#emirates nbd home loan

Explore tagged Tumblr posts

Text

Why choose Emirates NBD Home Loans?

Owning a home is expensive and may seem out of your reach. But there are many loan options in the market that can help you work towards your dream.

While there are many banks and financial institutions in the market offering home loans, Emirates NBD’s home loans are worth checking out. There are several different options to choose from and the bank offers easy processing and quick approvals for both built-up and off-plan properties, in Dubai as well as other emirates.

You can also take an Emirates NBD home loan for expatriates which allows you to buy a home in the UAE while residing in your home country. Just fill in this form and one of the Emirates NBD home loan experts will get in touch and tailor a loan plan for you with manageable EMIs.

Let us quickly dive into the requirements for a home loan:

Eligibility

The eligibility differs from lender to lender, simply being employed or having a source of income doesn’t make you automatically eligible for a home loan. Some of the general eligibility criteria include:

You must be a UAE national or a resident of UAE (unless applying to Emirates NBD for an expatriate home loan)

Minimum salary of AED 20,000 (may differ for different banks)

Aged between 21 – 65 years

If you are a self-employed individual, the minimum tenure of your business in the UAE must be at least 3 years.

Some lenders may also require your job notice period, credit score, company license (self-employed), character certificate, documents of dependent’s etc.

Documentation

The documentation you need to apply for a home loan may differ depending on the lender’s requirements and policies. Some of the general documents required are:

KYC documents (passport, emirates ID, Visa copy)

Employment documents (proof of employment, salary certificate, salary slips)

Credibility documents (credit score, bank statement from last 6 months, credit card statements)

Residence proof (DEWA bill, tenancy contract, proof of residence)

While these may be the general requirements, lenders often perform background checks as per their policies. Your credit score is a big factor that influences weather you can get a loan and how much you can borrow. Read this article to learn more about credit scores and how you can improve yours.

Let’s have a look at some repayment options for your home loan:

Partial settlement:

Banks often offer partial settlement, and this can help you settle your loan quicker and save on interest payments.

Learn more about partial settlement.

Early loan settlement:

Settling your home loan early has many advantages. It improves your credit score, reduces expense on interest leading to more savings, and since you will be debt-free you can invest your funds where they can grow. Know more about early loan settlement.

Restructure your loan:

If you are facing financial difficulties and finding it hard to pay your installments, you can restructure your loan together in consultation with your bank. Emirates NBD offers some great options to restructure your loan so that you can rest easy.

Loan transfer:

You can always shop around for better interest rates and terms and conditions. Transferring your loan to another bank is easy if you find a better bargain. If you chose to move your loan to Emirates NBD, for instance, the bank will offer you a better interest rate than your current one, and higher loan amounts. Read more about Emirates NBD home loans here. Over the years, the options for home loans have grown and it does not hurt to do your research before you sign on the dotted line.

#home loan#emirates nbd#home loan eligibility#home loan in uae#emirates nbd home loan#best bank in uae

0 notes

Text

Navigating the Mortgage Market: Finding the Best Mortgage Company in UAE

Navigating the mortgage market in the UAE can be challenging, given the numerous options available. This guide will help you find the best mortgage company for your needs, ensuring you secure favorable mortgage terms and rates.

For more insights into Dubai's real estate market, visit home loan dubai.

Understanding the UAE Mortgage Market

Market Overview: The UAE mortgage market is diverse and competitive, with a wide range of local and international banks offering various mortgage products. Understanding the market landscape is essential for making the right choice.

Types of Mortgages: Mortgages in the UAE can be classified into fixed-rate and variable-rate mortgages. Fixed-rate mortgages provide stability with consistent monthly payments, while variable-rate mortgages fluctuate based on market conditions.

Eligibility Criteria: Each mortgage company has its own eligibility criteria, including income requirements, employment status, and credit history. Understanding these criteria will help you identify which companies you qualify for.

For more investment options, explore Buy Commercial Properties in Dubai.

Key Features of Mortgage Companies

Competitive Interest Rates: Leading mortgage companies offer competitive interest rates, helping you save money over the loan term. Compare the rates offered by different companies to find the best deal.

Flexible Loan Terms: Look for mortgage companies that offer flexible loan terms, including various repayment periods and options for early repayment without penalties.

Customer Service: Excellent customer service is essential when dealing with mortgage companies. Choose a company with a strong reputation for providing responsive and helpful support.

Quick Approval Process: The approval time for mortgages can vary between companies. Select a company known for its quick and efficient approval process to avoid delays in your property purchase.

Additional Services: Some mortgage companies offer additional services such as mortgage insurance, property valuation, and financial planning advice. These services can add value and convenience to your mortgage experience.

For mortgage services, visit Mortgage Financing in Dubai.

Steps to Finding the Right Mortgage Company

Research and Compare: Start by researching various mortgage companies in the UAE. Use online platforms, read customer reviews, and compare their mortgage products and services.

Seek Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can provide valuable insights into the reliability and efficiency of different mortgage companies.

Consult a Mortgage Broker: A mortgage broker can provide expert advice and help you find the best mortgage deals. They can also assist with the application process and negotiations.

Pre-Approval: Get pre-approved for a mortgage to understand your borrowing capacity and increase your chances of securing a good deal. Pre-approval also makes you a more attractive buyer to sellers.

Meet with Representatives: Schedule meetings with representatives from different mortgage companies to discuss your needs and ask questions. This will help you gauge their responsiveness and willingness to assist.

Review Terms and Conditions: Carefully review the terms and conditions of the mortgage offers. Pay attention to interest rates, loan terms, fees, and any other conditions that may affect your mortgage.

For property management services, visit Apartments For Rent in Dubai.

Popular Mortgage Companies in UAE

HSBC: Known for its competitive interest rates and flexible mortgage options, HSBC is a popular choice for homebuyers in the UAE.

Emirates NBD: Emirates NBD offers a range of mortgage products tailored to different needs, along with excellent customer service and quick approval times.

Mashreq Bank: Mashreq Bank provides personalized mortgage solutions with attractive rates and minimal fees, making it a preferred choice for many buyers.

ADCB: Abu Dhabi Commercial Bank (ADCB) offers comprehensive mortgage products with competitive rates and flexible repayment options.

Dubai Islamic Bank: For those seeking Sharia-compliant mortgage solutions, Dubai Islamic Bank offers a variety of Islamic mortgage products with favorable terms.

For property sales, visit Property For Sale in Dubai.

Real-Life Success Story

Consider the case of Noor and Hadi, who recently purchased their dream home in Dubai. By working with a reputable mortgage company, they secured a mortgage with favorable terms. The mortgage company provided expert advice, handled the paperwork, and ensured a smooth process from start to finish. This allowed Noor and Hadi to focus on finding their perfect home without worrying about the complexities of securing a mortgage.

For more insights into Dubai's real estate market, visit home loan dubai.

Future Trends in the UAE Mortgage Market

Digitalization: The UAE mortgage market is embracing digitalization, with many companies offering online application processes, digital document submission, and virtual consultations. This trend is making the mortgage process more efficient and convenient.

Sustainable Mortgages: There is a growing demand for sustainable mortgages that support environmentally friendly and energy-efficient homes. Mortgage companies are beginning to offer products that cater to this demand.

Flexible Mortgage Products: Mortgage companies are increasingly offering flexible mortgage products that cater to the diverse needs of homebuyers. This includes options for expatriates, first-time buyers, and investors.

For property sales, visit Sell Your Apartments in Dubai.

Conclusion

Navigating the mortgage market in the UAE involves careful research, comparison, and consideration of various factors. By understanding the market, seeking recommendations, and evaluating your options, you can secure a mortgage that meets your needs and financial goals. For more resources and expert advice, visit home loan dubai.

6 notes

·

View notes

Text

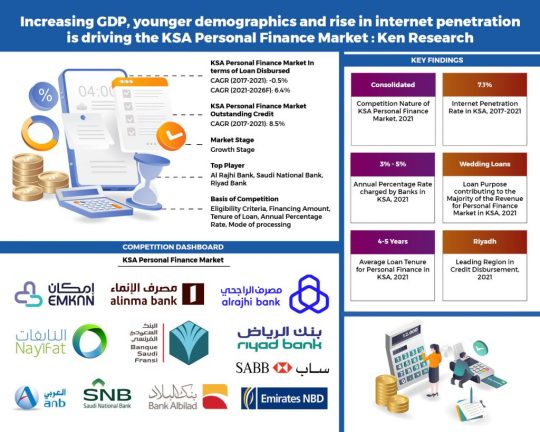

KSA Personal Finance Market to grow exponentially with size of outstanding credit expected to contribute more than SAR 800 Bn by 2026F: Ken Research

Buy Now

The KSA Personal Finance Market is in growing stage, being driven by technological advancements and digitalization in personal financing. Banks dominate the supply side of the KSA personal finance ecosystem, however the emerging non-banking finance companies and FinTech companies are expected to create tough competition in the market.

Due to shift of focus towards ownership of homes in Saudi Arabia Vision 2030 project, the renovation and home improvement segment is expected to grow and that might aid the personal finance market in the country.

The major players in the personal finance market include Al Rajhi and SNB followed by Emirates NBD, Banque Saudi Fransi. Non-banks are in the market include Nayifat Finance Company and Emkan Finance Company.

Working women population in KSA has been on an increasing trend and is expected to lead to an increase in the market, thereby positively affecting the KSA Personal Finance Market.

Future of KSA Personal Finance Market: The KSA Personal Finance Industry is expected to grow at a robust CAGR. Outstanding personal loans are expected to grow with in the next four years. Wedding loans are expected to account for the majority share by renovation and home improvement loans, which is mainly driven by Saudi Arabia Vision 2030. Due to increasing privatization and the goal of privatization being included in Vision 2030, the number of employed workforces is expected to increase and the workforce is also expected to decline for public sectors.

Entrance of New Players in the market: New players entering the KSA Personal Finance Market are FinTech companies. The country currently has 82 FinTech companies and the number in these companies is expected to grow rapidly over the next few years. The market has witnessed partnership between FinTech companies and decision analytics companies to make their digital lending process more robust. With new entrants, strict changes in policies can be seen related to insolvency and other parameters.

Government policies: Vision 2030 by the KSA government has massive plans for the economy targeting to improve employment figures that might be fruitful for the personal finance market as well. The loans borrowed by Large Corporation and Private Sector is expected to grow mainly due to increasing privatization as one of the goals in Vision 2030. KSA’s Vision 2030 includes Financial Sector Development Program which envisions better access to financial products and aims to increase the share of cashless transactions by developing the digital infrastructure. The Program also focuses on enabling FinTechs to drive innovation and competition. FinTech companies are expected to contribute immensely towards the growth of the market.

The report “KSA Personal Finance Market Outlook to 2026F – Driven by Growing Digitalization and Increased Consumption Needs” by Ken Research provides a comprehensive analysis of the potential of the Personal Finance Industry in KSA. The report also covers the overview and genesis of the industry, market size in terms of outstanding credit and number of loans; market segmentation by purpose of loan, by supplier, by tenure of loan, by booking mode, by geography, by nationality of borrower, by employment of borrower; growth enablers and drivers, challenges and bottlenecks, trends driving digital adoption; regulatory framework; industry analysis, competitive landscape including competition scenario, market shares of major players on the basis of outstanding credit. The report concludes with future market projections of each segmentation and analyst recommendations.

Key Segments Covered:-

KSA Personal Finance Market

By Purpose of Loan

Wedding

Renovation & Home Improvement

Consumer Durables

Tourism & Travel

Medical

Education

Debt Consolidation

Others

By Supplier

Banks

Non-Banks (NBFIs & FinTechs)

By Tenure of Loan

< 1 year

1-2 years

2-3 years

3-4 years

4-5 years

By Booking Mode

Online

Offline

To learn more about this report Download a Free Sample Report

By Geography

Riyadh

Jeddah

Dammam

Others

By Nationality of Borrower

Saudi

Non-Saudi

By Employment of Borrower

Government Employee

Large Corporation Private Sector Employee

Medium & Small Corporation Private Sector Employee

Self-Employed

Others

Key Target Audience:-

KSA Finance Industries

Government Bodies & Regulating Authorities

Finance Industry

Finance Companies

Visit this Link :- Request for custom report

Time Period Captured in the Report:-

Historical Period: 2017-2021

Base Year: 2022

Forecast Period: 2022– 2026F

Companies Covered:-

Banks

Al Rajhi Bank

Saudi National Bank

Riyad Bank

The Saudi British Bank (SABB)

Banque Saudi Fransi

Arab National Bank

Al Bilad Bank

Emirates NBD

Alinma Bank

Non-Banks

Nayifat Finance Company

Emkan Finance Company (owned by Al Rajhi Bank)

Murabaha Marena Financing Company

United Company for Financial Services (Tasheel Finance)

Al Yusr Leasing & Financing

Al-Amthal Finance Company

Tamam

Quara Finance Company

Tayseer Finance

Saudi Finance Company (acquired by Abu Dhabi Islamic Bank)

Abdul Latif Jameel United Finance Company

Osoul Modern Finance Company

Matager Finance Company

Key Topics Covered in the Report:-

KSA Personal Finance Market Overview

Ecosystem of KSA Personal Finance Market

KSA Personal Finance Industry Evolution

KSA Personal Finance Market Size, 2017-2021

KSA Personal Finance Market Segmentation, 2021 (By Purpose of Loan, By Supplier, By Booking Mode, By Tenure of Loan, By Geography, By Nationality of Borrower, By Employment of Borrower)

Industry Analysis of KSA Personal Finance Services

Value Chain of KSA Personal Finance

Key Growth Drivers in Personal Finance Market in KSA

Trends and Developments in KSA Personal Finance Industry

SWOT Analysis of KSA Personal Finance Industry

Islamic Financing

Issues and Challenges in KSA Personal Finance Industry

Government policies affecting the KSA Personal Finance Industry

Competition Framework for KSA Personal Finance Market

Future Outlook and Projections of the KSA Auto Finance Market, 2021-2026F

Market Opportunities and Analyst Recommendations

Research Methodology

For more insights on the market intelligence, refer to below link:-

KSA Personal Finance Market

Related Reports by Ken Research:-

Germany Remittance Market Outlook to 2027F

Malaysia Buy Now Pay Later Market Outlook to 2027F

Australia Remittance Market Outlook to 2027F

Belgium Remittance Market Outlook 2027F

0 notes

Link

Find Emirates NBD Home Loans with Variable And Fixed Interest Rate in Dubai, UAE only at soulwallet.com. Get Variable And Fixed Interest Rate offer with Emirates NBD Home Loans Online with Extensive features & other great benefits. Apply Today!

0 notes

Text

GULF INTERNATIONAL FINANCE LIMITED

Finance/ Byzakria Nadeem

Gulf International Finance Limited (GIF) is a leading provider of Islamic banking, investment and financial services. GIF is headquartered in the United Arab Emirates and has offices in Bahrain, Jordan, Kuwait, Oman, Qatar and Saudi Arabia.

GIF was established in 1974 as a joint venture between the Abu Dhabi Investment Council (ADIC) and the DubaiFinancialGroup (DFG). The company has grown to be one of the largest Islamic financial institutions in the world with assets of more than $100 billion.

The company operates under Sharia principles which means that its products are based on Islamic law. This means that no interest can be charged on loans or investments and all transactions must comply with Islamic law. It also means that GIF does not offer any products or services that involve forbidden practices such as gambling or alcohol consumption. Their international division offers products such as multi-currency mortgages, foreign exchange trading and wealth management services for high net worth individuals from non-Muslim countries. (Gulf International Finance Limited)

The firm’s customers include multinational corporations across various industries such as healthcare providers, food manufacturers, banks and construction companies among others. (Gulf International Finance Limited)

INTERNATIONAL FINANCE COMPANIES IN DUBAI

Dubai is one of the world’s most important financial centres, and is home to many internationalfinance companies.These companies play a vital role in the city’s economy, and provide a wide range of financial services to businesses and individuals.

The Dubai International Financial Centre (DIFC) is the city’s main financial district, and is home to many of the world’s leading banks andfinancialinstitutions. The DIFC is a hub for international trade and investment, and provides a gateway to the Middle East’s financial markets.

The Dubai Financial Market (DFM) is another important financial centre in Dubai, and is the largest stock exchange in the Middle East. The DFM is a major regional player in the global financial markets, and offers a wide range of investment opportunities.

Another few international finance companies in Dubai are Emirates NBD, Emirates Islamic Bank, Abu Dhabi Commercial Bank, and National Bank of Abu Dhabi.

Dubai is also home to many privatebanksand wealth management firms, which provide a range of services to high-net-worth individuals. These firms offer a wide range of investment products and services, and provide expert advice on financial planning and investment strategies. Some of these firms include Barclay’s Wealth Management, HSBC PrivateBankingServices, and Standard Chartered Private Wealth.

TOP LIST OF FINANCE COMPANIES IN DUBAI

There are many finance companies in Dubai that offer a wide range of services. These companies can help you with everything from getting a loan toinvesting your money.The List is too long But I am Sharing with you Some of the top finance companies in Dubai include

-Emirates NBD

-Citibank

-Standard Chartered

– Emirates NBD

– HSBC

– Standard Chartered Bank

– Mubadala Development Company

– Abu Dhabi Commercial Bank

– Investment Corporation of Dubai

– Dubai Islamic Bank

– Mashreq bank

So, If you’re looking for a loan, these finance companies can offer you competitive rates and terms. If you’re looking to invest your money, they can offer you a variety of options and help you find the best investment for your needs. No matter what your financial needsare, there’s a finance company in Dubai that can help you. You just need to take some time to do some research on the different companies and figure out which one is right for you.

PRIVATE FINANCE IN DUBAI

Private finance in Dubai is an important and growing industry. With the city’s economy booming, there is a growing demand for private financial services.

There are a number of privatefinancialinstitutions in Dubai that offer a range of services, from investment and banking services to insurance and financial planning. These institutions play an important role in the city’s economy, and provide a vital service to its residents.

So, The private financial sector in Dubai is highly regulated, and all institutions must adhere to strict guidelines. This ensures that the industry is safe and sound, and that consumers are protected.

The privatefinanceindustry in Dubai is a vital part of the city’s economy, and plays an important role in its development. Many institutions offer a wide variety of services, with new ones continually opening. As long as you choose wisely and abide by the laws set out by regulatory bodies such as DIFCA or DFSA, then you will be well looked after.

TOP FINANCE COMPANIES IN UAE

There are many finance companies in UAE that cater to the needs of different customers. These companies offer a variety of products and services that can meet the needs of individuals and businesses. These companies offer a variety of financial products and services, such as loans, investment banking, asset management, and more.

Some of the top finance companies in UAE are Al Hilal Bank, Emirates NBD, HSBC, Mashreqbank, Abu Dhabi Commercial Bank, First Abu Dhabi Bank, Dubai Islamic Bank, and more.

Al Hilal Bank is one of the leading banks in UAE that offers a range of services including personal and corporate banking, investment banking, and Islamic banking.

Emirates NBD is another leading bank in UAE that provides a wide range of banking products and services.

HSBC is another multinational bank that offers a variety of banking products and services to its customers.

Mashreqbank is another leading bank in UAE that offers a wide range of banking products and services including personal banking, corporate banking, and investment banking.

Abu Dhabi Commercial Bank is also a leading bank in UAE which offers a variety of banking products and services for individuals, SMEs, and corporates.

First Abu Dhabi Bank is another popular bank with diverse banking offerings for all types of customer segments.

Dubai Islamic Bank is also an established company offering various types of financial services like mortgage financing, consumer financing, leasing financing, vehicle financing etc.

#gulf#uae#dubai#kuwait#bahrain#oman#qatar#ksa#gulfkanawut#mewgulf#porsche#q#mewsuppasit#travel#tharntype#muscat#mew#gulfofmexico#abudhabi#florida#tharntypetheseries#saudiarabia#gulfcoast#gcc#university#gt#beach#lemans#love#art

0 notes

Photo

Home Loans for UAE Nationals | Emirati Mortgage | Emirates NBD

Avail finance up to 85% of property value at Emirates NBD bank in UAE offering home loans for UAE nationals up to 25 years. Apply for Emirati housing loan.

0 notes

Text

Emirates NBD’s Turkey Bet Just Got $1bn Cheaper

On the face of it, Emirates NBD PJSC’s acquisition of Turkey’s Denizbank AS has become about $1 billion cheaper. Still, the deal could prove to be the riskiest yet for Dubai’s biggest bank.

Since Emirates NBD agreed to buy the Turkish lender from Russia’s Sberbank for 14.6 billion liras — worth $3.2 billion on May 22 — the value of the acquisition has fallen to about $2.27 billion in dollar terms after a 28 percent plunge in the lira, with most of that occurring last week. A deal is expected to close later this year.

The lira plunge “might trigger a materially adverse clause that would benefit Emirates NBD, creating the possibility of renegotiating the deal with Sberbank,” Arqaam Capital Ltd. analysts led by Jaap Meijer said in a note on Sunday. This could reduce the purchase price and make it “more manageable from a capital perspective.”

Emirates NBD is “closely monitoring” events in Turkey, a spokesman said in an emailed statement on Sunday. The sales and purchase agreement contains various terms as part of the overall commercial arrangement, which are confidential and cannot be disclosed, he said.

Financial Crisis

Turkey’s highly-competitive banking sector of 51 lenders is under pressure as investors worry that the country is sliding toward a full-blown financial crisis. The lira slumped as much as 17 percent against the dollar on Friday after President Recep Tayyip Erdogan showed no signs of backing down in a standoff with the U.S.

Turkish banks are also being squeezed as a supply of government-backed credit starts to run out and as the government presses banks to keep extending loans at interest rates that barely make up for inflation.

The deal has value for Emirates NBD “because of the growth opportunities and diversification benefit, but they are entering at the wrong time, which might require a higher capital injection into Denizbank,” Bloomberg Intelligence analyst Edmond Christou said in an email. “Non-performing loans will increase, lending growth will decline from double digits to high single digit rate and margins will be pressured as the cost of funds rises.”

Faced with limited expansion opportunities at home, Turkey’s young and under-banked population of over 80 million is an attractive proposition for Gulf-based lenders. Qatar National Bank bought National Bank of Greece SA’s Turkish unit in 2016 and Commercial Bank of Qatar took full ownership of Alternatifbank AS the same year.

Denizbank, which mainly offers retail and corporate banking as well as loans to the agriculture and tourism industries, posted a second-quarter net income of 700.7 million liras ($109 million).

“It all boils down to the commercial terms and clauses that they have negotiated with DenizBank,” Aarthi Chandrasekaran, a vice-president at Shuaa Capital PSC, said by email. “A depreciation of 41 percent against the dollar is a big deal, and if this decline is not contained then it could possibly move the initial purchase agreement.”

The post Emirates NBD’s Turkey Bet Just Got $1bn Cheaper appeared first on Bloomberg Businessweek Middle East.

from WordPress https://ift.tt/2MLOohc via IFTTT

2 notes

·

View notes

Text

Easy payment personal loans in Dubai

The banks in the United Arab Emirates give out around 1.3 trillion dirhams (355 billion dollars) as loans each year. This is largely given to the immigrants, who earn a steady salary and have a valid residential permit.

For those of you who have been looking for loans to help out family or make important payments, the country of UAE is one of the most liberal ones. The country is also known for its small interest rates, which is helpful to the takers rather than the banks.

Depending on your salary and bank, you can pay a certain amount on a monthly basis and over the course of a particular time period. This timing can vary depending on the size of the loan and your ability to pay the maximum amount.

These easy payment personal loans in Dubai can be multiple times your salary, and this is entirely dependent on the bank. The duration of payment, however, is fixed and is usually in the range of 2 to 5 years. Different banks have various kinds of offers and schemes; here is an overview to help you make your decision better.

RAKBANK RAK Islamic Personal Finance

A bank with a rich history in the country, they are known to give loans to everybody and up to 20x their salary.

The minimum salary requirement for a person to be eligible for loans is 3000 AED.

There are two rates offered by the banks namely fixed interest and reducing interest. The former is used for short-term loans, i.e. duration less than 18 months and the latter is used for long-term loans.

The bank can give out an amount of 1.25 million AED, and one has to meet the salary criteria to get the loan. The bank gives out maximum term up to only 48 months or 4 years.

The scheme also offers a holiday period where the loanee does not have to pay the amount for a month; this can be availed once six months of payments have been completed.

For anyone looking for a quick loan to help them, RAKBANK offers a great range of schemes and offers.

Click here to apply for the RAKBANK RAK Islamic Personal Finance

Emirates NBD personal loan for expats:

For the immigrants and the residents here on work permits, it might be harder to find a suitable loan scheme.

The salary requirements are low and can be recessed in 7 days. This is beneficial to new employees, who want to apply early in order to help out with monetary issues back home. The minimal requirement is for a person to earn just over 5000 AED monthly.

There is a flat rate of 2.63% and a reducing rate of 4.99%. If you plan to apply for a big loan, it is smart to opt for the reducing rate as it helps curb interest rates in the long run.

There is also a holiday period where you can skip two non-consecutive instalments per year. This loan scheme allows you to apply even if you are self-employed.

Click here to apply for Emirates NBD personal loan for expats

Citibank salary transfer loan:

One of the most well-renowned banks in the world offering loans in a country which has some of the lowest rates.

This loan offer is one of the best you can find. It is offered to salaried individuals earning over 8000 AED in a month. The reducing rate is generally fixed around 6.99% but can vary according to the profile of the individual.

The flat rate as per a four-year calculation is around 3.73%. This loan is strictly for salaried employees, and the maximum term is 4 years.

For individuals looking for a quick loan to help, this option by Citibank seems to be popular for good reasons.

Click here to apply for Citibank salary transfer loan

Standard Chartered Saadiq personal finance:

This loan option is one of the more big ones available; customers can take up to 1 million AED in loans. The minimal salary requirement for such a loan is 30000 AED and comes with a 7.05% reducing rate and a 3.76% fixed rate.

The maximum term for such a borrowing is 4 years. If you want a rather big loan to finance getting your house, buying your dream car; this option is the best for you. You also avail a holiday period of two installment payments after a 12-month period.

There is no minimum balance requirement once you decide to get to the finance period. There is also a top-up facility given by the bank to help you if out if you need it.

Click here to apply for Standard Chartered Saadiq Personal Finance

CBD Bank Absher personal finance for UAE nationals:

For the citizens of the UAE looking to get a loan, the CBD bank has a great choice for you. With just a minimum salary of AED 8000 required to take this loan, you can take up to 20 times the salary.

Since it is offered to the citizens of the country, the maximum amount is far greater than what any other bank can offer.

If you can afford it, the bank will allow you to take nearly 2.5 million AED. For the ambitious ones among you looking to purchase a bungalow and other such luxuries, this loan is perfect.

The reduced rate of just 5.50% is a boon, however, depending on your profile and credit score it can jump to nearly 11%.

The flat rate is also a lowly 3%, great for any short-term loan you are looking to take. There are holiday options, it can be taken for the duration of 4 years and is only available to salaried employees.

Click here to apply for CBD Bank Absher Personal Finance

United Arab Bank personal loan for expats:

This alternative from the UAB is another one for the expatriates. It requires just a minimum salary of just 7500 AED and the reducing rates are just under 5.25%.

The flat rate is the lowest among any offering and comes in at just under 2.87% per annum. For those of your fortunate enough to have a big salary, you can take loans of up to 2 million AED.

If you want to settle here and get a big house and raise a family, loans of such magnitude are perfect.

You get additional benefits such as top-ups for any other expenses, free credit cards for the first year and a revolving overdraft facility. You can also get a holiday period on your payment once you have completed the first 12 months.

Click here to apply for United Arab Bank Personal Loan for Expats

These loan options are some of the many that are available. Personal loans can be used to alleviate pressures back home and for to help you lead out a more comfortable life here. With the low rates of interest, there is no better place to take it than the United Arab Emirates.

0 notes

Text

Post COVID-19: UAE banking sector remains resilient to global challenges

Headquarters of First Abu Dhabi Financial institution. The UAE’s banking sector remains robust and resilient regardless of a number of challenges posed by global financial developments final yr, in accordance to the 2019 annual report of the Central Financial institution of UAE (CBUAE). Picture Credit score: DailyKhaleej Archive

Dubai: The UAE’s banking sector remains robust and resilient regardless of a number of challenges posed by global financial developments final yr, in accordance to the 2019 annual report of the Central Financial institution of UAE (CBUAE).

“Despite the turbulent external environment, the UAE’s banking sector remained sound in 2019 with strong levels of capital and liquidity,” stated Abdulhamid Saeed the Governor of CBUAE, in his message within the 2019 annual report.

The Governor stated the banking sector will likely be going through a tougher 2020. “The outlook is uncertain, marked by the global impact of the COVID-19 pandemic, both in terms of human lives, health and the economic activity,” stated Saeed.

“The strength and resilience of the banking sector will be tested, and the CBUAE shall continue to play its role in terms of guiding the banking sector through this period, with active intervention in various facets ranging from liquidity, capital adequacy and other policy measures to ensure we continue to help the business environment in the UAE, with a special focus on small and medium enterprises.”

Stability-sheet progress

The UAE’s banking sector witnessed main progress on consolidation final yr with 7.5 per cent progress in gross belongings to Dh3.08 trillion. Complete credit score grew 6.2 per cent to Dh1.75 trillion in contrast to 2018’s Dh1.65 trillion. For underlying home credit score, the lending progress was primarily pushed by lending to the federal government sector, which elevated by 34 per cent in addition to to government-related entities, which rose 10 per cent.

Islamic banks have a share of 18.6 per cent of complete belongings and 20.eight per cent in complete gross financing.

Complete home credit score grew 5.5 per cent to Dh1.59 trillion. Regardless of the decline in lending to people, the rise in credit score to non-public corporates led to an increase in general credit score progress to the non-public sector. The sectors with the very best year-on-year progress had been manufacturing; electrical energy, gasoline and water; transport, storage and communication, and monetary establishments (excluding banks).

Dubai Islamic Financial institution, the biggest Islamic Financial institution within the UAE. Islamic banks have a share of 18.6 per cent within the complete belongings and 20.eight per cent within the complete gross financing of the banking system. Picture Credit score: DailyKhaleej Archive

The sectors experiencing a decline in credit score on the finish of 2019 had been agriculture, mining and quarrying, building and actual property and commerce.

On the legal responsibility facet, buyer deposits had been increased by 6.5 per cent to Dh1,87 trillion. Nearly 90 per cent of complete deposits are held by residents. The rise in resident deposits was primarily due to the change in non-public sector deposits, which elevated by Dh48.5 billion, as well as to the rise in GRE deposits by Dh36.6 billion.

Deposits by the kind of banks – i.e., standard vs. Islamic banks – signify 78.5- and 21.5 per cent of complete deposits on the finish of 2019. In the meantime, the share of nationwide and overseas financial institution deposits represents 88.6 per cent and 11.four per cent, respectively.

Asset high quality

For 2019, the UAE banking sector reported a web non-performing mortgage ratio of two.four per cent.

The CBUAE continued to consider banks’ administration of credit score, liquidity and capital associated dangers via its annual banking system stress-test train to make sure the resilience of the banking sector. All UAE nationwide banks and 4 overseas banks participated within the stress check.

The outcomes of the stress exams served as an enter to banking supervision and their supervisory actions the place related. As well as, the CBUAE carried out thematic stress exams specializing in liquidity and government-related enterprises (GRE).

Monetary soundness

In accordance to the report, banks stay properly capitalised, with a median capital adequacy ratio (CAR) of 17.7 per cent, Tier 1 capital ratio at 16.5 per cent, and customary fairness Tier 1 ratio (CET 1) at 14.7 per cent by finish 2019.

The loan-to-deposit (L/D) ratio for the entire banking system decreased barely to 94 per cent by December. Eligible liquid belongings, as a ratio of complete liabilities, elevated to attain 18.1 per cent on the finish of 2019. This stage of liquid belongings constitutes an sufficient buffer as it’s properly above the 10 per cent regulatory minimal required by the CBUAE.

The extent of complete liquid belongings at banks as on the finish of December stood at Dh455.9 billion, or Dh48.three billion increased in contrast to finish 2018, which corresponds to a 12 per cent enhance.

Emirates NBD, one of many largest banks within the UAE accomplished the acquisition of Turkey’s Denizbank from Russia’s Sberbank in 2019. Picture Credit score: DailyKhaleej Archive

Variety of banks and branches within the UAE

In 2019, the variety of licensed business banks dropped by one, due to merger of two native banks, to attain 59.

The third quarter additionally noticed the acquisition of a Turkish financial institution by a UAE financial institution. The whole variety of banks includes 21 nationwide and 38 overseas banks, together with 11 wholesale banks.

The Central Financial institution’s annual report exhibits that nationwide banks continued to cut back their branches, which declined to 656 on the finish of December in contrast to 743 the earlier yr. The variety of staff in nationwide and overseas banks declined to 35,637 in December 2019.

from WordPress https://ift.tt/35zY2xN via IFTTT

0 notes

Text

Egypt’s economy shows signs of life

AT TIMES last year it looked as if Abdel-Fattah al-Sisi, Egypt’s authoritarian president, was losing his grip. Faced with a faltering economy, he told Egyptians that they needed to sacrifice—by not eating or sleeping, if necessary. Perhaps they could send him their spare change too, he said.

Rummaging behind the cushions hardly seemed enough to turn around an economy plagued by political instability, and by terrorism that had scared off tourists and foreign investors. Moreover, while exhorting his countrymen to tighten their belts, Mr Sisi was squandering billions of dollars of aid from Gulf states on wasteful subsidies and on defending Egypt’s overvalued currency. The futility of these policies can be seen in a handful of figures: a gaping fiscal deficit that hit 12% of GDP last year; ballooning public debt (101% of GDP) and high unemployment (over 12%).

Yet there are signs that Mr Sisi is starting to put Egypt back on a more sensible economic track. In order to obtain a $12bn loan from the IMF last year, his government has raised the price of subsidised fuel and electricity, brought in new taxes and allowed the Egyptian pound to float.

The currency float was promptly followed by a sickening lurch in which it lost 50% of its value. It bounced back sharply in February, then retreated again (see chart). Though the medicine was bitter, it seems to have been just what was needed to lure foreign investors back into the Egyptian market. A sale of $4bn-worth of government bonds in January was more than three times oversubscribed, and foreign purchases of Egyptian treasury notes doubled in the same month. This appetite for investing in Egypt partly reflects a broader demand for emerging-market debt. But it is also a clear sign of growing confidence in the Egyptian economy.

That change in mood is also felt by Egyptians working abroad. Remittances, which accounted for as much as 7% of GDP in 2012, slumped by a fifth last year as people held onto foreign currency rather than send it home to be converted into overvalued pounds. Since the currency has floated, remittances are rising once more.

A weaker currency is also spurring growth, albeit gradual, in trade and tourism. Non-petroleum exports increased by 25% in January compared with the year before. Earnings from exports, along with new loans from the IMF and other sources, are plumping up the country’s foreign-currency reserves. In February they hit their highest level since 2011, promising to ease a shortage of dollars that has hindered Egyptian business. To be sure, businessmen gripe that it is still difficult to get the dollars that they need, and the government is still clearing a backlog of payments to oil firms and other multinationals.

Yet even as exporters celebrate, firms serving the domestic market are struggling. One measure of the health of the domestic economy comes from a purchasing managers’ index (PMI) compiled by Emirates NBD, a bank. Its figures suggest that private, non-oil economic activity has contracted for 17 consecutive months, even though official figures show that the economy as a whole (including oil and the state) has been growing. One reason is that the government’s efforts to cut subsidies mean Egyptians are spending more of their income on fuel and electricity, and have less left over for other things. A weaker currency has also led to higher prices for imports and fuelled consumer inflation. Red tape continues to tie firms in knots, although the government has promised to make it easier to do business, for example by smoothing the process for getting licences and permits to open factories.

The struggles of Juhayna, a big juice and dairy producer, are typical. Its profits declined by 34% in the third quarter of 2016 compared with the same period in 2015. Now it plans to raise prices and cut investment. Seif El Din Thabet, its CEO, blames its troubles on “the recession and low consumer purchasing-power”.

Yet there are signs that a broader recovery may come soon. The weaker currency is proving a fillip to some manufacturers, as consumers switch from expensive imports to cheaper domestic alternatives. Egypt’s trade deficit in January was 44% smaller than it had been a year earlier.

These benefits are yet to trickle down to the average Egyptian. “We hear about the improvement on TV and read about it in the newspapers, but on the ground, nothing is getting better,” says Ashraf Muhammad, a barber in Agouza. Inflation climbed to 28% in January. It will probably remain high if the government cuts subsidies and raises taxes this year, as planned. Prices for staples have skyrocketed; other products are no longer available. “Some medicines I use disappeared for a while,” says Mr Muhammad, who suffers from diabetes. “Now they are available, but at higher prices than before.”

The protesters who toppled Hosni Mubarak, the strongman who ruled Egypt from 1981 to 2011, demanded social justice. So Mr Sisi may be wary of imposing too much pain on Egyptians. His government has backed away from reforms in the past and may lose any sense of urgency when Zohr, a lucrative gasfield, starts production at the end of the year. But international investors and institutions are watching closely for any sign of backtracking. The IMF will review matters before sending Egypt more cash later this year. “We are seeing good progress,” said Christine Lagarde, the head of the fund, last month.

Egyptians are more circumspect. “I don’t blame the government for taking the hard way, but, at the same time, they should have considered the poor people,” says Mr Muhammad. Still, he is sure that things will get better, albeit slowly.

This article appeared in the Middle East and Africa section of the print edition under the headline "Green shoots"

http://ift.tt/2m77RM5

0 notes

Text

Dubai’s Amlak Close to Restructuring $1.2 Billion With Creditors

(Bloomberg) — Amlak Finance is nearing a deal to restructure debt for a second time as the Dubai-based Islamic mortgage provider navigates an ongoing property slump, according to two people with knowledge of the plan.

Read: Warren Buffett Bets on Dubai Property

The company is asking creditors to reschedule repayments on $1.2 billion of loans over the originally agreed period that ends in 2026, said the people, asking not to be identified because the information is private. Most lenders have agreed to the new terms but a final deal hasn’t been signed, they said.

PricewaterhouseCoopers LLP is advising a group of about 28 creditors on their negotiations with Amlak, the people said. A spokeswoman for Amlak declined to comment.

Mobius Says Don’t Buy Dubai Property Before ‘Real Slump’

Dubai’s ‘Long Decline’ in Property Prices Isn’t Over Yet for S&P

Dubai property market: Avalanche of New Homes Extends Stubborn Slump

Amlak, in which Emaar Properties PJSC holds a 45% stake, is restructuring its debt again after it agreed to new terms on $2.7 billion of loans in 2014. Delaying some of the repayments may help Amlak if and when the property market rebounds.

Property prices in Dubai, the Persian Gulf’s business hub, have slumped 27% since October 2014 amid excess supply and sluggish economic growth. The emirate will host the World Expo next year which it hopes will spark a recovery. Rising oil prices may also help boost economic growth and support demand.

Emirates NBD PJSC, the United Arab Emirates’ second-biggest lender, Standard Chartered Plc, Dubai Islamic Bank PJSC, Abu Dhabi Islamic Bank PJSC, Dubai’s Department of Finance and the National Bonds Corp. PJSC are among creditors.

The post Dubai’s Amlak Close to Restructuring $1.2 Billion With Creditors appeared first on Businessliveme.com.

from WordPress https://ift.tt/2xQG0aw via IFTTT

0 notes

Text

What is Emirates NBD Home Loan Calculator?

When you have finally decided to own a home of your own, you may be looking for a home loan. With a plethora of choices from different lenders, one of the most important things to consider is the EMI (equated monthly installments) on the loan. Your EMIs are a fixed amount, which includes the principle and interest which you will pay on a monthly basis, until your loan is fully paid back.

An EMI calculator is often used by the lenders to give you an idea of your loan timeline and the EMIs to be paid monthly.

There are 3 main factors that influence an EMI:

Loan amount: Principal amount borrowed from your lender.

Interest rate: The rate at which your lender has agreed to grant you the loan.

Tenure: Duration for which you have taken the loan.

Based on the above factors, an EMI calculator computes the interest to be paid monthly. Calculate your monthly EMIs using Emirates NBD’s loan calculator.

The calculator also helps you to ascertain affordability and can show you how to enhance your repayments for early debt retirements.

Let’s have a look at some of the benefits of using a home loan calculator:

No need for personal details: When you use an EMI calculator, there’s no requirement to reveal your personal identity, making it safe to toggle and calculate your loan repayment.

Future planning: The EMI loan calculator enables you to plan, as you can expect to set aside a monthly amount to be paid. This way your budgets are more efficiently managed, and you can work your way towards owning your dream home.

Comparison of other loans: Use the calculator to easily compare loans from other banks.

Borrowing a home loan is a big responsibility, but using an EMI calculator and planning ahead enables you to plan your finances better. Learn to manage your debts better here.

0 notes

Text

A Complete Guide to Mortgage Companies in UAE

Choosing the right mortgage company in the UAE is a crucial step in securing a home loan with favorable terms. This complete guide will provide you with everything you need to know about mortgage companies in the UAE.

For more information on Dubai's real estate market, visit home loan dubai.

Understanding the UAE Mortgage Market

Market Overview: The UAE mortgage market is diverse and competitive, with a wide range of local and international banks offering various mortgage products. Understanding the market landscape is essential for making the right choice.

Types of Mortgages: Mortgages in the UAE can be classified into fixed-rate and variable-rate mortgages. Fixed-rate mortgages provide stability with consistent monthly payments, while variable-rate mortgages fluctuate based on market conditions.

Eligibility Criteria: Each mortgage company has its own eligibility criteria, including income requirements, employment status, and credit history. Understanding these criteria will help you identify which companies you qualify for.

For more investment options, explore Buy Luxury Property in UAE.

Key Features of Mortgage Companies

Competitive Interest Rates: Leading mortgage companies offer competitive interest rates, helping you save money over the loan term. Compare the rates offered by different companies to find the best deal.

Flexible Loan Terms: Look for mortgage companies that offer flexible loan terms, including various repayment periods and options for early repayment without penalties.

Customer Service: Excellent customer service is essential when dealing with mortgage companies. Choose a company with a strong reputation for providing responsive and helpful support.

Quick Approval Process: The approval time for mortgages can vary between companies. Select a company known for its quick and efficient approval process to avoid delays in your property purchase.

Additional Services: Some mortgage companies offer additional services such as mortgage insurance, property valuation, and financial planning advice. These services can add value and convenience to your mortgage experience.

For mortgage services, visit Dubai Mortgage Advisors.

Steps to Choosing the Right Mortgage Company

Research and Compare: Start by researching various mortgage companies in the UAE. Use online platforms, read customer reviews, and compare their mortgage products and services.

Seek Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can provide valuable insights into the reliability and efficiency of different mortgage companies.

Consult a Mortgage Broker: A mortgage broker can provide expert advice and help you find the best mortgage deals. They can also assist with the application process and negotiations.

Pre-Approval: Get pre-approved for a mortgage to understand your borrowing capacity and increase your chances of securing a good deal. Pre-approval also makes you a more attractive buyer to sellers.

Meet with Representatives: Schedule meetings with representatives from different mortgage companies to discuss your needs and ask questions. This will help you gauge their responsiveness and willingness to assist.

Review Terms and Conditions: Carefully review the terms and conditions of the mortgage offers. Pay attention to interest rates, loan terms, fees, and any other conditions that may affect your mortgage.

For property management services, visit Apartments For Rent in Dubai.

Popular Mortgage Companies in UAE

HSBC: Known for its competitive interest rates and flexible mortgage options, HSBC is a popular choice for homebuyers in the UAE.

Emirates NBD: Emirates NBD offers a range of mortgage products tailored to different needs, along with excellent customer service and quick approval times.

Mashreq Bank: Mashreq Bank provides personalized mortgage solutions with attractive rates and minimal fees, making it a preferred choice for many buyers.

ADCB: Abu Dhabi Commercial Bank (ADCB) offers comprehensive mortgage products with competitive rates and flexible repayment options.

Dubai Islamic Bank: For those seeking Sharia-compliant mortgage solutions, Dubai Islamic Bank offers a variety of Islamic mortgage products with favorable terms.

For property sales, visit sell house quickly.

Real-Life Success Story

Consider the case of Hassan and Fatima, who recently purchased their dream home in Dubai. By working with a reputable mortgage company, they were able to secure a mortgage with favorable terms. The mortgage company provided expert advice, handled the paperwork, and ensured a smooth process from start to finish. This allowed Hassan and Fatima to focus on finding their perfect home without worrying about the complexities of securing a mortgage.

For more insights into Dubai's real estate market, visit home loan dubai.

Future Trends in the UAE Mortgage Market

Digitalization: The UAE mortgage market is embracing digitalization, with many companies offering online application processes, digital document submission, and virtual consultations. This trend is making the mortgage process more efficient and convenient.

Sustainable Mortgages: There is a growing demand for sustainable mortgages that support environmentally friendly and energy-efficient homes. Mortgage companies are beginning to offer products that cater to this demand.

Flexible Mortgage Products: Mortgage companies are increasingly offering flexible mortgage products that cater to the diverse needs of homebuyers. This includes options for expatriates, first-time buyers, and investors.

For property sales, visit Sell Your Property.

Conclusion

Choosing the right mortgage company in the UAE involves careful research, comparison, and consideration of various factors. By understanding the market, seeking recommendations, and evaluating your options, you can secure a mortgage that meets your needs and financial goals. For more resources and expert advice, visit home loan dubai.

5 notes

·

View notes

Link

0 notes

Text

The Debt Panel: Dubai bank employee owes Dh235,000 and has been in debt since 2006

I am facing problems with my debts and need a loan to clear them. My liabilities include credit cards and money I have borrowed from others. In total I owe Dh75,000 to different friends and relatives and a further Dh160,000 to the banks. I signed up for my first credit card in 2006 and then borrowed money from credit cards to settle other cards and the loan for my marriage, and to send to India when my father was not well. My debts include the following:

Credit cards

■ Dunia Finance: Dh8,000

■ Emirates NBD: Dh12,000

■ Najm: Dh8,000

■ Abu Dhabi Islamic Bank: Dh7,000

■ HSBC: Dh15,000

■ Rakbank: Dh18,000

■ Finance House: Dh8,000

■ Union National Bank: Dh3,000

■ Dubai Islamic Bank: Dh8,500

■ Samba: Dh18,000

■ Noor Bank: 4,500

Loans

■ Emirates NBD personal finance: Dh40,000

■ Al Hilal Bank car loan: Dh10,000

While I work as an office manager for a bank earning Dh13,800, my wife works as a head teller earning Dh7,000. We have good salaries but Dh10,000 a month just goes on debt. We want to consolidate these debts, but I have crossed the debt burden ratio and cannot borrow anymore and my wife is on my visa, so she cannot take out a loan. Also my wife’s father is unwell and cannot manage his business at the moment. If we can clear our debts and stop paying so much interest, that will be a great help to my family. We also have a daughter studying in KG1 and to continue her studies here, we need to settle everything. KK, Dubai

Debt panellist 1: Ambareen Musa, founder and chief executive of Souqalmal.com

Your top priority should be to dig yourself out of the credit card debt worth Dh110,000 that you’ve accumulated. This is the biggest drain on your finances and will only multiply further, owing to the high interest rates averaging about 40 per cent per year. The repayment strategy that will help you get out of debt faster involves making the minimum payment on each of your credit cards without fail, completely paying off the credit card that levies the highest interest rate first and closing each credit card account as you go.

Have you approached the bank where you work and discussed with them a debt consolidation plan? This could mean consolidating your most expensive loan and credit card debt into a fixed-tenure loan, lowering interest or extending the tenure to make repayments more manageable.

If you’re not able to qualify for debt consolidation, how about your wife applies for a loan in her name. Since she is employed as a head teller in a bank in the UAE, she should be eligible to apply for a salary-transfer personal loan at a competitive rate. The sponsorship details on her residence visa should not affect her eligibility in this case, assuming she meets all other qualifying requirements. You could use the personal loan amount to pay down a big chunk of your credit card debt.

Do you have any assets back home such as property, gold, investments and such that you can liquidate? Doing so will help you bring the extra cash here to settle your debts.

As a precaution going forward, make sure you put away a small portion of your monthly salary in an emergency fund. This way you won’t have to depend on debt to tackle unforeseen financial emergencies in the future.

Debt panellist 2: Rasheda Khatun Khan, a wealth and wellness planner

Unfortunately, with this number of creditors it is highly unlikely that a bank will provide further lending or a consolidation option. Your only option of consolidation may be with a specific debt management company. You can could try Lotus Loans & Overdues Rescheduling to see how they can help you. They have been referred to in previous articles.

It’s also time to cut right back and think about what you can say yes to and no to. Try not to increase your liabilities by taking on other expenses. Are there other options to your father-in-law’s medical expenses? Can you approach other family members? Sometimes it can be a tough decision, but you have to weigh up the consequences and long-term cost it has on you. Sure, if we have available money we are in a position to help. But when you are in the situation you are now in, you really have to think twice and this could cost you your family’s well-being. The outcome of unpaid debt here in UAE is jail time. Think seriously about increasing that debt.

I suggest trying the snowball effect for repaying your credit cards. This means taking the cards with your lowest balance – Union National Bank Dh3,000, Noor Bank Dh4,500 – and repaying them off in full with your allocated Dh10,000 you’re using every month towards all of the cards. Use the remaining Dh2,500 to put towards your ADIB card. The following month use the Dh10,000 to clear the ADIB card with a remaining balance of Dh4,500 and use the Dh5,500 towards another card with an Dh8,000 balance. This way, within two months you will have cleared three cards. Go back to repaying the minimum balances on the others for a month and then use your Dh10,000 again on one card at a time and so on. The more you repay, the better. This way you can wipe out your cards and only have your loans left. Be sure to do your numbers to make this work.

Ask yourself if there anything else you can cut back on and ensure your living expenses are not more than your income. If they are, even after you have repaid most of the debt, then you seriously need to consider alternative living arrangements – and this may mean leaving UAE, as you will always continue to accumulate debt. It’s time to make some smart choices.

The Debt Panel brings together four financial experts: Philip King, the head of retail banking in the UAE at Abu Dhabi Islamic Bank; Ambareen Musa, the founder and chief executive of the comparison website Souqalmal.com; Rasheda Khatun Khan, a wealth and wellness planner and founder of Design Your Life; and Keren Bobker, The National’s On Your Side columnist and an independent financial adviser with Holborn Assets in Dubai. Together they answer queries in a weekly online column to help readers better tackle their debts. If you have a question for the panel, write to [email protected].

Follow The National’s Business section on Twitter

Source: The National

The Debt Panel: Dubai bank employee owes Dh235,000 and has been in debt since 2006 was originally published on JMM Group of Companies

0 notes

Photo

Expat Mortgage | Home Loans for Expatriates | Emirates NBD

Avail expat mortgage instantly from Emirates NBD and get perfect Home Loans for Expatriates at competitive rates.

0 notes