#etoro philippines

Explore tagged Tumblr posts

Text

10 Best Bitget Alternatives In Philippines

In this blog post, I will write about the best Bitget replacements in the country. Filipino traders have seen growth in cryptocurrency trading hence there is a demand for platforms that can facilitate this business. Though offering fabulous features, other exchanges like eToro, KuCoin, and PancakeSwap are also unique in their own way. This guide will help you to make an informed decision by…

0 notes

Text

Top 10 Accurate Forex Signals Service Providers for the Philippines.

The forex market is one of the most dynamic financial markets in the world. Traders in the Philippines, both new and experienced, often rely on forex signal providers to gain insights and make profitable decisions. With the right forex signals, you can navigate this fast-paced market confidently and maximize your returns.

In this article, we will highlight the top 10 accurate forex signals service providers for the Philippines, with Forex Bank Liquidity taking the top spot for its exceptional reliability and proven track record.

1. Forex Bank Liquidity

Why Forex Bank Liquidity is #1 for Philippine Traders Forex Bank Liquidity has earned its reputation as the leading forex signals provider for traders in the Philippines and globally. With a commitment to accuracy and user-friendly services, this platform ensures traders have the tools they need to succeed.

Key Features:

90–95% Accurate Signals: Consistently reliable signals tailored to maximize profits.

Real-Time Updates: Stay ahead of market trends with instant alerts.

Scalping Expertise: Ideal for short-term, high-frequency trading.

Comprehensive Account Management: Designed for traders who prefer hands-off management.

24/7 Support: Dedicated team available to assist whenever needed.

2. Learn 2 Trade

Learn 2 Trade offers accurate and actionable forex signals, making it a popular choice among Philippine traders. Their Telegram channel delivers signals and in-depth market analysis.

Why Choose Learn 2 Trade?

Expert-generated signals.

Free and premium options.

Covers various currency pairs and market types.

3. ForexSignals.com

ForexSignals.com combines educational resources with reliable trading signals. It is ideal for traders looking to learn while earning.

Key Benefits:

Live trading rooms for interactive learning.

Comprehensive mentoring programs.

Signals generated by professional traders.

4. FX Leaders

FX Leaders is a top-rated provider known for its free forex signals. They cater to traders looking for an easy-to-use and accessible platform.

Features:

Free signals for forex, indices, and commodities.

Advanced analysis tools for deeper insights.

Mobile app for signals on the go.

5. 1000pip Builder

1000pip Builder focuses on delivering high-quality signals to traders worldwide. Their personalized support makes them a preferred choice for traders in the Philippines.

Highlights:

Signals delivered via email and SMS.

High success rate with verified performance.

Excellent support for new traders.

6. MQL5

MQL5 is an established platform offering a variety of forex signals from experienced providers. Philippine traders appreciate its customizable features and integration with Meta Trader.

Key Features:

Access to thousands of signal providers.

Transparent performance statistics.

Automatic trade copying available.

7. Zulu Trade

Zulu Trade combines forex signals with copy trading, making it easy for Philippine traders to follow top-performing professionals.

Why Zulu Trade?

Copy trades from experienced traders.

Social features for learning and interaction.

Real-time performance tracking.

8. Pipchasers

Pipchasers is a dedicated platform for forex signals with a focus on accuracy and transparency. Their straightforward approach is ideal for traders in the Philippines.

Features:

Signals for various trading strategies.

Easy-to-follow instructions.

Active trader community for support.

9. Trading Central

Trading Central offers a blend of AI-powered signals and expert insights, making it a reliable choice for professional and beginner traders alike.

Standout Benefits:

High-quality signal analysis.

Compatible with most broker platforms.

Regular updates on market trends.

10. eToro

eToro is a popular platform that combines forex signals with social trading. It’s perfect for traders who want to learn from and copy experienced traders.

Why Choose eToro?

Integrated copy trading with signal services.

Regulated and secure platform.

Educational resources for beginners.

Why Forex Signals are Essential for Philippine Traders

The forex market operates 24/5, with opportunities arising at all hours. Forex signals help traders in the Philippines to:

Save Time: Focus on executing trades while experts analyze the market.

Improve Accuracy: Benefit from professional insights and precise signals.

Manage Risks: Follow clear entry and exit points to minimize losses.

Enhance Profitability: Seize opportunities with real-time alerts.

How to Choose the Best Forex Signal Provider

When selecting a forex signal provider, consider these factors:

Accuracy: Look for consistent and proven results.

Transparency: Choose providers that share detailed performance reports.

User-Friendly: Ensure the platform is easy to navigate and understand.

Customer Support: Reliable support is crucial for smooth trading.

Reputation: Opt for providers with positive reviews and a strong track record.

Why Forex Bank Liquidity is Perfect for the Philippines

Forex Bank Liquidity stands out for its dedication to delivering accurate, timely, and actionable forex signals. With features tailored for Philippine traders, it offers the tools needed to succeed in a competitive market.

Conclusion

Forex signals are essential for navigating the complexities of the forex market. With options like Forex Bank Liquidity leading the way, traders in the Philippines can confidently make informed decisions and achieve financial success. Explore these providers and elevate your trading experience today!

#forextrading#forex education#forexsignals#forex robot#forex expert advisor#forexbankliquidity#forex#bankliquidity#forex market#digital marketing

0 notes

Text

Digital Currency Trading Platform Market Growing Popularity and Emerging Trends in the Industry

A Latest intelligence report published by AMA Research with title "Global Digital Currency Trading PlatformMarket Outlook to 2027. This detailed report on Digital Currency Trading Platform Market provides a detailed overview of key factors in the Global Digital Currency Trading PlatformMarket and factors such as driver, restraint, past and current trends, regulatory scenarios and technology development.

Digital currency trading platform offers to transfer, exchange, or trade cryptocurrencies online and cryptocurrency exchanges work as an intermediary between buyers and sellers. The use of cryptocurrencies in businesses for investment, and making payment has been increasing as it has the same value worldwide and is easy to transfer from one to another. Further, the cryptocurrency market is available for 24x7 to make transactions as there is no centralized governance work that can create significant opportunities for the market in the nearer future.

Major Players in this Report Include are

PDAX (Philippines)

Coinbase (United States)

Binance (Seychelles)

Voyager (United States)

Kraken (United States)

BlockFi (United States)

Uphold (United States)

Bitcoin IRA (Unites States)

eToro (United Kingdom)

Crypto.com (Singapore)

BitFlyer (Japan)

Changelly (Malta) Market Drivers: Huge Investment in Crypto Currencies by Individuals Due to Its Durability, Portability, and Fungibility

Increasing Government Initiatives to Support Cryptocurrencies in Developing Economies like India

Market Trend: Decentralized Financial Services or DeFi Project is the Biggest Trend for Cryptocurrency

Opportunities: Increased Adoption of App-Based Platform with the Increasing Use of Smartphones and Other Mobile Devices

The Global Digital Currency Trading Platform Market segments and Market Data Break Down by Type (App-Based Platform, Desktop Platform), Application (Personal, Business), Vertical (Travel & Hospitality, Media & Entertainment, Retail & E-commerce, BFSI, Others), Operating System (Android, Windows, MacOS, Linux, Others), Currency Type (Bitcoin, Ethereum, Ripple, Dash, Litecoin, Dogecoin, Others)

Geographically World Digital Currency Trading Platform markets can be classified as North America, Europe, Asia Pacific (APAC), Middle East and Africa and Latin America. North America has gained a leading position in the global market and is expected to remain in place for years to come. The growing demand for Global Digital Currency Trading Platform markets will drive growth in the North American market over the next few years.

Presented By

AMA Research & Media LLP

0 notes

Text

ETORO LAUNCHES ITS DEBIT CARD FOR UK CUSTOMERS

The firm’s debit card will initially launch for select eToro members in the UK Club program without any additional or recurring monthly charges, before expanding to Europe. After this, the company plans to extend its debit offering to non-eToro users. eToro has well over 20 million registered users and expects take-up of the card to be strong.

The news is hardly big surprise as the Israeli firm revealed these plans in 2020 after it acquired UK-based e-money business, Marq Millions, which then rebranded as eToro Money. The company also acquired a Principal Membership with Visa and an electronic money institution (EMI) licence from the Financial Conduct Authority.

The context to this was that the social trading network was racing to build up its UK user base ahead of a potential launch by competitor Robinhood. The no-fee app, however, shelved plans to expand in the UK.

In its efforts to streamline operations, eToro card provides instant “cash-out and cash-in” functionality to customers, a feature that the company says their user-base has been requesting for a while. eToro expects the debit card will further provide its customers with a convenient way to withdraw and spend their funds.

Trading competition in the UK “I’m proud and excited that eToro Money is now available to all of our UK users. We know from our beta testing that eToro Money greatly improves our user experience providing instant cash-in and cash-out. We look forward to adding more features to the eToro offering and to expanding the user base beyond the UK,” Doron Rosenblum, Vice President of Business Solutions at eToro, said in a statement.

eToro has been among the biggest beneficiaries of the retail investing COVID-19 boom. While eToro’s social investing product did most of the success since its inception 15 years ago, cryptocurrency trading on the platform took off. Trading commissions generated from digital asset trading accounted for nearly two thirds of the total commissions eToro earned in 2021.

But in the third quarter, crypto trading activity declined from record highs earlier in the year, leading to considerably fewer new funded accounts.

eToro added 1.6 million new clients in the second quarter, an 8 percent increase from the same period last year, but down from Q2’s 2.6 million new registered users. It had 24.8 million total users and 2.14 million funded accounts as of September 30, 2021. Assets under administration (AUA) now stands at $10.6 billion, up 13 percent compared with Q2’s $9.4 billion.

To get the latest news about eToro, visit WikiFX official website.

Also, visit and follow WikiFX Philippines Facebook Page for more updates.

0 notes

Text

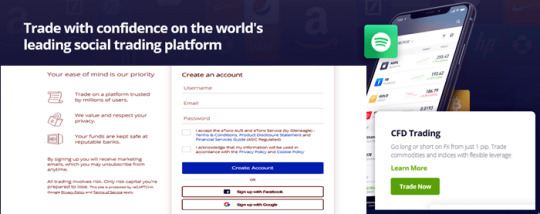

How to Open eToro Trading Account - Easy Guide for Beginners

How to Open eToro Trading Account – Easy Guide for Beginners

This easy guide for beginners will teach you the simplest way to open an eToro trading account. eToro trading account is the gateway to access the eToro trading platform. The process takes only a few minutes to open your trading account. (more…)

View On WordPress

#etoro#etoro fees#etoro joint account#etoro minimum deposit#etoro registration requirements#etoro sign up requirements#how long does it take to open an etoro account#how long does it take to open etoro account#how to open etoro account uae#open etoro account in malaysia#open etoro account philippines#open etoro demo account#open eToro trading account

0 notes

Video

youtube

Etoro Copy Trading Portfolio Update [Dec 2019] | Passive Income Philippines

5 notes

·

View notes

Video

youtube

Etoro review Philippines

1 note

·

View note

Text

APAC Social Trading Market is Anticipated to Record the Rapid Growth and Prominent Players Analysis

"

<a href=https://www.reporthive.com/request_sample/2802442 target=""""_blank"""" rel=""""noopener""""> Get Sample Report<a href=https://www.reporthive.com/checkout?currency=single-user-licence&reportid=2802442 target=""""_blank"""" rel=""""noopener""""> Buy Complete Report<a href=https://www.reporthive.com/request_customization/2802442 target=""""_blank"""" rel=""""noopener""""> Request for Customization

A new market study is released on APAC Social Trading Market 2021 with data Tables for historical and forecast years represented with Chats & Graphs with easy to understand detailed analysis. The report also sheds light on present scenario and upcoming trends and developments that are contributing in the growth of the market. In addition, key market boomers and opportunities driving the market growth are provided that estimates for Global APAC Social Trading Market till 2026. The authors of the APAC Social Trading Market report have piled up a detailed study on crucial market dynamics, including growth drivers, restraints, and opportunities. APAC Social Trading Market report carries out research and analysis of the market for a particular product/service which includes the investigation into customer inclinations. It performs the study of various customer capabilities such as investment attributes and buying potential. This market report involves feedback from the target audience to understand their characteristics, expectations, and requirements. The report provides new and exciting strategies for upcoming products by determining the category and features of products that the target audiences will readily accept. The global APAC Social Trading market research report collects data about the target market such as pricing trends, customer requirements, competitor analysis, and other such details.

>>Get technical analysis | Request a FREE PDF Sample Copy @ https://www.reporthive.com/request_sample/2802442

Research objectives: Post-COVID analysis on market growth and size (growth potential, opportunities, drivers, industry specific challenges and risks). To study and analyze the global APAC Social Trading market size by key regions / countries, product type and application, historical data from 2015 to 2021 and forecast to 2026. The study covers the current APAC Social Trading market size and its growth rates based on 5-year records with a company overview of key players / manufacturers:

Ayondo, LiteForex, EToro, InstaForex, NAGA Trader, Darwinex, Myfxbook, Mirror Trader, Tradeo, ZuluTrade

To understand the structure of APAC Social Trading market by identifying its various subsegments. Focuses on the major players of the global APAC Social Trading Market, to define, describe, and analyze the value, market share, market competitive landscape, SWOT analysis, and development plans in the coming years. To analyze the APAC Social Trading Market with respect to individual growth trends, future prospects, and their contribution to the total market. Analyze competitive developments such as expansions, agreements, new product launches and acquisitions in the market to better understand the pre and post COVID scenario. Reporthive has released an updated research report highlighting the title Global APAC Social Trading Market Research Report 2021, which presents a modern market growth outlook as well as the forecast forecast along with the Investment Rate (ROI) as a whole., with a developing CAGR close to XX% throughout the 2019-2026 period. The file studies the revenue of the APAC Social Trading industry in the global market, especially in the North of the United States, China, Europe, Southeast Asia, Japan and India, with production, consumption, income, import and export in those areas. Market by APAC Social Trading Type: Single Trade, Copy Trade, Mirror Trade Market by APAC Social Trading Application: Individual, Enterprise APAC Social Trading Geographic Market Analysis: The report provides information on the APAC Social Trading market area, which is subdivided into subregions and countries. In addition to the market share in each country and sub-region, this chapter of the report also provides information on profit / growth opportunities and also mentions the share according to the impact of COVID-19 for each region, country, and sub-region. * North America (Mexico, USA, Canada) * Europe (Netherlands, Germany, France, Belgium, UK, Russia, Spain, Switzerland) * Asia Pacific (China, Australia, Japan, Korea, India, Indonesia, Thailand, Philippines, Vietnam) * Middle East and Africa (Turkey, Saudi Arabia, Egypt, United Arab Emirates, South Africa, Israel, Nigeria) * Latin America (Brazil, Chile, Argentina, Colombia, Peru). Reason for purchasing this report: - It offers research and analysis of changing serious situations. - For the improvement of expert choices in organizations, it offers systematic information with essential organizational viewpoints - It helps to understand the important parts of the key elements. - The report explains the major key factors of the market, for example, drivers, limitations, models and openings. - It offers a provincial survey on the global APAC Social Trading market along with the business profiles of some partners. - It offers tremendous information on the introduction of new elements that will impact the advancement of the Global APAC Social Trading

>>> Direct purchase Our report (Edition 2021) Below @ https://www.reporthive.com/checkout?currency=single-user-licence&reportid=2802442

TOC Highlights: Chapter 1. Introduction: The APAC Social Trading research work report covers a concise introduction to the global market. This segment provides assessments of key participants, a review of APAC Social Trading industry, outlook across key areas, financial services, and various difficulties faced by APAC Social Trading Market. This section depends on the Scope of the Study and Report Guidance. Chapter 2. Outstanding Report Scope: This is the second most significant chapter, which covers market segmentation along with a definition of APAC Social Trading. It characterizes the whole scope of the APAC Social Trading report and the various features it is describing. Chapter 3. Market Dynamics and Key Indicators: This chapter incorporates key elements focusing on drivers [Includes Globally Growing APAC Social Trading frequency and Increasing Investments in APAC Social Trading], Key Market Restraints[High Cost of APAC Social Trading], opportunities [Arising Markets in Developing Countries] and introduced in detail the arising trends [Consistent Innovate of New Screening Products] development difficulties, and influence factors shared in this latest report. Chapter 4. Type Segments: This APAC Social Trading market report shows the market development for different kinds of products showcased by the most far-reaching organizations. Chapter 5. Application Segments: The analysts who composed the report have completely assessed the market capability of key applications and perceived future freedoms. Chapter 6. Geographic Analysis: Each provincial market is deliberately examined to understand its current and future development, improvement, and request situations for this market. Chapter 7. Impact of COVID-19 Pandemic on Global APAC Social Trading Market: 7.1 North America: Insight On COVID-19 Impact Study 2021-2026 7.2 Europe: Serves Complete Insight On COVID-19 Impact Study 2021-2026 7.3 Asia-Pacific: Potential Impact of COVID-19 (2021-2026) 7.4 Rest of the World: Impact Assessment of COVID-19 Pandemic Chapter 8. Manufacturing Profiles: The significant players in the APAC Social Trading market are definite in the report based on their market size, market served, products, applications, regional development, and other variables. Chapter 9. Estimating Analysis: This chapter gives price point analysis by region and different forecasts. Chapter 10. North America APAC Social Trading Market Analysis: This chapter includes an appraisal on APAC Social Trading product sales across major countries of the United States and Canada along with a detailed segmental viewpoint across these countries for the forecasted period 2021-2026. Chapter 11. Latin America APAC Social Trading Market Analysis: Significant countries of Brazil, Chile, Peru, Argentina, and Mexico are assessed apropos to the appropriation of APAC Social Trading. Chapter 12. Europe APAC Social Trading Market Analysis: Market Analysis of APAC Social Trading report remembers insights on supply-demand and sales revenue of APAC Social Trading across Germany, France, United Kingdom, Spain, BENELUX, Nordic, and Italy. Chapter 13. Asia Pacific Excluding Japan (APEJ) APAC Social Trading Market Analysis: Countries of Greater China, ASEAN, India, and Australia & New Zealand are assessed, and sales evaluation of APAC Social Trading in these countries is covered. Chapter 14. Middle East and Africa (MEA) APAC Social Trading Market Analysis: This chapter centers around APAC Social Trading market scenario across GCC countries, Israel, South Africa, and Turkey. Chapter 15. Research Methodology The research procedure chapter includes the accompanying primary realities, 15.1 Coverage 15.2 Secondary Research 15.3 Primary Research Chapter 16. Conclusion >> [With unrivaled insights into the APAC Social Trading market, our industry research will help you take your APAC Social Trading business to new heights.] <<

>>>> For more customization, connect with us at @ https://www.reporthive.com/2802442/enquiry_before_purchase

Why Report Hive Research: Report Hive Research delivers strategic market research reports, statistical surveys, industry analysis and forecast data on products and services, markets and companies. Our clientele ranges mix of global business leaders, government organizations, SME’s, individuals and Start-ups, top management consulting firms, universities, etc. Our library of 700,000 + reports targets high growth emerging markets in the USA, Europe Middle East, Africa, Asia Pacific covering industries like IT, Telecom, Semiconductor, Chemical, Healthcare, Pharmaceutical, Energy and Power, Manufacturing, Automotive and Transportation, Food and Beverages, etc. Contact Us: Report Hive Research 500, North Michigan Avenue, Suite 6014, Chicago, IL – 60611, United States Website: https://www.reporthive.com Email: [email protected] Phone: +1 312-604-7084"

0 notes

Link

Alrighty.

i have been consuming a lot of real estate related content. Videos, podcast, blogs, FB groups, you name it!

In the effort to increase my income streams, I have come across this blog and it seemed interesting.

I have never heard of Real Estate Investment Trust before and I would really like to know more.

I do not know where to start though.

Maybe an eToro account would help. haha!

Anyway, I remember chatting with my sister about investments and income streams, she said that she’s looking at 7 income streams. Quite a lot if you ask me. But maybe doable.

Looking at what I have now, I need 5 more. I have a long way to go. But I don’t want to launch it all in 1 go. There must be some organisation in my activities.

I will have to focus on the ones I have now.

Well, maybe add in REITs as a 3rd :)

0 notes

Text

The blockchain/crypto week in quotes

The blockchain/crypto week in quotes

“We had this first wave of massive hype around ICOs in 2017, early 2018, and then a little bit of a pullback. And now in 2019, it feels like people are focused on building… I think the market is going to be quiet for a little bit, while people focus on actually creating things. It feels like a little bit of a Mesopotamia, ‘cradle of civilisation’ moment, where everyone has the ingredients they need, needs to focus in and start to build out those empires, and create what the future is going to look like, and that’s what this year is going to be about.” CoinList CEO Andy Bromberg

“In a single hour of trading yesterday (30th January), XRP managed to erase an entire week’s worth of losses. A jump of 10% seems to have buoyed the entire crypto market and sentiment is once again optimistic. Ripple was in the news yesterday as CEO Brad Garlinghouse and CEO of SWIFT Gottfried Leibbrandt appeared onstage together at the Paris Fintech Forum. The SWIFT CEO announced a partnership with payments provider R3, which Ripple also does business with.

Crypto investors have joined the dots and, rather than rivalry between the two companies, are seeing the development of a larger network, which includes all the major players in the industry and represents the next step in cryptoasset technology. We’ll have to watch and wait to be sure, but this potential collaboration seems to have further buoyed market sentiment.” Mati Greenspan, Senior Market Analyst, eToro

“There are basically three key pillars to providing banking in developing markets. Nobody in Haiti says, “My problem is that I’m unbanked.” Most people in Haiti don’t know what the eff that word means. You go to Mexico, you go to the Philippines, you go to Indonesia—nobody says, “Oh, my God, if only I wasn’t unbanked.” Nobody cares about that, except maybe people with great intentions at NGOs.

What people care about is, “Can I get credit in a pinch? Can I send or receive money at reasonably low cost? And can I invest? If I’m saving my family’s money, even if it’s only $50 a month, can I invest that money, or do I have to leave it under the mattress? And can I invest it in something other than my country’s failing currency?” In Venezuela or Argentina, if you’re older than 40 you’ve probably seen this rodeo 10 times: currencies failing and getting propped up, or failing and starting over. So all three of those models are relevant in developing markets.

Now, this is where crypto starts to get interesting. For two reasons. One is Bitcoin’s ability to serve as hard money. But, and this is a big one, it’s only going to become useful for the average consumer in the short term—the next five years—if you can take that hard money and use it to collateralise other asset classes. Because the average consumer does not have the mental capacity right now to understand what a cryptocurrency means. It would be like explaining TCP/IP to your grandmother so that she can watch Netflix. It’s not going to happen. But if you can collateralise real-world assets using crypto, [without] introducing new third-party custodians, you’re onto something really interesting. Because now you can represent fiat currencies, stocks, bonds, commodities in a way that doesn’t require you to become a bank. That’s interesting. You’ve got a combination of hard money and regulatory arbitrage to solve real consumer problems. That’s what I think it’s going to take to break into developing markets.” Abra CEO Bill Barhydt

Some salty comments here. No one is forcing you to buy any coin. We simply provide a method for people who do. I have a feeling most of the salty comments come from people who wants to buy the coin badly. We will see. https://t.co/VottD2IlrH

— CZ Binance (@cz_binance) January 30, 2019

“I do think that Bitcoin pulled a little bit of demand away from gold last year, in 2017. Interestingly, we just polled 4,000 Bitcoin investors and their number one investment for 2019 is actually gold. So gold lost to Bitcoin and now it’s going the other way.” Jan Van Eck, CEO, Van Eck Associates

Maximalism: The idea that decentralization is extremely important but only one blockchain and only one form of money is acceptable

— Erik Voorhees (@ErikVoorhees) January 28, 2019

“It’s definitely not a case of if, but when crypto ETFs will begin to emerge. As crypto assets gain legitimacy as an asset class of their own, it is imperative that businesses that make money by providing access to different asset classes will cater to crypto assets as well.

For this to happen, two main things are required. Firstly, it’s crucial that the valuation of crypto assets moves from the current, purely speculative approach to a focus on the fundamentals. As well as this, the support of regulatory bodies that recognise crypto/digital assets as a legitimate asset class that they do not deem to be too risky will be essential to getting ETFs approved.

It should be noted that some exchange-traded products do exist at present, for example the Swiss listed ETP. Given the regulatory landscape, it is likely that the ETFs will be available in jurisdictions outside of the USA first. If one has to predict a possible date for a USA listed crypto ETF, 2019 seems too optimistic.” Vaibhav Kadikar, Founder and CEO, CloseCross

I mean, I been calling this P&D shitshow for like 9 months now. It’s a joke. Glad people are finally wising up to it. Will it be the next Bitconneeeeeeeect? Who knows… But I sure as hell wouldn’t recommend anybody goes anywhere near it! https://t.co/jtfbWDwTxn

— Josiah [Not interested in Bank-Coins] Spackman (@dgb_chilling) January 30, 2019

“Blockchain isn’t going to reinvent the global payment system, but it will provide marginal improvements. The most meaningful impact will probably be three to five years away and mostly on trade finance.” JPMorgan’s Chair of Global Research, Joyce Chang

It’s a sad day when Tether is in the number 4 spot… pic.twitter.com/MbVds9Igle

— Ran NeuNer (@cryptomanran) January 29, 2019

“As we motor on into 2019, we have already seen the first piece of communication from the FCA in the form of a consultation paper from their Crypto Asset Task Force, issued last week. This document looks to set out the FCA’s proposed guidance on the existing regulatory perimeter and how crypto assets fall within that. For those who expected this communication to be ground-breaking and definitive, we are a long way from that as we await the final findings in Summer 2019 which is when we expect to see some firm guidance that we can all work to, so in the meantime we will have to make do with the snippets that they choose to publish to the market.

From a GlobalBlock standpoint it is great to see a combined and concerted effort from the government, HMRC and UK regulator to bring some clarity to the market, and we look forward not only to the protections and clear tax implications that it brings to investors, but also the overarching structure and framework presented. This should really assist in bringing the next level of investment from wider sectors to assist in the next phase of market evolution and adoption across both retail and institutions.

From a retail perspective, we cannot emphasise enough the importance of consumer protection in the guidance in line with existing financial services regulations. Despite a significant fall in crypto prices over the last 12 months, we are still experiencing solid interest from the retail part of the market, which we feel will only grow once the confidence is there that protection is available.

The institutional key to success is simple with four main drivers to future growth, the first two being education and security and the second two, and most pertinent being regulation and compliance. Essentially, the compliance environment in crypto, whilst hailed for its anonymity, makes it very difficult to verify identity and risk profiles to be compliant with KYC/AML rules, so any progression here will be welcomed. From a regulatory perspective, the current landscape is nascent and so even if other countries’ governments and financial authorities are being a little slower to react, having some insight and guidance in the UK can only be a good thing, especially given how highly regarded the FCA is.” David Thomas, Director and Co-Founder, GlobalBlock

8 FOR 8 in #Wyoming! The stock certificate token bill just passed the House 57-1, so all 8 bills are thru originating chamber & ready to cross to other chamber next week. Still a ways to go before they become law but we have nice momentum! Thx @JaredSOlsen! @lex_node @ConsenSys pic.twitter.com/b5iPp1hp2S

— Caitlin Long

(@CaitlinLong_) February 1, 2019

Source link http://bit.ly/2WMKESe

0 notes

Text

The blockchain/crypto week in quotes

The blockchain/crypto week in quotes

“We had this first wave of massive hype around ICOs in 2017, early 2018, and then a little bit of a pullback. And now in 2019, it feels like people are focused on building… I think the market is going to be quiet for a little bit, while people focus on actually creating things. It feels like a little bit of a Mesopotamia, ‘cradle of civilisation’ moment, where everyone has the ingredients they need, needs to focus in and start to build out those empires, and create what the future is going to look like, and that’s what this year is going to be about.” CoinList CEO Andy Bromberg

“In a single hour of trading yesterday (30th January), XRP managed to erase an entire week’s worth of losses. A jump of 10% seems to have buoyed the entire crypto market and sentiment is once again optimistic. Ripple was in the news yesterday as CEO Brad Garlinghouse and CEO of SWIFT Gottfried Leibbrandt appeared onstage together at the Paris Fintech Forum. The SWIFT CEO announced a partnership with payments provider R3, which Ripple also does business with.

Crypto investors have joined the dots and, rather than rivalry between the two companies, are seeing the development of a larger network, which includes all the major players in the industry and represents the next step in cryptoasset technology. We’ll have to watch and wait to be sure, but this potential collaboration seems to have further buoyed market sentiment.” Mati Greenspan, Senior Market Analyst, eToro

“There are basically three key pillars to providing banking in developing markets. Nobody in Haiti says, “My problem is that I’m unbanked.” Most people in Haiti don’t know what the eff that word means. You go to Mexico, you go to the Philippines, you go to Indonesia—nobody says, “Oh, my God, if only I wasn’t unbanked.” Nobody cares about that, except maybe people with great intentions at NGOs.

What people care about is, “Can I get credit in a pinch? Can I send or receive money at reasonably low cost? And can I invest? If I’m saving my family’s money, even if it’s only $50 a month, can I invest that money, or do I have to leave it under the mattress? And can I invest it in something other than my country’s failing currency?” In Venezuela or Argentina, if you’re older than 40 you’ve probably seen this rodeo 10 times: currencies failing and getting propped up, or failing and starting over. So all three of those models are relevant in developing markets.

Now, this is where crypto starts to get interesting. For two reasons. One is Bitcoin’s ability to serve as hard money. But, and this is a big one, it’s only going to become useful for the average consumer in the short term—the next five years—if you can take that hard money and use it to collateralise other asset classes. Because the average consumer does not have the mental capacity right now to understand what a cryptocurrency means. It would be like explaining TCP/IP to your grandmother so that she can watch Netflix. It’s not going to happen. But if you can collateralise real-world assets using crypto, [without] introducing new third-party custodians, you’re onto something really interesting. Because now you can represent fiat currencies, stocks, bonds, commodities in a way that doesn’t require you to become a bank. That’s interesting. You’ve got a combination of hard money and regulatory arbitrage to solve real consumer problems. That’s what I think it’s going to take to break into developing markets.” Abra CEO Bill Barhydt

Some salty comments here. No one is forcing you to buy any coin. We simply provide a method for people who do. I have a feeling most of the salty comments come from people who wants to buy the coin badly. We will see. https://t.co/VottD2IlrH

— CZ Binance (@cz_binance) January 30, 2019

“I do think that Bitcoin pulled a little bit of demand away from gold last year, in 2017. Interestingly, we just polled 4,000 Bitcoin investors and their number one investment for 2019 is actually gold. So gold lost to Bitcoin and now it’s going the other way.” Jan Van Eck, CEO, Van Eck Associates

Maximalism: The idea that decentralization is extremely important but only one blockchain and only one form of money is acceptable

— Erik Voorhees (@ErikVoorhees) January 28, 2019

“It’s definitely not a case of if, but when crypto ETFs will begin to emerge. As crypto assets gain legitimacy as an asset class of their own, it is imperative that businesses that make money by providing access to different asset classes will cater to crypto assets as well.

For this to happen, two main things are required. Firstly, it’s crucial that the valuation of crypto assets moves from the current, purely speculative approach to a focus on the fundamentals. As well as this, the support of regulatory bodies that recognise crypto/digital assets as a legitimate asset class that they do not deem to be too risky will be essential to getting ETFs approved.

It should be noted that some exchange-traded products do exist at present, for example the Swiss listed ETP. Given the regulatory landscape, it is likely that the ETFs will be available in jurisdictions outside of the USA first. If one has to predict a possible date for a USA listed crypto ETF, 2019 seems too optimistic.” Vaibhav Kadikar, Founder and CEO, CloseCross

I mean, I been calling this P&D shitshow for like 9 months now. It’s a joke. Glad people are finally wising up to it. Will it be the next Bitconneeeeeeeect? Who knows… But I sure as hell wouldn’t recommend anybody goes anywhere near it! https://t.co/jtfbWDwTxn

— Josiah [Not interested in Bank-Coins] Spackman (@dgb_chilling) January 30, 2019

“Blockchain isn’t going to reinvent the global payment system, but it will provide marginal improvements. The most meaningful impact will probably be three to five years away and mostly on trade finance.” JPMorgan’s Chair of Global Research, Joyce Chang

It’s a sad day when Tether is in the number 4 spot… pic.twitter.com/MbVds9Igle

— Ran NeuNer (@cryptomanran) January 29, 2019

“As we motor on into 2019, we have already seen the first piece of communication from the FCA in the form of a consultation paper from their Crypto Asset Task Force, issued last week. This document looks to set out the FCA’s proposed guidance on the existing regulatory perimeter and how crypto assets fall within that. For those who expected this communication to be ground-breaking and definitive, we are a long way from that as we await the final findings in Summer 2019 which is when we expect to see some firm guidance that we can all work to, so in the meantime we will have to make do with the snippets that they choose to publish to the market.

From a GlobalBlock standpoint it is great to see a combined and concerted effort from the government, HMRC and UK regulator to bring some clarity to the market, and we look forward not only to the protections and clear tax implications that it brings to investors, but also the overarching structure and framework presented. This should really assist in bringing the next level of investment from wider sectors to assist in the next phase of market evolution and adoption across both retail and institutions.

From a retail perspective, we cannot emphasise enough the importance of consumer protection in the guidance in line with existing financial services regulations. Despite a significant fall in crypto prices over the last 12 months, we are still experiencing solid interest from the retail part of the market, which we feel will only grow once the confidence is there that protection is available.

The institutional key to success is simple with four main drivers to future growth, the first two being education and security and the second two, and most pertinent being regulation and compliance. Essentially, the compliance environment in crypto, whilst hailed for its anonymity, makes it very difficult to verify identity and risk profiles to be compliant with KYC/AML rules, so any progression here will be welcomed. From a regulatory perspective, the current landscape is nascent and so even if other countries’ governments and financial authorities are being a little slower to react, having some insight and guidance in the UK can only be a good thing, especially given how highly regarded the FCA is.” David Thomas, Director and Co-Founder, GlobalBlock

8 FOR 8 in #Wyoming! The stock certificate token bill just passed the House 57-1, so all 8 bills are thru originating chamber & ready to cross to other chamber next week. Still a ways to go before they become law but we have nice momentum! Thx @JaredSOlsen! @lex_node @ConsenSys pic.twitter.com/b5iPp1hp2S

— Caitlin Long

(@CaitlinLong_) February 1, 2019

Source link http://bit.ly/2WMKESe

0 notes

Text

The blockchain/crypto week in quotes

The blockchain/crypto week in quotes

“We had this first wave of massive hype around ICOs in 2017, early 2018, and then a little bit of a pullback. And now in 2019, it feels like people are focused on building… I think the market is going to be quiet for a little bit, while people focus on actually creating things. It feels like a little bit of a Mesopotamia, ‘cradle of civilisation’ moment, where everyone has the ingredients they need, needs to focus in and start to build out those empires, and create what the future is going to look like, and that’s what this year is going to be about.” CoinList CEO Andy Bromberg

“In a single hour of trading yesterday (30th January), XRP managed to erase an entire week’s worth of losses. A jump of 10% seems to have buoyed the entire crypto market and sentiment is once again optimistic. Ripple was in the news yesterday as CEO Brad Garlinghouse and CEO of SWIFT Gottfried Leibbrandt appeared onstage together at the Paris Fintech Forum. The SWIFT CEO announced a partnership with payments provider R3, which Ripple also does business with.

Crypto investors have joined the dots and, rather than rivalry between the two companies, are seeing the development of a larger network, which includes all the major players in the industry and represents the next step in cryptoasset technology. We’ll have to watch and wait to be sure, but this potential collaboration seems to have further buoyed market sentiment.” Mati Greenspan, Senior Market Analyst, eToro

“There are basically three key pillars to providing banking in developing markets. Nobody in Haiti says, “My problem is that I’m unbanked.” Most people in Haiti don’t know what the eff that word means. You go to Mexico, you go to the Philippines, you go to Indonesia—nobody says, “Oh, my God, if only I wasn’t unbanked.” Nobody cares about that, except maybe people with great intentions at NGOs.

What people care about is, “Can I get credit in a pinch? Can I send or receive money at reasonably low cost? And can I invest? If I’m saving my family’s money, even if it’s only $50 a month, can I invest that money, or do I have to leave it under the mattress? And can I invest it in something other than my country’s failing currency?” In Venezuela or Argentina, if you’re older than 40 you’ve probably seen this rodeo 10 times: currencies failing and getting propped up, or failing and starting over. So all three of those models are relevant in developing markets.

Now, this is where crypto starts to get interesting. For two reasons. One is Bitcoin’s ability to serve as hard money. But, and this is a big one, it’s only going to become useful for the average consumer in the short term—the next five years—if you can take that hard money and use it to collateralise other asset classes. Because the average consumer does not have the mental capacity right now to understand what a cryptocurrency means. It would be like explaining TCP/IP to your grandmother so that she can watch Netflix. It’s not going to happen. But if you can collateralise real-world assets using crypto, [without] introducing new third-party custodians, you’re onto something really interesting. Because now you can represent fiat currencies, stocks, bonds, commodities in a way that doesn’t require you to become a bank. That’s interesting. You’ve got a combination of hard money and regulatory arbitrage to solve real consumer problems. That’s what I think it’s going to take to break into developing markets.” Abra CEO Bill Barhydt

Some salty comments here. No one is forcing you to buy any coin. We simply provide a method for people who do. I have a feeling most of the salty comments come from people who wants to buy the coin badly. We will see. https://t.co/VottD2IlrH

— CZ Binance (@cz_binance) January 30, 2019

“I do think that Bitcoin pulled a little bit of demand away from gold last year, in 2017. Interestingly, we just polled 4,000 Bitcoin investors and their number one investment for 2019 is actually gold. So gold lost to Bitcoin and now it’s going the other way.” Jan Van Eck, CEO, Van Eck Associates

Maximalism: The idea that decentralization is extremely important but only one blockchain and only one form of money is acceptable

— Erik Voorhees (@ErikVoorhees) January 28, 2019

“It’s definitely not a case of if, but when crypto ETFs will begin to emerge. As crypto assets gain legitimacy as an asset class of their own, it is imperative that businesses that make money by providing access to different asset classes will cater to crypto assets as well.

For this to happen, two main things are required. Firstly, it’s crucial that the valuation of crypto assets moves from the current, purely speculative approach to a focus on the fundamentals. As well as this, the support of regulatory bodies that recognise crypto/digital assets as a legitimate asset class that they do not deem to be too risky will be essential to getting ETFs approved.

It should be noted that some exchange-traded products do exist at present, for example the Swiss listed ETP. Given the regulatory landscape, it is likely that the ETFs will be available in jurisdictions outside of the USA first. If one has to predict a possible date for a USA listed crypto ETF, 2019 seems too optimistic.” Vaibhav Kadikar, Founder and CEO, CloseCross

I mean, I been calling this P&D shitshow for like 9 months now. It’s a joke. Glad people are finally wising up to it. Will it be the next Bitconneeeeeeeect? Who knows… But I sure as hell wouldn’t recommend anybody goes anywhere near it! https://t.co/jtfbWDwTxn

— Josiah [Not interested in Bank-Coins] Spackman (@dgb_chilling) January 30, 2019

“Blockchain isn’t going to reinvent the global payment system, but it will provide marginal improvements. The most meaningful impact will probably be three to five years away and mostly on trade finance.” JPMorgan’s Chair of Global Research, Joyce Chang

It’s a sad day when Tether is in the number 4 spot… pic.twitter.com/MbVds9Igle

— Ran NeuNer (@cryptomanran) January 29, 2019

“As we motor on into 2019, we have already seen the first piece of communication from the FCA in the form of a consultation paper from their Crypto Asset Task Force, issued last week. This document looks to set out the FCA’s proposed guidance on the existing regulatory perimeter and how crypto assets fall within that. For those who expected this communication to be ground-breaking and definitive, we are a long way from that as we await the final findings in Summer 2019 which is when we expect to see some firm guidance that we can all work to, so in the meantime we will have to make do with the snippets that they choose to publish to the market.

From a GlobalBlock standpoint it is great to see a combined and concerted effort from the government, HMRC and UK regulator to bring some clarity to the market, and we look forward not only to the protections and clear tax implications that it brings to investors, but also the overarching structure and framework presented. This should really assist in bringing the next level of investment from wider sectors to assist in the next phase of market evolution and adoption across both retail and institutions.

From a retail perspective, we cannot emphasise enough the importance of consumer protection in the guidance in line with existing financial services regulations. Despite a significant fall in crypto prices over the last 12 months, we are still experiencing solid interest from the retail part of the market, which we feel will only grow once the confidence is there that protection is available.

The institutional key to success is simple with four main drivers to future growth, the first two being education and security and the second two, and most pertinent being regulation and compliance. Essentially, the compliance environment in crypto, whilst hailed for its anonymity, makes it very difficult to verify identity and risk profiles to be compliant with KYC/AML rules, so any progression here will be welcomed. From a regulatory perspective, the current landscape is nascent and so even if other countries’ governments and financial authorities are being a little slower to react, having some insight and guidance in the UK can only be a good thing, especially given how highly regarded the FCA is.” David Thomas, Director and Co-Founder, GlobalBlock

8 FOR 8 in #Wyoming! The stock certificate token bill just passed the House 57-1, so all 8 bills are thru originating chamber & ready to cross to other chamber next week. Still a ways to go before they become law but we have nice momentum! Thx @JaredSOlsen! @lex_node @ConsenSys pic.twitter.com/b5iPp1hp2S

— Caitlin Long

(@CaitlinLong_) February 1, 2019

Source link http://bit.ly/2WMKESe

0 notes

Text

The blockchain/crypto week in quotes

The blockchain/crypto week in quotes

“We had this first wave of massive hype around ICOs in 2017, early 2018, and then a little bit of a pullback. And now in 2019, it feels like people are focused on building… I think the market is going to be quiet for a little bit, while people focus on actually creating things. It feels like a little bit of a Mesopotamia, ‘cradle of civilisation’ moment, where everyone has the ingredients they need, needs to focus in and start to build out those empires, and create what the future is going to look like, and that’s what this year is going to be about.” CoinList CEO Andy Bromberg

“In a single hour of trading yesterday (30th January), XRP managed to erase an entire week’s worth of losses. A jump of 10% seems to have buoyed the entire crypto market and sentiment is once again optimistic. Ripple was in the news yesterday as CEO Brad Garlinghouse and CEO of SWIFT Gottfried Leibbrandt appeared onstage together at the Paris Fintech Forum. The SWIFT CEO announced a partnership with payments provider R3, which Ripple also does business with.

Crypto investors have joined the dots and, rather than rivalry between the two companies, are seeing the development of a larger network, which includes all the major players in the industry and represents the next step in cryptoasset technology. We’ll have to watch and wait to be sure, but this potential collaboration seems to have further buoyed market sentiment.” Mati Greenspan, Senior Market Analyst, eToro

“There are basically three key pillars to providing banking in developing markets. Nobody in Haiti says, “My problem is that I’m unbanked.” Most people in Haiti don’t know what the eff that word means. You go to Mexico, you go to the Philippines, you go to Indonesia—nobody says, “Oh, my God, if only I wasn’t unbanked.” Nobody cares about that, except maybe people with great intentions at NGOs.

What people care about is, “Can I get credit in a pinch? Can I send or receive money at reasonably low cost? And can I invest? If I’m saving my family’s money, even if it’s only $50 a month, can I invest that money, or do I have to leave it under the mattress? And can I invest it in something other than my country’s failing currency?” In Venezuela or Argentina, if you’re older than 40 you’ve probably seen this rodeo 10 times: currencies failing and getting propped up, or failing and starting over. So all three of those models are relevant in developing markets.

Now, this is where crypto starts to get interesting. For two reasons. One is Bitcoin’s ability to serve as hard money. But, and this is a big one, it’s only going to become useful for the average consumer in the short term—the next five years—if you can take that hard money and use it to collateralise other asset classes. Because the average consumer does not have the mental capacity right now to understand what a cryptocurrency means. It would be like explaining TCP/IP to your grandmother so that she can watch Netflix. It’s not going to happen. But if you can collateralise real-world assets using crypto, [without] introducing new third-party custodians, you’re onto something really interesting. Because now you can represent fiat currencies, stocks, bonds, commodities in a way that doesn’t require you to become a bank. That’s interesting. You’ve got a combination of hard money and regulatory arbitrage to solve real consumer problems. That’s what I think it’s going to take to break into developing markets.” Abra CEO Bill Barhydt

Some salty comments here. No one is forcing you to buy any coin. We simply provide a method for people who do. I have a feeling most of the salty comments come from people who wants to buy the coin badly. We will see. https://t.co/VottD2IlrH

— CZ Binance (@cz_binance) January 30, 2019

“I do think that Bitcoin pulled a little bit of demand away from gold last year, in 2017. Interestingly, we just polled 4,000 Bitcoin investors and their number one investment for 2019 is actually gold. So gold lost to Bitcoin and now it’s going the other way.” Jan Van Eck, CEO, Van Eck Associates

Maximalism: The idea that decentralization is extremely important but only one blockchain and only one form of money is acceptable

— Erik Voorhees (@ErikVoorhees) January 28, 2019

“It’s definitely not a case of if, but when crypto ETFs will begin to emerge. As crypto assets gain legitimacy as an asset class of their own, it is imperative that businesses that make money by providing access to different asset classes will cater to crypto assets as well.

For this to happen, two main things are required. Firstly, it’s crucial that the valuation of crypto assets moves from the current, purely speculative approach to a focus on the fundamentals. As well as this, the support of regulatory bodies that recognise crypto/digital assets as a legitimate asset class that they do not deem to be too risky will be essential to getting ETFs approved.

It should be noted that some exchange-traded products do exist at present, for example the Swiss listed ETP. Given the regulatory landscape, it is likely that the ETFs will be available in jurisdictions outside of the USA first. If one has to predict a possible date for a USA listed crypto ETF, 2019 seems too optimistic.” Vaibhav Kadikar, Founder and CEO, CloseCross

I mean, I been calling this P&D shitshow for like 9 months now. It’s a joke. Glad people are finally wising up to it. Will it be the next Bitconneeeeeeeect? Who knows… But I sure as hell wouldn’t recommend anybody goes anywhere near it! https://t.co/jtfbWDwTxn

— Josiah [Not interested in Bank-Coins] Spackman (@dgb_chilling) January 30, 2019

“Blockchain isn’t going to reinvent the global payment system, but it will provide marginal improvements. The most meaningful impact will probably be three to five years away and mostly on trade finance.” JPMorgan’s Chair of Global Research, Joyce Chang

It’s a sad day when Tether is in the number 4 spot… pic.twitter.com/MbVds9Igle

— Ran NeuNer (@cryptomanran) January 29, 2019

“As we motor on into 2019, we have already seen the first piece of communication from the FCA in the form of a consultation paper from their Crypto Asset Task Force, issued last week. This document looks to set out the FCA’s proposed guidance on the existing regulatory perimeter and how crypto assets fall within that. For those who expected this communication to be ground-breaking and definitive, we are a long way from that as we await the final findings in Summer 2019 which is when we expect to see some firm guidance that we can all work to, so in the meantime we will have to make do with the snippets that they choose to publish to the market.

From a GlobalBlock standpoint it is great to see a combined and concerted effort from the government, HMRC and UK regulator to bring some clarity to the market, and we look forward not only to the protections and clear tax implications that it brings to investors, but also the overarching structure and framework presented. This should really assist in bringing the next level of investment from wider sectors to assist in the next phase of market evolution and adoption across both retail and institutions.

From a retail perspective, we cannot emphasise enough the importance of consumer protection in the guidance in line with existing financial services regulations. Despite a significant fall in crypto prices over the last 12 months, we are still experiencing solid interest from the retail part of the market, which we feel will only grow once the confidence is there that protection is available.

The institutional key to success is simple with four main drivers to future growth, the first two being education and security and the second two, and most pertinent being regulation and compliance. Essentially, the compliance environment in crypto, whilst hailed for its anonymity, makes it very difficult to verify identity and risk profiles to be compliant with KYC/AML rules, so any progression here will be welcomed. From a regulatory perspective, the current landscape is nascent and so even if other countries’ governments and financial authorities are being a little slower to react, having some insight and guidance in the UK can only be a good thing, especially given how highly regarded the FCA is.” David Thomas, Director and Co-Founder, GlobalBlock

8 FOR 8 in #Wyoming! The stock certificate token bill just passed the House 57-1, so all 8 bills are thru originating chamber & ready to cross to other chamber next week. Still a ways to go before they become law but we have nice momentum! Thx @JaredSOlsen! @lex_node @ConsenSys pic.twitter.com/b5iPp1hp2S

— Caitlin Long

(@CaitlinLong_) February 1, 2019

Source link http://bit.ly/2WMKESe

0 notes

Text

The blockchain/crypto week in quotes

The blockchain/crypto week in quotes

“We had this first wave of massive hype around ICOs in 2017, early 2018, and then a little bit of a pullback. And now in 2019, it feels like people are focused on building… I think the market is going to be quiet for a little bit, while people focus on actually creating things. It feels like a little bit of a Mesopotamia, ‘cradle of civilisation’ moment, where everyone has the ingredients they need, needs to focus in and start to build out those empires, and create what the future is going to look like, and that’s what this year is going to be about.” CoinList CEO Andy Bromberg

“In a single hour of trading yesterday (30th January), XRP managed to erase an entire week’s worth of losses. A jump of 10% seems to have buoyed the entire crypto market and sentiment is once again optimistic. Ripple was in the news yesterday as CEO Brad Garlinghouse and CEO of SWIFT Gottfried Leibbrandt appeared onstage together at the Paris Fintech Forum. The SWIFT CEO announced a partnership with payments provider R3, which Ripple also does business with.

Crypto investors have joined the dots and, rather than rivalry between the two companies, are seeing the development of a larger network, which includes all the major players in the industry and represents the next step in cryptoasset technology. We’ll have to watch and wait to be sure, but this potential collaboration seems to have further buoyed market sentiment.” Mati Greenspan, Senior Market Analyst, eToro

“There are basically three key pillars to providing banking in developing markets. Nobody in Haiti says, “My problem is that I’m unbanked.” Most people in Haiti don’t know what the eff that word means. You go to Mexico, you go to the Philippines, you go to Indonesia—nobody says, “Oh, my God, if only I wasn’t unbanked.” Nobody cares about that, except maybe people with great intentions at NGOs.

What people care about is, “Can I get credit in a pinch? Can I send or receive money at reasonably low cost? And can I invest? If I’m saving my family’s money, even if it’s only $50 a month, can I invest that money, or do I have to leave it under the mattress? And can I invest it in something other than my country’s failing currency?” In Venezuela or Argentina, if you’re older than 40 you’ve probably seen this rodeo 10 times: currencies failing and getting propped up, or failing and starting over. So all three of those models are relevant in developing markets.

Now, this is where crypto starts to get interesting. For two reasons. One is Bitcoin’s ability to serve as hard money. But, and this is a big one, it’s only going to become useful for the average consumer in the short term—the next five years—if you can take that hard money and use it to collateralise other asset classes. Because the average consumer does not have the mental capacity right now to understand what a cryptocurrency means. It would be like explaining TCP/IP to your grandmother so that she can watch Netflix. It’s not going to happen. But if you can collateralise real-world assets using crypto, [without] introducing new third-party custodians, you’re onto something really interesting. Because now you can represent fiat currencies, stocks, bonds, commodities in a way that doesn’t require you to become a bank. That’s interesting. You’ve got a combination of hard money and regulatory arbitrage to solve real consumer problems. That’s what I think it’s going to take to break into developing markets.” Abra CEO Bill Barhydt

Some salty comments here. No one is forcing you to buy any coin. We simply provide a method for people who do. I have a feeling most of the salty comments come from people who wants to buy the coin badly. We will see. https://t.co/VottD2IlrH

— CZ Binance (@cz_binance) January 30, 2019

“I do think that Bitcoin pulled a little bit of demand away from gold last year, in 2017. Interestingly, we just polled 4,000 Bitcoin investors and their number one investment for 2019 is actually gold. So gold lost to Bitcoin and now it’s going the other way.” Jan Van Eck, CEO, Van Eck Associates

Maximalism: The idea that decentralization is extremely important but only one blockchain and only one form of money is acceptable

— Erik Voorhees (@ErikVoorhees) January 28, 2019

“It’s definitely not a case of if, but when crypto ETFs will begin to emerge. As crypto assets gain legitimacy as an asset class of their own, it is imperative that businesses that make money by providing access to different asset classes will cater to crypto assets as well.

For this to happen, two main things are required. Firstly, it’s crucial that the valuation of crypto assets moves from the current, purely speculative approach to a focus on the fundamentals. As well as this, the support of regulatory bodies that recognise crypto/digital assets as a legitimate asset class that they do not deem to be too risky will be essential to getting ETFs approved.

It should be noted that some exchange-traded products do exist at present, for example the Swiss listed ETP. Given the regulatory landscape, it is likely that the ETFs will be available in jurisdictions outside of the USA first. If one has to predict a possible date for a USA listed crypto ETF, 2019 seems too optimistic.” Vaibhav Kadikar, Founder and CEO, CloseCross

I mean, I been calling this P&D shitshow for like 9 months now. It’s a joke. Glad people are finally wising up to it. Will it be the next Bitconneeeeeeeect? Who knows… But I sure as hell wouldn’t recommend anybody goes anywhere near it! https://t.co/jtfbWDwTxn

— Josiah [Not interested in Bank-Coins] Spackman (@dgb_chilling) January 30, 2019

“Blockchain isn’t going to reinvent the global payment system, but it will provide marginal improvements. The most meaningful impact will probably be three to five years away and mostly on trade finance.” JPMorgan’s Chair of Global Research, Joyce Chang

It’s a sad day when Tether is in the number 4 spot… pic.twitter.com/MbVds9Igle

— Ran NeuNer (@cryptomanran) January 29, 2019

“As we motor on into 2019, we have already seen the first piece of communication from the FCA in the form of a consultation paper from their Crypto Asset Task Force, issued last week. This document looks to set out the FCA’s proposed guidance on the existing regulatory perimeter and how crypto assets fall within that. For those who expected this communication to be ground-breaking and definitive, we are a long way from that as we await the final findings in Summer 2019 which is when we expect to see some firm guidance that we can all work to, so in the meantime we will have to make do with the snippets that they choose to publish to the market.

From a GlobalBlock standpoint it is great to see a combined and concerted effort from the government, HMRC and UK regulator to bring some clarity to the market, and we look forward not only to the protections and clear tax implications that it brings to investors, but also the overarching structure and framework presented. This should really assist in bringing the next level of investment from wider sectors to assist in the next phase of market evolution and adoption across both retail and institutions.

From a retail perspective, we cannot emphasise enough the importance of consumer protection in the guidance in line with existing financial services regulations. Despite a significant fall in crypto prices over the last 12 months, we are still experiencing solid interest from the retail part of the market, which we feel will only grow once the confidence is there that protection is available.

The institutional key to success is simple with four main drivers to future growth, the first two being education and security and the second two, and most pertinent being regulation and compliance. Essentially, the compliance environment in crypto, whilst hailed for its anonymity, makes it very difficult to verify identity and risk profiles to be compliant with KYC/AML rules, so any progression here will be welcomed. From a regulatory perspective, the current landscape is nascent and so even if other countries’ governments and financial authorities are being a little slower to react, having some insight and guidance in the UK can only be a good thing, especially given how highly regarded the FCA is.” David Thomas, Director and Co-Founder, GlobalBlock

8 FOR 8 in #Wyoming! The stock certificate token bill just passed the House 57-1, so all 8 bills are thru originating chamber & ready to cross to other chamber next week. Still a ways to go before they become law but we have nice momentum! Thx @JaredSOlsen! @lex_node @ConsenSys pic.twitter.com/b5iPp1hp2S

— Caitlin Long

(@CaitlinLong_) February 1, 2019

Source link http://bit.ly/2WMKESe

0 notes

Text

The blockchain/crypto week in quotes

The blockchain/crypto week in quotes

“We had this first wave of massive hype around ICOs in 2017, early 2018, and then a little bit of a pullback. And now in 2019, it feels like people are focused on building… I think the market is going to be quiet for a little bit, while people focus on actually creating things. It feels like a little bit of a Mesopotamia, ‘cradle of civilisation’ moment, where everyone has the ingredients they need, needs to focus in and start to build out those empires, and create what the future is going to look like, and that’s what this year is going to be about.” CoinList CEO Andy Bromberg

“In a single hour of trading yesterday (30th January), XRP managed to erase an entire week’s worth of losses. A jump of 10% seems to have buoyed the entire crypto market and sentiment is once again optimistic. Ripple was in the news yesterday as CEO Brad Garlinghouse and CEO of SWIFT Gottfried Leibbrandt appeared onstage together at the Paris Fintech Forum. The SWIFT CEO announced a partnership with payments provider R3, which Ripple also does business with.

Crypto investors have joined the dots and, rather than rivalry between the two companies, are seeing the development of a larger network, which includes all the major players in the industry and represents the next step in cryptoasset technology. We’ll have to watch and wait to be sure, but this potential collaboration seems to have further buoyed market sentiment.” Mati Greenspan, Senior Market Analyst, eToro

“There are basically three key pillars to providing banking in developing markets. Nobody in Haiti says, “My problem is that I’m unbanked.” Most people in Haiti don’t know what the eff that word means. You go to Mexico, you go to the Philippines, you go to Indonesia—nobody says, “Oh, my God, if only I wasn’t unbanked.” Nobody cares about that, except maybe people with great intentions at NGOs.

What people care about is, “Can I get credit in a pinch? Can I send or receive money at reasonably low cost? And can I invest? If I’m saving my family’s money, even if it’s only $50 a month, can I invest that money, or do I have to leave it under the mattress? And can I invest it in something other than my country’s failing currency?” In Venezuela or Argentina, if you’re older than 40 you’ve probably seen this rodeo 10 times: currencies failing and getting propped up, or failing and starting over. So all three of those models are relevant in developing markets.

Now, this is where crypto starts to get interesting. For two reasons. One is Bitcoin’s ability to serve as hard money. But, and this is a big one, it’s only going to become useful for the average consumer in the short term—the next five years—if you can take that hard money and use it to collateralise other asset classes. Because the average consumer does not have the mental capacity right now to understand what a cryptocurrency means. It would be like explaining TCP/IP to your grandmother so that she can watch Netflix. It’s not going to happen. But if you can collateralise real-world assets using crypto, [without] introducing new third-party custodians, you’re onto something really interesting. Because now you can represent fiat currencies, stocks, bonds, commodities in a way that doesn’t require you to become a bank. That’s interesting. You’ve got a combination of hard money and regulatory arbitrage to solve real consumer problems. That’s what I think it’s going to take to break into developing markets.” Abra CEO Bill Barhydt

Some salty comments here. No one is forcing you to buy any coin. We simply provide a method for people who do. I have a feeling most of the salty comments come from people who wants to buy the coin badly. We will see. https://t.co/VottD2IlrH

— CZ Binance (@cz_binance) January 30, 2019

“I do think that Bitcoin pulled a little bit of demand away from gold last year, in 2017. Interestingly, we just polled 4,000 Bitcoin investors and their number one investment for 2019 is actually gold. So gold lost to Bitcoin and now it’s going the other way.” Jan Van Eck, CEO, Van Eck Associates

Maximalism: The idea that decentralization is extremely important but only one blockchain and only one form of money is acceptable

— Erik Voorhees (@ErikVoorhees) January 28, 2019

“It’s definitely not a case of if, but when crypto ETFs will begin to emerge. As crypto assets gain legitimacy as an asset class of their own, it is imperative that businesses that make money by providing access to different asset classes will cater to crypto assets as well.

For this to happen, two main things are required. Firstly, it’s crucial that the valuation of crypto assets moves from the current, purely speculative approach to a focus on the fundamentals. As well as this, the support of regulatory bodies that recognise crypto/digital assets as a legitimate asset class that they do not deem to be too risky will be essential to getting ETFs approved.

It should be noted that some exchange-traded products do exist at present, for example the Swiss listed ETP. Given the regulatory landscape, it is likely that the ETFs will be available in jurisdictions outside of the USA first. If one has to predict a possible date for a USA listed crypto ETF, 2019 seems too optimistic.” Vaibhav Kadikar, Founder and CEO, CloseCross

I mean, I been calling this P&D shitshow for like 9 months now. It’s a joke. Glad people are finally wising up to it. Will it be the next Bitconneeeeeeeect? Who knows… But I sure as hell wouldn’t recommend anybody goes anywhere near it! https://t.co/jtfbWDwTxn

— Josiah [Not interested in Bank-Coins] Spackman (@dgb_chilling) January 30, 2019

“Blockchain isn’t going to reinvent the global payment system, but it will provide marginal improvements. The most meaningful impact will probably be three to five years away and mostly on trade finance.” JPMorgan’s Chair of Global Research, Joyce Chang

It’s a sad day when Tether is in the number 4 spot… pic.twitter.com/MbVds9Igle

— Ran NeuNer (@cryptomanran) January 29, 2019

“As we motor on into 2019, we have already seen the first piece of communication from the FCA in the form of a consultation paper from their Crypto Asset Task Force, issued last week. This document looks to set out the FCA’s proposed guidance on the existing regulatory perimeter and how crypto assets fall within that. For those who expected this communication to be ground-breaking and definitive, we are a long way from that as we await the final findings in Summer 2019 which is when we expect to see some firm guidance that we can all work to, so in the meantime we will have to make do with the snippets that they choose to publish to the market.

From a GlobalBlock standpoint it is great to see a combined and concerted effort from the government, HMRC and UK regulator to bring some clarity to the market, and we look forward not only to the protections and clear tax implications that it brings to investors, but also the overarching structure and framework presented. This should really assist in bringing the next level of investment from wider sectors to assist in the next phase of market evolution and adoption across both retail and institutions.

From a retail perspective, we cannot emphasise enough the importance of consumer protection in the guidance in line with existing financial services regulations. Despite a significant fall in crypto prices over the last 12 months, we are still experiencing solid interest from the retail part of the market, which we feel will only grow once the confidence is there that protection is available.

The institutional key to success is simple with four main drivers to future growth, the first two being education and security and the second two, and most pertinent being regulation and compliance. Essentially, the compliance environment in crypto, whilst hailed for its anonymity, makes it very difficult to verify identity and risk profiles to be compliant with KYC/AML rules, so any progression here will be welcomed. From a regulatory perspective, the current landscape is nascent and so even if other countries’ governments and financial authorities are being a little slower to react, having some insight and guidance in the UK can only be a good thing, especially given how highly regarded the FCA is.” David Thomas, Director and Co-Founder, GlobalBlock

8 FOR 8 in #Wyoming! The stock certificate token bill just passed the House 57-1, so all 8 bills are thru originating chamber & ready to cross to other chamber next week. Still a ways to go before they become law but we have nice momentum! Thx @JaredSOlsen! @lex_node @ConsenSys pic.twitter.com/b5iPp1hp2S

— Caitlin Long

(@CaitlinLong_) February 1, 2019

Source link http://bit.ly/2WMKESe

0 notes

Video

youtube

eToro Weekly Portfolio Update Dec 9 to 13 2019 | Passive Income Philippines

2 notes

·

View notes