#ethereum mining device

Explore tagged Tumblr posts

Text

Osprey Hotspot G1 (US, Europe, China)

Osprey Hotspot G1 is for PoC Helium network, mining HNT. It works with the Helium LongFi architecture, which integrates the leading wireless LoRaWAN protocol with the Helium Blockchain technology. All Osprey Hotspot G1 are compatible with LoRaWAN.

LongFi connects the LoRaWAN enabled IoT devices to the network, allowing any LoRaWAN device to send and receive data for the Internet of Things. LongFi provides roaming capabilities and micropayment transactions.

With the Osprey Hotspot G1, you can begin creating coverage for the Internet of things. Anyone can start delivering wireless network coverage over hundreds of square miles within a few minutes.

Complete set-up in minutes using a smartphone or remote dashboard

LongFi™ technology maximizes range and battery life

Low Power – uses as much power as a broadband router (12W)

Easily manage gateways from the mobile app

#helium hotspot#helium hotspot miner#hotspot miner helium#lorawan hotspot helium#cryptocurrency mining device#ethereum mining device#crypto mining device#crypto miner hotspot

0 notes

Text

Discover Crypto Mining: Helium Hotspots and Top Mining Hardware

Discover the latest in crypto mining technology with helium hotspot devices and cutting-edge crypto mining machines and hardware. Explore efficient solutions for maximizing mining yields and staying ahead in the digital currency landscape.

For More:

#crypto mining#helium hotspot#cryptocurrency mining device#ethereum mining device#crypto mining hardware#blockchain technology company#crypto mining machines#helium compatible devices#SoundCloud

0 notes

Text

How Cryptocurrency Mining Works: Process, Methods, and Risks

Cryptocurrency mining is a topic of interest for many people. Today, there are numerous opportunities available for those who want to earn money, and one of them is cryptocurrency mining, which can provide a significant income.

What is Cryptocurrency Mining?

First, let’s understand what cryptocurrency mining means. It all started with Satoshi Nakamoto, who in 2007 began developing the principles of cryptocurrency mining (Bitcoin). In 2009, the first mining application was released. The generation of the first block, “Genesis 0,” brought the first 50 bitcoins to its creators. In the same year, the first purchase of BTC for dollars took place: $5.02 was sold for 5050 bitcoins (which is an astronomical sum today).

The essence of the cryptocurrency mining process is the creation of new blocks in the cryptocurrency network. For this, the mining equipment solves complex mathematical problems. For each new block, cryptocurrency coins are issued. Miners can then store them in their wallets or sell them on exchanges.

How Does Cryptocurrency Mining Work?

To understand the principles of mining, it is necessary to clearly understand how bitcoin is mined.

Information about each transaction within the BTC network is recorded in a special block, which confirms the authenticity of the transfer.

Blocks form a single chain — the blockchain. Each block contains the hash of the header of the previous block, the hash of the transaction, and a random number.

The miner’s equipment performs mathematical calculations to determine the block hash.

After calculating the hash, the miner receives a reward and adds a new block to the general register of transactions.

The mining process is protected using the Proof-of-Work and Proof-of-Stake algorithms. These are sets of rules according to which transactions are conducted, mining is carried out, and other actions are performed within the network.

Proof-of-work (“proof of work”). The algorithm organizes the operation of the entire cryptocurrency network, verifies the authenticity of transactions, and so on. After a certain amount of cryptocurrency is mined in the network, PoW increases the complexity of the calculations. As a result, miners are forced to constantly increase the power of their farms and devices. PoW is the algorithm of a large number of cryptocurrency networks: from bitcoin to LiteCoin and DogeCoin. Proof-of-Stake (“proof of ownership”). An analog of PoW, the essence of which is that the greatest chance of mining cryptocurrency is received by the one who owns the most coins, and not the most powerful equipment. The algorithm reduces the decentralization of the network but significantly reduces energy consumption. PoS is currently used by Ethereum.

Mining Algorithms

To understand how to mine cryptocurrency, you need to know about the most popular mining algorithms at the moment. These technologies form the basis of cryptographic calculations and affect the mining speed, the necessary equipment and its power, the level of energy consumption, and so on.

SHA-256. The basis of mining on this algorithm is the creation of a 256-bit signature. It is demanding on the hash rate (for mining, a minimum of 1 Gh/s is required). Calculations last from 7 minutes. It is used in the mining of Bitcoin, Bytecoin, Terracoin, 21Coin. Ethash. The hashing algorithm was first used to mine ether. In the mining process, the emphasis is on the volume of video card memory. Ethash is used in the networks Ethereum Classic, KodakCoin, Ubig.

Scrypt. It works on the PoW (Proof-of-work) principle. Compared to SHA-256, it has a higher calculation speed and lower requirements for the power of computing equipment. The algorithm is used in the mining of Dogecoiun, Gulden, Litecoin.

Equihash. An algorithm with which you can mine cryptocurrency on home computers. It is used in the mining of Bitcoin Gold, Zcash, Komodo. CryptoNight. The algorithm is designed for mining cryptocurrency on home computers. It allows you to mine even on a not very powerful video card. The only condition is that it must be discrete. It is used in the mining of Bytecoin and Monero.

X11. The algorithm was developed by the creators of the Dash token. It has excellent data protection and low energy consumption.

Types of Mining

What does cryptocurrency mining mean in terms of organizing the process? There are several types of mining that depend on the equipment used and the number of team members.

By Equipment Type

In mining, you can use different equipment: you need to choose a suitable cryptocurrency and install software. Each type of equipment will differ in calculation speed, resource consumption, durability, etc.

CPU (Central processing unit) CPU mining is the use of a PC processor for cryptocurrency mining. It is characterized by very low calculation speed and, accordingly, low profitability. However, it is still relevant among solo miners due to low energy consumption requirements. To increase mining efficiency, you need to choose processors with a high frequency, a large number of cores and threads. It is not recommended to mine on laptops. With CPU mining, you can mine Dogecoin, Monero, Electroneum.

FPGA-module (Field-Programmable Gate Array) The use of an FPGA module is one of the promising ways to mine cryptocurrency. Their advantage/difference lies in the possibility of reprogramming the module for the desired mining algorithm. Thus, you can switch between different cryptocurrencies. Another beneficial difference is that FPGA modules provide a better hash rate-energy consumption ratio. The main disadvantage of FPGA mining is the cost of the modules and the complexity of their setup.

Hard Drive You can also use the HDD of your PC for mining. The work is carried out according to the Proof-of-Capacity (“proof of resources”) algorithm. Mining on a hard disk takes place in two stages: plotting and mining. First, the generation of random solutions takes place, which are saved on the HDD. Then the number of the scoop is calculated, and the deadline is determined. Then the minimum deadline is selected, and the miner who beats the rest receives a reward. The calculations do not require high power but only a lot of free space on the hard drive.

By Number of Participants

You can mine cryptocurrency both alone and in a company with other miners. All this has both its advantages and disadvantages.

Solo Mining The oldest form of mining. The miner independently selects equipment, sets up software, chooses a cryptocurrency, and starts mining. All costs are borne by him. But the reward for the mined block is received in full by the solo miner. During the birth of the cryptocurrency industry, this was the most profitable form of mining, as the calculations were fast and did not require large capacities. Today, solo mining is worth doing when mining promising altcoins.

Mining Pools A mining pool is a combination of miners who start working on creating blocks together. As a result, this significantly increases the overall chances of getting cryptocurrency. There are two main types of pools with different payment mechanisms. Pay-Per-Share (PPS), in which the miner receives a reward for each hash created within the pool — even if the block was not created. Pay-Per-Last-N-Shares (PPLNS), with accrual of the reward only when the block is created.

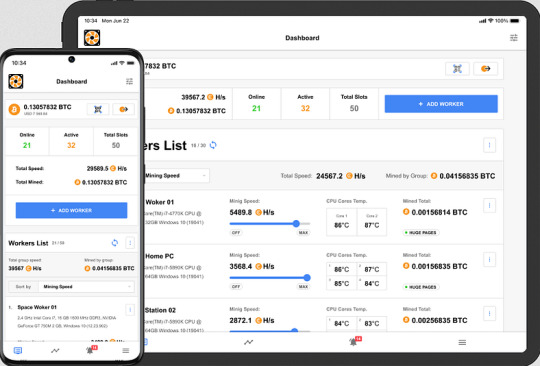

Cloud Mining This is a type of passive mining. In this case, the user pays for the rental of capacities on the territory of the data center of the company. The equipment starts mining, and with the help of a mobile application or a personal account on the site, the client monitors the results. Profit depends on the rented capacities, the cost of cryptocurrency, and the options in the company’s service.

Mining Profitability

To make a profit from cryptocurrency mining, you need to make a preliminary calculation of costs. If you want to create your own farm, you need to calculate:

Costs for purchasing and maintaining equipment. Payment for electricity. Rent of premises for the farm. The computing power of the equipment, which determines the amount of cryptocurrency mined per month. Assess changes in the value of the chosen cryptocurrency: an accurate forecast will allow you to imagine the expected income.

Mining profitability A profitable option for earning money can be the purchase/rental of ASICs or cloud mining. Their profitability depends only on the starting budget. If you calculate the minimum entry threshold by product, then you can get the following approximate figures:

Purchase of Antminer S21 188TH ($5000): expected income $550* per month. Rent of Antminer S21 188TH for 12 months ($3200): expected income $320* per month. Cloud mining contract ($150): expected income $225* for 60 months. These calculations provide you with forecast information based on the BTC forecast, which will reach $120 thousand. and FPPS 0.0000008. This is not a guarantee of future results, and accordingly, it is not advisable to rely too much on such information due to its inherent uncertainty.

Risks of Cryptocurrency Mining

The cryptocurrency industry has certain risks:

Problems with legislation. Very often, mining is not regulated by the legislation of countries, and in some, it can be completely prohibited, for example, in Taiwan, Kyrgyzstan, Vietnam, Romania, and Ecuador. Before starting to work with cryptocurrency, you definitely need to consult with a lawyer. A good solution to the problem can be the services of a hosting company, which will take any risks upon itself.

The issue of profitability. For successful bitcoin mining on your own, you need to buy powerful computing equipment. It not only costs quite a lot but also requires a huge amount of electricity and careful maintenance. Therefore, it will not be possible to place it at home. At the same time, mining on a home PC or a small farm will be unprofitable due to high competition with large farms and pools.

The difficulty of accurately forecasting income. It is difficult to calculate future income from the sale of mined cryptocurrency: the complexity of mining, the popularity of coins, and their value can and will regularly change.

The Future and Prospects of Cryptocurrency Mining

The industry continues to actively develop around the world. Users know that they can get a good income from cryptocurrency mining, even if they mine altcoins: Ethereum, Tether, BNB, Solana, etc. BTC is the undisputed leader of the industry, the course of which affects users’ trust in it.

After the fourth bitcoin halving in April 2024, the profitability of mining changed. To maintain the previous level of mining, it is necessary to increase existing computing powers. Therefore, miners continue to unite in pools or use the services of hosting companies. In the near future, this trend will not only be preserved but will also receive its development.

Conclusion

Despite periodic declines, bitcoin continues the trend of growth, which makes investing in cryptocurrency mining a profitable investment. With the development of mining pools and the appearance of large farms, it is difficult for a solo miner to get a significant income. Therefore, the best option may be cloud mining or the purchase/rental of an ASIC farm from a hosting company, which will take over the installation and maintenance of the equipment. With ECOS.am, you can focus on mining and investing in BTC. We take on all the other work.

4 notes

·

View notes

Text

https://mediamonarchy.com/wp-content/uploads/2024/05/20240521_MorningMonarchy.mp3 Download MP3 Video purges, Tetris records and human antennas + this day in history w/banning facial recognition in the Bay Area and our song of the day by Ibibio Sound Machine on your #MorningMonarchy for May 21, 2024. Notes/Links: Star Witness Michael Cohen Admits Stealing Tens of Thousands From Trump Organization https://www.theepochtimes.com/us/star-witness-michael-cohen-admits-stealing-tens-of-thousands-from-trump-organization-5653415 Mortgage Brokers Leak Sensitive Data to Facebook https://reclaimthenet.org/mortgage-brokers-leak-sensitive-data-to-facebook Thieves target electric vehicle charging stations, likely for copper https://www.fox29.com/news/thieves-target-electric-vehicle-charging-stations Video: BREAKING🚨 The Biden Administration is set to allow Jewish billionaire Dan Gertler to cash out his mining positions in the Democratic Republic of Congo which has enraged human rights activists… Gertler is responsible for thousands of child slave deaths in his illegal cobalt and diamond mines in the DRC… (Audio) https://x.com/resist_05/status/1792415747253428416 Biden open to easing sanctions on billionaire Gertler in return for Congo exit https://www.miningweekly.com/article/biden-open-to-easing-sanctions-on-billionaire-gertler-in-return-for-congo-exit-2024-05-17 Progressive Biden staffer who furiously resigned over White House support for Israeli ‘genocide’ is daughter of weapons company executive who’s helping Netanyahu government https://www.dailymail.co.uk/news/article-13433217/lily-greenberg-call-biden-israell-resignation-father-rtx-raytheon.html MIT students stole $25M in seconds by exploiting ETH blockchain bug https://arstechnica.com/tech-policy/2024/05/sophisticated-25m-ethereum-heist-took-about-12-seconds-doj-says/ LockBit Claims Wichita as Its Victim 2 Days After Ransomware Attack https://www.darkreading.com/cyberattacks-data-breaches/lockbit-claims-wichita-as-its-victim-two-days-after-ransomware-attack Reddit partners with OpenAI to integrate content into ChatGPT https://www.searchenginejournal.com/chatgpt-to-surface-reddit-content-via-partnership-with-openai/516605/ User Outcry as Slack Scrapes Customer Data for AI Model Training https://www.securityweek.com/user-outcry-as-slack-scrapes-customer-data-for-ai-model-training/ UK Disinformation Unit Minutes Reveal Consideration of Placing Government Employees Inside Social Media Companies https://reclaimthenet.org/uk-consideration-of-placing-government-employees-inside-social-media-companies Google’s New Conversation-Listening Tech Could Embolden Governments To Mandate On-Device Speech Scanning https://reclaimthenet.org/google-scam-listening-privacy-scanning French Government Blocks TikTok To Curb Civil Unrest in New Caledonia https://reclaimthenet.org/french-government-blocks-tiktok-new-caledonia Former Facebook and Nike DEI manager sentenced to 5 years in prison for fraud scheme; Barbara Furlow-Smiles, 38, admitted to stealing millions from Facebook and Nike in kickback schemes https://www.foxbusiness.com/lifestyle/former-facebook-nike-dei-manager-sentenced-to-5-years-prison-for-fraud-scheme Belgium and Hungary Launch Controversial Digital IDs, Vaccine Passport, Ahead of EU Regulations https://reclaimthenet.org/belgium-and-hungary-launch-controversial-digital-ids-vaccine-passport BREAKING: Klaus Schwab Resigns as World Economic Forum Chairman https://thenationalpulse.com/2024/05/21/breaking-klaus-schwab-resigns-as-world-economic-forum-chairman/ UK PM Sunak Endorses Facial Recognition, Implicitly Backs Mass Bank Surveillance https://reclaimthenet.org/uk-pm-sunak-endorses-facial-recognition-implicitly-backs-mass-bank-surveillance UK Army Unit Labeled Accurate COVID Reporting as “Malinformation” https://reclaimthenet.org/uk-army-unit-labeled-accurate-covid-reporting-as-malinformation YouTube Removes 35,000 EU Videos for “Misinformation,” Enhances Content Censorship Ahead of 2024 Elections https://reclaimthenet.org/youtube-removes-...

View On WordPress

#alternative news#cyber space war#Ibibio Sound Machine#media monarchy#Morning Monarchy#mp3#podcast#Songs Of The Day#This Day In History

2 notes

·

View notes

Text

Market Impact of Innosilicon's ASIC Miners

Innosilicon

Innosilicon is a well-known company in the cryptocurrency mining industry that specializes in the design and production of high-performance ASIC miners. Founded in 2006, Innosilicon has established itself as a leading player in the market, delivering innovative and efficient mining hardware solutions to miners worldwide.

The company prides itself on its commitment to research and development, continuously striving to improve upon its previous designs and deliver cutting-edge technology to its customers. By leveraging its expertise in semiconductor design and fabrication, Innosilicon has managed to stay ahead of the competition and earn a solid reputation for its products.

Here is the list of the best innosilicon miners as of 2023 ranked according to profitability, price and durability.

1.Innosilicon KAS Master Pro

2.Innosilicon Kas master 2 THS

3.Innosilicon Kas master 1 THS

4.Innosilicon T4 BTC Miner

5.Innosilicon a11 Pro 8gb

6.Innosilicon a10 pro 6 GB

Mining Hardware

Mining hardware is an essential component of the cryptocurrency mining process. It refers to the physical equipment utilized to validate and record transactions on a blockchain network. As the complexity of mining cryptocurrencies increases, miners require powerful and specialized hardware to compete and generate profits.

In the early days of cryptocurrency mining, miners utilized general-purpose CPUs and GPUs to mine cryptocurrencies like Bitcoin. However, as the industry evolved, ASIC miners emerged as the most efficient and cost-effective solution for mining popular cryptocurrencies. Companies like Innosilicon have played a crucial role in designing and manufacturing ASIC miners that offer superior performance and energy efficiency.

ASIC Miner

An ASIC (Application-Specific Integrated Circuit) miner is a mining device specifically designed to mine cryptocurrencies. Unlike general-purpose CPUs or GPUs, ASIC miners are optimized to perform a single task - the computation required for mining. This specialization allows ASIC miners to perform mining operations significantly faster and more efficiently than other hardware alternatives.

Innosilicon has been at the forefront of ASIC miner development and has released several generations of mining hardware over the years. Its ASIC miners are known for their high hash rates, low power consumption, and durability. The company's dedication to innovation has enabled them to continuously push the boundaries of mining technology.

Their ASIC miners are designed to mine various cryptocurrencies, including Bitcoin, Litecoin, Ethereum, and more. Innosilicon's product lineup includes a range of models catering to different levels of mining operations, from individual miners to large-scale mining farms.

One notable aspect of Innosilicon's ASIC miners is their focus on energy efficiency. The company understands the ecological impact of cryptocurrency mining and aims to minimize energy consumption while maximizing mining performance. This approach not only benefits the environment but also leads to reduced operational costs for miners.

Innosilicon's ASIC miners are designed to be user-friendly and accessible to miners of all skill levels. The setup process is straightforward, and the company provides comprehensive support and documentation to assist miners in getting started quickly. Additionally, their mining hardware is known for its reliability and durability, ensuring that miners can operate their machines without any major interruptions.

The constant evolution of Innosilicon's ASIC miners showcases their commitment to staying ahead in the competitive mining industry. By incorporating the latest advancements in semiconductor technology and constantly refining their designs, they continue to deliver top-of-the-line mining hardware to miners worldwide.

In conclusion, the rise of ASIC miners in the cryptocurrency mining industry has revolutionized the way miners operate. Innosilicon, as a prominent player in this space, has played a vital role in driving this evolution. Their dedication to innovation, energy efficiency, and user-friendly designs has contributed significantly to the progression of the mining hardware market. As the industry continues to evolve, it will be interesting to see what new advancements Innosilicon brings forth to further enhance the mining experience.

#crypto miner#crypto mining#mining hardware#asic miners#innosilicon miner#innosilicon#bitcoin#bitcoin latest news#ethereum#cryptocurrency news latest#btc latest news#cryptocurrency news#blockchain#crypto#digitalcurrency#fintech#investment#defi

4 notes

·

View notes

Text

Also checkout latest threats in 2024 onwards Before, cyber attacks were isolated incidents concocted by individuals with a talent for bypassing digital security and hacking personal devices, networks, and small business information systems. Now, it’s a completely different threat landscape, with cyber attacks occasionally being state-sponsored. That means more access to resources and training that’s fully backed by the power of an entire government. And for private sectors, the attacks are getting even more sophisticated as time goes by. Clearly, no business is completely safe from being targeted by a cyber attack. Which is why it’s crucial for all entrepreneurs to know which types of cyber attacks are increasing in trend in order to better protect their assets and reduce any form of compromise. The Biggest Cybersecurity Threats To Watch Out For Phishing The rise of electronic mail, or email, has also marked the start of one of the oldest forms of cyber attacks dating back to the 1990s: phishing. And you can bet that it’s even more widespread and relentless today, involving increasingly sophisticated techniques to get users to click on links or download attachments that contain malware or links to information-capture sites. Common features of phishing emails: Offers something too good to be true They tell you to ask fast (within minutes usually) Includes hyperlinks Contains misspellings in the URL of large company names that can be easy to miss (www.bankofarnerica.com instead of ‘america’) Suspicious (or even unsuspicious) sender Ransomware With different strains discovered every week, ransomware would be among the most dangerous cybersecurity threats of all. From WannaCry, BadRabbit, to NotPetya, this different ransomware wreaked havoc last 2017 by quickly spreading into the network of companies both small and large. And how they work is sinister. Essentially, ransomware restricts access to a device or software unless the target company or individual pays a certain amount of money. The Below Chart Shows The Global Number Of Ransomware Attacks From 2014 All The Way To 2017 One of the best things to do is to consult with an outsourced DPO about backing up your data, get an anti-ransomware application, or turn off your Internet connection as soon as you suspect something suspicious happening to your device. The last option won’t get rid of it, but it can interrupt the ransomware as it tries to finish its encryption, making the infiltration less serious. Cryptojacking The value of cryptocurrencies like Ethereum and Bitcoin gave rise to a new form of the hijacking: cryptojacking. With the focus more centered on Initial Coin Offering (ICO), the losses individuals and companies face are within the millions. And cybersecurity companies have traced that most of these incidents were caused by malware specifically designed for the purpose of stealing cryptocurrencies. Some websites have also fallen victim to this cryptocurrency-centered hijacking. Through mostly undetected script, site visitors were unknowingly letting their devices be used for coin mining on these affected websites. For users, we highly suggest installing an anti-cryptomining extension on your browsers such as No Coin and MinerBlock. And for businesses, the best method to prevent crypto jacking is to have a trained team whose job is to look for cryptomining software or script. The Weaponization of Artificial Intelligence While there’s clearly a place for machine learning and AI in cybersecurity, research is now showing that AI may end up becoming the threat, too. In a report detailing the possible threat of AI, the concerns proposed seem plausible. We’ve created a self-learning machine with the power to take over much of our technological processes. Imagine if attackers were to exploit vulnerabilities in the said AI. We can expect the scope and efficacy of these infiltrations to be increased, making it a more serious threat to cybersecurity, and with larger implications.

Cyber-Physical Attacks Before, it would have been difficult to imagine how a cyberattack could cause potential damages to physical infrastructures. Now, however, it’s as real a threat as any. Let’s not forget about how, between 2008 and 2010, the Stuxnet virus managed to destroy 20% of Iran’s centrifuges by causing them to spin out of control. The same virus then led to the destruction of a blast furnace owned by a German steel mill, adding to the terrifying reality of these cyber-physical attacks. And then there was the recent attack on Ukraine’s power grid that sent the country back to the dark ages. It was believed to be caused by a malware called Industry. As its name suggests, this malware may be among the biggest threats to industrial business networks since the Stuxnet incident. It also sheds light on the ever-growing threat of cyber-physical attacks, which is expected to become even more serious as time passes. Malvertising As businesses, we understand the power advertising has on getting people to take action. Unfortunately, cyber attackers know this too. They’ve now found a way to create highly-convincing advertising material that’s injected with malware and placed them in advertising networks and websites for unsuspecting site visitors. It’s a fairly new concept of spreading malware, but experts agree that they’ll be seeing more of it within the year since the identities of those responsible for the malvertising are often difficult to trace. What You Can Do There may never be a way to completely protect your business from every form of cyber attack, but there are ways for you to be better prepared and set up a better defense system against it, such as the suggestions below: Create a continuous cyber security assessment process. Make security awareness a part of your business’ natural mentality. Always make an assessment of your organization’s security strengths and weaknesses. With how our technology is evolving, we can expect to see scarier and more sophisticated cyber network threats in the next few years. The good news is that our security measures will also continue to evolve to better prepare individuals and organizations for such threats. What matters is that we remain adaptive to this data-driven environment if we want our businesses to survive and thrive. About Author Paul lives and breathes writing. He writes about marketing, business, sports, cybersecurity, or just about anything and everything under the sun.

0 notes

Text

Coin Mining: The Future of Crypto Mining with Insights from Coin Pulse HQ

Cryptocurrency mining remains a crucial a part of the digital asset environment, offering the infrastructure essential for blockchain networks to function correctly. Whether it's Bitcoin (BTC), Ethereum (ETH), or different altcoins, mining performs a vital function in transaction verification and community security. However, with increasing competition, regulatory adjustments, and evolving technologies, the mining industry is constantly reworking.

Coin Pulse HQ, a depended on supply for crypto information and evaluation, brings you the latest insights into the arena of coin mining, covering technological advancements, profitability traits, and future projections.

Understanding Coin Mining and Its Importance Coin mining, also called crypto mining, is the procedure of validating and including transactions to a blockchain ledger. Miners use computational energy to solve complex mathematical problems, incomes rewards within the shape of newly minted coins.

How Coin Mining Works Transaction Verification – Miners confirm and validate transactions, making sure that they're valid and stopping double-spending. Block Creation – Verified transactions are grouped into blocks, which are then delivered to the blockchain. Proof-of-Work (PoW) Mechanism – Bitcoin and plenty of other cryptocurrencies use PoW, in which miners compete to remedy cryptographic puzzles. The first to resolve the puzzle gets rewarded. Mining Rewards – Successful miners receive block rewards and transaction costs as incentives for keeping the community.

Proof-of-Work vs. Proof-of-Stake (PoS) While traditional coin mining operates on PoW, many newer cryptocurrencies are transferring closer to Proof-of-Stake (PoS) mechanisms, which rely upon validators in preference to miners. PoS is visible as a extra energy-green alternative, however PoW mining continues to dominate Bitcoin and a few altcoin networks.

Latest Trends in Coin Mining Bitcoin Mining Difficulty and Hash Rate The Bitcoin community has visible an boom in mining issue due to the developing range of miners and the adoption of extra powerful mining rigs. According to Coin Pulse HQ, Bitcoin’s hash charge (the whole computational strength used to mine and procedure transactions) has reached new highs, indicating a robust and competitive mining enterprise.

Higher trouble manner more opposition amongst miners. Mining profitability depends on energy fees, equipment performance, and BTC market charges.

Eco-Friendly Mining: The Shift to Sustainable Energy Environmental issues have brought about a shift towards sustainable mining solutions. Governments and environmental activists have criticized the electricity consumption of Bitcoin mining, pushing organizations to discover inexperienced options.

Coin Pulse HQ reviews that several mining farms are actually using renewable energy assets, inclusive of:

Hydropower in Canada and Iceland

Solar and wind strength in Texas and China Geothermal electricity in El Salvador These sustainable answers now not best reduce environmental impact but also lower power fees, making mining operations extra worthwhile ultimately.

Mining Hardware Innovations Mining performance largely depends on the hardware used. ASIC (Application-Specific Integrated Circuit) miners are the most effective mining devices, offering better hash costs with decrease energy intake.

Coin Pulse HQ highlights a number of the contemporary advancements in mining hardware:

Bitmain Antminer S21 – One of the maximum strength-green Bitcoin miners on the market. MicroBT WhatsMiner M50 – Offers high hash costs with optimized energy consumption. Intel’s Bitcoin Mining Chip – A game-changer for the industry, promising extra green and fee-effective mining. As technology evolves, miners need to live up to date with the latest system to keep profitability.

Coin Mining and Regulatory Challenges Global Crackdown on Mining Several nations have imposed regulations on crypto mining due to worries over electricity intake and monetary stability. According to Coin Pulse HQ:

China banned crypto mining in 2021, forcing miners to relocate to more crypto-friendly regions. Kazakhstan, formerly a mining hub, has brought stricter policies and higher electricity tariffs. The U.S. And Canada have emerged as important mining centers, with favorable rules in sure states and provinces.

Taxation and Compliance Governments worldwide are implementing taxation rules on mining earnings. Coin Pulse HQ advises miners to preserve music of tax policies in their regions to make certain compliance and keep away from criminal headaches.

Future of Coin Mining: What’s Next? The Impact of Bitcoin Halving (2024) Bitcoin undergoes a halving event about each four years, decreasing the mining praise by 1/2. The subsequent halving, predicted in April 2024, will reduce the block reward from 6.25 BTC to 3.A hundred twenty five BTC.

Coin Pulse HQ predicts that:

Mining profitability can also lower, forcing smaller miners out of the market. Larger mining farms will consolidate, leading to improved centralization of mining power. Bitcoin’s fee may additionally rise, potentially offsetting decrease mining rewards.

Rise of Cloud Mining and Mining Pools Individual miners frequently struggle with the excessive expenses of mining hardware and electricity. Cloud mining and mining swimming pools offer solutions through allowing customers to mine collectively.

Cloud Mining – Users lease mining strength from massive-scale mining organizations. Mining Pools – Miners be a part of forces to growth their probabilities of incomes block rewards, splitting profits proportionally.

Coin Pulse HQ notes that these options are making mining more accessible to retail buyers.

Will AI and Quantum Computing Disrupt Mining? With improvements in Artificial Intelligence (AI) and Quantum Computing, there are speculations about how those technology ought to impact mining.

AI-pushed mining algorithms should optimize strength intake and increase efficiency. Quantum computing, if realized, could threaten existing cryptographic security, forcing blockchain networks to upgrade their protection protocols. Coin Pulse HQ keeps to monitor those technological traits and their implications for the destiny of mining.

Conclusion Coin mining stays a vital issue of the cryptocurrency enterprise, making sure community security and decentralization. However, miners should adapt to challenges such as rising problem degrees, regulatory hurdles, and technological improvements to stay profitable.

Coin Pulse HQ offers in-depth insurance of the modern day coin mining traits, from hardware improvements and electricity-green answers to regulatory updates and future predictions. Whether you’re an individual miner, an investor, or really a crypto enthusiast, staying informed thru Coin Pulse HQ will assist you navigate the evolving panorama of cryptocurrency mining.

For more updates on Bitcoin mining, altcoin mining, and blockchain generation, live related with Coin Pulse HQ!

0 notes

Photo

Have you been hearing whispers about Bitcoin, Ethereum, and other cryptocurrencies but find the whole concept a bit mystifying? Maybe you’ve even wondered, “How does crypto mining actually work?” Don’t worry, you’re not alone! Many people initially find the technical aspects intimidating, but understanding the basics is surprisingly straightforward. This guide will demystify crypto mining for Indian readers, explaining the process in plain language, offering real-world examples relevant to our context, and showing you that it’s not as complicated as it might seem at first glance. We’ll leave the complex equations and technical jargon to the experts, offering a comprehensive yet easy-to-understand breakdown for anyone curious about this fascinating corner of the tech world. Let’s delve into the exciting world of cryptocurrency mining.

Understanding Crypto Mining: A Simple Explanation

Crypto mining is essentially the process of verifying and adding transactions to a blockchain, the digital ledger that records all cryptocurrency transactions. Think of it like this: imagine a group of friends sharing a digital notebook. Every time one person spends money, it’s written down in the notebook. To ensure nobody cheats, the task of verifying these transactions falls to miners; and the faster they solve more complex problems using their machines’ computing power, greater are possibility for earning mining rewards. The first miner to solve the provided problem validates that transaction; earning a newly minted cryptocurrency or coins. Those miners will further check multiple crypto transactions or problem statements and solve them one by one continuously within the distributed network, in order to maintain the currency in a secure network. If they discover any discrepancy; they bring up any such incidence quickly in distributed ledger making necessary correction. In this way the miners constantly monitors the blockchain. Let’s explore the various aspects that bring this fascinating procedure up.

The Role of Miners in Crypto Transactions

Miners act as gatekeepers of security and integrity of a distributed network ensuring network security. Their computing resources solve a tremendously complex mathematical problem, and in many different ways including use SHA -256, Scrypt, X11 including Ethash algorithms, which secure the network preventing malicious attacks and fraud and the digital money from theft. Those miners who validates all transactions securely and solve the mathematical riddle promptly add new “block” to blockchain and receive freshly coin as a reward (depending on specified mathematical problem complexity and several other criteria ) as reward; called mining rewards and transaction fees for adding blocks containing several crypto transactions. Adding “block” is frequently considered as mining’s very work.

Mining Hardware: More Than Just Your Laptop

To effectively mine cryptocurrency, specific miners frequently utilize powerful machines equipped with specialized processors rather than ordinary computers used everyday work. The most profitable type uses Application Specific Integrated Circuits, or ASICs, designed solely, for mining only, that are designed for particularly energy intensive tasks. High-end Graphics Processing Units (GPUs) are often used for “mining’ less energy cryptocurrencies, while CPUs. A number of Crypto currencies, such as those based on proof in-work (PoW) algorithm-based crypto network utilize high performing ASICs and similar miners while other some networks using Ethereum use only Graphics card processing hardware. In India, you might need to import some higher performing devices as they’re not always readily available locally but even higher power computers available at low cost or medium can mine on a low scale. Before even investing; please check miners efficiency and expected power usage requirements at maximum operating potential. Considering purchasing higher end performing miners than buying low value miner, would actually benefit by considering their computing speed and power consumed during a single mining effort. The returns or earnings, efficiency and sustainability depends on total miners’ investments on equipments & efficient power backup system such as energy efficient solar power setup is very much essential . Cost-profit analysis or potential returns is always critical to understand clearly. Overall network hash rate which also matters greatly. The greater the number of miners joining network which implies larger processing ability at a whole adds more power up; making overall security very stronger for crypto currencies at large and make network safer.

Mining Pools: Joining Forces for Higher Earnings

Mining Bitcoin or other popularly mined crypto currencies can be exceptionally difficult. An individual miner will usually have little resources when compared to very powerful hardware from organizations, thus an individual mine typically results in lesser rate. When compared that to network level performance there would be practically no possibility or return which practically makes it next to impossible. The potential increase in difficulty and higher power need further reduces profits for individual users. To address this there are crypto mining pools available. Mining pools provides an effective method. To resolve issues that arises, individuals joining these collaborative networks and combine several computers processing power. Doing so enable to contribute in higher computational speeds from a distributed network as it becomes significantly better than standalone device thus improving efficiency while earning rewards. Earning through mining requires understanding; of shared mining rewards, various pool structures depending on criteria, efficiency measures and transparent reward payout structures based on work carried out to gain rewarding outputs after successfully performing many steps through shared network. Rewards from several individuals collectively performing, sharing equally from earned potential profits or any other compensation schemes or systems which may or may not involve direct monetary inputs. After computing shared computations and problem resolution reward payouts are shared among groups through respective proportional share scheme they follow; usually followed based in hashing work done through collaborative computations distributed on pool network of interconnected resources collectively involved; working diligently.

Understanding Crypto Mining Profitability

Mining is influenced immensely by following. Network Difficulty, the electricity that powering system is based upon at specific geographical regions that influences cost per kw/hr. And also total efficiency from miners including types, cooling capacity etc which will effect mining costs. Then reward or payout given from pool varies also. Transaction fees and type of Crypto currency mined also. The prices of Crypto currencies matters which is volatile. As a factor; influencing any kind revenue, profit or returns expected by miners depends tremendously largely by fluctuating global marketplaces for Crypto. With varying crypto currency mining rewards payouts, and different difficulty, total pool distribution based system in place these makes analysis extremely challenging from prospective miners viewpoint before actual start. Therefore thorough thorough cost estimates including thorough power costs estimation , equipment & depreciation charges etc. needs to comprehensively analysis very well, thoroughly.

Types of Crypto Mining

While most people imagine enormous server farms when they think about crypto mining, not even mining happens only like that. There are important distinctions between PoW and PoS mining procedures. We’re seeing new types emerging which add to diversity; increasing the technological frontier:

Proof-of-Work (PoW) Mining

This is the most traditional method. Imagine doing that puzzle from multiple points and at different steps concurrently among several processors distributed; using many computing powers as combined forces to reach the final state where transaction has been verified and can’t be invalidated or faked, thus this proves legitimacy of crypto network operations’ by this validation proof via ‘work’ completed together cooperatively adding new data ‘block’ collectively created, secured. The larger overall computations done by these many contributors collectively proves the overall computational complexity and power done; which contributes more in security of the network overall. PoW-based cryptocurrencies, this involves significant computational investments. Examples, as we all hear on every occasion would be like most popular-Bitcoin, Ethereum (before “the merge”), and Litecoin.

Proof-of-Stake (PoS) Mining

This is considered to be an advance, comparatively less energy demanding technique and more productive. Instead of competitions; between many different processors’ powerful computational processing, this method depends on what amount or ‘stakes’- what token owners or holders invest proportionately- determining chances of approving or validating new block in blockchain distributed record database This is proportionally to what ‘stake’ coin holders owns’ in a crypto networks ecosystem. Many feel that because it consumes less energy and improves environment’s overall quality compared ‘work’-proof earlier methods there seems better opportunities and wider adoption. Solana, Cardano, and Tezos uses this new method . The reward or payoff process does however depends how much currency an individuals or ‘validator’ holders’ proportionate token they owns’.

Other mining techniques are also:

Proof-of-Capacity (PoC): This method focuses on storage instead of computations for validating blockchains securing procedure by using large size available hard-disks drives providing high end capacity data availability. Example includes this method in Burstcoin and its further expansions are undergoing.

Proof-of-Authority (PoA): Here, only ‘authorities’ who are pre vetted selected already beforehand in the system or designated, or in privileged groups or who is permitted to validate transactions and add new validated “block” as data, then secured in the blockchain record keeping system..This approach is suitable when network scales less which is less prone network delays, that needs more time. Examples widely distributed applications would include VeChain(VET) and various other implementations.

Proof-of-History (PoH): It’s used deterministically record time of transactions based strictly chronologically ordering procedures so transactions happen one after another on timeline based secure chronological ordering sequence mechanism that creates cryptographically verifiable and secure timestamp on transaction processes and thereby validation occurs secured, this is how the method validates new block procedure and adds them appropriately secured into blockchain. In essence this improves overall security level immensely providing superior level security . Example is created by Helium specifically dedicated to a new wireless type internet which involves these new mechanisms of validations to complete tasks that verifies secure operations and add validation data blocks appropriately secured.

FAQs: Your Burning Questions Answered

Before actually diving into the procedure you will surely need to understand some potential issues frequently questioned by most who are planning. Let’s dive for a quick glimpse through into various popularly requested topics as questions asked :

Q1: Is crypto mining profitable in India?

A1: The profitability of crypto mining varies extensively to numerous factors, all influenced heavily by the cost structure within a geography. Electricity costs vary extensively among Indian states . There are fluctuations in costs on maintaining, repairs , equipments , upgrades, internet costs, heat disposal cooling costs including depreciation and many more add upto those aspects. While Bitcoin’s high value usually keeps costs under certain limit ; when there high power need ; such costs adds immensely to operation’s total costs. Currently the global hash rate, increases, so joining larger or newer Crypto currencies in distributed decentralized network is vital if plan are on large-scale or considerable investment operations, thus these crucial data based decision-making should proceed for successful returns overall including successful financial returns as well. Further overall profits remain highly influenced by external factors: network prices of cryptocurrencies overall vary, depending on market trend cycles. Cryptocurrency costs generally varies over time thus potential returns as profits changes over time that remains subject to extremely high level uncertainty so investing based on these considerations might prove beneficial ultimately.

Q2: What are the risks involved in crypto mining?

A2: Crypto mining is relatively new that encompasses many investment elements combined together with considerable uncertain implications for many factors including market trends fluctuating randomly; risks generally include investments risk’ , costs on equipment that quickly depreciates as frequently faster new advances come up, that need consistent upgradation that eventually increase your losses even. Potential regulatory changes in India could unexpectedly happen affecting profits significantly adding further instability for businesses already set and working on them; power fluctuating unpredictably especially when not based purely or reliably on solar power installations that require higher amounts capital and resources need as a requirement especially initially that will determine sustainability , there are complexities that needs solving including technical breakdowns in equipments ; that requires extensive experience based technician involved handling and maintenance during those times. Then network difficulty increases for various crypto currencies. Always make informed and well studied choices. And never invest more than afford to safely afford to risk losing investments entirely without creating immense difficulties in day to day life or causes irreversible damage leading to financial troubles later stages after initial investments made. If any further assistance or questions do require qualified personnel consulting and then seek assistance further to get necessary professional advice regarding investment that is needed. You have options for making various informed well studied decisions based on that input of available accurate resources accordingly so that eventually success shall result your decisions made accordingly. These makes sure that profits occur more constantly while avoiding potential failures altogether in larger amounts from sudden failures unexpected reasons possibly during this operations so those are vital consideration throughout operation stage of various considerations made as needed.

Q3: How do I get started with crypto mining?

A3: Starting involves understanding basics of blockchain and Cryptocurrencies including technological developments that leads you selecting a suitable currency depending overall costs against profits calculations’ before start actual venture which ensures high potential profits likely in foreseeable future and selecting a mining pool which generally is recommended to be successful by taking several experts well studied suggestions based numerous factors discussed here this document including various external network considerations at certain phases that significantly influenced profits levels and sustainability of a chosen project , further careful planning involved making estimates before actual ventures makes far significant profits in long term period as long term goals, choosing mining hardware suited appropriately at initially investment point ensures effective operations start overall; keeping future upgrade planning’ at a check ensures better stability maintaining all technological requirements is needed to prevent unnecessary difficulties arises from such causes later ; always keeping legal obligations fully met within India regulatory compliance ensures avoidance future difficulties from legal implications in unforeseen situations thus making necessary information about what should undertaken in beginning phase which usually leads towards ultimately greater profitable outcomes if overall procedure carefully adhered effectively as well.

This is not an investment advisory information. All are suggestions and examples. Invest at you own risk.

Let’s continue this conversation! What are your biggest questions about crypto mining? Please ask below! We would like this entire blog to gain more valuable contribution through participation at all the stages within in coming times. Do like and share !

0 notes

Text

An Virtual Server Idea I'm handing off for open/free use

I had an idea for a Virtualized server ecosystem; and I keep running into potentially reinventing the crypto wheel.

The problem with Crypto in this application is that it's security is the prohibitively expensive "work" that basically means it costs the same effort and energy to hack crypto as it does to simply perform a transaction.

What I'm thinking of is a cloud ecosystem that relies on Player Clients in order to reduce the overall bandwidth needed and congestion at the Host Server.

What I'm envisioning; a Peer-to-Peer Virtualized platform that can rely on client software to perform needed game transactions.

This isn't inherently unhackable; But with enough players; should be relatively safe. Especially for Games without the need of a tightly balanced economy.

It might look something like Ethereum layer 2 by itself.

What I envision; is that when the User installs their Game; they're essentially installing the server software itself.

And the Player Actions (transactions) get verified in a virtual "Ledger" that gets *eventually* gets back to the Host Server.

See why I'm having trouble not reinventing the wheel yet?

My expertise is limited however; so I'm offering this to aspiring Crypto Enthusiasts and Game Developers; where Cloud Hosting space is prohibitively expensive.

Hence why I specifically said "Free and Open-Source Use" because if it works; it'll be invaluable for MANY different applications; even if the security for more intense applications isn't there.

Because it's for fun, not work. (But it could be for work that doesn't require big security)

My idea is this;

We create a Virtualized Space; that may rely on a core set of Servers or Cloud Services and incorporate the players device when they connect. It's not necessary in the case of typical Peer-to-Peer games of applications, but maybe necessary for long term storage of User Data.

I had thought that the Distributed Hash Table could be used in the form of a "String" of characters which represents a lot of data; and eventually worms its way throughout the ecosystem as a whole.

Similar to Crypto... *Sigh*

The important thing however is that we don't have a long-term storage of an entire ledger, nor the computational work typical Cryptographic Cloud Services need.

Which is a problem in current Cryptographic-Game systems; putting high stress and users device *and* being slower than a Meta-Platform-Game.

Good Luck; I hope it works out for indie devs.

P.s. Also needs to be cognizant of the damages an Unsupervised Unaccountable Algorithm can cause to the internet as a whole; and the Environment should have an "Off Switch" for emergency purposes that does not affect the data store requirements.

It most also... Not be hijacked for Crypto Purposes; because if the user wanted to mine crypto; they'd do it themselves.

Thanks.

0 notes

Text

Osprey Hotspot G1 (US, Europe, China)

Understand how Helium's network uses LoRaWAN technology for IoT connectivity and rewards in cryptocurrency, versus traditional Ethereum mining devices focused on blockchain transactions. Learn about their unique functions, benefits, and how they contribute to the expanding digital landscape. Osprey Hotspot G1 is for PoC Helium network, mining HNT. It works with the Helium LongFi architecture, which integrates the leading wireless LoRaWAN protocol with the Helium Blockchain technology. All Osprey Hotspot G1 are compatible with LoRaWAN.

LongFi connects the LoRaWAN enabled IoT devices to the network, allowing any LoRaWAN device to send and receive data for the Internet of Things. LongFi provides roaming capabilities and micropayment transactions.

For More:

#crypto hotspot#crypto mining#helium hotspot#helium hotspot miner#hotspot miner helium#lorawan hotspot helium#cryptocurrency mining device#ethereum mining device

0 notes

Text

Global Cryptocurrency Market: Key Players and Competitive Landscape

The global cryptocurrency market is projected to reach a size of USD 11.71 billion by 2030, according to a recent report by Grand View Research, Inc. The market is anticipated to grow at a compound annual growth rate (CAGR) of 13.1% from 2025 to 2030. This growth is expected to be driven by several factors, including the increasing demand for enhanced data security, greater operational transparency, and the integration of blockchain technology into digital payment systems. Furthermore, the ongoing legalization of the purchase, sale, and trading of digital currencies in several developed countries, including the U.S., is also expected to stimulate the expansion of the cryptocurrency market.

The cryptocurrency industry is set to benefit from the growing global adoption of digital currencies such as Bitcoin, Ethereum, and Litecoin. The increasing popularity of these digital currencies can be attributed to their ability to provide fast, transparent, secure, and efficient payment solutions to users. According to Crypto.com, the number of cryptocurrency owners surged to 295 million in December 2021, up from 228 million in July 2021, highlighting the accelerating growth and adoption of cryptocurrencies.

In addition to this, advancements in artificial intelligence (AI) are expected to positively impact the cryptocurrency market. The growing popularity of AI-powered cryptocurrency platforms has spurred interest and investment in this technology. For example, in August 2021, researchers at Los Alamos National Laboratory developed an AI algorithm capable of identifying unauthorized cryptocurrency miners who use research computers for cryptocurrency mining. Such innovations are expected to drive further market growth and encourage businesses to focus on the development of AI-based cryptocurrency solutions.

The COVID-19 pandemic had a negative effect on market growth in 2020, as global supply chain disruptions slowed the sales of cryptocurrency mining hardware, and border closures impacted operations. Additionally, blockchain companies were forced to reduce their staffing levels and budgets as a result of the pandemic's economic consequences. For instance, Cipher Trace cut jobs in its advertising and marketing departments, while Elliptic laid off employees in both the U.S. and the U.K. However, the market saw a recovery in 2021, with a steady uptick in growth as businesses adjusted to the new normal and demand for cryptocurrencies rebounded.

Gather more insights about the market drivers, restrains and growth of the Cryptocurrency Market

Cryptocurrency Market Report Highlights

• The hardware segment is expected to dominate the market in 2024. This dominance is primarily driven by the increasing demand for cryptocurrency mining devices, which are essential for mining new coins and adding them to the cryptocurrency supply chain. The growing reliance on mining operations and the necessity of efficient mining hardware will continue to fuel this segment's expansion.

• The graphics processing unit (GPU) segment is projected to experience the fastest growth during the forecast period. The rise in demand for GPUs in cryptocurrency mining is attributed to their ability to offer high-speed processing while consuming less energy compared to other types of hardware. This energy efficiency and processing power make GPUs the preferred choice for many cryptocurrency miners, driving growth in this segment.

• The wallet segment is also anticipated to witness the fastest growth during the forecast period. As cryptocurrencies gain broader adoption, the need for secure and user-friendly wallets to store, trade, send, and receive digital currencies will continue to rise. This growing demand for cryptocurrency wallets will be a key factor driving the expansion of this segment.

• The mining segment is expected to dominate the market in 2024. This is largely due to the significant investments being made by companies to establish large-scale cryptocurrency mining farms. These mining operations are crucial to the growth and sustainability of the cryptocurrency ecosystem, and continued investments in this area will contribute to the segment's market share.

• The bitcoin segment has been the dominant force in the cryptocurrency market in 2024 and is expected to grow at the fastest CAGR during the forecast period. This growth can be attributed to Bitcoin’s increasing popularity and its growing acceptance as a legitimate form of currency. Additionally, the adoption of Bitcoin by emerging countries, such as El Salvador, is expected to further fuel the segment’s growth as more nations recognize its potential.

• The retail & e-commerce segment is anticipated to grow at the fastest CAGR through the projection period. The increasing acceptance of cryptocurrencies by retail and e-commerce businesses, which are beginning to offer cryptocurrencies as a form of payment, will drive the expansion of this segment. As more consumers and businesses embrace cryptocurrencies, the retail and e-commerce industry will continue to see strong growth.

• The Asia Pacific region is expected to register rapid growth during the forecast period. The presence of a large number of cryptocurrency mining companies in the region, along with the growing adoption of cryptocurrencies, is expected to drive regional market growth. The region's established infrastructure and increasing investments in the cryptocurrency sector will contribute to its continued expansion.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• Augmented Reality Navigation Market: The global augmented reality navigation market size was estimated at USD 1.62 billion in 2024 and is expected to grow at a CAGR of 39.1% from 2025 to 2030.

• Serverless Computing Market: The global serverless computing market size was estimated at USD 24.51 billion in 2024 and is anticipated to grow at a CAGR of 14.1% from 2025 to 2030.

Cryptocurrency Market Segmentation

According to Grand View Research, the global cryptocurrency market is segmented into various components, processes, types, end-uses, and regions. Here’s a breakdown of the market:

Cryptocurrency Component Outlook (Revenue, USD Billion, 2018 - 2030)

• Hardware

o Central Processing Unit (CPU)

o Graphics Processing Unit (GPU)

o Application-Specific Integrated Circuit (ASIC)

o Field Programmable Gate Array (FPGA)

• Software

o Mining Software

o Exchange Software

o Wallet Software

o Payment Software

o Others

Cryptocurrency Process Outlook (Revenue, USD Billion, 2018 - 2030)

• Mining

• Transaction Processing

Cryptocurrency Type Outlook (Revenue, USD Billion, 2018 - 2030)

• Bitcoin

• Bitcoin Cash

• Ethereum

• Litecoin

• Ripple

• Others

Cryptocurrency End-use Outlook (Revenue, USD Billion, 2018 - 2030)

• Banking

• Gaming

• Government

• Healthcare

• Retail & E-commerce

• Trading

• Others

Cryptocurrency Regional Outlook (Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

• Asia Pacific

o China

o Japan

o India

o South Korea

o Australia

• Latin America

o Brazil

• Middle East and Africa (MEA)

o KSA

o UAE

o South Africa

List of Key Players in the Cryptocurrency Market

• Advanced Micro Devices, Inc.

• Binance

• Bit fury Group Limited

• Bit Go, Inc.

• Bit Main Technologies Holding Company

• Intel Corporation

• NVIDIA Corporation

• Ripple

• Xapo Holdings Limited

• Xilinx, Inc.

Order a free sample PDF of the Cryptocurrency Market Intelligence Study, published by Grand View Research.

#Cryptocurrency Market Growth Trends#Cryptocurrency Market#Crypto Trends#Crypto Adoption#Crypto Investment#Market Insights#Crypto Growth#Crypto Innovation

0 notes

Text

What Is Cloud Mining? Virtual Bitcoin Mining Explained

The concept of mining cryptocurrencies has been round on the grounds that Bitcoin’s inception in 2009. Mining is the backbone of blockchain networks, ensuring transactions are set up and introduced to the blockchain ledger. Traditionally, mining required effective hardware, fantastic investments, and quite a few technical know-how. However, the advent of cloud mining has changed the game by way of way of providing an much less difficult, more on hand alternative buy rdp private rdp buy rdp with btc.

In this blog, we’ll discover cloud mining in-intensity, explaining what it’s miles, how it works, its experts and cons, and the way equipment like Private RDP can make the technique extra stable and more green. We’ll moreover spotlight the developing trend of figuring out to shop for offerings the usage of Bitcoin, which incorporates how to buy RDP with BTC for better security and privacy.

What Is Cloud Mining?

Cloud mining is a way to mine cryptocurrencies together with Bitcoin without right away dealing with mining hardware. Instead of buying and preserving luxurious rigs, you rent computing power from a service company that operates mining farms—massive centers packed with immoderate-universal overall performance system optimized for cryptocurrency mining.

By buying a cloud mining settlement, customers gain access to part of the business enterprise’s mining power. The rewards earned from mining are then dispensed a number of the individuals primarily based on the hash energy they’ve rented.

Cloud mining gets rid of among the boundaries related to traditional mining, such as system expenses, energy intake, and technical know-how. However, to completely leverage cloud mining, the usage of a Private RDP is recommended for securely managing your mining account. Many users select to shop for RDP with BTC, consisting of another layer of privacy and convenience to the gadget.

How Does Cloud Mining Work?

Cloud mining operates on a clean premise: you pay for using mining hardware, and the issuer does the rest. Here’s a detailed breakdown of the manner it works:

Step 1: Choosing a Cloud Mining Provider

There are many cloud mining companies within the marketplace, each offering numerous applications and advantages. Research is critical to avoid scams and pick out an excellent issuer.

Step 2: Selecting a Mining Contract

Providers provide mining contracts with exclusive specs, together with:

Hash Rate: The computational electricity you’re renting.

Duration: The period of the settlement, frequently ranging from months to years.

Cryptocurrency: The sort of coin you need to mine, which consist of Bitcoin or Ethereum.

Step 3: Payment

After choosing a settlement, clients pay the issuer. Many offerings now take delivery of cryptocurrency payments, allowing you to shop for RDP with BTC and streamline the fee gadget.

Step 4: Start Mining

Once price is processed, the company allocates sources in your mining sports. You can display the progress through a web dashboard, frequently accessed securely the usage of a Private RDP.

Key Terms Related to Cloud Mining

Hash Rate Hash rate refers to the velocity at which a mining device or cloud service solves the mathematical puzzles required to mine cryptocurrency. A better hash rate increases the probabilities of efficaciously mining a block. When deciding on a cloud mining contract, the hash rate determines the computational strength you’re deciding to buy.

Mining Rig A mining rig is a computer machine designed especially for mining cryptocurrencies. Cloud mining removes the need to very own or preserve physical rigs by permitting customers to rent mining resources.

Mining Pool Cloud mining frequently includes joining a mining pool, where more than one customers combine their computational electricity to boom the opportunity of mining a block. The rewards are shared amongst contributors based totally on their contributed hash fee.

Cloud Mining Contract This is the settlement among the user and the provider, detailing the phrases of the mining operation, together with costs, hash rate, length, and payout shape.

Maintenance Fees Many cloud mining companies fee upkeep costs to cowl the price of strength, hardware preservation, and facts center operations. These prices are deducted from your mining rewards.

Cloud Mining: A Global Perspective

Cloud mining services are operated by means of way of agencies with statistics facilities in regions wherein strength is reasonably-priced and renewable strength resources are plentiful. For example:

Iceland: Known for its geothermal energy, Iceland hosts many records facilities dedicated to cryptocurrency mining.

China: Previously a hub for mining because of low strength fees, even though regulatory adjustments have impacted operations.

United States and Canada: Both nations have visible an increase in mining hobby due to get right of entry to to renewable power and supportive hints.

For clients across the globe, cloud mining presents an possibility to take part on this employer without geographical rules. A Private RDP can make certain seamless get entry to to those structures, and paying with Bitcoin allows customers to buy RDP with BTC resultseasily, regardless of their vicinity.

Types of Cloud Mining

There are most important types of cloud mining, each with its very very own benefits and disadvantages:

Hosted Mining In hosted mining, you hire bodily mining rigs from a provider. The tool is housed inside the company’s facility, but you hold full control over its operation. Using a Private RDP to get entry to your hardware remotely can beautify safety and overall performance.

Shared Hashpower This version allows customers to buy a percentage of the agency’s fashionable mining electricity. The rewards are dispensed based mostly on the hash charge you’ve rented. Shared hashpower is often extra low value and high-quality for novices. Both fashions can gain from the use of RDP offerings, in particular when you buy RDP with BTC, as it ensures stable get right of entry to and anonymity.

Advantages of Cloud Mining

Cloud mining gives several advantages, making it a well-known choice among crypto enthusiasts:

No Hardware Hassles

Setting up and retaining mining rigs requires huge attempt and know-how. Cloud mining removes these burdens, permitting clients to interest solely on mining income.

Reduced Upfront Costs

Traditional mining requires large investments in hardware and energy. With cloud mining, users simplest pay for the computing strength they want.

Easy Accessibility

Anyone with an internet connection can start cloud mining, regardless of region. For higher manage and safety, many clients combine Private RDP into their operations.

Energy Efficiency

Cloud mining reduces strength prices for customers, because the organisation absorbs those fees.

Disadvantages of Cloud Mining

While cloud mining has its advantages, it’s not without disturbing conditions:

Risk of Scams

The cloud mining employer is rife with fraudulent operators. Always verify the legitimacy of a issuer earlier than making an investment.

Lower Profit Margins

Providers fee costs for retaining hardware and infrastructure, decreasing your percentage of the rewards.

Lack of Control

Unlike traditional mining, cloud mining gives clients limited manage over the tool and tactics. To mitigate this, the use of a Private RDP can provide extra tracking capabilities.

The Role of RDP in Cloud Mining

RDP, or Remote Desktop Protocol, is a device that permits customers to connect to a faraway pc or server securely. In cloud mining, a Private RDP is beneficial for:

Secure Access

RDP guarantees your connection to mining systems is encrypted, protecting touchy information from capability threats.

Remote Monitoring

With RDP, you could display your mining activities from everywhere in the international.

Privacy with Bitcoin

When you purchase RDP with BTC, you add an additional layer of anonymity, safeguarding your monetary transactions and private facts.

How to Choose a Cloud Mining Provider

Selecting the right cloud mining company is crucial to fulfillment. Consider the following elements:

Reputation

Check reviews and person comments to decide the reliability of the issuer.

Transparency

Look for companies that disclose their mining operations, together with hardware specifications and payout systems.

Payment Options

Choose a corporation that helps cryptocurrency bills so you should purchase RDP with BTC for seamless integration.

Security Features

Ensure the provider has strong protection capabilities, at the side of -element authentication and encrypted connections.

How to Buy RDP for Cloud Mining

RDP offerings play a crucial role in optimizing cloud mining operations. Here’s a step-thru-step manual to shop for RDP with BTC:

Step 1: Find a Reliable RDP Provider

Look for a provider that focuses on secure and high-speed RDP offerings.

Step 2: Choose the Right Plan

Select a plan that meets your mining desires, considering factors like bandwidth, garage, and safety features.

Step 3: Make a Payment

Use Bitcoin to buy RDP plan. Paying with BTC guarantees privateness and rapid transactions.

Set Up Your RDP

Follow the provider’s commands to configure your RDP for stable get entry to in your cloud mining platform.

Cloud Mining vs. Traditional Mining

Cost Comparison

Cloud mining has decrease upfront costs, at the identical time as traditional mining calls for large funding in hardware.

Maintenance

In cloud mining, groups cope with upkeep, whilst conventional miners must manipulate their very own rigs.

Profit Potential

Traditional mining gives better income margins however comes with more risks and responsibilities.

Why Use Bitcoin for Payments?

Bitcoin is a in reality perfect fee method for cloud mining services and RDP plans due to its:

Privacy: Bitcoin transactions do not require personal information.

Speed: Payments are processed short compared to standard banking strategies.

Global Accessibility: Bitcoin can be used anywhere, making it handy to buy RDP.

….Is Cloud Mining Worth It in 2024?….

The profitability of cloud mining relies upon on severa elements, together with the rate of Bitcoin, the fee of contracts, and the company’s reliability. With the proper equipment, at the side of a Private RDP, and with the aid of choosing to buy RDP, cloud mining can be a profitable investment for each beginners and professional miners. By adopting secure practices and staying knowledgeable, you could maximize your earnings and enjoy the blessings of this contemporary approach to cryptocurrency mining.

0 notes

Text

6 Best Bitcoin Mining Software [Updated List]

It is important to select relevant Bitcoin mining software for your Bitcoin mining. This has a huge impact on your mining profitability and winning rewards. Let’s explore this updated list of the top 6 Bitcoin mining software:

CGMiner

CGMiner is a dedicated Bitcoin mining software for mining lovers. This software is an open-source platform for both novice and advanced miners. It also lets users mine other cryptocurrencies like Dogecoin, Ethereum, and Litecoin. CGMiner is compatible with Windows, Mac, or Linux.

Awesome Miner

Awesome Miner is cloud-based Bitcoin mining software. It helps miners to perform their mining activities remotely. You can control and manage your operations from multiple devices. Currently, the software is compatible with Windows and Linux.

EasyMiner

EasyMiner is a top-rated Bitcoin mining software for newbie users. Its graphical representation makes it easy for users to operate and adjust their mining settings seamlessly. The software provides a safe and secure place for mining.

Kyptex Miner

Kyptex Miner is the best Bitcoin mining software for Windows users. It helps users to access their hardware setting directly from their personal computers. Kyptex Miner is a cost-effective Bitcoin mining solution for those who want to start their mining journey with minimal investment.

Ecos

Echos is a well-known Bitcoin mining software. It provides a robust platform for users to control their hardware settings. By gaining data-driven insights from this software, users can avoid mistakes and make better decisions for higher profitability.

Foreman Mining

Foreman Mining is a popular Bitcoin mining software. This software is suitable for miners who want to participate in heavy mining activities. You can adjust and customize your settings with it for a better mining experience.

1 note

·

View note

Text

MB Miners: Your Gateway to Crypto Mining Success

The world of cryptocurrency mining is expanding rapidly, and MB Miners stands at the forefront of this revolution. As the top crypto miners in India, MB Miners offers an extensive range of mining machines, including Antminers, Whatsminers, ASIC miners, and more. Whether you’re a seasoned miner or just starting, MB Miners provides the tools and expertise you need for a profitable mining journey. For those looking to start or expand their mining operations, MB Miners is the go-to place to buy Antminer India online.

Why Choose MB Miners?

MB Miners has earned its reputation as the leading provider of crypto mining machines in India due to several key factors: