#eligible for dtc

Explore tagged Tumblr posts

Photo

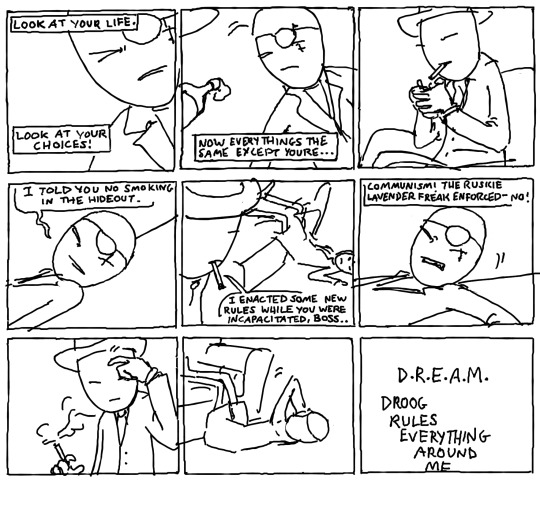

#spades slick#diamonds droog#homestuck#midnight crew#night in#dreaming while waking#you know whats gonna happen#eligible for dtc

107 notes

·

View notes

Text

DTC Eligibility Services for Seamless Securities Trading

Gain unrestricted access to the broader securities market with our DTC Eligibility services. As a trusted provider, we specialize in facilitating the eligibility process for Depository Trust Company (DTC), enabling seamless and efficient securities trading. For more information visit at colonialstock.com/dtceligibility.htm.

0 notes

Text

So the Canada Disability Benefit (CDB) (which the gov't passed last year, Bill C-22), which was passed with the intent of "lifting people with disabilities out of poverty," finally got funded in the budget that was released today - and it's such fucking bullshit.

It's a maximum amount of $200/month ($2400/year)

You have to be approved for the Disability Tax Credit (DTC) to be eligible - something that advocates were specifically saying should not happen because it's so fucking difficult to get on. The CDB should be barrier-free.

Doesn't start until July 2025

It's such fucking bullshit. $200 a month? And not for another fucking year? Not to mention the DTC requirement? Are you fucking kidding me?? I'm so mad.

This CBC article about it can contains this quote - "Khedr estimates that roughly 1.6 million Canadians with disabilities are living below the poverty line. But Tuesday's budget says only 600,000 would be eligible for the new national benefit." This is because of the DTC requirement. Jesus Christ.

Anyway, Canadian folks, please for the love of god contact your MPs and tell them how awful this is. It needs to be more money, it needs to be enough to actually have an impact, and it needs to not require DTC eligibility.

I'm so mad.

140 notes

·

View notes

Text

Does ADHD Qualify for Disability Tax Credit in Canada? | Adult ADHD Centre

Does ADHD qualify for Disability Tax Credit in Canada? The Adult ADHD Centre helps you navigate eligibility criteria, benefits, and the application process with expert guidance. Get the support you need today! #ADHD #DisabilityTaxCredit #AdultADHDCentre

0 notes

Text

Understanding the Drug Treatment Court Regina: A Path to Recovery

For individuals in Regina, Saskatchewan, who have criminal charges related to drug use, they can choose to participate in drug treatment court without going to the regular court. This program is what specializes in offering rehabilitation instead of scary punishments. It is for offenders of non-violent drug-related crimes who are addicted to drugs and thus offense-oriented. The whole purpose of the court is really life-changing, trying to break up cycles of addiction and reoffending.

In Saskatchewan, CDSA lawyer Saskatchewan expertise becomes indispensable when it comes to the job of Drug Treatment Court (DTC). This is where drug treatment courts provide an entire system and supportive environment that motivates people to treatment while being monitored for their illegal actions. Let us investigate how drug treatment court Regina works and how it could benefit an individual while further improvement by consulting a CDSA lawyer Saskatchewan.

Drug Treatment Courts are specialized courts established in order to give treatment rather than punishment among those who get into trouble due to substance abuse but commit non-violent drug-related crimes. The drug treatment court Regina is targeted at the root causes of the criminal behaviour caused by addiction and provides an alternative for the participant to take towards recovery and reintegration into society.

DTCs, or Drug Treatment Courts, are established courts in the states for the unique purpose of rehabilitation as opposed to incarceration. These courts can act as an avenue to mitigate the consequences that the participants suffer from non-violent drug-related crimes. Counselling with substance abuse, vocational training among many others are among the medical and other supportive services offered in DTCs to the participants. These programs have been made according to the needs of each participant so that they could have what they need to break free from addiction and build their future.

Qualification for Drug Treatment Court

Not everyone arrested related to drug possession qualifies for a drug treatment court Regina. There are strict eligibility requirements, and it is very important to have the help of a good CDSA lawyer Saskatchewan to get through the process. The basic requirements depend on the following factors:

Be charged with a non-violent drug offense, usually on the Controlled Drugs and Substances Act (CDSA).

Have proved and recognized substance abuse issues that contribute to behaviour which leads to criminal acts.

Be willing to participate in those programs as well as follow instructions of the court.

Have no significant history of criminality or previous violence.

An expert CDSA lawyer Saskatchewan can ascertain your condition, profile eligibility and place you on the best strategy for accessing the Drug Treatment Court program.

Role of a CDSA Lawyer Saskatchewan in Drug Treatment Court

How a CDSA lawyer Saskatchewan can help a person with one’s Drug Treatment Court needs would include evaluating eligibility, advice during the entire program, and more. Most importantly, a competent CDSA lawyer Saskatchewan would make sure that the rights of the accused are protected during the whole process. Defence by a CDSA lawyer Saskatchewan ensures participation in teamwork that works closely with treatment providers, courts, and other stakeholders to bring out the best possible outcome for the clients.

In particular, a CDSA lawyer Saskatchewan will assist participants with an understanding of the different Drug Treatment Court program criteria such as frequent court appearances, drug testing, and adherence to treatment plans. With an experienced attorney busy handling all the complexities of the program, personal success is increasingly likely without any hassle.

Source URL: https://medium.com/@rcriminallaw/drug-treatment-court-regina-path-to-recovery-and-rehabilitat-1f5bc6de852d

#Bail lawyer regina#criminal lawyers in Regina#criminal lawyer regina#criminal attorney regina#criminal defence lawyer#criminal defense attorney#drug treatment court Regina#drug lawyer regina saskatchewan#CDSA lawyer saskatchewan#Drug charges lawyer regina#Drug defence lawyer#DUI attorney Regina#DUI LAWYER REGINA#Dui defence attorney

0 notes

Text

Get A Financial Support: A Guide to the Disability Tax Credit for Invisible Disabilities

Invisible disabilities often come with unique challenges, but financial support is available to help ease the burden. This FAQ-style guide explains how Canadians with invisible disabilities can access the Disability Tax Credit (DTC) and highlights how CountSmart simplifies the process for you.

What Are Invisible Disabilities?

Invisible disabilities refer to conditions that aren’t immediately visible but can significantly impact daily life. These include mental, cognitive, and chronic health conditions such as:

Anxiety or depression

Autism spectrum disorder or ADHD

Chronic fatigue syndrome or fibromyalgia

How Do You Qualify for the Disability Tax Credit?

Eligibility depends on having a severe and prolonged impairment that restricts daily living activities. The impairment must:

Be certified by a qualified medical practitioner on the Disability Tax Credit Certificate (T2201).

Be expected to last at least 12 months.

What Are the Benefits of the DTC?

The DTC provides a reduction in taxable income, offering significant financial relief. In some cases, you may also receive retroactive payments for previous years.

Eligible groups include:

Adults with invisible disabilities (discover more about the disability tax credit for adults).

Seniors with chronic or age-related conditions (read about the disability tax credit for seniors).

How to Claim the Disability Tax Credit

Follow these steps to claim the DTC:

Determine Eligibility: Consult with your doctor to confirm your condition qualifies.

Complete Form T2201: Have it certified by a medical professional.

Submit to the CRA: Once approved, apply the credit to your tax return.

For more details, check our guide on how to claim the Disability Tax Credit.

What If My Application Is Denied?

Don’t lose hope if your application is rejected. You can:

Submit an appeal with additional documentation.

Reapply with professional assistance from CountSmart.

Can Seniors Benefit from the DTC?

Yes! Seniors with invisible disabilities such as arthritis, dementia, or mobility issues can qualify. Visit our dedicated page to learn more about the disability tax credit for seniors.

Why Choose CountSmart for DTC Assistance?

Navigating the DTC process can be complex, but CountSmart ensures it’s stress-free. Our services include:

Eligibility assessments

Accurate application preparation

Appeals for denied applications

Final Thoughts

Invisible disabilities shouldn’t prevent you from accessing financial relief. The Disability Tax Credit can make a meaningful difference in your life. CountSmart is here to help you every step of the way.

Visit CountSmart and take the first step towards claiming your Disability Tax Credit.

0 notes

Text

A Step-by-Step Guide to Personal Tax Filing in British Columbia

Filing personal taxes in British Columbia can feel easy when done step-by-step. This guide breaks it down for first-time filers & anyone seeking clarity on their tax duties. In this article, we learn about the process of filing personal taxes in British Columbia in step-by-step

1. Preparing for Tax Season

Start by understanding the basics:

Key Dates: Canadian taxes cover income from January 1 to December 31, with a typical filing deadline of April 30. File early to avoid penalties.

Who Must File: If you earn income in Canada, including employment, freelance, or investments, you must file a tax return.

What to Have Ready:

Your Social Insurance Number (SIN)

Any CRA correspondence, like your Notice of Assessment (NOA)

Banking information for direct deposit of refunds

2. Gather Necessary Documents

Having the correct documents is critical:

Income Slips: Collect T4s from employers, T5s for investment income, and any freelance income records.

Receipts for Credits: Keep proof of deductions, such as medical expenses, childcare & tuition fees.

Home and Work Expenses: If you work remotely, claim home office deductions with proper receipts.

3. Understand Tax Credits and Deductions

In British Columbia, certain credits can reduce your tax payable:

BC Sales Tax Credit: A refundable credit for low- and moderate-income residents.

Charitable Donations: Receipts for charitable contributions can boost your refund.

Disability Tax Credit (DTC): Available for eligible individuals or their caregivers.

4. Choose a Filing Method

There are several ways to file your taxes:

Use Tax Software: CRA-approved software like TurboTax or Wealthsimple can help you file online.

Paper Filing: Download forms from the CRA, fill them manually, and mail them.

Hire a Tax Professional: If your taxes are complex, a professional ensures accuracy and helps maximize deductions.

For online filing, use NETFILE, CRA’s secure portal, to submit your return directly.

5. Complete Your Tax Return

When filling out your return:

Report all income accurately, including employment, self-employment, and investments.

Deduct eligible expenses, including BC-specific credits.

Double-check for accuracy to avoid delays in processing.

Important: Use the CRA’s My Account to track tax documents and confirm submission.

6. Submit and Pay Taxes Owed

Submit your tax return electronically via NETFILE or by mail for paper submissions. If you owe taxes:

Pay using online banking, CRA’s My Payment service, or by cheque.

Late payments attract interest, so pay promptly.

7. Track Your Refund or Assessment

After submission:

Check the status of your refund via the CRA website or mobile app.

Your Notice of Assessment (NOA) will confirm if your return was processed and outline any corrections.

Common Questions About Tax Filing in BC

Do I Need to File if I Earned Below a Certain Amount? Yes, filing ensures access to benefits like GST/HST credits or Canada Child Benefits.

Can I File Taxes Late? Yes, but late submissions may incur penalties and interest.

What if I Made a Mistake? Submit a correction using the CRA’s ReFILE service online.

Final Thoughts

Filing personal taxes in British Columbia doesn’t have to be hard. With good planning & a bit of care, you can meet deadlines, get the most from your refund & skip any penalties.To know more personal tax filing In British Columbia Canada please feel free connect with us.

0 notes

Text

DELHI TECHNICAL CAMPUS (DTC) [Updated]: Eligibility, Ranking, Courses, Fees, Admission, Placement and Cut-off

Delhi Technical Campus (DTC), Greater Noida is a premier Institute established in 2013. It is located in Uttar Pradesh. It is affiliated with GGSIPU and approved by AICTE and COA. Institute offers Degree courses including 9 UG and 1 PG courses. These programs are offerred in full-time mode. It is a well-known institution for BArch, BCA, BTech, MBA/PGDM courses. These programs are delivered by highly experienced faculty. It provides scholarship facility. For More: https://radicaleducation.in/blogs/delhi-technical-campus-dtc/

0 notes

Text

Grayscale Concludes Reverse Share Splits: A New Era for Bitcoin, Ethereum ETFs

Key Points

Grayscale Investments has completed reverse share splits for its Bitcoin and Ethereum ETFs.

The firm’s Bitcoin ETF options will begin trading from 21st November.

Grayscale Investments, a prominent digital asset manager, has carried out reverse share splits for its Bitcoin Mini Trust ETF and Ethereum Mini Trust ETF.

These changes were implemented on the 20th of November, following the execution of the reverse share splits the previous night.

What is a Reverse Share Split?

A reverse share split is a process where multiple shares are combined into one, which reduces the total number of shares but increases the share price.

David LaValle, Grayscale’s Global Head of ETFs, expressed his belief that this decision was beneficial for both their clients and the investment community in a recent blog post.

Implications of the Reverse Share Split

Grayscale highlighted the benefits of reverse share splits, including their ability to streamline trading and make it more cost-effective for market participants.

Following this move, Grayscale’s Ethereum Mini Trust ETF underwent a 1:10 reverse share split, which increased the price per share to 10 times its pre-split net asset value (NAV), while reducing the number of shares proportionately.

In a similar manner, Grayscale’s Bitcoin Mini Trust ETF executed a 1:5 reverse split, raising the price per share to five times its pre-split NAV, with a corresponding decrease in shares outstanding.

However, Grayscale noted that shareholders might end up holding fractional shares after the split.

These fractional shares, based on the policies of their Depository Trust Company (DTC) participant, can either be tracked internally or aggregated and sold, with shareholders receiving cash proceeds.

It’s important to note that fractional shares are not eligible for trading on the NYSE Arca.

Performance of Grayscale’s Bitcoin and Ethereum ETFs

Post-split, the firm’s ETFs for Bitcoin and Ethereum showed mixed performance, according to Yahoo Finance.

The Bitcoin Mini Trust ETF closed at $41.84, marking a 1.80% increase during regular trading hours.

Conversely, the Ethereum Mini Trust ended at $28.93, representing a depreciation of 0.92%. However, it saw a pre-market rise to $29.58, gaining 2.25%.

Launch of BTC ETF Options

This reverse share split comes just before a significant development for the firm.

Grayscale is poised to launch the Bitcoin ETF options for its Grayscale Bitcoin Trust (GBTC) the Mini Trust on the 21st of November, marking a significant expansion in the U.S. market.

This development follows the debut of BlackRock’s IBIT options, which saw nearly $1.9 billion in trading volume on its opening day.

0 notes

Text

First Phosphate Announces OTCQB Market Listing and DTC Eligibility in the United States

Saguenay, Quebec – Newsfile Corp. – November 18, 2024 – First Phosphate Corp. (CSE: PHOS) (OTCQB: FRSPF) (FSE: KD0) (“First Phosphate” or the “Company”) is pleased to announce that its common shares have commenced trading today on the OTCQB Venture Market (the “OTCQB”) under the ticker symbol FRSPF. The Company is equally pleased to announce that its common shares are eligible for electronic…

0 notes

Text

These are jobs that you can do anywhere in the world from home and you go into other peoples homes to present the items. And usually these people do parties and you can rent venues. Yeah, rent it at the hotels or at any area of these places that cater any events, weddings, you can have an event at the casino... You can also build a team of people under you....

wikiHow

https://www.wikihow.com

How to Become a Tupperware Sales Consultant: 12 Steps

As a Tupperware sales consultant, you'll earn a percentage of the sales you make. To become a consultant, you'll need to work with a current

Mary Kay

https://www.marykay.com

Sell Mary Kay

Mary Kay offers opportunities for education and personal development that can help you build your sales skills. Assorted Mary Kay® products styled

Can I sell products from my home?

Class A permit.

You can get a Class A permit in California if you want to sell only directly to customers within the state of California. With a Class A permit, you can sell at farmers' markets, festivals, from your home, or in other ways that allow individuals to purchase products directly from you.

https://www.nolo.com

Starting a Home-Based Food Business in California - Nolo

So these are direct to consumer brands.It goes from the manufacturer and you are the representative and you present the brand and sell the Brand to the consumer! There are numerous companies in the images and there are forty one total in the link below.... You are a manufacturer's representative selling the brand directly to the consumer... You can build your own team of people!!!

What company sell products directly?

Direct-to-consumer brands sell directly to customers online, bypassing the “middlemen” of wholesalers and retailers. This allows them to control the user experience, collect first-party shopper data and increase margins. DTC brand examples include Allbirds, Casper and Warby Parker.

https://builtin.com

41 Direct to Consumer (DTC) Brands to Know - Built In

https://www.google.com/search?ie=UTF-8&client=ms-android-comcast-us-rvc3&source=android-browser&q=Companies+that+allow+you+to+sell+products+from+home&jbr=sep:0

You can be a manufacturer's representative selling dell computers to consumers, factory direct representative...

Here are some ways to sell Dell computers from your home:

Dell Trade In: You can trade in eligible Dell and non-Dell devices for credit towards Dell.com purchases. You can start the process online, answer questions about your device to determine its value, and then securely transfer and erase your data. You can then ship the device to Dell or take it to a FedEx Office. If your device doesn't qualify for credit, Dell will recycle it for free.

STS Electronic Recycling: This company buys used, unwanted, and new Dell computers nationwide.

Dell Trade In

Dell Trade In

Just answer a few questions about your device to determine its trade-in value, securely tr...

https://www.google.com/search?ie=UTF-8&client=ms-android-comcast-us-rvc3&source=android-browser&q=Selling+dell+computers+from+your+home

And if you have relatives or friends in any country, you can build these businesses out in any country around the World..... And they will ship the product directly from the factory to any location.In the World... So if you wanna host internet parties and then present these like webinars or any other type of internet service that allows you to do these web parties, you can present these goods to a group of people across the World 🌎 ... Megan, who had four kids to make extra income, was a manufacturer direct representative, for vitamin supplements.....

Modern Direct Seller

https://moderndirectseller.com

Host a Home Party!

You could be missing out on a lot of business if you aren't doing home parties. Read this post to learn how to host a successful home party

Here's how to host a virtual company party and yes, you can do this, and then you would order the food Food bite having a farm, a survey you send out to each of them, they fill it out and then you would get the food sent to them food and beverage for the virtual web party... So this could be for a company party or for prospects.That you're looking to introduce your product to!!!

How do I host a virtual company party?

Organize your virtual office party by deciding on a reason to celebrate, selecting an appropriate time and sending out invitations. Create a virtual party structure with a theme, video platform, food, drinks and gifts for your guests, and plan interactive activities and competitions to make it memorable.Feb 4, 2024

https://www.kumospace.com

Virtual Office Party Ideas to Boost Morale - Kumospace

https://www.google.com/search?ie=UTF-8&client=ms-android-comcast-us-rvc3&source=android-browser&q=How+to+host+web+parties+to+present+goods

So again, you can do this from here and sell anywhere in the world!!!!

So in image number 8 and the link below, you will see Spanish-speaking populations around the world, and if you want to sell into the Spanish market around the world, that's fine as well, you can do it here from the United States and you can introduce the product to any of these people. Around the world build up ground troops and then help them present your product to them.The spanish speaking populations...

https://www.google.com/search?ie=UTF-8&client=ms-android-comcast-us-rvc3&source=android-browser&q=A+map+of+spanish+speaking+populations+around+the+world

If you're english speaking, you can presented to english speaking populations around the world...

Like in ghana, africa, they speak english.Here's a list of english speaking countries around the world...

10 countries with the most English speakers

India (1,393,409,038 English Speakers) ...

United States (332,915,073 English Speakers) ...

Pakistan (225,199,937 English Speakers) ...

Nigeria (211,400,708 English Speakers) ...

Philippines (111,046,913 English Speakers) ...

United Kingdom (68,207,116 English Speakers)

More items...•Dec 18, 2023

https://transly.eu

10 countries with the most English speakers

Feedback

About featured snippets

Wikipedia

https://en.wikipedia.org

List of countries by English-speaking population

The following is a list of English-speaking population by country, including information on both native speakers and second-language

https://www.google.com/search?ie=UTF-8&client=ms-android-comcast-us-rvc3&source=android-browser&q=A+list+of+english+speaking+populations+around+the+world

0 notes

Text

Understanding The Basics Of CRA Disability Tax Credit

CRA Disability Tax Credit (DTC) lowers taxes for Canadians with disabilities, including extra credits for those under 18. It offers federal and provincial benefits, unlocking additional support like the Registered Disability Savings Plan, Child Disability Benefit, and other Canada Disability Benefits. Eligibility includes both severely disabled and those with slowed daily activities. For assistance, consult Disability Team. Visit us: https://disabilityteam.ca/cra-disability-benefits

0 notes

Text

Financial Help for Everyday Heroes: Your Guide to the Disability Tax Credit (DTC) in Canada

Canada is a country that values inclusivity, and the Disability Tax Credit (DTC) is a program that reflects this commitment. If you or someone you know faces a disability, the DTC can offer significant financial support to help manage the extra costs associated with daily living. This FAQ, leveraging insights from Count Smart [link to Count Smart's Disability Tax Credit page], addresses your questions about the DTC and how it can benefit you.

What is the Disability Tax Credit (DTC)?

The DTC is a non-refundable tax credit offered by the Canada Revenue Agency (CRA) to help people with disabilities reduce their income tax owing. What is the Disability Tax Credit in Canada? This credit acknowledges the additional expenses often incurred by individuals with disabilities, such as:

Special medical equipment or therapy

Attendant care

Modifications to a home or vehicle

Who is Eligible for the DTC?

To qualify for the DTC, you must meet the following criteria:

You have a severe and prolonged impairment in mental or physical function.

Your impairment limits your ability to perform daily activities.

You meet the eligibility requirements outlined by the CRA.

How Do I Apply for the DTC?

The application process for the DTC involves obtaining a completed form T2201, Disability Tax Credit Certificate, from a qualified medical practitioner. This form will document your impairment and its impact on your daily activities. Count Smart offers valuable resources to guide you through the application process.

What are the Benefits of Claiming the DTC?

The DTC can offer significant financial relief, reducing your federal income tax owing and potentially increasing your tax refund. In some cases, you may also be eligible for additional benefits and provincial programs.

How Can Count Smart Help?

Count Smart understands the complexities of navigating the DTC application process. They offer a wealth of resources, including guides and helpful tips, to ensure a smooth and successful application. What is the Disability Tax Credit in Canada?

Remember: The Disability Tax Credit is a valuable program designed to support Canadians with disabilities. If you have questions or are unsure about eligibility, consult with a medical professional or visit the Count Smart website for more information.

0 notes

Text

Amazon Buy Box: 5 Ways to Win It

Buy Box is the fiercely contested prized possession of sellers in the eCommerce arena. The battle is for the shoppers attention as sellers success and growth on the eCommerce platform mostly depend on it.

According to a research report, approximately 82% of all sales get converted due to the Buy Box. The fact clearly, reflects why every seller seeks Buy Box on the eCommerce platform. Amazon Buy Box is the most coveted need of every seller on Amazon, the world-leading eCommerce Marketplace.

So, take lets a closer look and find out how to win Amazon Buy Box.

What is Amazon Buy Box?

In simple terms, its a CTA that takes a shopper directly to the purchase page and leads to a swift purchase. But not every seller has it. Lets first understand why its so valuable and what makes sellers eligible for a chance to win the buy box.

Amazon has mainly 5 types of sellers – Manufacturer & Direct-To-Consumer (DTC) Brands, which Produce and sell their products under their own brand names, Private Label Brands, which Sell products manufactured by a third party under a different brand name, Factory Brands, sourced from often overseas factories and go direct to global consumers with more often at comparatively lower prices, Resellers, who buy products in bulk and often sell them at a higher price to make a profit and Aggregators, Companies that purchase multiple Amazon brands with the purpose of consolidating and growing them. Read More..

#buybox#buyboxamazon#buyboxwin#ecommerceintelligence#ecommercecompetitiveintelligence#ecommercebusinessintelligence

0 notes

Text

Understanding the Consequences of Misreporting on Your DTC Application: A Simple Guide

Applying for the Disability Tax Credit (DTC) can be a great financial relief for individuals and families in Canada. However, it's crucial to fill out your application accurately and honestly. Misreporting information, whether intentional or accidental, can lead to serious consequences. In this blog, we will answer some of the most common questions about the risks of misreporting on a DTC application and explain how expert guidance can help you avoid costly mistakes.

Introduction

The Disability Tax Credit (DTC) is a non-refundable tax credit designed to help individuals with disabilities or their caregivers reduce the amount of income tax they have to pay. However, applying for the DTC can be tricky, and it’s important to provide accurate information. Even small mistakes can lead to delays, rejections, or even penalties. In this blog, we’ll discuss the consequences of misreporting on a DTC application and how you can ensure your application is successful.

What happens if I misreport information on my DTC application?

If you misreport information on your DTC application, the consequences can vary depending on the nature of the mistake. Some of the potential outcomes include:

Application rejection: If inaccurate or misleading information is discovered, your application may be rejected, and you’ll need to reapply with correct information.

Delays in processing: Even if the error is unintentional, it can lead to long delays in the approval process while the Canada Revenue Agency (CRA) reviews your application more closely.

Penalties: In cases where misreporting is found to be intentional, you could face financial penalties or even be charged with tax fraud.

Loss of trust: Once misreporting is detected, CRA may take a closer look at your future applications and tax filings, which can affect your ability to receive credits or benefits in the future.

Can I fix mistakes after submitting my DTC application?

Yes, you can fix mistakes on your DTC application after submission. If you realize you’ve made an error, it’s important to correct it as soon as possible by contacting the CRA. Being proactive in correcting errors can prevent your application from being rejected or delayed, and may help you avoid penalties.

What are some common mistakes on DTC applications?

Here are a few common mistakes that people make when filling out their DTC applications:

Incomplete information: Leaving out important details or failing to provide supporting documentation.

Inaccurate medical information: Providing incorrect or vague descriptions of your disability or how it affects daily activities.

Misunderstanding eligibility: Applying when you don’t meet the criteria or misunderstanding how severe your impairment needs to be.

Filing too late: Missing the deadline for submission, especially for retroactive claims.

How can expert guidance help with my DTC application?

Hiring an expert or consulting with a DTC specialist can significantly reduce the risk of misreporting on your application. Professionals have a deep understanding of the application process and can help with:

Thorough review of your application: Experts ensure that every section is completed accurately and that all required documents are attached.

Accurate medical descriptions: They can help you correctly describe your condition and its impact on your life, improving your chances of approval.

Navigating complex situations: If you have a unique or complex case, a professional can provide guidance on how to present your situation clearly to the CRA.

Appealing rejected applications: If your application is denied, experts can guide you through the appeals process and help you address any issues.

Why should I avoid DIY DTC applications?

While it may seem simple to complete the DTC application on your own, the potential for errors is high, especially if you’re not familiar with the process. Without expert help, you might:

Miss key information that could lead to rejection.

Provide incorrect or unclear medical descriptions, making it harder for the CRA to approve your application.

Struggle with the appeals process if your application is denied.

How can I ensure my DTC application is successful?

To increase your chances of success, follow these tips:

Double-check your application: Review every detail before submission and ensure all required documents are included.

Be honest and thorough: Provide clear and accurate information about your disability and how it impacts your daily life.

Consult an expert: Working with a DTC specialist can save you time and help avoid costly mistakes.

Respond quickly to CRA inquiries: If the CRA contacts you for additional information, reply as soon as possible to avoid delays.

Conclusion

Applying for the Disability Tax Credit in Canada can make a big difference in your financial situation, but it’s important to avoid mistakes on your application. Misreporting information, whether intentional or accidental, can lead to serious consequences, including application rejection, delays, or penalties. By seeking expert guidance and thoroughly reviewing your application, you can ensure your application process is smooth and successful.

If you're unsure about any part of the DTC application process or need assistance, reaching out to professionals like the team at Count Smart can help you avoid costly errors and improve your chances of approval.

0 notes

Text

Guest Blog - Improved Disability Tax Application Helps the Mentally Ill

By Lembi Buchanan The new DTC Certificate Form T2201 for 2024 is a huge win for all who have advocated for important improvements in the determination of eligibility to ensure fairness to Canadians with disabilities living with severe and prolonged physical and mental impairments. But it hasn’t been an easy fight. Over the years, the Canada Revenue Agency (CRA) demonstrated the brutal lack of…

View On WordPress

0 notes