#download salary slip

Explore tagged Tumblr posts

Text

No Salary Slip? No Problem! Apply for Instant Loan Online Without Documents in 2025

Struggling to get a loan due to low income, no salary slip, or poor credit score? You’re not alone.

In today’s fast-paced world, financial emergencies don’t wait. Whether it's a medical bill, urgent travel, or rent payment, people often need instant cash loans in 1 hour in India without the hassle of paperwork. However, traditional banks demand documents, proof of income, and a good CIBIL score.

What if we told you that in 2025, there are real solutions to get instant approval loans online without any salary slips, CIBIL checks, or even detailed income proofs?

Let’s explore India’s best no-verification loan apps that are helping thousands of users like you get money in minutes – stress-free.

Why Do People Look for Instant Loans Without Documents?

Many salaried individuals, freelancers, or small business owners often face these challenges:

No salary slip or bank statement

Low or no credit score (CIBIL)

No ITR or formal income proof

Need for urgent funds (within 1 hour)

That’s where instant loans without a salary slip and no-proof personal loan apps step in.

These apps leverage AI-powered credit engines, alternative data, and KYC to offer instant loan disbursal in minutes – even to first-time borrowers with no formal documents.

Who Can Apply?

You can apply personal loan online instantly if you meet the following:

Age: 18+ years

Basic KYC: PAN + Aadhaar

Bank account for loan disbursal

Mobile number linked to Aadhaar

Basic repayment capacity (even gig work/freelancing)

Top No-Verification Loan Apps in India (2025)

Here’s a list of trusted apps where you can get an instant loan without documents or a CIBIL check:

Most of these apps offer quick cash loans without income proof, helping even those with bad credit get personal loan approval.

How to Apply for a Loan Without Income Proof or CIBIL Check?

Here’s a step-by-step guide for an easy personal loan application online in India:

Download the App (Investkraft, KreditBee, CASHe, etc.)

Complete eKYC – Aadhaar + PAN verification

Enter Basic Details – Employment type, monthly income (self-declared)

Bank Account Link – To receive disbursal

Loan Offer & Approval – Instant approval in most cases

Get Funds – Loan disbursal in minutes to your bank or wallet

That’s it! No need to upload salary slips, bank statements, or wait for long approvals.

Real-Life Scenario: How Ramesh Got ₹20,000 in 15 Minutes

I work part-time and earn ₹12,000 monthly. No ITR, no salary slip. I had a sudden health expense and tried KreditBee. I just uploaded my Aadhaar, PAN, and filled in basic info. ₹20,000 was credited to my account in under 15 minutes. Zero paperwork, no credit check!

— Ramesh, 21, Delhi

Is It Safe to Borrow from No-Proof Loan Apps?

Yes, but choose only RBI-registered NBFC-backed apps. Read reviews, verify data encryption policies, and ensure they don’t ask for unnecessary permissions.

Avoid shady apps that:

Demand advance payments

Call your contacts

Threaten legal action

Stick to reputed names like KreditBee, CASHe, and PaySense for a trusted instant loan without a credit score check in India.

Common Myths Busted

Top 5 FAQs – Instant Personal Loans Without Documents in India

1. Can I get a loan without a CIBIL or a salary slip?

Yes. Many apps allow a loan without a salary slip or a bank statement using KYC and alternate data.

2. How fast can I get the loan amount?

You can receive funds within 5 to 30 minutes, depending on the app and verification speed.

3. Is my low CIBIL score a problem?

No. Several platforms specialize in offering loans without a credit score check in India or to low-CIBIL borrowers.

4. Which is the best app for quick cash without income proof?

KreditBee and TrueBalance are top-rated for quick cash loans without income proof.

5. Do I need a job to get a personal loan?

Not always. Some apps offer loans to freelancers, students, and self-declared income earners.

Final Thoughts – Raise Instant Funds Without Hassle in 2025

In 2025, getting instant personal loans without income proof, CIBIL score, or documents is no longer be a dream. With the rise of AI-driven loan platforms, users across India can now meet urgent needs without fear of rejection.

Whether you're looking to apply personal loan online instantly, get an instant cash loan in 1 hour in India, or use a no proof personal loan app, the options are many – and very real.

Choose your app wisely. Stick to trusted names. Borrow only what you need. And enjoy the freedom of instant funds without paperwork.

#Get instant approval loan online#apply personal loan online instantly#instant cash loan in 1 hour in India#insta loan app without salary slip#bad credit personal loan approval guaranteed#loan without salary slip or bank statement#easy personal loan apply online India#instant loan disbursal in minutes#get instant loan without documents#quick cash loan without income proof#no proof personal loan apps#loan without credit score check in India

2 notes

·

View notes

Text

HR Software: Your Online Managing Partner.

It's no secret that managing people is difficult. Managing employee records, processing salaries, and keeping track of attendance can quickly become too much to handle, regardless of how big your business is. That is precisely where HR software comes in—not just as a fancy tool, but as a true digital companion that makes life easier for employees and the HR team.

What Is HR Software, Then?

Consider HR software to be your digital HR assistant in one place. From a single platform, it handles routine duties like hiring, payroll processing, leave tracking, attendance management, and even performance reviews.

Why Do Businesses Swear by It?

It Saves Time (and Headaches) Let’s be honest — no one enjoys approving the same leave requests or generating payslips manually every month. With automation, HR folks can focus on what really matters: building a better workplace instead of just managing files.

Fewer Mistakes, More Trust Manual work comes with errors — it's just human. But when hr management software takes over the repetitive stuff, accuracy improves big time. Everything’s documented clearly, which also makes audits less stressful.

Employees Get More Control People love being independent at work. With self-service portals, employees can check their own leave balance, download salary slips, or track performance reviews without bugging HR. It saves time and keeps everyone happy.

Is It Exclusive to Large Businesses?

Absolutely not. HR software can be customised to meet your needs and size, regardless of how many employees you have—five people or hundreds. Even small businesses can afford to go digital without going over budget thanks to the flexible plans offered by many platforms.

The Bottom Line

The workplace is rapidly evolving. Digital tools, remote work, and artificial intelligence are all becoming the new norm. Purchasing HR software system is essential for staying ahead of the curve, not just for efficiency. People genuinely enjoy working in a more seamless, intelligent, and connected workplace thanks to it.

0 notes

Text

Unlocking Panama: Your Guide to Visa for Indian Citizens | Panama Mission India

Panama, a vibrant nation bridging two continents and two oceans, beckons with its stunning natural beauty, rich culture, and the iconic Panama Canal. For Indian citizens eyeing this Central American gem, understanding the Panama visa for Indian citizens process is the first crucial step. This blog post will demystify the requirements and application procedure, focusing on the role of the Embassy of Panama and the Panama Embassy in India.

Do Indian Citizens Need a Visa for Panama?

Yes, Indian passport holders generally require a visa to enter Panama. While some nationalities enjoy visa-free entry, India is not currently on that list. However, there's a significant exception: if you hold a valid, multiple-entry visa (not a transit visa) for the USA, UK, Canada, Australia, European Union/Schengen States, Japan, or South Korea, and have used it at least once to enter the respective country, you may be eligible for a visa on arrival in Panama (for a fee of USD 35). This visa must be valid for at least six months from your date of entry into Panama. Always verify the latest regulations before your trip.

Navigating the Panama Visa Application from India

The application process for a Panama visa for Indian citizens is primarily offline, requiring submission at the Embassy of Panama in New Delhi or the Consulate General in Mumbai. While you can apply in person, many applicants opt for the convenience of a reputable visa agency.

Here's a general overview of the documents you'll typically need:

Valid Passport: Your passport must be genuine, in good condition, and valid for at least six months beyond your intended stay in Panama. It should also have a minimum of two adjacent blank pages for the visa stamp. Don't forget to include photocopies of your passport, including all stamped pages.

Old Passports: If you have any old passports, submit them along with your current one to provide your travel history.

Visa Application Forms: Two duly filled visa application forms, completed in block letters without any corrections. These are usually available for download on the Embassy of Panama website.

Passport-sized Photographs: Three recent passport-sized photographs (typically 2x2 inches or 35x45 mm), with a clear white background, matte finish, and neutral facial expression. Glasses should generally be avoided unless for medical reasons, and headgear only for religious purposes.

Covering Letter: A personal covering letter from the applicant stating the purpose and duration of the visit, along with personal and passport details.

Invitation Letter (if applicable): If visiting for business or invited by a resident, an invitation letter from the Panamanian company or resident, along with their relevant documents (e.g., public registry, ID copy, bank solvency letter).

Proof of Sufficient Funds: You need to demonstrate financial solvency to cover your expenses during your stay. This can be shown through:

Bank statements for the last three months

Income Tax Returns (ITR) for the last one year.

Salary slips for the last three months.

Traveler's Cheques.

A letter from your employer stating your monthly wages (should be translated to Spanish).

Travel Itinerary: Confirmed flight tickets (round trip) showing entry and exit from Panama.

Accommodation Proof: Confirmed hotel reservations for your entire stay in Panama.

Proof of Profession: Documents indicating your employment status (e.g., leave sanction certificate for employed individuals, business registration for self-employed, retirement proof for retirees, student ID for students).

Indian Identity Documents: Copy of your PAN Card, Voter ID card, or Driving License.

Police Clearance Certificate (PCC): In some cases, a PCC may be required to confirm you have no criminal record.

Travel Insurance: While not always explicitly mentioned for short-term visas, having travel insurance is highly recommended for unforeseen emergencies, trip cancellations, or baggage loss.

The Role of the Embassy of Panama in India

The Embassy of Panama in India (New Delhi) and the Consulate General of Panama in Mumbai are the primary points of contact for visa applications. Their responsibilities include:

Accepting Applications: They accept both direct applications and those submitted through authorized visa agents.

Document Verification: Thoroughly verify all submitted documents to ensure their validity and authenticity.

Visa Interviews: May conduct interviews with applicants as deemed necessary.

Issuing Visas: Granting and stamping visas after due approval from the National Migration Service of Panama.

Consular Services: Providing various consular services to Panamanian citizens in India, including passport issues and emergency assistance.

Processing Time and Fees

The processing time for a Panama visa for Indian citizens generally ranges from 4-5 working days after receiving approval from the Panamanian authorities. However, it can take longer depending on various factors, including the volume of applications and the complexity of the case.

Visa fees typically involve a processing fee and a visa payable only after the visa is stamped). These fees should be paid in the form of a pay order favoring "Consulate of Panama" payable in New Delhi.

Important Considerations:

No E-Visa: Panama does not currently issue e-visas. The application process is entirely offline.

Personal Presence: The Embassy may request your personal presence for an interview, depending on your case.

Apply in Advance: It's highly recommended to apply for your Panama visa well in advance of your planned travel dates to account for any unforeseen delays.

Official Sources: Always refer to the official website of the Embassy of Panama in Indiaor contact them directly for the most up-to-date and accurate information on visa requirements and procedures, as regulations can change.

With proper preparation and understanding of the requirements, your journey to the "Crossroads of the Americas" can be a smooth and exciting experience. Start planning your Panamanian adventure today!

#panama ship registry#panamanian passport renewal#embassy of panama in new delhi#panama consulate in india

0 notes

Text

Tips & Tricks for Stress-Free ITR Filing

Dreading the July 31st deadline? Don’t stress — filing your Income Tax Return (ITR) can be simple with the right tips. Here’s how you can breeze through tax season and make the most of your income.

✅ Calculate All Your Income Right Don’t miss out on:

Savings & FD interest

Capital gains & losses (use losses to cut taxes!)

Dividends, rent, and even foreign income

Everything counts — report it accurately!

✅ Claim Every Deduction & Exemption Reduce your tax bill with smart claims:

80C: Investments in ELSS, PPF, NPS (up to ₹1.5 lakh)

80D: Health insurance premiums

80G: Donations to charities

80TTA/80TTB: Savings interest up to ₹10,000

Don’t leave money on the table!

✅ Match Your Records with 26AS & AIS Check your Form 26AS (TDS, big transactions) and AIS (interest, dividends, mutual funds) before filing. Make sure everything matches — no surprises later!

✅ Choose the Right ITR Form Pick the form that suits you:

ITR 1: Salary + 1 house + income up to ₹50L

ITR 2: No business income

ITR 3: Business/Professional income

ITR 4: Presumptive scheme filers

Using the wrong form = rejected return!

✅ Keep Docs & Bank Details Ready Have these handy:

PAN, Aadhaar

Form 16, 26AS, AIS

TDS slips, investment proofs ✔️ Also, pre-validate your bank for smooth tax refunds!

✅ Verify Your ITR Filed it? Great! Now verify within 30 days:

Online (Aadhaar OTP = super quick!)

Offline (send signed ITR-V form to CPC, Bengaluru)

✨ File Easy Taxes with JJ Tax! Why struggle? Use the JJ Tax App for:

Expert help

Easy filing from your phone

Safe doc storage

Download from App Store or Google Play and file stress-free!

💡 Pro Tip: Filing early = no last-minute panic + faster refunds! Let’s make tax season a smooth ride this year. 🚀

Visit www.jjfintax.com to know more.

Download the JJ TAX APP

0 notes

Text

How to Apply for a Visa: A Step-by-Step Guide for Travelers

Planning an international trip is exciting, but one crucial step you can’t skip is figuring out how to apply for a visa. Whether you're traveling for tourism, work, study, or family visits, securing a visa is often a non-negotiable requirement. In this detailed guide, we'll walk you through the visa application process and equip you with everything you need to get started with confidence.

What is a Visa?

A visa is an official document or stamp that grants you permission to enter, stay in, or leave a country for a specific period. Depending on your nationality and the destination, the visa requirements may vary significantly. Understanding how to apply for a visa begins with knowing what kind of visa you need.

Types of Visas

Before applying, identify the type of visa that best suits your travel purpose. Here are the most common types:

Tourist Visa

Business Visa

Student Visa

Work Visa

Transit Visa

Family or Spouse Visa

Medical Visa

Knowing your category is essential when deciding how to apply for a visa properly.

Research Visa Requirements

The first real step in how to apply for a visa is researching the specific requirements of the country you’re visiting. Visit the official website of the embassy or consulate of that country. Common requirements include:

A valid passport (usually with at least 6 months of validity)

Completed visa application form

Passport-sized photographs

Proof of accommodation

Travel itinerary or flight tickets

Proof of financial means

Travel insurance

Visa fee payment receipt

Each country may request additional documents, so always double-check.

How to Apply for a Visa Online

With many countries moving toward digital processes, knowing how to apply for a visa online is a big time-saver. Here's how it typically works:

Visit the official visa application portal of the respective embassy.

Create an account if required.

Fill out the visa application form accurately.

Upload the required documents.

Pay the visa application fee via a secure online gateway.

Schedule an appointment for a biometric scan or visa interview, if necessary.

Track the application status through the portal.

Applying online is common for countries like the USA (DS-160 form), Canada, UK, Schengen area, and many more.

How to Apply for a Visa at the Embassy

If online submission is not available, you’ll need to visit the embassy or visa application center. Here's what to expect:

Download and print the visa application form from the official website.

Fill out the form and gather all supporting documents.

Book an appointment (if required).

Submit your application in person at the designated center.

Attend an interview if requested.

Wait for the visa decision, which may take days to weeks.

When learning how to apply for a visa, always check whether the application is processed by the embassy directly or through third-party visa services like VFS Global.

Documents Checklist for Visa Application

Creating a checklist is one of the smartest things to do when figuring out how to apply for a visa. Here's a standard document checklist:

Valid passport

Recent passport-sized photographs

Completed application form

Visa fee receipt

Proof of travel purpose (invitation letter, tour booking, etc.)

Proof of accommodation

Travel itinerary (return flights or tickets)

Financial statements (bank or salary slips)

Travel insurance (especially for Schengen visas)

Make sure all documents are current and translated if required.

Tips for a Successful Visa Interview

Many applicants get nervous about the visa interview. But knowing how to apply for a visa includes preparing mentally for this step. Here are some tips:

Dress professionally.

Be honest and confident in your answers.

Provide clear and concise responses.

Carry all original and photocopied documents.

Arrive at least 15–20 minutes early.

Interviews are common for visas to the US, UK, and Canada.

How Long Does It Take to Get a Visa?

Processing times vary widely based on the country and visa type. On average:

Tourist Visa: 5–15 business days

Student Visa: 2–6 weeks

Work Visa: 4–12 weeks

Business Visa: 5–10 business days

When figuring out how to apply for a visa, always apply early—at least 30 to 60 days before your planned travel date.

Common Reasons for Visa Rejection

Understanding how to apply for a visa also means knowing what not to do. Visa rejections can occur due to:

Incomplete application

False or misleading information

Lack of financial proof

Invalid passport

Suspicious travel intent

No ties to the home country

If rejected, don’t panic. You can usually reapply or appeal the decision with stronger documentation.

Tips for a Smooth Visa Application Process

Start early: Don’t wait until the last minute.

Double-check everything: Accuracy matters.

Stay organized: Keep digital and physical copies of documents.

Use official sources: Always apply through authorized websites.

Stay informed: Monitor application status online.

Conclusion

Knowing how to apply for a visa is crucial for any international traveler. The process may seem overwhelming at first, but breaking it down into steps makes it manageable. Whether you’re applying online or in-person, preparing the right documents, staying organized, and applying early can make the entire process stress-free. Always rely on official sources and don’t hesitate to ask for help from professionals if needed. Now that you know how to apply for a visa, you're one step closer to your next international adventure!

For more Information follow https://btwvisas.com/

0 notes

Text

Need Urgent Money? Here’s How to Get a Mini Loan Instantly

Life can be unpredictable. Whether it’s a medical emergency, unexpected travel, urgent home repairs, or a sudden cash crunch, financial challenges can strike at any time. In such moments, waiting for a traditional bank loan with its lengthy approval process is often not an option. That’s where mini loan online services come to the rescue—offering quick, short-term financial help with minimal hassle.

If you're in urgent need of funds, here’s everything you need to know about getting an instant mini loan and how it can help you handle emergencies with ease.

What is a Mini Loan?

A mini loan is a small-ticket, short-term loan that is typically disbursed quickly and meant for urgent financial needs. The loan amount usually ranges from ₹500 to ₹3,00,000 (or more depending on the lender), with a repayment period of a few days to a few months. These loans are ideal for salaried individuals, self-employed professionals, or even students facing unexpected expenses.

Benefits of an Instant Mini Loan

Quick Approval and Disbursal The biggest advantage of an instant mini loan online is the speed. With most lenders, the loan is approved within minutes and the funds are credited to your bank account within hours.

100% Digital Process Thanks to the rise of fintech platforms, getting a mini loan online is incredibly simple. No need to visit a branch or stand in queues. Just download an app or visit a website, fill out a form, and get your loan approved digitally.

Minimal Documentation Traditional loans often require heaps of paperwork. But with mini loans, all you usually need is:

Aadhaar Card

PAN Card

Bank statement

Salary slip or proof of income

Flexible Loan Amounts You can choose the loan amount based on your exact need—be it ₹5,000 for a phone repair or ₹20,000 for a last-minute trip. The flexibility makes mini loans online very practical.

No Collateral Required Most instant mini loans are unsecured, meaning you don’t have to pledge any asset as collateral. This makes them highly accessible for young professionals and first-time borrowers.

Who Can Apply for a Mini Loan Online?

Eligibility criteria may vary by lender, but in general, you must:

Be at least 21 years old

Be an Indian citizen

Have a regular source of income (salaried)

Maintain a good credit history

How to Apply for an Instant Mini Loan?

Follow these simple steps to get a mini loan online:

1. Choose a Trusted Lender

Start by researching lenders that offer instant mini loans. Look for customer reviews, transparency in terms and conditions, and strong customer support.

2. Fill Out the Application

Visit the lender’s website or download their mobile app. Fill out the online application with your personal, employment, and financial details.

3. Upload Documents

Scan and upload the required documents such as ID proof, address proof, and income proof. Some platforms also support Aadhaar-based eKYC for faster processing.

4. Get Instant Approval

Once submitted, your application will be reviewed in real-time. Many platforms use AI-based algorithms to assess eligibility instantly.

5. Receive Funds in Bank

If approved, the loan amount is disbursed directly to your bank account—sometimes within just 15 minutes!

Read More :10 Smart Ways to Use a Mini Loan to Meet Short-Term Financial Needs

Best Uses for a Mini Loan

Here are some common situations where an instant mini loan can help:

Medical Emergency: Cover unplanned hospital expenses or buy urgent medication.

Travel Plans: Book urgent tickets or manage trip costs without waiting for your salary.

Bill Payments: Avoid late fees on utility bills or credit card dues.

Educational Needs: Pay exam fees, tuition, or buy essential books and supplies.

Home Repairs: Fix a leaking roof, broken appliance, or plumbing issue immediately.

Things to Keep in Mind

Before you apply for a mini loan online, keep the following points in mind:

Interest Rates & Fees Since mini loans are short-term and unsecured, they may have slightly higher interest rates. Always read the terms and calculate the total repayment amount.

Timely Repayment These loans are meant for short-term needs, so repayment is expected in a few weeks or months. Timely repayment helps you avoid penalties and boosts your credit score.

Avoid Multiple Applications Don’t apply for mini loans from multiple lenders at once. Each hard inquiry can impact your credit score.

Read the Fine Print Understand the repayment terms, processing fees, prepayment charges, and late payment penalties before signing up.

Final Thoughts

In today’s fast-paced world, financial emergencies demand instant solutions. Thanks to digital lending platforms, getting a mini loan online is now faster and easier than ever. Whether you’re a student, a working professional, or a business owner, an instant mini loan can be your lifesaver in moments of need.Just remember to borrow responsibly, repay on time, and choose a trusted platform with transparent terms. With the right approach, a mini loan can bridge your financial gap without stress. Platforms like FlexSalary offer quick, reliable mini loans to help you stay financially secure when it matters most.

0 notes

Text

Documents Required for a Schengen Visa from Dubai: A Complete Checklist

Applying for a Schengen visa from Dubai can be a smooth process if you have all the required documents prepared in advance. Whether you're planning a European vacation, attending a business meeting, or visiting family, having a complete checklist will save you time and ensure your visa application is successful.

1. Valid Passport

Your passport must be valid for at least three months beyond your planned departure from the Schengen area. It should have at least two blank pages and be issued within the last 10 years. Make sure it’s in good condition without any damage.

2. Completed Visa Application Form

The Schengen visa application form must be filled out accurately and signed. You can usually download this form from the embassy or consulate website of the Schengen country you plan to visit first or spend the most time in.

3. Passport-Sized Photos

You need two recent passport-sized photos (35x45mm) with a white background. These should not be older than six months and must clearly show your face without any headgear (unless worn for religious purposes).

4. UAE Residency Visa

A copy of your valid UAE residency visa is required. It should be valid for at least three months beyond the return date of your trip. This confirms your legal residence in Dubai.

5. Travel Insurance

You must provide proof of travel medical insurance with coverage of at least €30,000. This insurance must be valid throughout the entire Schengen area and cover expenses related to emergency medical treatment and repatriation.

6. Flight Itinerary and Hotel Booking

A confirmed round-trip flight reservation and proof of accommodation (hotel bookings or invitation letter from a host) are mandatory. These help show your travel plans and support the credibility of your application.

7. Proof of Financial Means

You must show that you can financially support yourself during your trip. This can include:

Recent bank statements (last 3–6 months)

Salary slips

A letter from your employer or sponsor

8. No Objection Letter (NOC)

A letter from your employer (or school, if you're a student) confirming your employment status, leave approval, and return to the UAE is often required. Self-employed individuals should submit a trade license copy and self-declaration letter.

Applying for a Schengen visa from Dubai is an important step toward your European journey. With all the right documents in place, you increase your chances of approval and avoid unnecessary delays.

And if you're also planning an overseas trip, such as applying for an America visit visa from Dubai, make sure you check the country-specific requirements.For expert assistance, document verification, and end-to-end visa support, trust Ontime Visa — your reliable visa consultant in Dubai. Let us simplify your travel plans today!

1 note

·

View note

Text

Integrating Real-Time Biometric Attendance with Payroll and HRMS

In an era where automation and precision define business success, companies are turning to smarter products to streamline workforce management. One such advancement is the integration of biometric attendance systems with payroll and HRMS (Human Resource Management Systems). This synergy isn't just a tech upgrade—it's a transformation of how organizations handle time tracking, compensation, and employee records.

As workplaces become increasingly dynamic—with remote work, flexible hours, and global teams—traditional attendance tracking methods fall short. Punch cards, manual logs, or even standalone digital systems often fail to deliver the real-time data and accuracy required for efficient payroll processing and HR decision-making. This is where biometric attendance systems step in, offering a secure and seamless bridge between employee presence and workforce management.

Why Biometric Attendance Systems Are Gaining Popularity

Biometric systems use unique physiological traits such as fingerprints, facial recognition, or iris scans to identify individuals. Unlike swipe cards or passwords, biometrics cannot be shared, lost, or forgotten—making them an incredibly reliable way to track attendance.

Key Benefits of Biometric Attendance Systems:

Eliminates Buddy Punching: Since identification is based on personal biometric data, employees cannot clock in for one another.

Accurate Time Logs: Real-time capture ensures precise data for payroll and compliance.

Efficient Workforce Monitoring: Managers can track employee hours, late entries, and overtime instantly.

Enhanced Security: Limits unauthorized access to workspaces.

These features alone make biometric attendance systems a valuable investment. But when integrated with payroll and HRMS platforms, their full potential is realized.

The Power of Integration: Biometric, Payroll, and HRMS

Integrating biometric attendance systems with payroll and HRMS automates the entire employee lifecycle—from time tracking to salary disbursal. Here’s how this integration adds value:

1. Real-Time Data Synchronization

Biometric systems log attendance data instantly. When connected to HRMS and payroll software, this information flows directly into time sheets and employee profiles, removing the need for manual data entry and reducing errors.

2. Automated Payroll Calculation

Payroll software relies on accurate working hours to compute salaries. Integrated systems can automatically calculate pay based on real-time attendance data, overtime, leaves, and shifts—ensuring accurate, on-time payroll.

3. Leave and Absence Management

HRMS platforms track leaves, holidays, and absenteeism. Biometric attendance feeds real-time data into the system, allowing HR to reconcile leaves without manual input, improving compliance and employee satisfaction.

4. Regulatory Compliance

Labor laws often require accurate attendance records and timely salary payments. Integration ensures compliance with these regulations by maintaining auditable records and timely payroll execution.

5. Employee Self-Service

Some integrated platforms offer employee portals where staff can view their attendance logs, apply for leave, or download salary slips—reducing the burden on HR and improving transparency.

Why Real-Time Integration Matters

Delayed data is one of the biggest challenges in HR and payroll operations. A system that updates only at the end of the day, or worse, after days, can cause payroll discrepancies, confusion around leave balances, and disputes about working hours.

With real-time biometric attendance systems, updates occur immediately. HR personnel and managers can access the latest data whenever needed. This responsiveness enhances decision-making, supports better resource allocation, and ensures smoother payroll operations.

Cloud-Based Systems: Enabling Remote and Multi-Location Management

In today’s distributed work environments, businesses need systems that are accessible anytime, anywhere. Cloud-based biometric attendance systems make this possible. They not only offer centralized data management for multi-location businesses but also allow integration with cloud HRMS and payroll products for a seamless end-to-end solution.

One of the standout providers in this space is Spintly. Known for its wireless, smartphone-based, and cloud-connected access control and attendance systems, Spintly delivers scalable solutions that effortlessly sync with HRMS platforms. This enables real-time insights into workforce behavior, absence trends, and payroll readiness—all from a single dashboard.

Spintly’s approach also reduces dependency on physical hardware, making deployment faster and more cost-effective, especially for businesses with a hybrid or mobile workforce.

Use Case: A Growing Tech Firm

Imagine a mid-sized tech company with offices in three cities and a hybrid work policy. Before adopting a biometric system, HR struggled with collecting time logs from each branch, matching them with leave records, and ensuring accurate salary disbursement.

After integrating a biometric attendance system with their payroll and HRMS software:

Attendance data from all locations synced in real-time.

Employees clocked in via facial recognition or smartphone-based access.

Overtime and late coming reports were automatically generated.

Payroll errors dropped by 95%, and the HR team saved hours of manual work.

This level of efficiency not only improved employee satisfaction but also positioned HR as a strategic function, rather than just administrative.

What to Look for When Choosing a Biometric Attendance System

To ensure successful integration and long-term ROI, consider the following features:

Integration Capabilities: Ensure the system supports APIs or direct plugins with your HRMS/payroll software.

Real-Time Syncing: Look for systems with cloud infrastructure to enable live updates.

Multi-Device Support: Consider mobile-based attendance for hybrid or field teams.

Scalability: Choose systems that can grow with your organization.

Data Security: Since employee biometrics are sensitive data, the system must comply with data protection regulations.

Spintly ticks all these boxes by offering a modern, mobile-first solution that can be tailored to a business’s unique needs. Its secure, encrypted platform ensures that biometric data is protected, and its ability to integrate with various HRMS platforms makes it a practical choice for businesses ready to embrace digital transformation.

Conclusion

The convergence of biometric attendance systems, payroll, and HRMS is a powerful move toward smarter workforce management. It eliminates inefficiencies, reduces compliance risks, and empowers HR teams to focus on strategic initiatives rather than data entry.

In this evolving landscape, it’s not enough to just collect attendance data - you need to act on it in real-time. Integrated systems like those offered by Spintly make this not only possible but seamless. With features designed for modern, agile organizations, Spintly is helping businesses automate attendance, optimize payroll, and simplify HR processes - all while enhancing security and user convenience.

Whether you're a fast-scaling startup or a large enterprise managing multiple branches, integrating biometric attendance with payroll and HRMS isn't just a tech upgrade - it's a business imperative.

#biometric attendance#biometric authentication#mobile access#visitor management system#spintly#access control solutions#access control system#accesscontrol#biometrics#smartacess#time and attendance software#attendance management

0 notes

Text

Comprehensive Guide to Salary Slip Format for Employees and Employers

A salary slip might seem like just another monthly formality — but it’s much more than that. Every month, employees receive a salary, and with it, a crucial document: the salary slip or payslip. While many ignore it, this slip plays a big role in your financial life — from tax filing to loan approvals.

In this guide, you’ll learn everything you need to know about the salary slip format: what it contains, why it matters, and how to read or design one effectively.

What Is a Salary Slip?

A salary slip is a monthly document provided by an employer that details an employee’s earnings, deductions, and net pay. It is a legal proof of income and is often required for financial transactions, including applying for loans or filing taxes.

In many organizations, salary slips are now generated digitally through HRMS (Human Resource Management Systems), making them easy to download and store.

Why Is a Salary Slip Important?

1. Proof of Income

Salary slips are essential when applying for home loans, personal loans, credit cards, and even rental agreements. It proves you have a steady income.

2. Tax Filing

Your payslip includes information on tax deductions like TDS and helps with accurate income tax filings. It also helps you track HRA, exemptions, and other benefits.

3. Transparency and Trust

A clear salary slip assures employees that the company is transparent about pay structures. It helps avoid disputes over salary or deductions.

4. Visa and Immigration

Many embassies request recent salary slips as part of visa applications to confirm employment and financial stability.

Components of a Salary Slip

Salary slips are divided into specific sections that make it easier to understand how your pay is structured.

A. Earnings Section (Gross Pay)

This includes all payments made before deductions:

Basic Salary: The fixed part of your salary and the base for calculating other benefits.

House Rent Allowance (HRA): Helps cover rent; typically 40–50% of basic.

Dearness Allowance (DA): Aimed at offsetting inflation, mainly in government jobs.

Conveyance Allowance: Travel-related reimbursement.

Medical Allowance: For medical expenses.

Special Allowance: Bonuses or performance incentives.

B. Deductions Section

This includes mandatory and voluntary deductions:

Provident Fund (PF): A retirement fund; usually 12% of basic salary.

Professional Tax (PT): Deducted based on state laws.

TDS (Tax Deducted at Source): Based on your estimated annual income.

ESIC: Insurance contribution if your salary falls within eligibility limits.

Loan/Advance Repayment: Any company loans deducted from your salary.

C. Employer Contributions

These are shown for informational purposes:

Employer’s PF Contribution

Gratuity Accrual

ESIC (Employer Share)

These don’t affect your take-home pay but count toward long-term benefits.

Sample Salary Slip Format

Here’s a simple example:

Company Name: XYZ Pvt Ltd Employee Name: Raj Mehta Employee ID: 10245 Designation: Software Developer Month: March 2025

Earnings

Basic Salary: ₹30,000

HRA: ₹12,000

Conveyance: ₹1,600

Medical Allowance: ₹1,250

Special Allowance: ₹2,000 Total Earnings: ₹46,850

Deductions

PF: ₹3,600

TDS: ₹1,200

Professional Tax: ₹200 Total Deductions: ₹5,000

Net Salary (Take-Home): ₹41,850

Alt text for sample image: Sample salary slip showing employee details, earnings, deductions, and final net pay.

Digital vs. Paper Salary Slips

Many companies now provide digital salary slips through portals or emails. They are:

Easy to download and store

Secure and tamper-proof

Environmentally friendly

Still, some official processes might require printed copies, so having both options available is ideal.

Legal Requirements and Compliance

In India, salary slips are implied under labor and tax laws, even if not mandated directly. Relevant regulations include:

Minimum Wages Act, 1948

Payment of Wages Act, 1936

State-specific Shops and Establishments Acts

Organizations under EPF or ESIC must maintain accurate salary records for deductions and contributions.

Employees should keep at least 6 to 12 months of salary slips for income proof and tax compliance.

Best Practices for Creating a Salary Slip

Clearly show employee and employer details

Categorize earnings and deductions properly

Include net pay and gross salary

Avoid confusing terms or ambiguous entries

Use official digital signatures or stamps

Ensure it complies with the latest tax and labor laws

Common Mistakes to Avoid

Incorrect tax or PF deduction calculations

Missing or outdated information

Ambiguous item names (e.g., “Other Allowance”)

No total or net pay shown

Errors in employee details

Mistakes like these can create compliance risks and employee dissatisfaction.

Conclusion

A salary slip is more than just a formality — it’s a vital financial and legal document. It helps in income verification, tax planning, and employee-employer transparency.

Whether you’re in HR designing payslips or an employee reviewing yours, understanding the salary slip format will help you manage your financial affairs more confidently.

Would you like this reformatted for a website or Word document?

FAQ's

1. What is a salary slip?

A salary slip is a monthly document provided by an employer to an employee. It shows a breakdown of earnings, deductions, and net salary. It acts as proof of income and is often used for tax filing and loan applications.

2. Why do I need a salary slip?

You need a salary slip to prove your income, file taxes correctly, apply for loans or credit cards, and meet certain visa or job application requirements. It's also helpful for keeping personal financial records.

3. What are the main parts of a salary slip?

A typical salary slip includes three parts: earnings (basic pay, HRA, allowances), deductions (PF, TDS, professional tax), and net salary. Some slips also show employer contributions to PF or insurance.

4. Is it mandatory for employers to provide salary slips?

Yes, in most countries including India, employers are expected to provide salary slips to comply with labor and wage laws. It ensures transparency and protects the rights of the employee.

5. How can I get my past salary slips?

You can request them from your HR or payroll department. If your company uses an HRMS portal, you may be able to download previous salary slips directly from there.

0 notes

Text

Why QkrHR is the Only HRMS You Need in 2025

The Evolving Role of HR in 2025

As we move further into 2025, the way companies approach human resource management has drastically changed. HR is no longer just about tracking attendance or handling monthly payroll — it’s about building a better workplace, enabling employee success, and streamlining operations. To meet these demands, businesses are turning to powerful HRMS software that can do it all. One standout solution leading this evolution is QkrHR, a next-generation platform developed by Qkrbiz.

One Platform to Manage It All

QkrHR is more than just a tool — it’s an all-in-one HRMS software designed for the way modern businesses operate. Whether you’re a growing startup or a well-established company, QkrHR offers the full range of HR capabilities from a single, unified dashboard. HR teams can effortlessly manage employee onboarding, attendance, payroll, expense approvals, leave requests, field tracking, and task assignments — all without juggling multiple platforms.

Truly Mobile-First HRMS

One of the most common complaints about traditional HRMS software in India is the lack of mobile optimization. QkrHR solves this problem by offering a fully responsive and mobile-first interface. Whether you’re setting up a policy, approving a salary slip, or tracking field employees, every function works flawlessly across smartphones, tablets, and desktops. With QkrHR, HR is truly at your fingertips — wherever you are.

Built for Speed and Simplicity

QkrHR is built with speed and simplicity in mind. It automates time-consuming HR tasks such as timesheet calculations, leave management, and payroll processing — saving HR teams hours every week. It’s especially powerful for companies looking for scalable HRMS in India that doesn’t slow down or require complex add-ons as their workforce grows.

More Than Just Core HR

QkrHR covers every aspect of workforce management. Beyond Core HR, it includes modules for field force tracking with GPS check-ins, advanced payroll automation, expense claims, and even employee engagement tools like surveys and announcements. Task management is also fully integrated, allowing HR teams and managers to assign and track work in real time.

A Platform Employees Love to Use

HR systems only succeed if employees actually use them. QkrHR is designed to be intuitive for everyone — from HR professionals to field executives. Employees can apply for leave, check their attendance, download payslips, or submit expenses, all from their mobile devices. Meanwhile, HR teams get powerful insights and real-time reports that drive better decisions.

Leading the Future of HRMS in India

There are many HRMS software in India, but very few deliver a complete, scalable, and mobile-first experience like QkrHR. With its ease of use, powerful automation, and comprehensive features, QkrHR is rapidly becoming one of the most trusted choices for growing companies and distributed teams across the country.

The Future of HR Starts Here

If your business is still struggling with outdated tools or juggling multiple platforms for HR operations, now is the time to make the switch. QkrHR combines everything your HR team needs in one simple, efficient, and affordable solution. It’s not just another HR tool — it’s the only HRMS in India you’ll need in 2025 and beyond.

To get started, visit https://www.qkrbiz.com/hrms-software and request your free demo today.

0 notes

Text

HR Software: Why is it a Smart Investment for Every Modern Business?

In today's business world, HR is not just limited to hiring and attendance. Now the role of HR is to streamline strategy, growth and employee experience. And in this journey, HR software emerges as a silent hero.

Let's know what is HR software and why it is necessary for every business.

What is HR Software?

In simple terms, HR software is a digital tool that manages HR-related tasks — such as:

Hiring & onboarding

Attendance & leave tracking

Payroll processing

Performance reviews

Employee data management

This software provides a centralized system where the HR team can easily access and manage everything — without the hassle of paperwork.

1. Time Saving & Error Free Process

Manual HR tasks are time-consuming — updating data in Excel sheets, sending email approvals, or explaining policies.

HR software automates all these tasks. Be it applying for leaves or downloading salary slips — everything is done through the employee portal, without disturbing HR.

2. Data Accuracy & Security

When it comes to employee data, salary, and compliance, both accuracy and security are important.

HR software in India updates real-time data and keeps sensitive information encrypted. This not only reduces errors but also keeps the company's compliance strong.

3. Better Decision Making with Reports

Modern HR tools also offer analytics and reporting. You can see:

Which team has more attrition?

Which employee's performance is consistently at the top?

Who is taking how many leaves?

This data allows you to make smart HR decisions — without guesswork.

4. Improved Employee Experience

The biggest benefit of an HR software system is that it improves the employee experience. Employees can submit their own documents, leaves, payslips, and feedback, without filling out forms or running after HR.

This independence makes them feel empowered.

Final Thoughts

In today's fast-paced work culture, if you want your company to run smoothly, compliance to be sorted, and employees to be happy, then HR software is a necessary investment, not an optional tool.

Be it a small or a big team, when the HR system is strong, the business grows naturally.

0 notes

Text

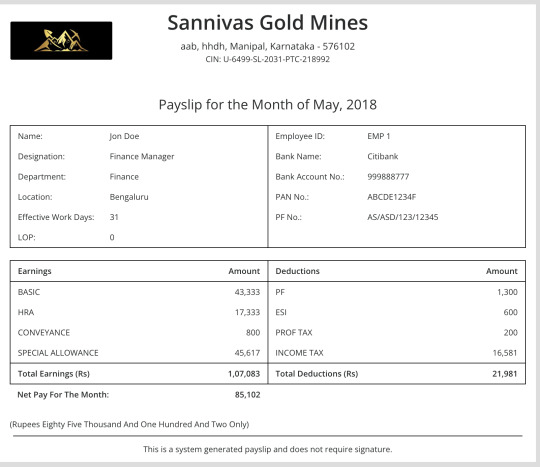

This salary slip format image shows a clean and professional monthly payslip layout, suitable for HR, accountants, and employers. It includes basic pay, HRA, allowances, deductions, and net salary. Download or reference this template for your company payroll or employee record-keeping. Ideal for Excel or PDF use.

0 notes

Text

Dealing with Back Taxes? Here’s How to File Previous Years' ITRS

Missed filing your ITR? Don’t stress! You can still fix it and save yourself from penalties and missed refunds. This step-by-step guide will simplify Belated Return Filing for you. ✅

Why Should You File Your Previous Years’ ITRs?

✔ Avoid penalties & interest on late tax payments ✔ Claim refunds if extra TDS was deducted ✔ Get smooth loan approvals (banks love ITR proofs!) ✔ Stay legally compliant and stress-free

📄 Documents You’ll Need

PAN Card

Aadhaar Card

Form 16/16A

Bank Statements

Investment Proofs

Home Loan Statements

Form 26AS

Other Income Proofs

🔎 Step-by-Step Guide to File Back ITRs

Step 1: Know Your Deadlines You can file late returns within 1 year from the end of the assessment year. (Ex: For FY 2023-24 → Deadline is 31 Dec 2025)

Step 2: Gather Your Income Docs Collect salary slips, Form 16, bank & portfolio statements. Sort them year-wise!

Step 3: Calculate Tax Liability Check total income ➡ deduct eligible deductions (80C, 80D, 80G) ➡ apply slab rates.

Step 4: Don’t Miss Deductions Double-check all possible deductions and rebates to reduce tax.

Step 5: Pay Tax + Interest Pay any pending tax along with interest (under sections 234A, 234B, 234C). Then file.

Step 6: File Online Login at Income Tax Portal ➡ choose correct form ➡ fill and submit!

Step 7: Verify Your ITR Complete e-verification within 120 days — via Aadhaar OTP, bank EVC, or Demat.

💡 Our Tip:

Filing back ITRs is easier than it looks — and totally worth it! Timely filing = less stress + smoother loans + peace of mind. ✅

Need Help? Download the JJ Tax App and chat with JIA, our expert-powered bot, for personalized tax guidance!

Visit www.jjfintax.com to know more.

Download the JJ TAX APP

0 notes

Text

Explore the Top Benefits of Online Payslip Generators

Managing employee payroll is a critical task for any organization. However, traditional methods of generating payslips manually often lead to errors, compliance risks, and administrative burden. This is where an Online Payslip Generator steps in, offering businesses a modern solution to streamline their payroll processes.

With increasing demand for efficiency, accuracy, and digital accessibility, more companies are adopting tools like Kredily's Online Payslip Generator to simplify operations and enhance employee satisfaction. If you are considering moving towards a digital payroll system, understanding the benefits of using an online salary slip generator can help you make an informed decision.

Let’s explore why online payslip generators are transforming payroll management for businesses across industries.

What is an Online Payslip Generator?

An Online Payslip Generator is a digital tool that automatically creates and distributes salary slips to employees. It calculates earnings, deductions, taxes, and other financial details based on the company's payroll policies.

Unlike manual methods that involve spreadsheets or handwritten documents, an online salary slip generator ensures that the information is accurate, compliant with legal requirements, and delivered instantly. Companies can now manage salary disbursement processes efficiently, saving time, resources, and reducing the chances of errors.

The growing popularity of tools like a salary slip online generator reflects the changing needs of businesses aiming for speed, security, and transparency in payroll management.

Key Benefits of Using an Online Payslip Generator

1. Improved Accuracy and Compliance

Accuracy in payroll processing is not just important — it's essential. Manual salary slip creation often results in mistakes like incorrect calculations, missing deductions, or tax filing errors. A salary slip generator automates these calculations, ensuring employees are paid correctly and on time.

Moreover, an Online Payslip Generator follows predefined compliance rules related to taxes, PF contributions, and labor laws. By adhering to regulatory standards automatically, businesses avoid penalties, audits, and employee dissatisfaction related to salary disputes.

2. Increased Efficiency and Time-Savings

Payroll generation involves multiple steps — calculation, verification, printing, and distribution. Using an online salary slip generator simplifies the entire process. Payroll administrators no longer need to spend hours manually preparing salary slips every month.

With a few clicks, the salary slip online generator completes tasks that would otherwise take days, allowing HR teams to focus on strategic initiatives rather than repetitive administrative work. Faster payroll also means employees receive their salaries on time, boosting overall workplace morale.

3. Enhanced Data Security and Privacy

Employee salary information is highly sensitive and must be protected against unauthorized access. Traditional paper-based payroll systems expose organizations to data theft, loss, or mishandling.

A salary slip generator provides encrypted, secure storage for all payroll records. An Online Payslip Generator ensures only authorized personnel can access employee data, protecting your business against internal and external data breaches. Compliance with data protection laws like GDPR becomes easier with digital tools that prioritize privacy and security.

4. Convenient Access and Accessibility

In today’s digital-first world, employees expect to access their personal information quickly and easily. An online salary slip generator offers employees the flexibility to view, download, or print their payslips from anywhere at any time.

Unlike paper payslips that are easy to lose or damage, a salary slip online generator allows employees to maintain their salary records digitally for personal reference, tax filing, or loan applications. This convenience enhances the employee experience and reduces the administrative burden on HR teams who otherwise have to resend misplaced payslips.

5. Cost-Effectiveness

Switching to an Online Payslip Generator is not just about efficiency; it also reduces operational costs. Traditional methods involve expenses related to paper, printing, ink, postage, and physical storage.

An online salary slip generator eliminates these expenses, offering a budget-friendly alternative. Businesses no longer need to invest heavily in full-fledged payroll management software either. Tools like Kredily's solution offer professional-grade payroll management at a fraction of the cost, making it accessible for startups and growing enterprises alike.

6. Real-Time Payroll Insights and Transparency

With manual payroll processes, getting a consolidated view of salary payments, taxes, or deductions requires hours of effort. A salary slip generator provides real-time dashboards and reporting features, enabling finance and HR teams to monitor payroll metrics effortlessly.

For employees, the ability to view detailed salary breakdowns using a salary slip online generator fosters transparency. They gain clarity into their earnings, deductions, bonuses, and benefits — building trust and minimizing payroll-related confusion or dissatisfaction.

Why Businesses Are Adopting Online Payslip Generators

The shift toward digital solutions like an Online Payslip Generator is being driven by the need for speed, accuracy, transparency, and cost efficiency.

Companies no longer view payroll as a back-end administrative task but recognize its role in shaping employee experience and ensuring legal compliance. Tools like Kredily's platform offer a user-friendly interface, integration with attendance systems, automatic tax calculations, and compliance-ready payslip formats — all designed to meet the demands of modern businesses.

Adopting a digital payroll solution is also about future-proofing operations. As businesses scale, managing hundreds or thousands of employee payslips manually becomes unsustainable. Investing early in an online salary slip generator sets the foundation for growth without increasing administrative workload.

How Kredily's Online Payslip Generator Stands Out

Among the many digital payroll solutions available, Kredily stands out for its commitment to affordability, ease of use, and comprehensive HR features. Kredily's Online Payslip Generator is built specifically for Indian businesses, ensuring compliance with Indian labor laws and providing seamless integration with other HR modules like attendance management and leave tracking.

Businesses can generate unlimited payslips, automate salary processing, and give employees secure access to their salary records — all from a single platform. Kredily’s solution eliminates the complexity traditionally associated with payroll, helping businesses focus more on growth and employee engagement.

Conclusion: Embrace Smarter Payroll Management

Payroll management has evolved beyond spreadsheets and manual calculations. A modern Online Payslip Generator offers businesses a faster, safer, and more transparent way to manage employee compensation.

By using an online salary slip generator, companies improve payroll accuracy, ensure legal compliance, enhance employee satisfaction, and save valuable time and resources. In today's competitive business environment, adopting a salary slip online generator is not just a convenience — it’s a strategic advantage.

Choosing a trusted solution like Kredily enables businesses of all sizes to unlock the full potential of digital payroll management. It's time to move forward with smarter, simpler, and more secure payroll solutions.

#online payslip generator#Salary Slip Generator#Online Salary Slip Generator#payslip generator#Salary Slip Generator Online

0 notes

Text

Access Salary Pay Slip Online PDF Easily

Managing financial documents has become more convenient than ever with digital tools offering streamlined access and control. Whether you’re a professional keeping track of monthly earnings or someone needing financial records for verification purposes, being able to download or generate a salary pay slip online PDF is both a time-saver and an essential tool in today’s world. Digital pay slips not only simplify documentation but also make filing, applying for loans, or preparing taxes far more efficient.

What is a Salary Pay Slip Online PDF?

A salary pay slip online PDF is a digital version of your monthly or bi-weekly earnings report that can be downloaded directly from your employer’s portal or payroll service. It typically contains your gross income, tax deductions, net pay, insurance contributions, and other relevant financial details. These PDFs are especially handy when you need to submit income proof quickly, whether it's for renting a house, applying for a visa, or submitting financial documents for a personal loan.

The digital nature of these slips means you no longer have to wait for hard copies or go through HR for every request. Most companies now use automated payroll systems that allow employees to access their pay slips from anywhere with an internet connection. This enhances not just accessibility but also security and record-keeping.

Importance of Authentic Financial Documentation

Accurate and authentic financial documents are crucial in many aspects of modern life. Banks, landlords, government agencies, and employers frequently request documents like pay slips and bank statements to verify income or financial stability. In this context, having your salary pay slip online PDF handy can make the difference between a fast approval and a delayed application.

However, there’s a growing trend of individuals seeking ways to create or modify financial documents. While some of these needs may stem from legitimate document loss or format requirements, others might enter the gray area of document manipulation.

Understanding the Demand for Fake Chase Bank Statement

Among the most searched financial document-related terms is the Fake Chase Bank Statement. This phrase often leads users to online services offering templates or document recreation services. While the reasons for needing a fake bank statement can vary—from educational demonstrations to replacing lost data—the line between legitimate use and fraudulent intent can easily blur.

A fake Chase bank statement might look very similar to a real one, down to the transaction list, bank logos, and account details. Some people use them to test systems, present mockups for design purposes, or recreate statements they’ve accidentally deleted. However, using such documents to deceive or commit fraud is illegal and unethical.

That’s why it’s critical to understand the intention behind obtaining these documents. If you’re missing important records or require editable formats of your own financial documents for a legitimate reason, there are professional services that can help you recreate them legally and accurately.

Digital Document Services: Use with Care

Whether you’re looking to access your salary pay slip online PDF or recreate a lost Chase bank statement, always be cautious about the service providers you choose. The internet is filled with document editing tools, but not all of them follow legal or ethical guidelines. Choose platforms that clearly state their purpose and operate with transparency.

There are legitimate document services that provide assistance in reformatting, recreating, or restoring lost financial documents. These services can help if you need a clearer PDF version of your pay slip, or a corrected version of your bank statement for accounting purposes.

Conclusion: Get Professional Help When Needed

Managing financial documents like salary pay slips and bank statements doesn’t have to be complicated or risky. Whether you need a clear salary pay slip online PDF or need help recreating a Fake Chase Bank Statement for a valid and legal reason, trusted platforms like fixyourdocs.com offer professional solutions that prioritize accuracy, privacy, and integrity. Always make sure your financial documentation is handled by experts who understand the importance of legitimacy and security.

0 notes

Text

Income Tax Return Filing & GST Consultant in Mumbai – Expert Tax Solutions

Mastering Tax Compliance: A Complete Guide to Income Tax Return Filing and Choosing the Best GST Consultant in Mumbai

Tax compliance is a crucial responsibility for individuals and businesses alike. Whether it's filing income tax returns or ensuring smooth Goods and Services Tax (GST) compliance, handling tax matters correctly can save you from penalties and legal complications.

If you're unsure how to go about Income tax return filing or need professional guidance from an expert GST consultant in Mumbai, this blog is your ultimate guide.

In this detailed blog, we’ll cover everything from the basics of income tax filing to the benefits of hiring a GST consultant. Let’s get started!

What is Income Tax Return Filing?

Income Tax Return (ITR) filing is the process of reporting your income, expenses, tax deductions, and tax payments to the Income Tax Department. This ensures transparency and compliance with tax laws.

Who Needs to File an Income Tax Return?

Salaried Employees – If your annual income exceeds the basic exemption limit, you must file ITR.

Business Owners & Freelancers – Self-employed individuals must report income and expenses.

Companies & Corporations – All registered businesses must file tax returns, regardless of profit or loss.

Individuals with Foreign Income – NRIs and residents with overseas assets need to file returns.

People Claiming Tax Refunds – If excess TDS has been deducted, you can claim a refund via ITR filing.

Why is Filing ITR Important?

Avoid Penalties – Late filing attracts fines and interest charges.

Loan & Credit Card Approvals – Banks require ITR documents for loan applications.

Visa Applications – Some embassies ask for ITR proof during visa processing.

Claiming Refunds – If you’ve paid more tax than required, you can claim a refund.

Legal Compliance – Non-filing may invite scrutiny and penalties from tax authorities.

Step-by-Step Guide to Income Tax Return Filing

Filing an Income tax return filing has become easier with online platforms. Here’s how you can do it:

Step 1: Gather Necessary Documents

PAN Card and Aadhaar Card

Salary Slips & Form 16 (for salaried employees)

Bank Statements

Investment & Deduction Proofs (PPF, LIC, Mutual Funds)

TDS Certificates

Step 2: Select the Right ITR Form

Different forms cater to different taxpayers. For instance:

ITR-1: Salaried individuals with income up to ₹50 lakh

ITR-3: Business owners and professionals

ITR-4: Presumptive income scheme filers

Step 3: Calculate Your Taxable Income

Add income from all sources and subtract eligible deductions under Sections 80C, 80D, etc., to arrive at taxable income.

Step 4: Pay Outstanding Tax, If Any

If the calculated tax liability exceeds TDS, pay the balance online through the tax portal.

Step 5: File & Verify Your ITR

Submit the return via the e-filing portal and verify it using Aadhaar OTP, net banking, or by sending a signed ITR-V copy to the Income Tax Department.

Step 6: Keep Acknowledgment for Future Reference

Download the acknowledgment receipt (ITR-V) for documentation.

Understanding GST and the Need for a GST Consultant in Mumbai

Goods and Services Tax (GST) has streamlined India’s tax system by replacing multiple indirect taxes. However, GST compliance is complex, making it essential for businesses to seek guidance from a GST consultant in Mumbai.

Who Needs a GST Consultant?

Startups & New Businesses – To ensure correct GST registration.

E-commerce Sellers – GST rules for online businesses can be tricky.

Exporters & Importers – Special GST provisions apply to international trade.

Businesses with High Transactions – Regular GST compliance is needed.

Companies Facing GST Audits – Expert assistance is crucial to handle audits and notices.

Benefits of Hiring a GST Consultant

✅ Error-Free GST Registration & Filing – Avoid mistakes in your GST compliance. ✅ Timely GST Returns – Delays can lead to penalties, so timely filing is essential. ✅ Tax Optimization – Maximize your input tax credit (ITC) to reduce tax liability. ✅ Handling GST Audits & Notices – Get professional assistance in case of tax scrutiny. ✅ Peace of Mind – Focus on business while experts handle your tax compliance.

Common GST Services Offered by Consultants

A GST consultant in Mumbai provides:

GST registration and filing

Monthly and annual return preparation

GST reconciliation and audits

GST refunds and ITC claims

Compliance with e-invoicing and e-way bills

Common Mistakes to Avoid in Tax Compliance

Income Tax Filing Mistakes

❌ Failing to report all income sources ❌ Selecting the wrong ITR form ❌ Forgetting to verify the ITR ❌ Missing tax deductions ❌ Not linking PAN with Aadhaar

GST Filing Mistakes

❌ Delayed GST registration ❌ Incorrect GST classification and rates ❌ Errors in filing GST returns ❌ Missing ITC claims ❌ Failing to respond to GST notices

Seeking expert help for Income tax return filing and hiring a professional GST consultant in Mumbai can prevent these issues.

Why Choose Jadhav & Associates for Your Tax Needs?

Jadhav & Associates is a reputed name in tax consultancy, offering expert guidance in Income tax return filing and GST consultant in Mumbai.

Why Work with Jadhav & Associates?

✅ Expertise in Income Tax & GST Compliance ✅ Seamless ITR & GST Return Filing ✅ Customized Tax Solutions for Businesses & Individuals ✅ Affordable & Transparent Pricing ✅ Proven Track Record of Accuracy & Compliance

Whether you need assistance with Income tax return filing or require an expert GST consultant in Mumbai, Jadhav & Associates can help ensure hassle-free compliance.

Conclusion: Stay Compliant & Maximize Savings with Expert Tax Assistance

Filing your ITR and staying compliant with GST regulations is essential to avoid legal troubles and maximize tax benefits. By working with tax experts, you can save time, minimize errors, and ensure seamless compliance.

If you’re looking for professional Income tax return filing services or need guidance from a reliable GST consultant in Mumbai, get in touch with Jadhav & Associates today!

Take control of your taxes and enjoy peace of mind with expert guidance.

#Income Tax Return Filing#GST Consultant in Mumbai#Tax Filing Services#GST Return Filing#Income Tax Consultant#Tax Consultant Mumbai#ITR Filing Online#GST Registration#Business Tax Solutions#Tax Compliance

0 notes