits through their Irish operations to take advantage of Dublin’s lower business taxes. Although difficult and complex to calculate, Apple’s shifting of intellectual property assets to Ireland is estimated to have contributed half of Ireland’s miraculous 26 percent GDP growth in 2016. That bizarre fact inspired New York Times columnist Paul Krugman to ridicule Ireland’s “leprechaun economics”—and the Irish statistics office to move away from using GDP as a measure of economic growth.

Yet the surge of U.S. investment in Ireland is also real. In particular, Ireland’s role as a pharmaceuticals manufacturing hub dramatically increased during the COVID-19 pandemic. Nine out of the world’s top 10 drug companies have significant production facilities in Ireland. The U.S. State Department thinks the corporate build-out in Ireland will continue, given Ireland’s status as the only remaining English-speaking European Union country following Britain’s departure. That makes it easy for international companies to operate and enjoy barrier-free access to the EU’s single market.

It’s hard to exaggerate Ireland’s dependence on U.S. tech and pharma companies for investment and taxes. Corporate tax receipts are now the second-largest source of tax revenue (after income tax) for the Irish state: 27 percent of all tax income in 2022. The average was just 9 percent in the 38 member countries of the Organisation for Economic Co-operation and Development (OECD) in 2020, the last year for which data is available. This, in turn, is fueling an unprecedented torrent of tax income for the Irish government. Corporate tax revenues were up nearly 50 percent in 2022 alone.

Just 10 multinationals—all of them U.S.-based tech and pharmaceutical companies—now pay nearly 60 percent of Ireland’s corporate tax. Directly and indirectly, U.S. multinationals employ more than 375,000 people in Ireland, approximately 15 percent of the country’s labor force. Driven by investment from the United States, foreign multinationals now account for 53 percent of all payroll taxes paid by corporate employers.

Driven by the windfall in corporate tax receipts, the Irish government’s budget surplus is expected to swell further, to 10 billion euros in 2023 and 16 billion euros in 2024. Relative to the size of the economy, this would be equivalent to a U.S. budget surplus of more than 1 trillion dollars in 2024.

The problem for Ireland is that this singular dependence exposes the country to growing risks. Take the tech sector: As multinationals like Google, Microsoft, Meta, and Amazon see their profits shrink and slash jobs worldwide, it will not only hurt the Irish economy, but deprive Dublin of tax income as well.

What’s more, the threat to Ireland’s stability from its overdependence on U.S. companies is about to be multiplied. In 2021, nearly 140 tax jurisdictions, including Ireland, agreed to a major reform of how multinationals companies will be taxed in the future. Pillar 2 of these reforms—a minimum corporate tax rate of 15 percent for large companies—is already coming into effect. In 2024, Ireland’s corporate tax rate is due to increase to 15 percent from its current level of 12.5 percent, reducing its attractiveness as a tax haven compared to other countries. The United States also approved the minimum tax plan in August 2022, despite significant private sector and political opposition.

However, it is Pillar 1 of the OECD’s reforms that will dramatically erode Ireland’s future income from corporate taxes. This reform will reallocate a share of company profits to where sales (or users) are actually located. Previously, tax liability was calculated on where the company or its subsidiary was legally based, no matter how many profits it rerouted from other parts of the world for tax-avoiding purposes. For Ireland, the consequences are obvious: U.S. multinationals operating in the EU will be forced to divide some of their sales by member state, thus significantly reducing the amount of sales and profits that can be “booked” through Ireland. This reform is due to come into force in 2024. The end of Ireland’s windfall is therefore only a matter of time.

The Irish Department of Finance estimated in January that around half of Ireland’s corporate tax receipts—$10 billion—are “transitionary” and will be lost as the new tax rules are implemented. That translates to more than 10 percent of total government spending in 2022—more than the entire Irish education budget. This is putting the Irish government on the precipice of another financial disaster, little more than a decade after it had to be bailed out of impending bankruptcy by the European Commission, European Central Bank, and the International Monetary Fund. That disaster left Ireland with one of the highest per capita public debt levels in the world.

Regardless of the impending financial train wreck, however, Dublin is unlikely to wake up from its American dream anytime soon. Diversifying its economy and revenue sources away from U.S. multinationals would require Ireland to shift its economic and geopolitical orientation, downgrade (in Dublin’s eyes) its deep relationship with the United States, and seek greater integration into the EU economy and its myriad rules.

That’s because Ireland’s dependence on U.S. multinationals is just another expression of the country’s affinity with the United States—the “shared heritage” referenced by U.S. presidents from John F. Kennedy to Ronald Reagan to Joe Biden. These ties to the United States long precede Dublin’s embrace of European integration and make it unlikely that Ireland will ever have the same intensity of economic, cultural, and other ties to France, Germany, or the rest of the EU.

The approaching economic and fiscal train wreck resulting from the new tax rules requires a fundamental change of mindset from Irish policymakers. Squaring the circle—holding on to its deep U.S. ties while integrating more closely with the EU to diversify its economy—means Dublin must give a little (and lose a little) to both sides. Yet Ireland’s ability to navigate this conundrum is doubtful. Even though the coming changes have been plain for all to see, Dublin’s current Trade and Investment Strategy does not contain any concrete policies to mitigate the overdependence on U.S. investment flows. Although the document acknowledges that EU market opportunities are underutilized, it again recognizes the importance “markets such as the UK and the US, which offer familiarity with language and culture.”

If there is no short-term solution to Ireland’s financial vulnerabilities, a few longer-term needs stand out. Dublin should ensure that its current budget surplus is invested wisely to help diversify its drivers of growth. One such driver would be significant increases in public investment in housing and public transport infrastructure to bring the country closer to Western European standards. Ireland’s tax base should be widened to allow for a wider distribution of income sources. For example, In 2021, Ireland gained just 5 percent of its tax receipts from property taxes, compared to more than 11 percent in both Britain and the United States.

Most importantly, Ireland must deepen its trading relationships outside the English-speaking world. Notwithstanding the country’s 50-year membership of the EU, a dearth of foreign language teaching has created a monolingual business culture, which priorities existing links with the United States over the development of new markets, both within and outside the EU. This needs to change if Ireland is to build a sustainable economic model.

Biden—whose family, like so many in the United States, has Irish roots—said in 2021 that “everything between Ireland and the United States runs deep.” This is Ireland’s economic reality today. As the corporate tax boom ebbs, Ireland should ensure that its American dream doesn’t become a recurring economic and financial nightmare.

2 notes

·

View notes

Text

Building Power Monitoring Solutions Market Share, Size, Demand, Key Players by Forecast 2032

The global building power monitoring solutions market refers to the market for systems and devices that monitor and manage energy usage in buildings. These solutions help building owners and managers to reduce energy consumption, improve energy efficiency, and save costs.

The market is driven by factors such as the need for energy efficiency, government regulations for energy efficiency, increasing demand for smart buildings, and the growing adoption of renewable energy sources. Additionally, the increasing awareness about the benefits of building power monitoring solutions is expected to further drive the market growth.

Download a Sample Copy of Building Power Monitoring Solutions Market: https://stringentdatalytics.com/sample-request/building-power-monitoring-solutions-market/3768/

The market can be segmented based on component, building type, end-user, and geography. Based on the component, the market can be segmented into hardware, software, and services. Based on building type, the market can be segmented into commercial buildings, industrial buildings, and residential buildings. Based on end-users, the market can be segmented into building owners, facility managers, and energy service companies.

Geographically, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to hold the largest market share due to the increasing adoption of smart buildings and the presence of major market players in the region. Asia-Pacific is expected to witness significant growth due to the increasing demand for energy efficiency and the growth of the construction industry in the region.

Market Segmentations:

Global Building Power Monitoring Solutions Market: By Company

Schneider Electric

Vertiv

Broadcom

Rittal GmbH & Co. KG

Siemens AG

ABB

Raritan

Sunbird

Packet Power

Wattics

En-trak

Rockwell Automation

Global Building Power Monitoring Solutions Market: By Type

Cloud-based

On Premise

Global Building Power Monitoring Solutions Market: By Application

Commercial Building

Residential Building

Industrial Building

Visit Report Page: https://stringentdatalytics.com/reports/building-power-monitoring-solutions-market/3768/

Reasons to Purchase Building Power Monitoring Solutions Market Report:

To gain insights into market trends and dynamics: this reports provide valuable insights into industry trends and dynamics, including market size, growth rates, and key drivers and challenges.

To identify key players and competitors: this research reports can help businesses identify key players and competitors in their industry, including their market share, strategies, and strengths and weaknesses.

To understand consumer behavior: this research reports can provide valuable insights into consumer behavior, including their preferences, purchasing habits, and demographics.

To evaluate market opportunities: this research reports can help businesses evaluate market opportunities, including potential new products or services, new markets, and emerging trends.

To make informed business decisions: this research reports provide businesses with data-driven insights that can help them make informed business decisions, including strategic planning, product development, and marketing and advertising strategies.

Overall, market research reports provide businesses and organizations with valuable information that can help them make informed decisions and stay competitive in their industry. They can provide a solid foundation for business planning, strategy development, and decision-making.

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs.

Contact US:

Stringent Datalytics

Contact No - 91-9763384149

Email Id - [email protected]

Web - https://stringentdatalytics.com/

2 notes

·

View notes

Text

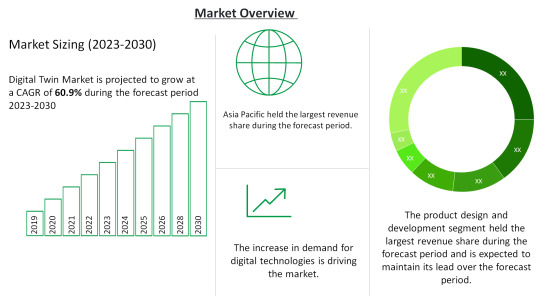

Digital Twin Market Size 2023-2030: ABB, AVEVA Group plc, Dassault Systemes

Digital Twin Market by Power Source (Battery-Powered, hardwired with battery backup, Hardwired without battery backup), Type (Photoelectric Smoke Detectors, Ionization Smoke Detectors), Service, Distribution Channel, and region (North America, Europe, Asia-Pacific, Middle East, and Africa and South America). The global Digital Twin Market size is 11.12 billion USD in 2022 and is projected to reach a CAGR of 60.9% from 2023-2030.

Click Here For a Free Sample + Related Graphs of the Report at: https://www.delvens.com/get-free-sample/digital-twin-market-trends-forecast-till-2030

Digital twin technology has allowed businesses in end-use industries to generate digital equivalents of objects and systems across the product lifecycle. The potential use cases of digital twin technology have expanded rapidly over the years, anchored in the increasing trend of integration with internet-of-things (IoT) sensors. Coupled with AI and analytics, the capabilities of digital twins are enabling engineers to carry out simulations before a physical product is developed. As a result, digital twins are being deployed by manufacturing companies to shorten time-to-market. Additionally, digital twin technology is also showing its potential in optimizing maintenance costs and timelines, thus has attracted colossal interest among manufacturing stalwarts, notably in discrete manufacturing.

The shift to interconnected environments across industries is driving the demand for digital twin solutions across the world. Massive adoption of IoT is being witnessed, with over 41 billion connected IoT devices expected to be in use by 2030. For the successful implementation and functioning of IoT, increasing the throughput for every part or “thing” is necessary, which is made possible by digital twin technology. Since the behavior and performance of a system over its lifetime depend on its components, the demand for digital twin technology is increasing across the world for system improvement. The emergence of digitalization in manufacturing is driving the global digital twin market. Manufacturing units across the globe are investing in digitalization strategies to increase their operational efficiency, productivity, and accuracy. These digitalization solutions including digital twin are contributing to an increase in manufacturer responsiveness and agility through changing customer demands and market conditions.

On the other hand, there has been a wide implementation of digital technologies like artificial intelligence, IoT, clog, and big data which is increasing across the business units. The market solutions help in the integration of IoT sensors and technologies that help in the virtualization of the physical twin. The connectivity is growing and so are the associated risks like security, data protection, and regulations, alongside compliance.

During the COVID-19 pandemic, the use of digital twin technologies to manage industrial and manufacturing assets increased significantly across production facilities to mitigate the risks associated with the outbreak. Amid the lockdown, the U.S. implemented a National Digital Twin Program, which was expected to leverage the digital twin blueprint of major cities of the U.S. to improve smart city infrastructure and service delivery. The COVID-19 pandemic positively impacted the digital twin market demand for twin technology.

Delvens Industry Expert’s Standpoint

The use of solutions like digital twins is predicted to be fueled by the rapid uptake of 3D printing technology, rising demand for digital twins in the healthcare and pharmaceutical sectors, and the growing tendency for IoT solution adoption across multiple industries. With pre-analysis of the actual product, while it is still in the creation stage, digital twins technology helps to improve physical product design across the full product lifetime. Technology like digital twins can be of huge help to doctors and surgeons in the near future and hence, the market is expected to grow.

Market Portfolio

Key Findings

The enterprise segment is further segmented into Large Enterprises and Small & Medium Enterprises. Small & Medium Enterprises are expected to dominate the market during the forecast period. It is further expected to grow at the highest CAGR from 2023 to 2030.

The industry segment is further segmented into Automotive & Transportation, Energy & Utilities, Infrastructure, Healthcare, Aerospace, Oil & Gas, Telecommunications, Agriculture, Retail, and Other Industries. The automotive & transportation industry is expected to account for the largest share of the digital twin market during the forecast period. The growth can be attributed to the increasing usage of digital twins for designing, simulation, MRO (maintenance, repair, and overhaul), production, and after-service.

The market is also divided into various regions such as North America, Europe, Asia-Pacific, South America, and Middle East and Africa. North America is expected to hold the largest share of the digital twin market throughout the forecast period. North America is a major hub for technological innovations and an early adopter of digital twins and related technologies.

During the COVID-19 pandemic, the use of digital twin technologies to manage industrial and manufacturing assets increased significantly across production facilities to mitigate the risks associated with the outbreak. Amid the lockdown, the U.S. implemented a National Digital Twin Program, which was expected to leverage the digital twin blueprint of major cities of the U.S. to improve smart city infrastructure and service delivery. The COVID-19 pandemic positively impacted the digital twin market demand for twin technology.

Regional Analysis

North America to Dominate the Market

North America is expected to hold the largest share of the digital twin market throughout the forecast period. North America is a major hub for technological innovations and an early adopter of digital twins and related technologies.

North America has an established ecosystem for digital twin practices and the presence of large automotive & transportation, aerospace, chemical, energy & utilities, and food & beverage companies in the US. These industries are replacing legacy systems with advanced solutions to improve performance efficiency and reduce overall operational costs, resulting in the growth of the digital twin technology market in this region.

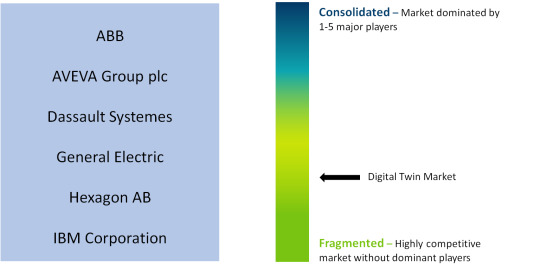

Competitive Landscape

ABB

AVEVA Group plc

Dassault Systemes

General Electric

Hexagon AB

IBM Corporation

SAP

Microsoft

Siemens

ANSYS

PTC

IBM

Recent Developments

In April 2022, GE Research (US) and GE Renewable Energy (France), subsidiaries of GE, collaborated and developed a cutting-edge artificial intelligence (AI)/machine learning (ML) technology that has the potential to save the worldwide wind industry billions of dollars in logistical expenses over the next decade. GE’s AI/ML tool uses a digital twin of the wind turbine logistics process to accurately predict and streamline logistics costs. Based on the current industry growth forecasts, AI/ML might enable a 10% decrease in logistics costs, representing a global cost saving to the wind sector of up to USD 2.6 billion annually by 2030.

In March 2022, Microsoft announced a strategic partnership with Newcrest. The mining business of Newcrest would adopt Azure as its preferred cloud provider globally, as well as work on digital twins and a sustainability data model. Both organizations are working together on projects, including the use of digital twins to improve operational performance and developing a high-impact sustainability data model.

Reasons to Acquire

Increase your understanding of the market for identifying the best and most suitable strategies and decisions on the basis of sales or revenue fluctuations in terms of volume and value, distribution chain analysis, market trends, and factors

Gain authentic and granular data access for Digital Twin Market so as to understand the trends and the factors involved in changing market situations

Qualitative and quantitative data utilization to discover arrays of future growth from the market trends of leaders to market visionaries and then recognize the significant areas to compete in the future

In-depth analysis of the changing trends of the market by visualizing the historic and forecast year growth patterns

Direct Purchase of Digital Twin Market Research Report at: https://www.delvens.com/checkout/digital-twin-market-trends-forecast-till-2030

Report Scope

Report FeatureDescriptionsGrowth RateCAGR of 60.9% during the forecasting period, 2023-2030Historical Data2019-2021Forecast Years2023-2030Base Year2022Units ConsideredRevenue in USD million and CAGR from 2023 to 2030Report Segmentationenterprise, platform, application, and region.Report AttributeMarket Revenue Sizing (Global, Regional and Country Level) Company Share Analysis, Market Dynamics, Company ProfilingRegional Level ScopeNorth America, Europe, Asia-Pacific, South America, and Middle East, and AfricaCountry Level ScopeU.S., Japan, Germany, U.K., China, India, Brazil, UAE, and South Africa (50+ Countries Across the Globe)Companies ProfiledABB; AVEVA Group plc; Dassault Systems; General Electric; Hexagon AB; IBM Corp.; SAP.Available CustomizationIn addition to the market data for Digital Twin Market, Delvens offers client-centric reports and customized according to the company’s specific demand and requirement.

TABLE OF CONTENTS

Large Enterprises

Small & Medium Enterprises

Product Design & Development

Predictive Maintenance

Business Optimization

Performance Monitoring

Inventory Management

Other Applications

Automotive & Transportation

Energy & Utilities

Infrastructure

Healthcare

Aerospace

Oil & Gas

Telecommunications

Agriculture

Retail

Other Industries.

Asia Pacific

North America

Europe

South America

Middle East & Africa

ABB

AVEVA Group plc

Dassault Systemes

General Electric

Hexagon AB

IBM Corporation

SAP

About Us:

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

Contact Us:

UNIT NO. 2126, TOWER B,

21ST FLOOR ALPHATHUM

SECTOR 90 NOIDA 201305, IN

+44-20-8638-5055

[email protected]

WEBSITE: https://delvens.com/

#Digital Twin Market#Digital Twin#Digital Twin Market Size#Digital Twin Market Share#Semiconductors & Electronics

2 notes

·

View notes

Text

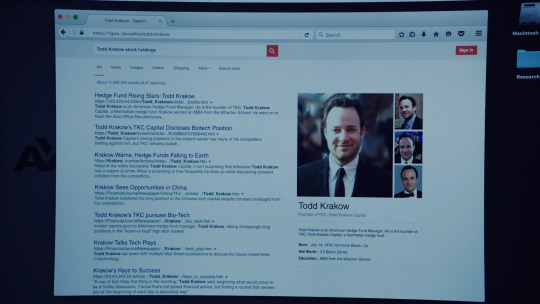

Todd Krakow

Founder of TKC, Todd Krakow Capital

Todd Krakow is an American Hedge Fund Manager. He is the founder of TKC, Todd Krakow Capital, a Manhattan hedge fund.

Born: July 14, 1976, Hermosa Beach, Ca

Net Worth: 3.2 Billions (2016)

Education: MBA from the Wharton School

Hedge Fund Rising Stars: Todd Krakow

https://123.223.54.23/en/Todd_Krakow/article/…/profile.htm

Todd Krakow is an American Hedge Fund Manager. He is the founder of TKC, Todd Krakow Capital, a Manhattan hedge fund. Krakow earned an MBA from the Wharton School. He went on to head the Asia Office Manufacturers…

Todd Krakow’s TKC Capital Discloses Biotech Position

https://Todd_Krakow/biotech/article/…/E439894727929442.htm

Todd Krakow Capital’s strong positions in the biotech sector has many of his competitors betting against him, but TKC remains bullish…

Krakow Warns: Hedge Funds Falling to Earth

https://Krakow_number/fortune/index/…/Todd_Krakow.htm

Head of the wildly successful Todd Krakow Capital, it isn’t surprising that billionaire Todd Krakow has a reason to smile. What is surprising is how frequently he does so while discussing constant criticism from his competitors…

Krakow Sees Opportunities in China

https://FinancialJournalNewspaper/China/TFJ/…/article/…/Todd_Krakow.htm

Todd Krakow bolstered his long position in the Chinese tech market despite constant onslaught from his competitors…

Todd Krakow’s TKC pursues Bio-Tech

https://FinancialJournalNewspaper/…/Krakow/…/bio_tech.htm

Insider reports point to billionaire hedge fund manager, Todd Krakow, taking increasingly long positions in the “boom-or-bust” high tech market.

Krakow Talks Tech Plays

https://FinancialJournalNewspaper/…/Krakow/…/tech_play.htm

Todd Krakow sat down with multiple Wall Street publications to discuss his future investments in technology…

Krakow’s Keys to Success

https://23.43.343.22./article…/Todd_Krakow/…/keys_to_success.htm

“A cup of Earl Gray first thing in the morning,” Todd Krakow said, beginning what would prove to be a fruitful discussion. “I know that’s not typical financial advice, but finding a routine that centers you at the beginning of each day is absolutely key.”

mediaPresence_krakow_170312_02

Krakow Media Presence

MONTH ENDING | CHINA | CHINA UNDERVALUED | WEARABLE TECH | MANUFACTURING | HEDGE FUND MALFEASANCE | TECHNOLOGY | EUROPE | SEC

10/1/2015 | 0 | 0 | 0 | 0 | 0 | 5 | 3 | 5

11/1/2015 | 1 | 2 | 3 | 2 | 3 | 6 | 4 | 6

12/1/2015 | 2 | 2 | 4 | 3 | 4 | 8 | 3 | 5

1/1/2016 | 4 | 3 | 5 | 5 | 4 | 9 | 5 | 4

2/1/2016 | 8 | 10 | 15 | 6 | 5 | 10 | 4 | 7

3/1/2016 | 12 | 14 | 18 | 8 | 6 | 11 | 4 | 5

4/1/2016 | 16 | 18 | 22 | 10 | 7 | 11 | 4 | 7

5/1/2016 | 18 | 24 | 28 | 11 | 7 | 13 | 4 | 8

6/1/2016 | 22 | 25 | 28 | 13 | 8 | 14 | 4 | 9

7/1/2016 | 27 | 29 | 35 | 13 | 10 | 15 | 5 | 10

8/1/2016 | 31 | | | 15 | | | |

9/1/2016 | | | | 16 | | | 8 |

10/1/2016 | | | | | | | |

11/1/2016 | | | | | 67 | 78 | |

12/1/2016 | | | | | | | |

1/1/2017 | | 67 | | 90 | | | |

2/1/2016 | | | | | | | |

3/1/2017 | | | | | | | |

4/1/2017 | | | | | | | |

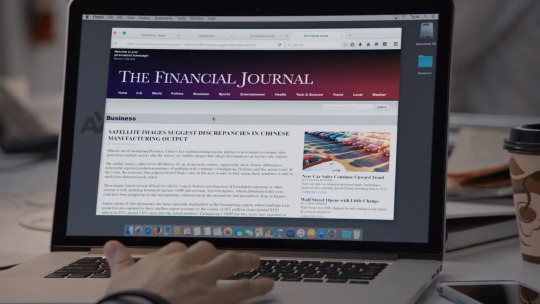

THE FINANCIAL JOURNAL

SATELLITE IMAGES SUGGEST DISCREPANCIES IN CHINESE MANUFACTURING OUTPUT

BY JOYCE CRANDALL

Officials out of Guangdong Province, China’s key manufacturing region, pledge to investigate data reports from multiple sectors after the release of satellite images that allege discrepancies in factory site outputs.

The satellite images, culled from AR Metrics by an anonymous source, supposedly show drastic differences between the reported production numbers of multiple tech company’s Guangdong facilities and the actual yield. If this is true, the economic data gathered from China’s sites in the area would, in fact, mean these numbers would be much lower than previously stated.

These images caused several officials to call for a top to bottom investigation of fraudulent reporting in other sections as well, including household income, GDP, and revenue. Growth figures, which plummeted this year, could have been propped up by this misreporting, culminating in the mysterious and precipitous drop in figures.

Similar reports of data discrepancy has been especially highlighted in the Guangdong region, where multiple tech production sites captured by these satellites report revenues to the county of 865 million yuan (around $130 million) in 2015, around 130% more than the actual numbers. Guangdong’s GDP rise two years ago, reported at

#tumblr really did not want me to add those fake links lol#billions#2x02#todd krakow#and whoever wrote these really was dead set on this episode taking place in 2017. sorry but it's just not realistic#especially that file name suggesting it's march 2017 trying to convince us taylor couldn't have been around during season 1#it will not work! not after the chronology established in dialogue!#also shoutout to the Chat text option for letting me do monospaced font with little effort. great for reproducing that table

3 notes

·

View notes

Text

The thermal spring water of Fiuggi Fonte Bonifacio VIII reopens its doors.

The town of Fiuggi, located south of Rome, boasts the presence of two thermal springs, Fonte Bonifacio VIII and Fonte Anticolana, which have given rise to one of the largest and oldest thermal complexes in Italy, with ancient origins.

Fiuggi is one of the most important hot spring resort towns in Europe. It has two beautiful parks and is known for its healing mineral springs that flow from Fonte Bonifacio VIII and Fonte Anticolana.

The sources reopen after a period of stasis with a wholly redesigned new look. The ribbon-cutting ceremony for the Boniface VIII Spring will take place on April 1st, according to the new management who recently took over the water bottling, golf course, and Anticolana spring.

This is a long-awaited piece of news in the city for all the local economic actors. The seasonal reopening of the hot springs symbolizes the start of the city's economic engine. It's linked to an allied industry with dozens of hotels, businesses, and workers.

The new owners of the Terme di Fiuggi, the entrepreneurs Stirpe, Borgomeo, Battisti, and Benedetto, have kept to the schedule announced at the press conference at the beginning of the year, proposing the same operational goals that characterize the Fiuggi facilities. The golf course is already accessible, the Bonifacio VIII spring will be opened on April 1st, and the Anticolana spring traditionally will open its doors on June 1st.

As announced by the new ownership, there won't be any profound changes or upheavals inside the park. But there will be a profound innovation in the services offered and a lot of investment in the historical relationship between the spa and the medical and scientific world.

Satisfaction and gratitude also for the staff employed during the other months and until the planned closure foresees between October and November.

In short, it's good news. It restores confidence and strengthens the work of the categories, which look forward with great hope to revitalize the thermal industry.

Fun fact. Pope Boniface VIII claimed his kidney stones had been healed by the mineral waters from the Fiuggi springs.

Yet one more hint for today's story:

To stay up to date on all events and to know what to do during your stay, check out at ⏩ L' Acqua di Bonifacio VIII

To be kept informed on unique locations and special experiences for a more responsible way of traveling around the world, contact NP Collection at ⏬⏬

Initially published by Anagnia in bio ⏩ La Fonte Bonifacio VIII di Fiuggi riapre i battenti

Get Direction on Map ⏩ Fiuggi spa centre.

⏩ The Board Behind

#visit lazio#lazio eterna scoperta#lazio to discover#the board behind#thermal waters#thermal spring#theboardbehind#fiuggi#natural hot spring#hot spring water#hot springs#thermal baths#spa water#healing water

2 notes

·

View notes

Text

Infertility Treatment Market Scope of Current and Future, Key Players Analysis by 2026

According to the new market research report "Infertility Treatment Market by Product (Equipment, Media, Accessories), Procedure (ART (IVF,ICSI, Surrogate), Insemination, Laparoscopy, Hysteroscopy, Patient Type (Female, Male), End User (Fertility Clinics, Hospitals, Research) - Global Forecast to 2026", published by MarketsandMarkets™, the global Infertility Treatment Market size is projected to reach USD 2.2 billion by 2026 from USD 1.5 billion in 2021, at a CAGR of 8.1% during the forecast period.

Browse in-depth TOC on "Infertility Treatment Market"

215 – Tables

40 – Figures

255 – Pages

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=43497112

The decline in the fertility rate, increase awareness about the availability of infertility treatment procedures, rising number of fertility clinics, increasing public & private investments and growing technological advancements are expected to drive market growth in the coming years

The infertility treatment market include major Tier I and II suppliers of infertility treatment equipment, media & consumables are The Cooper Companies Inc. (US), Cook Group (US), Vitrolife (Sweden), Thermo Fisher Scientific, Inc. (US), Esco Micro Pte. Ltd. (Singapore), Genea Biomedx (Australia), IVFtech ApS (Denmark), FUJIFILM Irvine Scientific (US), The Baker Company, Inc. (US), Kitazato Corporation (Japan), Rocket Medical plc (UK), IHMedical A/S (Denmark), Hamilton Thorne Ltd. (US), ZEISS Group (Germany), MedGyn Products, Inc. (US), DxNow, Inc. (US), Nidacon International AB (Sweden), Gynotec B.V. (Netherlands), SAR Healthline Pvt. Ltd. (India), and InVitroCare Inc. (US). These suppliers have their manufacturing facilities spread across regions such as North America, Europe, Asia Pacific.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=43497112

COVID-19 has impacted their businesses as well. Logistical issues, managing patients with the disease, prioritizing patients with comorbidities and pre-existing conditions, and protecting public & hospital frontline workers from exposure to the COVID-19 infection are the major challenges faced by healthcare systems across the globe. One in six reproductive-aged couples experiences infertility, and many turn to treatments such as intrauterine insemination (IUI) and in vitro fertilization (IVF), which require in-person appointments to complete.

The fertility rate worldwide is declining steadily owing to various factors, such as the growing trend of late marriages and increasing age-related infertility. Global fertility rates are projected to decline to 2.4 children per woman by 2030 and 2.2 children per woman by 2050. This declining fertility rate has led to a significant increase in the demand for infertility treatment products that determine the fertility window in males and females.

The rise in number of fertility clinics to support the market growth during the forecast period.

Significant rise in number of fertility clinics, coupled with the decline in the fertility rate across the globe. Along with this growing focus of players and government towards the launching and acquiring new fertility centers across the globe is likely to contribute towards the growth of the segment. The expansion of fertility clinics equipped with advanced technology is anticipated to increase the accessibility of infertility treatment devices among infertile couples.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=43497112

Asia Pacific likely to emerge as the fastest-growing infertility treatment market, globally

Geographically, the emerging Asian countries, such as China, India, Japan and Singapore, are offering high-growth opportunities for market players. The Asia Pacific point of care market is projected to grow at the highest CAGR of 9.1% from 2021 to 2026. Expansion of healthcare infrastructure and increase in disposable personal income, rising medical tourism in Asian countries, increasing healthcare expenditure, and growing awareness among people about infertility are supporting the growth of the infertility treatment market in the region.

Prominent players in this market are The Cooper Companies Inc. (US), Cook Group (US), Vitrolife (Sweden), Thermo Fisher Scientific, Inc. (US), FUJIFILM Irvine Scientific (US), Kitazato Corporation (Japan), and Hamilton Thorne Ltd. (US), among others

3 notes

·

View notes

Text

Massive IOT (mIOT) Market - Forecast (2022 - 2027)

The market for Massive IoT is forecast to reach $121.4 billion by 2026, growing at a CAGR of 7.1% from 2021 to 2026. The Massive IoT Market is estimated to witness substantial growth over the forecast period primarily due to the growing demand for large scale Automation and machine intelligence. The rising adoption of IoT technology across various industry verticals such as manufacturing, automotive, and healthcare, is driving the market’s growth for bandwidth sensor technologies. With the traditional manufacturing sector amid a digital transformation, the IoT is triggering the next industrial revolution of intelligent connectivity and communication protocols. With the development of wireless networking technologies, especially low power networks, and the emergence of advanced data analytics, a reduction in the cost of connected devices adn indoor asset tracking, are some of the major factors driving the market. The adoption of cloud computing and cloud platform is another factor boosting the market growth during the forecast period 2021-2026.

Report Coverage

The report: “Massive IOT Market– Forecast (2021-2026)”, by IndustryARC covers an in-depth analysis of the following segments of the Massive IOT Market.

By Platform – Device Management, Application Management, Network Management, Cloud Platform and Others.

By Connectivity – Wireless, Field.

By Component – Hardware (Transmitters, Memory, Processors,Other), Software, Services.

By End User – Manufacturing, Transportation, Healthcare, Retail, Energy and Utilities, Residential, Other.

By Geography - North America (U.S, Canada, Mexico), South America(Brazil, Argentina and others), Europe (Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, South Korea, and Others), and RoW (Middle east and Africa).

Request Sample

Key Takeaways

The Massive IoT Market is estimated to witness substantial growth over the forecast period primarily due to the growing demand for large scale Automation. The rising adoption of IoT technology across various industry verticals, such as manufacturing, automotive, and healthcare, is driving the market’s growth.

North America is holding a strong grip in the market, due to the growing role of IoT among the significant revenue-generating end-user industries of the region, driven by the deployment of connected cars, smart facilities, smart energy projects, home automation, and a focus on smart manufacturing.

The current and future IoT applications with respect to their requirements and then identify the feasible connectivity technologies for each application category. Massive IoT has played a major role across a variety of verticals by generating new revenue streams and other benefits, such as improved quality.

Inquiry Before Buying

Massive IoT Market Segment Analysis - By Platform

The Industrial Internet of Things is the biggest and most important part of the Internet of Things now but consumer applications will catch up from a spending perspective. The growing demand of industrial automation and the penetration of industry 4.0 has boosted the Massive IoT market. The device management of the massive IoT has the largest market growth in the market, as the industrial automation includes mainly device management and machine to machine communication. For instance in March 2020 Cisco and Microsoft announced a partnership for seamless data communication between Cisco IoT and Microsoft Azure IoT cloud.

Massive IoT Market Segment Analysis - By End User

The current and future IoT applications with respect to their requirements and then identify the feasible connectivity technologies for each application category. Massive IoT has played a major role across a variety of verticals by generating new revenue streams and other benefits, such as improved quality. The transportation market is also growing rapidly with the penetration of Massive IoT and the market has already invested $78 billion, just as is the case for the IoT manufacturing market. The main use case in transportation is freight monitoring, remaining a key driver in the market during the forecast period of 2021-2026.

Massive IoT Market Segment Analysis – By Geography

North America is holding a strong grip in the market with 37% share in 2020, due to the growing role of IoT among the significant revenue-generating end-user industries of the region, driven by the deployment of connected cars, smart facilities, smart energy projects, home automation, and a focus on smart manufacturing. The rapid implementation of the digital era across industry verticals and technological advancements have further boosted the growth of IoT in this region. The Massive internet of things (MIoT) market is highly competitive to the presence of many large and small enterprises in the market operating in the domestic as well as in the international market. APAC is an industrial hub of many verticals that makes it the fastest-growing.

Schedule a Call

Massive IoT Market Drivers

Technological Advancement

Industry 4.0 and Massive-IoT are at the centre of new technological approaches for the development, production, and management of the entire logistics chain, otherwise known as smart factory automation. The massive change in manufacturing due to industry 4.0 and the implementation of IoT requires enterprises to adopt the smarter way to advance production with technologies that reduce industrial accidents caused by a process failure. This is changing the way industries approach the machines to improve efficiency and reduce downtime. This development in connectivity will lead to a larger base of individuals interested in purchasing IoT devices. The boost in the development of high-speed wireless network technology and the number of devices enabled with this technology are increasing rapidly with the penetration of MIoT. These changes in the industry vertical will be driving the market during the forecast period of 2021-2026.

Technology-enabled solutions to the healthcare organizations

During this Covid-19 pandemic, the vendors are taking this as an opportunity by offering emerging technology-enabled solutions to healthcare organizations. For instance, during the early stage of Covid 19 when the virus was infecting people of Shanghai the Shanghai Public Health Clinical Centre (SPHCC) has utilized the California-based connected health start-up Viva LNK’s continuous temperature measuring device to monitor COVID-19 patients, which reduces the risks of doctors and the nurses being infected by the virus.

Buy Now

Massive IoT Market Challenges

Security and the Pandemic

Massive IoT has opened serious security breaches that have drawn the attention of top line tech firms and government agencies across the world. The hacking of industrial Instruments, drug infusion pumps, cameras, and even assault rifles are signifying a security nightmare being caused by the future of IoT. Due to the recent outbreak of Covid-19 IOT investment and deployments have certainly slowed down. However, with major disruptions in global healthcare and supply chains, governments, hospitals, and logistics providers are heading to react quickly for a more connected world that could help better address the current crisis and mitigate future ones. The Covid 19 has done major damage to the Massive IoT market by shutting down the industries and ruining the economy. These factors will be restraining the market during the forecast period.

Massive IoT Market Landscape

Product launches, acquisitions, and R&D activities are key strategies adopted by players in the Massive IOT market. The Massive IOT market is dominated by major companies such Vates (US), Science Soft (US), HQ Software (Estonia)CISCO (US), Huawei (China), Bosch (Germany), SAP (Germany).

Acquisitions/Technology Launches/Partnerships

In March 2020, Microsoft & Cisco Systems announced a partnership to enable seamless data orchestration from Cisco IOT Edge to Azure IOT Cloud. This partnership will be providing the customers a pre-integrated IOT edge-to-cloud application solution.

In January 2020, IBM Corporation announced a collaboration with Sund & Bælt, which owns and operates some of the largest infrastructures in the world, to assist in IBM's development of an AI-powered IOT solution designed to help prolong the lifespan of aging bridges, tunnels, highways, and railways.

For more Electronics related reports, please click here

#Massive IOT (mIOT) Market#Massive IOT (mIOT) Market price#Massive IOT (mIOT) Market share#Massive IOT (mIOT) Market trends#Massive IOT (mIOT) Market report#Massive IOT (mIOT) Market forecast#internet of things

2 notes

·

View notes

Text

Dubai's Financing Opportunities

Dubai's position as a global financial hub provides a rich landscape for various financing options. The city's robust financial infrastructure, combined with its strategic geographic location bridging Europe, Asia, and Africa, creates a fertile ground for investment and financing. Whether you are a startup, a growing business, or an individual looking for personal financing, Dubai offers numerous avenues to explore.

Key Financing Opportunities in Dubai

Bank Loans and Credit Facilities: Dubai's banking sector provides a wide range of loan products, including personal loans, business loans, and mortgages. Banks offer competitive interest rates and flexible terms, tailored to meet the needs of different borrowers.

Venture Capital and Private Equity: For startups and growth-stage companies, Dubai's venture capital and private equity firms offer substantial funding opportunities. These investors provide capital in exchange for equity stakes, helping businesses scale and achieve their growth potential.

Government Grants and Subsidies: The UAE government offers various grants and subsidies to support entrepreneurship and innovation. Programs such as the Dubai SME Development Program provide financial assistance and incentives for small and medium-sized enterprises (SMEs).

Real Estate Financing: Dubai's real estate market is a major sector for investment, with numerous financing options available for property purchases and developments. Investors can access mortgages and financing solutions for residential and commercial real estate projects.

Islamic Finance: Dubai is a global leader in Islamic finance, offering Sharia-compliant financing solutions. Products such as Sukuk (Islamic bonds) and Murabaha (cost-plus financing) provide alternative financing methods that adhere to Islamic principles.

Trade Finance: As a key trading hub, Dubai offers trade finance solutions that facilitate international trade. These include letters of credit, trade loans, and export financing, helping businesses manage their trade-related financial needs.

Crowdfunding Platforms: Emerging as a popular option, crowdfunding platforms in Dubai allow businesses to raise capital from a large number of investors through online platforms. This method offers an alternative to traditional financing sources.

Conclusion

Dubai’s financing landscape is both diverse and dynamic, providing numerous opportunities for individuals and businesses seeking capital. From traditional bank loans to innovative financing solutions like venture capital and crowdfunding, the city’s financial ecosystem supports various funding needs. With its strategic location, favorable regulatory environment, and extensive financial services, Dubai continues to be a leading destination for accessing financing opportunities and driving economic growth.

0 notes

Text

Global Arc Quenching Device Market Overview and Strategic Insights 2024 - 2031

The global arc quenching device market is experiencing robust growth, driven by advancements in electrical safety technology and increasing demand for efficient power management systems. This article delves into the market dynamics, including key drivers, challenges, emerging trends, and regional insights.

Market Dynamics

The arc quenching device market is poised for substantial growth as industries increasingly prioritize safety, efficiency, and reliability in electrical systems. Understanding the market dynamics, challenges

Key Drivers

Increasing Demand for Safety in Electrical Systems

The rising awareness of electrical safety and the potential hazards associated with arc faults are driving the demand for arc quenching devices. These devices play a crucial role in protecting electrical equipment and personnel by minimizing the risks of electrical fires and equipment damage.

Growing Investments in Infrastructure Development

As countries around the world invest heavily in infrastructure development, the demand for reliable electrical systems is increasing. This growth is particularly evident in sectors such as construction, energy, and transportation, where arc quenching devices are essential for ensuring system reliability and safety.

Technological Advancements

Innovations in arc quenching technologies, such as the development of smart devices with enhanced monitoring and control capabilities, are driving market growth. These advancements enable faster response times to arc faults and improve overall system efficiency.

Challenges

High Initial Costs

One of the significant challenges facing the arc quenching device market is the high initial investment required for advanced systems. This cost can deter smaller companies and facilities from adopting these technologies, potentially limiting market growth.

Lack of Awareness and Technical Expertise

In many regions, there is a lack of awareness regarding the importance of arc quenching devices and their benefits. Additionally, the need for specialized technical expertise to install and maintain these devices can pose challenges for widespread adoption.

Emerging Trends

Integration with Smart Grid Technologies

The integration of arc quenching devices with smart grid technologies is becoming increasingly prevalent. These devices can enhance the resilience of electrical systems by providing real-time monitoring and automated fault detection, improving overall grid reliability.

Growing Focus on Renewable Energy

As the world shifts toward renewable energy sources, the need for reliable electrical protection systems becomes more critical. Arc quenching devices are being integrated into renewable energy systems, such as solar and wind, to ensure safe and efficient operation.

Regional Analysis

North America

North America holds a significant share of the global arc quenching device market, driven by stringent safety regulations and a strong emphasis on electrical safety. The presence of key players and ongoing investments in smart grid technologies support market growth in this region.

Europe

Europe is witnessing substantial growth in the arc quenching device market, fueled by the increasing focus on renewable energy and sustainable infrastructure. The region’s regulatory frameworks promote the adoption of advanced safety technologies, enhancing market opportunities.

Asia-Pacific

The Asia-Pacific region is expected to see significant growth in the arc quenching device market due to rapid industrialization and urbanization. Countries like China and India are investing heavily in infrastructure development, driving demand for reliable electrical systems.

Future Outlook

The global arc quenching device market is anticipated to grow steadily over the coming years. Factors such as increasing investments in infrastructure, advancements in technology, and growing awareness of electrical safety will continue to drive market expansion. Key players are likely to focus on product innovation and strategic collaborations to enhance their competitive positioning.

Conclusion

The arc quenching device market is poised for substantial growth as industries increasingly prioritize safety, efficiency, and reliability in electrical systems. Understanding the market dynamics, challenges, and emerging trends will be essential for stakeholders looking to capitalize on opportunities in this evolving landscape.

#Global Arc Quenching Device Market Size#Global Arc Quenching Device Market Trend#Global Arc Quenching Device Market Growth

0 notes

Text

How to Maximize Rental Income from Your Hua Hin Property

Hua Hin, known for its serene beaches, luxurious lifestyle, and close proximity to Bangkok, has become a thriving hub for both tourists and expatriates. The city’s growing popularity has driven an increase in demand for rental properties, particularly among retirees and long-term expats seeking a quieter lifestyle compared to bustling cities like Phuket and Pattaya. For property owners, this surge presents a golden opportunity to maximize rental income from their Hua Hin properties. Here’s a guide on how to optimize your rental potential by leveraging the demand for vacation homes, long-term rentals, and proper property management strategies.

1. Understand Your Target Market: Tourists, Expats, and Retirees

Hua Hin attracts a diverse set of renters:

Tourists: As a popular beach destination, Hua Hin sees a continuous influx of short-term vacationers. The demand for fully-furnished, short-term rentals remains high, particularly during peak seasons such as holidays and festivals.

Long-term Expats: Many expatriates are relocating to Hua Hin due to the city’s affordable cost of living, excellent healthcare facilities, and laid-back environment. These individuals are typically looking for long-term rental solutions ranging from six months to several years.

Retirees: Hua Hin’s appeal to retirees, especially from Europe, Australia, and the U.S., has skyrocketed over the years. Retirees are more likely to seek out long-term rentals that offer comfort, proximity to essential services, and community activities.

Understanding the needs and preferences of each group can help property owners structure rental offerings to meet market demands. For example, vacationers are likely to prioritize proximity to the beach and amenities, while retirees may seek more peaceful, community-based living environments.

2. Choose the Right Type of Property

Location matters when determining the kind of renters you will attract and the rates you can charge. Prime beachfront properties will command higher rates from vacationers, while homes situated in quiet residential areas appeal more to long-term expats and retirees. Villas, condos, and serviced apartments are especially popular in Hua Hin.

Condos: Foreigners can own condos outright in Thailand, making them a highly attractive investment option for rental purposes. Condos close to the city center or beachfront areas, with easy access to amenities, will always remain in demand for both short-term and long-term leases.

Villas: Larger properties, such as villas, appeal more to retirees or expats who plan to stay long-term. These properties can fetch higher monthly rentals if they offer privacy, a garden, and additional features like a private pool or clubhouse access.

3. Optimize Your Property for Rentals

To maximize your rental income, ensure your property is well-maintained and appealing to potential renters. Consider the following enhancements to increase value:

Furnish and Decorate: For short-term and long-term rentals alike, fully furnished properties are often more desirable. Invest in modern, functional furnishings that appeal to the tastes of international renters. Consider using neutral tones and high-quality appliances, and ensure all necessary amenities like air conditioning, Wi-Fi, and a fully equipped kitchen are available.

Maintain Regular Upkeep: Routine maintenance is key to maintaining property value. Broken fixtures, peeling paint, or outdated amenities can discourage potential renters and reduce the amount they’re willing to pay. Ensure that the property is always in top condition, with regular inspections and timely repairs.

Focus on Curb Appeal: First impressions matter. Enhance the exterior of your property with clean landscaping, freshly painted walls, and well-maintained outdoor areas. For villas, make sure the garden and pool areas are pristine.

4. Market Effectively to Attract Renters

Marketing your property effectively is essential to keeping it occupied and maximizing rental returns. Here are several strategies to consider:

Leverage Online Platforms: Use popular real estate websites and platforms like Airbnb, Booking.com, or long-term rental portals targeting expats to list your property. High-quality photos, detailed descriptions, and positive reviews can make a big difference in attracting prospective tenants.

Social Media and Expat Forums: Hua Hin has a strong expatriate community. Engaging with expat forums, local Facebook groups, and online communities can help you connect with potential long-term renters. Tailoring your listings to expatriates looking for long-term rentals can also prove beneficial.

Partner with Local Agents: Working with a trusted local real estate agency like Hua Hin Property Search can provide invaluable support in finding suitable tenants for your property. With deep knowledge of the Hua Hin rental market and an extensive network, partnering with an established local agent can reduce vacancies and ensure your property is rented out at competitive rates.

5. Consider Property Management Services

One of the most effective ways to maximize rental income is by employing property management services. For property owners who live abroad or are unable to manage day-to-day operations, a reliable property management company can help in:

Handling Tenant Relations: Property managers act as intermediaries between you and your tenants, addressing any concerns or issues that arise, which is particularly useful for absentee landlords.

Ensuring Regular Maintenance: Professional property managers will handle regular maintenance, ensuring that your property stays in excellent condition year-round.

Managing Bookings and Payments: From advertising the property to managing bookings, handling payments, and conducting tenant background checks, property management services reduce the time you spend on these tedious processes while maximizing occupancy.

In Hua Hin, property management services are often essential for foreign property owners who may not be familiar with local laws or who cannot manage their property from afar. A reputable company like Hua Hin Property Search can assist with these services, ensuring you get the best return on your investment.

6. Adjust Rental Rates Seasonally

Hua Hin’s rental market experiences seasonal fluctuations, particularly due to tourism. Property owners should consider adjusting rental rates to align with high-demand periods such as the holiday season, school vacations, or local festivals. Charging premium rates during peak seasons can significantly boost rental income, while offering discounts during off-peak periods can help maintain occupancy.

7. Legal Compliance and Taxation

To maximize your rental income, it’s crucial to understand the legal requirements and tax obligations for foreign property owners in Thailand:

Rental Licenses: Ensure that your property is registered for short-term rentals if you plan to rent it out on a nightly or weekly basis. Unregistered short-term rentals can lead to fines and other penalties.

Taxes: Rental income is subject to taxation in Thailand. Make sure you are aware of the applicable tax rates, and file the necessary paperwork to remain compliant with local tax laws.

Conclusion

With its growing popularity among tourists, expats, and retirees, Hua Hin offers a fantastic opportunity for property owners to maximize rental income. By understanding your target market, optimizing your property, marketing effectively, and leveraging property management services, you can significantly increase your returns. For professional assistance with rental management and property investments, consider working with Hua Hin Property Search, a trusted real estate agency that can help guide you through the process and ensure you get the most out of your Hua Hin property.

#buy property in thailand#commercial real estate#real estate#thailand#thailand real estate investing#house#hua hin#rental properties

0 notes

Text

Enel Locations: A Global Powerhouse in Energy Solutions

As one of the world’s leading integrated electricity and gas operators, Enel has made a significant impact on the energy sector since its founding in 1962. Headquartered in Rome, Italy, the company has expanded its operations across multiple continents, establishing a robust presence in Europe, the Americas, Africa, and Asia. This article explores the various Enel locations worldwide, highlighting the company's strategic approach to energy production, distribution, and innovation in renewable energy solutions.

Enel’s Global Presence

Enel operates in more than 30 countries, catering to over 74 million customers globally. The company’s extensive network of subsidiaries, partnerships, and joint ventures enables it to deliver energy solutions that meet the diverse needs of its customer base. Here’s an overview of Enel’s key locations and operations:

1. Italy

As the birthplace of Enel, Italy remains a crucial hub for the company's operations. Enel produces and distributes electricity and natural gas across the country, playing a vital role in Italy's energy landscape. The company is a leader in renewable energy, with significant investments in wind, solar, and hydroelectric power sources. Key facilities include:

Enel Green Power: Focused on developing renewable energy projects, Enel Green Power operates numerous wind and solar farms across Italy.

Thermal Power Plants: Enel manages several thermal power plants that contribute to the country's energy mix while transitioning towards greener solutions.

2. Spain

Enel’s presence in Spain is marked by its subsidiary, Endesa, which is one of the largest electric utilities in the country. Endesa plays a critical role in the generation, distribution, and commercialization of electricity. Key initiatives in Spain include:

Renewable Energy Investments: Enel is heavily investing in solar and wind energy projects, aiming to increase the share of renewables in Spain's energy mix.

Smart Grid Development: The company is focused on improving energy efficiency and reliability through the implementation of smart grid technologies.

3. Latin America

Enel has a strong foothold in Latin America, with operations in several countries, including:

Chile: Enel is the largest electricity distributor in Chile, providing energy to millions of customers. The company is also a leader in renewable energy generation, with significant investments in geothermal, wind, and solar projects.

Brazil: Enel operates in Brazil as Enel Brasil, focusing on electricity distribution and renewable energy generation. The company has made substantial investments in wind and solar energy, contributing to Brazil's transition to sustainable energy sources.

Colombia and Peru: Enel continues to expand its presence in Colombia and Peru, focusing on renewable energy projects and enhancing energy access for local communities.

4. North America

Enel's operations in North America are primarily centered around Enel Green Power North America, which focuses on renewable energy generation. Key activities in this region include:

Wind and Solar Projects: Enel Green Power is involved in the development and operation of numerous wind and solar farms, contributing to the growing renewable energy landscape in the U.S. and Canada.

Energy Solutions: The company is working on innovative energy solutions, such as energy storage and demand response programs, to enhance grid reliability and sustainability.

5. Africa and Asia

Enel is increasingly focusing on emerging markets in Africa and Asia, where energy demand is rapidly growing. Key initiatives include:

South Africa: Enel operates renewable energy projects in South Africa, contributing to the country’s efforts to diversify its energy sources and reduce reliance on coal.

India: Enel is exploring opportunities in India’s renewable energy sector, focusing on solar and wind energy projects that align with the country’s sustainability goals.

Other African Nations: Enel is assessing potential investments in other African countries, with a focus on expanding access to electricity and promoting renewable energy development.

Commitment to Sustainability

Enel is committed to leading the energy transition towards a more sustainable future. The company has set ambitious targets to reduce its greenhouse gas emissions and increase the share of renewable energy in its generation portfolio. Some key initiatives include:

Carbon Neutrality: Enel aims to achieve carbon neutrality by 2040, with intermediate targets for reducing emissions by 70% by 2030.

Investment in Renewables: The company is heavily investing in renewable energy projects worldwide, with plans to allocate a significant portion of its capital expenditure to green technologies.

Community Engagement: Enel actively engages with local communities to promote energy efficiency, sustainability, and social responsibility. The company implements programs that support education, job creation, and access to clean energy.

Conclusion

Enel's global footprint and commitment to sustainability position it as a leader in the energy sector. With operations spanning multiple continents, the company is not only focused on providing reliable energy solutions but also on driving the transition to a greener and more sustainable energy future. As Enel continues to innovate and expand its renewable energy initiatives, it plays a pivotal role in shaping the global energy landscape and addressing the challenges posed by climate change. By leveraging its diverse locations and expertise, Enel is well-equipped to meet the evolving energy needs of the world while contributing to a sustainable future for generations to come.

0 notes

Text

Argentina Construction Market Overview: Trends, Opportunities, and Challenges in 2024

Argentina's construction market has witnessed significant growth in recent years, driven by government initiatives, private investments, and infrastructure development programs. In 2024, the sector continues to present numerous opportunities, albeit facing some economic and regulatory challenges. This article explores the current state of the construction market in Argentina, its key drivers, and what the future holds for this critical industry.

1. Market Size and Key Segments

The construction industry in Argentina is a key contributor to the national economy, accounting for a substantial share of GDP. In 2024, the market is projected to grow further, supported by investments in infrastructure, residential, and commercial projects. The sector is divided into several key segments:

Residential Construction: Ongoing demand for housing, especially in urban areas such as Buenos Aires, Córdoba, and Rosario, is pushing forward residential projects. Affordable housing schemes and real estate developments are gaining momentum.

Infrastructure Development: Public and private investments in transport (roads, railways, ports), water supply, and energy infrastructure are critical growth drivers.

Commercial Construction: The rising demand for office spaces, hotels, and retail facilities is propelling growth in this segment, particularly as Argentina seeks to recover from the economic downturn of previous years.