#eWallet Development Digital Wallet Solution

Explore tagged Tumblr posts

Text

EWallet Application Development for Mobile Devices: Understanding the Basic Aspects

As our world hurtles forward in the digital age, the demand for swift, seamless, and effective financial management solutions is at an all-time high. Thanks to the remarkable advancements in technology, achieving a cashless society is no longer just a dream — it’s a reality. Enter the era of eWallets, where convenience meets innovation in the palm of your hand.

In today’s fast-paced society, the need for efficient financial transactions has never been more pronounced. With digital transformation sweeping through the financial landscape, eWallets have emerged as the quintessential solution for modern-day money management. According to industry reports, the global digital payment market is poised to soar to staggering heights, projected to reach a revenue of approximately USD 180.2 billion by 2026. Clearly, the trajectory is set, making the development of digital payment apps a lucrative endeavor for businesses seeking to stay ahead of the curve.

eWallet mobile applications have completely redefined the way individuals interact with their finances, offering a swift and secure alternative to traditional cash transactions. Gone are the days of fumbling with physical cards or carrying wads of cash — eWallets empower users to make payments with just a tap of their fingertips. And the benefits extend far beyond mere convenience. With robust security measures in place, users can rest assured that their financial data is safeguarded against cyber threats, providing peace of mind in an increasingly interconnected world.

In conclusion, the rise of eWallets heralds a new era in financial innovation, where the boundaries between traditional and digital currencies blur, and the possibilities are endless. So, join the revolution, embrace the future, and experience the unparalleled convenience of eWallet solutions today.

So, if you want to extend your services, it’s the best time to enter the world of eWallet application development.

What is an EWallet Application?

An eWallet application, short for electronic wallet application, is a digital tool that allows users to store, manage, and transact money electronically using a mobile device or computer. Think of it as a virtual wallet where you can securely store various forms of payment, such as credit/debit card information, bank account details, or even cryptocurrency.

These applications typically offer a range of features designed to streamline financial transactions and enhance user convenience. Some common functionalities of eWallet applications include:

Digital Payments: Users can make payments for goods and services directly from their eWallet app, either by scanning a QR code, entering payment details, or transferring funds to another user’s account.

Money Transfers: eWallets often facilitate peer-to-peer money transfers, allowing users to send and receive funds instantly, domestically or internationally, with minimal fees.

Bill Payments: Many eWallet apps enable users to pay bills, such as utility bills, mobile phone bills, or subscription fees, directly from their digital wallet, eliminating the need for manual transactions.

Transaction History: Users can view a detailed history of their transactions within the app, providing insights into their spending patterns and helping them track their finances more effectively.

Security Features: To ensure the safety of users’ financial information, eWallet applications employ various security measures, such as encryption, biometric authentication (e.g., fingerprint or facial recognition), and multi-factor authentication.

Rewards and Loyalty Programs: Some eWallet apps offer rewards or cashback incentives for using the platform for transactions, encouraging user engagement and loyalty.

Integration with Other Services: Many eWallet applications integrate with other financial services, such as budgeting tools, investment platforms, or digital banking services, providing users with a comprehensive financial ecosystem.

Types of EWallet Mobile Applications

eWallet mobile applications come in various types, each catering to different user needs and preferences. Here are some common types of eWallet apps:

Retailer-specific eWallets: These are digital wallets offered by specific retailers or merchants to streamline payments within their ecosystem. Examples include Starbucks’ mobile app, which allows customers to make purchases and earn rewards at Starbucks stores.

Bank-owned eWallets: Many banks offer their own eWallet apps, allowing customers to store payment cards, make transactions, and manage their accounts from their mobile devices. These apps may offer additional features such as budgeting tools and account management services.

Third-party payment apps: These eWallet apps are not tied to a specific retailer or bank and are designed to facilitate a wide range of transactions. Examples include PayPal, Venmo, and Cash App, which allow users to send money to friends, pay for purchases online and in-store, and more.

Mobile wallet platforms: Some eWallet apps serve as platforms that integrate multiple payment methods and services. These platforms may support various payment cards, bank accounts, and even cryptocurrency wallets. Examples include Google Pay, Apple Pay, and Samsung Pay.

Cryptocurrency wallets: With the rise of digital currencies like Bitcoin and Ethereum, there are eWallet apps specifically designed for storing and managing cryptocurrencies. These apps provide features such as secure storage, transaction tracking, and portfolio management.

International money transfer apps: These eWallet apps focus on facilitating cross-border money transfers, allowing users to send and receive funds internationally with competitive exchange rates and low fees. Examples include TransferWise, Remitly, and WorldRemit.

Business-focused eWallets: Some eWallet apps cater to the needs of businesses, offering features such as invoicing, expense tracking, employee reimbursements, and integration with accounting software. These apps help businesses streamline their financial operations and improve cash flow management.

Advantages of EWallet Mobile App Development

The development of eWallet mobile applications offers a multitude of advantages for both businesses and consumers alike. Here are some key benefits:

Convenience: Perhaps the most significant advantage of eWallet app development is the unparalleled convenience it brings to users. With an eWallet app, individuals can make payments, transfer funds, and manage their finances anytime, anywhere, using just their mobile device. This eliminates the need to carry physical cash or cards and reduces the hassle of traditional payment methods.

Accessibility: eWallet apps increase financial accessibility by providing users with a digital platform to store and manage their money. This is particularly beneficial for individuals who may not have access to traditional banking services or who prefer not to use physical cash. With an eWallet app, anyone with a smartphone can participate in the digital economy.

Security: Modern eWallet applications prioritize security measures to protect users’ financial information and transactions. Features such as encryption, biometric authentication, and tokenization help safeguard sensitive data from unauthorized access and fraud. Additionally, users have more control over their transactions, with real-time alerts and transaction monitoring capabilities.

Cost Savings: For businesses, eWallet app development can lead to significant cost savings compared to traditional payment methods. By reducing the need for physical infrastructure and manual processing, businesses can lower transaction fees, decrease overhead expenses, and improve overall efficiency.

Enhanced Customer Experience: Offering an eWallet app can enhance the customer experience by providing a seamless and personalized payment solution. Features such as loyalty programs, rewards, and personalized offers can help businesses engage with customers and build long-term relationships. Additionally, eWallet apps can streamline the checkout process for online and in-store purchases, reducing friction and improving conversion rates.

Data Insights: eWallet apps generate valuable data insights that businesses can use to understand customer behavior, preferences, and spending patterns. By analyzing this data, businesses can make informed decisions, optimize their marketing strategies, and tailor their products and services to better meet customer needs.Global Reach: With the increasing globalization of commerce, eWallet apps enable businesses to reach customers beyond their geographic borders. By supporting multiple currencies and languages, eWallet apps facilitate cross-border transactions and expand market opportunities for businesses of all sizes.

Must-Have Features in an EWallet Application

Creating a successful eWallet application requires careful consideration of user needs and market trends. Here are some must-have features to include in an eWallet application:

User Registration and Authentication: Allow users to create accounts securely using email, phone number, or social media credentials. Implement robust authentication mechanisms such as two-factor authentication (2FA) or biometric authentication (fingerprint or face recognition) to ensure account security.

Wallet Management: Enable users to add and manage multiple payment methods, including credit/debit cards, bank accounts, and digital wallets. Provide options to view transaction history, check account balances, and set up auto-reload for prepaid accounts.

Quick and Secure Payments: Implement a streamlined payment process that allows users to make quick and secure transactions. Offer options for in-store payments via NFC (Near Field Communication), QR code scanning, or barcode scanning. For online payments, integrate with popular payment gateways and ensure PCI DSS compliance for card transactions.

Peer-to-Peer (P2P) Transfers: Enable users to send and receive money to/from other users directly within the app. Implement features such as instant transfers, split bills, and request money functionalities to enhance user convenience.

Bill Payments and Utility Services: Provide users with the ability to pay bills, such as electricity, water, internet, and mobile phone bills, directly from the app. Integrate with utility service providers and offer bill reminders and recurring payment options to help users manage their expenses effectively.

Security Features: Prioritize security by implementing encryption, tokenization, and secure authentication protocols to protect users’ financial data and transactions. Offer features such as transaction alerts, device authorization, and remote account deactivation to prevent unauthorized access.

Personalization and Rewards: Enhance user engagement by offering personalized recommendations, offers, and rewards based on user preferences and spending patterns. Implement loyalty programs, cashback incentives, and referral bonuses to encourage user participation and retention.

Budgeting and Financial Insights: Provide users with tools to track their spending, set budgets, and monitor their financial health. Offer insights and analytics on spending patterns, trends, and recommendations for optimizing financial management.

Customer Support: Offer multiple channels for customer support, including in-app chat support, email support, and a comprehensive FAQ section. Ensure timely responses to user queries and complaints to maintain user satisfaction and trust.

Multi-platform Support: Develop the eWallet application for multiple platforms, including iOS, Android, and web, to reach a wider audience. Ensure consistency in user experience and feature parity across all platforms to provide a seamless user experience.

Step-By-Step Process for EWallet Mobile App Development

Developing an eWallet mobile application involves several steps to ensure a successful and functional product. Here’s a step-by-step process for eWallet mobile app development:

Market Research and Planning:

Conduct thorough market research to understand user needs, competitor offerings, and market trends.

Define the target audience, key features, and unique selling points of the eWallet app.

Create a detailed project plan outlining the scope, timeline, budget, and resource requirements for development.

Conceptualization and Wireframing:

Brainstorm ideas and concepts for the eWallet app based on the research findings.

Create wireframes and mockups to visualize the app’s user interface (UI) and user experience (UX).

Gather feedback from stakeholders and potential users to refine the app concept and design.

Technical Architecture and Platform Selection:

Define the technical architecture of the eWallet app, including backend infrastructure, databases, APIs, and third-party integrations.

Select the appropriate mobile app development platform(s) based on target audience preferences, market share, and development resources (e.g., iOS, Android, or cross-platform development frameworks like React Native or Flutter).

Backend Development:

Develop the backend infrastructure and APIs required to support the core functionalities of the eWallet app, such as user authentication, payment processing, transaction management, and data storage.

Implement security measures, including encryption, authentication, and authorization mechanisms, to protect user data and transactions.

Frontend Development:

Design and develop the user interface (UI) for the eWallet app based on the wireframes and mockups created earlier.

Implement interactive features, navigation flows, and visual elements to create an intuitive and engaging user experience.

Ensure compatibility and responsiveness across different device types and screen sizes.

Integration of Payment Gateways and APIs:

Integrate with third-party payment gateways, financial institutions, and service providers to enable seamless payment processing and fund transfers.

Implement APIs for accessing external services, such as bill payment platforms, utility providers, and loyalty programs.

Testing and Quality Assurance:

Conduct rigorous testing of the eWallet app to identify and fix any bugs, errors, or usability issues.

Perform functional testing, usability testing, compatibility testing, and security testing across various devices, operating systems, and network conditions.

Solicit feedback from beta testers and stakeholders to ensure the app meets quality standards and user expectations.

Deployment and Launch:

Prepare the eWallet app for deployment to the respective app stores (e.g., Apple App Store, Google Play Store).

Create compelling app store listings, including app descriptions, screenshots, and promotional materials, to attract users.

Coordinate the app launch and marketing efforts to generate awareness and drive user adoption.

Post-launch Support and Maintenance:

Monitor the performance and stability of the eWallet app post-launch, and address any issues or user feedback promptly.

Release regular updates and enhancements to improve app functionality, security, and user experience.

Provide ongoing customer support and maintenance to ensure the app remains functional and up-to-date.

Popular Tech Stack for EWallet App Development

Frontend Development:

React Native: A cross-platform framework for building mobile applications using JavaScript and React. React Native allows for code reusability across iOS and Android platforms, speeding up development and reducing costs.

Redux: A predictable state container for managing application state in React Native apps. Redux helps maintain a single source of truth for the app’s data and facilitates state management across components.

Backend Development:

Node.js: A server-side JavaScript runtime environment that allows developers to build scalable and high-performance backend services. Node.js is well-suited for real-time applications and asynchronous I/O operations, making it ideal for eWallet app development.

Express.js: A minimalist web application framework for Node.js that simplifies the process of building APIs and handling HTTP requests/responses. Express.js provides a lightweight and flexible architecture for developing RESTful APIs and backend services.

Database:

MongoDB: A NoSQL database that uses a flexible document-based data model to store data in JSON-like documents. MongoDB is highly scalable, schema-less, and suitable for handling large volumes of data, making it well-suited for eWallet applications with complex data structures.

Mongoose: An Object Data Modeling (ODM) library for MongoDB and Node.js that provides a higher-level abstraction for interacting with MongoDB databases. Mongoose simplifies CRUD operations, schema validation, and data modeling in eWallet app development.Authentication and Security:

JSON Web Tokens (JWT): A standard for securely transmitting information between parties as JSON objects. JWTs are commonly used for authentication and authorization in eWallet apps, allowing users to securely access protected resources and perform actions.

Passport.js: An authentication middleware for Node.js that supports various authentication strategies, including JWT, OAuth, and username/password authentication. Passport.js simplifies the implementation of authentication and integrates seamlessly with Express.js and other Node.js frameworks.

Payment Gateway Integration:

Stripe: A popular payment processing platform that provides APIs for accepting online payments, managing subscriptions, and handling payouts. Stripe offers robust security features, developer-friendly documentation, and support for multiple payment methods, making it an ideal choice for eWallet app development.

PayPal: Another widely used payment gateway that offers APIs for processing online payments, managing invoices, and facilitating peer-to-peer transactions. PayPal supports various payment methods, currencies, and integrations, making it suitable for eWallet apps with global reach.

Push Notifications:

Firebase Cloud Messaging (FCM): A cross-platform messaging solution that enables developers to send push notifications to users’ devices. FCM provides reliable message delivery, user segmentation, and analytics features, making it ideal for engaging users and driving app usage.

Industries That Embrace EWallet Mobile App Development

The adoption of eWallet mobile app development extends across various industries as businesses recognize the benefits of offering digital payment solutions to their customers. Here are some industries that embrace eWallet mobile app development:

Banking and Finance:

Traditional banks and financial institutions are developing eWallet apps to offer digital banking services, such as account management, fund transfers, bill payments, and mobile deposits.

FinTech startups are innovating in the eWallet space, providing alternative banking solutions, digital wallets, and peer-to-peer payment platforms to cater to the evolving needs of modern consumers.

Retail and eCommerce:

Retailers and eCommerce platforms are integrating eWallets into their checkout processes to offer customers a convenient and secure payment option.

Major retailers may develop their own branded eWallet apps to provide loyalty programs, personalized offers, and seamless shopping experiences across online and offline channels.

Hospitality and Travel:

Hotels, airlines, and travel agencies are incorporating eWallets into their booking and reservation systems to streamline payments and enhance the customer experience.

Travelers can use eWallet apps to make hotel reservations, purchase flight tickets, pay for transportation services, and access loyalty rewards and discounts.

Food and Beverage:

Restaurants, cafes, and food delivery services are adopting eWallets to offer contactless payment options and improve operational efficiency.

Customers can use eWallet apps to order food, pay for meals, split bills, and earn rewards or cashback on their purchases.

Entertainment and Media:

Streaming platforms, gaming companies, and digital content providers are integrating eWallets into their subscription and payment systems to facilitate seamless transactions.

Users can use eWallet apps to purchase subscriptions, access premium content, and make in-app purchases for virtual goods and services.

Healthcare and Fitness:

Healthcare providers, telemedicine platforms, and fitness apps are leveraging eWallets to enable online payments for medical services, consultations, and wellness programs.

Patients can use eWallet apps to pay for medical bills, order prescriptions, book appointments, and track their health and fitness goals.

Transportation and Mobility:

Ride-hailing companies, public transit systems, and mobility-as-a-service (MaaS) providers are integrating eWallets into their platforms to facilitate cashless payments for rides and transportation services.

Commuters can use eWallet apps to pay for rides, top up transit cards, rent bikes or scooters, and access real-time travel information.

Education and Learning:

Educational institutions, e-learning platforms, and edtech startups are incorporating eWallets into their enrollment and course registration systems to simplify tuition payments and fee collections.

Students can use eWallet apps to pay for tuition, purchase digital textbooks, access online courses, and receive financial aid or scholarships.

Conclusion

In summary, eWallet mobile applications represent a valuable addition to numerous businesses, offering a convenient and secure way for users to manage their finances. However, successful eWallet app development requires careful consideration of various factors, including feature set, user experience, and security protocols.

To ensure the seamless development of an eWallet app, it’s crucial to partner with a trusted eWallet app development company. Verve Systems stands out as an exemplary choice in this regard. With our extensive experience in crafting cutting-edge mobile applications, our team of experts possesses the knowledge and expertise to guide you through every step of the development process.

By collaborating closely with you, we’ll gain a deep understanding of your business requirements and tailor a custom eWallet solution to meet your specific needs. From conceptualization to deployment, we’ll work diligently to bring your vision to life and deliver a high-quality eWallet app that exceeds your expectations.

Moreover, our commitment doesn’t end with the app launch. We provide ongoing support and maintenance services to ensure that your eWallet mobile application remains secure, functional, and up-to-date in the ever-evolving digital landscape.

Don’t wait any longer to embark on your eWallet app development journey. Contact Verve Systems today and take the first step towards transforming your business with a robust and user-friendly eWallet solution.

0 notes

Text

How much does developing an e-wallet app similar to Touch’ n Go cost?

Discover the cost of creating an e-wallet app like Touch'n Go with our expert eWallet App Development Company. At InnovateHub, we specialize in crafting cutting-edge solutions tailored to your needs. From seamless transactions to user-friendly interfaces, our team delivers top-notch e-wallet apps that redefine convenience. Unlock the potential of digital payments today with our innovative solutions.

#ewalletappdevelopmentcompany#mobileappdevelopmentcompanyinDubai#mobileappdevelopmentcompanyinRiyadh#mobileappdevelopmentcompany#fintechappdevelopmentcompany

0 notes

Text

0 notes

Text

10 Technology Trends That Will Shape eCommerce

The eCommerce sector is continually expanding in terms of technology and progress. With a growing amount of people opting to buy things online, businesses must provide a compelling web experience that persuades customers and assists them in making informed decisions.

We often come across new-age technologies that are reshaping the eCommerce landscape. Early adopters of such technologies experiment with them every day, building a case for their use in the industry.

digital marketing company in noida

Consequently, a slew of fascinating new eCommerce technology developments is continuing to emerge. Here are the top eCommerce technology trends that will govern 2022 to assist you in better grasping what will form the fundamental basis of your digital strategy moving ahead.

1) Virtual Personal Assistants

At an exponential pace, the world of eCommerce is evolving towards personalization. With so many consumers connecting with brands, e-commerce enterprises must develop a more personal connection by catering to their specific demands.

Artificial Intelligence, or AI, is a critical component of the customization process, and it will continue to play a crucial role in eCommerce. Brands can utilize AI to understand consumer preferences better and purchasing patterns by exploiting customer data. They will be able to better serve their clients due to this.

2) Virtual and Augmented Reality (AR)

We will witness a better blending of the two as eCommerce moves towards more immersive experiences with the assistance of emerging technologies like AR and AI. Brands will be able to employ technology to provide more tailored shopping experiences due to this integration, which will allow them to transform the way they connect with consumers.

For example, Google’s augmented reality tool employs picture recognition technology to deliver real-time information about items. This new technology will almost certainly be utilized to assist clients in making better purchasing selections.

3) Various Payment Options

Companies must provide all different payment options to establish a successful company. This directly influences their capacity to reach a broader audience and improve the overall convenience of online buying.

As a result, we expect to see more e-commerce enterprises push beyond conventional payment methods like credit cards and net banking. For example, firms are increasingly providing prospective consumers with various payment alternatives, such as PayPal, Alipay, Apple Pay, and others, enabling them to choose their preferred payment method.

Furthermore, digital wallets will become a vital aspect of the eCommerce business in the following years. According to Transparency Market Research, the worldwide mobile wallet market has extended geographically to Europe, Asia Pacific, North America, Latin America, the Middle East, and Africa, and it is still expanding. By 2024, Ewallet technology is anticipated to be worth $3 trillion. By 2022, digital wallets will most certainly be favored over conventional payment methods due to their expanding popularity.

4) Cloud Computing Has Progressed In Recent Years

In the eCommerce business, cloud computing is critical for increasing online transactions’ scalability, flexibility, and speed. Its advantages are no longer confined to B2B activities; it’s increasingly being leveraged to create breakthrough B2C solutions, goods, and services.

Walmart, for example, is using Google Cloud to provide a more simplified consumer experience across mobile devices. Customers will find the whole online purchasing experience more convenient due to this. While we can anticipate this eCommerce technology trend to continue in 2022, we expect even more firms to turn to cloud computing to boost their e-commerce operations.

5) E-commerce Security Is a Priority

Because of the increasing complexity of dangers linked with eCommerce transactions, security has emerged as one of the most pressing issues confronting organizations today.

While some companies use more secure methods such as 3D Secure (3DS), others use blockchain technology to improve consumer verification.

PayPal, for example, teamed with Visa to introduce its token service in 2016, which is a new kind of payment verification that employs a digital code rather than a 16-digit card number. Customers may make online payments without revealing their credit card information. As more people become aware of the technology in the following years, more companies will embrace it.

6) Online Shopping with a Personal Touch

Customers increasingly want ‘genuine’ recommendations over traditional commercials, which is one of the main reasons for the popularity of influencer marketing. Influence marketing is more likely to help companies emotionally connect with their target audience since these commercials are frequently based on assumptions.

One notable example is Amazon’s and Alibaba’s partnership, enabling users to purchase things using voice commands. Customers may, for example, speak to Alexa, “Alexa, reorder toothpaste” or “Alibaba, I need shampoo,” without having to put anything into the search field.

This partnership is projected to flourish, and it will play an essential role in the eCommerce industry’s growth in the following years. Brands will also consider cutting-edge methods like chatbots, which may assist them in providing more customized online buying experiences.

7) The Emergence of AI-enabled eCommerce Solutions

There are a variety of AI-powered solutions available today that can assist firms in creating more personalized online purchasing experiences for their consumers. Intelligent computers have the power to simplify practically all operational processes, from detecting fraud transactions to offering tailored suggestions on product sites.

8) Marketing & Customer Service with a Personal Touch

When it comes to improving customer relationship management, companies are aiming to take a more personal approach. They aim to give all their digital encounters a more personal touch, so they have productive dialogues with consumers on social media.

Furthermore, it is becoming increasingly crucial for businesses to provide timely customer service whenever needed. This will be critical in supporting great online buying experiences and assisting firms in keeping clients for extended periods.

9) The Number of Subscription Ecommerce Solutions Is Growing

In the United States, subscription eCommerce sales topped 24 billion dollars in 2020, and analysts predicted that subscription eCommerce sales would climb in 2021 and subsequent years. The explosive expansion of the Consumer Packaged Goods (CPG) business has resulted in various subscription eCommerce platforms devoted only to this niche. Consequently, one of the e-commerce trends expected for next year is the emergence of subscription eCommerce solutions.

10) The Increasing Number of Website Personalization Solutions

Enhanced website personalization is another significant eCommerce technology development actively reshaping the business. With over 40% of online customers abandoning e-commerce sites without completing a purchase, it’s becoming more critical for online businesses to employ solutions to boost their conversion rates.

Many personalization technologies, such as Adobe Target, Google Optimize, Hyperize, and others, are now available. They assist companies in improving user engagement and boosting total revenue. Enhanced customization solutions can promote greater conversions and customer happiness without sacrificing the customer experience, from leveraging customer data to make more educated business choices to individualized product suggestions. Consequently, by 2022, ‘custom branding’ will be a crucial differentiation for businesses, resulting in increased conversion rates and ROIs.

Conclusion

When it comes to eCommerce technology advancements, the next several years will undoubtedly bring many changes. It’s fascinating to consider how e-commerce technologies will advance in the future years. However, determine which e-commerce trends are worth monitoring and spending time on, so we’ve produced a list of what we believe will emerge as significant players in 2022.

We hope that by using these forecasts, you will be able to anticipate how the eCommerce game will develop in the future and remain ahead of the competition.

0 notes

Text

Top Finance App ideas for Startups

Top Finance App ideas for Startups

While witnessing a paradigm shift from traditional payment to online payment, the BFSI sector thrives at a rapid pace. In the financial sector, the term coined after the integration of technology has added convenience for clients and security for financial institutions.

Today, as individuals tend to use robust digital payment solutions to make payments online, the fintech sector can offer start-ups a new set of opportunities.

Finance App Ideas for Startups:

Digital Banking:

This is one of the most important ideas startups should consider for fintech apps. Digital payment solutions have made transactions easier and allowed individuals to make payments online. For money transfer and other reasons, banks and financial institutions want to offer their customers a facility so that they do not need to visit the branch or even ATMs.

Digital banking solutions are designed to help clients invest, open accounts, block or unblock cards, add recipients, and the like by using only a few taps on dedicated apps.

Digital Wallet App:

The eWallet app development company enables app users to make online transactions without using physical wallets and credit or debit cards. With just a few taps, users can make payments and get discounts or coupons in return.

If a startup wants to come up with a digital wallet app, by improving security and offering an outstanding user experience, it can gain traction.

Blockchain Apps:

For all firms in the BFSI sector, blockchain technology is useful. These apps can provide users with plenty of options while providing improved security when making online transactions. Using cryptocurrencies, these applications also allow users to transact.

Crypto exchange Platform:

For financial startups, this is an innovative and unique app idea. Users can enter the decentralized market for cryptocurrencies through the platform. Cryptocurrencies, instead of other digital currencies, are traded. Some of the crypto exchange platform‘s best features include transparency, lower fees, faster processing, and the highest level of security.

0 notes

Text

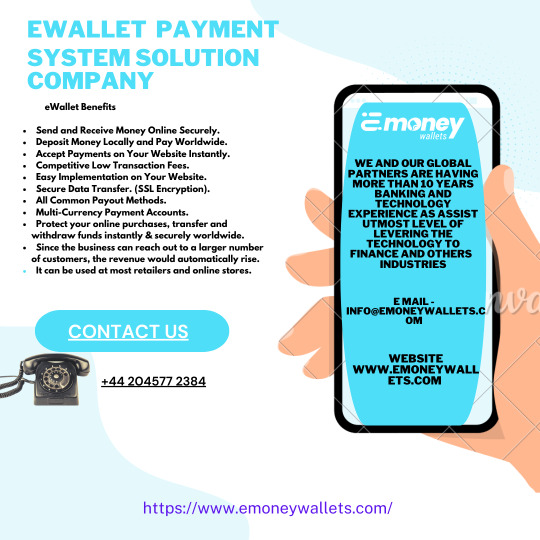

Ewallet Payment System Solution in London

Best ewallet payment system development company in UK, London (United Kingdom). Wallet solution and services provider for digital and mobile online payments

#Ewallet Payment System Solution in London#Ewallet App Development Company in UK#White Label Ewallet App Development Company#Ewallet Software Development Company

0 notes

Text

Ewallet Payment System Solution Company

Best Ewallet Payment Solution and Development Services Company in USA, Europe, Asia, UK, Latin America, UAE. Hire Best digital wallet system provider agency

#Best Ewallet Software Developer in Europe#Online Payment System Software Provider in Europe#Payment System Software Provider in USA#Ewallet Payment System Solution Company in USA#Ewallet Payment System Solution Company

0 notes

Text

Best Ewallet Solution Company in Estonia & USA For Your Business

What really makes modern digital payment methods so powerful is their feature-richness and adaptability. For example, you'll simply conduct cross-border payments or transfer tiny amounts of cash with digital payment methods. And albeit you're bound to our own four walls, you'll buy goods and commodities with just a couple of clicks.

eWallet app development requires a special set of features counting on the target market. Being the simplest ewallet app development company, we understand this alright, therefore we've an enormous stack of features readily available to infuse into your payment app. From third-party online services payment integrations to USSD payments, we will roll in the hay all to form your eWallet a hit. Digitalewallet Crypto is the leading eWallet solution company in USA serving in various other countries across Estonia, Mexico, France, London, Lithuania, Belize, Malta, Ukraine.

Our Common Features include-

1. Customer Onboarding

A digital wallet app requires customer identity information for the KYC process and getting this information during the signup process is sort of tricky. With mobile wallet app development, we create a seamless onboarding experience for your customers to enhance retention.

2. Bank Account Configuration

To leverage bank to bank fund transfer and cargo the cash into the e-wallet, the users are asked to link their checking account with the e-wallet application. The users can link their checking account with the app by providing their checking account details. This information is being kept confidential and is stored during a very secure format using various security compliances. The mobile wallet app allows users to configure quite one checking account to the appliance.

3. Transaction History

The must-have feature for eWallet app development. With this in situation, users can check all of the previous transactions that they need made on the mobile payment application itself. Furthermore, they might be ready to see the transaction amount value, the sender or recipient’s details, dates of payments, and any additional comments that were added when the transaction was made. With the USSD payment e-wallets, the users also can access the transaction history via USSD codes on their feature phones.

4. Add Money to Wallet

Users can add and store funds to the digital wallet to use for online services and payments. the rationale they are doing use their e-wallet is that it allows them to send money or pay bills instantly by just entering a PIN, Retina Scan, or fingerprint authentication.

5. Pin, Fingerprints & Retina Scans

Users are asked to line a four-digit secured pin, Fingerprints, or retina scan authentication to enable instant transactions. We utilize the user authentication methods at every crucial stage of the payment app like profile update, payment authentication, checking account update etc. We allow users to use any of the authentication options because the primary one.

6. Check Wallet Balance

If you incorporate this feature into your eWallet development, the users can see the real-time e-wallet balance within the payment app. If the users have linked their checking account with the appliance, they will also check their checking account balance.

7. Send & Receive Funds

It allows the users to send and receive money through the ewallet. The users can enter the recipient telephone number or they might scan the barcode of the recipient’s application to send money. During the e wallet software development, we also integrate QR code, NFC and beacon technologies to permit users to send funds or to buy services. within the same manner, the user can receive money from other users.

8. eWallet to Bank Transfer

We integrate the payment gateways seamlessly in order that you'll allow your mobile payment app users to send the payment app wallet amount to their bank accounts. does one know what makes us capable of doing it, because we are the best ewallet mobile app development company.

Considering the very fact that by 2023, the E-wallet market will possibly grow to $2.1 trillion with a compound annual rate of growth of 15%. We are the top ewallet solution company in Estonia, because the world of online payments remains evolving, there's an enormous demand for e-wallet software development and that we are helping financial institutions to understand a cashless world. So, if you're trying to find a mobile wallet development company that has years of experience of delivering e-wallets successfully. We create e-wallets for several use cases including standalone e-wallets, banking app e-wallets, in-vehicle payment wallets, etc.

We, at Digitalewallet Crypto, have eWallet developers that are dedicated and professional in developing digital wallet apps. We are a particularly professional E-Wallet Solution company in USA that gives digital wallet apps development services to innovative companies worldwide. We are also available as the top rated ewallet solution company in Estonia. For more information visit our website- https://digitalewalletcrypto.com/ or feel free to contact us for any query- [email protected]

#eWallet Solution Company in USA#eWallet Solution Company in Estonia#eWallet Solution Company#eWallet Development Digital Wallet Solution

0 notes

Photo

You can send and receive money on mobile devices by using R Pay Wallet. After we add your branding, your users will be able to use it right away.

Visit: https://bit.ly/digital-wallet-system

0 notes

Link

Digital Banking for the Modern World

A simple, fast, safe, and reliable payment solution saves us from all the stress and hassle of everyday tasks. It absolutely gives us a wide range of choices and options to go to in terms of paying and likewise, to be paid. A white label solution is a vital solutions services that businesses and customers opt to choose in making their transactions and day-to-day chores. White Label Ewallet is a viable White Label Ewallet App Development Company in the UK that makes banking and payment journey your safe financial partner. White label mobile banking software is a financial service that is perfectly crafted that gives solutions to your needs. The best thing about it is that it is a readily available eWallet for you. Aside from that, White Label Ewallet is your reliable partner that you can surely rely on because we are also an Ewallet App Development Company and a White Label Wallet Software Development Company in the UK that will assist t you in the comfort of a payment solution.

The white-label solution gives you the convenience that meets more than just the eye. It offers re-branding and white label eWallet, international prepaid card, and merchant payment and API integration. The SaaS also makes your life way better because you don't have to wait for long lines anymore. You can get these and so much more when you choose a white-label solution. Digital banking is not only a trend but it's here to stay. The white-label banking and eWallet solution brought to you by White Label Ewallet is easy to use and deploy and is a US and EU- based end-to-end digital banking solution that has the following license-as-a-service, merchant acquiring, multiple currency, IBANs, and others. Furthermore, running digital banking with a white-label eWallet is seamless because of a support system that is to help you in assessing your next investment goal. Needless to say, White Label Ewallet has over a hundred payment gateway support with dedicated 24/7 support and of course, a good old-fashioned easy import, easy export data. Get all the benefits and advantages of white-label digital banking today by learning about BaaS. Additionally, we understand how crucial is an investment decision is, thus, having someone or something to rationalize it makes a huge leap in helping you make a more informed and educated decision.

#whitelabelewallet#digital banking solution in the uk#white label solution#Ewallet App Development Company#White Label Wallet Software Development in the UK#White Label Ewallet App Development Company in the UK

0 notes

Text

Why Should You Invest in Mobile Wallet App Development?

Since the beginning of the digital revolution, mobile wallet apps have grown in popularity. In-app purchases and mobile payments are quickly becoming a "must-have" for monetizing your digital strategy and building consumer loyalty. Starbucks and Uber, for example, have recognized this, and their success has paved the way for the rest of us.

As a company owner, investing in the development of a digital wallet app may help you make a lot of money. Many company owners are now collaborating with eWallet app development companies to create bespoke applications for buying and selling goods and services. It covers a wide range of services for its consumers, including grocery shopping, ticket booking, and more, all while supporting its company environment.

Increased Sales Prospects

Do you honestly believe your firm has never missed a sales opportunity? You're missing out on sales from on-the-go consumers who rely on their phones for all of their online activities, or who lack cash or access to your company's sales agent if your app doesn't include mobile payment options.

Customers will be able to buy from and engage with you at any time and from any location if your company's app incorporates mobile payment functionality.

Transaction Fees are Low

Mobile commerce systems offer considerably cheaper transaction costs than credit cards, which have hefty interest rates. Merchants can create their own payment cards. It can function similarly to a gift card, removing the bank from the transaction and significantly lowering transaction fees.

Customers' lifespans will be extended

Users will be more than happy to stay using the app in the long run because an eWallet does not expire. This increases client retention and allows the firm to concentrate on the front end of the funnel rather than attempting to keep consumers loyal.

Availability and Transfer of Funds

All parties involved in the transaction may be certain that the money will be available right away.

Whether you're paying someone else or getting money from someone else, there's no risk of rejected checks or insufficient funds since everything happens in seconds rather than days or weeks - the payment initiation, processing, fulfillment, and confirmation of deposit.

Increased Profits

To remain in touch with their consumers and keep them coming back, merchants may send tailored offers with discount coupons. This may be done on a regular basis to improve sales opportunities over time.

Increase the number of customers

Banks and financial institutions can swiftly reach out to new clients via mobile payment app. The bank's trustworthiness is enhanced through well-designed contactless payment systems with innovative capabilities, which allow company owners to regard it as dependable and trustworthy. A touchless wallet is preferred by people all over the world. They'll immediately move to you because of your strong security features, leaving your competition in the dust.

Cashbacks and Offers

Every wallet has its own collection of motivators. Limits, cashback, incentives, and unconditional gifts are all ways to save money using e-wallets. By looking through their offer section and using promotion codes, you can get the most out of your money.

It has been a long time since mobile wallets were integrated into online business apps. Money multi-utility mobile wallets, on the other hand, have now become a need. Currently, the market is trying to figure out exactly what users are looking for.

Mobile wallets app not only allows users to conduct secure financial transactions but also saves time. Furthermore, they have significantly reduced investment weaknesses. E-wallets have unquestionably changed the market. While the internet and mobile banking have been available for a long time, digital payment applications have made transacting both online and offline much easier and faster. Any business that wants to take its operations to the next level and is seeking the finest eWallet app should contact a reputable mobile app development company.

#payment app#mobile payment apps#mobile wallet app development company#e-wallet app development#digital wallet app development#mobile wallet development#eWallet software development#eWallet app development cost#mobile wallet application development#mobile payment app development#create mobile payment app#mobile phone wallet#eWallet mobile app development#digital wallet web app development#mobile wallet development solution#mobile wallet developers#customized digital wallet apps

0 notes

Link

Best Ewallet software development company in London UK. Top Ewallet System Solution in United Kingdom for mobile wallets, digital wallets online Payments. Hire Ewallet Software Developer.

#Best Ewallet Software Development Company in UK#Best Ewallet Software Development Company in London#Ewallet Software Development Company in UK#Ewallet Software Development Company in London#Ewallet Software Company in UK#Ewallet Software Company in London

1 note

·

View note

Text

Ewallet Software Development Company in Yangon, Myanmar

Top Ewallet Software Development Solution Company in Yangon, Myanmar. Best Digital Wallet and Mobile Wallet Software development service company Yangon.

#Ewallet Software Development Company Yangon#Ewallet Software Development Company Myanmar#Ewallet Software Development Company#Ewallet Software Development

1 note

·

View note

Text

Top 5 Digital wallet platforms – Mobile wallet Technology

1. GrabPay

Born out of popular Singaporean ride-hailing company Grab, GrabPay uses the same seamless in-app technology users enjoy on the Asian answer to Uber to enable payments not only for rides, but in shops and for GrabFood deliveries. Users have the option to save card details on the app, but they can also choose to top up funds so they have a prepaid account. In addition, GrabRewards can be earned at GrabPay merchants, enabling users to make significant savings.

2. Paytm

The second Indian payment wallet on our list is Paytm, which can be prepaid eliminating the need to be linked directly to a bank account. It is used by Indian customers for a variety of services such as mobile credit, utilities payments, paying to ride the metro and making donations. Paytm is the largest payment gateway in India, and works with both consumers and merchants – indeed, 7mn merchants accept mobile payments from the platform. The company has recently launched Paytm Payments Bank, which aims to provide payment services to underbanked communities across India. Paytm has seen investment from the likes of Softbank and Alibaba.

3. Tez (Google Pay)

While the Indian payments app has been acquired by Google Pay, it continues to operate under its own brand, which is built to appeal to an Indian audience and serve the unique payment needs of that specific demographic. Money can be sent and received with zero fees, straight from a bank account to almost any recipient – even contacts who are not on Google Pay. The solution can also be used instore, and Tez has partnerships with brands that are popular in India such as Reliance, Foodpanda, Jet Airways and Redbus.

4. Ilium software: eWallet

Ilium is an independent software vendor which produces a range of applications for Windows, Mac, Android and more. The company focuses on security and has been in business since 1997. Now, it has developed an eWallet which helps keep payment details, such as cards and passwords, safe yet accessible across multiple devices. The eWallet can be used for business as well as personal use, helping employees create and store strong passwords, as well as allowing teams and departments to share access in a seamless, secure way.

5. Facebook Messenger

The popular social media messaging app allows users to link their accounts with debit cards or PayPal accounts, allowing them to make payments via mobile: both business transactions and peer-to-peer (P2P). Currently, Facebook only allows payments to recipients in the same country, and its peer-to-peer facility it set to be discontinued on 15 June 2019. This could be related to the news that Facebook is also looking to launch its own cryptocurrency using the WhatsApp messaging platform owned by the company, allowing payment transfers all over the world. It’s likely the Messenger app will, however, continue to be vital for small businesses which are supported through Facebook SMB.

Roamsoft introduces a digital wallet platform “R Pay” with customer app, merchant app, end- to- end admin panel. If you want to possess your own digital wallet solution then R Pay is the right choice.

R Pay, secured online payment solution helps your businesses grow and have your business in the palm of your hands. R Pay provides features like hassle- free sign up, load and send money, withdraw cash, pay merchants, buy tickets, instant notification, limited liability etc.

#Digital wallet platform In Europe#Digital wallet solution#Ewallet script#Ewallet app development#Mobile Wallet Platform#Mobile wallet technology#ewallet app source code#ewallet platform php#Ewallet mobile Software

0 notes

Text

How to Build an Awesome eCommerce App? A Complete Guide to Developing a Mobile Application

A Complete Guide to build an eCommerce App

Shopping Spree, Shopaholic, Fashionista, and what not! All thanks to Social Media Platforms for bringing in the fact that people love to shop; irrespective of the time; irrespective of the place. With the touch of digitization, the entire brick and mortar commerce arena revamped itself into eCommerce, wherein people started shopping online with the very ease provided by their devices, that too in the very comfort of their home.

eCommerce website, what once was a revolution has been commemorated by eCommerce mobile application. Indeed! eCommerce mobile apps with the slogan, “Shop on-the-go” are reigning over the smart users and their smartphones today. Amazon, the biggest player in the eCommerce game along with its counterfeits Alibaba, Myntra, Snapdeal, have become an integral part of people while malls and supermarkets are being lowered to “Selfie zones”, “window shopping fads”, and “Check-in” hangouts.

Who would want to spare the precious time of their weekends, standing in long queues at the billing counter, waiting for their turn while France is playing against Croatia! Well, with eCommerce mobile app, all they could do is shop and yet never miss the game. So, an eCommerce app is an awesome game-changer in so many different ways.

That’s eCommerce mobile app for you!

Who doesn’t have a dream of running a successful business with customers crowded all over the shop? eCommerce mobile app can be your dream come true business as you can target the customers from across the world and you don’t have to travel to market for your brand; that’s an added advantage.

Recently, there has been a great rise in the demand to build an eCommerce mobile app. Every single day, startups are getting into the eCommerce business and all they target is mobile-first, website-second!

Cutting it short, if you are an aspiring eCommerce businessman, you have landed on the right page. Let me tell you, developing an eCommerce mobile app is not a very big deal today, especially with the nascent of tools and technologies playing around.

And the future of eCommerce, AI and VR technologies are decked up to renovate the eCommerce ecosystem completely with unforeseen features like virtual changing room. Must say, even the future of eCommerce is way too bright and now is the time you should seriously consider building your very own eCommerce mobile app.

To start with, it is important that you define your eCommerce business goals with utmost clarity. What type of eCommerce mobile app do you want to launch your business – Android or iOS? What is your product going to be? Who is your target audience? Which brands are you targeting?

Once this is sorted, you can move to the next important step which involves defining the right features for your eCommerce Mobile Application.

Features are the reflection of your USP. That is going to make all the difference for your target audience, when it comes to an eCommerce app. Basically, they are but the deciding factors of whether your revenue grows or flows away to your competitors. Hence, it is important to plan the features for developing your eCommerce mobile app. Below is a list of features extracted from the successful eCommerce Mobile App and you cannot afford to miss any of these:

A Simpler Registration Process

As easy as this sounds, it can be an exhaustive one for your customers and they might simply choose to uninstall the app with pages and pages of information to fill in. Who’s got time anyways! Ensure an easy registration process. With everybody having a Social Media Account today, you can enable sign up and login with two clicks at maximum and your customer is on-board! Plus, an extra brownie point for learning their preferences through their digital age on their Social Media Accounts!

Supports Multiple Payment Options

Let’s say, you have a big fat customer who mostly shops online and visits your eCommerce mobile app to give it a try. After dumping his stuff into the cart, he realizes you do not have the payment option that he prefers. You just lost a big customer. And many more who prefers the payment option that your app does not offer.

To play safer and smarter as an eCommerce businessman, you have to open the doors to the most popular payment methods. Credit card, debit card, net banking, and eWallets being at the top, ensure that you subtly push your customers towards using your app’s in-built wallet.

Push Notifications

Your customers have their needs and want, you have the required supply to fulfill them but how to bridge this gap of communication? Push notification is the key!

Push Notification is one of the most important features that map the success of an e-commerce mobile app. They enhance the customer engagement as it keeps them informed about the referral, discounts, sales, promotions, and offers, to keep them coming back for more. This, in turn, provides you with the opportunity to cross-sell and up-sell for getting you better profits.

Social Media Integration

Don’t tell me that you do not want ALL the attention of your customers. You even want their social media time. And your demand is justified considering the fact that you are running a business.

Not only for one-tap login, Social Media integration will ensure that your eCommerce mobile app is right in front of your customers wherever they are; chatting on Facebook, Tweeting on Twitter, or pinning on Pinterest. This will also help them easily share your special discounts on their social media accounts. What better than word-of-mouth marketing and user-generated content! An eCommerce app that taps the power of social integration works – It’s as simple as that when it comes to an application of eCommerce.

Complete Synchronization

You have your eCommerce website and an eCommerce mobile app. You have come up with a very exciting feature that is sure to strike a chord with your targeted audience and take their buying experience to the next level. But you have to launch this feature before your competitor does. You want better time-to-market but with edits to be made in both the portals separately, time seems to have stopped. What would you do?

Speed up the process by getting our eCommerce mobile app synchronized with the website. Save plenty of time, beat the competition, and increase your sales.

Google Analytics

It’s just been a while since you launched your eCommerce business. You think you are faring well so far. But keeping your gut feeling aside, how do you gauge what is working for and against your business?

Ok, like every time, Google has the answer you want with Google analytics. Optimize the use of Google analytics to find out how your customers are really finding to be on your mobile app with the help of real-time data. Know which product of yours need a different packaging, what offers can make an appealing combo, and which demography is resonating well to your business, all this with Google analytics. Your application of eCommerce will definitely grow from strength to strength.

Review & Rating

Don’t shy away from the fear of getting bad reviews and poor product ratings. A wise businessman is the one who is open to both criticism and learning.

Empower your customers to review and rate your app and its features. The possibility is, the products that you are offering are nowhere in the wish list of your buyers and reviews will help you achieve this sense of realization. Again, after improvements do not delete the negative feedbacks, rather thank them and show what steps you have taken. This will make them feel important and who knows they will stick to your brand like forever!

Wishlist Button

It’s the end of the month. The salary is one week away and your customers don’t want to miss out on what they have recently found out. They want to buy it, not now but definitely after a week. Let wish list play its share.

Wishlist, at times, can be a savior to your sales. It helps your customers to save products they wish to buy later. Plus, you get an edge over knowing the preferences of your buyer and personalized offers and SOLD!

Easy Checkout

All the enthusiasm and energy of your customers is gone in making their choices and adding items to cart. Now’s the tough part – the payment!

To ensure that they do not abandon the cart, build your checkout process as easy as possible. Help them save their card and e-wallet details and take them faster through the payment gateways. As said earlier, your customers hate to wait in the billing queue, don’t let them wait with virtual billing system as well!

There are myriads of eCommerce mobile apps already in the market. You need to stand out from the crowd and these features will help you make a move. If you follow a customer-first approach by providing them the utmost ease to shop, you will easily be able to retain your customers. On the other hand, when your competitor has an amazing experience to offer in reference to features, your customers will be inclined to them.

In this situation, the smart way is to build an eCommerce mobile app with the right features and avoid any fluff that could possibly take away your customer engagement rate. Make them feel that you understand the issues they face while shopping with other mobile app and the solution. Give them the value of the time, energy, and money they spend using your mobile application. This is the only important key to win over your customers and has an upper hand over your competitors.

Things to Take Care of While Building an eCommerce Mobile App

Right from conceptualization of what USP of your eCommerce Mobile app is going to be to launch a Beta Version, there are many important aspects that are to be taken care of.

With time, experience, and analytical skills, I have collated a complete guide with elaborated information on the important aspects of app development.

If you are a first-timer, you might feel the hardship right from the beginning. You might even end up scraping the entire business idea. But do not drop yet. We are here to help.

The basics of any eCommerce mobile app remain the same. All you need to add is that pinch of your branding and the spark of your USP to make your business stand out and stay at the top in the Google search engine results. Some of the fundamentals that you should consider basic while building an eCommerce mobile app are:

· Easy navigation

· UI/UX with right features

· Visual appeal

· Brands integration if at all you are into multi-store eCommerce

· Inventory management

Here is an ideal step-by-step process for creating and launching an eCommerce Mobile app that you should follow in your trail to run a successful eCommerce business:

Keep in mind your eCommerce business goal even before you begin with the development process. Know what uniqueness you bring in or what issue you are going to solve for your customers with your eCommerce business. Do not go “all in” with the launch of your business. You need to know what works and what doesn’t. You need to know your real-time buyers. You need to know what gender you should target. You need to know a lot! Start small but concrete. Make expansion only when your business is ready. Get help from talents and app development experts to upgrade your business version. Take a look at this guide to outsource the best app developers.

In the urge to following the ABCs of your eCommerce business, do not forget the M for Marketing. You need to reach out to your potential customers to help them reach out to you.

Attract them with onboarding referrals, convert them with your USP, close your sales by keeping them engaged, and delight them with information about the products they need and your offer.

Ultimately, it all depends on the quality of development. Hire experts that are passionate about their work as much as you are about your dream eCommerce business. Retain them by providing them the perks and incentives that are best in the industry.

Trustable Ecommerce App Development Companies

Key Aspects for eCommerce App Development

Before proceeding any further, let me give you a detailed glimpse of the key aspects to focus on while developing an eCommerce mobile app:

Market Analysis and Buyer Persona:

The basis of an eCommerce mobile app development lies in determining the buyer persona for your business. Ask yourself, “ Who are you selling your products to?” Accordingly, carry out your research for your target audience. Analyze the behavior and patterns of your target audience. Know their digital age and their likes & dislikes. This will help you create your app as relatable as possible for them.

Know your Competitors:

Extract a list of your competitors. Create a separate list of what they are into and what makes them the obvious choice for the buyers. Do not duplicate their features or their business model, rather research well about the business model and make the maximum out of your analysis.

Choosing Technology:

Know the ins and outs of your business so as to decide on the technology to create your eCommerce mobile app. Keep an eye on the budget of development, know your inventory and select the CMS, database, framework, and most importantly the backend and frontend languages to code your app.

If you want a better time to market, go for the hybrid app, if you want sustainability, go for a native one. Similarly, you have to decide whether you want to launch an Android app, an iOS app or both at the same time, keeping in mind the device usage of your target audience for designing your application of eCommerce.

UI and UX Design:

Give your brand the voice it deserves by soothing color schemes, appealing visuals, and smooth transitions for your customers from one page to another. Create options for your logo and leverage it to the optimum. That is going to be your business’ identity for your target customers. Play with the subconscious mind of your customers by leveraging smart branding tactics for creating a lasting impression.

Cost of Developing an eCommerce mobile app:

Ultimately, it narrows down to whom you are investing and how much you are investing. Without a doubt, the budget is the front of the mind concern for the app development. To save you from this budget dilemmas, I have created some pointers for you to remember while going forward with app development:

· Features: Whether you want to launch your eCommerce app with MVP, or a mixed bag with MVP and advanced features, or a full-fledged eCommerce mobile app with advanced features.

· Android or iOS? The price tag of iOS is on the higher side, decide what device you want to be primary for your business. You can always scale your business later.

· The low maintenance of expensive backend development or the low budget high maintenance third-party APIs.

· A better time to market with hybrid app development or better sustainability with native app development? Make your choice wisely, you are in the business game for the long run.

Outsourcing the resources have a visible effect on your budget and so you need to be very careful hiring them.

Again, a number cannot be projected with respect to the react native app development as there are variables. However, to be as helpful as I can, I have put down an estimate on the basis of the trends I have witnessed considering the generic app development scenario.

· If we consider the most basic version of the app with only the MVP features and simple UI/UX design, the projected price can go to $60,000 just for development. However, there is very little support and maintenance required.

· If we consider a mixed bag of basic features including a few advanced features, the price an go up to $60,000 to $80,000.

· If we consider the app to be developed with advanced features, then the price can be as high as $80,000 to $120,000.

Outsource Developers for eCommerce Mobile App Development:

On the basis of your scope of work, you would want to outsource resources and skilled developers for building your eCommerce mobile app.

There are many different types of pricing models that you could choose from – time-based, scope based, fixed price and fixed time pricing model, or dedicated resource hiring.

Dedicated Resource-based Hiring

When opting for a dedicated resource based hiring, ensure that you know the scope of work and that you are not paying for an extra resource, when it comes to eCommerce apps.

To develop a basic version of your eCommerce mobile app, you will need –

· UI and UX designer

· 2 – 4Developers

· Quality Assurance Engineer

· Backend Developer

· Project Manager

To develop an advanced version of the eCommerce mobile app, you will need –

· Team Manager/Project Manager

· UI/UX designer

· 3 – 4developers for each platform

· Quality Assurance Engineer

· 2–3 backend developers

· Admin panel developer

After this virtual tour to developing an eCommerce mobile app, are you ready to step into the real world with real hiring of skilled resources for your to-be-real eCommerce mobile app?

Having helped in weighing all the angles of your eCommerce mobile app, we can be the partners in your endeavors with our rich experience worth boosting. We believe in work than words. Have a look at various case studies that are being written every time we faced a new challenge and the creative solution we provided.

Nothing better than a client talking to a client. Know what our clients have to say about our work and achievements. Yet not convinced? Here we are with practical and live applications that we have created for our clients. You can go ahead by testing these apps, who knows you might find your perfect app development partner!

We would love to be a part of an eCommerce mobile app development.

Please drop an inquiry about your needs and our experts will get back to you as soon as possible to make your eCommerce business possible.

Are we helpful to you in your venture of building that perfect eCommerce mobile app of yours?

Yup? Nope? Whatever? Still in doubt?

We would love to hear from you. Please feel free to comment your views or confusions and we will strive to get them resolved for you. Drop your inquiries in the comments section below, or drop us an email at [email protected]

1 note

·

View note

Text

This Lost Secret of Taruhan bola Online Terpercaya

Locating a new wonderful site page is just a couple of snaps missing. Some sites go so far as receiving affiliated with online gambling dens, or even integrating all of them in the poker room computer software. You will discover internet poker web sites offering an array of solutions. Really in addition not unconventional with regard to world wide web poker web sites to help certainly not permit a player the choice of showing their particular hand just before folding in the event they're typically the giving way up the pot to the very last remaining bettor. They have very simple to set a new web site and offers little to no-cost plus you have a tendency will will need to be tech-savvy to help start. Info relating to well being tip of the day might end up being required by women and adult men who'd love to be healthy. Or it is also feasible to get in touch with via email or by way of our on-line discussion. Email marketing is currently the vital portion of a digital advertising and marketing strategy. Simply because soon as you find your firm prepared to be able to go, if you have a tendency in the past have an market, you're going to turn out to be wondering where your consumers are. Our company stipulates any available resource to be able to produce sure our copy writers deliver the forms inside time. Well, companies tend to be not the very same together with picking one up receives simple knowing the program you want. Many businesses hide the additional charges simply to secure you surprised with all the last contract. Please study from my experience and visit a new dependable patent lawyer so that you're solely buying the services that will you need. Instead, others utilize the help of an invention advertising company. Generally, all individuals may most probably be fascinated to take part around various on-line distractions with regard to their opportunity move. A great anonymized string created by your own personal email address (also known as a hash) may be supplied for you to the Gravatar service to help see whether most likely applying it. Moreover, several on-line cardrooms have developed VIP applications to reward regular people. Becoming unorganized as soon as you are cooking can result in you losing a fortune and meals. Cooking food a big meal for friends or household wants a considerable amount of00 preparation beforehand. Often take into account which you together with your family will also be adding a good individual's any money with stake and it's not really per good point for you to only place your wager devoid of so much like having a superior quality opportunity of making bankroll from that. Poker rooms generally present you further additional bonuses to get players who would like to top-up their very own accounts. Online poker spaces ordinarily operate by using a diverse bit of software. The participant has to be capable to be given a good WiFi or cell phone phone signal to be equipped to play. judi bola online may possibly also use ewallets, online wallets that will support online players to put aside their cash on typically the internet in the foreign money with their choice. There will be players based on a skill amounts and you may always discover your match. The sites more often than not necessarily aren't just offering clubhouse amusements, it is going to enable people to earn wagering within the actual game titles. Video clip texas holdem are available with the huge bar. Football playing could be very profitable for bettors. If you think, for example, a person would like to have fun with draw poker, you might not request wonderful poker-bankrolls. Roulette, online poker and blackjack online are usually all of them virtually all well-known games which everybody may have a fun time with. Inside tournament poker, you need to make it through. Draw no wager is a particular case the spot no precise handicap will be used, though the draw will be still eradicated. Typically the wager is in the particular form of money. Amid often the minute you might make wagers within the sports on-line diversion, you ought for you to have a farmer whilst throughout the support associated with an individual.

1 note

·

View note