#demat account comparison

Explore tagged Tumblr posts

Text

Discover the pinnacle of trading with the best online Demat account in India. Streamlined processes, low fees, and advanced tools await. Elevate your investment journey with seamless trading. Open yours today!

#best online demat account in india#most popular demat account in india#best app for demat account#best demat account in india#demat account comparison

0 notes

Text

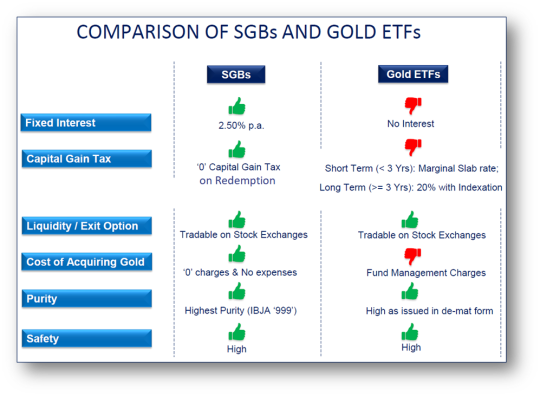

Sovereign Gold Bond vs. Gold ETF: A Comprehensive Comparison for Smart Investors

Over the last few years, the concept of digital gold has arrived in a big way. It started off with gold ETFs and then came the highly popular Sovereign Gold Bond scheme. There are also other digital gold holding vehicles like international gold funds, gold futures and digital gold. In this blog, the focus would largely be on understanding the relative merits and demerits of the sovereign gold bond vs gold ETF debate, and which is more suitable and under what circumstances. Also, a comparison of gold ETF vs SGB is provided on parameters like liquidity, flexibility, charges and tax implications.

What are Sovereign Gold Bonds (SGB) all about?

SGBs or Sovereign Gold Bonds have been around in India since Nov-2015 and have been gradually gaining in heft. These SGBs are central government-backed bonds, denominated in grams of gold. The underlying holding in grams of gold is guaranteed by the central government. In addition, these sovereign gold bonds also bear an interest of 2.50% annually on the issue price, which is paid semi-annually to the investor. Investors also get an upfront discount of Rs. 50/- per gram if the payment mode is digital. SGBs are also advantageous as they do not have the hassles like storing gold, making charges, risk of loss etc.

What really stands out about the SGB is the sovereign guarantee and that the returns are pegged to the price of gold. What the government guarantees is the payment of interest at 2.50% per annum and the holding of gold in grams. Considering that gold has generally given positive returns over longer periods of time, it makes investment in SGBs relatively secure and attractive too.

The SGBs can be held either in physical form or in demat form, as part of the demat account.

Gold ETFs (Exchange Traded Funds)

Unlike SGBs that are issued by the central government, gold ETFs are issued by the mutual fund houses registered with SEBI. They are issued in the form of gold units pegged as equivalent to a certain weight in gold expressed in grams. Gold ETFs are typically closed-ended in that once the NFO period is over, the fund does not offer any purchase or sale of units. However, being Exchange Traded Funds, they are mandatorily listed on the stock exchanges and investors wanting to buy or sell gold ETFs can do so using their existing demat account and trading account.

Gold ETFs are very liquid and hence, entry & exit is hardly a problem without any price damage. You can trade in gold ETFs just as you trade in stocks. It must be noted here that gold ETF issuing mutual funds are required to maintain physical gold equivalent to the units sold with a gold custodian bank as a backing.

Sovereign Gold Bond VS Gold ETF

Let's compare the sovereign gold bonds and the gold ETFs on a variety of parameters like returns, risk, flexibility, liquidity, taxation, etc. This sovereign gold bond vs gold ETF comparison will allow investors to make the best choice.

Here are the highlights of the gold ETF vs SGB debate.

1. How do SGBs and Gold ETFs compare in returns?

Remember, both SGBs and gold ETFs are linked to the price of gold. If the price of gold goes up, then the capital appreciation will benefit the SGB and also the gold ETFs. The difference lies in the interest paid. For instance, SGBs pay an additional assured interest of 2.50% per annum, but such assured returns do not exist in gold ETFs.

2. How do SGBs and Gold ETFs compare in risk?

One can argue that since both are backed by gold, there is no asset risk; however, there is a difference.

Even though SGBs do not have physical gold backing, the returns on these bonds are pegged to gold prices. And they have an explicit guarantee by the central government regarding the gold holding and the interest payable. In the case of gold ETFs, there is no explicit guarantee (sovereign or otherwise) but they do have the physical gold with the gold custodian bank.

3. How do SGBs and Gold ETFs compare in taxation?

Gold ETFs are treated as non-equity assets and hence the capital gains, if any, would be treated as short-term gains if held for less than 3 years and taxed at the marginal tax rate applicable. If the gold ETFs are held for more than 3 years, they are long-term capital gains and they attract tax at 20% with the benefit of indexation.

In the case of SGBs, the method of taxation is the same, with just one critical difference. If the SGBs are held till redemption, then any capital gains on the SGBs are fully tax-free in the hands of the investor. However, interest on gold bonds is fully taxable.

4. How do SGBs and Gold ETFs compare in costs?

Sovereign gold bonds don’t have any recurring cost of ownership. Gold ETFs on the other hand, have annual charges, including brokerage and expense ratio ranging from 0.50 – 1.00%. The costing of SGBs is a lot more transparent than Gold ETFs.

5. How do SGBs and Gold ETFs compare in liquidity?

Gold ETFs can be bought and sold in the secondary market using your existing trading and demat account with your stock broker. SGBs can be bought at the new issue period, which can be several times during the fiscal year. Outside that, SGBs are listed on the stock exchange, but the liquidity is limited.

Let’s look at the table below to quickly review the gold ETF vs SGB debate

To sum up the sovereign gold bond vs gold ETF debate, both are digital modes of holding gold and are linked to gold prices.

Among 6 key parameters viz. fixed interest, taxation, liquidity, costing, purity and safety, SGB stands out across all. On the other hand, Gold ETFs are highly liquid and do not have a maximum investment limit, allowing investors to buy as much as they want while in case of SGBs maximum investment limit for individual investors is 4kg in a Financial Year

Eventually, investors need to take a call on the gold ETF vs SGB choice based on their financial goals & risk profile; and returns, risk, liquidity, taxation, & convenience the products have to offer.

Source URL: https://www.sbisecurities.in/blog/sovereign-gold-bond-vs-gold-etf

0 notes

Text

GOLD MUTUAL FUNDS: TYPES AND BENEFITS OF INVESTMENT

Gold mutual funds: Types and benefits

Gold has always been one of the preferred investment options of investors, particularly in India as it holds great value in terms of monetary and culture. It is a symbol of status in Indian society. Investment in gold can be done in many ways. For example, traditionally it was purchased in form of jewelry or gold bars. But as the world is changing, so does the investment avenues. There are many new options that have emerged like gold ETF, gold funds, sovereign gold bond scheme, etc. in which investors like to invest.

In this article, we are going to talk about gold funds or gold mutual funds, its types and benefits, etc.

So let’s start with the meaning of gold mutual fund

What do you mean by gold Mutual fund?

A gold mutual fund is a type of mutual fund that demands investment in various forms of gold, as the name suggests. The investment in these funds generally made on physical gold and on stocks of mining companies and stocks of gold producing and distributing syndicates providing an alternative of physical gold investment to investors. The main objective of these types of funds is to provide a cushion against market collapses.

Types of Gold Mutual Funds:

There are three types of gold funds:

Gold mining funds: gold mining funds are the types of gold funds that invest in gold mining companies. The return of these funds is dependent on the performance of the mining companies.

Gold ETF: Gold ETF or Gold Exchange Trade Funds are those funds that have gold as their underlying asset. They closely track the performance of domestic prices of gold.

Gold fund of funds: Gold FoF or gold Fund of Fund are those funds that invest in units of gold ETF.

Advantages of investing in Gold Mutual funds

There are many advantages of investing in gold mutual funds that you get when you invest in gold mutual funds.

Some of the major advantages are discussed below:

The first and foremost advantage of gold fund investment is that there is no issue of storage that always happens when you purchase physical gold. The investments are in electronic form so there is no concern about the storage of the gold. This makes it one of the safest alternatives to physical gold.

Second, investing in gold mutual funds make your portfolio more diversified and reduce your risk. That makes it a good option for investors looking for low-risk investments.

Third, there is no need for you to have a Demat account to invest in gold mutual funds. So you can make an investment through a mutual fund advisor with a nominal account.

Fourth, there is a great advantage of liquidity that you can avail when you invest in gold mutual funds rather than physical gold. You can sell or redeem your funds easily.

Fifth, investment in gold mutual funds are cost-effective in comparison to physical gold. Gold mutual funds provide great flexibility to their investors. The investors can also invest in gold mutual funds with SIP (systematic Investment Plan). Thus providing small investors the advantage to invest in gold mutual funds and avail the benefits of diversification and reduce their risk.

Last but not the least, this advantage is important which gets ignored sometimes by the investors that investment in gold mutual funds provides protection during the period of inflation.

Risk on investing in Gold Mutual Funds

Since you are now aware of the advantages of Gold Mutual funds now it’s time to see what are the risks involved in it. Because before making any investment you should consider the risk associated with it and compare it with your risk-taking capacity. So let’s start-

To read more, Click the link below

0 notes

Text

Smallcase vs Mutual Fund

Mutual funds and Smallcases are the two asset structures in contention, and we’ll compare them over the course of this article to understand the fundamental difference between Smallcase and mutual funds.

As investors, most of us spend a considerable amount of time window-shopping for the right investment avenues. “Should I invest in the safety of debt instruments or should I stay equity-focused? Should I pick evergreen stocks or can I benefit more from trading the seasonal ones? What about adding some cryptocurrencies to my portfolio? How long should I stay invested?” Questions, so many questions. The truth is that unless you’re an exceptionally nuanced investor with well-rounded insights about multiple sectors, a diversified portfolio can hold the answer to most ‘what and why questions as far as investments are concerned. Two financial avenues facilitate this diversification optimally; the first is a household name and the second has emerged as a buzzword in the last year or two. Mutual funds and Smallcases are the two asset structures in contention, and we’ll compare them over the course of this article to understand the fundamental difference between Smallcase and mutual funds.

What are Mutual Funds?

A mutual fund is a pool of money collected from many investors to invest in securities like stocks, bonds and other assets. Professional fund managers, vetted and hired by mutual fund houses or Asset Management Companies (AMCs) are responsible for picking the constituents of the fund and allocating capital; they can attempt capital gains or income production based on the investment objectives of the fund as per the prospectus set out at the time of the fund launch (called NFO).

What is a Smallcase?

A Smallcase, on the other hand, represents a capital allocation structure similar to portfolio management services (PMS) that were previously reserved for wealthy individuals (Read: HNIs and UHNIs). As a product, this is an idea that has caught the fancy of many well-heeled millennials as well as on-the-brink wealthy, ever since SEBI hiked the minimum investment amount for portfolio management services (PMS) from ₹25 lakh to ₹50 lakh in November 2019. In some sense, Smallcase may be called affordable PMS – with a starting price as low as Rs199/month. Basically, a Smallcase is a basket of stocks or ETFs, decisively created by the top qualified and Registered Investment Advisors (RIAs) in India, based upon a theme, strategy, or objective.

David vs Goliath: A legacy product vs a promising challenger

If we have to compare the sheer size of the market with respect to Assets Under Management (AUM), mutual funds represent ₹36.74 trillion as of September 30, 2021. In comparison, Smallcases are a disruptive product that has been around for approximately 6 years now. Quoting the founder and CEO Vasanth Kamath “Our users multiplied three times from 9 lakh in March 2020 to 28 lakh in March 2021.” In FY21, the firm saw Rs 8,000 crore invested through its platform. A drop in the ocean, as far as the larger financial products industry is concerned.

Smallcase vs Mutual Funds: Points of Comparison

1. Exercise Control

Investing In Smallcases potentially offers investors better control over securities as the shares are credited directly in the Demat account. Having the portfolio right at your fingertips allows you to time your exit and know where each investment goes, which isn’t possible with mutual funds; you can cherry-pick which mutual fund you want to invest in, but the customization ends there.

2. Risk Mitigation Mechanisms

Smallcases are thematic investments; they invest in companies and securities that follow an underlying strategy or idea. For example, there can be a Smallcase that focuses on Clean Energy companies or fast-growing tech companies that focus on enterprise software integrations. Since these ideas are highly specific, diversification is restricted. For those intent on diversification, mutual funds offer a basket of good companies that are related by larger themes such as industry type and revenue benchmarks that may be a better hedge against volatility over several business cycles.

3. Cost of Leaving

In many mutual funds, there is an in-built penalty for liquidating your assets before the minimum stipulated time (generally just about a year)- this expense is called the exit load which ranges from 1-2% of the total investment. Typically, all mutual fund houses adjust this amount against the net asset value (NAV) of the fund. Smallcases, by design, allow investors to buy individual units of securities that are directly credited in the demat account like common shares. Since there is no exit load on selling shares, there is no exit load on selling smallcases.

4. Management Fee

Any asset allocation structure is only as good as the people managing it, i.e., the fund manager- who in these cases is typically someone who holds high repute in the financial markets. Understandably, this expertise attracts a certain cost, apart from the cost of monitoring and managing the fund. In the case of mutual funds, this cost, called the expense ratio, is a percentage of the total fund value, capped at 2.5% by SEBI. Smallcases have no fixed range – the cost differs from case to case and RIA to RIA, depending on the nature and theme of the basket of investments. For example, TejiMandi charges just Rs 199/month for its smallcases!

5. Access to Returns

Smallcases give investors direct access to their holdings since the shares are directly credited to their demat account. Hence, all corporate actions such as dividend distribution as well as the issue of bonus shares take place directly with the investors. In the case of mutual funds, the returns are collected in real-time but distributed quarterly.

6. Volatility

Due to the nature of the theme-wide concentration of Smallcases, they are typically more volatile than the stock market in general since the risk is concentrated in a specific strategy or idea. However, as one of the fundamental principles of finance states – the higher the risk, the higher is your potential for gains. Mutual funds, on the other hand, spread the risk across companies working in different areas even if the fund is concentrated in a specific industry. Hence, the latter is more resilient during market ups and downs.

0 notes

Text

Smallcase vs Mutual Funds: Key Differences

Mutual funds and Smallcases are the two asset structures in contention, and we’ll compare them over the course of this article to understand the fundamental difference between Smallcase and mutual funds.

As investors, most of us spend a considerable amount of time window-shopping for the right investment avenues. “Should I invest in the safety of debt instruments or should I stay equity-focused? Should I pick evergreen stocks or can I benefit more from trading the seasonal ones? What about adding some cryptocurrencies to my portfolio? How long should I stay invested?” Questions, so many questions.

The truth is that unless you’re an exceptionally nuanced investor with well-rounded insights about multiple sectors, a diversified portfolio can hold the answer to most ‘what and why questions as far as investments are concerned. Two financial avenues facilitate this diversification optimally; the first is a household name and the second has emerged as a buzzword in the last year or two. Mutual funds and Smallcases are the two asset structures in contention, and we’ll compare them over the course of this article to understand the fundamental difference between Smallcase and mutual funds.

What are mutual funds?

A mutual fund is a pool of money collected from many investors to invest in securities like stocks, bonds and other assets. Professional fund managers, vetted and hired by mutual fund houses or Asset Management Companies (AMCs) are responsible for picking the constituents of the fund and allocating capital; they can attempt capital gains or income production based on the investment objectives of the fund as per the prospectus set out at the time of the fund launch (called NFO).

What is a Smallcase?

A Smallcase, on the other hand, represents a capital allocation structure similar to portfolio management services (PMS) that were previously reserved for wealthy individuals (Read: HNIs and UHNIs). As a product, this is an idea that has caught the fancy of many well-heeled millennials as well as on-the-brink wealthy, ever since SEBI hiked the minimum investment amount for portfolio management services (PMS) from ₹25 lakh to ₹50 lakh in November 2019. In some sense, Smallcase may be called affordable PMS – with a starting price as low as Rs199/month. Basically, a Smallcase is a basket of stocks or ETFs, decisively created by the top qualified and Registered Investment Advisors (RIAs) in India, based upon a theme, strategy, or objective.

David vs Goliath: A legacy product vs a promising challenger

If we have to compare the sheer size of the market with respect to Assets Under Management (AUM), mutual funds represent ₹36.74 trillion as of September 30, 2021. In comparison, Smallcases are a disruptive product that has been around for approximately 6 years now. Quoting the founder and CEO Vasanth Kamath “Our users multiplied three times from 9 lakh in March 2020 to 28 lakh in March 2021.” In FY21, the firm saw Rs 8,000 crore invested through its platform. A drop in the ocean, as far as the larger financial products industry is concerned.

Smallcase vs Mutual Funds: Points of Comparison

1. Exercise Control

Investing In Smallcases potentially offers investors better control over securities as the shares are credited directly in the Demat account. Having the portfolio right at your fingertips allows you to time your exit and know where each investment goes, which isn’t possible with mutual funds; you can cherry-pick which mutual fund you want to invest in, but the customization ends there.

2. Risk Mitigation Mechanisms

Smallcases are thematic investments; they invest in companies and securities that follow an underlying strategy or idea. For example, there can be a Smallcase that focuses on Clean Energy companies or fast-growing tech companies that focus on enterprise software integrations. Since these ideas are highly specific, diversification is restricted. For those intent on diversification, mutual funds offer a basket of good companies that are related by larger themes such as industry type and revenue benchmarks that may be a better hedge against volatility over several business cycles.

3. Cost of Leaving

In many mutual funds, there is an in-built penalty for liquidating your assets before the minimum stipulated time (generally just about a year)- this expense is called the exit load which ranges from 1-2% of the total investment. Typically, all mutual fund houses adjust this amount against the net asset value (NAV) of the fund. Smallcases, by design, allow investors to buy individual units of securities that are directly credited in the demat account like common shares. Since there is no exit load on selling shares, there is no exit load on selling smallcases.

4. Management Fee

Any asset allocation structure is only as good as the people managing it, i.e., the fund manager- who in these cases is typically someone who holds high repute in the financial markets. Understandably, this expertise attracts a certain cost, apart from the cost of monitoring and managing the fund. In the case of mutual funds, this cost, called the expense ratio, is a percentage of the total fund value, capped at 2.5% by SEBI. Smallcases have no fixed range – the cost differs from case to case and RIA to RIA, depending on the nature and theme of the basket of investments. For example, TejiMandi charges just Rs 199/month for its smallcases!

5. Access to Returns

Smallcases give investors direct access to their holdings since the shares are directly credited to their demat account. Hence, all corporate actions such as dividend distribution as well as the issue of bonus shares take place directly with the investors. In the case of mutual funds, the returns are collected in real-time but distributed quarterly.

6. Volatility

Due to the nature of the theme-wide concentration of Smallcases, they are typically more volatile than the stock market in general since the risk is concentrated in a specific strategy or idea. However, as one of the fundamental principles of finance states – the higher the risk, the higher is your potential for gains. Mutual funds, on the other hand, spread the risk across companies working in different areas even if the fund is concentrated in a specific industry. Hence, the latter is more resilient during market ups and downs. Read more about smallcase vs mutual funds

0 notes

Text

GOLD MUTUAL FUNDS: TYPES AND BENEFITS OF INVESTMENT

There are many advantages of investing in gold mutual funds that you get when you invest in gold mutual funds.

Some of the major advantages are discussed below:

The first and foremost advantage of gold fund investment is that there is no issue of storage that always happens when you purchase physical gold. The investments are in electronic form so there is no concern about the storage of the gold. This makes it one of the safest alternatives to physical gold.

Second, investing in gold mutual funds make your portfolio more diversified and reduce your risk. That makes it a good option for investors looking for low-risk investments.

Third, there is no need for you to have a Demat account to invest in gold mutual funds. So you can make an investment through a mutual fund advisor with a nominal account.

Fourth, there is a great advantage of liquidity that you can avail when you invest in gold mutual funds rather than physical gold. You can sell or redeem your funds easily.

Fifth, investment in gold mutual funds are cost-effective in comparison to physical gold. Gold mutual funds provide great flexibility to their investors. The investors can also invest in gold mutual funds with SIP (systematic Investment Plan). Thus providing small investors the advantage to invest in gold mutual funds and avail the benefits of diversification and reduce their risk.

Last but not the least, this advantage is important which gets ignored sometimes by the investors that investment in gold mutual funds provides protection during the period of inflatio

To read more click the link shown below.

https://news.jugaadin.com/gold-mutual-funds-types-and-benefits-of-investment/

0 notes

Text

Why Stock Knocks Is The Best Investment Research Platform

Stock Knocks is a one-of-a-kind platform that provides comprehensive information about listed and unlisted companies, advanced analytical tools, and the opportunity to connect with market participants via an industry-specific social network.. These distinct features are offered at zero subscription rates, making Stock Knocks the best investment research platform in India today. Let us look at what all a market enthusiast can do on Stock Knocks!

RESEARCH LISTED COMPANIES

Stock Knocks has comprehensive information on all listed companies in India. This includes company background, financial data, management particulars, shareholding profile, and corporate announcements. Stock Knocks also provides price data and market updates in real-time. Users can use the 50+ data points that has been carefully curated from company Annual Reports to study companies in detail and make robust investment decisions.

ANALYSE COMPANIES USING ADVANCED TOOLS

Stock Knocks provides advanced analytical tools like ratio analysis, customised peer comparison, flexible watchlists, technical analysis charting software etc. These tools can be used to analyse performance of companies on different parameters, to assess whether a company is over-valued or under-valued and to calculate Return on Investment (ROI). Stock Knocks is one of the only platform in India to provide users unrestricted use of these advanced features for free.

DISCOVER HIDDEN INVESTMENT OPPORTUNITIES IN UNLISTED SPACE

In addition to providing a comprehensive database for listed companies, Stock Knocks also provides structured, detailed data on 500+ unlisted companies. Unlisted companies are companies that are not registered on formal stock exchanges. However, these companies are often traded in over-the-counter (OTC) markets aka grey markets. Investing in good quality unlisted companies can allow investors to participate in a company’s growth from an early stage and make supernormal profits that are not common in the listed space. Stock Knocks provides information on such unquoted companies and allows investors to discover hidden investment opportunities in the unlisted space.

EXECUTE TRADES

Stock Knocks allows users to integrate their DEMAT account with their Stock Knocks account. The integration is very straightforward and allows users to search, scan, study and execute all in one place. Stock Knocks also facilitates buying and selling of unlisted shares in the grey market.

ENGAGE WITH MARKET COMMUNITY

Stock Knocks platform has a unique social network component, that gives users the opportunity to connect with other market participants. These market participants can range from industry experts, investment advisors, research analysts, brokers, intermediaries, to fellow traders and investors. Using the COMMUNITY page, Stock Knock users can interact with each other, share ideas and opinions, and even avail paid services of market experts. Users can also broadcast messages via the COMMUNITY CHANNELS and build their own following. Stock Knocks is the one-stop-destination for everything related to the stock market. It provides essential tools for research, fundamental analysis, technical analysis, unlisted investments and community building. These distinct features are offered at zero subscription rates, making Stock Knocks the best investment research platform in India today.

1 note

·

View note

Text

5 Investment Case for Performance Management Systems

Customized investment portfolios, curated and managed by professional portfolio managers with SEBI licenses, are available through Portfolio Management Services (PMS). A diversified portfolio tailored to your preferred level of risk and return!

Before we get into the benefits of investing, there are a few important things to remember.

The investment account you use, known as a "Demat," is your portfolio. If you want to get anywhere in life, it's all up to your Demat account. Because of this, PMS is a promising investment market.

Stocks, bonds, commodities, real estate, structured products, and cash are all fair game for PMS.

PMS provides greater independence than Mutual Funds by providing more information, more choices, and greater flexibility.

1) Investing Guidance From Industry Professionals

PMS offers customized investment strategies to serve the diverse requirements of its clientele. Depending on their comfort level with risk, investors can select from several different portfolio options, such as those focused on large, mid, multi, or small companies.

Unlike mutual funds, Portfolio Management Services grants you substantial ownership of a company. Individual investors typically work with a portfolio manager who tailors investment strategies and trade execution to their specific needs (depending on the type of PMS selected). PMS is significant for two reasons: investors who want a professional to handle their equity and fixed-income holdings directly, and clients who want to diversify their equity holdings by investing in niche markets or using thematic strategies.

2) Total Transparency

As required by law, PMS fully discloses all costs to all investors.

The SEBI mandates that portfolio managers put their client's money into stocks, bonds, money market instruments, mutual fund shares, and any other securities the board may approve from time to time.

3) Meticulous Threat Assessment

Checks like these are part of the risk management plan that managers use.

Detailing the portfolio's make-up and value as of the date of report, including a description of the securities and goods held, the number of securities, the value of each security held, the number of units of goods, the value of each good, the cash balance, and the aggregate value of the portfolio.

Details of all purchases and sales made during the reporting period, along with the dates and amounts.

4) Extremely Tight Controls!

While PMS offers investors a great deal of leeway, it does so within the framework of a legally binding relationship between investors and fund managers. Asset Management Companies (AMCs) and PMS managers must meet stringent requirements set by the Securities and Exchange Board of India (SEBI).

5) Seeking Alpha Constantly

A primary goal of a PMS is to generate sizable alpha in comparison to relevant benchmark indices. It outperforms other investment options like Mutual Funds because it is tied to ongoing modifications in response to changing circumstances.

Researchers work with a portfolio manager to analyze the financial market and recent events. They monitor a client's portfolio so that they can make educated (entry/exit) trades and protect their returns even in the face of market volatility.

0 notes

Text

Zerodha Account Opening Charges: Everything You Need to Know

Zerodha is a leading online stockbroker in India, known for its innovative trading platform, low brokerage charges, and top-notch services. Understanding the account opening charges is crucial for any trader or investor who is looking to open a Zerodha account. In this blog post, you will get a comprehensive understanding of Zerodha account opening charges, the process to open an account, the benefits, and frequently asked questions.

Zerodha Account Opening Charges:

Zerodha has a very simple and transparent pricing structure, with no hidden charges or fees. The charges for opening a Zerodha account include a one-time account opening fee, annual maintenance charges (AMC) for the demat account, and brokerage for trading. In comparison to other brokers, Zerodha has one of the lowest account opening charges and brokerage fees, making it an attractive option for traders and investors.

Zerodha Account Opening Process:

The process to open a Zerodha account is straightforward and can be completed online. Here’s a step-by-step guide to help you open a Zerodha account:

Visit the Zerodha website and click on the “Open an Account” button.

Fill in the online application form with personal and financial details.

Submit the necessary KYC and other documents as required.

Once the account is approved, you will receive login credentials and can start trading.

Zerodha Account FAQs:

Here are some of the most common questions about Zerodha account opening charges:

How much does it cost to open a Zerodha account?

The charge for opening a Zerodha Trading and Demat account online is Rs 300. Rs 200 for Equity and Rs 100 for Commodity. Commodity derivatives can be traded through MCX by enabling the Commodity segment after the Trading Demat account is opened.

What are the annual maintenance charges for Zerodha demat account?

Zerodha charges Rs 300 as AMC (annual maintenance charges) for the Demat account.

Is there a difference in charges for intraday trading and delivery trading?

Yes, there is a difference in brokerage charges for intraday trading and delivery trading. Intraday trading charges are different from delivery-based trading charges. The charges for intraday trading can range from Flat ₹ 20 or 0.03% (whichever is lower) per executed order. On the other hand, the delivery trading charges are free. Also there are other statutory charges like STT, GST, stamp duty, exchange fees, and turnover tax.

Are there any hidden charges for Zerodha account?

There are no hidden charges in Zerodha, but are some additional charges apart from brokerage and taxes.

Additional charges of Rs 50 per order for call and trade facility

DP (Depository participant) charges are Rs 13.5 + GST per scrip per day

Conclusion:

In conclusion, Zerodha is a great option for traders and investors due to its low account opening charges, transparent pricing structure, and top-notch services. The process to open a Zerodha account is straightforward and can be completed online. Additionally, Zerodha has a wide range of benefits, including low brokerage fees, a user-friendly trading platform, and a range of investment options. Overall, if you are looking to start trading or investing, Zerodha is definitely worth considering.

0 notes

Text

#10 Best Demat Account in India 2023#Best Demat Account in India#est Demat Account in India 2023#top Demat account#ist of Top 10 Demat accounts in India#best demat account in india for beginners#demat account charges list#demat account comparison

0 notes

Text

Difference Between Commodity Market and Stock Market

The market provides a wide range of assets where people can invest their unused funds to make money. Investors seeking strong returns typically invest in either equities or commodities, which are two different asset classes. Stocks signify ownership in a corporation, whereas commodities are items like metals, energy, and agricultural products. Both of these asset groups have substantial potential for profit. They are exchanged, nonetheless, on various markets. Therefore, before investing in either, it is crucial to understand the differences between the stock market and the commodity market.

By inexperienced investors, the phrases stock market & commodity market are frequently used interchangeably. Even so, there are several key distinctions between the two that might guide your choice of investment. The distinctions between these two markets, if you're novice to investing, will become clearer as your wealth increases. Nevertheless, even seasoned investors occasionally succumb to the parallels between equities and commodities. There are certain distinctions between them, though, and we'll discuss those in this post. If you're not familiar with how the stock market operates, you might want to review the fundamentals before going any further.

Stock Exchange

It alludes to a group of stock exchanges where shares are bought, sold, and traded. As was already established, stocks represent a company's ownership. These are best understood as components of the total equity of a corporation. Each business understands only Rs. 1000 of a company's total equity if its capital is worth Rs. 1000 crores and there are 1 crore shares. One share of stock entitles the holder to only that fraction of the company's ownership.

The value of one's holding regularly varies with adjustments in the statement of financial position, driven about by a multiplicity of circumstances, both internally and externally. Depending on their investing goals, a person may decide to sell their stocks the same day they are purchased, a year later, or even 10 years later.

The stock market, which has numerous exchanges within it, is the market that makes it possible to purchase and sell. In the Indian stock market, there really are two primary stock exchanges -

● National Stock Exchange

● Bombay Stock Exchange

Individuals must have a trade and DEMAT account in order to invest in equities listed on either of these markets or others.

Commodity Market

It is a commodity market, as the name would imply. These products fall into two categories:

● Hard commodities

● Soft commodities

The former speaks of products that are mined and extracted, such as crude gold and oil. These are 2 of the most valuable and traded commodities on the planet. Rice, wheat, eggs, pigs, cattle, and other agricultural commodity and livestock items are included in the latter group. Comparatively speaking to hard goods, these often have a significantly shorter lifespan.

These products can be bought, sold, and traded in commodity markets. The trading process is one of the comparisons between commodities and stocks. The majority of dealers that trade commodities do so using futures contracts. These agreements bind the parties to carry out a transaction at the agreed-upon price and on the agreed-upon date. Futures contracts are frequently used by manufacturers and farmers as a hedge against possible losses. These, nevertheless, also serve as a remarkable tool for realising a profit.

A person may decide to invest immediately in commodities. To that goal, India has six commodity exchanges:

● Multi Commodity Exchange (MCX)

● Ace Derivatives Exchange (ACE)

● The Universal Commodity Exchange (UCX)

● National Multi Commodity Exchange (NMCE)

● Indian Commodity Exchange (ICEX)

● National Commodity and Derivatives Exchange (NCDEX)

What distinguishes the commodity market from the stock market?

Analyzing the influence of various economic elements on each market is crucial if one wants to clearly comprehend the differences between both the stock market or commodity market.

● Inflation

A rising tendency in the prices of almost all items in an economy is referred to as inflation. Inflation typically happens along with rising consumer income. The former does, however, occasionally surpass the latter.

A commodity market flourishes in an inflationary environment because as raw material costs rise, a growing number of investors turn to those markets. As a result, the cost of manufactured items rises, which lowers consumption. It spirals into subpar performance across numerous industries, causing the stock market to move downward. It's one of the key distinctions between the stock market and the commodity market.

● US dollar's value

The impact of USD on gold is extremely pronounced. The value of gold is inversely correlated to the US dollar. Typically, when the USD is performing poorly, investors look to gold as a safe haven. On the other hand, if the US currency strengthens, investors are less likely to like it.

In other instances, as in the most recent recession that shook the market in late February, this propensity for gold also correlates with such a disinterest in the stock market. Before choosing to invest in either, it is essential to understand the differences between the stock market and the commodity market. In order to make an informed choice in these marketplaces, it's crucial to analyze the possibilities available.

#wheat price#steel prices#palm oil price#sugar price#coffee price#ai techniques#oil forecast#soybean price today#commodity prices#metal price#silver forecast#gold forecast#palm oil price today#cotton price#crude palm oil price#commodity futures prices#gold price forecast#coal price in india#oil price forecast

0 notes

Text

The Top Tradable Currencies In The World

Because they allow you to trade currencies, people occasionally refer to the foreign exchange markets, or forex, as a "banker's game." This could be an excellent approach to diversify your investments. If your portfolio has struck a brick wall, this is very crucial. You have several possibilities on the FX markets when other global markets aren't moving. Furthermore, it's increasingly simple to trade FX online, and both novice and seasoned traders are participating in the market.

Before deciding how to invest in stocks or forex, it's important to learn about forex and the basics that make it work. The key to a profitable investment and future success as a trader or investor is to learn as much as you can. So, here is a list of the central banks of the four currencies that all traders need to know about.

1. The strong US dollar

No one has ever begun online forex trading without familiarizing themselves with the USD, or US dollar. It was established in 1913 by the Federal Reserve Act and is a member of the Federal Reserve System (the Fed). The United States of America, which has the biggest economy in the world, uses the USD, sometimes known as the "greenback," as its "home denomination." The USD is underpinned by economic fundamentals like the GDP (gross domestic product), the number of jobs, and the volume of goods produced, much like other currencies.

However, if you trade currencies online, you should be aware that the US dollar is significantly influenced by the central bank and any remarks it makes regarding interest rate policy. The US dollar's usage as a benchmark for trading against other significant global currencies including the British pound, the euro, and the Japanese yen is its most significant feature.

2. European Euro

The European Central Bank oversees the EUR, or euro. All 19 of the member nations of the eurozone utilize the Euro. The USD's worst adversary, so the saying goes, is the Euro. In comparison to the British pound or the Australian dollar, the EUR usually moves more slowly. On a typical trading day, the base currency fluctuates by roughly 70 to 80 percentage points (pips), with a daily average volatility of about 100 pips. Time management is crucial when dealing with the euro. Trading procedures for FX (forex) must be properly planned because the forex market is open around-the-clock.

3. The Japanese Yen Is Easy to Understand

Third-largest economy in the world uses the Japanese yen as its currency. The yen is under the control of the Bank of Japan. Every investor who does forex trading online is aware that the JPY trades as a "carry-trade" component. The JPY competes with currencies that offer higher yields despite having a low interest rate. They are the Australian and New Zealand dollars, as well as the British pound. Forex traders must consider technical aspects over the long run because the underlying has a propensity to behave messily.

4. The Pound of England

The British pound is governed by Bank of England regulations (GBP). Because you can deposit any profits you make directly into your bank account, you can trade currencies without having a demat account. The currency itself is the asset, and while the British pound is more erratic than the euro, it might still be quite profitable for you. It is frequently referred to as the "cable" or "pound sterling," and it tends to fluctuate more during the day. Additionally, a 20 pip narrow range with 100–150 pip swings is possible for the GBP. Since the British pound/Swiss franc and the British pound/Japanese yen are two popular pairs for international online forex trading, The currency's volatility is likely to be at its highest during US and British trading hours. In Asia, volatility is at its lowest during trading hours.

Open a demat account online with Zebu and begin your currency trading journey right away if you want to trade currencies in India.

#online trading company#online trading platform#lowest brokerage#stock market#stock market basics#basics of share market#stock market beginner#stock split#stock trading

0 notes

Text

Best Stock Broker Review

Get full review of the top stock brokers in India to open a Demat account, and compare brokerage charges, account opening charges and features with other brokers in just a few clicks.

#stock broker#brokerage#stock market#demat account#open demat account#broker comparison#stock broker reviews

0 notes

Text

What is the difference between Smallcase vs Mutual Fund?

Mutual funds and Smallcases are the two asset structures in contention, and we’ll compare them over the course of this article to understand the fundamental difference between Smallcase and mutual funds.

As investors, most of us spend a considerable amount of time window-shopping for the right investment avenues. “Should I invest in the safety of debt instruments or should I stay equity-focused? Should I pick evergreen stocks or can I benefit more from trading the seasonal ones? What about adding some cryptocurrencies to my portfolio? How long should I stay invested?” Questions, so many questions.

The truth is that unless you’re an exceptionally nuanced investor with well-rounded insights about multiple sectors, a diversified portfolio can hold the answer to most ‘what and why questions as far as investments are concerned. Two financial avenues facilitate this diversification optimally; the first is a household name and the second has emerged as a buzzword in the last year or two. Mutual funds and Smallcases are the two asset structures in contention, and we’ll compare them over the course of this article to understand the fundamental difference between Smallcase and mutual funds.

What are mutual funds?

A mutual fund is a pool of money collected from many investors to invest in securities like stocks, bonds and other assets. Professional fund managers, vetted and hired by mutual fund houses or Asset Management Companies (AMCs) are responsible for picking the constituents of the fund and allocating capital; they can attempt capital gains or income production based on the investment objectives of the fund as per the prospectus set out at the time of the fund launch (called NFO).

What is a Smallcase?

A Smallcase, on the other hand, represents a capital allocation structure similar to portfolio management services (PMS) that were previously reserved for wealthy individuals (Read: HNIs and UHNIs). As a product, this is an idea that has caught the fancy of many well-heeled millennials as well as on-the-brink wealthy, ever since SEBI hiked the minimum investment amount for portfolio management services (PMS) from ₹25 lakh to ₹50 lakh in November 2019. In some sense, Smallcase may be called affordable PMS – with a starting price as low as Rs199/month. Basically, a Smallcase is a basket of stocks or ETFs, decisively created by the top qualified and Registered Investment Advisors (RIAs) in India, based upon a theme, strategy, or objective.

David vs Goliath: A legacy product vs a promising challenger

If we have to compare the sheer size of the market with respect to Assets Under Management (AUM), mutual funds represent ₹36.74 trillion as of September 30, 2021. In comparison, Smallcases are a disruptive product that has been around for approximately 6 years now. Quoting the founder and CEO Vasanth Kamath “Our users multiplied three times from 9 lakh in March 2020 to 28 lakh in March 2021.” In FY21, the firm saw Rs 8,000 crore invested through its platform. A drop in the ocean, as far as the larger financial products industry is concerned.

Smallcase vs Mutual Funds: Points of Comparison

1. Exercise Control

Investing In Smallcases potentially offers investors better control over securities as the shares are credited directly in the Demat account. Having the portfolio right at your fingertips allows you to time your exit and know where each investment goes, which isn’t possible with mutual funds; you can cherry-pick which mutual fund you want to invest in, but the customization ends there.

2. Risk Mitigation Mechanisms

Smallcases are thematic investments; they invest in companies and securities that follow an underlying strategy or idea. For example, there can be a Smallcase that focuses on Clean Energy companies or fast-growing tech companies that focus on enterprise software integrations. Since these ideas are highly specific, diversification is restricted. For those intent on diversification, mutual funds offer a basket of good companies that are related by larger themes such as industry type and revenue benchmarks that may be a better hedge against volatility over several business cycles.

3. Cost of Leaving

In many mutual funds, there is an in-built penalty for liquidating your assets before the minimum stipulated time (generally just about a year)- this expense is called the exit load which ranges from 1-2% of the total investment. Typically, all mutual fund houses adjust this amount against the net asset value (NAV) of the fund. Smallcases, by design, allow investors to buy individual units of securities that are directly credited in the demat account like common shares. Since there is no exit load on selling shares, there is no exit load on selling smallcases.

4. Management Fee

Any asset allocation structure is only as good as the people managing it, i.e., the fund manager- who in these cases is typically someone who holds high repute in the financial markets. Understandably, this expertise attracts a certain cost, apart from the cost of monitoring and managing the fund. In the case of mutual funds, this cost, called the expense ratio, is a percentage of the total fund value, capped at 2.5% by SEBI. Smallcases have no fixed range – the cost differs from case to case and RIA to RIA, depending on the nature and theme of the basket of investments. For example, TejiMandi charges just Rs 199/month for its small cases!

5. Access to Returns

Smallcases give investors direct access to their holdings since the shares are directly credited to their demat account. Hence, all corporate actions such as dividend distribution as well as the issue of bonus shares take place directly with the investors. In the case of mutual funds, the returns are collected in real-time but distributed quarterly.

6. Volatility

Due to the nature of the theme-wide concentration of Smallcases, they are typically more volatile than the stock market in general since the risk is concentrated in a specific strategy or idea. However, as one of the fundamental principles of finance states – the higher the risk, the higher is your potential for gains. Mutual funds, on the other hand, spread the risk across companies working in different areas even if the fund is concentrated in a specific industry. Hence, the latter is more resilient during market ups and downs. Read more about smallcase vs mutual fund

#smallcase vs mutual fund which is better#difference between smallcase vs mutual funds#smallcase vs mutual fund

0 notes

Link

0 notes

Link

0 notes