#doji candlestick pattern

Explore tagged Tumblr posts

Text

Bearish Engulfing Candlestick Pattern: A Simple Guide

The bearish engulfing candlestick pattern is a popular signal, most traders use this to predict the potential reversals in the stock or forex market.

It’s often considered a warning that an upward trend may end and that a price drop could happen anytime soon.

Here, I’ll explain what the pattern looks like, how it works, and why it’s important.

#candlestick patterns#bearish engulfing pattern#bearish engulfing candlestick#candlestick pattern#engulfing candlestick pattern#bearish engulfing candlestick pattern#bearish engulfing#candlestick patterns for beginners#candlestick trading#bullish engulfing pattern#bullish engulfing candlestick pattern#bearish engulfing candle pattern#candlestick bearish patterns#trading candlestick patterns#candlestick chart patterns#doji candlestick pattern

0 notes

Text

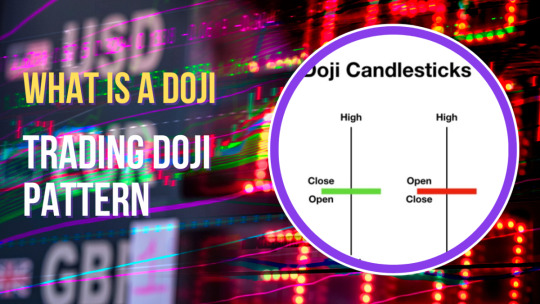

Doji Candlestick Pattern and Trading Doji

The doji pattern is a candlestick pattern commonly used in technical analysis to indicate indecision in the market. It occurs when the opening price and the closing price of an asset are very close to each other, resulting in a candlestick with a very small real body. The doji pattern can have different shapes, but the common characteristic is that it has a small real body, a long upper and…

View On WordPress

#candlestick patterns#Candlesticks#Doji#dragonfly doji#gravestone doji#learn technical analysis#long legged doji#Patterns#stock markets#stock trading#technical analysis#trading doji

3 notes

·

View notes

Text

Doji Candlestick: Gain an Edge in Trading

Candlestick charts are important for traders, which have common 35 types candlestick patterns. One of the most popular patterns is Doji patterns. It stand out for their ability to signal market indecision and potential reversals. A Doji candlestick pattern occurs when a security’s open and close prices are nearly equal, creating a cross-like shape on the chart. This pattern indicates a balance between buyers and sellers, often hinting at a pause or potential change in the market trend.

What Is Doji Candlestick?

A Doji candlestick is a unique and valuable formation on a price chart that indicates a state of indecision in the market. It occurs when a security’s opening and closing prices are almost equal, resulting in a very small or non-existent body and a cross-like appearance. This pattern is significant because it reflects a balance between buyers and sellers, often preceding a potential reversal or significant change in the market trend.

⚠️Tip: “Cross-like appearance” refers to the shape resembling a cross or plus sign (+).

Characteristics of a Doji Candlestick

Appearance: The Doji candlestick resembles a plus sign or a cross due to its very narrow body and equal length upper and lower shadows.

Formation: It is created when the price of security opens, fluctuates to a high and low, and then closes at a point very close to the opening price.

Interpretation: The Doji indicates market indecision and can often precede a reversal or continuation of the current trend, depending on its position on the chart and other market indicators.

Types of Doji Candlestick

Gravestone Doji This type of Doji has a long upper shadow and no lower shadow, with the open, close, and low prices all at the same level. It often indicates a potential bearish reversal when it appears at the top of an uptrend, suggesting buyers could not sustain higher prices and sellers took control by the close.

Dragonfly Doji The Dragonfly Doji has a long lower shadow and no upper shadow, with the open, closed, and high prices all at the same level. When found at the bottom of a downtrend, it typically signals a potential bullish reversal, indicating that sellers dropped prices lower. Still, buyers could bring prices back up to the opening level.

Long-Legged Doji Characterized by long upper and lower shadows and a small body in the middle, the Long-Legged Doji indicates significant market indecision. The extensive price range within the session shows that neither buyers nor sellers could gain control, making it a strong signal of potential market reversal or continuation, depending on the context.

Standard Doji This Doji pattern has small upper and lower shadows, with the open and close prices nearly equal. It signifies general indecision in the market. Traders should look at the preceding and following candlesticks to interpret its meaning, as it can signal either a reversal or continuation of the current trend.

4-Price Doji The rarest type, the 4-Price Doji, has the open, high, low, and close prices all at the same level, resulting in a simple horizontal line without any shadows. This pattern represents complete market indecision and typically occurs during periods of very low volatility.

Read more: FinxpdX

Download PDF: 35 Candlestick Patterns

#investing#investment#finance#financial#forex#forextrading#forex market#forex indicators#candlestick#candlesticks pattern#Doji candlestick

0 notes

Text

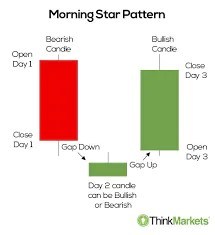

Mastering the Morning Star Pattern: A Step-by-Step Guide

Title: Mastering the Morning Star Pattern: A Step-by-Step Guide Introduction:The world of technical analysis offers traders a plethora of tools to identify potential trend reversals and market opportunities. One such powerful pattern is the Morning Star pattern, a three-candlestick formation that signals a potential bullish reversal after a downtrend. In this step-by-step guide, we will explore…

View On WordPress

#bullish reversal#candlestick patterns#comprehensive trading approach.#confirmation factors#doji candle#downtrend#false signals#market sentiment#momentum shift#Morning Star pattern#position sizing#price action#resistance levels#Risk Management#spinning top#stop-loss#support levels#technical analysis#trading strategy#trading volume#Trend Reversal#volume analysis

0 notes

Text

This blog serves as a user-friendly guide for those just stepping into the world of forex trading. It meticulously breaks down the concept of forex trading signals, highlighting their immense value for beginners in navigating the intricate forex market. It emphasizes the advantages of using signals, such as their potential to save time, reduce emotional stress, and offer a learning opportunity for novice traders. Throughout the guide, the presence of Funded Traders Global as a supportive and educational partner is evident, ensuring that beginners gain confidence in their learn more...

#Analyzing Fundamental Data#Basics of Trading Signals#Candlestick patterns#Complete Guide to Forex Trading Signals for Beginners#currency pairs#Defining Forex Trading Signals#dojis#economic calendars#economic indicators#engulfing candles#Evaluating Sentiment Indicators#Forex charts#Forex News Sources#forex trading 2023#Forex Trading Signals for Beginners#Fundamental Analysis Signals#hammers#How to Choose a Reliable Provider#How to Find Forex Trading Signals#Interpreting Forex Trading Signals#MACD (Moving Average Convergence Divergence)#Market Analysis Tools#Market Sentiment Indicators#mood and perceptions of traders in the market#moving averages#Position Sizing Strategies#Risk Management in Forex Trading#RSI (Relative Strength Index)#Self-Analysis and Research#Sentiment Analysis Signals

0 notes

Text

Day Trading Forex: Everything You NEED To Know!

Are you interested in exploring the world of forex trading and want to take advantage of short-term price movements? Day trading forex might be the perfect strategy for you.

In this article, we will delve into the ins and outs of day trading forex, from understanding the forex market to developing effective strategies and managing risks. So let’s get started!

Introduction to Day Trading Forex

Benefits of Day Trading Forex

Day trading forex offers several advantages compared to other trading styles. Some of the benefits include:

Potential for quick profits: Day traders seek to profit from intraday price movements, aiming to close positions before the market closes.

High liquidity: The forex market is the largest and most liquid financial market globally, providing ample trading opportunities.

Flexibility: Traders can choose from a wide range of currency pairs and trade during different market sessions.

Lower capital requirements: Compared to other markets, forex trading allows for smaller initial investments, enabling traders to start with less capital.

Understanding Forex Market

To become a successful day trader in forex, it’s essential to have a solid understanding of the market dynamics.

Major Currency Pairs

The forex market consists of various currency pairs, but some major pairs dominate the trading volume. These include EUR/USD, GBP/USD, USD/JPY, and USD/CHF, among others. Familiarize yourself with these major currency pairs and their characteristics.

Market Hours

The forex market operates 24 hours a day, five days a week. However, certain trading sessions offer higher volatility and trading opportunities. The major sessions include the London, New York, Tokyo, and Sydney sessions. Knowing the active market hours can help you optimize your trading strategy.

Getting Started with Day Trading Forex

Before diving into day trading forex, you need to set up your trading infrastructure.

Setting Up a Trading Account

Choose a reputable forex broker that provides a user-friendly trading platform, competitive spreads, reliable execution, and comprehensive customer support. Ensure the broker is regulated by a recognized authority.

Selecting a Reliable Forex Broker

Research different forex brokers and compare their offerings, including trading costs, available currency pairs, leverage options, and deposit/withdrawal methods. Read reviews from other traders to gauge the broker’s reputation and reliability.

Funding Your Trading Account

Technical and Fundamental Analysis

Successful day trading forex relies on a combination of technical and fundamental analysis techniques.

Candlestick Patterns

Candlestick patterns provide valuable insights into price dynamics. Learn to identify patterns such as doji, engulfing, and hammer, which can signal potential reversals or continuations in the market.

Moving Averages

Moving averages help smooth out price fluctuations and identify trends. Experiment with different moving average periods, such as the 50-day and 200-day moving averages, to identify potential entry and exit points.

Support and Resistance Levels

Support and resistance levels are price levels at which the market tends to bounce or reverse. Identify key support and resistance levels using horizontal lines on your charts and incorporate them into your trading decisions.

Economic Indicators

Economic indicators, such as GDP growth, inflation rates, and employment data, can significantly impact currency prices. Stay informed about major economic releases and their potential effects on the forex market.

News Events

Popular Day Trading Strategies

To succeed in day trading forex, you need to implement effective trading strategies that suit your trading style and risk appetite.

Scalping

Scalping involves making multiple trades within a short time frame, aiming to capture small profits from quick price movements. Scalpers often rely on tight spreads and fast execution to capitalize on these rapid price changes.

Breakout Trading

Breakout traders look for significant price breakouts above resistance or below support levels. They aim to enter trades early in a new trend to maximize profit potential. Breakout strategies often utilize technical indicators to confirm breakouts.

Momentum Trading

Risk Management in Day Trading Forex

Managing risk is crucial in day trading forex to protect your capital and preserve long-term profitability. Here are a few ways to help manage your risk:

Setting Stop-Loss Orders

Always use stop-loss orders to limit potential losses on each trade. Determine an appropriate level for your stop-loss order based on your risk tolerance and the characteristics of the currency pair you are trading.

Implementing Proper Position Sizing

Calculate your position size based on the size of your trading account and the percentage of capital you are willing to risk per trade. Avoid overexposing your account by trading positions that are too large relative to your account size.

Managing Leverage

Emotions and Psychology in Day Trading

Controlling emotions and maintaining a disciplined mindset are crucial in day trading forex.

Controlling Greed and Fear

Greed and fear are common emotions that can cloud judgment and lead to irrational trading decisions. Develop self-awareness and discipline to overcome these emotions and make objective trading choices.

Maintaining Discipline

Stick to your trading plan and avoid impulsive trades driven by emotions. Follow your strategy and trading rules consistently, even when faced with market fluctuations.

Developing a Trading Plan

Building a Trading Routine

Establishing a structured trading routine can help you stay organized and make better trading decisions.

Pre-market Analysis

Before the market opens, conduct a thorough analysis of the currency pairs you are interested in trading. Review economic calendars, technical indicators, and news events that may impact the market.

Executing Trades

Once the trading day begins, execute your trades based on your predefined strategies and analysis. Stick to your risk management rules and avoid impulsive trades based on emotions.

Reviewing and Analyzing Trades

Resources and Tools for Day Traders

Several resources and tools can assist day traders in their trading activities.

Educate Yourself

It is important to stay up to date and learn constantly when you are day trading. It’s always a good idea to begin your journey with a day trading forex course such as the Cash on Demand Trades Education or The Ultimate Forex Strategy

Trading Platforms

Choose a user-friendly trading platform that provides real-time charts, technical indicators, order execution capabilities, and access to relevant news and analysis.

Charting Software

Utilize charting software to analyze price patterns, apply technical indicators, and identify potential trade setups. Popular charting platforms include MetaTrader, TradingView, and NinjaTrader.

Economic Calendars

Stay informed about upcoming economic events and news releases using economic calendars. These calendars provide information on scheduled economic indicators, central bank meetings, and other market-moving events.

Online Communities and Forums

Engage with other day traders through online communities and forums. Participate in discussions, share ideas, and learn from experienced traders. Collaborating with like-minded individuals can enhance your trading knowledge and skills.

Tips for Successful Day Trading

Consider the following tips to improve your day trading performance:

Stay Informed and Educated: Continuously update your knowledge about the forex market, trading strategies, and risk management techniques. Follow reputable sources of market analysis and stay informed about economic developments.

Practice Risk Management: Always prioritize risk management to protect your capital. Implement appropriate stop-loss orders, manage your position sizes, and avoid overtrading.

Start with Small Positions: When starting out, focus on small position sizes to minimize risk. Gradually increase your position sizes as you gain experience and confidence in your trading abilities.

Keep Emotions in Check: Emotions can cloud judgment and lead to poor trading decisions. Maintain emotional discipline, stick to your trading plan, and avoid impulsive actions driven by fear or greed.

Review and Learn from Your Trades: Regularly review your trading performance, analyze your trades, and identify areas for improvement. Learn from both successful and unsuccessful trades to refine your strategy.

Final Thoughts

Day trading forex offers exciting opportunities for traders to profit from short-term price movements in the forex market.

By understanding the market dynamics, implementing effective strategies, managing risks, and maintaining emotional discipline, you can increase your chances of success in day trading forex.

4 notes

·

View notes

Text

The Hidden Power of Heiken Ashi in a Sideways Market: The Little-Known Secret to Outsmarting Market Noise Why Most Traders Get It Wrong (And How You Can Avoid It) Imagine you're driving on a road full of bumps and potholes—that's what a sideways market feels like to most traders. Now, picture your car magically smoothing out all those bumps; that's what using Heiken Ashi in a sideways market does for your trading strategy. Many traders underestimate this technique, thinking it's only for trendy markets. Well, surprise! Heiken Ashi is a hidden gem for navigating sideways conditions. Let me explain why (and how you can make it work for you). Most traders approach sideways markets like trying to herd cats—chaotic, unpredictable, and, frankly, just exhausting. Instead, Heiken Ashi candles act as the secret sauce that turns a spaghetti mess of price action into a neat, manageable dish. Think of it like that friend who magically brings order to the chaos at a party—they make everything look simple. Why Heiken Ashi is Your Sideways Market Superpower Let's get into the meat of it. Heiken Ashi candles aren't your regular candlesticks. They smooth the data, averaging price action in a way that filters out market noise. And if there's anything a sideways market loves to do, it's throw noise your way—kind of like trying to have a quiet dinner next to a group of loud tourists. In a typical sideways market, where prices fluctuate like a toddler's moods, Heiken Ashi allows you to ignore small reversals and stick to your game plan. Traders who don't use Heiken Ashi in these conditions often feel like they are chasing their own tails—or worse, they experience the infamous "whipsaw effect." You know, that awful feeling when you get in too late, only to get out too early? Yeah, that one. Hidden Patterns that Drive the Market Here's the kicker: Heiken Ashi doesn't just make things clearer, it unveils hidden patterns that other traders miss—especially during sideways markets. These patterns can point to crucial support and resistance zones. Imagine the Heiken Ashi as glasses that suddenly bring everything into focus—except, instead of squinting at random colors, you're seeing potential profit. Moreover, it’s all about spotting those doji-like formations within the Heiken Ashi structure. This indicates indecision—a sign to keep your eyes peeled for potential breakouts or breakdowns. Most traders look at sideways markets and think "no clear direction." But with Heiken Ashi, you can see potential zones where the big players are probably accumulating. Why Most Traders Get Stuck: Misreading the Noise Sideways markets are notorious for luring traders into overtrading. I like to think of it as trying to open every door in a hallway when only one door leads to a shortcut. Traders who misread sideways markets often get in and out faster than me after mistakenly biting into a piece of durian (a fruit that, trust me, is an acquired taste!). Heiken Ashi smoothens things out, so you don't mistake every flicker for a trading signal. It helps you breathe, calm down, and actually make sense of what you're seeing. You’re not constantly reacting; you’re analyzing. The "Heiken Ashi Strategy" for Sideways Market Mastery Here's the simple, yet effective way to employ Heiken Ashi during sideways markets: - Start by Identifying the Sideways Market: Before slapping Heiken Ashi on your chart, make sure you're truly in a sideways market. Look for clear, non-trending price action. - Use Heiken Ashi for Noise Reduction: Replace your standard candlestick chart with Heiken Ashi. Notice how it takes all those jerky ups and downs and turns them into a more uniform direction. - Spot the Doji-like Candles: These are a trader's best friend in sideways markets. They signal market indecision and are a fantastic indicator of possible breakouts. - Combine with Oscillators: Use an RSI or Stochastic with Heiken Ashi. If oscillators are overbought or oversold while Heiken Ashi is showing indecision, there might be a move coming. - Patience and Timing Are Everything: Wait for confirmation! Unlike an aggressive breakout strategy, Heiken Ashi in a sideways market is all about calm waters. The doji candle followed by two consistent colors indicates a better entry point. Think Like a Contrarian: The Ninja Tactic Most traders despise sideways markets. They skip them, thinking there’s no money to be made. This is where your opportunity lies. Picture yourself as that kid who knows about the secret candy stash in the kitchen, while everyone else complains about being out of snacks. Heiken Ashi gives you that contrarian edge, allowing you to see setups that others just walk away from. Next time the market moves sideways, think: "Heiken Ashi strategy time." You'll start seeing these situations not as wastelands of opportunity, but as predictable environments that Heiken Ashi helps you navigate like a pro. Advanced Insights: When Market Noise Becomes Your Friend Noise isn’t necessarily bad. It just needs to be controlled. Traders often make the mistake of wanting clean, clear trends all the time—like wanting perfect sunshine without a cloud in sight. In reality, markets are messy. Heiken Ashi helps you befriend that noise instead of fearing it. By using the smoothness of Heiken Ashi, you can literally turn confusion into clarity. It’s like putting on noise-canceling headphones in a crowded airport—suddenly everything else fades away, and you can focus on what's important. The One Simple Trick That Can Change Your Trading Mindset Want to know a secret that sets apart professional traders from rookies? It’s knowing when to do nothing. Yep, the power of patience. Using Heiken Ashi, especially in a sideways market, is about not overreacting to every movement. Watch the formation of candles, note the color consistency, and only pull the trigger when a clear signal emerges. Most traders let impatience lead them to unnecessary losses. It's like taking every flight just because you can, even if the destination makes no sense. Trust Heiken Ashi to tell you when the destination is worth it. Wrapping It All Up: Using Heiken Ashi to Gain an Edge So, next time you find yourself frustrated with a sideways market, remember: Heiken Ashi is your secret weapon. It smooths out market noise, gives you clear, actionable signals, and most importantly, it brings sanity to chaos. The key to trading a sideways market isn’t predicting the next big move—it’s about making sense of the seemingly senseless. With Heiken Ashi, you turn a market most traders avoid into a goldmine of opportunity. Now, apply what you've learned: Add Heiken Ashi to your charts during the next sideways market, and observe the difference. Feel free to share your experience or ask questions below—I’m here to help. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Link

0 notes

Text

Stock Trading | Investing: Technical Analysis Stock Market

Stock trading and investing have become increasingly popular as individuals look for ways to build wealth. One of the most effective methods for analyzing stock market trends is through technical analysis. Technical analysis focuses on the study of historical price data, volume, and market patterns to make informed trading decisions. In this article, we’ll dive deep into technical analysis, its importance, and how traders can use it to enhance their stock market strategies.

What is Technical Analysis?

At its core, technical analysis is a method used to predict future price movements of assets based on past price data. Unlike fundamental analysis, which evaluates a company’s financial health, technical analysis revolves around price charts, patterns, and indicators. Traders use these tools to identify trends, understand market sentiment, and time their trades.

Why is Technical Analysis Important in Stock Trading?

Technical analysis provides insights that are often overlooked by fundamental analysis. While a company’s earnings and news may affect long-term value, price action reflects the collective behavior and sentiment of traders in real-time. By identifying patterns and trends, traders can capitalize on short-term price movements and optimize their entry and exit points.

Here are some of the key reasons why technical analysis is essential:

Helps identify trends: Recognizing whether a stock is in an uptrend, downtrend, or range can significantly influence trading decisions.

Predicts price reversals: Indicators such as moving averages and oscillators can signal when a trend is about to change.

Enhances timing: While fundamental analysis may tell you what to buy, technical analysis tells you when to buy or sell.

Key Concepts in Technical Analysis

1. Price Trends

Trends are the foundation of technical analysis. The stock market is often viewed as being in one of three states: an uptrend, downtrend, or sideways movement. Understanding the direction of the trend allows traders to align their strategies accordingly.

Uptrend: A series of higher highs and higher lows. It suggests increasing demand and bullish market sentiment.

Downtrend: A series of lower highs and lower lows, indicating bearish sentiment.

Sideways: When the price moves within a defined range, neither forming higher highs nor lower lows.

2. Support and Resistance Levels

Support and resistance levels are horizontal lines that represent price levels where the stock has historically reversed its movement.

Support: The price level at which a stock tends to find buying interest, preventing it from falling further.

Resistance: The price level where selling pressure tends to increase, preventing the stock from rising further.

3. Moving Averages

Moving averages are one of the most widely used indicators in technical analysis. They smooth out price data to help traders identify the overall trend.

Simple Moving Average (SMA): This is calculated by averaging the closing prices over a set period. It’s used to identify the overall direction of a trend.

Exponential Moving Average (EMA): This places more weight on recent data, making it more responsive to new information.

4. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions.

Overbought: When the RSI is above 70, the stock may be overbought and due for a correction.

Oversold: When the RSI is below 30, the stock may be oversold and due for a rebound.

5. Candlestick Patterns

Candlestick charts are a popular tool in technical analysis due to their detailed representation of price movements. They consist of open, high, low, and close prices within a specified timeframe. Certain candlestick patterns can signal reversals or continuation of trends:

Doji: A candlestick with a very small body, signaling indecision in the market.

Hammer: A bullish reversal pattern that indicates potential buying pressure.

Shooting Star: A bearish reversal pattern suggesting that sellers are in control.

Popular Technical Analysis Tools

1. Bollinger Bands

Bollinger Bands consist of three lines: a simple moving average (SMA) in the middle, with an upper and lower band placed two standard deviations away. These bands expand and contract based on volatility, helping traders identify overbought and oversold conditions.

2. Fibonacci Retracement

The Fibonacci retracement tool is used to identify potential support and resistance levels based on Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 100%). Traders use these levels to predict potential reversals in the stock price.

3. MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a stock’s price. The MACD line is calculated by subtracting the 26-period EMA from the 12-period EMA. When the MACD crosses above its signal line, it’s considered a bullish signal, and when it crosses below, it’s a bearish signal.

How to Start Using Technical Analysis for Stock Trading

1. Choose a Trading Platform with Technical Analysis Tools

Most online brokerages offer platforms with built-in charting tools and technical indicators. Popular platforms include MetaTrader, ThinkorSwim, and TradingView. Ensure the platform provides real-time data and allows customization of charts.

2. Master the Basics Before Moving to Advanced Strategies

As with any skill, mastering the basics of technical analysis—such as trend lines, support and resistance, and moving averages—is essential before diving into advanced techniques like harmonic trading or Elliott Wave Theory.

3. Combine Technical and Fundamental Analysis

While technical analysis is powerful, combining it with fundamental analysis can give traders a complete picture. For example, understanding a company’s financial health while also analyzing its price patterns can lead to better-informed trading decisions.

4. Backtest Your Strategies

Before applying your technical analysis strategies in live markets, it’s crucial to backtest them. This involves using historical data to see how your strategy would have performed. Most platforms offer a backtesting feature that allows you to assess the reliability of your approach.

5. Stay Updated on Market News

No analysis is complete without staying informed on current market conditions. Even the best technical analysis can fail if there’s unexpected news affecting the stock. Ensure you follow financial news outlets and stay updated on earnings reports, geopolitical events, and central bank decisions.

Conclusion

Becoming proficient in technical analysis is essential for anyone serious about stock trading and investing. By mastering tools like moving averages, RSI, candlestick patterns, and more, traders can make informed decisions and increase their chances of success. Whether you’re a beginner or an experienced trader, honing your technical analysis skills will provide a valuable edge in the competitive stock market.

0 notes

Text

Dragonfly Doji Pattern

The Dragonfly Doji is a significant candlestick pattern in technical analysis that provides traders with valuable insights into market sentiment and potential trend reversals. This pattern is characterized by a single candlestick with a small body, long lower shadow, and little to no upper shadow. The overall appearance of the candlestick resembles a dragonfly, hence the name. Here’s a detailed…

View On WordPress

#Bullish Reversal#Candlestick Charting#candlestick patterns#Chart Patterns#day trading#dragonfly doji#Financial Markets#Japanese Candlesticks#Market Analysis#Market Trends#Market Volatility#price action#Price Patterns#stock market#swing trading#technical analysis#Trading Patterns#Trading Psychology#trading signals#Trading Strategies

0 notes

Text

Price Action Trading Strategy

Financial markets keep moving, and one always wants an edge. One of the oldest methods which have always worked in this regard is the Price Action Trading Strategy. Unlike most trading strategies that depend upon a host of technical indicators, price action trading depends upon the movement of price itself. In this tutorial, Profithills Education will walk you through the basics of price action trading and help you build a solid foundation.

What is Price Action Trading?

Price action trading is a methodology of trading that is based on the analysis of past prices. It does not depend on the usage of lagging signals like moving averages or oscillators. Price action traders express interest in raw data interpretation from price charts. Emphasis is on the interpretation to read market sentiment and patterns repeated over time.

The key aspects include:

Candlestick patterns

Support and resistance levels

Trendlines

Market structure

Price action simply portrays the psychology of all participants in the market and, for this reason, serves as a strong tool for deciphering the probable future movements.

Why Trade with Price Action?

Simplicity: It doesn't involve complicated technical indicators when trading with price action, which makes it very simple to understand and apply by traders of any level.

Flexibility: The trading strategy can be applied to any market, from stocks and forex to commodities and cryptocurrencies.

Timeliness: Price action strategies allow for timely entry and exit signals with no lag, as price is generally a leading indicator.

Key Components of Price Action Trading

1. Candlestick Patterns

Candlestick patterns are the foundation upon which price action trading rests. These serve as a window to the sentiment of market participants and also identify impending price reversals. Commonly used patterns include:

Doji: It shows indecision in the market.

Hammer: A probable bullish reversal pattern.

Engulfing Pattern: A candlestick reversal pattern in which one candle completely engulfs the real body of the preceding candle. It signals a change in the balance of power between the buyers and sellers.

2. Support and Resistance

Support and resistance are those price levels where usually a sudden change is seen in the movement of price, causing the trend to reverse or consolidate. Price action traders define these zones in order to extract buying or selling opportunities.

Support: A level where a lower degree of price swing is likely to be witnessed, resulting in the termination or reversal of the downtrend.

Resistance: A price level from which an uptrend is likely to meet resistance and may temporarily or ultimately be turned around.

The ability to successfully identify these enables the trader to effectively place their trades, for example, opening a trade when the price nears support and closing when approaching resistance.

3. Trendlines

Trendlines are-diagonal lines that are drawn in price charts to help somebody identify the direction of a market. They basically aid a trader in determining whether the market is in an uptrend, a downtrend, or range-bound. Normally, if the price breaks a trendline, it can indicate a possible reversal or acceleration of the trend.

4. Price Patterns

The trading of price action also involves the identification of patterns that suggest impending movements of the market. Some of the common patterns include:

Head and Shoulders: A trend-reversing setup.

Double Tops/Bottoms: The market has reached a turning point.

Triangles: The price will break upwards or downwards, indicating that the consolidation phase is ending.

How to Create a Price Action Trading Strategy

Price action trading is somewhat straightforward. However, you still need to have a specific strategy in place. Here's how to do this in detail:

Step 1: Define Your Market and Time Frame

Before looking into any price charts, first define what asset you are going to trade and what timeframe you want to trade on. One can trade price action on lower or higher timeframes: stocks, forex, commodities, etc. Every timeframe has its characteristics: for example, more turbulence is evident in the lower timeframes, while stronger trends are produced by higher timeframes.

Step 2: Identify Key Levels

Mark the key levels of support and resistance on your chart. These levels provide the potential points of return and enable you to have an idea of the best places to get in and out of trades.

Step 3: Confirm

The most important thing in trading price action is patience. Once you have identified a key level, wait for a confirmation signal-this could be a certain candlestick pattern, such as an engulfing pattern, or even a break of a trendline.

Step 4: Set Stop Loss and Take Profit

One must manage the risk. Always place a stop loss to limit your potential losses if the trade doesn't go your way. Conversely, have a take-profit level where you'll close the trade and bank that profit.

Step 5: Refine and Adapt

As the market is in continuous evolution, price action trading also needs ongoing evolution. Continuous refinement should be done with respect to your approach through reviewing of trades you have taken and modifying your approach according to new price data.

Common Mistakes in Price Action Trading

Overtrading: One may be seduced into laying on many trades, but one should always be on the lookout for setups. Fewer but of high quality always beats the high quantity and low quality.

Market Context: The price action needs to make sense in the broader context of the market. For example, a bearish candlestick pattern will not have as much force in a bull market that's in good shape.

Lack of Discipline: Emotional trading-like cutting losses or overly leveraging a position-can quickly whittle away at one's profits. Stick to one's plan and rules of risk management.

Conclusion

Price action trading is an incredibly powerful and adaptable approach that aligns you with the natural rhythms in the market. Understanding a few crucial ones, like candlestick patterns, support and resistance, and trendlines, will enrich your trading choices, both in how timely they are and in the quality of timing.

At Profithills Education, we firmly believe that mastery of price action will finally equip you with the necessary skills to venture into different markets with confidence. Some cornerstones for being a successful price action trader are practice, patience, and discipline.

0 notes

Text

Candlestick Charts Explained: A Trader's Guide to Market Trends – TraderKnows

A candlestick chart is a technical analysis tool used in financial markets to display price movements of an asset over time. Each "candlestick" represents a specified time period (e.g., one day, one hour) and shows four critical price points: the opening, closing, high, and low prices within that period.

A candlestick consists of a rectangular body and thin lines called wicks (or shadows). If the closing price is higher than the opening price, the body is usually colored green or white, indicating bullish activity. Conversely, if the closing price is lower than the opening, the body is red or black, signaling bearish activity.

There are various candlestick patterns, such as Doji, Hammer, and Engulfing patterns, which traders use to predict potential market movements. For example, a Doji pattern, where the opening and closing prices are almost the same, may indicate market indecision. Patterns like these can be crucial for making informed decisions, especially when combined with other technical indicators. To deepen your understanding of candlestick charts and how they are used in market analysis, check resources like TraderKnows, which provides comprehensive insights into financial tools.

Candlestick charts provide traders with a visual representation of market sentiment, making it easier to spot trends, reversals, and continuations. These charts are valuable in identifying potential entry and exit points for trades. For instance, a series of bullish candlesticks may indicate an upward trend, while bearish candlesticks suggest a potential decline. Using tools like those highlighted by TraderKnows, traders can refine their strategies and enhance their market analysis.

Ultimately, understanding candlestick charts is crucial for both novice and experienced traders. These charts reveal market psychology and help traders interpret price movements more effectively. For a broader exploration of candlestick patterns and their practical applications, TraderKnows offers a variety of educational resources and tools to improve financial knowledge.

0 notes

Text

BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital Options BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital OptionsThe ultimative Price Action guide (7 edition) for any kind of financial instrument (Binary Options, Forex, FX Options, Digital Options) any kind of time frame from 1 min over 5 min up to 15 min, 30 min and above and any kind of broker. This ebook is all you need, especially as a binary option turbo trader or Forex day trader to get profit out of the market, to get out of debt, make yourself a living or help your friends and family and to archieve financial freedom. Don't miss the opportunity to get this ultimative Price Action guide (7 edition)File Size: 12597 KBPrint Length: 118 pagesPublisher: BO Turbo Trader; 7 edition (October 24, 2018)Publication Date: October 24, 2018Content:Mindset for consistent profits- Practice- Win Rate- Discipline- Money Management- Emotions Candlestick Patterns- Hammer, Inverted Hammer, Takuri Line, Shooting Star and Hanging man- Dragonfly Doji, Gravestone Doji- spinning top - long-legged doji, high wave and rickshaw man- Pinbar - Pin Bar - Pinocchio bar or Kangaroo Tail - Tweezer Top and Tweezer Bottom- bearish harami, bullish harami and bullish harami cross and bearish harami cross- three inside down, three inside up- descending hawk and homing pigeon- bearish meeting line - counterattack line and bullish meeting line- bearish belt hold - black opening shaven head - black opening marubozu- bullish belt hold - white opening shaven bottom - white opening marubozu- bearish kicker signal - bullish kicker signal- matching high and matching low- bearish stick sandwich and bullish stick sandwich - bearish breakaway and bullish breakaway- ladder top and ladder bottom - tower top and tower bottom- three stars in the north and three stars in the south- bearish sash pattern and bullish sash pattern- engulfing candlestick pattern or the big shadow pattern- (bearish) dark cloud cover and (bullish) piercing line- Breakaway gap, exhaustion gab, continuation gap and common gaps- rising window and falling window- marubozu and big belt- inside bar and mother bar- evening star, morning star and evening doji star and morning doji star- three white soldiers and three black crowsChart Patterns- Double Top - M Formation - Mammies and Double Bottom - W Formation - Wollahs- J-Hook pattern and inverted J-Hook candlestick pattern- bearish last kiss - bearish pullback and bullish last kiss and bullish breakout- Head and Shoulders and inverted Head and Shoulders Pattern- Trend Channel - uptrend and downtrend- symmetrical triangle- ascending triangle and descending triangle- bullish flag and bearish flag - bullish pennant and bearish pennant - rising wedge and falling wedge- Broadening Bottoms and Broadening Tops- Rectangle Bottoms and Rectangle TopsConcepts- Candlestick Mathematics- Rejection - market move - weak snr and strong snr- trending and ranging market- minor and major trend- adapting forex strategies to binary options turbo trading- proper rejection - invalid rejection- false breakouts - channel breakouts- reversal and retracements- highest probability trading setups- high probability techniques- market pressures and types of market pressures- upper shadow and lower wick or tail- advanced candlestick charting techniques- overbought and oversold - oscilator - RSI CCI Stochastic Oscilator- different market conditions and market conditions examples- cycle of market emotions, psychology and dynamics- trading setups without rejections as confirmation - multiple time frame trading concept, system, methology and strategy- candlestick momenting- direction of candlestick momentum- inside swing and outside swing- support and resistance - minor snr and major snr and much more concepts ... Also by the same author: BOTT Mentorship Self-Study Video Pack 1-4 BOTT Price Action Indicator BOTT Price Action Bible by BO Turbo Trader

0 notes

Text

Master technical analysis with our candlestick pattern guide!

Join our free course and enhance your trading knowledge. 📈✨ Learn to read green and red candlesticks to spot key patterns like Doji, Hammer, and Engulfing. Watch our video for expert insights and boost your trading skills. Perfect for all traders. Start learning today. 🌟📚

Address : 207, Hari Kripa Complex, MP Nagar Zone 2, Madhya Pradesh , Bhopal Contact No.:+918225022022 Visit Now : https://www.takingforward.com/

#TradingTips#CandlestickPatterns#TechnicalAnalysis#StockMarket#ForexTrading#CryptoTrading#FinancialFreedom#StockMarketTips

0 notes

Text

Solana (SOL) at $130: Safety Insights; Shiba Inu (SHIB) Hits Secure $0.000015 Threshold

XRP Potential Reversal with Morning Doji Star Pattern XRP appears poised for a potential reversal as it has formed a morning doji star candlestick pattern, marking a significant technical reversal signal after a prolonged downtrend. The morning doji star pattern typically takes three days to form: Day 1: Continuation of downtrend with a long bearish candlestick. Day 2: Doji candle indicating…

0 notes

Link

0 notes