#due diligence data room

Explore tagged Tumblr posts

Text

Secured File Sharing - Confiex Data Room

A secure online document sharing platform powered by Software as a Service (SaaS) is offered by Confiex Data Room, enabling enterprise-class collaboration and compliance regardless of geographic or IT constraints. Leading Investment Banks, Law firms, Private Equity Companies, Resolution Professionals, Auditors, Government bodies, and Corporations frequently use Confiex Data Room's internationally renowned Virtual Data Room as a secure and compliant method of sharing confidential business data with third parties. Confiex has established itself as one of the best Secured file sharing platforms in the market today.

For more information do visit: https://confiexdataroom.com/

#virtual data room#data room service provider#data room pricing#data room software#data room india#data room for m&a#confiex data room#secured data room for deals#due diligence data room#data room for investors#secured file sharing

0 notes

Text

Virtual Deal Data Room

A virtual data room, also known as a VDR or deal room, is an electronic information vault used for document storage and distribution. A virtual data room is frequently employed to streamline the due diligence procedure throughout an M&A transaction, loan syndication, or private equity and venture capital transactions. The disclosure of documents during this due diligence process has historically been accomplished using a physical data room. Virtual data rooms have largely replaced the more traditional physical data rooms due to cost, efficiency, and security considerations.

#Virtual Data Room#Data Room#Data Room Service Providers#Data Room Pricing#Data Room M&A#Investor Data Room#Data Room Due Diligence#Data Room Software#Data Room Providers

0 notes

Text

Their voicelines about you.

FT. Riddle, Leona, Azul, Kalim, Vil, Idia and Malleus. + Rollo.

Synopsis: The boys sharing their comments regarding with you, some can be sarcastic, otherwise it's cool ♪

Warnings: None!! Wholesomeness overload <33

꒰ ꕤ ꒱ ─── Riddle Rosehearts

— About you?

“...A question to me? Are you asking to how I think about Yuu? My first impression of them? Well, they are hardly polite if I had to say, with them colliding against a housewarden that is. Yes, I am referring to when they tumbled on me during the beginning of this year. It was admittedly too much. They are a handful to manage. And keen, no doubt about it.”

꒰ ꕤ ꒱ ─── Leona Kingscholar

— About you?

“Oi, what's this? An interview about that herbivore? Did they pay money to you for this? Are they brave for me? I guess? Or moronic since normally no one would be able to handle overblots. It hurts my ego every time I wonder how I lose to them. If that lizard gets beat up like the rest of us, I will be grateful. I can't wait for that day— so I can sneer at him.”

꒰ ꕤ ꒱ ─── Azul Ashengrotto

— About you?

“About them? I fail to understand the point of this topic. They are incisive, hilarious and tactful. Outsmarting others was one thing but me? Me? As much as I dislike to speak this out, they are doing nicely being a prefect on our school grounds... Oh my? You don't believe in me? I am genuine. I haven't scar anyone, have I? You have my word at least.”

꒰ ꕤ ꒱ ─── Kalim AI-Asim

— About you?

“I have been wanting to tell you that! They are carefree, unique, a person you can rely on. Night Raven College wouldn't be the same without them. Please, tell them how much I care for their happiness. Yuu is an honest friend, and them being magicless doesn't change anything. We should look up to them even! Strive to be willing to confess we are flawed.”

꒰ ꕤ ꒱ ─── Vil Schoenheit

— About you?

“Curiosity? What was it that you stated? The supervisor for Ramshackle dormitory? They are skilled in encouragement, diligence, unluckily due to being appointed by the headmaster without proving if they deserve their status beforehand. Some people gossip about them. Ah, do not worry about it, I squashed any complaints they have to that already.”

꒰ ꕤ ꒱ ─── Idia Shroud

— About you?

“They are like the main characters of a shonen manga. C-could they be? Because the dorm leaders like them, some just wouldn't reveal they do. I have the data from Ortho to confirm my observations. I steer clear from them mostly though, they always are around with extroverts.. I prefer my room to them. Are we finished yet? I'm — leaving so bye...”

꒰ ꕤ ꒱ ─── Malleus Draconia

— About you?

“My treasure? An intriguing idea. They are fearless, doesn't mind my ramblings about gargoyles. I was invited by them, it made my heart filled with anticipation and I am rather fond of their remarks. If I am any more selfish I would wish to cage them up inside a tower so that I can preserve them forever. Alas, it's too cruel for them, isn't it? I suppose.”

꒰ ꕤ ꒱ ─── Rollo Flamme

— About you?

“Their decision was unsavory, why must it be Draconia? And what does he have that I do not? It plaques me how obstinate that clueless sheep is. Magic users are notorious, insidious, when will they learn? If only they agree to let me whisk them away from that concept. For I, Rollo Flamme, would not treat them as their Headmaster Crowley does.”

#twisted wonderland#twst scenarios#twst x you#twst x reader#twisted wonderland x mc#twisted wonderland x yuu#twst headcanons#twst riddle x reader#twst riddle x yuu#twst leona x reader#twst leona x yuu#twst azul x reader#twst azul x yuu#twst kalim x reader#twst kalim x yuu#twst vil x reader#twst vil x yuu#twst idia x reader#twst idia x yuu#twst malleus x reader#twst malleus x yuu#twst rollo x reader#twst rollo x yuu#twst mc#disney twisted wonderland#twst prompts#twst fluff#gender neutral reader#etihw.writes

589 notes

·

View notes

Text

Saturday, April 15th, 2023

[ Sorry for the prolonged absence! Life got complicated for both of the admins and for the time being you'll need to deal with me! ]

ANYWAY, Goro Akechi Time

So, as is considered nearly common knowledge by now, data present in P5 and P5R points to the existence of a scrapped Akechi Palace for our ✨lovely pancake boy✨, but how much is known about it *really?* Here's a data breakdown of the scraps left over!

Every field in Persona 5 has a Major and Minor Field ID, and the game is programmed to assume Major ID's between 150 and 200 are Palaces. The final game uses IDs 150 to 162 for each Palace like so:

f150 - Prologue [ Casino Duplicate ]

f151 - Castle Pt.1

f152 - Castle Pt.2

f153 - Museum

f154 - Bank

f155 - Pyramid

f156 - Moon Base

f157 - Casino

f159 - Cruiseship

f160 - Holy Grail Path

f161 - Mementos Depths

f162 - Labratory

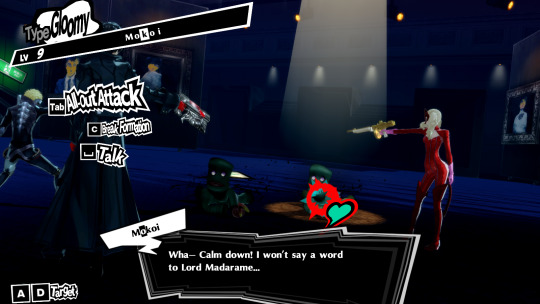

As you can see, there are missing Fields between 157 and 159, but how can we prove this is Akechi? We look at the dialogue for negotiating with Shadows!

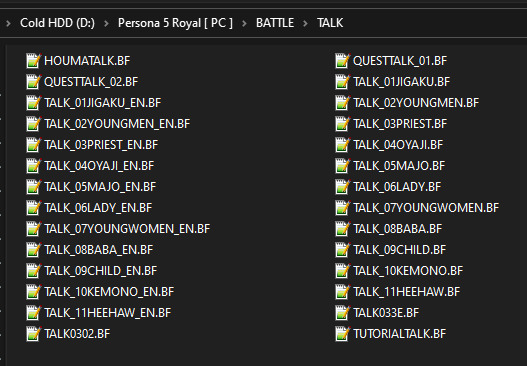

When knocked down, Shadows occasionally mention whatever Palace Ruler is currently active. This data is stored in BATTLE\TALK in various .BF ( Binary Flowscript ) files that are run based on the enemy type.

Inside the BMD ( Binary Message Data ) chunk of these files, there's some unused dialogue:

Flee while you still can! Ahahaha! It is futile to oppose Lord Akechi! You would do well to tread carefully. Lord Akechi is a man possessed of immense desire. Hmph… I wonder if your power would even pose a threat to Lord Akechi… I give up… *sob* Lord Akechiii…

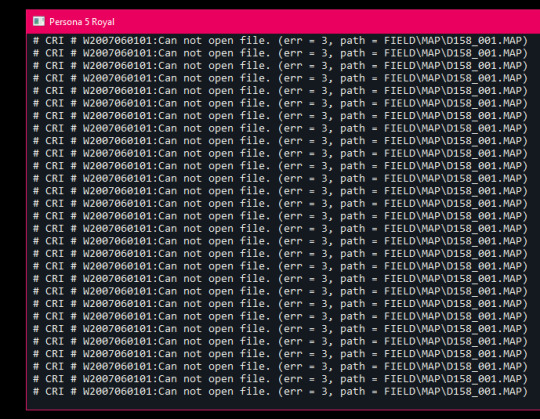

There are 27 lines in total from Shadows referencing "Lord Akechi", all of them localized! Normally, this is where most investigation ends. There was a planned Akechi Palace between Sae and Shido, but all data was scrapped and any attempts to load into the Palace by force fail due to an intense scrub of all related data.

( Generally this is a sign things are not going well )

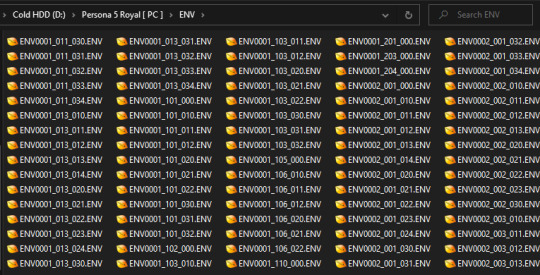

This, however is not the end of things just yet—Atlus was not entirely diligent in the data wipe. One of the things left behind is a single .ENV ( Environment ) file. These files—among many other things—specify properties like texture color, color grading, light effects and so on for every field.

ENV\ENV0158_001_000.ENV is found in this folder, corresponding to the missing 158 Palace ID. However, since there's no meshes left over, we can only see ENV 158's effects by placing it on another field. Here is the front hall of the Bank Palace as seen in-game normally:

Here is what Akechi's Palace would have looked like, at least the ambiance, had development continued:

( I'm sure someone can make some kind of argument about how this represents Akechi thematically, lord knows I can. )

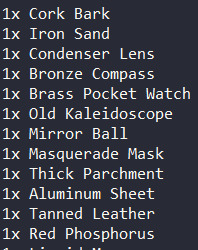

One other aspect still remaining is found in FIELD\FTD\FLDDNGPACK.FTD, a list that specifies what encounters can be found in any Palace, along with loot in Chests and Search Objects. Akechi's DNGPACK List is not entirely empty!

We can see by parsing this file that Akechi's Palace would have had around 21 different Fields, about the standard for every Palace in P5R, though this excludes Safe Rooms. While the Encounter Entries sadly lead only to default Kamoshida Castle battles, his list references a unique Random Loot Table 7! At the time of writing, it appears no other part of the game references Random Loot Table 7. While it lacks unique items found in other Palaces, the data is indicative of what could've been found inside Akechi's Palace Search Objects.

Jades and Garnets are placed at surprisingly high priority, along with the Marble Chessboard. Of note are the items such as the Marble Chessboard and Brass Pocket Watch, those specific Item IDs cannot be found in any other location in the ENTIRE Random Loot Table .FTD file.

Until more info about how Palaces function is uncovered, it seems like our Detective Prince will continue to elude us in his heavily fog-covered ways, this subject clearly needs more research to find any more remnants!

That’s all for now, see you soon!

476 notes

·

View notes

Text

I think a big issue is that this is EXACTLY why there are teams of people who do this — because the types of people who really like doing extensive research and are proficient at employing those skills often don't have overlapping skills focused on writing, or video editing, or communicating to an audience.

Even with old Newspaper journalism, the writer is a different person from the editor, and they often aren't the core researchers. The misperception of the ubiquity of a one-off individual as the "face" of information presentation also being all of those things is because we get exposed to the EXTREME statistical outliers where that is the case in addition to the TV/media figurehead newsroom presentation shifting into YouTube "guy in his room" making it seem like that's a reality.

Some passionate person will deep dive on a thing they know about, and even while they start out not being able to pay a whole team of people to assist in a few passion projects where they happen to do those things well enough to catch algorithmic focus, when you never see the process and just the result through one central figure even as the process changes behind the scenes, this just further exacerbates this false perception.

Passion projects always entangle your personal interests into the narrative. This is why I like how Simon Whistler has a kajillion YouTube channels, but it's always clear that he's just the face of everything as factboy™ and it's his writers putting together various stories on topics for him to present, and his editors adding an additional layer of video flavor top of all of that. Everyone's doing what they're best at, but in a way that's visibly a collaborative process drawing intentionally explicit detail to it not being just the one dude with a "credits" list of Patreon supporters.

If your passion involves the ambition to make your video into a successful vessel for you to be the next whoever, it inevitably becomes an element of the reporting and often overshadows the topic itself.

Your work will always contain elements of what you bring to it personally, which is why people like Summoning Salt cover speedrunning, but it took him SEVEN YEARS to finally cover the game he does himself because there's a difference of interest in how to highlight his own SIGNIFICANT achievements objectively. You have to make sure that your interests are there to serve that work and not the other way around …and that's fundamentally at odds with how "content creation" works.

Not every attempt at research will give you a video worth making or a story worth writing, and ones that do will often drag you down a myriad of different paths and utterly dismantle what you initially intended to focus on, or balloon the scope into something that doesn't work for 99% of people.

This is why reinforcing the fact that the most successful and effective versions of these things are an interdependent cooperative effort of multiple people with varying skills, and NOT this image of an independently successful figurehead who does everything themselves.

The part that really worries me is that AI-generated summaries are going to flood the Internet with SO MUCH factually inaccurate oversimplification that research is going to become even more critically important at a time when people are far less apt at the due diligence necessary to dredge out the facts from an overwhelming sea of data — and will be more inclined to cut corners rather than build up a team of people to tackle that project together.

The trouble with the rise of the YouTube Video Essayist™ is that everybody wants to be the next Defunctland or Hbomberguy, but all the wannabes know is how to be an influencer, so the resulting video essays are always really about themselves. You'll get a forty-five-minute video with maybe fifteen minutes of actual, topical information padded out with half an hour of tedious theatrics about how hard it was to do research for the video and how nobody wanted to talk to them, and I'm just sitting here like "yeah, dude, it was hard because you don't know how to perform research, and nobody wanted to talk to you because your behaviour toward your prospective sources amounted to borderline harassment, and that's how it looks in your own version of events which has clearly been spun for optics – I can't even imagine how badly you must have gone about this in reality".

16K notes

·

View notes

Text

What to Look for in a 2BHK or 3BHK Villa in Jigani

Jigani, a rapidly developing area on the outskirts of Bangalore, offers a blend of modern living and tranquility. With a variety of 2BHK and 3BHK villas in jigani available, you might be considering making this vibrant locale your home. This guide will help you navigate your search effectively.

Location: Strategic Considerations in Jigani

Proximity to Key Amenities: Schools, Hospitals, and Shopping

When looking for a villa in Jigani, consider how close it is to essential services. Here’s what to look for:

Schools: Research nearby educational institutions for your children.

Hospitals: Access to healthcare facilities is crucial.

Shopping Centers: Look for local markets, malls, and grocery stores.

Connectivity and Commute Times: Assessing Road Networks and Public Transport

A well-connected villa can save you a lot of time. Keep these factors in mind:

Road Access: Check how close major roads and highways are.

Public Transport: Look for nearby bus stops or metro stations.

Neighborhood Safety and Security: Researching Crime Rates and Community Features

Safety is paramount when choosing a new home. Evaluate:

Crime Rates: Find data on the area’s safety statistics.

Community Features: Friendly neighborhoods can enhance your living experience.

Budget and Financing: Navigating the Financial Landscape

Determining Your Budget: Factors Affecting Affordability

Understanding your budget is key. Consider:

Income: Assess your monthly earnings.

Living Expenses: Factor in your everyday costs.

Exploring Financing Options: Home Loans and Other Financing Methods

Look into various financial avenues:

Home Loans: Consult banks for mortgage options.

Government Schemes: Investigate any applicable grants or subsidies.

Hidden Costs: Property Taxes, Maintenance Fees, and Other Expenses

Don’t forget about extra expenses:

Property Taxes: Know what annual taxes you will pay.

Maintenance Fees: Look into costs for upkeep.

Layout and Features: Maximizing Space and Comfort

Space Optimization: Evaluating Room Sizes and Functionality

A well-planned layout can enhance your home life:

Room Sizes: Ensure bedrooms and living areas are spacious enough.

Functionality: Check the flow of the space for convenience.

Essential Amenities: Parking, Storage, and Outdoor Spaces

Consider must-have features:

Parking Spaces: Is there ample parking for your vehicles?

Storage Options: Look for closets and cabinets.

Modern Features: Smart Home Technology and Energy Efficiency

Investing in modern features can save you money:

Smart Technology: Check for automated systems for ease.

Energy Efficiency: Opt for homes with eco-friendly installations.

Construction Quality and Legal Due Diligence

Assessing Construction Quality: Inspecting Materials and Workmanship

Quality construction matters. Pay attention to:

Building Materials: Look for durable and high-quality supplies.

Workmanship: Check for professional finishes.

Verifying Legal Documentation: Title Deeds, Approvals, and Ownership

Don’t skip the paperwork:

Title Deeds: Confirm the seller’s ownership.

Approvals: Ensure the property has been legally built.

Seeking Professional Advice: Engaging Lawyers, Architects, and Real Estate Agents

Get expert guidance:

Real Estate Agents: They can offer valuable insights.

Lawyers: Legal professionals can help with documentation.

Negotiation and Closing: Securing Your Dream Villa

Negotiation Strategies: Making Offers and Counteroffers

Negotiation is key. Here’s how to approach it:

Initial Offers: Start with a fair price based on market research.

Counteroffers: Be prepared to negotiate to find common ground.

Understanding the Closing Process: Documentation, Payments, and Transfer of Ownership

Know what to expect at closing:

Documentation: Gather necessary papers for finalization.

Transfer of Ownership: Ensure a smooth transition of ownership.

Post-Purchase Considerations: Insurance, Maintenance, and Community Involvement

After purchasing, keep these in mind:

Home Insurance: Protect your investment.

Maintenance Plans: Schedule regular upkeep.

Conclusion: Your Journey to Owning a Villa in Jigani

Owning a villa in Jigani can be a rewarding experience. Here are some key takeaways:

Research and Planning: Take your time to gather information.

Budget Wisely: Always stay within your financial limits.

Maintain Transparency: Legal clarity ensures peace of mind.

For further research, explore local real estate websites and connect with professionals who can assist you in your journey. Your dream villa awaits!

Visit Website More information :

0 notes

Text

Ensure Safe Business Ventures With Due Diligence Investigations

Investment security has never been more important in the fast-paced, dynamic corporate world of today. Businesses encounter a variety of risks during mergers and acquisitions, partnerships, and investments that may compromise their operational stability, financial security, and even reputation. Due diligence investigations are the cornerstone of well-informed decision-making, giving investors and business owners the knowledge they need to take calculated risks. Due diligence guarantees asset protection and fosters sustainable growth by guarding against potential hazards and unanticipated obstacles. We'll explore the fundamentals of due diligence investigations in this blog post, including their importance, what they involve, and how they benefit businesses. Knowing the nuances of due diligence can make all the difference, whether you're an investor trying to buy a company or a business owner thinking about forming a partnership.

How Due Diligence Investigations Work

Due diligence investigations entail a thorough assessment of a company, business, or person in order to confirm pertinent data, evaluate risks, and authenticate facts. By identifying any problems that can affect future success, these investigations are essential for companies looking to validate their partnership or investment choices. Due diligence helps companies make decisions based on correct, verified information by looking at a company's reputation, operational effectiveness, legal status, and financial health. Due Diligence Types - To assess financial health, financial due diligence involves looking at cash flow, balance sheets, income statements, and financial records. This type of due diligence aids in locating any debts, liabilities, or financial concerns that might affect performance in the future. - Legal Due Diligence: Evaluates potential legal risks, pending court cases, regulatory concerns, and compliance needs. It assists companies in avoiding possible liabilities and legal problems that could impact a partnership or merger. - Operational Due Diligence: Assesses a possible partner's internal procedures, assets, personnel productivity, and daily operations. This makes it easier to verify that the partner's operations are scalable and effective. - Assessing a potential partner's reputation, ethical status, and public image is known as reputational due diligence. A bad reputation could harm the brand's reputation and put it in danger of negative customer feedback. Companies and investors alike gain from a comprehensive due diligence process because it lowers risk, identifies potential value, and creates a clear picture of what to expect.

Key Components of a Successful Due Diligence Investigation

A thorough due diligence inquiry looks at a number of important factors that may impact a business venture's success: - Background Verification: It's critical to comprehend the prior actions, moral principles, and reliability of stakeholders. A negative record could raise suspicions about the reliability of the people involved. - Financial Analysis: A corporation's financial health can reveal its stability and potential. A thorough grasp of financial stability enables firms to make well-informed decisions by examining historical performance, present financial state, and future projections. - Legal Compliance and Risks: Recognizing any legal risks and regulatory concerns can help avoid future liabilities. Due diligence makes it easier to ensure that the potential partner complies with applicable laws and regulations. - Industry and Market Position: Contextualizing the market landscape involves assessing a company's position within its industry, including a competition study. This might assist a company in determining its competitive edge and room for expansion. - Reputation and Brand Image: A brand's reputation is extremely valuable in today's industry. A company's or individual's public perception is crucial since a damaged reputation might hurt new business endeavors and collaborations. By carefully evaluating these elements, businesses may move forward with more assurance, knowing that they have reduced any possible dangers.

Why Businesses Should Prioritize Due Diligence

- Mitigation of Risk: A properly conducted due diligence procedure can identify risks related to joint ventures, acquisitions, and other commercial endeavors. Businesses can prevent negative outcomes by spotting any red flags and making proactive adjustments. - Recognizing Warning Signs: Due diligence investigations frequently uncover critical warning indicators, such as concealed liabilities, pending litigation, or previous unethical business practices. Early identification of these problems can prevent future troubles. - Making Certain Value Alignment: Companies looking to form alliances need to make sure that the ethics and values of the possible partner match their own. A positive value match fosters a more cohesive and cooperative working relationship, ensuring long-term success. - Preventing Fraudulent Transactions: Due diligence serves as a precaution against frauds and misrepresentations, especially as fraud cases increase. Businesses can prevent fraudulent agreements by closely examining financial records, legal standing, and reputations.

Steps Involved in Due Diligence Investigations

- Data collection: Compiling pertinent records, financial statements, legal documents, and operational data about the company is the first stage in the due diligence process. - Analysis and Review: Following collection, data is carefully examined to find any discrepancies, possible dangers, or areas of concern. This report sheds light on the company's compliance, operational effectiveness, and financial stability. - Cross-checking and Verification: In due diligence investigations, data accuracy is crucial. Cross-referencing information from several sources guarantees that it is correct, up-to-date, and comprehensive. - Reporting: After the inquiry, we compile the results into a comprehensive report that incorporates practical recommendations. Stakeholders are able to make well-informed decisions by using this report as a guide. - Follow-Up: To address any unanswered questions from the initial investigation, additional follow-up actions may be required to confirm more information or address any unresolved concerns.

Challenges in Conducting Due Diligence Investigations

- Information Availability: Private organizations or enterprises may face restrictions on access to trustworthy data. Since accurate due diligence greatly depends on transparent information, this could be problematic. - Time and Complexity: Especially for large corporations or instances involving several entities, thorough due diligence examinations can be difficult and time-consuming. Time limits and thoroughness present a problem that needs to be carefully handled. - Issues with Confidentiality: Maintaining confidentiality during due diligence is crucial to prevent harm to one's reputation or legal issues. A successful inquiry depends on handling sensitive material in a discrete manner. - Cost Factors: Due diligence research requires a specific financial investment. The secret to successful and reasonably priced research is striking a balance between thoroughness and cost-effectiveness.

Hiring a Professional Due Diligence Investigation Agency

Due diligence is complicated; hence, many companies choose to deal with specialized agencies for more efficiency and knowledge. Hiring a corporate due diligence investigation service gives you access to seasoned experts who know how to carry out exhaustive investigations while keeping information private. Advantages of Expert Help Professional agencies bring reputable investigative methods, industrial experience, and a wealth of knowledge. They assist in obtaining more precise insights, enabling businesses to make informed decisions. Characteristics of an Investigative Agency Businesses should think about things like the agency's credentials, experience, transparency, and customer feedback when selecting a due diligence firm. An agency's dedication to moral and open practices guarantees reliable results. Maintaining Adherence Professional agencies make sure they conduct investigations within the law by keeping up with industry standards and regulatory regulations. This guarantees the integrity of the investigation and assists companies in avoiding possible legal repercussions.

In conclusion

In a world where companies frequently face hidden risks, due diligence investigations are an essential tool for ensuring safe commercial operations. By analyzing the advantages and disadvantages of possible alliances, investments, or acquisitions, these studies assist businesses in making well-informed decisions. Due diligence lays the groundwork for fruitful commercial partnerships by detecting warning signs and confirming value alignment. At Spy Detective Agency- the best detective agency in Delhi, we specialize in providing premium corporate due diligence investigations that meet the demands of modern companies. In order to give our clients the information they require for secure and successful endeavors, our skilled staff use cutting-edge methods and exhaustive investigative procedures. To find out how our due diligence services may help your company's security and growth, get in touch with the Spy Detective Agency right now. Read the full article

0 notes

Text

How Hebbia AI Enhances Due Diligence for Legal Teams

Conducting due diligence is a crucial, yet time-consuming process for legal teams. Hebbia AI provides an efficient solution by automating the analysis of contracts, regulatory documents, and other data, ensuring legal professionals can focus on delivering value to their clients.

Problem Statement: Due diligence often requires the review of large volumes of complex documents. This manual process is not only labor-intensive but can lead to delays and errors, especially when critical information is overlooked.

Application: Hebbia AI allows legal teams to automate the extraction and synthesis of relevant information from due diligence documents. The platform identifies key clauses, red flags, and inconsistencies across contracts, reducing the need for extensive manual review. By synthesizing data, Hebbia AI helps legal professionals quickly access actionable insights, accelerating the due diligence process.

Outcome: By using Hebbia AI, legal teams can conduct due diligence more efficiently, reducing review times and enhancing accuracy. The automated process helps identify potential risks faster, ensuring clients receive timely and comprehensive legal advice.

Industry Examples:

Mergers & Acquisitions: Conduct thorough due diligence across large data rooms, extracting key terms from contracts, financial documents, and regulatory filings.

Corporate Legal Teams: Use Hebbia AI to review supplier contracts, ensuring compliance and identifying non-standard provisions.

Real Estate Law: Automate lease abstraction and extract critical details from property sales contracts for a faster, streamlined process.

Additional Scenarios: Hebbia AI can also assist law firms in building precedent libraries, summarizing deposition key points, and automating regulatory reviews, enhancing productivity across all legal processes.

Enhance your due diligence process with Hebbia AI’s powerful automation tools. Start today and experience the difference AI can make in legal workflows!

#HebbiaAI#LegalTech#DueDiligence#AI#WorkflowAutomation#LegalInsights#BusinessIntelligence#MergersAndAcquisitions#ContractAnalysis#TechInnovation

0 notes

Text

How To Maximize Returns With AI In Asset Management

After losing their wealth, Johnny Rose and his family had to move to the small town of Schitt's Creek. As Johnny began unpacking their meager belongings in their shabby motel room, he reflected on their drastic change in fortune. Yes, this is the premise of the beloved sitcom, Schitt's Creek!

As the series progresses, Johnny and his family adapt to their new life. Johnny pulled out his laptop and accessed his asset management portal, relieved that he still had some control over his remaining assets. He realized it was time to re-strategize his investments and properties for better management.

This led him to discover the latest in asset management technology—AI assistants! These sophisticated chatbots, integrated into management platforms, could analyze market data, make real-time bids, and provide personalized recommendations for asset management. Within moments, Johnny’s AI assistant was guiding him on how to safeguard and enhance his assets. Johnny felt reassured, even in Schitt's Creek, with this cutting-edge technology at his disposal.

AI has become indispensable in modern asset management, and this article will explore how Artificial Intelligence is revolutionizing this field. Continue reading to learn more!

Let's return to Schitt's Creek!

As Johnny utilized his AI assistant to optimize and grow his remaining assets, he diversified into a well-balanced portfolio of stocks, bonds, and real estate. His friends Roland and Bob were amazed by Johnny's advanced approach—though not so much by his living conditions. (After all, it’s called Schitt's Creek for a reason!)

“That AI is quite impressive!” Roland said during their financial discussions.

“I may not fully grasp all the data, but I trust the AI to make smart decisions,” Johnny, an asset manager, responded.

Johnny realized that with AI's help, not only could he rebuild his fortune, but he could also contribute to improving the small town he now called home. Even his friends were astounded by AI’s capabilities!

While Roland and Bob were curious about AI’s role in asset management, let’s delve into that topic:

What Is AI In Asset Management?

Asset Management involves overseeing a company’s assets to optimize resource use and achieve favorable returns. The advent of AI in Asset Management has made the process more streamlined, automated, and entirely digital!

The asset management sector is rapidly adopting AI tools to keep pace with big data, automation, and the accelerating business environment. AI assists in various areas, from identifying opportunities for asset valuation to making informed investment decisions and managing portfolios.

In 2022, the global AI in Asset Management market was valued at $2.78 billion. It is expected to reach $47.58 billion by 2031, reflecting a significant compound annual growth rate of 37.1% from 2023 to 2031. This growth highlights the increasing use of AI tools across industries, with asset management benefiting significantly.

So, how does AI function in asset management? Let’s break it down:

Key Components of AI in Asset Management

Three core elements make up the technological foundation of AI-driven asset management:

Machine Learning: These algorithms improve their performance by learning from data patterns. They identify investment opportunities, risks, and potential valuations that might be overlooked by humans.

Deep Learning: Using neural networks, deep learning performs complex analyses such as asset categorization, evaluation, and pricing based on various features, providing insights for due diligence.

Natural Language Processing (NLP): NLP allows computers to understand and interpret text-based inputs, such as earnings reports and asset descriptions, to extract essential metadata and organize assets accurately.

Together, these AI techniques enhance the accuracy and efficiency of asset management, offering a significant edge in today’s data-rich environment. Here’s how AI is applied in asset management:

Use Cases of AI in Asset Management

With its data-crunching, pattern-recognition, and adaptive learning abilities, AI complements human intelligence in asset management across several applications:

Predictive Analytics: AI models analyze market and consumer data to forecast price movements, risks, and opportunities, aiding investment strategies.

Algorithmic Trading: AI automates trading actions, such as executing trades and rebalancing portfolios, to improve efficiency and consistency.

Asset Allocation Optimization: AI algorithms simulate risk/return scenarios to create optimized portfolios tailored to individual goals.

Economic Forecasting: AI models process economic and market data to make informed predictions about growth, interest rates, and corporate profits.

Top Trends for AI in Asset Management

AI is revolutionizing asset management with several key trends:

Advanced Research: AI can analyze extensive data, from financial reports to social media, providing asset managers with accurate insights and predictions.

Robo-Advisors: These AI tools handle regulatory reporting, document processing, and operational tasks, reducing costs and streamlining workflows.

Risk Management & Fraud Detection: AI scans portfolios to detect anomalies and potential fraud, acting as a vigilant watchdog.

AI continues to drive advancements in asset management, offering enhanced research capabilities, automation, and risk management. However, while AI augments human skills, skilled oversight is essential for interpreting insights and making creative, ethical decisions.

In conclusion, as AI technology evolves, its role in asset management will expand, balancing artificial and human intelligence for optimal outcomes. Just imagine, Alexis Rose would likely let AI handle all her tasks if she could!

To explore more about AI technology and its innovative applications, click here to dive into the future of AI!

0 notes

Text

Unveiling the Power of AI in Finance: A Beginner’s Guide

Artificial Intelligence is taking over the world, slowly. It’s not very different with respect to the financial world. Since the sudden growth of AI technology, many people began to wonder how AI works and what this really means for the future of finance. This guide attempts to take the mystery out of AI in the financial sector, discussing its applications like wealth management, investment banking, due diligence, and many more.

AI in Finance-What is it?

AI in finance deploys sophisticated algorithms and machine learning models to analyze information, forecast trends, and execute operations without human intervention. The big difference here between simple software, which follows rules and decisions, and artificial intelligence is that it does learn from data, finds patterns, and then makes quite substantial decisions based on them. It is this “learning” ability and its adaptation potential that make AI highly effective within the financial vertical, with an enormous volume of data and fast changes in market conditions-conditions demanding top-level analyses.

The Impact of AI on Wealth Management

AI is changing wealth management, making the handling and optimization of financial advisors’ client portfolios even better. Conventionally, the investment decisions in client portfolios had to be made based on historical trends and the personal judgment of wealth managers. With AI, this convention has changed to real-time analysis and insight driven by data. Such AI tools process a huge volume of data, right from market trends down to individual clients’ behaviors, to offer more tailored advice.

This may be further applied to a case wherein AI systems assess a customer’s risk tolerance and advise on appropriate investment strategies to meet the customer’s financial goals. These tools can track market conditions constantly and make necessary adjustments to the portfolios automatically. This is one of the ways of making the process personalized and agile without being conceivably done earlier, immensely benefiting the advisor and client alike.

AI’s Role in Due Diligence

Due diligence, particularly in M&A, is one of the most critical parts of financial dealings. This conventionally required laborious manual verification-from monetary records down to every other document presented. AI is now making due diligence seamless as it automates the process of going through large volumes of data and brings out risks such as inconsistencies in financial records or hidden liabilities.

AI will make the process of due diligence faster and more refined, leaving less room for costly mistakes. Therefore, AI became a crucially important weapon for financial institutions involved in complex transactions to provide efficiency and reliability for the operation of due diligence procedures.

Looking Ahead: The Future of AI in Finance

With further development, the future of AI in finance is promising, indeed one should expect even more creative uses. The most important thing for any newcomer to recognize in AI applications in finance is the fact that AI is not a technological hype but a conceptual change in how financial operations are performed.

Be it wealth management, investment banking, or even due diligence, the impact of AI on finance is monumental and reaches further. As this industry continues to adapt these technologies, professionals and clients alike are going to witness further personalization of services, quicker decision-making, and stronger risk management.

In brief, AI in finance is here to stay and promises enormous advantages and opportunities. This book forms the foundation to know the fundamentals of AI and its applications in finance, keeping you updated and relevant in a progressively digital data-driven world.

#AI in Financial Research#AI in Due Diligence#AI in Finance#Photon Insights#AI in investment banking#Automated diligence#AI in Wealth Management

0 notes

Text

Benefits of Virtual Data Room - DocullyVDR

A virtual data room (VDR) is a secure, online platform that allows users to store and share sensitive information, such as financial documents, legal agreements, and proprietary information, with authorized parties. VDRs are commonly used in mergers and acquisitions, due diligence, and other business transactions where sensitive information needs to be shared with multiple parties. They typically include features such as document management, user access controls, and version tracking. To get the best Virtual Data Room service you can opt for https://www.docullyvdr.com/

There are several benefits to using a virtual data room (VDR) for storing and sharing sensitive information, including:

Security: VDRs use advanced security measures, such as encryption and multi-factor authentication, to protect sensitive information from unauthorized access.

Convenience: VDRs allow users to access and share information from any location, at any time, as long as they have internet access.

Collaboration: VDRs enable multiple parties to access and collaborate on the same documents, streamlining the due diligence or transaction process.

Auditability: VDRs provide a clear and concise record of who has accessed, downloaded, or edited a document, providing a clear audit trail of activity.

Cost-effective: VDRs can be more cost-effective than traditional data rooms, as they eliminate the need for physical space and document copying.

Scalability: VDRs can be easily scaled up or down to match the needs of the project, with the ability to add or remove users and documents as required.

Environmentally friendly: VDRs reduce the need for physical document storage and transportation, which can be beneficial for the environment.

Source: https://www.docullyvdr.com/

0 notes

Text

The Transformative Impact of AI on Due Diligence

Artificial intelligence is now swift and unstoppable as a force in changing the ways due diligence operates, impregnating traditional processes with exceptional tools that ease efficiency and better decision-making. Thanks to innovative technologies contributed by AI, today’s businesses can effectively cope with extensive reviews and minimize risks while ensuring better compliance.

These technologies avail every insight of value that is needed to make better decisions in complex transactions.

Key Benefits of AI in Due Diligence

Advanced Data Analysis: AI can now process structured and unstructured data well to spot patterns, anomalies, and correlations that would have been very hard to find using the traditional methods of analysis. It thus enables the firm to have a better grasp of its operational activities, financial health status, and possible risks involved.

2. Speed and Efficiency: AI automates routine tasks in document review, data extraction, and risk assessment, saving enormous amounts of time and resources compared to due diligence. Efficiency enables firms to accelerate the pace of transactions and capitalize on market opportunities promptly.

3. Regulatory Monitoring: AI continuously monitors changing regulatory and compliance requirements across diverse jurisdictions. It ensures deal compliance with legal standards, reducing the risk of compliance issues during due diligence.

4. Decision Support: AI avails actionable insights through scenario analysis and predictive data to the decision-maker to make optimized decisions, thereby minimizing uncertainties in a complex transaction.

Applications of AI in Due Diligence

Due diligence has experienced a wide application of AI across diverse areas that include:

Financial Due Diligence: Studying the financial statements, cash flow, and market trends of a target company to arrive at their viability from a financial perspective.

Explainable AI: In the development of AI systems, to provide transparent and interpret-able insights that instill trust among stakeholders and regulatory bodies in general.

Continuous Learning Algorithms: This involves deploying models in AI where continuous learning, through coming data and feedback, is incorporated to bring out more effectiveness in accuracy and prediction within due diligence appraisals.

Ethical Considerations and Building Trust

AI is changing the game of due diligence practices. It would, therefore, be of the essence for an organization to create room for ethical considerations such as data privacy, algorithmic bias, and responsible use of AI. Stakeholder trust will be developed by ensuring transparency in the application of AI while viewing ethical practices as part of compliance with regulatory frameworks.

Conclusion

AI is revolutionizing due diligence, allowing businesses to conduct more comprehensive reviews in a much quicker and wiser way. Embedded with AI technologies, an organization will have far better decision-making with reduced risks and will move further in advancing strategic imperatives. Be it the complex global market, embracing AI in due diligence is not a technological upgrade but a strategic necessity for success in today’s fast-moving business environment.

#AI in Financial Research#AI in Due Diligence#AI in Finance#Photon Insights#AI in investment banking#Automated diligence#AI in Wealth Management

0 notes

Text

Understanding the Essentials: Floor Plan, Fire Risk Assessment, and INCR

When it comes to building design and safety, understanding key concepts like floor plans, fire risk assessments, and INCR (Incident Notification and Control Report) is crucial. Each of these elements plays a vital role in ensuring the safety, functionality, and regulatory compliance of a structure. Whether you're a homeowner, a real estate professional, or involved in property management, familiarizing yourself with these aspects can significantly impact the quality and safety of any property.

Floor Plan: The Blueprint of Functionality

A floor plan is a scaled diagram that represents the layout of a building from above. It outlines the dimensions, locations of walls, doors, windows, and other structural elements. More than just a technical drawing, a floor plan serves as a blueprint for the functionality and flow of a space.

A well-designed floor plan ensures that the space is utilized efficiently, taking into account factors like natural light, ease of movement, and the specific needs of the occupants. For example, in residential settings, a good floor plan might position bedrooms away from noisy areas like the living room or kitchen. In commercial buildings, it might prioritize easy access to exits, restrooms, and workstations.

In real estate, floor plans are invaluable tools for marketing properties. They give potential buyers or tenants a clear understanding of the layout and how the space can be used, making it easier for them to envision living or working in the property.

Fire Risk Assessment: Ensuring Safety

Fire risk assessment is a systematic evaluation of a building’s potential fire hazards and the effectiveness of its fire prevention measures. The goal is to identify possible risks and implement strategies to minimize the likelihood of a fire, as well as to ensure that occupants can evacuate safely if a fire does occur.

A comprehensive fire risk assessment considers various factors, including the building’s design, the materials used in construction, the presence of fire detection and suppression systems, and the behavior of occupants in case of an emergency. Regular assessments are essential, especially when changes are made to the building, such as renovations or a change in use.

Property owners and managers are legally required to conduct fire risk assessments, and failure to do so can result in severe penalties. Beyond legal obligations, these assessments are critical for protecting lives and minimizing property damage in the event of a fire.

INCR (Incident Notification and Control Report): Managing Incidents Effectively

The INCR, or Incident Notification and Control Report, is a crucial document used in the management of safety and emergency incidents. It provides a structured approach to reporting, documenting, and managing incidents that occur within a building or on a property.

An INCR typically includes detailed information about the incident, such as the date and time, location, individuals involved, and a description of what occurred. It also outlines the steps taken to control the situation and prevent further incidents. This report is essential for ensuring that all safety protocols are followed and that lessons are learned from each incident to improve future responses.

For property managers, having a well-maintained INCR system is vital for demonstrating due diligence and ensuring that all safety incidents are handled appropriately. It also provides valuable data that can be used to refine safety procedures and prevent future incidents.

Conclusion

Understanding and implementing the concepts of floor plans, fire risk assessments, and INCR is crucial for anyone involved in property management or real estate. These elements not only contribute to the functionality and safety of a building but also ensure compliance with regulations and enhance the overall quality of the property. By paying attention to these details, property owners and managers can create safer, more efficient, and more desirable spaces.

0 notes

Text

Get Top ContractZen Virtual Data Room Software

ContractZen stands out as the best virtual data room software for secure document management and collaboration. Our solution combines cutting-edge security with an easy-to-use interface, making it ideal for handling critical data during transactions and due diligence. Enjoy seamless integration, robust features, and unparalleled protection for your documents. Choose ContractZen for the ultimate virtual data room experience and ensure your data is always safe and accessible.

0 notes

Text

How Artificial Intelligence Has Transformed M&A Due Diligence

Due diligence is a key process in merger and acquisition (M&A) transactions. It involves an in-depth assessment of a target company’s financial, legal, and operational aspects. Due diligence is costly, time-consuming, and labor-intensive, involving extensive human manual data collection and analysis.

However, artificial intelligence (AI) has streamlined due diligence, allowing tasks to be completed faster and more efficiently, facilitating stronger M&A transactions. For starters, machine learning algorithms can quickly analyze massive volumes of data within short periods of time and allow the extraction of valuable insights and trends that humans may be unable to capture.

AI-powered tools and applications can seamlessly examine customer data, financial statements, and legal contracts, thus significantly reducing the time taken during due diligence. AI also facilitates virtual data rooms (VDRs) where buyers and sellers can exchange information, analyze various documents uploaded to VDR platforms, and ask questions about VDR documents to understand a target company's documentation better.

In addition, AI helps identify risks and opportunities, which is one of the major goals of any M&A due diligence process. AI systems can analyze historical data to check for non-compliance or financial irregularities. Artificial Intelligence systems have strong predictive capabilities that forecast future risks and provide stakeholders with valuable insights regarding the long-term viability of an M&A transaction. Thanks to accurate data-driven insights, AI allows for enhanced decision-making as there is sufficient financial performance and cultural assessment data to ensure decisions can be made promptly with a high degree of confidence.

0 notes

Text

How Virtual CFOs Help With Fundraising And Investor Relations?

In today's dynamic business landscape, raising capital and managing investor relations are crucial elements for growth and sustainability. Virtual CFOs (Chief Financial Officers) play a pivotal role in supporting businesses during fundraising efforts and nurturing relationships with investors. Here’s how they contribute effectively to these critical aspects of business development:

Strategic Financial Planning

Virtual CFOs bring strategic financial planning expertise that is essential for fundraising success. They analyze the financial health of the business, assess funding needs, and develop comprehensive financial projections and forecasts. These documents are crucial for demonstrating the company's potential to investors, showcasing growth opportunities, and aligning financial strategies with business goals.

Preparation of Investment Materials

Virtual CFOs play a key role in preparing investment materials that are compelling and informative. This includes crafting investor decks, financial models, and business plans. These documents are designed not only to attract investors but also to provide transparency and clarity regarding the company's financial performance, market positioning, and growth strategy.

Valuation Analysis

Determining the company’s valuation is critical during fundraising rounds. Virtual CFOs employ their financial expertise to conduct thorough valuation analyses, considering market trends, industry benchmarks, and financial metrics. They ensure that the valuation accurately reflects the company's worth, which is crucial for negotiating terms with investors and securing favorable funding deals.

Investor Due Diligence Support

During the due diligence process, Virtual CFOs provide comprehensive support by organizing financial records, facilitating data rooms, and ensuring that all financial information is accurate and readily accessible. This diligence is essential for building trust with potential investors and demonstrating the company's commitment to transparency and accountability.

Negotiation and Deal Structuring

Virtual CFOs bring valuable negotiation skills to the table, helping businesses secure funding on favorable terms. They work closely with legal advisors and executive teams to structure deals that align with the company's long-term financial objectives while safeguarding its interests. This includes evaluating financing options such as equity, debt, or hybrid structures, and assessing the implications of each on the company's financial health.

Compliance and Regulatory Guidance

Navigating regulatory requirements is critical when engaging with investors. Virtual CFOs ensure that fundraising activities comply with relevant securities laws and regulations. They provide guidance on reporting obligations, investor disclosures, and compliance frameworks, minimizing legal risks and fostering a positive regulatory environment.

Investor Relations Management

Building and maintaining strong relationships with investors is essential for long-term business success. Virtual CFOs act as primary points of contact for investors, providing regular updates on financial performance, strategic initiatives, and market developments. They facilitate communication channels, manage investor inquiries, and address concerns promptly, enhancing transparency and fostering investor confidence.

Financial Performance Monitoring

Post-fundraising, Virtual CFOs continue to play a vital role in monitoring and managing financial performance. They track key performance indicators (KPIs), analyze financial results, and provide insights into business performance trends. This ongoing financial oversight ensures that the company remains on track to deliver on its promises to investors and achieve its growth targets.

Crisis Management and Contingency Planning

In times of financial uncertainty or crisis, Virtual CFOs offer expertise in crisis management and contingency planning. They develop robust financial strategies to mitigate risks, preserve cash flow, and maintain investor trust during challenging periods. Their proactive approach helps businesses navigate volatility and emerge stronger from adverse economic conditions.

Conclusion

Virtual CFOs in Marlboro, NJ bring strategic financial leadership and expertise to support businesses throughout the fundraising process and in managing investor relations effectively. From strategic financial planning and valuation analysis to compliance guidance and crisis management, their contributions are instrumental in securing funding, building investor confidence, and driving long-term business success. By leveraging their specialized skills, businesses can navigate the complexities of fundraising and investor relations with confidence, positioning themselves for sustainable growth and profitability.

0 notes